This article is devoted to evaluating the role of intangible assets in the process of increasing the value of a company. As a sample, we have chosen FMCG companies around the world. The research was done on 90 FMCG companies. The theoretical part presents the “Value Creation Mixer” model that allows visual identification and determines the role of this type of asset in creating company value. This study reveals that the majority of FMCG companies are undervalued in terms of the value of intangible assets by comparing the market value of intangible assets with the fundamental and theoretical value. Our empirical findings support the positive impact of intangible assets on companies’ value based on a dynamic panel approach. The policy implications suggest managers protect intangible assets intending to maximize the value of the fast-moving consumer goods companies.

The role of intangible assets is increasing in determining the company's value and becoming the most important factor in the company's competitiveness. In a decade, in a dynamic and constantly changing environment, to gain superiority over competitors, companies need to focus on their intangible assets (Grant, 1991; Nahapiet & Ghoshal, 1998; Teece, 2000). Companies can achieve high market performance and shareholder value if strategies are applied that influence market opportunity and allow rapid deployment of resources. Technological changes and economic transitions have changed attitudes toward the value of standards. Managers need clearly understand the composition and structure of intangible assets, as well as their impact on the creation of company assets. The work of Kaplan & Norton (2004) showed that “the intangible assets are the main source of sustainable existence”. Studies (Lev & Feng, 2001) suggest that 40% of a company's value is not reflected in the balance sheet, while for high-tech companies, this figure is reduced by 50%. Thus, up to 50% of the company's value can be attributed to intangible assets and this figure can be up to 90%. Lev (2003) revealed that intangible assets are “the main drivers of growth and asset value in most sectors of the economy”.

Intangible assets are of particular importance in connection with the transfer of the world economy to an innovative path of development. The condition and development of intangible assets depend on their sectoral affiliation. In this regard, it is relevant to study intangible assets by type of economic activity. For this action, we chose one of the innovative and fast-oriented FMCG sectors (fast-moving consumer goods). The importance of intangible assets as a factor in the growth of the company's value explains the need to develop mechanisms for involving them in economic turnover and using these assets. The rational use of intangible assets, taking into account the properties of their components, can have a significant impact on the value of any company. However, this relationship is poorly investigated in the case of FMCG companies. Many models and approaches use tangible and financial assets, but there is no comprehensive approach to the use of intangible assets in theory and practice for FMCG sectors.

The great importance of intangible assets determines their important role in modern science. Numerous studies are devoted to theoretical issues, including the nature, value and classification of intangible assets (Mayorova, 2014; Proskurina & Gorokhovets, 2016), accounting of intangible assets (Shakhbanova, 2016; Ugnecheva & Omelchenko, 2017; Shevchenko, 2017), audit of intangible assets (Ismailova & Mamaeva, 2018; Rustemov & Kenesbayeva, 2016), the impact of intangible assets on the profitability, efficiency, competitiveness and economic security of business entities (Biimyrsaeva, 2016; Ivanov & Mayorova, 2015; Mingaleva, 2018; Perepechko, 2018). There are also studies on methodological aspects of the analysis and evaluation of the effectiveness of the use of intangible assets in commercial activities (Dudenkova, 2017; Ibragimov, 2018; Mayorova, 2014; Bolgucheva, 2016; Vodyakho, 2016), and problems of intangible asset management (Pakhomova, 2016; Artemenko & Vorobieva, 2017; Kukurudziak, 2016).

