Nearly three decades have passed since the new knowledge and technologies like genetics and biotechnology have emerged. By passing through various periods in which labor force, resources and capital, each one at a certain time, have been comparative and competitive advantages for a more powerful economy, biotechnology is one of the advanced technologies that countries are investing in, in order to achieve sustainable development in the current century. The capabilities of this knowledge are the creation of fundamental and gradual innovations, in addition to the several applications that generate wealth for countries. For this purpose, innovation policies in biotechnology have been addressed here. This study draws on the resource based theory and examines the research development polices, international-corporate collaboration policies and government supportive innovation policies. The statistical population of this study consisted of 165 responses from the directors and experts active in the field of biotechnology industry in Iran (pharmaceutical, food and agriculture). Research hypotheses were tested using SMART PLS software. The results of the research revealed that research development polices, international corporate collaboration policies and government supportive innovation policies have a significant impact on the development of biotechnology innovation activities. In addition, we have discussed the implications of the study as well as given some future directions.

Biotechnology has had a growing impact on the environmental, agricultural, pharmaceutical, energy and industrial sectors, and has provided innovations in genetic engineering, diagnostic and tissue engineering and culture engineering (Fumento, 2003). By 2010, the industry had more than 6200 private biotech companies (Bertoni & Tykvová, 2015; Ernst & Young, 2011), 64% of small and medium-sized enterprises (SMEs) active in the field of biotechnology, separated from scholarship, have been focused on four key markets: United States, Canada, Europe and Asia/Pacific. The United States directs more than 60% of global biotechnology revenues. Canada has the second position with more than 400 companies. The European biotechnology market has grown further with more product and investment approvals than ever. The Asia/Pacific market is emerging and expanding throughout the region, with Australia, China, India and Singapore operating in this market (Ernst & Young, 2009).

Given the fact that the biotechnology industry has become more diversified geographically, companies have followed a lot of collaborations; global competition has also increased in this field. It is considered as the best investment for promising deals and technologies, regardless of location. Due to the strict legal framework and increased costs for clinical trials, it cannot only be done by SMEs. For example, while in the United States in 2001, 24 biotechnology drugs, vaccines and symptoms and new uses were approved, more than 450 cases still exist in clinical trials (Thompson, Vonortas, & Carruth, 2005).

Even when a product finally reaches the market, its success is not entirely guaranteed. For example, former agricultural leader and biotechnologist Monsanto, heavily invested in insect-resistant genetically modified crops, although these products were a major technological success, their efforts to introduce the product to the market were negative due to the resistance of public opinion (Chataway, Tait, & Wield, 2004). To succeed in the market, companies in each sector must deal with marketing issues and deal adequately with them. Biotech companies are a special case, because strategic decisions and marketing issues may not be normal. In fact, given the nature of science, most technology-based companies, often operating in the development of new, highly innovative products, are still in the process of evolving. It is difficult for these companies to gain a leading market share. Therefore, companies must upgrade their technological capabilities through leverage using R & D projects that lead to competitive advantages (Siontorou & Batzias, 2010).

Options mainly include two major parts. The first is to choose the pioneering order, the company that acts as a creator of knowledge, aims to introduce products and technologies in the market. Biotechnology is still heavily restricted to basic research. It is easy for existing universities to provide more innovation than other traditional technology sectors, provided that the company has the ability to meet the high costs and risk of widespread research for the development and promotion of products. It is clear that multinational corporations can only provide this option. The second option is a combination of applied and basic research projects that are created using the resources of domestic and foreign research and development of the company and building existing knowledge. In the first option, companies can usually refer to R&D activities, while the latter may involve purchasing or licensing technologies from other companies, or joining a strategic alliance to acquire technology. International and technical/scientific knowledge and skills can be published in a variety of ways: patents, publications, technical meetings, conversations between employees of similar companies or competitive companies, participation in a consortium that performs a major project, the recruitment of employees from competing companies and reverse engineering of products can be also considered (Nonaka & Takeuchi, 1995; O’Connor & DeMartino, 2006).

Opportunities are mainly caused by certain inevitable defects of products, which require a lot of research and development, and are a valuable strategy to strengthen the position of the company (Bernstein & Singh, 2006). Depending on the resources and capabilities of these companies, technological development may either begin with the advancement of biochemical research, as a representative, or may use the evolution/redesign of next products. When a biotechnology company is looking for balance between research and development in the specified areas resulted from organizational knowledge and profitable research and development, it must increase its innovative ability to survive in the market (Tsvetkova, Thill, & Strumsky, 2014).

Innovation is a key to competing for industrial companies and nations. Having an innovative national system in a country is one of the most important indicators implying the level of competition and its growth potential (Lange & Wagner, 2019; Tylecote, 2019). In addition, we live in a global community in which business cooperation and the flow of capital and information are beyond national boundaries and across continents. Therefore, they argue that research on innovation activities and the competitiveness of firms or industries should focus on a broader horizon in a parallel measure and focus on interactions, transactions and exchanges on a global scale. On the other hand, it has increasingly been acknowledged that innovative activities have been undertaken locally or regionally in recent decades (Su & Wu, 2015).

Survival is the goal of any organization. Based on a resource - constrained view, increasing competition is one of the organizational sustainability strategies. Organizational sustainability can be a source of opportunity for companies, which is a factor in competitive performance (Lopes, Scavarda, Hofmeister, Thomé, & Vaccaro, 2017). To survive an organization, companies should focus their activities on innovation and knowledge management. Knowledge-based innovation, environmental, social, and economic criteria of organizations, according to the competitive environment, provides sustainability in organizations. In other words, innovative skills can produce knowledge for the organization, which plays a fundamental role in organizational sustainability. Although, the development of new products will increase the complexity of the new product development process in the traditional way, will equally be a potential source of achievements for the economy, society and people (Lopes et al., 2017). The innovation capabilities of companies are closely related to the extent to which knowledge is acquired or applied. An increasing number of companies have found the importance of knowledge as an intangible asset in choosing and using knowledge management in a knowledge-based economy and in general, knowledge management processes play an important role in the management system (Nowacki & Bachnik, 2016).

Given the importance of business innovation, most firms are in the early stages of the innovation process. Innovation helps companies compete with competitors. It is argued that companies, which destroy their creativity and innovation process, reduce their survival probability. If business owners believe in the development of their activities, they must invest in the development of their activities, and there is a relationship between innovation and the possibility of exit (bankruptcy) (Tsvetkova et al., 2014).

The study of the relationship between innovation and performance strategies is not new. However, it is somewhat different to determine this relationship in the field of innovation and performance in the biotechnology industry, and this issue is not completely solved. In fact, these issues may not be new, but the risks of innovation and performance strategies in the biotechnology industry must be well understood. For example, what are the entrepreneurial orientation, learning orientation, the strategies of innovation and research and development in the field of biotechnological products? How do environmental forces and innovation strategies affect company performance? (Wu, 2013)

The empirical literature of the past two decades has shown that the growth and survival of companies depend on the success of adapting the strategies of the company to the changing environment. In such a situation, innovation as a competitive position can increase the company’s potential for market success. This impact is important for new institutions as well as reputable companies. Innovation may be the chance to survive in a competitive environment. Innovation is also necessary for prestigious companies to cope with new innovations (Cefis & Marsili, 2012).

