Official online stores and online marketplaces present distinct challenges and opportunities for retail brands, impacting their control over the customer experience, pricing, and brand presentation. Understanding consumer intentions in online channel selection is crucial, especially given the rise of online shopping and the impact of the COVID-19 pandemic on consumer behavior. This study explores the factors influencing channel selection intention within official online stores and online marketplaces, focusing on customers who have purchased Apple electronics. A quantitative questionnaire facilitated data collection, resulting in responses from 490 individuals and 606 samples. Those who shopped through both channels were requested to complete the questionnaire twice. The respondents were divided into two groups based on their purchasing experience, and structural equation modeling was employed for hypothesis testing. In official online stores, cross-channel searching negatively impacts channel selection intention, whereas brand loyalty and channel pricing advantage have positive effects. In contrast, no significant relationships between these variables were observed in online marketplaces. Channel satisfaction was found to positively influence channel selection intention across official online stores and online marketplaces, while perceived risk demonstrated a negative impact. Based on these findings, several recommendations are proposed to aid in developing effective sales channel strategies.

Online shopping has undergone a remarkable surge in popularity in Taiwan, as evidenced by 78 % of consumers engaging in this activity and 65 % doing so on a weekly basis (Sun, 2021). The COVID-19 pandemic further fueled this trend, as shoppers increasingly opt for online purchases to maintain social distancing. In 2021, Taiwan's online retail sector achieved a milestone with sales hitting 430 million, marking a substantial 24.52 % increase compared to the previous year and constituting 10.8 % of the nation's total retail sales (Ministry of Economic Affairs Department of Statistics, 2022). The domain of online retailing has experienced significant expansion, encompassing a variety of sales channels such as online marketplaces, social media, and official online stores (MorePower, 2021). In this landscape, 91.3 % of Taiwanese consumers prefer online marketplaces such as PChome, momo, and Shopee. Meanwhile, 32.6 % gravitate towards official online stores. On social media, 15.9 % of shoppers utilize LINE, and 8.7 % opt for Facebook for online purchases (Zhang, 2020).

Selling on a brand's official online store offers several advantages over online marketplaces. Firstly, it allows brands to maintain greater control over their branding, customer experience, and product presentation (M.O.N.I. Group, 2020). Secondly, a brand's online store provides a direct channel for customer interaction and feedback, fostering stronger relationships with consumers (WareIQ, 2022). Additionally, brands can leverage their online stores to collect valuable customer data, which can inform marketing strategies and product development (Lopienski, 2023). However, operating an online store can incur significant setup costs, including website development, maintenance, and marketing expenses (nibusinessinfo.co.uk, n.d.). Brands may struggle to attract traffic to their online store, especially without established brand recognition or a loyal customer base (Matthews, 2023). Additionally, managing inventory, fulfillment, and customer service can be time-consuming and resource-intensive for brands (Debutify, 2023).

Online marketplaces offer new avenues for retail brands to expand their reach on a broader scale, eliminating the need for companies to invest in developing their own e-commerce platforms (Kawa & Wałęsiak, 2019). Selling on online marketplaces can tap into heavy traffic, gaining visibility for products (Lim & Hu, 2022). By selling on reputable marketplaces, sellers can leverage trust and reliability, instilling confidence in shoppers. Moreover, starting to sell on a marketplace is both cheaper and quicker compared to establishing one's own online platform, as the marketplace handles tasks such as website design, order processing, and financial transactions. However, online marketplaces also bring drawbacks, including intense competition, fees, limited personalization options, and potential pricing control by the platform (Lim & Hu, 2022).

This research draws inspiration from interactions with retail brands at a digital advertising agency, highlighting a typical scenario where market managers handle multiple sales channels. This situation positions the official marketplace as a competitor to the official online store, presenting a unique dynamic for exploration.

MIC. (2019) reported an increase in management of official brand stores, despite 95.5 % of consumers expressing a preference for shopping via online marketplaces. This apparent contradiction prompts an investigation into the necessity of brands establishing their official online stores. While diversifying sales channels has the potential to enhance product visibility, market managers often navigate challenges in handling an extensive array of channels. Consequently, the primary dilemma for many of these professionals lies in devising a strategic approach to e-commerce sales channel management.

Customers frequently encounter the challenge of selecting the same product offered at varying prices across channels. Maier and Wieringa (2021) investigated the impact of sales on both online marketplaces and retailer-owned channels through a comprehensive analysis of sales data. Furthermore, research conducted by Xu and Jackson (2019), Antolis and Agus (2020), and Nguyen and Nguyen (2022) explored customer channel selection intentions within the omnichannel environment. However, their work primarily focused on comparisons within this environment, which presents challenges in translating the findings directly to the context of official versus third-party channels.

This research investigates the influences of individual factors—such as brand loyalty and cross-channel searching—as well as three channel factors (channel satisfaction, channel price advantage, and perceived channel risk) on online channel selection intention. The goal is to enrich our comprehension of customer preferences within a multi-channel framework.

This research has been meticulously crafted to answer the subsequent questions:

- 1.

What are the key factors influencing customers' channel selection intention when they shop via an official online store versus an online marketplace?

- 2.

How do the factors affecting customers' channel selection intention differ when comparing purchases made through an official online store to those made through an online marketplace?

Deciding whether to sell products via an official online store or online marketplace represents a prevalent conundrum for retail brands. In the contemporary marketplace, it is increasingly common for retail brands to adopt both strategies simultaneously. Retail brands, in their endeavor to cater to customer requirements, need to focus on understanding not just the purchase intention but also the choice of channel for making purchases. While there is a growing focus on omnichannel strategies, there is still a dearth of research addressing official online stores versus online marketplaces.

