This article emphasizes the significance of researching the cross effect of using jointly external audit quality and ownership structure over managerial discretion in a largely unexplored, non-Western and emerging context. The analysis is based on a sample of 61 Tunisian firms listed and unlisted on the Tunis Stock Exchange and operating in the industrial and commercial sectors during the period 2007-2011. To provide evidence on this topic, we conduct an empirical examination. First, we examine the effect of external audit quality and ownership structure on the discretionary accruals for the whole sample. We find that only auditor reputation has a negative and significant effect on earnings management. Second, this article provides empirical evidence on the cross effect of external audit quality variables and capital concentration on earnings management. This test suggests that this combination has a negative and significant effect on earnings management in industrial firms but it has a positive and non significant effect in commercial firms. Finally, the third empirical test concerns the combined effect of external audit quality and institutional property on earnings management. We find that the cross effect of this combined relation is negatively and significantly associated with earnings management of industrial firms but it has no significant effect on the earnings management of commercial firms. As for the cross effect of the auditor seniority and the institutional property, it has a positive and a significant effect in the commercial sectors, while, it is positively and non-significantly associated with earnings management of industrial firms.

Este artículo enfatiza la importancia de investigar el efecto cruzado del uso conjunto de la calidad de la auditoría externa y la estructura propietaria sobre el criterio gerencial, en un contexto emergente no occidental y ampliamente inexplorado. El análisis se basa en una muestra de 61 empresas tunecinas y no cotizadas en la bolsa de Túnez, que operan en sectores industriales y comerciales durante el período 2007-2011. Para aportar evidencia sobre esta cuestión, realizamos un examen empírico. Primeramente, examinamos el efecto de la calidad de la auditoría externa y la estructura propietaria sobre el acumulado discrecional de la muestra en su totalidad. Encontramos que únicamente la reputación del auditor tiene un efecto negativo e importante sobre la gestión de los ingresos. En segundo lugar, este artículo aporta evidencia empírica sobre el efecto cruzado de las variables de calidad de la auditoría externa y la concentración del capital sobre la gestión de los ingresos. Este test sugiere que esta combinación tiene un efecto negativo sobre la gestión de los ingresos en las empresas industriales, aunque presenta un efecto positivo y no significativo en las empresas comerciales. Por último, el tercer test empírico se refiere al efecto combinado de la calidad de la auditoría externa y la propiedad institucional sobre la gestión de los ingresos. Encontramos que el efecto cruzado de esta relación combinada es negativo y está asociado de manera importante a la gestión de los ingresos de las empresas industriales, pero no tiene un efecto significativo sobre la gestión de los ingresos de las empresas comerciales. En cuanto al efecto cruzado de la antigüedad del auditor y la propiedad institucional, tienen un efecto considerable sobre las empresas comerciales, mientras que están asociados a la gestión de los ingresos en las empresas industriales, de modo positivo y no significativo.

Under the agency theory, the relationship between managers and shareholders is such a conflictive relation. The separation of the property functions and control engenders agency conflicts that materialize in a context of asymmetric information by an opportunistic manager's behavior. Indeed, the need for shareholders to control the managers is positively related to the organization complexity. This can be explained by a more and more important number of hierarchical levels which establishes a limit for shareholders to monitor managers’ activities (Bonazzi & Islam, 2007; Kesten, 2013; Massimo, Annalisa, & Samuele, 2014). In front of this organization complexity and the decision function diffusion, we can assist an increase in agency problems and the associated costs, the firm owners are in front of the difficulty of controlling and observing the efforts of their agents. Taking advantage of this asymmetric information, managers can adopt opportunistic behavior against proprietary interests while trying to maximize their own utilities (Jensen, 1993).

As governance mechanisms, the fundamental role of audit as well as ownership structure is to reduce asymmetric information between managers and shareholders (Jones, 2011; Usman, 2013). We expect that an effective control exercised by these two governance mechanisms is associated with lower levels of earnings management (Johnson & Waidi, 2013; Anis, 2014). The mechanisms of control are interrelated and the relationship between these variables is based on agency theory (Jensen & Meckling, 1976). In order not to be limited to assessing the effectiveness of a mechanism in isolation, it becomes favorable to study the effect of their interactions on the accounting manipulations and check the sense of different mechanisms, used in conjunction, on the earnings management (Kathleen, Emre, & Jin, 2014; Domenico & Ray, 2014). In this framework, the failure of a potential mechanism may possibly be offset by the action of an alternative mechanism (Brav & Mathews, 2011; Kee-Hong, Jae-Seung, Jun-Koo, & Wei-Lin, 2012; Paul et al., 2014).

We think that it would be of great interest to conduct this article for many reasons. First, most research about governance mechanisms are conducted in the context of developed countries. Even if there are few studies focused on exploring the impact of governance mechanisms on earnings management, conducted in the context of a developing country such as Tunisia (Zgarni, Hlioui, & Zehri, 2012), they are interested in studying the influence of these mechanisms one by one (separately and not jointly). This paper, to the authors’ best knowledge, is the first to investigate the specificities and uniqueness of the combination's effect of external audit quality (particularly auditor reputation and auditor-audited relationship seniority) and ownership structure (specifically capital concentration and institutional property) on earnings reported by listed and unlisted Tunisian firms. So, this article contributes to extent existing empirical work on emerging markets by examining a new database given by the case of the Tunisian industrial and commercial sectors. This led us to identify if the empirical results concerning other market hold for the Tunisian Stock Exchange. Second, the context of a developing country is novel. It would be interesting to provide a contribution to the literature by releasing new ultimate ownership data for firms’ sample listed and unlisted on pure agency market such as the Tunisian Stock Exchange (TSE). The value of the findings may, however, be extended to other similar countries. This is important given the role that can generate the functioning in joint title of governance mechanisms in limiting managerial discretion. Finally, the findings may be helpful for managers to understand the influence of the governance mechanisms’ interaction and for market participants, especially for institutional investors, to adopt optimal regulatory policies and choose efficient mechanisms’ combinations.

According to the aforementioned, the questions that are necessary to highlight are: what is the impact of audit quality on accounting manipulation level in a context of concentrated ownership within Tunisian companies? What is the impact of sector affiliation on the relevance of the results found between the set of audit and ownership structure variables and earnings management?

In this particular framework, our aim is to empirically examine within a Tunisian perspective, the impact of synergy, between some variables related to the external audit quality and the ownership structure, on discretionary managerial discretion exercised through earnings management. The results suggest that institutional investors have no influence on earnings management. Therefore, they do not influence the leaders of the selected companies.

Specifically, it comes to examine the interaction between the following variables: the belonging of the external auditor to a “Big 4”1, the external auditor seniority, the capital concentration and the presence of institutional investors out in the presence of other factors affecting this phenomenon, which are the firm size and the debt ratio.

The remainder of this paper is organized as follows: section 2 provides theoretical background, section 3 carries about literature review and hypotheses for the study, section 4 describes the methodology used, section 5 reports the results of the empirical study and section 6 concludes.

2Theoretical frameworkThe inability of traditional research to explain the phenomenon of earnings management was behind the formulation of a positive theory based primarily on the paradigm of accounting information's contractual utility (Watts & Zimmerman, 1978). This theory seeks to explain and predict the behavior of both producers and users of accounting information with the ultimate aim to clarify the genesis of the financial statements. To do this, it borrows its models to the agency theory and the economic theory of regulation.

