Board governance is an important aspect of internal bank governance. We conduct an empirical study on 100 banks in China for the period from 2004 to 2017 using a time-varying growth bank shareholder network to investigate the relationship and mechanism between bank shareholder network and board governance. The bank shareholder network is found to have a positive impact on board governance. This positive effect differs across bank's service areas and ownership properties, indicating a reinforcing weakness effect. The empirical analysis shows that enhancement of network centrality can improve board governance in a bank shareholder network through three mechanisms: information sharing, reputation incentives, and effective connections. These findings provide new evidence for applying social networks in the financial services industry and identify policy implications for improving internal governance from an informal institutional perspective.

Improvement in bank governance is imperative for the development of high-quality dimensions in the banking industry. Some banks are still facing problems such as nonstandard equity relations, poor internal risk control mechanisms, and ineffective corporate governance during shareholder and senior directors’ meetings.1 The study of bank governance has theoretical and practical significance for improving the internal governance structure of commercial banks and for promoting sustainable development in the banking industry and optimizing the benefits of financial supply side reforms. Given that the social network of common shareholders is rooted in business decisions and daily interactions with banks, it is necessary to clarify the shareholding relationship of commercial banks and its influence on bank governance. First, we explore the time-varying growth pattern of the bank shareholder network formed by the common shareholder relationship between banks, and later study the impact of this network on bank governance.

The social network revolution tends to appear first but is mostly ignored by people. Social networks help to connect with relatives, friends, business contacts, and other relationships. Through the complex network structure, people communicate with each other emotionally or in terms of interests, thereby affecting individual behaviors (Granovetter, 1973). The existing literature (e.g., Larcker et al., 2013; Engelberg et al., 2013; Fracassi, 2016; Kang et al., 2018; Bajo et al., 2020) supports the view that social networks have a positive impact on enterprise development. As shareholders are both owners and ultimate beneficiaries of an enterprise, a shareholder network, as a form of social network, has high research value in corporate behavior as opposed to other social networks. Shareholders’ actions and decisions will have a direct impact on the business activities, internal governance, and future strategic planning of the enterprise, thus maximizing the value of social networks.

A significant body of literature on shareholder networks (Li et al., 2015; Yang et al., 2018; Riccaboni, 2019; Huang & Li, 2019; Li & Zhang, 2020) focuses on the effectiveness of shareholder networks on corporate behavior. For example, Li et al. (2015) and Li and Zhang (2020) reported that shareholder networks affect the behavioral side of mergers and acquisitions (M&A) and have a favorable impact on M&A performance. Riccaboni (2019) also found a positive relationship between the centrality of shareholder networks and corporate performance. The significance of this positive relationship decreased with the expansion in group size. Regarding the degree centrality and eigenvector centrality of the shareholder network, the higher the centrality, the better is organizational performance (Yang et al., 2018), indicating that the network provides shareholders the ability to express their views. Huang and Li (2019) concluded that shareholder networks are a weak rather than strong type of relationship network, explaining that shareholder networks rely on information advantage as opposed to resource advantage. The information advantage of shareholder networks can improve operating efficiency and promote expansion behavior, leading to improved corporate performance.

The above literature focuses on nonfinancial enterprises, and few studies discuss the impact of bank shareholder networks on bank board governance. Li et al. (2018) and (2019) used bank samples as their research objectives, but their focus is primarily on the impact of shareholder networks on lending behavior, bank performance, and risk-taking behavior, overlooking the positive role that shareholder networks play in bank governance. Shareholder networks may impact board governance through their role as links between different banks. First, shareholder networks expand information access and reduce search and acquisition costs, thereby reducing information asymmetry. Second, shareholder networks provide banks with implicit guarantees. The spread of good reputation in a network is beneficial as it can foster reputation incentives. Additionally, local commercial banks are gradually becoming more influential and central to the network system due to their booming development.

This study investigates the impact of bank shareholder networks on bank board governance by constructing a time-varying growth bank shareholder network. By calculating network centrality, we quantify the structural features of the shareholder networks of 100 commercial banks in China from 2004 to 2017. We aim to answer the following questions: First, is the improvement in the location of a bank shareholder network conducive to the enhancement of bank board governance? Second, how does a bank's shareholder network influence board governance? As a fundamental feature of social networks, can the mechanism of information sharing fully account for the impact of bank shareholder networks on board governance, and can other channels explain this effect? Third, for banks with different service areas and ownership properties, are there any heterogeneities in the impact of bank shareholder networks on board governance? The answers to these questions will not only help correct limitations in the existing literature, but could also provide helpful directions for improving the internal governance structure of commercial banks, deepening financial supply side reforms, and strengthening the supervision of banks in China.

To conduct our analysis, we first construct a two-part bank shareholder network. Based on the method and characteristics of the network construction, we make three improvements. First, we adopt a dynamic perspective. Unlike Li et al. (2019), who built a static bank network in 2012, we extend the sample period from 2004 to 2017. This allows us to capture the impact of the changing strength of the financial sector regulations and the boom in the development of shareholdings on the network over time. Second, from a growth perspective, we expand on existing literature that has analyzed bank networks in a discontinuous manner. For instance, Li et al. (2018) disregarded the original members and connections in a network and treated each year as a separate entity. However, considering the significant sunk cost of building a relationship and the fact that China values a relationship-based culture, it is not feasible to examine the network without considering the previous years. Therefore, we retain the nodes and relationships that existed in the network during previous years. Third, regarding construction rationality, most of the existing research on social networking in the financial and economic domains overlooks the complexity of the actual network structure and only considers a single subject as the network node. For example, in the shareholder network, most studies only focus on enterprises or banks as the nodes for building the network but tend to ignore the common shareholders who form the main body of connections in the network. Disregarding their presence would result in a failure to capture the intricate relationships in the actual network and would lack rationality. Therefore, we adopt a balanced approach and consider banks and shareholders as two equally important nodes to build a two-part network, primarily to ensure that the complexity of the relationships in the network is reflected.

Our study builds on the literature that explores the importance and factors of bank governance. Existing literature has clarified the importance of bank governance in the financial field by comparing the similarities and differences between bank governance and corporate governance (Fernandes et al., 2018). Governance of a bank's board, in particular, is a significant governance mechanism that acts as a bridge between the shareholders and board of directors (Li and Song, 2013). This role becomes critical during a financial crisis because the board of directors plays a vital role in stabilizing systemic risks and maintaining social stability (Andres & Vallelado, 2008). However, there is a paucity of literature on how to fully utilize the positive role of bank board governance and improve governance levels. This study aims to address this gap by introducing the social network theory to analyze the promotion effect of bank board governance from the perspective of social capital and informal institutions. Similar to findings on the positive impact of shareholder networks on corporate performance (Riccaboni, 2019; Li & Zhang, 2020), we believe that the bank shareholder network can also improve the level of bank board governance.

Our analysis also contributes to the literature on the positive impact of social networks. As mentioned previously, social networks provide the advantage of information sharing and expansion of information sources within the network (Granovetter, 1973). In this study, we examine if the bank shareholder network can influence bank board governance through the information effect. Additionally, we aim to explore other transmission mechanisms from the perspective of the joint shareholder relationship. Our findings suggest that the impact of reputation incentives and effective connections are also mechanisms for the bank shareholder network to promote board governance; therefore, their impact cannot be disregarded.

Literature review and hypothesisBank shareholder network and bank board governanceShareholder network and corporate governanceTwo distinct categories of research exist in the literature on the benefits of social networks in economics and finance. The first category pertains to research that benefits individuals. Nguyen (2012) examined the impact of social connections on CEO turnover by analyzing data from listed French companies for the period between 1994 and 2001. The found that CEOs with connections to many directors within the same social network were less likely to be dismissed because of their poor performance.

The second document pertains to the advantages of social networks for enterprises, which is the primary focus of this study. Lin et al. (2012) analyzed social networks from three perspectives: personal social networks, ownership networks, and technology networks. Their findings indicated that social networks can enhance corporate governance. Engleberg et al. (2013) used the BoardEX database to examine the employment history of CEOs, including their involvement in volunteer organizations, clubs, and educational institutions. This allowed them to build a CEO network and explore the value of CEOs in corporate governance. Their research revealed that companies can benefit from a CEO network. Additionally, research conducted by Larcker et al. (2013), Chuluun et al. (2017), and Tsai et al. (2019) demonstrated that directors and executive networks have improved investment efficiency, performance, and innovation.

Shareholders, directors, and executives are considered important members of a company. The social connections that bind them can enhance the overall value of a business. Consequently, it can be inferred that shareholder networks can have a significant influence on corporate conduct and governance.

Bank shareholder networkBank networks refer to social networks that are formed based on shared-interest relationships among banks. A large body of the existing literature suggests that these networks are created through interbank transactions, mutual shareholder relationships, and CEO social connections (Li et al., 2019; Ardekani et al., 2020). Prior studies have focused on interbank transaction networks and their impact on systemic risks. Most of these studies examined the generation of networks and employed statistical methods to analyze the topological characteristics (e.g., Dungey & Gajurel, 2015; Silva et al., 2016; Brunetti et al., 2019). The current studies in the banking domain are primarily centered on the internal operations of the banking industry, disregarding the identity of banks as financial intermediaries. However, this overlooks the fact that banks are driven by multiple interests, including social shareholders, who possess ultimate control over the bank's development trajectory. The social connections of these shareholders can have a significant impact on the bank's internal governance. Therefore, it is imperative to examine the bank shareholder network and governance structures of banks to gain a comprehensive understanding of their functioning.

The bank shareholder network comprises two crucial elements: commercial banks and common shareholders. Previous research has focused solely on one of these elements, either considering commercial banks as network nodes and disregarding shareholders who establish connecting links, or considering shareholders as network nodes and focusing on the reasons for network formation. However, this study does not delve into the behavior of direct interbank transactions but study the shareholding behavior instead. Therefore, relying on a single attribute node is unreliable. A more intricate network structure with two parts or layers can be established to capture information that cannot be obtained from a single nodal type of network. For instance, Li and Yang (2022) created a multilevel network using internet companies and other stakeholders as nodes to examine the complexity of three network models related to social responsibility cooperation among Chinese internet firms. We consider both banks and common shareholders as the network nodes to construct a two-part bank shareholder network.

