Previous studies have provided mixed evidence on the relationship between internationalisation and firm performance. We advance theoretically in this line of research by investigating the impact of the family dimension of a business on this relationship. Using a panel data analysis for the 2006–2011 period, we find empirically that Spanish family SMEs follow a W-curve. Our findings highlight the importance of differentiating family from non-family firms, and provide a potential explanation for the previous mixed evidence.

Family businesses (hereafter FBs) are the predominant form of business organisation today (Koopman and Sebel, 2009). According to the Spanish Family Business Institute, FBs account for 85% of the Spanish business sector, 70% of national GDP and 70% of employment in the private sector.

Internationalisation is one of the main challenges that FBs must address to survive in an increasingly global and complex environment. However, FBs face a twofold challenge. As for any firm, expansion into new foreign markets involves costs to adjust to the foreign environment and leads to new structural changes within the firm (Sui and Baum, 2014). Family members also retain significant control over the firm and they wish to preserve what they call its socio-emotional wealth, which is the stock of all the affection-related non-financial value a family derives from its ownership position in the firm (Gómez-Mejia et al., 2010; Arregle et al., 2012; Miller and Le Breton-Miller, 2014). Since internationalisation can pose threats to this wealth, FBs seem more reluctant to expand internationally than non-family businesses, or NFBs (Merino et al., 2014; Sciascia et al., 2012). Consequently, FBs confront two opposing forces. On the one hand, the globalisation of the world economy drives them to grow and expand beyond their traditional markets. On the other, their family dimension leads to conservatism and the development of low-risk projects within the domestic market.

The significant role played by FBs in international markets has recently come to be recognised (Fernández and Nieto, 2006; Arregle et al., 2012; Sciascia et al., 2012). What, specifically, has been learned about FB internationalisation efforts? First, only a very limited number of studies, to our knowledge, have focused on FB internationalisation (Banalieva and Eddeleston, 2011). Moreover, most of these studies have focused on FBs’ reluctance to internationalise compared to NFBs (e.g., Fernández and Nieto, 2005; Claver et al., 2009; Kontinen and Ojala, 2010a,b). Relatively few studies have analysed the question of whether and to what extent the family character of a firm has an effect on the internationalisation-performance relationship. Consequently, whether the performance of the FB internationalisation process differs significantly from that of NFBs is still debatable (Cerrato and Piva, 2012; Pukall and Calabrò, 2014).

The objective of this research is to fill this gap by investigating how the relationship between internationalisation and firm performance is moderated by the family dimension. In doing so, this paper firstly contributes by offering new evidence on the relationship between internationalisation and performance, which has been inconclusive so far (Chen and Tan, 2012; Hsu et al., 2013). We propose that the lack of consensus on the nature of the internationalisation-performance relationship results from a failure to fully grasp three effects.

First, most empirical studies are descriptive and cross-sectional, especially regarding the analysis of the internationalisation behaviour of Spanish family small and medium-sized enterprises, or SMEs (an exception is Sacristán et al., 2011). But longitudinal studies are more appropriate for capturing the dynamic nature of the phenomenon of company internationalisation (Chiao et al., 2006). We contribute to previous literature by studying the performance of the internationalisation process of a panel of Spanish industrial family firms from 2006 to 2011. We focus on SME family firms since SMEs represent around 99.88% of all enterprises in Spain, according to the Spanish Central Directory of Companies, produced by the Spanish Institute of Statistics (this register excludes agriculture and fishing). In addition, more than 80% of Spanish SMEs are considered FBs (Merino et al., 2014). Likewise, we focus on export activities, because most of FBs’ international expansion efforts are likely to take the form of exports (Okoroafo, 1999; Fernández and Nieto, 2005).

Second, the conflicting results in the relationship between internationalisation and firm performance may be due to the fact that company characteristics differ. A review of the literature shows that a broad spectrum of firms has been studied so far, including large companies (Kotabe et al., 2002; Li, 2007), new international ventures (Almodóvar and Rugman, 2014) and SMEs (Lu and Beamish, 2001; Chiao et al., 2006). Since FBs have different attributes to NFBs (e.g., familiness, long-term orientation, conservative attitude, and a lack of financial resources, managerial skills and social capital), we can expect this to have an influence on that relationship. This paper contributes to the debate by offering new evidence on the influence of the family dimension on the internationalisation-performance relationship.

Finally, another reason for the inconsistent empirical findings on the internationalisation-performance relationship that several scholars highlight is an inadequate conceptualisation and measurement of the internationalisation construct (Ruigrok and Wagner, 2003; Wagner and Ruigrok, 2004; Li and Qian, 2005; Li, 2007). For instance, the most widely-used measure of internationalisation in international business empirical research is the proportion of exports over total sales for a particular firm (Pla-Barber and Alegre, 2007), but other measures of internationalisation have included the number of export countries (Delios and Beamish, 1999), the number of dissimilar geographic regions (Kim et al., 1989; Hitt et al., 1997), and a combination of them encompassing both dimensions of geographic scale and scope (Pangarkar, 2008; Fernández-Olmos, 2011). In this study, consistent with the latter authors, we use an operational measure of the degree of internationalisation (DOI) that combines the international scale and scope of the firm in order to reflect the true nature of the internationalisation process (Qian and Li, 1998).

This paper is structured as follows. In the next section we present the theoretical framework forming the basis for the empirical hypothesis we propose to test. The third section describes the data set and the statistical approach used. The fourth section sets out the results of the empirical analysis. The final section provides a discussion of the results, and offers some conclusions and areas for future research.

Theoretical frameworkInternationalisation and firm performanceWhether there is a systematic relationship between the internationalisation of firms and their performance has long been a topic of interest to international business researchers (e.g., Hsu et al., 2013; Powell, 2014). But despite many years of research, there is no clear consensus on the effects of internationalisation on firm performance (Powell, 2014).

International expansion is one of the most important pathways for firm growth (Lu and Beamish, 2001). It is a particularly important growth strategy for FBs confined within a narrow geographic scope (Graves and Thomas, 2008). When firms expand into new international markets, they find greater opportunities to achieve economies of scope and scale and grow. Furthermore, there are differences in market conditions across different geographic areas. By leveraging resources in different markets, firms are in a position to exploit market imperfections (Caves, 1971) and achieve higher returns on their resources. According to the resource-based view (RBV), firms with unique, valuable, and inimitable resources (e.g. technological, marketing and human resources) developed in domestic markets can transfer those resources to foreign markets to create competitive advantages (Barney, 1991; Delios and Beamish, 1999; Lu and Beamish, 2004).