The study of intangible assets by taking into account the sectorial affiliation also has taken the attention of researchers. Among such works, we can distinguish those devoted intangible assets to industrial enterprises (Strizhakova, 2017), the military-industrial complex (Gosteva, 2016), enterprises using subsoil (Nurmatov, 2018), construction enterprises (Egorov, 2017), agricultural enterprises (Miroshnichenko, 2016) and tourism enterprises (Egorov et al., 2016). Also, several works (Mayorova, 2014, 2016) are devoted to studying the effect of intangible assets in the trading industry. Competition between business segments is intensifying and retail chains are actively developing. Under such conditions, intangible assets become one of the main factors in ensuring the efficiency and competitiveness of the trade industry. Despite a large number of studies of intangible assets, taking into account the industrial operation, many issues remain debatable. In particular, there is no generally accepted approach to determining the essence of intangible assets, their composition, methods, indicators of analysis and evaluation of the effectiveness of using intangible assets. However, Turovets (2021) discovered that, whereas intangible assets were previously assumed to boost production on a macro scale, few research have explored intangible assets as predictors of firm efficiency. Furthermore, Ferdaous & Rahman (2019) utilized a similar strategy to investigate manufacturing companies in Bangladesh, discovering that intangible assets have a mixed influence on corporate performance, with favorable benefits on financial strength but negative effects on market-based performance. These findings in underdeveloped nations are less consistent than those in wealthy ones, signaling that more study using more robust techniques and a larger data sample is required (Nguyen-Anh et al., 2022).

There are several contributions of this study to the literature. First, determining the role of intangible assets in creating value for companies; second, modeling the impact of intangible assets, as one of the most important factors of competitiveness on the value of companies; third, quantifying the value of intangible assets and their impact on the value of FMCG companies; fourth, developing theoretical and methodological provisions in the field of the integrated use of intangible assets through empirical study with various approaches and methods.

Theoretical modelsVarious models graphically illustrate the place and role of intangible assets in creating value for companies. The company's value creation model provided in the PRISM13 report is one of the most commonly cited in academic studies. This initiative focuses on competencies, capabilities, and knowledge flows as the foundation for modern organizational growth. The “value creation mixer” model is the name given to this concept (Eustace, 2003) (Please see Fig. 1).

Value creation mixer (Source: PRISM13 (Eustace, 2003)).

All four blocks of assets are strategic assets of the organization. To the left of the “value mixer” are the assets to which the organization has certain rights and these rights are statutory. Tangible assets include physical assets such as land, plant, machinery and equipment, cash and cash equivalents, securities and investments. Intangible assets, in turn, include intellectual property, brands, trademarks, know-how, etc.

To the right of the “value mixer” are intangible competencies and latent abilities, the latter are called “assets in waiting” by the developers of the model for which the company does not have formal ownership rights. Intangible competencies include organizational and human capital. Latent ability refers to leadership, talent at work, and organizational ability, which also includes networking, market opportunities and innovative abilities. These abilities are needed in an unpredictable, dynamic environment and the real need for them is felt when a company is faced with restructuring its current activities to meet new conditions.

At the center of the model is the “value mixer” in which the manager can use and manage all the resources at his disposal, to maximize the value of the firm. The developers of the model emphasize that in today's highly competitive economy, organizations must have access to unique resources or at least hard-to-imitate resources and competencies that allow them to gain sustainable competitive advantages. The effective management of intangible resources is the key to superiority over competitors.

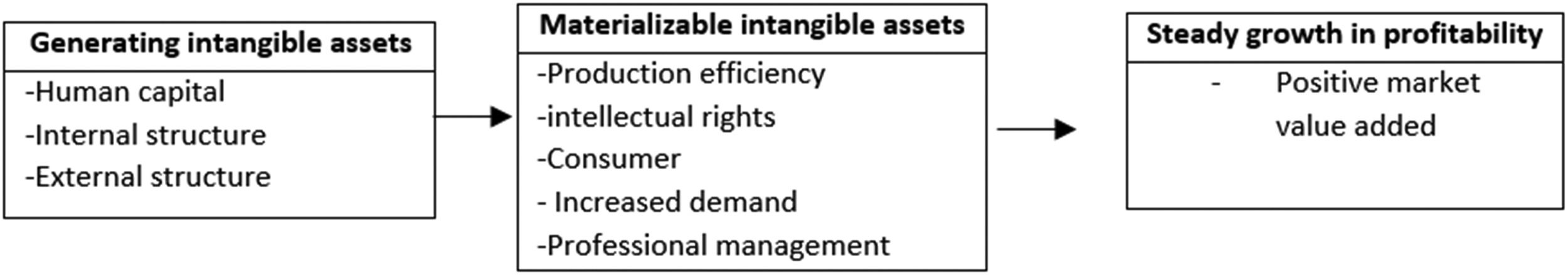

Ahonen (2000) presents an “intangible value chain” (Fig. 2), as a result of which a firm can receive a return higher than the industry average.