This study analyzes the perceptions of biotechnology-based companies from an innovation strategy that helps in understanding new literature and contributes to the overall credibility of each of its constructive relationships. The main contribution of this study is to provide a broad understanding of the innovation strategy for biotechnology products. For this purpose, the present research seeks to answer the question of whether the appropriate innovation policies in the biotechnology industry can affect their performance. The next section examines literature related to biotechnology innovation policy. Finally, the research model, research method, research findings and research suggestions are presented. In this research, the structural equations of Smart PLS are used to test the hypotheses. PLS is a kind of multi-variable analysis tool that is useful for testing structural models with hidden variables. In particular, this approach is suitable for predictive studies. In addition, PLS structural model is also useful for small-scale analyzes, and doesn’t need to presuppose normalization of the data for the implementation of the model. The coefficients in the PLS structural model are standardized on the basis of regression coefficients. In addition, this method is very suitable for studies with samples less than 500 (Bentler & Huang, 2014). In the last section, the conclusions of the study are presented.

Literature reviewInnovation policyInnovation has been widely recognized as a key to success in economic development and competition among companies and countries. In addition, increased demand for an efficient use of resources and sustainable production has led to a need for innovation in various dimensions due to problems such as resource scarcity, population growth, land shortages and global warming (Van Lancker, Mondelaers, Wauters, & Van Huylenbroeck, 2016). The innovation capacities of companies are related to the extent to which knowledge is acquired or applied. An increasing number of companies have noticed the importance of knowledge as an intangible asset in choosing and applying knowledge management in a knowledge-based economy. And in general, knowledge management processes play an important role in the management system (Nowacki & Bachnik, 2016).

Types of innovation will be in the following categories: innovation in product, process technology, marketing, and non-technological organizational issues (Evangelista & Vezzani, 2010). The degree of innovation can be distinctly radical and incremental. Radical innovation involves significant changes in product technology, a gradual innovation in the development and improvement of products. Radical innovations are usually more costly than incremental innovation, which can have a negative impact on corporate financial position. A resource-based theory (Grant, 1991) provides an appropriate lens to examine the benefits of enterprise-level innovation capabilities. This theory provides a special bundle of resources and capabilities for achieving superior competitive advantage and superiority. Resources include tangible and intangible assets invested in exports. A better company can use its own resources and achieve distinct capabilities. In the initial research, innovation capabilities are often measured by a benchmark or two-part variables, such as process or product; radical or incremental capabilities. Innovation is an incredibly complex phenomenon that requires a mix of organizational elements for breakthroughs (Vicente, Abrantes, & Teixeira, 2015).

Innovation in biotechnologyBiotechnology is one of the most important industries in a knowledge-based economy. National and local governments that are keen on developing the biotechnology industry should upgrade their workforce skills and flourish in the era of globalization by creating a research and development base for the future of the country's economy. Development agenda is of particular importance in countries that need to provide their manufacturing-based economies to a knowledge-based one for future. However, the challenges that come with it are very important, including high-tech biotechnology, long-term development and long-term business cycles. Also, unlike leading countries such as the United States and England, the scale of this industry, which is predominantly in the early stages of development, is small and its infrastructure is weak in developing countries. In addition, capital companies in developing countries cannot be well established and financial resources are limited. The biotechnology industry is an intensive science sector that seeks to develop the progress of natural sciences. Therefore, innovative activities in biotechnology require strong research and development activities in the biological sciences, so that firms should communicate with a large number of scientific institutions and firms to obtain the necessary information. On the other hand, a large number of innovators, in particular small and medium-sized enterprises (SMEs), identify the biotechnology industry. The innovation and diversity of bio-based technology encourages the creation of new companies, and as a result, the development of the biotechnology sector is based on the emergence of a large number of SMEs (Kang & Park, 2012).

Innovation systems and science policies focus mainly on the relationship between university and industry, and the commercial translation of scientific discoveries. In such analyzes, the discovery of knowledge in academic research and the non-commercial aspect of science is ignored. The desire to move research, practical programs to capture the benefits of scientific discovery, has long depended on the motivation of the science budget and the development of the program, especially in the biotechnology sector. The distinction between “pure” and “applied” science occurred during the 1960s and 1980s. However, the linear model of innovation has been widely recognized, in which pure science has been published in the scientific literature, and then it has been removed by industry, and has become a useful application, which is basically unnecessary and often false. Most likely, innovation systems and science policies focus on the linkages between universities and industry and the commercial translation of academic discoveries. In such an analysis, the discovery of knowledge in scientific research and non-commercial aspects of science is ignored. Scientific research is likely to contain both aspects of basic research (discovery) and practical application (tools), and move between these two. Scientific-related biological research is currently in the field of two scientific and industrial cycles and provides a compression mechanism through an efficient technology transfer stream (Bishop, D’Este, & Neely, 2011; Schmoch, 2007).

Companies have changed their strategies based on the fundamental research network, which is associated with multi-disciplinary and decentralized dynamics, has increased the connection between the results of scientific outputs, led to the emergence of specialized biotechnology technology firms and requires inter-industrial cooperation as well as university - industry connections (Canongia, 2007; Salicrup & Fedorková, 2006). Given the role of innovation and commercialization of scientific achievements in biotechnology, biology and medical fields, however, there was not much interest in investing in the knowledge and innovation produced at universities in this industry (Siontorou & Sidiras, 2011).

In this study, a national approach to the innovation system and a resource-based perspective is developed to define a framework that can be used to evaluate the state-sponsored mechanism of research and development and collaboration between biotechnology companies in SME innovation.

Innovation strategiesBiotechnology has become a driving force behind radical changes in innovation processes in different sectors. Biotechnology companies and government research organizations are becoming the main sources of knowledge production, tools and new materials. For this reason, the innovation system in the biotechnology industry has been very much considered. Therefore, it is necessary to understand the innovation systems in this industry. Because it can help to understand the progress of these industries. The role of governments in innovation policy has changed dramatically over the past decades. For example, the policy tools of the linear innovation model, first-generation innovation policies in the post-war period, had generally focused on R&D funds, especially basic research. In this regard, a budget was allocated to compensate for the market failures so that leading companies could use in R&D investment. In the mid-1990s, the complexity of the state system required innovation based on a “system failure” approach. In this regard, innovation policies developed to address the limitations of innovation to help companies, based on a systematic vision. Innovation policies are designed to address systemic defects. The failures in the innovation process lead to a logical reason for government involvement in the development of innovation, not only through funding for basic research, but also generating the second generation innovation policies. The government has played a decisive role in the development and protection of innovation as a new entity in ensuring that the innovation system works well. The focus of the second-generation policy priorities was on research and education systems, business systems, infrastructure conditions, and intermediaries. The focus of third-generation policies has been on the government itself. An important function is to bridge the “coordination gap” within the government across separate segments that each of them is linked to particular aspects of the innovation chain. It also provides good cooperation between national, international and regional governments (OECD, 2006).

