Under what conditions do originators of innovation benefit from knowledge spillover by learning from knowledge recipients, and when do they not? This study examines how originator firms’ learning from recipients differs depending on their spillover characteristics. These characteristics were captured using the Spillover Knowledge Pool (SKP). It also examines how technological alliances moderate the relationship between SKP characteristics and originator follow-on innovations. An analysis of 62 firms over 10 years confirms that while the technological diversity of the SKP has a positive impact on the originator's innovation, the technological overlap of the SKP relative to the originator's knowledge has a negative impact. Furthermore, technological alliances enhance the positive effect of technological diversity while exacerbating the adverse effects of technological overlap. This study contributes to the literature on knowledge spillover, particularly within the knowledge-based view of firms, by providing a balanced perspective that addresses the dual impact of knowledge spillover on originator firms. Furthermore, this research highlights the contingent effects of knowledge spillover by examining the interplay between spillover phenomena and strategic factors, specifically technological alliances. The findings have concrete managerial and policy implications conducive to enhancing firms’ innovation performance in the context of knowledge spillover.

The conventional knowledge-based view (KBV) encourages firms to regard knowledge spillover as something they should deter to maintain their technological competitiveness because of the risks of imitation and subsequently catch up with competitors (Awate & Makhija, 2022; Cohen et al., 2000; James et al., 2013; Kogut & Zander, 1992).

A few studies have emerged, however, which emphasize the positive aspects of knowledge spillover in terms of the originator's research and development (R&D) process with empirical evidence, while adopting the KBV perspective (Alnuaimi & George, 2016; Jee & Sohn, 2023; Varshney & Jain, 2023; Yang et al., 2010; Yang & Steensma, 2014). They suggest that the potential positive effects of spillover on an originator firm's innovation stem from the possibility that originators may learn vicariously from recipient firms as a type of cognitive search activity in the originator firm's R&D process (Cyert & March, 1963; Yang et al., 2010; Yang & Steensma, 2014). A few real-world cases verify the findings of emerging studies that some firms seem to leverage rather than deter knowledge spillover. Tesla has disclosed its electric vehicle and battery technology patents since 2014; however, it has sustained its competitive advantage in the battery and electric vehicle industries, while its knowledge has spilled over to other firms (Bessen, 2014; Lambert, 2015). In addition, recent trends in the software industry have seen companies sharing project outcomes through open-source communities, such as Github and Arduino (Conti et al., 2021; Henkel, 2006).

To sum up, knowledge spillovers have double-sided effects on a firm's innovation in knowledge-intensive industries, which calls for the adoption of a contingency approach. Despite the double-sided effects of knowledge spillover on the innovation process, a clear understanding of the conditions under which an originator firm can augment the benefits of spillover and/or mitigate its negative impacts is lacking. First, few studies explicitly address the double-sided effects of knowledge spillover on the originator firm's ability to sustain competitive advantage in innovation, focusing on either the positive or negative side (Jee & Sohn, 2023). Second, an integrated approach to identify the contingent effects of knowledge spillover on an originating firm's innovation is lacking. In other words, an approach to investigate contingent effects of spillovers by considering firm strategies that may create positive synergies with spillovers is lacking. This is because previous studies on knowledge spillover have not sufficiently addressed its exogenous characteristics (Alnuaimi & George, 2016; Jee & Sohn, 2023; Varshney & Jain, 2023; Yang et al., 2010). Considering that originators cannot control the extent of spillover once knowledge is announced (Mansfield, 1985), investigating the effects of the specific characteristics of knowledge spillover on a firm's performance has limited implications on how firms can strategize to enhance the benefits from spillover. Rather, it is necessary to investigate the interactions between knowledge spillover and firm strategies that the originator firm may adopt to mitigate the difficulties of vicarious learning from recipient firms and to increase the positive effects of knowledge spillover.

To fill these gaps, this study first investigates the contingent effects of knowledge spillover on the originator firm by exploring how the specific characteristics of a firm's knowledge spillover influence its subsequent innovation performance. To capture the characteristics of knowledge spillover, we adopt the concept of a spillover knowledge pool (SKP), which refers to “all external knowledge that has been linked directly to the originator's knowledge by recipient firms through spillover” (Yang et al., 2010). We posit that opportunities and challenges in vicariously learning from recipients and follow-on applications by the originator may differ according to the characteristics of the SKP. The underlying mechanisms are that the effects of knowledge spillover depend on the originator's absorptive capacity for the SKP components and also, the impact of spillover on the originator's further development of the dynamic capability that fosters organizational change and evolution varies depending on the knowledge spillover characteristics (Zahra & George, 2002).

Furthermore, by adopting an integrated approach to examine contingent effects, we investigate the moderating effect of technological alliances as firm strategies that may create synergies with spillovers. Technological alliances are a widely utilized firm strategy aimed at acquiring external knowledge, but they have the risk of knowledge leakage (Lucena & Roper, 2016; Oxley, 1997). This double-sided effects of technological alliance could exacerbate the difficulties associated with vicarious learning from recipient firms or rather, may help the originator leverage the positive effects of knowledge spillover more efficiently.

We test our hypotheses using a unique dataset of 62 firms in the telecommunications equipment industry from 1992 to 2001. We find that while the technological diversity of an SKP contributes to the originator's subsequent innovation, a technologically overlapping SKP hampers the originator's dynamic capability to sustain innovation competitiveness. The technological alliance, which is the moderator, enhances the positive effects of the SKP's technological diversity while aggravating the negative impacts of a technologically overlapping SKP on the originator's follow-on innovation. Our study makes the following key contributions to the literature. First, by underscoring the contingent nature of knowledge spillover effects on the originator of innovation, this study provides a balanced perspective for the literature on knowledge spillover, particularly those adopting the KBV of firms. Second, this study contributes to the knowledge spillover literature by highlighting its multifaceted effects, building on and extending Zahra and George's (2002) definition of absorptive capacity (ACAP) as an organization's dynamic capability to change and evolve. Third, this study challenges the conventional view of the homogeneous effects of knowledge spillover within each group of firms, emphasizing the idiosyncratic aspects of leveraging knowledge spillover (Jee & Sohn, 2023). We elaborate on these contributions and the managerial and policy implications of the discussion.

Theory and hypothesesWhile the conventional knowledge-based view considers knowledge spillover as something that the originator of an invention should deter for its technological competitiveness (Cohen et al., 2000; James et al., 2013), a few studies from the early 2010s revealed that a firm may leverage the positive effects of knowledge spillover by learning vicariously from recipient firms. Yang et al., (2010) showed that with specific features of recipients’ innovation outcomes, originators can improve their innovation performance through vicarious learning mechanisms. Similarly, Yang and Steensma (2014) suggest that originators can reduce the challenges and uncertainties in exploring unfamiliar areas through recipients’ guidance, and this tendency becomes stronger in highly competitive and dynamic market conditions. Alnuaimi and George (2016) posited the potential benefits of vicarious learning and demonstrated that the originator's retrieval of its own knowledge, which previously spilled over, hinges on the knowledge- and organization-level characteristics of the originator. Varshney and Jain (2023) also focus on the reverse knowledge flow to the originator when knowledge spillover occurs through the inventor's exit and explore the conditions under which such reverse flows are invigorated. These studies suggest that the channels of knowledge spillover, which seemingly hamper the originator firm's competitive advantage, can be a potential source of innovation.

The vicarious learning mechanism can be understood as a form of the originator's cognitive search activity, which is a key mechanism through which the originator may enhance technological competitiveness through knowledge spillover. Innovation is a series of solution-searching processes for problems, accompanied by the novel recombination of knowledge elements (Dosi, 1988; Fleming, 2001; Henderson & Clark, 1990). Cognitive search refers to the processes that evaluate knowledge elements and their combinations before an actual experiential search (Gavetti & Levinthal, 2000; March, 1991). Vicarious learning allows the originator to reduce trial and error in their R&D by learning cognitively from the recipient firms’ successful outcomes before the experiential search, thus enabling the augmentation of efficiency in problem solving (Cyert & March, 1963; Yang et al., 2010).

Despite its positive potential (Yang & Steensma, 2014; Yang et al., 2010), vicarious learning from recipients does not necessarily enhance the originators’ innovation performance, and the effects can be positive or negative, depending on the conditions. The current study suggests that the double-sided nature of knowledge spillover pertains to the originator's level of ACAP to leverage SKP and the impact of knowledge spillover on the further development of ACAP, a dynamic capability to evolve and change.

Characteristics of spillover and the ACAP of the originatorConsidering that vicarious learning is a form of learning from external knowledge sources, there can be significant heterogeneity among firms in identifying, assimilating, transforming, and exploiting the knowledge acquired vicariously from recipient firms. This study adopts the definition and categorization of ACAP suggested by Zahra and George (2002), which states that ACAP is a dynamic capability embedded in a firm's routines and processes by which firms acquire, assimilate, transform, and exploit knowledge. The authors proposed two ACAP components: potential ACAP (PACAP) and realized ACAP (RACAP). PACAP indicates the capacity to acquire and assimilate external knowledge (Lane & Lubatkin, 1998), whereas RACAP denotes the capability to transform and exploit assimilated knowledge.

This study posits that whether an originator can leverage the spillover of knowledge to sustain competitiveness in subsequent innovation depends on the attributes of the spillover. This is because the levels and types of opportunities and challenges encountered in vicarious learning may vary based on the originator's PACAP and RACAP for the SKP. In addition, the impact of vicarious learning on the originator firm's ongoing development and advancement of ACAP varies depending on the aspects of knowledge spillover.

To capture the characteristics of knowledge spillover, we adopted the SKP concept suggested by a previous study by Yang et al. (2010). Yang et al. (2010) indicate that SKP comprises all the external knowledge of the originator that recipients have generated based on the originator's knowledge and other knowledge that the recipients used to apply the originator's knowledge. An SKP is idiosyncratic to each originator, and by definition, originators have a high level of understanding of the SKP compared to other external knowledge, increasing the efficiency of the application of SKP components.

Among the various properties of a knowledge pool, this study focuses on technological diversity as an absolute dimension and technological overlap between SKP and the originator's existing knowledge base as a relative counterpart.

Technological diversity of the SKP and innovationA technologically diverse SKP enables the originator to secure various alternative knowledge recombination sets with high recombination potential. The technological diversity of SKP indicates the extent to which the technological advances made by recipients are distributed across various technological fields.

Although recipients’ innovations building on the originator firm are dispersed across different technological fields, originators can have a high level of PACAP, as SKP has a direct and/or indirect linkage to the originator firm's innovation. Therefore, the originator can efficiently identify and acquire recipients’ innovations, which has a high potential for creating synergy with the originator's own knowledge.