Furthermore, An et al.’s (2018) study provided valuable insights into the relationship between common institutional and noninstitutional shareholders, which elucidates the mechanism for establishing a bank shareholder network. The occurrence of cross-shareholding among different commercial banks renders the behavior of participants within the network more intricate and variable. Consequently, it is imperative to capture more nuanced connections within the bank shareholder network.

Bank board governanceBanks not only inherit the general principles of corporate governance but also possess unique characteristics that cannot be overlooked versus other nonfinancial enterprises (Fernandes et al., 2018). As financial intermediaries, banks are present across all institutions in the economy and society, with most of their core activities being opaque (Srivastav & Hagendorff, 2016), which can lead to the transmission of uncertainty. Therefore, it is critical to prevent systemic risks in the banking sector to avoid disastrous consequences (Andres & Vallelado, 2008), as the failure of bank governance can result in significant costs. Given the importance of banks in the economy and the nature of their activities, analyzing the governance mechanism of the banking sector is both highly specialized and critical (Adams & Mehran, 2012).

Similar to traditional corporate governance, bank governance mechanisms can be categorized into internal and external types. The internal governance mechanism encompasses shareholders, board of directors, executives, and employees, whereas the external governance system comprises depositors, lenders, regulators, and creditors. Becht et al. (2011) suggested that the governance system in banks is more complex as several stakeholders are involved. The internal governance mechanism is more crucial than the external governance system in theory and practice as it can effectively address any operational banking issue. Regarding ownership structure, the traditional principal-agent theory highlights the strained relationship between shareholders and the board of directors. Laeven and Levine (2009) applied this theory to the banking industry, and a comparison of ownership and cash flow rights reveals that banks with influential owners tend to take greater risk.

In addition to the ownership structure, the board of directors is one of the most important governance mechanisms (Andres & Vallelado, 2008). For example, during a financial crisis, improvement in bank governance is attributable to the board's governance quality (Fernandes et al., 2018). A bank's board of directors plays a critical role in providing both supervisory and advisory functions. The supervisory function empowers the board to scrutinize the rationality of its decisions to prevent corruption and other undesirable behaviors (Fama & Jensen, 1983; John & Senbet, 1998; Adams & Ferreira, 2007). Meanwhile, the advisory function leverages the board's professional expertise and provides valuable advice on the bank's strategic decisions. The board of directors is an important oversight mechanism to ensure the soundness and integrity of a bank's operations (Coles et al., 2008, 2012).

The characteristics of a board are crucial indicators of its capacity to fulfill duties effectively (Harris & Raviv, 2008). It is widely acknowledged that the size of the bank's board of directors has an inherent trade-off relationship with regard to discharger of duties and responsibilities (Kim et al., 2014). Specifically, a larger number of internal directors can mitigate information asymmetry, thereby enabling the board to perform its consulting function more effectively and provide valuable suggestions for the bank's development (Fernandes et al., 2018). Conversely, a larger number of outside directors can enhance the board's oversight role and mitigate any potential conflicts of interest with the board of directors (Fernandes et al., 2018). By striking the right balance between internal and external directors, the board can effectively fulfill its fiduciary obligations and ensure the soundness and sustainability of the bank's operations.

Some scholars have also proposed that the frequency of board meetings can impact the bank's performance. The intensity of the activity reflects the board's enthusiasm to discharge their duties. In terms of the supervisory function, a higher frequency of meetings indicates stronger scrutiny by the top management. In turn, this may reduce agency costs and improve bank performance (Grove et al., 2011). From the perspective of the consulting function, frequent meetings can be advantageous for the board to obtain relevant information (Adams & Ferreira, 2012), reduce information asymmetry, and provide useful opinions for strategic decision-making.

Network centrality and governanceTo examine the advantages of bank shareholders, we analyze it through the lens of network centrality, which is a widely used metric for evaluating network structures and member placement (Newman, 2003; Zaheer & Bell, 2005). We employ four measures to describe the network characteristics: degree centrality, betweenness centrality, closeness centrality, and eigenvector centrality. Typically, a central network has a more favorable impact.

Degree centrality measures the extent to which an individual is directly connected to others within a network (Rowley, 1997). Computationally, it calculates the number of relational ties formed by the network participants. Individuals with a high degree centrality are more likely to have access to valuable resources, such as information and support, as they can connect with a larger number of people (Rowley, 1997). Essentially, a higher degree centrality facilitates more direct connections between banks in a network, leading to stronger social relations and easier access to diversified resources (Jiang & Park, 2022). Betweenness centrality captures an individual's indirect connections with others in a network and serves as a link (Rowley, 1997). A higher betweenness centrality for a bank indicates more -indirect connections with other nodes, increasing its likelihood of being in the path of other nodes, and strengthening its control ability in the network. This results in heterogeneous information being obtained at a lower cost. Agency theory and resource-dependence theory can be used to explain that the bank shareholder network also has a significant advantage in accessing diversified and heterogeneous information. This advantage can be particularly helpful for banks with a strong demand for information and poor governance, as it can improve corporate information asymmetry (Karlan, 2007) and agency problems. Leveraging this advantage can improve bank governance and performance.

Closeness centrality captures an individual's average distance to reach all other nodes in a network (Freeman, 1978). A high closeness centrality indicates that the individual is situated closer to other nodes in the network. The eigenvector centrality is a measure of global centrality obtained by calculating the eigenvector of nodes in a network (Bonacich, 1972). This metric indicates a bank's overall position in the network, with a high eigenvector centrality implying more connections to star banks and greater potential for high-quality cooperation. Additionally, a high eigenvector centrality can generate strong positive reputation, allowing banks to benefit from positive externalities within the network. A bank's connections to other nodes with superior network locations and reputations can be leveraged to enhance status and reputation (Gao & Wang, 2016). This information is important because it signals a bank's positioning in the network and its potential to access external knowledge (Ramos-Rodriguez, 2010). Furthermore, connecting to banks with excellent reputations can facilitate business communication and expand development boundaries (Coleman, 1988).

In conclusion, analyzing the structural characteristics of the bank shareholder network reveals a positive correlation between improved network centrality and enhanced corporate governance and performance. Board governance has a key role in bank governance and performance, with the board composition and frequency of activities reflecting both its work and function. However, current research on the governance of a bank's board has not adequately explored the governance effects of social networks as informal institutions. Compared with nonfinancial enterprises, a bank's board governance is a significant governance mechanism that serves as a bridge between shareholders and the board of directors (Li and Song, 2013). Shareholders’ behavior and decision making strongly influence bank governance, and this relationship becomes more complex with common shareholders and the expansion of the bank shareholder network. Therefore, the network structure and the bank's position within it are critical to board governance, leading us to propose the following hypothesis.

Hypothesis 1 A bank's shareholder network has a positive impact on board governance, and improvement in network centrality is conducive to improving board governance.

Most core banking activities depend on information and are highly opaque (Srivastav & Hagendorff, 2016), thus access to information plays a vital role in board decision making. Banks with high network centrality have a competitive advantage in obtaining internal information (Granovetter, 1973), which is manifested in the following two aspects:

First, the bank shareholder network provides access to internal information. Banks find it difficult to obtain soft information that is difficult to quantify and deliver from external sources (Yin et al., 2018). Compared with other information acquisition channels, the shareholder network is more private and recessive. As network nodes, common shareholders transmit internal information to and from their controlling banks, resulting in knowledge externalities and systematic network effects. By sharing information, network members can gain access to private information that is difficult to retrieve. Thus, it is beneficial to transform the information advantage of a single bank into the joint information advantage of multiple banks in a network and reduce information asymmetry.

Second, the bank shareholder network can lower the cost of obtaining external information. As an informal institution, shareholder networks can facilitate communication and information sharing within the network, thus enabling members to spend less time and effort searching for and obtaining external heterogenous information (Engelberg et al., 2013). Furthermore, bank shareholder network is characterized by a weak relationship network, allowing banks to collect a large amount of heterogeneous information.

In fact, information is updated quickly; therefore, the board of directors tends to hold temporary meetings more frequently for key decisions and takes more time to perform duties, thus improving the board's diligence during its tenure (Lipton & Lorsch, 1992). Favorable information can help banks grasp the internal personnel changes of other banks in a timely manner and adjust their own board structure, further strengthening the ability of internal decision-making, supervision, and consultation (Kang et al., 2018). Based on this discussion, we propose the following hypothesis:

Hypothesis 2 Enhancement of centrality in the bank shareholder network improves the ability of common shareholders to share information, thus creating a mechanism to share information.

From the game theory perspective, reputation has a significant influence on rational economic players’ decisions (Weigelt & Camerer, 1988). In a multistage repeated game, players’ current strategies affect their future gains, so they have an incentive to build a positive reputation to receive increased gains (Mailath & Samuelson, 2006). Accordingly, corporate reputation is defined as an enduring concept with a long-term impact, and the banking industry, in particular, has recently become more concerned about reputational issues (Piñeiro-Chousa et al., 2017). Based on this concept, we analyze how banks realize the reputation as an incentive mechanism in the bank shareholder network.

In China, which is typically a relationship-based culture, interpersonal communication and business transactions are largely confined to specific areas where people live, work, or share joint interests, making it difficult for strangers to build trust through communication (Zhang & Ke, 2002). Social networks provide a platform for strangers to communicate. A positive reputation, which is guaranteed to deter behaviors such as breach of contract, allows trading of interests between unfamiliar companies. At the same time, social capital is an advantage rooted in social networks. Based on Coleman ’s (1988) understanding of social capital, the bank shareholder network precisely satisfies the three core dimensions of social capital: resources, social relationships, and mobilization. A bank shareholder network is deemed as a resource that is derived from resources that are embedded in the social network and rooted in shareholder associations in the social structure. In this context, a bank shareholder network can also be considered as a form of social capital that is conducive for banks to achieve a good reputation and drive a reputation incentive.

