Edited by: Brij B. Gupta, Kwok Tai Chui

Last update: July 2022

More infoCredit data barriers, such as incomplete credit records, false credit information, and low security of credit data, exist in the supply chain financial credit system, rendering it difficult to support the closure of the whole financing chain's credit system. Emerging blockchain technology can help improve credit-reporting ability through greater integrity, decentralization, transparency, security, and reliability. Aiming to address the problem of extensive credit investigation data and privacy protection, we propose a blockchain-based model to realize access control and management of the shared transaction information in the supply chain. Our model adopts a consensus mechanism to solve the problem of large credit investigation data and privacy protection of credit investigation data and realizes access control and management of the shared data chain. In our model, data are stored on the cloud server and shared with the proxy reencryption method. The model's data structure and workflow are designed to facilitate specific applications in supply chain finance. The embedded blockchain technology helps build the open shared reference architecture and establish the entire life cycle of a monitoring mechanism. The existing blockchain consensus mechanism has low security and a large resource consumption; as such, it is particularly important to design a new consensus mechanism to serve the credit investigation system. In this study, blockchain data sharing and traceability can be realized by improving the consensus mechanism, helping to improve the existing credit investigation service system. Our findings help optimize the existing supply chain financial credit system and enhance the efficiency of supply chain financing.

In traditional supply chain management (SCM) models, the financing difficulty of supporting enterprises upstream and downstream of a supply chain is the bottleneck factor restricting the operational efficiency of the overall supply chain.

An enterprise's credit information can reflect its credit status, including various credit records generated by businesses in economic activities (Tsai, 2017). Developed countries in Europe and America have over 100 years of enterprise credit investigation history, relative to developing countries like China, where enterprise credit has recently received attention. The continued development of IT infrastructure has greatly facilitated the evolution of financial and credit systems. As such, it is worthwhile to assess how emerging technologies can further enhance the performance of credit information reporting, sharing, and investigation.

Although there is a significant demand in the enterprise credit market, credit investigation fails to solve information-sharing issues, especially for small and medium-sized enterprises (SMEs). SMEs are notorious for their financing problems; many SMEs cheat banks and other financial institutions to obtain financial services. SMEs’ financing difficulty is at the core of credit problems (Jin & Zhang, 2019) as their internal information is not transparent, and their financial system is not particularly sound (Ge et al., 2020; Gupta & Narayan, 2020; Wang et al., 2018; Xia et al., 2020). A high degree of information asymmetry, the need for in-depth surveys and audits, and high credit costs contribute to the SMEs’ credit information acquisition difficulty.

Some banks, such as the People's Bank of China, have established a credit reporting system to integrate a complete collection of credit information, harnessing the most comprehensive coverage using a credit information database (Credit Investigation Center of the People's Bank of China, 2020; Jia et al., 2021; Law et al., 2021; Lin et al., 2021; Liu et al., 2021; Uniyal et al., 2021). However, the information of many licensed financial institutions outside the debtor's liabilities is not included, including that from Internet-based financial institutions (Borodako et al., 2021; Cheng et al., 2021; Gomber et al., 2017; Shao et al., 2021; Zhang & Srite, 2021). Therefore, it is necessary to design and develop an enterprise credit information-sharing mechanism to mitigate the existing problems of credit data (Benamati et al., 2021; Mutambik et al., 2021;Zheng et al., 2019). Furthermore, to promote the development of market-oriented credit investigation institutions, big data analytics, cloud computing, the Internet of Things (IoT), and other emerging technologies have been increasingly applied to evaluate SMEs’ credit to help them obtain financing (Al-Qerem et al., 2021; Chopra et al., 2022; Cvitić et al., 2021; Elgendy et al., 2021).

Traditional SCM is challenged to meet the financing needs of enterprises in the chain. Supply chain finance (SCF) is the natural demand of every supply chain (Hu & Huang, 2009), which consists of the core enterprises and a complete set of upstream and downstream enterprises. Specifically, SCF focuses on the coordinated management of enterprises’ finance to respond effectively to the upstream and downstream enterprise fund shortages that restrict the whole supply chain's efficiency; in so doing, it helps to form a sustainable ecosystem with mutually beneficial coexistence and benign interaction. The current SCF situation faced by many enterprises shows the dilemma of their demand for cash in the context of lack of credit. Such a dilemma also creates problems with credit transfers between tier-1 suppliers and SMEs, aggravating their financing problems. As SCF represents a system with nonholonomic closed states, emerging technologies are particularly applicable to effectively solve enterprises’ credit problems in SCF.

As a new generation of emerging financial technologies, blockchain technology can promote the construction and development of a new system-wide trust mode. Blockchain technology can intelligently adjust the remaining available credit line within SCF and effectively unify the “four flows”—logistics, business, capital, and information flows—through smart contracts (Chang et al., 2019; Gholami et al., 2021; Klein & Rai, 2009; Liu & Yu, 2021; Mondal & Chakrabarti, 2021; Srivastava et al., 2021). Therefore, blockchain-based financial technology can boost the development of SCF.

Prior research has different views on using blockchain technology to develop an effective SCF credit system (Kamble et al., 2020; Kamilaris et al., 2019; Mao et al., 2018; Zheng et al., 2021a). However, blockchain technology is still relatively new, and its credit investigation function in SCF will gradually manifest itself. Existing studies mainly focus on blockchain technology's feasibility in credit embedding of the SCF system. They fail to explore the measures from the perspective of the life cycle of SMEs and stakeholders.

As a decentralized distributed data system jointly maintained between nodes, blockchain technology has been widely used in financial transactions, copyright protection, product tracking, and access control due to its security, data traceability, data tampering, and other characteristics and advantages (Liu et al., 2021; Zhou et al., 2021). The emergence of Ethereum, super ledger, and other platforms promotes the rapid development of blockchain technology (Quan, 2022). While blockchain technology is favored by people, its disadvantages of high energy consumption and low performance also cast doubt over the widespread development of blockchain (Ding et al., 2022). As the core of blockchain technology, the consensus mechanism is the underlying mechanism for nodes to sort received transactions, simulate execution, ensure that nodes reach consensus in a distributed network, and ensure data security (Liu et al., 2022; Zhang et al., 2022).

Designing new consensus mechanisms in the service of the SCM credit reporting system is particularly important. This study aims to achieve the data sharing and traceability chain blocks through improved consensus mechanisms, thus improving the existing credit-reporting services system. Our research proposes to design the SCF credit investigation system based on blockchains to potentially solve the dilemma supply chain enterprises face—demanding funds but lacking credit—which bears important theoretical and practical significance.

The rest of the paper is organized as follows. The next section reviews prior literature. Section 3 presents the enterprise credit information sharing model based on blockchain technology. Section 4 shows the recommendations to optimize the supply chain financial credit reporting system with embedded blockchains. The last section concludes the paper with theoretical and practical contributions, limitations, and future research directions.

Literature reviewBlockchain may be considered a multidisciplinary blend of cryptography, statistics, economics, and computer science, developed based on new technology. With distributed storage, anonymity, and the advantages of data consistency, it is widely used in supply chain finance. The combination of blockchain and privacy protection can reduce the risk of lax third-party supervision, ensure data security and effectiveness to a certain extent, and have broader application value. This study sorts out the research progress of consensus mechanism and related research progress of blockchain in SCF from the following aspects.

Research progress of consensus mechanismThe consensus mechanism refers to the process of making nodes reach a consensus on the content of the distributed database in the process of a dynamic transaction. Blockchain uses a consensus mechanism to make nodes reach a consensus on the transaction, thus weakening the function of a centralized supervision system. From Proof of Work (PoW) to Practical Byzantine Fault Tolerance (PBFT), Proof of Stake (PoS) to delegated Proof of Stake (DPoS), Proof of Authority (PoA), and Katka are a series of consensus mechanisms. The consensus mechanism has been constantly improved, corresponding to the different requirements of the field to different directions of evolution. As the core technology of blockchain, a consensus mechanism can effectively reach consensus on the data of each node in the blockchain, quickly complete transaction data processing, and ensure the consistency and reliability of data. The typical consensus mechanism is shown in Table 1.

