Business Angels (BAs) are pivotal in early-stage funding for entrepreneurship. This study explores the factors influencing BA investment decisions. We propose a theoretical model based on signaling theory to assess the impact of signals about the quality of entrepreneurs and projects on investment assessments and decisions. Using qualitative comparative analysis (QCA) on 88 survey responses from BAs in Spain, we identify the signal combinations influencing both preliminary evaluation and final investment decisions.

Our findings highlight two key insights. First, both entrepreneurial and project-related factors are crucial in assessing opportunities and making investment decisions, with the entrepreneur's personal characteristics, particularly trust, being vital. Second, we examine the varying configurations of evaluation criteria used by BAs at different investment stages, revealing that selection criteria evolve from initial screening to the final decision, challenging the previously believed compensatory decision model.

This article enhances the understanding of investment criteria asymmetry, providing valuable insights for the entrepreneurial ecosystem to close funding rounds effectively and revealing significant heterogeneity in BAs investment strategies, thus confirming the concept of equifinality.

Startups are emerging companies with high growth potential, which is essential for economic growth, innovation, and competitiveness (Kartini & Callista, 2021); moreover, the entrepreneurs who create these startups are recognized as key drivers of economic growth (Botella-Carrubi et al., 2025). To fuel growth and thus transfer innovation, startups need early access to financial capital (Macht & Robinson, 2009; Svetek, 2022; Topaler & Adar, 2023). In the initial stages of development, business angels (BAs) are among the main sources of funding (Kartini & Callista, 2021; Morrissette, 2007). BAs are individuals who invest their own capital in startups and provide mentorship, networking, and business experience without prior family connections, assuming active roles postinvestment (Falcão et al., 2023; Mason et al., 2019; Siefkes et al., 2025).

Despite the importance of BAs in startups' early financing (and, therefore, growth), their investment decision process is not fully understood. It is a complex process that considers multiple factors (Brush et al., 2012; Lavi & Yaniv, 2023; Skalicka et al., 2023; Svetek, 2022; Vazirani & Bhattacharjee, 2021) to estimate the unobservable quality of entrepreneurial projects. This complexity arises because startups often lack any significant track record (Edelman et al., 2021; Topaler & Adar, 2023) and operate under high uncertainty and asymmetric information (Cardon et al., 2017; Huang, 2018).

Under the conditions that characterize the early stages of financing, insiders (entrepreneurs) can use various signals to demonstrate their project's quality to investors (Edelman et al., 2021; Svetek, 2022). When investors trust these signals, they can make an informed assessment of the project, potentially leading to investment (Topaler & Adar, 2023; Wesley II et al., 2022). However, as Ko and McKelvie (2018) noted, few studies have examined how signals work together rather than independently, even though evidence suggests that investors do not evaluate signals in isolation (Huang, 2018; Svetek, 2022). The few configurational analyses that have been carried out on early-stage financing (Edelman et al., 2021; Topaler & Adar, 2023) have focused on the signals issued by the entrepreneur rather than how investors receive and interpret them. This leaves a critical component of the signaling process unexplored: the credibility of the signal (Connelly et al., 2011), which depends on the characteristics of the entrepreneur that influence the level of trust BAs have in the signal issuer. Our paper fills this research gap by identifying the specific combinations of signals received by BAs, considering both project quality and the entrepreneur that lead to a positive evaluation of investment opportunities. Additionally, we explore how these combinations differ from those that lead to a negative evaluation, thus contributing to the literature on the asymmetry of investment criteria (Skalicka et al., 2023).

Furthermore, the second research gap we investigate is the evolution of the specific evaluation criteria the BAs use at different stages of the investment process following the call of Tenca et al. (2019). We find evidence that the selection criteria change between the initial assessment at the screening stage and the final investment decision stage, as posited by a strand of the extant literature (Croce et al., 2017; Granz et al., 2020; Maxwell et al., 2011; Svetek, 2022). However, our results confirm that, rather than using a compensatory decision model that weighs many characteristics as previously believed, BAs use a decision-making heuristic known as elimination by aspects to reduce the number of investment opportunities to a manageable size (Maxwell et al., 2011).

We accomplish this by directly eliciting the views of a sample of 88 Spanish BAs through the analysis of a survey on their investment criteria using qualitative comparative analysis (QCA). This approach is particularly well suited for understanding causal complexity in decision-making processes, as it allows us to analyze how different conditions interact to produce specific outcomes (Ordanini et al., 2014). QCA is ideal for capturing equifinality, asymmetry, and conjunctural causation. These characteristics align naturally with the investment decision-making process of BAs, which is inherently complex and varies across different stages, from initial assessment to divestment (Mason & Botelho, 2018; Svetek, 2022). Given the substantial heterogeneity among BAs –who differ in experience, background, and motivation (Mason & Harrison, 2002; Lahti, 2011)– QCA provides a robust methodological framework to identify multiple configurations of factors that may lead to the same outcome.

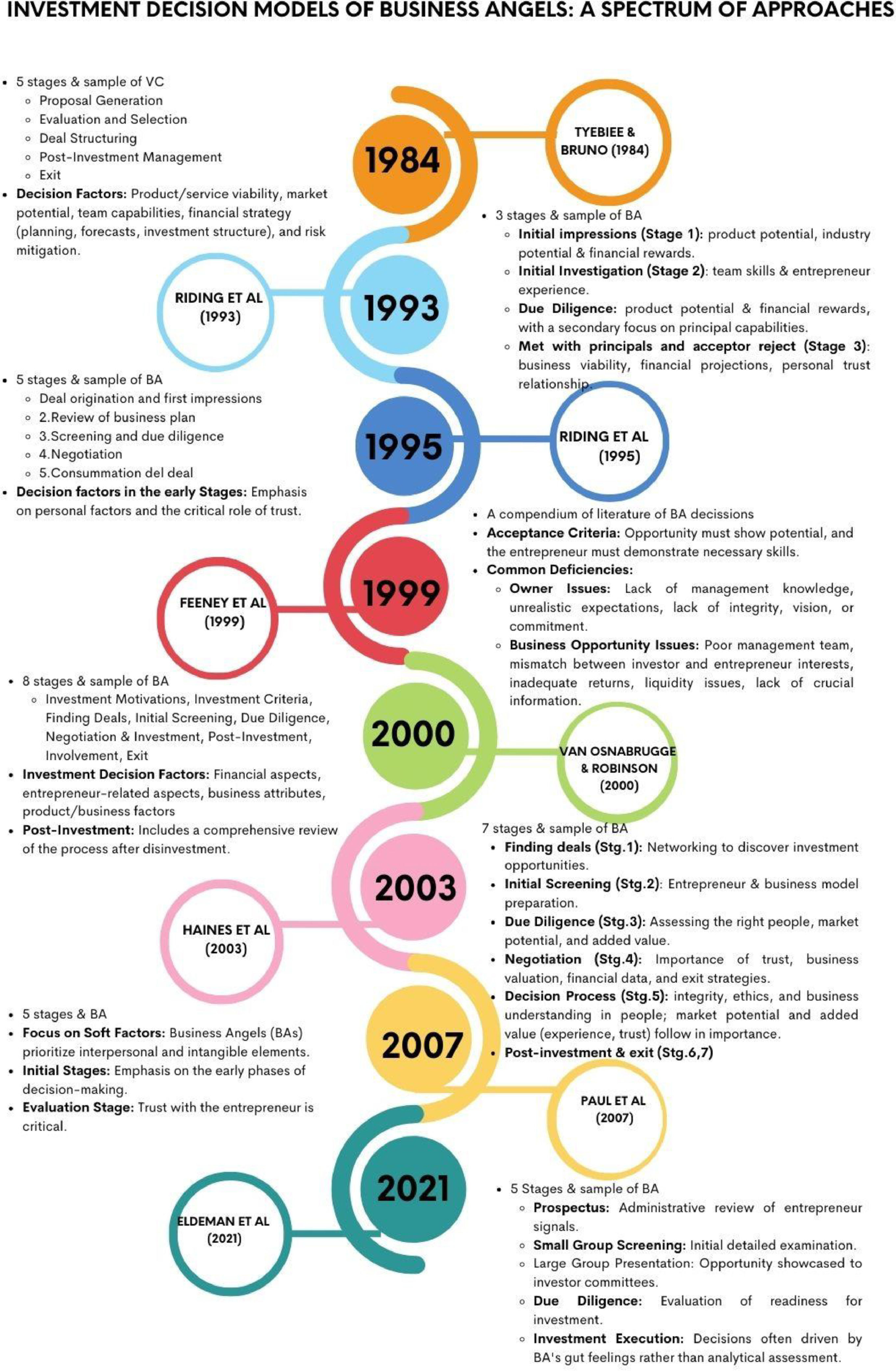

Theoretical backgroundBusiness angel investment decision modelsThe literature agrees that the investment decision-making process for BAs is complex and varies significantly across different stages, from initial assessment to divestment (Mason & Botelho, 2018; Svetek, 2022). Various models have been proposed to understand the early-stage investment decision process, which we have summarized in Fig. 1 and discuss below. For a detailed review, see B.A. White and Dumay (2020) or Ganz et al. (2020). All these models recognize different stages in the decision-making process. As the process progresses, fewer entrepreneurs make it through each stage of the funnel, allowing BAs to gather more information about them and their projects until the final investment decision is made.

Tyebjee and Bruno (1984) developed an investment decision model composed of five phases: proposal generation, evaluation and selection, deal structuring, postinvestment management, and exit. Although initially designed for venture capital (VC) decisions, the model has also been applied to the study of BAs (Feeney et al., 1999; G.H. Haines et al., 2003). Many factors are considered in this model, including product or service viability, market potential, management team capability, financial strategy, and investment structure. The model also looks at the project risks and how to mitigate them.

Next, Riding et al. (1993) proposed a three-phase model for BAs comprising initial impressions, initial research, and postmeeting decisions, where due diligence before final acceptance or rejection is critical. Aspects such as product and industry potential and financial rewards are assessed in the first stage. In the second stage, the most important factors are the entrepreneurial team's skills and experience. Before the final decision is made in the third stage, due diligence is performed, where the aspects that are most highly valued are product potential, financial rewards, and, again, the team's capabilities. Financial rewards are the most important factor in this stage, and a team's skills are the least important. The reason for this weight is that if investors had not already liked the entrepreneur's team, the evaluation would have been negative in earlier phases. Finally, in the third stage, when the project is accepted or rejected, the critical factors are business viability, the realism of projections, and the relationship of trust between the BA and the entrepreneur. Riding et al. (1995) extended the model above, establishing five stages: deal origination and first impressions, review of the business plan, screening and due diligence, negotiation, and, finally, deal consummation. In their study, the importance of the entrepreneurial team increased significantly after the initial evaluation. Moreover, product potential decreases slightly, emphasizing that a lack of confidence explains many project rejections at the final investment stage.

