Edited by: Brij B. Gupta, Kwok Tai Chui

Last update: July 2022

More infoWithin the context that global scientific and technological innovation continues to break through discipline constraints and achieve cross-domain group breakthrough development, large enterprises are constantly seeking new ways of opening and enabling. Corporate venture capital (CVC) has become an important way for large enterprises to seize knowledge, achieve symbiotic innovation, and explore external resources. By employing the bionics research method and focusing on the symbiosis mechanism between large enterprises and start-ups, this paper conducts an in-depth analysis on the symbiosis motivation, the composition of the symbiosis system, and the symbiosis environment, and explores the evolutionary simulation after the increase or decrease of resource capacity, the intrusion of the innovation population, or the equipotential integration into the innovation ecosystem when the external environmental factors change to verify the coordinated development within the enterprise population and between the enterprise population and the environment. The results show that: (1) The symbiosis, self-consistency, evolution, spillover, and other effects within the CVC ecological community fully realize the “positive sum game” process of both sides; (2) The large enterprise population and entrepreneurial enterprise population in the CVC ecological community form a two-dimensional symbiotic system; and (3) When the resource capacity of the innovation ecosystem changes, the innovation population invades the system with a strong jump in the queue, and the innovation population participates in the system with a weak allelic fusion. This paper points out the influence, interaction, and evolution development laws between enterprise species, enterprise groups, and the innovation system environment and enriches and expands the theory of the relationship between venture capital and enterprise innovation.

Large enterprises and innovative and entrepreneurial enterprises are either in the same industry or in different industries. The relationship between them is not simply “capital supply” and “capital demand.” In the process of innovation and development, the large enterprise population and the entrepreneurial enterprise population are not zero-sum games. The two sides are in the same space-time range and take corporate venture capital (CVC) as the symbiotic interface to create value in the dynamic game according to the wishes, capabilities, and opportunities of both sides. Large enterprises and start-ups in the CVC ecological community continue to innovate in the process of learning and growth and interact with other symbiotic subjects in the innovation ecosystem to form the CVC ecological field (Rossi et al., 2022). It is a strong centripetal force that can help gather more innovation symbiosis units, gather innovation resources to form an ecological field with competitive advantages, continuously improve the density of the symbiosis system, and enable the rapid and efficient circulation of innovation materials, innovation energy, and innovation information. The evolution of niches in the CVC ecological community reflects the characteristics of repeated games between large enterprises and start-ups. CVC activities are also innovative activities. Core groups seek technological innovation, realize value cultivation and value innovation, constantly form new competitive advantages in industry competition, improve their niche, and then achieve their strategic and financial goals (Veer et al., 2022).

The development of CVC is a process of knowledge acquisition and innovation resource gathering. Large enterprises and start-ups form a competitive relationship based on the complementary matching of innovation resources and capital support. The innovation resources owned by both parties may have obvious progressiveness, structure, and stickiness. In the ecosystem, there is not only pure cooperation or competition among market players; competition and cooperation alternate or coexist at the same time. The CVC ecological community in the innovation ecosystem generates its innovation achievements based on the accumulation of innovation resources and achievements of the original large enterprises and start-ups. In the new CVC cooperation, the two sides play to their advantages in specific knowledge fields and form a symbiotic relationship. The company can obtain more opportunities through direct investment so that the investment portfolio can meet the special needs of large enterprises (Rossi et al., 2022; Ma et al., 2021; Wu & Chen, 2021). Venture capital fund limited partnership, direct investment, and venture capital subsidiary of the company are the main methods to acquire CVC (Li et al., 2023). Venture capital subsidiaries can maximize strategic income. When financial return is the only goal, venture capital funds are the best choice (Drover et al., 2017; Zheng et al., 2021a; Zheng et al., 2021b; Han et al., 2022; Jin et al., 2022).

In the relevant research on CVC, early scholars focused on the classifying investment models and chose organizational models according to the different strategic motives and objectives of large enterprises and the requirements for the control rights of start-ups. In recent years, scholars used empirical methods to explore the effects of different organizational models of venture capital, such as equity participation, holding and independent venture capital, entrepreneurial enterprises in combination with industry characteristics, heterogeneity of large enterprises, and different market institutional environments. However, there are few studies on CVC value symbiosis and niche evolution regarding both large enterprises and start-ups. Therefore, based on bionics theory and methods, it is of great significance to explore the symbiosis mechanism analysis, dynamic mechanism, and simulation evolution of the CVC ecological community.

The paper analyzes the literature using the following methods. First, the formation motivation of the CVC ecological community is analyzed from the perspective of large enterprises and start-ups. Second, the symbiotic system of the CVC ecological community is constructed from the three basic elements of the symbiotic unit, symbiotic mode, and symbiotic environment, and its environment and symbiotic mechanism are analyzed. Third, to verify the impact of the symbiotic environment and summarize the symbiotic mechanism, the CVC ecological community niche under the change in the symbiotic environment is simulated and analyzed from the perspective of resource capacity change, innovation population queue jumping competition invasion, and innovation population equipotential competition integration to exert changes on the symbiotic ring.

The conclusions of this study make up for the shortcomings of previous studies and offer some contributions. First, this paper uses bionics to study the value symbiosis mechanism between large enterprises and start-ups in CVC, which is an area in which scholars have called for further research. Second, the research results provide a theoretical basis for studying how large enterprises and start-ups achieve a collaborative and symbiotic dynamic alliance and form a new value creation process in the innovation ecosystem based on their own core capabilities and heterogeneous resources.

The rest of this paper is organized as follows. Section 2 presents the literature review. Section 3 analyzes the symbiosis mechanism of the CVC ecological community. Section 4 presents the analysis results of the CVC ecological community niche simulator under changes in the symbiotic environment. Finally, Section 5 summarizes the conclusions.