Development of consensus mechanisms.

| Name | Characteristics | Advantages and Disadvantages |

|---|---|---|

| PoW, proof of work | It is used to establish distributed untrust consensus and identify the “double spend” problem (Yang et al., 2018). | Widely used in slow speed, high energy consumption, vulnerable to “economies of scale.” |

| PoS, proof of stake | PoS is proposed as an alternative to PoW. PoS does not support the consumption of all computing power at one time. | Energy saving, increasing the cost of the attack, not affected by “economies of scale”; affected by the “Nothing at Stake” attack (Guo et al., 2021) |

| DPoS, delegated proof-of-stake | Equity holders can elect Witness. These leaders are authorized by the equity holders to vote. This mechanism makes DPoS faster than normal PoS. | Energy saving and efficient; slightly centralized. Participants with high equity can vote themselves as verifiers (Wang, 2020). |

| PoA, proof-of-authority | PoA-based networks, transactions, and blocks are authenticated by accredited accounts called Validato (Zang, 2022). | Energy saving and efficient; slightly centralized. Although available for public blockchains, it is generally used for private and licensed blockchains. |

| PoET, proof of elapsed time | PoET is used for licensing blockchain networks to determine the mining rights of those who acquire blocks in the network. Its implementation needs to ensure two important factors: (1) the participating nodes naturally choose a random time in nature, rather than a deliberately short time chosen by one of the participants to win and, (2) the winner did complete the waiting time (Zhang et al., 2020) | Efficient decentralization makes it easier for participants to verify whether the leader is legally elected, and the election process is proportional to the value obtained. Specific hardware needs to be used, which cannot be adopted on a large scale and is not suitable for public blockchain |

| PoSpace, proof of space | A way to solve a challenge provided by a service provider by allocating a certain amount of memory or disk space. | Use space instead of computing so environmentally friendly can be used for malware detection against denial of service (DoS) attacks; there are problems with incentives (Tan et al., 2020). |

| PoSV, proof of stake velocity | PoSV was proposed as an alternative to PoW and PoS to improve the security of P2P networks, which in turn is used to confirm Reddcoin transactions (Wu et al., 2020). | High efficiency and energy saving; safety improvement; an improvement of PoS. |

| PBFT, practical Byzantine fault tolerance | PBFT operates very efficiently because it uses a smaller number of preselected generals (Li et al., 2019). | High transaction throughput and high throughput; slightly centralized for licensing networks. |

| FBA, federated Byzantine agreement | The general idea of the FBA was that each Byzantine general was responsible for his own chain, establishing facts by ordering information once it arrived. It is widely used because throughput is better than all consensus mechanisms. | High throughput, low transaction overhead, and good network scalability; only used on private and licensed networks (Efanov et al., 2019). |

| dBFT, delegated Byzantine fault tolerance | DBFT can provide f=(n-1)/3 fault tolerance for a consensus system with n consensus nodes. This fault tolerance also covers security and availability, is immune to checkman and Byzantine errors, and is suitable for any network environment. | Fast, expandable chain. Everyone is competing to be able to have multiple root chains (Castro et al., 2002). |

| RAFT | RAFT provides a common way to implement distributed state machines in a cluster of computing systems, ensuring that each node in the cluster is consistent on the same set of state transitions, with a range of open-source reference implementations. Byzantine mistakes will not be tolerated | The model is simpler than Paxos, provides equal security, and is implemented in multiple languages for both private and licensed networks (Ding, 2022). |

| DAG,acyclic directed graphs | Each block and transaction requires only a few prior blocks to be confirmed and can be added to the block and transaction in parallel (Liu et al., 2022) | Highly expandable, fast; energy saving; smart contracts can only be implemented using Oracle. |

In developing consensus mechanisms to address the issues in blockchain systems, such as power and resource consumption, experts proposed the mechanism based on a consensus improvement scheme. However, this kind of mechanism is based on the resources available and is still unable to solve the problem with a centralized consensus node to tradeoff blockchain system performance. To improve the performance, a consistency algorithm is attractive to blockchain systems, which is to reach a consensus through voting to ensure the efficiency and safety of the consensus process in systems with less common nodes, even the Byzantine error nodes.

Blockchain application in SCFThe core of SCF is to help enterprises integrate their assets, reduce financing costs, and mitigate the risks from financing enterprises in the supply chain (Konashevych & Khovayko, 2020; Kumar et al., 2021). Before blockchain technology was formally introduced into the SCF industry, some scholars had already proposed that blockchain could promote the development of the capital market. For instance, Buehler & Matthieu (2016) discussed the integration of blockchain technology in the capital market and highlighted the corresponding benefits in clearing and financial audits. They also identified some practical and feasible blockchain operations for the capital market, categorized the problems encountered in the process, and made suggestions for their mitigation. Yang et al. (2020) found that blockchain has significant advantages in verifying corporate credit ratings, especially when applied to comparing the business methods of two lending banks.

In recent studies on the application of blockchain technology in the SCF industry, a few scholars put forward their understanding of the value of blockchains in SCF. Rashideh (2020) believed that blockchain technology provides a certain level of information security guarantee for SCF by maintaining the steady development of SCF, preventing information theft crime, and ensuring that the information content and transmission process are accurate and effective. Mohanta et al. (2020) pointed out that integrating blockchain into SCF is an inevitable trend and suggested investors incorporate it into enterprise application models to realize its full potential in SCF.

Although blockchain technology has good development prospects in SCF, its technical nature may lead to some inevitable shortcomings, such as the expensive resource cost and challenges for large-scale applications (Zhang, 2020). While most scholars agree that blockchain technology can be integrated with SCF, some scholars believe its technological advantages are also a disadvantage. For instance, Farnaghi & Mansourian (2020) argued that the characteristics of blockchain technology information should not be tampered with; doing so could hinder its universal promotion in application to a certain extent. Specifically, tampering behavior infringes on customers’ privacy, deprives them of the right to change information, and impedes the technical use of the SCF service platform.

SCF credit systemInformation asymmetry is one of the most significant obstacles to SCF development (Almomani et al., 2021; Lu et al., 2020; Mengesha et al., 2021; Peng et al., 2021; Wang et al., 2021), as it directly affects the transactional activities between suppliers, dealers, and many service organizations, especially the SMEs in the marginal area of SCF. Therefore, the financing channels cannot cover the real capital needs. Additionally, banks and other financial institutions, for risk aversion purposes, only conduct credit identification of primary suppliers and dealers for core enterprises (Yan et al., 2017). The problems existing in the credit information systems of SCF are reflected in the following aspects.

Credit data barriersCredit data barriers are a prominent problem in the credit information systems of supply chains, affecting the transmission efficiency of credit records among financial institutions and financing subjects (Wang-Mlynek & Foerstl, 2020), as well as the interactions between core enterprises and SMEs (Alora & Barua, 2019). Credit-data interconnection is challenging on diversified networks; different enterprises, systems, and multiple components become isolated information clusters in SCF due to information asymmetry (Gomber et al., 2018; Kesharwani et al., 2021; Shih et al., 2021). Credit data and financial intermediaries should be made available for potential enterprises with financing needs to properly process their credit records. Nevertheless, commercial banks and other financial institutions function on their self-interest maximization to protect their business interests (Bris & Cantale, 2004). Meanwhile, credit-data barriers exist between core and SMEs in SCF, further weakening the support for SMEs to obtain financing from financial institutions (Abdulsaleh & Worthington, 2013; Gao et al., 2021; Rivera-Trigueros & Olvera-Lobo, 2021; Trappey et al., 2021). Trust transmissions must be linked between financial institutions, upstream and downstream SMEs, and core enterprises for all individual rational entities with particular information protection needs (Ada et al., 2021; Ruan et al., 2021; Yuan et al., 2019; Zhang et al., 2021a). Therefore, it is critical to comprehensively evaluate the credit subject's credit level and find a way to overcome the credit data barriers with the help of emerging technology.

Lack of integrity of credit historyThe integrity of credit records and information refer to the comprehensive and multidimensional data used to evaluate the credit of stakeholders of SCF in credit evaluation (Ali et al., 2019; Meso et al., 2021; Zhu et al., 2021). From a theoretical standpoint, stakeholders get quality credit records that aim to promote their financing needs. Furthermore, credit records from financial institutions to the core enterprise allow them to gain full credit levels of suppliers and dealers. Core enterprises can transfer credit to upstream and downstream SMEs. Therefore, credit transfers ensure financial credit records’ integrity throughout the supply chain (Al-Taie et al., 2021; Graafland & van de Ven, 2011; van Rensburg, 2021; Zhang et al., 2021b; Zheng et al., 2021b). Nowadays, the laborious development process, complex enterprise data, and limited technology appeal often result in low-quality information from financial institutions. The nerve center function of core enterprises is also limited in practice, which leads to insufficient credit record integrity of the financial subject of the whole supply chain (Wang et al., 2019a). The intermediary role of credit finance in the financial chain of the supply chain is not entirely played (Jin et al., 2019). It cannot accurately and effectively evaluate the changing trajectory of credit information for all links in the life cycle of financial transaction activities (Wang et al., 2020a; ZareRavasan & Krčál, 2021). Notably, adequate support for the financial strength of the credit data transmission for SMEs is lacking.

