25 years ago, Gallo and Sveen (1991) published the first paper about internationalization of family businesses. Since then, research in this area has steadily increased. In this article, I review the evolution of the literature that has combined international business and family firms (102 papers from 1991 to 2015), and I identify six promising areas for research through a dialogue between both disciplines: (1) mission and objectives of firms: the meaning of “performance”, (2) corporate government and international business, (3) attitude to risk and internationalization patterns, (4) timing, pace and speed of internationalization, (5) cross-cultural management, and (6) network perspective and social capital of firms.

Hace ahora 25 años, Gallo and Sveen (1991) publicaron el primer artículo sobre la internacionalización de la empresa familiar. Desde entonces, la investigación en esta área ha crecido significativamente. En este trabajo se hace una revisión de la literatura que se encuentra en la intersección de los campos de estudio de negocios internacionales y la empresa familiar (102 trabajos a lo largo del periodo 1991 a 2015) y se identifican 6 áreas prometedoras de investigación como fruto del diálogo entre ambas disciplinas: 1) la misión y visión de las empresas: el significado del «rendimiento»; 2) el gobierno corporativo de los negocios familiares internacionales; 3) la actitud ante el riesgo y los patrones de internacionalización; 4) el ritmo y la velocidad de la internacionalización; 5) la gestión cros-cultural, y 6) la perspectiva de redes y el capital social en la empresa familiar.

The study of the international activities undertaken by family businesses is a growing field of research that straddles the two disciplines of international business (IB) and family business (FB). Following the first article by Gallo and Sveen (1991), research in this area has steadily increased over the intervening 25 years (Arregle, Duran, Hitt, & van Essen, 2016; Kontinen & Ojala, 2010; Pukall & Calabro, 2014). There are two reasons for the growing interest in research into the international dimension of family business (IFB). Firstly, patterns of internationalization and globalization have changed in recent decades, with new actors being introduced to the global arena, such as born-global firms, multinational SMEs, and multinational corporations (MNCs) from emerging countries. This changing scenario presents new opportunities for family firms, the majority of which are smaller than non-family companies (Fernández & Nieto, 2006). Secondly, the increasing number of researchers and the greater impact of their publications mean that studies into family business are becoming increasingly relevant (Casillas & Acedo, 2007; Zattoni, Gnan, & Huse, 2015). These two opportunities can be illustrated by examples of family multinational firms all over the world, such as Samsung (South Korea), Koch Industries (USA), Carrefour (France), Faber-Castell (Germany), Bombardier (Canada), Tata Group (India), Cemex (Mexico), and so on.

The majority of research has focused solely on the internationalization of family businesses (Arregle et al., 2016; Pukall & Calabro, 2014), although the field of international business covers many other areas (Acedo & Casillas, 2005; Melin, 1992). With regard to the process of family business internationalization, Pukall and Calabro (2014) summarize what we actually know and propose a hybrid model that combines the socio-emotional wealth (SEW) view of family businesses (Gómez-Mejía, Haynes, Núñez-Nickel, Jacobson, & Moyano-Fuentes, 2007) and the stage model of the internationalization process (Johanson & Vahlne, 1977, 2009). Different authors find contradictory results in their review of the literature on family business internationalization, showing a positive (e.g. Carr & Bateman, 2009), negative (e.g. Fernández & Nieto, 2006), or no relationship (e.g. Cerrato & Piva, 2010) between the internationalization activities of family and non-family businesses (Arregle et al., 2016). In fact, as Pukall and Calabro (2014) argue, not all family businesses are homogeneous, and the most important variable that pushes family firms towards internationalization is the ownership structure (the role of external owners), via the board of directors.

However, as we have indicated above, international behavior goes beyond the level of a firm's internationalization. In their seminal works, Hawkins (1984), Toyne (1989) and Melin (1992) identify different areas of research in the international business field, only one of which is concerned with the internationalization process; other topics include the organizational behavior of MNCs, or cross-cultural management, among others. New approaches have arisen in recent decades in relation to international activities, such as the emergence of born-global firms and international new ventures, the role of networks, etc. (Coviello, 2015; Jones, Coviello, & Tang, 2011; Knight & Cavusgil, 2004; Oviatt & McDougall, 1994, 2005). These topics have largely neglected the prominent role of family businesses, which indicates that there are opportunities for a fruitful dialogue between the disciplines. In this paper, we review the evolution of the literature that has combined international business and family firms over the past 25 years (from the first article by Gallo and Sveen in 1991, to 2015); and identify promising areas for research through a dialogue between the disciplines of international business and family business.

Convergent evolution of IB and FBGallo and Sveen (1991) published the first paper on the international dimension of family businesses 25 years ago, in Family Business Review. Since then, interest in the topic has grown significantly among researchers all around the world. Our criteria for the selection of articles published over the past 25 years were the following: (1) articles must be published only in peer-reviewed journals; (2) the title or abstract should include the words international and family business (or similar words); and (3) the article should deal with the international dimensions of family business. The criteria for each paper were assigned on a case-by-case basis. To test our selection, we also looked at two previous review papers, published by Pukall and Calabro (2014) and Kontinen and Ojala (2010). The sample for our literature review consisted of 102 papers.1 This figure is higher than in previous review processes in this area (Kontinen and Ojala included 25 papers in 2010; Pukall and Calabro analyzed 72 works, in 2014).

