This study aims to conceptualize how the initial conditions of firms at the start of franchising affect the equilibrium level of franchising. Based on the study of dual distribution, we suggest testable propositions.

The equilibrium proportion of franchised units in a chain might depend on the initial and current system size, the initial capital, and the degree of geographical dispersion. Also is proposed the moderating effect of age between the equilibrium proportion of franchised units in a chain and the initial system size, the initial capital and the degree of geographical dispersion.

The organizing approach, “plural forms,” which occurs when firms use vertical integration and market governance simultaneously for the same function, has been widely used in multiple industries (Bradach & Eccles, 1989). An example of plural forms can be seen in the case when companies (i.e., franchisors) license the operation of some of their units to franchisees, while owning and operating some units themselves in the same restaurant or hotel chain (Srinivasan, 2006). For the plural forms occurring downstream, we refer to the system specifically as “dual distribution.” According to Sorenson and Sørensen (2001), only 11 percent of restaurant chains in 1998 pursued a pure governance strategy (i.e., either exclusive vertical integration or market governance). Additionally, the average franchisor franchises 80 percent of its outlets and owns 20 percent of them (International Franchise Association & Horwath International, 1994).

The question as to why firms use the dual distribution system has drawn much interest from many researchers. The common logic inherent in the existing theoretical explanations for dual distribution is the firm’s desire to balance the distinct advantages that both company-owned units and franchised units provide. Franchising helps firms to overcome resource constraints, whether they are capital, managerial talent, or local information (Oxenfeldt & Kelly, 1969). On the other hand, company ownership can signal a high quality of their business format and can distinguish themselves from low-quality firms (Gallini & Lutz, 1992). Moreover, company ownership can improve control (Bradach, 1997) and its bargaining position over the activities of franchised units (Bai & Tao, 2000). In addition, Sorenson and Sørensen (2001) add an interesting explanation by comparing two governance structures in terms of different learning styles. Whereas the managers of company-owned units exploit existing routines, and entrepreneurs running the franchises pursue more exploratory learning, neither offers an ideal alternative. In light of these explanations, there is some consensus that firms strategically employ dual distribution systems. Bradach and Eccles (1989) suggest that franchising chains employ dual distribution not only because some individual units are best suited for one form and some for another, but also because the existence of each form positively influences the management of the other side of the business. Meanwhile, Lafontaine and Kaufmann (1994) propose that the benefits of a mixed ownership structure are learned through the ongoing management of a system; thus, these learned synergistic managerial benefits may act to dampen movement toward either full ownership or fully franchised systems.

Based on these attributes of dual distribution, the determinants of the mix of governance structures in a chain have drawn increased attention, from both academic scholars and practitioners. However, the existing studies in this stream have largely used cross-sectional and aggregate level data; thus, they offer little insight into why firms have heterogeneous levels of franchising. Shane (1998) points out that the correct question for franchising scholars to ask is not why firms franchise, but what the optimal proportion of franchised outlets is, given other firm characteristics.

In this paper, the study of dual distribution will be advanced by proposing a model of how the initial conditions of firms at the start of franchising affect the equilibrium proportion of franchising.

