Literature on how regional integration within a country affects corporate innovation is limited. This study proposes a dynamic mechanism for integration of the Yangtze River Delta (YRD) to promote corporate innovation based on the peer effect among enterprises. It constructs a panel regression econometric model and a difference-in-differences (DID) model for empirical analysis using Chinese A-share listed manufacturing companies from 2007 to 2021. The study's results show that corporate innovation has a peer effect in the same industry and same region. The peer effect among enterprises in the same industry in the YRD is more significant than that in other regions, and YRD integration has a greater effect on the corporate innovation of cities with close economic ties in the YRD region. The study's findings indicate that regional integration and innovation-driven strategies adopted by China are highly synergistic. Therefore, accelerating the regional integration of each city cluster, establishing regional economic coordination organizations, and increasing the peer effect of firms in the same city are necessary to promote corporate innovation in China.

Technological innovation is key to an enterprise's sustainable growth and long-term competitive advantage. It can help enterprises develop new or higher-quality products to gain more market opportunities and profits. For a country or region, knowledge and technological innovation help build a modern industrial system, promote economic growth, and actively address global competition (Pradhan et al., 2018; Mustapha et al., 2022). Governments of developed and developing countries need to stimulate enterprises’ innovation vitality and enhance their innovation activities when formulating and implementing public policies, industrial policies, and market rules (Chen & Naughton, 2016; Feng, 2019; McCarthy, 2021; Kivimaa, 2022).

The peer effect of corporate innovation refers to the mutual influence and transmission between enterprises in innovation that can be realized through cooperation, competition, imitation, and communication (Lieberman & Asaba, 2006; Machokoto et al., 2021). In the peer effect of corporate innovation, interaction and communication between enterprises are the most critical as they stimulate the innovative thinking and innovation ability of enterprises. The influence of peer effects can be positive or negative. A firm is in a peer environment where innovation is fostered is likely to be motivated to increase its own innovation input and output. Conversely, a firm in a peer environment that lacks innovation may be uninspired to innovate.

The integration of different regions within a country has become a powerful driving force and an important development strategy for a country's economic development and technological innovation. An example of such integration is the Yangtze River Delta (YRD) integration, promoted by China, which is profoundly influencing China's economic development and reshaping the global industrial chain (Zhang et al., 2018; Huan et al., 2022). Regional integration aims to eliminate economic and trade barriers in different administrative regions, promote the free flow of elements and resources, and realize rational industrial distribution and collaborative division of labor (Tang et al., 2015). Regional integration promotes economic communication, information exchange, and mergers and acquisitions of enterprises within the region. Therefore, it is bound to have an impact on enterprises’ innovation activities through peer effects such as information, experience, and externality (Zeng et al., 2021). However, scholars do not thoroughly examine how regional integration within a country affects the peer effects of corporate innovation and whether it has a significant amplifying or reinforcing effect.

Based on the innovation input data of China's listed manufacturing companies, this study discusses the peer effect of Chinese enterprises’ technological innovation and the strengthening effect of regional integration on the peer effect of corporate innovation. The 20th National Congress of the Communist Party of China, held in October 2022, emphasizes that innovation-driven development and regional integration are two important strategies for China's economic development. YRD integration is expected to be further promoted to the whole country in the future, greatly influencing the innovation activities of Chinese enterprises. Therefore, exploring the relationship between regional integration and corporate innovation activities not only has academic value but also practical significance.

Compared with the existing research, this study has several marginal contributions. First, the existing literature (Deng & Li, 2021; Wu et al., 2023) generally examines the impact of regional integration on corporate innovation using the difference-in-differences (DID) model; although, it does not empirically analyze its driving mechanism. In contrast, this study identifies and empirically analyzes the micro-mechanism of regional integration within a country to promote corporate innovation, that is, regional integration promotes enterprises to engage in technological innovation by strengthening the peer effect among enterprises. Second, different from the existing studies that focus on peer effects from firms in the same industry, this study distinguishes peer effects from firms in the same industry and those in the same region, which enriches the research on peer effects of corporate investment and innovation. This study aims to strengthen the peer effect among enterprises in the same region and provides a new implementation path for strengthening corporate innovation and enhancing enterprise innovation. Third, this study integrates the YRD as the research object and focuses on regional integration within a country, providing important empirical evidence for China to promote regional integration, realize innovation drives, and provide experience for other developing countries to learn from China's experience to enhance the vitality of enterprise technological innovation.

The remainder of this paper is organized as follows: Section 2 offers a literature review, and Section 3 analyzes the theoretical mechanisms. Section 4 presents the data and empirical model, and Section 5 discusses the results. Lastly, Section 6 concludes the study and tackles the implications.

Literature reviewMotivation and conditions of corporate innovationScholars have extensively analyzed the dynamics and conditions that drive firms’ technological innovation. Two factors motivate firms to engage in technological innovation: innovation power and the market. Innovation power is determined by the social attributes of firms. For example, to cope with economic difficulties, enterprises in developing countries explore and innovate under the incentive of “national consciousness” (Suto & Takehara, 2022). Outstanding and ambitious entrepreneurs constantly strive to improve human living conditions and achieve sustainable development; therefore, they introduce great technological innovations (Marvel et al., 2007). In addition, corporate innovation is driven by the economy and market. Specifically, enterprises innovate to win more economic benefits and market shares (Goodale et al., 2011), as well as cope with economic transformation and market demand changes (Demirel & Kesidou, 2019).

External and internal factors encourage enterprises to engage in technological innovation. Existing studies discuss various external factors, including government subsidies (Cowling et al., 2018), tax policies (Howell, 2016; Peters et al., 2022), financial markets (Capizzi et al., 2011; Amore et al., 2013), and market competition (Aghion et al., 2005; Hoskins & Carson, 2022). Other studies examine the internal factors, including firm innovation culture (Matzler et al., 2015; Majeed & Breunig, 2022), innovation capital (Audretsch & Link, 2012; Ganguly et al., 2019), capital structure (Aibar-Guzmán et al., 2022), development strategy (De Massis et al., 2018; Hilmersson & Hilmersson, 2021), knowledge strategy (Bhatti et al., 2016), and ownership structure (Chen et al., 2014; Cao et al., 2020). These studies show that sufficient market competition, good policy support, and excellent corporate strategy promote corporate innovation. The peer effect discussed below is also regarded as an important factor in promoting the technological innovation of enterprises.

Regional integration and corporate innovationRegional integration is important in corporate innovation. International academic research on regional integration mostly focuses on the integration process between countries, particularly European integration. European integration is a practical movement in European social, political, and economic experiences after World War II (Höpner & Schäfer, 2012; Tober & Busemeyer, 2022). Two views exist on the impact of European integration on the innovation activities of member countries (Semenets et al., 2020). On the one hand, European integration brings about economic prosperity, creates new employment opportunities, and strengthens corporate innovation activities through the free flow of factors, growth of foreign, and a unified market. On the other hand, European integration negatively affects new member countries that are mostly underdeveloped as it leads to deindustrialization, emigration of capable populations, and a decrease in employment opportunities and enterprise innovation activities. Radosevic (2009) examines the impact of European integration on the R&D and innovation activities of South-Eastern Europe (SEE) and highlights that inadequate demand for innovation at the firm level and insufficient support systems for corporate innovation are the biggest obstacles hindering economic growth and competitiveness improvement of SEE countries. Semenets et al. (2020) find that after Ukraine joined the Free Trade Area, the number of new technological processes implemented by enterprises and the share of innovative products sold as industrial products have gone down.

