Severance pay, a fixed-sum payment to workers at job separation, has been the focus of intense policy concern for the last several decades, but much of this concern is unearned. The design of the ideal separation package is outlined and severance pay emerges as a natural component of job displacement insurance packages, serving both as scheduled reemployment wage insurance and, if search moral hazard is a problem, as scheduled UI. Like any firm-financed separation expenditure, severance pay can induce excessive job retention, but such distortions do not appear to be of practical significance at benefit levels typically mandated in the industrialized world. Moreover there is no evidence that firms attempt to avoid these firing cost distortions by substituting severance savings plans, which have zero firing costs. Indeed severance insurance plans similar to those mandated are often offered voluntarily in the U.S. The appropriate role of government in the market for severance pay is briefly considered.

La indemnización por despido, el pago de una suma fija a trabajadores cuando pierden su trabajo, ha sido el foco de una intensa preocupación política en las últimas décadas, aunque gran parte de esta preocupación no está justificada. Se describe el diseño del paquete ideal de despido y la indemnización por despido aparece como un componente natural de los paquetes de seguros por pérdida de empleo, sirviendo tanto como seguro salarial programado de reintegración al trabajo como, en caso de que el riesgo moral de búsqueda sea un problema, seguro de desempleo programado. Como cualquier pago por despido financiado por la empresa, la indemnización por despido puede dar lugar a una conservación del trabajo excesiva, aunque estas deformaciones no parecen tener una significación práctica en los niveles de beneficios típicamente exigidos en el mundo industrializado. Además, no hay pruebas de que las empresas traten de eludir estas deformaciones de los costes por despido sustituyendo planes de ahorro de indemnizaciones, que no conllevan ningún coste por despido. De hecho, a menudo en los Estados Unidos se ofrecen de manera voluntaria planes de seguros por despido similares a los exigidos. Se plantea brevemente la función adecuada del Gobierno en el mercado para la indemnización por despido.

The last twenty years have witnessed intense concerns about severance pay distortions, often labeled “firing cost” distortions.1 Among the influential early calls of concern was Blanchard et al. (1986). Concern turned to alarm when Lazear (1990) published a piece that appeared to confirm the pervasive, negative effect of severance pay on the performance of national labor markets.2

Policy skepticism of severance pay may simply reflect an unfortunate coincidence of high unemployment and widely mandated severance pay in Western Europe that prevailed in the 1980s.3 A more careful reading of Lazear (1990) and exhaustive follow-up studies by Addison et al. (2000) and Addison and Teixeira (2003), among others, allayed the worst fears about this distortion. In retrospect the idea that such a modest fringe benefit could drive national labor markets seems a bit fanciful. The subsequent literature turned to a broader policy villain—Employment Protection Legislation (EPL), Emerson (1988) and OECD (1999, 2004, 2006)—and yet more extensive economic regulations. Unfortunately the early, if perhaps misdirected, focus on severance pay distortions has diverted attention from the ideal design of severance pay plans and their benefits.

The net benefits of severance plans may be substantial, as revealed by the existence of private severance pay plans in the United States, which has no national severance mandate, Parsons (2005a,b,c). Voluntary plans have the same “firing cost” implications as do mandated ones—the key is the firm's self-finance of the separation cost—but the distortions do not discourage voluntary provision. Although these voluntary benefit schemes are not overly generous—one week or two weeks of pay per year of service is common, Parsons (2005c)—many mandated plans worldwide have just this algorithm, Holzmann et al. (2012).

Severance pay has much to recommend it, and in this essay I consider the benefits as well as the costs of severance pay in light of research since the 1980s. In the process of assessing the social value of severance pay, the role of severance pay in the ideal job displacement insurance package is outlined. The optimal design of such programs will differ significantly across economies, industrial sectors, and worker job skills. The question of the proper role of the state in the provision of severance pay is also considered.

The paper proceeds as follows. In the next section, a few key definitions are introduced. The role of severance pay in job displacement insurance is then outlined in Section 3. Job displacement insurance is a vector of benefits designed to smooth consumption following permanent layoff, especially from a long-held job.4 In the first-best job displacement insurance plan, unemployment benefits compensate laid-off workers for the lost earnings during job search, while wage insurance compensates them for reemployment earnings losses.5 Severance serves as scheduled wage insurance if the administrative costs of actual loss wage insurance are high. If (search) moral hazard limits unemployment insurance benefits, then severance may serve as scheduled unemployment insurance as well.6

Fixed-sum payouts, unaffected by actual loss experiences, give the insured no reason to incur unnecessary lost worktime—indeed that is just the reason that severance benefits may be substituted for unemployment insurance benefits. But any expenditure has its relevant margin, which in this case is the layoff decision itself. Firm-financed severance pay may encourage employers to retain in low demand states workers who they might otherwise layoff—the firing cost effect, Section 4. As it happens, if firing cost distortions are large, the firm can “contract around” the mandate, Lazear (1990). Lazear illustrates this avoidance process, using a single period model with an upfront bond paid by the worker, but a more familiar mechanism would be a savings account, in this case a severance savings account payable at separation, Section 5. The absence of this sort of substitution provides indirect evidence of the limited importance of firing cost concerns.

The paper turns in Section 6 to consideration of the direct empirical evidence on “firing cost” effects on aggregate employment, unemployment, and related labor market phenomenon. Briefly summarizing the section—there is no serious evidence that severance pay per se negatively affects aggregate labor market functioning, Parsons (2012a). Another piece of evidence for the same conclusion, the existence of voluntary severance insurance plans in the U.S., is discussed in Section 7. With voluntary severance plans as background, potentially useful governmental interventions are considered in Section 8. Parallels are drawn with government interventions in support of firm-provided pension plans in the U.S. The question of whether severance plans should be mandated is also considered, given the pervasiveness of the practice internationally.