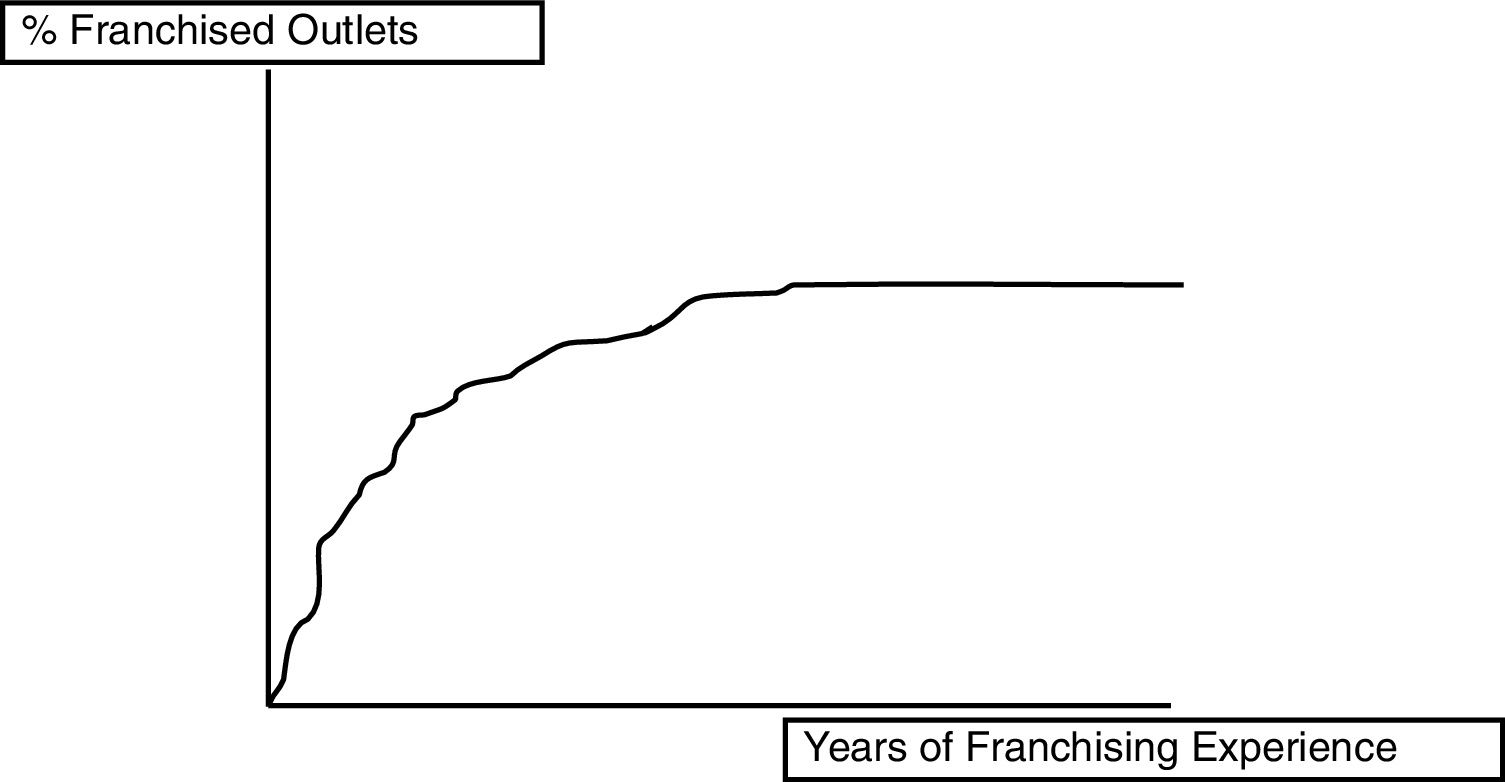

Fig. 1 shows the expected evolutionary pattern of the franchising level at the firm level.

Theoretical background and propositionsTraditionally, the franchising ownership pattern at a certain point of time has been explained by the firm characteristics represented at that time. In this study, this relationship will be further examined by considering how the initial conditions at the start of franchising have an effect on the equilibrium level of franchising, in addition to considering the effects of contemporary factors simultaneously.

The choice of equilibrium dual distribution configuration is a strategic decision. Dant, Kaufmann, and Paswan, (1992) suggest that the practice of dual distribution within franchise systems can be explained as being at least partly strategically motivated. Lafontaine and Shaw (2005) also propose that firms ‘target’ certain levels of company ownership. Actually firms often include the target configuration of their dual distribution system in the firms’ mission statements or stated strategies. In Howard (1994)’s article about Burger King, he refers to “the 7432-unit chain’s goal to eventually own and operate just 10 percent of the system.” In light of the consensus on the view concerning configuration strategies,” it is appropriate to approach the determinants of the extent of franchising with a strategic-choice perspective. This view is distinguished from unit-level decisions, which usually consider efficiency based on agency theory. In addition, while admitting the limitation of his study in terms of a low R-squared value, Shane (1998) suggests that factors other than those hypothesized (e.g., degree of geographic dispersion, royalty rates, system growth rate) clearly affect franchise ownership.