The neoclassical agency theory defines the firm as a “legal fiction” which serves as a nexus for contracting relationships among agents and principals, whose ultimate aim is to maximize their interests (Jensen & Meckling, 1976). This theory postulates that the firm activity arises on delegation and on mandate relationships (implicit or explicit) which necessarily lead to “principal-agent” problem, and face to the asymmetric information, it becomes necessary to establish incentive or limitative clauses to reduce such divergences and therefore limit earnings management.

The economic theory of regulation (Posner, 1974) apprehends the political process as a competition between individuals to maximize their interests. It postulates that the purpose of the regulations is to make wealth transfers. Accounting numbers, particularly the accounting income and the equity, are used as technical arguments from the politicians voters.

Entrenchment theory stems from the two aforementioned theories, but unlike these two theories which assume that the leader is in confrontational relationship with the shareholder and is therefore opportunistic behavior, the Entrenchment theory considers that the leader has an active behavior. This theory begins from the observation that control mechanisms and incentives to increase efficiency of leaders’ management are not always enough to constrain leaders to manage the company in accordance with shareholders interests. The primary objectives of leaders, according to this theory, are to make costly their replacement for the firm, allowing them to increase their authorities and their discretionary spaces. Leader's entrenchment logic aims to preserve and to broaden managerial discretion which can be proof of opportunism. Indeed, leaders give priority to their personal interests, they seek to maximize their income while enjoying their informational advantages in order to appropriate from rents and placing the firm value maximization in a second plane, which is prejudicial to the company.

3Literature review and hypotheses developmentThe term of “earnings management” is often considered as a “deliberate intervention in the process of preparing financial statements in order to derive private gain”. Although this definition is the most widely cited in the literature, it has been the subject of some criticism and recent developments emphasizing the remarkable difficulty in clearly defining this concept (Jeanjean, 2002).

3.1External audit quality: a control mechanismSeveral criteria of audit quality and ownership structure have received attention in previous studies in corporate governance; will also be examined in this article. These criteria are: the auditor reputation, the auditor-audited relationship seniority, the capital concentration and the institutional property (Kamel & Elbanna, 2010; Lord, 2011; Jones, 2011; Rodriguez & Alegria, 2012; Kimberly, Mark, & Brian, 2013).

3.1.1External auditor reputation and earnings managementMcNair (1991) states that, the issuing of an audit value judgment is based on the firm's reputation, which will serve as his substitute. Various variables measuring the auditor reputation have been expressed by several researchers, such as the litigation rate proposed by Palmrose (1988), the membership of the audit firm to an international network (DeFond, 1992) and the size as well as the level of the fees prescribed by Moizer (1997).

Jiraporn, Miller, Yoon, & Kim (2008) mentioned that the recent scandals at Enron, WorldCom and Elsewhere have generated a public perception that earnings management is utilized opportunistically by firm managers for their own private benefits rather than for the benefits of the stockholders. Kim, Chung, & Firth (2003) noted that «the Big 4 exercise more effective control when managers have incentives to manipulate earnings upward». Therefore, this type of auditor is able to monitor and detect opportunistic managerial behavior (Memis & Jetenak, 2012; Brian et al., 2013).

In terms of the published reports’ relevance, some studies indicate that the information published by the companies audited by the “Big 4” are relevant and show a positive association between the “Big 4” and the relevance of accounting results (Teoh & Wong, 1993; Caramanis & Lennox, 2008; Chen, Lin, & Lin, 2008) as cited by Haapamäki, Tuukka, Lasse, & Mikko (2012) and Andre, Geraldine, Christopher, & Alain (2013). Thus, they find a higher coefficient of results relevance of firms audited by “Big 4” than for customers of none “Big 4”. The hypothesis related to the impact of audit quality on earnings management is also tested in the Belgian context (Vander Bauwhede, Willekens, & Gaeremynck, 2003); in Korea (Jeong & Rho, 2004) and in French (Piot & Janin, 2004).

Overall, the results of these studies are inconclusive and do not confirm the relevance of audit quality in the reduction of earnings management.

On the ground of such developments, the following hypothesis is likely to emerge:Hypothesis H1 The belonging of the external auditor to a “Big 4” has a negative impact on the earnings management.

In studying the relationship between the mandate term and the accounting results quality, Johnson, Khurana, & Reynolds (2002) categorize the audit duration as short (from 2 to 3 years), medium (from 4 to 8 years) or long (9 years or more). When they studied the firms audited by the “Big N” for the period 1986-1995, they observed that a short relationship is associated with a reduction in abnormal accruals and a long relationship has no effect on this measure of earnings management.

In two opposing studies of Mayangsari (2007) and Chen, Elder, & Hsieh (2007), the first shows that mandatory rotation imposed by law admits a negative impact on the result quality. While the second finds that the audit duration improves the accounting results quality.

In the same context, Mayangsari (2006) suggests that the auditor mission's seniority positively affects investor perceptions about the reported earnings quality. We will try to examine this relationship in the Tunisian context and we suggest the following hypothesis:Hypothesis H2 The external auditor seniority has a positive impact on the extent of earnings management.

Agency theory and corporate governance literature (Charreaux, 1997; Vishny & Shleifer, 1997) assume that the ownership structure may be an effective means of managers control, as it brings together when certain conditions are present (capital concentration and shareholders nature), the bases of an efficient control system (Hayam & Khaled, 2013; Gibson, 2014).

3.2.1Capital concentration and earnings managementThe major shareholder is a relevant factor in corporate governance research. Indeed, a concentrated property into the hands of a main shareholder allows controlling effectively the process of preparation and presentation of financial statements. In fact, the holders of control blocks are more inclined to act in the shareholders interests and curbing leaders’ discretionary behavior in subjects of earnings management (Dechow, Sloan, & Sweeney, 1996; Marrakchi, 2000).

The effect of the capital concentration on earnings management is empirically ambiguous. In fact, many studies have found a positive effect of the presence of a main shareholder on the accounting manipulations extent (Renneboog & Szilagyi, 2011; Usman & Yero, 2012; Zekri, 2012). While other studies have concluded that there is no relationship between the capital concentration and the earnings management. The empirical results obtained in the U.S. show that the information content of accounting earnings increases with the capital percentage held by administrators, managers and main owners (Warfield, Wild, & Wild, 1995). In U.K. the results of studies confirm a negative relationship between the accounting earnings relevance and the level of main shareholder's voting rights.

The results of these studies, for civil law or common law countries, appear mixed. The relationship between the capital concentration and the earnings management is sometimes positive, sometimes negative as cited by Mohamed, Abdul Rashied, & Mohammed Shawtari (2012). Therefore, it seems interesting to test this relationship in the Tunisian context. The third hypothesis is as follows:Hypothesis H3 The presence of a main shareholder negatively influences earnings management.

The identity of major shareholders can influence agency costs, the effectiveness of monitoring managers and the firm performance. Institutional shareholders, due to the significant resources that they have and to their ability to access to the relevant available information, benefit from several advantages allowing them to exercise control at the lowest cost.

According to the agency theory, the institutional ownership can serve as an element of effective control. The institutional investors are considered the most demanding agents in terms of regular financial information and timely publish (Healy, 1985).

Empirically, the results of studies carried on the matter show that institutional property can deviate the recourse to discretionary accruals (Cornett et al., 2006, Agnes Cheng & Reitenga, 2009; Jalil & Rahman, 2010; Hadani, Goranova, & Khan, 2011). It seems that such investors have a particular control role over managers such as the role of limiting opportunistic management decisions to reduce R&D costs (Maizatul, 2012; Allen, Jacob, & Israel, 2014).

These arguments advanced in the context of agency theory show that the presence of institutional investors is positively related to earning performance and corporate value (Mitanni, 2010). Hence our hypothesis is as follows:Hypothesis H4 There is a negative relationship between institutional property and earnings management.