Urgency to curb false credit informationAs an innovative way of combining industry and finance, SCF spans industrial chain and financial activities. Finance is naturally leveraged and risky, and false credit information is easy to breed. The primary reason is the prominence of fictitious transactions (Firth et al., 2005). For instance, low-quality supervision, arbitrage, tax arbitrage, and foreign exchange arbitrage are frequent among enterprises, financial institutions, and other service entities. Second, it is due to the lack of reliable identification of warehouse receipts (Su & Wang, 2020). Some enterprises use this regulatory loophole to obtain credit lines using false and repeated pledge warehouse receipts (Hofmann et al., 2018). Third, it may be caused by the need for extending multichannel default access to SCF funds (Zhen et al., 2020). Primarily, enterprises obtain external funds through their business in SCF. Alternatively, they may carry out supply chain businesses early and change business goals in the middle and later stage accordingly, such as expanding performance and listing operations. Therefore, it is crucial to fully use fintech to effectively curb the false information transmission of relevant fields of SCF to enhance confidence and improve transaction efficiency (Chen et al., 2020; Vyas et al., 2019).

Low security of credit dataThe security of credit data will significantly affect the regular transactions of SCF-related subjects.

Credit data storage security In the SCF system, the security of credit data storage is related to every stakeholder who participates in financial services activities and impacts the orderly operations of regular financial transactions (Anagnostopoulos, 2018). From an internal perspective of SCF, core, upstream, and downstream supply chain enterprises are motivated to tamper with their credit data to increase their earnings (Ma et al., 2019). From an external perspective of SCF, all enterprises have the possibility of credit data being attacked and stolen (Xu, 2016). The current SCF credit system cannot eliminate such risks.

Credit data assurance to generate value SCF reinforces credit support to SMEs in a relatively weak position through the trust transmission of core businesses, aiming to solve the problems of financing difficulty and costly finance for SMEs (Fayyaz et al., 2020). Therefore, the role of core enterprises is critical as they take advantage of their special status, take moral risks in using and transmitting credit data, and engage in self-serving behaviors (Papadimitri et al., 2020). Other businesses in a relatively weak position cannot effectively obtain safe credit data and force the capital of SMEs (Liang et al., 2018). Therefore, the whole SCF could be severely unbalanced.

SCF credit reporting system integrated with blockchainTamper-proof credit recordTamper-proof ability means that under the constraint of an intelligent algorithm, each block's information input is traceable so that one-way tampering is prohibited (Wu et al., 2019). Blockchain structure can check the order information, credit information, financing request, and operation progress of the SCF business while converting paper vouchers such as enterprise orders, contracts, and bills into digital assets to generate smart contracts (Chong et al., 2019; Liu et al., 2020a). Diverse subjects use blockchain data from the same source to improve the liquidity of collaterals or collaterals in the traditional SCF market, promoting the further release of core business creditability and effectively mitigating the problem of the lacking credit certificates for SMEs (Wang et al., 2019b).

Blockchain integrates the advantage of untampered data into the credit data records and forms the credit economy recognized by stakeholders in SCF (Maesa & Mori, 2020). The credit data of the trading entity's financial service activities are recorded objectively by each node of the blockchain, which is traceable and credible (Wang et al., 2020b). They cannot be tampered with in one direction, thus playing a supervision warning role. Therefore, this is conducive to effectively integrating enterprise credit assessment, nurturing confidence in the current SCF credit investigation system, and improving credit record storage integrity (Baillette & Barlette, 2020; Guo & Wang, 2020; Li et al., 2020; Wang et al., 2020c).

Decentralization and active expansion of credit transmissionA decentralized, distributed storage strategy is to prevent data service centers and other traditional mediation. The data exchange between all shared nodes safeguards credit data integrity (Ma et al., 2020). The rights and obligations are equal; a single node that suspends operation does not affect the system's operation, effectively improving the credit data security and conveniently lowering maintenance costs (Rouibah et al., 2020; Yang et al., 2019). After introducing blockchain technology service for a final order of multiple vendors, core businesses and financial institutions form a chain block, extending to all levels involved in accounts receivables and the business credit information, such as the full records on this blockchain. Financial institutions provide information to any level of trading suppliers, create the core business, and facilitate payment credit agreements for accounts payable on the entire supply chain multistage transmission (Ensslin et al., 2020; Kopyto et al., 2020).

Blockchain technology serves as a transparent and credit transmission technology by (i) promoting the SCF credit-data swap while supporting a viable core business to the upstream and downstream SMEs’ credit limited situations, (ii) recognizing the rights and interests of stakeholders, and (iii) improving service level quality of SCF (Du et al., 2020).

Enhance publicity, transparency, and parties’ contract awarenessDisclosure transparency means that the supplier of blockchains has its subdatabase. Based on the shared and open characteristics, all participants can obtain and apply data through the public entrance and form an open credit data record (Casino et al., 2019). On the one hand, blockchain technology has its identical mathematical algorithm, and the credit data of each node is automatically exchanged, integrated, and consistent (Niranjanamurthy et al., 2019). Each financial entity of the supply chain can effectively distinguish the authenticity of credit data through the blockchain ledger, reasonably avoid the generation of participants’ malicious behaviors, and control the overall loss to a minimum. On the other hand, each SCF subject has relatively symmetrical credit data information (Li et al., 2020). The core enterprise's monopoly advantage over unique credit data is weakened. The participants’ motivation for breaching a contract due to a lack of contract spirit will be effectively restrained. Therefore, the blockchain is seen as a technology with openness and transparency that is conducive to enterprises strengthening their performance spirit and improving the credit coefficient (Saberi et al., 2019).

Reliability and reasonable control of credit risksReliability means that blockchain, as a trust segmentation instrument, provides a stable environment for financial transactions (Kshetri, 2018). It establishes a trust basis by endorsing in a purely mathematical way and can reasonably judge whether credit data is adequate, manages financial risks, controls costs, and reduces credit risks. Credit data storage and application have multinode distribution characteristics under blockchain technology (Liu & Zou, 2019), bringing the synergistic effect into play. Failure or destruction of one node will not affect the entire network's regular operation (Du et al., 2020), making it difficult for a single risk to spread to the entire SCF system.

The “blockchain + supervision” pattern of SCF will gradually take shape to grasp in-depth supervision and accurate services that can reasonably control credit risks (Wong et al., 2020). Under the traditional SCF system, commodity trading and business financing exist as independent links in financial services. Suppliers, core enterprises, and financial institutions have credit blind spots and credit transmission problems. After introducing blockchain technology, the credit information of suppliers, core enterprises, and financial institutions is recorded within the blockchain, reducing the time, labor, and transaction cost and effectively avoiding the generation of credit risks (Morkunas et al., 2019).

At present, the value of blockchain technology for enterprises and industries is most impacted by the public and the market. This research area mainly addresses the questions of which markets or industries will be affected by blockchain systems, how to design business models to derive economic value from blockchain, and how to measure these values.

For the industry value of blockchain, the financial field is often the area most examined by researchers. For example, in the SCF field, researchers found that blockchain technology not only can effectively solve the pain points, according to decentralization, trust, stability, safety, increased production, improved supply chain of each member's income and accounts receivable financing benefit maximization.

The industry value of blockchain is most commonly discussed in financial markets, but other areas, such as logistics and public services, are also becoming a focus of attention. With the development of blockchain technology, industry decision-makers are also aware of the value-added potential of this technology. In addition, the transportation and power industries have also been widely impacted. The existing research results provide the theoretical basis for this study and theoretical support for improving blockchain technology. However, there is little mention in existing studies of how to improve systems and services for blockchain applications in specific situations.

The existing blockchain consensus mechanism has low security and large resource consumption, so it is particularly important to design a new consensus mechanism to serve the credit investigation system. In this study, blockchain data sharing and traceability can be realized by improving the consensus mechanism to improve the existing credit investigation service system. Our findings help optimize the existing supply chain financial credit system and enhance the efficiency of supply chain financing.

Blockchain-based enterprise credit information sharing modelThis section proposes an enterprise credit information sharing model based on blockchain technology to support information sharing, subject to mutual constraints for the alliance members in a supply chain. The mutual supervision between members in our model enables reliable credit information sharing. Additionally, blockchain autonomy effectively reduces management complexity, the risks of a centralized system's single-point failure, and the potential issues resulting from data-sharing such as ownership, use, and circulation path problems, which, ultimately, result in a shared, open, transparent, and traceable process with tech-oriented recognition.