Banks with a high network centrality have greater social capital advantages that are more beneficial from reputation incentives. The larger a bank's social capital, the easier it is to gain the trust of stakeholders, investors, and potential customers (Lins et al., 2017). In the long run, a bank's reputation widens gradually in the network and eventually results in a stronger incentive return (Fama & Jesen, 1983), thus providing more favorable investment opportunities for businesses. In view of the strong contagion effect of social capital (Gao & Wang, 2016), banks with high network centrality face huge potential reputation costs. Given that a bank's reputation influences future development, repairing a negative reputation takes a long time. Therefore, banks with higher network centrality tend to strengthen the governance of internal affairs and the oversight of board of directors to achieve higher reputation incentive returns. Based on this, the following hypothesis is proposed:

Hypothesis 3 Enhancement of centrality in the bank shareholder network boosts bank board governance via the advantage of reputation incentives, indicating the existences of a reputation incentive mechanism.

Social network relationships can be categorized into strong and weak ties. Strong relationship networks are characterized by repetitive, persistent, and fixed relationships among members, whereas weak relationship networks have nonrepetitive, nonpersistent, and nonfixed relationships. Emotional networks, such as clan and alumni networks, fall under the category of strong relationship networks because of the strong influence that members have on each other (Jenssen & Koenig, 2002). In contrast, benefit networks, including director, CEO, and shareholder networks, are primarily weak-relationship networks, where the connections between nodes are subtle and dependent on heterogeneity (Granovetter, 1973). Bank shareholder networks are also weak relationship networks, and communication between shareholders occurs only during major resolutions or meetings. Broadly, minority shareholders choose free riders. Therefore, only major shareholders play an important role in the network. Thus, we can conclude that, as an effective connection mechanism, the bank shareholder network has two advantages.

The bank shareholder network makes it easier for major shareholders to exercise their power, enhances the centralization of the actual ownership structure of banks, and supports major shareholders to play a connecting role. Incomplete contract theory maintains that material assets are not the only source of power (Rajan & Zingales, 1997); thus, the bank shareholder network, as an informal institution, has a prominent role in the implicit control of a bank's chains. Meanwhile, resource dependency theory emphasizes that participants who are able to provide more resources, especially scarce ones, tend to have a stronger voice in the organization. Through the bank shareholder network, major shareholders, who are also common shareholders, have scarce resources and a greater influence in the board's decision-making process. In turn, they are encouraged to obtain information and seek better development (Dahl & Pedersen, 2005).

Besides, the bank shareholder network dilutes government equity, weakens government control and influence over commercial banks, and provides scope for the effective connection role of major shareholders in the network (Ferri, 2009). Considering that government equity is not a “supporting hand” but more a “grabbing hand” (Hong et al., 2017), it has a negative effect on the development of banks (Megginson, 2005). Fortunately, the shareholder network connects other shareholders and allows them to jointly benefit from the advantages of the network and reduce the negative impact of government equity.

Based on the above two advantages, the relationship between banks in the bank shareholder network is more stable, and the dominant role of major shareholders is m prominent, thus improving bank governance. We propose the following hypothesis:

Hypothesis 4 Enhancement of centrality in the bank shareholder network improves board governance by effectively enhancing the connection capabilities of major shareholders, indicating an effective connection mechanism.

China's banking industry has implemented significant modernization reforms since 2003, centered on banking supervision. The establishment of the China Banking Regulatory Commission in April 2003, and the introduction of the “one bank and three committees” regulatory model for financial institutions has marked a significant milestone in strengthening banking risk management, and progress made in this area has been impressive. In 2018, the China Banking Regulatory Commission and the China Insurance Regulatory Commission merged to form the China Banking and Insurance Regulatory Commission. This new regulatory body introduced a “one council, one bank, and two committees” regulatory guidelines designed to meet the increasingly complex regulatory requirements initiated by financial innovation and banking development. Given the potentially wide-ranging impact of financial regulatory reforms on the industry's overall strategy or direction of development, it is essential to consider each bank's internal governance goals. This study examines the behavior of banks during the period from 2004 to 2017, primarily with the aim of comprehending their code of conduct amid stringent financial regulations. The selected timeframe is intended to facilitate a deeper understanding of the subject, while mitigating the impact of institutional disparities resulting from the existence of two distinct regulatory models.

This analysis focuses solely on China's commercial banks, excluding policy banks such as the Agricultural Development Bank of China, functional banks such as the Postal Savings Bank of China, and branches of foreign banks such as Citibank. As not all commercial banks in China are publicly listed, obtaining reliable and comprehensive shareholder and financial information can be challenging. Specifically, this applies to rural and urban commercial banks because such data may not be readily available through open channels and databases. To address this issue, we manually sort annual bank reports from official websites and extracted the required information and data. We use this information to construct a time-varying growth bank shareholder network that requires only shareholder information. After excluding banks with significant data gaps, we collect data from 122 banks. In the empirical analysis, we exclude banks with negative total assets and missing key financial data, resulting in a final sample of 100 banks.

We also source banks’ annual reports from 2004 to 2017 to obtain shareholder and board information. The ten largest shareholders and their shareholding percentages are manually collected from annual reports to construct the bank shareholder network. Information about board meetings and board members is also obtained from annual reports to construct dependent variables.

Additionally, the control variables and variables in the robustness test are sourced from annual reports, Wind's database, and China City Statistical Yearbook for the period from 2004 to 2017, or calculated from original data.

Time-varying growth bank shareholder networkFinancial fluctuations and systemic risks have long been a central topic of academic inquiry. Researchers have developed innovative methods and technologies to examine specific financial events, such as random matrix theory and eigenvalue decomposition (Pineiro-Chousa et al., 2016). In the aftermath of the 2008 global financial crisis, interest in the behavioral interdependence of financial actors and network science has emerged as a popular tool for investigating economic and financial phenomena, offering a fresh perspective on the analysis of traditional financial problems. Li et al. (2019) actively explored the application of static network tools in traditional finance. Most networks change constantly. From the perspective of dynamic networks, this study constructs a time-varying bank shareholder network that describes the static structural characteristics of a single moment and the changes in structural characteristics over time. Compared with static networks, the time-varying bank shareholder network can describe the relationship in a more detailed manner (Holme & Saramäki, 2012).

A time-varying network is divided into a growing network and a nongrowing network based on whether past nodes and edges remain unchanged. In the former, all the nodes and edges increased but did not decrease with time, whereas in the latter, the nodes and edges increased and decreased with time. Consequently, based on whether the time-varying network is characterized by growth, it can be differentiated into time-varying growth and nongrowth networks. The time-varying network model includes two network characteristics: time varying and growth. Among them, the time-varying feature shows the connection relationship at each moment and illustrates the abrupt nature of the connection relationship at different moments and its influence on the system. The growth feature describes the growth of both nodes and edges in the network and their impact on the system over time. This feature comprises all relationships from the initial point to the current point.

Evidently, the time-varying growth network model in this study better reflects the dynamic changes in bank shareholder relationships. Given the high costs incurred in the initial establishment and maintenance of the network and the importance of maintaining interpersonal relationships in China, which is characterized by relational systems of interaction, members who leave the network tend to maintain long-term contact with other members. By maintaining relationships that appear in a network, network construction becomes more practical and logical. Moreover, the network depicts an increasing bank shareholder relationship over time, indicating a growth trend. Our model deems banks and shareholders as nodes in the network, and the shareholding relationship between them is the connecting edge. We construct the proposed time-varying growth network model in two steps, each of which can be expressed as a tensor.