Literature ReviewMoore proposed that in addition to competition and cooperation, enterprises also need to constantly meet customer needs in innovation. Enterprises have evolved from a single industrial member role to a part of the industrial ecosystem. Taking Apple, IBM, Ford, and Walmart as examples, Moore studied how core enterprises build service, technology, and value network platforms to form a business ecosystem with their own characteristics and then obtain value returns (Moore, 1999). Hannan and Freeman first applied niche theory to the field of enterprise strategic competition and proposed that the enterprise niche is a collection of selection ranges of resources and environmental variables around the enterprise, which typically include economic, technical, social, institutional, and other multidimensional resource spaces (Hannan and Freeman, 1977). Rukhamate used the theory of natural ecosystem evolution to study the innovation path of high-tech enterprises and found that the dependence of the enterprise innovation path has ecological characteristics of inheritance and variation (Rukhamate, 2018; Huang et al., 2021; Si et al., 2021; Bian and Yan, 2022). At present, niche theory has been widely used in industrial economy, space economy, development economy, and other fields, forming a powerful theoretical analysis and practical tool. Evolutionary game theory, which originated in the field of biology, combines evolutionary analysis with dynamic evolutionary processes (Smith and Price, 1973). Dosi and Nelson explain economic changes from the perspective of dynamic evolution. Hannan and Freeman proposed that enterprise adaptation and environmental selection are the main paths of population evolution (Dosi and Nelson, 1994). Teirlinck and Spithoven believe that the internal and external resources of enterprises are equally important, and the use of external resources and external channels by enterprises is conducive to the commercialization of their new technological achievements. Enterprises should quickly implement innovation, reduce innovation costs, and cooperate with professional venture capital institutions to improve innovation performance (Teirlinck and Spithoven, 2008; Hu et al., 2021).

Existing studies have applied niche theory to regional economic ecosystems, industrial clusters, enterprise niche evaluation, high-tech service innovation networks and other fields, mainly focusing on niche evaluation, niche width, niche overlap, niche suitability measurement, niche situation analysis, niche coevolution, and other issues.

There is a strong symbiotic relationship between large enterprises and start-ups. Exploring their interactive symbiotic model and studying their evolution and development have important practical significance and enrich the existing innovation ecosystem theory. Both large enterprises and start-ups have cyclical characteristics. They are linked by CVC projects, which complement and support each other.

Analysis of the symbiosis mechanism of the ecological community of CVCLarge enterprises and start-ups linked by CVC complement each other based on their own strategies, technologies, knowledge, and resources (Stylianou et al., 2022). Due to the high failure tolerance of venture capital, the company has more opportunities to carry out disruptive technological innovation in the field of common noncompetitive interests (Chemmanur et al., 2014). Large enterprises and start-ups have formed a symbiotic relationship based on the process of value proposition, value creation, and value realization. CVC forms an innovation alliance, which effectively improves the acquisition rate of innovation resources, closely couples all links of innovation, improves the survival rate of technological innovation, and greatly improves the possibility of accidental technological innovation becoming inevitable. In the innovation and entrepreneurship ecosystem, the CVC ecological community refers to the seed round, angel round, pre-A, A, B, C, D, E or prelisting investment of a large enterprise population and entrepreneurial enterprise population according to their own strategic and financial goals in a specific time and space. The large enterprise population and entrepreneurial enterprise population are in the material, information based on energy exchange, circulation, and transformation, it is a complex interactive innovation system to realize value cocreation and competition cooperation symbiosis. The exchange of talents, funds, technologies, resources, knowledge, information, policies, and more is manifested, maintaining a dynamic and balanced relationship of continuous evolution. By coupling, competition, symbiosis, and so on, it realizes coordinated evolution and symbiotic development through the formation, growth, maturity, and renewal periods. According to the author's previous research (Meng et al., 2020) and Echols and Tsai's research (Echols and Tsai, 2005), the paper analyzed the similarities between the CVC ecological community and natural biological community in constituent elements, structure, function, and characteristics, as shown in Table 1.

Similarity analysis of the CVC ecological community and biological community

| Similarity | Biome | CVC Ecological Community | |

|---|---|---|---|

| Constituent elements | Biological diversity | With mature large enterprises, start-ups, CVC projects, or activities as the main body, including various intermediary organizations | |

| Structural Similarity | Relationship between elements | The interaction between more than two elements and between elements and environment is large | Listed and unlisted large enterprises, start-ups, etc., interaction between organization and environment |

| Entirety | With biology as the main body, each component interacts with each other to form a whole | Take mature large enterprises and start-ups as the main body, and form a whole with the participants in the CVC ecological chain | |

| Orderly hierarchy | Community, population, individual | CVC community, large enterprises and entrepreneurial enterprise group, single innovative enterprise | |

| Open thermodynamic system | Input, processing, output | Input of talents, technology, information, management, and other resources; Technology and innovation mode; Output of new technologies, new models, and new products | |

| Feedback characteristics | Positive and negative feedback | Positive and negative feedback | |

| Value structure | food chain | Technology value chain, value chain | |

| Function | Energy flow, material flow, biological production | Capital flow, technical information dissemination, talent flow, research and development (R&D), and production interaction | |

| Features | Environmental effect | Natural selection and adaptability | Survival of the fittest and adaptation to the environment |

| self-adaptation | Certain adaptive ability | The self-organization and self-adaptive ability are continuously improved | |

| Dynamic characteristics | Occurrence, formation, development, and evolution | Formation, development, and evolution | |

| Competitiveness | Intraspecific competition and interspecific competition | Competition among communities and populations | |

Source: collated by the author.

In the innovation and entrepreneurship ecosystem, which is mainly composed of various large enterprises, start-ups, universities, scientific research institutes, intermediaries and users, species enterprises, and population industries form various ecological communities in a variety of operation modes. The CVC ecological community formed by the large enterprise population and entrepreneurial enterprise population studied in this paper forms a complex system of competition, cooperation, and symbiosis in the main body interaction. This system ensures the orderly operation of the ecological community and the coevolution of species through the value cocreation mechanism, which improves the innovation efficiency of the whole ecological community.

Analysis of motivation from the perspective of large enterprisesStrategic and financial objectivesPrevious research shows that CVC motivation includes strategic objectives and financial objectives. Strategic objectives are an important reason for large enterprises to carry out CVC. In CVC activities, for large enterprises, obtaining the latest technology is the ultimate goal. Large enterprises have gradually realized that breakthrough innovation cannot be effectively achieved solely by internal R&D, and thus enterprises need external learning. CVC leverages the internal innovation of large enterprises by stimulating the innovation ability of innovative and entrepreneurial enterprises, and CVC activities meet the innovation needs of large enterprises (Erns et al., 2005). The emerging consensus is that large enterprises must enhance their competitiveness in the industrial chain through core technological innovation. In addition to internal R&D, technology purchases, technology alliances, and technology mergers and acquisitions (M&A), CVC has become an important choice for large enterprises. First, technological innovation brings innovation value. Scholars use the Tobin's Q value to measure whether CVC can significantly enhance the value of large enterprises. Second, CVC carried out by large enterprises is beneficial to the improvement of their core business capabilities and the transformation and innovation of business models (Van Dyck, 2012). The strategic motivation of corporate venture capital leads enterprises to enter new fields, explore, and establish themselves at the core of an innovation ecosystem. Third, large enterprises obtain acquisition opportunities through CVC to improve production processes. Therefore, through CVC, mature large enterprises can explore new market boundaries, innovate business models, and seek opportunities for secondary transition and upgrading, maintain the leading position of existing business, and continue to carry out technological innovation to make up for technological weaknesses.