The originator's RACAP for the SKP with high technological diversity, however, might not be as robust as the PACAP due to the complexities in the R&D process (Olson et al., 1995). This is largely because of the nature of knowledge. Considerable parts of a firm's knowledge are tacit and often embedded in the inventor or organizational routines (Lei et al., 1997). Additionally, the use of knowledge and recombination patterns in R&D activities differ for each firm, resulting in idiosyncratic outcomes even with the same knowledge elements (Allen, 1977; Nelson & Winter, 1982; Yayavaram & Ahuja, 2008). Because originators have limited direct access to recipients’ idiosyncratic contexts such as R&D routines (Yang et al., 2010), originator firms would face limitations in vicariously learning solely by observing recipients’ innovation outcomes. However, based on the direct/indirect link of the originator with knowledge in SKP, a certain level of RACAP can be secured compared to external knowledge that has no connection to the originator.

Inspired by novel approaches and the significant application potential of recipients’ knowledge, originators are motivated to systematically set up organizational routines and processes. These systematic organizational changes are beneficial for the originators’ further development of ACAP in terms of both PACAP and RACAP aspects (Zahra & George, 2002). Taken together, these factors contribute to the originator firms’ effectiveness in enhancing innovation. In other words, SKP's technological diversity contributes to the originator's innovation performance.

Hypothesis 1

(H1). The technological diversity of SKP positively affects the subsequent innovation performance of the originator.

Technological overlap of the SKP and innovationTechnological overlap between the SKP and the originator firm's knowledge base affects the originator firm's PACAP for the SKP, allowing the originator firm to identify and assimilate recipient innovations more efficiently.

Conversely, originators may face challenges regarding the RACAP for SKP components in high overlap condition. Transforming and exploiting knowledge vicariously learned from recipients to create new innovations requires the originator to identify novel aspects that differentiate its ideas from those of the recipients. When innovation outcomes highly overlap, the originator struggles to find unique points in the recipients’ advancements. This overlap makes it difficult for originators to differentiate their innovations from those of recipients, hindering the originator's ability to transform and apply knowledge components in SKP.

Furthermore, when SKP highly overlaps with the originator's knowledge base, it impedes the originator's further development of PACAP and RACAP, exacerbating the originator's subsequent innovation activities. First, an originator with an SKP that highly overlaps with its knowledge base may become rigid in R&D activities. As the aspiration level of an organization is determined by social references (Cyert & March, 1963; Festinger, 1954; Massini et al., 2005), a high level of overlap between the originator's technological area and the recipients’ innovation lowers the originator's aspiration level for innovation. In other words, an originator is likely to maintain the status quo in innovation activities, inhibiting the development of the dynamic capabilities necessary for organizational change and evolution in R&D routines and processes. Consequently, not only the originator's capabilities for identifying and assimilating valuable external knowledge will be degenerated, but so will the originator's capabilities for recombining the acquired knowledge (i.e., RACAP) (Bromiley et al., 2001; Zahra & George, 2002).

Second, when the SKP overlaps with the originator firm's knowledge, the originator firm's search activities may become inefficient because of redundancy as it impedes the originator firm's cross-fertilization of knowledge elements and the generation of novel outcomes (Ahuja & Katila, 2001; Makri et al., 2010; Sears & Hoetker, 2014). Exposure to redundant resources reduces the time required to identify and assimilate knowledge, thus enhancing PACAP for vicarious learning in the short term. However, in the long term, being trapped in a redundant search environment causes the originator firm's future PACAP to decline.

Technological overlap weakens the originator firm's innovation performance in subsequent periods.

Hypothesis 2

(H2). Technological overlap between the originator firm's knowledge base and SKP negatively affects the originator firm's subsequent innovation performance.

Moderating effects of technological alliancesTechnological alliances play a crucial role as a firm's channel to access and acquire external knowledge, while the risks of unintended knowledge leakage exist during technological alliances. While participating in a technological alliance, firms may have the opportunity to observe alliance partners’ knowledge application during joint R&D activities, and the positive impacts via knowledge acquisition and organizational learning mechanisms are supported empirically by previous studies (Hagedoorn, 1993; Lin et al., 2012; Lucena & Roper, 2016; Subramanian et al., 2018). The explicit and tacit knowledge that underlies the technology is transferred among alliance partners (Becerra et al., 2008; Lane & Lubatkin, 1998). As a firm's explicit and tacit knowledge is interwoven, it makes disentanglement difficult (Lei et al., 1997). Therefore, knowledge transfer through technological alliances carries the risk of knowledge leakage. Thus, some studies consider technological alliances to be an undesirable strategic factor because they hamper the preclusion of others (Ahuja et al., 2013; Oxley, 1997).

In this sense, technological alliances can be a double-edged sword for the originator in a knowledge spillover situation, either enhancing or impeding vicarious learning and further exploiting knowledge for innovation.

Technological alliance and technological diversity of the SKPAn originator's participation in a technological alliance could enhance the positive effects of the SKP's technological diversity on the originator's ACAP for the SKP, as well as on the subsequent development and evolution of dynamic capabilities for innovation. Through technological alliances, not only is the technology specified in the alliance contract transferred, but also the ways in which each organization forms and develops innovation-related routines and manages the tacit knowledge of innovation are exposed to the alliance partners (Becerra et al., 2008), This leads to the positive effects on the originator's vicarious learning from technologically diverse SKP.

First, the originator firm's exposure to other firms’ idiosyncratic contexts of innovation improves its understanding of other firms’ organizational contexts, thus enhancing the originator firm's PACAP in the process of vicarious learning. Capabilities accumulated through technological alliances can further increase the efficiency of identifying recipient outcomes with high potential applicability.

Second, the capabilities accumulated through technological alliances can mitigate the comparatively limited level of RACAP that the originator may have for SKP components under conditions of high technological diversity. Securing a high level of RACAP can be challenging when recipients’ utilization of the originator's knowledge is dispersed across technological fields. However, exposure to alliance partners’ R&D routines and organizational systems can enable the originator to better understand recipients’ idiosyncrasies, thereby making the subsequent recombination of SKP components more efficient. This reduces the potential risks of complexity and attention allocation problems during the transformation and exploitation of SKP components.

Third, technological alliances may motivate originators to further develop PACAP and RACAP, which are crucial to future innovation competitiveness. Exposure to different alliance partners’ organizational systems can spur the originator to continuously improve the allocation of R&D resources and optimize R&D systems. Thus, originator technological alliances amplify the positive effects of SKP technological diversity on originators.

Hypothesis 3

(H3). Technological alliances augment the positive relationship between SKP's technological diversity and originators’ innovation performance.

Technological alliance and technological overlap of the SKPTechnological alliances can exacerbate the challenging situations originators face when learning vicariously from technologically overlapping SKP. Under technologically overlapping SKP conditions, securing the originator's idiosyncratic contexts and proprietary knowledge that enables its own innovations becomes more imperative for the originator to sustain competitiveness in innovation (Collins & Hitt, 2006). This is because it is difficult for the originator to find differentiation points in the knowledge recombination outcomes compared to those of the recipients, resulting in a low level of RACAP for the SKP components.

However, if an originator takes part in technological alliances, the originator's tacit knowledge and innovation-related know-how may unintentionally leak (Becerra et al., 2008), dissipating the originator's advantage of its own innovations. Combined with the low RACAP for SKP, leakage of the originator firm's knowledge embedded in its organizational routines and processes can have a detrimental impact on its competitiveness in innovation.

Although exposure to alliance partners’ routines can alleviate rigidity in developing organizational capabilities under high technological overlap, the negative impact of tacit knowledge leakage becomes more pronounced. Therefore, technological alliances exacerbate the negative situations in technologically overlapping SKP.

Hypothesis 4

(H4). Technological alliances of the originator firm aggravate the negative relationship between technological overlap—overlap between the originator firm's knowledge base and SKP—and the originator's innovation performance.

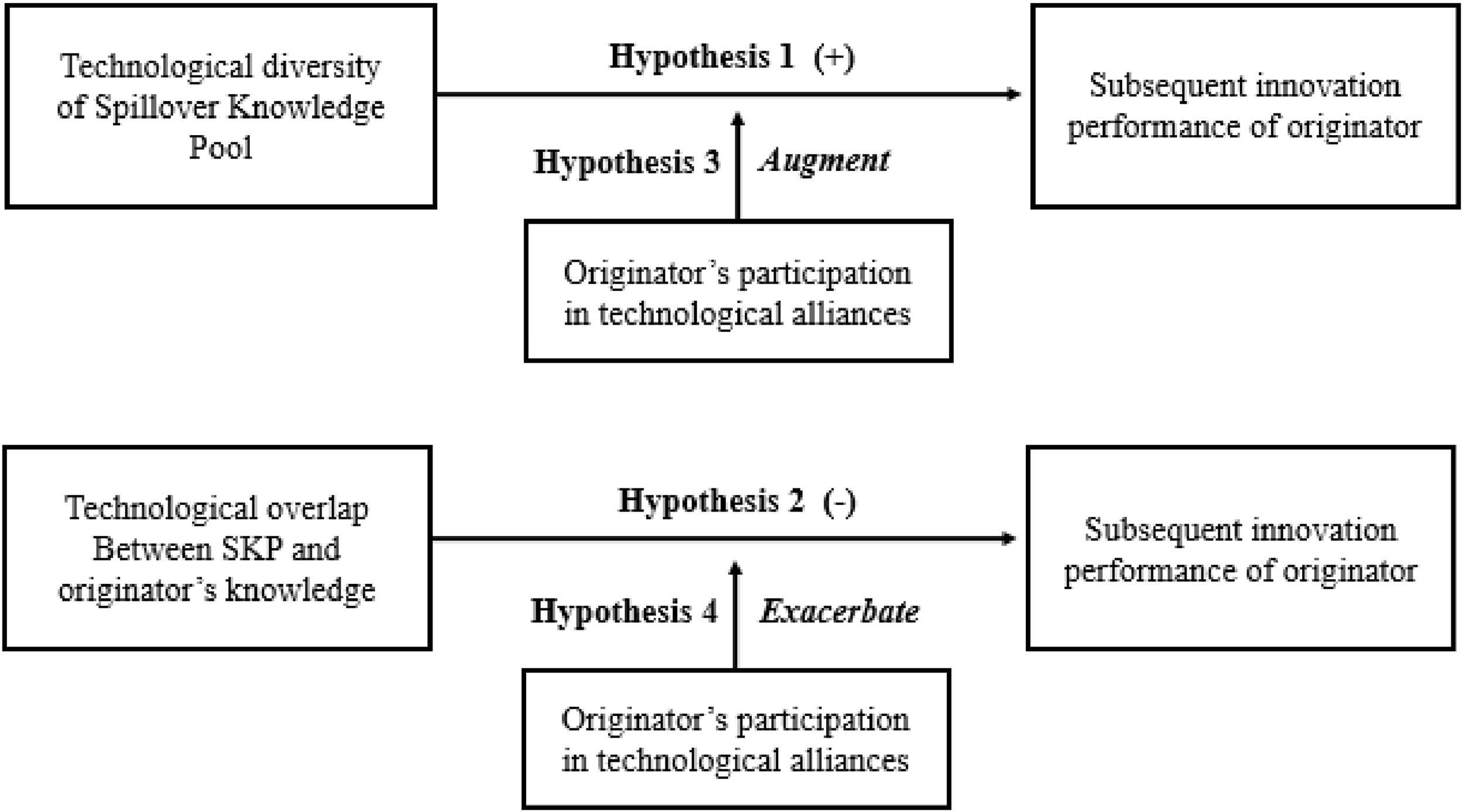

The hypotheses are presented in the conceptual diagram in Fig. 1.