Research on the impact of China's regional integration policy on corporate innovation at the city level focuses on the analysis of the structure and evolution of urban innovation networks in urban agglomerations and the impact of regional integration on urban innovation capacity. Li and Ye (2021) find that the overall innovation capacity of cities in the YRD has continuously improved, and the collaborative innovation links between cities has gradually strengthened. However, the innovation development of cities in the YRD is unbalanced and shows a significant “core-periphery” spatial structure and a “multi-center, multi-level” pattern. Using panel data from 27 cities with the highest degree of economic integration in the YRD from 2009 to 2018, Liu and Chang (2021) analyze the impact of market integration on regional innovation. Their results show that market integration positively impacts and promotes regional innovation. At the firm level, many studies focus on the impact of YRD integration green innovation and the energy efficiency of enterprises from an environmental perspective. These studies demonstrate that YRD integration strengthens technological innovation and environmental regulation, thereby improving energy efficiency (Cao et al., 2020; Zhang et al., 2020), and that the YRD realizes the regional collaborative integration of green innovation (Zeng et al., 2021). Some recent studies examine the impact of regional integration on firms’ innovation output. For example, Wu et al. (2023) select the expansion of the YRD urban agglomeration in 2010 as a quasi-natural experiment to examine the impact of regional integration on the quality of enterprise innovation. They find that regional integration improves the quality of enterprise innovation.

Peer effect and corporate innovationThe technological innovation behavior of peer firms is also considered an important market power source or incentive condition that affects firms’ technological innovation (Machokoto et al., 2021). Peer effect, which is originally derived from the field of education, refers to the influence that groups of young people who are similar in terms of age and background have on each other (Sacerdote, 2001). It has since been expanded to include studies in sociology, economics, and other fields (Dahl et al., 2014; Leary & Roberts, 2014; Park et al., 2017). Peer effects include information, experience, and externality effects. Peer effects can influence firms’ innovation activities and promote knowledge and innovation diffusion (Xiong et al., 2016).

Recently, scholars have started to empirically investigate the link between peer effects and firm innovation. Gordon et al. (2020) examine the impact of peer research and development (R&D) disclosure on firm innovation using a sample of foreign firms cross-listed on US exchanges. They find that R&D disclosure can generate externalities for related firms, enabling them to better infer a high-return investment program. Using a large sample of 4545 US firms over the period 1968–2018, Machokoto et al. (2021) find robust and significant positive peer effects on corporate innovation. In terms of the selection of research variables, the above studies generally focus on the peer effect from enterprises in the same industry but not on the peer effect from enterprises in the same region. Wang et al. (2022) explore the effect of peer firms on the green innovation activities of the Chinese A-share listed firms in the manufacturing industry from 2011 to 2020 and investigate the influencing factors of peer effect. Xiao et al. (2022) find that firms’ innovative investment is significantly influenced by their peers; the weaker the firms’ market competitiveness, the greater the influence of their peers on their innovative investment.

SummaryResearch on the relationship between corporate innovation and regional integration and between corporate innovation and peer effect is extensive. However, research on the link among corporate innovation, regional integration, and peer effects remains limited. International scholars focus on the integration of countries and neglect regional integration within countries. In China, the regions significantly differ in terms of natural resources, population size, income level, and scientific and technological strength. Regional integration has become an important development strategy for the Chinese government to achieve economic growth. However, existing research on the promotion of corporate innovation by regional integration in China is still lacking at the micro level. An in-depth study of the micro-mechanism of regional integration promoting enterprise innovation and the design of targeted innovation support policies has important theoretical and practical significance for improving the collaborative innovation ability of regional cities and promoting the coordination and common growth of regional urban economies. Thus, based on the peer effect of enterprises, this study examines the impact mechanism of the YRD integration on urban enterprise innovation in the region at the micro level.

Analysis of theoretical mechanismsThis section first analyzes the generation mechanism of peer effect that encourages enterprises to engage in technological innovation. YRD integration is taken as an example to explain how regional integration affects the peer effect on enterprises’ innovation activities. Finally, the mechanism of YRD integration in promoting enterprise innovation is summarized.

The mechanism of peer effect promoting enterprises to engage in technological innovationCurrently, the concept of peer effect is widely used to analyze enterprise investment activities or innovation diffusion, which can explain the process of mutual imitation, learning, and knowledge transfer of enterprises, as well as the convergence of enterprise investment and industrial structure in the regional economy (King & Raza, 2020). From the perspective of the interaction between enterprises, dynamic competition, social learning, and social network relationships are regarded as the reasons and channels for enterprises to be affected by peer effects in investment and innovation activities.

From the viewpoint of the dynamic competitive relationship among enterprises, enterprises choose the same or similar innovation activities as their peers to maintain competitive advantages and avoid investment risks. The degree of learning and imitation or the size of the peer effect is related to the degree of industry competition (Park et al., 2017; Bustamante & Frésard, 2021), market position of enterprises (Chen & Ma, 2017), and effects of learning and imitation. In general, the learning and imitation benefits of investment and innovation activities are affected by the market space and number of competitors in the industry. When market capacity is large, opportunities are abundant, industry competitors are few, benefits of learning and imitation are higher, and the peer effect of enterprise investment or innovation activities is stronger. The demand for emerging industries and markets leads enterprises to engage in many similar investment or innovation activities. At present, many converging investment and innovation activities are present in China's new energy vehicles industry and their upstream and downstream industries.

In terms of the existence of social learning relationships between enterprises, peer enterprises’ investment and innovation activities have important information transmission values. Enterprises analyze the investment or innovation activities of their peers to obtain more information about the prospects of products or projects, thus reducing the uncertainty of enterprise investment or innovation activities and improving the enthusiasm of enterprises in investment or innovation activities (Bala & Goyal, 1998; Young, 2009). The peer effect of enterprise investment and innovation activities is stronger if the information exchange between enterprises is convenient, the technical openness and transparency of investment or innovation activities are high, and the enterprise has the required financial and human capital support for investment or innovation activities.

Furthermore, the peer effect of enterprise investment or innovation activities are affected by the social relationships of enterprises, and the effect is not limited to enterprises in the same industry, but also extends to those in the same region with social relations (Bramoullé et al., 2020). In China, different regions have different business cultures, and enterprises from the same region often form business groups or entrepreneur groups with distinct regional characteristics based on geographical and blood relationships. The investment or innovation activities of leading companies or business leaders in a region are consistent. For example, from 2010 to 2012, many enterprises in Wenzhou, Zhejiang Province, have participated in real estate investment activities, which eventually led to a severe credit and financial crisis in Wenzhou.

Therefore, the study's first theoretical hypothesis is as follows.

Hypothesis 1

Peer effect exists in the technological innovation activities of enterprises; that is, corporate innovation is affected by the association of peer enterprises, and there is a convergence of innovation activities among enterprises.

Under Hypothesis 1, as information is more likely to be effectively transmitted through intra-industry competition and spatial proximity, and social networks have an important impact on corporate innovation, peer effects may stem from enterprises in the same industry or the same region.

How regional integration can strengthen the peer effect in business innovation?Administrative divisions, household registration systems, and local protection have seriously restricted the formation of a unified, fair, competitive, and orderly big market in China. The implementation of a regional integration strategy is an important measure for eliminating market segmentation in China. In 2018, integrated development of the YRD has become a national strategy. Over the past decade, the YRD has made significant progress in regional infrastructure connectivity, free flow of factors and resources (Zhang et al., 2018), and the regional industrial collaborative division of labor. YRD integration has strengthened the peer effect of corporate innovation in the region by promoting the exchange and dissemination of innovative information, improving the flow of innovative factors and resources, and strengthening competition and cooperation between enterprises in the industrial chain.

By 2022, the total length of railway operations in the YRD has reached 13,374 km, including 6329 km of high-speed railways, thus becoming the densest railway network in China. High-speed trains have been operating between cities in the YRD, driving the efficient and rapid flow of logistics, people, and information in the region and promoting commercial trade and M&A investment activities between enterprises in the region (Wang et al., 2019; Gao et al., 2020). Simultaneously, cities in the YRD continue to loosen the policy of population settlement, provide rich material incentives for talent introduction, and strengthen industrial cultivation and investment attraction by supporting industrial policies. As the capital, technology, and talent required for innovation activities are more evenly distributed among cities in the region, enterprises have the elements to support innovation activities, which greatly reduces the cost of innovation and the risk of failure and makes enterprises more inclined to follow the innovation activities of their peers.

