The Great recession has brought back to foreground the link between trade credit, international trade and economic growth. Scholars have recently found that the effects of the fall in trade finance are strong and accurately explain the recent fall in international trade. We argue that the lost decade that followed Latin America's debt crisis is a useful comparative benchmark to recognize the scope of impact on international trade stemming from a sharp decline in trade finance. The years that followed the Mexican debt default of 1982 experienced a decrease in the financial flows to the region. However, the lending policies adopted by export agencies had a countercyclical effect. They reacted to defaults by suspending their cover activities for exports to defaulting countries, but soon reintroduced them once governments entered into a credit program from the IMF. This paper is the first to estimate the impact of trade finance on international trade in the aftermath of Latin America's debt crisis.

La Gran recesión ha vuelto a situar en primer plano la conexión entre la financiación comercial, el comercio internacional y el crecimiento económico. Estudios recientes demuestran que los efectos de la caída de la financiación comercial son marcados, y explican con precisión el reciente descenso del comercio internacional. Nosotros argumentamos que la década perdida que siguió a la crisis de la deuda Latinoamericana constituye una referencia comparativa y útil para comprender el alcance del impacto sobre el comercio internacional, derivado del fuerte descenso de la financiación comercial. Los días que siguieron al incumplimiento de la deuda mexicana de 1982 experimentaron una disminución de los flujos financieros hacia la región. Sin embargo, las políticas sobre préstamos adoptadas por las agencias de exportación tuvieron un efecto anti-cíclico. Reaccionaron al incumplimiento suspendiendo sus actividades de cobertura a las exportaciones a los países incumplidores, aunque pronto las volvieron a introducir una vez que los gobiernos se adhirieron al programa de créditos del FMI. Este documento es el primero en calcular el impacto de la financiación comercial en el comercio internacional, como consecuencia de la década perdida en Latinoamérica.

The subprime crisis renewed the interest from academia and policymakers on the impact of trade finance on international trade and economic growth. Moreover, the debt crisis in Europe has raised concerns regarding the impact of the governments’ weakened financial position on their access to finance, as this could further deteriorate the perspectives for economic recovery. The general pessimistic environment has depressed credit markets overall, and trade credit is not an exception. At the moment of writing, the ongoing debate focuses on the manner in which international cooperation and public support may provide relief to this negative dynamic.

In this paper, we assess the role of trade finance on Latin American imports during the international debt crisis of the 1980s. This was a period where a wave of sovereign defaults seriously threatened to trigger an international banking crisis, thereby affecting international credit. Latin America was the region that most suffered the decline in international credit. The crisis had an abrupt impact on the region's day-to-day needs for trade finance. Most works describing the process of debt renegotiations mention that a main priority for governments from defaulting countries was the rapid resumption of trade finance, for which Export Credit Agencies (ECAs) were regarded as key actors. While certain countries avoided a continued shortage of trade-credit, other countries were obliged to reduce imports to minimum levels.

Latin America's debt crisis has recently emerged as a favorite mirror for researches looking for historical parallels to the current Southern European debt crisis (Cavallo and Fernandez-Arias, 2012). Noteworthy, these works have overlooked the role of trade finance from their analyses on the consequences of the crisis. In fact, to our knowledge, there has been no proper analysis on the link between the behavior of Latin America's external sector and the fall of international credit. Historical evidence shows nevertheless that policymakers in Latin America and economists working in international organizations (mainly the IMF and the World Bank) were concerned that the lack of trade-finance could constitute a main obstacle to Latin America's development. Most of the imports of capital goods were financed through credits from exporting countries. In the middle of what Diaz-Alejandro (1984) had called the major development crisis since the Great Depression, this was an issue of serious concern.

We provide new evidence on the impact of trade finance on developing countries’ imports. We use original archival evidence and reconstruct series on trade-related debt that allows us to make accurate estimations on the link between sovereign defaults and the fall in trade. As we discuss below, one of the secondary effects of the crisis was the general recognition on the necessity to obtain information on international inter-bank activity and in particular that related to trade finance. The Bank for International Settlements (BIS) and the Organization for Economic Cooperation and Development (OECD) commenced to gather data on trade-related credits during these years. These figures were as pioneering as they were imperfect. Despite their potential shortcomings, they confirm the qualitative evidence showing that there was an abrupt impact of the crisis on trade finance that mainly affected Latin America.

An ex-post analysis of the debt renegotiation process demonstrates that export-credit was resumed to some extent for countries rescheduling their debts and finding arrangements with their creditors. A political economy perspective of this outcome would suggest that the request by borrowing countries to obtain trade credit matched the interest from governments in creditor countries, who attempted to retain an increasingly relevant export market. The need for trade credit was regarded as important as the recovery of defaulting countries. Whereas restoring economic growth became a major problem after 1982, trade finance was a reachable objective for which creditor governments collaborated with international organizations and with defaulting countries.

Further evidence demonstrates that ECAs in developed countries played a main role. Most of them had only moderately suspended their covering and credit activities after defaults, most often assuming the consequent losses. This policy had been promoted by the ECAs’ own governments, and was part of a more general and broad strategy, that included a parallel pressure on creditor banks to maintain open credit lines to developing countries. In most cases, governments from creditor countries also encouraged defaulting countries to renegotiate their debt by conditioning their support, and that of their ECAs, to the resolution of the debt problems. As a result, although imports of defaulting countries expectedly fell in the early stages of the crisis, they gently recovered afterwards and never really constituted a threat to growth. A relieving conclusion we draw is that the lost decade could have been even worse.

Our work qualifies previous works that analyzed trade finance in the 1970s and 1980s. The IMF (2003) contends that trade finance was a less important problem then than in the 1990s. According to this work, banks assumed a double role as providers of long-term finance to countries in difficulties and as financiers of international trade. The banks had therefore sufficient incentives to continue supplying trade credit, as this could avoid aggravating the potential repayment difficulties of debtor countries. The evidence that we provide in this paper is at odds with these findings, because banks rapidly reacted to debt problems by cutting their credit to countries in financial distress. Our results confirm to some extent what Auboin and Engemann (2013) suggest, that trade finance was less affected by financial crises in the 1970s and 1980s given the importance of officially guaranteed credit over the total quantity of trade between developed and developing countries. However, whereas these authors also explained that there was a common interest by banks and governments to keep trade flowing, we show that this was not immediate and rather, most ECAs went “off cover” to countries when first hit by the crisis.

The rest of the paper is organized as follows. In the following section we make a brief literature review on the role of trade finance in a recent historical perspective, and describe the particularities of the 1970s and 1980s financial practices. Section 3 describes the consequences of the debt crisis on the international banks’ lending activities to developing countries. In Section 4 we show that the debt renegotiation process was influenced by the need to restore trade finance. Section 5 provides empirical evidence that shows that macroeconomic variables do not entirely account for the behavior of imports from Latin American countries in the early stages of the crisis. Section 6 presents an econometric analysis that aims to isolate the impact of trade finance on imports and analyze the behavior of ECAs. We conclude in the last section.

2Financial crises and trade finance: the historical contextIn the aftermath of World War II, economists and policymakers intended to avoid any protectionist temptations that could damage the recovery of international trade and the world economy. The consequent need for trade finance was to be met by a smooth international expansion of banking activities and the establishment of ECAs. These agencies had their origins as early as 1919 in Britain, followed later by other countries such as the U.S., that establshed the Export-Import Bank (Eximbank) in 1933, though most of them were created in the post-1945 period (Stephens, 1999). Their main aim was to promote exports through insurance services against different kind of risks.1 Other trade finance facilities include direct short-term credits and long-term loans for certain type of goods.

During the 1960s, as production of industrial goods increased, competition among developed countries intensified and strengthened the need to expand and consolidate positions in existing export markets. The oil shocks further reinforced this trend, adding to the pressure on these countries to adopt more aggressive measures to support their export sector. Among these measures, the role of ECAs became highly relevant. These entities, most of them government owned, increasingly subsidized loans, granting them at interest rates below those at which they borrowed (Moravcsik, 1989). This competition led to a successive series of disputes at a diplomatic level. Since the mid-1970s, different agreements were adopted that intended to restrict competition and interest rate subsidies. International cooperation among ECAs had begun earlier with the establishment of the Bern Union in 1934 (Stephens, 1999), but the need for more coordination increased in the 1960s. In 1976 a first arrangement called the “Consensus” provided a nonbinding set of guidelines related to minimum down payments, interest rates and maximum duration of credits. Though this agreement was extended and formalized in 1978, in practice it was far from perfect and had only a marginal impact on the ECAs’ general behavior (Moravcsik, 1989).