MethodsData and sampleIn this study, we use patent data to capture firms’ knowledge creation and flow. Patents have been used extensively in the literature (Almeida, 1996; Duguet & MacGarvie, 2005; Jaffe et al., 1993). First, firms in the high technology industry often apply for patents to protect intellectual property and secure returns from their inventions (Cohen et al., 2000; James et al., 2013; Stuart, 2000). Second, for a patent, an invention must satisfy certain criteria—novelty, inventive step, or industrial applicability (Brown et al., 2023; Encaoua et al., 2006; Griliches, 1992). Third, patent applicants are required to indicate the prior art relevant to an invention (Brown et al., 2023; Griliches, 1990). Thus, patent data are appropriate for analyzing firms’ invention activities, subsequent performance, and knowledge flow among patent holders.

We include firms from the global telecommunications equipment manufacturing industry in our sample.a This industry provides a suitable setting to test our hypotheses as it has undergone rapid technological changes since the early 1970s (Yang et al., 2010). In such a high-technology industry, a firm's competitive advantage strongly depends on its knowledge creation and technological development (James et al., 2013; Stuart, 2000). Most importantly, previous studies found that the diffusion of technological knowledge is highly active in this industry (Dowling & McGee, 1994; Griliches, 1992; Klevorick et al., 1995; Levin et al., 1987; Yang et al., 2010). Thus, knowledge spillovers are an important phenomenon. Moreover, firms in this industry also form R&D collaborations to sustain competitiveness and survive in the face of rapid technological changes (Pisano et al., 1988).

The selection of the telecommunications equipment industry as the research context is particularly appropriate when considering the research timeframe, which spans from 1992 to 2001. During this period, the telecommunications equipment manufacturing industry went through rapid technological changes and demonstrated high R&D intensity, spurred by the development of the Internet (e.g., the World Wide Web and navigator browsers were released in the early 1990s) (Amesse et al., 2004). In addition, the 1990s and the early 2000s saw a boom in mobile telecommunications. Global telecommunications deregulation intensified competition among industry entities (Cheng et al., 2003), exemplified by the enactment of the Telecommunications Act of 1996 in the US (Shelanski, 2007). The rise of e-commerce has further increased the demand for telecommunication networks, leading to a surge in the demand for networking equipment (Cheng et al., 2003). The need to ensure compatibility with other network facilities, coupled with increased competition following deregulation, likely spurred innovation activities and collaboration among industry entities. Moreover, the end of the dotcom bubble in the early 2000s significantly altered the business landscape. To avoid the potential effects of market realignment following the external shock of the dotcom bubble, we confine our main analysis to the period before 2001. The sample period minimized left and right censoring and secured the accessibility of financial, patent, and alliance data for the sample firm. Furthermore, the ten-year panel of firms allowed for effective control of the sources of unobserved firm heterogeneity by including firm-fixed effects.

The study consisted of ten-year panel data on 62 firms obtained from 1992 to 2001. We began by collecting 100 firms by rank-ordering each firm's average industry sales in the first three years of the sample period in the telecommunications equipment manufacturing industry. Among these firms, 17 firms for which patent information was not observable during the sample period were excluded, and four other firms were excluded because their financial information throughout the sample period was unavailable. This resulted in 79 firms being included in the sample. As we investigated the effects of knowledge spillover along with the moderating effects of technological alliances, firm-year observations without any knowledge spillover were excluded, resulting in 467 firm-year observations from 73 firms. Furthermore, seven firm-year observations for which financial information was unavailable were excluded, leaving 70 firms with 460 firm-year observations in the sample.b The geographical distribution of the final sample is as follows: 58 firms are headquartered in the US, four in Canada, and two in Japan. The remaining six firms were based in England, Finland, France, Ireland, Israel, and Sweden.

We collected patent data from the US Patent and Trademark Office for the period 1987–2006 based on the application date of the patents eventually granted. We collected patents applied for since 1987 because the patent data for the previous five-year period were required for each firm-year observation to measure the independent variables. For accurate measures of patent assignees and knowledge flow across firm boundaries, we aggregated subsidiary-level patents with their firm-level counterparts. We used the Directory of Corporate Affiliations of LexisNexis to find the subsidiaries of each sample firm and aggregate the patents filed by a firm's subsidiary at the parent firm level. We also investigated the focal firm's mergers and acquisitions (M&As) for the sample period using the Securities Data Company (SDC) platinum database. We then adjusted the ownership change of the patents according to M&A occasions, which allowed us to trace knowledge spillover more accurately. If a focal firm went bankrupt during a certain year, we excluded it from the sample in the year after bankruptcy. The bankruptcy data were based on financial data from the COMPUSTAT and Datastream databases and were confirmed by checking the information on corporate webpages or news regarding firm history and bankruptcy.

Alliance data were collected from SDC Platinum for the period 1987–2001. Financial data were obtained mainly from the COMPUSTAT and Datastream databases. Missing observations of financial variables were complemented by the firm's SEC filings.

VariablesDependent variableWe used patent data to construct a dependent variable for Subsequent innovation performance. Following previous studies that adopted measures reflecting the quantity and quality of a firm's innovation (Correa & Ornaghi, 2014; Trajtenberg, 1990), we adopted a citation-weighted patent count. The weighted patent count (WPC) of each firm is operationalized as follows (Hall et al., 2005; Sime et al., 2023; Trajtenberg, 1990).

where nj denotes the total number of patent applications filed by the patents that firm j applied for in the year of observation t and was finally granted to the firm, and Ci indicates the number of forward citations that each patent i received during the subsequent period. The forward citations are observed for three years following the application year of the focal patent, from t+1 to t+3, considering that patents receive their majority of citations within the next three years (Mehta et al., 2010). We set a one-year lag between the independent and dependent variables to account for the time lag between the firm's R&D inputs and innovation outcomes.Independent variableOperationalization of the spillover knowledge poolThe SKP of each sample firm is operationalized as follows: we identified the knowledge stock of originator firm i which has accumulated over five years (from t–5 to t–1), and the knowledge components (i.e., patents) of originator firm i are spilled over to other firms within the next five years. As originator firm i's patents spill over, recipient firms make new innovations based on originator firm i’s patents. However, the recipient's innovations are based not only on the spillover of originator i’s knowledge but also on other firms’ innovation outcomes. Here, the SKP of the originator i captured at time t is formed. That is, recipients’ innovations generated at time t building on originator i’s previous five-year knowledge stock and other innovations apart from the originator firm's knowledge stock—on which those innovations of recipients are also based—constitute originator firm i’s SKP. The components in the SKP of the originator i exclude its own innovation outcomes. While Yang et al. (2010) adopted a ten-year time frame of knowledge base of the originating firm and allowed ten years for the spillover of the originator's patents, this study adopted a five-year knowledge base for the originator and set a five-year period for the originator's knowledge to spill over. Adjustments of the time period were based on previous studies, which revealed that a patent's citation reaches its peak within three years after patent application and decreases drastically after five years (Gittelman & Kogut, 2003; Kim et al., 2012; Mehta et al., 2010).

Technological diversity of the spillover knowledge poolWe capture Technological diversity of SKP using the primary main class information of the patents that comprise each originator's SKP. First, we identified each originator's SKP at time t. Then, we obtained the primary main class assigned to all patents that comprised the SKP of each firm. We adopt the measure of Shannon (1948) as a measure of technological diversity. The technological diversity of originator firm i’s SKP is operationalized as follows:

Here, pk indicates the proportion of patents of firm i’s SKP in technological field k out of all patents that comprise the SKP of firm i, and n denotes the total number of technological fields in which each originator has at least one granted patent (Ahuja & Katila, 2001; Van Rijnsoever et al., 2015).Technological overlap between spillover knowledge pool and originator's existing knowledge baseThe relative dimension of SKP, Technological overlap between the SKP and originator's existing knowledge base, was measured as a ratio variable. First, we determined the originator firm's existing knowledge base at time t accumulated for the previous five years, from t–5 to t–1, allowing us to compare the originator firm's SKP and existing knowledge base, and measure the level of overlap between the two. Previous studies measured the technological overlap of the acquirer in the technological M&A context as the ratio of the number of redundancies in the knowledge base of the acquirer and target firm to the number of patents constituting the acquirer's knowledge base (Cloodt et al., 2006; Sears & Hoetker, 2014). Similarly, this study applies the measure in the knowledge spillover context, focusing on the overlap in technological fields, captured by the primary main class of each patent, between the SKP and the originator's knowledge base. The variable is operationalized as follows:

Technological allianceIn this study, following Yayavaram et al. (2018), an alliance involving either R&D, cross-licensing, or manufacturing flags in the SDC Platinum database is considered a technological alliance. We first identified the information on all technological alliances that an originator firm had formed from t–5 to t–1. We then identified the partner(s) of each identified technological alliance deal. This study focuses on the double-edged effect of inter-organizational knowledge transfer among alliance partners on the originator. Every technological alliance in which the originator participates has the opportunity to learn from its partners as knowledge is shared among them. Simultaneously, however, originators also face the risk of losing their proprietary knowledge. Considering that firms often form alliances with their previous partners and that the extent to which a partnership is repeated may alter its effects, we adopt the measure of repeated alliances adopted by Zheng and Yang (2015). The variable was operationalized based on the calculation of the geometric mean, which allocates a greater weight to even distributions (Fink & Jodeit, 1976). The geometric mean has a relative advantage over the arithmetic mean because the former is less influenced by extreme values in a skewed distribution (Clark-Carter, 2010). Because the value of technological alliance formation has a skewed distribution, a geometric-mean-based measure is deemed appropriate.

