This paper proposes a model to investigate the direct effects of Business Intelligence (BI) on performance, and the indirect effects, through network learning (NL) and innovativeness (INNOV). The investigation is based on a sample of 228 startups from different European countries. We explore those relationships using Structural Equation Modeling.

The results of this study point to positive effects among the different variables and we can conclude that Business Intelligence capacities have an impact on network learning, innovativeness and performance. From these findings, it can be argued that some attention must be made to the business intelligence capacities in startups, given the impact it can have on firm performance. Also, the network learning effect through BI is significative and presents a positive influence in performance.

As startups usually are struggling with lack of resources and the team faces multiple attention demands it seems that proposing business intelligence practices is a new challenge to overcame, but as information is a key resource for better decision making it can payoff.

There is no commonly accepted term for referring to internal and external intelligence required for business decision-making, we consider Business Intelligence (BI) as an umbrella term consisting of technologies and processes to deal with information to improve decision making (Wanda & Stian, 2015). BI is “both a process and a product.” The process is composed of methods that organizations use to develop useful information, or intelligence, that can help organizations survive and thrive. The product is information that will allow organizations to predict the behavior of their “competitors, suppliers, customers, technologies, acquisitions, markets, products and services, and the general business environment” with a degree of certainty.

Business Intelligence (BI) is attracting attention because there is an increase in information availability through electronic means of acquisition, processing and communication that can be used as a basis for intelligence practices. Also, the context of great worldwide political and social change, increased global competition from new or more aggressive competition, and rapid technological changes (Nasri, 2012) requires improved information use. The growing uncertainty leads to increasing information processing activities within firms (Dishman & Calof, 2008). If not, the survival of firms may be at risk (Shollo, 2010).

Startups work hard to achieve their space in the market and must perform to survive and grow. We must note that a small firm is not a scaled-down version of larger firms. There are differences in terms of their structures, resources available, management practices, environmental response and the way they compete in the market (Man, Lau, & Chan, 2002).

In a strongly competitive, dynamic and volatile environment, firms must make the efforts to gather information to improve their decisions. This can be a challenge for every business but a more marked one to startups struggling in the market (Foster et al., 2015). This process can assist managers to maintain an effective fit with their environment and increase their firms’ performance (Zahra & Garvis, 2000; Zahra, Neubaum, & El-Hagrassey, 2002)

The resource-based view (RBV) theory asserts that, to develop and maintain competitive advantages companies must use their physical, human, and organizational assets, both tangible and intangible (Lonial & Carter, 2015; Molina, Del Pino, & Rodriguez, 2004). An important notion of this theory is that firms controlling valuable and rare resources have the capacity to build a competitive advantage, moreover, if these resources are difficult to imitate or substitute (Wiklund & Shepherd, 2011).

Complementary, the knowledge-based view (KBV) focuses on knowledge as the most valuable resource in the company (Villar, Alegre, & Pla-Barber, 2014). It builds upon the theoretical foundation of the RBV by viewing knowledge as the primary factor of production from which a firm can derive competitive advantage.

BI is one of these assets because it can be used to obtain information, and, simultaneously, can contribute to increase the pool of knowledge available to managers. This is possible because of the processes involved in knowledge production are both of searching and recombination (Colombelli, Krafft, & Quatraro, 2013).

In this paper, we approach BI by its characteristics seen as a multidimensional construct that evaluates several aspects: Intraindustry comprehensiveness, Interindustry analysis, BI formality and Perceived usefulness. The first two are concerned with external aspects of intelligence and the others with internal structure and use of information. This combination can give us an understanding of the intelligence efforts to support decision.

The relation with innovativeness, a key concept to organizational success is considered. Also, the process of gathering knowledge by means of network learning is studied. The interaction with different actors that possess technical or non-technical knowledge can be of importance to speed the acquisition of this intangible resource. Finally, the relations between these constructs and performance are evaluated. Because these processes can assist managers to maintain an effective fit with their environment and increase performance (Zahra & Garvis, 2000; Zahra et al., 2002).