Developing countries had directly or indirectly benefited from this competitive environment. Exporters in developed countries asked for guarantees and insurance services given the different perceived risks in trading with these countries. Developing countries offered attractive markets for their exports and for major capital goods projects, for which financing was crucial. Wellons (1987) provides a general perspective on the link between trade and finance. He argues that the balance of payments problems in developed countries pushed governments to promote policies to support exports. Governments encouraged therefore banks to provide financial support to potential importers and in parallel they also increased the capacity of export agencies to meet competition. Commercial banks, increasingly internationalized, were particularly well placed to finance trade. This was complemented through loans to governments and public enterprises in developing countries, which were major borrowers in international financial markets. Finally, ECAs provided direct credit to foreign buyers and provided insurance services to domestic exporters.

As a result, developing countries increased their imports, some of them at unsustainable levels. In Latin America, the state-led industrialization process that would reach its peak in 1973–1974, pushed strongly the imports of capital and intermediate goods (Diaz-Alejandro, 1984).2 This situation could be prolonged as long as external finance was available, which ceased to be the case after adverse external shocks restricted international liquidity in the early 1980s. Certain Latin American countries had overvalued currencies and had only weakly supported their export sector, a side effect result of the import substitution policies followed during the period (Sachs, 1985). As the availability of foreign currency became rare, it was only a matter of time before the first payment difficulties emerged, something that abruptly started in 1982.

3The international debt crisis of the 1980sMexico's government publicly announced a temporary debt moratorium on the 20th August 1982. Though not entirely unexpected, the default had an impact on commercial banks’ lending to developing countries. It marked a definitive end to a lending boom that had started in the mid-1970s, and opened a new period of financial volatility. Mexico was not only a major economy; it was also a country where major financial and political interests were on stake. Moreover, this country was only one of many other countries that were also suspected to share the same problems. This situation led to a prompt reaction from governments in creditor countries. In the case of Mexico, the negotiations to obtain financial support and reschedule debt service involved the Federal Reserve, the IMF and the commercial banks themselves. The BIS also participated through the provision of a short-term bridge loan to help the Mexican government meet its short-term commitments.3

A rapid overview of the contemporary debate demonstrates that U.S. commercial banks were perceived as worryingly exposed not only to Mexico but also to other heavily indebted countries. Loans of U.S. banks to Eastern Europe and non-oil developing countries stood at 155 percent of their total capital by the end of 1982, while for the nine largest banks this figure was even higher at 235.5 percent for East European and non-oil developing countries, and 282.8 percent including some OPEC countries (Cline, 1984, p. 22).4 This fact explains why credit rating agencies downgraded the long-term debt of U.S. money-center banks all along the decade.5 Faced with higher risks, the natural reaction by most banks was to reduce their exposure to developing countries. This general behavior, however, threatened to aggravate the financial position of countries in financial distress and by extension the risk of the banks longer-term commitments.

A deeper perspective demonstrates that banks began reconsidering their position to emerging markets before the crisis. A first shift in the banks’ attitudes toward lending to developing countries arose from the difficulties encountered in Eastern Europe. The defaults that took place in this region became a source of tensions between creditor and borrowing governments. They started in 1981 with Poland's default and with other countries threatening to follow, with two of them eventually doing so (Romania and Yugoslavia defaulted in 1982). Poland's default had consequences on the lending decisions mainly from German banks, which were the most heavily exposed. The resolution was further complicated because the Soviet Union did not provide the support it was expected to provide, and these countries were not members of the IMF (Carvounis, 1984). Worth noting is the fact that lending to Eastern Europe was highly motivated by the will of developed countries to increase trade with the region, and most of the capital flows were used to finance imports. These drawbacks had consequences on the borrowing terms to other countries, as noted for instance by the Euromoney magazine in the first months of 1982, or in the BIS’ report of 1982, which showed that banks started reducing the maturity of the loans to developing countries since 1981 (BIS, 1982).

Nevertheless, despite increasing signals of financial distress, the shift in the banks’ behavior to emerging markets was modest compared to their reaction in 1982. Brazil's macroeconomic imbalances became evident since 1981, with GDP growth close to cero for the first time in three decades, political instability, and high public deficits (Carvounis, 1984). The same occurred in Argentina, though the real interruption of bank lending to this country took place during the first half of 1982, mainly as a reaction to the war with Great Britain. While payment difficulties had also been present before in other Latin American countries (Bolivia in 1980 or even Peru in 1978), banks’ continued lending was only smoothly affected before 1982. A plausible reason for this is the fact that, even if banks seemed to be aware of the increasing risk of the loans, competition discouraged them from retreating prematurely (Devlin, 1989).6

Mexico's moratorium marked a veritable turning point of this situation. External finance dried and most countries in Latin America had to face an adverse external environment in the form of unfavorable terms of trade and higher real interest rates which added to the volume of debt service given the variable interest rate nature of the loans. Governments were the first affected and this had a direct impact on public investment. Their exclusion from capital markets also involved public and semi-public enterprises, and national development banks, because governments had acted as guarantors for the loans and bonds that they issued. Furthermore, defaulting governments had also acted as guarantors for the credits obtained by importing firms. These firms were already under financial pressure given the deteriorating economic situation in their national economies, reflected in certain cases in devaluations or depreciating exchange rates. When payment delays or plain defaults increasingly arose in 1982, governments were required to step in, something they were unable to do.

4Trade finance during the debt renegotiationThe delicate financial position of Latin American governments required a prompt solution for which debtors and creditors collaborated. Negotiations with the IMF involved Fund-prescribed austerity measures, which were depicted in the underlying stand-by agreements (or other IMF-related programs). In return, commercial banks, accepted to reschedule existing debt and to extend tied new credit lines. Along with conditional financial assistance from multilateral organizations and developed countries’ governments and central banks, the group of creditors provided the funding needed to deal with debtors balance of payment imbalances and allowed the countries to meet their external debt obligations. The result was a collective debt management strategy that, though initially set to rescue Mexico, was applied case-by-case to every developing country coming into debt crisis from 1982 until the inception of the Brady Plan in 1989.7 Trade credit lines played an important role within this strategy and during debtors and creditors renegotiations.

Trade finance was a priority for debtor countries’ negotiators. Their position was initially targeted at having the banks and official export agencies keeping open credit lines and avoiding a lack of trade finance. The example of Mexico's first rescheduling and financing program illustrates the pattern. In December 1982, the Mexican government presented, in agreement with its Bank Advisory Committee,8 a proposal to the international financial community in which “trade credits involving the import, pre-export or export of tangible goods” were excluded from restructuring.9 The reason behind such a position was that, as Mexico lead negotiator Angel Gurria observed: “by not rescheduling [trade financing debt], they could expect official sources to renew outstandings and to provide significant net new flows.”10 Indeed, unlike the rest of the country's external debt obligations, Mexicans continued to promptly pay the amortization and interest on trade finance facilities when due even after the debt moratorium declaration.11 A similar rescheduling approach was also adopted by other big Latin American debtors, such as Brazil, Venezuela and Argentina.

In the case of the Brazilian debt crisis, one of the so-called projects that made up the four-part 1983 Financing Plan dealt, entirely and exclusively, with trade finance issues. Under Project III, Brazilian authorities negotiated with their public and private creditors the maintenance of their short-term trade-related debt to Brazil at no less than the outstanding level at all times. In a communication to its creditors in December 1982, Brazilian government representatives insisted on the fact that “the financing of raw material imports and pre-financing of Brazilian exports [was] essential to Brazil's ability to earn hard currency” and that “maintenance of such financing at this level [was] critical to Brazil's integrated financing plan for 1983.”12 Moreover, in addition to the financing provided through Project III, Brazil's government was also working in setting up a US$ 1.5 billion new trade facility, consisting of guarantees and insurance, with the U.S. Eximbank. The main idea was that “the United States and other countries through their export credit agencies would offer a program of guarantees of [commercial banks] financing for exports to Brazil.”13 Brazilians themselves recognized that the country “[could] not go to autarky (lacking oil and certain raw materials) and [did] not have the cash reserves to support necessary imports without external finance.”14

Argentina's Financing Plans dealt with trade credit in a very similar way. For instance, the 1985 refinancing agreements excluded trade finance from restructuring and set a number of new money facilities for trade financing. It also involved a commitment of creditors to maintain trade financing at the level of September 30, 1984, as a minimum.15 In the case of Venezuela, one of the four subcommittees created by its Bank Advisory Committee to manage the country's 1983 moratorium was focused on trade-related debt issues. The main purpose of this Trade Debt Subcommittee was to act “as a link among trade creditors, Venezuela trade debtors and the Ministry of Finance in relation to the Ministry's decision to pay short-term trade debt and to encourage trade creditors to maintain their credit lines to Venezuela to finance trade.”16

Trade financing was also relevant from the standpoint of official creditors. International organizations, such as the IMF and the World Bank, and governments from creditor countries worked together with debtors and commercial banks to support countries in financial distress meet their trade funding requirements. In the case of the Philippines refinancing plan of January 1984, the World Bank proposed a US$ 120 million co-financed credit line with the Nippon Bank available to general trade finance uses. Further archival evidence demonstrates that the World Bank “urged the banks to do something promptly to revive trade finance.”17 In a similar vein, part of the country's imports financing needs, which were set by the Philippine government during the negotiation process, were to be covered by U.S. official funds. Again, as in the case of Mexico, the Philippines was a country where, because of the “big export interest involved,” the U.S. Eximbank had continued to run short-term business even after other agencies had pulled out.18