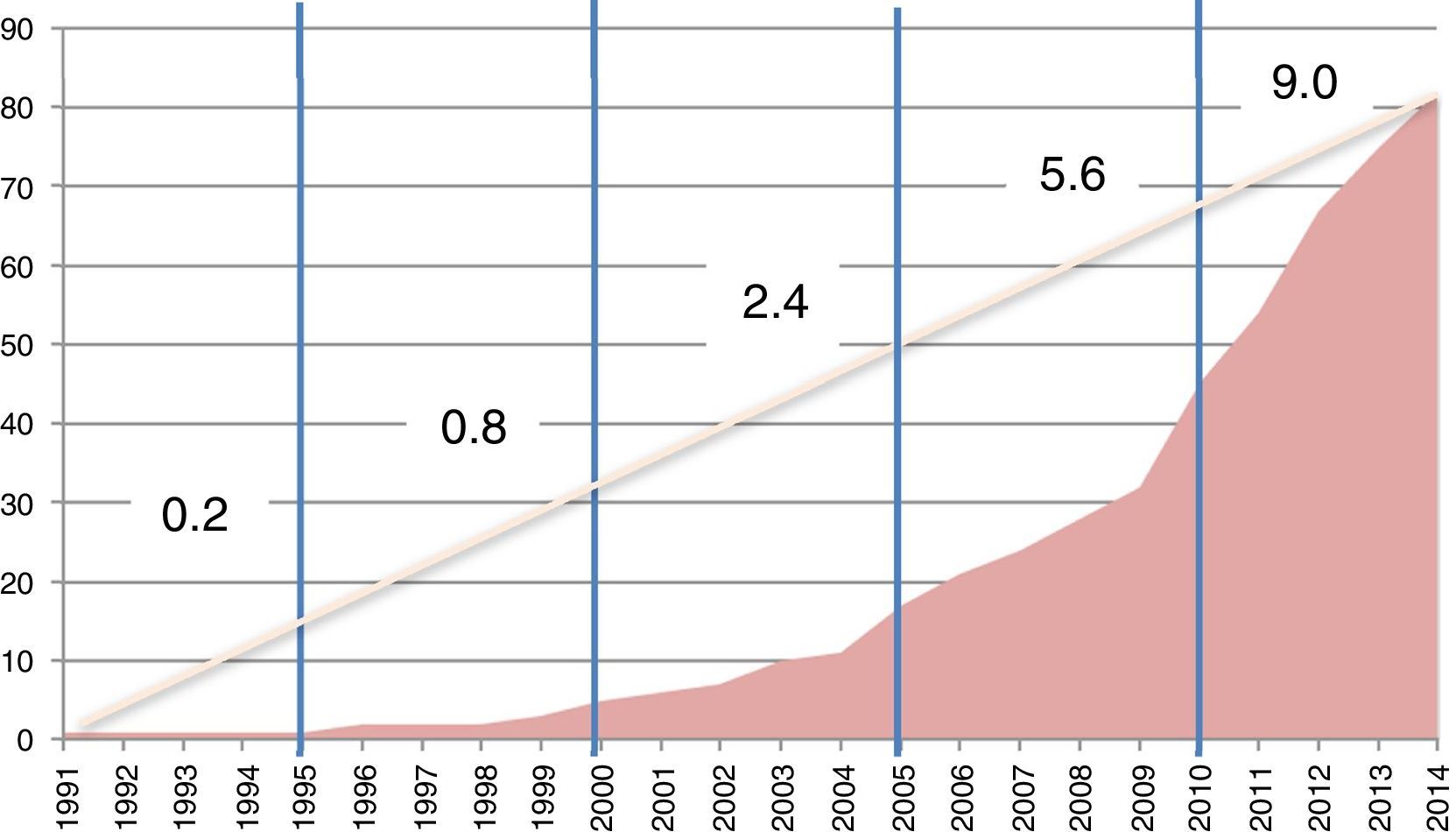

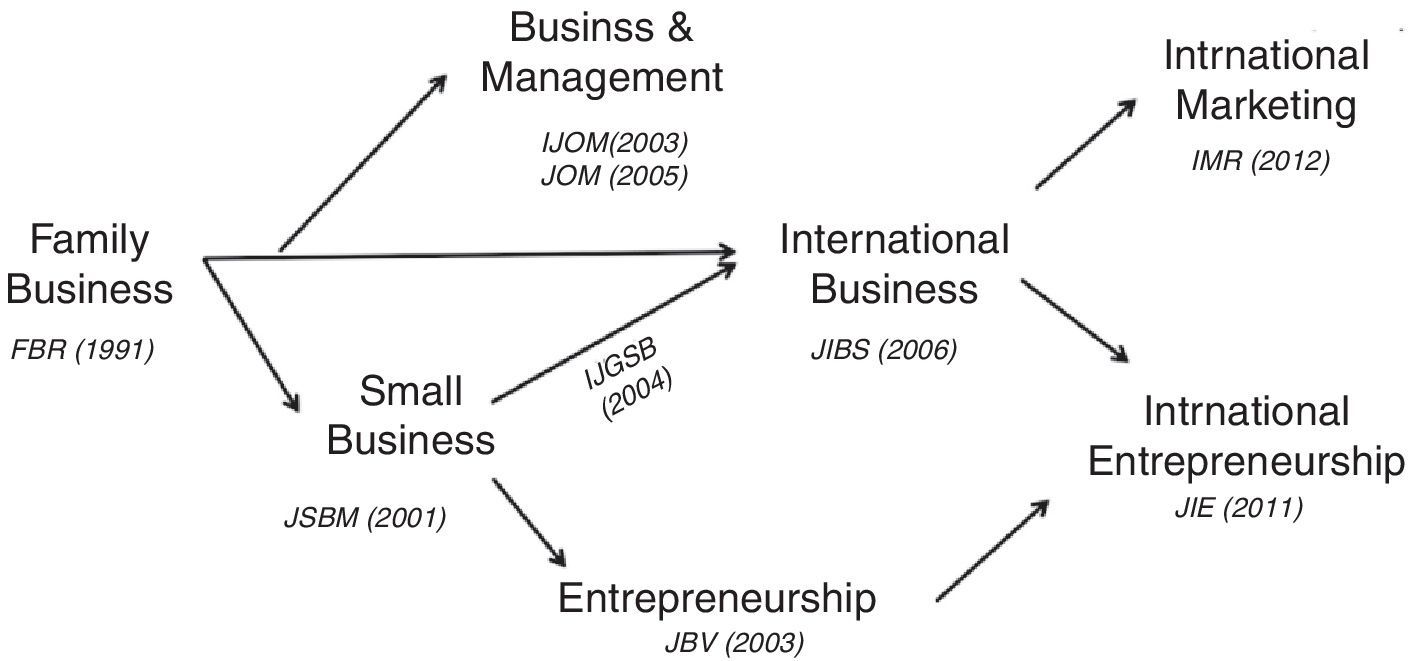

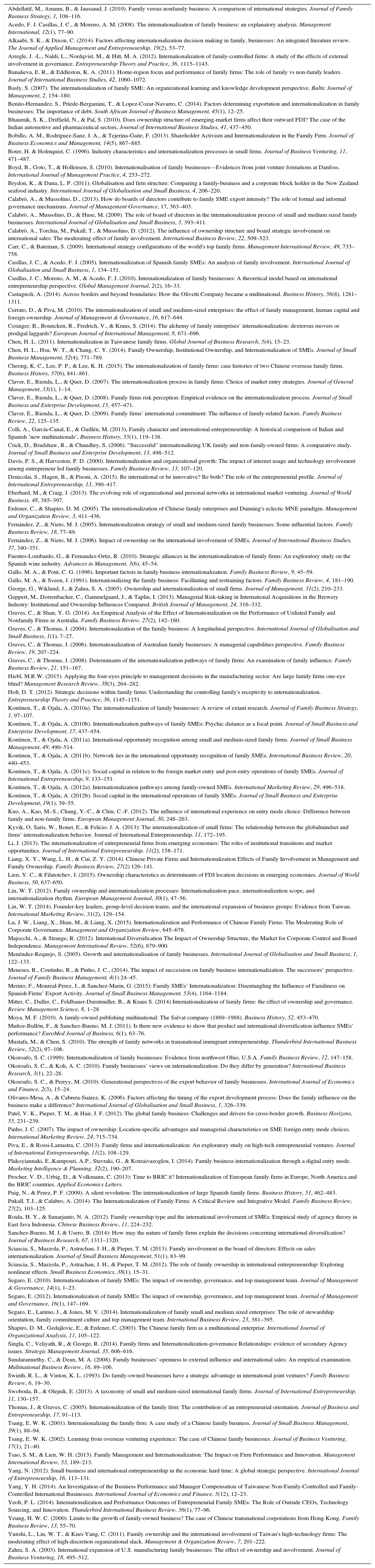

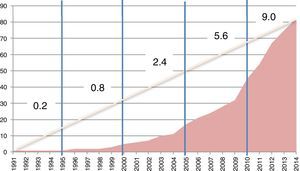

As stated above, there has been an annual increase in the research into the international dimension of family business, as Fig. 1 shows. More than four papers have been published every year during the last quarter of a century, but if we divide the last 25 years into five-year periods, we obtain the following average number of papers per year (Fig. 1): 0.2 between 1991 and 1995 (one paper); 1 between 1996 and 2000 (five papers); 2.4 between 2001 and 2005 (12 papers); 5.4 from 2006 to 2010 (27 papers), and finally, 11.4 articles in the period 2011–2014 (57 papers). We have analyzed the dynamic evolution of the discipline by looking at the journals in which the 102 articles were published (see Fig. 2). To create our figure, we classified the journals by their main research aims, creating seven categories: (a) Family Business (FBR, JFBS, etc.); (b) International Business (JIBS, IBR, etc.); (c) SMEs (e.g. JSBM); (d) Entrepreneurship (JBV, ETP, etc.); (e) Management and Business (JoM, EMJ, etc.); (f) International Marketing (e.g. IMR); and (g) International Entrepreneurship (e.g. JIEN).

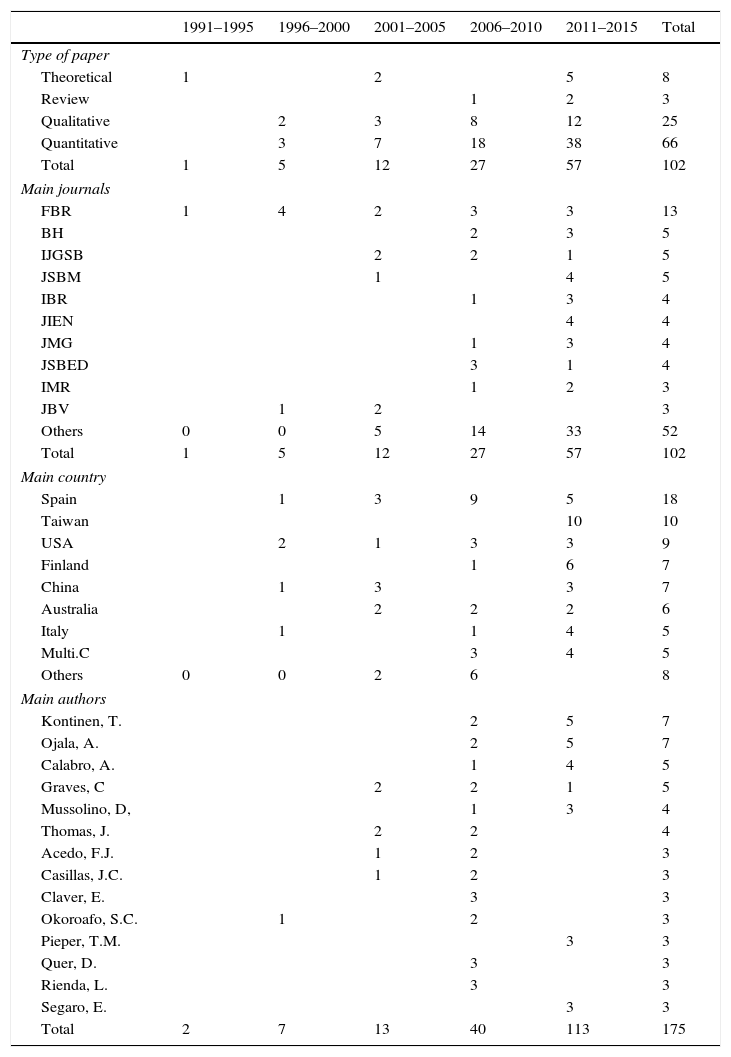

We found this area of research was initiated by scholars in the field of family business, since the five of the first six articles were published in FBR (1991–2000). Three papers were published in an entrepreneurship-oriented review (JBV) from 1996 to 2003, and one article the topic appeared in an SME journal (JSBM) in 2001. Also in 2013, two papers were included in a management journal (IJOA). In 2005 two articles were published in a journal oriented towards the internationalization of SMEs (IJGSB) and a year later the first paper appeared in a journal with a clear focus on international business (JIBS, 2006). In other words, the discipline was born in the field of family business and it took 15 years to attract the attention of international business scholars. During these years, internationalization of family business was analyzed from Family Business, Entrepreneurship and Small business fields. Since then, some papers have been published in journals focused on different areas, such as international entrepreneurship (JIEN, 2011) and marketing (IMR, 2012). An overview of the types of paper, journals, countries of samples/cases, and main authors is represented in Table 1.

