The recent disruptions within the global financial system have led to a notable reassessment of heterodox economic theories in hope that their unique insights into the capitalist business cycle can help illuminate the underlying instabilities that may have contributed to recent crises. This paper focuses in particular on the work of noted post-Keynesian economist Hyman P. Minsky and his associated theories of financial fragility and the inherent instability of modern financial capitalism. We emphasize the theoretical foundations of Minsky's work, notably his financial instability hypothesis, and then apply this conceptual framework to the recent Asian financial crisis of 1997-98. Financial instability and overleveraging were important features in the Asian crisis, thus proving the validity of some of Minsky's assertions. The massive increases in speculation and dependence on external capital drove these economies toward a Minsky moment, when the bubble eventually burst.

Las recientes perturbaciones en el sistema financiero mundial han conducido a un replanteamiento considerable de las teorías económicas heterodoxas con la esperanza de que sus percepciones singulares acerca del ciclo económico capitalista puedan echar luz sobre las inestabilidades subyacentes que hayan podido contribuir a las últimas crisis. Este documento se centra concretamente en la obra del economista poskeynesiano Hyman P. Minsky y en sus teorías de la fragilidad financiera y la inestabilidad inherente del capitalismo financiero moderno. Hacemos hincapié en los fundamentos teóricos de la obra de Minsky, especialmente en su hipótesis de la inestabilidad financiera, y a continuación aplicamos este marco conceptual a la crisis financiera asiática de 1997-1998. La inestabilidad financiera y el endeudamiento excesivo fueron características importantes en la crisis asiática, lo que otorga validez a algunas de las afirmaciones de Minsky. El aumento masivo de la especulación y de la dependencia del capital externo llevó a estas economías a un momento de Minsky, cuando finalmente la burbuja explotó.

The widespread turmoil inflicted upon the global economy over recent years by the convulsions of the financial system has prompted the reappraisal of economic thought previously relegated to the fringes of the academic and financial communities. This paper examines the theories and potential applications of one such economist, Hyman P. Minsky, who argued that economic stability is inherently destabilizing due to its effects on both the level of private investment, leading to overleveraging, and the gradual undermining of associated capital structures. Minsky's work, termed the financial instability hypothesis, provides a thought provoking and timely theoretical framework for examining the recent bout of financial crises that have plagued the global economy. Specifically, this paper applies Minsky's financial instability hypothesis to the Asian financial crisis of 1997, and argues that it was largely investment-driven growth, financed through increasingly speculative methods and combined with bad institutions, that led to the accumulated economic fragility that would be the downfall of the high-flying “Asian Tigers.”

Hyman Minsky developed his financial instability hypothesis as an adaptation of the investment-driven business cycle put forward by John Maynard Keynes in 1936 within The General Theory of Employment, Interest, and Money. Minsky argued that Keynes’ theory was fundamentally flawed because it largely ignored the development of the capital structure that supported the associated investment cycle, and therefore could not adequately explain the potentially destabilizing role of finance in the business cycle. To address this weakness Minsky first bolstered the Keynesian business cycle by incorporating Michal Kalecki's profit equation, derived from a heterodox accounting of macroeconomic stocks and flows, and then integrated this more comprehensive theory of the business cycle into the modern financial system. This paper utilizes this comprehensive framework to analyze both the domestic and international sources of economic instability that were building within the seemingly unrelenting expansion of the Asian Tigers during the early-to-mid nineties.

This paper provides a quantitative overview and analysis of both domestic and international economic data to examine the development of financial instability within the Minskian framework. National statistics on asset prices, capital investment, credit expansion, and economic growth are used to illustrate the tenuous nature of growth in corresponding Asian economies during the time period. In addition, we want to look at the role that both private and public credit played in the crisis. Moreover, we will analyze the structural characteristics of these time series. It is also noteworthy that the Asian financial crisis provides an opportunity to study Minsky's theory on an international scale, as a primary source of fragility within many of the Asian economies was their growing dependence on foreign-denominated debt. Therefore, relevant balance of payments data from each nation will also be incorporated into the final analysis.

The findings of this paper bolster Hyman Minsky's argument that modern capitalist economies, i.e. those that developed in the post-Second War period and matured by the 1970s, trend toward instability due to the confluence of the aforementioned factors that Minsky laid out in his financial instability hypothesis. Beneath the veneer of unparalleled economic growth the Asian economies were becoming increasingly unstable. They exploited artificially cheap foreign debt and government subsidized domestic lending to fuel increasingly speculative investments that were only deemed rational either through outright cronyism and bad institutions and/or the rose-colored glasses that have adorned financial bubbles throughout history.

2Histories and Theories of Financial Crises and Business CyclesFinancial crises are as topical as ever, given the recent world-wide financial crisis. There is a plethora of new research on the history and causes of bubbles and busts. Often those perspectives are linked to the debate as to why the so-called Great Moderation, i.e. the period from at least the 1980s when economic volatility decreased substantially, has come to an end. Macroeconomics as a whole is a state of turbulence, since the old maxims of Keynesianism or the tenets of Neoclassical economics no longer seem to offer such obvious solutions to modern economic problems.1

The causes of the current lingering financial and economic crisis are hotly debated among academic and policy circles. Some, like Carmen Reinhart and Kenneth Rogoff, have sounded the alarm about public sector's indebtedness in the aftermath (or on the road to) of financial crisis. They have argued that a public debt-to-GDP ratio of over 0.9 pose a risk for long-run economic growth, an argument that sounds quite reasonable given recent debt problems and defaults by countries like Greece. While they do not seem as concerned about private (or foreign) debt, they do recognize that often governments have had to absorb lots of private debt in the form of toxic assets. Crises can come in various shapes and forms, including sovereign debt crises, inflationary crises (often related to wars or bad policies), banking crises (such as in the 1930s), and currency crises.2

There have been a number of critiques of Reinhart and Rogoff's focus, primarily, on public debt levels.3 One clear distinction in particular that should be made concerns whether public debt is from domestic or foreign sources.4 As Niall Ferguson and others have pointed out, domestic sources of public debt, primarily a result of wars and crises, have led to the creation of financial markets and more democratic forms of government in the last centuries.5

A more internationalist approach to financial crises that has grown in popularity in recent years centers on the concept of global imbalances.6 Ben Bernanke most famously advocated this theory in a 2005 speech where the future Fed Chairman coined the term “global savings glut” (GSG).7 The Fed Governor argued that excessive net savings in emerging markets (mainly China and oil exporting nations) were flowing into the United States bond market, distorting interest rates and consequently helping to fuel asset prices through the expansion of cheap credit (mainly in the form of “safe” mortgage-backed securities).8 With this framework Bernanke tied together global capital flows, the rise of structured finance, and the resulting asset price speculation in the US housing market. The aforementioned economic historian Niall Ferguson further popularized this model in his 2008 book The Ascent of Money with his introduction of “Chimerica” into the academic vernacular. Ferguson presented American debt-fueled consumption and the Chinese desire to accumulate foreign exchange reserves as a kind of symbiotic relationship that formed between the world's largest debtor and creditor nations.9

The GSG theory of financial crisis has been severely criticized in the years since Ben Bernanke's original speech. Harvard economists David Laibson and Johanna Mollerstrom illustrated in a 2010 paper for the National Bureau of Economic Research (NBER) that global savings rates did not exhibit the robust rise one would expect if there were truly a global glut.10 They also note that it was the asset bubble and associated consumption boom in America that drove the expansion of the trade deficit and led to the offsetting financial inflows noted in GSG thesis. This reversal of Bernanke's original line of causation was further supported by research done on behalf on the Bank of International Settlements (BIS) in 2011.11 This paper notes that financial flows have come to dwarf the current account movement of real goods and services (in 2010 gross financial inflows to the US were 60x the current account deficit). The authors argue that it was the international banking system, mainly large US and European financial institutions, that drove asset price speculation throughout the developed world through the process of endogenous credit creation and excessive leverage. This reformulation of Bernanke's GSG has been termed the “global banking glut,” and finds ultimate culpability in the rise of cross-border speculative lending as opposed to developing world excess savings.12

Another theory of financial crisis that has received growing interest in recent years is the concept that income and wealth inequality foster economic fragility and lead to recurrent crises. This argument was at the core of the University of Chicago's Booth School of Business professor Raghuram Rajan's 2010 book, Fault Lines: How Hidden Fractures Still Threaten the World Economy.13 Rajan argues that a confluence of political and socioeconomic factors (e.g. unequal access to education, weakened labor unions, skewed tax policy, etc.) have led to the stagnation of working-class wages in America over the past three decades. Meanwhile, the wages at the top of the income pyramid soared, creating an increasingly large gap between the potential consumption levels of the two groups. According to Rajan this gap was filled with increasingly cheap and easy to get credit, allowing American families to consume far beyond their means and contributing to both the debt buildup and financial speculation that led to the most recent crisis.14

Michael Bordo and Christopher Meissner have recently countered the inequality thesis. In a paper released earlier this year they note that credit booms do raise the possibility of economic crisis, but argue that empirical research finds no evidence that rising inequality leads to rapid credit expansion.15 Instead, they advance the more orthodox argument that low interest rates and high levels of economic growth are the two best indicators of credit expansion. This is a more traditional “boom and bust” argument, with both empirical and theoretical roots that can be found throughout the economic and historical literature. Bubbles, like financial and debt crises, of course have occurred frequently in the economic history of modern nations.16 Famous instances of bubbles and busts include Dutch tulip mania in the 17th century, the South Sea bubble in the 18th century, and for example the IT bubble in the beginning of the 21st century. The study of excessive speculation and business cycles has been abundant in the 20th and 21st centuries. The famous studies by Joseph Schumpeter, Friedrich Hayek, and John Maynard Keynes before mid-century set the stage for the search for the recognition of business cycles, their measurement, and ultimately the efforts to try to tame them.17 This foundation on the booms and busts has led some modern economists to draw parallels to the current crisis – one of such scholars is Nouriel Roubini, who has argued that excessive speculation and economic crises are predictable. In his view, the build-up of overt leveraging in the private and public sectors, lack of regulation, and the changing perception of risk have contributed to the financial tsunami that still affect Western economies, just like they have in the past.18