Intangible value chain (Source: Ahonen, 2000).

Obtaining superiority over competitors in the form of positive market value added is possible only through the use of intangible assets, which contribute to the fact that the company can become the owner of:

- 1.

Efficient production (savings in costs and diversity, superior technology, effective contracts with suppliers);

- 2.

Registered property rights (patents, brands, property rights);

- 3.

Rising demand (growth markets);

- 4.

Highly effective management.

A company can obtain commercialized intangible assets through either mergers and acquisitions or its own efforts to generate them.

The intangible assets that underlie the generation process can be classified as follows (Table 1):

Generating intangible assets indicators.

Source: Ahonen (2000).

From the presented approach to value creation, we can conclude that the basis for obtaining sustainable competitive advantages by a company is the commercialization of intangible assets, i.e. assets that can bring profit to the company. That is why, to increase the value of the company, managers need to pay attention and effectively manage business processes and strategically important resources, which include intangible assets.

Methodologies for determining the optimal volume of intangible assetsConsidering the sphere of management of intangible assets, we can conclude that the issues of formation and use of such assets, as well as determining the degree of their impact on the efficiency of the enterprise and innovative growth in general, where are one of the problematic areas of the modern company. To ensure effective management of innovative development based on the analysis of intangible assets, it is necessary to assess the economic consequences of managerial decisions concerning intangible assets. When developing a strategy for the innovative progress of an industrial company, the role of intangible assets is determined and evaluated, which will lead to an increase in the innovative potential of the company. When managing intangible assets at the company level, the issues of organizing the assessment of the cost indicators of intangible assets and the formation and use of a portfolio of intangible assets in a competitive environment remain the least developed. The value of intangible assets obtained as a result of the assessment is probabilistic, predictive and expected. The assessment of intangible assets should be considered as the result of an analytical study and generalization of the conditions, procedure and nature of the use of such assets in the financial and economic activities of a particular company (Teece, 2000). The cost of intangible assets can affect the level of innovative development of a company. An analytical review of the existing methods for assessing intangible assets made it possible to combine them into two groups: the first group includes measurement methods and indicators that give a detailed idea of intangible assets; the second group includes methods for assessing the intangible assets of an enterprise in monetary terms (Kovalev, 2000).

The valuation of intangible assets is associated with numerous problems compared to tangible assets and in more cases, there is a need to make decisions regarding the following aspects:

- 1.

The problem of defining boundaries;

- 2.

The problem of determining the cost;

- 3.

Partial exception.

However, among the existing approaches and methods, seven categories can be distinguished, which were grouped based on element-by-element measurement of intangible assets or measurement of intangible assets of the enterprise as a whole, as well as received financial or intangible assets.

Some of these approaches and methods are extensive and represent a detailed description of the relationship between intangible assets and tangible assets with further explanations, others, on the contrary, give a brief overview of the situation in the company (Table 2).

Conditions for the application of methods for assessing intangible assets.

The main task of the current methods is mainly to determine the value and cost of each intangible asset separately. Because of this, the estimated indicators do not connect, and each intangible asset is looked at separately from the rest. For a more accurate assessment of how intangible assets affect the company's value, it is necessary to combine several different intangible assets used for the same purpose into a single cumulative intangible asset (Hilorme et al., 2020). The use of different methods in nature leads to different results of the valuation. Therefore, the final assessment of intangible assets should be based on the synthesis of various indicators of the value, liquidity and structure of intangible assets to obtain a multidimensional projection of the measured intangible assets of the company. With an integrated approach to the assessment of intangible assets and the development of a unified system for analyzing the intangible assets in the structure of an enterprise to optimize its innovative development, the following conditions must be observed:

- 1.

The valuation should be based on future profits, not past costs;

- 2.

The result of the assessment should be on specific cost indicators;

- 3.