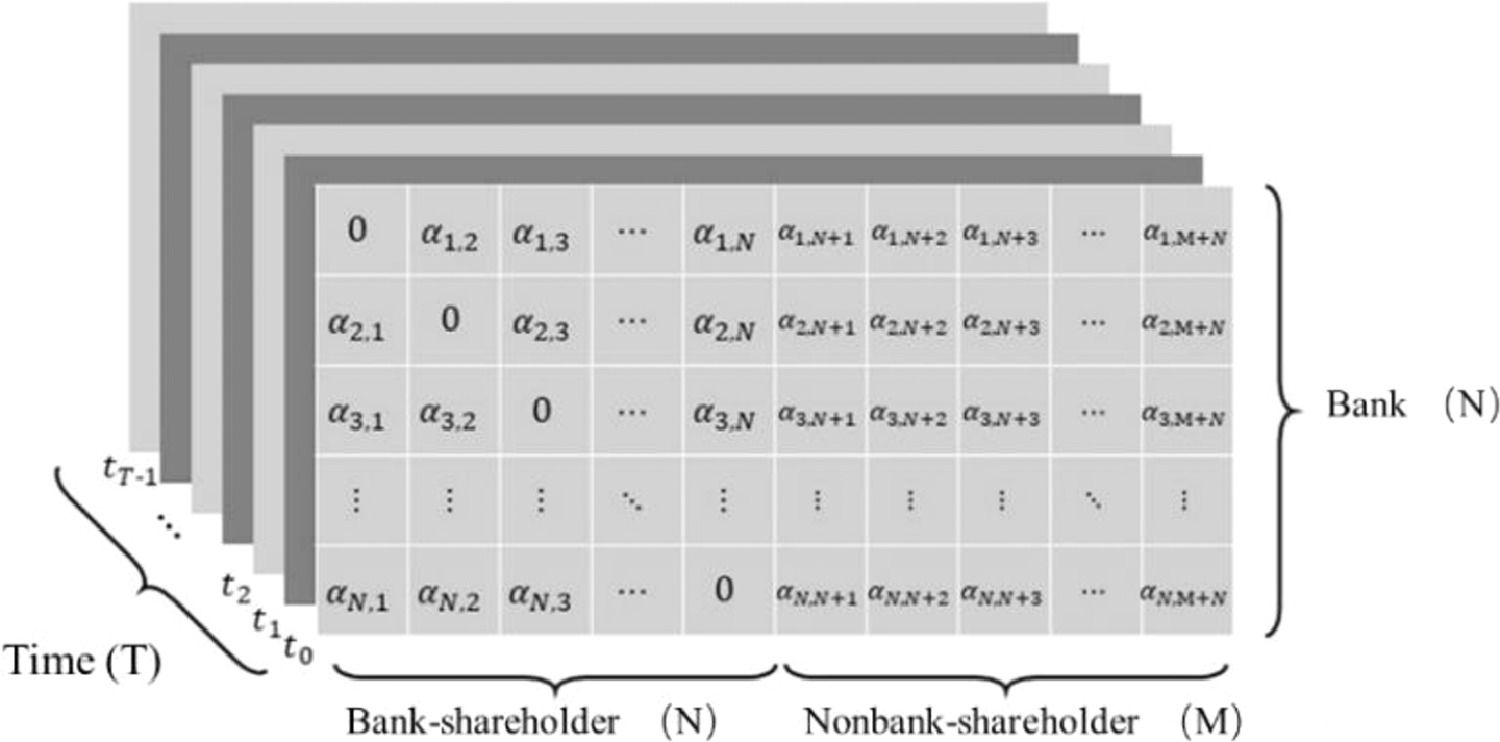

The first step is to construct a time-varying nongrowth network, which is mathematically expressed as the following tensor form. The network is a three-dimensional tensor Aijte⇀ie⇀je⇀t, its two-dimensional representation Aij represents the adjacent matrix of the network structure, and t represents the time segment where the network structure is located. The network does not have growth features. We set a time fragment length of years; therefore, during the same year, all the nodes of banks and shareholders can be divided into bank and nonbank nodes. Among them, a bank node is interpreted as both the bank part and bank shareholder part of the bank shareholder network, whereas the nonbank node is deemed as the nonbank shareholder part of the bank shareholder network. If a shareholding relationship exists between a bank and a shareholder (bank shareholder or nonbank shareholder) in the current year, then there is a 1-hop connection between the bank and shareholder nodes. As no bank holds its own shares in this data, as shown in Fig. 1, the diagonal element of the adjacent matrix between the bank and the bank shareholder is 0.

All banks during the sample time period (2004–2017) are denoted by E, where N indicates the number of elements in set E, namely |E|=N. We also set the rest of the shareholders who do not belong to set E in the sample period (2004–2017) as B, where M denotes the number of elements in set B, namely the|B|=M.

Some banks may be shareholders of other banks; that is, there are cross-shareholdings among banks. In Fig. 1, each row represents a bank (N banks mean N rows), and each column represents a shareholder. To describe the cross-shareholding structure between banks, the first N columns represent bank shareholders and the last M columns represent nonbank shareholders. The tensor element αi,j,t is defined as in Formula (1).

Following the construction of the time-varying nongrowth network, growth characteristics were incorporated to construct a time-varying growth network. In other words, the time-varying growth network in each year t is the aggregation of all networks from the initial year t0 to the current year. In this study, the initial year t0=2004. According to the features of the time-varying growing network, the three-dimensional tensor A~ijte⇀ie⇀je⇀t can be constructed from the time-varying nongrowing network three-dimensional tensor Aijte⇀ie⇀je⇀t , as given in Formula (2).

where the step function ε(x) is defined in Formula (3).Therefore, the element a~i,j,t in the time-varying growth ownership relationship matrix can be calculated from the element αi,j,t in the time-varying nongrowth ownership relationship matrix using Formula (4).

According to the time-varying growth ownership relationship matrix, banks can be directly linked through the cross-shareholding relationship or through the common shareholder relationship in the current year and over the long term. This objectively reflects the high cost of establishing and maintaining network relationships that causes network members to have the tendency of maintaining long-term contact, and underscores the importance of sustaining interpersonal relationships in the context of China's cultural values.

As the construction of a time-varying growth bank shareholder network has been completed, the corresponding static network structure characteristic variables can be calculated. Currently, the centrality index of each node is the commonly used micro-index to describe the network structure in network science. Following Chen and Xie (2011), we define degree centrality, closeness centrality, betweenness centrality, and eigenvector centrality of the time-varying bank shareholder network in the year to reflect the bank's local breadth, global depth, global mediation degree, and global location centrality degree, respectively.

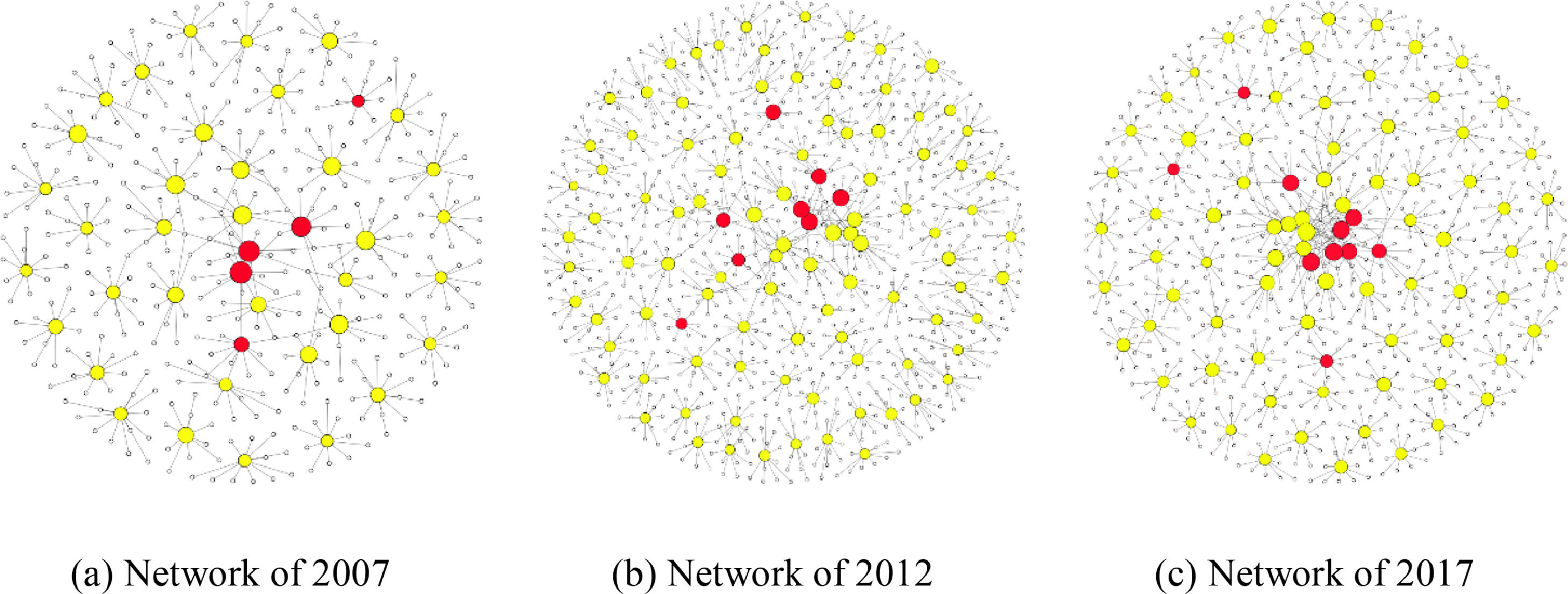

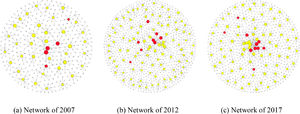

Fig. 2 depicts the structure of the bank shareholder network in 2007, 2012, and 2017. To display the structure of the bank shareholder network, we adopt the Fruchterman–Regingold layout form, which distributes the largest connected subgraph in the center of the graph as far as possible and distributes other small connected subgraphs around, presenting the layout in a star structure. The characteristics presented in Fig. 2 can be summarized as follows.

Two features can be found from the cross-sectional dimension: First, there is a large connected subgraph in the center, and banks with cross-shareholdings and shareholders exist in this connected subgraph. Second, the other smaller connected subgraphs represent banks and their shareholders that do not have cross-shareholdings among banks on all four sides. The basic network structure is a star type of network topology where the bank is located in the central area and shareholders are in the peripheral area.

As time progresses, it is obvious that the time-varying bank shareholder network exhibits the following characteristics. First, the number of banks and shareholders are increasing with banks growing from 6 in 2004 to 112 in 2012 and 122 in 2017. Similarly, increase in shareholding also had a snowball effect. Second, the bank shareholder network has become closer overall. The continuous expansion of the centrally connected subgraph shows a stronger relationship between banks, and a more pronounced trend toward centralization. Finally, the density between the central nodes increased significantly in the network, thereby enhancing the network cohesion. The data show that the bank centrality indices improved significantly across the four categories. In terms of degree centrality, banks’ network centrality grew from 10.333 in 2004 to 18.698 in 2017, an increase of 80.95%, highlighting the typical proximity of commercial banks to central locations.

VariablesDependent variablesAccording to Fernandes et al. (2018), diligence (activity frequency), independence (supervisory function), and executive (advisory function) are three essential characteristics of bank board governance, and this study focuses on these three attributes. First, board diligence measures the annual meeting frequency of the board of directors, which reflects their performance to a certain extent. Board diligence is measured as the natural logarithm of the total number of board meetings held each year. Second, board executive capacity is determined by the proportion of executive directors on the board of directors. As a component of bank board governance, the board's structure indicates the influence of its internal executives and the strength of its advisory function. Third, board independence is measured based on the number of independent directors. Independent directors, as an important embodiment of bank board governance, can act as an internal supervision mechanism.

Mediation variablesThe proposed study hypotheses indicate three influence mechanisms, and three mediator variables are established as follows:

CSRi,t denotes the information sharing variable, which is measured by the proportion of common shareholders, that is, number of direct shareholders of bank i holding shares in other banks among all direct shareholders of bank i in year t. The specific calculation is as follows:

In Formula (5), CSRi,t represents the number of direct shareholders of bank i, which is also a major shareholder of other banks, and TSi,t is the total number of direct shareholders of bank i in the bank shareholder network. The greater the value of CSRi,t, the stronger the ability of bank i to obtain information resources through common shareholders.

REPUi,t is the reputation incentive variable. To obtain the reputation incentive variable, it is necessary to establish the bank's reputation evaluation system. According to international credit rating agencies’ rating methodologies for banks2 and combined with the characteristics of the empirical model developed in this study, we analyze the reputation of banks in relation to their ability to prevent and control risk. First, the following baseline model (Formula (6)) controls the fixed effects of year and city, thus reducing the impact of different types of bank operating environments on reputation ratings to a certain extent. Second, some bank profitability factors, such as bank size and other financial indicators, have been incorporated into the control variables. Primarily, these factors affect the positive reputation, whereas we focus on the potential risk factors that may lead to a negative reputation. Therefore, we choose 23 bottom indicators to build the bank reputation evaluation system. According to the principal component analysis, common factors with an accumulated explanatory variance of more than 80% are selected to calculate the reputation incentive variable REPUi,t.