According to Hay, Knechel, & Ling (2008), the results dealing with the relationship between the auditor reputation and the capital concentration studies are mixed. Some authors, including (Mitra, Deis, & Hossain, 2007), found a negative and significant link between the property concentration (ownership exceeds 5%) and the audit quality.

In fact, the majority position of shareholders would certainly lead them to exert a strong influence on the company through their control over the managers. Shareholders holding a significant part may require managers to work in their favor by opposing their decisions when they are against the objective of maximizing shareholders wealth. Consequently, they do not need to rely on the services of an audit of quality as a means of controlling managers (Cornett, Marcus, & Tehraniam, 2008).

Other authors, like Hay et al. (2008), find a positive relationship. Indeed, the position of the main shareholders should not prevent them from requesting an audit of quality in order to defend their interests. The authors suggest another argument by differentiating between majority and minority shareholders. In reality, the first are seeking an external audit with high quality to protect themselves against the power of the second. Besides, the external shareholders also require a higher quality of audit, as far as they do not participate automatically in the made of all the internal decisions. Some authors (Hay et al., 2008) show that when the ownership is concentrated, interest conflicts between managers and shareholders or between majority and minority shareholders are increasing. It follows that a good quality of the external audit will be required. O'Sullivan (2000) reached, from its part, insignificant results.

We will predict the sense of this cross effect in the Tunisian context. Hence, our hypotheses appear as follows:Hypothesis H5 The interaction between the external auditor reputation and the capital concentration has a negative impact on the earnings management. The interaction between the auditor seniority and the capital concentration affects the earnings management negatively.

The complementarities between the capital proportion held by institutional investors and the external audit quality have not yet been brought in a clear way.

O'Sullivan (2000), supposes a positive relation between the institutional property and audit fees because such shareholders, possessing important parts in the capital, want to insure more control to protect their interests. Alternatively, to attract a large number of institutional investors, companies turn to auditors offering better services, what allows creating a positive perception of their financial reporting quality (Mitra et al., 2007). Thus, institutional investors will be attracted by the companies which present financial statements coating the signatures of the most reputed auditors (Labelle & Piot, 2003). Other studies, like that of Mitra et al. (2007), show a negative relationship between institutional property and the external audit quality. Actually, institutional investors seem to have the motivation and the ability to control the managers by themselves. Indeed, the periodic financial reports made by managers stand out as an important source of information for institutional control activities. In addition, they are able to analyze the financial statements in more detail compared to individual investors (Velury, Reisch, & O’reilly, 2003). So, the increased monitoring exercised by the institutional shareholders can discourage the responsible to choose an audit of high quality when this type of property is elevated.

To examine the impact of the interaction between the existence of institutional investors and the belonging of the external auditor to a “Big 4” on the one hand and the auditor-audited relationship seniority on the other hand, on the practice of earnings management, we set the following hypotheses:Hypothesis H7 The interaction of a better external audit reputation and the existence of institutional investors weaken the ability of managers to manage results. The effect of the interaction between the external auditor seniority and the existence of institutional investors weakens the ability of managers to manage results.

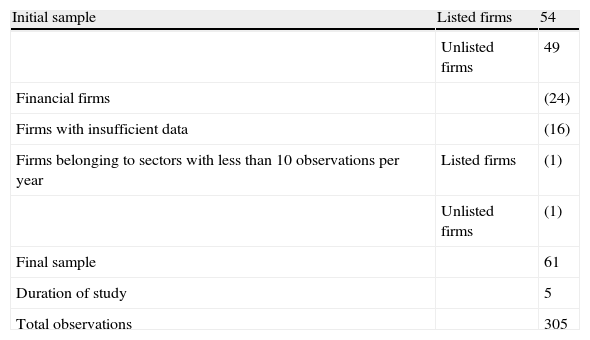

As our sample includes listed and unlisted firms, we chose the balanced panel to make sure that we will have consistent results. The initial obtained sample contains 103 Tunisian firms listed and unlisted on the Tunisia's Stock Exchange (TSE) during 5 years ranging from 2007 to 2011. This choice is mainly justified by the need to provide a favorable framework to study the impact of the interaction between ownership structure and external audit quality on the extent of accounting manipulation. Especially that unlisted Tunisian companies form the majority economic structure of the Tunisian market. The choice of unlisted firms has focused on the city of Sfax, which is considered as an economic pole and covering a wide variety of activities. From the initial sample, we have eliminated firstly, foreign firms in order to test a purely Tunisian population. We have eliminated in the second rank the financial firms. This exclusion is justified by the fact that they are governed by a special legislation in the preparation of their financial statements and by specific sector accounting standards. Thirdly, to work on a balanced panel, we have chosen to remove firms with missing necessary data. Finally for statistical reasons, the firms belonging to sectors that contain less than 10 observations per year were not included2. Hence, 61 firms and 305 observations remain in our sample. This sample is divided in two subsamples according to sectors: 41 industrial firms and 20 commercial firms.

Regarding listed companies, accounting data were collected from the financial statements available on the website of the Tunis Stock Exchange and Financial Market Council. For unlisted companies, the data are collected from the accounting offices.

4.2Regression model specificationsTo verify our research hypotheses we apply a statistical methodology implementing three linear panel regressions.

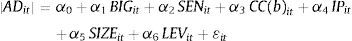

From a first regression (1) we are going to test the effect of the variables of the external audit quality and the ownership structure as well as the control variables on the absolute value of discretionary accruals for the whole sample. Our first model is as follows:

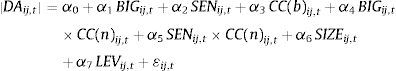

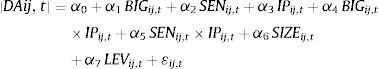

Where; |ADit|: absolute value of discretionary accruals; BIGit: auditor reputation of firm i in year t; SENit: auditor seniority of the firm i in year t; CC(b)it: capital concentration of firm i in year t, this variable is measured by a binary value which takes value 1 if there is a main shareholder holding at least 50% and 0 otherwise; IPit: percentage of shares detains by institutional investors in the firm i in the year t; SIZEit: logarithm of total assets of firm i in year t; LEVit: debt ratio of firm i in year t.In the second and third regressions we are going to test, for each sector, the effect of the interaction of the various variables of external audit quality with the variables of the ownership structure on earnings management. Indeed, from a second regression (2), we will test the impact of the interaction, between the external audit quality variables and the capital concentration (main shareholder), on the earnings management. Then, we are going to test from a third regression (3) the combined effect of the external audit quality and institutional property on earnings management.

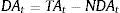

Where; CC(n)ij,t: capital concentration of firm i in industry j in year t, this variable is defined as the capital percentage at least 50% held by the main shareholder (Shabou, 2003).4.3Variables Measurement4.3.1Dependent variable measurement - Earnings managementWe will use the discretionary accruals (DA) as proxy of earnings management. This measure consists in estimating first of all the total accruals (TA) then in extracting from these accruals the not discretionary part (NDA).

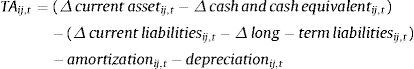

To estimate discretionary accruals, we are going to calculate first of all for each company «i» and for every year «t» the total accruals according to the indirect approach. We calculate the total accruals by using the model of Dechow, Sloan, & Sweeney (1995) as being the change of the elements of non-cash working capital requirement less of amortization and depreciation. The formula is as follows:

Having calculated the total accruals for each firm we move to the estimation of the non-discretionary accruals which are the accruals part that is not supposed to be manipulated by the managers and it corresponds to a sincere and regular application of the accounting principles in a given country (Jeanjean, 2002).