Another theoretical explanation of international expansion is the aspect of organisational learning. Internationalisation gives firms the opportunity to acquire additional knowledge and experience, which enables them to create competitive advantages compared to competitors that have restricted their business activities to the domestic market in their home countries. Moreover, the internationalisation experience may increases the firm's ability to reconfigure and adjust its resources and capabilities base to other markets, making it more nimble and dynamic in response to international contingencies (Sapienza et al., 2006; Eisenhardt and Martin, 2000). The development of dynamic capabilities will allow the firm to integrate internal and external competencies to cope with changing environments (Teece et al., 1997). In this respect, several authors have highlighted the importance of the dynamic capabilities view (DCV) in enriching the research in the field of internationalisation (Knudsen and Madsen, 2002; Prange and Verdier, 2011; Teece, 2014; Villar et al., 2014; Michailova and Zhan, 2014). The wider access to relevant knowledge afforded by international expansion and the boost to the firm's dynamic capabilities are expected to lead to superior firm performance (Johanson and Vahlne, 1977; Kogut and Zander, 1993).

Nevertheless, while entering international markets opens up new opportunities for long-term value creation, implementing such a strategy creates many unique challenges in addition to the common ones associated with the domestic growth of SMEs (Lu and Beamish, 2001). Many of the challenges are typical of the difficulties associated with the liabilities of foreignness (Hymer, 1976) and newness (Stinchcombe, 1965) when operating a business in a foreign domain. The liability of foreignness refers to the fact that new entrants typically display unfamiliarity with local culture, lack local information, and are treated in a discriminatory fashion by host governments, customers and suppliers (Zaheer, 1995; Li, 2007). When a firm expands into new geographic markets, it faces the increased costs of liability of newness arising from being exposed to new rules and new methods of doing business (Stinchcombe, 1965; Lu and Beamish, 2004). Furthermore, firms entering foreign markets typically face greater organisational and environmental complexity that increases governance, coordination, and transaction costs (Zaheer and Mosakowski, 1997).

Thus, since there are arguments both in favour of and against internationalisation, there is no clear consensus on the relationship between internationalisation and performance. Several studies have shown that higher levels of internationalisation lead to superior performance (e.g., Grant, 1987; Daniels and Bracker, 1989; Kim et al., 1993; Qian, 1996; Zahra et al., 2000); others have failed to find any relationship (Buckley et al., 1978); and yet others have found a negative relationship (Siddarthan and Lall, 1982; Kumar, 1984; Michel and Shaked, 1986). Alternatively, some studies have found non-linear relationships, such as a U-shaped (Lu and Beamish, 2001; Capar and Kotabe, 2003; Ruigrok and Wagner, 2003; Contractor et al., 2007), inverted U-shaped (Daniels and Bracker, 1989; Geringer et al., 1989; Hitt et al., 1997), or S-shaped relationship (Contractor et al., 2003; Lu and Beamish, 2004; Thomas and Eden, 2004; Li, 2005), all of them for samples of firms without differentiating between family and non-family firms. Inverted U-shaped models have been predominantly confirmed in large manufacturing firms, generally the most internationalised (Geringer et al., 1989; Hitt et al., 1997). They highlight the importance of home-based resources and capabilities and the leverage of economies of scale in a first stage, and subsequently the increased cost of coordination when the firm spreads out its international operations. In contrast, U-shaped relationship studies primarily work with smaller and newly internationalised companies (Lu and Beamish, 2001; Capar and Kotabe, 2003), or service firms, which are usually smaller than manufacturers (Contractor et al., 2007). They argue that initially the performance is negative when the firm internationalises but over time it becomes positive, mainly because of the organisational learning from the international experience (Ruigrok and Wagner, 2003). The S-shaped model combines arguments from both the inverted and the regular U-shaped models and establishes a sigmoid relationship between internationalisation and performance; this has been confirmed both in large manufacturing multinationals (Thomas and Eden, 2004) and in service firms (Contractor et al., 2003). Recently, building upon these arguments, some authors have even found M-shaped (Almodóvar and Rugman, 2014) and W-shaped relationships (Almodóvar, 2012). Using a sample of international new ventures Almodóvar and Rugman (2014) argue that newly born and small firms experience a ‘born global illusion’ when they start the internationalisation process, despite not having learning about foreign markets. This first positive stage is followed by a traditional S-shaped relationship between internationalisation and performance, which explains the global M-curve. This M-shape is also confirmed by Almodóvar (2012) for product standardisation firms, while she finds a W-shaped for product customization firms, and thus indicates that it depends on the product marketing strategy followed by the firm. Consequently, despite the wealth of empirical research to date, this diversity of findings the internationalisation on the internationalisation-performance relationship still remains one of the major unresolved research questions in the international business field (Powell, 2014).

Some explanations have been given for this lack of consensus. Many scholars find problems with the conceptualisation of internationalisation in empirical analysis (Powell, 2014). Although international activities occur in the geographic scale and scope of foreign operations, a vast body of the research literature has only employed the export intensity (Pla-Barber and Alegre, 2007). But this measure is only a rough proxy for the firm's degree of internationalisation (since it ignores the dispersion of foreign sales across markets), so it lacks validity (Pangarkar, 2008).

The discussion of the effects of internationalisation on performance has mainly covered large organisations (Hitt et al., 1997; Tallman and Li, 1996), although recently it has also focused on SMEs (Hsu et al., 2013). The applicability of previous conclusions to FBs remains unclear, as there are numerous and significant differences between family and non-family firms in terms of ownership, resources, governance and management (Chrisman et al., 2005). FBs are expected to pursue a traditional pathway to internationalisation: growing incrementally by progressively exporting into international markets with greater psychic distance (Graves and Thomas, 2008).

Internationalisation and performance in FBsEmpirical research on how a firm's family dimension influences its internationalisation process is relatively scarce (Gallo and Sveen, 1991; Gallo and García-Pont, 1996; Okoroafo, 1999; Zahra, 2003; Graves and Thomas, 2008; Sciascia et al., 2013). However, the FB literature suggests that family firms have different attributes to non-family firms (Habbershon and Williams, 1999; Chrisman et al., 2005; Eddleston et al., 2008), and this may affect FBs’ international orientations and success (Graves and Shan, 2014). Following the RBV (Barney, 1991) and agency model (Fama and Jensen, 1983) theoretical perspectives, the unique family resources of FBs and their risk aversion and preference for keeping control can be used to explain the influence of the family on the firm's internationalisation (Merino et al., 2014). In broad terms, FBs are typically more risk averse and lack the financial and managerial resources and the social capital held by non-family firms. In contrast, inherent attributes resulting from interactions between family members, the family and the business (Chrisman et al., 2005), such as higher commitment, trusted relationships or a long-term orientation may enhance organisational learning and the development of dynamic capabilities. These aspects could provide FBs with unique weaknesses and strengths that affect their ability to implement an internationalisation process (Koopman and Sebel, 2009; Arregle et al., 2012).