In prior studies, the integration of the current blockchain model with the credit information sharing environment is not complete, and many problems remain to be solved. This study's enterprise credit information sharing model based on blockchain technology addresses such issues by effectively combining credit information sharing scenarios with blockchain technology. Specifically, in terms of the credit information sharing schemes and sharing domains, existing models either share data directly on the blockchain or cannot manage data when sharing data under the chain. Moreover, many models’ consensus algorithms still require mining, in essence, resulting in a severe waste of resources. In this research, the model, combined with the credit information-sharing environment, has made corresponding improvements on these issues.

Suitable conditionsBlock data on the chain is transparent to all members. However, there is also a need to validate credit data and share confidential information; the credit reporting data is not transmitted directly through the block trading but only under the transmission chain, making it complicated to obtain data-share management. For that reason, it needs to ensure that the credit information provider uploads the corresponding credit information. Also, to prove an agency receives the credit information, the cloud server's design should allow storing the shared data and consider the privacy protection shared access scheme.

Due to the current business competition among different enterprises, some information as business secrets cannot be shared between enterprises, so it is difficult to achieve complete information sharing between different enterprises. In this study, it is proposed that the information sharing between different enterprises can be realized by building the alliance and cooperation relationship of mutual trust between enterprises. The best applicable subjects of this model are large multinational corporations or chain enterprises. This type of enterprise essentially belongs to a parent company, and each subsidiary can carry on the complete information sharing. Through the model constructed in this study, the alliance relationship between different enterprises can also be built to realize the majority of information sharing or complete information sharing. Our model adopts the RPBFT consensus mechanism for the credit information sharing environment—a practical Byzantine fault-tolerant algorithm (Veronese et al., 2011). It was further improved through the design of BIA (Blockchain Information Alliance) and BCA (Blockchain consensus Alliance) to reduce the traffic caused by the number of nodes and improve the consensus's efficiency (see Table 2).

Correlation of this research with other blockchain models.

| Models Studied | ||||||

|---|---|---|---|---|---|---|

| Liu et al. (2021) | Zhou et al. (2021) | Sun et al. (2022) | Liu et al. (2020) | Model Proposed | ||

| Capabilities | User security | Y | Y | N | N | Y |

| Data security | N | N | N | Y | Y | |

| Access security | N | N | Y | N | Y | |

| Shared security | N | Y | Y | N | Y | |

Solutions are proposed based on the studied model, aiming to solve potential issues in exchanging business credit information (see Table 3).

Model's solutions proposed and main issues identified in credit information sharing.

| Security issues | Model's solutions proposed |

|---|---|

| User security |

|

| Data security |

|

| Access security |

|

| Shared security |

|

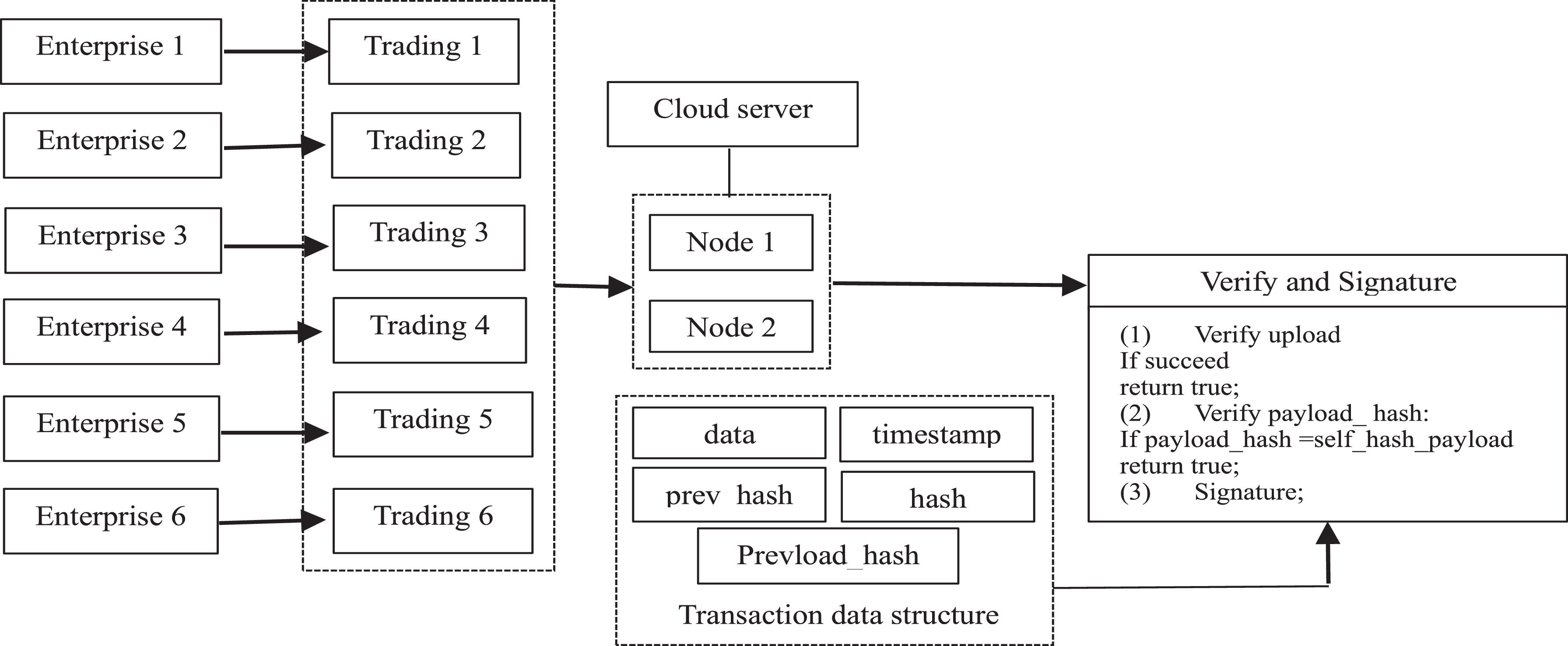

The nodes are the main body in the model based on blockchain technology to maintain the blockchain network. The credit information providers upload certificates and send a unique data structure of “transaction.” The consensus mechanism ensures that the node in the form of a “block” is recorded in the blockchain ledger, guaranteeing that the certificate is tamper-proof. In addition to the model's roles, framework, and flow, the model design includes a node, a consensus mechanism, and a data structure design.

Model role designThe model's main participants are credit information providers, cloud service providers, and regulatory agencies, who play the following role.

Information bodyThe data entity is the credit information belonging to the structure that should have the right to control. Financial institutions such as credit institutions, electronic commerce, and nonfinancial institutions, such as telecommunications operators and government departments, store credit information. When it is necessary to collect personal credit information, its use must be fully informed and authorized.

Credit investigation agenciesCredit bureaus systematically collect, sort out, process, and analyze credit information about enterprises or individuals, provide them with credit reports, and offer diversified credit investigation services. Generally, they do not generate credit investigation data. Collecting and sorting out comprehensive and accurate credit information is the key prerequisite of providing credit reports.

Credit information providerCredit information providers are banks, securities, and other financial institutions with credit sales and lending information as well as other nonfinancial institutions such as telecommunications operators and government departments. These institutions have corporate or personal credit information. Therefore, they share it, and the agencies generate credit reports, thus providing credit reporting services.

Cloud service providerCloud service providers provide cloud storage, cloud computing, and other services. The credit data are shared by credit information providers to credit agencies. As the information is relatively large, data management benefits by uploading credit information to the cloud server first; then, credit reference agencies shall download the shared data from the cloud server after verification.

Regulatory agenciesIt offers rights assurance to all subjects involved in the credit-data information exchange and the platform's regular operation. The model establishes a regulatory agency to deal with all parties’ objections in the sharing process, such as the objection of the information related to the credit information uploaded by the credit information sharers.