Stinchcombe (1965) notes that events surrounding the creation of a new organization have a long-lasting effect on its future development. Several organizational researchers have noted the importance of history. Lawrence (1984) argues that an organization’s history is crucial to its future development, and that organizations can only be understood in light of their early phases and subsequent evolution. Kimberly (1979) notes that “the conditions under which an organization is born and the course of its development in infancy have important consequences for its later life” (p. 438). In light of the previous literature, one can infer that past organizational characteristics have a bearing on present strategies. Thus, the most logical place to begin an investigation regarding the determinants of the equilibrium extent of franchising is the earliest phase of a chain’s existence. Here, however, the initial conditions at the start of franchising are replaced for the firm’s founding. Although examining the effects of the founding conditions on the configuration of a dual distribution system may also be worthwhile, focusing on the initial conditions at the start of franchising should be the first step in a retrospective study. Indeed, the objective to be explained here is the extent of franchising and the conditions that a firm had when it decided on franchising as being equivalent to the founding conditions, regarding the firm’s general history.

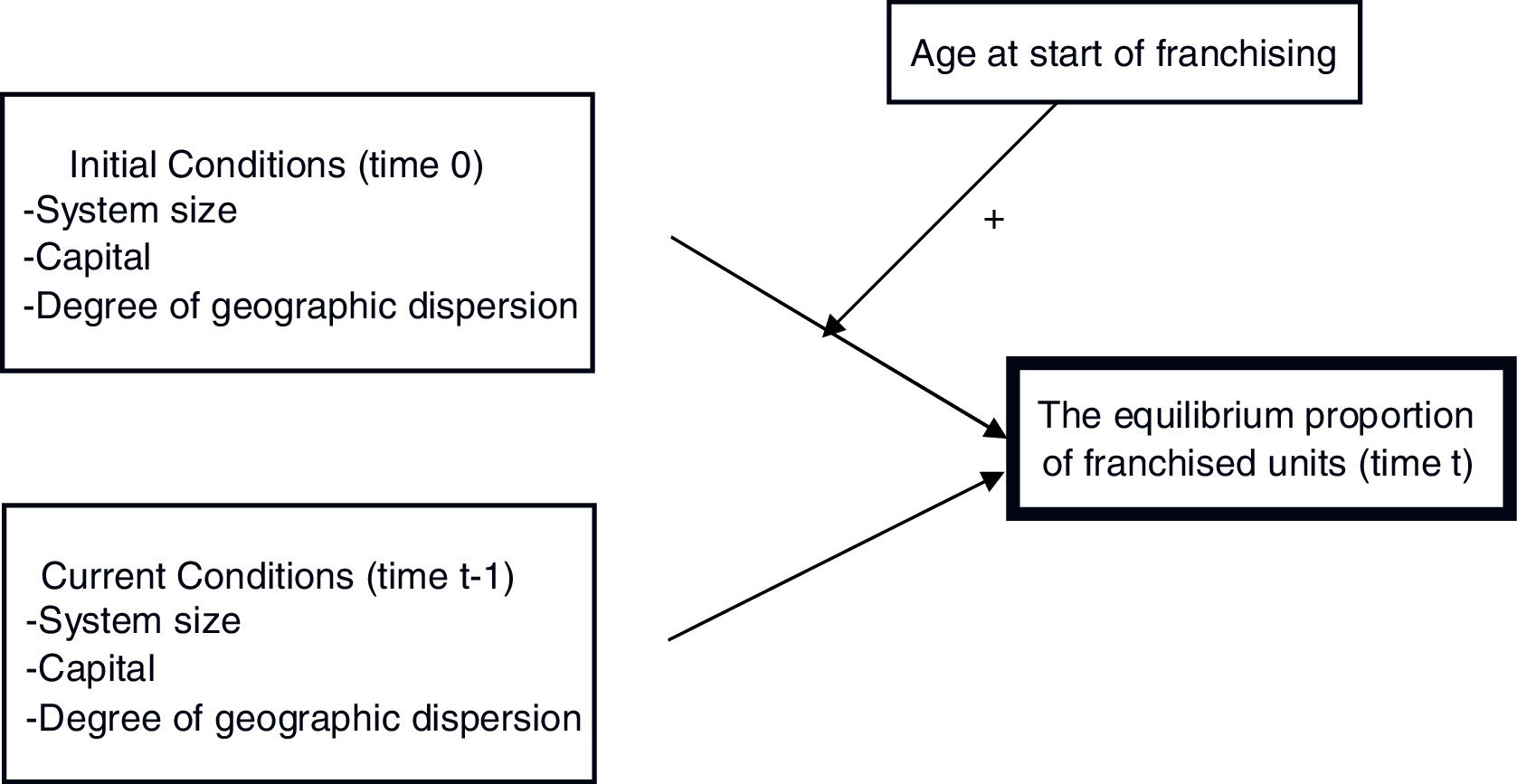

The initial conditions at the start of franchising embed not only a firm’s willingness and ability to franchise, but also maximum room for franchising. In other words, the current equilibrium level of franchising is under the influence of the initial conditions that made firms adopt plural forms. Three conditions can specifically be proposed through which one can interpret a firm’s motive to franchise and its impact on the later configuration of dual distribution (Fig. 2).

System size (the number of company-owned units)The system size of the chain that starts franchising equals the number of company-owned units. In Lafontaine (1992)’s survey report, she found that while only 36% of the franchisors mentioned the positive impact of franchised outlets on the company-owned side of the business, 75% mentioned the positive impact of company-owned outlets on the management of the franchised side. Furthermore, many authors mention the signaling effect of company-owned units to potential franchisees. One of these authors, Cline (1989), states the following: “The franchisor should own at least one or two company stores so that he has a real stake in the continuity of the system” (p. 54). A second author, Zinn (1985), states, “Experts say a good franchise will always own some of its own units” (p. 167).” Thirdly, Bond (1989) asserts, “The mix of company-owned vs. franchised units is indicative of the willingness of the franchisor to ‘put his money where his mouth is’ to some extent (p. 28). In this sense, one expects that large firms are willing to own many franchised units in order to exploit synergistic benefits from a mixed form and in order to attract many franchisees by favorable signaling.