The result of the assessment should not depend on subjective factors of a temporary nature, such as rumors, stock price dynamics, etc.;

- 4.

It is not the knowledge of the company's employees that is subject to assessment but technologies that allow them to be used effectively. For example, management processes, general moral values and norms, image, brand, etc.;

- 5.

Evaluation methods should be flexible to take into account the specific conditions of the company but should include indicators that allow you to compare their work with the work of competitors;

- 6.

Assessment methods should help reveal the hidden potential of the company's intangible resources (Pindyck, 1991).

The main stages of the methodology for determining the optimal amount of intangible assets in the structure of the innovative potential of the company should include analysis of the innovative development of the company and determining the need to optimize the volume of intangible assets, determining the value and assessing the liquidity of intangible assets, changing the structure of intangible assets and forming a portfolio of intangible assets.

The assessment of the impact of intangible assetsFor the valuation of intangible assets of FMCG companies, we have chosen the ROA method and empirical estimation using the value of the company (Tobin's q). The assessment of the value of intangible assets was carried out among 90 FMCG companies around the world based on available reports for 2018-2020 years. Data collection was carried out through the Orbis Database. The sample covers active FMCG companies: manufacture of food products, manufacture of bread and manufacture of fresh pastry goods and cakes, manufacture of rusks and biscuits, manufacture of preserved pastry goods and cakes, manufacture of beverages and manufacture of tobacco products.

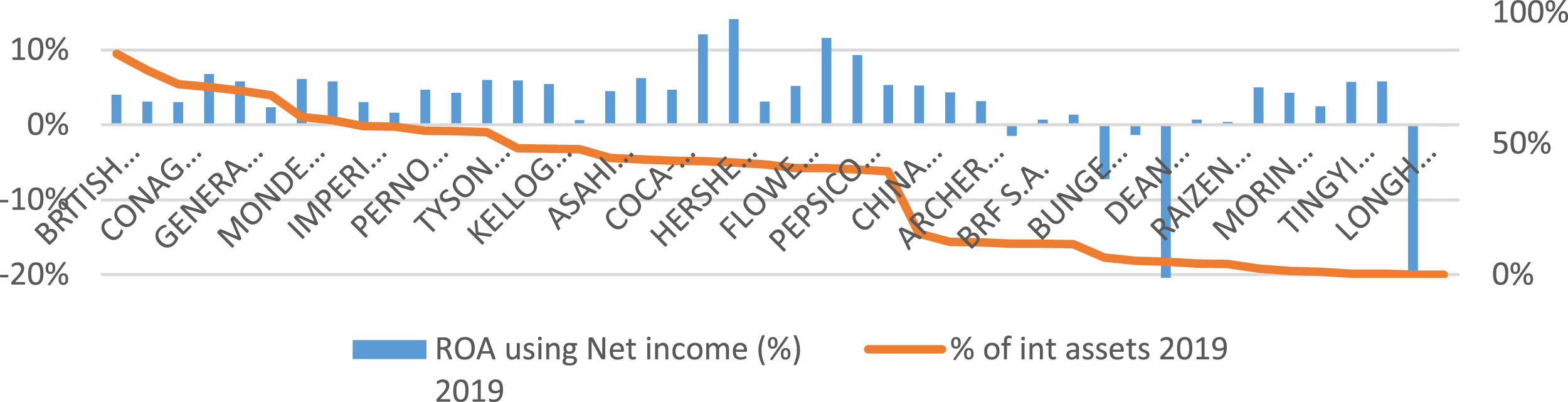

The results of the analyses based on the ROA approach are represented in the below graphs (Graphs 1–3). In these graphs, we can see the illustration of the linkage between the ROA percentage and intangible asset percentage for each company. Based on this analysis, we see a trend where companies with a higher percentage of intangible assets generate a higher return on assets using net income. Companies with the lowest indication of intangible assets portion in their balance sheet are showing lower and even negative ROA. We observed a similar trend of intangible asset impact to ROA for the 2018-2020 years. In addition, we also took the average ROA to observe the graphical relationship. The result is similar to the yearly analysis.