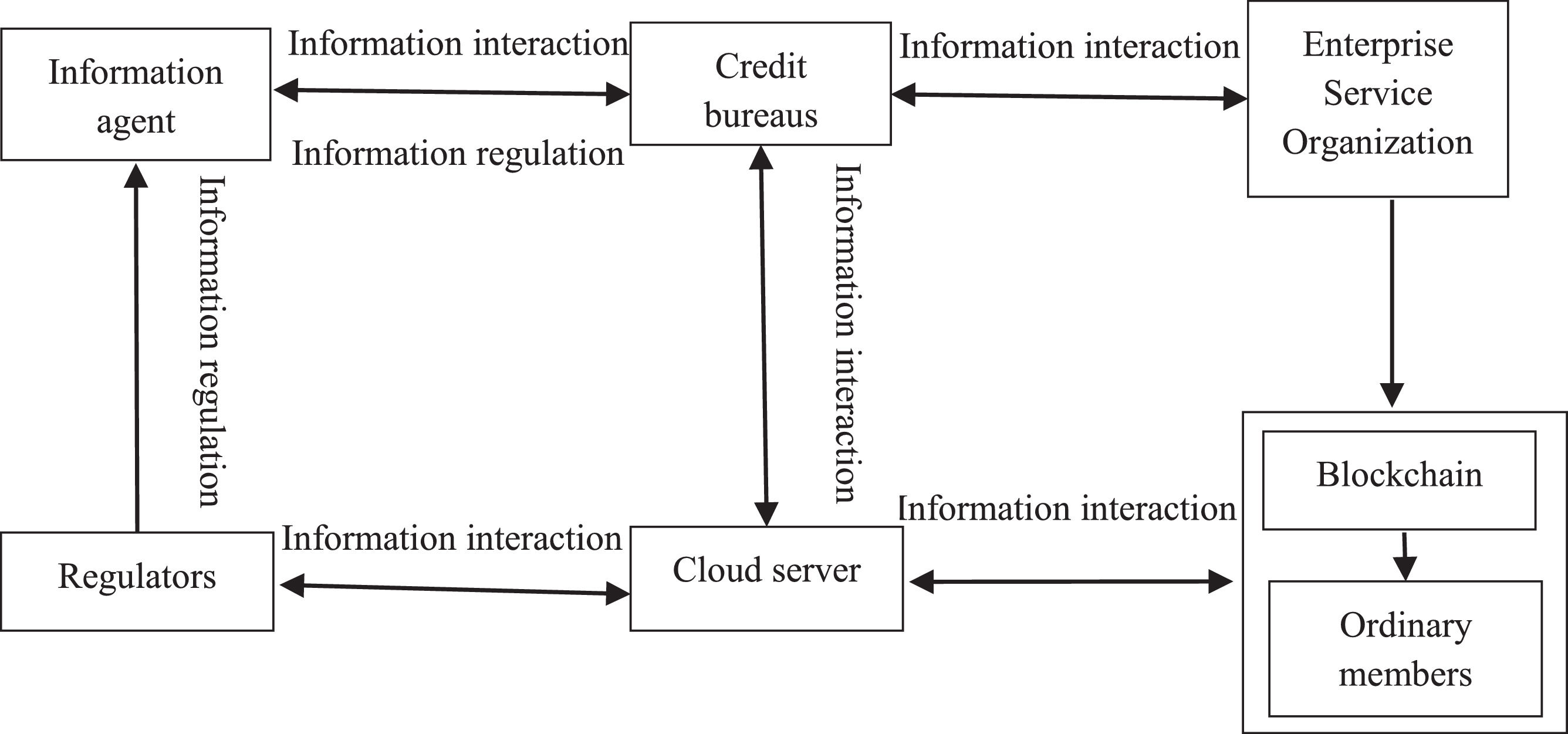

Model framework designThe model adopts the blockchain model's underlying architecture, including the P2P network, message transmission mechanism, and block data structure. In addition to blockchain technology's elemental architecture, the model's basic framework in the present paper also includes the following elements.

Interaction between credit investigation agencies and information subjectsThe credit investigation agency must first obtain the user's authorization for the requested data. The credit investigation agency can then request the credit information provider's corresponding data under the authorization signed by the information subject.

Interaction with the cloud serverAfter receiving a request per the specific data-format requirements, the credit information providers upload data encryption to the cloud server to protect credit information providers’ rights and interests. The credit information providers include the object request, metadata, and other information transaction to blockchain nodes to load documents while uploading data. The records require user authorization, and the data and information uploaded by credit information providers are recorded on the blockchain. The blockchain has the characteristics of being a tamper-proof and untraceable instrument. Multiple nodes maintain it, so it can be used to deal with conflicts and provide a fair and credible credit investigation information sharing environment.

Interaction with regulatorsThere will inevitably be disputes in sharing credit investigation information, so the model includes a regulatory agency as the authority to deal with the conflicts and protect each participant's rights and interests.

Interaction between credit bureaus and information agentsThe credit bureaus need to obtain the user's authorization for the requested data first, and then the credit bureaus can request the credit information provider to obtain the corresponding data by relying on the authorized information signed by the information subject.

Interaction between information agents and cloud serverAfter receipt of a request and following the requirements for certain data formats, upload data encryption to cloud the server. To protect the rights and interests of credit information providers, credit information providers include uploading data, the request object, metadata, and other information to blockchain nodes to upload documents. The request records of user authorization and credit investigation agencies, as well as the data uploaded by credit information providers, are recorded on the blockchain. The blockchain has the characteristics of being imitable and traceable and is jointly maintained by multiple nodes. Therefore, it can serve as the basis for contradiction handling and provide a fair and credible environment for sharing credit information.

Interaction with regulatory authoritiesThere will inevitably be some disputes in the sharing of credit information, so the model includes the regulatory agency as the dispute settlement authority to protect each participant's rights and interests.

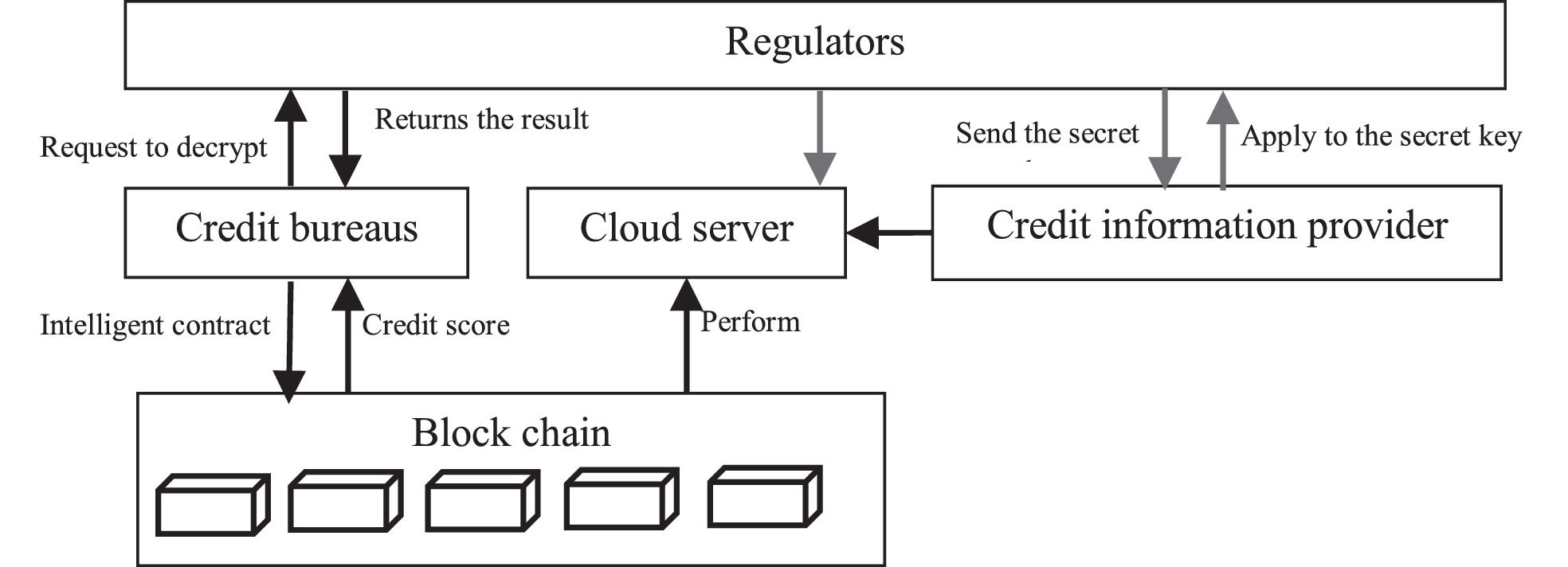

The enterprise credit information sharing model's basic framework based on blockchain technology is shown in Fig. 1.

According to each node's roles and functions in the model, the business as a consensus node is divided into enterprise audit and service alliances. Both members are generated by the enterprise credit ranking from high to low.

Blockchain information alliance

The Blockchain Information Alliance (BIA) is mainly responsible for verifying whether the credit information provider uploads valid transaction information. If the transaction is verified to be valid, it endorses the credit information provider's transaction. The specific working process of BIA is as follows:

Step 1: The credit information provider initiates the transaction, broadcasting to all BIA nodes.

Step 2: The BIA node verifies the transaction and endorses the transaction if the transaction format and summary information are correct; it broadcasts the endorsed transaction.

Step 3: A transaction is considered legal only if enough signatures endorse it.