Evolution of past research and characteristics of the papers.

| 1991–1995 | 1996–2000 | 2001–2005 | 2006–2010 | 2011–2015 | Total | |

|---|---|---|---|---|---|---|

| Type of paper | ||||||

| Theoretical | 1 | 2 | 5 | 8 | ||

| Review | 1 | 2 | 3 | |||

| Qualitative | 2 | 3 | 8 | 12 | 25 | |

| Quantitative | 3 | 7 | 18 | 38 | 66 | |

| Total | 1 | 5 | 12 | 27 | 57 | 102 |

| Main journals | ||||||

| FBR | 1 | 4 | 2 | 3 | 3 | 13 |

| BH | 2 | 3 | 5 | |||

| IJGSB | 2 | 2 | 1 | 5 | ||

| JSBM | 1 | 4 | 5 | |||

| IBR | 1 | 3 | 4 | |||

| JIEN | 4 | 4 | ||||

| JMG | 1 | 3 | 4 | |||

| JSBED | 3 | 1 | 4 | |||

| IMR | 1 | 2 | 3 | |||

| JBV | 1 | 2 | 3 | |||

| Others | 0 | 0 | 5 | 14 | 33 | 52 |

| Total | 1 | 5 | 12 | 27 | 57 | 102 |

| Main country | ||||||

| Spain | 1 | 3 | 9 | 5 | 18 | |

| Taiwan | 10 | 10 | ||||

| USA | 2 | 1 | 3 | 3 | 9 | |

| Finland | 1 | 6 | 7 | |||

| China | 1 | 3 | 3 | 7 | ||

| Australia | 2 | 2 | 2 | 6 | ||

| Italy | 1 | 1 | 4 | 5 | ||

| Multi.C | 3 | 4 | 5 | |||

| Others | 0 | 0 | 2 | 6 | 8 | |

| Main authors | ||||||

| Kontinen, T. | 2 | 5 | 7 | |||

| Ojala, A. | 2 | 5 | 7 | |||

| Calabro, A. | 1 | 4 | 5 | |||

| Graves, C | 2 | 2 | 1 | 5 | ||

| Mussolino, D, | 1 | 3 | 4 | |||

| Thomas, J. | 2 | 2 | 4 | |||

| Acedo, F.J. | 1 | 2 | 3 | |||

| Casillas, J.C. | 1 | 2 | 3 | |||

| Claver, E. | 3 | 3 | ||||

| Okoroafo, S.C. | 1 | 2 | 3 | |||

| Pieper, T.M. | 3 | 3 | ||||

| Quer, D. | 3 | 3 | ||||

| Rienda, L. | 3 | 3 | ||||

| Segaro, E. | 3 | 3 | ||||

| Total | 2 | 7 | 13 | 40 | 113 | 175 |

Before we can identify areas for a dialogue between the family business (FB) literature and international business (IB) literature, we need to understand some of the changes that have occurred in both areas over the last 25 years. During this time, all of the world's economies have become aware of the existence of family firms as a type of firm with a different set of characteristics and realized their importance in the economies of the West. This can be seen in the proliferation of the associations of family firms and professionals throughout the world (Family Firm Institute, Family Business Network, European Family Business, to name but a few), and the interest in the availability of statistics regarding the weighting of this type of firm in the economy (Astrachan & Shanker, 2003; Bjuggren, Johansson, & Sjögren, 2011; IEF, 2015). Many of these firms are important actors in the global economy (Carr & Bateman, 2009; Casillas & Pastor, 2015), such as Samsung (Asia), Ford (America) or Exor (Europe). Furthermore, the majority of universities around the world have institutes, courses or family business centers. Even institutions such as the European Union have recognized the importance of this type of firm, highlighting the need for reliable statistics and information relating to a reality that is dominating around the world.

This reality has attracted academic interest since the beginning of the 1990s. Firstly, FB research was focused on two main themes (Casillas & Acedo, 2007): the definition and characterization of family businesses (as a category), and succession. However, from 1990 new topics emerged, relating to themes such as strategic management, conflict management, innovation, and internationalization (Bird, Welsch, Astrachan, & Pistrui, 2002; Chrisman, Chua, & Zahra, 2003; Sharma, 2004; Zahra & Sharma, 2004). More recently, new concepts and frameworks have been developed to accommodate the research into these new challenges, such as the F-PEC Scale (Klein, Astrachan, & Smyrnios, 2005), the concept of “familiness” (Habbershon, Williams, & McMillan, 2003) or the socio-emotional (SEW) perspective (Gómez-Mejía et al., 2007). The SEW approach has emerged as an insightful approach integrating a behavioral perspective into the study of family businesses. This is interesting, as behavioral theory is also one of the dominant approaches to the internationalization process of the firm (Johanson & Vahlne, 1977).

IB has also changed over the last 25 years. In these years, new internationalization patterns have emerged, and globalization is no longer a trend, but a fact. When the study of FB internationalization was emerging, Melin (1992) defined and represented the main corpus of international business research. The IB field was in a pre-paradigmatic stage (Acedo & Casillas, 2005) at the end of the eighties and there was no consensus about the conceptual domain of international business (Toyne, 1989). Melin identified three main themes: (1) the stage model of internationalization; (2) studies of the link between strategy and structure in MNCs; and (3) studies of administrative process in MNCs and “recent” organizational models for MNCs. While a small number of theoretical approaches dominated IB research until the 1980s (the stage model of the internationalization process, the OLI paradigm, economic views of MNCs), towards the end of 1980s new phenomena arose, such as the emergence of networks (Ellis, 2000; Johanson & Vahlne, 2003), born-global firms (Knight & Cavusgil, 2004), international new ventures (Oviatt & McDougall, 1994), and MNCs from emerging countries (Cuervo-Cazurra & Genc, 2008; Jormanainen & Koveshnikov, 2012), and micro-multinationals (Dimitratos, Johnson, Slow, & Young, 2003). These processes have incorporated new, younger and smaller incarnations of international business, and new emerging markets, helping a growing number of family firms to expand to foreign markets, which gives rise to family multinationals (Carr & Bateman, 2009; Casillas & Pastor, 2015; Lubinski, Fear, & Perez, 2013).

Taking the model proposed by Melin (1992) as a foundation for the initial stage in the IB field, we have classified the 102 papers analyzed in this review, and find that most research is concentrated on the internationalization process of the firm (63 papers). The rest of the papers fall into a number of groups, with 22 articles oriented towards the strategic issues of internationalization. The smaller groups of papers are focused on transactions and the transfer of technology, with 13 papers that analyze transaction costs, agency theory, FDI decisions and networks. So, as we indicated at the beginning, research has focused on the internationalization of family businesses, while many other topics remain under-investigated.

A dialogue between the disciplines Of FB and IBHaving described the 102 selected papers, our main objective now is to identify gaps in the overlapping area between IB and FB in order to find avenues for future research. As we have already seen, there is a clear concentration of research around a small area; the analysis of how the involvement of a family (family business versus non-family business, family involvement, etc.) in a firm affects its internationalization process. The results of investigations over the past 25 years show (Pukall & Calabro, 2014) (1) that family firms tend to follow the Uppsala model (Johanson & Vahlne, 1977, 1990) for their internationalization, in an attempt to minimize the risks of international expansion and longer-term orientation; (2) a diversity of results relating to the influence of family ownership and management on the level of internationalization of family firms compared to non-family firms; (3) it is rare to use cooperation instruments or international alliances (and when these are employed they prefer to do so as partners with other family firms); (4) the succession processes tend to influence the internationalization process, either in initiating or accelerating it; and (5) the internationalization of family firms is put in place in the context of a scarcity of resources and capabilities.