In terms of the management of the crisis, trade finance was not only important for balance of payment purposes, but because it affected the debtors’ ability to obtain the inputs and capital goods necessary for economic growth. To some extent, the debt management strategy built on the work of influential economists that regarded the recovery of imports as equally important to the expansion of exports to restore economic growth in countries with payment difficulties.19 This belief relied on the two-gap model developed by Chenery and Strout (1966), where imports of capital goods and raw materials are treated as an additional factor of production that under certain circumstances can constitute a “binding constraint” to economic growth. With the crisis, “exports of capital goods to developing countries, which have been growing most rapidly, were the most severely affected.”20 In the particular case of Latin America, “imports have been reduced to essential items, which will necessarily need to expand in a general economic recovery.”21 As stressed by IMF staff reports and memorandums, exports credit flows were a vital component of the international trade system and performed a crucial role in keeping the import capacity of countries with payment difficulties.22 For creditor banks, an expansion of “export credit guarantees [was] a logical way to foster the urgently needed revival of capital goods imports by LDCs.”23

Overall, the decline in trade finance from private sources that affected countries in financial distress was confronted by a close cooperation between creditor governments and their ECAs. The importance of ECAs and the volume of their official export credits benefiting debtor countries were widely recognized. To quote but one example, the President of the FRBNY, Antony Salomon, declared that, the debt management approach could “be substantially improved if there were much more availability of official credits, particularly export credits.”24 In the same spirit, the IMF expected that the manner through which ECAs responded to the crisis would have a major influence on the terms and sustainability of financing flows to developing countries. The general argument was twofold. First, the terms of trade of developing countries could further deteriorate if exports’ cover (in developed countries) was no longer available, because exporters would raise their prices to “build in a risk premium against delay in payments.”25 Second, the lack of trade finance would negatively affect the volume of foreign exchange reserves and further debilitate the external position of developing countries.

Nevertheless, this consensus did not exclude major obstacles. The debt crisis had put export agencies under a political and financial dilemma. On the one hand, they were under pressure from their home governments (and exporters) as a rapid withdraw from their export covering affected the exporters’ competitive position triggering losses in their market shares. On the other hand, ECAs had been operating under losses from 1982, since they considered to have remained on cover too long with countries that later encountered payment difficulties. The transmission period in which export agencies modified their cover policies occurred between late 1981 and 1983. For certain countries, such as Argentina, Brazil and Romania, agencies began to tighten cover policies even before the crisis broke up in August 1982. In other cases, agencies moved effectively to restrict trade credit in the second half of 1982 and during 1983, as was the case for Mexico, Nigeria and the Philippines.26 Overall, the picture for developing countries was “that officially supported export credits, which had peaked at about 15 percent of total net resource flows to developing countries from [OECD] countries during 1980, fell to [zero in 1983].”27

The importance of ECAs in financing international trade with developing countries cannot be undervalued. According to BIS/OECD (1993) data report on trade credit, officially supported non-bank trade-related claims accounted in average two thirds of the total trade-related outstanding debt of developing countries, while the remaining third corresponded to guaranteed export bank debt.28 The most widely used method for financing international trade was through the intermediation of commercial banks, while the most common instrument was the letter of credit.29 Even if a major share of international trade among developed nations operated without guarantees, when trading with developing countries, exporters usually requested some kind of assurance or collateral (Tambe and Zhu, 1993).

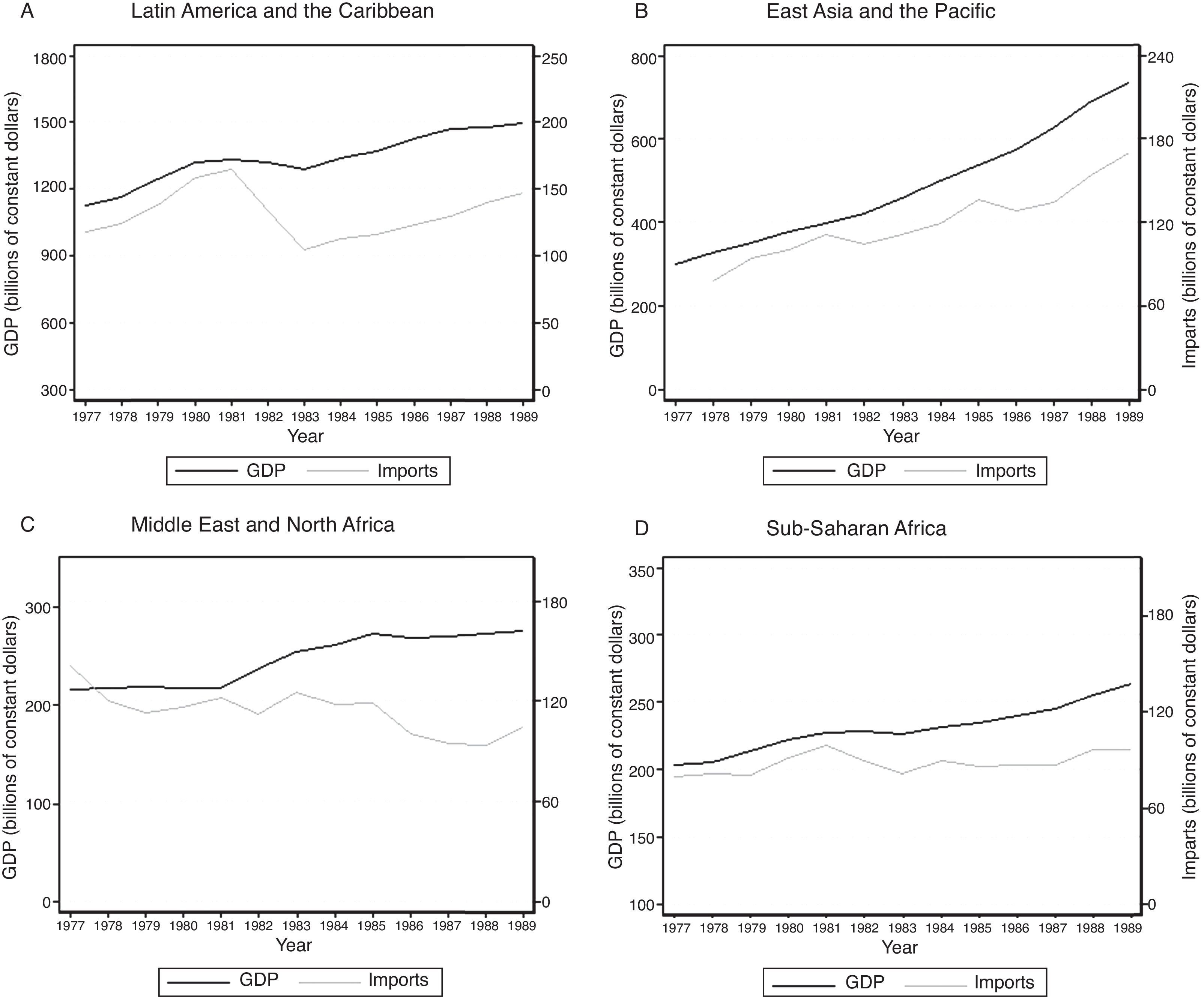

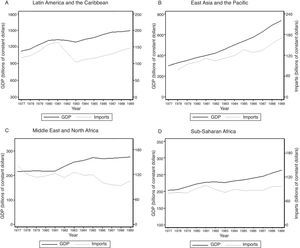

5Imports behavior during the crisisImports of developing countries expectedly fell in the aftermath of the crisis. Fig. 1a–d shows their evolution along with the trajectory of real GDP. We classified them by regions. We observe in all cases that imports fell in 1982, but the collapse is particularly acute for the case of Latin America and the Caribbean. In 1983, and in only two years, imports plummeted to almost half the level of 1981. Afterwards, Latin American imports grew and steadily recovered until the end of the decade. Nevertheless, in 1989 the region still imported at levels 10% below the peak of 1981. It seems clear that imports in other developing countries had a much less dramatic behavior that in Latin America at the time of the crisis, even compared to the trend of GDP. This fact reinforces our suspicions about the existence of third factors that could further explain the Latin American development crisis of the 1980s.