Roubini has also provided some important clues for the analysis of the Asian financial crisis that hit the fast-growing Asian economies in 1997, leading to currency crises, rapidly escalating foreign debt shares, and plummeting confidence in the financial systems. He has suggested that the main causes of the crisis were institutional weaknesses, bad policies and corruption, and structural distortions in the economies in question; all of which contributed to a severe financial panic once it got underway and in fact made it worse than the initial economic conditions would have suggested.19 While the observations by Roubini and others are fairly persuasive, they are not necessarily based on a particular theoretical framework that would form a comprehensive explanatory apparatus for the analysis of past and future financial crises. Other scholars have also severely criticized the IMF interventions, both in terms of their effectiveness and goals.20

A noted scholar who did just that was Charles Kindleberger, who adapted a distinctly Minskian framework to provide the theoretical foundation for his historical account of financial crises; Manias, Panics, and Crashes: A History of Financial Crises, first published in 1978.21 Kindleberger emphasized the instability of the credit system, the preponderance of mass irrationality in euphoric cycles, and the asymmetry of information between business insiders and outsiders as key factors in the continual booms and busts of capitalism. He noted that this model of economic fragility, which strongly resembled Minsky's financial instability hypothesis, was reliably found within more past bubbles and speculative booms than any other model of financial crises. From Kindleberger's work we can see that the factors identified by Minsky as central to the endogenous cyclicality of modern capitalism are timeless.22 Therefore, we argue that in order to better understand modern financial crises we must also turn to Minsky, in order to both enhance our current analysis as well as to develop more useful policy alternatives for the future.

3A Minskian FrameworkHyman Minsky (1916-1996) was an American economist and professor commonly associated with the Post Keynesian school of thought. His most enduring and consequential work focused on the tendency of capitalist economies toward boom and bust cycles of expansion and contraction. In particular, Minsky emphasized the role of private finance and debt accumulation in the pro-cyclical amplifying and perpetuating of this cycle.23 He conceptualized these ideas into an encompassing theory of economic crises referred to as the financial instability hypothesis (FIH); Minsky's most durable and renowned contribution to modern economic thought.24

Hyman Minsky developed his financial instability hypothesis as an adaptation of the investment-driven business cycle put forward by John Maynard Keynes in 1936 within The General Theory of Employment, Interest, and Money. Minsky argued that Keynes’ theory was fundamentally flawed because it largely ignored the development of the capital structure that supported the associated investment cycle, and therefore could not adequately explain the potentially destabilizing role of finance in the business cycle. To address this weakness Minsky first bolstered the Keynesian business cycle by incorporating Michal Kalecki's profit equation, derived from a heterodox accounting of macroeconomic stocks and flows, and then integrated this more comprehensive theory of the business cycle into the modern financial system.

Through the financial instability hypothesis Minsky related private finance and aggregate demand through the impact of financial markets on business investment and the subsequent impact of investment on incomes, money flows, and asset prices.25 According to Minsky economic stability is inherently destabilizing over the long term, primarily based upon the devaluing of liquidity, the easing of lending standards, and the ensuing accumulation of private debt in order to support inflated asset values and the buildup of increasingly expensive capital stock. Profit-seeking firms are incentivized to become increasingly indebted, as liquid and conservative capital structures are tempted by higher prospective returns on equity capital and the potential for higher profit margins that come from debt financing. Liquidity is devalued as costly long-term assets are financed through progressively shorter-term debt, increasing the possibility that any shock to the system could result in a liquidity crisis that exposes underlying structural insolvency.26

Minsky defined the dynamic process of private debt accumulation by identifying three different levels of private borrowing transactions and their respective locations within the aforementioned boom and bust cycle. In “hedge” transactions the borrower can make all debt payments, principal and interest, from current asset cash flows. These are typified by businesses with a relatively large percentage of equity financing and retain solvency in all but the worst of prospective markets. “Speculative” transactions involve a borrower whose probable cash flows can cover interest payments but is not able to fully repay principle. A speculative borrower needs to continually refinance part of its debt in order to avoid a potentially ruinous cash shortfall. It is important to note that in Minskian analysis most financial institutions are fundamentally speculative. Finally, “Ponzi” transactions involve borrowers who cannot depend on asset cash flows to fulfill either interest or principal payments. These debtors must continually issue either new debt or equity, or sell liquid, marketable assets to meet their obligations. Ponzi borrowers are dependent on both asset price appreciation as well as liquid and stable debt and equity markets for their future solvency.27

In a Minskian analysis modern capitalism, with its innate boom and bust cycle and profit-seeking firms, is driven toward a more unstable and leveraged capital structure over the course of the business cycle. As leverage increases the size of the shock needed to induce a financial crisis declines. Something as simple as a flattening of asset prices, or a marginal rise in interest rates, will cause the Ponzi borrower to default. At this point Minsky identifies a chain reaction that spreads through modern financial markets; ponzi borrowers liquidate marketable assets to meet obligations, this magnifies the downward pressure on asset prices; collateral previously pledged by other borrowers is then devalued, forcing further selling of assets in a vicious cycle. This ripple of forced selling and liquidation spreads through the financial system causing lenders and borrowers alike to rush for liquidity and safety, devaluing risk assets and perpetuating a series of margin calls and defaults.28

Helping to perpetuate this cycle is the Keynesian idea of uncertainty, which is central to Keynes theory of the business cycle according to Minsky, who famously stated that, “Keynes without uncertainty in something like hamlet without the Prince.” Uncertainty for Keynes, and for Minsky as well, was centered on the idea that capitalists and households make economic decisions whose consequences are dependent upon the future outcomes of variables that those individuals have no reasonable chance of knowing. As Keynes noted, these are not merely decisions made under vague probabilities, but instead are decisions for which “there is no scientific basis on which to form any calculable probability whatever.”29 This uncertainty has a particular influence on private sector investment decisions, and therefore is a key component of the investment-driven business cycle. In particular, Keynes identified the effects of uncertainty on the propensity to hoard cash, as well as capitalists’ opinions on the future profitability of current capital investment, as the primary means through which uncertainty influenced the business cycle. Minsky, further developing Keynes’ argument, reasoned that because modern capital investment is both increasingly expensive and long lasting, uncertainty plays an increasingly important role in the decision making that surrounds capitalist investment.

The role of uncertainty in inhibiting investment is compounded by what Keynes referred to as the “fetish of liquidity.” In the General Theory he noted that capitalism incentivizes investors to hold liquid assets, ranging from stocks and bonds to treasuries and cash. This desire is directly related to the aforementioned uncertainty, as Keynes asserted, “our desire to hold Money as a store of wealth is a barometer of the degree of our distrust of our own calculations and conventions concerning the future.... The possession of actual money lulls our disquietude; and the premium which we require to make us part with money is the measure of the degree of our disquietude.”30 This disquietude and liquidity fetishism leads capitalists to place a higher value on holding liquid assets over long-term assets, and therefore requires a greater potential return on investment to induce the spending on capital equipment and structures needed to reignite the business cycle and spur growth. Minsky updated and revised this concept when he noted that every institutional innovation that leads to both new ways to finance business and new substitutes for cash assets decreases the volume of liquidity available to redeem the debts incurred in investment as well as to provide a true source of liquidity as a buffer during crisis. This Keynesian vision of the liquidity paradox implies that while throughout the boom period, the distinction between near money and money fades away, it comes to the fore again when distress and crisis erupts.

According to Minsky, “A financial crisis leads to an economic crisis when investment declines so that a decline in profits as well as output, employment, and wages takes place.”31 The decline in profits leads to a further decline in asset prices, financial firms pull back on lending for investment, and businesses cut capital expenditures and employment to protect margins. For this aspect of the financial instability hypothesis Minsky was fusing the work of two of the early twentieth century's most distinguished economists, John Maynard Keynes and Michal Kalecki. Minsky adopted Keynes’ view that changes in interest rates and the price of employment cannot be counted on to realign the economy toward equilibrium, spurring investment and therefore employment, profits, and aggregate demand.32 There is no natural tendency toward full employment or the maximizing of aggregate demand. To better illustrate this, and to provide a framework for tracking the effects on money flows through the economy, Minsky utilized Kalecki's profit equation. Kalecki showed that in a capitalist economy the primary sources of private sector aggregate profits are business investment, the government deficit, and the reduction of worker savings.33

The financial instability hypothesis illustrates the adverse effects of financial crises on the real economy through their effect on the level of gross investment and aggregate demand. As asset prices fall and credit contracts the level of business investment and employment declines, this leads to a decline in aggregate profits. Declining profit leads to a further reduction in investment and wages, as Keynes’ “animal spirits” are dampened and liquidity and capital preservation take precedence over investment and expansion. Since investment is the primary driver of business profits; and investment is only made if there is a reasonable chance of expanding profits in the future, this creates a vicious cycle of cost cutting and declining aggregate profit.34 For Minsky, as well as Keynes and Kalecki, this is why counter-cyclical government deficits are vital. They supplant private investment with deficit fueled aggregate demand, supporting business profits and breaking, or preventing altogether, the aforementioned cycle of cost cutting, capital preservation, and falling aggregate demand.35 We will next turn to the analysis of the Asian Tigers, to evaluate their long and short-term economic development.

4Long and Short Term Perspectives on the Asian TigersTypically the term Asian Tigers refers to the rapid growth of Hong-Kong, Singapore, South Korea, and Taiwan in the post-war period. Nonetheless, this perspective may be somewhat misleading, since it ignores some of the less successful Asian economies in the same time period, especially those that did not fare as well during and after the financial crisis of 1997. Therefore we argue we need to also examine the experiences of countries like Indonesia, Thailand, Philippines, and Malaysia, among others. One could also include the big economies, such as China, India, and Japan, but the former two nations were still utilizing foreign capital controls and trade management policies to a greater extent than the East Asian economies. Even as such, it will be difficult for us to analyze these nations beyond some of the economic indicators and data. Regardless of that, these data reveal the patterns that led to the actual crisis.

