This article investigates the relationship between corporate social responsibility and earnings management. Using panel data methodology for a sample of Spanish non-financial companies between 2005 and 2012, we find a negative impact of corporate social responsibility practices on earnings management. Corporate social responsibility is related to ethical and moral issues concerning corporate decision-making. Engaging in socially responsible activities not only improves stakeholder satisfaction, but also has a positive effect on corporate reputation.

The results show that corporate social responsibility practices may be an organizational device that leads to more effective use of resources, which then has a negative impact on earnings management practices.

Earnings management has recently received considerable attention both from regulators and the popular press. Earnings management can be defined as the alteration of firms’ reported economics performance by insiders to either mislead some stakeholders or to influence contractual outcomes (Healy and Wahlen, 1999; Leuz et al., 2003). Managers may be inclined to manage earnings due to the existence of explicit and implicit contracts, the firm's relation with capital markets, the need for external financing, the political and regulatory environment or several other specific circumstances (Vander Bauwhede, 2001). These deliberate managerial actions, contrived to disguise the real value of a firm's assets, transactions, or financial position, have negative consequences for shareholders, employees, the communities in which firms work, society at large, and managers’ reputations, job security and careers (Zahra et al., 2005).

Accounting earnings are more reliable and more informative when managers’ opportunistic behavior is controlled through a variety of monitoring systems (Dechow et al., 1996). After several recent financial scandals, there has been an international trend toward developing and implementing corporate governance mechanisms to fight against the opportunistic behaviors that have undermined investors’ credibility in financial information. Corporate governance attributes help investors by aligning the interests of managers with the interests of shareholders and by enhancing the reliability of financial information and the integrity of the financial reporting process (Watts and Zimmerman, 1986).

Decades of empirical research have focused on the factors influencing the quality of earnings, specifically the accruals. However, there is also increasing attention being paid to the managerial activities which can lead to the manipulation of earnings. Previous studies document mixed results regarding the association between corporate social responsibility (CSR) and transparent financial reporting. In this article, we examine the relationship between CSR and earnings quality by using Spanish firms from 2005 to 2012. The earnings quality is measured by using the absolute value of abnormal discretionary accruals from the modified Jones model.

CSR is related to ethical and moral aspects about corporate decision-making and behavior and, as such, addresses complex issues like environmental protection, human resources management, health and safety at work, local community relations, and relationships with suppliers and customers (Castelo and Lima, 2006). Engaging in socially responsible activities not only improves stakeholder satisfaction, but also has a positive effect on corporate reputation (Orlitzky et al., 2003) and reduces the financial risk incurred by the firm (Orlitzky and Benjamin, 2001).

CSR research has employed a variety of theories and methodologies to study the potential relationship between CSR activities and other traditional measures of a firm's success (Mahoney and Roberts, 2007, p. 234). Previous studies focus on the link between CSR and economic or financial firm's performance (Moore, 2001; Orlitzky et al., 2003; Brammer et al., 2007) and the evidence is mixed. As Jorgensen and Knudsen (2006) note, this relationship represents the most questioned area of CSR (Angelidis et al., 2008); while a lot of research points in favor of a mild positive relationship (Aupperle et al., 1985; McGuire et al., 1988; Orlitzky et al., 2003; Maron, 2006; Wu, 2006; Rodgers et al., 2013) this connection has not been fully established (Neville et al., 2005; Prado-Lorenzo et al., 2008; Park and Lee, 2009) and the mechanisms through which financial performance is enhanced by CSR is not well understood (Jawahar and McLaughlin, 2001; Doh et al., 2009). The literature review suggests there remains a lack of understanding about how CSR initiatives can influence on accounting quality by reducing earnings management. Accordingly, our study fills this gap by studying the effects of CSR practices on discretionary accruals.

The country's legal system, economic development, the importance of stock markets and ownership concentration all affect the country's accounting standards, which in turn affect the country's quality of financial reporting. We use Spanish data because they generally reflect an institutional setting similar to most continental countries, classified by La Porta et al. (1997) as French-origin civil law countries, where high concentration of ownership, weak investor rights and boards which are not independent of controlling shareholders are prevalent.1 Fundamental stakeholders in the Spanish corporations include banks and industrial firms, although the role of financial institutions is not as prevalent as in other countries such as Germany and Japan, and the main agency problem arises from controlling and minority shareholders, as occurs in most European countries. The international accounting literature provides evidence that the magnitude of earnings management is on average higher in code-law countries with low investor protection rights, compared to common-law countries with high investor protection rights (Ali and Hwang, 2000; Ball et al., 2000; Leuz et al., 2003).