Technological innovation breakthrough and search for new blue ocean core objectivesIn essence, CVC has broken the boundary between mature large enterprises and start-ups. CVC pursues technological innovation by finding a new blue ocean or a new industry growth point while achieving financial goals. Large enterprises use CVC to realize value cultivation and value innovation by monitoring and analyzing their own competitive enterprises and industry value curves. In the early stage of CVC investment, large enterprises nurture and support start-ups as “parents” and establish strategic partnerships to replace competition with cooperation to meet more intense challenges in the future. Through this support, start-ups provide value by creating demand and the market for innovation (Ma, 2020; Li et al., 2023a; Gupta et al., 2023). Large enterprises with strong technical relevance and industrial barriers, with the help of their strong capital strength, cooperate with their core businesses to carry out CVC vertically. While empowering start-ups, large enterprises still promote rapid R&D of core technologies, stay on the cutting-edge of technology, and ultimately form an industrial ecosystem with themselves at the core.

Effective ways to realize external open innovationCVC is one of the main ways to start a business outside the company. First, large enterprises can cover a variety of valuable potential technology fields through a small amount of CVC, make venture capital investments in alternative technologies that may become their core technologies, open the window of cutting-edge science and technology, quickly upgrade existing technologies, and enhance large enterprise products or services, and finally enter the potential emerging high growth fields (Sahaym et al., 2010). Second, large enterprises will invest in the upstream and downstream technologies of their core businesses. This is conducive not only to integrating relevant technologies but also to realizing new technological breakthroughs, thus driving the improvement of the value of enterprise products or services and the stability of production. It is also beneficial for enterprises to expand new markets, deepen the utilization efficiency and application scope of the existing core resources of large enterprises, carry out technological collaborative innovation with start-ups, and improve the core competitiveness of large enterprises. Third, large enterprises invest in new or less relevant technology fields from a strategic perspective, opening the door for large enterprises to reposition new fields of core business. After investment and cultivation, they enter new fields through mergers and acquisitions to achieve transformation. In highly uncertain markets, mature large enterprises prefer CVC as their strategic means of growth (Vanhaverbeke et al., 2008; Tong& Li, 2011; Guo et al., 2022; Xu et al., 2021; Hou, 2021; Cheng et al., 2023; Guo et al., 2023).

Analysis of motivation from the perspective of entrepreneurial enterprisesCVC offers enterprises or industries an opportunity for real growth and is most suitable for helping long-term and bottom-level source innovation, addressing the financing problems of small and medium-sized science and technology enterprises, promoting overall innovation in start-ups, and contributing to innovation performance (Alvarez-Garrido& Dushnitsky, 2016). Innovation, initiative, and risk bearing are the characteristics of start-ups (Mille, 1983), and start-ups often face the risk of early failure and generate new liabilities. CVC is the key support for their innovation activities, which impact the innovation performance of start-ups. From the perspective of signal theory, CVC also has an endorsement effect on start-ups (Di Lorenzo& van de Vrande, 2019), which helps to improve their market recognition and ability to obtain other types of future investment. The reputation, brand effect, and business status of the start-up enterprises that accept CVC in the market will also be improved.

First, the term of CVC funds is longer. Since large enterprises directly provide funds for CVC, investment is not restricted by the contract between limited partners and general partners. Start-ups can obtain financial support from large enterprises through multiple rounds and stages. The core strategic goal for large enterprises to carry out CVC activities is technological innovation. The high failure tolerance of CVC is the best incentive for start-ups to focus on innovation. A CVC's long fund cycle can ensure that start-ups have enough time to carry out long-term innovative R&D. The compensation of the investment team is not sensitive to the performance and innovation achievements of the start-up companies. The financial return of venture capital is not the first goal. Therefore, newly established start-ups with high risks but involving cutting-edge high-end technology or in highly competitive industries will have more opportunities to obtain CVC financing and sustainability.

Second, the operation of CVC will provide more value-added services to invested start-ups. CVC can promote the development of start-ups that need special complementary assets (Park& Steensma, 2012). Entrepreneurial enterprises often lack the necessary resources and expertise to commercialize their innovative achievements. Cooperation with existing large enterprises provides a way for new enterprises to obtain complementary resources, increase their chance of survival, and improve the probability of market success. CVC is usually the first relationship between start-ups and existing enterprises in the industry. Before the investment funds of large enterprises are made available, due diligence activities related to business plans, technical resources, innovative products, and market prospects also provide start-ups with a unique opportunity to learn about large enterprises. Large enterprises have certain advantages in the professional knowledge, technical mode, and development characteristics of related fields. Their original social networks and proprietary assets, such as excellent and efficient investment teams, have rich experience in specific industries and have a deeper understanding of related technologies than ordinary investors. With its rich professional management and operation experience, it guides start-ups to carry out innovation activities. The business system integrating “R&D, production, sales, service” and other core links is a resource that entrepreneurial enterprises can borrow. CVC has advantages in industry integration and operation management. The relationship capital and investment capital held by large enterprises are also very attractive sources of innovation to start-ups. Start-ups can take advantage of manufacturing plants, distribution channels, core technologies, brand effects, and other resources of large enterprises through CVC (Kim et al., 2019).

Third, when the strategies of large enterprises and start-ups align, large enterprises can not only provide financial support for start-ups but also provide technical support and industry experience based on their own advantages and invest in higher risk and more promising projects, which further improves the innovation ability of start-ups (Chen& Liang, 2016; Liu et al., 2022; Yang et al., 2020; Li et al., 2023b). Through CVC investment, start-ups can also open innovation windows and learn from the experience and resources of large enterprises. Under low investment complexity, start-ups will jointly develop a new knowledge base with large enterprises to supplement their limited capabilities with their technical expertise and knowledge to obtain innovation performance. The source of innovation not only exists within start-up companies but also usually exists in the cooperation between start-ups and large enterprises (Powell et al., 1996). The professional experience and skills generated by the unique social interaction of new start-ups are more likely to bring innovation advantages. Startups seek more alliance experience and investment intensity to provide the required innovation (Ahuja, 2000).