YRD integration has also resulted in the formation of a sound industrial chain within the region. For example, Shanghai is where the enterprise headquarters is located and is a regional innovation center, while Zhejiang and Jiangsu provinces, as manufacturing bases, mainly support the production of key parts around core enterprises. The improvement in the industrial chain layout in the YRD has strengthened competition and cooperation among enterprises. On the one hand, the enterprises in the industrial chain form a more closely related enterprise network, and the innovation activities among enterprises have a synergistic effect (Nestle et al., 2019). The product and technology innovation of core enterprises produce new requirements for upstream enterprises; thus, enterprises on the chain are required to strengthen their technological innovation efforts simultaneously and enlarge the peer effect of corporate innovation activities. On the other hand, to ensure that enterprises in the supply chain remain in the industrial supply chain system, they compete with enterprises in the same industry to carry out R&D and innovation activities; that is, the competition effect amplifies the peer effect of enterprises’ innovation activities (Ferras-Hernandez & Nylund, 2019).

The study of corporate innovation activities in different cities can clarify the influence of regional integration on enterprise innovation. Jiaxing, Shaoxing, and Wenzhou in Zhejiang Province are at different locations in the YRD, and the depth of their participation in YRD integration differs. Jiaxing, which is adjacent to Shanghai, has greatly benefited from the YRD integration as manufacturing enterprises from Shanghai and other cities in Zhejiang Province have transferred to the city. According to the surveyed enterprises, the YRD integration has fully promoted the industrial upgrading and enterprise innovation of Jiaxing. Meanwhile, Shaoxing is adjacent to Hangzhou and is 1.5-hours away from Shanghai via high-speed rail. According to the surveyed enterprises, the YRD integration has brought great industrial opportunities to Shaoxing. The enterprises mainly produce parts and components for the core enterprises located in Shanghai. The pressure and motivation to innovate is greatly increased, and the enterprises keep increasing innovation input to attract the inflow of innovation factors. Wenzhou is in the southern part of Zhejiang Province, and is 3.5-hours away from Shanghai via high-speed rail. The interviewed enterprises state that due to geographical limitations, Wenzhou's integration into the YRD is relatively low; enterprises have difficulty attracting innovative elements and upgrading the manufacturing industry. Thus, the gap between Wenzhou and other cities in Zhejiang Province is constantly increasing.

Accordingly, the study's second theoretical hypothesis is as follows:

Hypothesis 2

Regional integration strengthens the peer effect of corporate innovation, thereby promoting firm innovation.

Regional integration refers to the integration of different administrative regions within the same country to break the administrative division, factor flow restrictions, and local protection behavior. In this study, regional integration in Hypothesis 2 refers to YRD integration. As YRD integration promotes information exchange and strengthens economic ties, Hypothesis 2 can be further divided into two hypotheses.

Hypothesis 2.1

Compared with other regions, the innovation activities of enterprises in the YRD are more influenced by enterprises in the same industry from other cities in the region.

Hypothesis 2.2

Cities with close economic ties and a high degree of integration in the YRD have a higher level of corporate innovation input than other cities in the region.

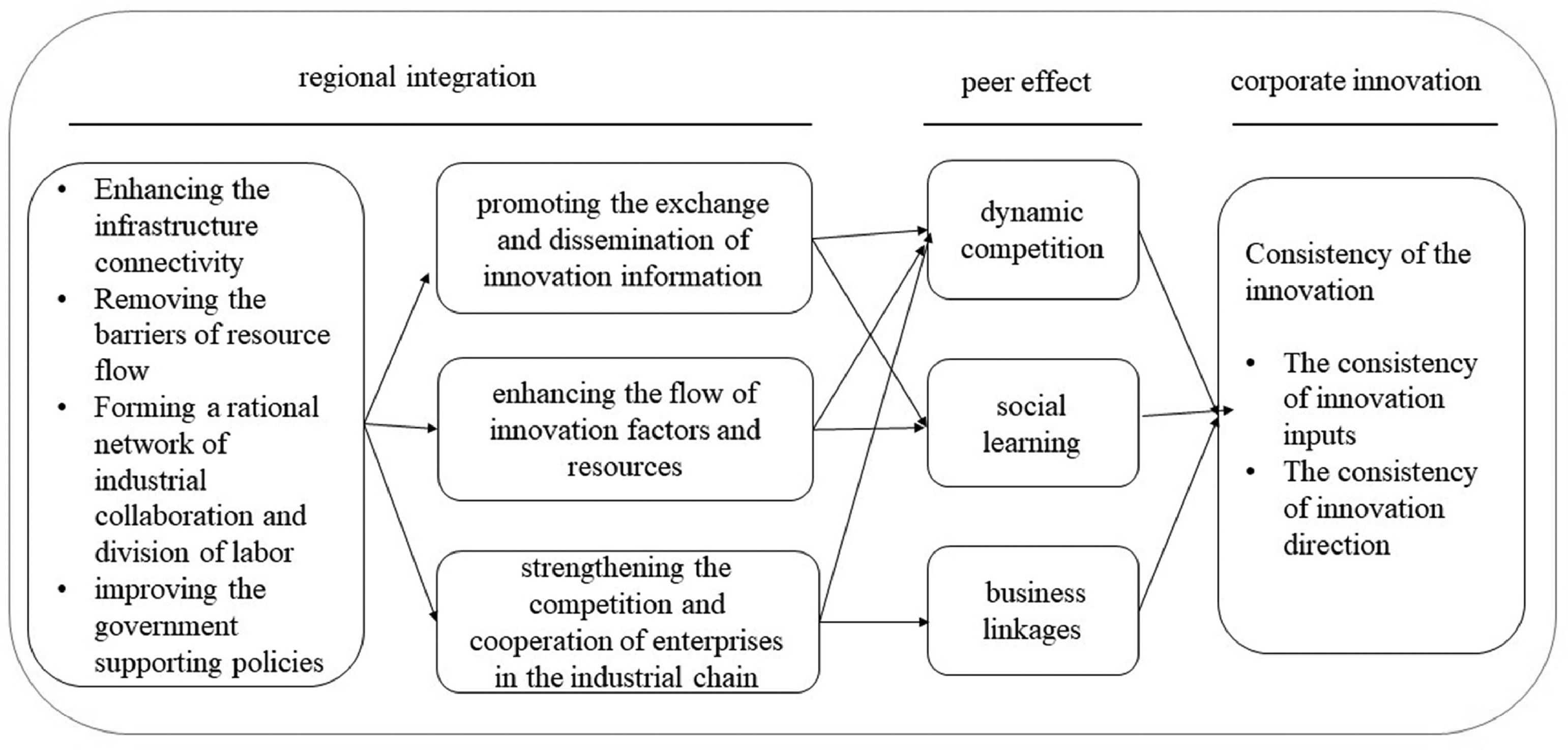

Connection mechanism of regional integration, peer effect, and corporate innovationDynamic competition, social learning, and social network connections among enterprises bring about peer effects, which encourage enterprises to emulate each other and engage in technological innovation. Regional integration strengthens the peer effect of regional enterprises’ innovation by promoting the exchange and dissemination of innovative information, improving the flow of innovative factors and resources, and strengthening competition and cooperation between enterprises in the industrial chain. Thus, this study establishes an internal correlation mechanism of regional integration, peer effects, and firm innovation, as shown in Fig. 1.

Samples, models, and variablesThis study empirically investigates the peer effect of corporate innovation among Chinese A-share listed companies and tests the impact of the YRD integration on the peer effect of corporate innovation (Hypotheses 1, 2.1, and 2.2). This section presents the data sample and empirical models.