Section 9 digresses from the central theme of this review to raise one cautionary note—severance pay has an alternative use, as a tool in the struggle for workplace control between the firm and worker which might have substantial productivity effects. Shop-floor discipline (as it might be labeled in an earlier, industrial setting) is crucial to efficient management, and can be eroded with appropriate severance pay design. A severance package designed to encourage worker retention is likely to look quite different from one designed for insurance purposes, and is likely to be accompanied by direct retention impediments. Section 10 draws a few conclusions from this review.

2Some definitionsJob turnover distinctions are important in the job displacement insurance plans. Consider the following partition of job separations,

- (i)

Quits (employee-initiated job separation);

- (ii)

Layoffs (employer-initiated job separations without cause);

- (iii)

Discharges (employer-initiated job separations with cause), and

- (iv)

Other, including most prominently retirement.

Employee-initiated and employer-initiated separations are often referred to as voluntary and involuntary respectively (from the perspective of the worker). Each of these separations may be treated differently in unemployment insurance programs and severance plans. The distinction between temporary and permanent layoffs is also important. Job displacement of course refers to permanent employer-initiated job separations. Temporary layoffs, common in the United States, are employer-initiated job separations that are expected to result in rehire, often after a known time period. Permanent layoffs carry no such expectations.7

Possible programs to smooth consumption at job separation come in a variety of forms. Consider the following program types:

Unemployment insurance. Separation payments linked to the worker's post-separation unemployment experience. These are typically periodic payments more or less coincident with the unfolding unemployment.

Wage insurance. Separation payments linked to the worker's reemployment wage losses. If hours are stable, this is a form of wage rate insurance.

Severance insurance. Fixed-sum separation payments (in excess of accrued wages, vacations, and accrued leave) that do not depend on the worker's actual post-separation experience. These may be lump-sum or periodic payments.

Savings accounts.8 These involve contributions to an explicit worker asset account that can be disbursed to the worker under a variety of conditions. Common payout restrictions define the following four types of funds:

Severance. Involuntary job separation or retirement are permissible disbursement contingencies.

Unemployment. Involuntary job separation and unemployment are common permissible disbursement contingencies. Disbursement may be periodic, more or less coincident with the unfolding unemployment.

Retirement (pensions). Retirement is the permissible disbursement contingency.

Comprehensive (provident funds). Admit a broad range of permissible disbursement contingencies—job separation/unemployment, disability, retirement, and possibly house purchase or educational finance. Separation from the firm is not required.

The lines between these definitions are often blurred, and considerable care must be taken in assessing the individual characteristics of each plan. For example, unemployment insurance programs are equivalent to severance pay plans with periodic payments if most laid off workers “exhaust” their benefits. Tracking a separated worker's unemployment experience is difficult in highly developed economies with small informal sectors, and is often infeasible in economies with a large informal sectors and a substantial small-farm agricultural sector. In this case, severance pay will be the primary job displacement insurance element.

The distinction between severance savings accounts, which target job separation and/or retirement pensions, and pensions, which theoretically target only retirement needs, is also likely to blur in practice. In the United States, for example, workers can put resources into a tax-deferred retirement savings account, most prominently 401(k) plans. If the worker separates from the employer, she may choose to roll-over the account into an alternative plan or she can withdraw the funds for current use.9 The worker faces substantial economic penalties if she withdraws the funds—the funds are taxed as regular income and the worker is assessed a 10% penalty. The introduction of economic penalties for withdrawal generates a continuum of possible combinations of severance savings accounts and pensions, with zero sanctions creating a “pure” severance savings account, and prohibitive sanctions a pure pension.

Similarly the distinction between severance insurance plans and severance savings plans depends critically on the question of whether the separated worker retains rights to the account at retirement or voluntary departure (quits), Parsons (2012b). Practically the distinction varies in importance with the nature of turnover. If involuntary turnover is high, for example, and the worker is unlikely to remain with the firm into retirement, then the two plans are essentially equivalent—severance insurance plans.

3Severance pay and job displacement insurance: the fundamentalsWorkers face many threats to their earnings. One serious concern, perhaps second only to the early onset of a serious disability, is the loss of a long time job (job displacement). A large literature establishes that displaced senior workers often experience long unemployment spells and lower wages upon reemployment.10 Complete insurance would require either guaranteed employment or a layoff contract with

- (i)

unemployment insurance and

- (ii)

wage insurance

Layoff contracts will be preferred if negative demand shocks are large and the alternatives to current employment attractive, Azariadis (1975) and Parsons (2012c). The balance between guaranteed employment and layoff is also affected by the inability or unwillingness of firms (or governments) to supply appropriate job displacement insurance.

In a market in which unemployment and wage insurance are efficiently provided, fixed-sum severance payments are unnecessary. Severance pay—a payout whose value is fixed at the time of separation—arises optimally only when one or both of the two primary instruments are absent or limited. If (actual loss) wage insurance is unavailable, perhaps because of high administrative costs,11 severance benefits are essentially scheduled wage loss benefits and may in the right circumstance be a satisfactory alternative. Most labor economists believe that unemployment insurance benefits based on actual unemployment spells are distortionary, inducing search moral hazard, although there is much debate over the magnitude of this effect. The concern is that the worker may prefer to remain on unemployed benefits rather than seek and/or accept reemployment job offers.12 If these concerns limit unemployment benefits, severance pay may serve as scheduled (if partial) unemployment insurance, with the fixed sum element reducing search distortions. Severance pay then serves two functions:

- (i)

as scheduled, rather than actual-loss based, wage insurance, and

- (ii)

as a scheduled supplement to actual-loss based unemployment insurance constrained by search moral hazard concerns.