The family dimension of the firm comprises three dominant characteristics that could result in a lower inclination to internationalise: (1) desire to keep control; (2) conservative attitude; and (3) limited resources (Gómez-Mejia et al., 2007; Arregle et al., 2012; Galve and Salas, 2011). According to some authors (Gómez-Mejia et al., 2007), the most critical point that guides FBs’ decision-making is the desire to preserve the stock of their socio-emotional investment in the firm. Based on this logic, FBs show less willingness to internationalise compared with other firms because they see international expansion as a threat to the family's control of the firm (Arregle et al., 2012; Lin, 2012). Furthermore, agency theory holds that family firms tend to have a conservative attitude and be risk averse. This results in a slow process of internationalisation, especially as family principals have most of their welfare tied to one firm and cannot easily diversify their portfolio (George et al., 2005; Gómez-Mejia et al., 2007).

Compared to NFBs, FBs are usually at a disadvantage when accessing additional resources and capabilities for internationalisation (Fernández and Nieto, 2005; Arregle et al., 2012). It is well known that financial resources are necessary to support successful international expansion. They are required to invest in manufacturing facilities to meet overseas demand, implement country-specific R&D and marketing activities, and employ the requisite human resources to manage international trade (Graves and Shan, 2014). FBs have a limited capacity to obtain the financial resources required to expand internationally because they have problems accessing traditional equity or debt markets (Sirmon and Hitt, 2003; Graves and Thomas, 2008). Instead, they prefer family and internal equity financing that does not erode the firm's independence. However, avoiding external financial intervention can limit the FB's capitalisation because family members’ contributions to capital are likely to be smaller than those of other potential shareholders, and thus prevent their successful internationalisation (Moen, 1999).

Not only do FBs have limited financial resources, they also have managers with little or no international experience, limited knowledge of the international environment and limited international network relationships (Gallo and García-Pont, 1996; Graves and Shan, 2014). Managerial capabilities, in other words the human resources available for managerial tasks, are required to manage the internationalisation process (Ibeh, 2003). Since international expansion increases the environmental complexity FBs face, these skills are fundamental for selecting, entering and servicing foreign markets, as well as creating routines that facilitate the undertaking of international operations (Westhead et al., 2001). Likewise, an internationalisation process requires changes in the organisational structure and professional management systems that encourage a decentralisation of the decision-making process (Gallo and Sveen, 1991; Abetti and Phan, 2004; Fernández and Nieto, 2005; Graves and Thomas, 2006).

FBs grow internationally with significantly fewer managerial capabilities than NFBs for several reasons. First, the founding families are usually reluctant to make changes in their organisational structures and professional management systems because they fear losing control (Gallo and Sveen, 1991; Gómez-Mejia et al., 2010). They are also less likely to employ qualified salaried professionals, undertake managerial training, or develop export plans (Fernández and Nieto, 2005; Graves and Shan, 2014). Finally, FBs rely heavily on informal controls and decision-making (Moores and Mula, 2000) because of their intuitive knowledge of the business. This personal knowledge may no longer be sufficient when the FB grows internationally, because foreign environments are often more complex than domestic ones and the information processing demands placed on them increase. Hence the usual control forms used in family firms are generally thought to be poorly adapted to changes to compete successfully in international markets (Aaby and Slater, 1988). In this context, family inertia as a result of FB culture may constrain the creation of the dynamic capabilities needed to respond to changing markets (Chirico and Nordqvist, 2010). All this suggests that FBs may have greater difficulty in expanding their activities to new countries.

Finally, FBs have limitations in developing external networks and interorganisational social capital. In a general sense, social capital is perceived as the value of a person's social relationships (Burt, 1992). As far as internationalisation is concerned, how relationships between the founder and firms abroad can be leveraged for information, knowledge and learning is relevant. According to Eisenhardt and Schoonhoven (1996), this type of relationship network may help increase the supply of foreign market knowledge by generating access to information. Consequently, such a network of external relationships is an important resource to implement FB internationalisation successfully. However, FBs have been shown to be significantly less likely to engage in external networking than NFBs (Graves and Thomas, 2004; Kontien and Ojala, 2010), possibly because the family is a source and builder of internal social capital (Bubolz, 2001). However, external social capital ties prevent family firms from having an attitude that is too conservative and too risk-adverse (Miller et al., 2008).

Based on the above arguments, FBs may have greater difficulty in successfully implementing an internationalisation strategy due to limited financial and managerial resources and company networks. However, while a lack of relevant resources is one of the factors limiting internationalisation in FBs, researchers have found FB attributes that can have a beneficial influence on their internationalisation, such as familiness, speed in decision-making, long-term orientation and social capital (Stein, 1989; James, 1999; Miller and Le Breton-Miller, 2005; Pearson et al., 2008).

A main resource that differentiates family from non-family firms is familiness (Pearson et al., 2008), which is defined as “the unique bundle of resources a particular firm has because of the systems interaction between the family, its individual members and the business” (Habbershon and Williams, 1999, p. 11). Interactions between family and business allow FBs to develop idiosyncratic knowledge and specific dynamic capabilities by reconfiguring resources and capabilities that were built up over generations (Chirico and Salvato, 2008). Thus, this unique family resource is crucial to appreciate fully how the family is likely to have a considerable impact on a firm's international operations. Consistent with this, several authors have recognised that familiness has a significant influence on the internationalisation of FBs (Merino et al., 2014).

Other elements characterising the family firm that deeply affect the firm's international activities are the long-term orientation of the family shareholders and speed in decision-making (Allouche et al., 2008; Kontinen and Ojala, 2010a,b). Proprietors are anxious to keep ownership and control of the firm within the family and pass it on to future generations. This orientation may mean that long-term survival underlies decisions in all aspects of the firm (Donckels and Frohlich, 1991), and, in particular, supports the implementation of an optimal investment policy in the long run (James, 1999; Stein, 1989) and emphasises long-term performance goals as opposed to short-term profit targets (Daily and Dollinger, 1993; Harris et al., 1994).

Furthermore, family firms’ long-term orientation may be useful to establish long-term relationships based on trust with their partners (James, 1999; Zellweger, 2007). According to Sirmon and Hitt (2003), social capital is one resource that differentiates FBs from NFBs. Although FBs are argued to have a disadvantage in engaging in networking with other firms (since they have fewer company networks compared with NFBs), they may in fact be able to extract more value out of each network relationship. Dyer (2006) argues that FBs’ ability to cultivate long-standing relationships with firm stakeholders across generations gives them unique advantages in developing social capital. In the same vein, the results of the study by Miller et al. (2008) predict that family firms develop more enduring networks with their customers.