Modern biotechnology requires a multi-disciplinary approach, because its techniques are used in a number of technology-based sectors. Carlson (1996) and other researchers (Traxler, 2004) consider the biotechnology innovation system as a network of agents interacting with each other, including institutionalized infrastructure, production infrastructure, diffusion and technology exploitation. Perhaps Bartholomew (1997) was the first writer who referred to a national system of biotechnology innovations, called it “special institutional arrangements in a country that affects scientific knowledge in biotechnology, and the diffusion of that knowledge influences the industry” (Marsh, 2003; Yagüe-Perales, Niosi, & March-Chorda, 2015).

Innovation strategy in organizations has been the focus of attention in recent years, because it is vital for organizational adaptation and modernization as well as competitive advantage. Despite the agreement on the importance of innovation in organizations, there are a lot of debates on innovation and there is no dominant theoretical approach to combine several research strategies of innovation. Innovation strategy consists of various structures including innovation generation, innovation adoption and innovation diffusion. The gap in this field is not well understood due to the strategies of innovation, R&D strategy and innovation process elements. The contemporary competitive landscape highly emphasizes the price, quality, and customer satisfaction, and requires an increased recognition of innovation as a strategic competence. Innovation strategy, as a major factor in corporate success and performance, is an important issue in organizational management research. Innovation strategy is an alternative marketing strategy that comes with better performance. In previous studies, the innovation strategy enables the company to profit from higher market returns (Bhasin, 2012; Lee & Chen, 2009).

In previous studies, the number of patented inventions has been considered as the benchmark for the process of innovation. Although the number of patented inventions (the number of patents filed by the company) can provide useful information, researchers set several limitations related to this benchmark. Ecombe and Bairley (2006) and Guillerchess (1990) argue that there is a problem with the method of counting patent benchmark, because the technological application and economic value of patents are widely differentiated. Previous studies have used similar activities of patented inventions. This means that the success of the new product has largely been ignored. The success and application of a new product or project may take into account the dimensions of the company’s innovation performance. Innovation performance brings a market reward that leads to sales growth and profitability through new products. Previous research shows that innovation performance indicators include the introduction of new products, new product lines, modifications and derivatives that can help companies identify the best performance (Griliches, 1990; Coombs & Bierly, 2006).

Creating knowledge differs from innovation. Innovation involves finding a profitable innovative program based on the knowledge or idea that has been created (Huarng & Hui-Kuang Yu, 2011). Innovations are to provide benefits to organizations, while knowledge can be created.

Hypothesis frameworkIntercorporate collaboration and innovation performancePrevious studies have shown positive relationships between corporate innovations and interactions with other activists (Baum, Calabrese, & Silverman, 2000; Belussi, Sammarra, & Sedita, 2010; George, Zahra, & Wood, 2002; Hagedoorn, 1993; Romijn & Albaladejo, 2002; Rothaermel & Deeds, 2006). The researchers said that these interactions help companies overcome the shortcomings in information and scientific knowledge as well as resources and competencies (Becheikh, Landry, & Amara, 2006; Kang & Lee, 2008; Romijn & Albaladejo, 2002). In addition, studies have shown that companies choose different partners in the value chain and in different geographic areas according to their goals (Arranz & de Arroyabe, 2008; Tödtling, Lehner, & Kaufmann, 2009). Studies in the biotechnology section usually address either the relationship between biotechnology companies and universities, public research institutes or hospitals that can be upstream partners or the relationship between biotechnology firms and established businesses, such as pharmaceutical companies that are usually downstream partners.

Biotechnology firms maintain a wide range of interactions with universities (Stuart, Ozdemir, & Ding, 2007). In addition to the formal contractual relations, non-contractual relationships also try to determine the relationship between companies and public research organizations in the form of re-collaboration. Some scholars, who are investigating the collaboration of journals, have argued that newly established biotechnology firms heavily rely on the ability of universities to research, especially in terms of human capital, such as prominent scientists (Stuart et al., 2007; Zucker, Darby, & Brewer, 1994; Zucker, Darby, & Armstrong, 2002). Studies on the impact of intercorporate contractual relationships indicate that formal relationships with universities increase the corporate knowledge share (Baum et al., 2000; George et al., 2002; Rothaermel & Deeds, 2006) and there is a positive correlation between the size of this relationship and the innovative output of biotechnology companies (Baum et al., 2000; George et al., 2002).

Studies have shown that the complementary nature of collaboration between biotechnology firms and established corporations can enhance the performance of the corporate. While new biotechnology corporates specialize in a particular type of knowledge, products, and applications, large corporations incorporate new inventions that include large-scale production, marketing, and distribution, and supervisory processes (Audretsch & Feldman, 2003). Rothaermel and Deeds (2006) found a U-inverse relationship between the number of alliances and the performance of companies, and Baum et al. (2000) also showed that biotechnology firms with downstream alliances usually exhibit higher initial yields (Baum et al., 2000; Rothaermel & Deeds, 2006).

Although international networks have become a frequent research topic, as a globalized economic activity, limited studies have been done on the effects of international alliances in the innovation performance of SMEs. Furthermore, studies about the effects of international alliances on corporate performance have indirect results. Vernon (1971) found that multinational corporations (MNCs) earn more revenue than non-multinational corporations (Vernon, 1971). Siddharthan and Lall (1982) found that the degree of internalization has a negative impact on the growth rate of the company (Siddharthan & Lall, 1982). Daniels and Bracker (1989) found that financial performance has improved with increasing internalization (corporate internal development) (Daniels & Bracker, 1989). Marsh and Oxley (2005) also showed that domestic collaboration had a negative impact on corporate performance, but international collaboration had a positive impact on New Zealand’s biotechnology performance (Marsh & Oxley, 2005).

Given the effects of international cooperation in developing countries, studies show that knowledge international networks strengthen the capabilities of companies, introduce the advanced science and technology bases to them and help them to enter new markets or create collaborative platforms for new products and services (Ganesan & Kelsey, 2006; Glaister, 1998; Inkpen & Dinur, 1998; Sirmon & Lane, 2004). Therefore, we examined the following hypothesis about the relationship between intercorporate collaboration and innovation and examined the effects of international and domestic collaborations:

H1.Intercorporate collaboration is positively associated with innovation performance

State budget and innovation performanceGovernment supports to promote the innovation of private companies, which is justified by a clear theoretical economic logic. Economists have argued that failure in the innovation market can be due to leakage and explosion, which reduces private income and prevents research and development (Arrow, 1962; Clarysse, Wright, & Mustar, 2009; Falk, 2006). System problems, such as network problems, also justify the government interventions, because they cannot be solved by market forces (Chaminade & Edquist, 2006). In spite of clear reasons for government involvement in the innovation of private companies, government pressure can be effective to illustrate its economic justification and its effectiveness in obtaining government support (Lee & Wong, 2009).

Government support for promoting innovation in the form of subsidies, tax and/or loan incentives enhances innovation activities (Beugelsdijk & Cornet, 2002; Romijn & Albaladejo, 2002). Government funding programs for research and development have increasingly been accepted (Wallsten, 2000). Governments support innovation and economic growth through the support of high-potential research and development projects, high social return rates (Feldman & Kelley, 2006).