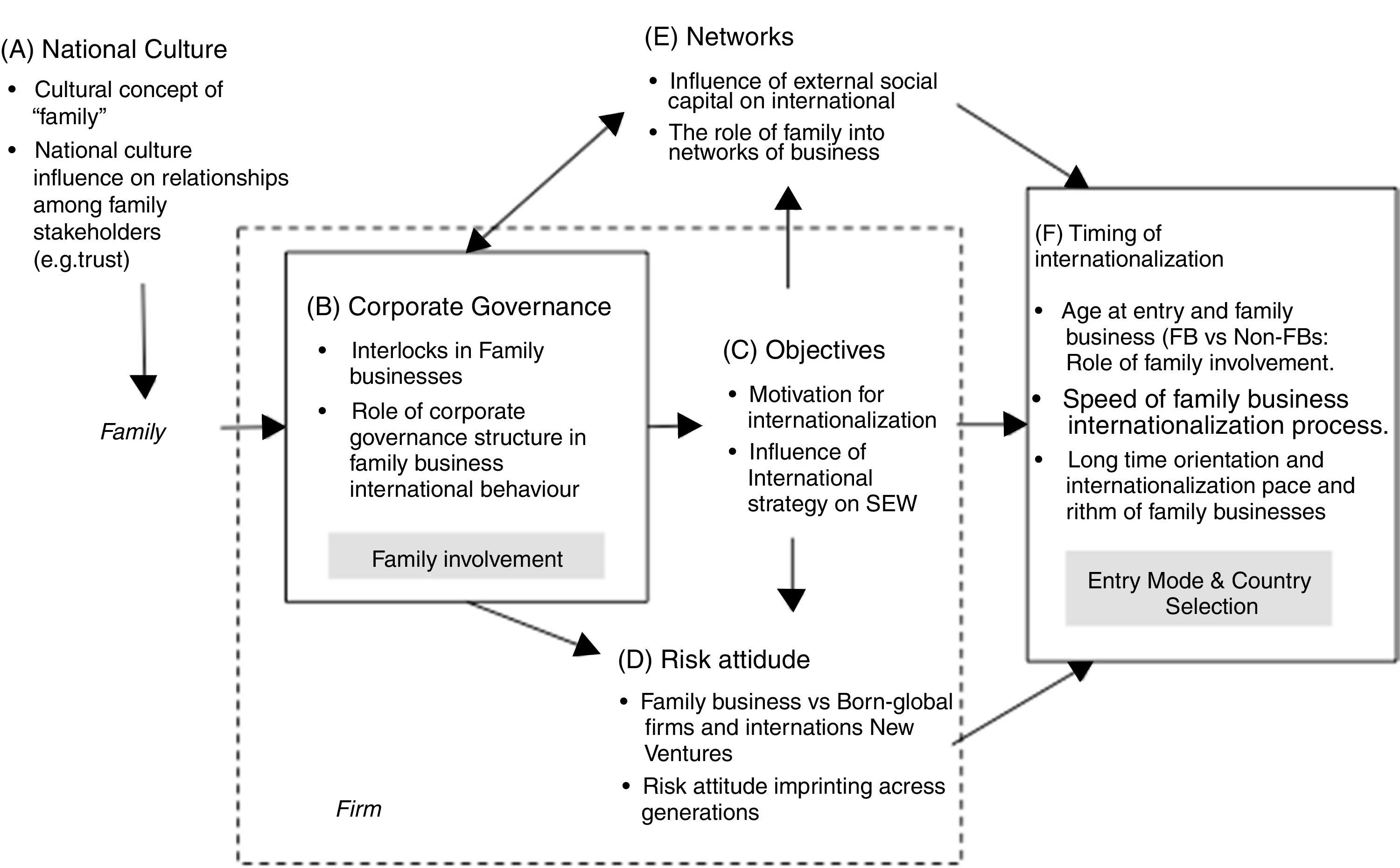

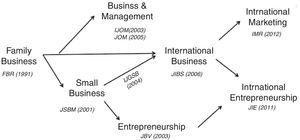

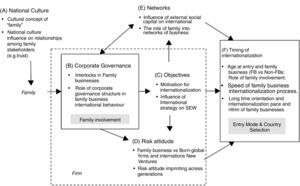

But IB is much more than the internationalization process (Pukall & Calabro, 2014), and internationalization covers more than entry mode decision and market selection (Arregle et al., 2016). In identifying new gaps in the literature, we adopt an approach that requires the unit of analysis to be the family firm (in the centre), whose international behavior (results) depends on both internal and external factors. We have set out this framework in Fig. 2. A notable essential external factor in this type of firm is the family, and institution that is not often included in the Management field (Jaskiewicz, Combs, Shanine, & Kacmar, 2017). Thus cultural aspects affect a number of dimensions of the family (e.g., Bloom & van Reenen, 2007). Thus there has been little investigation into the influence of cultural differences in entrepreneurial decision-making through the family (gap A). And in the internal context, the corporate governance of the firm takes on particular relevance as the central decision-making body. In this field, the role of family involvement in the governing bodies (Board of Directors and TMT). However, many other factors remain unexplored, such as the role of family interlocks or the influence of coalitions with family ties in the internationalization decision-making (gap B). Similarly, a differentiating characteristic of family firms is the type of objectives and the importance of non-economic factors, such as socio-emotional wealth (Gómez-Mejía et al., 2007). This aspect has scarcely been investigated as an aspect relating to the motivations and types of decisions regarding international expansion (gap C). Linked to this latter point, it is generally accepted that family firms are more risk-averse than non-family firms (Zahra, 2005). However, beyond inferring the sequential expansion of family firms (Pukall & Calabro, 2014), very little is known how this aversion to risk evolves over generations and its influence on the possible existence of rapid internationalization family firms (gap D). But the internal and external dimensions are related, especially in the current open economy. Thus the participation of family firms in inter-organizational networks (e.g., the global-factory) has hardly been studied (gap E). Finally, while the majority of studies have focused on the types of international decisions of family firms, it is also true that they have focused almost exclusively on the two classic decisions of internationalization: commitment and market selection (depth and breadth – Arregle et al., 2016). However, the influence of the family on the third main area of internationalization, relating to time (Eden, 2009) has received scant attention and the view of the internationalization “process” (Welch & Paavilainen-Mäntymäki, 2014) (gap F). In summary, we propose six areas for future research that would serve as a meeting point for the interests of FB and IB, that we detail in the following sections.

Cross-cultural managementCross-cultural management has been at the centre of the IB discipline for several decades (Adler, 1983; Adler, Doktor, & Redding, 1986). A recent review of 265 selected articles published between 2000 and 2012 in the area of national culture and international management (López-Duarte, Vidal-Suárez, & González-Díaz, 2015) identifies three major streams of research: (1) internationalization decision, (2) entry mode strategy, and (3) strategy and structure of MNCs. However, the authors conclude that this topic is under-developed, identifying potential avenues for future research. One of these is specifically related to family business. López-Duarte et al. (2015) refer to the role of cultural differences in potential work-related problems for family members when they are expatriated (Bader, Berg, & Holtbrugge, 2015). This is important because the international activities of family businesses require the international involvement of family members.

Prior literature has shown that contextual and cultural diversity between countries not only influences firms, but also families. For example, Aryee, Fields, and Luk (1999) compare the similarities and differences of the work-family interface in Hong-Kong and the USA. Aspects such as the role of women in family firms (Brush, 1992) and the educational level of successors (Sharma & Rao, 2000) are clearly culturally affected. More recently, some researchers are focusing on the influence of cultural dimensions on entrepreneurship and its drivers (see for example the recent work by Liñán and Fernández-Serrano, 2014, in the European context). Similarly, Cullen, Johnson, and Parboteeah (2014) find that the unique mixture of cultural and institutional variables and their interactions are predictors of the rates of nation-level opportunity entrepreneurship. Following these ideas, cultural dimensions can be considered as a potential moderator in much of the research that has been developed in the field of entrepreneurship (entrepreneurial orientation, for example) and family businesses performance.

Cultural dimensions have a direct influence on many family-business interactions, most of which are still under-investigated. For example, culture may affect the boundaries of the “family”, and the strength of family ties. For example, Latin countries have a broader concept of “family” and stronger ties between their members than Anglo-Saxon countries, and Chinese families are very different from western families. Different family theories (as birth-order theory—Bloom & van Reenen, 2007, or parental control theory—Watabe & Hibbard, 2014) have also found that there are cultural differences in family dynamics (Jaskiewicz et al., 2017). As a consequence of these cultural differences, family businesses worldwide are not homogeneous. Secondly, the overlap between the family and the company (family business identity, or self-awareness) is likely to vary according to national culture. The national culture influences the relative importance of values (family versus business values), and affects the predominance of business versus family goals (Chrisman, Sharma, Steier & Chua, 2013).

To be even more specific, national culture is assumed to be a predictor of personal relationships. For example, in their classic article, Doney, Cannon, and Mullen (1998) develop a framework that identifies and describes five cognitive trust-building processes that help explain how trust develops in business contexts, and demonstrate how societal norms and values influence the application of the trust-building processes. Considering the role of trust within family businesses presents a new opportunity to investigate how national culture influences relationships between stakeholders (family members involved in the business —paying special attention to the CEO, passive family members, external owners and managers, and so on). In summary, there is a broad avenue along which the FB and IB fields can advance in their respective research, using inter-cultural approaches.

Corporate government and international businessInternationalization decisions are mainly taken by the board of directors (BoD) and/or top management team (TMT), and one of the defining characteristics of family firms is the involvement of family members on the BoD and TMT (Astrachan, Klein, & Smyrnios, 2002). There is a consensus view in the literature that family firms and non-family firms differ in their governance structures (Chrisman et al., 2013; Wiklund, Nordqvist, Hellerstedt, & Bird, 2013). For that reason, many papers have researched the role of the involvement of family and non-family members serving on the BoD with regard to its internationalization decisions (Calabro & Mussolino, 2011; Casillas, Acedo, & Moreno-Menéndez, 2007; Sciascia, Mazzola, Astrachan, & Pieper, 2012) and special attention has been paid to the role of the CEO as a member of the family (Calabrò, Torchia, Pukall, & Mussolino, 2012; Singla, Veliyath, & George, 2014; Yeoh, 2014). Conversely, several papers have analyzed the role of non-family members in internationalization decisions (Arregle, Naldi, Nordqvist, & Hitt, 2012; Calabrò, Mussolino, & Huse, 2009; Holt, 2012). Finally, some researchers have adopted a social capital approach (Basly, 2007; Kontinen & Ojala, 2010, 2012).