The publication of new European rules or codes of best practice for publicly listed companies has further intensified the discussion in Spain. However, Spain is a country in which corporate social responsibility ranks significantly behind others such as the USA and the UK. The reason must be sought in a culture which, to date, has not given sufficient importance to responsible corporate behavior. The Spanish Accounting Standards Board obliges Spanish firms to produce and disclose an environmental report in their annual accounts owing to the financial repercussions this information has on firms and the growing demand for this information from users. But social information is considered voluntary information.

The study is organized as follows. We review earlier research and provide the rationales for our hypothesis in ‘Literature review and hypothesis development’ section. This is followed by a presentation of the methodology, including how the sample was obtained and the data gathered and how the variables used were measured in ‘Research design’ section. We describe the analysis of the results in ‘Results’ section and the study ends with the main conclusions in ‘Conclusion’ section.

Literature review and hypothesis developmentThe impact of CSR on economic performance has received considerable attention in the literature over the past three decades (Waddock and Graves, 1997; Griffin and Mahon, 1997; McGuire et al., 1988; McWilliams and Siegel, 2000, 2001; Hillman and Keim, 2001; Simpson and Kohers, 2002; Orlitzky et al., 2003; Coombs and Gilley, 2005; Brine et al., 2006; Margolis et al., 2009; Aras et al., 2010). The instrumental stakeholder theory (Donaldson and Preston, 1995; Donaldson, 1999; Jones and Wicks, 1999) argues that good management implies positive relationships with key stakeholders, which, in turn, improve financial performance (Freeman, 1984; Waddock and Graves, 1997). The main idea here is that everything else being equal, firms that practice stakeholder management will perform better in profitability, stability and growth (Pesqueux and Damak-Ayadi, 2005).

For the purpose of this research, stakeholder theory is the accepted paradigm to explain why companies involve themselves in socially responsible activity as a strategy to maximize their long-term return on investment – sustainable business success, by recognizing the importance of each stakeholder group and incorporating this knowledge into their corporate strategy. Because the stakeholders control resources that are essential for the existence of the organization, a manager who wishes for the continued success of the firm has to strategically devote his attention to the needs of stakeholders. From this perspective, socially responsible firms are inclined to foster long-term relationships with stakeholders rather than maximize their short-term profit. The basic assumption behind this theory is that CSR may be an organizational device that leads to more effective use of resources (Orlitzky et al., 2003), which then has a positive impact on corporate financial performance. Transparent financial reporting indicates that information provided to a firm's stakeholders is more relevant to their decision making. In this regard, providing quality earnings is closely connected to CSR activities, especially in the aim to meet the needs of the stakeholders (Choi et al., 2013).

Previous research (Gelb and Strawser, 2001; Chih et al., 2008; Choi and Pae, 2001) argues that socially responsible firms are focused not only on increasing current profits but also on fostering future relationships with stakeholders (the long-term perspective hypothesis). From this perspective, socially responsible firms are inclined to foster long-term relationships with stakeholders rather than maximize their short-term profit (Choi et al., 2013). Because the stakeholders control resources that are essential for the existence of the organization, a manager who wishes for the continued success of the firm has to strategically devote his attention to the needs of stakeholders (Choi et al., 2013). In support of this view, empirical evidence demonstrates that firms that are more committed to CSR engage less in earnings management (Chih et al., 2008; Hong and Andersen, 2011; Choi et al., 2013).

In support of the long-term perspective hypothesis, the study of Chih et al. (2008) investigates whether the CSR-related features of 1.653 corporations in 46 countries had a positive or negative effect on the quality of their publicly released financial information during the 1993–2002 period. They argue that since it has neither been documented, nor globally tested whether CSR mitigates or increases the extent of earnings management, they studied three kinds of earnings management: earnings smoothing, earnings aggressiveness, and earnings losses and decreases avoidance. They find that the type of relationship between CSR and earnings management depends on which earnings management they consider. They concluded that with a greater commitment to CSR, the extent of earnings smoothing is mitigated, that of earnings losses and decreases avoidance is reduced, but the extent of earnings aggressiveness is increased. So, a firm with CSR in mind tends not to smooth earnings, and displays less interest in avoiding earnings losses and decreases. Hong and Andersen (2011) study the relationship between CSR an earnings management. They address two forms of earnings management: accruals based and activity based. Their sample consists of non-financial U.S. firms from the time period 1995–2005. They find evidence that firms which engage in CSR are less likely to manage earnings.

The paper of Choi et al. (2013) focuses on how CSR ratings are associated with earnings quality for firms with different ownership structures. They use a sample of Korean firms from 2002 to 2008. They find that CSR ratings are negatively correlated with the level of earnings management when all firms are considered. However, the relationship is weaker for chaebol firms and firms with highly concentrated ownership, which suggests that CSR practices can be abusively used by those firms to conceal their poor earnings quality.