Feeney et al. (1999) reviewed the existing models, emphasizing the asymmetry in the investment decision process, as the factors leading investors to reject an investment are not necessarily the opposite of those that determine acceptance. To accept an investment, private investors require not only that the opportunity shows potential but also that the entrepreneur has the necessary skills. Some of the main deterrents to investment are owner-related issues, such as a lack of management skills, realistic expectations, integrity, vision, or commitment. Other deterrents are related to the business opportunity, including a lack of an appropriate return, fit between the investor's and the entrepreneur's interests, liquidity, or information, among others. Occasional investors are found to place more weight on these aspects.

Subsequently, Van Osnabrugge and Robinson (2000) introduced an eight-stage model that emphasized the critical factors of a project's evaluation prior to investment. The stages of this model are investment motivations, investment criteria, finding details, initial screening based on the investor's typology, execution of the due diligence process, negotiation and determination of the level of control over the investment according to the contractual agreement, postinvestment monitoring (determined by the contractual relationship established at the time of closing the investment), analysis of the exit structure, and analysis of the investment process once the divestment is completed. The novelty of this model lies in recognizing the importance of the factors analyzed by early-stage investors during the investment process, such as their motivations and the criteria applied in the search for opportunities (G.H. White & Dumay, 2020).

G.H. Haines Jr et al. (2003) combined the models of Tyebjee and Bruno (1984) and Van Osnabrugge and Robinson (2000) to propose a seven-stage approach to the BAs' decision-making process, adding three new stages to Tyebjee and Bruno (1984) model: due diligence, negotiation, and decision-making (B.A. White & Dumay, 2020). This approach emphasizes the importance of networks in identifying investment opportunities (first stage). During the initial evaluation, the critical factors are the entrepreneur's preparation and the strength of the business model. The third stage focuses on the suitability of the team, market potential, and ability to add value. Trust plays a vital role in the negotiation stage, impacting the project's valuation, financial data, and exit strategies. Finally, the competence and integrity of the management team are critical in the decision-making phase (fifth stage). However, for a limited number of BAs, the product's market potential is even more crucial.

Amatucci and Sohl (2004) describe a three-stage model from the entrepreneur's perspective rather than the BA's perspective. They also identify that trust is one of the values most appreciated by investors. In addition, they highlight the importance of maintaining open, honest, and direct communication between entrepreneurs and investors, as well as the effective use of networks. Their model has a preinvestment phase that includes the screening process, an investment event resulting from contract negotiation, and a postinvestment phase that addresses future funding rounds.

Paul et al. (2007) proposed a new five-stage model comprised of familiarization (when the BAs learn about new investment opportunities), evaluation (a preliminary screening of proposals), negotiation (when the terms of the potential deal are discussed and agreed upon), active management of the investment by the BAs, and harvesting (when the exit of the investment is planned). This study highlights the importance that BAs attach to soft skills, such as trust and value compatibility, especially in the early stages of the process. In addition, establishing a relationship of trust between the BA and the entrepreneur during the evaluation phase is critical to positive investment decisions. These findings show that, for the BAs, an in-depth knowledge of the entrepreneurial team and a solid relationship with it are as decisive as the financial and strategic aspects of the business.

Finally, Edelman et al. (2021) proposed a model based on signaling theory. The authors analyzed the signals entrepreneurs emit to BAs at each of the five identified stages: prospectus (administrative review), small group screening, large group presentation of the opportunity by the investor in its committees, due diligence, and, finally, investment. At the final investment stage, the authors observed that BAs decide more often on the basis of their feelings than on the basis of the analysis itself, which is very different from how VCs make decisions (Lefebvre et al., 2022). Lefebvre et al. stated “the gut feeling about the entrepreneur and the team is the deal killer of BAs' investment decisions” (2022, 4).

Factors that influence the BA investment decisionAlthough the literature conceptualizes the BA investment decision-making process as a funnel with several stages, there is no widespread agreement on the factors BAs consider when making their decision, their relative weights, or how any of these change at different stages as potential investment opportunities move through the funnel. To identify all potential factors that influence a BA's investment decision, a systematic review was conducted using the Web of Science (WoS) database. The keywords "investment," "decisions," and "Business Angels" were used in the search, yielding 34 research papers published in the last seven years. Of these, thirteen were discarded because they did not match the topic. Four new relevant references were identified while the papers were read, resulting in a total of 25 articles being reviewed. This analysis identified three factors: those influencing the assessment of a project at a stage before final investment, those determining whether the project is funded, and those related to the characteristics and preferences of the BAs themselves.

Ferrati and Muffatto (2021) categorized the criteria used by BAs to evaluate entrepreneurial projects, distinguishing between the characteristics of the management team, the product or service, and the market. Factors such as a lack of honesty and competence of the entrepreneur, product or market characteristics, and problems in financial or business plans are crucial in rejecting investments (Mason et al., 2017). Thus, the attributes of both the project (product, innovation, differentiation, business model) and the entrepreneur are crucial in the early stages of investment assessment (Skalicka et al., 2023). There is no widespread agreement in the literature about the relative weights of these different factors or if they can be substituted for each other. Roh et al. (2022), for example, showed how founders’ experience has differential effects on the contribution of institutional ownership to the success of new international ventures. With respect to BAs, Svetek (2023) discussed how they evaluate entrepreneurs based on their competence (experience) and cooperativity (ability to be trainable and engaged), prioritizing competence over cooperativity, considering that the lack of experience can be compensated for with solid knowledge of the market and training. Moreover, Botelho et al. (2023) highlighted that training programs and entrepreneur motivation can significantly mold project assessment by BAs. Clingingsmith and Shane (2018) showed the importance of effective communication and preparation in investment evaluation while also highlighting the business model's relevance, whereas Sort and Nielsen (2018) demonstrated that using the business model canvas facilitates communication and understanding, leading to a more favorable assessment of the investment opportunity. Therefore, information structuring tools are crucial in the intermediate stages of the investment process, where critical decisions are made (Sort & Nielsen, 2018). Finally, Wessendorf et al. (2020) analyzed the nonfinancial determinants of the valuation of early-stage technology companies and found that entrepreneurship is key to valuing an investment more highly, along with a unique selling proposition, intellectual property, and market growth.

Another set of papers has studied the determinants of the probability of investment by BAs. Altmeier and Fisch (2023) explore the role of psychological attributes. Other factors, such as personal, entrepreneurial, and investment experience, have also been identified as important (Croce et al., 2023; Qin et al., 2022; B.A. White & Dumay, 2020). B.A. White and Dumay (2020) find that trust, the need to contribute, and realistic expectations of entrepreneurs. In addition, social effects have been claimed to compensate for the lack of individual entrepreneurial experience, highlighting the importance of networks and shared expertise in the initial stages of evaluation (Mason et al., 2022; Qin et al., 2022).

Finally, from the BA's perspective, the literature shows that experience moderates the effects of passion and financial motivation on the willingness to take risks (Croce et al., 2020). Similarly, personal judgment and intuition are critical in BA decision-making (Jinyun & Zheng, 2024; Tenca et al., 2019), as are networking (or group support) and economic criteria (Block et al., 2019; Bonini et al., 2018; Mason et al., 2022). However, any model of BA decision-making must consider that BAs are very heterogeneous. Morrissette (2007), for example, classified them as economic (focused on ROI), hedonistic (motivated by the enjoyment of the investment process), or altruistic (interested in social impact).

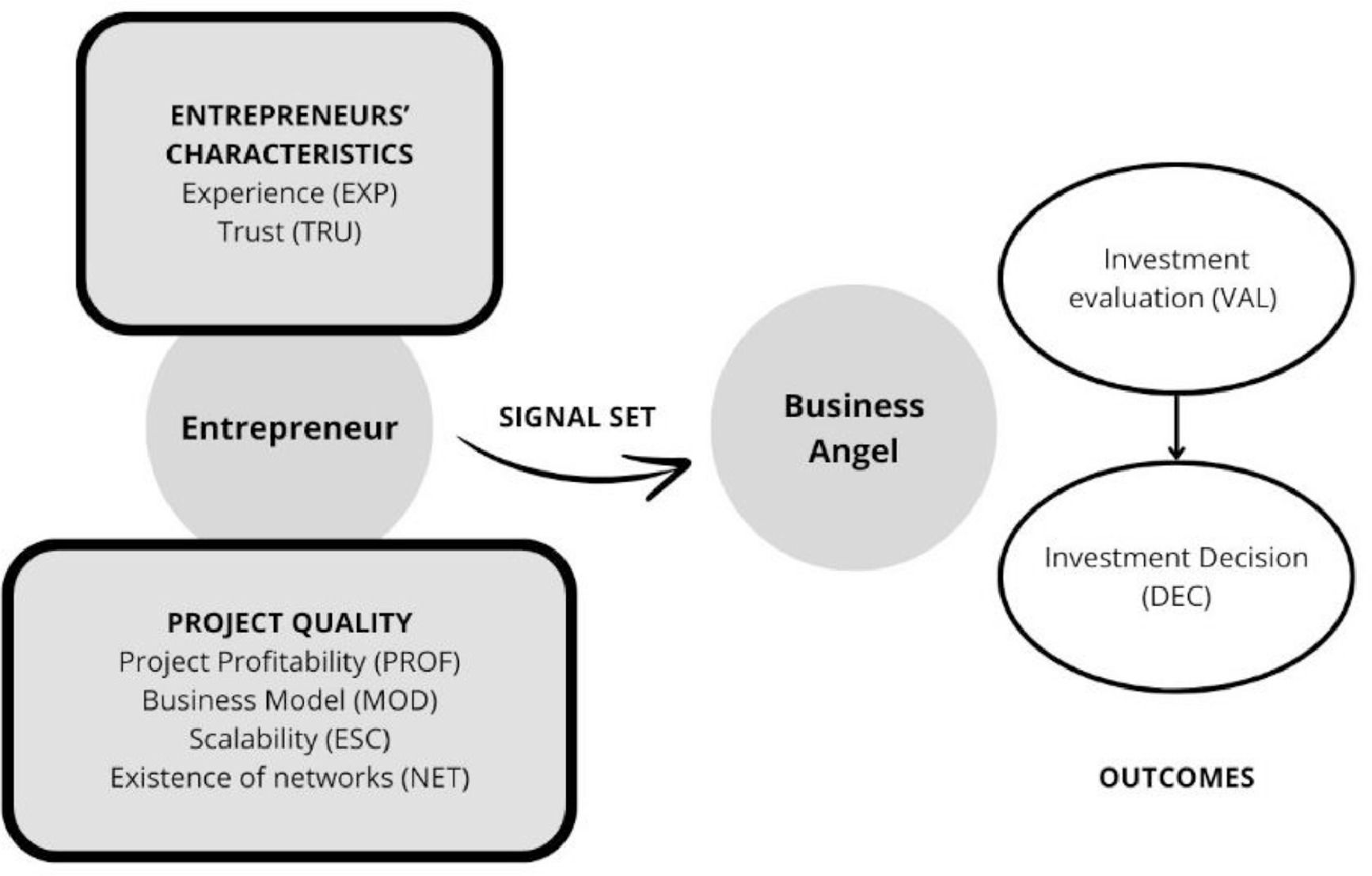

Theoretical model and justification of propositionsTheoretical modelSince BAs' investments are marked by high uncertainty and risk, they require holistic assessment (Skalicka et al., 2023). Following Ferrati and Muffatto (2021), we posit that a comprehensive and effective assessment of investment opportunities includes both the strength and quality of the entrepreneurial team in addition to other critical factors. This study applies a theoretical model to explain the assessment of an investment opportunity by BAs and the ultimate decision to invest, which evaluates the relative importance of BAs' perceptions of the entrepreneur's credibility and the quality of the project.