These considerations shape severance plans in obvious ways. For example, severance benefit schedules, whether mandatory or voluntary, are almost always increasing in seniority Holzmann et al. (2012) and Parsons (2005c) respectively. This is the logical consequence of the scheduled wage insurance dimension of severance pay. The job displacement loss literature provides ample evidence for the common belief that earnings losses are larger for workers with long seniority. Both mandated and voluntary plans incorporate that loss profile in simple ways, usually a linear algorithm with a benefit structure that offers one or two “weeks of pay” per year of service.13

Scheduled insurance benefits, even after this seniority adjustment, are likely to be imperfect in their targeting. Some displaced workers will be undercompensated, others overcompensated, and it is important to assess the size of this inefficiency. The main concern expressed in the firing cost literature, however, is quite another. If the firm self-finances severance benefits, then layoff moral hazard may emerge—firms may excessively retain redundant workers in a downturn. Inefficient retention of workers in downturns in turn is likely to smooth employment over the business cycle. This inefficiency and the implied higher labor costs,may lower average employment.14 This issue is discussed further in the next section.

4Firing cost concernsAn extensive literature raises concerns about the potential layoff distortions induced by the mandating of employer-financed severance plans (firing costs). That said, it is important to emphasize that firing cost concerns arise from financing considerations, not from the design of the benefits, Parsons (2012d). In that sense, the link between severance pay and firing costs may be an historical accident. Most of the OECD countries that were the focus of early discussions mandated that the firm provide the separation benefit, with financing then falling entirely on the firm. The same countries operated and funded unemployment insurance quite differently—plans were not “experience rated,” which is to say firms did not get charged for the benefits paid out to their own separated workers, so the firm has no program-related incentive to avoid layoffs.

Clearly other systems are possible, and indeed the U.S. unemployment insurance system has embedded within it substantial experience rating. As a rule of thumb, one might assume that U.S. firms are charged for 50% of the unemployment benefits distributed to their own laid off workers. Firms are responsible for 100% of their voluntary severance benefits. In the U.S. then expected firing costs, critical for the retention decision, would be the sum of severance pay and 50% of expected unemployment benefits. The typical severance benefit algorithm has benefits as an increasing, often linearly increasing, function of seniority. Combined with the common practice of last-in first-out layoff queues, this policy insures that severance-based firing costs for the marginal worker are likely to be small, so firing costs in the U.S. are dominated by unemployment-insurance.

The proximate distortion induced by firing costs is of course excessive retention of workers in low demand periods. Labor hoarding is of course common in all firms, especially those in product markets characterized by small demand shocks. More generally worker retention in a downturn is likely to be a (negative) function of the probability of securing an attractive job if laid off or, failing that, the worker's valuation of leisure in unemployment, Azariadis (1975) and Parsons (2012d). Firing costs disturb this balance, and induce firms to keep workers inefficiently in more severe downturns.

The inefficient retention of workers in low demand times by definition reduces firm productivity. The economic distortions highlighted in the early firing cost literature—high unemployment rates, low employment rates, etc.—are less certain implications of high firing costs. Its impact on employment depends on the flexibility of wages and the nature of supply responses to variations in wages, while its impact on unemployment is yet harder to predict (because it is model specific). Elegant dynamic models, Bentolila and Bertola (1990) and Bertola (1990, 1992), illustrate that it is at least possible for firing costs to have negative employment effects. In his comprehensive review of this literature, however, Bertola (1999) appears to encourage the reader to look elsewhere, especially at wage policies, to explain labor market dysfunctions.

Distributional implications are more direct. Excessive retention of workers in low demand times will moderate job turnover across the business cycle, favoring those with jobs and penalizing those without, more notably new entrants (the young). The old-young distributional concern is potentially accentuated by the insurance structure of severance pay, Pagés and Montenegro (2007). As noted earlier, the weeks-of-pay per year of service algorithm has firms paying only modest benefits to low tenured workers (the young) and much more to high tenured workers.15 Clearly there are two views on the social value of this reallocation.

5Mandated severance pay and firm avoidance strategiesAn oddity of the early firing cost literature is that one of the papers that fueled concern about firing cost distortions of severance mandates, Lazear (1990), contained a simple model that illustrated the ease of avoiding them. Lazear demonstrated that severance mandates can be “contracted around” by having the firm require that the worker post a bond at the beginning of a work period, which is then returned to the worker at the end of the period—either as a result of an involuntary job separation, satisfying the severance mandate, or not. By paying the benefit to those retained as well as those laid off, any artificial advantage from retaining a worker in bad times is eliminated. Firing costs in this case are the difference between the payouts to those laid off and the payouts to those retained, or zero.

Explicit bonding in the labor market is not common, which may explain why empirical work on severance pay distortions continued,16 but the same end can be reached by more familiar means. The firm need only convert the mandated severance insurance payout into a severance savings plan or pension, payable at departure from the firm. Although workers in this case would get benefits only upon permanent separation, undistributed benefits would accrue to the workers’ accounts. The firm paying out severance at layoff incurs a cost, but this is offset by an equal and opposite reduction in its future liabilities (expected payouts), Parsons (2012b). Indeed the firm may not hold the savings at all, but assign it to a third party, presumably a financial intermediary. In this case, the firm's only involvement with the job separation payout is to certify the existence of the event.