Tij denotes the total number of technological alliances originator i formed with partner j from t–5 to t–1, and N indicates the total number of technological alliances the originator formed during the same period. For example, if originator i formed 13 technological alliances during the period: five alliances with partner X, three with partner Y, two with partner Z, and one alliance with partners A, B, and C, respectively, the value of the Technological alliance of originator i at t would be (5 × 3 × 2 × 1 × 1 × 1)1/13. We log-transformed the values when they were included in the model.

Control variablesOther variables that may have affected the dependent variables were also included in the empirical model. First, considering that a firm's R&D intensity may influence its absorptive capacity for knowledge (Cohen & Levinthal, 1990; Martínez-Noya & García-Canal, 2021), it was included in the model. The variable R&D intensityit was operationalized as the R&D expenditure of originator firm i in year t divided by the sales of the originator firm in year t. Based on the idea that a firm's search range, capability, and innovation performance are influenced by its slack resources (Du et al., 2022; Kim et al., 2008; Nohria & Gulati, 1996), the variable Current ratioit, measured by the current assets of originator firm i divided by the current liabilities of the originator firm at time t, was included in the model. Finally, the variable Technological diversity of existing knowledge baseit was included because a firm's diversification strategy in innovation might affect its innovation activities and outcomes. The variable is operationalized as the number of technology classes of originator firm i's knowledge stock at time t divided by the technological capability (i.e., the number of patents that consist of the knowledge stock) of firm i at time t. The main independent variable, Technological diversity of SKP, represents the diversity of SKP, while Technological diversity of existing knowledge baseit represents the diversity of the originator's own internal knowledge base.

EstimationWe used Poisson pseudo-maximum likelihood (PPML) regression as our regression model. The regression model has the advantage of non-negative data, which have the possibility of many zero values, and is thus suitable for patent citation count data (Correia et al., 2020). PPML enables the handling of zero variables without adjustments and provides an overdispersion-robust estimator (Hausman et al., 1984; Silva & Tenreyro, 2011).

We also included year- and firm-fixed effects in the regression analyses. By including firm fixed effects in the model, we effectively control for the time-invariant unobserved characteristics of firms (Slavova & Jong, 2021; Wooldridge, 2010). All independent and control variables were mean-centered when they were included in the empirical models because mean centering makes it easier to interpret the regression results of the moderation model (Dawson, 2014).

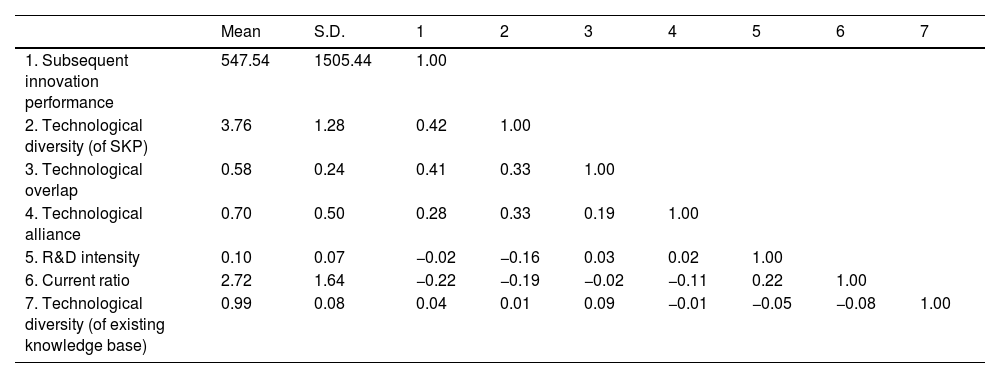

ResultsTable 1 shows the descriptive statistics and the correlation of the main variables. The mean and maximum value of variance inflation factors (VIFs) were lower than five, alleviating the concern of potential multicollinearity problem (García-Granero et al., 2020; Hair et al., 2011). The originator firms included in our sample generated 98.75 patents that received, on average, 448.78 forward citations within three years.

Descriptive statistics and correlations.

| Mean | S.D. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

|---|---|---|---|---|---|---|---|---|---|

| 1. Subsequent innovation performance | 547.54 | 1505.44 | 1.00 | ||||||

| 2. Technological diversity (of SKP) | 3.76 | 1.28 | 0.42 | 1.00 | |||||

| 3. Technological overlap | 0.58 | 0.24 | 0.41 | 0.33 | 1.00 | ||||

| 4. Technological alliance | 0.70 | 0.50 | 0.28 | 0.33 | 0.19 | 1.00 | |||

| 5. R&D intensity | 0.10 | 0.07 | −0.02 | −0.16 | 0.03 | 0.02 | 1.00 | ||

| 6. Current ratio | 2.72 | 1.64 | −0.22 | −0.19 | −0.02 | −0.11 | 0.22 | 1.00 | |

| 7. Technological diversity (of existing knowledge base) | 0.99 | 0.08 | 0.04 | 0.01 | 0.09 | −0.01 | −0.05 | −0.08 | 1.00 |

The descriptive statistics includes the actual values of each variable. In the regression analyses, some variables are adopted with log-transformation due to the skewness.

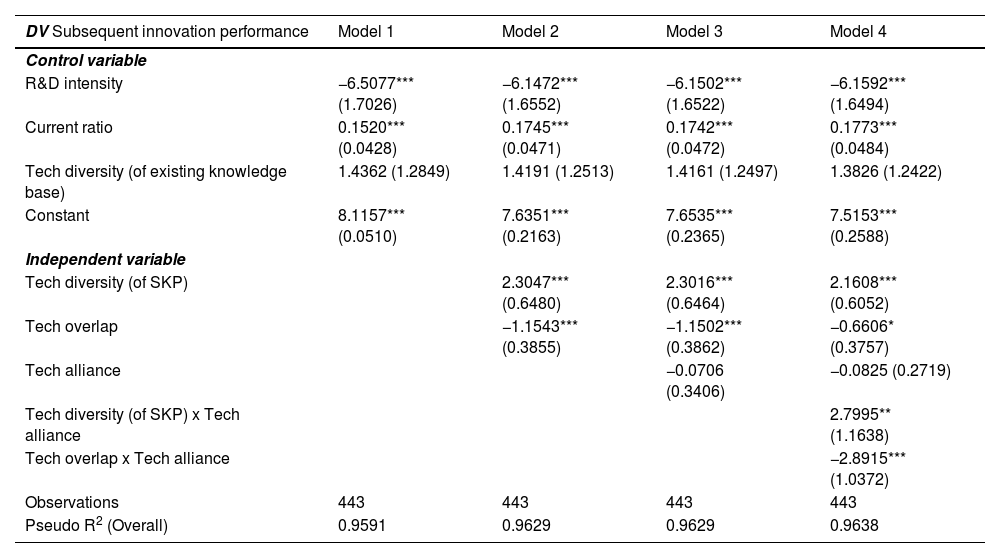

Table 2 presents the results of regression analyses. In Model 3, Technological diversity of SKP, Technological overlap, and Technological alliance are adopted to test the direct effect of Technological diversity of SKP and Technological overlap. In Model 4, the interaction term between Technological diversity of SKP and Technological alliance, and the interaction term between Technological overlap and Technological alliance are adopted to test the moderation effect of Technological alliance. The positive effect of Technological diversity of SKP on the originator's subsequent innovation performance (H1) is statistically supported throughout Models 3 (p = .000) and 4 (p = .000). The negative relationship between the Technological overlap and Subsequent innovation performance (H2) is also supported in both Models 3 (p = .003) and 4 (p = .079). In order to examine effect sizes, firms with high Technological diversity of SKP (at 1 SD above the mean) are compared with firms at mean levels of Technological diversity of SKP. Firms with high Technological diversity of SKP generate 95.04 %c higher Subsequent innovation performance than firms with mean levels of Technological diversity of SKP. In case of Technological overlap, firms with 1 SD higher Technological overlap above the mean generate 14.44 % lower Subsequent innovation performance than those with mean levels of Technological overlap of SKP.

Poisson pseudo maximum likelihood regression results.

| DV Subsequent innovation performance | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| Control variable | ||||

| R&D intensity | −6.5077*** (1.7026) | −6.1472*** (1.6552) | −6.1502*** (1.6522) | −6.1592*** (1.6494) |

| Current ratio | 0.1520*** (0.0428) | 0.1745*** (0.0471) | 0.1742*** (0.0472) | 0.1773*** (0.0484) |

| Tech diversity (of existing knowledge base) | 1.4362 (1.2849) | 1.4191 (1.2513) | 1.4161 (1.2497) | 1.3826 (1.2422) |

| Constant | 8.1157*** (0.0510) | 7.6351*** (0.2163) | 7.6535*** (0.2365) | 7.5153*** (0.2588) |

| Independent variable | ||||

| Tech diversity (of SKP) | 2.3047*** (0.6480) | 2.3016*** (0.6464) | 2.1608*** (0.6052) | |

| Tech overlap | −1.1543*** (0.3855) | −1.1502*** (0.3862) | −0.6606* (0.3757) | |

| Tech alliance | −0.0706 (0.3406) | −0.0825 (0.2719) | ||

| Tech diversity (of SKP) x Tech alliance | 2.7995** (1.1638) | |||

| Tech overlap x Tech alliance | −2.8915*** (1.0372) | |||

| Observations | 443 | 443 | 443 | 443 |

| Pseudo R2 (Overall) | 0.9591 | 0.9629 | 0.9629 | 0.9638 |

Standard errors are in parentheses. *p < 0.1, **p < .05, ***p < .01.

In addition, the regression results of Model 4 show that the coefficient of interaction term between Technological diversity of SKP and Technological alliance is positive and statistically significant (p = .016). This indicates the positive moderation effect of Technological alliance on the relationship between Technological diversity of SKP and the originator's innovation performance and thus, H3 is supported. Conversely, the coefficient of interaction term between Technological overlap and Technological alliance is negative and statistically significant (p = .005); thus, H4 is also supported.