The East Asian post-Second World War growth miracle had its foundations in domestic monetary policies, high trade shares as a percentage of GDP, and export-oriented development strategies; all of which eventually contributed to the crisis.36 Furthermore, East Asia's rapid growth was notable due to the widespread adoption of public policies for regulating both the organization of domestic financial markets, as well as the allocation of financial resources.37 Public policy in both of these spheres was reversed substantially prior to the financial crisis.38 Additional causes of the rapid growth are still debated, and include export-driven (and import-substituting) growth strategies, public and private investments, education policies, and so on.39 Yet, it may be that many of these countries were much weaker than they perhaps appeared. As Paul Krugman presciently pointed out in 1994, the newly industrialized Asian Tigers achieved their growth “miracle” primarily by increasing inputs, labor and capital, i.e. mobilizing resources at a mass scale. It appears that fairly little of the growth was due to efficiency gains.40 This would also suggest that the growth was, to varying degrees, fairly artificial and vulnerable to shocks.

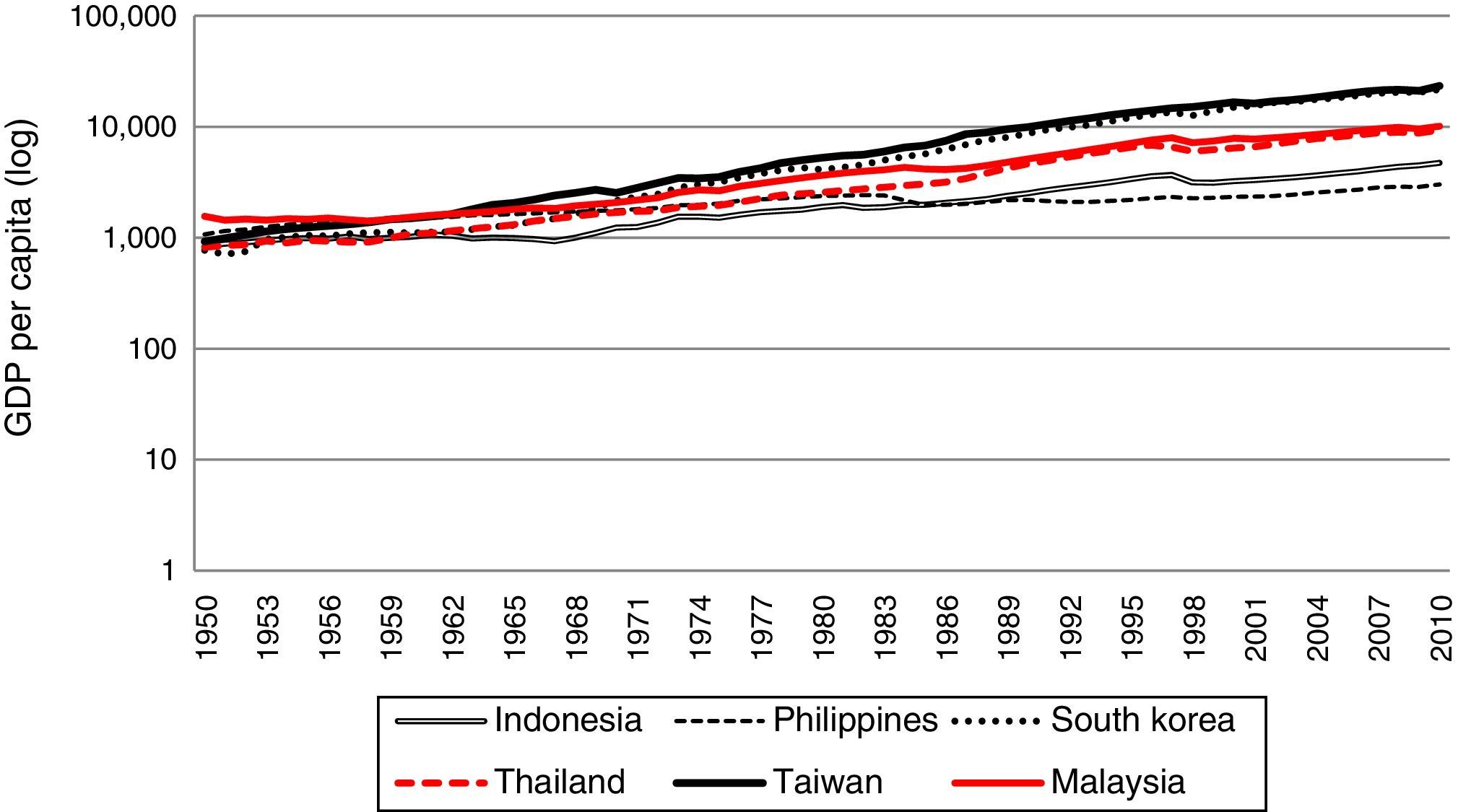

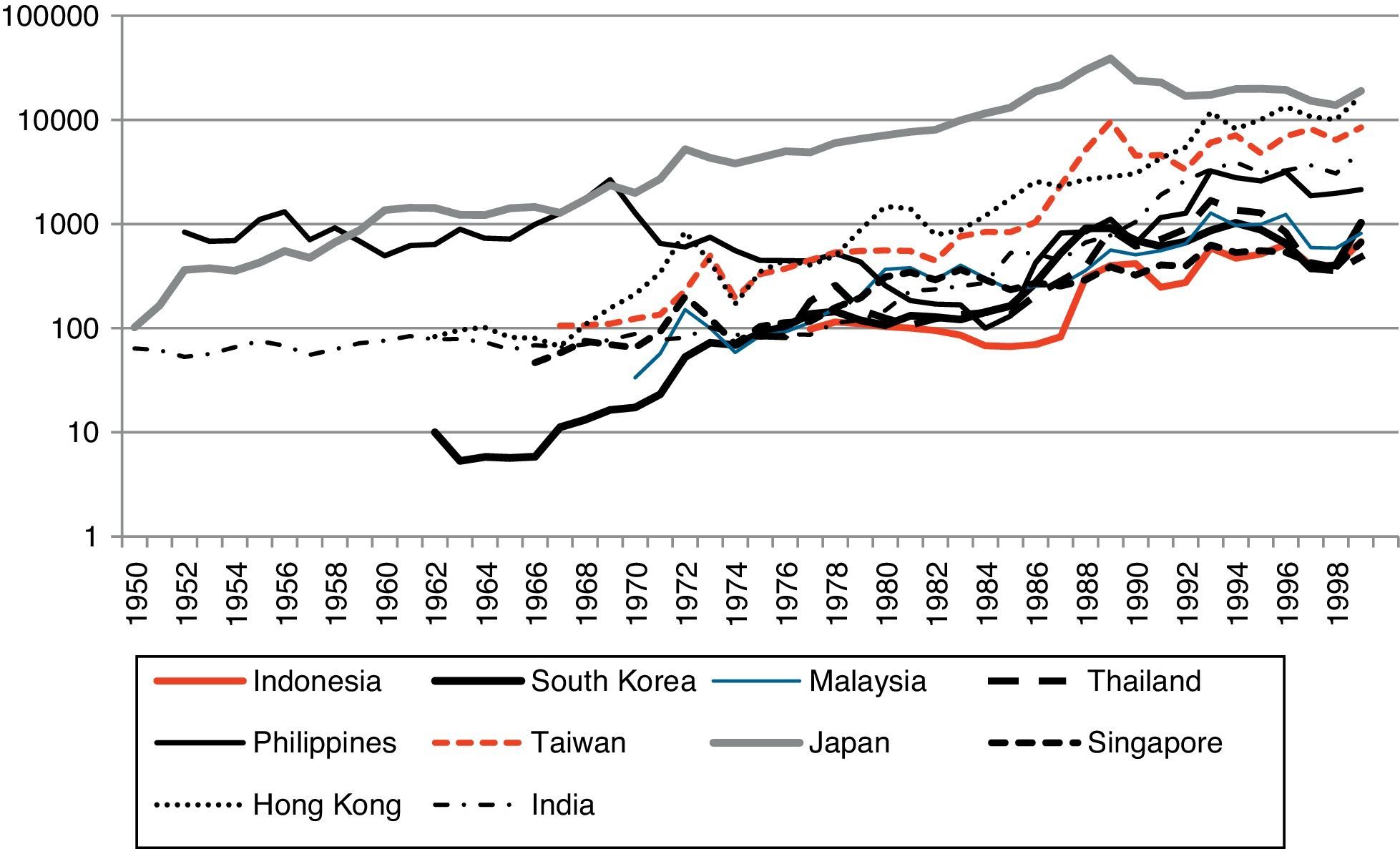

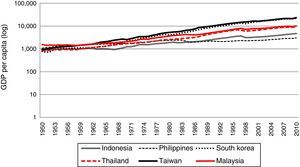

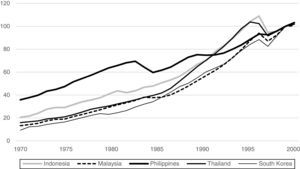

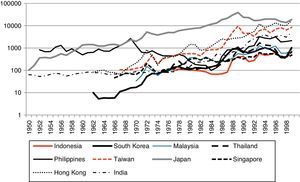

As seen in Figure 1, the long term economic growth paths differed greatly among the six nations depicted in the graph. Taiwan and South Korea were among the high performing nations, and they were less affected by the financial crisis, whereas Thailand and Malaysia in the middle group. The economic growth trend for both of them was halted by the crisis. Moreover, Indonesia's modest growth trend was abruptly halted by the crisis, and Philippines had almost flat economic performance for the last two decades of the 20th century. What about the relative size and performance of the main Asian economies in the 1990s in particular?

Real GDP Per Capita for Six Asian Nations, 1950-2010.

Sources: Maddison, Angus (2003). The World Economy. Historical Statistics. Paris: OECD; Bolt, Jutta and J. L. van Zanden (2013). The First Update of the Maddison Project; Re-Estimating Growth Before 1820. Maddison Project Working Paper 4.