Since a lack of research regarding BI studies in small firms is reported (Hoppe, 2015), we try to advance theory by exploring some aspects of BI in this type of organizations. Of importance, is the approach to Business intelligence in a managerial perspective rather than the traditional technological perspective (Trieu, 2017).

The aim of this paper is to present a study of the relationship between Business Intelligence characteristics (BIC) and its impact on network learning (NL), innovativeness (INNOV) and performance (PERF) of startups, and simultaneously the moderation effect of NL and innovativeness on performance. A model to study the direct and indirect relations among variables is presented and evaluated using Structural Equation Modeling.

To achieve our objectives, the article is structured as follows. Section “Theoretical background and hypotheses” reviews prior research on Business Intelligence as the basis for proposing a series of research hypotheses. Section “Method” presents the data and method used to analyze empirically the hypotheses developed in a sample of European startups. Section “Results” presents the results obtained. Finally, Section “Final considerations, limitations and future directions” discusses the results, presents some limitations of this study and points some future research directions.

Theoretical background and hypothesesBusiness IntelligenceIntelligence studies applied to business gained interest in recent years, although the concept has a long history (Dishman & Calof, 2008; Tej Adidam, Banerjee, & Shukla, 2012). BI uses elements and processes from other fields like the military, government administration, and to some extent intelligence-driven cultures (Maune, 2014), where intelligence practices have a marked tradition.

In the military, intelligence is the collection of information on the enemy and the battlefield environment they must confront and has existed since the beginnings of armies and wars. Governing bodies throughout history used intelligence, specifically military intelligence, to advance their respective economic, political, and social interests. The use of concepts traditionally associated with the military is not new in business and it seems that intelligence is one of those cases.

Business Intelligence can be seen as an umbrella term, covering different activities, processes and technologies for collecting, storing, analyzing and disseminating information to improve decision making (Wanda & Stian, 2015). It is a broad and complex initiative which has been defined and discussed differently by several authors and thus does not have a unanimous definition (Lukman et al., 2011) and may even be confusing. But all include the idea of analysis of data and information into condensed and useful managerial knowledge (AL-Shubiri, 2012).

In the field of management, the concept has been studied under different titles (Tej Adidam et al., 2012). Some authors use the term BI to convey the concept of “environmental scanning”, which is focused on how managers “scan” their organizations’ environment; others refer to competitive intelligence or analysis (Berndtsson, Gudfinnsson, & Strand, 2015; Dishman & Calof, 2008; Shollo, 2010; Wright & Calof, 2006) more focused on the competitors, their strengths, weaknesses and behavior; while others mention technological intelligence oriented toward technological dynamics (Hannula & Pirttimäki, 2003; Pellissier & Nenzhelele, 2013; Tej Adidam et al., 2012).

Other labels are used to approach the same concept and include market (or marketing) intelligence, customer intelligence, product intelligence and environmental intelligence (Hannula & Pirttimäki, 2003; Venter & Tustin, 2012) or capturing other, more specific types of intelligence (Hoppe, Hamrefors, & Soilen, 2009; Shollo, 2010).

The practice allows firms to convert data into useful knowledge (Hoppe et al., 2009), and then make better and faster decisions (Chang, Hsu, & Wu, 2014; Hannula & Pirttimäki, 2003) to enhance business performance and support decision-making at all organizational levels, i.e., strategic, tactical and operational levels (Berndtsson et al., 2015). It has a permanent nature and allows the discovery of problems and general awareness about the state of activities (Shollo & Galliers, 2015) and the environmental challenges.

It is important to note that BI has impact not only in decision making process but also in the practices of organizational actors – how they make sense of, create and share knowledge (Shollo & Galliers, 2015) and thus can be regarded as a cultural dimension.

In a review by Wanda and Stian (2015) the main perceived benefits from BI are: better decisions, improvements in business processes and support for the accomplishment of strategic business objectives among others.

Network learningLearning occurs when people share their data, information, and knowledge. Knowledge can be perceived as meaningful information acquired by understanding, awareness, and familiarity through study, investigation, observation or experience over the course of time.