However, an opposite view posited by some researchers suggests that CSR can be abused by managers to mask their opportunistic behaviors (the managerial opportunism hypothesis). CSR policies can be used by managers as their entrenchment strategy. Consistent with this argument, Prior et al. (2008) document a positive impact of earnings management on CSR by using archival data from a multi-national panel sample of 593 firms from 26 countries between 2002 and 2004. They argue that earnings management practices damage the collective interests of stakeholders; hence managers who manipulate earnings can deal with stakeholder activism and vigilance by resorting to CSR practices. They also suggest that executives with incentives to manage earnings will be very proactive in boosting their public exposure through CSR activities, particularly in firms with high visibility. Alternatively, firms with low levels of earnings management have fewer incentives to seek public exposure by promoting socially responsible activities.

Following the long-term perspective hypothesis, Chih et al. (2008) affirm that financial transparency and accountability (both as vital to shareholders as they are to employees, customers, communities, and leaders at all levels of society) are fast becoming principles of CSR that could reduce the extent to which insiders abuse their information advantage over outsiders. So, socially responsible firms do not undertake earnings management. The reason underlying this is that a firm that is socially responsible does not hide unfavorable earnings realizations and, therefore, conducts no earnings management (Chih et al., 2008). In this regard, Shleifer (2004) interprets that earnings manipulation, which many people find ethically objectionable, occurs less often in corporations with a strong commitment to social responsibility. CSR augments transparency and reduces the number of opportunities to manage (Chih et al., 2008). Similarly, Gelb and Strawser (2001) find that a limited sample of U.S. firms that engage in socially responsive activities provides more informative and/or extensive disclosures compared with companies that are less focused on advancing social goals. By equal measure, Shen and Chih (2005) find that greater transparency in accounting disclosure in the banking industry can reduce bank's incentive to manage earnings.

In line with previous research (Gelb and Strawser, 2001; Chih et al., 2008; Choi and Pae, 2001), we expect that socially responsible firms have low incentive to manage earnings. Alternatively, firms with poor CSR activities have more levels of earnings management. These arguments lead to the following hypothesis:H1 The extent of corporate social responsibility is negatively associated with the level of earnings management.

The sample employed in this study consists of the 100 most reputable Spanish companies according to the Merco index for the period 2005–2012. We complement these data on corporate responsibility with financial data from SABI database. Following previous literature on earnings management, we do not consider financial firms in our analysis (Prior et al., 2008; Hong and Andersen, 2011). The final sample is an incomplete panel data of 286 firm-year observations.

Panel A of Table 1 shows the distribution of the sample by year. Panel B of Table 1 provides industry breakdown.

Sample characteristics.

| Number of firm-year observations | Percentage of firm-year observations | |

|---|---|---|

| 286 | ||

| Panel A: Composition by year | ||

| 2005 | 46 | 16.08 |

| 2006 | 51 | 17.83 |

| 2007 | 45 | 15.73 |

| 2008 | 31 | 10.84 |

| 2009 | 25 | 8.75 |

| 2010 | 17 | 5.94 |

| 2011 | 24 | 8.39 |

| 2012 | 47 | 16.44 |

| Panel B: Composition by industry | ||

| Manufacturing | 32 | 11.19 |

| Construction | 35 | 12.24 |

| Commercial | 140 | 48.95 |

| Service | 79 | 27.62 |

| Total | 286 | 100 |

The purpose of this study is to investigate empirically how the corporate social responsibility in Spain influences the level of earnings management. Following previous studies (Warfield et al., 1995; Gabrielsen et al., 2002) we employ the absolute value of discretionary accruals [Abs(DACC)] as our measure of earnings management. In order to evaluate the effect of CSR on discretionary accruals, we regress the absolute value of discretionary accruals [Abs(DACC)] on CSR and control variables (Model 1).

where Abs(DACC)it is the absolute value of discretionary accruals in year t, scaled by lagged total assets; CSR is a is the natural logarithm of MERCO index in year t; LEV as end-of-year total liabilities divided by end-of-year total equity; SIZEit is the natural logarithm of total assets in year t; ROAit as net income by end-of-year total assets; LIST is a dummy variable (company listed=1, else=0); BI is a vector of industry dummies (Manufacturing industry, Construction industry, Commercial industry, Services).Measurement of earnings managementPrior studies used discretionary accruals to measure the extent of earnings management. Discretionary (abnormal) accruals are defined as total accruals minus estimated normal (non-discretionary) accruals, where the estimated normal accruals can be derived from a number of discretionary accruals models widely used in prior studies (Dechow et al., 1995, 2003; Larcker and Richardson, 2004; Kotari et al., 2005; Jones et al., 2008). Since earnings management can involve either income-increasing accruals or income-decreasing accruals to meet earnings targets, consistent with prior studies (Warfield et al., 1995; Reynolds and Francis, 2000; Klein, 2002; Van Tendeloo and Vanstraelen, 2005; Bowen et al., 2008), the magnitude of absolute discretionary accruals is used in this study to assess the extent of earnings management. A higher magnitude of absolute discretionary accruals corresponds to a greater level of earnings management, or lower accounting quality, and vice versa.