TOP10i,t is the effective connection variable measured by the sum of the shareholding ratio of the bank's top ten shareholders. The larger the value, the stronger the connection effect of the bank's major shareholders through the bank shareholder network.

Control variablesMacro-level control variables are critical for examining the behavior and operation of commercial banks, as they can be influenced by macroeconomic conditions (Maddaloni & Peydró, 2011), which can affect governance decisions. Therefore, consistent with Wang et al. (2019), we incorporate the GDP growth rate and the ratio of fiscal surplus to GDP into the regression model as control variables. First, the GDP growth rate (N_GDPi,t), represented by the nominal GDP growth rate, is a comprehensive index for measuring the economic strength of banks and indicates the overall economic development level of a region. Second, the ratio of fiscal surplus to GDP (FISi,t), which is calculated by the proportion of the difference between fiscal revenue and fiscal expenditure in the GDP of the city where the bank is located, reflects the extent to which the government of a region has intervened in the economic activities of banks.

Referring to the practice of Laeven and Levine (2009) and Safiullah (2020), two key control variables are identified at the bank level: capital adequacy ratio (CARi,t) and bank growth ability (GROi,t). CARi,t is defined as the ratio of net capital to risk-weighted assets and represents a bank's risk-bearing capacity. GROi,t is measured by the growth rate of total assets. Additionally, we consider the degree of equity balance (EBi,t) as a proxy for ownership structure, which can impact both the structure of the bank shareholder network and bank governance. EBi,t is measured by the ratio of the sum of shares held by the second to tenth shareholders to the share of the largest shareholder.

Consistent with Jensen (1993) and Fernandes et al. (2018), it has been established that the size of the board of directors and separation of the roles of the chairman and bank president are critical in determining the effectiveness of board governance. Accordingly, we introduce control variables at the board level. The first variable, board size (BSi,t), is determined by the natural logarithm of the number of board members. We also include a duality variable (DUALi,t), which takes the value of 1 if the chairman and president are the same individual, and 0 if they are separate.

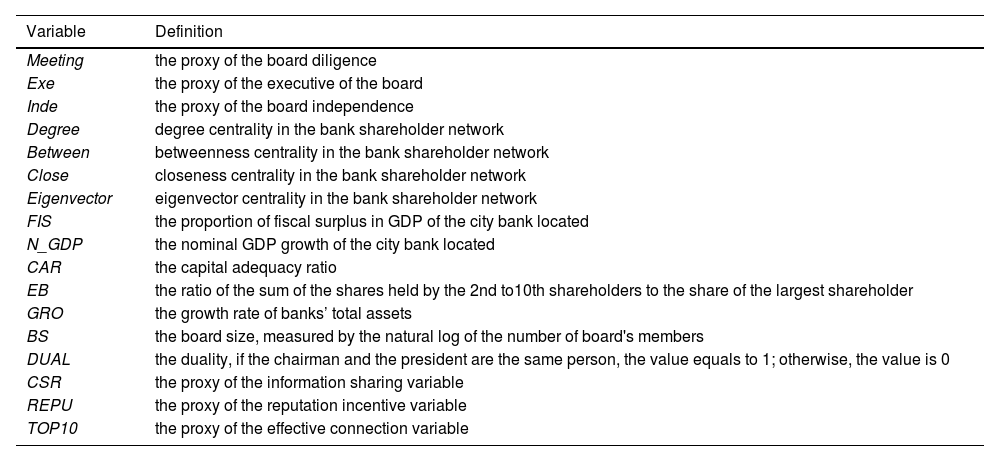

Table 1 lists the main variables and their definitions used in the empirical model.

The list and definition of variables.

Hypothesis 1 proposes that the bank shareholder network has a positive effect on board governance, and improvement of network centrality is conducive to strengthening board governance. Based on the previous discussion on network centrality, bank board governance, and control variables, we construct the following empirical model:

The dependent variable, denoted as Govi,tj, represents the governance of bank i's board in year t. This study considers board diligence (Meetingi,t), board executive capacity (Exei,t), and board independence (Indei,t) as the proxies for bank board governance. The network centrality variable, denoted as Cenki,t, represents the kth centrality measure of bank i in year t; that is, Degreei,t, Betweeni,t, Closei,t, and Eigenvectori,t. The control variable, denoted as Conm,i,t, represents the control variable m of bank i in year t, that is, FISi,t, N_GDPi,t, CARi,t, GROi,t, EBi,t, BSi,t, and DUALi,t. μi and νt are city fixed effect and time fixed effect respectively, and εi,t is the random error.

Mechanism test modelWe construct the following two-stage regression model to test three mechanisms.

First stage regression:

Second stage regression:

The mediating variable, denoted as MVni,t, represents the nth mediating variable of bank i in year t, that is, the information sharing variable (CSRi,t), the reputation incentive variable (REPUi,t), and the effective connection variable (TOP10i,t). The key coefficients are θ1 in the first stage of regression and φ2 in the second stage of regression. If these coefficients are significant, it indicates that information sharing, reputation incentives, and effective connections are the mediating variables of the bank shareholder network affecting bank board governance. Meanwhile, we expect that coefficient φ1 in the second-stage regression will decrease compared with coefficient α1 in the baseline model.