Sample selection and data sourcesThis study focuses on manufacturing companies listed in the Shanghai and Shenzhen stock exchanges from 2006 to 2021. To measure an enterprise's innovation investment or innovation activities, indicators such as R&D expenditures, number of patent applications, and number of patent authorizations are commonly used. R&D is important for technological innovation and helps the sustainable development of enterprises. Data on R&D expenditures of listed companies are publicly available and easily accessible. Therefore, similar to other studies (Machokoto et al., 2021; Huňady & Pisár, 2021), this study uses enterprises’ R&D expenditures to measure their investment in technological innovation. Before 2006, China's Accounting Standards for Business Enterprises (ASBE) require all R&D expenditures to be expensed. After 2006, the new ASBE, issued by the Ministry of Finance, has allowed some R&D expenditures to be capitalized, enhancing the scope for enterprises to engage in earnings management. Since then, listed companies have gradually begun to disclose R&D expenditure data. Therefore, the starting year for the sample is 2006. Special treatment companies are excluded from the study to avoid the influence of abnormally operating companies. On this basis, the missing samples of control variables used in the empirical model are eliminated, and the extreme values of all continuous variables are winsorized at 1–99 %. The sample consists of 26,760 observations from listed companies.

Data sources are from the Wind database. Sample enterprises are from 263 cities, covering 31 provinces, municipalities, and autonomous regions of mainland China. The manufacturing industry has adopted the secondary industry classification standards issued by the China Securities Regulatory Commission in 2012. There are 31 secondary manufacturing industries.

Model construction and variable selectionDrawing on existing literature (Leary & Roberts, 2014; Machokoto et al., 2021) on the measurement of the peer effects of corporate innovation, the following benchmark model is constructed:

where RDijrt is the R&D expenditure at time t of firm i belonging to industry j and region r. RDPEER1−ijt denotes the average R&D expenditure of peer firms in the same industry. RDPEER2−irt denotes the average R&D expenditure of the peer firms in the same region. ui and vt are the individual and time-fixed effects, respectively. t and t-1 represent period t and period t lags by one period, respectively. In this study, individual fixed effects are chosen over industry or regional fixed effects because industry and regional fixed effects are presumably included in the individual fixed effects. εijrt is the random error term. Controlvar are the control variables, including the market-to-book ratio PB, the firm's cash to satisfy the investment ratio CASHINVE, the return on total assets ROA, the gearing ratio DEBT, and the top ten shareholders’ shareholding ratio SHAREHOLDERS_10. These control variables are common financial variables that affect enterprise investment decisions (Czarnitzki & Kraft, 2009; Machokoto et al., 2021; Nemlioglu & Mallick, 2021). Enterprises enjoy greater innovation incentives and face less financial constrains when their market-to-book ratio, cash, and return on assets are high; hence, they spend more on R&D. Concentrated ownership makes it easier for companies to reach R&D incentive decisions, and high corporate debt burdens may suppress corporate innovation investment.To test the effect of regional integration on the peer effect of corporate innovation (Hypothesis 1), Eq. (1) is modified to construct the following empirical model:

1i∈Y denotes a value of 1 when firm i is in a city in the YRD and 0 otherwise. 1i∉Y indicates a value of 1 when firm i does not belong to a city in the YRD, and 0 otherwise. Eq. (2) analyzes the heterogeneity of the sample according to whether the enterprise belongs to the YRD (Hypothesis 2.1).

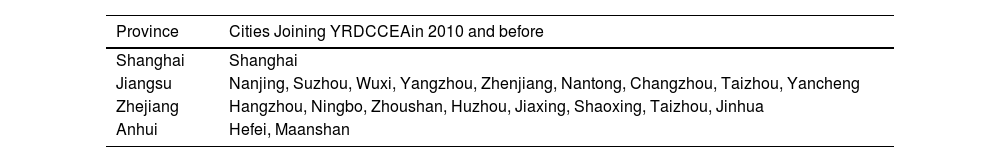

This study uses a DID model to evaluate the YRD integration policy (Hypothesis 2.2). The implementation of the “Yangtze River Delta Regional Plan” has been approved by the State Council in 2010; hence, the first year of YRD integration or the year of policy implementation can be traced back to 2010 or 2011, considering the policy time lag. There are 41 cities in the YRD, including Shanghai, 11 cities in Zhejiang Province, 13 cities in Jiangsu Province, and 16 cities in Anhui Province. Of the 41 cities, 27 have been classified as central cities in the YRD, and 20 of these central cities have joined the YRD Urban Economic Coordination Association (YRDCCEA) in 2010 or earlier, as shown in Table 1. The cities that joined the YRDCCEA are those that are most actively integrated and profoundly influenced by the YRD integration policy.

The 20 cities in Table 1 are included in the experimental group and the other 21 cities are used as the control group. Eq. (3) is used to assess the actual effect of the YRD integration policy on enhancing the peer effect of corporate innovation.

In terms of research methods, this study aims to establish baseline regression, carry out heterogeneity analysis by dividing different samples, and further divide subsamples into experimental and control groups for policy assessment. This study follows a progressive analysis path, from general to special. In terms of model design, unlike the studies of Leary and Roberts (2014) and Machokoto et al. (2021), the model in this study distinguishes between peer effects from firms in the same industry and peer effects from firms in the same region.