Following Dechow et al. (1995), we compute the accrual component of earnings as:

where ΔCAit=change in total current assets; ΔCashit=change in cash and cash equivalents; ΔCLit=change in total current liabilities; ΔSTDit=change in long-term debt included in current liabilities; Depit=depreciation and amortization expenses.We use the cross-sectional version of the modified Jones (1991) model to estimate the non-discretionary component of total accruals (TAC) (DeFond and Jiambalvo, 1994; Yeo et al., 2002; Larcker and Richardson, 2004).

For each year and industry we regress total accruals (TAC) on the change in revenues (ΔREV) and the level of gross property, plant and equipment (PPE), scaled by lagged total assets (At−1) in order to avoid problems of heteroscedasticity. The industry classification is based on the Spanish National Classification of Economic Activities (CNAE) made by the National Institute of Statistics (INE). The estimation of the regression coefficients is carried out using all Spanish firms available in the SABI database. Industry-years with fewer than six observations are excluded from the analysis (DeFond and Jiambalvo, 1994; Park and Shin, 2004).

Using the estimates for the regression parameters, (βˆ0, βˆ1, βˆ2), we estimate each sample firm's non-discretionary accruals (NDCA) by adjusting the change in sales for the change in accounts receivable (ΔAR) to allow for the possibility that firms could have manipulated sales by changing credit terms (Dechow et al., 1995).

And we define discretionary accruals (DACCit) for firm i in year t as the remaining portion of total accruals:

Following previous studies (Warfield et al., 1995; Gabrielsen et al., 2002) we employ the absolute value of discretionary accruals [Abs(DACC)] as our measure of earnings management. Table 2 shows the descriptive statistics of estimated discretionary accruals, and t-test to examine if the mean discretionary accruals are different from zero did not find evidence of income increasing or decreasing manipulation in our sample, except for the year 2010.

Descriptive statistics of estimated discretionary accruals.

| Mean | Median | SD | T | Sign | |

|---|---|---|---|---|---|

| DACC-2005 | 0.010 | −0.003 | 0.144 | 0.47 | 0.63 |

| DACC-2006 | 0.020 | 0.000 | 0.130 | 1.09 | 0.27 |

| DACC-2007 | 0.031 | 0.033 | 0.150 | 1.38 | 0.17 |

| DACC-2008 | −0.002 | −0.012 | 0.123 | −0.09 | 0.92 |

| DACC-2009 | −0.003 | 0.003 | 0.104 | −0.14 | 0.88 |

| DACC-2010 | −0.030 | −0.021 | 0.067 | −1.84 | 0.08* |

| DACC-2011 | −0.009 | 0.001 | 0.088 | −0.50 | 0.62 |

| DACC-2012 | −0.008 | −0.006 | 0.105 | −0.52 | 0.60 |

| DACC-Total | 0.005 | −0.002 | 0.123 | 0.68 | 0.49 |

We use the MERCO index to measure the extent of CSR. MERCO is the Spanish Monitor of Corporate Reputation, a tool that is already a reference for large companies in the assessment and management of their reputation, as it is the only Spanish monitor to annually evaluate (since 2000) the reputation of the companies that operate in Spain, as is done by Fortune or The Financial Times.

Merco seeks to measure and assess the various facets that make up a firm's reputation. It uses a process based on a variety of steps that are aimed at collecting data from different sources of information. The processes used by Merco to obtain the information required are:

- 1.

Interviews with directors. The aim of this interview is to ascertain the opinion held by directors of the most important companies in Spain about the corporate reputation of firms operating in our country. Within the appraisals of these agents, the Merco questionnaire distinguishes between two areas: overall rating, in which a director rates up to 10 companies which he or she considers to enjoy the best reputation in his or her country, regardless of the firms’ activities; sectorial rating, in which those answering the questionnaire are asked to indicate the two firms in their own sector that enjoy the best reputation.

- 2.

Assessment by experts. This seeks to incorporate in the corporate reputation rating the views of several outside agents. In this stage, the 90 firms selected in the previous process are rated by 5 groups of experts: Financial Analysts; Consumer Associations; NGOs; Trade Unions; and Economic Journalists (Table 3).