There is little evidence of such avoidance strategies, which suggests that firing cost distortions are modest, though not necessarily zero. Lazear mentions the financial costs, with the worker having difficulty financing the upfront bond. Presumably firm-provided savings plans are funded by foregone earnings, but the earnings offset may be less than dollar for dollar if workers are liquidity constrained or myopic.

Of course, avoidance behaviors are appropriate only if the firm does not value the benefit. As we shall see shortly, Section 7, voluntary severance pay is common in the United States where severance benefits are not mandated. Indeed the benefit algorithm in firms where benefits are voluntarily offered is comparable to that under many OECD severance mandates, which suggests that the firm believes it is profitable for it to offer the insurance, so avoidance is not an issue. That does not mean that firing cost distortions do not exist—the potential distortion arises whenever separation benefits are firm-financed—but that the effects are probably not large.

U.S. firms that offer severance pay almost universally provide severance insurance, not severance savings plans, which again suggests that firing cost distortions are not large. This preference is perhaps not surprising following passage of the Employee Retirement Income Security Act (ERISA) of 1974, which placed pensions and pension-like plans such as severance savings plans under rather stringent and costly regulation. The policy preference for severance insurance predates ERISA however and indeed held even in the early years of formal plans, the 1930s, Parsons (2005a,b).

6Severance pay distortions: the empirical recordA critical review of the extensive empirical literature on mandate effects supports that interpretation. Severance mandates, unaccompanied by other labor regulations, appear to have little impact on worker separations (or accessions) or average employment levels, the target most often considered in the firing cost literature. This conclusion is not always apparent in individual studies, because sufficiently broad interventions in the economy do have substantial negative consequences. The challenge is to disentangle the effects of these more substantial policies from that of a single component, severance pay generosity. A serious impediment to empirical analysis of severance mandate effects is that changes in mandate requirements are typically embedded in broad policy “reforms,” making the identification of severance policy consequences impossible. Employment Protection Legislation (EPL), for example, is a vector of policy instruments, only one of which is job displacement insurance.17

I have undertaken a detailed review of the firing cost literature elsewhere, Parsons (2012a). As I note there, “Evidence of adverse efficiency effects of government interventions is most compelling when the range of interventions is large” (p. 149), examples of this abound. Comprehensive government intervention in the economy—heavy tariffs, highly regulated product and factor markets, including capital controls and capital market restrictions as well as those in the labor market—have large, negative effects on the labor market, while broad economic “reforms” easing these restrictions yield large, positive gains. Similarly broad labor regulations, especially with regard to collective bargaining and dispute resolution, may have large (negative) consequences on labor force aggregates and the economy.18

As the package of simultaneous policy changes narrows, so do the consequences. Employment Protection Legislation (EPL)—a combination of severance pay mandates, advance notice mandates, and limits on disciplinary discharges—appears to have substantial, negative (and verifiable) effects only on worker separations and accessions, and therefore aggregate turnover. Reflecting the EPL effects on turnover, evidence of EPL distributional consequences is robust. EPL restrictions make permanent contracts more difficult for new workers to secure, which favors “prime age” men at the expense, most consistently, of the young and the low skilled, and, in some circumstances, women and older workers.

The few studies that credibly isolate variations in severance pay alone provide scant reason for concern. Even large benefit mandates appear to have only slight firing cost effects, although large benefit mandates are observed only in developing economies where enforcement is likely to be weak. See below Section 8. The lesson for job displacement insurance designers is that indirect mandate effects of severance pay are modest over the range observed in industrialized economies. Within some reasonable bounds, benefit generosity can apparently be set by the worker's demand for the insurance coverage without concern for moral hazard effects. That said, a variety of results point toward workplace control issues, including the employer's ability to release unsatisfactory workers, and collective bargaining rules, as an important concern.19

7Voluntary severance pay: a profileAlthough the large expected losses from permanent job displacement are well-documented, much less is known about the nature of severance pay, the primary insurance plan designed to mitigate those losses. Private severance pay is widespread in the U.S. economy, a logical response to the potentially large losses that senior, permanently displaced workers suffer.20 In 2001, one-quarter (26%) of the full-time workforce was covered by a formal severance plan, with large differentials by occupation, work hours status, firm size, and industrial sector. Occupationally, 42% of full-time professionals and administrators were covered, but only 29% of clerical and sales workers, and 16% of blue-collar and service workers. Establishment size is also a powerful factor, with about 36% of all full-time workers in medium and large establishments (one hundred or more employees) covered, but only 16% of small establishments.21

By sector, total severance coverage in 2001 was as high in the goods-sector as in the service-sector, although that is misleading because the goods-sector employs a disproportionate share of low-coverage blue-collar workers, and relatively fewer clerical/sales and administrative/professional workers. Within occupations, coverage was substantially higher in the goods-sector for all but blue collar/service workers, and was especially so in medium and large establishments. In medium and large establishments, almost two-thirds (65%) of full-time administrative/professional workers in the goods-producing sector were covered, compared to less than one half (48%) in the service-producing sector.

Data on the generosity of benefits when offered is less than ideal. Public sources provide little evidence on severance plan structure, despite the fact that one-quarter of the U.S. work force has such coverage. The BLS, for example, has never systematically collect information on severance plan design, and in 2006 stopped collecting information on the presence of a severance plan in its National Compensation Survey. Major collective bargaining agreements, which are available from the BLS, provide a reliable data source, but only for a small and shrinking share of the labor force, and tabulations of contract characteristics from the raw files are costly.