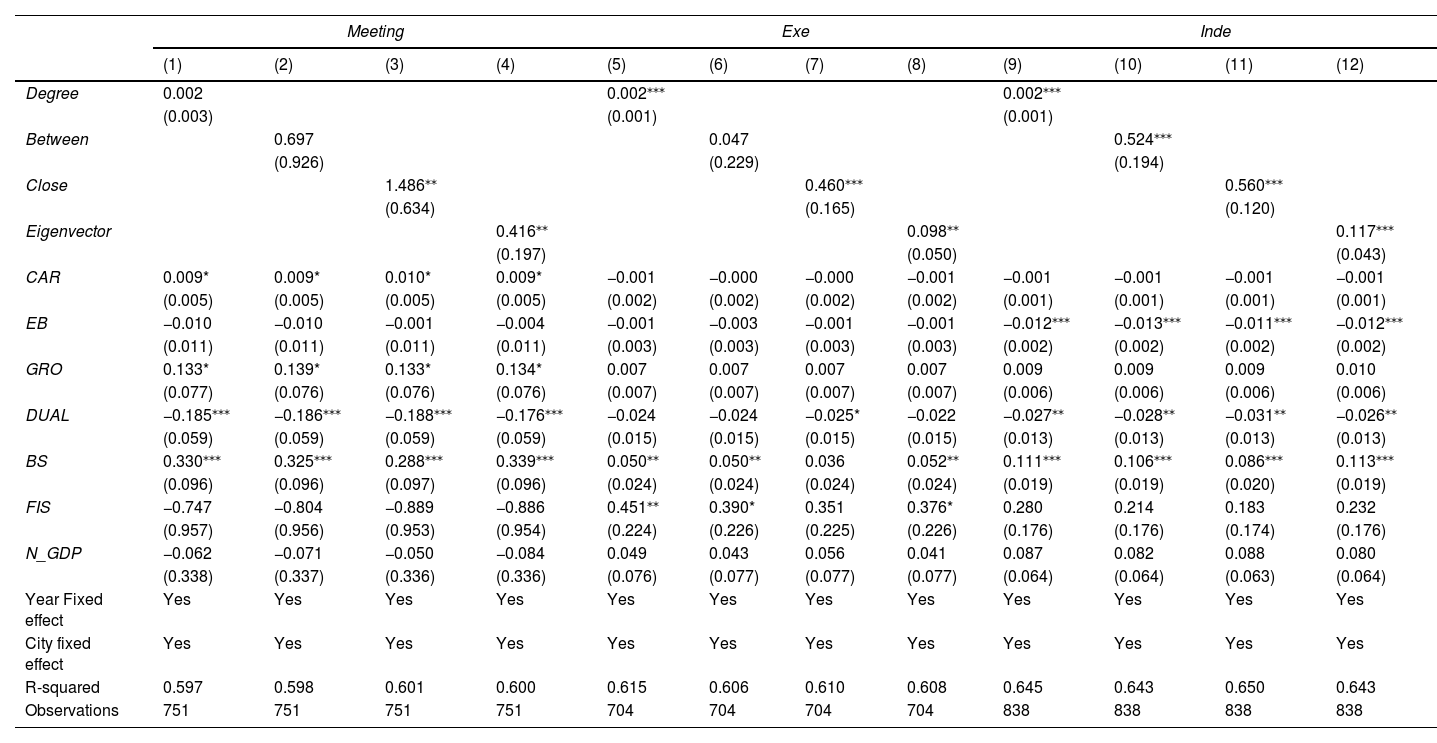

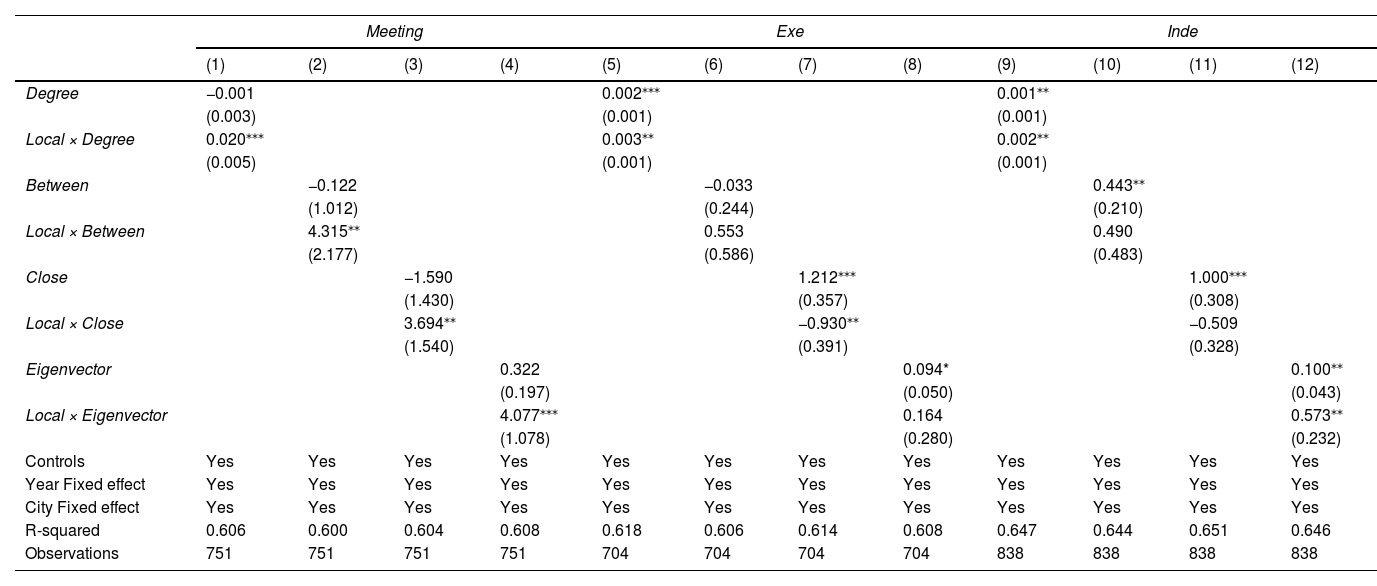

Results and discussionBaseline resultsTo verify Hypothesis 1, a fixed effects regression was performed. Table 2 presents the baseline regression results for network centrality and board governance. In columns (1) ∼ (4), the coefficients of Degree and Between are statistically significant, whereas the coefficients of Close and Eigenvector are both significantly positive. Thus, in the bank shareholder network, the closer the bank is to the center, the better its overall position, and the higher the level of board diligence. In columns (5) ∼ (8), the coefficients of Degree, Close and Eigenvector are significant at the 5% level, whereas Between is not statistically significant. In the bank shareholder network, the wider the social solidarity of the bank, the closer it is to the network center, the better its position in the global network, and the stronger the board's executive ability. In columns (9) ∼ (12), the four coefficients are all positive and significant, indicating that the improvement in network centrality is beneficial to board independence.

Results of baseline regression.

Notes: *, ** and *** denote the 10, 5 and 1 percent significance levels, respectively. The value in parentheses is standard error.

According to this study, the bank shareholder network has a positive effect on bank board governance, and the improvement in network centrality is conducive to increasing diligence, execution, and independence of the board of directors. A bank with a higher degree centrality has more extensive social connections, thus enabling it to obtain more valuable information resources. The greater the betweenness centrality of a bank, the greater is its control ability within the network. By serving as a link between other financial institutions, it can provide heterogeneous information, broaden resource channels, and alleviate the pressure of information asymmetry. Meanwhile, the higher the closeness centrality of a bank, the closer it is to the center of the network, the smaller the average distance to other banks, and it can obtain information resources rapidly and at a lower cost. Additionally, the higher the eigenvector centrality of a bank, the better its overall position in the network. It can connect to more powerful banks in the network, thereby improving its reputation. To maintain a market reputation, banks must improve the internal governance system using social networks for monitoring. Thus, all regression results support Hypothesis 1.

Our findings provide further evidence of the trade-off role of bank shareholder networks in bank governance. Li et al. (2019) demonstrated trade-offs between information, resources, voice, and collusion when weighing the impact of shareholder networks. If collusion outweighs the right to obtain resources and speak during normal operations, then the position of a malicious bank's shareholder network is strengthened, resulting in higher risk taking. Ardekani et al. (2020) confirmed that interbank networks may underestimate liquidity risk, highlighting the negative side of network effects. However, it is important to note that networks have positive effects on bank governance. While risk taking is an aspect of internal governance, board governance is equally vital, particularly during a financial crisis (Fernandes et al., 2018). Additionally, risk may arise from a bank's initiative to expand its profit growth points within the confines of risk control. Compared to other governance indicators, board governance is closer to the source of the shareholder network, and its direct influence is more apparent. Hence, we observe a positive tradeoff effect.

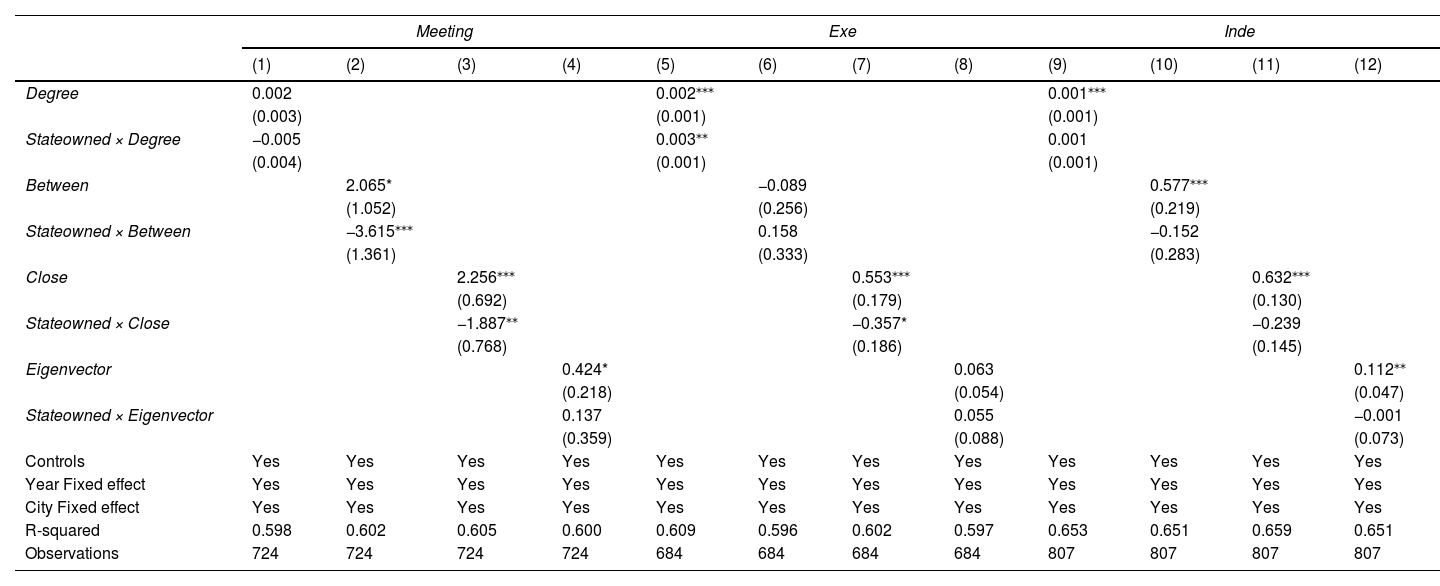

Heterogeneous effectsService areasTable 3 reports the results of the heterogeneity test based on different service areas of banks. Local is the dummy variable indicating if a bank is local. In columns (1) ∼ (4), the heterogeneity effect of Degree, Between, Close, and Eigenvector on board diligence are approximately the same. Compared with national banks, the positive effect of bank shareholder network on the diligence practiced by the boards of local banks is significant and the improvement effect is stronger. In columns (5) ∼ (8), although Degree, Close, and Eigenvector have a significant positive effect on the board executive capacity, heterogeneity effects vary across the network centrality. Specifically, the coefficient of Local × Degree is positive, indicating that compared with national banks, the improvement effect of Degree on the board executive capacity of local banks is on average 0.003 units higher per unit. With respect to Close, the coefficient of Local × Close is negative, indicating that the improvement effect of Close on the board executive capacity of local banks is reduced by 0.930 units on average. Besides, there is no difference in the improvement effect of Eigenvector on the board executive capacity. In columns (9) ∼ (12), the coefficients of Local × Degree and Local × Eigenvector are both positive, indicating that compared with national banks, the improvement effect of local breadth and global location on the board independence of local banks are 0.002 and 0.573 units higher, respectively. However, there is no difference in the improvement effect for betweenness centrality and closeness centrality on board independence.

Results of heterogeneous effect: service areas.

Notes: The control variables include FIS, N_GDP, CAR, EB, GRO, BS and DUAL, and the coefficients of them are omitted for brevity. *, ** and *** denote the 10, 5 and 1 percent significance levels, respectively. The value in parentheses is standard error.

In conclusion, we find that the bank shareholder network has a significant positive effect only on the board diligence of local banks, and the positive effect of the bank shareholder network on board independence is discernible in local banks. In addition, the positive impacts of the bank shareholder network on board executive capacity differ from the various network structure perspectives. Perhaps, this is because the largest shareholders of local banks are generally local governments or state-owned firms. Local governments have a strong influence and control over local banks owing to financial pressure and the burden of official performance. Thus, local governments have a strong positive impact on the diligence and independence of the board of directors. However, for most national banks, vertical management of branches may limit local government directives; therefore, bank board governance is less restricted. However, a large board of directors, complex organizational structure, and the historical advantages of a good reputation may obscure the impact of network centrality on bank board governance.

Ownership propertiesTable 4 presents the results of heterogeneity tests based on various ownership properties. Stateowned is the dummy variable that reflects ownership properties. Columns (1) ∼ (4) present the results using board diligence as an explained variable. The coefficients of Stateowned × Between and Stateowned × Close are both significantly negative, indicating that compared with nonstate banks, for each unit of betweenness centrality and closeness centrality, the impact of improvement on the board diligence of state-owned banks decreased by 3.615 and 1.887 units on average, respectively. Columns (5) ∼ (8) show that Degree and Close have opposite heterogeneity effects on the board executive capacity. Specifically, the coefficient of Stateowned × Degree is 0.003, indicating that the impact of improvement in local breadth on the board executive capacity of state-owned banks is on average 0.003 units higher than that of nonstate banks. However, the coefficient of Stateowned × Close is -0.357, indicating that compared with nonstate banks, the improvement effect of global depth on the board executive capacity of state-owned banks is reduced by 0.357 units on average. Columns (9) ∼ (12) indicate that for banks with different ownership properties, there is no heterogeneity in the improvement effect of network centrality on board independence.

Results of heterogeneous effect: ownership properties.