However, there are some areas that lack research. First of all, the role of interlocks is especially relevant in these kinds of companies. Interlocks are the links created between two or more companies through a common director. Interlocks have been extensively investigated in the literature as a source of external social capital (Hillman & Dalziel, 2003; Kor & Sundaramurthy, 2009; Tian, Haleblian, & Rajagopalan, 2011). Most authors assume that interlocking directorates have positive impacts on company performance by providing management with access to a variety of key resources (Kiel & Nicholson, 2006). Consequently, interlocks are a source of vicarious knowledge for international expansion (Casillas, López-Fernández, Meroño, Pons, & Beiges, 2015) promoting internationalization (Barroso, Villegas, & Pérez-Calero, 2011). However, there is a lack of research regarding interlocking within family businesses and its influence on the international expansion of these firms.

Secondly, the influence of corporate governance structures in family business on international decision-making is also under-investigated. There are dimensions of corporate governance in family businesses that differ from non-family businesses. We would highlight the following: (1) how the role of CEO (stewardship vs. agency) influences the internationalization process; (2) how the presence of women in the corporate governance of family businesses affects international expansion; (3) how the similarities or differences between board members (with regard to the generational level, for example) affect international decisions; (4) how family stakeholders influence the board's decisions on internationalization; or (5) how the configuration of board dynamics and board capabilities in family businesses (the relationship between family and non-family directors) affects international activities. These questions are examples of the potential new debates in the overlapping area between corporate governance, international business and family business.

Mission and objectives of firms: the meaning of “performance”Management research has largely been focused on performance, paying particular attention to the economic and financial performance of firms. However, new developments in the FB field underline the role of socio-emotional wealth (SEW), defined as the stock of all the affect-related non-financial value a family derives from its ownership position in the firm (Gómez-Mejía et al., 2007). The SEW approach can alter perspectives relating to why, when, and how family firms expand their operations internationally, owing to the balance that is required between financial and socio-emotional performance (Arregle et al., 2012).

According to the stakeholder theory (Donaldson & Preston, 1995), business can be understood as a set of relationships between groups that have a stake in the activities that make up the business (Larmar et al., 2010). The tradeoff between stakeholders can explain the behavior of firms and their adaptation to the capitalist economy (Phillips, 2003). It is the executive's job to manage and shape these relationships to create as much value as possible for stakeholders and to manage the distribution of that value. In this context, families controlling firms constitute a crucial stakeholder in which value is not only economic, but also socio-emotional. In the international context, the concept of the family as a stakeholder is useful for understanding (a) how value is created and traded in a growing, rapidly changing and global business context; (b) the nature of the connection between family values and business ethics in a global context; and (c) how family should respond to both of these questions. International business literature has extensively researched two related issues: what motivates a business to expand internationally and what is international performance. In the family business context, the SEW approach offers new answers to these classical research questions.

First, the motivation to expand internationally may differ between family and non-family firms, depending on the family's goals and shared values for the future (Kotlar & De Massis, 2013). However, family goals are not passed on to the firm automatically; the transfer of family values and goals depends on different factors. Previous IB research considers several drivers for internationalization, such as home-market maturity and the problems of growing at home, the opportunities for entering emerging and growing countries, the search for cheaper and more efficient resources (workforce, knowledge, financial, raw materials, and so on), among others (Dunning, 1993). However, none of this research has taken account of the drivers and motivations related to the firm's ownership and control, or, more specifically, the family control of the company. Cuervo-Cazurra and Narula (2015) recently assumed that there are economics-driven and psychology-driven motives for internationalization. However, previous literature has focused on firm level issues, relating to “sell more, buy better, upgrade, and escape” (Cuervo-Cazurra & Narula, 2015, p. 26). Family business literature has contributed to the international business field with a more psychological explanation of the motives for expanding into foreign markets. But, in the future, family theories (see Jaskiewicz et al., 2017, for a review) can also be helpful to explain how family firms select their values, mission and objectives. For example, family communication patterns (as conversational families) may have a positive impact on opportunity recognition skills of CEO, directors or managers (Dyer, Gregersen, & Christensen, 2008).

Second, international performance has been mostly viewed from a behavioral or financial perspective. The behavioral performance of internationalization includes measures such as export performance, international commitment, international intensity, the diversity and distance (physical, psychological, etc.) of foreign markets, and so on. Financial performance refers to international profitability, return on investment in foreign countries, growth, etc. (Bonaccorsi, 1992; Calof, 1994; Johanson & Vahlne, 1977, 1990). However, the measurement of performance is more complex within family business, due to the influence of family goals on strategies and decision-taking processes. We need, for example, more insights into how much an internationalization strategy may improve the SEW of a family, in terms of reputation, a better position for family members on the board and family CEO, long-term survival, etc.

Attitude to risk and internationalization patternsThe FB literature has widely discussed the attitude of family firms towards risk (Jones, Makri, & Gómez-Mejía, 2008; Zahra, 2005) and there is contradictory evidence regarding the risk attitudes of family businesses. For example, Zahra (2005) finds that family ownership and involvement promote entrepreneurship, but some family firms become conservative and unwilling to take the risks associated with entrepreneurial activities. Most research assumes that family businesses are risk averse, although the origin of most family businesses can be traced back to an entrepreneur assuming a high degree of risk. Furthermore, the SEW approach links family firms’ risk aversion to potential losses of SEW as a catalyst for diversification (Gómez-Mejía, Makri, & Larraza-Kintana, 2010) and international expansion (Arregle et al., 2012; Claver, Rienda, & Quer, 2008).

Risk is also central to the stage model approach to the internationalization process (Johanson & Vahlne, 1977; Johanson & Wiedersheim-Paul, 1975). According to the stage model approach, firms expand gradually into foreign markets in order to minimize the risks associated with entering uncertain environments. For that reason, firms begin their expansion by entering closer countries (in terms of psychological and physical distance) and using entry modes with lower resource commitments (Johanson & Vahlne, 1990). FB literature has implicitly assumed that family companies follow the stage model proposed by the Uppsala approach in their internationalization process. The model proposed by Pukall and Calabro (2014) in their review paper is a proof. In their model, they integrate the SEW approach to family business (Gómez-Mejía et al., 2007) with Johanson and Vahlne's (1990) model of internationalization.

Nevertheless, risk attitude, as part of the internationalization decisions taken by family businesses, is still, in our opinion, an underexplored area. First of all, as previous literature suggests, a risk attitude evolves over time, across generations. The attitude to risk of the firm's founder is expected to be different from their successors’. Accordingly, the stage model is not always appropriate for explaining the internationalization process of family businesses. Approaches based on international entrepreneurship perspectives could be applied to the initial international expansion of new family businesses. For example, many start-ups emerge from a single entrepreneur, a couple, or two friends. Many, but not all, will never become a family business, which leads us to question: can some born-global firms be family businesses (e.g. couple family firms), and how does this type of firm deal with risk?

Here, again, different theories about family (Jaskiewicz et al., 2017) can be useful to understand risk attitudes in family businesses. For example, Family Development Theory explains how families related with risk depending of the phase in the family's life cycle (Chaulk, Johnson, & Bulcroft, 2003). Family-Niche Model of Birth Order and Personality proposes that risk attitude is influenced by birth order, in that way that firstborn children are more conservative (Dubno & Freedman, 1971), while later-born children are more aggressive and creative (Berger & Ivancevich, 1973).

Related to the entrepreneurial dimension, risk attitude and internationalization, new patterns of growth are emerging in family businesses: the entrepreneurial activities of successors (Discua Cruz, Howorth, & Hamilton, 2013). A new line of research analyses how the founder's entrepreneurial orientation and risk attitude imprint following generations, whether they are inside or outside the family company (Mathias, Williams, & Smith, 2015), creating an entrepreneurial legacy (Jaskiewicz, Combs, & Rau, 2015). These papers contribute to our understanding of why and how family businesses can maintain and develop the initial entrepreneurial orientation and risk attitude. However, these ideas have not been applied to the processes used by family businesses for discovering and exploiting international opportunities across generations. Potential new research might investigate how family business deals with internationalization risk by using the family's social capital, creating international entrepreneurial teams, promoting international spin-offs, etc.

Network perspective and social capital of firmsFrom the network perspective, internationalization is seen as a diverse range of cross-border network relations and exchanges (Ellis, 2000; Welch & Luostarinen, 1993). The stage model approach has evolved from the concept of liability of foreignness to the liability of outsidership (Johanson & Vahlne, 2009). However, social networks are not only crucial to the stage model of expansion (Johanson & Vahlne, 2003, 2009), but also to SMEs and born-global firms (Coviello & Munro, 1997; Zhou, Wu, & Luo, 2007). International businesses are currently organized as a network of businesses from a number of countries, forming different parts of the global value chain. A clear example of this approach is the emergence of the “global factory”, where brand owners will control design, engineering and marketing while outsourcing large areas of production to parts suppliers and they may well contract out final assembly” (Bartels, Buckley, & Mariano, 2009).