This research aims to fill this gap, exploring how individual and channel factors impact online channel selection intention within multi-channel retailing. It explores five key factors: brand loyalty, cross-channel searching, channel satisfaction, channel price advantage, and perceived channel risk. The insights from these findings can offer substantial value to retail brands, equipping them with the necessary information to refine and optimize their sales channel strategies.

Literature reviewBrand loyaltyAccording to Jacoby and Kyner (1973), brand loyalty is characterized by six essential conditions: a nonrandom commitment to the brand, observable behavioral responses reflecting this commitment, consistency in these behaviors over time, decision-making control on the part of the consumer, the ability to choose from alternative brands, and the impact of underlying psychological processes. It is considered a significant asset for firms, as highlighted by Mellens et al. (1995). Recent research highlights that brand loyalty remains a critical concept, evolving with market dynamics. For example, a study by Mostafa and Kasamani (2020) emphasizes that brand experience significantly influences brand loyalty through brand passion, self-brand connection, and brand affection. Rahman and Susila (2022) also highlights that both brand passion and self-brand connection significantly impact the relationship between brand experience and brand loyalty. This underscores the role of emotional factors in loyalty, which aligns with the experiences Apple aims to create through its ecosystem.

Apple's unique ecosystem is a key factor in fostering brand loyalty. Apple's strategy integrates hardware, software, and services to create a seamless user experience, making it difficult for consumers to switch to other brands (Storyly, 2023). This brand loyalty, as noted by recent literature (Machado et al., 2014), is not just about repeat purchases but about the emotional and experiential ties consumers have with the brand. The ability of Apple to maintain and enhance customer loyalty is significantly supported by its integrated ecosystem (Aditya et al., 2021).

Behavioral loyalty, characterized by repeat purchases, is associated with an augmented market share, while attitudinal loyalty, reflecting a positive emotional attachment to the brand, correlates with an elevated brand value (Chaudhuri & Holbrook, 2001). Loyalty measurement can be divided into two main categories: behavioral and attitudinal. Behavioral loyalty includes observable actions such as repeat purchasing, while attitudinal loyalty encompasses aspects like preference, commitment, and purchase intention (Mellens et al., 1995). Odin et al. (2001) underscored the importance of distinguishing real brand loyalty, characterized by a pronounced brand sensitivity, from simple inertia in repurchasing behavior. Konus et al. (2008) subsequently presented measures for brand and retailer loyalty; Van de Zande (2016) later employed these measures utilizing a 7-point Likert scale for assessment.

Cross-channel searchingMulti-channel shopping (Neslin et al., 2006; Neslin & Shankar, 2009; Verhoef, 2012; Jo et al., 2020), as well as cross-channel shopping (Doosti et al., 2018), entails the utilization of various channels to research and consider products during a single shopping session. Research on shopping behaviors indicates that consumers often gather product information from one channel and proceed to make their purchase through another (Pauwels et al., 2011; Verhoef et al., 2007; Voorveld et al., 2016). Such behavior is commonly attributed to research shoppers (Neslin et al., 2006; Verhoef et al., 2007), or to multi-channel shoppers (Konus et al., 2008; Rangaswamy & Van Bruggen, 2005; Jo et al., 2020).

Cross-channel searching focuses on acquiring information prior to making the final purchase decision (van de Zande, 2016), primarily driven by the desire for product details, brand-related information, pricing details, and promotional offers (Jo et al., 2020). Pre-purchase orientation plays a significant role in shaping channel choice intentions (Gensler et al., 2012; van de Zande, 2016). Shoppers engaged in this behavior tend to demonstrate a heightened awareness of price and quality (Jo et al., 2020), and there exists a negative correlation between cross-channel shopping and impulsive buying tendencies (Doosti et al., 2018). To measure this, Van de Zande (2016) defined a dummy variable based on prior research, which assesses whether shoppers browsed products on various channels prior to making their purchases either online or offline.

Channel price advantagePrice sensitivity plays a crucial role in shaping customer behavior, with shoppers frequently exploiting price discrepancies across different channels (Fassnacht & Unterhuber, 2016). Price promotions have a significant impact on purchasing intentions, often more so than low prices (Raju & Hastak, 1980). By lowering the cost, they enhance the perceived value, amplifying the disparity between benefits and expenses—which in turn bolsters the intent to purchase (Lichtenstein et al., 1990).

Due to the readily accessible information, customers find it easy to compare prices (Verhoef et al., 2015). Engaging in price comparison is a prevalent practice, and pricing significantly influences purchasing decisions (Abad & Jaggi, 2003). Price differentiation across various channels is acknowledged as a strategy that maximizes profits (Biyalogorsky & Naik, 2003). Although some multi-channel retailers opt for consistent pricing across all platforms to maintain uniformity (Wolk & Ebling, 2010), consistently applying price discounts in both online and offline channels has enhanced intentions to purchase across channels and contact points (Kim & Lee, 2020). The measurement of channel price advantage takes into account both the perceived price in comparison to other channels and the actual price differences between the selected channel and the cheapest or second-cheapest option, as outlined in Xu and Jackson (2019).

Channel satisfactionCustomer satisfaction is commonly conceptualized in two distinct manners: transaction-specific satisfaction, evaluating individual experiences with a product or service; and cumulative satisfaction, providing a comprehensive assessment of a customer's total interactions with a product or service (Johnson et al., 1995). Channel satisfaction, according to Van de Zande (2016), pertains to a customer's holistic evaluation of their purchasing experience with a specific channel. Montoya-Weiss et al. (2003) identified crucial determinants that impact overall customer satisfaction. These include elements related to website design (e.g., the richness of informational content, the architecture of navigation, and the style of graphics) along with customer assessments about the quality of service and perceptions of risk. Overall satisfaction is evaluated based on customer experiences, which are shaped by channel attributes such as transparency, consistency, and convenience (Nguyen & Nguyen, 2022). A 7-point Likert scale is often utilized to gauge overall satisfaction, wherein customers are prompted to respond to a solitary question regarding their satisfaction (Montoya-Weiss et al., 2003).