Blockchain consensus alliance

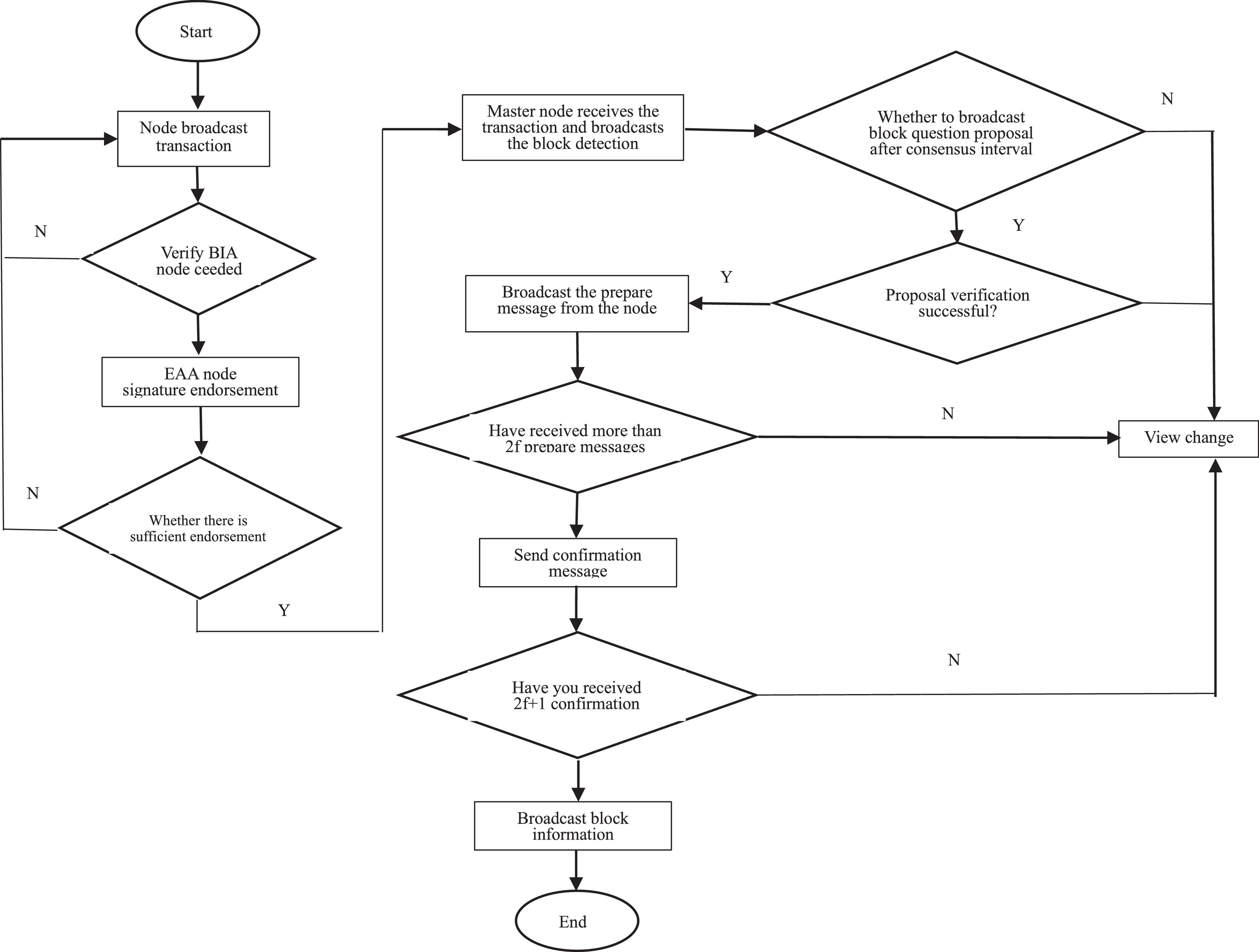

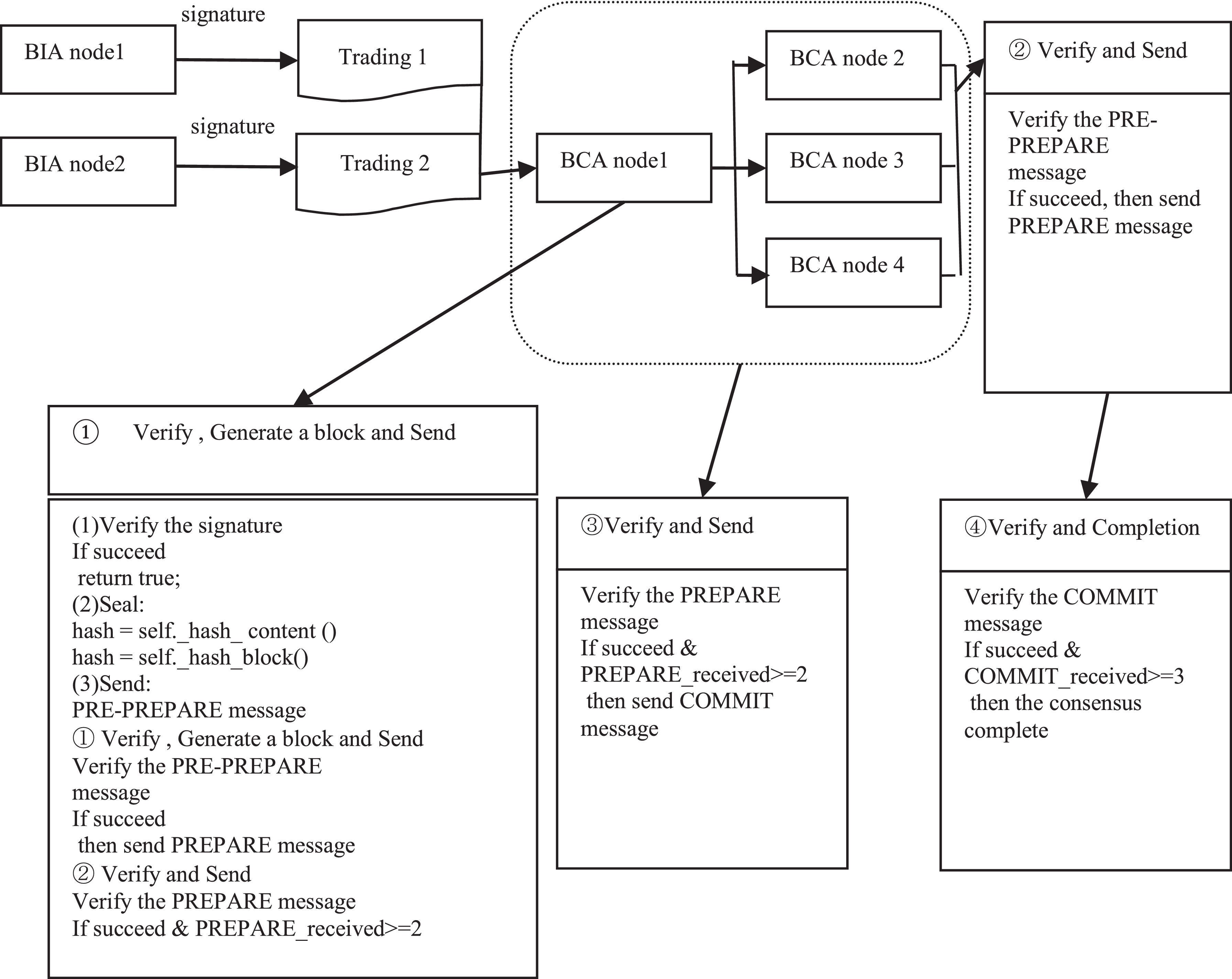

The Blockchain Consensus Alliance, or BCA, is responsible for reaching a consensus on the deal to form untamable credentials. The main process of the consensus mechanism is shown in Fig. 2. The specific working process of BCA is as follows:

Step 1: The master node in BCA sorts the collected legitimate transactions, packages the sorted transactions into blocks, and generates the block proposal.

Step 2: The primary node sends the preprepared message << PRE-PREPARE, v, n, d>, m> to the slave node, where v represents the view number, m is the block message, d is the summary of the request message, and n is the height of the new block.

Step 3: The preprepared message is verified from the slave node. In the verification passes, the prepared message will be broadcasted to other consensus nodes, where “i” represents the information from the slave node and receives the prepared message sent by other consensus nodes.

Step 4: If a node receives more than 2f prepare messages, v, n, d> sends a commit message to other consensus nodes.