Value cocreation of the CVC ecological community under synergistic effectsCVC is based on the strategic and technical similarities between large enterprises and start-ups that result in a certain degree of technical fit which form a state of mutual matching and complementary synergy that is conducive to fostering innovation. There is complementarity between large enterprises and start-ups, and the higher the complementarity is, the greater the degree of social interaction. Social interaction further drives the knowledge transfer and acquisition of large enterprises and start-ups (Maula et al., 2009). Large enterprises increase their involvement in start-ups through capital investment and enhance their social interaction with start-ups. In start-ups, the board of directors and the board of supervisors, as well as the relevant managers and technicians, comprehensively supervise start-ups and help them solve technical problems, which then improves their technological innovation performance of start-ups (Ivanov & Xie, 2010). The complementarity of assets, knowledge, technology, and other key resources between large enterprises and start-ups provides the basis for the coordinated development of both sides. In practice, the venture capital industry has gathered CVC, independent venture capital (IVC), and government venture capital (GVC) to invest in start-ups by stages and industries, forming a collaborative relationship and interaction in the whole venture capital. CVC enables large enterprises and start-ups to form synergy and gradually evolve into an orderly organizational ecological community in the innovation ecosystem through two-way selection (Schöll, 2012; Reddy et al., 2011), thus building their own niche with greater advantages and improving the competitiveness of the whole population or community.

Relevance enhances synergy and promotes the formation of strategic alliancesLarge enterprises and start-ups carry out CVC activities based on vertical correlation and business expansion in the industrial chain. The two sides form a strategic alliance, provide financial support to each other, and exchange resources to improve the possibility of learning (Lin & Lee, 2011). There is a certain industry correlation between large enterprises in CVC and start-ups, which makes both parties effectively improve the relevance of professional technology, the optimal allocation of production resources, and the coordination of industry market position in the process of CVC activities. Through time in the industry and market, large enterprises have accumulated advanced management experience and gathered high-level professional managers and technicians with strategic vision. Large enterprises can help start-ups with their own advantages in marketing, production, technology, and risk control, bring them into the enterprise strategic development track, and become strategic alliance partners. Start-ups need not only highly relevant objective conditions but also subjective willingness to share resources to achieve value creation. High relevance can promote the formation of economies of scale or economies of scope between the businesses of large enterprises and start-ups in the long run. A knowledge correlation effect can be generated based on common resources, a technology base, and senior managers holding important positions in large enterprises and start-ups. At the same time, horizontal association can increase the scale effect, vertical association can save transaction costs, and management relevance as a communication bridge can help play a synergistic role. CVC investment meets the R&D needs of start-ups to a certain extent, increases innovation opportunities, and enhances the cross synergy between R&D and innovation. When large enterprises repeatedly participate in CVC activities, their alliance experience and investment will adjust and improve the future actions of start-ups and affect the development of innovation (Jiménez et al., 2018).

Evolution and stability promote sustainable innovation on both sidesEvolutionary game theory proposes an evolutionary stability strategy, which suggests the combination of natural selection and mutation will stabilize the population. First, CVC in the innovation and entrepreneurship ecosystem promotes the coordinated development of large enterprises, start-ups, and CVC projects. In a complex environment, it is difficult for a single organization to maintain its continuous innovation ability, but under the system synergy effect, it can contact different resources through the sharing and exchange process and carry out cluster knowledge exchange to improve collective efficiency. Large enterprises and start-ups generate a common knowledge base, which can be used to increase the innovation ability of both sides. This joint innovation improves their competitive advantages (Ritala, Hurmelinna-Laukkanen, 2013). Second, organizations can learn together and support shared experiments and R&D through knowledge creation to form collective learning advantages. Regarding risk avoidance, CVC activities can effectively reduce the risks of participants, especially R&D risks. This synergy of technological innovation, business incubation, strategic guidance, and resource sharing through innovation network integration and interorganizational learning, access to complementary or cutting-edge knowledge sets, and information sharing to reduce risks is at the core of the value that CVC offers.

Composition of the symbiotic system of the CVC ecological communityCVC integrates economic management and financial thinking while considering the financial objectives of cost minimization and profit maximization and the balance between risk and future income. Large enterprises and start-ups are regarded as two innovation groups in the innovation and entrepreneurship ecosystem with complex intragroup and intergroup relationships between them. A symbiotic evolution system is formed through a dynamic game. Under the partner selection mechanism, trust and communication mechanism, resource convergence mechanism, value exchange mechanism, balance adjustment mechanism, risk control mechanism, benefit distribution mechanism and incentive mechanism, the two sides adopt a “positive sum game.” Open collaboration and resource sharing realize value-added and carry out collaborative development and symbiotic evolution.

Symbiosis theory has been continuously applied in the economic circle. Symbiosis is an intimate lifestyle among biological populations, which means that two species improve their viability and profitability through cooperation between subjects, achieve harmonious interaction with the ecosystem environment, and form a symbiotic body by sharing similar resources or complementing different resources (Miller, 2015). This paper assumes that there is no confrontation or conflict between large enterprises and start-ups in the innovation and entrepreneurship ecosystem. As two core symbiotic groups, large enterprises will neither “squeeze” the innovation space of start-ups nor “drag down” the innovation and development of start-ups. Instead, they will promote the development of start-ups, encourage each other, deepen internal relations, and achieve symbiosis and win‒win outcomes. The symbiotic system of the CVC ecological community includes three basic elements: (1) symbiotic unit, (2) symbiotic mode, and (3) symbiotic environment.