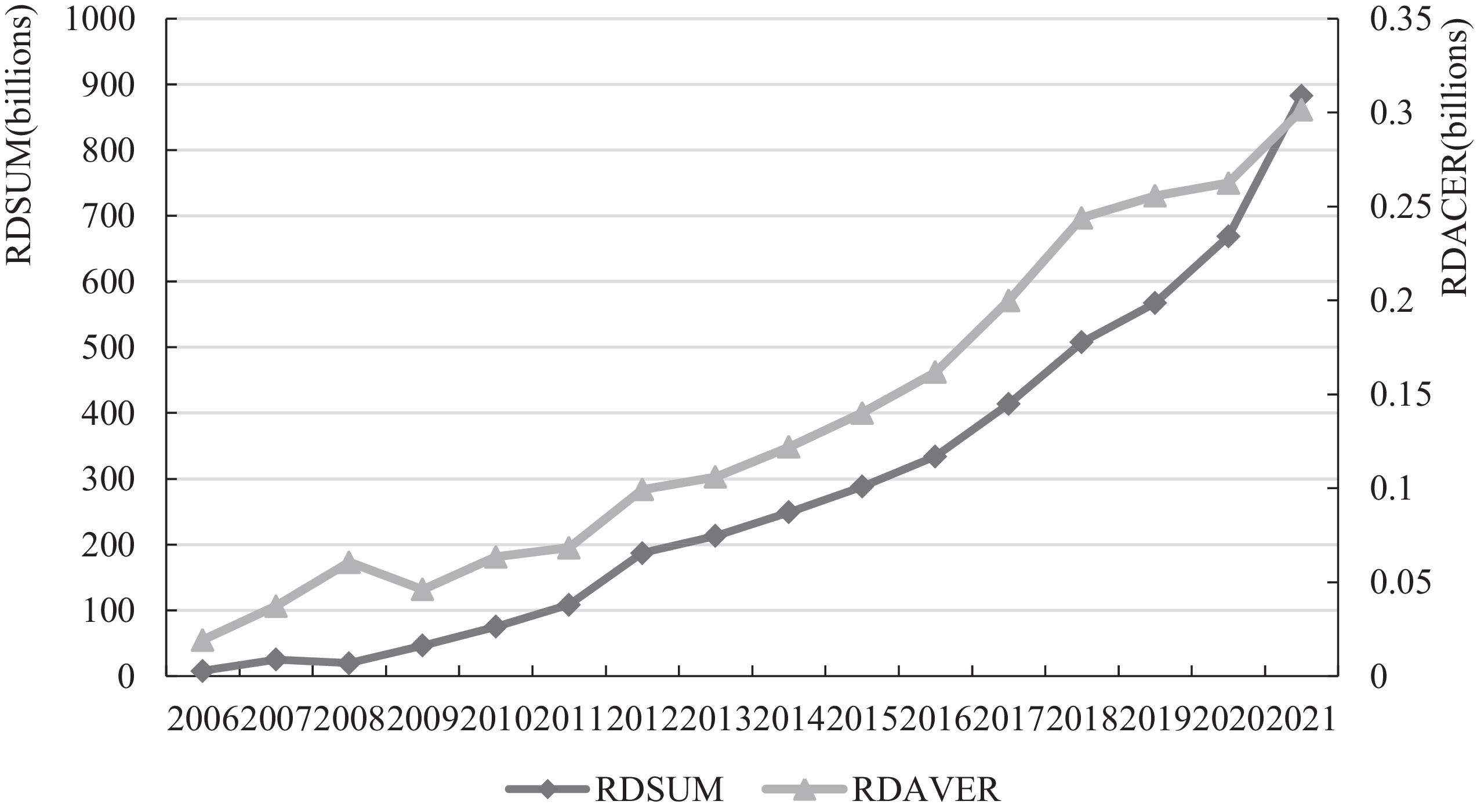

Descriptive statistics of variablesFig. 2 shows the total and average R&D expenditures of A-share listed manufacturing companies in China from 2006 to 2021. In terms of both total size and average size, the R&D expenditures of listed Chinese manufacturing companies has gradually increased. Total R&D has increased from RMB6.14 billion in 2006 to RMB882.65 billion in 2021. Meanwhile, the average size of R&D has increased from RMB15.66 million in 2006 to RMB301.35 million in 2021, which translates to an average annual growth rate of 25.4 %. The data indicate that Chinese enterprises attach increasing importance to innovation and R&D activities. Since 2016, the growth rate of innovation and R&D of Chinese enterprises has increased compared with previous years (the slope of the graph has become steep), which indicates that China places more importance on industrial upgrading and technological innovation under the supply side reform and Sino-US trade conflict.

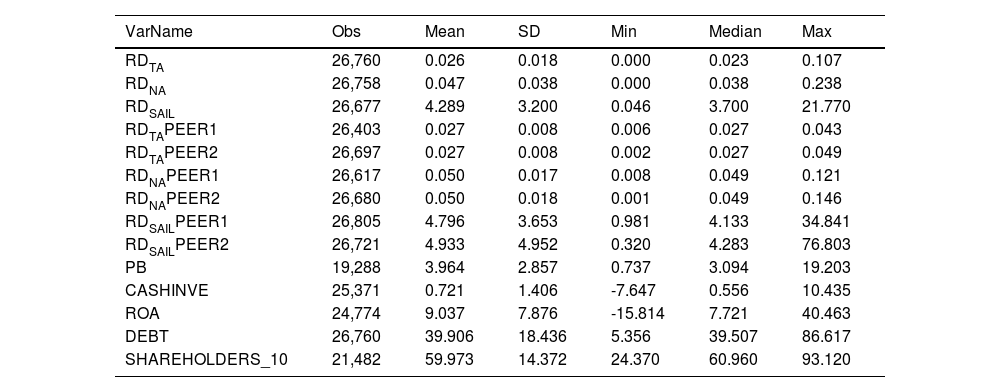

Table 2 presents the descriptive statistics of the main variables in this study. RDTA, RDNA, and RDSAIL denote the ratios of R&D expenditure to total assets, net assets, and sales revenue, respectively. RDTAPEER1 denotes the average value of RDTA of enterprises in the same industry to measure the peer effect of enterprises in this industry, and RDTAPEER2 denotes the average value of RDTA of enterprises in the same city to measure the peer effect of enterprises in this city. RDNAPEER1, RDNAPEER2, RDSAILPEER1, and RDSAILPEER2 had the same expressive meanings.

Summary statistics.

| VarName | Obs | Mean | SD | Min | Median | Max |

|---|---|---|---|---|---|---|

| RDTA | 26,760 | 0.026 | 0.018 | 0.000 | 0.023 | 0.107 |

| RDNA | 26,758 | 0.047 | 0.038 | 0.000 | 0.038 | 0.238 |

| RDSAIL | 26,677 | 4.289 | 3.200 | 0.046 | 3.700 | 21.770 |

| RDTAPEER1 | 26,403 | 0.027 | 0.008 | 0.006 | 0.027 | 0.043 |

| RDTAPEER2 | 26,697 | 0.027 | 0.008 | 0.002 | 0.027 | 0.049 |

| RDNAPEER1 | 26,617 | 0.050 | 0.017 | 0.008 | 0.049 | 0.121 |

| RDNAPEER2 | 26,680 | 0.050 | 0.018 | 0.001 | 0.049 | 0.146 |

| RDSAILPEER1 | 26,805 | 4.796 | 3.653 | 0.981 | 4.133 | 34.841 |

| RDSAILPEER2 | 26,721 | 4.933 | 4.952 | 0.320 | 4.283 | 76.803 |

| PB | 19,288 | 3.964 | 2.857 | 0.737 | 3.094 | 19.203 |

| CASHINVE | 25,371 | 0.721 | 1.406 | -7.647 | 0.556 | 10.435 |

| ROA | 24,774 | 9.037 | 7.876 | -15.814 | 7.721 | 40.463 |

| DEBT | 26,760 | 39.906 | 18.436 | 5.356 | 39.507 | 86.617 |

| SHAREHOLDERS_10 | 21,482 | 59.973 | 14.372 | 24.370 | 60.960 | 93.120 |

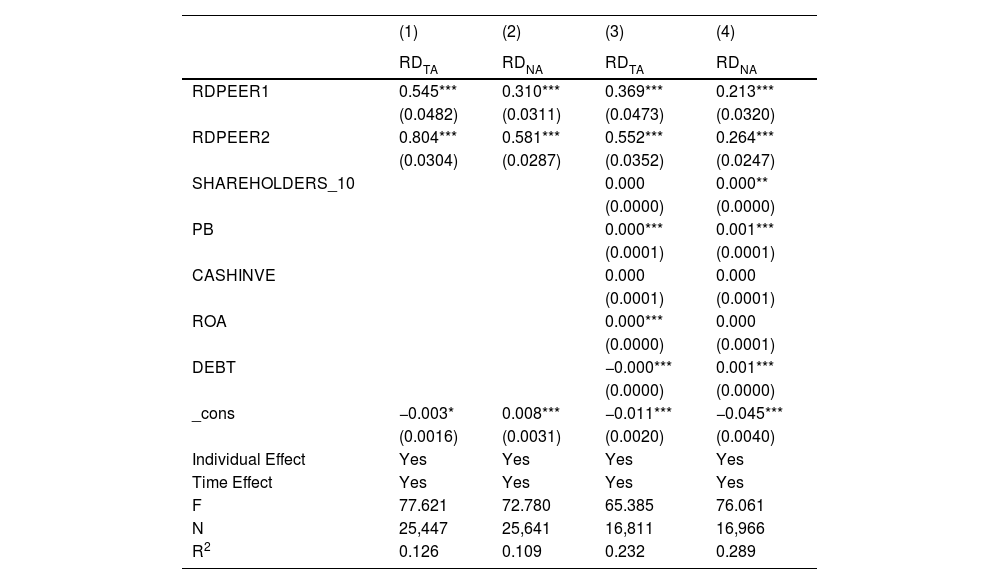

Equation (1) is used to test the peer effect of innovation in Chinese manufacturing enterprises. Table 3 presents the empirical results. Columns (1) and (2) show the regression results of the model without control variables, while Columns (3) and (4) show the regression results with the added control variables. According to the regression results, regardless of whether RDTA or RDNA is used as the explained variable, enterprises in the same industry and the same region all deliver the peer effect of corporate innovation, which significantly affects their R&D expenditures. The coefficient of RDPEER2 is larger than that of RDPEER1, which indicates that enterprises are more likely to be influenced by enterprises in the same region than by enterprises in the same industry. Therefore, Hypothesis 1 is supported.

Regression of Eq. (1).