Block and Keller (2008) examined the 100 most recent innovations recorded in 1970s to 2006, and found that roughly 90 percent of the US institutions that won the innovation awards had received federal funding (Block & Keller, 2009). Researchers have done some studies on whether R&D can affect the firm’s internal activities, such as cost and recruitment. Lach (2002) showed a positive impact on the cost of R&D for small Israeli companies (Lach, 2002). Almus and Czarnitzki (2003) also compared the R&D costs of subsidized companies with non-subsidized companies, using a comparative approach, and showed that the intensity of R&D had a significant impact (Almus & Czarnitzki, 2003). Gonzalez and Pazo (2008) also analyzed the impact of government subsidies in a comparative approach and found that the impact of government support on private R&D costs was positive and significant (González & Pazó, 2008). In another study, Hall and Bagchi-Sen (2007) also found that the state budget for research and technical training is linked to the intensity of R&D in the U.S biotechnology firms. In the studies of the U.S (Hall & Bagchi-Sen, 2007). Lerner (1999) and Wallsten (2000) also find a positive correlation between receiving state aid and employment in Small Business Innovation Research Program (Lerner, 2000; Wallsten, 2000). Therefore, we have tested the following hypothesis:

H2.The state budget for biotechnology R&D projects is positively associated with the innovation performance

R&D sources and innovation performanceOn the other hand, R&D domestic sources of companies, which are often measured by R&D expenditures and human capital, have an important impact on innovation performance. Studies in various industrial sectors confirm the positive relationship between R&D domestic resources and the innovation performance of companies (Basant & Fikkert, 1996; Belussi et al., 2010; Freel, 2003; Hitt & Tyler, 1991; Parthasarthy & Hammond, 2002; Ramani, 2002; Romijn & Albaladejo, 2002). Hall and Bagchi-Sen (2002), 2007) found strong relationships between the intensity of R&D and the innovation performance of companies in the biotechnology industry (Hall & Bagchi-Sen, 2002, 2007). Kang and Lee (2008) showed the lack of professional technical personnel could be a serious constraint for innovation (Kang & Lee, 2008). Researchers believe that R & D resources at the company level have the company's internal capacity to capture and exploit new knowledge and innovate (Bougrain & Haudeville, 2002; Cohen & Levinthal, 1990; Hoffman, Parejo, Bessant, & Perren, 1998; Parisi, Schiantarelli, & Sembenelli, 2006; Tödtling et al., 2009).

In addition, there is a close relationship between the domestic R&D sources of companies and their networks. Muscio (2007) showed that the company's domestic R&D activities have a positive impact on the possibility of networking with other companies (Muscio, 2007). In addition, DE JONG and Freel (2010) found that the absorbed capacity through domestic R&D expenditures enables companies to overcome the geographical distance of knowledge partners (DE JONG & Freel, 2010). Therefore, we have tested the following hypotheses about the indirect effects of state-sponsored R&D on the innovation of companies affected by domestic R&D resources:

H3A.R&D human capital positively correlates with innovation performance

H3B.R&D expenditures positively correlate with innovation performance

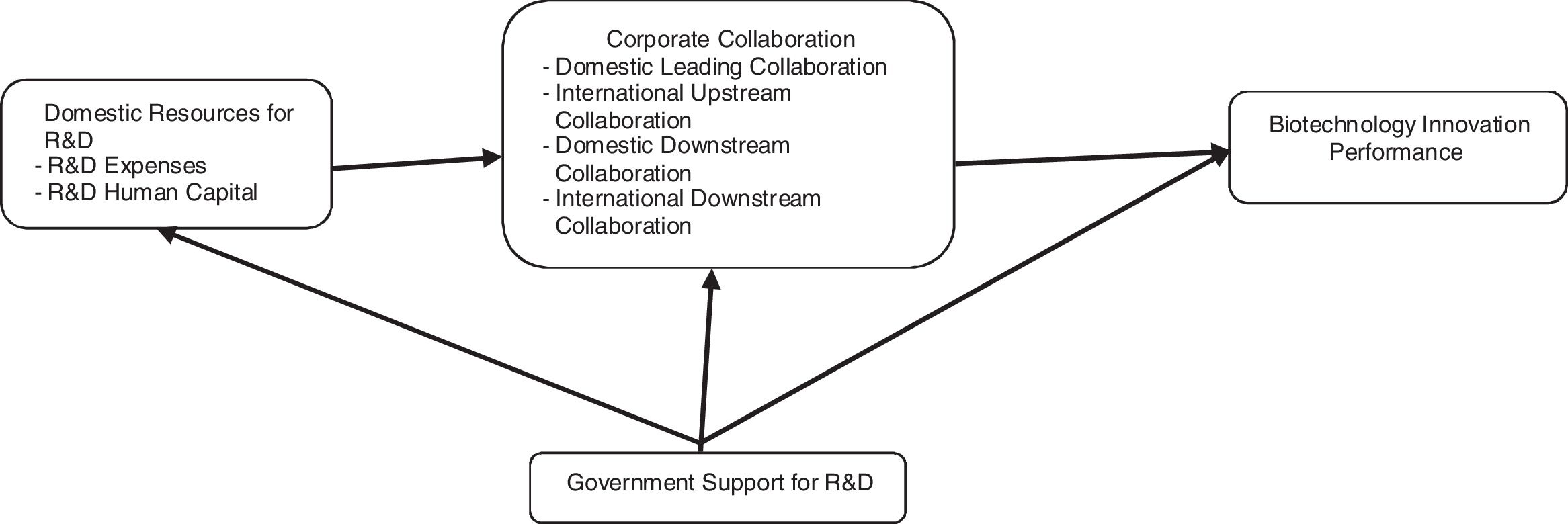

According to the literature, the general model including research hypotheses is presented in Fig. 1

MethodologyResearch designThe present study was a descriptive survey method research. The data collection tool was a questionnaire consisting of 16 items. The target population was 320 of the directors and experts in the field of biotechnology (medicine, food and agriculture). 180 questionnaires were distributed. Then after 10 days, a total of 165 questionnaires were collected. In this research, Structural Equation Modeling and SMART PLS software were used to study the hypothesis. Collection tool included 4 dimensions and 16 questions. Research innovation performance was based on the number of patents approved compared to the main competitors and the age of the company's patented invention compared to the other (Kang & Park, 2012; Wu, 2013). Government support is also measured based on the amount of support for innovation (Kang & Park, 2012) and allocation of subsidies (OECD, 2006). R&D expenditures are also measured based on the amount of research and organizational funding allocated (Kang & Park, 2012). Corporate collaboration is also measured based on the amount of national and international collaboration (Kang & Park, 2012), upstream and downstream collaboration, strategic alliances, R&D collaboration and university collaboration (Nag & Mohapatra, 2012).