Knowledge is generated through learning and learning new capabilities helps firms to compete effectively, survive, and grow (Hitt et al., 2001). As knowledge changes and it must be re-constructed based on study and experience where continuous change requires continuous learning. So, knowledge is neither absolute nor universal (Psarras, 2006).

Attention has been paid to an organization's ability to identify, capture, create, share or accumulate knowledge because it is becoming the most important element in production and a source of competitive advantage (Wang & Wang, 2012).

Normally large firms have the means to internally develop much of the knowledge used in innovation. But small firms do not possess all the inputs required for successful and continuous technology development and are forced to seek external knowledge (Weerawardena et al., 2014). They face a unique “problem-type” with regard to organizational learning, which must be differentiated from large companies (Frank et al., 2012).

Most new ventures have limited, and often specialized knowledge bases and they encounter unique challenges regarding to external sources of knowledge. The firm's awareness of where useful complementary expertise exists, specially outside the organization is an important prerequisite for this purpose: “the sort of knowledge of who knows what, who can help with what problem, or who can exploit new information” (Weerawardena et al., 2014).

Given these constrains, some startups are dependent on nearby institutions to gain access to new knowledge. They can cultivate their closeness to these groups but are dependent greatly on the amount of social interactions among individuals, firms, and other organizations (Larrañeta, Zahra, & González, 2012) – their networking.

InnovativenessInnovativeness refers to a firm's tendency to engage in and support new ideas, experimentation, and creative processes that may result in new products, services, or technological processes (Lumpkin & Dess, 1996; Shan, Song, & Ju, 2016). In the context of entrepreneurship denotes the degree of “newness” the business puts in the market. As mentioned by Paradkar, Knight, & Hansen, 2015 “start-ups that are ultimately successful compete with rival firms by creating entirely new benefits for customers or by significantly improving extant ones”. Also, innovative performance is seen in the literature as one of the most important drivers of other aspects of organizational performance and fosters the formation of organizational learning dynamics (Gunday et al., 2011).

Firm innovativeness is conceptualized from two perspectives. The first views it as a behavioral variable, that is, the rate of adoption of innovations by the firm. The second views it as a willingness to change (Calantone, Cavusgil, & Zhao, 2002).

This capacity can make better use of existing resources, improve efficiency and potential value, but also bring new intangible assets into organization.

The ability to innovate is recognized as one of the determinant factors for organizations to survive and succeed (Wang & Ahmed, 2004). More innovativeness can be a significant enabler to create value and will help to respond to customers’ needs, in developing new capabilities that allow to achieve and sustain better performance or superior profitability in the increasingly complex, competitive and rapidly changing environment (Calantone et al., 2002; Cepeda-Carrion, Cegarra-Navarro, & Jimenez-Jimenez, 2012; Wang & Wang, 2012).

The literature presents innovation capability as one of the most important determinants of firm performance supported by many empirical studies (Calantone et al., 2002; Prajogo, 2015). Innovative companies, creating and introducing new products and technologies, can generate better economic performance and are sources of economic growth (Wiklund & Shepherd, 2003).

Startup performancePerformance is the capability to attain objectives in an expected or superior manner. The concept of organizational performance involves various perspectives (e.g., shareholder versus employees), time periods (e.g., long-term versus short-term), and criteria (e.g., market share versus profit) (Gerschewski & Xiao, 2015).

In a review by these authors three different types approaches to measuring organizational performance are presented. The first relates to financial performance, which is an outcome-based indicator of performance and is considered as the narrowest conception of business performance. A second conceptualization includes financial and operational dimensions of performance, incorporating non-financial measures (for example, product-market outcomes, such as market share, introduction of new products, and marketing effectiveness and internal process outcomes. These operational factors may eventually contribute to financial performance.

The broadest conceptualization of performance relates to organizational effectiveness. Some measures for organizational, or overall effectiveness are: survival of the firm, reputation, perceived overall performance, and achievement of goals.

Hypotheses developmentBy analyzing performance, we can understand the degree of success attained by a business. Therefore, it is a central objective in any organization and can be analyzed by itself, or resulting from internal processes (Man et al., 2002).