Our model is based on Huang et al. (2022) and uses signaling theory to explain BAs' investment decision-making. BAs choose which projects to invest in, using their limited resources in an environment where entrepreneurs compete for their attention (Wesley II et al., 2022). This environment leads entrepreneurs to issue signals highlighting the likelihood of success and potential returns of their startups, aiming to persuade investors to invest (Cardon et al., 2017). When investors process these signals, they assign different degrees of credibility on the basis of their perceptions of entrepreneurs and the level of trust between them. Thus, we categorize the factors that influence BAs' decisions into two groups: those related to entrepreneurs and their credibility and those associated with the quality of projects. In the following subsections, we identify the main factors following the extant literature. Fig. 2 shows the model proposed in this study.

Factors linked to the founding team or the entrepreneurAccording to Lavi and Yaniv (2023), the combination of several attributes of entrepreneurs determines investment decisions, highlighting the long-term and interpersonal relationships between BAs and entrepreneurs, in contrast to the more transactional approaches of venture capital investments (Mason & Stark, 2004). In addition to the project's idea, investors in startups value the capabilities of the people behind the company and consider human capital a critical factor for success (Bernstein et al., 2017; Edelman et al., 2021; Huynh, 2016; Vazirani & Bhattacharjee, 2021), which can contribute to its growth potential (Kartini & Callista, 2021; Topaler & Adar, 2023).

We follow the extant literature and identify two critical signals related to the entrepreneurial team: their level of experience (Block et al., 2019; Granz et al., 2020; G.H. Haines Jr et al., 2003; Jeffrey et al., 2016; Ko & McKelvie, 2018; Lavi & Yaniv, 2023; Prohorovs et al., 2019; Riding et al., 1993; Topaler & Adar, 2023) and the trust they generate with investors (Bammens & Collewaert, 2014; Lavi & Yaniv, 2023). BAs look for transparency, honesty, competence, and market knowledge in entrepreneurs. Therefore, a lack of credibility or adequate knowledge of the market or the competition is a critical factor for rejection (Mason et al., 2017). This competence can be ascertained during the pitch, where transmitting credibility is vital to increasing funding probability (de Villiers Scheepers et al., 2021). The empirical specification of our model measured both factors, coding them as EXP and TRU.

Because BAs rely on informal monitoring mechanisms, trust—established through the perception of an entrepreneur's credibility and competence—critically affects investment decisions (Bammens & Collewaert, 2014; Lefebvre et al., 2022; Taylor, 2019). Management skills and the ability of entrepreneurs to inspire trust are highly valued by BAs, even more so than the soundness of the business plan (Bellier & Cheffou, 2020). Moreover, as products and markets are not well established during the early stages of a startup and business are expected to evolve and may even pivot completely, investors heavily weigh the quality of the management team in their investment decisions (Huang & Pearce, 2015). The level of trust from BAs depends on a startup's reputation and position in the ecosystem, and it is greater if the entrepreneur is recommended by credible sources (Paul et al., 2007), such as other entrepreneurs from a trusted ecosystem or other BAs from the same network. Therefore, the absence of trust is critical to rejecting investment (Mason et al., 2017), especially when entrepreneurs lack experience (Skalicka et al., 2023).

There is a relationship between trust and experience. The entrepreneur's previous experience acts as an antecedent to the confidence experienced by BAs (Collewaert & Manigart, 2016; G.H. Haines Jr et al., 2003; Harrison et al., 2015; Lavi & Yaniv, 2023), signaling that the entrepreneur is a trustworthy and potentially successful partner, thus reducing perceived risk and increasing project valuation in the early stages of financing (G.H. Haines Jr et al., 2003; Jeffrey et al., 2016; Ko & McKelvie, 2018; Lavi & Yaniv, 2023). Cardon et al. (2017) show that preparation and commitment by the entrepreneur increase trust, with preparation being more determinant in the final investment decision.

Factors linked to the quality of the projectSkalicka et al. (2023) suggested that certain project characteristics can compensate for the lack of data inherent in startup valuation. The literature has identified critical factors associated with project quality, project profitability (coded in our empirical section as PROF), business model quality (MOD), scalability (SCAL), and networking (NET).

Croce et al. (2017) reported that BAs are prone to rejecting proposals if the expected growth and profitability are low due to information asymmetry between BAs and entrepreneurs, which complicates the analysis of investment viability and profitability. In more advanced stages, after a thorough analysis, BAs tend to reject proposals from companies with poor financial records. Although profitability is not the only factor considered, it plays a crucial role in the later stages of the evaluation process, where financial considerations are decisive (Croce et al., 2017; Granz et al., 2020; Jeffrey et al., 2016; Martínez-Martínez et al., 2022).

Market viability verification is often nonexistent in startups, which introduces uncertainty about the return on investment (Falcão et al., 2023). A credible business plan helps mitigate uncertainty, and it is important both in the preselection stage to capture the interest of BAs (Bellier & Cheffou, 2020) and in the final investment decision (Prohorovs et al., 2019). Investors look for projects with clear and feasible proposals and a sound approach that minimizes business risk (Bellier & Cheffou, 2020; Jeffrey et al., 2016; Prohorovs et al., 2019). Vazirani and Bhattacharjee (2021) also highlight the critical role of the business model and the project's growth potential as essential investment criteria. Mason et al. (2017) indicate that a low-quality business plan—due to poor planning, excessive valuations, or unrealistic expectations—is also a significant reason for BAs' rejection of a project.

Business model scalability is a determining factor in attracting investment (Block et al., 2019). Ko and Mckelvie (2018) indicate that, in the second round of funding, investors place more value on the growth signals associated with scalability and innovation. In this context, the analysis of revenue projection models in the business plan is a valid indicator of investment opportunity (Hsu et al., 2014; Van Osnabrugge, 2000). Furthermore, Croce et al. (2017) show that BAs negatively evaluate businesses in the prescreening phase that lack scalability.

Networks and the identities of previous investors are critical in the evaluation process and increase the chances of success (Jeffrey et al., 2016; Macht & Robinson, 2009). The social validation and risk reduction obtained through collective investment and the support of recognized investors can significantly influence the BA's perception of the quality and viability of the project (Iruarrizaga & Saiz Santos, 2013; Macht & Robinson, 2009). Croce et al. (2017) demonstrated that proposals recommended by the BA network or known VCs are more likely to pass the initial phases, acting as preliminary filters and quality certifiers. Additionally, Iruarrizaga and Saiz Santos (2013) emphasize that establishing networks to connect investors with suitable projects is crucial for investment. From the viewpoint of signaling theory, networks are essential because signals issued by several members of the same group (different BAs from the same network, for example) are perceived as more credible (Claes & Vissa, 2020), leading to more favorable decisions (Wang et al., 2019).

Justification of propositionsFeeney et al. (1999) suggested that private investors require both potential in the opportunity and skills of the entrepreneur to accept an investment. Following our theoretical model based on signaling theory and the literature strands summarized in the sections above, we posit that BAs place weight on the signals they receive on project quality by the credibility of the entrepreneur and, therefore, consider factors related to the quality of the project, such as the viability of the business model and the strength of the proposal (Skalicka et al., 2023; Tenca et al., 2019; Zinecker et al., 2022), and the personal characteristics of the entrepreneur, such as honesty and competence (Mason et al., 2017), in an integrated manner (Topaler & Adar, 2023) when assessing investment opportunities and making their final decision. Thus, we propose the following:

Proposition 1a

The positive evaluation of the investment proposal and the final investment decision are explained by a combination of conditions linked to the entrepreneur and the project.

Proposition 1b

The negative evaluation of the investment proposal and the final decision not to invest are explained by a combination of conditions linked to the entrepreneur and the project.

Furthermore, as proposed in the extant literature discussed in the previous section (for example, Croce et al., 2017; Skalicka et al., 2023), we posit that the criteria used in the initial evaluation of the investment proposal and in the final decision to invest vary. The number of configurations that explain the positive or negative assessment of the investment (VAL) is expected to exceed that of the configurations that explain the final decision (DEC) (Edelman et al., 2021). We interpret this variation as being due to any critical defects identified during the selection phase, allowing the final decision criteria to be minimized or even eliminated (Maxwell et al., 2011). There is no consensus in the extant literature regarding the evolution of the relative importance of conditions related to the project and the entrepreneur. For example, Van Osnabrugge and Robinson (2000) argue that BAs tend to value financial aspects related to profitability less in the initial stages of the funding decision, placing more weight on the entrepreneurial team. However, according to Maxwell et al. (2011), it is crucial to distinguish between the selection stage, where the feasibility of a project is assessed, and the postselection stage, characterized by negotiations that culminate in the final investment decision. Riding et al. (1993) argue that after the initial evaluation, the importance of the entrepreneurial team increases significantly, whereas the product's potential decreases slightly, with a lack of confidence in the team explaining, in large part, the rejections in the investment stage. However, authors such as Brush et al. (2012) state that the measurable aspects of a project are still important in the final phase of the investment decision. Thus, we propose the following:

Proposition 2a

There are differences in the combination of the conditions linked to the entrepreneur and the project to explain the valuation of the investment and the investment decision.

Proposition 2b

There are differences in the combination of the conditions linked to the entrepreneur and the project to explain the negation of the valuation of the investment and the negation of the investment decision.