Perceived riskOnline channel risk refers to the uncertainty and potential adverse outcomes that customers might encounter when interacting online with a specific service provider (Montoya-Weiss et al., 2003). This includes various risks such as financial, performance, time, delivery, privacy, psychological, and social risks (Iconaru, 2012). Trust is crucial in reducing these risks, encompassing aspects like the website's security, confidence in transaction processes, and the security of payment methods (Tavares, 2021). Perceived risk is measured by assessing customer apprehensions regarding channel reliability and product performance, utilizing a 5-point Likert scale (Xu & Jackson, 2019). Additionally, Nguyen and Nguyen (2022) employed adapted scales from Yan et al. (2019) and Xu and Jackson (2019), placing a significant emphasis on assessing customer concerns related to the performance of the channel and the product.

Channel selection intentionNumerous research efforts have delved into the determinants of customer channel selection intentions. Findings from these studies indicate that while perceived risk tends to impact these intentions negatively, the customer's perception of behavioral control and the perceived advantage of channel pricing exert positive influences (Xu & Jackson, 2019). Cognitive and affective attributes significantly impact online shoppers' decisions to buy offline. Conversely, relational attributes influence these shoppers when an offline channel is added to their purchasing trip (Tarek et al., 2019).

Antolis and Agus (2020) highlighted the importance of how customers perceive control and risk in their decision-making process for channel selection, with a specific focus on offline channels. Truong (2020) highlighted the importance of compatibility, risk, showrooming, and webrooming in shaping consumers' intentions to purchase within an omnichannel retail environment. On the other hand, Si-zong (2021) examined how product features, channel characteristics, and consumer traits influence the intention to choose a particular sales channel. Nguyen and Nguyen (2022) focused on several pivotal factors, including customer experience, perceived innovativeness, personalization, risk, and credibility, highlighting their substantial impact on channel selection decisions. When it comes to assessing channel selection intention, different studies adopt various approaches; some concentrate on understanding customer preferences, while others delve into tendencies to switch between channels, as noted by van de Zande (2016).

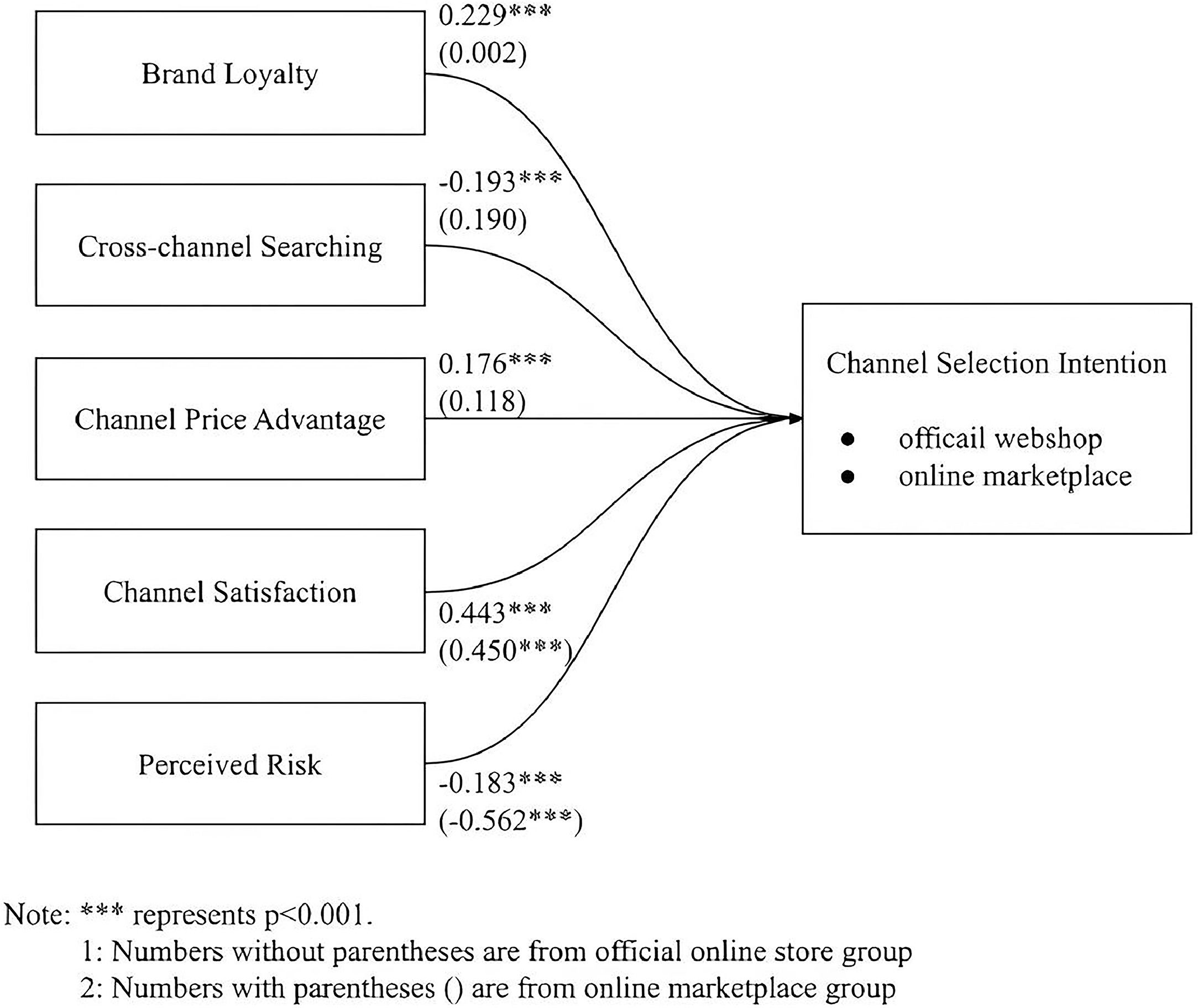

Research methodsConceptual structureThis research aims to examine factors influencing consumers' intentions to choose between online marketplaces and official brand stores while concurrently comparing the distinct impacts of these factors. The conceptual structure is presented in Fig. 1.