There are some studies that link business intelligence (and knowledge, understood as a BI result) to business performance (Hitt et al., 2001; Ireland et al., 2001; Pellissier & Nenzhelele, 2013; Wanda & Stian, 2015), but there is a lack of studies to understand this relation in new ventures.

This limited evidence, suggests that this interrelationship is important because of the actions taken and the consequent changes in resources used to respond to new opportunities and environmental changes (Wiklund & Shepherd, 2003). The challenge to manage existing competences based on (recent) success and constantly renew themselves in the light of environmental change is relevant to superior firm performance (Wang, Senaratne, & Rafiq, 2015). And there is a challenge in entrepreneurship research to understand performance dimensions of startups (Bruyat & Julien, 2001).H1

A direct positive relation exists between business intelligence characteristics and startup performance.

Innovativeness as the degree to which a firm engages and embraces new ideas, experimentation and creativity that may lead to new products, services or processes (Lumpkin & Dess, 1996; Wang, 2008), can be viewed as an aspect of a firm's culture, and help his survival in a volatile environment (Calantone et al., 2002).

Innovation is seen as an activity that management can control (Prajogo, 2015), engaging in experimentation and creative processes that may result in new products, services or technological processes (Dhliwayo, 2014). Firm's actions, including their innovative activities, are contingent, and sometimes driven, by external factors including customer (market) demand, competitors’ actions, or even government's legislation (Prajogo, 2015).

Of importance is the relation between innovation and organizational learning (Calantone et al., 2002) and available prior knowledge, as they can support understanding of new technology and market conditions, and generation of new ideas and products (Cepeda-Carrion et al., 2012). Higher innovation capacity allows companies to respond faster and better to environmental challenges than non-innovative ones (Cepeda-Carrion et al., 2012).

A business that possesses the ability to transform and exploit knowledge may determine its level of innovation, such as new problem-solving methods and new products for rapid reaction to market demand (Wang & Wang, 2012).

From the literature, we can anticipate a relation between BI and innovativeness. Since BI is concerned with information use for better decisions, it can influence innovative actions by the firm. Better information by itself does not substantially lead to an increase in business performance and efficiency, the key is what organizations are doing with this information (Lukman et al., 2011). We can postulate that information gathering and better use of that information can influence innovativeness dimension positively.H2

There is a positive relation between business intelligence characteristics and innovativeness in startups.

Theoretically, innovativeness facilitates the pursuit of new opportunities by proposing new products/services to the market. If these activities result successfully they will impact and enhance performance (Su, Xie, & Wang, 2015).

Firms with greater innovativeness will be more successful in responding to customers’ needs and in developing new capabilities that allow them to achieve better performance or superior profitability. The literature has gradually paid more attention to the effects various aspects of innovation have on firm performance (Wang & Wang, 2012) and thus we can anticipate a relation between these constructs.H3

A positive relationship exists between innovativeness and startup performance.

BI gives organization the ability to understand the internal and external environment through systematic acquisition, analysis, interpretation and exploitation of information (Sangar & Iahad, 2013).

Network learning as the firm's capacity to build, integrate, and reconfigure technical and non-technical knowledge generated through external links and institutions, can contribute to the knowledge intensity of the firm (Weerawardena et al., 2014).H4

There is a positive relation between business intelligence characteristics and network learning in startups.

Many scholars have suggested that the ability to exploit external knowledge is a critical component of innovative capabilities (Cepeda-Carrion et al., 2012). The attempt to learn from external sources can help uncover new ideas, processes, or techniques that can be applied and foster innovation development and application.

Competitiveness and the associated performance may result from taking advantage of knowledge management and learning (Liu, Chen, & Tsai, 2005). But few firms possess all the capabilities for innovation (Weerawardena et al., 2014), obtaining help from external sources can be of great importance, especially for startups (Martini, Neirotti, & Appio, 2017). Based on this the following hypothesis is made.H5

A positive relationship exists between network learning and innovativeness.

As mentioned in the previous hypotheses there is a growing evidence in literature that links innovation and firm performance. Since network learning can improve knowledge gathering at different levels, and knowledge has impact on decision and resource allocation, we will explore if network learning can have impact on performance.H6

A positive relationship exists between network learning and startup performance.