Materials and methodsMethod of analysisFields such as entrepreneurship and management are characterized by the unpredictability of human behavior, multicausality, and the interaction of multiple variables in shaping outcomes. Given these inherent complexities in the social sciences, QCA has emerged as a particularly suitable methodological approach (Botella-Carrubi et al., 2025). Building on this premise, the present study employs QCA as a technique that enables a deeper understanding of how various conditions interact to produce a particular effect (Ordanini et al., 2014). QCA is particularly well suited for capturing causal complexity through three key principles: equifinality (where different combinations of conditions can lead to the same outcome), asymmetry (where the explanation for the presence of an outcome differs from its negation), and conjunctural causation (where the role of explanatory conditions depends on how they are combined). These dynamics are inherently present in the BAs' investment decision-making process. Additionally, QCA helps identify necessary and sufficient conditions, further enhancing its relevance for analyzing complex social phenomena.

Given that investors make decisions based on their judgments about both the project and the entrepreneur (Jinyun & Zheng, 2024), it is essential to employ an analytical technique that examines the combined impact of these conditions. In this context, QCA offers a powerful methodological approach for capturing complex interactions in decision-making processes.

QCA is grounded in configurational theory, which describes causal complexity using set-theoretic logic (Van Nguyen et al., 2024). In QCA, cases are understood as configurations of attributes (Cabrilo et al., 2024). The use of configurational thinking has emerged as a response to bridge the gap between theories and methods applied in the study of complex organizational phenomena. While many studies rely on symmetric theories to explain the effects of individual factors, complex organizational processes rarely rely on these theories, which view causal conditions not as competing explanations for variation in outcomes but as a single cause. Therefore, there is increasing emphasis on configurational thinking by potential collaborators contributing to these results (Cabrilo et al., 2024; Van Nguyen et al., 2024).

Traditional symmetric methods primarily assess the independent effects of variables, offering a limited understanding of how they interact. In contrast, QCA focuses on the combined effects of multiple conditions (Van Nguyen et al., 2024). One of the key advantages of fsQCA over traditional symmetric approaches is that it allows for the identification of alternative multivariate solutions without imposing an a priori assumption about their nature (Cabrilo et al., 2024).

QCA has been widely applied to explain financing processes, such as how startups communicate their underlying quality (Edelman et al., 2021), the application of signaling theory to project financing (Gómez-Olmedo et al., 2024), and the role of capabilities in securing funding (Topaler & Adar, 2023). Additionally, it has been used to holistically explore the factors that shape financing (Anglin et al., 2023). In the field of crowdfunding, researchers have employed QCA to test signaling theory (Huang et al., 2022) and assess how communication strategies influence funding outcomes (Sendra-Pons et al., 2024). More broadly, QCA has been used to study the effects of institutional environments on innovation performance (Ding, 2022) and entrepreneurial willingness (Huang et al., 2023).

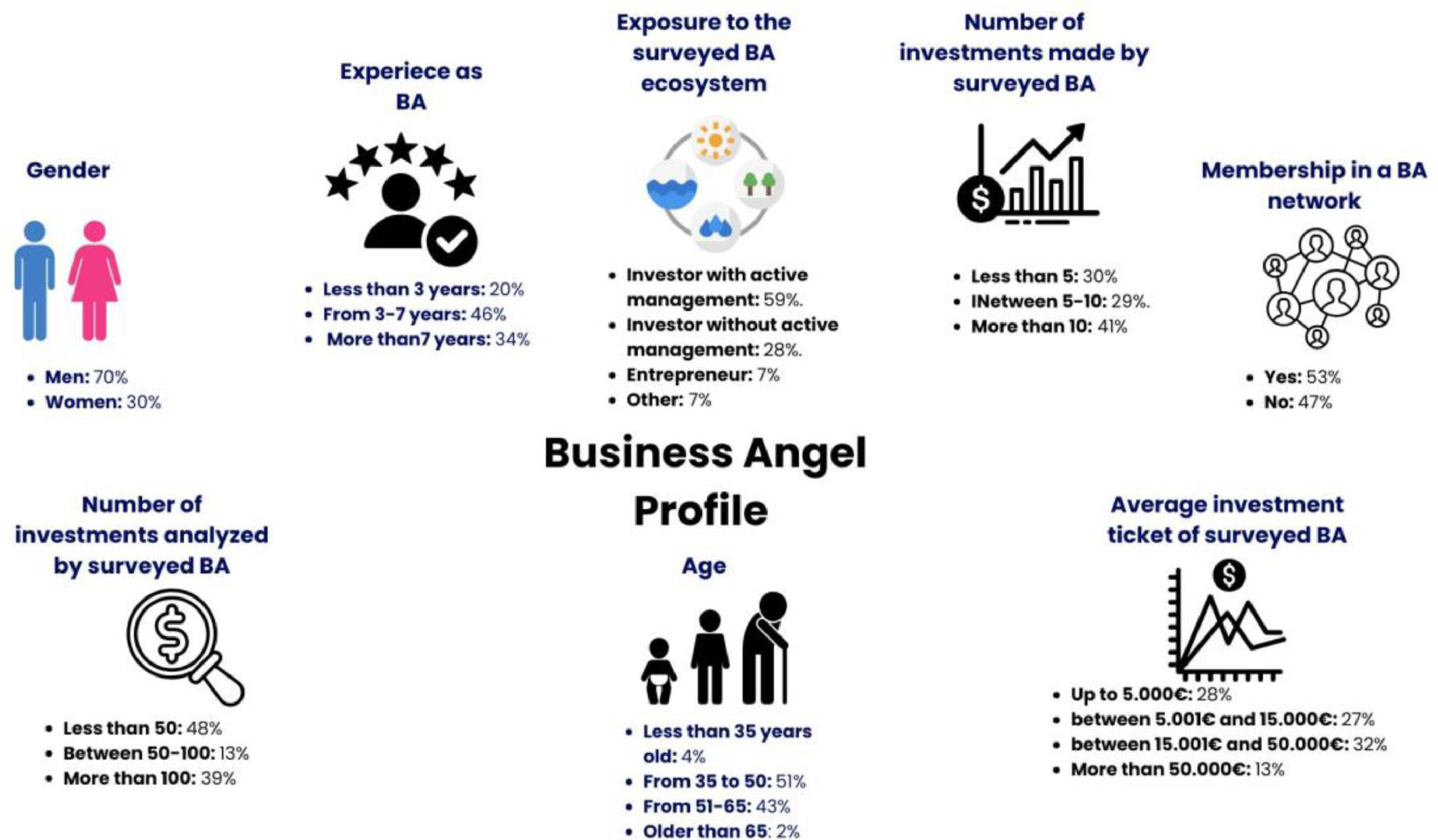

Data collection and samplingA survey was conducted among active BAs in Spain between August 13 and October 3, 2023. A total of 94 responses were collected, a significant number of which considered the secretive nature of BAs, the lack of centralized databases, and their general reluctance to participate in surveys—challenges that have traditionally hindered research in this field (Mason et al., 2016).

After the data were filtered, 88 valid responses were obtained, six of which were incomplete. This represents a response rate of 4.4% of the total BAs in Spain. When analyzing the investment strategies of BAs and venture capitalists (VCs), it is common practice to focus on a single country, given the unique characteristics of each market (i.e., Altmeier & Fisch, 2023; Amoah et al., 2022; Brush et al., 2012; Cardon et al., 2009, 2017; Collewaert & Manigart, 2016; Croce et al., 2017; Edelman et al., 2021). The profile of the BAs in the sample is shown in Fig. 3.

In the context of QCA, the focus is not on statistical representativeness but on case-based knowledge. QCA does not rely on large sample sizes for inferential purposes but rather on identifying configurational patterns within a set of cases. The sample size is therefore not a limitation per se, as long as it provides enough variation to capture different possible configurations leading to investment decisions. While larger samples could add further nuance, increasing the number of cases requires maintaining a deep understanding of each case to preserve the validity of the set-theoretic approach (Ragin, 2017).

In qualitative studies, cases are often selected based on the extent of knowledge available or the ability to develop a deep understanding of them. Furthermore, some cases may be substantially more important than others, meaning that a randomly selected large sample is not necessarily superior to a smaller, high-quality sample where case knowledge is well established (Goertz & Mahoney, 2012).

The survey included general questions on control variables (gender, age, experience as a BA, and exposure to the entrepreneurial ecosystem) as well as specific questions based on validated scales for the entrepreneur (16 items from Renko et al., 2021; Tang et al., 2017) and project quality (10 items from Block et al., 2019). Empirical evidence on the role played by BAs in the venture financing process remains scarce because of the challenges associated with data accessibility (Vega-Pascual et al., 2024).

Outcome conditionsTwo outcome variables were evaluated from responses to the questionnaire described above: (i) the investment decision (DEC), coded as 1 for a favorable decision to invest and 0 for rejections, and (ii) the assessment of the investment opportunity (VAL), coded using a 7-point Likert, where one meant the project did not meet any criteria for investment and seven meant it met all the criteria.

On the basis of the 88 responses obtained from the survey, a principal component analysis was developed to group the questionnaire items derived from validated scales and extract the factors that the model would use to explain the outcome variables. Two components could explain a cumulative 56.90% of the variance in the variables. Tests of the two factors used for the explanatory conditions (Kaiser–Meyer–Olkin measure = 0.866, Bartlett's test of sphericity chi-square=1130.919, gl=171, Sig. <0.001) confirmed the suitability of the data for factor analysis.