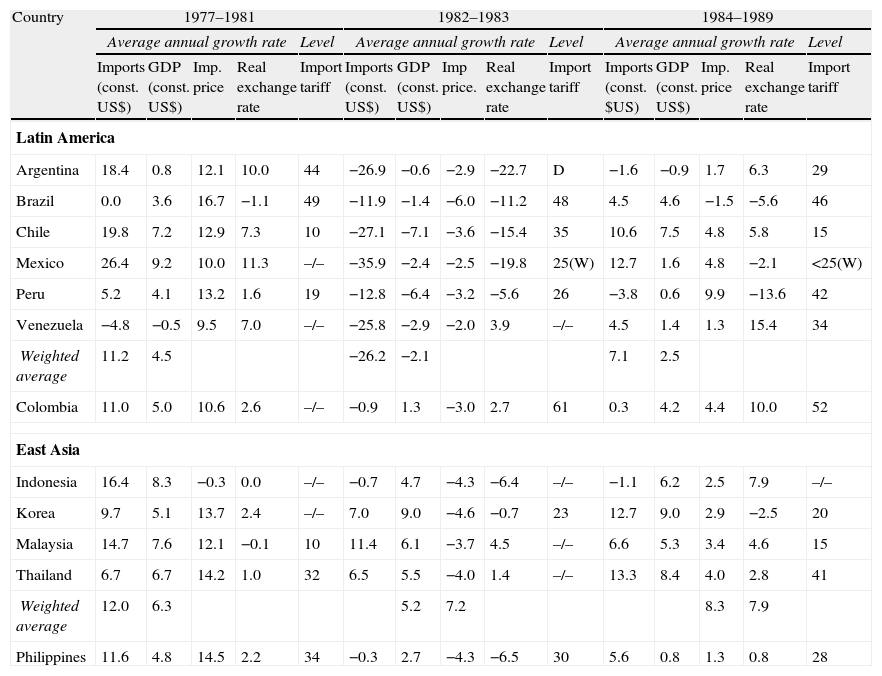

Table 1 provides a general perspective on imports and the behavior of the main macroeconomic variables that may have had an effect on them. We separated the periods before, during and after the outbreak of the crisis for a sample of representative countries in Latin America and East Asia. Latin America's imports dramatically dropped by a 26.2% yearly average during 1982–1983. This fall largely exceeds the annual decline of the GDP, which fell by 2.1% on average over the same period. Moreover, the collapse took place in a context of declining import prices, appreciation of the real foreign exchange and diminishing tariff protectionism, all of which favored the growth of imports. Colombia was the only exception to this trend. This country avoided default, and its imports remained stable while keeping GDP growth on a positive trend. Among East Asian countries, only Philippines, a defaulting country, along with Indonesia experienced declines in imports and negative GDP growth.30

Imports performance and other related variables, 1977–1989.

| Country | 1977–1981 | 1982–1983 | 1984–1989 | ||||||||||||

| Average annual growth rate | Level | Average annual growth rate | Level | Average annual growth rate | Level | ||||||||||

| Imports (const. US$) | GDP (const. US$) | Imp. price | Real exchange rate | Import tariff | Imports (const. US$) | GDP (const. US$) | Imp price. | Real exchange rate | Import tariff | Imports (const. $US) | GDP (const. US$) | Imp. price | Real exchange rate | Import tariff | |

| Latin America | |||||||||||||||

| Argentina | 18.4 | 0.8 | 12.1 | 10.0 | 44 | −26.9 | −0.6 | −2.9 | −22.7 | D | −1.6 | −0.9 | 1.7 | 6.3 | 29 |

| Brazil | 0.0 | 3.6 | 16.7 | −1.1 | 49 | −11.9 | −1.4 | −6.0 | −11.2 | 48 | 4.5 | 4.6 | −1.5 | −5.6 | 46 |

| Chile | 19.8 | 7.2 | 12.9 | 7.3 | 10 | −27.1 | −7.1 | −3.6 | −15.4 | 35 | 10.6 | 7.5 | 4.8 | 5.8 | 15 |

| Mexico | 26.4 | 9.2 | 10.0 | 11.3 | –/– | −35.9 | −2.4 | −2.5 | −19.8 | 25(W) | 12.7 | 1.6 | 4.8 | −2.1 | <25(W) |

| Peru | 5.2 | 4.1 | 13.2 | 1.6 | 19 | −12.8 | −6.4 | −3.2 | −5.6 | 26 | −3.8 | 0.6 | 9.9 | −13.6 | 42 |

| Venezuela | −4.8 | −0.5 | 9.5 | 7.0 | –/– | −25.8 | −2.9 | −2.0 | 3.9 | –/– | 4.5 | 1.4 | 1.3 | 15.4 | 34 |

| Weighted average | 11.2 | 4.5 | −26.2 | −2.1 | 7.1 | 2.5 | |||||||||

| Colombia | 11.0 | 5.0 | 10.6 | 2.6 | –/– | −0.9 | 1.3 | −3.0 | 2.7 | 61 | 0.3 | 4.2 | 4.4 | 10.0 | 52 |

| East Asia | |||||||||||||||

| Indonesia | 16.4 | 8.3 | −0.3 | 0.0 | –/– | −0.7 | 4.7 | −4.3 | −6.4 | –/– | −1.1 | 6.2 | 2.5 | 7.9 | –/– |

| Korea | 9.7 | 5.1 | 13.7 | 2.4 | –/– | 7.0 | 9.0 | −4.6 | −0.7 | 23 | 12.7 | 9.0 | 2.9 | −2.5 | 20 |

| Malaysia | 14.7 | 7.6 | 12.1 | −0.1 | 10 | 11.4 | 6.1 | −3.7 | 4.5 | –/– | 6.6 | 5.3 | 3.4 | 4.6 | 15 |

| Thailand | 6.7 | 6.7 | 14.2 | 1.0 | 32 | 6.5 | 5.5 | −4.0 | 1.4 | –/– | 13.3 | 8.4 | 4.0 | 2.8 | 41 |

| Weighted average | 12.0 | 6.3 | 5.2 | 7.2 | 8.3 | 7.9 | |||||||||

| Philippines | 11.6 | 4.8 | 14.5 | 2.2 | 34 | −0.3 | 2.7 | −4.3 | −6.5 | 30 | 5.6 | 0.8 | 1.3 | 0.8 | 28 |

Note: Import tariffs are unweighted average unless otherwise specified (W=weighted; D=declining).

The general macroeconomic environment in most Latin American countries was hostile to the region's imports since the early 1980s. Certain countries such as Argentina, Brazil, Chile, Ecuador, Mexico, Peru, Uruguay and Venezuela, confronted massive balance of payments problems and financial crises. A wide response in all countries consisted in the an abandon of previous crawling peg or traditional pegged exchange rate regimes, while devaluating their currencies significantly. Nevertheless, the consequent rise of inflation outweighed the previous devaluations conducting to real appreciations of the exchange rates in 1982 and 1983. During the rest of the decade, exchange rates remained unstable, a fact partly explained by the high inflationary environment that continued until the end of the decade.31

The strong negative impact of the crisis in debtor countries’ economies in 1982 and 1983 led to an increase of protectionist measures during the subsequent years. For countries such as Argentina, Peru and Chile this reaction implied a reversal of the trade liberalization policies set up by the end of the 1970s. Restrictions on imports were not only imposed by raising import tariffs but also by reintroducing non-tariff barriers, such as import-licensing mechanisms and foreign exchange controls. However, with the exception of Brazil and Peru who remained the most inward-oriented economies, during the rest of the decade most countries reversed this trend and adopted more import liberalizing trade policies. By 1989, Argentina, Chile, Colombia, Ecuador and Venezuela had almost dismantled the protection measures introduced in the aftermath of the debt crisis.32

The recovery experienced during the 1984–1989 period was sluggish. Crisis-hit countries introduced a series of adjustment policies that were set under IMF-supported programs. This shift in the economic policy regime was part of the international debt strategy set up since the start of the crisis. It was accompanied by a set of new loans to meet the short-term external commitments, so that countries could remain solvent before macroeconomic equilibrium could be reestablished. Furthermore, as we mentioned above, export credits became an important element of the debt strategy. The role contemplated for banks and credit agencies was to assist defaulting countries by remaining open on their trade credit lines. As a result, the IMF (1984, p. 21) confirmed that “most agencies reported having taken actions toward greater flexibility since 1983.” Although still keeping a reluctant position when facing countries in payment difficulties, “agencies have shown increasing flexibility of cover policy in situations where countries sought rescheduling from official creditors.”33

Table 2 shows the proportions of imports for a subset of developing countries that were covered or financed by ECAs from OECD countries around 1982. We have classified our sample according to the external-debt position of each country. In Panel A. we have included a benchmark group of countries (the same as in Table 1) that did not default nor restructured their debt. Panel B. includes countries that defaulted but adopted an IMF-program before 1983 and Panel C. includes countries that defaulted and did not adopt any IMF-program. We observe that the shares of imports covered by export agencies decreased only for defaulting countries (Panel C.) as compared to the levels of 1980 (−25%), the first year for which these figures are available. On the contrary, the highest increase is found for Panel B. countries (10.9%). Furthermore, between 1982 and 1983 the impact of the crisis affected all countries with the noteworthy exception of Panel B. countries, which increased the level of covered imports by 7.1%, with Brazil and Chile among the most benefited (around 25% each). Table 2 allows us to confirm that Panel C. countries suffered the most in terms of imports coverage, and that this fall was considerable (15% on average). This result is in blatant contrast with the one obtained for defaulting countries adopting IMF programs and by extension rescheduling their debts, and materializes the support from creditors to defaulting countries approaching the IMF that was expressed during the debt renegotiation process.