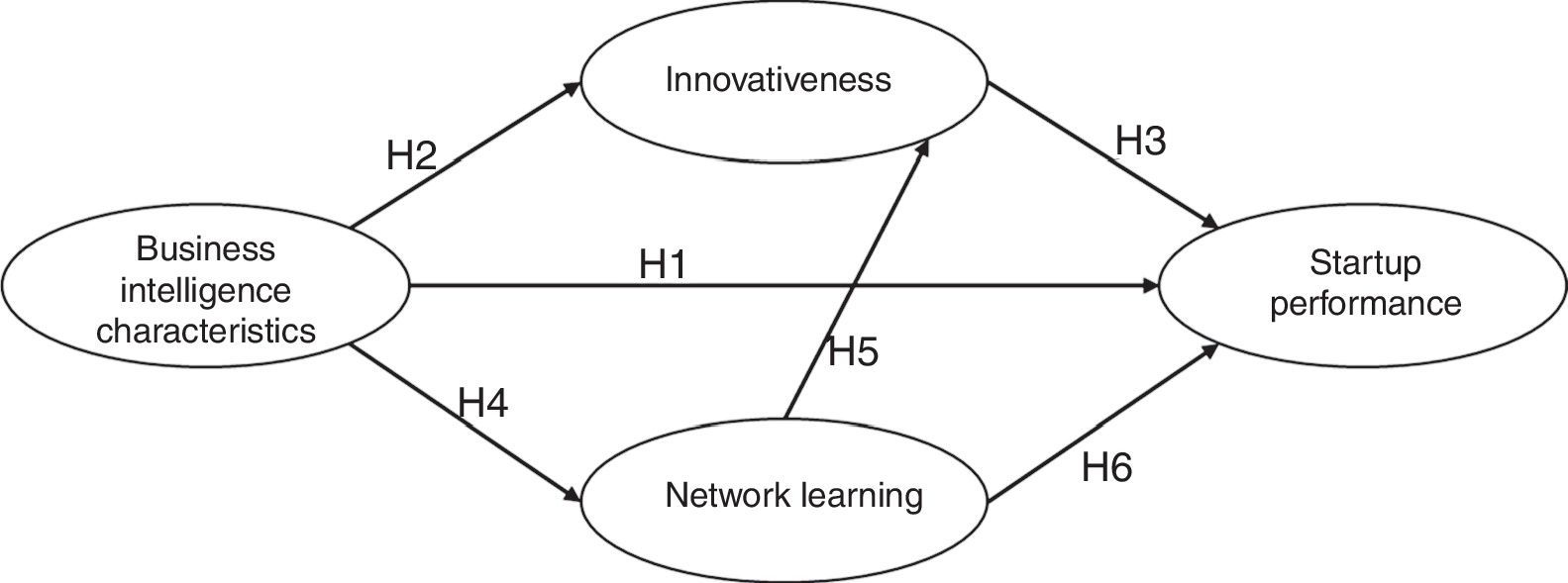

MethodA structural equation model is adopted for analyzing the conceptual model and the research hypotheses proposed for this study as shown in Fig. 1.

SampleThere is no up-to-date list of nascent firms that can be used as a sample basis. To overcome this problem, we contacted several business incubators as a mean to access startups, since they work directly with the population we want to address. The incubators were selected based on references in specialized publications mentioning their successful work and were in different European countries.

A database with a total of 3100 emails was constructed with a list of startups being supported or being fallowed by the incubators services. An individual email was sent, inviting to participate and answer the questions in an online survey, created and managed using the open-source software Limesurvey.

Two follow-up reminders were sent at the third and sixth week after the initial invitation email. A total of 664 responses were obtained. From these, 228 were used because of completion issues. The reply rate was of near 7%. Although the response rate may appear low, it is offset in part by the fact that most of the reviewed papers use samples of similar or lower size.

A higher number of answers were obtained from Portuguese startups (n=143/63%), and the remaining cases were divided between different European countries (n=85/37%).