Table 3.Variables assessment by group of experts.

Group of experts Merco dimension Rated variable Financial Analysts Economic-financial results Economic-financial results

Quality of the economic information.NGO Corporate ethics and responsibility Commitment with the community.

Social and environmental responsibility.Consumer Associations Quality of the commercial offer Quality of product – service.

Respect for consumer rights.Trade Unions Internal reputation Labor quality. Economic Journalists Corporate ethics and responsibility Transparency of information.

Accessibility.Own: Merco (2013).

- 3.

Direct Assessment. The aim is to have a rating by qualified specialists in Analysis and Research of the relative merits and corporate reputation presented by the 90 firms selected from the provisional ranking. This rating will require firms to accredit their reputational values via a questionnaire and documents that back up the information in the same. The variables analyzed by the specialists are shown in Table 4.

Table 4.Variables analyzed by the specialists.

Merco dimension Rated variable Economic and financial results Sheetprofit.

Profitability.

Quality of the economic information.Quality of the commercial offer Product values.

Brand values.

Customer service and care.Internal reputation Labor quality.

Ethical and professional values.

Identification with the business project.Corporate ethics and responsibility Ethical corporate behavior.

Commitment to the community.

Social and environmental responsibility.International dimension of the firm Number of countries in which it operates.

Turnover abroad.

International strategic alliances.Innovation Investments in R+D.

New products and services.

New channels.Own: Merco (2013).

- 4.

Merco Tracking. This phase seeks to obtain a rating from the population as a whole for the reputation of the firms selected and to detect any possible evolution of the ranking.

Merco Persons is a monitor that seeks to identify the attractiveness of the various firms in terms of places to work in. The starting point here is the views of various agents: the firm's employees; university students; former students of business schools; the general population; and human resource managers. It also uses benchmarking to make a comparison of the main indicators of people management.

The final ranking is calculated at the close of each phases outlined as the weighted sum of the scores obtained in those phases. The weighting used are given in Table 5.

Weighting percentages.

| Overall ranking | 37% |

| Sectoral ranking | 8% |

| Financial analysts | 8% |

| Trade unions | 5% |

| Consumer associations | 5% |

| NGOs | 5% |

| Economic journalists | 8% |

| Merco tracking | 8% |

| Merco persons | 8% |

| Direct assessment | 8% |

Own: Merco (2013).

Firms which do not achieve at least 8 points from other firms in the overall ranking or that receive all their overall points from a single participating firm, aside from their own, are excluded from the final ranking. If necessary, the general ranking components are given a weighting to remove the corporate vote effect.

Thus, after totaling all the Merco components and correcting the possible undesired effects (group votes, massive votes for organizations of small importance, etc.), we obtain a score index over 10,000 and the ranking derived from it, which is published annually.

Control variablesTo control for differences in earnings management incentives, we include the following variables based on prior research (Ashbaugh, 2001; Pagano et al., 2002; Tarca, 2004; Barth et al., 2006; Lang et al., 2006). First, we include the natural logarithm of total assets (SIZE) to proxy for the size of a company. The political cost hypothesis states that larger firms are more likely to prefer downward earnings management, because the potential for government scrutiny increase as firms are larger and more profitable (Watts and Zimmerman, 1990; Young, 1999). Closer scrutiny by outsiders can potentially reduce managers’ opportunities to exercise their accounting discretion in big firms. The expected relationship between discretionary accruals and firm size is negative.

Second, the variable leverage (LEV) controls for the likelihood of bankruptcy. A higher total debt to asset ratio indicates a higher possibility of debt covenant violation, which creates an incentive to increase reported earnings thorough accruals-based earnings management. According to Park and Shin (2004), firms that face financial constraints or distress have an incentive to adjust earnings upward in order to avoid a potential loss from disclosing a financial problem. These arguments would predict a positive relationship between discretionary accruals and financial leverage. Press and Weintrop (1990) and Sweeney (1994) also report that firms respond to debt contracting by strategically reporting discretionary accruals.

Third, the return on assets (ROA) is included as a proxy for the profitability of a firm. Dechow et al. (1995) and McNichols (2000) report that firms with abnormally high (low) earnings have positive (negative) shocks to earnings that include an accrual component and thus, firms with high (low) earnings tend to have high (low) accruals. As a consequence, one is more likely to find a positive relationship for the most profitable firms.