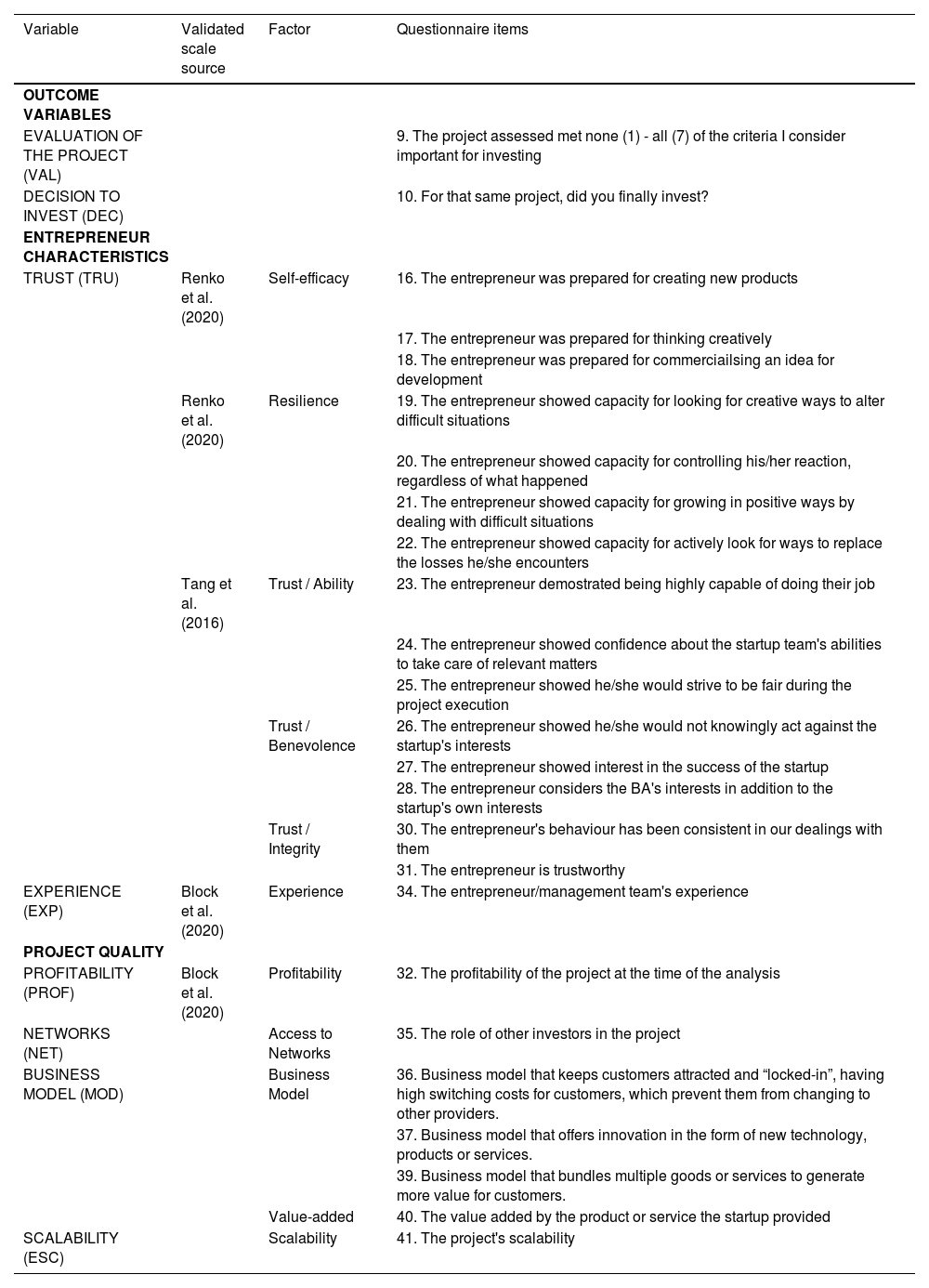

Explanatory conditionsThe explanatory conditions were measured through a 7-point Likert scale to determine how relevant each factor was to the decision. The factors related to the entrepreneur were TRUST, which measures the BA's trust in the entrepreneur through 15 items ranging from the team's perceived efficacy to resilience or integrity, and EXP, which measures the management team's experience. The factors related to the project were MOD, which measures how compelling the project's business model is through 4 items that range from innovativeness to value creation for customers—PROF, the current profitability of the project; ESC, whether the project is scalable; and NET, which measures the relevance of having another investor from the same network in the current or a previous financing round (see Table 1).

Mapping of questionnaire items to factors.

| Variable | Validated scale source | Factor | Questionnaire items |

|---|---|---|---|

| OUTCOME VARIABLES | |||

| EVALUATION OF THE PROJECT (VAL) | 9. The project assessed met none (1) - all (7) of the criteria I consider important for investing | ||

| DECISION TO INVEST (DEC) | 10. For that same project, did you finally invest? | ||

| ENTREPRENEUR CHARACTERISTICS | |||

| TRUST (TRU) | Renko et al. (2020) | Self-efficacy | 16. The entrepreneur was prepared for creating new products |

| 17. The entrepreneur was prepared for thinking creatively | |||

| 18. The entrepreneur was prepared for commerciailsing an idea for development | |||

| Renko et al. (2020) | Resilience | 19. The entrepreneur showed capacity for looking for creative ways to alter difficult situations | |

| 20. The entrepreneur showed capacity for controlling his/her reaction, regardless of what happened | |||

| 21. The entrepreneur showed capacity for growing in positive ways by dealing with difficult situations | |||

| 22. The entrepreneur showed capacity for actively look for ways to replace the losses he/she encounters | |||

| Tang et al. (2016) | Trust / Ability | 23. The entrepreneur demostrated being highly capable of doing their job | |

| 24. The entrepreneur showed confidence about the startup team's abilities to take care of relevant matters | |||

| 25. The entrepreneur showed he/she would strive to be fair during the project execution | |||

| Trust / Benevolence | 26. The entrepreneur showed he/she would not knowingly act against the startup's interests | ||

| 27. The entrepreneur showed interest in the success of the startup | |||

| 28. The entrepreneur considers the BA's interests in addition to the startup's own interests | |||

| Trust / Integrity | 30. The entrepreneur's behaviour has been consistent in our dealings with them | ||

| 31. The entrepreneur is trustworthy | |||

| EXPERIENCE (EXP) | Block et al. (2020) | Experience | 34. The entrepreneur/management team's experience |

| PROJECT QUALITY | |||

| PROFITABILITY (PROF) | Block et al. (2020) | Profitability | 32. The profitability of the project at the time of the analysis |

| NETWORKS (NET) | Access to Networks | 35. The role of other investors in the project | |

| BUSINESS MODEL (MOD) | Business Model | 36. Business model that keeps customers attracted and “locked-in”, having high switching costs for customers, which prevent them from changing to other providers. | |

| 37. Business model that offers innovation in the form of new technology, products or services. | |||

| 39. Business model that bundles multiple goods or services to generate more value for customers. | |||

| Value-added | 40. The value added by the product or service the startup provided | ||

| SCALABILITY (ESC) | Scalability | 41. The project's scalability | |

Source: Own elaboration

Reliability analysis was performed through Cronbach's alpha (Amoah et al., 2022) to ensure the consistency of the identified factors that consisted of more than a single item, exceeding the required thresholds for TRUST (0.940) and MOD (0.756).

ResultsCalibration & skewness checkA QCA analysis was performed using the R software and the SetMethods package. The calibration was carried out as follows. The investment decision (DEC) model was analyzed using crisp-set qualitative comparative analysis (csQCA). For this model, both the conditions and outcomes were dichotomized. For conditions measured through factor loading (TRUST, MOD), values above the mean were used as the point of maximum inclusion, and those below the mean were used as total exclusion. For conditions measured through a Likert scale of 1–7 (EXP, PROF, ESC), the inclusion points are those greater than 4, and the exclusion points are those below or equal to 4. The model for evaluating an investment opportunity (VAL) was analyzed using fuzzy set qualitative comparative analysis (fsQCA). For conditions measured through factor loadings, the 95th, 5th, and 50th percentiles were used as points of total inclusion, total exclusion, and maximum ambiguity, respectively. For conditions measured using a Likert scale of 1–7, values of 6, 4, and 2 were used as points of total inclusion, maximum ambiguity, and total exclusion, respectively.

Most of the variables analyzed pass the asymmetry check, with values of EXP=76.14, TRU=65.91, NET=61.36, PROF=52.27, MOD=60.23, and DEC=55.68 and VAL=62.5. However, the value of 82.95 for the ESC condition, exceeding 80%, indicated asymmetry. This has been considered in the discussion of results, reflecting its potential impact on the overall analysis and interpretations.

Necessary conditionsFirst, an analysis of the atomic necessary conditions for both the decision to invest (DEC) or not to invest (∼DEC) and the positive evaluation of the investment opportunity (VAL) or the lack of it (∼VAL) was performed.

For the BAs to decide to invest (DEC), trust (TRU) is necessary (Cons.Nec=0.918; Cov.Nec=0.776; RoN=0.698). No necessary conditions were identified for the decision not to invest (∼DEC). In addition, no super subsets exceeded the established thresholds (incl=0.9 and RoN=0.6). For the positive evaluation of the investment opportunity or lack thereof (VAL/∼VAL), no necessary conditions were discovered. This finding underscores a significant difference between the valuation and decision processes. While trust is necessary for a positive investment decision, it is not necessary for a negative investment decision.

Sufficient solutions for dec and VALEnhanced standard analysis was performed to identify the sufficient conditions that explain DEC/∼DEC and VAL/∼VAL. This analysis was performed carefully to avoid contradictory simplifying assumptions (CSAs), which arise when the same logical remainder row is used in the minimization of both the presence and nonoccurrence of an outcome. Additionally, trust (TRU) is considered a necessary condition for the decision to invest (DEC).

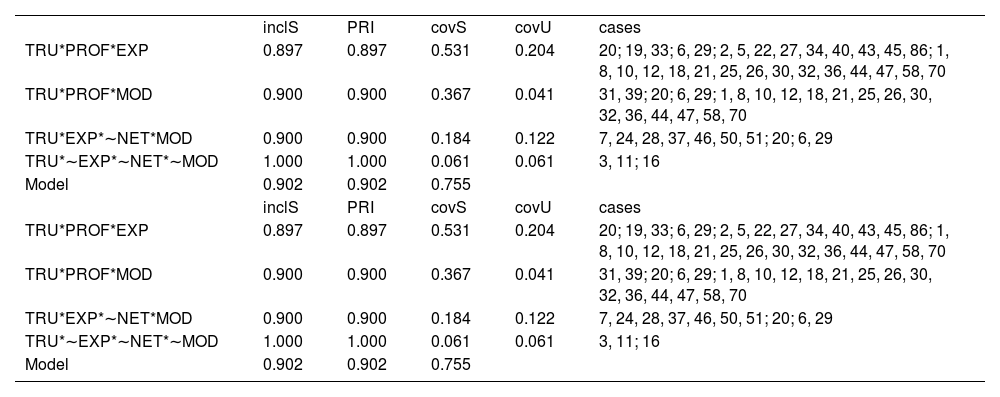

The enhanced parsimonious solution for the decision to invest (DEC) can be explained through four configurations: EXP*TRU*PROF + TRU*PROF*MOD + ∼EXP*TRU*∼NET*∼MOD + EXP*TRU*∼NET*MOD -> DEC (see Table 2).