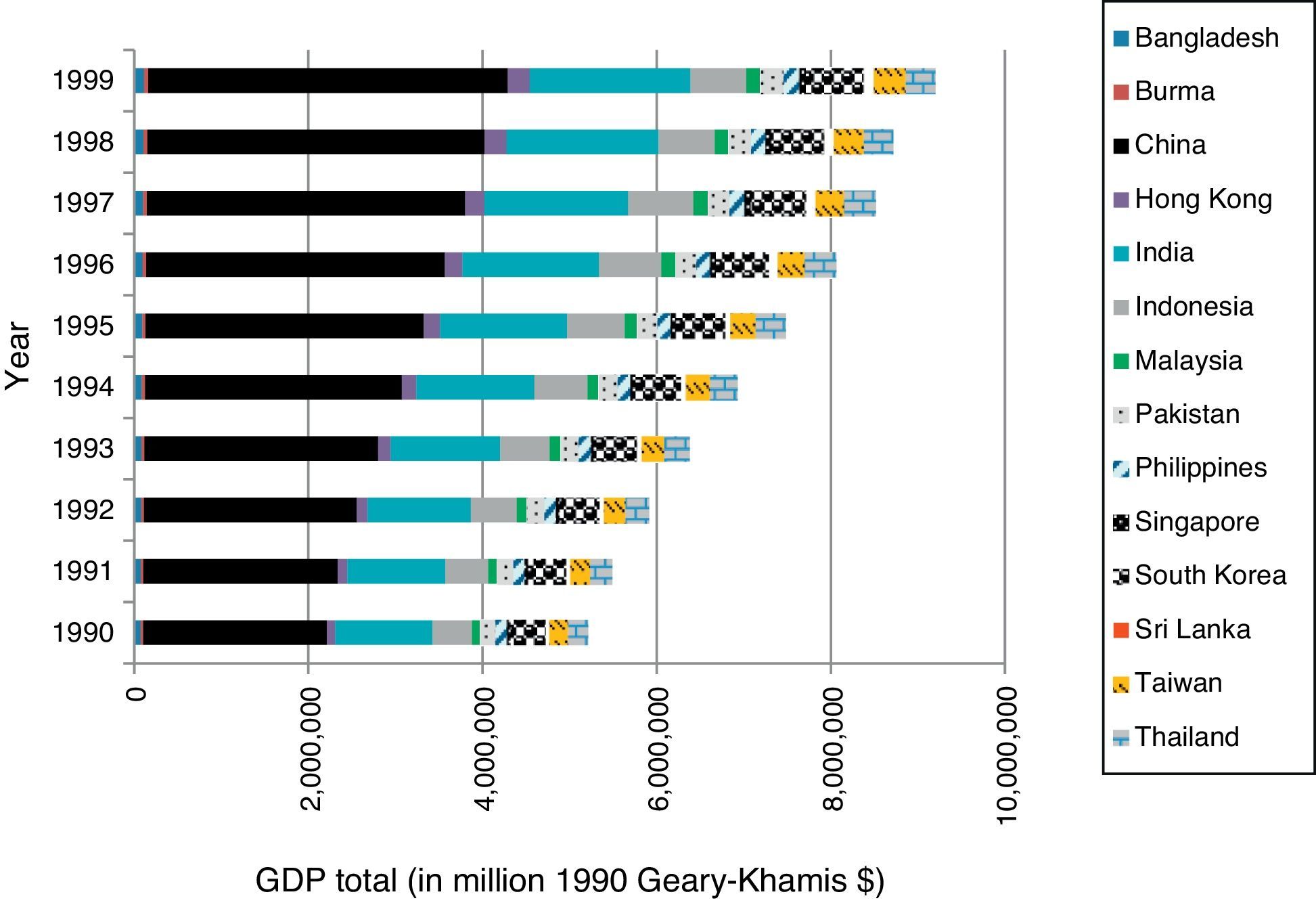

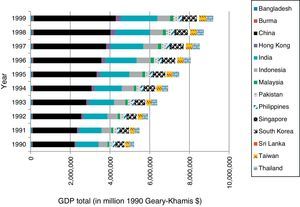

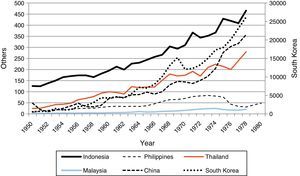

As seen in Figure 2, the relative weight of China and India grew rapidly in the 1990s. On the other hand, South Korea as well as Taiwan and Thailand also increased their relative weight, Pakistan and Thailand more modestly so. Comparatively, Indonesia's growth was halted during this decade.

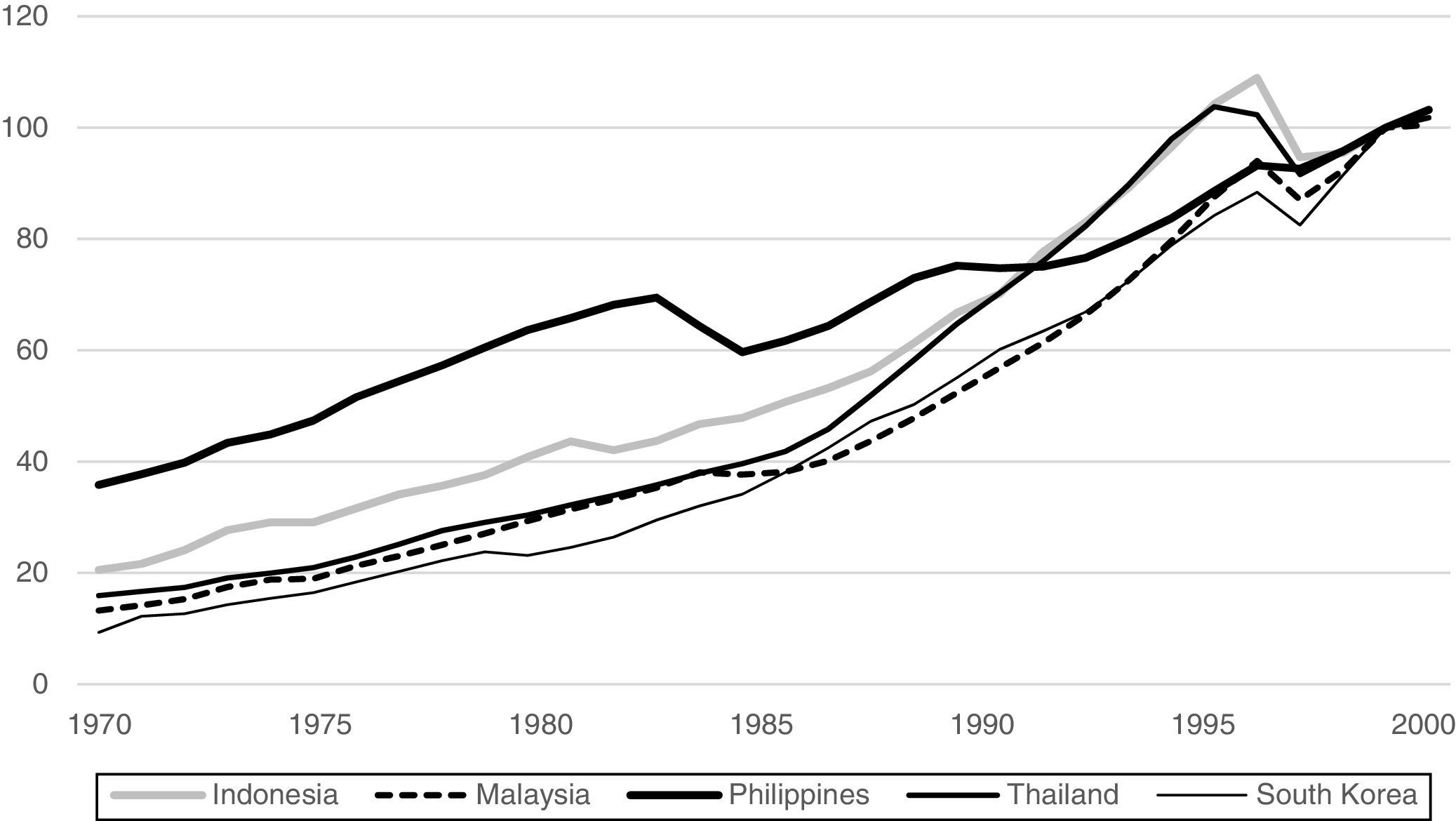

The specific growth paths of some of the key players in our story are shown in Figure 3. In terms of real GDP, the countries that were hardest hit were Indonesia and Thailand, then Malaysia and South Korea, with the Philippines enduring the shallowest decline. It also seems that the growth performances converged toward the end of the decade.