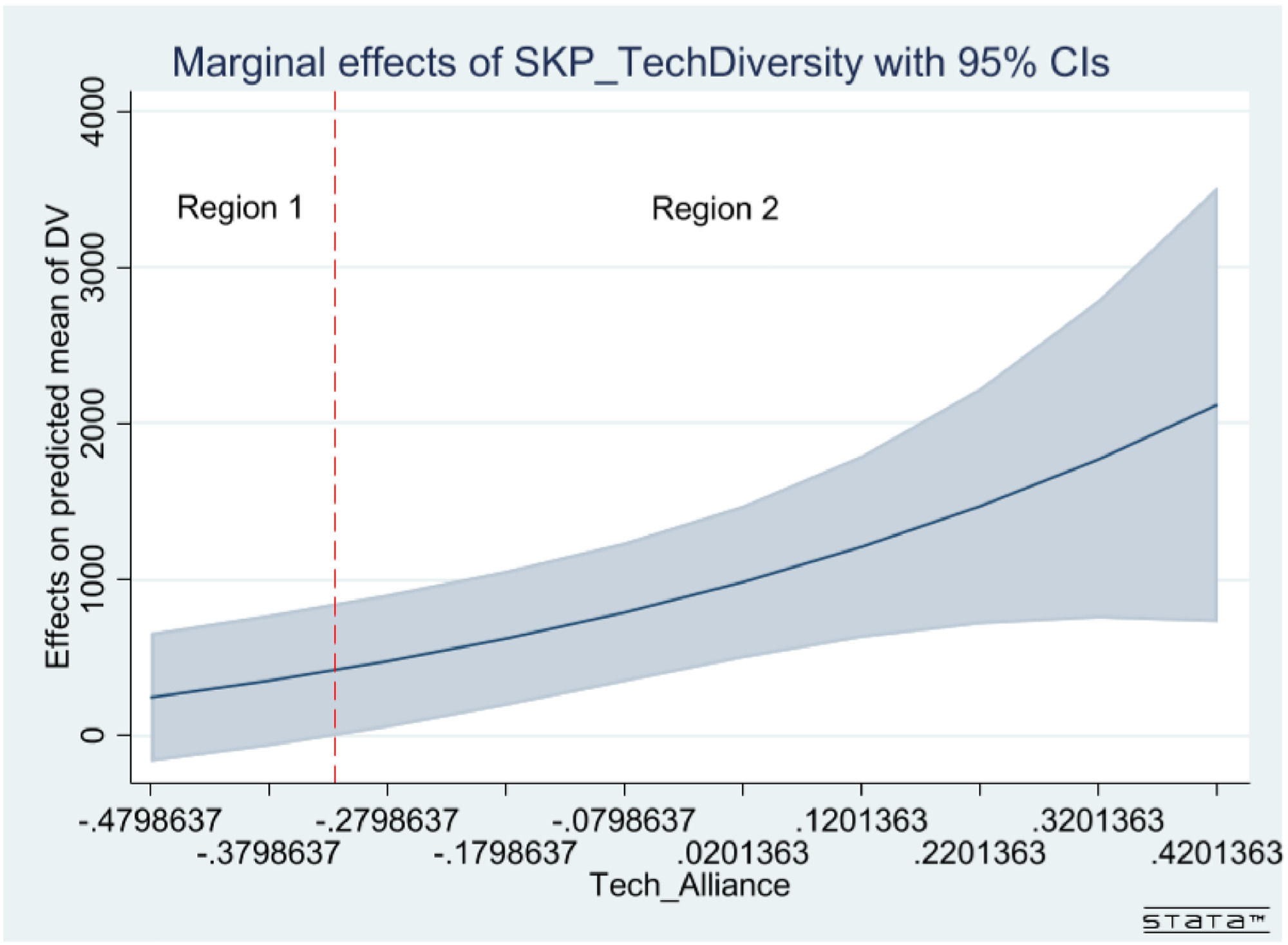

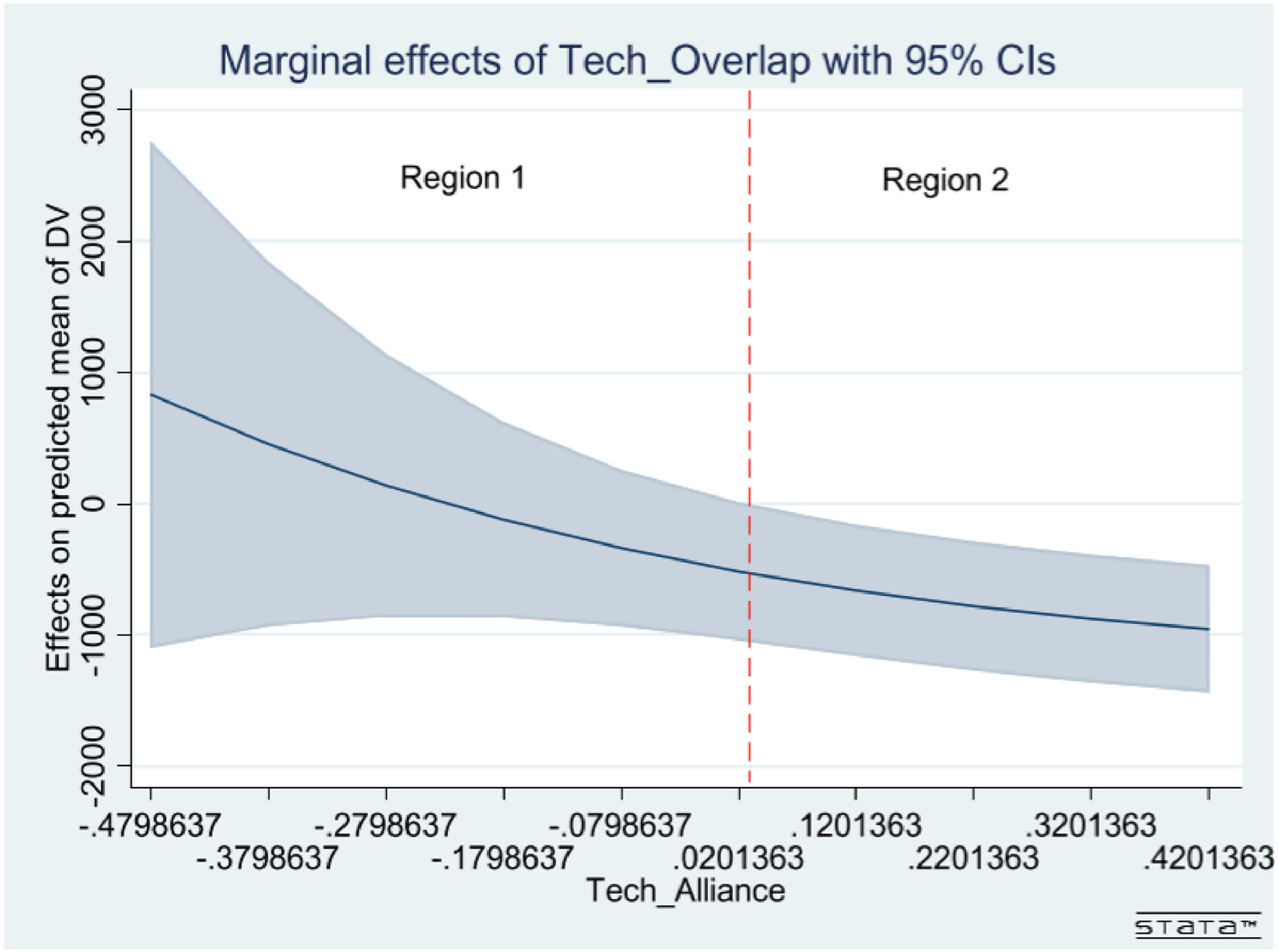

Along with the regression results, it is required to plot the marginal effect of an independent variable conditional on the other independent variable to check the statistical significance of the interaction term (Greene, 2010). In non-linear models, the marginal effects and the confidence intervals are influenced not only by the value of one independent variable but also by the values of all independent variables. Therefore, there are limitations in interpreting the estimated coefficients only with the regression results (Hoetker & Agarwal, 2007; Yan & Chang, 2018; Zelner, 2009).