Finally, Lang et al. (2003) find that cross-listed firms appear to be less aggressive in terms of earnings management and report accounting data that are more conservative. Firms with a foreign exchange listing are presumed to have greater incentives to report transparently because they are subject to restrictions imposed by different countries and are exposed to a higher litigation risk. Therefore, we include a dummy variable to control if is a cross-listed firm or not. It can be expected that earnings quality is enhanced when listed on an international capital market (Ball et al., 2000, 2003).

We also include industry dummies to control for industry effects on earnings management.

Following Petersen (2009), we use t-statistics based on standard errors clustered at the firm and the year level, which are robust both to heteroscedasticity and within-firm serial correlation.2

ResultsDescriptive statisticsThe descriptive statistics of the variables are shown in Table 6. The mean value of absolute earnings management moves around 0.089. This value is higher in our sample in comparison to that of Choi et al. (2013) and Prior et al. (2008). The descriptive analysis shows that the CSR variable (natural logarithm of Merco index) shows a mean value of 7.90.

Descriptive statistics.

| Variable | Mean | Median | STD | Min | Max |

|---|---|---|---|---|---|

| Abs (DACC) | 0.089 | 0.061 | 0.085 | 0.0003 | 0.3668 |

| CSR | 7.904 | 7.908 | 0.534 | 7.071 | 9.210 |

| LEV | 0.645 | 0.664 | 0.203 | 0.118 | 1.512 |

| SIZE | 12.234 | 12.000 | 2.187 | 6 | 18 |

| ROA | 0.034 | 0.033 | 0.063 | −0.454 | 0.390 |

| Yes (%) | No (%) | ||||

| LIST | 74.2 | 25.8 | |||

Where Abs(DACC) is the absolute value of discretionary accruals using Jones modified model; CSR: natural logarithm of Merco index in year t; LEV: as end-of-year total liabilities divided by end-of-year total assets; SIZE: natural logarithm of total assets in year t; ROA: as net income divided by end-of-year total assets; LIST: dummy variable (company listed=1, else=0).

In Table 7, the absolute value of discretionary accruals is displayed by CSR intervals, suggesting a negative relation between CSR and discretionary accruals with an inflection point for low levels of CSR.

The correlation matrix between variables is presented in Table 8. The correlation coefficient of CSR with size is significantly positive. The correlation coefficient of EM with leverage and listing firms are significantly positive, and significantly negative with size.

Correlation matrix.

| Abs(DACC) | CSR | LEV | SIZE | ROA | LIST | |

|---|---|---|---|---|---|---|

| Abs (DACC) | 1 | |||||

| CSR | −0.056 | 1 | ||||

| LEV | 0.133* | −0.095 | 1 | |||

| SIZE | −0.153** | 0.154** | 0.062 | 1 | ||

| ROA | 0.015 | −0.048 | −0.273** | 0.056 | 1 | |

| LIST | 0.172** | −0.045 | 0.018 | −0.608** | −0.058 | 1 |

Significantly different from zero at the 0.01 level.

Where Abs(DACC) is the absolute value of discretionary accruals using Jones modified model; CSR: natural logarithm of Merco in year t; LEV: as end-of-year total liabilities divided by end-of-year total assets; SIZE: natural logarithm of total assets in year t; ROA: as net income divided by end-of-year total assets; LIST: as a dummy variable taking the value 1 if it is a listing firm and 0 if it is a no-listing firm.

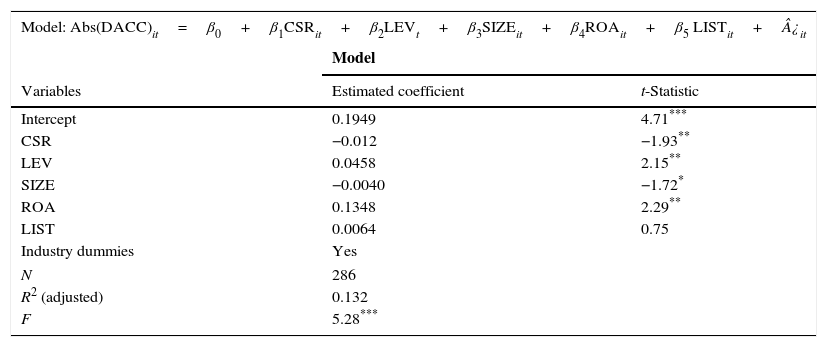

The results of Model 1 are presented in Table 9. We use t-statistics based on standard errors clustered at the firm and the year level (Petersen, 2009), which are robust both to heteroscedasticity and within-firm serial correlation. The results show a consistently significant negative relationship between corporate social responsibility practices (CSR) and absolute discretionary accruals. The discretionary accruals are substantially lower to more socially responsible firms, and this difference is statistically significant at the 0.05 level. These results provide strong evidence for the effect of corporate social responsibility practices in reducing earnings management by Spanish firms. Our findings provide support for Hypothesis 1.