Hypothesis developmentBrand loyalty and channel loyalty are intricately connected. Research by Konus et al. (2008) highlights the tendency of brand-loyal consumers, particularly in complex service acquisitions, to remain steadfast in their channel preferences. This propensity stems from the time-intensive and risky nature of switching brands and channels in these scenarios. Van de Zande (2016) reaffirms this interconnection, specifically when purchasing clothing or electronics within an omnichannel setting. Antolis and Agus (2020) further highlight the critical role of brand loyalty in shaping channel selection intentions, especially among millennial mothers purchasing baby products. Considering the long-lasting and costly characteristics of electronics, customers tend to dedicate considerable time to the decision-making process and prefer to remain with well-known brands and channels. This phenomenon underscores the robust relationship between brand loyalty and channel loyalty. Therefore, this research proposes the following hypotheses:

H1. Brand loyalty exerts a positive influence on channel selection intention.

H1–1. Brand loyalty positively impacts channel selection intention for official online stores.

H1–2. Brand loyalty positively influences channel selection intention for online marketplaces.

While research conducted by Choi and Park (2006) and Konus et al. (2008) has shown that cross-channel searching plays a role in shaping channel choice behavior, Van de Zande (2016) observed no notable effect on the tendency to switch channels in omnichannel settings. Nevertheless, this research posits that customers dedicating time to research a product generally possess a heightened interest in the product, leading them to make more conscious and deliberate choices regarding the sales channels they choose. Kim et al. (2004) additionally established a positive correlation between the intention to search for products online and the subsequent intention to make purchases through online channels. In the case of durable and relatively expensive electronics, customers tend to engage more in cross-channel shopping, demonstrating a preference for thoughtful decision-making over impulsive purchases—a relationship highlighted by the negative correlation identified by Doosti et al. (2018). Moreover, an official online store can bolster customers' trust in less familiar brands found on online marketplaces following their cross-channel search activities. Therefore, this research proposes the hypothesis as follows:

H2. Cross-channel searching positively affects channel choice intention.

H2–1. Cross-channel searching positively affects channel choice intention on official online stores.

H2–2. Cross-channel searching positively affects channel choice intention on online marketplaces.

Different studies have found varied results on the impact of channel price advantage on channel selection intention. Xu and Jackson (2019) found a positive effect in an omnichannel context in their research conducted in the United States and the United Kingdom. Antolis and Agus (2020) also identified a positive influence on channel selection intention for millennial moms, spanning both online and offline channels. However, Sombultawee and Weeraphattarawanich (2021) observed that among Thai consumers aged 18 to 36, channel price advantage did not significantly influence their channel selection intention. In the online shopping landscape, where customers can effortlessly switch between platforms and utilize price comparison websites, the channel price advantage's positive impact on channel selection intention finds support in the studies conducted by Xu and Jackson (2019) and Antolis and Agus (2020). Kim and Lee (2020) additionally observed that persistent price reductions across both online and offline channels enhance purchase intentions in both cross-channel and contact-channel scenarios. This phenomenon could guide customers toward preferring channels that offer the most advantageous pricing. Consequently, this research proposes the hypothesis as follows:

H3. Channel price advantage positively influences channel choice intention.

H3–1. Channel price advantage positively affects channel choice intention on official online stores.

H3–2. Channel price advantage positively affects channel choice intention on the online marketplace.

Previous experiences with a channel significantly influence future intentions to select that channel. Devaraj et al. (2002) highlighted the crucial role of channel satisfaction in shaping channel preferences. In a study on omnichannel retailing, Van de Zande (2016) explored channel switching tendencies, uncovering that higher channel satisfaction reduces the likelihood of customers switching between online and offline channels, particularly when purchasing clothing or electronics. Nguyen and Nguyen (2022) reinforced the notion that channel experience is vital for determining channel selection intentions, specifically within the context of an omnichannel retail landscape. Given these insights, this research formulates the following hypotheses:

H4. Channel satisfaction exerts a positive influence on channel choice intention.

H4–1. Channel satisfaction significantly enhances channel choice intention towards the official online store.

H4–2. Channel satisfaction markedly boosts channel choice intention in the context of an online marketplace.

Perceived risk is a significant deterrent for online consumers in their decision-making process regarding e-commerce purchases (Kim et al., 2008). In a study that involved participants from the United Kingdom and the United States, Xu and Jackson (2019) unearthed that perceived risk adversely influences channel selection intention in an omnichannel retail setting. Similarly, Antolis and Agus (2020) found that perceived risk exerts a negative influence on the online channel selection intentions of millennial moms when they are purchasing baby products. Nguyen and Nguyen (2022) conducted a study focusing on customers buying electronic devices, and similarly pinpointed perceived risk as a detrimental factor impacting channel selection intention. Based on these insights, this research puts forth the following hypotheses:

H5. Perceived risk negatively affects channel choice intention.

H5–1. Perceived risk negatively affects channel choice intention for official online stores.

H5–2. Perceived risk negatively affects channel choice intention for online marketplaces.

This study focuses on customers in Taiwan who have purchased from official online stores or online marketplaces. Momo Shop and PChome 24 h Shopping, the most popular platforms in this category (MIC, 2022), were selected as representatives of online marketplaces. Shopee, although considered one of the top marketplaces, has been excluded from this study due to its predominant C2C (customer-to-customer) business model.