FB scholars have also focused their attention on the family as a network, analyzing the social and relational capital of families (Arregle, Hitt, Sirmon, & Very, 2007; Salvato & Melin, 2008). Some researchers have considered this perspective (Gallo & Sveen, 1991), and conclude that family businesses prefer international joint ventures with other foreign family businesses (Swinth & Vinton, 1993). Since this seminal work, international alliances (Fuentes-Lombardo & Fernandez-Ortiz, 2010) and joint ventures (Abdellatif, Amann, & Jaussaud, 2010; Boyd, Goto, & Hollensen, 2010) have been considered in numerous studies over the last 25 years.

However, we need to improve our understanding of the effect of family networks on the international expansion of family businesses. At the individual level, one line of research comes from the influence of external social capital (Kim & Cannella, 2008) on internationalization, and pays specific attention to the external ties of family members on the board or TMT. As we noted earlier, the notion of interlocks (family and non-family) has been under-investigated. Related to external social capital, there is another gap around the influence that the relationships between family owners and family managers—through family business associations (national and mainly international)—have on international businesses. In recent decades, this type of organization has appeared all around the world, generating a network of family business members, which could be used for international expansion, to seek advice or exchange new contacts in potential new markets.

At organizational level, the role of the family within business networks is also interesting for a number of reasons. Firstly, several family business are evolving into conglomerates, in order to (a) diversify the family financial wealth, (b) allow the next generations to become integrated into the company, and (c) exploit attractive opportunities in emerging sectors around the world. This kind of conglomerate tends to develop a network with other businesses and private and public institutions, with the family as the node. Secondly, many family businesses can grow and survive in the long term as part of a larger network that is usually dominated by a large global multinational. These large MNCs (from the automobile, energy, telecommunications sectors, and so on) develop a network of smaller companies, most of which are family-controlled. And thirdly, even without a large MNC taking the lead, new networks of SMEs—the majority of them family businesses—are emerging (not only in the dynamic, technological, and innovative sectors, but also in traditional sectors) as a way to become internationally competitive.

Timing, pace and speed of internationalizationInternationalization is, by definition, a dynamic process (Johanson & Vahlne, 1977; Jones & Coviello, 2005; Welch & Paavilainen-Mäntymäki, 2014). However, most research has focused on entry mode decisions and market selection. As Eden (2009) states, timing is one of the dimensions that has been less investigated in IB literature. Since 1994, the international entrepreneurship perspective has focused on speed of entry into international markets (Oviatt & McDougall, 1994) and the analysis of born-global firms and international new ventures has attracted the attention of a growing number of researchers over the last two decades. Furthermore, IB researchers are investigating the speed of internationalization post-entry (Casillas & Acedo, 2013; Chetty, Johanson, & Martin, 2014), adopting a process view of internationalization (Welch & Paavilainen-Mäntymäki, 2014), using different time spans. For example, Kutschker, Bäurle and Schmid (1997) differentiate between international evolution, international episodes, and international epochs, while Jones and Coviello (2005) view the internationalization process as a chain of international fingerprint patterns and a dynamic profile of streams of events (internationalization evidence).

FB scholars suggest that family firms may have some advantages in terms of the so-called “patient capital” (Sirmon & Hitt, 2003), assuming the long-term orientation of family businesses (Lumpkin & Brigham, 2011; Lumpkin, Brigham, & Moss, 2010). Long-term orientation (LTO) has been considerd in relation to the internationalization of family businesses (Colli, García-Canal, & Guillén, 2013; Fernández & Nieto, 2006; Segaro, Larimo, & Jones, 2014, etc.) in an attempt to improve our understanding of the internationalization pathways of family firms (Kontinen & Ojala, 2012).

However, there have been no investigations into the internationalization speed, pace, and rhythm of family business. In fact, there are three distinct gaps in IFB literature related to timing. Age at entry of the family business; speed of the process; and rhythm. Firstly, we do not have any understanding of the potential differences of the age at entry between family and non-family firms, and more specifically, how different family-related characteristics (family involvement, family CEO, etc.) influence the speed of the commencement of the internationalization behavior of family businesses. A potential line of research would explore the relationships between family business and several categories of firms, based on their age at entry, such as born-global firms, born-again globals, international new ventures, and so on. For example, born-global firms or INVs can be family businesses from the very beginning or after a certain period of time. Secondly, once a family firm has started its internationalization process, it would be interesting to establish whether this is as rapid/slow as non-family firms. In other words, we have no knowledge regarding the internationalization speed of family companies or how it is influenced by family characteristics.

This then leads to a whole new branch of potential research areas. For example, it would be relevant to analyze the effect of succession (and how succession takes place)—as a critical event in a business’ evolution—on the acceleration of internationalization speed. At the same time, several issues related to the family's involvement with corporate governance may change the speed of the internationalization process. And thirdly, the family firm's long-term orientation may potentially influence the pace and rhythm of its internationalization. For example, it would be interesting to identify the differences between the long-term and short-term pace of the internationalization process of family and non-family businesses (stability vs. instability) and which family factors affect the rhythm of international expansion. In this line, there is a great space for non variance-based methodologies, as qualitative (Tan & Matheus, 2015) and process related (Whittington, 2007), and historical (Colli et al., 2013).

Discussion and conclusionOver the past 25 years, the presence of family firms on the international stage has increased exponentially (Carr & Bateman, 2009; Casillas & Pastor, 2015), and with it, the interest of researchers, through the connection between international business and family businesses (Arregle et al., 2016; Kontinen & Ojala, 2011; Pukall & Calabro, 2014). The majority of articles that have been published and that are reviewed in this paper have focused on the internationalization process and the effect that family involvement has on the classical decisions taken in this process (entry modes, choice of country), based on the premise that this type of business is a good fit for the Uppsala model (Pukall & Calabro, 2014). However, alongside the growing number of works that take this approach (an area of study which could be said to have reached saturation point), this work identifies spheres within the field of international business that barely take account of the role of family businesses (under-investigated topics). We identified six of these gaps in the previous section.

However, these under-investigated areas (gaps) are not independent of one another, but rather, are interrelated, as Fig. 2 shown. Considering family and firm as two separate institutions (Jaskiewicz et al., 2017), family is affected by national cultures (A) and therefore, its character, its reach, values and goals will vary between countries with different cultures, as will its influence on the entrepreneurial institution. From here, the family institution exerts its influence on the business through its participation in (B) the governance bodies (board of directors and management teams). This influence extends beyond the percentage of family members in these groups (saturated area); their participation in the firm's governing bodies affects (C) the objectives and aims of the business, (D) its risk attitude and (E) the type of networks and social capital that this type of firm will establish. Their values and objectives are linked to their attitude to risk and the international networks that are generated. All of these factors will eventually have an impact on (F) international decisions; some of these have already been widely investigated (how and when), while other areas still need to be developed (when) (Fig. 3).

The advance in these research fields faces a number of theoretical and empirical challenges. From the theoretical standpoint, the existing conceptual frameworks need to be improved. For example, while a reasonable consensus has been reached on the concept of family businesses (GEEF, 2007), the same cannot be said of the family itself. There are very few studies that have analyzed the family as an institution; its characteristics, such as size, embeddedness, harmony, culture, etc., and how these affect the firm that it controls. Up until now, the vast majority of investigations have focused on family members who participate in the governing bodies, but tend to ignore those who are not involved and, furthermore, those who are not the owners. Similarly, a proper investigation is needed into the socio-emotional and rational factors. Approaches such as SEW (Gómez-Mejía et al., 2007) include the role of the non-economic aspects of the firm's decision-making process, aspects that are also considered by the behavioral approaches to internationalization (Johanson & Vahlne, 1977, 1990). However, not all of the non-economic aspects have the same characteristics, nor should they be studied using the same unit of analysis. For example, while aversion to risk could be something that is common to all international businesses, the concept of SEW should be analyzed within the context of the owning family, as this will not be the same for a small exporter as for a large multinational corporation.

From the empirical point of view, the challenges lie in the study of the family in an international or global context, that is to say, in establishing methods that will enable the identification and measurement of the differences between owning families according to their national and cultural origins. Similarly, the implementation of identifying a family firm is still not standardized (Astrachan & Shanker, 2003; Bjuggren et al., 2011; IEF, 2015; Shanker & Astrachan, 1996). Although a few data bases of multinational family firms (Casillas & Pastor, 2015), have started to appear in recent years, they are far from being sufficiently developed to be of use in research. This makes it difficult to make comparisons between the countries of the sample firms or to carry out multicultural studies. Finally, a greater connection between investigators in different fields is required. As our review demonstrates, the majority of investigators are based in the field of family firms and their understanding of international business is limited, focusing primarily on the internationalization process. Researchers from the international business field need to introduce the family nature of the firm as a possible explanatory variable in their models and vice versa; family firm researchers must break into fields of international management and international business other than the internationalization process. In this work, we have shed some light on some of the possible intersections where fruitful dialogue may take place in the future. We are convinced that in time, new gaps will appear in the continual advances in our understanding of an ever-increasing reality: the family business in the international context.

FundingThis manuscript has been financed by Santander Family Business Chair of the University of Seville and the Ministry of Economy and Competitiveness (ECO2013-45329-R Project).