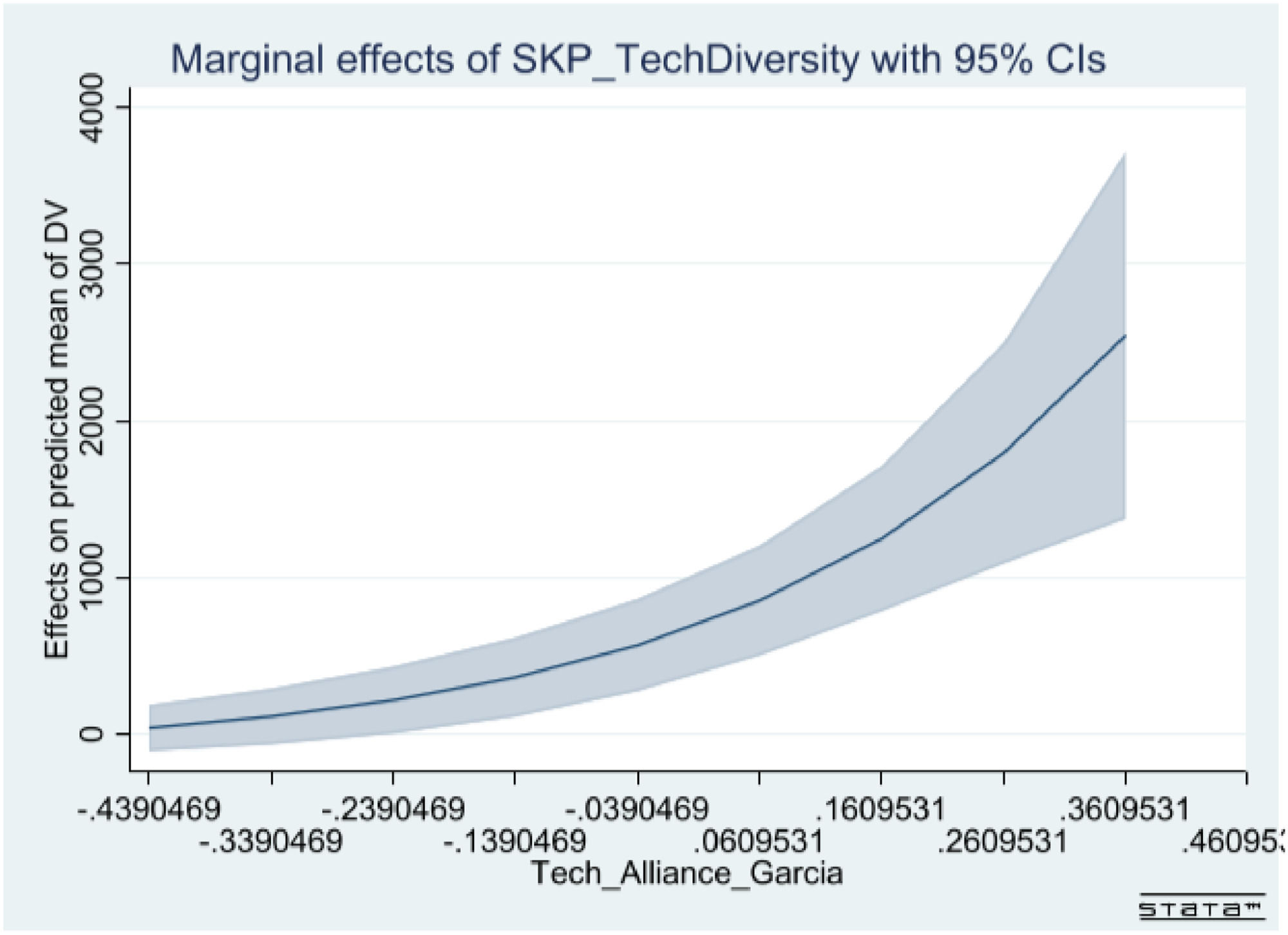

Fig. 2 presents the graphical representation of marginal effects of the Technological diversity of SKP on the Subsequent innovation performance conditional on Technological alliance. Based on the figure, we can check the statistical significance of the positive moderation effects of Technological alliance. The shaded area consists of the 95 % confidence interval for each estimate of the marginal effect at each level of Technological alliance. In Region 1 of Fig. 2, the confidence intervals include zero throughout the different levels of Technological alliance, which indicates that the estimated marginal effects are statistically insignificant in the region. If the level of Technological alliance is within Region 2 of Fig. 2, the marginal effects of Technological diversity of SKP are positive and statistically significant. Moreover, as the level of Technological alliance increases, the marginal effects of Technological diversity of SKP further increases. This provides statistical support for H3.

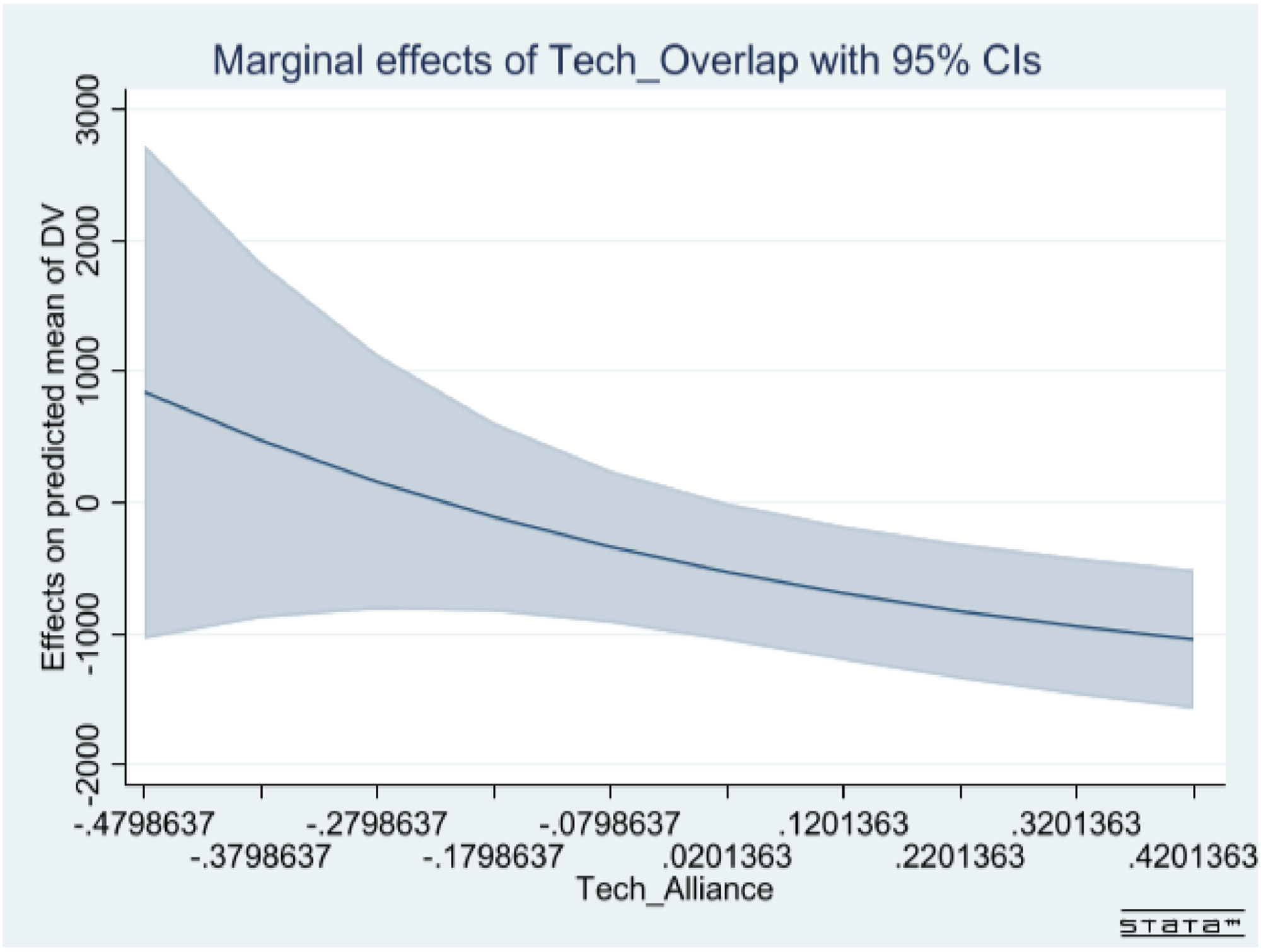

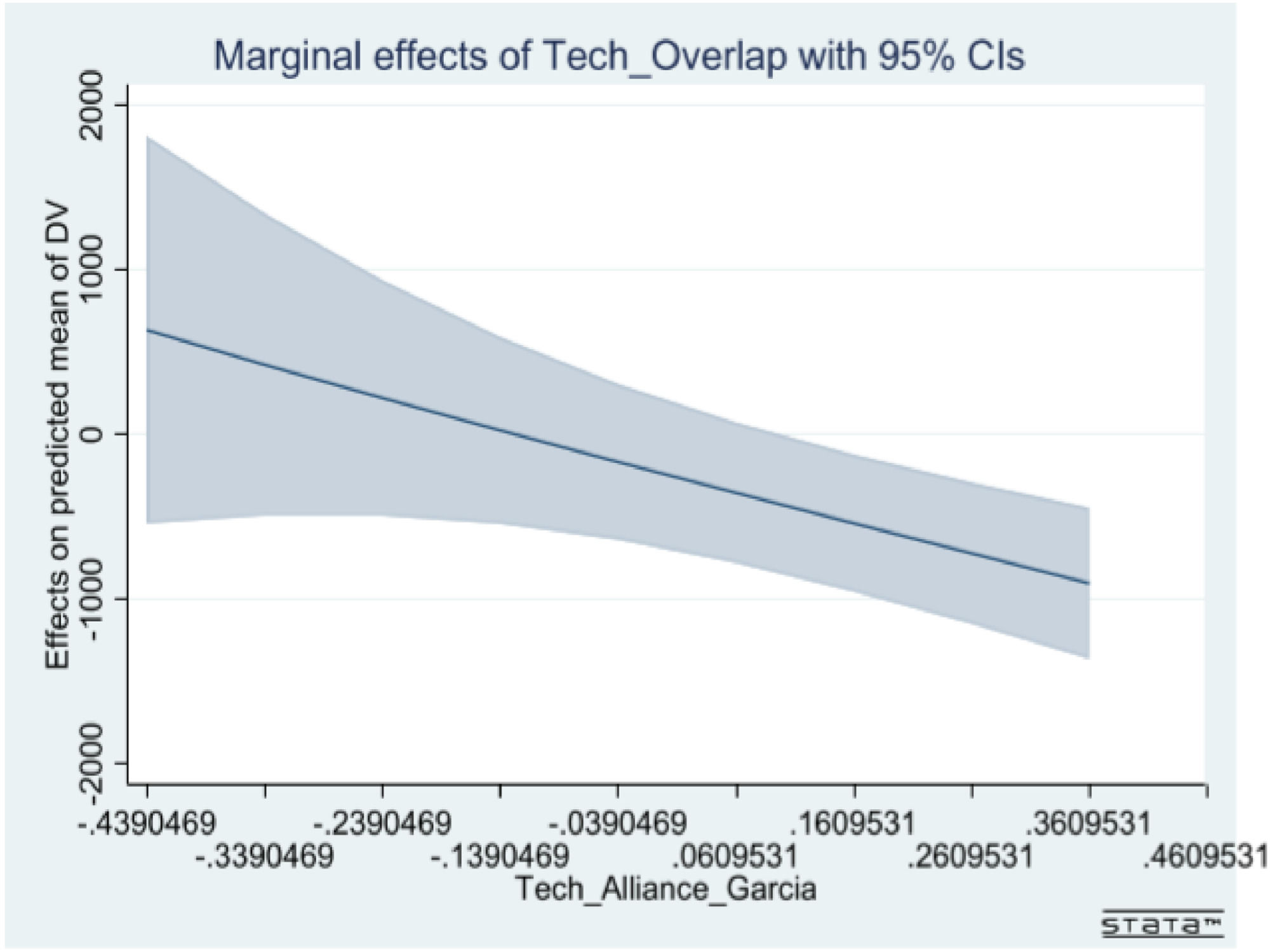

The graphical representation of the marginal effects of the Technological overlap conditional on the different levels of Technological alliance is presented in Fig. 3.

From the figure, we can check the statistical significance of the moderation effects of Technological alliance on the relationship between Technological overlap and Subsequent innovation performance. The effects are statistically insignificant when Technological alliance is within Region 1. In the rest of the region, the confidence intervals do not include zero. In addition, as the level of Technological alliance increases, the marginal effects of Technological overlap further decrease. This indicates that the moderation effect is negative and significant. This provides statistical support for H4.

Robustness testWe conducted additional analyses to ensure robustness of the results. First, we tested whether the potential endogeneity of the technological alliances might influence the analyses and relevant interpretations. We adopted an instrument variable that influences the formation of a technological alliance but has no direct relationship with the originator's subsequent innovation performance. Following Li et al. (2019), we used the Combined reporting index of each originator as our instrumental variable. For more details about the concept and operationalization of Combined reporting, please refer to Appendix A1.