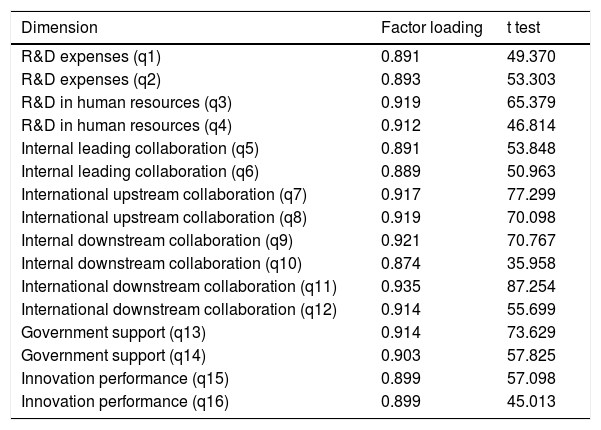

Validity and reliability of variablesA standard questionnaire was used to measure variables. The power of the relationship between the factor (latent variable) and observed variable is shown by the factor loading. The factor loading is between zero and one. If it is less than 0.3, the relationship is considered weak and is discarded. If it is between 0.3 and 0.6, the relationship is desirable and it is great in case of being more than 0.6. In Table (Table 1), it can be seen that all the factor loadings are greater than 0.5, and this confirms that the reliability of the measurement model is acceptable

Factor loadings and research variables.

| Dimension | Factor loading | t test |

|---|---|---|

| R&D expenses (q1) | 0.891 | 49.370 |

| R&D expenses (q2) | 0.893 | 53.303 |

| R&D in human resources (q3) | 0.919 | 65.379 |

| R&D in human resources (q4) | 0.912 | 46.814 |

| Internal leading collaboration (q5) | 0.891 | 53.848 |

| Internal leading collaboration (q6) | 0.889 | 50.963 |

| International upstream collaboration (q7) | 0.917 | 77.299 |

| International upstream collaboration (q8) | 0.919 | 70.098 |

| Internal downstream collaboration (q9) | 0.921 | 70.767 |

| Internal downstream collaboration (q10) | 0.874 | 35.958 |

| International downstream collaboration (q11) | 0.935 | 87.254 |

| International downstream collaboration (q12) | 0.914 | 55.699 |

| Government support (q13) | 0.914 | 73.629 |

| Government support (q14) | 0.903 | 57.825 |

| Innovation performance (q15) | 0.899 | 57.098 |

| Innovation performance (q16) | 0.899 | 45.013 |

The observed factor loading in all cases is larger than 0.5, indicating that there is a good correlation between the observed variables with their own latent variables. Also, based on the results of the model, the bootstrapping (t test) is greater than the critical value of 1.96 in all cases, showing that there is a significant correlation between the observed variables with its own latent variables.

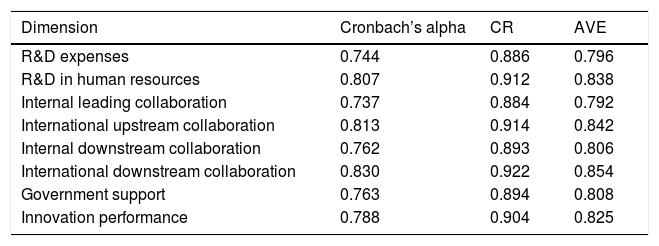

Then, the reliability of the variables was measured by Cronbach’s alpha with a standard of over 0.7 (Cronbach, 1951), composite reliability (CR) with a standard level higher than 0.7 and average variance extracted (AVE) with a standard value of 0.5 (Fornell & Larcker, 1981) using Smart-PLS software. Table 2 shows that the variables possess convergent reliability and validity.

Convergent reliability and validity of variables.

| Dimension | Cronbach’s alpha | CR | AVE |

|---|---|---|---|

| R&D expenses | 0.744 | 0.886 | 0.796 |

| R&D in human resources | 0.807 | 0.912 | 0.838 |

| Internal leading collaboration | 0.737 | 0.884 | 0.792 |

| International upstream collaboration | 0.813 | 0.914 | 0.842 |

| Internal downstream collaboration | 0.762 | 0.893 | 0.806 |

| International downstream collaboration | 0.830 | 0.922 | 0.854 |

| Government support | 0.763 | 0.894 | 0.808 |

| Innovation performance | 0.788 | 0.904 | 0.825 |

It is observed that the combined reliability coefficient (CR) and Cronbach's are more than 0.7 alpha for all dimensions of the studied model. Therefore, it can be claimed that the questionnaire has an acceptable reliability. The average variance extracted (AVE) is always greater than 0.5 and the combined reliability coefficient (CR) is also greater than 0.7 in all cases, which is also greater than the average variance extracted (AVE). Therefore convergent validity is also confirmed.

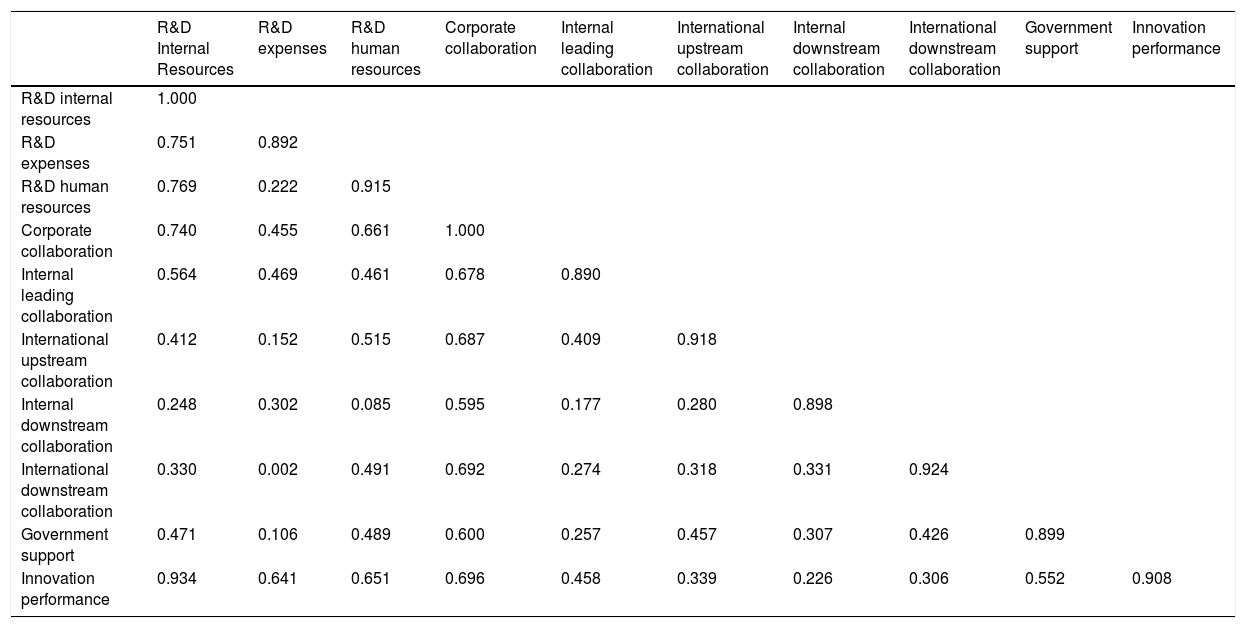

Divergent validity (Fornell and Larker Method)In divergent validity, the difference between the indices of a structure and other structural indices in the model is compared. This work is calculated by comparing the square root of AVE in each structure with the correlation coefficients between the structures. To do this, a matrix must be formed in which the main diameter is the values of square root of AVE for each structure, and the lower and upper values of the main diameter are the correlation coefficients between each structure with other structures. This matrix is shown in Table (Table 3).