The absence of reliable government data on the structure of severance plans has induced a variety of private efforts, including ambitious surveys by the National Industrial Conference Board Right Associates/Right Management Consultants, and Lee Hecht Harrison, among others, Parsons (2005a,b). These private studies are/were designed to inform human-resource-sensitive companies about severance pay practices in similarly structured firms, not to provide policy makers with a description of the labor market. They are, by their nature, less transparent in their methodologies and less universal in their sample frames, and the raw data may be proprietary.

Despite the apparent methodological variations in the private studies, a consistent picture of voluntary severance benefit generosity emerges. The private severance system, unlike the U.S. public unemployment system, targets permanently displaced workers, not those on temporary layoff, and the basic benefit algorithm is broadly consistent with what is known of job displacement losses. For those eligible, benefits are offered at the time of displacement in proportion to the worker's weekly wage and years of service.

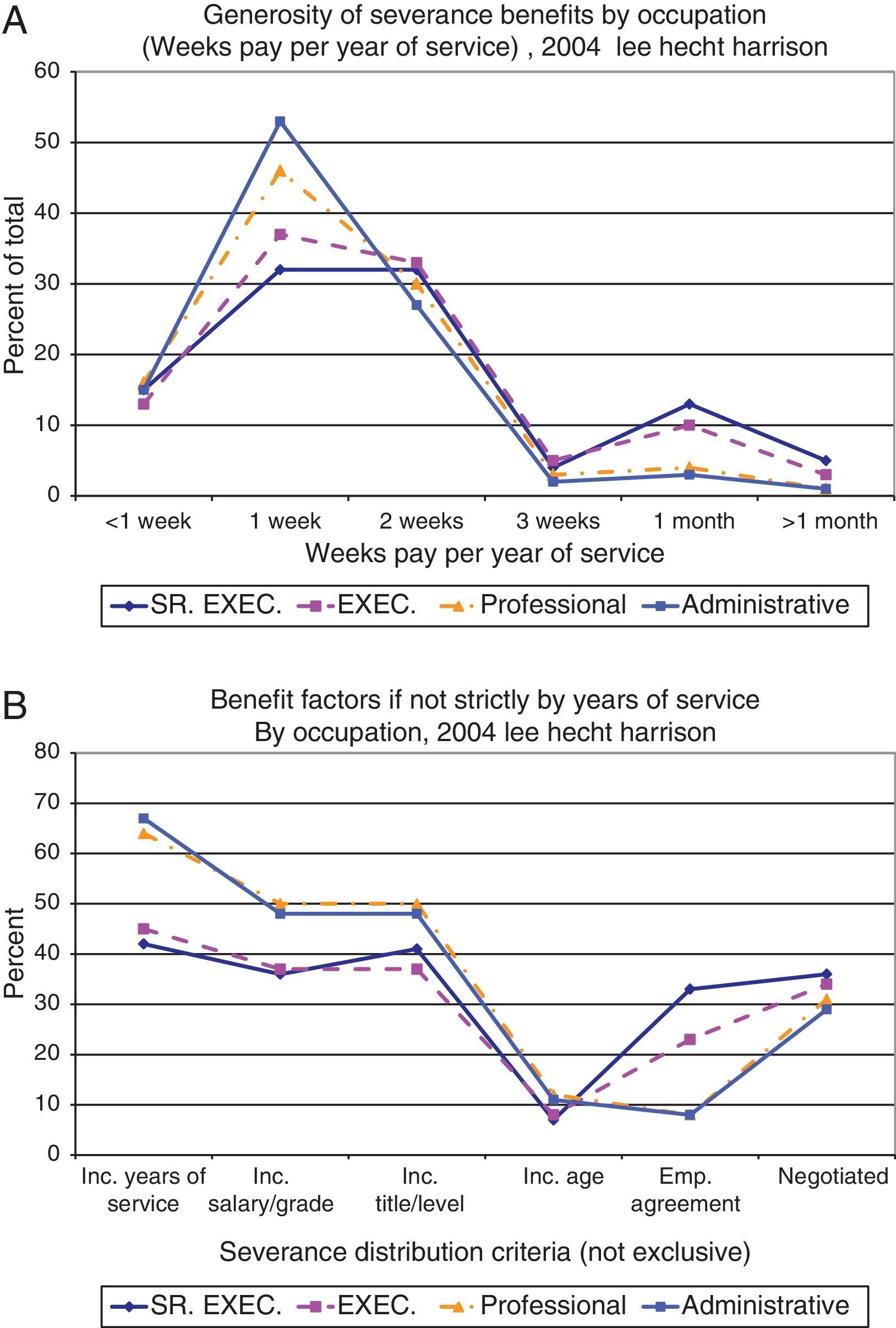

To take one example.Lee Hecht Harrison, a management consulting firm, conducted an ambitious survey of senior HR executives at U.S organizations about their severance plans in 2004, and received 925 completed surveys, Lee Hecht Harrison (2005, pp. 1–2). Most organizations offered some form of severance benefits and of those that did, benefit algorithms differed by occupation. Approximately 70% offered benefit schedules to professional (managerial) and administrative staff that were strictly based on years of service, 69% and 73% respectively. Benefit algorithms for senior executives ad executives were likely to be less rigid, with only 33% and 41% respectively reporting a strict years of service formula.22

Among those whose benefits were determined strictly by years of service, one week of pay per year of service was about as common as two weeks among executives, while among professionals (managers and their staff) and administrative staff it was distinctly less common, Fig. 1, Panel A. The alternative algorithms when benefits were not strictly related to years of service also varied sharply across the two groups. Among professionals and administrative staff, two-thirds contained years-of-service as one part of a mix of criteria. Among executives, benefits determined by their employment contracts, presumably at hire, were common, Fig. 1, Panel B.