The focus of this research is on electronics—a category that dominates online shopping, with products such as mobile phones, computers, tablets, and earphones leading the sales (Liao, 2022). With Apple holding a significant portion of Taiwan's smartphone and tablet market, it stands out as a pertinent brand for this study to explore (J.-C. Huang, 2021). Apple's adoption of a multi-channel distribution approach, which includes both official online stores and prevalent online marketplaces such as Momo Shop and PChome 24 h Shopping, presents an optimal setting for this investigation.

Given constraints in time and budget, this study employs convenience sampling to garner responses from 450 participants. This sample size is targeted to attain a 95 % confidence level and a 5 % margin of error, while accounting for an anticipated response rate of 85 % (J.-Y. Huang, 2010).

Questionnaire design and pretestThe questionnaire uses a 5-point Likert scale and comprises six constructs, as outlined in Appendix A. The questionnaire is systematically divided into three sections: the first section addresses brand loyalty and cross-channel searching behaviors, the second section delves into purchasing experiences, and the final section gathers demographic information about the respondents.

This study defines brand loyalty as the positive brand performance measured through repurchasing behavior and brand sensitivity, using a six-item scale based on Odin et al. (2001) and Konus et al. (2008). Cross-channel searching is defined as the act of investigating multiple channels prior to making a purchase. This construct is measured using a scale comprised of four items, derived from Konus et al.(2008), Van de Zande (2016), and Jo et al. (2020). Meanwhile, channel price advantage assesses the customer's perception of the cost associated with making purchases from official online stores versus online marketplaces. It employs a method from Xu and Jackson (2019), comprising three items that assess marked prices, shipping costs, and overall sales prices compared to other channels. Channel satisfaction is measured by evaluating overall experiences within a channel, encompassing four subdimensions and seven items adapted from the work of Nguyen and Nguyen (2022). On the other hand, perceived risk is assessed based on uncertainties and concerns related to channel choice, utilizing a seven-item scale drawn from Tavares (2021) and Nguyen and Nguyen (2022). Channel selection intention is measured to determine the customer's willingness to make a purchase through either official online stores or marketplaces. This is done using a three-item scale derived from Xu and Jackson (2019) and Nguyen and Nguyen (2022).

A pretest was conducted with 85 participants who purchased Apple electronics from official online stores and online marketplaces. The results, as displayed in Table 1, demonstrated that all Cronbach's alpha values were above 0.7, indicating the reliability of the questionnaire.

Data collection and analysis methodIn the questionnaire, respondents were asked to indicate whether they had experience purchasing Apple electronics through official online stores or online marketplaces. They were also required to specify the types of products they had purchased. These questions served as screening criteria to filter out invalid responses and ensure the inclusion of only relevant data. Quantitative data were collected using a Google Form questionnaire and analyzed using SPSS and SPSS Amos software. Following Xu and Jackson (2019) and Nguyen and Nguyen (2022), the sample was categorized into two groups: customers of official online stores and online marketplaces (see Fig. 2). The data analysis methods encompassed descriptive statistics, reliability and validity analysis, and structural equation modeling for testing the hypotheses.

Empirical resultsThis study sought to explore the critical factors that shape consumers' intentions to choose particular channels for purchasing Apple electronics, focusing on official online stores and online marketplaces. Data was gathered through an online survey, targeting respondents with prior purchasing experiences from Apple's official online store (www.apple.com) or prominent online marketplaces such as Momo Shop and PChome 24 h Shopping. The study examined brand loyalty, cross-channel searching, channel price advantage, channel satisfaction, and perceived risk as independent variables. The dependent variable in this context was the consumers' channel selection intention, distinguishing between official online stores and online marketplaces.

Sample descriptionThe data collection process spanned from June 25 to July 2, 2022, utilizing an online survey disseminated via diverse channels such as the researchers' networks, social media platforms, and personal contacts. Although 519 responses were initially gathered, 29 were subsequently discarded due to their non-targeted nature or errors in the responses. Consequently, 490 valid questionnaires were retained for analysis. Notably, participants who had made purchases through both channel types were asked to complete the survey on two separate occasions, culminating in a total of 606 valid samples. See Table 2 for a comprehensive summary of the effective questionnaire statistics, and appendix B for the answer process of the questionnaire.

Fig. 3 illustrates the distribution of the sample, categorizing 437 respondents into the official online store group and 169 into the online marketplace group.

Reliability and validity analysisDuring the reliability and validity analysis, the study guaranteed content validity by adapting items from previous research to align with the present context. With a sample size of 606 participants, the study satisfied the prerequisites for conducting exploratory factor analysis (EFA), assuring an ample dataset for factor analysis.

A. Official online storeAs shown in Table 3, the overall Kaiser–Meyer–Olkin (KMO) value was above 0.8, and the result of Bartlett's test of sphericity was significant, with a p-value <0.05. These outcomes demonstrate that the dataset is suitable for factor analysis.

After removing specific items (BL1, CCS2, PR4, BL2, CS3, PR3, PR1, PR2), the factor loadings for all remaining items surpassed 0.5, and the total explained variance achieved 69.57 %. This surpasses the required threshold of 50 % for cumulative explained variation, demonstrating the model's adequacy. Additionally, Cronbach's Alpha values for all dimensions were above 0.7, which confirms the high reliability of the measurements, as shown in Table 4.

Official online store group: Reliability and validity analysis.

Table 5 reveals a KMO value of 0.826, surpassing the 0.8 threshold, coupled with a significant result from Bartlett's test (p-value < 0.05), demonstrating favorable conditions for factor analysis.