We also carried out a descriptive analysis (Table 3). Results show that the value of intangible assets of FMCG companies is low, revealing that companies undervalue the importance of intangible assets. The correlation matrix (Table 4) shows that the relationship between intangible assets and the value of the company is positive and statistically significant. This may mean that companies should pay attention to the increase in intangible assets.

Descriptive statistics.

Note: VALUE – Company Value (measured by Tobin's q), INTA – Intangible Assets, ROA – Return on Assets, CR – Current Ratio, SIZE – Size (measured by the log of total assets), LEV – Leverage (measured by total debt).

Correlation matrix.

Note: * p<0.01, ** p<0.05, *** p<0.1; VALUE – Company Value, INTA – Intangible Assets, ROA – Return on Assets, CR – Current Ratio, SIZE – Size, LEV – Leverage.

For robustness purposes, we also assessed the empirical part of our findings by using the dynamic two-step Generalized Method of Moments (Table 6). Before estimation, we also checked the relationship between the factors that affect the value of the company by using the variance inflation factor. Table 5 shows that there is no multicollinearity issue in the selected model. The result of the dynamic approach (Table 6) confirms that intangible assets have a positive impact on the value of the company. In the model, we also take into account other factors, such as liquidity (CR), size (SIZE), leverage (LEV), and profitability (ROA). Profitability and leverage have a positive impact on the value of FMCG companies. Managers in FMCG companies should also have strategic decisions to increase the profit and to borrow up to the optimal level to positively impact the value. Our results are confirmed by diagnostic tests: the second-order serial autocorrelation (Arellano & Bond, 1991) (AR(2)) and Hansen's J statistic (Hansen, 1982) to identify the overidentification restrictions. The value of AR(2) is 0.815. It means that no autocorrelation problem is detected in the model. The Hansen test's value is 0.193; it indicates that the model is correctly specified. To sum up, for FMCG companies, intangible assets are one of the key drivers to generating more value for the company. Thus, the connection between intangible assets and the value of the company is directly proportional. Therefore, FMCG companies should invest more in increasing the intangible asset part of the balance sheet to generate more income and increase the value of the company.

Dynamic panel-data estimation, two-step system GMM.

Note: Robust standard errors are in parentheses; *** p<.01, ** p<.05, * p<.1

The financial and economic mechanisms of the influence of intangible assets on the company's value can be effectively implemented with qualitative and quantitative approaches. An important role is played by the valuation of intangible assets, which is designed to provide both: the management of companies and their investors with the necessary information. This study assesses 90 FMCG companies to quantify the impact of intangible assets on the value of the company for the period of 2018-2020.

It is important to remember that for the creating of value for stockholders, many positive aspects to handling intangible assets are:

- 1.

In the case of merger and acquisition, the value of an acquired company that has intangible assets will be significantly higher than that of one which does not evaluate its intangible assets;

- 2.

The company which values and accounting their intangible assets can count on higher appraisals to attract loans, cause the level of confidence in such companies is higher;

- 3.

Increasing the volume of cash flows withdrawn from intangible assets, closing the liquidity of transactions. The ability to create the resources that are needed to solve complex problems. Increases its flexibility in a rapidly changing business environment. Stakeholders get the opportunity to receive income in the most convenient form, which stimulates the flow of resources into the company;

- 4.

The company calculates and comprehensively analyses its intangible assets with the value of earnings. It helps investors more accurately forecast future appraisals, which measure the risk of a share's price change.

The company's managers must protect intangible assets with great care. Management procedures determine the choice of a system of statistical and operational decisions in which all aspirations and actions are aimed at maximizing the value of the company. As a consequence of the emergence and development of the financial market, the company's activity and value turn out to be the primary indicator of the success, competitiveness and sustainability of the business. This is a universal indicator that integrates various economic, financial and non-financial factors and can be used by both: the company's management and external stakeholders (investors, creditors, customers and partners). Therefore, increasing the value becomes a priority goal for any commercial organization regardless of the field of activity. The study of factors that affect the value of companies is becoming an important area of research for researchers and practitioners in corporate finance.