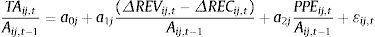

The estimation of discretionary accruals passes in a first stage by the estimation of the total accruals using the Modified Jones model (1995). Then, the estimated coefficients are used to give off a normal level of accruals for each firm per year expressed in terms of percentage of its opening total assets. The model so appears:

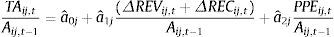

Where; TAij,t: total accruals for firm i in industry j in year t; Aij,t-1: total assets of firm i in industry j in year t-1. All variables are standardized by total assets t-1 to reduce the problem of heteroscedasticity; ΔREVij,t: variation in net sales for firm i in industry j between t and t-1; ΔRECij,t: variation in net receivables for firm i in industry j between t and t-1; PPEij,t: property, plant and equipment of firm i in industry j in year t; ¿ij,t: term error of firm i in year t.By using the estimated coefficients, we calculate the non-discretionary part (NDA), for each observation (ij,t) of the sample. The Modified Jones model (1995) appears as follows:

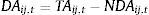

Where; â0j, â1j and â2j represent respectively the estimation of α0j, α1j and α2j by the OLS estimator.The discretionary accruals (DA) are obtained by difference between the total accruals (TA) of each firm and the normal accruals (NDA), we obtain:

As long as we try to examine the effect of the interaction, between the ownership structure and the external audit quality, on the earnings management rather than on the particular sense of this practice, we are going to use the measure of the discretionary accruals in absolute value (Warfield et al., 1995; Peasnell et al., 1998; Klein, 2002) (Table 1).

Sample selection.

| Initial sample | Listed firms | 54 |

| Unlisted firms | 49 | |

| Financial firms | (24) | |

| Firms with insufficient data | (16) | |

| Firms belonging to sectors with less than 10 observations per year | Listed firms | (1) |

| Unlisted firms | (1) | |

| Final sample | 61 | |

| Duration of study | 5 | |

| Total observations | 305 |

Author (Own elaboration)

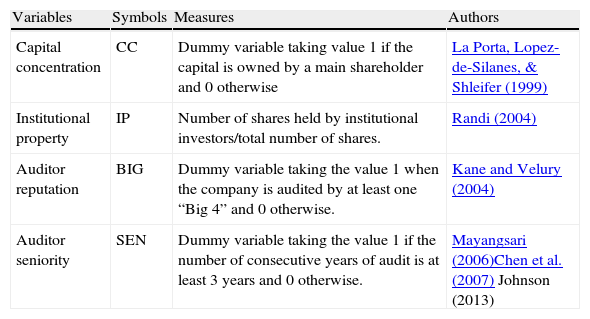

Table 2 shows the exogenous variables’ measurements.

Explanatory variables definitions and measurements.

| Variables | Symbols | Measures | Authors |

| Capital concentration | CC | Dummy variable taking value 1 if the capital is owned by a main shareholder and 0 otherwise | La Porta, Lopez-de-Silanes, & Shleifer (1999) |

| Institutional property | IP | Number of shares held by institutional investors/total number of shares. | Randi (2004) |

| Auditor reputation | BIG | Dummy variable taking the value 1 when the company is audited by at least one “Big 4” and 0 otherwise. | Kane and Velury (2004) |

| Auditor seniority | SEN | Dummy variable taking the value 1 if the number of consecutive years of audit is at least 3 years and 0 otherwise. | Mayangsari (2006)Chen et al. (2007) Johnson (2013) |

Author (Own elaboration)

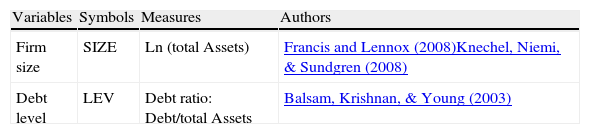

The table below (Table 3) shows the control variables’ measurements.

Control variables definitions and measurements.

| Variables | Symbols | Measures | Authors |

| Firm size | SIZE | Ln (total Assets) | Francis and Lennox (2008)Knechel, Niemi, & Sundgren (2008) |

| Debt level | LEV | Debt ratio: Debt/total Assets | Balsam, Krishnan, & Young (2003) |

Author (Own elaboration)

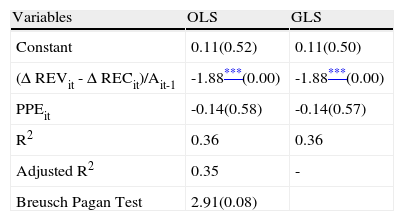

The estimation's results of the Modified Jones Model (1995) by OLS and GLS estimators are summarized in the following table:

The Modified Jones model (1995) produced an Adjusted R2 equal to 0.36 with strong overall significance at the 1% level (F=23.03, p-v=0.00). So 36% of the total accruals variation is explained by changes in net turnover less net receivables (ΔREV - ΔREC) and by property, plant and equipment (PPE). The part unexplained by these variables (65%) represents the discretionary accruals.

From Table 4, we record that the coefficient concerning the variables (ΔREV - ΔREC) is negative (-1.88) and significant at the 1% level (p-v=0.00). In fact, according to Jones (1991), the account of accruals associated with elements related to the changes in working capital requirement can be positive for receivable bills and negative for payable bills. Moreover, the coefficient relating to the property, plant and equipment (PPE) although it appears with a negative sign (-0.14) due to the depreciation of fixed assets, it is not significant (p-v=0.57) and had no effect on the total accruals. Moreover, Pope et al. (1998) suggest that the depreciation of fixed assets seems an inadequate vehicle to the earnings management because of its visibility by mention in the appended note.

Mean coefficients from the estimation of Modified Jones Model (1995): N=305.

| Variables | OLS | GLS |

| Constant | 0.11(0.52) | 0.11(0.50) |

| (Δ REVit - Δ RECit)/Ait-1 | -1.88***(0.00) | -1.88***(0.00) |

| PPEit | -0.14(0.58) | -0.14(0.57) |

| R2 | 0.36 | 0.36 |

| Adjusted R2 | 0.35 | - |

| Breusch Pagan Test | 2.91(0.08) |

ΔREV: variation in net sales; ΔREC: variation in net receivable; PPE: property, plant and equipment.

Author (Software Output)

Several tests must be made to qualify our panel data mainly testing the presence of heteroscedasticity problem and multicollinearity problem.

- •

Heteroscedasticity test

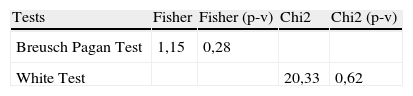

To detect this problem we use two tests: the Breusch Pagan test and the White test. According to Table 5, the tests applied allowed to accept the null hypothesis of heteroscedasticity (p-v=0.28).