Analysis of the symbiotic environment of the CVC ecological communityThe symbiotic environment of venture capital consists of the macroeconomic, scientific and technological, legal and policy, humanistic and social, financial market, and talent environments. First, the development of CVC is closely tied to the macroeconomic environment and the business cycle, which are the external conditions for the coevolution of large enterprises and start-ups. Second, the legal and policy environment have a crucial impact on the development of CVC, especially the improvement of venture capital-related policies that can promote the effective demand and supply of various types of venture capital; it can improve the efficiency of venture capital; and policy stability and innovation guidance will actively promote the development of CVC. Meanwhile, market access, fiscal policy, preferential tax policy, and risk guarantee policy are closely related to the development of CVC. The design, implementation, and coordination of policies are the necessary conditions for the coevolution of innovation and entrepreneurship ecosystems. Third, in the environment of innovation and entrepreneurship, an active and open innovation culture, trusting relationship, and entrepreneurship also play an important supporting role. In addition, CVC is an active financial force. The perfection of the financial capital market environment is the key to the sustainability of the symbiotic relationship. CVC realizes capital circulation through fundraising, operation, and withdrawal. A multilevel and sound capital market can guarantee the operation of CVC at all stages. At the same time, the first element of the harmonious evolution of the CVC ecological community is talent, including innovative talent, entrepreneurial talent, entrepreneurs, and investment experts. First, scientific research and technological development need a steady stream of talent. These talents should have rich knowledge in the financial field, good morals, keen industry insight, and enterprise management ability. Second, the intellectual resource environment composed of the innovation ability and professional technical ability of the core cutting-edge technical talents of start-ups is also an important part of the symbiotic environment.

Symbiosis mechanism among enterprise populations in the CVC ecological communityAccording to ecosystem theory, the large enterprise population and entrepreneurial enterprise population in the CVC ecological community form a two-dimensional symbiosis, which is similar to the biological community in structure and nature and has common characteristics in terms of constituent elements, structure, and function. The operating mechanism of the CVC ecological community includes opening and sharing, learning and feedback, and diffusion and absorption. There are complex relationships among the large enterprise population, entrepreneurial enterprise population, and other populations in the CVC ecological community, such as the material cycle, capital cycle, and energy cycle. The CVC ecological community has a certain composition and nutritional structure. The main characteristics of the CVC ecological community include diversity, openness, dynamism, and systematic evolution.

First, as a part of the innovation and entrepreneurship ecosystem, the CVC ecological community has a large number of interacting populations or species of different levels and types, including listed or unlisted mature large enterprises. It also includes small and medium-sized innovation and entrepreneurship enterprises in various industries at different stages of development, intermediary organizations in venture capital activities, relevant government departments and stakeholders. The CVC ecological community also has a variety of relationships, including research and development, technology transfer, and technology application in the vertical technology value chain, as well as horizontal technology consulting, evaluation, and service. There is both competition and cooperation between large enterprises and start-ups.

Second, the CVC ecological community, which mainly refers to the formation of an innovation network through CVC and the interconnection and opening of large enterprises, start-ups, and CVC projects, is an open system. The exchange of material, information, and energy among the subjects and the introduction of capital resources, intellectual resources, and information resources of the ecological community have improved the benefits of the entire CVC ecological community. The metabolism of various groups in the process of structural renewal, organizational adaptation, and elimination ensures the upgrading and vitality of the CVC ecological community.

Third, the whole CVC ecological community is also constantly changing. According to changes in the environment, the flow of resources from the external environment and the internal entities of the system has formed the transmission, transformation, and value-added of technology and value, and innovative technologies continuously adapt. In the innovation and entrepreneurship ecosystem, to obtain more resources and occupy a better living space, the CVC ecological community will also constantly adjust, separate, or expand its niche, and achieve cooperation or competition, which will promote the continuous value creation of large enterprise groups and entrepreneurial enterprise groups. To maintain the vitality of the CVC community, the CVC ecological community will undergo a spiral coordinated evolution from disorder to order and from low-level to high-level.

Niche simulation of the CVC ecological community under changes in the symbiotic environmentThe survival and development of a large enterprise population and entrepreneurial enterprise population in the CVC ecological community are closely related to the innovation ecosystem environment, which plays a decisive role. The CVC ecological community formed by large enterprises and start-ups faces a variety of external environmental factors, and its impact on the two populations and the CVC community is also different.

Niche simulation of the CVC ecological community under changes in resource capacityThe innovation and entrepreneurship ecosystem are composed of different types of innovation populations and innovation ecological communities. Different innovation populations have different competitiveness and reproductive capacity. They achieve dynamic balance through mutual coevolution. When the environmental capacity of external resources changes, the large enterprise population and entrepreneurial enterprise population in the CVC ecological community will compete for limited resources. Tilman (1997) combines the Levins metapopulation model (Levins,1969) and Hanski's two species metapopulation model (Hanski, 1994) and proposes that the change in external environmental factors makes the large enterprises and entrepreneurial enterprises in the CVC ecological community co-evolved according to the multiple population metapopulation dynamics model in biology. It is assumed that there are n innovative populations in the CVC ecological community. When multiple population sets reach equilibrium, the resources occupying the ecosystem will change and form a new ecological order, as shown in Formula (1):

where A is the spatial change rate of niche resources of the CVC ecological community caused by the innovative ecological environment; Si is the space occupancy rate of population I niche resources in the CVC ecological community; and ci is the birth rate of innovation population i, which can represent the ability of resource integration, boundary expansion, symbiotic network expansion, etc.θi is the emigration rate and mortality rate of the innovative population; n refers to the number of populations. Different populations have different niches, resources, and innovation abilities, so they have different competitiveness, diffusion abilities, learning abilities and absorption abilities. Here, ciSi(1−A−∑j=1iSj) means that the original niche resources of the original innovative population in the innovation ecosystem are occupied or looted by innovative population i; θiSi indicates the proportion of niche resources caused by the migration or death of innovative population i; and ∑j=1i−1cjSjSi indicates that the strong innovative population occupies the innovative niche resources of the weak competitive population. Therefore, in the fierce innovation and entrepreneurship ecosystem, when the innovation population does not have strong competitiveness, it must maintain a large number of survivals in the ecosystem through strong reproduction ability and low emigration rate and mortality to have the opportunity to evolve. The symbiosis and evolution between n innovation populations are realized due to nonlinear effects and show a dynamic equilibrium state.When the number of populations in the innovation ecosystem tends to be infinite, the stable value of the proportion of niche resources occupied by the metapopulation when it reaches equilibrium is S^i, that is, the ecological order in the ecosystem, which represents the size of the innovation resource space occupied by each innovation population in the ecosystem due to its strong or weak competitiveness and can be sorted according to the value.

When there is no change in the external innovation ecological resources, {S^i} is the proportional series of the stable value of the proportion, and the series S^i=q(1−q)i−1 shows the sorting law from large to small,qrepresenting the proportion of the innovation population with the strongest competitiveness in the CVC ecological community of the innovation ecosystem to the resources in the system.