Neither the benefit structure nor the generosity of these voluntary severance plans is markedly different in structure or generosity from plans mandated in other OECD countries. For example benefits increase more or less linearly in seniority. Holzmann et al. (2012) have compiled a detailed compendium of country mandates, and the relationship between mandated benefits at four years and those at twenty are illustrated in Fig. 2A (for OECD countries with mandates and reported benefits at the two service levels). A simple regression of mandated benefits at 20 years of service on benefits at 4 (illustrated in the trend line of the figure) reveals an intercept of 1.715 with a standard error of 1.142 and a coefficient on benefits at 4 years of 3.237 with a standard error of 0.595 with 22 observations; about 60% of the variation in benefits at 20 years of service can be explained by benefit mandates at 4 years R2=0.597.

The common benefit schedule of 1-weeks pay per year of service is also similar to the mandated benefits in many other OECD countries, Fig. 2B. More than a third (8 of 22) mandate benefits that average less than one week per year of service over twenty years. The great bulk of the remainder fall within the one to two weeks of pay interval common in voluntary plans in the U.S. Only Israel, South Korea, Portugal, and Turkey are sharp (positive) outliers.

A variety of countries, largely developing countries, have from time to time mandated benefits sharply higher than these. Abidoye et al. (2008, p. 6) for example report that in 2002, “a Sri Lanken worker with 20 years of service received an average severance package equal to 29 months of wages…”). They assessed the impact of this extraordinary mandate on employment growth by firm size and sector--firms with fewer than fifteen workers were legally exempt as were firms in export processing zonesdue to the laxity of enforcement. These set up a difference-in-difference approach to employment growth rates (measured as the fraction of firms that expanded employment). They found only modest and sometimes perverse effects of these immodest mandates. One might conclude that the regulations were not systematically enforced.

8Severance pay: designing a public strategyGovernment involvement in unemployment insurance plans is extensive, with governments typically both designing and operating plans. Government involvement in severance plans has been much more limited, mandating that firms provide a specified level of coverage. In a number of large economies, notably the U.S. and Canada, even that modest intervention is largely absent.

The exceptions do raise the natural question of whether governments should be involved in the provision of severance pay, and if so how. Government intervention in a sector of the economy is often rationalized by one of two arguments,

- (i)

that there is a “missing market,” perhaps because of some failure of property rights or information asymmetry, or

- (ii)

the market exists, but workers are not competent to make their own choices on the issue.

If the former, the government might play a useful role in supporting the market by encouraging or supplying elements required to have the market function appropriately. If the latter, the government, either directly or through incentives, must override worker decisions that it believes are made poorly. The latter explains for instance the widespread existence of mandatory retirement income plans, essentially forced savings, even in highly developed economies which have no shortage of secure savings vehicles.23

The missing market argument seems implausible with severance pay, which is a relatively simple instrument, requiring only the payout of a fixed-sum, often in lump-sum form, at the time of (involuntary) separation. Presumably severance has emerged voluntarily because of this administrative simplicity. Contrast this with the complexity of (actual loss) unemployment insurance or wage insurance. For the employing firm to credibly offer either of these, it must monitor the behavior of workers long after they have separated from the firm. Is the laid off worker in fact still unemployed, and, if reemployed (elsewhere), at what wages and hours? Even governments have not embraced the second task.

That is not to say that problems do not arise in the voluntary severance “market.” A major concern is that the firm may not pay benefits as promised at the time of involuntary separation or may not be able to do so because of bankruptcy, Parsons (2011). Bankruptcy is not a negligible prospect when, as in a severance pay plan, large payouts often occur when the firm is under serious stress.If a firm continues to operate, need it make good on severance promises, and how can that be secured? If the firm goes bankrupt, bankruptcy law lays out how remaining resources are allocated among rival claimants.

Markets have ways of dealing with the nonperformance issue beyond simply accepting the risk. Firms may reinsure with third parties, which is not uncommon for fringe benefits such as life or health insurance. The reinsurance approach is limited for severance insurance because the firm is both purchasing the insurance and determining whether the insured event will occur. A third-party insurer will naturally be wary of adverse selection, much as it would if offering a life insurance policy with suicide a covered event.

An alternative mechanism is to provide dedicated reserves against losses. This is an expensive proposition in the absence of pooling (reinsurance), essentially a savings plan with the asset reverting to the firm if the worker leaves the firm through quit or retirement. Growing firms especially are chronically short on capital and having accumulated assets sitting in an escrow account to guarantee payment of severance is not likely to be attractive to employers. The legal status of such escrow accounts in bankruptcy also must be defined.

The nonperformance problem is not unique to severance pay. Concerns about nonperformance of pension promises in the United States led to passage of the Employee Retirement Income Security Act of 1974, which dealt broadly with the firm's performance of fringe benefit promises. Pensions, much the largest fringe benefit in financial magnitude, received special status. As part of ERISA, the Pension Benefit Guarantee Corporation (PBGC) was established to insure faithful payments of retirement benefit promises. Not only is the PBGC given broad oversight of pension management and related fiduciary responsibilities, it operates a bankruptcy protection fund, which collects premiums and pays out benefits, perhaps only partial if benefits are especially generous, if the firm becomes insolvent.