Imports covered by officially supported export credits from OECD countries, 1980–1983 (percentages of total).

| Change | Change | |||||

| 1980 | 1981 | 1982 | 1983 | 80–83 | 82–83 | |

| (1) | (2) | (3) | (4) | (4)–(1) | (4)–(3) | |

| A. Non-defaulting countries | ||||||

| Colombia | 5.8 | 10.4 | 22.4 | 17.8 | 12 | −4.5 |

| Indonesia | 11.9 | 23.1 | 32.2 | 14.7 | 2.8 | −17.5 |

| Korea | 7.5 | 6.5 | 15.2 | 9.3 | 1.8 | −5.9 |

| Malaysia | 2.2 | 4.7 | 11.5 | 9.7 | 7.5 | −1.8 |

| Thailand | 6.3 | 7.9 | 9.9 | 3.4 | −2.9 | −6.5 |

| Average | 4.2 | −7.2 | ||||

| B. Defaulting with an IMF program in 1982 | ||||||

| Argentina | 18 | 7.6 | 5.5 | 5.5 | −12.5 | 0 |

| Brazil | 11 | 12 | 22 | 46.5 | 35.5 | 24.5 |

| Chile | 3 | 12.5 | 10.1 | 35 | 32 | 25 |

| Mexico | 17.9 | 25.2 | 26.2 | 21 | 3.1 | −5.1 |

| Peru | 16.8 | 21.4 | 28.5 | 32.6 | 15.8 | 4 |

| Philippines | 13.1 | 14.3 | 10.4 | 4.7 | −8.4 | −5.7 |

| Average | 10.9 | 7.1 | ||||

| C. Defaulting countries with no IMF program | ||||||

| Bolivia | 3.3 | 4.5 | 8 | 6.4 | 3.1 | −1.6 |

| Mozambique | 46.3 | 40.2 | 59.1 | 11.5 | −34.8 | −47.6 |

| Nicaragua | –/– | 0.7 | 6.2 | 10.3 | –/– | 4.1 |

| Nigeria | 11.1 | 24.9 | 48.1 | 33.2 | 22.1 | −14.9 |

| Poland | 91.9 | 52.4 | 17.1 | 3.6 | −88.3 | −13.5 |

| Venezuela | 5.4 | 7.1 | 12.6 | 6.2 | 0.8 | −6.4 |

| Average | −25 | −15.6 | ||||

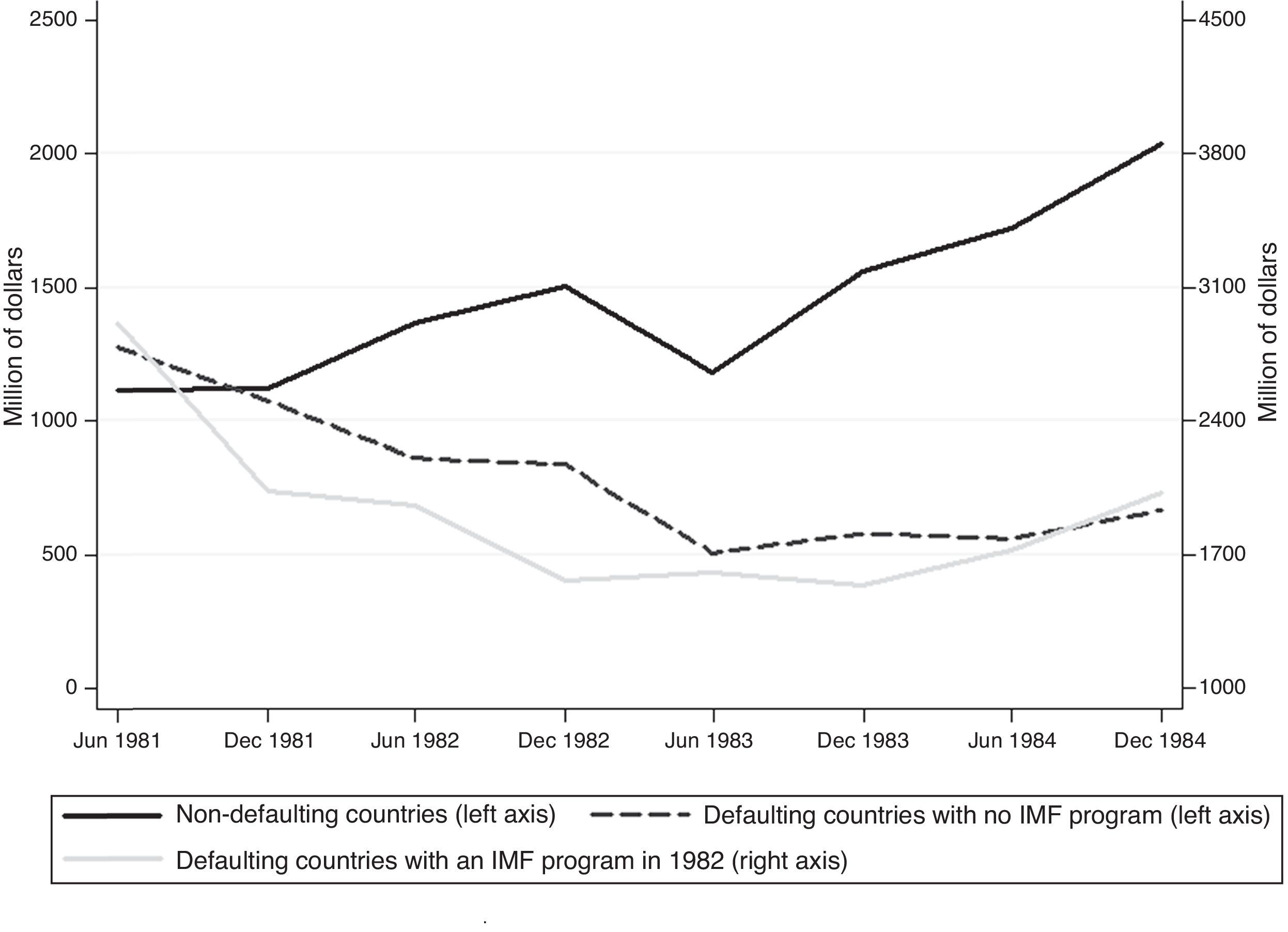

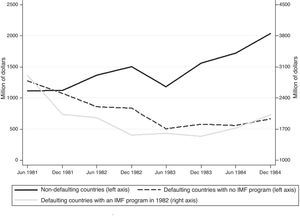

A similar pattern can be observed when considering trade finance instruments other than those provided or guaranteed by ECAs. Fig. 2 shows the evolution of letters of credits commitments of U.S. commercial banks toward the group of developing countries presented in Table 2 for the same period of time.34 These letters of credits represented cross-border contingent claims with the borrower country's importer or with their domestic banks and they were issued to finance bilateral trade with U.S. exporters. The graph shows that, despite a short-living interruption during the first half of 1983, U.S. letters of credits commitments to developing non defaulting countries (Panel A) steadily increased all over the period. Conversely, defaulting countries suffered from a drastic contraction on letters of credits financing between June 1981 and December 1983 (50% overall). However, the incipient subsequent recovery seemed to have been better for defaulting countries under an IMF program from 1982 (Panel B) than for countries with no such an IMF program (Panel C): 31.8% against 15.1% annual increase respectively by the end-1984.

6Econometric analysis6.1The dataIn this section we analyze the impact of the fall in trade credit on imports. We proceed in two stages. First, we use a panel dataset to estimate an import equation for developing countries over the period 1983 to 1989, where we include the availability of trade finance. Second, because this procedure may have a reverse causality problem, we estimate this equation using instrumental variables. The set of instruments we use are related to risk factors that may have determined the coverage decisions of export rating agencies. The consistency of these instruments constitute a further test of the importance of the debt management strategy one which provided incentives for rapid rescheduling through open provision of trade finance to avert a stronger fall of imports.