Using the Combined reporting index, we tested the endogeneity of the technological alliance variable by adopting instrumental variable panel OLS estimation for the specification of two-stage models.d The results confirmed that our model did not have an endogeneity problem (See Appendix A2 for more details of results of endogeneity test).

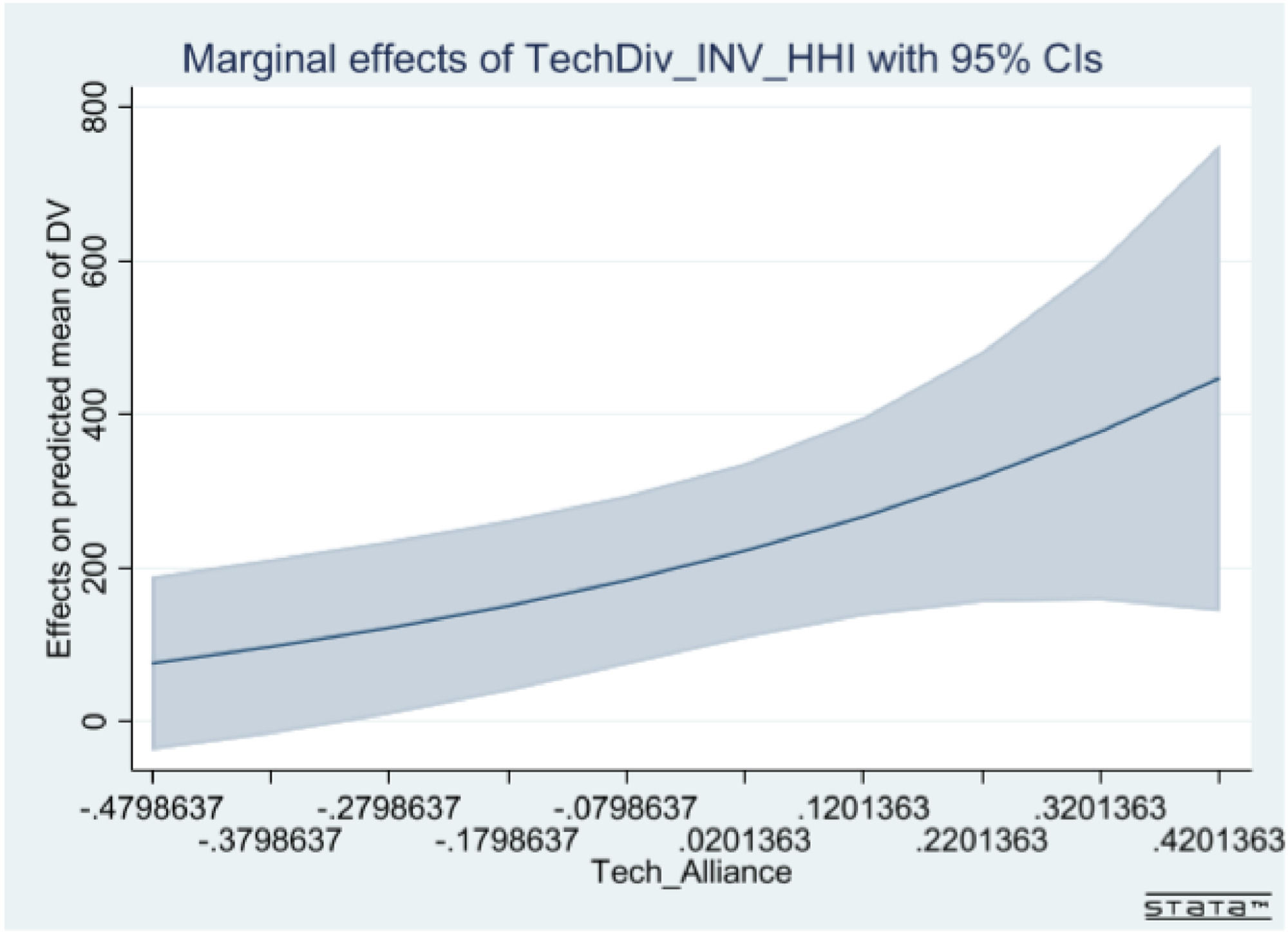

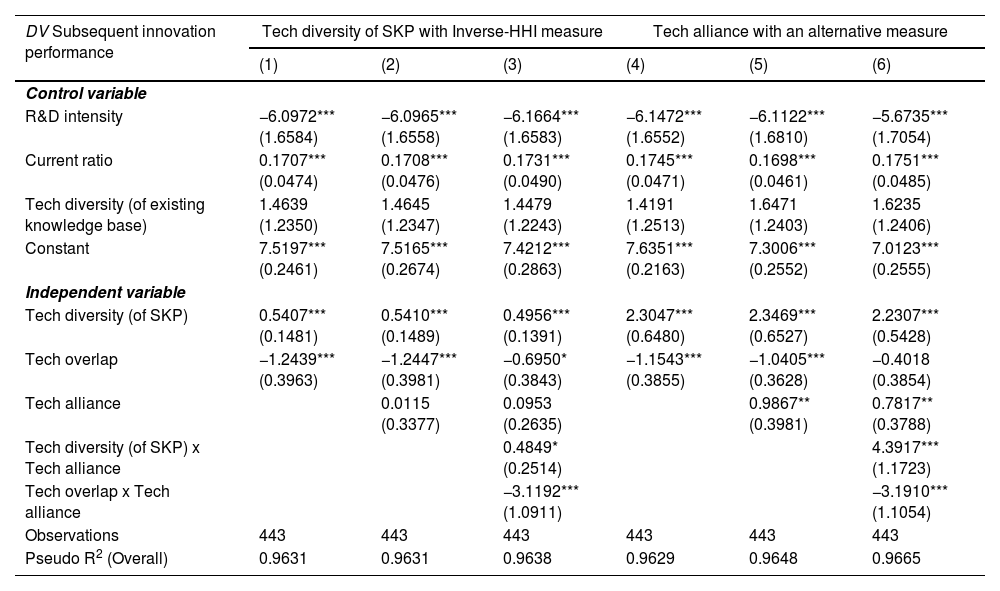

To ensure the robustness of our results, we conducted several supplementary analyses. We performed additional analyses with an alternative measure for Technological diversity of SKP. We adopted the inverse-Herfindahl index of technological diversity to measure Technological diversity of SKP (Garcia-Vega, 2006).

Here, the index i indicates the firm and j indicates the technological class of a patent, and N denotes the number of technological fields of the patents that compose the originator i's SKP. pj denotes the ratio of the number of patents in the originator i’s SKP that hold technological field j to the total number of patents that compose the originator i's SKP. As higher values of Herfindahl index indicate lower levels of technological diversity, we adopted the inverse-Herfindahl index for measuring diversity. Following Bowen and Wiersema (2005), we calculated the inverse-Herfindahl index with 1/H - 1.

Models (1), (2), and (3) of Table B1 in the Appendix show the results of adopting inverse-HHI index for Technological diversity of SKP. The results confirmed a positive and statistically significant effect (p = .000 for Models (1), (2), and (3)) of Technological diversity of SKP on the innovation performance, consistent with our finding from the main analyses (H1). Furthermore, the statistical significance of the positive moderation effects of Technological alliance on the positive relationship between Technological diversity of SKP and Subsequent innovation performance was maintained (H3) with the alternative measure of Technological diversity of SKP (p = .054 for Model (3)). In addition, Fig. B1 in the Appendix confirms the statistical significance of the moderation effects of Technological diversity of SKP on the innovation performance depending on a level of Technological alliance. H2 was maintained throughout the Models (1), (2), and (3) (p = .002 for Models (1) and (2); p = .071 for Model (3)). The moderation effects of Technological alliance on the negative relationship between Technological overlap of SKP and Subsequent innovation performance was also maintained (p = .004). Fig. B2 in the Appendix confirms the statistical significance of the moderation effects of Technological alliance (H4).

We conducted additional tests by adopting alternative definition of technological alliance. García-Canal et al. (2008) defined technological alliance as those that accompany either technology transfer of existing technology and/or undertaking of joint R&D activities. The variable Technological alliance was calculated based on the alternative definition of technological alliance and the regression results are presented in Models (4), (5), and (6) of Table B1 in the Appendix B. The results showed that H1 is supported (p = .000 for Models (4), (5), and (6)), H3 (p = .000) and H4 (p = .004) were supported in Model (6). H2 was supported in Models (4) (p = .003) and (5) (p = .004), but not in Model (6). The statistical significance of moderation effects was confirmed with marginal effects plot in Fig. B3 (H3) and Fig. B4 (H4).

DiscussionConclusionThis study investigated the conditions under which an originator firm can derive opportunities to enhance its dynamic capability from the spillover of knowledge, particularly by emphasizing the duality and contingency of the effects. By taking an integrated approach to identifying the effects of knowledge spillover, we examined the moderating effects of technological alliances on knowledge spillover effects. Technological alliances exhibit either opportunity-augmenting or challenge-deteriorating effects. We argue that both opportunities and challenges exist in the originator firm's vicarious learning from knowledge recipients and that the levels and types may differ depending on knowledge spillover characteristics.

By adopting the PACAP and RACAP dimensions of absorptive capacity suggested by Zahra and George (2002), we explore how knowledge spillovers and technological alliances influence originators’ dynamic capabilities to change and evolve continuously, thereby sustaining competitiveness in innovation.

Theoretical contributionsThe present study provides a balanced view regarding the knowledge spillover by highlighting the contingency of the knowledge spillover effects. Few studies have explicitly addressed the double-sided effects of knowledge spillover on the originator's sustained competitive advantage, focusing on either the positive or negative side (Jee & Sohn, 2023). However, the empirical findings of the current study reveal double-sided aspects of knowledge spillover on originators’ dynamic innovation capabilities.

This study also contributes to the knowledge spillover literature by highlighting the multifaceted effects of knowledge spillover, and building on and extending Zahra and George's (2002) definition of absorptive capacity as an organization's dynamic capability. While SKP inherently has a connection to the originator, generally ensuring a certain level of ACAP, viewing ACAP as a dynamic capability Zahra and George (2002) suggests that SKP does not always guarantee high levels of PACAP and RACAP. For instance, certain SKP characteristics can lead to PACAP, but in terms of the originator's capability to evolve, SKP can hamper the originator's development of organizational routines.