According to Tilman's hypothesis, the emigration rate and mortality rate of each species are equal, and is set θi=θas a constant. At that time dSidt=0, a series with equal diffusivity can be obtained. Among them, ci=θ/(1−q)2i−1 shows the sorting rule from small to large. At this time, the metapopulation in the CVC ecological community in the innovation ecosystem tends to be stable, and each innovation population realizes collaborative symbiosis and evolution. At this time, the niche resources occupied by the innovation population in the system are as follows:

At that time S^i≥0, Sie=S^i=1−A−θici−∑j=1iS^i(1+cjci); At that time S^i≤0, When A value is large, A≥1−θiri , Sie=0.

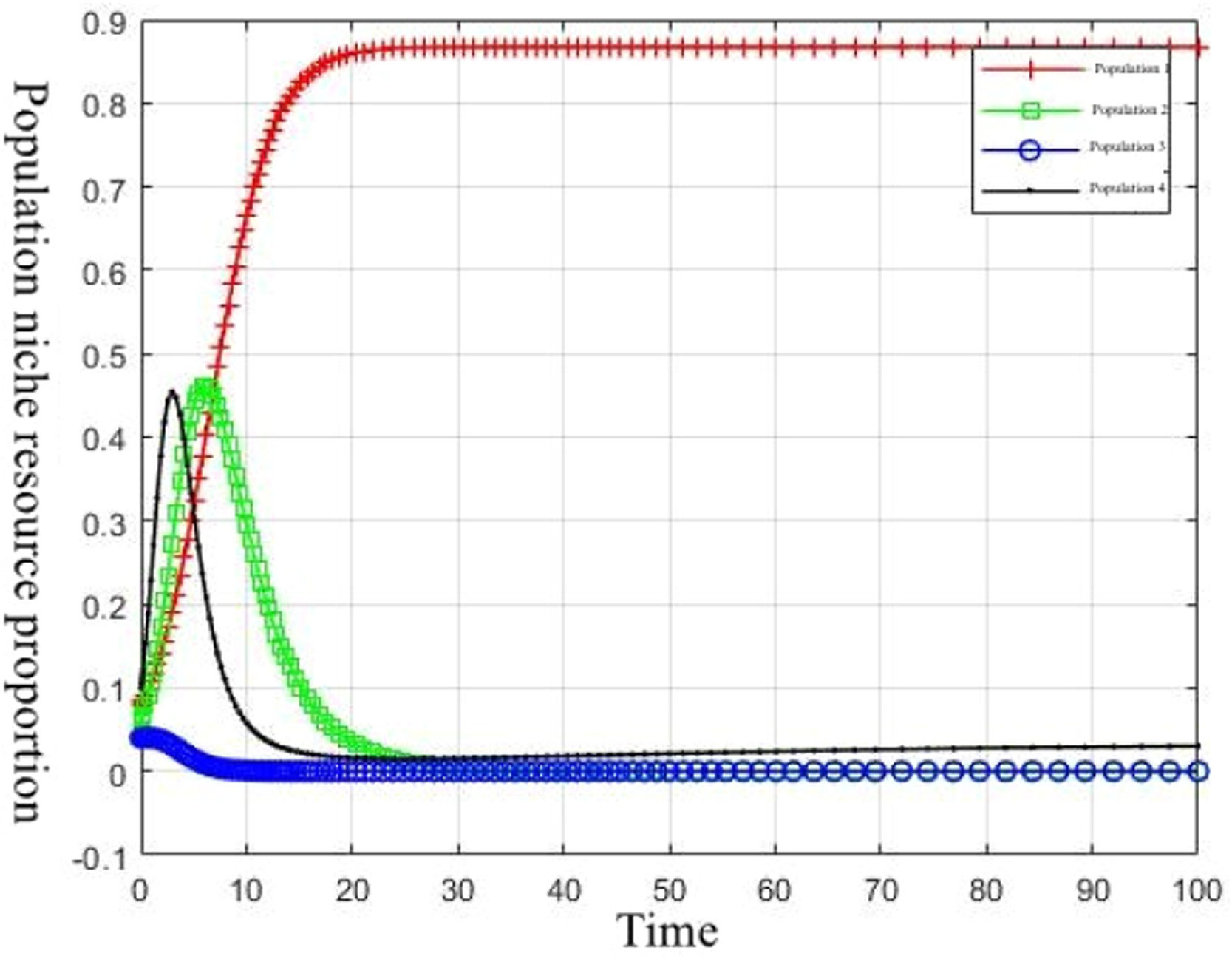

Assuming the evolution time T=100 and the number of population types in the CVC ecological community n=4, the ecological order of S1,S2S3, and S4 is arranged from large to small, and the proportion of niche resources occupied by each innovative population shows a geometric distribution. Assuming the initial value of niche Si(0)=0.1, the mortality of the innovative population θi=0.193, and the niche of the strongest innovative population q=0.25. When the ecological environment does not change, the evolution track of niche resources of each innovative population is shown in Fig. 1.

Impact of adverse changes in the environment of the innovation ecosystemWhen the external innovation ecological environment changes, it will have a favorable or unfavorable impact on the development of the CVC ecological community. Therefore, changes in the ecological environment reduce the capacity of available niche resources, including market demand, technical talent, and innovative industries. When the value of A is different, that is, A=0.04, A=0.4, and A=0.8, the simulation graph is shown in Figs. 2, 3, and 4.

It can be seen from the simulation diagram that when the innovation ecosystem environment is not conducive to the development of the CVC ecological community, the total amount of niche resources available will decrease. Thus, competition for resources in the system will be intensified by the innovation population, and the competition for niche resources of the large enterprise population, entrepreneurial enterprise population, incubator population, and industrial fund investment population will change. On the one hand, the competition will become more intense. On the other hand, the innovative population will explore new markets or look for alternative and complementary resources to maintain the competitiveness of the population to maintain its ecological order and innovation niche in the original ecosystem. Here, the interaction between populations is dynamic and nonlinear. The evolution process among innovation groups will fluctuate, but after a series of fierce competitions, it will enter a new stage of relatively stable development and form a new ecological balance.

With the increasing occupancy of the A resource space, the total niche space of each large enterprise population and entrepreneurial enterprise population in the CVC ecological community will decrease. When the resource space of an innovation ecosystem is large enough to exceed a certain threshold, other populations will be affected by changes in environmental resources, and the resource space of system innovation will be forced to shrink, which will further affect the scale and competitiveness of innovation populations. From the above simulation of spatial changes in resources, it can be concluded that when external environmental resources change adversely, the most competitive innovation group will be the most negatively affected. The main reason is that strong competitiveness must be supported by relatively rich talent, capital, technology, and mechanisms and since demand for these core resources is also large, and it may be difficult to quickly find alternative resources, transformation costs may be higher. Therefore, this kind of innovative population will face more severe difficulties and even rapidly evolve in the direction of decline.