The four phases of the W-curve for FBsAs a result of their particular characteristics (e.g. risk-averse nature and limited financial capital), FBs are expected to take a traditional pathway to internationalisation, growing incrementally by progressively entering foreign markets with greater psychic distance. During the initial internationalisation stage, FBs first seek expansion of their business only in familiar and proximate markets with low levels of sales, coherent with their conservative attitude and risk aversion. In our case, FBs are expected to start their internationalisation in the European Union. Indeed, most Spanish FB exports included in our panel database went to the EU. In this stage, FBs lack information about foreign markets and the international process, and find that the liabilities of newness and foreignness result in significant entry costs. In the absence of international firm-level experience, firms in general can counteract these difficulties by importing routines from the international experience of their managers. But FBs’ characteristics limit their access to external managers with prior international experiences for two reasons. First, FBs’ lack of financial resources makes it harder for them to hire internationally experienced managers. And second, FBs’ preference for control implies that they tend to place trusted relatives in key positions instead of hiring non-family executives with knowledge of international markets (Gómez-Mejia et al., 2010; Sapienza et al., 2006). Hence, FBs’ ability to develop international capabilities is largely dependent on the expertise of the family managers (Graves and Thomas, 2008). The involvement of later family generations, often better trained in international affairs (Gallo and García-Pont, 2006), may partially counteract this weakness, although this depends on the vision and qualities of the successor (Graves and Thomas, 2008). The presence of external influences on the board of directors and in the ownership (Arregle et al., 2012) or the establishment of external networking (Graves and Thomas, 2004) may be useful for internationalisation too, although they are also limited by these firms’ risk aversion and preference for control.

In conclusion, given that FBs generally lack the managerial capabilities required to manage a growth process, and initially have insufficient economies of scale, the costs of this first stage outweigh the benefits.

In the second stage, FBs increase their levels of sales to their familiar and proximate markets to achieve a minimum efficient scale in these markets, and as there are no significant extra costs for selling more products to these countries, these economies are expected to enhance their performance. Moreover, with increasing international experience, FBs acquire experiential learning about how to do business in unknown markets, imitate best practices, and develop dynamic capabilities that increase their ability to integrate, build and reconfigure domestic and local knowledge. Drawing on the DCV, FBs’ long-term orientation encourages them to reconfigure their capabilities to adapt to international markets and create competitive advantage (Eisenhardt and Martin, 2000). Furthermore, their members’ strong commitment towards organisational learning plays a key role in these efforts. Because the creation of dynamic capabilities requires the accumulation and reconfiguration of knowledge (Vilar et al., 2014), the higher commitment and motivation of family firm members to share knowledge will be crucial. Similarly, their long-term orientation allows FBs to accumulate specific market experience and supports the progressive building of dynamic capabilities. This allows FBs to overcome the lack of foreign market knowledge evident in the previous stage (Gallo and García-Pont, 1996), which reduces the costs associated with being new and foreign. Moreover, as the family firm increases its presence in its home regional market and interactions with international agents (customers, suppliers, partners, etc.) are repeated, it consolidates its reputation and strengthens relational trust useful for internationalisation.

Hence, we posit a positive relationship between internationalisation and performance in this stage.

After learning from their closest and most familiar markets, in a third phase FBs venture into more distant markets. As these regions are substantially different from their home country, FBs face significant costs associated with adjusting to the new cultural and institutional environments, and these costs are expected to be greater than in countries with a lower psychic distance (Zaheer, 1995; Shenkar, 2001). As Teece (2014, 1977) argues, organisational capabilities may be difficult to replicate in a culturally different context. In particular, FBs’ specific advantages based on reputation and relational contracting capabilities are not easy to transfer outside the home regional market (Banalieva and Eddeleston, 2011). Thus, FBs have to invest efforts to develop new capabilities that are sometimes drastically different from those that they already possess, in order to overcome the inter-regional liabilities of foreignness (Rugman and Verbeke, 2007). Additionally, the predominantly local and regional value of FBs’ strengths – such as strong personal network relationships in the closest markets – may even hamper FBs’ ability to exploit new international opportunities (Van Essen et al., 2015). FBs also suffer additional difficulties to acquire specialised knowledge from external sources because they are less willing to establish international ties and hire non-family managers from the host country (Gómez-Mejia et al., 2010).

Besides costs related to cultural and institutional complexity, FBs also face a range of costs associated with governance and coordination, which rise as they expand internationally into more and more countries. This is especially true when firms are subject to the liability of smallness, as most of the FBs investigated in this study are. Furthermore, FBs are less willing to make changes in their organisational structures and professional management systems because of their desire to retain control and safeguard their socio-emotional wealth (Gallo and Sveen, 1991; Gómez-Mejia et al., 2010). This may lead FBs to restrict their top management teams to a small cadre of trusted insiders and to keep the decision-making centralised among top family members, which is ill-suited for complex international activities (Van Essen et al., 2015). Moreover, cultural distance seriously aggravates the higher information-processing demands and coordination difficulties (Ruigrok and Wagner, 2003). Thus, FBs suffer additional costs of doing business when they expand beyond their home regional market.

All of the above implies that this expansion initially generates more costs than benefits.

As a consequence of their strong affective commitment to the business, long-term orientation and familiness, FBs can devote significant investments and time to learn from the host environment. Thus, with an increasing level of geographic diversification, FBs are expected to be in a better position to reconfigure their internal and external knowledge and develop dynamic capabilities that allow them to adapt their products and/or services to international markets. Moreover, when FBs increase their sales in the new market they achieve economies of scope and scale and they may get opportunities to exploit market imperfections (Caves, 1971) that bring higher returns on their resources. At the same time, FBs are expected to know how to build the social capital required to develop long-term network relationships characterised by commitment and trust (Graves and Shan, 2014). Although these firms are less willing to engage in external networking (Graves and Thomas, 2004), in the long-term they possess unique advantages enabling them to establish more valuable networks and to develop and exploit reputational assets and social capital (Arregle et al., 2007; Sirmon and Hitt, 2003). In particular, family firms often benefit from well-established name recognition and long-term relationships with other FBs overseas (Gallo and García-Pont, 1996; Zahra, 2003). Furthermore, the intention to keep the business in the family and to include later generations offers incentives to invest in reputation building and enduring networks. Kontinen and Ojala (2010a,b) observe the importance of the next generation's involvement for the internationalisation in some family SMEs. These unique characteristics – familiness, culture of commitment, long-term orientation and strong network relationships – may enable FBs to successfully implement an internationalisation strategy in the long term, which is the fourth phase.