Conflict of interestI declare that I have no conflict of interest in this paper and it has not been sent to any other journal or conference. The paper is completely original.

| Abdellatif, M., Amann, B., & Jaussaud, J. (2010). Family versus nonfamily business: A comparison of international strategies. Journal of Family Business Strategy, 1, 108–116. |

| Acedo, F. J. Casillas, J. C., & Moreno, A. M. (2008). The internationalization of family business: an explanatory analysis. Management International, 12(1), 77–90. |

| Alkaabi, S. K., & Dixon, C. (2014). Factors affecting internationalization decision making in family, businesses: An integrated literature review. The Journal of Applied Management and Entrepreneurship, 19(2), 53–77. |

| Arregle, J. -L., Naldi, L., Nordqvist, M., & Hitt, M. A. (2012). Internationalization of family-controlled firms: A study of the effects of external involvement in governance. Entrepreneurship Theory and Practice, 36, 1115–1143. |

| Banalieva, E. R., & Eddleston, K. A. (2011). Home-region focus and performance of family firms: The role of family vs non-family leaders. Journal of International Business Studies, 42, 1060–1072. |

| Basly, S. (2007). The internationalization of family SME: An organizational learning and knowledge development perspective. Baltic Journal of Management, 2, 154–180. |

| Benito-Hernandez, S., Priede-Bergamini, T., & Lopez-Cozar-Navarro, C. (2014). Factors determining exportation and internationalization in family businesses: The importance of debt. South African Journal of Business Management, 45(1), 12–25. |

| Bhaumik, S. K., Driffield, N., & Pal, S. (2010). Does ownership structure of emerging-market firms affect their outward FDI? The case of the Indian automotive and pharmaceutical sectors, Journal of International Business Studies, 41, 437–450. |

| Bobillo, A. M., Rodríguez-Sanz, J. A., & Tejerina-Gaite, F. (2013). Shareholder Activism and Internationalization in the Family Firm. Journal of Business Economics and Management, 14(5), 867–885. |

| Boter, H. & Holmquist, C. (1996). Industry characteristics and internationalization processes in small firms. Journal of Business Venturing, 11, 471–487. |

| Boyd, B., Goto, T., & Hollensen, S. (2010). Internationalisation of family businesses—Evidences from joint venture formations at Danfoss. International Journal of Management Practice, 4, 253–272. |

| Brydon, K., & Dana, L. P. (2011). Globalisation and firm structure: Comparing a family-business and a corporate block holder in the New Zealand seafood industry. International Journal of Globalisation and Small Business, 4, 206–220. |

| Calabrò, A., & Mussolino, D., (2013). How do boards of directors contribute to family SME export intensity? The role of formal and informal governance mechanisms. Journal of Management Governance, 17, 363–403. |

| Calabrò, A., Mussolino, D., & Huse, M. (2009). The role of board of directors in the internationalization process of small and medium sized family businesses. International Journal of Globalisation and Small Business, 3, 393–411. |

| Calabrò, A., Torchia, M., Pukall, T., & Mussolino, D. (2012). The influence of ownership structure and board strategic involvement on international sales: The moderating effect of family involvement. International Business Review, 22, 509–523. |

| Carr, C., & Bateman, S. (2009). International strategy configurations of the world's top family firms. Management International Review, 49, 733–758. |

| Casillas, J. C., & Acedo, F. J. (2005). Internationalization of Spanish family SMEs: An analysis of family involvement. International Journal of Globalisation and Small Business, 1, 134–151. |

| Casillas, J. C., Moreno, A. M., & Acedo, F. J. (2010). Internationalization of family businesses: A theoretical model based on international entrepreneurship perspective. Global Management Journal, 2(2), 16–33. |

| Castagnoli, A. (2014). Across borders and beyond boundaries: How the Olivetti Company became a multinational. Business History, 56(8), 1281–1311. |

| Cerrato, D., & Piva, M. (2010). The internationalization of small and medium-sized enterprises: the effect of family management, human capital and foreign ownership. Journal of Management & Governance, 16, 617–644. |

| Cesinger, B., Bouncken, R., Fredrich, V., & Kraus, S. (2014). The alchemy of family enterprises’ internationalization: dexterous movers or prodigal laggards? European Journal of International Management, 8, 671–696. |

| Chen, H. L. (2011). Internationalization in Taiwanese family firms. Global Journal of Business Research, 5(4), 15–23. |

| Chen, H. L., Hsu, W. T., & Chang, C. Y. (2014). Family Ownership, Institutional Ownership, and Internationalization of SMEs. Journal of Small Business Management, 52(4), 771–789. |

| Cheong, K. C., Lee, P. P., & Lee, K. H. (2015). The internationalization of family firms: case histories of two Chinese overseas family firms. Business History, 57(6), 841–861. |

| Claver, E., Rienda, L., & Quer, D. (2007). The internationalization process in family firms: Choice of market entry strategies. Journal of General Management, 33(1), 1–14. |

| Claver, E., Rienda, L., & Quer, D. (2008). Family firms risk perception: Empirical evidence on the internationalization process. Journal of Small Business and Enterprise Development, 15, 457–471. |

| Claver, E., Rienda, L., & Quer, D. (2009). Family firms’ international commitment: The influence of family-related factors. Family Business Review, 22, 125–135. |

| Colli, A., García-Canal, E., & Guillén, M. (2013), Family character and international entrepreneurship: A historical comparison of Italian and Spanish ‘new multinationals’, Buisness History, 55(1), 119–138. |

| Crick, D., Bradshaw, R., & Chaudhry, S. (2006). “Successful” internationalizing UK family and non-family-owned firms: A comparative study. Journal of Small Business and Enterprise Development, 13, 498–512. |

| Davis, P. S., & Harveston, P. D. (2000). Internationalization and organizational growth: The impact of internet usage and technology involvement among entrepreneur led family businesses. Family Business Review, 13, 107–120. |

| Denicolai, S., Hagen, B., & Pisoni, A. (2015). Be international or be innovative? Be both? The role of the entrepreneurial profile. Journal of International Entrepreneurship, 13, 390–417. |

| Eberhard, M., & Craig, J. (2013). The evolving role of organizational and personal networks in international market venturing. Journal of World Business, 48, 385–397. |

| Erdener, C., & Shapiro, D. M. (2005). The internationalization of Chinese family enterprises and Dunning's eclectic MNE paradigm. Management and Organization Review, 3, 411–436. |

| Fernández, Z., & Nieto, M. J. (2005). Internationalization strategy of small and medium-sized family businesses: Some influential factors. Family Business Review, 18, 77–89. |

| Fernández, Z., & Nieto, M. J. (2006). Impact of ownership on the international involvement of SMEs. Journal of International Business Studies, 37, 340–351. |

| Fuentes-Lombardo, G., & Fernandez-Ortiz, R. (2010). Strategic alliances in the internationalization of family firms: An exploratory study on the Spanish wine industry. Advances in Management, 3(6), 45–54. |

| Gallo, M. A., & Pont, C. G. (1996). Important factors in family business internationalization. Family Business Review, 9, 45–59. |

| Gallo, M. A., & Sveen, J. (1991). Internationalizing the family business: Facilitating and restraining factors. Family Business Review, 4, 181–190. |

| George, G., Wiklund, J., & Zahra, S. A. (2005). Ownership and internationalization of small firms. Journal of Management, 31(2), 210–233. |

| Geppert, M., Dorrenbacher, C., Gammelgaard, J., & Taplin, I. (2013). Managerial Risk-taking in International Acquisitions in the Brewery Industry: Institutional and Ownership Influences Compared. British Journal of Management, 24, 316–332. |

| Graves, C., & Shan, Y. G. (2014). An Empirical Analysis of the Effect of Internationalization on the Performance of Unlisted Family and Nonfamily Firms in Australia. Family Business Review, 27(2), 142–160. |

| Graves, C., & Thomas, J. (2004). Internationalization of the family business: A longitudinal perspective. International Journal of Globalisation and Small Business, 1(1), 7–27. |

| Graves, C., & Thomas, J. (2006). Internationalization of Australian family businesses: A managerial capabilities perspective. Family Business Review, 19, 207–224. |

| Graves, C., & Thomas, J. (2008). Determinants of the internationalization pathways of family firms: An examination of family influence. Family Business Review, 21, 151–167. |

| Hiebl, M.R.W. (2015). Applying the four-eyes principle to management decisions in the manufacturing sector: Are large family firms one-eye blind? Management Research Review, 38(3), 264–282. |

| Holt, D. T. (2012). Strategic decisions within family firms: Understanding the controlling family's receptivity to internationalization. Entrepreneurship Theory and Practice, 36, 1145–1151. |

| Kontinen, T., & Ojala, A. (2010a). The internationalization of family businesses: A review of extant research. Journal of Family Business Strategy, 1, 97–107. |

| Kontinen, T., & Ojala, A. (2010b). Internationalization pathways of family SMEs: Psychic distance as a focal point. Journal of Small Business and Enterprise Development, 17, 437–454. |

| Kontinen, T., & Ojala, A. (2011a). International opportunity recognition among small and medium-sized family firms. Journal of Small Business Management, 49, 490–514. |

| Kontinen, T., & Ojala, A. (2011b). Network ties in the international opportunity recognition of family SMEs. International Business Review, 20, 440–453. |

| Kontinen, T., & Ojala, A. (2011c). Social capital in relation to the foreign market entry and post-entry operations of family SMEs. Journal of International Entrepreneurship, 9, 133–151. |

| Kontinen, T., & Ojala, A. (2012a). Internationalization pathways among family-owned SMEs. International Marketing Review, 29, 496–518. |