Nevertheless, according to resource constraint theory, larger franchising systems have adequate capital and are therefore less likely to opt for the franchising form, which primarily taps into the capital contributed by franchisees (Alon, 2000). If resource constraint theory is accurate, this argument leads to competing expectations. Along with the same number of franchised units, firms with a high number of company-owned units at the outset will necessarily adopt a lower proportion of franchising. Therefore, one can propose that there are competing propositions regarding the effect of system size on the equilibrium proportion of franchising.Proposition 1a

The equilibrium proportion of franchised units in a chain is likely to increase as the initial system size increases.

Proposition 1bThe equilibrium proportion of franchised units in a chain is likely to decrease as the initial system size increases.

Capital (sales revenue)It is clear that franchisors perceive growth as an important reason for franchising, as indicated by survey research (Dant, 1995; Lafontaine, 1992). However, rapid growth requires significant increases in human and financial capital, as well as expertise in unfamiliar markets; these are resources to which a young organization may not have easy access (Lafontaine & Kaufmann, 1994). Selling franchises is a way of obtaining more expansion capital, as chains make no capital investment in franchised units, even as they earn income set as a fixed percentage of the franchisees’ revenues. Under this resource constraint argument, firms with abundant capital will not have a high level of franchising, inasmuch as there is no need to use franchisees as sources of capital; therefore, the proportion of company-owned units should increase with the age of the franchisor (e.g. Lafontaine & Kaufmann, 1994).

Meanwhile, having much capital affords firms to provide more financing to franchisees. Financing makes franchises easier to sell. The provision of direct financing by the franchisor to the franchisee can therefore imply that a franchisor with abundant capital will plan to have more franchised units. These arguments are formalized in the propositions below:Proposition 2a

The equilibrium proportion of franchised units in a chain is likely to increase as the initial capital increases.

Proposition 2bThe equilibrium proportion of franchised units in a chain is likely to decrease as the initial capital increases.

Degree of geographic dispersionFranchising replaces salaried managers with owner managers who have the right to claim residual profits after having paid their franchising fees. In fact, the managers of company-owned stores are motivated more by the opportunity of promotion to higher positions within the corporate hierarchy than by pay-for-performance compensation (Yin & Zajac, 2004). Therefore, franchising is superior to company ownership, as franchising helps firms minimize agency costs, especially in remote locations where the cost of monitoring unit managers is high. The biggest advantage of franchising compared to company ownership is that franchisees are more responsive to market needs because of their decision rights and incentives.