The combination of a guarantee fund and relatively strict regulatory oversight surely increased pension performance rates, but did so at a cost. The fiduciary responsibilities for defined benefit plans, which promise benefits based on earnings while working, are especially heavy, and administrative costs under ERISA correspondingly high. The cost burden led to the rapid decline of defined benefit plans—plans that based benefits on some combination of the worker's history of earnings with the firm, Parsons (1991) and Bloom and Freeman (1992). Retirement savings plans (defined contribution plans) have emerged as a low cost alternative, but lack many attractive features of defined benefit plans.24

It is natural to speculate that voluntary severance pay coverage would also shrink if ERISA protections were extended to severance pay plans. As a theoretical issue, this conclusion is unclear. With secure funding and guaranteed benefits, the worker might be more willing to forego current earnings if offered a severance plan. That has not been the case in the pension market, however. The history of pension regulation seems to make clear that firms will offer less generous programs, and perhaps no program at all, if administrative costs become heavy.

A solution might be both (i) to impose the regulatory protections embedded in ERISA's pension provisions on the plans, and (ii) to mandate that the severance plan will be offered.25 That will not eliminate the various costs of supplying severance, of course, and will disproportionately affect firms that would not otherwise supply severance. As noted earlier, in the United States, voluntary severance pay is concentrated among higher skilled workers employed in larger firms in relatively volatile sectors of the economy. The social value of extending severance pay mandates and regulatory machinery to lower paid workers in smaller firms in relatively stable sectors is unclear without more detailed analyses. Is less wage insurance required of lower paid workers because they suffer proportionately lower wage losses? Are there fixed costs of each account that make absolute wage losses a key consideration? Fixed costs of accounts would also argue against coverage in highly stable sectors with little prospect of mass layoffs—though the pain of layoff may be the same for those unfortunate few who are laid off in these circumstances. The coincidence of high administrative costs of government programs and small firm size is one that replays itself throughout the policy environment; large firms are ceteris paribus more efficient in highly regulated environments.

9Control of the workplace: an alternative use of severance paySeverance pay is one of several instruments essential for providing job displacement insurance, the focus of this essay. Severance pay also has an alternative use of a more contentious sort, including the shifting of workplace control from management to workers. Confusion over the two uses may explain some of the belief that severance is a serious impediment to workplace productivity. The firm's productivity is critically dependent on efficient hiring and discharge or firing (involuntary separation for cause) practices. Severance pay can be strategically designed to discourage release of individually unproductive workers.

Voluntary severance plans usually restrict severance payouts to involuntary separations without cause, Parsons (2005a,b). The involuntary restriction makes obvious sense as insurance. Voluntary departures are under the worker's control and typically promise better outcomes. Involuntary separations “with cause,” most often insubordination or other relatively aggressive actions, do have large negative consequences for future wages, but again are likely to be under the individual worker's control and therefore uninsurable.

Of course, when firms pay out nothing to those fired for cause and something to those laid off, firms have an incentive to resolve any uncertainties in their favor and declare a separation as with cause. That is unlikely to be a practical problem in large firms in which layoffs are likely to be large number events, and disciplinary separations more idiosyncratic. In small firms, however, in which both types of separations are likely to be small in number, the adjudication issue is more substantial.

Administrative problems aside, a severance plan designed to shift workplace control from the firm to workers, individually or collectively, is likely to have a payout scheme quite distinct from the usual insurance motivated severance. For example disciplinary separations occur disproportionately among new hires, largely young workers, and the usual severance insurance payout—in voluntary plans or mandated plans in most countries—offers only modest benefits to these workers. Severance plans designed to limit disciplinary separations are likely to require large payments to younger workers upon involuntary separation. Severance for control is also likely to be associated with more direct measures, including the possibility of reinstatement by a third-party.

10ConclusionInterest in potential firing cost distortions was piqued by early results that suggested that severance pay mandates in industrialized economies negatively drive key elements of the aggregate labor market, including employment and unemployment. Subsequent research provided reassurance that severance mandates have modest, perhaps trivial effects on these aggregate measures, although they might affect the balance between young and old in the competition for jobs. The absence of effect is perhaps not surprising, because mandated benefits are in general not especially generous in most of the industrialized world. In the industrializing world, some mandated severance payouts are high but these may be sustainable because of limited enforcement, perhaps targeting large foreign firms as an implicit extractive resource tax.

Voluntary severance plans are not uncommon in the United States, which does not have mandated severance. This suggests that mandates might be “ineffective” in many countries with benefit structures similar to voluntary plans in the U.S.—that is, the firms might provide separation benefits in the absence of mandate. Any separation instrument that is financed by the firm, voluntary or mandated, raises firing cost concerns, but voluntary provision indicates that net benefits are positive, and firing costs at least not prohibitive. Indeed there are methods of avoiding firing costs while maintaining separation payouts, but these avoidance techniques are not used. For example, were firing costs a serious problem, they could be avoided by substituting a severance savings plan for the mandated severance insurance plan. Voluntary severance savings plans are virtually unknown in the United States, and they are rarely mandated internationally. Of course the administrative costs of any savings plan are likely to be large relative to the occasional payout of severance insurance, and, if workers are myopic, the expenditures on such a plan may not be offset by lower wages. Nonetheless it does suggest an upper bound on the burden of severance provision.

Unfortunately the early focus on firing cost distortions diverted attention from the broader question of the potential role that severance pay may play in worker income security. Severance pay may serve both as scheduled wage insurance and scheduled supplemental unemployment insurance. In the latter case, severance partially substitutes for actual-loss-based unemployment insurance, which may discourage active job search. Severance pay should then be more generous (i) if reemployment wage losses are typically large and (ii) if workers are sensitive to unemployment insurance disincentives.