Putting the above arguments together, we hypothesise a W-curve for the internationalisation–performance relationship:Hypothesis 1 The relationship between internationalisation and performance for FBs is a W-curve with four phases: In the initial phase, the DOI of FBs has a negative impact on performance; In the second phase, the DOI of FBs has a positive impact on performance; In the third phase, the DOI of FBs has a negative impact on performance; In the fourth phase, the DOI of FBs has a positive impact on performance.

Spanish family company data were obtained from the Survey on Business Strategies (SBS), a panel survey conducted by the SEPI Foundation, a government institution, with the support of the Spanish Ministry of Industry. This survey offers information on Spanish firms’ strategies for the 1990–2011 period, although the family variable is only available from 2006 onwards. Nevertheless, a longitudinal panel from 2006 to 2011 is a better test of the relationship between internationalisation and performance over time than an analysis with cross-sectional data (Almodóvar, 2012).

We chose the SBS for several reasons. First, this anonymous survey covers a wide range of relevant company characteristics analysed mainly with non-perceptual measurements. Another relevant characteristic of this survey is its representativeness. The SBS provides a good insight into the Spanish manufacturing industry by including a representative sample of the population of Spanish manufacturing firms with 10 or more employees. The selection combined exhaustiveness for the first category, which includes those firms with over 200 employees, and whose participation was required, and random sampling criteria for the second category, which includes firms employing between 10 and 200 workers. Consequently, this survey has multiple respondents. In particular, in our first year of study, 2006, 4357 firms with the above-mentioned criteria were interviewed (5039 firms in 2011). The SEPI Foundation applies different criteria to maintain the representativeness3 of the reference population. Finally, many other researchers have used the SBS to study the exporting activity of Spanish firms (e.g., Merino and Salas, 2002; Fernández and Nieto, 2005).

Initially, to select the sample, we identified Spanish manufacturing firms that are SMEs, family firms4 and which export. Although the upper limit for an SME is 250 employees according to the European Commission, we set the limit at 200 employees because the Survey on Business Strategies uses this threshold when sampling the Spanish manufacturing sector (Almodóvar and Rugman, 2014). Other papers that have defined SMEs as those with fewer than 200 employees are Chandra et al. (2009) and Muñoz-Bullón and Sánchez-Bueno (2011). For the purposes of this paper, family businesses are defined according to the following criterion: they self-classify themselves as family business based on the involvement of a family group in the control.

Dependent variablePerformance is most often measured in internationalisation studies by profit to sales (ROE) or profit to asset ratios (ROA) (e.g., Grant, 1987; Geringer et al., 1989; Contractor et al., 2003; Lu and Beamish, 2004). In this study, we use return on sales5 (ROS) because this measure avoids the effects of differential asset valuations resulting from new investment and depreciation (Geringer et al., 1989). Other studies that have also used this measure are Tallman and Li (1996), Almodóvar (2012) and Almodóvar and Rugman (2014).

Independent variablesDegree of internationalisation (DOI). As we mentioned earlier, the most widely used measure for capturing the degree of internationalisation has been the export intensity ratio (Chiao et al., 2006). However, previous literature has concluded that it is important to use an operational measure combining both dimensions of a firm's internationalisation, the international scale and international scope of its export activities, to reflect the true nature of its internationalisation process (Qian and Li, 1998). Firms may serve foreign markets either through exports or foreign direct investment (FDI). We focus on exports because it is the dominant vehicle of internationalisation for our family SMEs.

Similar to Grant et al. (1988), Pangarkar (2008) and Fernández-Olmos (2011), we propose the following ratio combining the traditional proportion of foreign sales variable and the dispersion of foreign sales across geographic regions6:

To study the relationship between the degree of internationalisation and a firm's performance, we include the squared, cubed and fourth power DOI term (DOI2, DOI3 and DOI4, respectively).

Control variablesTo isolate the relationship between the degree of internationalisation and firm performance, it was important to control for other variables that are likely to affect firm performance. Thus, in addition to the strategy variable (i.e., degree of internationalisation), we introduced another five firm variables: R&D intensity (R&D), advertising intensity (ADV), firm size (SIZE), proportion of foreign capital (FCAP), and firm age (AGE). Likewise, we also controlled for industry effects. The inclusion of the first three firm variables in the model is based on the resource-based view of the firm. Previous studies have identified these as the variables that affect performance in internationalisation (e.g., Delgado et al., 2004; Chiao et al., 2006; Chen and Hsu, 2009). R&D intensity was measured by taking R&D expenses divided by sales (Lu and Beamish, 2004; Chiao et al., 2006). In keeping with previous studies (e.g., Qian, 2002), advertising intensity was measured as the ratio of advertising expenses to sales. Following previous studies (e.g., Chen and Hsu, 2009), we use once-lagged for the R&D intensity and advertising intensity variables. We measure size as the logarithm of the firm's total number of employees because this captures relative changes in the firm's size (Arregle et al., 2012; Almodóvar and Rugman, 2014).

Basile (2001) found that being part of a foreign company might facilitate the process of becoming an exporter; foreign ownership is, therefore, expected to have an important contributory influence on a firm's export performance. We include the percentage of the firm's foreign ownership (Halkos and Tzeremes, 2007).

We also control for firm age in the analysis. The effect of a firm's age on the performance of internationalisation is ambiguous. On the one hand, older firms are usually more stable in their resource endowment than younger firms, which may cause them to have a higher absorptive capacity (Zahra and George, 2002). Younger firms, on the other hand, are less rigid and narrow in their perceptions, and possess the learning advantages of newness (Autio et al., 2000; Sapienza et al., 2006). This variable is measured as the logarithm of the number of years (plus one7) since the year of establishment (Anderson and Reeb, 2003).

Finally, several studies in the field of industrial economics have shown that a firm's performance can be influenced by the sector (Bain, 1968). The industry effect on firm performance is controlled by adopting the taxonomy proposed by Pavitt (1984), which classifies firms into four different categories: traditional, scale-intensive, specialised suppliers and high technology. We introduced three Pavitt dummy variables in the model, but to keep the results simple we do not show them because all of them are non-significant.

Table 1 shows a summary of the variables, measures and expected direction of signs of influence on firm performance.