After removing certain items (CCS2, CS6, BL2, BL1, PR4, CS5, and CS7), all remaining items demonstrated factor loadings greater than 0.5. Consequently, these factors explained 68.843 % of the total variance. The dimensions presented in the study showed satisfactory internal consistency, with Cronbach's Alpha values exceeding 0.7. It is worth noting that the channel price advantage dimension, with a Cronbach's Alpha of 0.616, falls slightly below the conventional threshold but remains within an acceptable range, as detailed in Table 6.

Online marketplace group: Reliability and validity analysis.

The path model underwent validation through SPSS Amos 26, utilizing a sample group of 437 participants. Initially, some of the model fit indices did not meet the suggested criteria. To address this, modifications were made to the model based on the modification indices. Specifically, covariance was established between two measurement errors belonging to the same construct. This adjustment aimed to improve the model's fit to the data and enhance its explanatory power. Subsequent evaluations showed that a majority of the model fit indices eventually met the established standards, indicating a significant improvement in model fit. Further details of the values of model fit indices before and after the modifications. are provided in Table 7.

Official online store group: Evaluation of goodness of model fit.

Table 8 presents the estimated results of the structural equation model. All dimensions exhibited T values (4.762, −4.090, 3.740, 7.949, −3.960) exceeding the critical value of 1.96, confirming their statistical significance. The model accounted for 35 % of the variance in the dependent variable, as indicated by the R squared value of 0.350, suggesting the model's predictive relevance. Among the five dimensions evaluated, channel satisfaction (0.443) emerged as the most substantial predictor of channel selection intention, followed by brand loyalty (0.229). In contrast, channel price advantage demonstrated the weakest association with channel selection intention (0.176). The structural equation model's path diagram is depicted in Fig. 4.

Official online store group: Estimation results of structural equation model.

Note: *** represents p < 0.001.

1: variance of structure estimated of channel selection intention.

2: R2 of channel selection intention.

Table 9 summarizes the hypothesis testing for the official online store group. In line with our expectations, brand loyalty, channel price advantage, and channel satisfaction exhibited a positive influence on channel selection intention, whereas perceived risk demonstrated a negative effect. Contrary to initial assumptions, cross-channel searching did not significantly impact channel selection intention; the data indicated a notable negative influence.

- B.

Online Marketplace

This sample group includes 169 participants. Initially, only a few model fit indices reached the recommended values. Following adjustments informed by the modification indices, roughly half of the model fit indices achieved the standard. This result suggests a less optimal fit in comparison to the online marketplace group, as detailed in Table 10.

Online marketplace group: Evaluation of goodness of model fit.

Table 11 presents the estimation outcomes of the structural equation model. The T values for the dimensions were 0.036, 2.575, 1.778, 4.928, and −5.107. Brand loyalty and channel price advantage did not reach statistical significance, as their T values were below the critical value of 1.96. The R squared value was 0.568, surpassing 0.4, showcasing the model's predictive relevance. In all five dimensions, perceived risk (−0.562) exhibited the strongest relationship with channel selection intention, with channel satisfaction (0.450) following closely. The study found no significant relationship between brand loyalty, cross-channel searching, channel price advantage, and channel selection intention. The results are represented in the structural equation model's path diagram (see Fig. 5).

Online marketplace group: Estimation results of structural equation model.

Note: *** represents p < 0.001.

1: variance of structure estimated of channel selection intention.

2: R2 of channel selection intention.

Table 12 summarizes the hypothesis testing for the online marketplace group. As initially hypothesized, channel satisfaction exhibits a positive influence on channel selection intention, while perceived risk has a negative impact. Contrary to expectations, brand loyalty, cross-channel searching, and channel price advantage do not demonstrate a significant positive effect on channel selection intention.

Fig. 6 shows the path relationships among the variables. According to the structural equation model, channel satisfaction exhibits a robust relationship with channel selection intention in both the official online store and the online marketplace contexts. Perceived risk demonstrates a stronger relationship with channel selection intention in the online marketplace but exhibits a weaker association in the official online store setting. Brand loyalty holds the second-strongest relationship with channel selection intention in the official online store, followed by cross-channel searching and perceived risk. The weakest relationship in the official online store exists between channel price advantage and channel selection intention. It is important to highlight that within online marketplaces, there is no discernible relationship between brand loyalty and channel selection intention. Similarly, cross-channel searching, and channel price advantage do not exhibit any significant influence on channel selection intention.

Table 13 provides a comprehensive summary of the hypothesis testing, clearly illustrating the relationships between variables within the two distinct groups.

Result of hypothesis testing.

First, the positive impact of brand loyalty on channel selection intention holds substantial significance. This aligns with the findings of Konus et al. (2008) and Van de Zande (2016), who observed that customers exhibiting stronger loyalty to a brand tend to show less inclination towards switching channels. This implies a close and intricate connection between brand loyalty and channel loyalty.

Second, the hypothesis asserting that cross-channel searching positively influences channel selection intention was not supported. Instead, it was found that cross-channel searching has a significant negative impact on channel choice intention. These findings are at odds with the results of Van de Zande (2016), who noted no significant effect of cross-channel searching in influencing customer channel migration across both online and offline channels. This discrepancy could be attributed to the greater flexibility that customers experience when switching between multiple online channels, a situation distinct from omnichannel conditions. Online shopping provides significantly more facilitation of product searches compared to offline shopping, as highlighted by Yang and Wu (2021). Customers exhibiting greater channel elasticity and habitual engagement in cross-channel searching, referred to as multi-channel shoppers, are more prone to switching between channels.

Third, the significant positive effect of channel price advantage on channel selection intention is noteworthy. The findings align with the model's proposition, highlighting customers' sensitivity to price. Channels that offer a price advantage tend to bolster the intention to choose them, corroborating the research conducted by Xu and Jackson (2019) and Nguyen and Nguyen (2022).