We also extend and add to the studies that go against the conventional view of knowledge spillover, with an underlying assumption of homogeneity in the effects among specific categories of firms (Jee & Sohn, 2023; Varshney & Jain, 2023; Yang & Steensma, 2014; Yang et al., 2010). This study is based on the premise that the effects of knowledge spillover that each originator can draw on are idiosyncratic to each firm, depending on the aspects of the spillover of each originator's knowledge. Different characteristics of knowledge spillover can have different impacts on an originator firm's dynamic capability to sustain competitive advantage.

Finally, we extend the literature on knowledge spillovers by exploring the interplay between knowledge spillover phenomena and technological alliances. Considering that originators are unable to control the extent of spillover once knowledge is announced Mansfield (1985), investigating the effects of the specific characteristics of knowledge spillover on a firm's performance has limited implications for how firms strategize to enhance the benefits of spillovers (e.g.,Yang et al. 2010). Thus, it is necessary to adopt a combined view to investigate the interactions between knowledge spillovers and a firm's strategic factors. This study addresses this by examining the integrated effects of knowledge spillover and originators’ technological alliances.

Practical implicationsThe results of this study have several implications for managers. First, firms’ innovation managers must constantly monitor the way firms’ knowledge spills over so that technological alliances can be strategically adopted by considering the interaction with spillover characteristics. Second, the study proposes specific ways in which managers of originating firms can strategize according to the context or situation to create knowledge spillover, which in turn would be beneficial to the firm. If an R&D manager monitors the spillover knowledge pool of a firm and the identified SKP has a high level of technological diversity, the firm would be able to augment the potential benefits of vicarious learning by participating in technological alliances. However, when the technological overlap between the firm's knowledge base and SKP is high, technological alliances would deteriorate the firm's ability to leverage the opportunities of vicarious learning, hampering subsequent innovation outcomes. In these cases, firms must exercise due diligence when forming technological alliances.

Our findings have important implications for policy-makers. By investigating how knowledge spillovers among firms occur in each industry, policymakers may identify knowledge spillovers across diverse technological fields in some industries. Firms in such industries would benefit from spillovers by participating in technological alliances, as technological alliances augment the positive effects while reducing the potential side effects under technologically diverse SKP conditions. In such case, therefore, policymakers may enact policies to alleviate regulations that hinder the formation of technological alliances.

Limitations and future researchA limitation of this study arises from the use of patents to identify knowledge creation and spillovers. As we captured knowledge spillover using patent citations, we could not directly observe the inter-organizational flow of knowledge that firms strategically decided not to reveal, including trade secrets (Scheppele, 1988).

There may be limitations associated with the time frame of the study, which spanned from 1992 to 2001. During this period, the telecommunications equipment industry experienced active R&D, significant technological advancements, and widespread dissemination of knowledge. This makes it a suitable context for examining the effects of knowledge spillovers, technological alliances, on the dynamic capabilities of companies to sustain competitive advantages. However, restrictions on this earlier period may limit the generalizability of our findings. Future research could explore these dynamics in more recent periods of revitalization in the telecommunication equipment industry, such as the period following the dotcom bubble, to provide further insights into knowledge spillovers.

We suggest that future research apply a contingency approach to investigate the effects of knowledge spillovers on originators in other industries. This study investigates the double-sided effects of knowledge spillovers and the moderating effects of technological alliances on originators’ subsequent innovations in the telecommunications equipment industry. The implications of these findings can be applied to other high-tech industries. However, it would be meaningful if future research delves into the dynamic and double-sided effects of knowledge spillover on originators in an industry that shows a unique knowledge spillover trend. Investigating the ways in which firms can benefit from spillovers, along with a consideration of context-specific factors, would provide meaningful implications.

In addition, future research could delve into the impact of the geographical proximity of originators and recipients on the effectiveness of vicarious learning from spillovers. Previous studies, such as the scientometric analysis of knowledge spillover literature by Cerver-Romero et al. (2020), suggest that one of the major approaches in the field of knowledge spillover is the location or geographical approach. As geographical proximity significantly influences the spillover of knowledge between innovation entities, such an investigation could provide valuable insights.

CRediT authorship contribution statementYura Rosemary Jung: Writing – review & editing, Writing – original draft, Validation, Methodology, Investigation, Formal analysis, Data curation, Conceptualization. Jaehyun Lee: Writing – review & editing, Investigation, Conceptualization. Junseok Hwang: Supervision, Investigation, Conceptualization. Noelia Lombardo Gava: Writing – review & editing, Resources, Methodology.

The authors sincerely appreciate the guidance and invaluable comments provided by the editor and anonymous referees. Likewise, the authors extend their gratitude to Prof. Seungryul Ryan Shin at the Ulsan National Institute of Science and Technology (UNIST) for detailed feedback and priceless suggestions. This study won the grand prize at the 2020 Management & Innovation Research and Case Study Contest hosted by the Korea Management Association (KMA) Hoenam Foundation and the Korea Management Association Consulting (KMAC).

A1. The concept and the operationalization of Combined Reporting Index

The idea of using the Combined reporting index as an instrumental variable stems from the observation that each state in the US has differences in the adoption of a combined reporting system for corporate income (Bodnaruk et al., 2013; Mazerov, 2009). In combined reporting, when calculating the state income tax, a corporate parent and its subsidiaries are treated as one entity. The state assesses taxes on the share of each company's nationwide combined income, and the share is calculated based on corporate group-level activities in the state in comparison with those in other states (Huddleston & Sicilian, 2011; Mazerov, 2009). The system effectively eliminates within-corporate group income-shifting transactions, which leads to a reduction in opportunity costs (Huddleston & Sicilian, 2011), alleviating the costs of forming alliances vis-à-vis internal projects. Following Li et al. (2019), we expect that the more subsidiaries an originator has in states that adopt combined reporting, the higher the likelihood of the originator forming technological alliances. Bodnaruk et al. (2013) provide empirical evidence to confirm this relationship.

To construct the Combined reporting index for each firm in each year, we obtained information on the location of the subsidiaries of each firm in each year and on the adoption of a combined reporting system in each US state in each year. Information on the combined reporting system adoption for each state was obtained from Mazerov (2009). We collected the location information of corporate affiliations from Nexis, 2019. We gathered all historical locations of each firm's affiliations during the sample period, except for 1992 because the database provides affiliation information only from 1993.

We construct a yearly Combined reporting index for each firm. This allows our instrumental variables to vary over time. Following previous studies, we set the combined reporting indicator of each subsidiary (including headquarters) in each year to 1 if the state of the corporate subsidiary adopts combined reporting and 0 otherwise. A corporate-level Combined reporting index indicates the sum of the indicator variables across all subsidiaries of each firm (including headquarters) divided by the total number of subsidiaries of the firm. When subsidiary information was unavailable, the headquarters was used.

A2. The results for testing the endogeneity using Combined Reporting Index

For a variable to be a valid instrumental variable, it should satisfy the conditions of relevance and exogeneity (Kennedy, 2008). The weak identification F-statistics of our instrument variable showed that it satisfied the condition of relevance (Staiger & Stock, 1997). While the combined reporting variable is statistically related to the potentially endogenous technological alliance variable (p = .000) in the first-stage model, it is not related to subsequent innovation performance in the second-stage model, fulfilling the exogenous condition. We conduct a Hausman test to further examine the endogeneity of the focus variable. We obtained a chi-square value of 23.52 (p = .1004), indicating that the null hypothesis, stating that the 2SLS estimators and the original regression estimator (without addressing endogeneity) were not systematically different, could not be rejected.

Figs. B1, B2, B3, B4, Table B1

Poisson pseudo maximum likelihood regression results.

| DV Subsequent innovation performance | Tech diversity of SKP with Inverse-HHI measure | Tech alliance with an alternative measure | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Control variable | ||||||

| R&D intensity | −6.0972*** (1.6584) | −6.0965*** (1.6558) | −6.1664*** (1.6583) | −6.1472*** (1.6552) | −6.1122*** (1.6810) | −5.6735*** (1.7054) |

| Current ratio | 0.1707*** (0.0474) | 0.1708*** (0.0476) | 0.1731*** (0.0490) | 0.1745*** (0.0471) | 0.1698*** (0.0461) | 0.1751*** (0.0485) |

| Tech diversity (of existing knowledge base) | 1.4639 (1.2350) | 1.4645 (1.2347) | 1.4479 (1.2243) | 1.4191 (1.2513) | 1.6471 (1.2403) | 1.6235 (1.2406) |

| Constant | 7.5197*** (0.2461) | 7.5165*** (0.2674) | 7.4212*** (0.2863) | 7.6351*** (0.2163) | 7.3006*** (0.2552) | 7.0123*** (0.2555) |

| Independent variable | ||||||

| Tech diversity (of SKP) | 0.5407*** (0.1481) | 0.5410*** (0.1489) | 0.4956*** (0.1391) | 2.3047*** (0.6480) | 2.3469*** (0.6527) | 2.2307*** (0.5428) |

| Tech overlap | −1.2439*** (0.3963) | −1.2447*** (0.3981) | −0.6950* (0.3843) | −1.1543*** (0.3855) | −1.0405*** (0.3628) | −0.4018 (0.3854) |

| Tech alliance | 0.0115 (0.3377) | 0.0953 (0.2635) | 0.9867** (0.3981) | 0.7817** (0.3788) | ||

| Tech diversity (of SKP) x Tech alliance | 0.4849* (0.2514) | 4.3917*** (1.1723) | ||||

| Tech overlap x Tech alliance | −3.1192*** (1.0911) | −3.1910*** (1.1054) | ||||

| Observations | 443 | 443 | 443 | 443 | 443 | 443 |

| Pseudo R2 (Overall) | 0.9631 | 0.9631 | 0.9638 | 0.9629 | 0.9648 | 0.9665 |

Standard errors are in parentheses. *p < 0.1, **p<.05, ***p<.01.

Present affiliation/address: National Institute of Green Technology, Address: 60, Yeouinaru-ro, Yeongdeungpo-gu, Seoul, Republic of Korea

Among global telecommunications equipment manufacturing industry, firms in “telephone and telegraph apparatus” (SIC 3661), “radio and TV communications equipment” (SIC 3663), and “communications equipment not elsewhere classified” (SIC 3669) were selected as the sample firms (Wadhwa & Kotha, 2006).

The Poisson pseudo maximum likelihood regression model adopted in the present study automatically rules out singletons and separated observations. Thus, 17 observations were dropped, resulting in 443 firm-year observations of 62 firms (Correia et al., 2020). Specifically, firm-year observations of four firms were dropped as they were singletons, and 13 firm-year observations of four firms were dropped as they were separated observations.