Variables, measures and expected signs of influence on performance.

| Variables | Measures | Expected signs |

|---|---|---|

| Dependent variable | ||

| ROS | Return on sales | |

| Independent variables | ||

| DOI | Degree of internationalisation | Negative |

| DOI2 | Degree of internationalisation2 | Positive |

| DOI3 | Degree of internationalisation3 | Negative |

| DOI4 | Degree of internationalisation4 | Positive |

| Control variables | ||

| R&D | R&D expenditures/total sales | Positive |

| ADV | Advertising expenditures/total sales | Positive |

| SIZE | Log (total number of employees) | Positive |

| FCAP | Proportion of foreign capital | Positive |

| AGE | Log (number of years +1) | Ambiguous |

We ran a longitudinal analysis with non-linear terms similar to the one Almodóvar (2012) conducts. Since longitudinal surveys reduce the error arising from using a single source, common method variance is not a serious problem for the validity of our results and conclusions (Chang et al., 2010).

We conducted several tests to identify the best statistical model. We ran a Breusch-Pagan LM test to choose between a pooled OLS and a panel data model. As the null hypothesis is rejected, the panel data are not poolable, and hence the pooled OLS is inappropriate. Thus, the econometric model for individual i=1,…,N, which is observed at several time periods t=1,…,T, is as follows:

where α is the intercept, β is the parameter, ci is an individual-specific effect and μit is an idiosyncratic error term.Next we performed the Hausman specification test to choose between a fixed-effects versus a random-effects model. As the value of the test was negative (Chi2(9)=−53.09) we implemented the Wooldridge test and obtained the following result: F(9, 442)=0.57 Prob>F=0.8188. Thus, we rejected the null hypothesis and concluded that the preferred model is random effects. In this model, the individual-specific effect, ci, is a random variable that is uncorrelated with the explanatory variables. Following Beck and Katz's (1995) recommendation, we used the so-called panel-corrected standard errors (PCSE) instead of feasible generalised least-squares regression (FGLS), because the number of time periods in our study was relatively small compared to the number of observations. Moreover, the PCSE are assumed to be heteroskedastic and contemporaneously correlated across panels (Greene, 2003).

To mitigate the problem of multicollinearity between the original term DOI and its squared, cubed and fourth power terms, we followed the procedure suggested by Aiken and West (1991) and used mean-centred variables.

Moreover, a preliminary analysis was conducted to determine the relationships between each of the explanatory variables used in the regression.

ResultsA firm's degree of internationalisation is a dynamic variable in this study. In our data set, there is annual location information. Table 2 illustrates the values of some variables related to internationalisation measured in this research from 2006 to 2011.

Evolution of number of exporting firms and export intensity in FBs and NFBs.

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |

|---|---|---|---|---|---|---|

| Number of family firms, of which: | 708 | 775 | 827 | 844 | 854 | 806 |

| Number of exporting firms | 424 | 470 | 514 | 545 | 569 | 560 |

| Average export intensity | 18.3% | 18.6% | 19.4% | 20.4% | 21.2% | 23.0% |

| Number of non-family firms, of which: | 1315 | 1238 | 1182 | 1171 | 1152 | 1010 |

| Number of exporting firms | 825 | 785 | 769 | 755 | 749 | 668 |

| Average export intensity | 25.3% | 25.7% | 26.2% | 27.1% | 27.3% | 30.1% |

| Mean DOI of family firms | 0.46 | 0.45 | 0.46 | 0.45 | 0.48 | 0.51 |

| Mean DOI of non-family firms | 0.52 | 0.51 | 0.53 | 0.56 | 0.57 | 0.61 |

As we can deduce from the table, there are some differences between non-family and family firms. While 62.73% of the non-family firms were involved in exporting activities in 2006, only 59.89% of the family firms were exporters. And during the period of study, the percentage of exporting firms increased in both groups, but more so in the family firms. Specifically, in 2011 69.48% of the family firms exported compared to 66.13% of the non-family firms.

Although non-family firms have a higher degree of average export intensity than family firms in the period 2006–2011, the evolution of export intensity over the sample period is similar in both groups of firms, export intensity increasing approximately by 5% in each group.

Finally, the longitudinal analysis shows the evolution in the degree of internationalisation, which has increased during the study period in both groups of firms. The increase in DOI is 17.31% in non-family firms compared to 10.87% in family firms, perhaps as a consequence of family firms’ reluctance to diversify geographically.

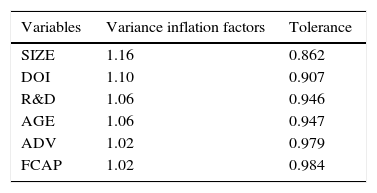

Table 3 provides means and standard deviations of the variables as well as Spearman's correlations8 for each pair. It demonstrates that degree of internationalisation, advertising intensity, R&D intensity, firm age and firm size tend to be positively correlated. To assess potential problems of multicollinearity, variance inflation factors (VIFs) were calculated. The VIFs range from 1.02 to 1.16 (see Table 4), and so are substantially less than the conservative cut-off of 10 for multiple regression models (Hair et al., 1998). These results lead us to conclude that the regression estimates presented in Table 5 are not biased by the presence of severe multicollinearity.

Spearman's correlations.

| Variables | DOI | ADV | R&D | FCAP | AGE | SIZE |

|---|---|---|---|---|---|---|

| DOI | 1 | |||||

| ADV | 0.144** | 1 | ||||

| R&D | 0.243** | 0.201** | 1 | |||

| FCAP | 0.072** | −0.002 | 0.025 | 1 | ||

| AGE | 0.128** | 0.073** | 0.129** | 0.005 | 1 | |

| SIZE | 0.276** | 0.185** | 0.325** | 0.141** | 0.251** | 1 |

| Mean | 0.400 | 1.245 | 0.008 | 1.243 | 3.203 | 3.547 |

| Std. Dev. | 0.505 | 1.893 | 0.026 | 10.280 | 0.623 | 0.847 |

*p<0.05.

Random effects panel data regression.