- •

Multicollinearity test

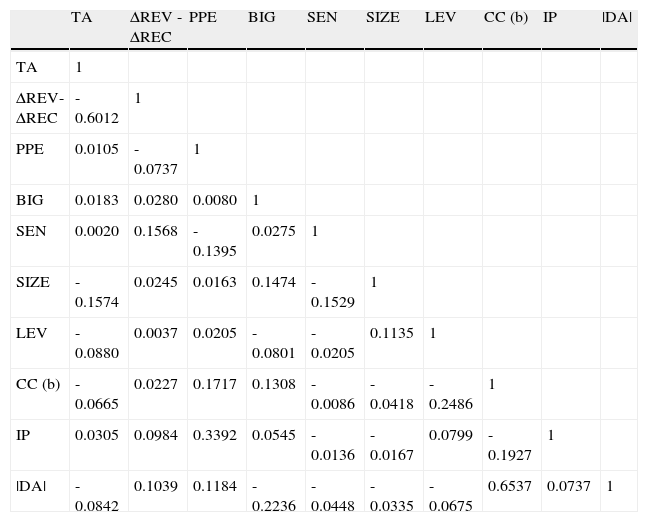

The multicollinearity is a computational difficulty that appears when two or more independent variables are highly correlated. From Table 6, we accept the null hypothesis of autocorrelation the fact that the explanatory variables (auditor reputation, auditor seniority, capital concentration, institutional property, firm size and debt level) are weakly correlated with each other.

Pearson correlations.

| TA | ΔREV -ΔREC | PPE | BIG | SEN | SIZE | LEV | CC (b) | IP | |DA| | |

| TA | 1 | |||||||||

| ΔREV-ΔREC | -0.6012 | 1 | ||||||||

| PPE | 0.0105 | -0.0737 | 1 | |||||||

| BIG | 0.0183 | 0.0280 | 0.0080 | 1 | ||||||

| SEN | 0.0020 | 0.1568 | -0.1395 | 0.0275 | 1 | |||||

| SIZE | -0.1574 | 0.0245 | 0.0163 | 0.1474 | -0.1529 | 1 | ||||

| LEV | -0.0880 | 0.0037 | 0.0205 | -0.0801 | -0.0205 | 0.1135 | 1 | |||

| CC (b) | -0.0665 | 0.0227 | 0.1717 | 0.1308 | -0.0086 | -0.0418 | -0.2486 | 1 | ||

| IP | 0.0305 | 0.0984 | 0.3392 | 0.0545 | -0.0136 | -0.0167 | 0.0799 | -0.1927 | 1 | |

| |DA| | -0.0842 | 0.1039 | 0.1184 | -0.2236 | -0.0448 | -0.0335 | -0.0675 | 0.6537 | 0.0737 | 1 |

TA: total accruals; ΔREV: variation in net sales; ΔREC: variation in net receivables; PPE: property, plant and equipment; BIG: auditor reputation; SEN: auditor seniority; SIZE: firm size; LEV: debt ratio; CC(b): capital concentration; IP: institutional property; |DA|: absolute value of discretionary accruals.

Author (Software Output)

The tables below present the descriptive and univariate statistics for the variables used in the analysis of the first regression (1).

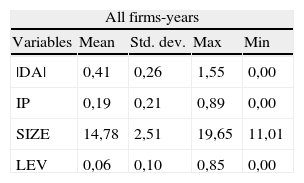

The results from Tables 7 and 8 allow us to observe that the discretionary accruals are positive (mean=0.41). There are so many Tunisian companies operating in the industrial and commercial sector, managing the results higher. The maximum and minimum recorded by this variable are respectively about 1.55 and 0.00. These results allow us to conclude that for the majority of Tunisian firms, discretionary accruals have a large impact on the level of published results.

Descriptive statistics of numeric variables.

| All firms-years | ||||

| Variables | Mean | Std. dev. | Max | Min |

| |DA| | 0,41 | 0,26 | 1,55 | 0,00 |

| IP | 0,19 | 0,21 | 0,89 | 0,00 |

| SIZE | 14,78 | 2,51 | 19,65 | 11,01 |

| LEV | 0,06 | 0,10 | 0,85 | 0,00 |

|DA|: absolute value of discretionary accruals, IP: percentage of shares held by institutional investors; SIZE: logarithm of total assets, LEV: debt ratio.

Author (Software Output)

Descriptive statistics of dichotomous variables.

| All firms-years | |||

| Variables | Modalities | Frequency | % |

| BIG | 0 | 148 | 85 |

| 1 | 27 | 15 | |

| SEN | 0 | 37 | 21 |

| 1 | 138 | 79 | |

| CC(b) | 0 | 105 | 60 |

| 1 | 70 | 40 | |

BIGit: external auditor reputation; SENit: auditor seniority; CC(b): capital concentration. A binary variable which takes value 1 if the capital is held by a main shareholder who detains at least 50% and 0 otherwise.

Author (Software Output)

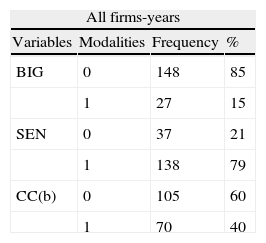

The tables show also that only 15% of Tunisian companies are audited by at least one of the “Big 4” and that 79% of these firms are audited by the same auditor during the 5 years of our study. For the rest of the firms (21%), the audit duration does not complete the mandate (3 years).

The ownership structure shows that institutional investors hold on average 19% of the firm capital with a maximum of 89% and lack of institutional investors in certain companies (min=0%). For the capital concentration (CC), it displays values concluding that the capital concentration in Tunisian firms is important. In fact, on average it is 40%. Turning to the control variables, the size of Tunisian firm measured by the logarithm of total assets recorded on average of 14.78 when t he debt ratio records 0.06. This result reveals a limited number of Tunisian companies which are highly in debt.

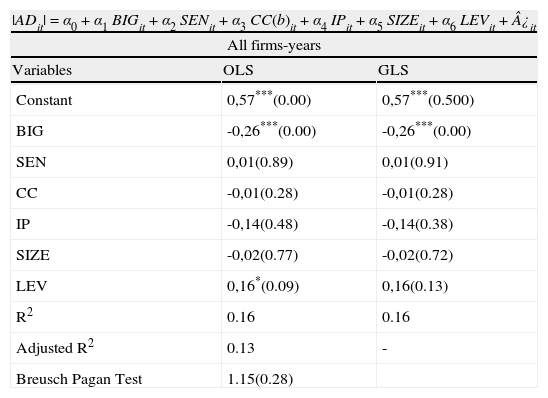

5.2.3Multivariate analysisTable 9 summarizes the results obtained from the estimation of the first regression (1).

First regression estimation (N= 305).

| |ADit|=α0+α1BIGit+α2SENit+α3CC(b)it+α4IPit+α5SIZEit+α6LEVit+¿it | ||

| All firms-years | ||

| Variables | OLS | GLS |

| Constant | 0,57***(0.00) | 0,57***(0.500) |

| BIG | -0,26***(0.00) | -0,26***(0.00) |

| SEN | 0,01(0.89) | 0,01(0.91) |

| CC | -0,01(0.28) | -0,01(0.28) |

| IP | -0,14(0.48) | -0,14(0.38) |

| SIZE | -0,02(0.77) | -0,02(0.72) |

| LEV | 0,16*(0.09) | 0,16(0.13) |

| R2 | 0.16 | 0.16 |

| Adjusted R2 | 0.13 | - |

| Breusch Pagan Test | 1.15(0.28) | |

BIG: external auditor reputation; SEN: external auditor seniority; CC: existence of a main shareholder; IP: institutional property; SIZE: firm size; LEV: debt ratio.

*/*** represents significance at the 10/1% level. Coefficient estimates are reported with t-statistics in parentheses.

Author (Software Output)

It is noticed that even in estimating the model with the GLS estimator, the results remain unchanged.

The test of the auditor reputation is in accordance with several previous researches. Indeed, the results of our study show that the coefficient associated with the external auditor reputation is negative (-0.26) reflecting a negative and significant (p-v=0.00) relationship between the auditor reputation and the discretionary accruals. Those results corroborate those of Defond (1992) and DeAngelo (1981b) who proved that the belonging of the auditor to a “Big N” is associated with a low level of earnings management. So, in the Tunisian context and for listed and unlisted companies operating in industrial and commercial sector, the belonging of an auditor to a “Big 4” reduces the level of accounting manipulation. The Tunisian context appears as an interesting field of investigation to answer the question of the relationship between the external auditor reputation and the discretionary accruals level.