Niche simulation of the impact of adverse changes in the innovation ecosystem environmentWhen the value of A changes and develops in a favorable direction, the resource space in the ecological environment has increased. For example, when A=-0.35, the simulation is shown in Fig. 5.

When the whole ecological environment develops in a favorable direction, the overall niche space will expand, and the innovative population will compete for new niche space through competition. Due to the different sensitivities and competitiveness of the innovative population to new resources, after a period of competitive evolution, it will gradually enter a period of stable development.

Niche simulation of innovative species under queue jumping competition invasionIn the innovation ecosystem, the growth of new industries is a process of invasion of innovation groups, which is limited by the internal effects of the innovation system, the relationship between innovation groups and the external environment of innovation. When an alien innovative species invades and the species in the system compete and coexist, the living space occupied by each species in the original CVC ecological community will be affected, so a series of adjustments will be made to form a new ecological order. The cooperative evolution and development mechanism and law of populations in the CVC ecological community are analyzed. Assuming that the alien innovative species jumps into the ecological sequence of the original system population, it has a certain comparative competitive advantage and can realize the competitive symbiosis of multiple populations, which will cause the ecological sequence number of all populations to decrease in turn.

If the external innovation population is set to enter the innovation ecosystem, it will be ranked ahead of the innovation population K in the form of strong queue jumping, forming a new ecological order in Formula (2):

When the alien innovative population invades the original innovation system, the ecological order increases to n+1. Since the total number of niche resources that can be utilized by the population in the ecological community remains unchanged, Formula (3) is as follows:

In the above formula, Si• is the stable value of the proportion of niche resources of the population after the new innovation population enters, and the innovation ecosystem is adjusted; S^i indicates the stable value of the niche resource space share of each innovative population after the new species group enters.

Because ∑i=1n+1Si•=1−(1−q2)n+1,∑i=1nS^i=1−(1−q1)n,q2=1−(1−q1)nn+1,q1 is the stable value of the niche resource proportion of the strongest innovation population in the CVC ecological community of the innovation ecosystem before the integration of the external innovation population; q2 represents the stable value of the niche resource proportion of the strongest innovation population in the community after the integration of the external innovation population.

When A=0, we select the symbiosis dynamic balance model of four types of innovative population coexistence and the CVC ecological community, as shown in Formula (4):

In this balanced CVC ecological community, new innovation populations are moved from other regions and industries S3e. Due to strong competitiveness, the new CVC ecological community coevolution model is shown in Formula (5):

In the above Model (5), the third population of the newly integrated population in the original innovation ecosystem S3is changed intoS4, and the ecological order of other populations is changed by analogy. Capital, technology, resources, talent, markets and other ecological resources are all contested, and the original ecological order is impacted. Through the competition of various innovation populations, a new ecological order will be gradually formed.