| Variables | M1 | M2 | M3 | M4 | M5 |

|---|---|---|---|---|---|

| Coeff. (Std Err.) | Coeff. (Std Err.) | Coeff. (Std Err.) | Coeff. (Std Err.) | Coeff. (Std Err.) | |

| ADVt−1 | 0.641* (0.263) | 0.829** (0.291) | 0.833** (0.293) | 0.846** (0.294) | 0.865** (0.296) |

| R&Dt−1 | −29.982 (19.050) | −32.238 (19.475) | −32.210 (19.500) | −33.022 (19.467) | −33.032 (19.735) |

| FCAPt | 0.028 (0.050) | 0.015 (0.057) | 0.015 (0.057) | 0.019 (0.057) | 0.020 (0.057) |

| AGEt | −2.294** (0.616) | −2.258** (0.679) | −2.260** (0.680) | −2.228** (0.674) | −2.230** (0.674) |

| SIZEt | 1.940** (0.710) | 2.095** (0.814) | 2.105** (0.820) | 2.112** (0.816) | 2.076** (0.818) |

| DOIt | 0.199 (0.812) | −0.076 (1.988) | −4.995 (4.165) | −15.226** (7.606) | |

| DOIt2 | 0.148 (0.845) | 6.415 (4.407) | 28.549** (13.339) | ||

| DOIt3 | −1.779 (1.146) | −16.147** (7.607) | |||

| DOIt4 | 2.765** (1.351) | ||||

| Constant | 7.337** (2.621) | 6.125* (2.989) | 6.088* (3.015) | 5.596* (2.998) | 6.057* (3.005) |

| Prob>X2= | 0.0004 | 0.0012 | 0.0026 | 0.0031 | 0.0035 |

We report the results in Table 5. Model 1 is the baseline model that includes only the control variables. We tested Hypothesis 1 using Models 2, 3, 4 and 5, in which we built the test of the W-shaped relationship by adding the linear term of degree of internationalisation in Model 2, its squared term in Model 3, its cubed term in Model 4 and its fourth-power term in Model 5.

Before analysing the coefficients of the models, we analysed the Wald Chi-Square statistic for each model. Given that the p-values are lower than 0.05, the Wald tests of all the models strongly reject the null hypothesis – i.e., at least one coefficient is statistically different from zero – so we can proceed to study the coefficients (Almodóvar and Rugman, 2014).

From Models 2, 3 and 4 we find that the linear, squared and cubed terms are not significant, suggesting that linear, U-shaped and S-shaped relationships do not exist for this data set. All the linear, squared, cubed and fourth-power terms are significant in Model 5, indicating that a W-relationship exists between degree of internationalisation and firm performance for this data set. This provides support for our hypothesis.

All the models provided the same results for the control variables. As we predicted, both advertising intensity and size have a positive impact on firm performance. The behaviour of advertising intensity highlights the important role that marketing resources play for family firms. Larger family SMEs perform better than smaller ones, as evidenced by the positive coefficient of the variable SIZE. Similar results were obtained by Almodóvar (2012).

Consistent with previous studies (e.g., Zou and Stan, 1998; Almodóvar, 2012), firm age has a negative impact on firm performance, i.e., older family SMEs perform worse than younger ones.

Finally, the R&D intensity and FCAP coefficients are both positive, though neither is significant.

ConclusionsTo date, little empirical research has been conducted to analyse the relationship between internationalisation and performance in family businesses. This study fills this gap by examining how the family dimension influences the relationship between the degree of internationalisation and firm performance in family SMEs. Prior research mainly focuses on this relationship for samples of firms without differentiating between family firms and non-family firms, and offers inconclusive evidence (e.g., linear, U-shaped and sigmoidal relationships). We re-examine this topic, exploring whether the previous conflicting evidence could result from the failure to consider the potential impacts of family involvement on the performance of exporting firms.

The main theoretical contribution of this paper is in its analysis of the particular relationship between the degree of internationalisation and performance in FBs, placing the emphasis on the influence of the unique attributes of FBs. Based on the particular characteristics of FBs associated with exporting, we provide arguments that this relationship is expected to follow a W-shaped curve. As anticipated, our empirical results, based on a sample of Spanish family SMEs, confirm that the family dimension moderates the relationship between internationalisation and firm performance and provide strong support for the hypothesis that a W-curve stage approach better describes the internationalisation-performance relationship in FBs.

Several effects can be put forward as to why FBs follow a W-shaped curve. In a first stage, FBs expand within their home region, following a traditional internationalisation pathway (Graves and Thomas, 2008). At this point, the FBs are inexperienced in foreign markets and lack financial resources, managerial capabilities and external networks. Thus, these firms have difficulties to successfully implement their internationalisation strategy and a negative relationship between internationalisation and performance is evident. In a second stage this relationship becomes positive because the FBs consolidate their expansion into the market and overcome the liability of foreignness by exploiting and transferring their specific advantages abroad, acquiring experiential learning and creating new knowledge. In the third stage, the FBs grow incrementally by progressively exporting into markets with greater cultural distance (Graves and Thomas, 2008; Kontinen and Ojala, 2011). Consequently, FBs experience a deterioration in their performance due to their lack of the market-related resources and capabilities they need to adapt to the new requirements along with the escalating costs of coordination and governance when the degree of internationalisation increases. Finally, once the FBs reach a higher degree of internationalisation, they spread their reputation, build trusted networks, and ultimately accumulate capabilities and reconfigure them to international markets. Thus, in the fourth stage the FBs are in a good position to reap the benefits of internationalisation.

This paper contributes to the existing body of knowledge in several ways. First, it helps to integrate theoretical knowledge from the family firm and international management literatures and enrich each domain. It sheds further light on the internationalisation literature by offering new evidence on the relationship between the degree of internationalisation and firm performance in a specific type of firm, and offers a new explanation for the previous inconclusive results (Chen and Tan, 2012; Hsu et al., 2013). Furthermore, the study contributes to the literature on FB performance by grasping the complexity of the influence of the family dimension on the relationship between internationalisation and performance. Finally, it also responds to the call for further research on FBs as a distinct entity (Kontinen and Ojala, 2010a,b).

The influence of FBs’ characteristics on the relationship between internationalisation and firm performance is explored by using agency theory, the resource-based view and the dynamic capabilities view. From agency theory, FBs’ risk aversion, preference for keeping control and concern to preserve their socioemotional wealth hinder access to the resources required for successful internationalisation when FBs enter in a new market. However, when FBs consolidate their position, according to the RBV and the DCV, their imperfectly imitable resources, such as familiness, long-term orientation, trust, reputation and strong commitment (Sirmon and Hitt, 2003), reinforce their ability to learn and apply knowledge to foreign markets in order to develop dynamic capabilities to cope with changes.

Lastly, our results also suggest other implications. Surprisingly, neither the R&D intensity nor the proportion of foreign capital has any influence on performance in Spanish family SMEs, despite previous empirical literature highlighting them as significant factors affecting a firm's performance. Recently, Schmid et al. (2014) have suggested that R&D intensity is expected to be higher in firms that are actively managed by the family. Based on this argument, future research could study if R&D behaviour varies between family firms in which the founder is actively involved and older family firms, as this could generate different results for the effect of R&D intensity. Likewise, Randoy and Goel (2003) conclude that founding family leadership moderates the relationship between ownership structure and firm performance. Future studies could explore this perspective, which might result in different conclusions on the impact of foreign capital on firm performance.