Enhanced parsimonious solution for the decision to invest (DEC).

| inclS | PRI | covS | covU | cases | |

| TRU*PROF*EXP | 0.897 | 0.897 | 0.531 | 0.204 | 20; 19, 33; 6, 29; 2, 5, 22, 27, 34, 40, 43, 45, 86; 1, 8, 10, 12, 18, 21, 25, 26, 30, 32, 36, 44, 47, 58, 70 |

| TRU*PROF*MOD | 0.900 | 0.900 | 0.367 | 0.041 | 31, 39; 20; 6, 29; 1, 8, 10, 12, 18, 21, 25, 26, 30, 32, 36, 44, 47, 58, 70 |

| TRU*EXP*∼NET*MOD | 0.900 | 0.900 | 0.184 | 0.122 | 7, 24, 28, 37, 46, 50, 51; 20; 6, 29 |

| TRU*∼EXP*∼NET*∼MOD | 1.000 | 1.000 | 0.061 | 0.061 | 3, 11; 16 |

| Model | 0.902 | 0.902 | 0.755 | ||

| inclS | PRI | covS | covU | cases | |

| TRU*PROF*EXP | 0.897 | 0.897 | 0.531 | 0.204 | 20; 19, 33; 6, 29; 2, 5, 22, 27, 34, 40, 43, 45, 86; 1, 8, 10, 12, 18, 21, 25, 26, 30, 32, 36, 44, 47, 58, 70 |

| TRU*PROF*MOD | 0.900 | 0.900 | 0.367 | 0.041 | 31, 39; 20; 6, 29; 1, 8, 10, 12, 18, 21, 25, 26, 30, 32, 36, 44, 47, 58, 70 |

| TRU*EXP*∼NET*MOD | 0.900 | 0.900 | 0.184 | 0.122 | 7, 24, 28, 37, 46, 50, 51; 20; 6, 29 |

| TRU*∼EXP*∼NET*∼MOD | 1.000 | 1.000 | 0.061 | 0.061 | 3, 11; 16 |

| Model | 0.902 | 0.902 | 0.755 |

Source: Own elaboration

As shown in Table 2, the parameters of the inclusion score (InclS)-0.902, proportional reduction in inconsistency (PRI)-0.902, and solution coverage (covS)- 0.755 are high.

This solution indicates that personal variables are crucial in the investment decision, appearing in all configurations. Trust (TRU) is a necessary variable present in all terms of the solution (Croce et al., 2017; Granz et al., 2020; Lefebvre et al., 2022). Trust is not, however, a sufficient condition. It must be combined with personal conditions and those signaling project quality to yield favorable investment decisions.

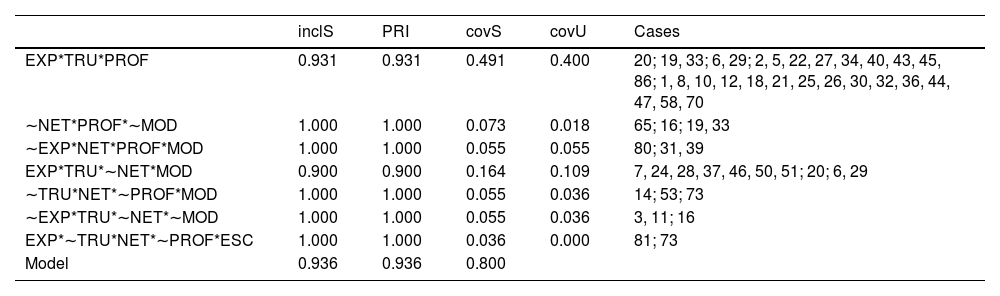

The enhanced parsimonious solution for the decision to positively evaluate an investment opportunity (VAL) is explained by seven configurations: EXP*TRU*PROF + ∼NET*PROF*∼MOD + ∼EXP*NET*PROF*MOD + EXP*TRU*∼NET*MOD + ∼TRU*NET*∼PROF*MOD + (∼EXP*TRU*∼NET*∼MOD + EXP*∼TRU*NET*∼PROF*ESC) -> VAL (Table 3).

Enhanced parsimonious solution for the positive evaluation of an opportunity (VAL).

| inclS | PRI | covS | covU | Cases | |

|---|---|---|---|---|---|

| EXP*TRU*PROF | 0.931 | 0.931 | 0.491 | 0.400 | 20; 19, 33; 6, 29; 2, 5, 22, 27, 34, 40, 43, 45, 86; 1, 8, 10, 12, 18, 21, 25, 26, 30, 32, 36, 44, 47, 58, 70 |

| ∼NET*PROF*∼MOD | 1.000 | 1.000 | 0.073 | 0.018 | 65; 16; 19, 33 |

| ∼EXP*NET*PROF*MOD | 1.000 | 1.000 | 0.055 | 0.055 | 80; 31, 39 |

| EXP*TRU*∼NET*MOD | 0.900 | 0.900 | 0.164 | 0.109 | 7, 24, 28, 37, 46, 50, 51; 20; 6, 29 |

| ∼TRU*NET*∼PROF*MOD | 1.000 | 1.000 | 0.055 | 0.036 | 14; 53; 73 |

| ∼EXP*TRU*∼NET*∼MOD | 1.000 | 1.000 | 0.055 | 0.036 | 3, 11; 16 |

| EXP*∼TRU*NET*∼PROF*ESC | 1.000 | 1.000 | 0.036 | 0.000 | 81; 73 |

| Model | 0.936 | 0.936 | 0.800 |

Source: Own elaboration

This analysis reveals notable differences between the determinants of the decision to invest (DEC in Table 2) and the positive evaluation of an investment opportunity (VAL in Table 3), with the number of variables involved in the first decision being much lower, as the scrutiny has already taken place in the previous phase, as Edelman et al. (2021) showed.

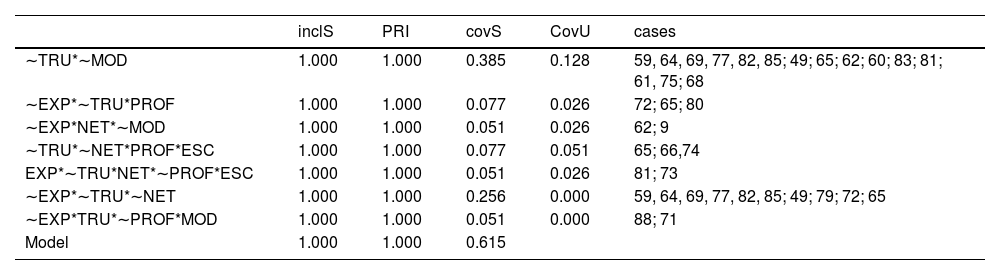

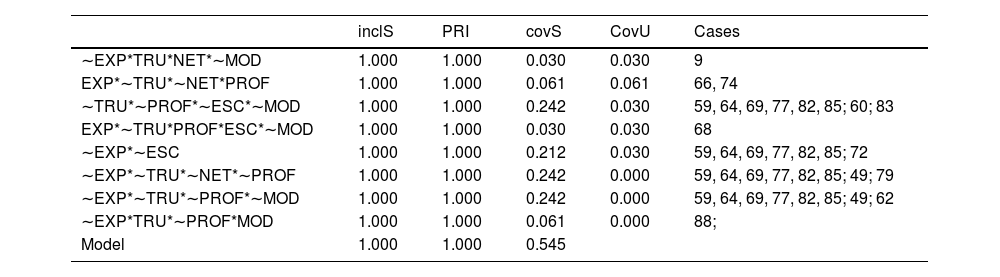

Sufficient solutions for ∼DEC and ∼VALThe enhanced parsimonious solution for the decision not to invest (∼DEC) is ∼TRU*∼MOD + ∼EXP*∼TRU*PROF + ∼EXP*NET*∼MOD + ∼TRU*∼NET*PROF*ESC + EXP*∼TRU*NET*∼PROF*ESC + (∼EXP*∼TRU*∼NET + ∼EXP*TRU*∼PROF*MOD) -> ∼DEC (Table 4), and for ∼VAL, it is: ∼EXP*TRU*NET*∼MOD + EXP*∼TRU*∼NET*PROF + ∼TRU*∼PROF*∼ESC*∼MOD + EXP*∼TRU*PROF*ESC*∼MOD + (∼EXP*∼ESC + ∼EXP*∼TRU*∼NET*∼PROF +∼EXP*∼TRU*∼PROF*∼MOD + ∼EXP*TRU*∼PROF*MOD) -> ∼VAL (see Table 5).

Enhanced parsimonious solution for the negation of the decision to invest (∼DEC).

| inclS | PRI | covS | CovU | cases | |

|---|---|---|---|---|---|

| ∼TRU*∼MOD | 1.000 | 1.000 | 0.385 | 0.128 | 59, 64, 69, 77, 82, 85; 49; 65; 62; 60; 83; 81; 61, 75; 68 |

| ∼EXP*∼TRU*PROF | 1.000 | 1.000 | 0.077 | 0.026 | 72; 65; 80 |

| ∼EXP*NET*∼MOD | 1.000 | 1.000 | 0.051 | 0.026 | 62; 9 |

| ∼TRU*∼NET*PROF*ESC | 1.000 | 1.000 | 0.077 | 0.051 | 65; 66,74 |

| EXP*∼TRU*NET*∼PROF*ESC | 1.000 | 1.000 | 0.051 | 0.026 | 81; 73 |

| ∼EXP*∼TRU*∼NET | 1.000 | 1.000 | 0.256 | 0.000 | 59, 64, 69, 77, 82, 85; 49; 79; 72; 65 |

| ∼EXP*TRU*∼PROF*MOD | 1.000 | 1.000 | 0.051 | 0.000 | 88; 71 |

| Model | 1.000 | 1.000 | 0.615 |

Source: Own elaboration

Enhanced parsimonious solution for the for the negation of a positive evaluation (∼VAL).

| inclS | PRI | covS | CovU | Cases | |

|---|---|---|---|---|---|

| ∼EXP*TRU*NET*∼MOD | 1.000 | 1.000 | 0.030 | 0.030 | 9 |

| EXP*∼TRU*∼NET*PROF | 1.000 | 1.000 | 0.061 | 0.061 | 66, 74 |

| ∼TRU*∼PROF*∼ESC*∼MOD | 1.000 | 1.000 | 0.242 | 0.030 | 59, 64, 69, 77, 82, 85; 60; 83 |

| EXP*∼TRU*PROF*ESC*∼MOD | 1.000 | 1.000 | 0.030 | 0.030 | 68 |

| ∼EXP*∼ESC | 1.000 | 1.000 | 0.212 | 0.030 | 59, 64, 69, 77, 82, 85; 72 |

| ∼EXP*∼TRU*∼NET*∼PROF | 1.000 | 1.000 | 0.242 | 0.000 | 59, 64, 69, 77, 82, 85; 49; 79 |

| ∼EXP*∼TRU*∼PROF*∼MOD | 1.000 | 1.000 | 0.242 | 0.000 | 59, 64, 69, 77, 82, 85; 49; 62 |

| ∼EXP*TRU*∼PROF*MOD | 1.000 | 1.000 | 0.061 | 0.000 | 88; |

| Model | 1.000 | 1.000 | 0.545 |

Source: Own elaboration

The first thing to note is the unfavorable outcomes—the decision not to invest (∼DEC) and the nonpositive evaluation of the opportunity (∼VAL)—are influenced by more factors than the favorable outcomes are.