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| RDTA | RDNA | RDTA | RDNA | |

| RDPEER1 | 0.545*** | 0.310*** | 0.369*** | 0.213*** |

| (0.0482) | (0.0311) | (0.0473) | (0.0320) | |

| RDPEER2 | 0.804*** | 0.581*** | 0.552*** | 0.264*** |

| (0.0304) | (0.0287) | (0.0352) | (0.0247) | |

| SHAREHOLDERS_10 | 0.000 | 0.000** | ||

| (0.0000) | (0.0000) | |||

| PB | 0.000*** | 0.001*** | ||

| (0.0001) | (0.0001) | |||

| CASHINVE | 0.000 | 0.000 | ||

| (0.0001) | (0.0001) | |||

| ROA | 0.000*** | 0.000 | ||

| (0.0000) | (0.0001) | |||

| DEBT | −0.000*** | 0.001*** | ||

| (0.0000) | (0.0000) | |||

| _cons | −0.003* | 0.008*** | −0.011*** | −0.045*** |

| (0.0016) | (0.0031) | (0.0020) | (0.0040) | |

| Individual Effect | Yes | Yes | Yes | Yes |

| Time Effect | Yes | Yes | Yes | Yes |

| F | 77.621 | 72.780 | 65.385 | 76.061 |

| N | 25,447 | 25,641 | 16,811 | 16,966 |

| R2 | 0.126 | 0.109 | 0.232 | 0.289 |

Note: ***, **, and* indicate significance at the 1 %, 5 %, and 10 % levels, respectively.

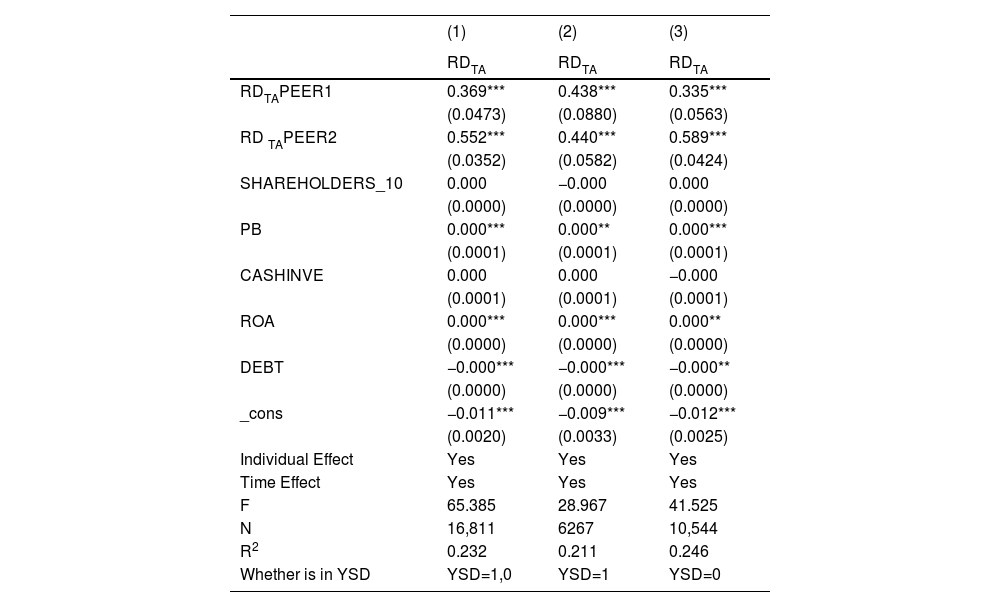

Eq. (2) is used to compare the possible differences between the more integrated YRD and the non-YRD regions in the peer effect of innovation. Table 4 presents the empirical results. Columns (1), (2), and (3) show the regression results for all samples, samples from the YRD, and samples from non-YRD regions, respectively. Regression results show that the peer effect between enterprises in the same industry and the same region exists in both the YRD and non-YRD regions. The coefficient of RDTAPEER1 in YRD regression is 0.438, which is higher than the full sample regression result of 0.369 and non-YRD result of 0.335. The results indicate that although the peer effect of enterprises in the same region remains higher than that of enterprises in the same industry, the innovation activities of enterprises in the YRD are more greatly enhanced by the peer effect between enterprises in the same industry compared with those of enterprises in non-YRD. Therefore, Hypothesis 2.1 is supported.

Regression of Eq. (2).

| (1) | (2) | (3) | |

|---|---|---|---|

| RDTA | RDTA | RDTA | |

| RDTAPEER1 | 0.369*** | 0.438*** | 0.335*** |

| (0.0473) | (0.0880) | (0.0563) | |

| RD TAPEER2 | 0.552*** | 0.440*** | 0.589*** |

| (0.0352) | (0.0582) | (0.0424) | |

| SHAREHOLDERS_10 | 0.000 | −0.000 | 0.000 |

| (0.0000) | (0.0000) | (0.0000) | |

| PB | 0.000*** | 0.000** | 0.000*** |

| (0.0001) | (0.0001) | (0.0001) | |

| CASHINVE | 0.000 | 0.000 | −0.000 |

| (0.0001) | (0.0001) | (0.0001) | |

| ROA | 0.000*** | 0.000*** | 0.000** |

| (0.0000) | (0.0000) | (0.0000) | |

| DEBT | −0.000*** | −0.000*** | −0.000** |

| (0.0000) | (0.0000) | (0.0000) | |

| _cons | −0.011*** | −0.009*** | −0.012*** |

| (0.0020) | (0.0033) | (0.0025) | |

| Individual Effect | Yes | Yes | Yes |

| Time Effect | Yes | Yes | Yes |

| F | 65.385 | 28.967 | 41.525 |

| N | 16,811 | 6267 | 10,544 |

| R2 | 0.232 | 0.211 | 0.246 |

| Whether is in YSD | YSD=1,0 | YSD=1 | YSD=0 |

Note: ***, **, and* indicate significance at the 1 %, 5 %, and 10 % levels, respectively.

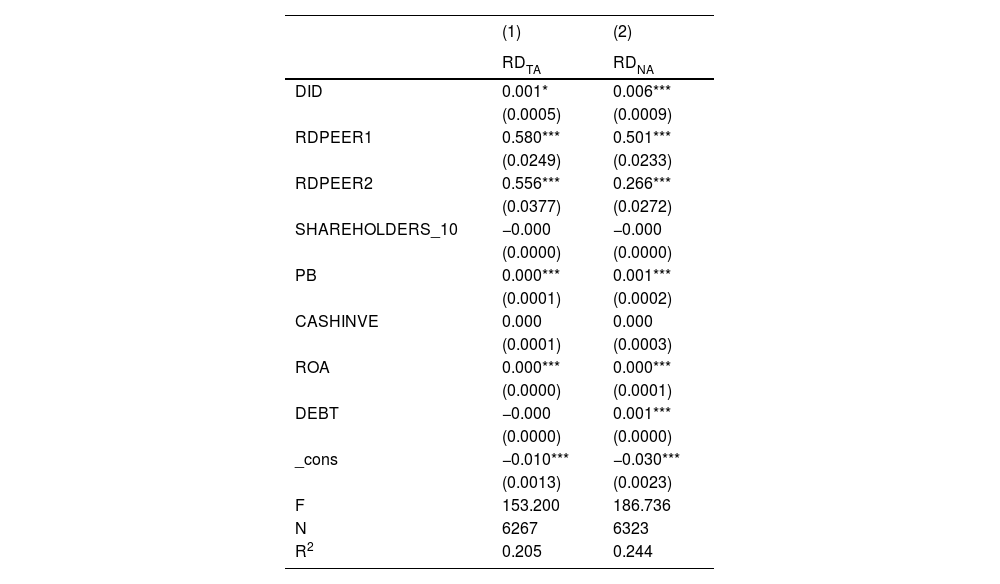

Within the YRD, the degree of communication and economic relations between cities greatly differ. YRD integration should have different policy effects on different cities. Eq. (3) is used to test the different impacts of integration policies on the peer effect of corporate innovation in the 20 cities with close economic ties and the other 21 cities. Considering that there is a time lag for the city to take corresponding supporting schemes and actions after the policy of the “Yangtze River Delta Regional Plan” is issued, this study chooses 2011 as the year of policy implementation. Before applying the DID model to the regression analysis, a parallel trend test is carried out. Fig. 3 presents the parallel trend test results. pre5 indicates 2006, which is the fifth year before the policy implementation. pre1 refers to 2010, which is one year before the policy implementation. post1 is 2012, which is one year after the policy, and post6 is 2017.