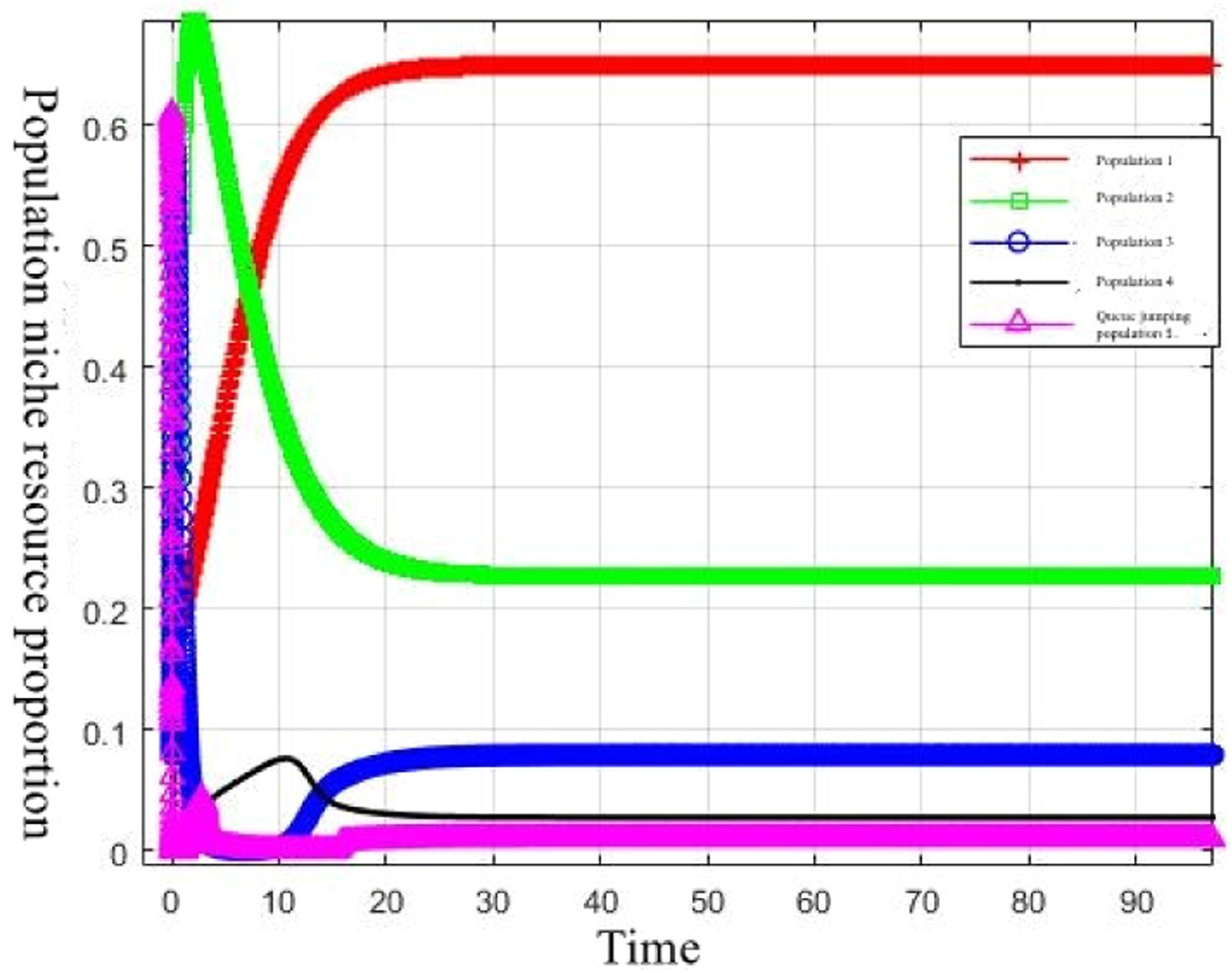

In Formula (5), Seis the stability of the proportion of niche resources occupied by the foreign innovative population in the CVC ecological community after they jump queues to compete and integrate. Assuming that the number of innovative populations in the CVC ecological community is four, the initial values of the proportion of each innovative population to niche resources are S1(0) = 0.16, S2(0) = 0.12, S3(0) = 0.08, S4(0) = 0.007 and mortalityθi = 0.15. The initial niche value of the newly integrated populationSe =0.11. Assuming that q=0.25 means that the competitiveness difference of innovative populations in the original ecosystem is small. When q=0.65, the competitiveness difference of innovative populations in the original ecosystem becomes larger. The evolution trajectory of the CVC ecological community after the invasion of new foreign species in two cases is simulated, and the simulation is shown in Figs. 6 and 7.

When there is an innovative population that invades by queue jumping in the system, it shows that it has experienced the adaptation of the initial innovation environment and population reproduction, and the number of individual species has also reached a certain scale. The rapid growth ability, strong environmental adaptability, and competitiveness of new populations enable them to quickly find their own niche, integrate resources, survive, and grow in the innovation ecosystem and reach a stable state. When a new innovative population enters the innovative ecological community by jumping in line, its niche competition ability is strong, and its ecological order is higher. When q1is small, the competitiveness difference between the innovation populations in the original system is also small. Regardless of where the innovation populations integrated into the system are, the innovation populations behind the row will be less affected. Moreover, the newly moved innovation populations can also enrich the ecological diversity of the original system, and the change law of the ecological order of the newly formed populations will evolve in a complex direction. However, when the competitiveness of the original populations is quite different, the new species will greatly affect the niche resources obtained by the original populations, and the proportion stability of these less competitive innovative populations in the niche resources space of the whole system will also be reduced.

Niche simulation of innovative population by integrating allelic competition into lower populationAssuming that the new species are integrated into the CVC ecological community to focus on the competition for a specific industry or resource, compete with a population in the original ecological community and coexist in the system, the evolution model is shown in Formula (6):

In the above formula, Se indicates the stability of the proportion of niche resources occupied by the new species after entering the system. When the competitive advantage of the newly entered population is not strong, it will have a nonlinear effect with other innovative populations in the system through allelic mode and finally reach a new stable state. At dSidt=dSedt=0, the stable values of niche resources occupied by new species and original populations are shown in Formula (7) and Formula (8):

Assuming that the number of innovative populations in the CVC ecological community is 4, the initial values of the proportion of each innovative population to niche resources are S1(0) = 0.16, S2(0) = 0.12, S3(0) = 0.08, S4(0) = 0.007 and mortalityθi = 0.15. Initial niche value of newly integrated populationSe=0.11. Assuming q=0.25, there is little difference in the competitiveness of innovative populations in the original ecosystem. When q=0.65, the competitiveness difference of the original ecosystem innovation population becomes larger, the evolution trajectory of the CVC ecological community after the invasion of foreign new species in two cases is simulated, and the simulation is shown in Figs. 8 and 9.

The impact of the newly integrated innovative population on the niche resources of the original population depends on the competitiveness difference between the original populations. When the competition difference between the populations in the system is smaller, the impact of the new species on the innovative population in the original system is also smaller. When the competitiveness of the original new species varies greatly, the newly settled innovative species will form greater competitive pressure with other species.

ConclusionThe cultivation and evolution of the CVC ecological community is based on the formation of symbiotic relationships. The professional advantages and capabilities of large enterprises and start-ups are the basis for their participation in symbiosis. The complementarity among multiple subjects makes them interdependent. Based on the common goals and mutual trust among subjects, they form a close relationship and gradually evolve into a stable symbiotic relationship. From the ecological perspective, this paper takes corporate venture capital as the research object. First, it constructs the conceptual model of the CVC ecological community and probes into the symbiosis mechanism between large enterprise groups and entrepreneurial enterprise groups in the CVC biological community. The results show that the symbiosis, self-consistency, evolution, spillover, and other effects in the CVC ecological community fully realize the “positive sum game” process between the two sides. According to ecosystem theory, the large enterprise group and the entrepreneurial enterprise group in the CVC ecological community form a two-dimensional symbiotic system. The CVC ecological community has the characteristics of open sharing, learning feedback, diffusion, and absorption, which are also the internal mechanism of CVC ecological community symbiosis. The logical starting point of symbiosis between large enterprise groups and entrepreneurial enterprise groups is value cocreation. In addition, the above theoretical mechanism has been verified through simulation analysis using MATLAB 2019a. The simulation results show that when the resource capacity of the innovation ecosystem changes, the innovation population invades the system in a strong jump queue, and the innovation population participates in the system through weak allelic fusion. The niche evolution path of the innovation population in the CVC ecological community will change, which indicates the influence, interaction and evolution between enterprise groups and the innovation system environment. Therefore, as a core part of the innovation and entrepreneurship ecosystem, the CVC ecological community shows a nonlinear and exponential growth trend. Only through effective symbiotic cultivation with entrepreneurial enterprises can symbiotic energy be continuously generated and guide the cyclic development of new symbiotic relationships in evolution. As an important mechanism in the entrepreneurial ecosystem, the CVC ecological community symbiotic cultivation mechanism maintains the stability of symbiotic relations through the adaptation, adjustment, and aggregation of system populations for value cocreation and distribution, thus promoting the balance and healthy development of the ecosystem and constantly improving the value of the entire innovation ecosystem.

Data availabilityThe simulation experiment data used to support the findings of this study are available from the corresponding author upon request.

This work was supported by Specialized Scientific Research Fund Project of Sanda University [Grant number: 2021BSZX04], General Project of Philosophy and Social Science Research in Colleges and Universities of Jiangsu Province [Grant number: 2022SJYB0374], the Youth Project of Shanghai Philosophy and Social Sciences Planning (2020) [Grant number: 2020EJB001].