Overall, we find that bank shareholder networks have a positive impact on board diligence and board executive capacity of nonstate banks, indicating an obvious short reinforcement effect. That is, the presence of control in the network or close to the center can affect board diligence and executives of nonstate banks, while a close relationship with direct shareholders affects the board executive capacity of state-owned banks. These findings align with the small-world features of financial networks that are most prevalent (Watts & Strogatz, 1998). Over time, most connections in small-world networks remain steady, whereas only a small number of local connections change. Consequently, nonstate banks find it challenging to expand their control through direct shareholder involvement and must fully leverage indirect relationships within the network. This may be attributable to the fact that the number of direct major shareholders and China's nonstate commercial banks’ social relations are relatively small compared to state-owned banks. Additionally, nonstate banks receive less government support. Therefore, board governance can be improved if nonstate banks have greater control over resource allocation or are closer to the center of the network. By contrast, state-owned banks may receive extra government support; however, they also face significant limitations and dependence. State-owned banks that have internal governance influenced by the government and undertake political tasks (Wang et al., 2019), it is challenging to leverage other network advantages, such as indirect shareholders in bank board governance, owing to the latter's influence. Furthermore, for banks with different ownership structures, there is no heterogeneity effect on the positive influence of the bank shareholder network on board independence.

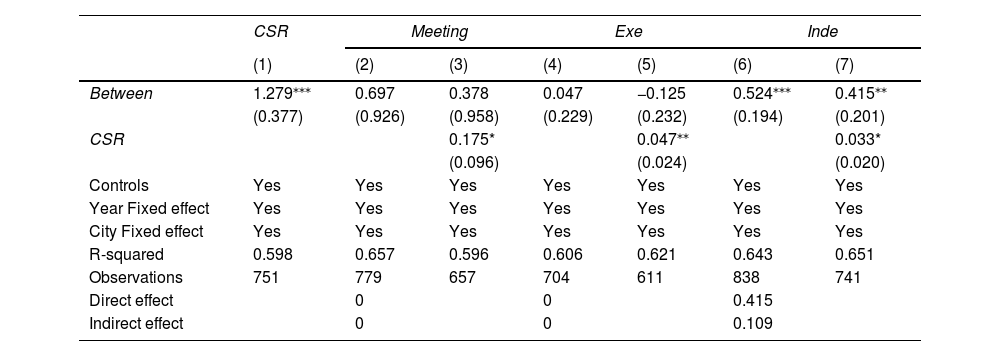

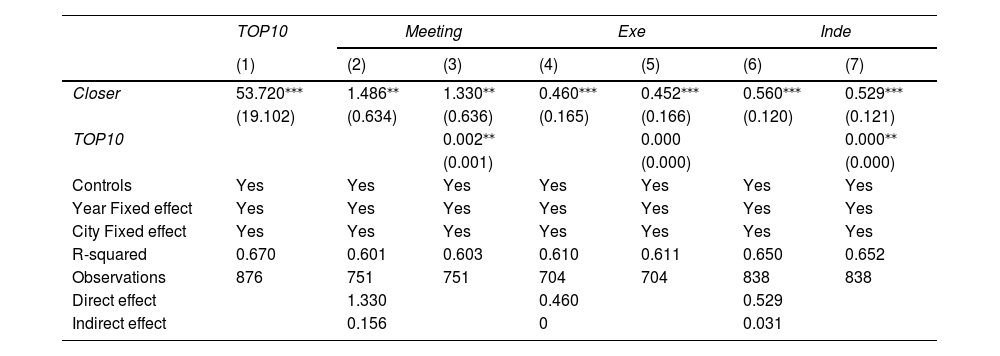

Mechanism and robustnessMechanism discussionInformation sharingBy sharing information, the bank shareholder network provides access to information, which may affect board governance. Table 5 presents regression results for the information-sharing mechanism. Column (1) shows the regression between Between and CSR, which is a proxy for the information sharing variable. The results show that Between has a significant positive effect on information sharing. Specifically, banks with greater control over the bank shareholder network are more likely to improve information acquisition and sharing, which indicates that the information sharing variable is indeed a mediation variable affecting bank board governance.

Information sharing mechanism.

Columns (2) ∼ (3), columns (4) ∼ (5), and columns (6) ∼ (7) present the regression results between the Between variable and board diligence, board executive capacity, and board independence, respectively, after the inclusion of CSR. Considering that Between only has a significant positive effect on board independence, based on the baseline regression results, the results in columns (6) ∼ (7) are important. In column (7), the coefficient of CSR is positive and significant, and the coefficient of Between is 0.415, which is less than 0.524, as shown in column (6). These results indicate that information sharing can improve board governance. Therefore, Hypothesis 2 is confirmed.

Notably, these regression results only indicate the presence of an information sharing mechanism between the betweenness centrality and bank board governance. However, the information-sharing mechanism between the other three indicators and bank board governance has not yet been examined. A possible explanation is that betweenness centrality assesses the ability of banks to control each another. The higher the score, the more prominent is the bank's position in the network. Additionally, this link facilitates easier links between banks, and those in this position can gather more information and spend less in sharing it. This intuition is consistent with Granovetter's (1973) analysis that social networks aid in the acquisition of diverse information.

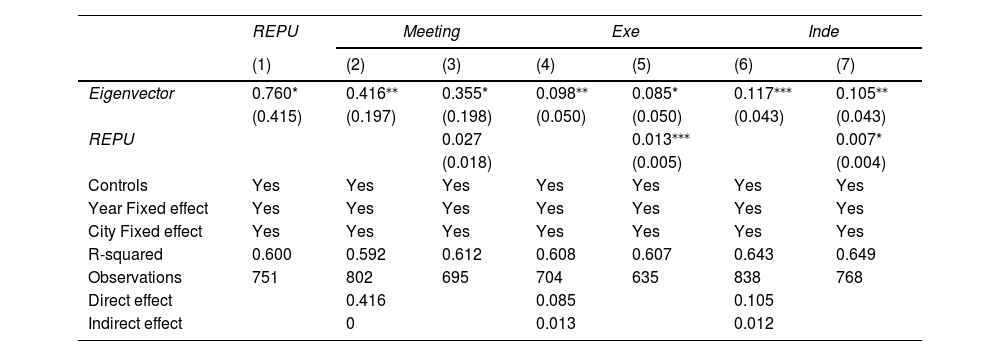

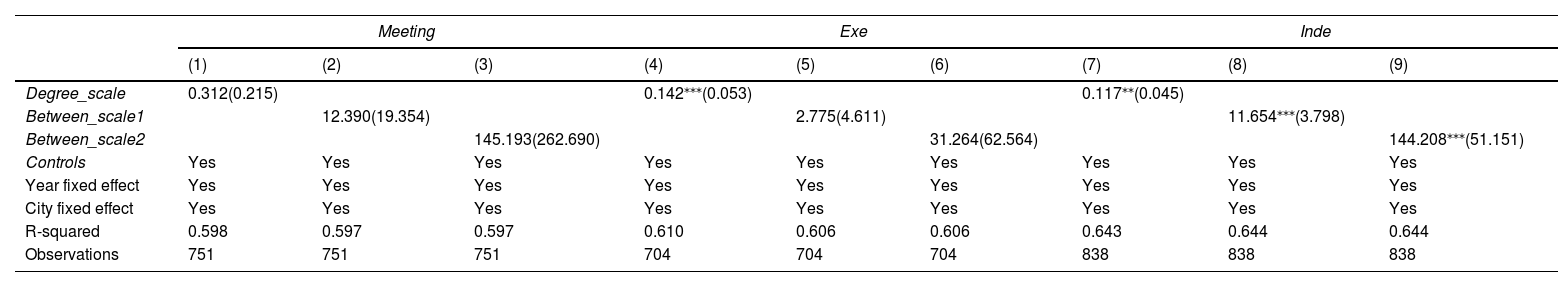

Reputation incentivesIn a positive position within the bank shareholder network, banks have high social capital and find it easy to win over stakeholders and investors (Li et al., 2019). For maintaining a good reputation, banks are inclined to strengthen their internal governance. Eigenvector is an indicator that measures the position of a bank in the overall network. The greater the value, the higher is the bank's reputation score. Therefore, we tested Hypothesis 3 using Eigenvector as the core explanatory variable.

Table 6 presents the regression results for the reputation incentive mechanism. Column (1) displays the regression results for Eigenvector and reputation incentive variable REPU. The results suggest that Eigenvector has a significant positive effect on REPU, that is, if the bank's overall position in the bank shareholder network is high, it obtains excellent reputation and trust scores. This shows that REPU is indeed the mediating variable of the bank shareholder network affecting bank board governance. Columns (2) ∼ (3) show the regression results between Eigenvector and board diligence after the inclusion of REPU. The coefficient of REPU is insignificant, indicating that there is no transmission path through reputation incentives. Columns (4) ∼ (5) show the regression results between Eigenvector and the board executive capacity after the inclusion of REPU. In column (5), the coefficient of REPU is positive and significant, and the coefficient of Eigenvector is 0.098, which is less than 0.085 in column (4), similar to the results in columns (6) ∼ (7). To sum up, Eigenvector can affect the board executive capacity and board independence through the reputation incentive mechanism. Therefore, Hypothesis 3 is confirmed.

Reputation incentive mechanism.

This mechanism is consistent with the economic intuition and features of China's social structure. Reputation affects the expectations and future choices of all those involved. Therefore, if an actor holds a favorable position in the bank shareholder network, the social capital and esteem they possess within the banking industry remains high, and their current status could motivate them to make improve further (Mailath & Samuelson, 2006). China attaches greater importance to maintaining its social image; therefore, both legal persons and individuals should focus on self-improvement and safeguard their existing interests.