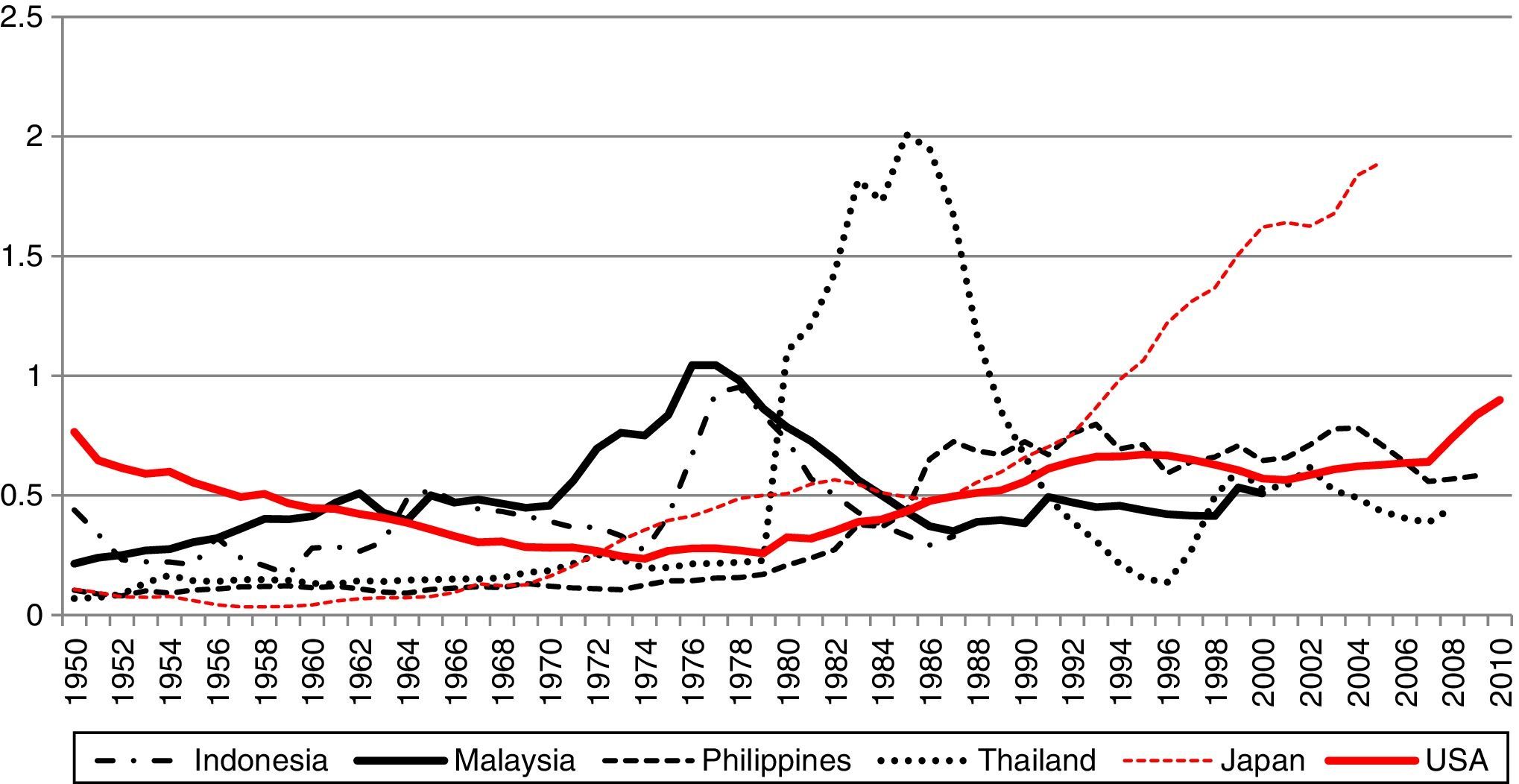

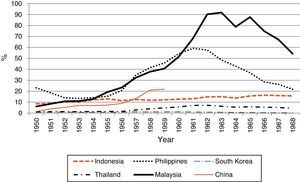

From a Minskian perspective, public debt does not necessarily need to appear as quite the boogeyman as in the Reinhart-Rogoff framework. In fact, Minsky argued that the post-Second World War stability was, by and large, a result of the large commitment of domestic public to the war effort, in the form of bonds and other such financial instruments, and that it led to a “robust financial system”.41 It is possible to hypothesize that a modest level of public debt, arising from domestic financial sources, can have a beneficial effect in moderating the financial markets’ inherent tendency toward instability. As seen in Figure 4, the historical public debt patterns varied greatly. The US debt ratio declined until the 1980s, then increased at fairly steady clip; for Japan, the decline occurred in the late 1980s, with a massive increase in the last two decades. What about the Asian nations? Their behavior also varied greatly – for example, Malaysia cut its public debt dramatically from the late 1970s onward, whereas the Philippines increased its debt load in the 1990s. Contrary to those experiences, Thailand cut its debt drastically. Of course, one would need to observe the external debt load to begin to assess the dependence on foreign sources of capital, the primary element of the Minskian framework.

Public Debt to GDP Ratios, Six Nations, 1950-2010.

Source: 1950-1980: Chen, D. H. C. (2003). Intertemporal excess burden, bequest motives, and the budget deficit. Washington, D.C.: World Bank; 1980-2010: Reinhart and Rogoff (2011), data available from: http://www.reinhartandrogoff.com/data/ (accessed February 1, 2013).

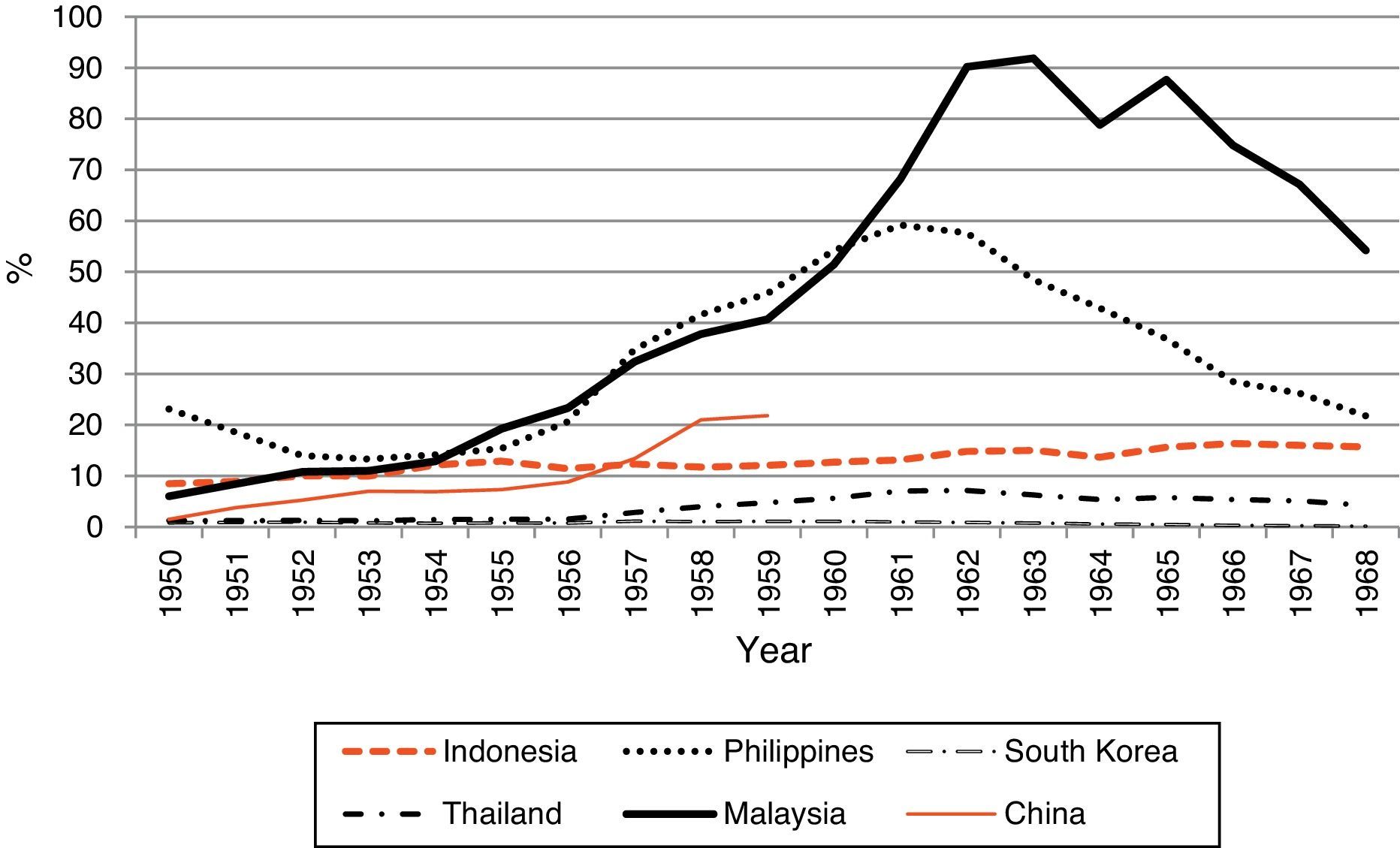

However, it is harder to come by the exact breakdown of that debt in the more modern period, which is not the exact focus here anyway, but we can first look to history to analyze some of those patterns. Malaysia had a high dependence on external debt and, to a lesser degree, also Philippines; South Korea and Thailand did not rely on much external credit during their heyday of economic growth, i.e. the period of high economic growth for the emerging Asian Tigers (see Figure 5). Moreover, not all the Asian economies were the same in the post-war period either; some experienced early peaks in foreign debt, whereas others did not.