Fourth, the positive influence of channel satisfaction on channel selection intention is significantly validated. Confirming our initial assumptions, the relationship between these two variables is notably strong. Ensuring customers have a positive experience with a channel significantly bolsters their intention to choose that channel again. This finding is in line with research conducted by Van de Zande (2016) and Nguyen and Nguyen(2022) in the context of omnichannel retailing.

Finally, the significant negative impact of perceived risk on channel selection intention is confirmed. As we initially hypothesized, a clear and inverse relationship exists between these two variables. Mitigating customer uncertainty regarding a channel enhances their intention to select it. This aligns with findings from Xu and Jackson (2019) and Nguyen and Nguyen(2022), further emphasizing the relevancy of these dynamics in an omnichannel environment.

- B.

Online Marketplace

First, the expected positive impact of brand loyalty on channel selection intention was not universally supported. While the official online store group supported a significant positive correlation, the impact was insignificant for the online marketplace group. This diverges from the findings of Konus et al. (2008) and Van de Zande (2016), challenging the assumed straightforward relationship between brand loyalty and channel selection. One possible explanation for this discrepancy could be that online marketplaces often surpass numerous retailers regarding brand awareness and customer loyalty (Maier & Wieringa, 2021). This suggests that the customers in this context might be more devoted to the channel rather than to specific brands—a unique dynamic in their purchasing behavior.

Second, the hypothesis that cross-channel searching positively influences channel selection intention has yet to be confirmed. While there were significant results for the official online store group, the scenario with online marketplaces paralleled Van de Zande's (2016) findings, indicating no substantial impact from cross-channel searching on channel choice. This outcome appears reasonable, given the nature of electronics. As products with longevity and durability, electronics are not typically repurchased by the same customer repeatedly in short timeframes. Customers often spend extended periods browsing and comparing alternatives before finalizing their purchase decision, especially regarding electronics. It is noteworthy that respondents who prefer online marketplaces exhibited a strong tendency towards cross-channel searching, with a high average characteristic score of 4.55. This implies that when purchasing electronics, customers are inclined to seek comprehensive information on product details, brand reputation, pricing, and promotions across various channels. As a result, cross-channel searching does not serve as a predictor of their channel selection intention.

Third, the hypothesis that channel price advantage positively influences channel selection intention is not supported in the context of the online marketplace group, but did show significance for the official online store group. This discrepancy may stem from the unique characteristics of electronics, which are trendy, feature advanced technology, and undergo rapid updates and iterations. Consumers have elevated purchasing expectations regarding electronics compared to more generic products, resulting in a reduced sensitivity to price for electronic items (Zhang et al., 2014). This diminished price sensitivity for electronics could explain the need for a significant relationship between channel price advantage and channel selection intention in the context of the online marketplace.

Fourth, the relationship between channel satisfaction and channel selection intention in the online marketplace group is significant, aligning with initial assumptions. Ensuring positive channel experiences for customers enhances their propensity to choose that channel. This result is consistent with findings from previous research, including Van de Zande (2016) and Nguyen and Nguyen (2022).

Lastly, the significant negative impact of perceived risk on channel selection intention within the online marketplace group aligns with our initial hypothesis. Mitigating customers' uncertainties about the channel enhances their intention to choose it. This outcome corroborates the findings from studies by Xu and Jackson (2019) and Nguyen and Nguyen (2022).

Conclusions and implicationsConclusionsThis study addressed the posed research questions as follows: Regarding the first question, the collected data offers compelling empirical evidence, highlighting channel satisfaction and perceived risk as the principal factors influencing channel selection intention across official online stores and online marketplaces. In response to the second question, the findings indicate some disparities in the influence factors of channel selection intention between the two channels. While brand loyalty, cross-channel searching, and channel price advantage significantly affect the selection intention regarding official online stores, their impact is insignificant on online marketplace selection intention. Intriguingly, the negative impact of cross-channel searching on channel selection intention stands out because it contradicts the initial hypothesis, shedding light on unique consumer behavior patterns in the digital shopping landscape.

In conclusion, this study addresses the two posed research questions. Firstly, the analysis of the collected data provides compelling empirical evidence, emphasizing the significant influence of channel satisfaction and perceived risk on channel selection intention across both official online stores and online marketplaces. Secondly, the findings reveal disparities in the factors influencing channel selection intention between the two channels. While brand loyalty, cross-channel searching, and channel price advantage significantly impact selection intention for official online stores, their influence is negligible for online marketplace selection intention. Furthermore, the unexpected negative impact of cross-channel searching on channel selection intention highlights unique consumer behavior patterns in the digital shopping landscape. These findings contribute to a deeper understanding of consumer behavior in online channel selection and offer valuable insights for the development of targeted marketing strategies.

Theoretical implicationsThe findings of this study enhance our comprehension of the factors influencing online channel selection intentions. The existing body of literature offers limited comparisons between official and third-party channels; hence, this study is crucial in pinpointing the key elements that drive customer channel selection intentions. In doing so, it paves the way for researchers to delve deeper into strategies tailored specifically for online sales channels, encompassing official online stores and online marketplaces. This research corroborates earlier studies (Nguyen & Nguyen, 2022; van de Zande, 2016; Xu & Jackson, 2019), underscoring the importance of channel price advantage, channel satisfaction, and perceived risk within omnichannel contexts, especially in multi-channel and cross-channel scenarios. Additionally, it highlights the critical role of customer traits, including brand loyalty and cross-channel searching behaviors, underscoring their potential implications for refining brand loyalty initiatives. Moving forward, it would benefit future studies to delve into the cross-channel influences exerted by alternative channels.