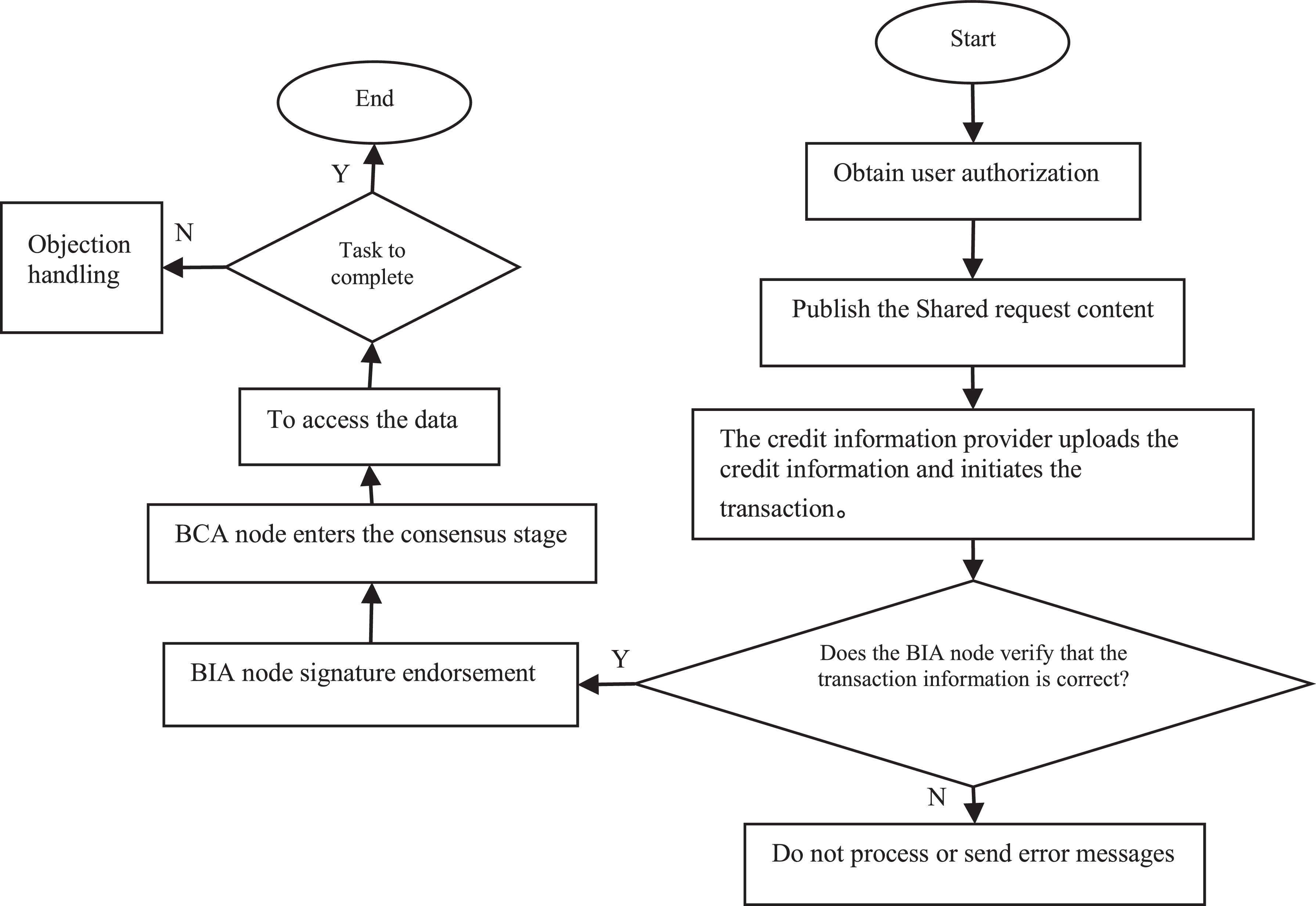

Step 5: When a node receives the confirmation message “2f + 1”, it indicates that the consensus node has reached an agreement on the proposal, records the new block in the proposal in the local blockchain ledger, and transmits the block to the entire node network. The ordinary node can receive the contents of the block and record it in its blockchain ledger. The entire workflow model is represented in Fig. 3.

After the transaction broadcast, the BIA node first verifies whether the data is uploaded completely and whether the data transaction format is correct. After the successful verification by the BIA node, the transaction will be signed and endorsed. The transaction will be considered legal only after a sufficient number of BIA nodes endorses the transaction. In the BCA node, the master node packages and verifies the legitimate transaction within a period of time and broadcasts it to the slave node in the form of a block, which enters the three-stage consensus stage. After completing the three stages, each node will add the block to its own blockchain ledger. Once the transaction appears on the blockchain, it indicates that the task requested by the exchange has been uploaded and completed. The credit investigation agency uses the key to access the shared data.

Consensus to achieve

I BIA transaction verification

In this model, six enterprises, respectively initiated six transactions after uploading their credit information. The BIA node first accepts the transaction, verifies the transaction structure and the accuracy of the uploaded information, signs the transaction after verification, encapsulates the transaction's data structure, and then broadcasts it to the master node in BCA. Fig. 4 shows the specific verification process of BIA nodes for transactions.

II ESA block generation and consensus reached

This model produces four blocks in three intervals, including the founding block that contains only original transaction information. For instance, Enterprise 1 uploads transactions to the second block; Enterprises 2 and 3 upload transactions to the third block; and Enterprises 4, 5, and 6 upload trading jointly to the fourth block. Fig. 5 shows the information for the entire blockchain query.

SCF credit reporting system with blockchainsThe following five aspects aim to effectively embed the blockchain technology into the SCF credit reporting system (see Fig. 6). Based on this proposed framework, we further discuss implications and make recommendations to take advantage of the blockchains to improve the performance of SCF credit reporting systems.

Privacy awareness is at an all-time high, companies see data as an asset, and some governments worry that sharing data could reveal state secrets. At present, the privacy protection method of credit investigation system is mainly based on access control, but the privacy protection based on this method is insufficient to protect the privacy of the enterprise, and the shared object can still get the original data of the enterprise. Therefore, it is an important direction of future research to study a credit information sharing scheme that can realize credit information sharing without revealing users’ real data.

This paper uses cryptography technology and emerging technologies to put forward the privacy protection reference box of the credit investigation system, as shown in Fig. 7. The framework is designed to obtain the corresponding calculation results of the data without disclosing users’ real data in the process of credit investigation data sharing. Under the framework of a typical scenario, an enterprise wants to get a loan, shares credit information with providers, applies to the regulator for homomorphic encryption keys, encryption keys are sent to the credit information provider, and relevant credit information data is uploaded to the cloud server after using secret key encryption. Blockchain technology is used to perform intelligent and payment operations such as contracts, agencies, or other research institutions. The intelligent contract can encrypt the data using the credit assessment algorithm to calculate a want credit score, but the process of credit bureaus and other users and cloud servers cannot get the credit information providers to upload the data of the original content. At the same time, when there is a dispute, the regulator can use the private key to resolve the conflict.

Build an open and shared credit frameworkSCF can build an open and shared credit framework with the advantages of decentralized, highly transparent, and reliable blockchains. It tracks stakeholders’ real-time credit movement in the SCF system from all aspects, levels, and angles.

In the framework of the embedded blockchains of SCF credit, both credit records managers (official credit reporting and unofficial credit departments) and credit record users (enterprises, financial institutions, the third-party organizations at all levels) all have the right to share the credit data and related supervision, maintenance, data security obligations. Each node in the blockchain keeps every enterprise's credit data in the transaction process, such as product delivery, financial transactions, and payment for goods, effectively preventing default occurrence.

Build a credit investigation platform for officials and civiliansThere are multiple levels of stakeholders within the SCF framework, especially for SMEs with weak contract spirit and unstable sustainable operations account for a large proportion, which leads to the spread of false information and the frequent occurrence of credit risks. Although the government-led official credit investigation platform is dominant, the credit investigation cannot access the whole SME field. The unofficial credit investigation platform can effectively make up for the deficiency of the official credit investigation platform.

Therefore, establishing a mixed credit investigation system coexisting with the public and private credit investigation systems is a significant breakthrough. To enhance the depth and breadth of credit investigation, we propose a framework that can fully release the energy of SCF's “blockchain + supervision” pattern.

The official credit investigation platform effectively guides the unofficial credit investigation platform to conduct reasonable credit investigation. The unofficial credit investigation platform actively supplements and assists the credit investigation record. At the same time, participants in the blockchain can timely read the credit data of various stakeholders in the SCF and provide real and useful credit information to the blockchain to truly realize an in-depth and accurate credit investigation. Therefore, blockchain technology is conducive to solving the problems that traditional credit reporting platforms cannot adapt, for instance, to improve the efficiency of modern SCF activities and reduce the high management cost due to weak sharing, insufficient openness, and low transparency.