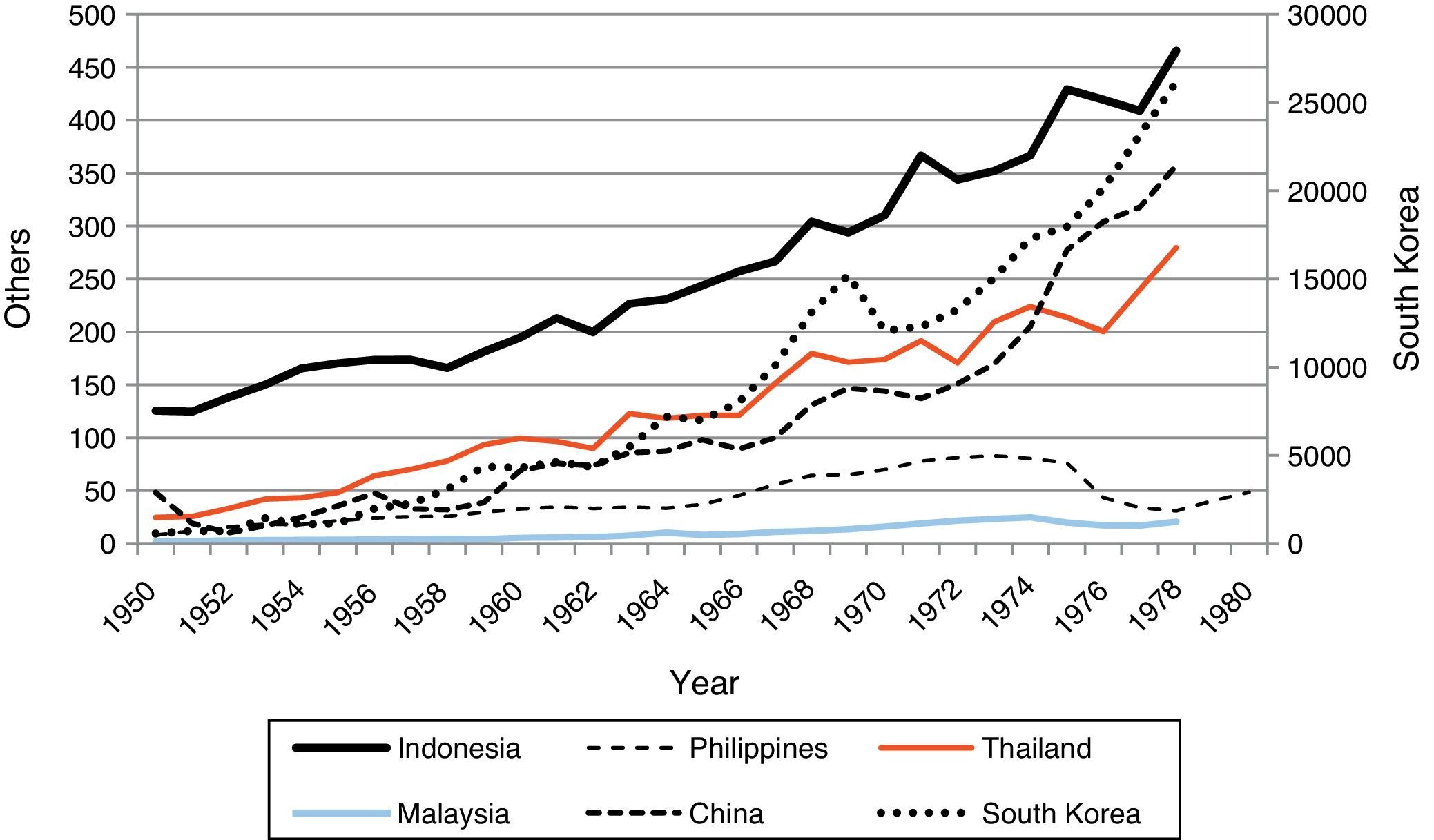

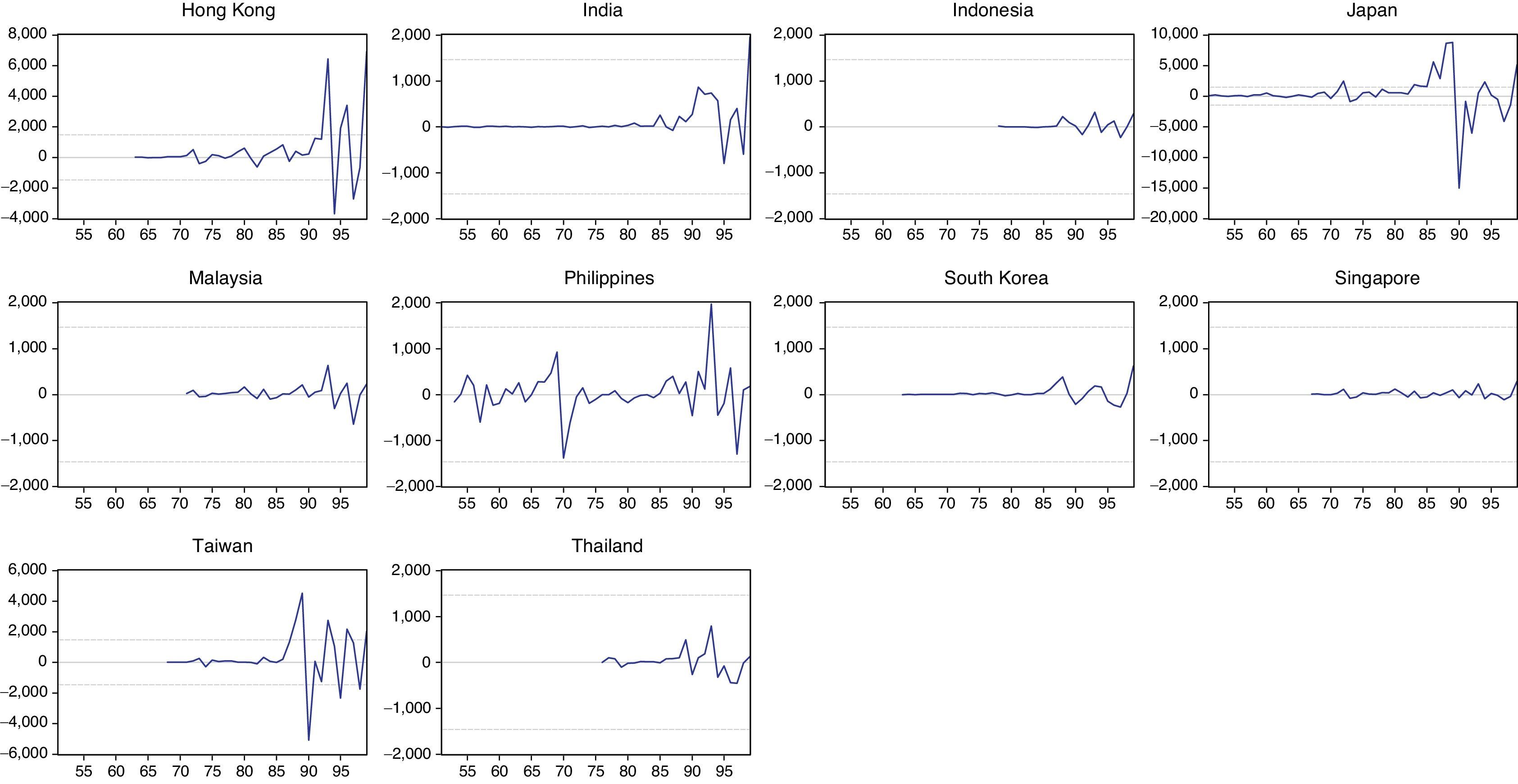

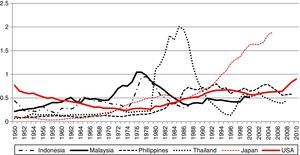

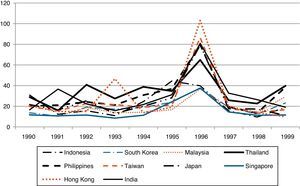

Another starting point is to look at the historical patterns of domestic investment; in the period from 1950 to 1980, South Korea was in a league of its own in terms of the size of the domestic investment. We can also see that Indonesia, Thailand, and China increased their domestic investment rapidly in this period, whereas Philippines and Malaysia were left behind. Speculation was also a big part of the picture, both in the long term and the short term. All the stock indices featured in Figure 7 trended strongly upwards during the period, and that growth trend intensified in the late 1980s and the early 1990s. The sharp decline is also equally apparent in the data.

The Main Stock Market Indices in Ten Asian Countries, 1950-1999.

Source: Global Financial Data (2000). Encyclopedia of Global Financial Markets, compiled by Bryan Taylor, 7th edition. Http://www.globalfindata.com.

While these long-run views give us some clues as to what happened, we need to take a closer look at these economies and their “Minskian” characteristics in the 1990s, in particular the extent of the overleveraging and the structural changes in the time series.

5Minsky and the Asian Financial CrisisThe idea that an “Asian” financial crisis took place in 1997-98 is a bit of a misnomer, if not an outright mischaracterization of events. It is certainly true that an economic tremor reverberated throughout the region, however; there was a wide disparity between those nations most affected by the crisis and those who emerged relatively unscathed. The former, specifically the nations of Indonesia, Malaysia, South Korea, Thailand, and the Philippines, were highly vulnerable at the onset of the crisis due to the accumulated fragility within their respective financial systems, although there were differences among this group too. This was the direct result of a prolonged process of accumulation built around financial liberalization, and private investment cycles financed through increasingly illiquid and short-term foreign debt.

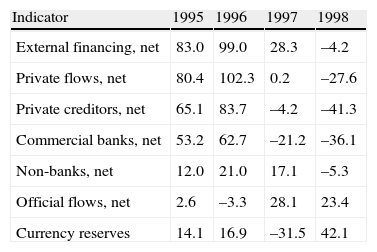

By the mid-1990s, the aforementioned Asian countries were hastily progressing through the economic liberalization programs designed for developing economies collectively known as the Washington Consensus.42 These reforms included the deregulating of interest rates, the lowering of bank capital and reserve requirements, the removal of capital controls, and the promotion of financial innovation and the importing of western financial products.43 As a consequence private sector financial institutions were able to import foreign savings in order to help finance domestic investment-driven asset booms. Foreign financial institutions were able to flood the Asian Tigers with ever-increasing amounts of short-term and highly speculative money flows, increasing financial volatility and driving asset price spikes. Table 1 illustrates both how commercial banks dominated the external financing of these respective nations, as well as the sharp and severe reversal of money flows that occurred at the onset of the crisis.

Total External Financing ($bn).

| Indicator | 1995 | 1996 | 1997 | 1998 |

| External financing, net | 83.0 | 99.0 | 28.3 | –4.2 |

| Private flows, net | 80.4 | 102.3 | 0.2 | –27.6 |

| Private creditors, net | 65.1 | 83.7 | –4.2 | –41.3 |

| Commercial banks, net | 53.2 | 62.7 | –21.2 | –36.1 |

| Non-banks, net | 12.0 | 21.0 | 17.1 | –5.3 |

| Official flows, net | 2.6 | –3.3 | 28.1 | 23.4 |

| Currency reserves | 14.1 | 16.9 | –31.5 | 42.1 |

Source: IMF.

This rapid rise in external financing for the Asian nations was aided by the fact that each of these respective countries was pegging its currency to the US dollar ($). The central governments were effectively backstopping the accumulation of foreign denominated debt by promising, through the maintenance of the currency peg, to ensure that foreign loans would not suffer from possible exchange rate risks. If anything the continual inflows of foreign currency through the capital account was seen as a reliable source of upward pressure on the Asian currencies. Domestic businesses had every reason to believe they would be paying back foreign loans with a stable domestic currency, while international investors believed that gains reaped from higher interest rates and booming asset prices were protected from currency devaluation by the exchange rate policies of the East Asian central banks.