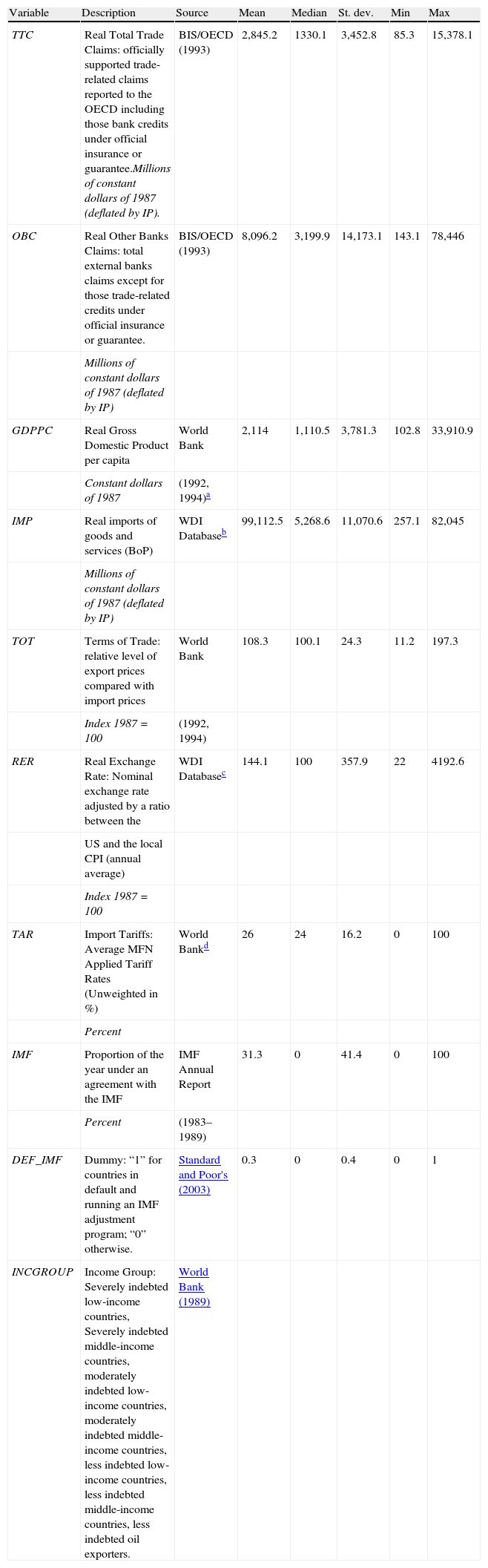

We have constructed our dataset from a number of original sources published by the World Bank, the BIS and the OECD. The initial basis was the joint reports of the OECD and the BIS on trade related-external claims on borrowing countries.35 Since homogeneous data on trade-credit is available since 1983, we are obliged to focus our analysis for the years 1983–1989. Among the 155 countries reported in the study, we included all the developing countries for which information on trade finance and macroeconomic situation was available. The sole condition that we imposed to our sample was that countries had to meet a minimum level of trade finance.36 The resulting sample consists of a total of 57 developing countries, of which 16 are from Latin America and the Caribbean. Tables A1 and A2 in the appendix show details on the countries included in the sample and the variables, sources and descriptive statistics of our dataset.

The countries included account for 76% on average of the trade credit debt reported by the BIS/OECD for developing countries.37 Our sample also reflects the extent to which defaults and IMF agreements were a common feature in the 1980s. On the one hand, 31 of the 57 countries were in default during at least one year between 1983 and 1989.38 Half of them occurred in the Latin American and Caribbean region. Colombia was the only non-defaulting country (in that same region), while the others 15 spent on average 6 of the 7 years in default, with major economies such as Mexico, Brazil, Argentina and Venezuela in default during the whole period. On the other hand, 38 of the 57 adopted an IMF adjustment program for at least one year, which means that almost all defaulting countries have at some point subscribed to an IMF agreement. There were cases of countries that adopted IMF programs even if they never defaulted, such as China, Korea and Portugal.

6.2The modelWe analyze the impact of trade credit on developing countries’ imports by following the methodology advanced by Auboin and Engemann (2013) and proceed in two stages.39 First, we estimate trade credit in relation to a set of variables that influenced the ECAs’ lending policy. Then, we use the predicted value of the first stage to measure the impact of trade credits on imports, controlling for other macroeconomic variables. There are several reasons that justify this empirical strategy. One main reason is that we avoid a potential reverse causality problem between imports and trade credit, mainly through the use of instruments whose choice is based on the lending policy of export agencies. Furthermore, this two-step approach allows us to first analyze the microeconomic behavior of export agencies before testing the macroeconomic impact of trade finance on imports. Finally, it enables us to revisit and test the historical qualitative evidence with an empirical data analysis. This is based on the reports on export credits prepared by the Exchange and Trade Relations Department of the IMF, which provide a description on the principles and practices of export agencies.40 These reports allow us to identify their guiding lines on cover policy decisions and therefore specify our fist-step equation on the basis of a real historical background.

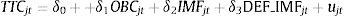

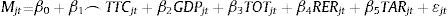

The model specification is the following:

TTCjt is the variable on total trade credit available for country j at year t. We define it as the total outstanding trade-related claims given the absence of information on the net flow of trade credit. Nevertheless, working with the stock has a particular advantage, to the extent that it represents more accurately the manner through which exports agencies based their cover policies decisions. A review of the contemporary discussions demonstrates that a main factor that explained ECAs’ decisions to extend or not new trade-credit lines or guarantees was their relative exposure to an individual borrowing country, and their willingness whether to increase it or reduce it.

The instruments that we use in Eq. (1) are the following. First, a variable on other banking credits (OBC), which measures the responsiveness of trade credit to the decision by other banks to increase (or lower) their exposure to a particular country, and is therefore expected to be positively correlated with TTC.41OBC captures the enthusiasm of banks in running business (other than financing trade) within a particular country. We included a dummy variable to measure the effect of an IMF program on a defaulting country (DEF_IMF). We did not include a dummy variable solely on defaults because in many cases these took place before the period of analysis and there is not enough variation in the data. DEF_IMF is equal to 1 for countries that defaulted and adopted an IMF program and zero otherwise. We expect it to be positive, which means that defaulting countries under an IMF program would generate a positive reaction of export agencies which would trigger an increase in trade credit. The logic is the following. As stressed by IMF (1986), in the late 1970s and the early 1980s export agencies generally imposed restrictions and suspended new cover on export credits for countries approaching the Paris Club or under negotiations with commercial banks. However, after the serial rescheduling of 1982 and 1983, and once the international debt strategy was set up, export agencies became more likely to maintain or reopen export cover for debtor countries in payment difficulties but implementing IMF adjustment programs. The effect would however be the opposite for non-defaulting countries under IMF programs captured by the variable IMF_M, as this would not modify the behavior of export agencies and rather, the recessionary effect would reduce the demand for trade credit. This variable measures the proportion of the year under which a country adopted the IMF program.

When running the two-step regression model we have included a set of variables that may have had an influence on the demand for trade credit and imports (Mjt). In Eq. (2), we regress imports on the estimated value of TTC from Eq. (1). We included real per capita GDP, terms of trade (TOT), the real exchange rate (RER) and a general level of tariffs (TAR). We expect that higher trade availability, higher real GDP levels and favorable terms of trade will have a positive impact on imports. On the contrary, changes in the real exchange rate are ambiguous, and will depend on whether the change is anticipated, but in the short-run we expect the effect to be negative, as in the case of tariffs.42

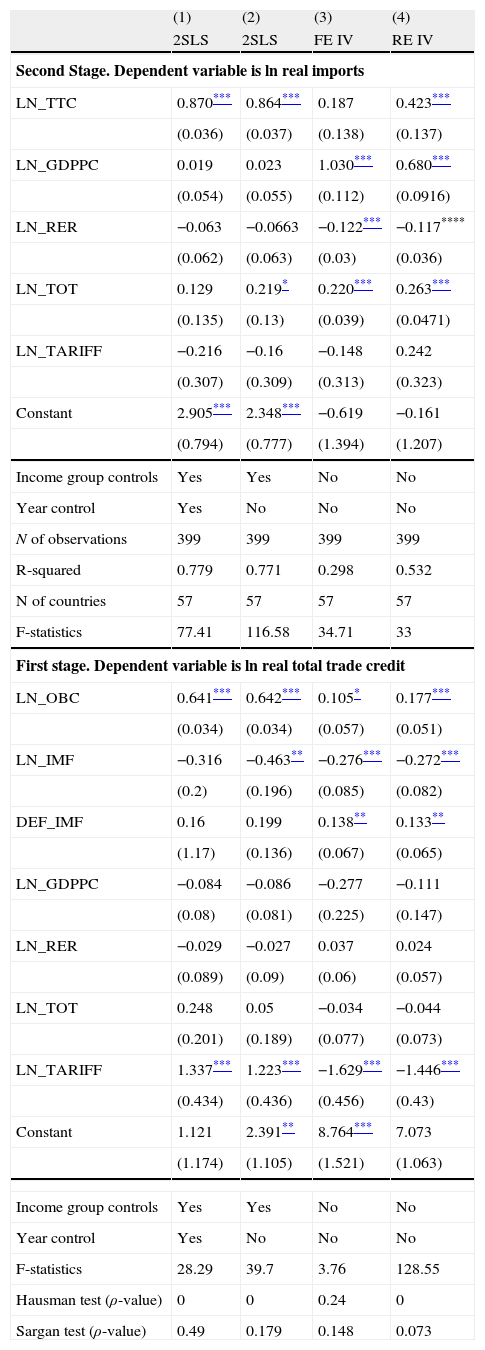

6.3ResultsThe results are reported in Table 3. We have included different controls regarding regions and income groups as classified by the World Bank. Regression (1) utilizes an OLS pool estimation method with an income group control variable, while regression (2) includes both income and year controls.43 In regression (3) we introduce a fixed effects specification, and in regression (4) we use random effects. We have also reported at the bottom of the table the ρ-values of the Wu–Hausman chi-squared statistic on endogeneity. They confirm that in all cases but regression (3) trade credit is endogenous at the 1% significance level. The use of instrumental variables is therefore justified. We have reported the F-statistic of the first-stage regression to verify the strength of our instruments. They show values well above 10, the threshold recommended in the literature, with the exception of regression (3). Finally, we included the Sargan test on the validity of the instrumental variables. Again, the ρ-values obtained shows that the instruments are exogenous, with the expected exception of regression (3). Given these results, when we pursue a Sargan–Hansen test to compare both fixed-effects and the random-effects model, we obtain a chi-squared statistic of 5.24, with a ρ-value of 0.07. We cannot reject therefore the null hypothesis that the difference in coefficients is not systematic, which means that our preferred estimation is the random-effects model, regression (4).