The resulting calculation is likely to vary across national economies as well as across worker skill classes and industrial sectors, although the simplicity required of government regulation insures that mandated severance can recognize only a few such distinctions. Voluntary severance plans naturally capture many of these nuances; in the U.S. for example, coverage is concentrated in larger firms and higher skilled workers in volatile demand sectors. The voluntary pattern of coverage is consistent with what would prevail under the assumption that benefit plans have fixed setup costs for the plan as a whole and for individual accounts. Whether economically efficient coverage is socially acceptable is a deeper policy question. Where offered, benefits are roughly as generous as those in many OECD countries that mandate severance.

Voluntary severance plans have an obvious weakness—the heaviest payouts come in periods of weak demand, when the firm is often strapped for financial resources. Perhaps surprising, nonperformance of severance pay in the U.S. appears limited to the most extreme case, that of bankruptcy. Bankruptcy is a fundamental problem, because control of the firm's finances shifts to the courts and legislative mandate. It is of course possible, if relatively expensive, to set up a regulatory system with deposit insurance to guarantee payment of severance. It is currently done in the U.S. for private pensions, through ERISA (1974). The cost of these regulatory interventions is likely to be substantial, and, judging from the now highly regulated private pension market, would induce sharp reductions in severance coverage. Mandating severance coverage eliminates this avoidance possibility, but does not eliminate the underlying cost, which is likely to weigh heaviest on firms that would not otherwise provide severance.

The conclusion that severance pay rarely induces major labor market distortion must be tempered by the concern that severance pay is not always designed to be part of a job displacement insurance package. Severance pay can for example be used to shift workplace discipline control from the firm to the worker. The form of such mechanisms is likely to be quite different from that generated by severance insurance motives, and is likely to be accompanied by a variety of other familiar instruments, including the threat of third-party reinstatement of the worker discharged. These administrative concerns aside, severance pay has much to recommend it as a part of a job displacement insurance plan.

I have received helpful comments and criticisms at a variety of forums from numerous colleagues, many recognized in the individual papers cited below. I would especially like to thank my colleagues in the GWU microeconomics seminar, who have patiently listened to most of my severance papers, some more than once.

This review relies heavily on my own work on severance pay over the past decade. A sabbatical year (2008–2009) in the middle of this project was invaluable.

The firing cost label appears to be used interchangeably between the costs that induce the distortions and the distortions themselves.

See for example the reviews and compendiums in Buechtemann (1992), Heckman and Pagés (2004), and Holzmann et al. (2012), and the review in Parsons (2012a).

This analysis focuses on severance plans offered to broad classes of workers, not the golden parachutes offered high level management, which follow a more situation-specific logic.

Consumption smoothing across temporary layoffs, still relatively common in the United States, is not considered.

Wage insurance is the less familiar of these. For an early policy discussion, see Baily et al. (1993); for later policy discussions, see Parsons (2000), Kletzer and Rosen (2006), Kling (2006), and LaLonde (2007).

See Baily (1977) for an early statement of this idea.

Because the future is unknown, permanently laid off workers are sometimes rehired, and voluntary severance plans typically provide for that contingency.

These savings accounts may be notional or fully funded, perhaps even held by the government or financial institutions.

For a readable summary of 401(k) plans, see http://invest-faq.com/articles/ret-plan-401k.html.

See especially Jacobson et al. (1993) and Farber (2011). Earlier reviews include Fallick (1996) and Kletzer (1998).

Separating losses due to wage reductions from work hours reductions is an obvious administrative problem.

Holmlund (1998), Karni (1999), and Fredriksson and Holmlund (2006) provide excellent reviews. Paradigm theoretical studies of optimal unemployment insurance include Azariadis (1975), Baily (1977), Mortensen (1977), Shavell and Weiss (1979), and Hopenhayn and Nicolini (1997).

See Section 7 below.

The effects on unemployment are yet more indirect, because workers who fail to find reemployment may leave the labor force rather than present themselves as unemployed. Nonetheless one might conjecture that unemployment will rise in such an environment.

Union contracts and norms in larger non-union workplaces often lead to the same layoff selection queue.

See Blanchard (1998) to get a sense of the greater impact of the Lazear insight in the theoretical literature. Separation “taxes,” though empirically irrelevant, became a staple of theoretical firing cost models.

Severance pay generosity at nine months, four years, and twenty years cumulatively is only 8% of the OECD's EPL index in 2004, OECD (2004, Table 2.11.1 pp. 103–105).

Again see the discussion in Parsons (2012a).

See below, Section 9.

For excellent surveys of the U.S. displacement cost literature, see Jacobson et al. (1993), Fallick (1996), Kletzer (1998), and Farber (2011). For a sample of international studies, see Kuhn (2002).

For a discussion of trends in coverage, see Bishow and Parsons (2004).

For a standardized occupational mix, union workers are more likely to be covered by a severance plan, but, among those with plans, the median benefit formula is also the familiar “a week of pay per year of service” algorithm that characterizes benefits outside the collectively bargained work places, Pita (1996).

Such compulsion may arise because of distortions induced by other government programs and objectives. If the government is committed to assuring a minimal level of consumption for the aged, forced savings may be necessary to insure that workers do not respond by saving nothing during their working lives. The compulsion in recent health care reforms in the United States appears to have this basis.

Indeed the most common defined contribution plan, the 401(k) plan, had its tax deferred status clarified only in 1978, shortly after ERISA was passed.

The U.S. government did not choose to do so, perhaps because it had in place a forced savings plan of its own, Social Security.