| Kontinen, T., & Ojala, A. (2012b). Social capital in the international operations of family SMEs. Journal of Small Business and Enterprise Development, 19(1), 39–55. |

| Kuo, A., Kao, M.-S., Chang, Y.-C., & Chiu, C.-F. (2012). The influence of international experience on entry mode choice: Difference between family and non-family firms. European Management Journal, 30, 248–263. |

| Kyvik, O, Saris, W., Bonet, E., & Felício, J. A. (2013): The internationalization of small firms: The relationship between the globalmindset and firms’ internationalization behavior. Journal of International Entrepreneurship, 11, 172–195. |

| Li, J. (2013). The internationalization of entrepreneurial firms from emerging economies: The roles of institutional transitions and market opportunities. Journal of International Entrepreneurship, 11(2), 158–171. |

| Liang, X. Y., Wang, L. H., & Cui, Z. Y. (2014). Chinese Private Firms and Internationalization Effects of Family Involvement in Management and Family Ownership. Family Business Review, 27(2) 126–141. |

| Lien, Y. C., & Filatotchev, I. (2015). Ownership characteristics as determinants of FDI location decisions in emerging economies. Journal of World Business, 50, 637–650. |

| Lin, W. T. (2012). Family ownership and internationalization processes: Internationalization pace, internationalization scope, and internationalization rhythm. European Management Journal, 30(1), 47–56. |

| Lin, W. T. (2014). Founder-key leaders, group-level decision teams, and the international expansion of business groups: Evidence from Taiwan. International Marketing Review, 31(2), 129–154. |

| Lu, J. W., Liang, X., Shan, M., & Liang, X. (2015). Internationalization and Performance of Chinese Family Firms: The Moderating Role of Corporate Governance. Management and Organization Review, 645–678. |

| Majocchi, A., & Strange, R. (2012). International Diversification The Impact of Ownership Structure, the Market for Corporate Control and Board Independence. Management International Review, 52(6), 879–900. |

| Menéndez-Requejo, S. (2005). Growth and internationalisation of family businesses. International Journal of Globalisation and Small Business, 1, 122–133. |

| Meneses, R., Coutinho, R., & Pinho, J. C., (2014). The impact of succession on family business internationalization. The successors’ perspective. Journal of Family Business Management, 4(1) 24–45. |

| Merino, F., Monreal-Perez, J., & Sanchez-Marin, G. (2015): Family SMEs’ Internationalization: Disentangling the Influence of Familiness on Spanish Firms’ Export Activity. Journal of Small Business Management, 53(4), 1164–1184. |

| Mitter, C., Duller, C., Feldbauer-Durstmuller, B., & Kraus S. (2014) Internationalization of family firms: the effect of ownership and governance. Review Management Science, 8, 1–28 |

| Moya, M. F. (2010). A family-owned publishing multinational: The Salvat company (1869–1988). Business History, 52, 453–470. |

| Muñoz-Bullón, F., & Sanchez-Bueno, M. J. (2011). Is there new evidence to show that product and international diversification influence SMEs’ performance? EuroMed Journal of Business, 6(1), 63–76. |

| Mustafa, M., & Chen, S. (2010). The strength of family networks in transnational immigrant entrepreneurship. Thunderbird International Business Review, 52(2), 97–106. |

| Okoroafo, S. C. (1999). Internationalization of family businesses: Evidence from northwest Ohio, U.S.A. Family Business Review, 12, 147–158. |

| Okoroafo, S. C., & Koh, A. C. (2010). Family businesses’ views on internationalization: Do they differ by generation? International Business Research, 3(1), 22–28. |

| Okoroafo, S. C., & Perryy, M. (2010). Generational perspectives of the export behavior of family businesses. International Journal of Economics and Finance, 2(3), 15–24. |

| Olivares-Mesa, A., & Cabrera-Suárez, K. (2006). Factors affecting the timing of the export development process: Does the family influence on the business make a difference? International Journal of Globalisation and Small Business, 1, 326–339. |

| Patel, V. K., Pieper, T. M., & Hair, J. F. (2012). The global family business: Challenges and drivers for cross-border growth. Business Horizons, 55, 231–239. |

| Pinho, J. C. (2007). The impact of ownership: Location-specific advantages and managerial characteristics on SME foreign entry mode choices. International Marketing Review, 24, 715–734. |

| Piva, E., & Rossi-Lamastra, C. (2013). Family firms and internationalization: An exploratory study on high-tech entrepreneurial ventures. Journal of International Entrepreneurship, 11(2), 108–129. |

| Plakoyiannaki, E.,Kampouri, A.P., Stavraki, G., & Kotzaivazoglou, I. (2014). Family business internationalization through a digital entry mode. Marketing Intelligence & Planning, 32(2), 190–207. |

| Procher, V. D., Urbig, D., & Volkmann, C. (2013): Time to BRIC it? Internationalization of European family firms in Europe, North America and the BRIC countries. Applied Economics Letters. |

| Puig, N., & Perez, P. F. (2009). A silent revolution: The internationalization of large Spanish family firms. Business History, 51, 462–483. |

| Pukall, T.J., & Calabro, A. (2014). The Internationalization of Family Firms: A Critical Review and Integrative Model. Family Business Review, 27(2), 103–125. |

| Roida, H. Y., & Sunarjanto, N. A. (2012). Family ownership type and the international involvement of SMEs: Empirical study of agency theory in East Java Indonesia. Chinese Business Review, 11, 224–232. |

| Sanchez-Bueno, M. J, & Usero, B. (2014): How may the nature of family firms explain the decisions concerning international diversification? Journal of Business Research, 67, 1311–1320. |

| Sciascia, S., Mazzola, P., Astrachan, J. H., & Pieper, T. M. (2013). Family involvement in the board of directors: Effects on sales internationalization. Journal of Small Business Management, 51(1), 83–99. |

| Sciascia, S., Mazzola, P., Astrachan, J. H., & Pieper, T. M. (2012). The role of family ownership in international entrepreneurship: Exploring nonlinear effects. Small Business Economics, 38(1), 15–31. |

| Segaro, E. (2010). Internationalization of family SMEs: The impact of ownership, governance, and top management team. Journal of Management & Governance, 14(1), 1–23. |

| Segaro, E. (2012). Internationalization of family SMEs: The impact of ownership, governance, and top management team. Journal of Management and Governance, 16(1), 147–169. |

| Segaro, E., Larimo, J., & Jones, M. V. (2014). Internationalization of family small and medium sized enterprises: The role of stewardship orientation, family commitment culture and top management team. International Business Review, 23, 381–395. |

| Shapiro, D. M., Gedajlovic, E., & Erdener, C. (2003). The Chinese family firm as a multinational enterprise. International Journal of Organizational Analysis, 11, 105–122. |

| Singla, C., Veliyath, R., & George, R. (2014). Family firms and Internationalization-governance Relationships: evidence of secondary Agency issues. Strategic Management Journal, 35, 606–616. |

| Sundaramurthy, C., & Dean, M. A. (2008). Family businesses’ openness to external influence and international sales: An empirical examination. Multinational Business Review, 16, 89–106. |

| Swinth, R. L., & Vinton, K. L. (1993). Do family-owned businesses have a strategic advantage in international joint ventures? Family Business Review, 6, 19–30. |

| Swoboda, B., & Olejnik, E. (2013). A taxonomy of small and medium-sized international family firms. Journal of International Entrepreneurship, 11, 130–157. |

| Thomas, J., & Graves, C. (2005). Internationalization of the family firm: The contribution of an entrepreneurial orientation. Journal of Business and Entrepreneurship, 17, 91–113. |

| Tsang, E. W. K. (2001). Internationalizing the family firm: A case study of a Chinese family business. Journal of Small Business Management, 39(1), 88–94. |

| Tsang, E. W. K. (2002). Learning from overseas venturing experience: The case of Chinese family businesses. Journal of Business Venturing, 17(1), 21–40. |

| Tsao, S. M., & Lien, W. H. (2013). Family Management and Internationalization: The Impact on Firm Performance and Innovation. Management International Review, 53, 189–213. |

| Yang, N. (2012). Small business and international entrepreneurship in the economic hard time: A global strategic perspective. International Journal of Entrepreneurship, 16, 113–131. |

| Yang, Y. H. (2014). An Investigation of the Business Performance and Manager Compensation of Taiwanese Non-Family-Controlled and Family-Controlled International Businesses. International Journal of Economics and Finance, 5(12), 12–23. |

| Yeoh, P. L. (2014). Internationalization and Performance Outcomes of Entrepreneurial Family SMEs: The Role of Outside CEOs, Technology Sourcing, and Innovation. Thunderbird International Business Review, 56(1), 77–96. |

| Yeung, H. W. C. (2000). Limits to the growth of family-owned business? The case of Chinese transnational corporations from Hong Kong. Family Business Review, 13, 55–70. |

| Yunshi, L., Lin, W. T., & Kuei-Yang, C. (2011). Family ownership and the international involvement of Taiwan's high-technology firms: The moderating effect of high-discretion organizational slack. Management & Organization Review, 7, 201–222. |

| Zahra, S. A. (2003). International expansion of U.S. manufacturing family businesses: The effect of ownership and involvement. Journal of Business Venturing, 18, 495–512. |