The coefficient associated with the variable auditor seniority (SEN) is positive (0.01). From this result we find that earnings management is positively related to the audit duration, that 79% of studied firms are characterized by a seniority of mandate exceeding 3 years. However, this coefficient is not significant (p-v=0.89). So the variable (SEN) has no effect on the absolute value of discretionary accruals, this confirms the study of Johnson et al. (2002), which examines the relationship between the term of office and the accounting results quality by studying firms audited by the “Big N” during the period from 1986-1995, they observe that a short relationship (from 2 to 3 years) is associated with a reduction in abnormal accruals, and a long relationship (more than 3 years) has no effect on this measure of earnings management.

As for the coefficient of the capital concentration (CC), it is negative (-0.01) and significant (p-v=0.28). So, we identify a negative and significant relationship between discretionary accruals and capital concentration. According to the results advanced in the framework of agency theory, earnings management is inversely related to institutional ownership (Cornett et al., 2006). Indeed, the coefficient of the variable (IP) is negative (-0.14). On the other side, the relation between the firm size and the discretionary accruals, produces a negative (-0.02) and not significant (0.77) coefficient. Hence, the firm size has no impact on the earnings management (Salehi & Mansoury, 2009). The debt ratio appears with a positive (0.16) and significant (10%) coefficient putting a positive association between the debt level of Tunisian companies and the absolute value of discretionary accruals. This is consistent with the hypothesis that the managers of indebted companies have an incentive to manage the accounting results.

5.3Cross effect: sector's analysisThe studies led on the Tunisian context have treated only one form of the impact of governance mechanisms on earnings management (Omri & Hakim, 2009). In the early part, we studied the impact of the external audit quality and the ownership structure on earnings management measured by the absolute value of discretionary accruals. In what follows, we will analyze the effect of the interaction of these two mechanisms on the earnings management.

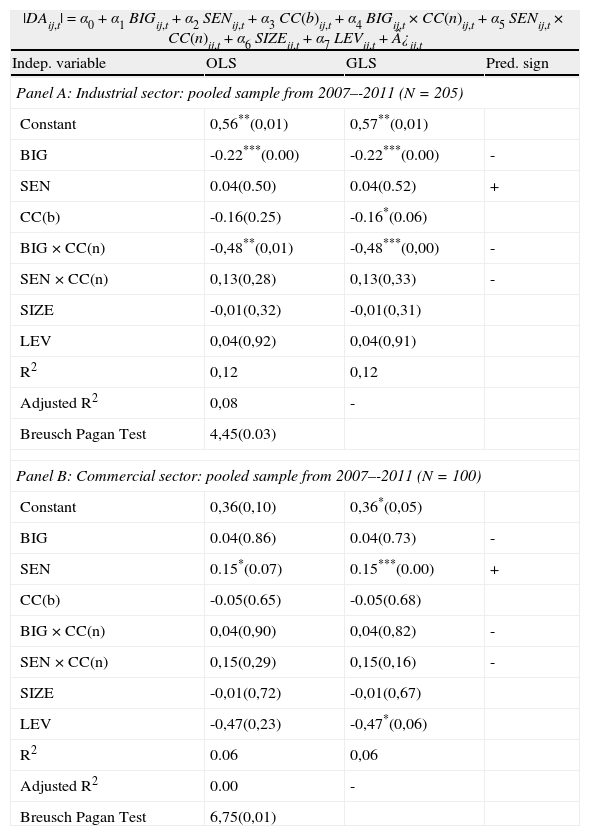

5.3.1The cross effect of the external audit quality and the capital concentration on earnings managementThe second regression (2) is used to test the effect of the interaction between ownership structure, measured by the existence of a main shareholder, and different variables of external audit quality, on accounting manipulations in listed and unlisted Tunisian firms.

Table 10 reports the valuation test using the following model:

Second regression estimation.

| |DAij,t|=α0+α1BIGij,t+α2SENij,t+α3CC(b)ij,t+α4BIGij,t×CC(n)ij,t+α5SENij,t×CC(n)ij,t+α6SIZEij,t+α7LEVij,t+¿ij,t | |||

| Indep. variable | OLS | GLS | Pred. sign |

| Panel A: Industrial sector: pooled sample from 2007–-2011 (N=205) | |||

| Constant | 0,56**(0,01) | 0,57**(0,01) | |

| BIG | -0.22***(0.00) | -0.22***(0.00) | - |

| SEN | 0.04(0.50) | 0.04(0.52) | + |

| CC(b) | -0.16(0.25) | -0.16*(0.06) | |

| BIG×CC(n) | -0,48**(0,01) | -0,48***(0,00) | - |

| SEN×CC(n) | 0,13(0,28) | 0,13(0,33) | - |

| SIZE | -0,01(0,32) | -0,01(0,31) | |

| LEV | 0,04(0,92) | 0,04(0,91) | |

| R2 | 0,12 | 0,12 | |

| Adjusted R2 | 0,08 | - | |

| Breusch Pagan Test | 4,45(0.03) | ||

| Panel B: Commercial sector: pooled sample from 2007–-2011 (N=100) | |||

| Constant | 0,36(0,10) | 0,36*(0,05) | |

| BIG | 0.04(0.86) | 0.04(0.73) | - |

| SEN | 0.15*(0.07) | 0.15***(0.00) | + |

| CC(b) | -0.05(0.65) | -0.05(0.68) | |

| BIG×CC(n) | 0,04(0,90) | 0,04(0,82) | - |

| SEN×CC(n) | 0,15(0,29) | 0,15(0,16) | - |

| SIZE | -0,01(0,72) | -0,01(0,67) | |

| LEV | -0,47(0,23) | -0,47*(0,06) | |

| R2 | 0.06 | 0,06 | |

| Adjusted R2 | 0.00 | - | |

| Breusch Pagan Test | 6,75(0,01) | ||

BIG×CC: cross effect of the external auditor reputation and the existence of a main shareholder; SEN×CC: cross effect of the external auditor seniority and the existence of a main shareholder.

*/**/*** represents significance at the 10/5/1% level.

Author (Software Output)

According to Table 10, the coefficient associated with the external auditor reputation (BIG) is negative (-0.22). Hence, a negative and significant relationship (p-v=0.00) between the auditor reputation and the absolute value discretionary accruals. Of these findings we note that in the industrial Tunisian context, the belonging of an auditor to a “Big 4” allows to restrict a down earnings management. This result, obtained for Tunisian firms, joined these of Becker, DeFond, Jiambalvo, & Subramanyam (1998) obtained for U.S. firms and Vander Bauwhede et al. (2003) obtained for Belgian firms. Indeed, these authors studied the effect of the auditor reputation measured by their belonging to a “Big 6” (in the past) on the intensity of earnings management as measured by the absolute value of discretionary accruals. An antonym of this result is generated by the panel of commercial firms. Indeed, the coefficient of the variable (BIG) is positive (0.04) and insignificant. This reflects that the auditors who belong to a “Big 4” cannot compel, in a significant way, managers against earnings management on the rise. So, the belonging of the external auditor to a “Big 4” has no effect on discretionary accruals. This can be explained by the fact that a small percentage of Tunisian commercial companies are audited by at least one of the “Big 4”. Our hypothesis is validated for industrial firms. However, it is not validated for commercial firms. The coefficient associated with the variable external auditor seniority (SEN) is positive (0.04) and not significant (p-v=0.52) for the industrial sector, it is still positive but significant (p-v=0.00) for the commercial sector. Our predictions are confirmed for the firms operating in the commercial sector.