Fig. 3 shows that the impact coefficient of the policy implementation from 2006 to 2010 is insignificant. This indicates that the difference between the treatment group and control group before the policy implementation is insignificant, and that the parallel trend test passes. The impact of the policy is relatively stable within four years of its implementation. After the fifth year, the impact coefficient of the regional integration policy becomes significantly positive and is constantly improving, indicating that the policy has a time lag effect.

Table 5 presents the empirical results for Eq. (3). In the regression equation with RDTA as the explained variable, the coefficient of DID was 0.001 at the 10 % level, whereas in the regression equation with RDNA as the explained variable, the coefficient of DID was 0.006 at the 1 % level. The results show that the more integrated the cities are into the YRD, the more motivated the enterprises in those cities are to innovate. Thus, Hypothesis 2.2 is supported.

Regression of Eq. (3).

| (1) | (2) | |

|---|---|---|

| RDTA | RDNA | |

| DID | 0.001* | 0.006*** |

| (0.0005) | (0.0009) | |

| RDPEER1 | 0.580*** | 0.501*** |

| (0.0249) | (0.0233) | |

| RDPEER2 | 0.556*** | 0.266*** |

| (0.0377) | (0.0272) | |

| SHAREHOLDERS_10 | −0.000 | −0.000 |

| (0.0000) | (0.0000) | |

| PB | 0.000*** | 0.001*** |

| (0.0001) | (0.0002) | |

| CASHINVE | 0.000 | 0.000 |

| (0.0001) | (0.0003) | |

| ROA | 0.000*** | 0.000*** |

| (0.0000) | (0.0001) | |

| DEBT | −0.000 | 0.001*** |

| (0.0000) | (0.0000) | |

| _cons | −0.010*** | −0.030*** |

| (0.0013) | (0.0023) | |

| F | 153.200 | 186.736 |

| N | 6267 | 6323 |

| R2 | 0.205 | 0.244 |

Note: ***, **, and* indicate significance at the 1 %, 5 %, and 10 % levels, respectively.

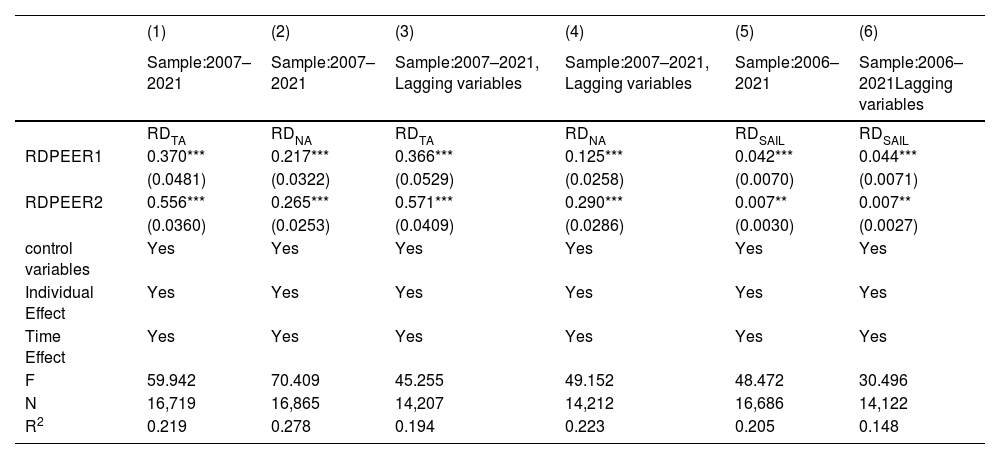

Robustness testing includes three main approaches. The first involves adjusting the sample scope. Considering that Chinese listed companies only began to pay attention to the capitalization treatment of R&D expenses and gradually standardized the disclosure of R&D expenditure data after the promulgation of the new ASBE in 2006, the quality of the publicly available R&D expenditure data of listed companies in 2006 may be poor; thus, the 2007–2021 data is used for robustness testing. Second, considering that the R&D investment decisions of enterprises at the beginning of the year may be based on the previous year's financial status and cash flow, a robustness test can be conducted by adjusting the sample scope while lagging the control variables by one period. Third, a new explanatory variable, RDSAIL (R&D as a percentage of sales revenue), is used for robustness testing since it is usually used to represent the R&D intensity of the enterprise. Table 6 presents the results of the robustness test for Eq. (1). The results indicate that peer effects are present among both same-industry and same-region firms, indicating that the regression results are robust. The same robustness test is repeated for Eqs. (2) and (3), and the regression results remain robust.

Robustness test results.

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Sample:2007–2021 | Sample:2007–2021 | Sample:2007–2021, Lagging variables | Sample:2007–2021, Lagging variables | Sample:2006–2021 | Sample:2006–2021Lagging variables | |

| RDTA | RDNA | RDTA | RDNA | RDSAIL | RDSAIL | |

| RDPEER1 | 0.370*** | 0.217*** | 0.366*** | 0.125*** | 0.042*** | 0.044*** |

| (0.0481) | (0.0322) | (0.0529) | (0.0258) | (0.0070) | (0.0071) | |

| RDPEER2 | 0.556*** | 0.265*** | 0.571*** | 0.290*** | 0.007** | 0.007** |

| (0.0360) | (0.0253) | (0.0409) | (0.0286) | (0.0030) | (0.0027) | |

| control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual Effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Time Effect | Yes | Yes | Yes | Yes | Yes | Yes |

| F | 59.942 | 70.409 | 45.255 | 49.152 | 48.472 | 30.496 |

| N | 16,719 | 16,865 | 14,207 | 14,212 | 16,686 | 14,122 |

| R2 | 0.219 | 0.278 | 0.194 | 0.223 | 0.205 | 0.148 |

Note: ***, **, and* indicate significance at the 1 %, 5 %, and 10 % levels, respectively.

Firms and peer firms learn and imitate each other. Furthermore, the innovation activities of different firms may be influenced by common factors such as industrial policies, government intervention activities, and natural and social environments in the same period or the same region, which leads to the mutual determination of the explanatory and explained variables, that is, the model suffers from endogeneity or pseudo-regression problems. Therefore, this study sets the explanatory variables measuring peer effects using lagged one-period values to reduce endogeneity and pseudo-regression problems. Table 7 presents the regression results for Eq. (1). The results show that firms’ R&D expenditures are still affected by the peer effect even after accounting for the endogeneity problem. The same endogeneity treatment procedure is applied to Eqs. (2) and (3), and the conclusions remain the same.

Regression results after endogenous treatment.

| (1) | (2) | (3) | |

|---|---|---|---|

| RDTA | RDNA | RDSAIL | |

| L.PEER1 | 0.321*** | 0.153*** | 0.311*** |

| (0.0526) | (0.0385) | (0.0519) | |

| L.PEER2 | 0.279*** | 0.126*** | 0.021* |

| (0.0334) | (0.0210) | (0.0107) | |

| L.control variables | Yes | Yes | Yes |

| Individual Effect | Yes | Yes | Yes |

| Time Effect | Yes | Yes | Yes |

| F | 36.371 | 44.753 | 30.793 |

| N | 14,146 | 14,209 | 13,978 |

| R2 | 0.149 | 0.201 | 0.150 |

Note: ***, **, and* indicate significance at the 1 %, 5 %, and 10 % levels, respectively.