The absence of a positive evaluation of the investment opportunity is driven by eight configurations (see Table 5).

The results shown in Table 5 confirm Maxwell et al.’s (2011) ‘fatal flaw’ theory. BAs reject an investment opportunity if they find a single significant negative aspect. This is true in our case, even when the fatal flaw is present together with positive factors such as trust and networks (in the first case); experience of the entrepreneur and profitability of the project (in the second); experience, profitability, and scalability of the project (in the third case); or trust and a compelling business model (eighth case).

DiscussionDiscussion of the results for propositions 1a and 2aWe can accept proposition 1a given the four configurations that account for the investment decision (DEC) and the seven that explain the investment evaluation (VAL). The conditions linked to the entrepreneur and the project are combined to both assess the proposal and make the final decision, as shown in Tables 2 and 3.

The configurations that lead to the decision to invest can be summarized in two broad paths. The first, TRU*PROF*(EXP+MOD), results in investment if BAs trust the team and the project is profitable, aligning with findings by Lefebvre et al. (2022), Brush et al. (2012), and Croce et al. (2017). To accept the investment, either the entrepreneurs' expertise, as noted by Mason et al. (2017), or a robust business model (Martínez-Martínez et al., 2022) may be needed, depending on the type of BA.

The second configuration, TRU*∼NET*(∼EXP*∼MOD+EXP*MOD), shows that some BAs base their decisions exclusively on trust, without the need to assess the quality of the project (relationships and business model) or the experience of the entrepreneur. These BAs may be driven by hedonistic concerns and focus less on economic potential (Morrissette, 2007; Van Osnabrugge, 2000). Among the respondents who presented this configuration, two BAs had between 5 and 10 years of experience, with average investment tickets ranging from €15,000–50,000, whereas one BA had one year of experience, with an average ticket ranging from €5000–15,000. More experienced BAs may require only personal aspects in the final decision-making process, as their experience allows them to focus on their intuition rather than on financial data (Harrison et al., 2015; Jinyun and Zheng, 2024), whereas less experienced BAs may have lower risk aversion and a lower average ticket, leading them to risk more. Granz et al. (2020) noted that BAs face more significant information asymmetries concerning the quality of the entrepreneurial team rather than the market. Thus, many BAs rely more on personal factors when making investment decisions.

Our results also confirm Proposition 2a. The positive evaluation of an investment opportunity (VAL) can be reached through more configurations (seven) than the final decision to invest (four), as indicated by Edelman et al. (2021) and Brush et al. (2012).

In the evaluation phase (VAL), the importance of networking is accentuated, appearing in three of the seven configurations (∼EXP*NET*PROF*MOD; ∼TRU*NET*∼PROF*MOD; EXP*∼TRU*NET*∼PROF*ESC). This finding supports Croce et al. (2017), who highlight that proposals submitted through trusted contacts are more likely to move forward, as networks act as a preliminary filter. In addition, two of these three configurations show that a solid business model is crucial for a positive assessment. This result aligns with Wallnöfer and Hacklin (2013), who highlight the importance of the business model to assess the competence, reliability, and openness of the team and justify the absence of the confidence variable in the ∼TRU*NET*∼PROF*MOD configuration. Thus, the presence of networks can be considered a substitute for trust since the confidence of BAs increases when entrepreneurs are recommended by credible sources (Macht & Robinson, 2009; Van Osnabrugge, 2000). While trust is necessary for the final investment decision (but not sufficient), in previous stages, it can be replaced by confidence transmitted through networks (Macht & Robinson, 2009).

Additionally, while there is a configuration leading to a favorable decision to invest that only requires personal conditions, there are three configurations that lead to a positive evaluation of the project based exclusively on its quality (∼NET*PROF*∼MOD), (∼EXP*NET*PROF*MOD), and (∼TRU*NET*∼PROF*MOD). The existence of these configurations contradicts previous studies that show that BAs combine factors related to the entrepreneur and project quality when making their decisions (Cardon et al., 2009; Huang & Pearce, 2015) and others that show that personal variables play a more relevant role in the investment valuation process (Feeney et al., 1999; G.H. Haines Jr et al., 2003; Paul et al., 2007; Van Osnabrugge, 2000).

The profit-only configuration contradicts Block et al. (2019) and Croce et al. (2017), who indicate that profitability is less important because the immaturity of startups and BAs prioritizes personal factors in the initial stages. Possible explanations for this configuration may be the BA's lack of experience, an especially uncertain project, or a higher-than-average ticket, all of which lead to a stronger reliance on quantitative criteria (Harrison et al., 2015). In our study, in the four cases (65, 16, 19, 33) with this configuration, the BA are men between 42 and 47. One BA has a single year of experience, which is one of the possible reasons behind this configuration. Two BAs have ten years of experience and ticket over €50,000, which could again explain the importance of the project's quality.

In the other two configurations, the BAs, which we call economic, focus on the network of contacts and the business model, with or without profitability. For these BAs (80, 31, 39, and 14, 53, 73), the fact that the opportunity came from their network gives them the confidence to assess the investment positively, in line with Croce et al. (2017), who highlight that proposals submitted through reliable contact channels are more likely to advance beyond the initial assessment. However, the network must be complemented by a quality business model showing profitability, especially for less experienced BAs who need more robust data, women, who are more conservative (Morrissette, 2007), or those with a higher-than-average ticket.

In our sample, the BAs for the first configuration are a woman with one year of experience and two men with eight years of experience who invest more than €50,000, thus possibly requiring more economic data. Additionally, as these are more generalist BAs that invest in markets that they do not know well, they may require stronger financial arguments to decide. Finally, the BAs in the last configuration include two men and one woman. The woman had a single year of experience. The 49-year-old man had been a BA for only two years and was a generalist investor, which may explain the focus on quantifiable characteristics. Finally, the 40-year-old man had ten years of experience, but in these ten years, he had made only five investments, with an average ticket of between €5000 and 15,000, so he was not a very active investor and was likely risk averse. These results align with those of Brush et al. (2012) and Maxwell et al. (2011).

Two configurations (EXP*TRU*PROF) and (EXP*TRU*∼NET*MOD) explain a project's positive evaluation and the final decision to invest by 29 and 10 BAs, respectively. Both reflect that personal variables and project quality are essential throughout the investment process (Skalicka et al., 2023). BAs focus on profitability in the first configuration, and in the second, they focus on the business model. This may be because 23 of the BAs are men, 48% of whom have an average ticket of more than €50,000, thus requiring more detailed economic data, especially in the final stages of the process. The six BAs in this configuration are women, who tend to have a lower average ticket, probably due to greater risk aversion. In the second configuration, where the business model is valued higher, all BAs are men except for one woman. Cases 6 and 20 (men) and 29 (woman) are repeated, indicating that profitability and the business model are essential for these three BAs. The other seven cases are men, with an average ticket of between €15,000 and €50,000 in most cases (6 cases). In 2 cases, tickets averaged up to €5000; in the final 2 cases, tickets were over €50,000. The BAs in question have 10 (case 50) and 18 years (case 37) of experience in these two cases.

Finally, two BAs (81 and 73) highlight the importance of the scalability of the startup's business model together with either entrepreneur experience or a network of contacts, in line with Brush et al. (2012) and Maxwell et al. (2011).

Our results confirm that BAs use a decision-making heuristic known as elimination to reduce the number of investment opportunities to a manageable size (Maxwell et al., 2011), contradicting the previous belief that BAs use a compensatory decision model that weighs many characteristics to reach a decision.

Discussion of the results for propositions 1b and 2bThe first thing to note is the decision not to invest (∼DEC) and the nonpositive evaluation of the investment opportunity (∼VAL) are explained by more configurations involving more factors than the explanations of their opposite DEC and VAL. This result is in line with Mason and Harrison (1996), who show that the factors for rejection are usually broader than the factors for acceptance. Another finding is that the configurations that explain a favorable result are not the opposite of those that explain an unfavorable result, in line with Feeney et al. (1999).

Proposition 1b is accepted since the conditions linked to the entrepreneur and the project are combined to explain the absence of a positive evaluation of the project (∼VAL) and the decision not to invest (∼DEC) (see Tables 4 and 5). Similarly, proposition 2b is accepted since the combination of factors that explain ∼DEC differs from the one that explains ∼VAL.

Mason et al. (2017) showed that factors associated with the entrepreneur, such as lack of honesty, openness, and market and product knowledge, were the most important in rejecting investment (∼DEC). These results are consistent with our empirical findings where in all configurations (seven), the absence of positive factors associated with the entrepreneur leads to the decision not to invest. In five of the seven configurations leading to rejecting the investment (∼DEC), lack of trust is decisive, in line with the extant literature (Lavi & Yaniv, 2023; B.A. White & Dumay, 2020). In addition, in four of the seven configurations, the entrepreneur's lack of experience also leads to rejection, as shown in Harrison et al. (2015) and Ko and McKelvie (2018).

Seven configurations explain the decision not to invest (∼DEC). The first (∼TRU*∼MOD) states that a lack of trust and a compelling business model are critical, in line with Mason et al. (2017) and Wallnöfer and Hacklin (2013). The second and sixth configurations can be summarized as follows: ∼EXP*∼TRU*(PROF+∼NET), where personal factors determine noninvestment, even if the project is profitable, in the first case. Granz et al. (2020) suggested that, in the final stages of decision-making, the lack of personal factors is more determinant than the number of quantifiable factors, which could explain this result. In the second case, the absence of personal factors is compounded by the lack of network connections. This result aligns with studies such as Macht and Robinson (2009), which state that lacking a network can result in a lower likelihood of investment.

In the third configuration (∼EXP*NET*∼MOD), the absence of a compelling business model and an inexperienced entrepreneur leads to noninvestment despite the opportunity coming from the BA's network, suggesting that although the network can be crucial in early stages (G.H. Haines Jr et al., 2003), as we have seen in Table 3, in later stages, the experience of the entrepreneur and a solid model can also configure a relevant pathway to convey confidence to BAs (Brush et al., 2012).

The fourth configuration (∼TRU*∼NET*PROF*ESC) presents a situation leading to noninvestment despite the scalability and profitability of the project because of a lack of trust and no network that could compensate. The three BAs that reported this configuration (65, 66, 74) have substantial experience. This result is in line with those of Huang (2018) and Harrison et al. (2015), who argue that experienced investors rely heavily on their "intuition," and with those of Macht and Robinson (2009), who establish the relevance of the network in the investment decision.