This is justified by the fact that the Tunisian auditors have the needed skills and qualities which are more important in the commercial sector than in the industrial sector. This proves that their presence may influence earnings management.

However, they are not confirmed for industrial firms. The coefficient linked to the variable capital concentration (CC) is negative for both industrial and commercial sectors respectively around (-0.16) and (-0.05). Also, this coefficient is not significant (0.25 and 0.68). From these results we find a negative and insignificant relationship between discretionary accruals and the existence of a main shareholder. The presence of a main shareholder reduces the intensity of earnings management. This result is consistent with studies conducted in the U.S. by Warfield et al. (1995). While this coefficient is not significant, so the variable (CC) has no effect on the earnings management of industrial and commercial Tunisian companies. Our hypothesis is not validated for both commercial and industrial panels.

Regarding the cross effect of the external auditor reputation and the capital concentration, this variable (BIG×CC) generates a negative (-0.48) and significant (p-v=0.00) coefficient. This proves that in an industrial context, the interaction between the existence of a main shareholder and the belonging of the auditor to a “Big 4” reduces the level of accounting manipulation. However, this interaction has no effect on earnings management in Tunisian commercial firms (p-v=0.82). So our hypothesis is validated for industrial firms but it is not validated for commercial firms.

As to the cross effect of the auditor seniority and the capital concentration, we find that the estimated coefficient related to the variables (SEN×CC) is positive and insignificant for both industrial and commercial sectors. This result reflects that the combined effect between the external auditor seniority and the existence of a main shareholder does not affect the earnings management of industrial and commercial Tunisian firms.

We expect that the control variable (SIZE) will appear with positive coefficient, however, it appears with negative and insignificant coefficient in both sectors. This allows us to conclude that the firm size does not affect the earnings management. According to the expected sign, the debt ratio appears in the industrial sector with a positive coefficient. However, this coefficient is not significant (p-v=0.91). This means that the debt level of the Tunisian industrial firms does not seem to have a major impact on earnings management. However, the commercial panel reported a negative (-0.47) and significant (p-v=0.06) coefficient. The debt contributes to reduce earnings management to avoid violating of restrictive debt clauses.

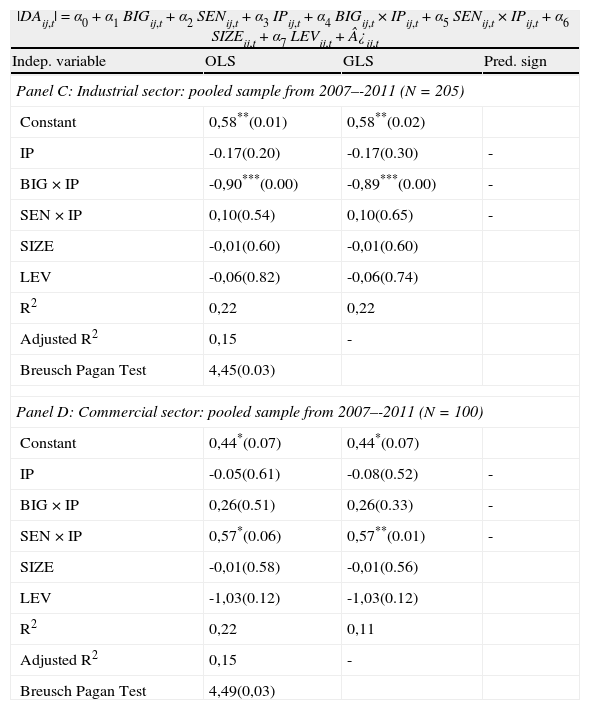

5.3.2The cross effect of the external audit quality and institutional property on earnings managementThe third regression (3) allows testing the effect of the interaction between the institutional property and the external audit quality on the earnings management of industrial and commercial Tunisian companies.

Table 11 shows that the coefficient of the variable (IP) is negative in both sectors (-0.17 and -0.08), which generates a negative relationship between this mechanism and earnings management. Previous studies have shown that more the property of institutional investors increases more they will be motivated to monitor (Triki & Omri, 2010). This explains the non-significance of this variable because of the low participation of the institutional investors in the firm capital.

Third regression estimation.

| |DAij,t|=α0+α1BIGij,t+α2SENij,t+α3IPij,t+α4BIGij,t×IPij,t+α5SENij,t×IPij,t+α6SIZEij,t+α7LEVij,t+¿ij,t | |||

| Indep. variable | OLS | GLS | Pred. sign |

| Panel C: Industrial sector: pooled sample from 2007–-2011 (N=205) | |||

| Constant | 0,58**(0.01) | 0,58**(0.02) | |

| IP | -0.17(0.20) | -0.17(0.30) | - |

| BIG×IP | -0,90***(0.00) | -0,89***(0.00) | - |

| SEN×IP | 0,10(0.54) | 0,10(0.65) | - |

| SIZE | -0,01(0.60) | -0,01(0.60) | |

| LEV | -0,06(0.82) | -0,06(0.74) | |

| R2 | 0,22 | 0,22 | |

| Adjusted R2 | 0,15 | - | |

| Breusch Pagan Test | 4,45(0.03) | ||

| Panel D: Commercial sector: pooled sample from 2007–-2011 (N=100) | |||

| Constant | 0,44*(0.07) | 0,44*(0.07) | |

| IP | -0.05(0.61) | -0.08(0.52) | - |

| BIG×IP | 0,26(0.51) | 0,26(0.33) | - |

| SEN×IP | 0,57*(0.06) | 0,57**(0.01) | - |

| SIZE | -0,01(0.58) | -0,01(0.56) | |

| LEV | -1,03(0.12) | -1,03(0.12) | |

| R2 | 0,22 | 0,11 | |

| Adjusted R2 | 0,15 | - | |

| Breusch Pagan Test | 4,49(0,03) | ||

BIG×IP: cross effect of the external auditor reputation and the institutional property; SEN×IP: cross effect of the external auditor seniority and the institutional property.

*/**/*** represents significance at the 10/5/1% level.

Author (Software Output)

In this sense, the institutional investors have not skills and necessary resources to discipline and influence leader's behavior.

Arriving to the combined effect of the external auditor reputation and institutional property, it follows from the table that the coefficient relating to the combined variables (BIG×IP) in the industrial sector is negative (-0.89) and significant (p-v=0.00). This coefficient is positive (0.26) and not significant (p-v=0.33) for the commercial sector. These findings shows that in a context characterized by the presence of institutional investors, the belonging of the auditor to a “Big 4” reduces earnings management in an industrial firm but has no effect on the earnings management of a commercial firm. This result confirms our hypothesis only for industrial sample (Table 12).