Matrix of the comparison of AVE root square and correlation coefficients.

| R&D Internal Resources | R&D expenses | R&D human resources | Corporate collaboration | Internal leading collaboration | International upstream collaboration | Internal downstream collaboration | International downstream collaboration | Government support | Innovation performance | |

|---|---|---|---|---|---|---|---|---|---|---|

| R&D internal resources | 1.000 | |||||||||

| R&D expenses | 0.751 | 0.892 | ||||||||

| R&D human resources | 0.769 | 0.222 | 0.915 | |||||||

| Corporate collaboration | 0.740 | 0.455 | 0.661 | 1.000 | ||||||

| Internal leading collaboration | 0.564 | 0.469 | 0.461 | 0.678 | 0.890 | |||||

| International upstream collaboration | 0.412 | 0.152 | 0.515 | 0.687 | 0.409 | 0.918 | ||||

| Internal downstream collaboration | 0.248 | 0.302 | 0.085 | 0.595 | 0.177 | 0.280 | 0.898 | |||

| International downstream collaboration | 0.330 | 0.002 | 0.491 | 0.692 | 0.274 | 0.318 | 0.331 | 0.924 | ||

| Government support | 0.471 | 0.106 | 0.489 | 0.600 | 0.257 | 0.457 | 0.307 | 0.426 | 0.899 | |

| Innovation performance | 0.934 | 0.641 | 0.651 | 0.696 | 0.458 | 0.339 | 0.226 | 0.306 | 0.552 | 0.908 |

As shown above, the root of AVE of each structure is greater than the correlation coefficients of that structure with other structures, suggesting the acceptability of the divergent validity of structures.