Regressions of absolute discretionary accruals on independent variables and control variables.

| Model: Abs(DACC)it=β0+β1CSRit+β2LEVt+β3SIZEit+β4ROAit+β5 LISTit+¿it | ||

|---|---|---|

| Model | ||

| Variables | Estimated coefficient | t-Statistic |

| Intercept | 0.1949 | 4.71*** |

| CSR | −0.012 | −1.93** |

| LEV | 0.0458 | 2.15** |

| SIZE | −0.0040 | −1.72* |

| ROA | 0.1348 | 2.29** |

| LIST | 0.0064 | 0.75 |

| Industry dummies | Yes | |

| N | 286 | |

| R2 (adjusted) | 0.132 | |

| F | 5.28*** | |

Significantly different from zero at the 0.01 level (two-tailed).

Where Abs(DACC) is the absolute value of discretionary accruals using Jones modified model; CSR: natural logarithm of Merco index in year t; LEV: as end-of-year total liabilities divided by end-of-year total assets; SIZE: natural logarithm of total assets in year t; ROA: as net income divided by end-of-year total assets; LIST: dummy variable (company listed=1, else=0). Models include industry dummies. Regressions are run using two-way cluster standard errors (Petersen, 2009) at the time and firm level which are robust to both heteroscedasticity and within-firm serial correlation.

These results are consistent with the findings of Chih et al. (2008), who argue that companies with greater CSR conduct less earning smoothing. However, these results are in contrast with the findings of Prior et al. (2008), who found a positive impact of earnings management practices on CSR. They explain such a result by the fact that managers who indulge in earnings management practices have two reasons to satisfy stakeholders’ interest. First, there is a pre-emptive reason-managers anticipate that stakeholder activism, as a result of earnings manipulation, may damage their position in the firm. A good way of avoiding such activism is to satisfy stakeholders’ interests. Second, an entrenchment reason-manager tends to collude with other stakeholders as a hedging strategy against disciplinary initiatives from shareholders affected detrimentally by these earnings management practices.

In terms of the control variables, we find that absolute discretionary accruals are decreasing in size, but increasing in leverage and profitability. Agency and political costs explain why firm size is significantly associated with earnings management. The coefficient size is significant and negative. Firm size is clearly a business characteristic that exhibits differences in the degree of earnings management, showing that high size firms have less discretionary accruals. This is often used as a proxy for political sensitivity. Large firms with large profits may try to manage earnings downwards (Zimmerman, 1983; Liberty and Zimmerman, 1986). The larger the firm, the more likely managers are to choose income-decreasing accruals.

The control variable Leverage (Lev) is found to be significantly and positively related to absolute discretionary accruals. High leverage has been found to be associated with closeness to the violation of debt covenants (Press and Weintrop, 1990), and debt covenant violation has been found to be associated with discretionary accrual choice (DeFond and Jiambalvo, 1994). To avoid debt covenant violation, managers of highly leveraged firms have incentives to make income-increasing discretionary accruals. However, high leverage is also associated with financial distress (Beneish and Press, 1995). According to DeAngelo et al. (1994), troubled companies have large negative accruals related to contractual renegotiations that provide incentives to reduce earnings. Our results are consistent with Watts and Zimmerman (1978), DeFond and Jiambalvo (1994), Sweeney (1994) and Dichev and Skinner (2002).

Robustness testTo examine the robustness of our results, we carry out an additional analysis. Different measures of discretionary accruals are used in the literature to proxy for earnings management. There exists extensive literature relating discretional accruals and free cash flow (Chung et al., 2005; Dechow and Ge, 2006; Bukit and Iskandar, 2009). These studies establish that the opportunity for earnings management is higher among companies with high surplus free cash flow. Free cash flow (FCF) is defined as the excess of cash available to a firm after it has invested in all positive-net-present-value projects that is not paid out in dividends (Jensen, 1986). Managers of low growth firms with high FCF are expected to be involved in non-value maximizing activities including an increase in perquisite consumption and compensation at the expense of shareholders as well as the manipulation of accounting number (Jensen, 1989; Shleifer and Visny, 1989; Lang et al., 1991; Christie and Zimmerman, 1994).

We therefore rerun our model but using like dependent variable the free cash flow (Model 2). Free cash flow is measured by operating income before depreciation minus expenses such as tax expense, interest expense and dividend (Lehn and Poulsen, 1989).

The results of this analysis are shown in Table 10. Ours results indicate that CSR has a negative impact on FCF. The results can be interpreted that minor CSR high free cash flow. These results are consistent with our Model 1, as managers of high free cash flow companies have incentive to engage in earnings management. The results again support Hypothesis 1. In term of control variables, we find that free cash flow is increasing in size and in ROA. The coefficients are significant and positive.