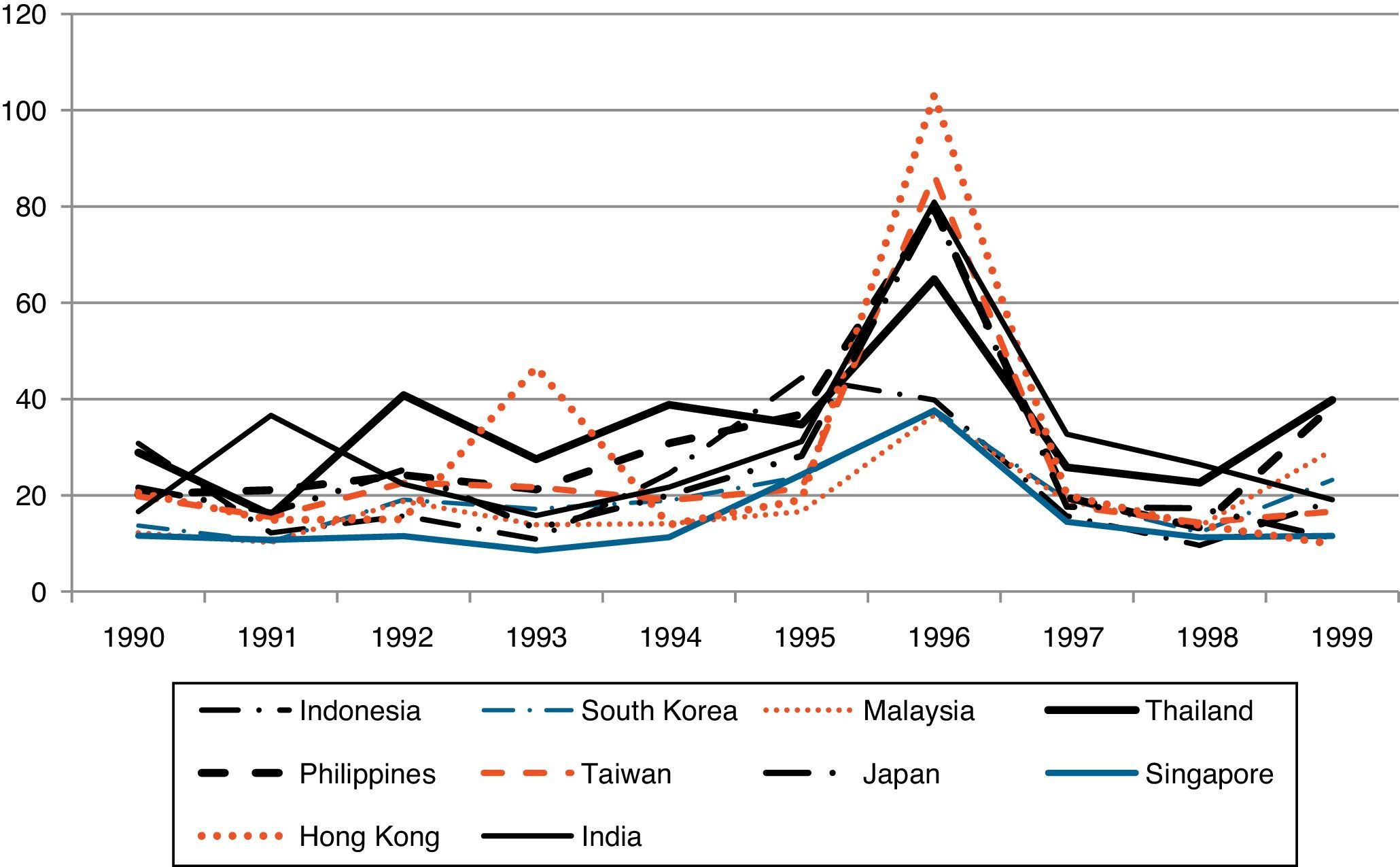

The currency peg also provoked debt-financed capital investment from foreign loans by decreasing the amount of Keynesian uncertainty involved in the financing process. By removing the specter of exchange-rate risk from foreign debt contracts national governments were providing the private sector with an artificially high sense of security. They were encouraging the proliferation of increasingly complex financial instruments and the buildup of growing levels of fragility at the exact time they should have been reigning in these very activities. The build-up of instability and the formation of a major bubble can be seen in Figure 8 – it seems that asset prices became inflated in a dangerous fashion in the period 1995-1996.

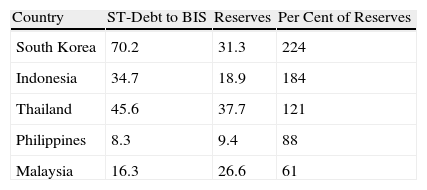

The currency pegs also introduced a distinctly Minskian dynamic as well, because pegging ones national currency to a foreign currency can only last as long as the domestic central bank has the needed foreign exchange reserves to support the national currency at the given exchange rate. The importance of central bank reserves was amplified in East Asia by falling export revenues due to increasing competition from Chinese and Japanese exporters and slowing regional economic activity.44 In order to know if a domestic central bank has the needed financial firepower to protect the peg one must estimate the potential capital outflows that may need to be converted. A good proxy for this estimation is the total level of short-term debt within the domestic economy that has been funded through external sources. These are loans maturing in less than twelve months that, if not rolled over or refinanced domestically, will result in capital outflows that will need to be cleared at the central bank at the given exchange rate. If private businesses operating within a fixed-rate economy accumulate too high a percentage of these foreign loans relative to the central bank's foreign exchange reserves they are effectively engaging in an international version of Minsky's speculative finance. They cannot realistically repay the principal of their loans at the contracted rate, as doing so would drain the central bank's reserves to an unacceptable level. Therefore, they are dependent on continually rolling over their upcoming loans or refinancing them with newly issued ones. The following Table 2 shows just how far the “Asian Tigers” had traveled down this perilous path by the onset of the crisis.

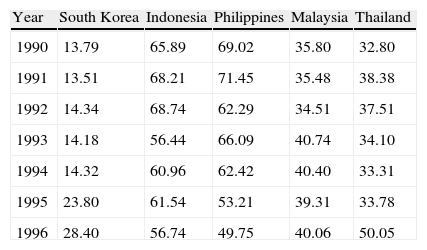

We can perhaps find some clues to why some Asian countries weathered better than others in this data. As seen in Table 3, for example South Korea was much less reliant on foreign sources of debt than the other four nations, same as it had been in the 1950s and 1960s. Thailand and Malaysia had similar amounts of external debt, and continued to get more leveraged in the 1990s. Indonesia and Philippines had very high levels of foreign debt, but this share actually declined somewhat in the 1990s. As we have already discovered, they had structural problems with their economies before the crisis hit, and their GDP per capita grew slower than the others in these comparisons.

Foreign Debt as a Percentage of GDP.

| Year | South Korea | Indonesia | Philippines | Malaysia | Thailand |

| 1990 | 13.79 | 65.89 | 69.02 | 35.80 | 32.80 |

| 1991 | 13.51 | 68.21 | 71.45 | 35.48 | 38.38 |

| 1992 | 14.34 | 68.74 | 62.29 | 34.51 | 37.51 |

| 1993 | 14.18 | 56.44 | 66.09 | 40.74 | 34.10 |

| 1994 | 14.32 | 60.96 | 62.42 | 40.40 | 33.31 |

| 1995 | 23.80 | 61.54 | 53.21 | 39.31 | 33.78 |

| 1996 | 28.40 | 56.74 | 49.75 | 40.06 | 50.05 |

Source: IMF.