Estimates of the relationship between trade credit and imports.

| (1) | (2) | (3) | (4) | |

| 2SLS | 2SLS | FE IV | RE IV | |

| Second Stage. Dependent variable is ln real imports | ||||

| LN_TTC | 0.870*** | 0.864*** | 0.187 | 0.423*** |

| (0.036) | (0.037) | (0.138) | (0.137) | |

| LN_GDPPC | 0.019 | 0.023 | 1.030*** | 0.680*** |

| (0.054) | (0.055) | (0.112) | (0.0916) | |

| LN_RER | −0.063 | −0.0663 | −0.122*** | −0.117**** |

| (0.062) | (0.063) | (0.03) | (0.036) | |

| LN_TOT | 0.129 | 0.219* | 0.220*** | 0.263*** |

| (0.135) | (0.13) | (0.039) | (0.0471) | |

| LN_TARIFF | −0.216 | −0.16 | −0.148 | 0.242 |

| (0.307) | (0.309) | (0.313) | (0.323) | |

| Constant | 2.905*** | 2.348*** | −0.619 | −0.161 |

| (0.794) | (0.777) | (1.394) | (1.207) | |

| Income group controls | Yes | Yes | No | No |

| Year control | Yes | No | No | No |

| N of observations | 399 | 399 | 399 | 399 |

| R-squared | 0.779 | 0.771 | 0.298 | 0.532 |

| N of countries | 57 | 57 | 57 | 57 |

| F-statistics | 77.41 | 116.58 | 34.71 | 33 |

| First stage. Dependent variable is ln real total trade credit | ||||

| LN_OBC | 0.641*** | 0.642*** | 0.105* | 0.177*** |

| (0.034) | (0.034) | (0.057) | (0.051) | |

| LN_IMF | −0.316 | −0.463** | −0.276*** | −0.272*** |

| (0.2) | (0.196) | (0.085) | (0.082) | |

| DEF_IMF | 0.16 | 0.199 | 0.138** | 0.133** |

| (1.17) | (0.136) | (0.067) | (0.065) | |

| LN_GDPPC | −0.084 | −0.086 | −0.277 | −0.111 |

| (0.08) | (0.081) | (0.225) | (0.147) | |

| LN_RER | −0.029 | −0.027 | 0.037 | 0.024 |

| (0.089) | (0.09) | (0.06) | (0.057) | |

| LN_TOT | 0.248 | 0.05 | −0.034 | −0.044 |

| (0.201) | (0.189) | (0.077) | (0.073) | |

| LN_TARIFF | 1.337*** | 1.223*** | −1.629*** | −1.446*** |

| (0.434) | (0.436) | (0.456) | (0.43) | |

| Constant | 1.121 | 2.391** | 8.764*** | 7.073 |

| (1.174) | (1.105) | (1.521) | (1.063) | |

| Income group controls | Yes | Yes | No | No |

| Year control | Yes | No | No | No |

| F-statistics | 28.29 | 39.7 | 3.76 | 128.55 |

| Hausman test (ρ-value) | 0 | 0 | 0.24 | 0 |

| Sargan test (ρ-value) | 0.49 | 0.179 | 0.148 | 0.073 |

Note: Robust standard errors in parentheses. The ρ-value of the Hausman test is for the Wu–Hausman chi-squared test. Income groups are defined by the World Bank classification of developing countries. The random effect regressions report the overall Wald chi-2 statistics.

The first-stage estimates are reported in the bottom panel of the table. In the four regressions, we observe that the instruments are mostly significant and have always the expected sign. Trade credit is expectedly correlated with other banking credit, while there is a strong negative impact of IMF programs on trade credit. Noteworthy for our study, this impact is the opposite for defaulting countries, and this confirms the qualitative evidence on the export agencies behavior in the wake of the debt crisis. Countries in default had an incentive to sign an IMF-agreement given the benefit from an increase in trade-credit support that would not be available otherwise. This is the logical result from the creditors’ debt strategy, which aimed to encourage defaulting countries to reschedule their old debt while providing further financial support conditioned on the adoption of IMF adjustment program. Finally, the negative sign of the variable IMF shows that the overall effect of signing an IMF agreement was for export agencies to reduce cover. This means that even for countries that did not go on default, approaching the IMF was a bad sign for export agencies that therefore reduce lending to the country. The results are strongly consistent since signs and significance of the coefficients do not show major changes in the regressions.

The results regarding the other variables included in the first stage are mixed. The GDP variable has an unexpected negative sign, though it is not significant. This may suggest that countries with higher income may be less dependent upon external trade credit. The signs of the coefficients for the real exchange rate and the terms of trade variables are not consistent, though none of them is significant. The general level of tariffs has a positive sign in regressions (1) and (2), but it changes in regressions (3) and (4). In all regressions the result is significant, which suggests that the impact varies across groups of countries and years.

The second stage regressions are consistent with our expectations. The trade credit variable is positive and significant with the exception of regression (3), though even here the sign is according to our expectations.

The estimated coefficients have values that are higher than those estimated in Auboin and Engemann (2013). This is most striking for models (1) and (2), whose values double those obtained by these authors (0.87 and 0.86 vs. 0.412). Per capita GDP has a significant impact in regressions (3) and (4). The size of the coefficient can be interpreted as the income elasticity of imports. RER has a negative impact on imports, though it is only significant in regressions (3) and (4). It means that an appreciation of the real exchange rate will lower the demand for imports. The positive and mostly significant result for the TOT shows that an improvement in the terms of trade variable will increase imports. Finally, the tariff variable has an obvious negative impact, though it is not significant. Overall, the R-2 values are high and show that our model accurately explains the variations of imports.

What do our results imply in terms of debt management and availability of trade credit? The benefits for defaulting countries from a debt rescheduling agreement and an IMF-supported program increased trade credit availability from 1.6% to 2% as shown by the size of the DEF_IMF coefficients in the first-stage regressions. These are not minor figures. From the results of our second-stage regressions, our model predicts that a 1% increase in trade finance lead to an increase of 4.2% to 8.7% in imports. Combining both results, the total benefit from debt rescheduling meant an increase in import capability of 6.2% to 17.4%. In other words, the incentive to follow the debt management trajectory followed by Mexico in 1982 was strong despite the potential recessionary costs and this may contribute to explain why most defaulting countries decided to adopt it at some moment during the 1980s.

7ConclusionsOne of the particularities of the 1982 crisis is that the availability of trade finance was directly linked to the results of the debt negotiation process. While today's fall in trade finance obeys mainly to market mechanisms, in the period post-1982 crisis the fall was somewhat mitigated by the explicit will of governments in creditor countries to avert a further collapse that could have had a negative impact on the recovery of defaulting countries, triggering simultaneously losses to their own banking sectors and to their exporters. This does not mean, nevertheless, that market mechanisms were absent. Trade finance, particularly in the form of exporter-finance credits related or not with banks, initially responded to financial distress in developing countries by suspending these credits. This was not different from todays’ crisis. The main contrast can be found in the comparatively strong participation of export credit agencies in financing international trade, because this allowed for a more rapid an efficient intervention by public authorities to avoid a further potential fall in international trade.

Latin America was the region that both suffered the absence of trade finance in the aftermath of the 1982 debt crisis, but also the one that most benefited from its availability once the debt rescheduling agreements were signed. This is explained by the fact the large majority of the defaults taking place between 1982 and 1983 were mainly concentrated in Latin America, but also because most defaulting countries negotiated an agreement with the IMF, and this was a condition to restore the credit necessary to finance imports. Whether this regained capacity to import contributed to restore economic growth is an issue that goes beyond the scope of this paper. However, given the nature of these credits, most of them of medium and long-term maturities, we would expect that they served to finance durable and capital goods, thereby adding to the productive capacity of developing countries.