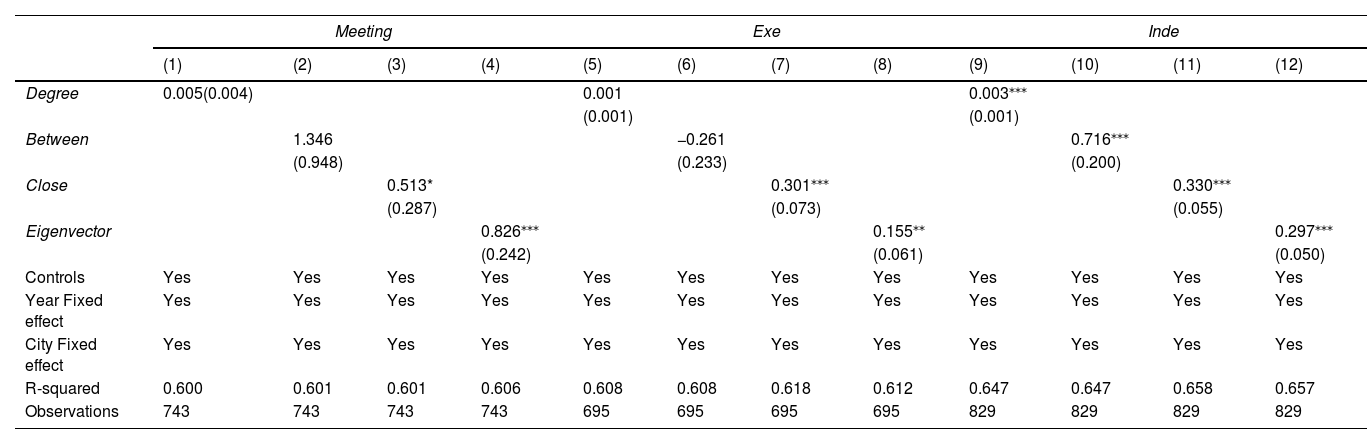

Effective connectionsAccording to Hypothesis 4, the bank shareholder network is a weak network connection, and only major shareholders in the network can enable a real connection role. The greater the value of Close, the easier it is for the bank to connect with other banks. Therefore, we tested Hypothesis 4 using Close as the core explanatory variable.

Table 7 reports the regression results for the effective connection mechanism. Column (1) shows the regression results for Close and effective connection variable TOP10. The results show that Close has a significant positive effect on TOP10, that is, the more central the bank is in the bank shareholder network, the smaller the average distance with other banks, the larger the value of TOP10, and the stronger the effective connection ability. This indicates that TOP10 is indeed a mediation variable of the bank shareholder network affecting bank board governance. The results in columns (2) ∼ (3) and columns (6) ∼ (7) indicate that Close can affect board diligence and board independence through the effective connection mechanism. Therefore, Hypothesis 4 is confirmed.

Effective connection mechanism.

We emphasize this mechanism because the shareholder network is more closely linked to the fundamental benefit of banks versus other networks. Conflicts between major and minority shareholders have existed for a long time. While major shareholders may engage in malicious collusion, minority shareholders’ free-riding can impede the efficiency of internal bank governance. Our benchmark results demonstrate that this study is favorably positioned on the trade-off spectrum. In this section, we provide further evidence that shareholder networks can amplify the views of major shareholders and reinforce the tangible link between equity rights (Dahl & Pedersen, 2005).

Robustness testEliminating size differencesBank shareholder networks will continue to grow in scale over time, and network centrality will also progress. Consistent with Chen and Xie (2011) and Shen et al. (2017), we eliminate the differences in each year caused by network size. We adjust the calculation methods for degree centrality and betweenness centrality and re-examine Hypothesis 1. The specific practices are as follows:

Redefine degree centrality as:

Redefine betweenness centrality into the following two forms:

where g is the total number of banks in the bank shareholder network for each year.Table A.1 shows the regression results, and the baseline results continue to hold.

Robustness tests of eliminating size differences.

Notes: *, ** and *** denote the 10, 5 and 1 percent significance levels, respectively. The value in parentheses is standard error.

We use a time-varying growth bank shareholder network, with banks and shareholders considered as nodes. Different network construction methods render the selection of network members and the identification of social relations slightly different, which may lead to differences between the bank shareholder network and bank board governance. Therefore, for the robustness test, we construct a time-varying growth bank network by treating each bank as a node. Table A.2 shows that the results are robust.

Robustness tests of changing network construction method.

Notes: *, ** and *** denote the 10, 5 and 1 percent significance levels, respectively. The value in parentheses is standard error.

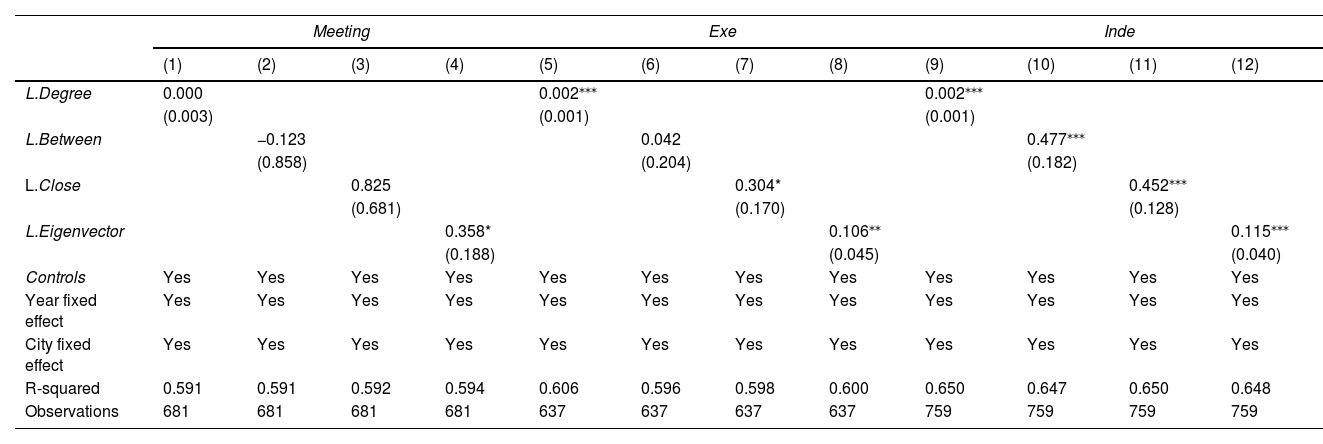

A bank with a high level of board governance may automatically broaden its social relationships and establish a good reputation in the network, thus gaining a favorable position within it, and reverse causality may exist. To alleviate the endogeneity problem, network centrality is treated with a one-period lag. Table A.3 shows that shareholders have a positive impact on bank board governance. The study conclusion is valid, notwithstanding the endogeneity problem.

Endogeneity discussion.

Notes: *, ** and *** denote the 10, 5 and 1 percent significance levels, respectively. The value in parentheses is standard error.

This study uses four types of network centrality measures to portray a bank's position within the shareholder network and examines the impact and mechanism of the network on board governance, including the board's diligence, executive capacity, and independence. Empirical findings show that a bank shareholder network has positive impact on bank board governance, indicating that if a bank has an advantageous position in the network, it will be helpful in improving bank board governance. In addition, network centrality measures emphasize various points of a bank's position, indicating that the impact of each network centrality measure on the board's diligence, executive capacity, and independence will differ slightly and needs to be analyzed on a case-by-case basis, rather than being generalized. Moreover, the impact of the bank shareholder network on board governance will be heterogeneous given the range of service areas and ownership properties, and it shows a reinforcing weakness effect. Furthermore, network location can improve board governance through information sharing, reputation incentives, and effective connections within the bank shareholder network.

This research not only provides novel ideas and a new basis for research in the banking industry but improves understanding on the relationship and mechanism between banks, shareholder networks, and board governance. Consistent with the above findings, this study suggests three policy implications for shareholders and a bank's board of directors to leverage strengths and improve performance, guidance for governments and regulatory agencies to regulate commercial banks, and suggestions for investors and market agents to make investment decisions.

First, shareholders can actively use their own information advantages in social networks to improve the bank's internal governance capacity. Commercial banks should conduct a concrete analysis of specific issues and implement governance goals to avoid poor or weak governance efficiency caused by the overuse of network effects. For example, to improve board diligence, banks can focus on their global position in the bank shareholder network and closeness to the center of the network, rather than focusing on increasing the number of directly connected banks.

Second, governments should provide different types of support and intervention to banks based on their service areas and ownership properties. For local banks, local government support is conducive to improving internal governance. Regarding nonstate banks, the government should not intervene excessively, but should give them appropriate internal governance space to maximize the positive impact of bank shareholder networks. Considering that changes in shareholding structure and the self-centered behavior of common shareholders may have a negative effect on the internal governance of banks, regulatory agencies should strengthen their oversight, focusing on the double-edged sword effect of the change in shareholding structure, and regulate their economic behavior.

Third, investors can indirectly assess the status, reputation, and internal governance quality of a bank by analyzing its ownership structure and common shareholders. Marketing agents should be cautious regarding bank networks, especially cross shareholdings. While such arrangements can improve banks’ ability to obtain information and enhance internal governance performance, they also expose them to external risks.

Our study has several limitations that highlight potential areas for future research. First, it examins only three fundamental types of bank board governance. However, board governance includes education, experience, diversity, and other characteristics that may affect bank performance drastically. Therefore, future research should explore the impact of bank networks on other governance mechanisms to enrich the existing literature. Second, our study focuses on China's banking industry, where indirect financing channels dominated by the banking sector are of greater importance, and personal relationships are crucial. Our findings may not be applicable to countries with developed direct financing or regions with a lower emphasis on relationship network customs. Thus, it is worthwhile examining cross-country perspectives and national heterogeneity to explore the influence of social networks on bank governance under various economic institutional environments.

This work was supported by Humanities and Social Sciences Project of the Ministry of Education of China (22YJA790055, 21YJC790107), Guangdong Philosophy and Social Science Planning Project (GD22YYJ06), Guangdong Basic and Applied Basic Research Foundation (2023A1515012583).

Senior management refers to the board of directors, board of supervisors, and senior management of the bank, such as the chief executive officer (CEO) and chief financial officer (CFO).

This study refers to S&P Global Ratings’ bank rating method and Moody's bank rating method, which are divided into two dimensions: individual credit assessment and external support assessment. Among them, individual credit assessment examines factors such as the macroeconomic environment, a company's business status, profitability, risk, and bank liquidity. In contrast, external support assessment examines the support willingness of the government and relevant institutions. In this study, we focus on bank liquidity and risk as the core factors of reputation evaluation.