Regressions of cash flow on independent variables and control variables.

| Variables | Estimated coefficient | t-Statistic |

|---|---|---|

| Intercept | 4.650 | 5.78*** |

| CSR | −0.374 | −2.48** |

| LEV | 0.093 | 0.18 |

| SIZE | 0.964 | 16.77*** |

| ROA | 6.108 | 3.98*** |

| LIST | −0.143 | −0.47 |

| Industry dummies | Yes | |

| N | 286 | |

| R2 (adjusted) | 0.819 | |

| F | 123.73*** | |

Significantly different from zero at the 0.01 level (two-tailed).

Where FCF: natural logarithm of free cash flow in year t; CSR: natural logarithm of Merco index in year t; LEV: as end-of-year total liabilities divided by end-of-year total assets; SIZE: natural logarithm of total assets in year t; ROA: as net income divided by end-of-year total assets; LIST: dummy variable (company listed=1, else=0). Models include industry dummies. Regressions are run using two-way cluster standard errors (Petersen, 2009) at the time and firm level which are robust to both heteroscedasticity and within-firm serial correlation.

The motivation for firms to engage in CSR has been an unresolved issue for which previous research has yielded mixed results. While some researchers suggest that CSR engagement is induced by the long-term perspectives for sustainable operations of a business, others argue that CSR is a practice used by managers who are involved in opportunistic behaviors. Stakeholder theory is the accepted paradigm to explain why companies involve themselves in socially responsible activity as a strategy to maximize their long-term return on investment – sustainable business success, by recognizing the importance of each stakeholder group and incorporating this knowledge into their corporate strategy. Stakeholder theory regards CSR as a success medium for managing stakeholder relationships (Ullman, 1985; Roberts, 1992).

In this article, we examine the relationship between CSR and earnings quality by using Spanish firms from 2005 to 2012. For the analysis, the MERCO index is employed as a proxy for the CSR ratings of Spanish firms. The earnings quality is measured by using the absolute value of abnormal discretionary accruals from the modified Jones model. In particular, we explore the thesis that managers manipulate earnings in order to obtain private benefits, and through these practices they damage the interests of stakeholders. A firm with CSR in mind tends not to manipulate earnings because it is not a responsible practice. And such firms, therefore, should act in a responsible manner when reporting accounting information.

The empirical results confirm to our theoretical contention. In particular, we find a negative impact of CSR practices on earnings management, so firms that are more committed to CSR engage less in earnings management. These results are consistent with Chih et al. (2008). They find that companies with higher social responsibility engage in less earnings smoothing and less earnings decrease/loss avoidance. Similarly, Shleifer (2004) interprets that earnings manipulation, which many people find ethically objectionable, occurs less often in corporations with a strong commitment to social responsibility. As suggested by Hong and Andersen (2011), more socially responsible firms have higher quality accruals and less activity-based earnings management, both of which impact financial reporting quality.

Socially responsible firms are inclined to foster long-term relationships with stakeholders rather than maximize their short-term profit. In this regard, providing quality earnings is closely connected to CSR activities, especially in that both aim to meet the needs of the stakeholders. This reason to engage in social responsibility is supported and supplemented by the log stream of empirical research that finds that CSR and financial performance are positively related (Orlitzky et al., 2003; Brammer et al., 2007). In this regard, as Labelle et al. (2010) indicate, higher level of corporate moral development is associated with higher quality financial reporting.

Analysis of the determinants of accounting quality has important policy implications. Since all EU countries will have consistent financial reporting rules, future improvements in accounting quality will be largely dependent on changes in a country's legal and political system and financial reporting incentives. Changing a country's overall institutional infrastructure is difficult, so addressing financial reporting incentives will perhaps be the least costly means of achieving any further improvements in accounting quality. This study offers insights for policy makers and managers interested in enhancing CSR.

These results must be interpreted with some limitations in mind. The study is not free from external validity problems caused by a restricted sampling frame and small sample size. Due to the feasibility of collecting CSR and financial data, the study includes in the sample only the most reputable companies in Spain. To enhance generalizability, future research using increased numbers of observations including all Spanish companies is encouraged.

Furthermore, the results show some increase of accruals for companies with a medium-high profile of CSR activities. This may reveal a potential non-linear relationship (maybe quadratic) between CSR and earnings management. Arguments taken from the different theories also may support this idea. Thus, future research could consider this issue as an interesting line of investigation.

La Porta et al. (1999) report that 85 per cent of Spanish firms have a controlling shareholder, in contrast to only 10 per cent in the UK or 20 per cent in the US.