Finally, a main contribution of this paper is the link provided between the microeconomic behavior of export credit agencies and a macroeconomic outcome. A complementary insight could analyze the differences among individual export agencies in terms of reaction functions to debt defaults, and how they affected bilateral trade. We lack unfortunately from reliable data on these bilateral relationships. Overall however, our results suggest that these differences may be of minor magnitude compared to the general picture. Furthermore, they suggest that a visible hand in the form of governmental intervention and international cooperation was able to impede a worse scenario than the one experienced in the Lost Decade.

FundingFinancial support from the Swiss National Science Foundation (Grant number 100016_129998) is gratefully acknowledged.

We thank archivists at the OECD archives, the IMF archives and the Federal Reserve of New York archives. We are grateful to two anonymous referees and participants at the Annual Meeting of the Mexican Economic History Association in August 2013.

See Tables A1 and A2.

List of countries included in the sample.

| Algeria | Indonesia | Philippines |

| Argentina | Iran, Islamic Rep. | Poland |

| Bolivia | Israel | Portugal |

| Brazil | Ivory Coast | Romania |

| Cameroon | Jordan | Saudi Arabia |

| Chile | Kenya | Senegal |

| China | Korea, Rep. | Sri Lanka |

| Colombia | Liberia | Sudan |

| Congo, Rep. | Libya | Syrian Arab Republic |

| Costa Rica | Malaysia | Thailand |

| Dominican Republic | Mexico | Tunisia |

| Ecuador | Morocco | Turkey |

| Egypt, Arab Rep. | Mozambique | United Arab Emirates |

| Gabon | Nicaragua | Uruguay |

| Greece | Nigeria | Venezuela, RB |

| Guatemala | Pakistan | Yugoslavia |

| Honduras | Papua New Guinea | Zaire |

| Hungary | Paraguay | Zambia |

| India | Peru | Zimbabwe |

Variable's definition, sources and descriptive statistics.

| Variable | Description | Source | Mean | Median | St. dev. | Min | Max |

| TTC | Real Total Trade Claims: officially supported trade-related claims reported to the OECD including those bank credits under official insurance or guarantee.Millions of constant dollars of 1987 (deflated by IP). | BIS/OECD (1993) | 2,845.2 | 1330.1 | 3,452.8 | 85.3 | 15,378.1 |

| OBC | Real Other Banks Claims: total external banks claims except for those trade-related credits under official insurance or guarantee. | BIS/OECD (1993) | 8,096.2 | 3,199.9 | 14,173.1 | 143.1 | 78,446 |

| Millions of constant dollars of 1987 (deflated by IP) | |||||||

| GDPPC | Real Gross Domestic Product per capita | World Bank | 2,114 | 1,110.5 | 3,781.3 | 102.8 | 33,910.9 |

| Constant dollars of 1987 | (1992, 1994)a | ||||||

| IMP | Real imports of goods and services (BoP) | WDI Databaseb | 99,112.5 | 5,268.6 | 11,070.6 | 257.1 | 82,045 |

| Millions of constant dollars of 1987 (deflated by IP) | |||||||

| TOT | Terms of Trade: relative level of export prices compared with import prices | World Bank | 108.3 | 100.1 | 24.3 | 11.2 | 197.3 |

| Index 1987=100 | (1992, 1994) | ||||||

| RER | Real Exchange Rate: Nominal exchange rate adjusted by a ratio between the | WDI Databasec | 144.1 | 100 | 357.9 | 22 | 4192.6 |

| US and the local CPI (annual average) | |||||||

| Index 1987=100 | |||||||

| TAR | Import Tariffs: Average MFN Applied Tariff Rates (Unweighted in %) | World Bankd | 26 | 24 | 16.2 | 0 | 100 |

| Percent | |||||||

| IMF | Proportion of the year under an agreement with the IMF | IMF Annual Report | 31.3 | 0 | 41.4 | 0 | 100 |

| Percent | (1983–1989) | ||||||

| DEF_IMF | Dummy: “1” for countries in default and running an IMF adjustment program; “0” otherwise. | Standard and Poor's (2003) | 0.3 | 0 | 0.4 | 0 | 1 |

| INCGROUP | Income Group: Severely indebted low-income countries, Severely indebted middle-income countries, moderately indebted low-income countries, moderately indebted middle-income countries, less indebted low-income countries, less indebted middle-income countries, less indebted oil exporters. | World Bank (1989) |

Zaire and Yugoslavia from World Bank (1992, 1994); Liberia and United Arab Emirates from IMF (1992, 1994).

Nicaragua and Yugoslavia from World Bank (1992, 1994); Romania and United Arab Emirates from Historical Real Exchange Rate form the U.S. Department of Agriculture.

The database has been completed with information from UNCTAD (1987) and World Bank's reports on developing countries economic trends (various issues).

These risks could have different origins. The most often quoted are: transfer risk (related to delays in payments from the importer), credit risk, currency risk, interest rate risk, collateral risk and convertibility risk (see Giddy and Ismael, 1983).

See also Bertola and Ocampo (2012).

See Kraft (1984) for a detailed account of the Mexican rescue.

The OPEC countries included are Algeria, Ecuador, Indonesia, Nigeria and Venezuela. Together Mexico and Brazil accounted for almost one third of U.S. nine largest banks exposure.

Moody's rating for Citicorp, Chase Manhattan and Manufacturers Hanover's long-term debt passed from ‘Aaa’ grade in 1981 to A1, Baa1 and Baa3 respectively in 1989 (see FDIC, 1997, p. 202).

See Bell et al. (1982a,b) and Mendelsohn (1981) for a survey on banks’ perceptions and behavior on international lending at the beginning of the 1980s.

See Sachs and Williamson (1986) for an economic and political economy approach of debt management strategy and Boughton (2001) for a detailed historical account of its implementation.

Bank Advisory Committees were the institutional arrangement created by commercial banks for handling third world debt problems, more broadly referred to as The London Club.

FRBNY Archives, Central Files, File: BAC 1982.

FRBNY Archives, Box 142529, File: Mexico.

Other facilities excluded from the restructuring scheme and serviced when due were International organization's credits, bonds, private placements, leases, banker's acceptances and interbank liabilities of branches and agencies of Mexican banks overseas; see Gurria (1988, p. 77).

FRBNY Archives, Central Files, File: BAC 1982.

FRBNY Archives, Box 142547, File: Brazil.

FRBNY Archives, Box 111377, File: Argentina and Brazil Trip 1983.

FRBNY Archives, Box 142547, File: Argentina.

FRBNY Archives, Box 142547, File: Venezuela.

FRBNY Archives, Box 50853, File: 740f(l) Foreign Visitors/Schedule of Appts.

FRBNY Archives, Box 142547, File: Rowen Interview.

See, for instance, Cline (1984).

Edmar Bacha, FRBNY Archives, Box 142547, File: Rowen Interview.

FRBNY Archives, Box 201360, File: Baker's proposal.

Anthony Salomon, FRBNY Archives, Box 142547, File: Rowen Interview.

See IMF (1984) for a detailed description of developed countries’ ECAs lending policies by country between 1980 and 1984.

Figures from BIS/OECD (1993) show that, in average for the period 1983–1989, officially supported non-bank trade-related claims were about 65% of total trade-related outstanding debt of the developing world.

See Giddy and Ismael (1983) and Lemle (1983) for a description of current financing practices on international trade during the 1970s and the 1980s.

Utilizing income elasticities as estimated by Pritchett (1987), we simulated imports for a sample of countries with data reported in the World Bank. According to our estimates, Argentina's imports should have been 30.4% higher in 1982, and Chile 20.6%. These figures are all negative (imports should have been lower) for non-defaulting countries such as Colombia, Korea or Indonesia. All results are available upon request.

For a general description of Latin America exchange rate regimes during the 1970s and the 1980s see Frenkel and Rapetti (2012, pp. 161–164).

See Laird and Nogues (1988) for a description of trade policies of highly indebted countries surrounding the debt crisis.

The only country not included is Mozambique because the FFIEC's Country Exposure Lending Survey does not report separate figures on U.S. letters of credit commitments to this country.

In practical terms, this means that we included all countries for which outstanding trade-related debt was over US$ 300 million in 1983. For the purpose of this study, we also include some Latin American countries, such as Nicaragua, Paraguay and Uruguay even though their debt was below the threshold criteria. We have excluded countries with offshore banking facilities.

This implies that we omitted countries such as the URSS, the German Democratic Republic, Czechoslovakia and Iraq, which accounted for other 12% of the total outstanding trade-related claims on developing countries.

Data on countries’ defaults are from Standard & Poor's (2003).

Whereas other methods could have been preferred, we have decided to pursue the kind of analysis advanced by the most recent literature on the subject and provide a standard benchmark for comparative purposes.

Other Bank Claims (OBC) is the aggregate of all bank non-trade related claims reported by the BIS/OECD (see Table A2).

See Auboin and Engemann (2013) for a detailed discussion.