On the other hand, franchising can also incur significant costs. For example, franchisees may attract customers on the basis of the franchisor’s reputation, but may deliver inferior products, thus profiting from such actions with limited negative consequences to them, while hurting the firm’s reputation. The monitoring of franchisees in new regions usually requires the creation of additional company-owned units. To partial out the effects of exogenous environmental conditions from franchisee efforts, franchisors often establish additional company-owned units in each region in which they operate (Shane, 1998). Therefore, if firms already operate geographically diverse company-owned units, the marginal costs of controlling the free riding of franchisees will be lower. In conclusion, with highly geographically dispersed company-owned units, firms can exploit the benefits of having franchisees without worrying about the free riding problem. The corresponding proposition relating the degree of geographical dispersion to the equilibrium proportion of franchising is as follows:Proposition 3

The equilibrium proportion of franchised units in a chain is likely to increase as the degree of geographical dispersion is initially widespread.

Moderating effect of ageThe firm’s age at the start of franchising is proposed to moderate the effect of initial conditions on the equilibrium proportion of franchising. By including the time lag before franchising (defined as “age” in this research) as a control variable, Shane (1998) found a significant and robust effect of it on the proportion of franchised units. Moreover, Lafontaine and Kaufmann (1994) found that newer and smaller franchise systems make different decisions about the distribution of company-owned and franchised units compared to older, larger franchise systems. Franchisors are more willing to permit a diversity of obligations early in their systems’ development than after they have gained experience and the concept has solidified. Because older firms are more likely to have stronger inertia in keeping what they have or establishing routines as to how they work compared to younger firms, it seems evident that firms are inclined to reserve the effects of initial conditions more and are thus more imprinted by them if they already have a long history when they start franchising. Therefore, the following can be proposed:Proposition 1-1

The age of a firm at the start of franchising is positively related to the effect of the initial system size on the equilibrium proportion of franchised units in a chain.

Proposition 2-1The age of a firm at the start of franchising is positively related to the effect of initial capital on the equilibrium proportion of franchised units in a chain.

Proposition 3-1The age of a firm at the start of franchising is positively related to the effect of the initial degree of geographic dispersion on the equilibrium proportion of franchised units in a chain.

The effects of current conditionsSince antecedent factors are likely to change as a franchised system matures (Lafontaine & Kaufmann, 1994), the effects of current conditions should also be considered. As the system matures, a franchisor may gradually become more aware of the efficiency-enhancing benefits of dual distribution; alternatively, opportunities for previously unavailable synergies may develop over time (Dant et al., 1992). Therefore, the current (at time t) value of the characteristics that we have considered above may have more information beyond merely succeeding initial conditions.

The same arguments suggested above generally apply here again for three variables.

System size (the number of total units in a chain)Here, system size includes not only company-owned units, but also franchised units. According to Shane (1998), as a firm becomes bigger, bounded rationality limits the spans of control that entrepreneurs can effectively manage. As a result, large companies have the incentive to depend on multiple outlet managers instead of solely depending on the founding entrepreneur. However, very large franchise systems often have saturated markets, which locate units close together and reduce monitoring costs. In this case, franchise companies may prefer to convert franchised units into company-owned ones. These arguments lead to the following propositions:Proposition 1c

The equilibrium proportion of franchised units in a chain is likely to increase as the current system size increases.

Proposition 1dThe equilibrium proportion of franchised units in a chain is likely to decrease as the current system size increases.

Capital (sales revenue)Proposition 2c

The equilibrium proportion of franchised units in a chain is likely to increase as the current capital increases.

Proposition 2dThe equilibrium proportion of franchised units in a chain is likely to decrease as the current capital increases.

Degree of geographic dispersionProposition 3a

The equilibrium proportion of franchised units in a chain is likely to increase as the degree of geographical dispersion is currently widespread.

Concluding remarksThis study have set out to provide an analytical and theoretical discussion of the imprinting effect of initial conditions on the configuration of dual distribution in franchising companies. Based on the study of dual distribution, we have showed major theoretical insights on which the equilibrium proportion of franchised units in a chain might depend on the initial system size, the initial capital, and the degree of geographical dispersion as well as current ones. We have discussed about equilibrium dual distribution configuration in an attempt to develop a set of propositions (Fig. 2). We believe this study will to receive benefit from further empirical investigations.