The empirical results of Eq. (1) and the corresponding results of robustness testing and endogeneity treatment support Hypothesis 1. Peer effect exists in the technological innovation activities of enterprises, and the peer effect between enterprises in the same region is higher than the peer effect between enterprises in the same industry. This finding is important, as local enterprises in China are more likely to be influenced by enterprises in the same region when they engage in technological innovation. This behavior could be due to two reasons. First, in a society that attaches great importance to geography, popularity, and blood relationships, enterprises in the same city have a strong social connection, which leads to them having a similar business culture, corporate governance, and innovation ideas. Second, the segmentation of China's administrative divisions and market competition among enterprises may negatively impact the information exchange and diffusion of innovative technologies.

The empirical results of Eq. (2) and the corresponding robustness testing and endogeneity treatment results support Hypothesis 2.1. The results show that YRD integration promotes the exchange and diffusion of innovative information among enterprises in the same industry in different cities. As described in this study, the integration of the YRD comprehensively strengthens economic ties and information exchange within the region by increasing the interconnection of infrastructure and eliminating the barriers to resource flow between different administrative divisions. Simultaneously, industrial collaboration and division of labor within the YRD lead to the formation of a close enterprise network or enterprise alliance and improved coordination and consistency in the innovation activities of enterprises in the same industrial chain, thus strengthening the peer effect among enterprises in the same industry.

The results of Eq. (3) and the corresponding robustness testing and endogeneity treatment results support Hypothesis 2.2. The integration policies of the YRD have different effects on the innovation activities of enterprises in different cities. Cities with a higher degree of integration in the YRD have a higher level of corporate innovation. Furthermore, YRD integration has a more significant impact on the cities that joined the YRDCCEA, which helps enterprises improve their R&D expenditure levels.

The empirical research results fully support the three hypotheses proposed in this study, confirming the linkage mechanism between regional integration and corporate innovation at the micro level. That is, regional integration encourages enterprises to carry out innovation activities by strengthening the peer effect among enterprises. The study's findings are consistent with those of macro-level studies that consider cities as the whole research object, such as Li and Ye (2021) and Liu and Chang (2021). Additionally, the study's results are consistent with those of existing micro-level studies such as Park et al. (2017) and Machokoto et al. (2021), who verify the significant peer effect of enterprise investment and innovation.

The significant peer effect of Chinese manufacturing enterprises indicates that China's manufacturing industry has adopted the strategy of cluster development and growth along the industrial chain. When developing the local economy, Chinese cities identify the key industries for local development and focus on industrial policies and investment attraction. Enterprises in different cities generally produce supporting products around the core enterprises in the region, thus forming a complete industrial chain. The spatial agglomeration of enterprises and symbiotic development along the industrial chain lead to significant peer effects in R&D activities among enterprises. The YRD integration accelerates the development of industrial clusters and coordinated distribution of industrial chains within the region.

Conclusions and implicationsConclusionsThis study examines the influence of YRD integration on corporate innovation, with peer effect as the link. This study is conducted at three levels. First, this study tests whether the technological innovation activities of Chinese manufacturing enterprises are influenced by the innovation activities of their peers, both in the same industry and in the same region; that is, whether peer effect exists. Second, the peer effect of corporate innovation in the YRD and non-YRD regions is analyzed and the result shows that YRD integration strengthens the peer effect of corporate innovation in the same industry. Finally, 41 cities in the YRD are divided into two groups according to the density of tight economic ties: cities that are greatly affected by the integration policy (experimental group) and those that are weakly affected by the integration policy (control group). The results show that YRD integration has a more significant impact on cities with close economic ties, which improves the intensity of innovation investment of enterprises in these cities.

ImplicationsThe study's findings suggest that regional integration within a country enhances the peer effect of corporate innovation and effectively boosts investments in technological innovation. Therefore, China's national government should continue promoting and implementing regional integration strategies and summarizing and replicating the experience of YRD integration nationwide to achieve high-quality economic development and improve the country's overall technological strength. Additionally, the experience of China's regional integration might be valuable to other developing countries that are aiming to raise their level of corporate innovation.

Regional integration should be accelerated in the Pearl River Delta, Beijing-Tianjin-Hebei, midstream Yangtze River city cluster, and Chengdu-Chongqing city cluster to build more economic growth poles in China and promote greater emphasis on technological innovation among manufacturing enterprises at the national level. Based on the experience of the YRD integration, the focus should be on enhancing infrastructure connectivity, removing barriers to the flow of factors and resources, and collaborating to build a modern industrial system. Each city should form a competitive industrial cluster, actively participate in the division of labor within the region, and strive to become a part of the innovation chain, otherwise they are not going to be able to keep up with the regional integration.

Furthermore, China is politically centralized and economically decentralized, and competition among its local governments is fierce. Competition among local governments helps drive China's long-term rapid economic growth; although, regional integration requires strengthening cooperation and coordination. Economic coordination organizations like the YRDCCEA should be established within urban agglomerations to effectively resolve conflicts between cities in the process of regional integration, promote industrial coordination and urban agglomeration spatial structure optimization, and encourage cities within the region to actively integrate into regional integration. Peripheral cities should strengthen integration with the central city for the construction of urban infrastructure and public service support facilities and optimize the industrial spatial layout. Economic coordination organizations should play a central role in this process.

Moreover, the peer effect of corporate innovation comes not only from enterprises in the same industry but also from enterprises in the same region. A firm is more vulnerable to the impact of enterprises in the same region. Therefore, in the implementation of the regional integration strategy, cities should formulate strong incentive policies to promote enterprise R&D and make scientific and technological investments according to the industrial foundation, industrial characteristics, and enterprise characteristics of local enterprises to provide innovative development impetus for them. Cities should create good enterprise collaborative innovation ecosystems; actively build information exchange platform among enterprises; and use industry associations, science and technology policy training conferences, investment and financing promotion conferences, and other platforms and opportunities to encourage learning, exchange, and common development among enterprises. Additionally, the innovation demonstration effect and driving effect of leading, core, and benchmark enterprises should be examined, and outstanding innovative enterprises should be publicized and commended to enhance the peer effect of corporate innovation.

Regional integration helps drive a country's economic growth. In the future, competition is going to be between urban agglomerations of different countries. Thus, China's regional integration experience could serve as a blueprint for other countries. It shows that the regional integration development strategy should be designed at the top level, and that regional integration should eliminate the barriers to the flow of production factors. Furthermore, China's experience demonstrates that cities within the region should form a reasonable industrial chain division, and that an urban agglomeration spatial structure should be developed around the metropolitan area.

Shortcomings and prospectsThis study focuses on Chinese A-share listed manufacturing companies. However, it does not distinguish between companies on the main, second, or sci-tech innovation boards. The main board market is for mature companies, while the second board and sci-tech innovation board markets are for innovative enterprises. The innovation behavior of listed companies in different markets may significantly differ. Thus, future research can comprehensively and systematically examine the innovative behavior of enterprises.

In addition, enterprise innovation activity is a decision-making behavior influenced by multiple internal and external factors. Among the external factors, the competitive environment faced by the enterprise greatly influences enterprise innovation behavior, while among internal factors, entrepreneurship plays a key role. In recent years, Chinese manufacturing enterprises have faced complicated domestic and foreign economic situations. Changes in the external environment, especially the trade conflict between China and the United States, have a profound impact on the innovation input and innovation behavior of China's manufacturing industry. The change in internal economic policy and the unfavorable economic situation also affects the confidence of private entrepreneurs. These complex factors are excluded from the econometric model of this study and thus can be explored in future research. In terms of research methods, as enterprise innovation behavior is closely related to entrepreneurship, qualitative research or structural regression models, which are important supplements to the panel regression method, can be used in future studies.

FundingThis research was funded by the National Social Science Fund of China (Grant 22BGL056). and Zhejiang Provincial Natural Science Foundation of China (Grant LGF22G030011).