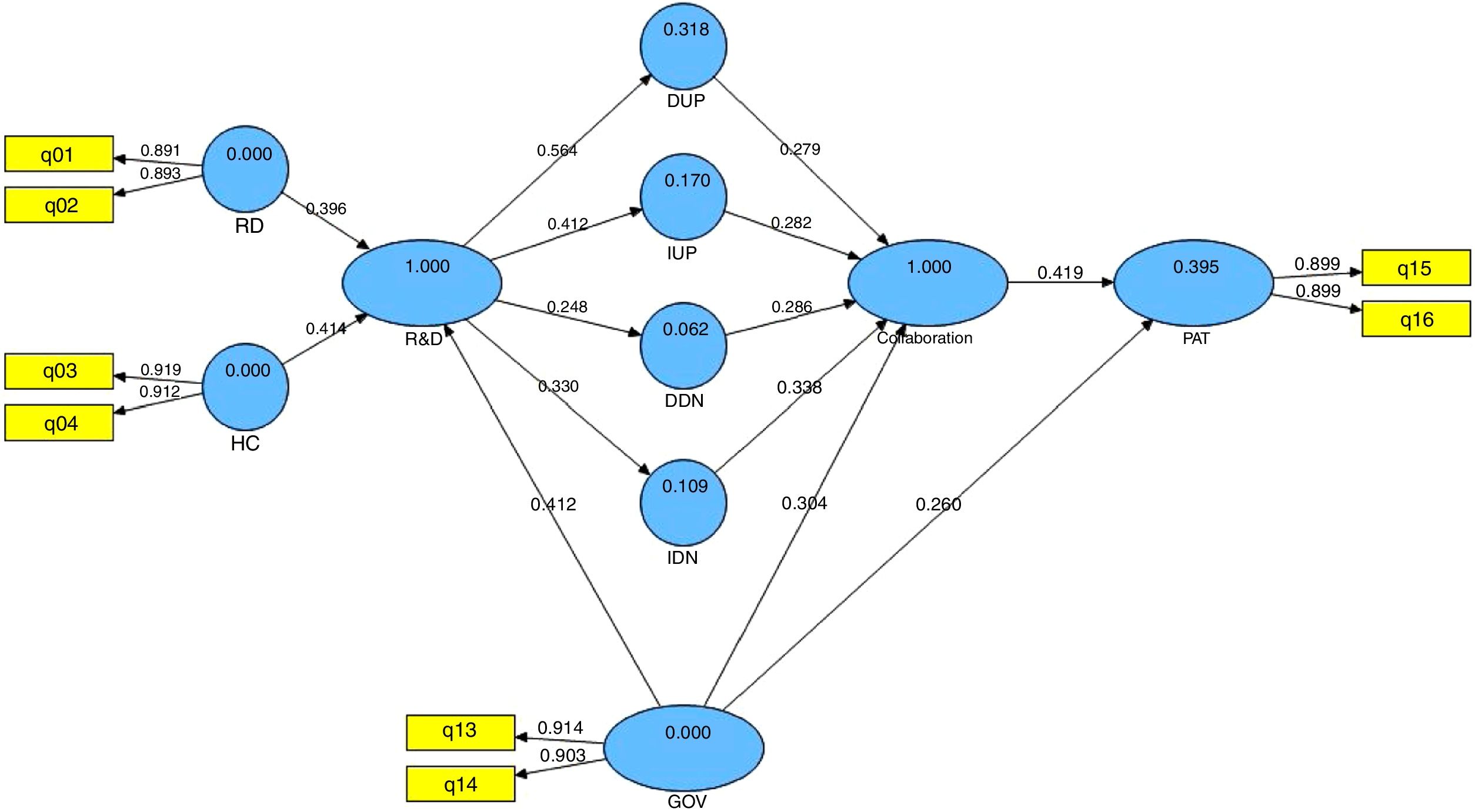

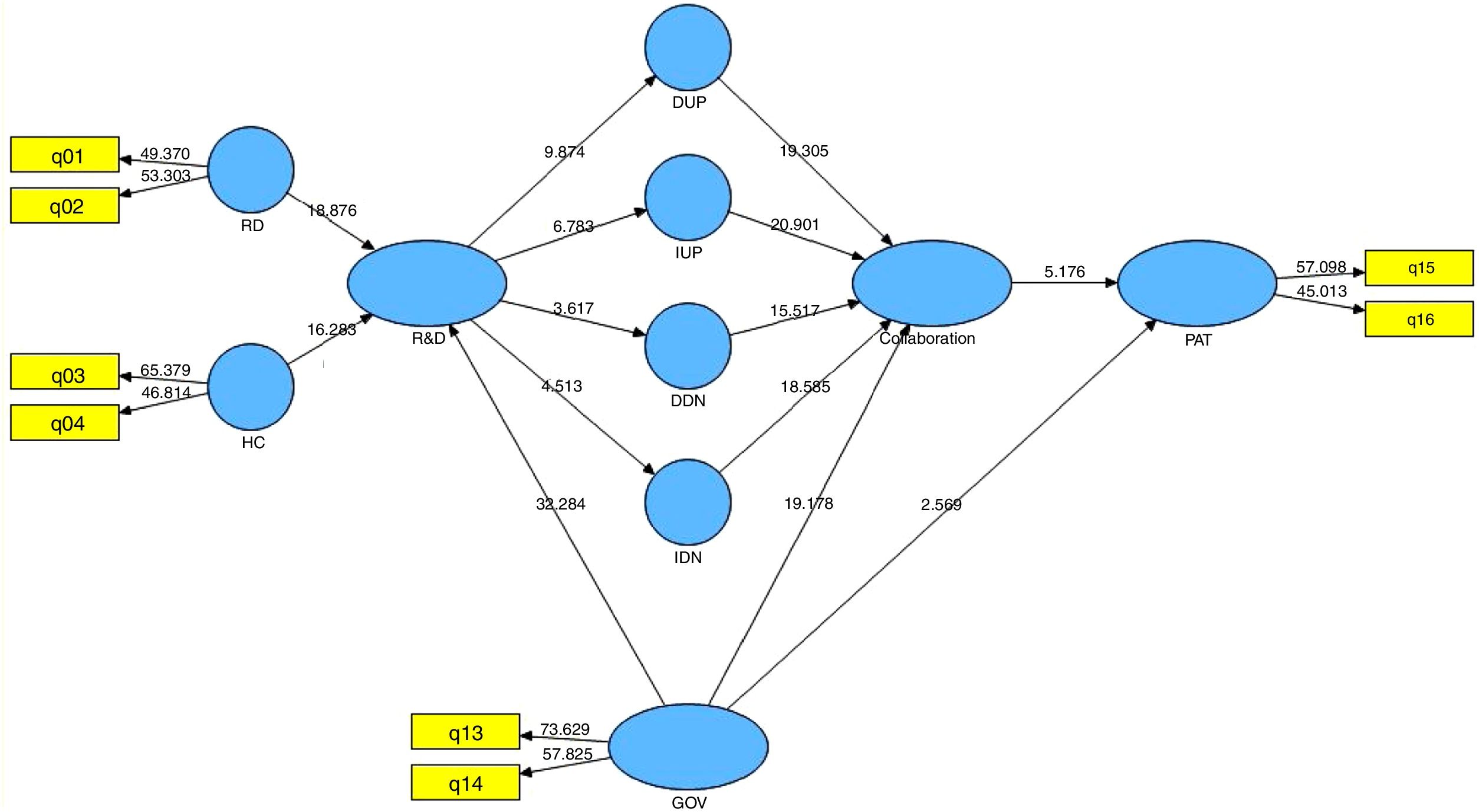

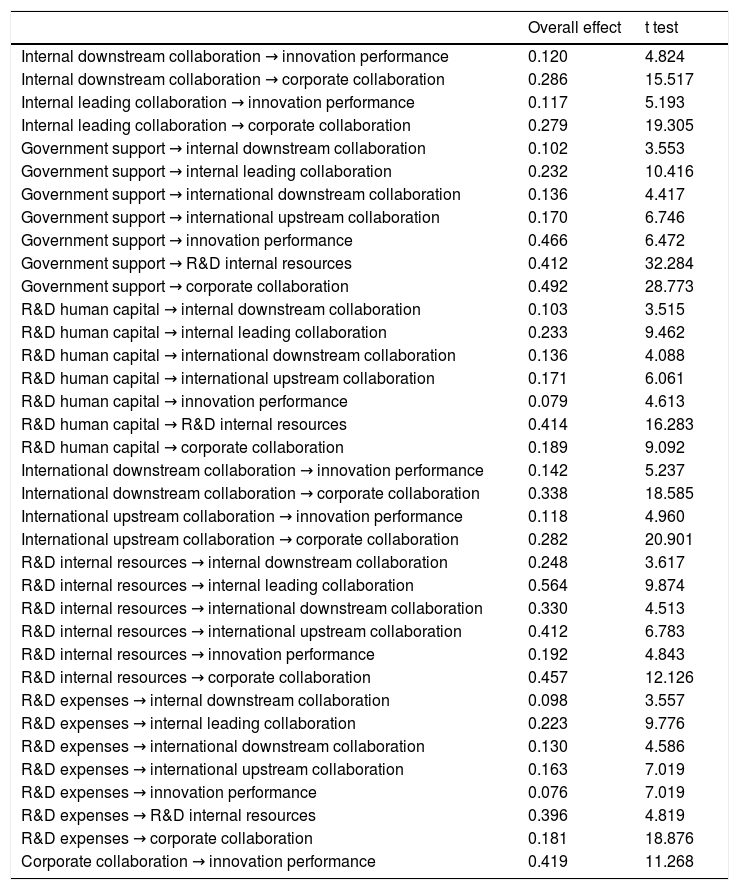

Research findingsThe relationship between the variables studied in each of the research hypotheses has been tested based on a causal structure with partial least squares (PLS) method. In the general model of research, which is depicted in Fig. 2, the measurement model (the relationship between observed variables and latent variable) and the path model (the relationships of latent variables with each other) has been calculated. To measure the significance of the relationships, the t test has been calculated using the bootstrapping technique shown in Fig. 3.

Smart PLS software performs all calculations for the analysis of sub-routes and presents them in a table called “overall effects”. As a result, we can observe the overall and meaningful impact of all variables. The results of these calculations are presented in the Table 4 below.

Overall effects of main model.

| Overall effect | t test | |

|---|---|---|

| Internal downstream collaboration → innovation performance | 0.120 | 4.824 |

| Internal downstream collaboration → corporate collaboration | 0.286 | 15.517 |

| Internal leading collaboration → innovation performance | 0.117 | 5.193 |

| Internal leading collaboration → corporate collaboration | 0.279 | 19.305 |

| Government support → internal downstream collaboration | 0.102 | 3.553 |

| Government support → internal leading collaboration | 0.232 | 10.416 |

| Government support → international downstream collaboration | 0.136 | 4.417 |

| Government support → international upstream collaboration | 0.170 | 6.746 |

| Government support → innovation performance | 0.466 | 6.472 |

| Government support → R&D internal resources | 0.412 | 32.284 |

| Government support → corporate collaboration | 0.492 | 28.773 |

| R&D human capital → internal downstream collaboration | 0.103 | 3.515 |

| R&D human capital → internal leading collaboration | 0.233 | 9.462 |

| R&D human capital → international downstream collaboration | 0.136 | 4.088 |

| R&D human capital → international upstream collaboration | 0.171 | 6.061 |

| R&D human capital → innovation performance | 0.079 | 4.613 |

| R&D human capital → R&D internal resources | 0.414 | 16.283 |

| R&D human capital → corporate collaboration | 0.189 | 9.092 |

| International downstream collaboration → innovation performance | 0.142 | 5.237 |

| International downstream collaboration → corporate collaboration | 0.338 | 18.585 |

| International upstream collaboration → innovation performance | 0.118 | 4.960 |

| International upstream collaboration → corporate collaboration | 0.282 | 20.901 |

| R&D internal resources → internal downstream collaboration | 0.248 | 3.617 |

| R&D internal resources → internal leading collaboration | 0.564 | 9.874 |

| R&D internal resources → international downstream collaboration | 0.330 | 4.513 |

| R&D internal resources → international upstream collaboration | 0.412 | 6.783 |

| R&D internal resources → innovation performance | 0.192 | 4.843 |

| R&D internal resources → corporate collaboration | 0.457 | 12.126 |

| R&D expenses → internal downstream collaboration | 0.098 | 3.557 |

| R&D expenses → internal leading collaboration | 0.223 | 9.776 |

| R&D expenses → international downstream collaboration | 0.130 | 4.586 |

| R&D expenses → international upstream collaboration | 0.163 | 7.019 |

| R&D expenses → innovation performance | 0.076 | 7.019 |

| R&D expenses → R&D internal resources | 0.396 | 4.819 |

| R&D expenses → corporate collaboration | 0.181 | 18.876 |

| Corporate collaboration → innovation performance | 0.419 | 11.268 |

H1: corporate cooperation affect innovation performance. The intensity of corporate cooperation on the performance of innovation is estimated at 0.419, t-test was also 5.176 which is greater than the critical value of t (1.96), indicating that the observed effect is significant. Therefore, corporate cooperation have a significant effect on innovation performance with 95% confidence and H2 is confirmed.