In the fifth configuration (EXP*∼TRU*NET*∼PROF*ESC), the lack of trust and profitability prevents the investment of two BAs (73,81), despite the scalability of the project, the fact that it came through the network and that the entrepreneur has experience. This finding is consistent with the importance of trust in the investment decision reported by Lefebvre et al. (2022), and it could be explained by a lack of experience that made the BA more reliant on quantifiable data. In our sample, one of the BAs who reported this configuration had one year of experience, and the other had more than nine but had not invested since 2013, which could explain a behavior similar to that of a less experienced BA.

Finally, the seventh configuration (∼EXP*TRU*∼PROF*MOD) derives the absence of investment from a lack of profitability and experience despite the project's compelling business model and the BA trusting the entrepreneur. This configuration underscores how critical experience is (Edelman et al., 2021). Although early-stage BAs tend to place less importance on financial and profitability aspects, these aspects are necessary at later stages. In fact, Croce et al. (2017) established that economic results are more important for certain BAs in the later stages of investment processes. Less experienced BAs lack the representativeness and availability heuristics (Harrison et al., 2015) of those with a longer track record who have confronted many instances when personal attributes have demonstrated more relevant than economic attributes (G.H. Haines Jr et al., 2003; Riding et al., 1993). For these less experienced BAs, quantitative data prevail over project-quality data.

Table 5 shows that the lack of a positive evaluation of the investment opportunity (∼VAL) is determined by the absence of a more extensive combination of factors related to both entrepreneurs and the quality of the project compared with the lack of investment (∼DEC). A negative assessment can be caused, in part, by the perceived lack of skills on the part of entrepreneurs (Svetek, 2023). In five of the eight configurations that explain ∼VAL, the absence of trust is decisive, combined with other factors. Trust is essential in the decision-making of BAs to alleviate the information asymmetry inherent in early-stage investment, as indicated by Riding et al. (1993), who reported that 80% of rejections by BAs were due to a lack of confidence in the team's abilities.

In addition, the absence of a solid business model is critical to an unfavorable assessment, as seen in four of the eight configurations (∼EXP*TRU*NET*∼MOD; ∼TRU*∼PROF*∼ESC*∼MOD; EXP*∼TRU*PROF*ESC*∼MOD; ∼EXP*∼TRU*∼PROF*∼MOD). In the first configuration, if the experience of the entrepreneurial team and the business model are not solid, the investment is rejected despite the presence of trust and the support of the network. This result aligns with those of Riding et al. (1993) and Vazirani and Bhattacharjee (2021). Analyzing case 9, we see that owing to the number of investments made by this BA (five) and his age (50 years), despite having been a BA for ten years, he may be risk averse; therefore, if he does not see an experienced team and a solid model, he will not invest. In the second configuration, the absence of scalability, profitability, and a convincing business model, coupled with a lack of trust, led to an unfavorable evaluation, in line with (Riding et al., 1993). The third configuration, which explains case 68, shows that the absence of a solid business model leads to a negative assessment despite the entrepreneur's experience and the project's scalability and profitability. This result aligns with Riding et al. (1993), who demonstrated that trust and a sound business model are essential for demonstrating trustworthiness to BAs. The fourth configuration, in line with B.A. White and Dumay (2020), shows that the absence of a business model with realistic expectations of growth and profitability, together with a lack of experience and confidence, can negatively influence the initial valuation of the investment, leading to rejection.

A lack of profitability (-PROF) combined with other variables also results in rejection, as observed in the following configurations: ∼TRU*∼PROF*∼ESC*∼MOD; ∼EXP*∼TRU*∼NET*∼PROF; ∼EXP*∼TRU*∼PROF*∼MOD; and ∼EXP*TRU*∼PROF*MOD. This result aligns with Croce et al. (2017) and Vazirani & Bhattacharjee (2021), who mention that BAs will likely reject proposals if expected growth is low due to information asymmetry. Moreover, it reflects how startups sometimes focus primarily on the economic benefits associated with their business model (Siefkes et al., 2025). The first of these configurations has been discussed above. The second and third can be discussed together because the lack of profitability, trust, and experience, combined with the lack of networks or a compelling business model, leads to rejection. This result aligns with that of Mason et al. (2017). The last configuration, which explains a single case (88), describes a path where owing to a lack of a profitable project and the entrepreneur not demonstrating competence, the investment is evaluated negatively despite a solid model and trust.

Finally, the decisions of six BAs (59, 64, 69, 77,82, 85) are explained by four different configurations: ∼TRU*∼PROF*∼ESC*∼MOD; ∼EXP*∼ESC; EXP*∼TRU*∼NET*∼PROF; ∼EXP*∼TRU*∼PROF*∼MOD. In all these cases, both personal factors and those related to the quality of the project are essential for a positive assessment of the investment, highlighting the need for a balance between both factors (Mason et al., 2017). Notably, most of these BAs are generalists with respect to investing, which may explain their need for experience on the part of the entrepreneur.

ConclusionsConclusionsOur study shows that both personal and project quality factors are crucial for a positive assessment of an investment opportunity and the final investment decision, which is consistent with an interpretation of the decision process of BAs as receivers that weigh the signals of project quality received by their assessment of issuers' (entrepreneurs’) credibility. However, we find differences between the factors that influence these two stages of the decision-making process. In the final stages, after proper scrutiny, personal factors ultimately tip the BA's scales toward investment or rejection. Confidence is revealed as a necessary variable in the investment decision process but not in the assessment phase. In this phase, the quality of the project and the networks are more important.

ContributionsTheoretically, our work shows the potential of the QCA to provide evidence of the heterogeneity in BA investment strategies, confirming the property of equifinality. Our analysis, of the lack of homogeneity among investors, responds to the suggestion by Mason et al. (2019) on the need to capture this diversity. Additionally, in line with Skalicka et al. (2023), our findings confirm the asymmetry in the motivations for investing or rejecting an investment opportunity. Moreover, our study reinforces that complex phenomena such as investment evaluation or the decision to invest cannot be explained by a single condition but rather by the combination of multiple factors, supporting the principle of conjunctural causation. These insights challenge traditional compensatory decision-making models—which assume that investors evaluate multiple factors simultaneously and weigh their importance accordingly—and instead suggest that investors may rely on a heuristic process of elimination to narrow potential investment opportunities. This perspective aligns with the increasing body of literature advocating for a more nuanced understanding of investor behavior in entrepreneurial finance. Moreover, this study reinforces the critical role of the signal sender's credibility—namely, the entrepreneur—in the investment process. these findings confirm that trust is a necessary but not sufficient condition in business angels’ decision-making.

The practical implications of this paper result from two findings: (i) Investors, in their decision-making, despite the high probability of failure in initial investments, use their intuition developed through years of experience to pick up subtle signals such as entrepreneurial confidence, and (ii) in the final investment stage, trust is essential.

Considering the importance of trust, entrepreneurs must prepare a compelling pitch that conveys credibility and inspires trust, as suggested by de Villiers Scheepers et al. (2021), where narrative elements and emotional connections play crucial roles. Our results also highlight the importance of experience, which aligns with the findings of Cardon et al. (2009), who highlight that preparation has more impact than does enthusiasm or commitment in the final stages. For this reason, educational institutions and government agencies should develop specific training programs to help entrepreneurs refine their skills in preparing and presenting their projects. Additionally, mentoring programs where experienced entrepreneurs guide newcomers can serve as a valuable mechanism for transmitting the importance of trust-building with investors.

In addition to formal training, networking events, industry meetups, and startup communities provide opportunities for entrepreneurs to interact with investors in a more informal setting, allowing them to understand firsthand how trust and long-term relationships influence funding decisions. Furthermore, testimonial-based learning, where seasoned entrepreneurs share their fundraising experiences, can serve as a powerful tool for illustrating the critical role of trust and relationship building in securing investment.

Finally, organizing workshops and pitch simulations where entrepreneurs practice their speeches and receive constructive feedback from investors and industry experts can further enhance their ability to establish credibility and foster trust throughout the investment process.

Limitations and future researchA fundamental limitation of this paper is that our sample is composed exclusively of BAs from the Spanish ecosystem. Expanding the study to include samples from other countries would help assess the external validity of our findings. This is particularly relevant when trying to extrapolate our results to countries with significantly different levels of institutional characteristics (such as regulation quality, social trust, and uncertainty tolerance) that have been found to affect the decision-making process of BAs (Ding et al., 2015). However, this remains a challenging endeavor due to the elusive nature of these informal investors and the lack of comprehensive databases with their contact information. Nonetheless, in the context of QCA, generalization is not based on statistical inference but rather on set-theoretic logic. The key question is not whether a larger sample would enhance representativeness but rather whether increasing the number of cases would still allow for an in-depth understanding of each case. If the objective is to examine the generalizability of our findings, a set-theoretic multimethod research (SMMR) approach would be necessary. This would involve a cross-case analysis to identify necessary and sufficient conditions, as well as a within-case analysis to explore the mechanisms driving positive or negative investment decisions (Schneider, 2024).

Additionally, while our findings indicate that most BAs in our sample (62 out of 88) do not focus on a specific industry when making investment decisions, we lack detailed data on the sectors of the funded projects. Although this suggests that our sample is not strongly biased toward a particular industry, future research could explore the actual distribution of investments across industries. This would provide deeper insights into sectoral preferences and potential biases in investment behavior.

Given the high degree of heterogeneity among BAs, future research could also examine whether the factors influencing investment decisions vary depending on specific characteristics of the BA, such as their level of experience, social capital, and professional network. Adopting a multilevel perspective to analyze how investment in startups can be influenced by variables of the entrepreneurial ecosystem and the regulatory regime would also be valuable. Finally, it would be interesting to analyze the combination of factors that explain the BA's investment decision according to their motivation (as per Morrissette, 2007).

Statements relating to our ethics and integrity policiesThe paper has followed all the ethics and integrity policies required.

FundingNot applicable

Code availabilityFree software QCA, R

Ethics approval statementNot applicable

Patient consent statementNot applicable

Permission to reproduce material from other sourcesNot applicable.

Clinical trial registrationNot applicable

CRediT authorship contribution statementOscar Arroyo-Revilla: Writing – review & editing, Writing – original draft, Visualization, Validation, Supervision, Software, Resources, Project administration, Methodology, Investigation, Formal analysis, Data curation, Conceptualization. Cayetano Medina-Molina: Writing – review & editing, Writing – original draft, Visualization, Validation, Supervision, Software, Resources, Project administration, Methodology, Investigation, Formal analysis, Data curation, Conceptualization. Carlos Bellón Núñez-Mera: Writing – review & editing, Writing – original draft, Visualization, Validation, Supervision, Software, Resources, Project administration, Methodology, Investigation, Formal analysis, Data curation, Conceptualization. Noemí Pérez-Macías: Writing – review & editing, Writing – original draft, Visualization, Validation, Supervision, Software, Resources, Project administration, Methodology, Investigation, Formal analysis, Data curation, Conceptualization.