In addition to the theoretical implications, identifying the effects of FBs’ degree of internationalisation on firm performance also leads to several managerial implications. It is crucial that family firms’ managers understand that this relationship is dynamic and the effects of the degree of internationalisation will cause two downturns in their firm's performance. The first is mainly caused by learning costs and the second by the costs associated with adjusting to new cultural and institutional environments. Although these firms’ patient capital and long-term commitment may help FBs to successfully internationalise in the long term (Graves and Thomas, 2008), if managers do not understand the stages of performance deterioration, they could stop new export ventures too early because of the lack of positive performance.

Furthermore, by knowing the factors that can affect their performance when they internationalise, FBs will stand a better chance of being able to handle them properly. In order to shorten the downturns in performance (stages 1 and 3 of the W-curve), as well as to reinforce the upturns (stages 2 and 4), managers need to focus on leveraging the learning opportunities from their international presence at the same time as they invest efforts to develop the required international capabilities. In this process it is important for firms to gain access to external resources such as financial, human, and social capital. The previous literature indicates that FBs may call for external sources of knowledge and expertise, such as non-family managers or expanded executive cadres. The presence of non-family members on the board of directors may provide greater access to networks outside the family realm and, therefore, knowledge useful to support the increased complexity of internationalisation (Arregle et al., 2012; Calabrò et al., 2009). Furthermore, FBs that hire external managerial talent will be in a better position to take advantage of international opportunities and family SMEs that have another company as a large shareholder will have better access to resources (Fernández and Nieto, 2005). A suitable combination of internal and external knowledge with a long-term commitment, familiness and family social capital may help FBs to limit the initial drop in performance when they expand into a new foreign market. Managers should also consider improving their managerial capabilities to develop international business networks with overseas firms that possess the required resources and capabilities before starting the internationalisation process, for example, by attending international exhibitions and trade fairs, where they can network with potential foreign partners (Osei-Bonsu, 2014). As Graves and Shan (2014) argue, the value of these international networks enables FBs to overcome the negatives related with limited financial and managerial resources.

The results of this study may also be relevant to policymakers who design and implement export promotion programmes to assist family SMEs. Policymakers should help family SMEs to follow a long-term strategy of internationalisation, preparing them for a low performance in the first and third phases of internationalisation and helping them to reach the second and fourth phases. In particular, policies should help family SME managers acquire international capabilities to achieve an optimal level of internationalisation. Possibly, they should promote the formation of network relationships between Spanish family SMEs and overseas firms with the international capabilities to implement an internationalisation strategy, or, for example, provide government-sponsored advisory services. Nowadays, a number of public and private initiatives organise activities to help SMEs (also FBs) to make contact with foreign companies.

Finally, the identification of the shape of the relationship between the family SME's degree of internationalisation and its performance could also be used as a managerial tool for exploring the firm's position in relation to its competitors.

Limitations and future researchThis paper suffers from some limitations that suggest some interesting possible avenues for future research. The first limitation concerns the sample used. Our study was based on family exporting firms from the Spanish manufacturing industry. Despite the representativeness guaranteed by the Survey on Business Strategies, and despite the fact that most empirical studies in the field of export performance use single-country samples (Ruzo et al., 2011; Almodóvar, 2012), future studies based on samples with other international business contexts, such as other countries or other industries (e.g., agriculture or services), would be able to generalise the findings of this research.

Some scholars suggest return on sales (ROS) as a measure to capture the overall firm performance and this is why our model estimation is based on this financial measure (Almodóvar, 2012; Almodóvar and Rugman, 2014). Hence, an attractive opportunity for research would be to test this model by using different performance measures, such as export survival.

Although our study has focused on the performance implications of deciding to export because this is their main way of expanding business internationally, we are well aware that there is a wide array of internationalisation mechanisms, such as the use of alliances and foreign direct investments (Cerrato and Piva, 2012). All of them share some common features, but they exhibit many distinct strengths and weaknesses that may differentially affect performance. Future research might also incorporate these other mechanisms of internationalisation to extend the generalisability of our findings. Moreover, due to data availability we measured the degree of internationalisation by grouping countries into five global regions. This approach may not be appropriate, however, since the countries’ history, culture, political development, economic development and religion are not the same. Thus, further research should include detailed country-specific data on this topic and employ the techniques used in this study.

This research has not been able to specify types of FBs according to their international experience. A measure of international experience would also allow further differentiation among the large group of FBs. The inclusion of international experience into theoretical explanations of family firm internationalisation is likely to produce new research questions related to the rate, speed and sequence of international expansion.

Family firms that became NFBs during the analysis period have not been taken into account and there may be a ‘survival bias’ in the sample (Vermeulen and Barkema, 2002). One way to counteract this bias would be to analyse whether the structure of the capital could be considered an endogenous variable (Demsetz and Lehn, 1985). In the case of exporting FBs, the evolution of past export performance may explain the permanence of control. If the export performance is poor, family shareholders may disengage and sell their shares, leading to the loss of their family status.

Finally, it is also important to recognise that family businesses are not a homogeneous group of companies (Miller and Miller Le-Breton, 2006). Thus, differences between FBs in ownership configurations, involvement of the founder, leadership or generational involvement will be important in explaining the internationalisation process and performance. The process of knowledge transfer through generations might also play an important role in the performance of family SMEs, especially when the family firm operates internationally (Fernández and Nieto, 2005; Basly, 2007). When multiple generations are involved in the process of international development, the family firm should be able to gain knowledge of the international environment, and, as a result, this should act as a source of competitive advantage for internationalisation. Future research should take into account the arrival of new generations when analysing the internationalisation of family firms. Similarly, the literature based on agency and stewardship theories hypothesises that family firm performance depends on their family leadership type (Banalieva and Eddeleston, 2011). In general terms, differences in family participation in ownership, management or generations involvement may determine the strength of the arguments indicated theoretically in this study and affect the evolution of the internationalisation-performance relationship in FBs in different ways. Unfortunately, we gathered our empirical data from a survey that does not contain information about family firm leadership or other unique characteristics of FBs. Future studies based on qualitative in-depth interviews should study how theses aspects affect the relationship between internationalisation and performance. It would be interesting to analyse empirically which FB characteristics are more critical for successfully managing the costs and benefits of internationalisation.

This paper has been supported by the ECO2012-36290-C03-01 project (Ministry of Science and Innovation) and the COMPETE and CREVALOR groups from University of Zaragoza.

Tel.: +34 978 618101; fax: +34 976761835.

Tel.: +34 976 761 000x84-2717; fax: +34 976761835.

See Fariñas and Jaumandreu (1999) and www.funep.es for further details.

To be a family firm, we required it to have had a family dimension continuously every year in our panel.

Hoskisson et al. (1993) demonstrates the correlation between various accounting measures of performance (ROA, ROE, ROS).