H2: government support affect innovation performance. The intensity of government support on the performance of innovation is estimated at 0.466, t-test was also 6.472 which is greater than the critical value of t (1.96), indicating that the observed effect is significant. Therefore, government support have a significant effect on innovation performance with 95% confidence and H3 is confirmed.

H3: R&D resources affect innovation performance. The intensity of the total R&D resources on innovation performance is estimated at 0.192, t-test was also 4.843 which is greater than the critical value of t (1.96), indicating that the observed effect is significant. Therefore, R&D resources have a significant effect on innovation performance with 95% confidence and H1 is confirmed.

H3a: R&D expenses affect innovation performance. The intensity of R&D expenses on the performance of innovation is estimated at 0.076, t-test was also 4.819 which is greater than the critical value of t (1.96), indicating that the observed effect is significant. Therefore, R&D expenses have a significant effect on innovation performance with 95% confidence and H1a is confirmed.

H3b: R&D human capital affect innovation performance. The intensity of R&D human capital on the performance of innovation is estimated at 0.079, t-test was also 4.613 which is greater than the critical value of t (1.96), indicating that the observed effect is significant. Therefore, R&D human capital have a significant effect on innovation performance with 95% confidence and H1b is confirmed.

Results and discussionToday’s world is more competitive than ever. Competition exists at all levels of individual and social life. Organizations as important elements in the economic and social processes of societies are important areas in the advent of creativity and innovation, and their survival depends essentially on change and innovation. Successful innovation requires an integrated design process, from the idea to the introduction of a new product into the market. Such efforts require good collaboration and design management, and must be planned through knowledge management techniques and tools. The innovation management process involves a step-by-step process that starts with a systematic review of all the factors affecting the creation of the idea and continues until new products are introduced into the market. Each innovation management framework should include an appropriate structure and flexibility that will successfully implement all the elements that affect innovation. Considering that an important part of the innovation process is commercialization and the success of the entire innovation process depends on the success of the market research achievement, a new literature has been introduced as “knowledge-based economy” in which technical knowledge, innovation, skills, and continuous learning play an important role. Accordingly, in such economies, there should be a range of institutions in society that support and facilitate innovation, learning and dynamism. Biotechnology-based industries and economy have specific characteristics, for instance its ratio of specialist staff to total staff is high. Universities are more involved in managing them. There are more technological changes in them. There is more research and development in them. Most developments are based on the development of technology, not on capital and hardware. Their competitive advantage is technology innovation and conquer new markets quickly. To establish a biotech knowledge-based economy, commercialization is a necessary process. Commercialization is the process of transferring knowledge and technology from research centers to existing industries or new businesses. In terms of innovation, commercialization means that new technology and knowledge should flow from its supplier to the industries and companies that are applying for it.

The results of the research showed that considering the R&D resources (R&D expenditure, R&D human capital), the application of cooperation strategies can affect the innovation performance of biotechnology companies. The results of this study were consistent with Kang and Park (2012) and Wu (2013) studies. Lavrynenko, Shmatko, and Meissner (2018)) also showed that the combination of skills required in biotechnology and the level of human skills development in teams has an impact on the innovation of the biotechnology industry (Lavrynenko et al., 2018).

The rate of technology utilization in various dimensions of development is the main indicator which introduces a country as a developed or backward. One of the main components of technology development policies and efficient innovation is to identify and measure the indicators affecting national performance, industries and enterprises in the field of technology development and innovation activities and monitor and evaluate their results. For this purpose, in order to identify the strengths and weaknesses of areas under study, measuring its current status, it is essential to compare it with the desired situation and finally extract the existing gap. Therefore, the use of indicators that can quantitatively measure and measure all aspects of a national innovation system is one of the essential elements of the planning of the national innovation system. Biotechnology is one of the most advanced technologies that countries have invested in this century in order to achieve sustainable development. The capabilities of this knowledge are to create fundamental and gradual innovations, as well as many uses that generate wealth for countries. Therefore, this advanced technology and its development have a special place and we should pay attention to this, along with human development, cultural development, economic development and scientific development.

The finding of the present study are underpinned by the Resource-based theory which supports the main assumptions of this research. Hence, the successful innovation requires an integrated design process, from the idea to the introduction of a new product into the market. Such efforts require good collaboration and design management, and must be planned through knowledge management techniques and tools. The innovation management process involves a process of order and stage that starts with a systematic review of all the factors affecting the creation of the idea, and continues until new products are introduced to the market. Each innovation management framework should include an appropriate structure and flexibility that will successfully implement all the elements that affect innovation. It is proposed to examine innovation models for the commercialization of biotechnology achievements.

ImplicationsThe current study contributes in several ways. First, it add to the literature of innovation in biotechnology and the factors affecting it. Second, the factors which influencing innovation in biotechnology are analyzed in the context of companies in Iran, which is quite unlike the past studies. Third, the findings of our research illustrate certain implications for the innovation in biotechnology focusing mainly on some perspectives which include the intercorporate collaboration, state budget and R&D source. The companies are advised to build intercorporate collaboration with other firms and corporations which is very useful for the organizations to overcome the deficit in skills, knowledge, resources and competencies. The state government needs to spare a certain budget for the R&D in biotechnology so as to bring innovation in the field and cope with the modern era of globalization. In addition, the R&D domestic sources of firms usually measured by the expenditures and human capital are also playing crucial role in bringing the innovation in biotechnology. In sum, all the factors affecting the innovation are very important and the companies devoid of these factors are recommended to pay attention to these in order to improve their performance and compete the advancements in the technologies.

Limitations and future directionsConsidering several implications of the research, some limitations are also there. First, the cross sectional data collected at single time is used to conclude the findings, the scholars are advised to collect the data at multiple times. Second, the sample population adopted is from the companies in Iran, the future studies may be conducted in different countries and cultures to increase the generalizability of our research model. Third, despite of trying hard in the data collection procedure, the sample used is not too large which may have the possibility of type II error. The future studies are recommended to use the large sample in order to minimize such possibility. Fourth, the future researchers may consider other factors affecting innovation in biotechnology. Fifth, this study is limited to innovation in biotechnology, the future studies are recommended to investigate factors affecting innovation in other sectors such as renewable sectors, ICT and nanotechnology sectors.

ConclusionThe present research sheds light on the innovation policies in biotechnology and the factors affecting it. The findings suggest that the intercorporate collaboration, state budget and R&D source greatly affect the innovation process in biotechnology, which is very useful for the field of biotechnology to bring in innovation. We hope that the present study will encourage and motivate the future researchers to test our model in different contexts.