Most the surveyed firms (80%) have less than 10 employees and 70% of them have less than 4 years operating in the market. The analysis of the results show that the sample operate mostly in services, consulting or software development (web and apps), as expected, since this is the typical profile we find in incubators and this can be seen as a limitation of the sampling approach used.

Variables and measuresThe measures used in this study were based on those used in previous studies on similar topics to ensure their content validity.

The measures of Business Intelligence characteristics were derived from the study by Zahra et al. (2002). It consisted on 16 measurement items grouped in four dimensions: Intra-industry comprehensiveness, interindustry analysis, formality and perceived usefulness. Respondents were asked to provide their perceived rating for the stated items, based on their startup experience and Business Intelligence practices, in a Likert-type scale of five items, ranging from strongly disagree (1) to strongly agree (5). The scale was evaluated for internal consistency using the Cronbach alpha with a value of 0.88.

For measuring innovativeness, a scale of 10 items was used (Ucbasaran, Westhead, & Wright, 2009). The scale was chosen because it takes in to account the full range of innovative activities, is applicable to firms in several industries, and not only the inputs into the innovation process. The value for scale Cronbach alpha is 0.83.

The scale developed by Weerawardena et al. (2014) was used to measure network learning. The scale uses 6 statements, and firms were asked to state their level of agreement in a 5-point Likert scale. The computed Cronbach alpha is 0.80.

Different indicators were used rather than just financial ones because some authors argue that they have limited applicability to the startup reality (Wu et al., 2008). If we take into consideration the nascent life cycle of these firms, financial figures do not necessarily reflect sustained improvements in their competitive performance and, they are hard to obtain and difficult to interpret in the context of new ventures (Stam & Elfring, 2008).

This scale is of multidimensional nature and describes the achievements of firms compared to their competitors. Other studies followed this approach of comparison the firms position with their competitors (Wiklund & Shepherd, 2003, 2011). The firms were asked to evaluate their performance related to the six above mentioned items, in a 5-point Likert scale, ranging from (1) “Much worse than competitors” to (5) “Much better than competitors”. The value of the Cronbach alpha for the scale is 0.76.

The presented variables were tested for normality. Literature presents different reference values that kurtosis (ku) and skewness (sk) measures must respect to assess for normality. We use the conditions that |ku|<2 and |sk|<7. None of the variables violate these limits.

Also, the tests for variance inflation factor (VIF) were calculated. The results show values for VIF<5 with their tolerance values higher that .2, so we can conclude that there are no collinearity problems.

Common method biasWhen self-report questionnaires are used to collect data at the same time from the same participants, a common method variance (CMV) can be a problem. Self-report data can create false correlations if the respondents have a propensity to provide consistent answers to survey questions that are otherwise not related (Chang et al., 2010; Podsakoff et al., 2003).

Since, some of the procedures used in this study can promote the emergence of CMV, we performed a Harman's single factor test and a common latent factor (CLF) analysis (Podsakoff, MacKenzie, & Podsakoff, 2011; Podsakoff et al., 2003).

Following the Harman's test, a single factor cannot explain more that 24% of the variance and there were 4 factors with eigenvalues greater than 1, explaining 65% of the total variance.

The CLF method requires that that all item of the model be restricted to load on a common single factor (Podsakoff et al., 2011) and examines the significance of theoretical constructs with or without the common factor method.

The results from these tests suggest that common method variance is not present and do not hinder the results.

ResultsA previous note regarding the results and the measurement of some constructs. From the indicators retrieved from the literature, we eliminated some from the model given the low load in the respective construct.

The path analysis is employed to test the causal relationship between the research constructs (Chi-square value was 115.32 DF=102 and a p-value of 0.173). The results revealed that the overall disposition of the model-fit indexes are excellent. The results for the common indexes were: GFI=.945, AGFI=.918, RMSEA=.024, NFI=.911 TLI=.985, and CFI=.988.