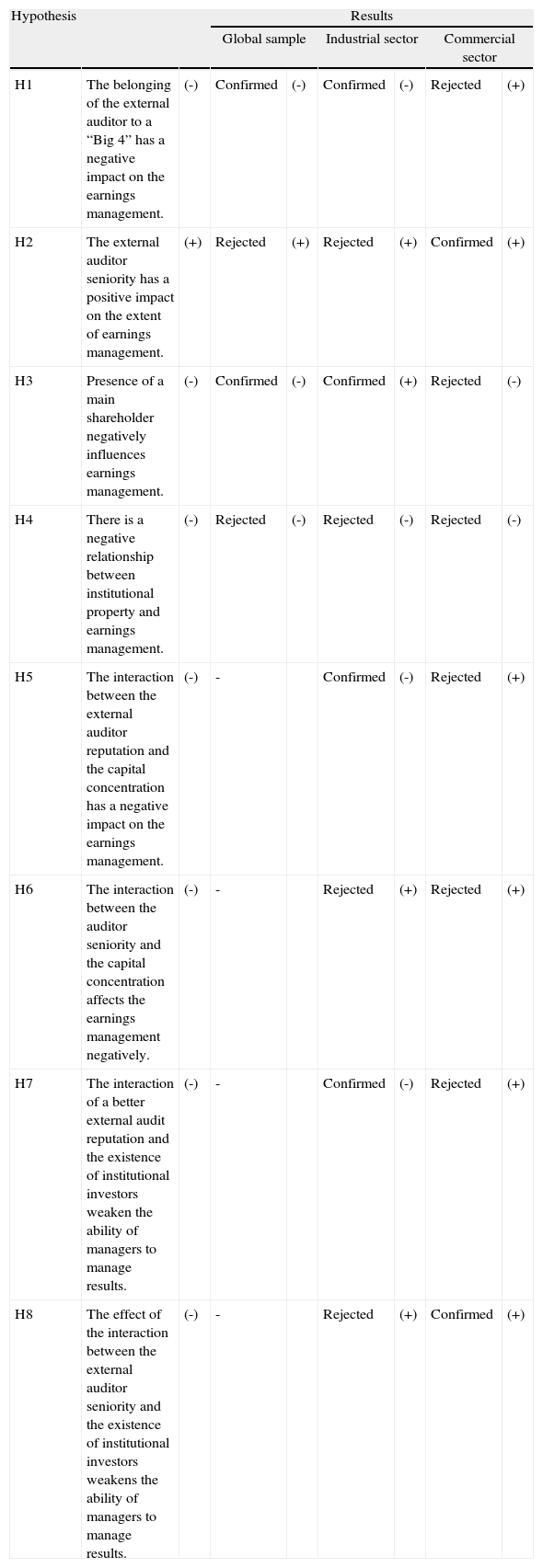

Hypotheses results, expected signs and obtained signs.

| Hypothesis | Results | |||||||

| Global sample | Industrial sector | Commercial sector | ||||||

| H1 | The belonging of the external auditor to a “Big 4” has a negative impact on the earnings management. | (-) | Confirmed | (-) | Confirmed | (-) | Rejected | (+) |

| H2 | The external auditor seniority has a positive impact on the extent of earnings management. | (+) | Rejected | (+) | Rejected | (+) | Confirmed | (+) |

| H3 | Presence of a main shareholder negatively influences earnings management. | (-) | Confirmed | (-) | Confirmed | (+) | Rejected | (-) |

| H4 | There is a negative relationship between institutional property and earnings management. | (-) | Rejected | (-) | Rejected | (-) | Rejected | (-) |

| H5 | The interaction between the external auditor reputation and the capital concentration has a negative impact on the earnings management. | (-) | - | Confirmed | (-) | Rejected | (+) | |

| H6 | The interaction between the auditor seniority and the capital concentration affects the earnings management negatively. | (-) | - | Rejected | (+) | Rejected | (+) | |

| H7 | The interaction of a better external audit reputation and the existence of institutional investors weaken the ability of managers to manage results. | (-) | - | Confirmed | (-) | Rejected | (+) | |

| H8 | The effect of the interaction between the external auditor seniority and the existence of institutional investors weakens the ability of managers to manage results. | (-) | - | Rejected | (+) | Confirmed | (+) | |

Author (Own elaboration)

In the industrial sector, the cross effect of the seniority of audit relationship and institutional property (SEN×IP) shows a positive (0.10) and not significant coefficient (p-v=0.65). Hence the interaction between these two variables has no effect on earnings management for Tunisian industrial firms. This finding does not confirm our hypothesis. We observe from the analysis of the commercial sample, a positive and significant coefficient (p-v=0.01). This result reveals that the managers of Tunisian commercial firms manage the result on the rise where there is interaction between the seniority of auditor-audited relationship and institutional property. Our hypothesis is confirmed for commercial firms, but it is not consistent with several studies and our predictions in the industrial sector.

Reaching the control variables, the results show that the variable (SIZE) has a negative and insignificant impact on discretionary accruals. The significance disappears also with the debt level in the two samples.

The following table summarizes the hypotheses results, as well as the signs of the different relationships studied:

6ConclusionsUsing data from a sample of listed and unlisted industrial and commercial Tunisian companies for the period from 2007 to 2011, we examine the cross effect of external audit quality and ownership structure on earnings management's practice, measured by the absolute value of discretionary accruals.

In accordance with the tests in previous section, we find that the interaction between the variables (BIG×CC) produces a negative and significant impact on the earnings management in the Tunisian industrial context. However, our hypothesis is rejected for commercial firms due to the non-significance of this interaction. The combination of variables (SEN×CC) has no effect on earnings management of Tunisian industrial and commercial firms. This goes against our hypothesis. We find also that with the presence of institutional investors, the simultaneous effect of the institutional property and the existence of a reputed auditor (BIG×IP) have a significant impact on earnings management. However, this impact is negative for industrial firms and positive for commercial ones. The interaction between the seniority of the auditor term and the presence of institutional investors (SEN×IP) has no significant influence on earnings management of industrial firms. However, this cross effect seems positively and significantly influencing the practice of earnings management of Tunisian commercial firms.

While external audit quality and ownership structure have a simultaneous impact on earnings management that impact have been ignored in accounting research. Furthermore, when this research manifests, it has been concerned with investigating Anglo-American and Western contexts. This paper instead emphasizes the significance of researching the cross effect of these two control mechanisms on managerial discretion. It critically verifies the impact of using jointly external audit quality and ownership structure over earnings management in a largely unexplored, non-Western and emerging context. Our research adds to a flourishing stream of empirical research on the topic of earnings management, breaking with the traditional framework of the relationship between governance mechanisms and earnings management. Indeed, it has contributed to verify the effect of the interaction between the external audit quality and the ownership structure on the manager's discretionary latitude in the context of an emerging country such as Tunisia. The missing part of literature does not stop us to complete this article.

This article has implications for the development of the link between control mechanisms and the effect of this relationship on earnings management. Also, it pushes organization to resort to the combined effect of governance mechanisms to reduce managerial discretion applied through earnings management. In this way the failure mechanism may possibly be offset by the action of an alternative mechanism. Furthermore, this study encourages institutional investors to own a stake in the capital of Tunisian firms in order to increase the degree of managers’ control. This supervision will have implications for improving the well-being of leaders, organizations and society as a whole.

In any study of this nature, there are certain limitations in the data gathering and analysis processes. First, the sample size examined is reduced to 61 firms due to non availability of all necessary annual reports for the period from 2007 to 2011. Second, the Jones (1991) model has undergone several developments which leads to various measurement models, maybe the estimation of discretionary accruals by another model than the Modified Jones (1995), can lead to different results, but because of the lack of information, earnings management is measured by the absolute value of discretionary accruals according to the Modified Jones model (1995), which suffers from some limitations despite its superiority. Even we have not been able to introduce in our models other variables that may influence the practice of earnings management (the board size, the existence of the audit committee, tax minimization …). Finally, it should be noted that the differences identified between our article and other research analyzing other contexts, can be explained by the specific economic, political and cultural factors in each country. Those limits constitute a motivation for further research. We suggest extending the study period and the number of firms to carry out a more useful pooled analysis study of this interaction.