Managerial implicationsBeyond its scholarly value, this study presents actionable insights for multi-channel retailers such as Apple, guiding them in enhancing customer channel selection intentions. Marketing professionals are encouraged to use these research outcomes when concentrating their efforts on cultivating brand loyalty initiatives that transition from mere attitudinal loyalty to tangible behavioral loyalty. Although channel price advantage positively influences channel selection intention, it is crucial to recognize that it is not the only factor at play. Enhancing channel satisfaction and minimizing perceived risk are equally important strategies to bolster channel selection intention. Retailers should focus on improving various aspects such as channel convenience, transparency, uniformity, and overall customer experience. Additionally, they should take steps to mitigate performance risks associated with online shopping. It is important to note that despite the negative impact of cross-channel searching on channel selection intention, allowing customers the flexibility to switch between different channels can ultimately contribute to increased satisfaction and loyalty (Nguyen & Nguyen, 2022).

Limitations and future researchThis study had certain limitations, which open avenues for future research. Primarily, this research concentrated on consumers with prior shopping experience on official online stores and online marketplaces. There is an opportunity for future studies to extend this research by investigating individuals who are in the planning stages of making a purchase. Such research would enable a broader understanding of the intentions and considerations of prospective customers. Second, the scope of this study was limited to Apple electronics, which served as a representative sample of the electronics category. To provide a more comprehensive understanding, future research endeavors should delve into other brands or product categories, such as clothing and cosmetics. These categories may present unique brand loyalty patterns and cross-channel searching behaviors, contributing to a richer analysis of channel selection intention across diverse market segments. Additionally, extending research beyond the regional context of Taiwan could provide insights into how different geographical markets influence consumer behavior and channel preferences. Third, this study's context was confined to e-commerce platforms, particularly official online stores and online marketplaces. Future investigations should broaden the scope to include other sales channels such as social media and physical stores, offering a more comprehensive view of consumer channel preferences. Fourth, this study delved into cross-channel searching but analyzed channel selection intentions for official online stores and online marketplaces separately. Future research could investigate the integrated impact of both channels and examine the influence of alternative channels on consumer behavior. Fifth, while this study highlighted discrepancies in determinants of channel selection intention between official online stores and online marketplaces, it did not extensively explore the reasons behind these differences. Future studies should probe into customer characteristics and customer perceptions of these channels to gain deeper insights. Additionally, to further validate the findings and reduce response bias, future research endeavors might incorporate the collection of behavioral data or the conduction of qualitative interviews.

CRediT authorship contribution statementYu-Bing Wang: Writing – review & editing, Supervision, Resources, Project administration, Investigation, Funding acquisition, Conceptualization. Pin Yin Chen: Writing – original draft, Software, Methodology, Formal analysis, Data curation, Conceptualization.

Appendix A. Measurement Scales

| Dimensions | Items | Statement | Source |

|---|---|---|---|

| Brand Loyalty | BL1 | The brand of electronics is important for me in my purchase decisions. | Odin et al. (2001) and Konus et al. (2008) |

| BL2 | If the Apple electronics I usually buy are not available in one shop, I go to another shop. | ||

| BL3 | Even if the price of Apple electronics I am used to buying strongly increases, I'll still buy it. | ||

| BL4 | I always buy Apple electronics. | ||

| BL5 | During my next purchase, I will buy Apple electronics as the last time. | ||

| Cross-channel Searching | CCS1 | I collect information about Apple electronics from one channel to another before making a purchasing decision. | Konus et al. (2008), Van de Zande (2016) and Jo et al. (2020) |

| CCS2 | In shopping of Apple electronics, a product's origin is important to you when making a purchasing decision | ||

| CCS3 | I compare the prices of Apple electronics on one channel to another before making a purchasing decision. | ||

| CCS4 | It is important for me to have the best price for Apple electronics. | ||

| Channel Price Advantage | CPA1 | When selecting this channel to purchase Apple products, shipping cost was a major consideration. | Xu and Jackson (2019) |

| CPA2 | The marked price of the product was the cheapest when utilizing this channel. | ||

| CPA3 | The total price (product + shipping) was the cheapest when utilizing this channel. | ||

| Channel Satisfaction | CS1 | It is easy to search for Apple electronics using this channel. | NGUYEN and NGUYEN (2022) |

| CS2 | It is easy to learn about Apple electronics using this channel. | ||

| CS3 | I received shopping recommendations related to personal preferences. | ||

| CS4 | I save time and energy using this channel. | ||

| CS5 | The delivery information is readily available. | ||

| CS6 | I can contact the seller directly regarding any transaction issue in this channel. | ||

| CS7 | I am satisfied with the shopping experience at this channel | ||

| Received Risk | PR1 | I am uncertain about the security of privacy using this channel. (Information about the object or service to be purchased, passwords and registration data, etc.) | Tavares (2021) and NGUYEN and NGUYEN (2022) |

| PR2 | I am uncertain about the security of the payment method using this channel. | ||

| PR3 | I am concerned that the transaction cannot be reversed easily and without additional costs for the consumer. | ||

| PR4 | I am concerned that the product will not be delivered by the date I need the product when using this channel. | ||

| PR5 | I am worried that the quality in this channel is not reliable. | ||

| PR6 | I am worried that sellers in this channel is not credible | ||

| PR7 | I am concerned that the after-sales service is not guaranteed. | ||

| Channel Selection Intention | CS1 | I would purchase Apple products using this channel in the future. | Xu and Jackson (2019) and NGUYEN and NGUYEN (2022) |

| CS2 | I would list this channel in the future as one of my top options to purchase Apple products. | ||

| CS3 | I would purchase Apple products using this channel in almost every situation | ||

| CS4 | I would recommend that people choose this channel to purchase Apple products in the future. |

Appendix B. Flow Chart of Questionnaire

Yu-Bing Wang (ybwang@mail.fcu.edu.tw) is an associate professor at the department of Marketing, Feng Chia University. Her research interests are in the areas of E-business, internet marketing, and service marketing. Dr. Wang's recent publications include Sustainability, International Journal of Research in Commerce, Journal of Management, Marketing and Logistics, Human-centric Computing, and Information Sciences, among others.