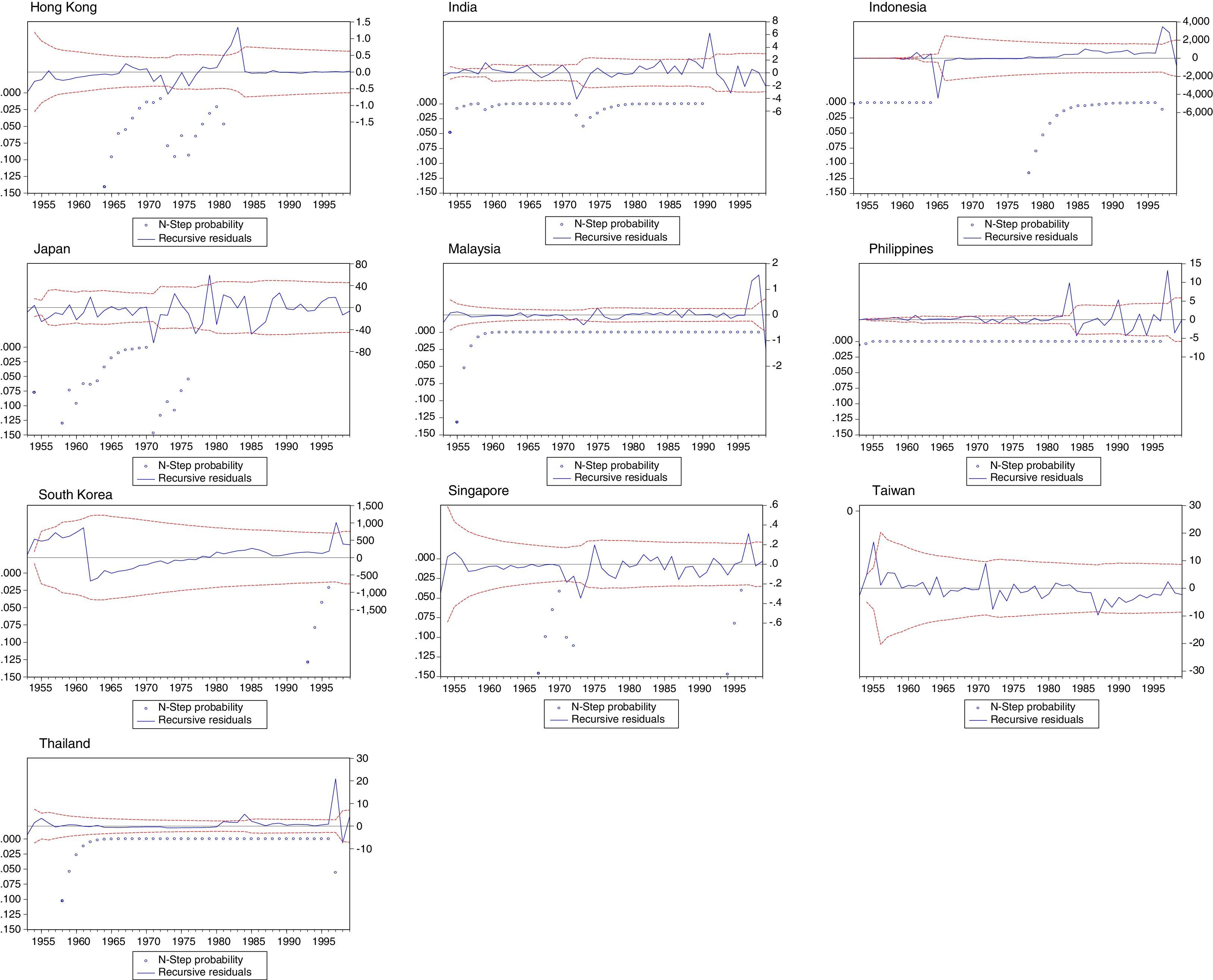

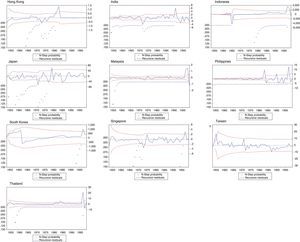

“Eyeballing” the data is, however, not enough to confirm the initial impressions, which is why we decided to examine the structural qualities of the time series, to pinpoint when the post-war trends in growth broke down, creating a bubble. If one regresses the dependent variable on itself, lagged one year, we can start observing those qualities. As seen in Figure 9, the trend over time for the Asian stock market indices becomes unstable (=the residuals start to behave erratically), typically, at the end of the period, in the late 1980s to the early 1990s. From this perspective it appears that Taiwan, Japan, and India experienced the crisis earlier, already in the 1980s. Moreover, the effect, at least initially, was less severe for Indonesia, Malaysia, and Singapore.

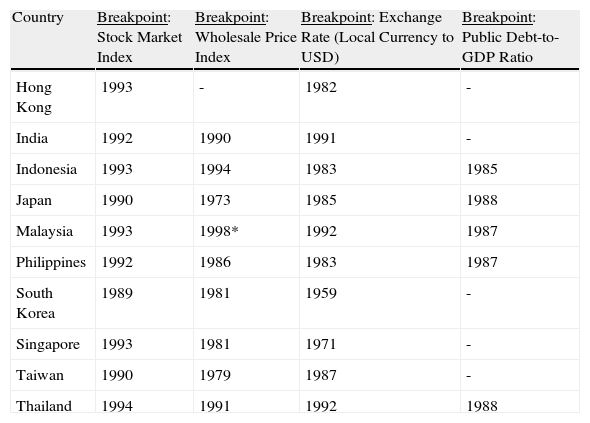

The exchange rate data is not quite as straightforward to interpret, as seen in Figure 10. It seems that most of the Asian countries experienced exchange rate volatility during the post-war period, and only Hong Kong, India, Japan, and Taiwan did not experience a structural break in the data in the 1990s. We confirmed this by pinpointing the most probable breakpoint in the stock indices, wholesale prices, exchange rates, and public debt-to-GDP ratios in this time frame, as seen in Table 4. Asian stock markets went off the tracks, so to speak, in the 1990s, whereas for wholesale prices and exchange rates this happened mostly in the 1980s and 1990s. Public debt patterns seemed to change in the late 1980s in particular.

Quandt-Andrews Unknown Breakpoint Tests for Stock Market Indices, Wholesale Prices, Exchange Rates, and Public Debt-to-GDP Ratios for Ten Asian Countries, 1950-1999.

| Country | Breakpoint: Stock Market Index | Breakpoint: Wholesale Price Index | Breakpoint: Exchange Rate (Local Currency to USD) | Breakpoint: Public Debt-to-GDP Ratio |

| Hong Kong | 1993 | - | 1982 | - |

| India | 1992 | 1990 | 1991 | - |

| Indonesia | 1993 | 1994 | 1983 | 1985 |

| Japan | 1990 | 1973 | 1985 | 1988 |

| Malaysia | 1993 | 1998* | 1992 | 1987 |

| Philippines | 1992 | 1986 | 1983 | 1987 |

| South Korea | 1989 | 1981 | 1959 | - |

| Singapore | 1993 | 1981 | 1971 | - |

| Taiwan | 1990 | 1979 | 1987 | - |

| Thailand | 1994 | 1991 | 1992 | 1988 |

Source: Global Financial Data (2000). Note: that the breakpoint maximum value is based on the LR F-statistic. * = Chow breakpoint test used due to data limitations. The data for the public debt-to-GDP ratios ends in 1996, i.e. it is based on Chen (2003). Some of the time series do not cover the first years of the period.

The results and methods used here have some limitations, however. For example the Bai-Perron tests additionally revealed that some of the time series covered in Table 4 most likely incurred several breaks. Nonetheless, usually at least one of the breaks coincided with the breaks listed in the table. Moreover, the periods were too short in most cases for adequate testing of unit roots, although typically both the common and individual series tests indicated the presence of a unit root in most cases. In addition, we discovered that the singe-equation Johansen cointegration tests found some cointegration, implying a unified response to the crises, among a sub-sample: Hong Kong, Japan, Philippines, and South Korea (for stock indices); and Japan, Malaysia, South Korea, and Thailand (for exchange rates).45 This leads us, in addition to the evidence utilized in this article before, that not only were the paths to the crisis different, but the responses were very different too. And, some of the countries may have more in common with each other than the rest of the sample.

6ConclusionMinsky's financial instability hypothesis provides a timely theoretical framework for examining the recent bout of financial crises that have plagued the global economy after the Great Moderation ended. Specifically, this paper applies Minsky's financial instability hypothesis to the Asian financial crisis of 1997, and argues that it was largely investment-driven growth, financed through increasingly speculative methods and combined with bad institutions, that led to the accumulated economic fragility and asset bubble that would be the downfall of the high-flying “Asian Tigers.”46

The quantitative overview provided in this paper reinforces the Minskian nature of the Asian economies, the underlying weaknesses of these economies in historical terms and the overleveraging of the 1990s in particular. Some, like Indonesia or the Philippines, were less developed by the time of the crisis, and were a bit less influenced by it (although the political ramifications were severe), whereas others, like South Korea and Taiwan, were already so developed and relatively stable politically that they did not suffer as long lasting aftereffects of the crisis. It seems that the countries that were most impacted by the crisis were those in the “middle of the pack”, like Thailand and Malaysia, were the most prone to overleveraging in the 1990s and also felt the crisis the deepest. One could argue that modern capitalist economies, and perhaps especially those that are rapidly developing by more intense utilization of economic resources, are indeed prone to financial instability and business cycles, despite Keynesian and monetarist ideas alike. Beneath the veneer of unparalleled economic growth the Asian economies were becoming increasingly unstable in the 1980s and 1990s, until the bubble finally burst. They exploited artificially cheap foreign debt and government subsidized domestic lending to fuel increasingly speculative investments that were only deemed rational either through outright cronyism and bad institutions and/or the rose-colored glasses that have adorned financial bubbles throughout history.47 The aftermath of the crisis and the long-term impacts of that crisis will have to be investigated at a later date, once we have enough data to examine that. And history will also tell if we have truly entered into a Minskian dynamic in which crises will be more frequent and more destructive one after another. One thing is for sure: Minsky's work can no longer be ignored or labeled marginal – we simply cannot afford to do that.

See Kates (2010), on the critique of neoclassical theory and institutional alternatives; see North (1997), Greif (1997), and Greif and Laitin (2004).

See Reinhart and Rogoff (2009), and Krugman and Wells (2010). See also Reinhart and Rogoff (2011).

One of the earliest to make this distinction, in theoretical terms, was Buchanan (1957).

See Ferguson (2001), Macdonald (2003), and Graeber (2011).

For an example of the widespread adoption of the “global savings glut” see “The great thrift shift” (2005), in The Economist.

For details of the original speech see Bernanke (2005).

After becoming Fed Chairman Bernanke further developed his theory in Bernanke et al. (2011).

For Ferguson's initial writings on “Chimerica” see Episode 6 within Ferguson (2008), this was later expanded upon in Ferguson and Schularick (2011).

For more details on the concept of a “global banking glut” see Shin (2011).

For more on the role of inequality in financial crises see Kumhof and Ranciere (2010), and Azzimonti et al. (2012).

For a counterargument to Rajan's thesis see Bordo and Meissner (2012).

On the history of financial crises, in addition to earlier studies, see also Eichengreen and Lindert (1989), and Eichengreen and Mitchener (2003).

See esp. Schumpeter (1939), Schumpeter (1928), Keynes (1940), Hayek (1975), Cochrane and Glahe (1999). The modern business cycle research has become very mathematical by nature; see Hamilton and Raj (2002).

For another example of Kindleberger's unique form of economic history see Kindleberger (1986).

For a recent attempt to integrate Minskian theory into New Keynesian macroeconomics see Eggertsson and Krugman (2012), and for a recent attempt to integrate Minskian theory into the analysis of financial institutions see Ryoo (2013)

Minsky laid out his financial instability hypothesis in a series of three books, Minsky (1975), Minsky (1982), and Minsky (1986).

Ibid.

Ibid.

For further discussion of Keynes’ ideas on the role of uncertainty within the business cycle see Keynes (1937).

Keynes (2008), 216.

For a more detailed explanation of Keynes thoughts see Keynes (2008), Book 4 and 5.

For a more detailed explanation of Kalecki's profit equation see Kalecki (1971).

For more on the role of financial regulation in the “East Asian Miracle” see Stiglitz and Uy (1996).

For an in-depth discussion on the role of financial market liberalization in the Asian Financial Crisis see Chang et al. (2001).

On the latter, see e.g. Morris (1996).

Minsky (1975), (14). Cf. Reinhart and Rogoff (2011).

For further discussion of these events and their impact on East Asia see Stiglitz (2002) and Furman et al. (1998).

The results are available from the authors by request. On Bai-Perron methodology, see Bai and Perron (1998). On testing for unit roots and structural breaks simultaneously, see e.g. Lee and Strazicich (2003).

For further analysis from a Minskian perspective, see Kregel (1998) and Mayer (1998).

For further analysis of global financial crises from a Minskian perspective, see Munoz (2011) and Wolfson (2002).