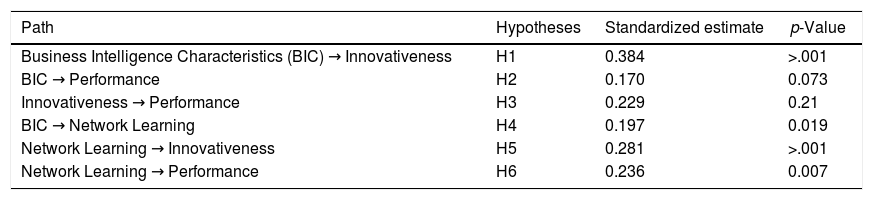

The analytical results support all but the third hypothesis (H3: A positive relationship exists between innovativeness and startup performance), as we can infer from the results shown in Table 1.

SEM path results.

| Path | Hypotheses | Standardized estimate | p-Value |

|---|---|---|---|

| Business Intelligence Characteristics (BIC) → Innovativeness | H1 | 0.384 | >.001 |

| BIC → Performance | H2 | 0.170 | 0.073 |

| Innovativeness → Performance | H3 | 0.229 | 0.21 |

| BIC → Network Learning | H4 | 0.197 | 0.019 |

| Network Learning → Innovativeness | H5 | 0.281 | >.001 |

| Network Learning → Performance | H6 | 0.236 | 0.007 |

These findings reinforce some literature that mentioned the links studied by the supported hypotheses (H1, H2 and H4) that consider the relation between BI and the performance (Prajogo, 2015; Trieu, 2017), innovativeness (Calantone, Garcia, & Dröoge, 2003; Wiklund & Shepherd, 2003) and network learning (Weerawardena et al., 2014), highlighting the importance of that asset as a source of knowledge and information to decision, namely in startups.

In the same perspective, the links between network learning and innovativeness (H5) and performance (H6) are also supported in literature. The increase access to knowledge available in the networks, can help firms to obtain technical and non-technical knowledge that can be mobilized to innovative applications (Husain, Dayan, & Di Benedetto, 2016). But also in their firm performance (Weerawardena et al., 2014).

Given the nature of the sample used, with more Portuguese firms a Chi Square test was used to verify for differences between the full model as presented above, and a model constrained by group (Portuguese and Other EU countries of origin).

The results of Chi-Square difference between models is 16,271 (Df=12). Since the critical Chi-square value for a 95% confidence interval is 21.02, we can assume that both models have no significant differences.

Final considerations, limitations and future directionsBusiness Intelligence is normally a capability that firms develop and explore that can influence the information available. It can be considered an internal organizational variable and as stated in previous literature, it can influence performance. BI can enhance the dimensions of network learning and innovativeness. From this, a positive impact results in better performance behaviors. These effects are supported by the results.

Despite the literature suggesting a positive relationship between innovativeness and performance (Wiklund & Shepherd, 2003), the results show no significant relation. This can be due to the nature of the sample or this relationship is rather indirect. Usually these studies tend to focus on stablished companies, with an established market record that can better access this relation.

Another contribution results from the analysis of BI in startups, addressing a gap in literature (Hoppe, 2015; Trieu, 2017).

As practical implications we highlight the importance that BI characteristics can have in improving the performance of the firm. Business Intelligence tends to focus mostly in technical aspects but is important to note the positive impact in business and organizational dimensions.

We think that, from the findings, practitioners must raise awareness to the impact BI practices and characteristics can have. This topic may be addressed in training and information sessions directed to startups, namely by incubators.

A few remarks can regarding the limitations of this study. One is the sample characteristics namely the representativeness of the different countries of origin of the startups. To try to overcome this limitation, we used only two groups: Portuguese and Other European startups.

Another possible limitation is tied to the fact that we considered the constructs: BI, Innovativeness, network learning and Competitiveness as latent variables measured by the mentioned literature factors. An improvement in the study can be made if we explore the same model but use a multidimensional construct approach instead. This can help understand which factors have impact in the relationships under analysis.

Future research questions not addressed in this paper can include the study of differences among groups of startups (e.g. by country, sector, previous experience or years of existence). Also, to verify the influence of factors external factors such as environmental turbulence or other important concepts in entrepreneurship literature, such as dynamic capabilities or absorptive capacity.