Improved sense of responsibility of stakeholdersSCF stakeholders fall into three categories. First, core stakeholders, who are related to SCF's development and operation efficiency, are mainly financial business participants, especially core and upstream and downstream SMEs. Second, the secondary core stakeholders are primarily government departments, third-party enterprises directly providing services, financial institutions providing funds, and comprehensive risk management institutions. Finally, marginal stakeholders have little connection with SCF development's operational efficiency and usually focus on the public and the media.

SCF involves many stakeholders, and their trading activities are convoluted, so improving their sense of responsibility is imperative. Under blockchain technology, core stakeholders supervise each other in the transaction process and timely report credit violations. Subcore stakeholders, especially government departments, should guide various entities in regulating their operations. Marginal stakeholders should play their role in social supervision. In this way, the responsibility consciousness of relevant stakeholders in SCF is gradually enhanced. A potential formation of a monitoring platform for all-around stakeholders will then emerge, so SMEs’ financing availability and efficiency will increase through the prevention of risks.

Establishing a life cycle monitoring mechanismThe fragmentation of blockchain technology and the distributed accounting function make each node's credit data run in real-time and cooperatively trace the credit change track in the whole process. Therefore, SCF can establish a credit monitoring mechanism from the whole life cycle perspective, presupervision, in-process supervision, and postprocess, and standardize the credit transaction process.

Prior supervision establishes rules for trading financial activities in advance, including specified actions that conform to the regulations, identifies illegal actions that do not conform to the regulations and credit authentication procedures, and embeds the rules into the blockchain. Then, mandatory trading is carried out at the beginning of SCF trading activities according to the specified action. Therefore, the whole life cycle monitoring mechanism of presupervision, in-process monitoring, and postsanction seems to comprehensively reduce the probability of breach of trust in the SCF subjects’ trading activities to reasonably avoid losses.

Improving the red list and blacklistAs one of the core mechanisms in the social credit system's operation, the credit information sharing list improves through positive guidance (publishing the red list) and harmful warning (establishing the blacklist) for the SCG embedded in the blockchain technology. For instance, the Bank of China pays settlement management departments to play a leading role through the red list. Commercial banks actively establish and share positive and negative feedback credit lists. After that, the government management department verifies the record and feeds the timely input into the official credit reporting system, which notifies and effectively adapts the blockchain credit data system. Participants encourage attention to the credit record, acceptable practices, and payment promises, promoting credit sanctions and engagement against bad practices to improve the SCF atmosphere.

Based on the above measures, the SCF credit investigation system with blockchain technology aims to make up for the deficiency of traditional SCF. However, to effectively optimize the design of the SCF credit investigation system from the practical level, the following three problems need to be addressed. First, improving the credit standard system of SCF by unifying the blockchain standard and establishing a scientific and standardized internal connection mechanism should be accomplished. Second, the credit supervision model should be optimized and innovated to enhance the sense of identity between government departments and core stakeholders, reduce resistance as much as possible, and effectively promote blockchain in constructing credit reporting systems of SCF. Finally, the investment in training blockchain technical talents should be increased. The credit investigation system's improvement promotes emerging technologies based on long-term experiments and explorations of talents and technologies.

DiscussionThe current privacy protection method in the credit investigation system is mainly based on the access control method. However, the privacy protection based on this method is insufficient to protect enterprises’ privacy as the shared objects can still access the original data. Therefore, it is imperative to develop a credit information sharing scheme to realize credit information sharing without revealing users’ real data.

The most radical solution to protecting the privacy and security of users in a big data environment is to encrypt all data. This paper proposes to use blockchain technology as a reference frame for privacy protection in credit investigation systems. The framework design aims to obtain the corresponding calculation results of the data without revealing users’ real data in the process of credit data sharing.

Under this framework, a typical scenario is when an enterprise wants to get a loan, it will share the credit information with the credit information providers in the alliance. The enterprise will first apply for homomorphic encryption keys with the regulator, who will send the encryption key to the credit information provider. Then, relevant data will be uploaded by the credit information provider to the cloud server after using secret key encryption. Blockchain technology is used to perform intelligent operations with agencies or other institutions during these processes. An intelligent contract can encrypt the data using the credit assessment algorithm to calculate credit scores, but the credit bureaus and other users cannot get the credit information providers to upload the data of the original content. Thus, the privacy protection of the original data is realized. At the same time, when disputes occur, regulators can resolve conflicts by means of private keys.

In the above framework and scenario, the secure multiparty computing technology based on homomorphic encryption allows each participant to encrypt their input using the homomorphic encryption algorithm and upload it to the cloud server. The homomorphic ciphertext is calculated, and the results are returned, thus realizing the confidentiality of the data. The application of blockchain technology enhances third-party trust in the centralized system and creates conditions for the practical application of smart contracts. The application of smart contracts in this scheme can solve the following problems.

First, smart contracts ensure the consistency of credit evaluation results. The credit evaluation algorithm needs to be effective in credit scoring, and the credit scoring results are also verifiable. Smart contracts can be verified by multiple parties and obtain consistent credit evaluation results.

Second, smart contracts are verifiable and traceable. Smart contracts record all the operations and execution of shared data. Therefore, credit investigation agencies or users can only carry out the data operations stipulated in the contract, thus ensuring the credit information provider's control over the data. Smart contracts are immutable and traceable through blockchain technology to be used as an effective management basis.

Third, smart contacts uphold the principle of timeliness in credit investigation. When executing credit evaluation, smart contracts can automatically respond to the execution code and get the execution result once the contract conditions are triggered, so they meet the principle of high efficiency and timeliness of credit investigation.

Conclusion and prospectConclusionBlockchain technology can promote the construction and development of a new system-wide trust mode to facilitate SCF development. Specifically, through smart contracts in SCF, blockchain technology can intelligently and effectively unify the “four flows”—logistics, business, capital, and information flows. Existing studies in this area mainly focus on blockchain technology's feasibility in credit embedding of the SCF system. Very few studies have explored the implementation mechanisms from the perspective of the life cycle of SMEs and stakeholders. Our research addresses the gap by designing the SCF credit investigation system based on blockchains to potentially solve the dilemma supply chain enterprises face when they demand funds but lack credit, which bears important theoretical implications.

First, this paper proposes an enterprise credit information sharing model based on blockchain technology to support information sharing for the alliance members in a supply chain. The mutual supervision between members in our model enables reliable credit information sharing. Additionally, blockchain autonomy effectively reduces the management complexity, the risks of a centralized system's single-point failure, and the potential issues resulting from data-sharing such as ownership, use, and circulation path problems. The use of blockchain will lead to a shared, open, transparent, and traceable process with tech-oriented recognition.

Second, in terms of the credit information sharing schemes and domains, existing models either share data directly on the blockchain or cannot manage shared data under the chain. Moreover, many models’ consensus algorithms still require mining, causing a severe waste of resources. In this research, the model, combined with the credit information sharing environment, has significantly improved these issues.

Finally, our model adopts the RPBFT consensus mechanism for developing a positive credit information sharing environment to solve potential issues in the exchange of business credit information. We further improve the mechanism through the design of EAA (Enterprise Audit Alliance) and ESA (Enterprise Service Alliance) to reduce the traffic caused by the number of nodes and improve the consensus's efficiency. According to the consensus mechanism, the node in the form of a “block” is recorded in the blockchain ledger, ensuring that the certificate is tamper-proof. In addition to the model's roles, framework, and flow, the model design includes a node, a consensus mechanism, and a data structure design.

This study also offers practical value to the stakeholders in SCF. Our model based on blockchain technology helps improve the performance of credit investigation systems by enhancing decentralization and strengthening trustworthy transactions. The proposed credit sharing design and a data management component within the supply chain support the structural and strategic opportunities that are identified and addressed. Similarly, our research offers critical solutions to address the main issues identified, such as data security, data privacy, and network transmission concerns. This proposed framework should improve the SCF information and credit sharing entities and process capabilities that help generate competitive advantages.

There are also limitations in this study that open up potential opportunities for future research. First, the proposed framework and model are based on a conceptual level and have not yet been tested and validated. Future research needs to utilize the technological infrastructure to verify the model's performance and compare it with other existing systems and mechanisms. Additionally, the suggested model's governance structure and management issues are not explicitly explored in the current study. Future research can extend this study to continue the exploration of regulations, policies, and guidelines to support the proposed framework.

ProspectBlockchain technology is gradually gaining popularity. Blockchain technology introduces technical features such as consensus mechanism and decentralization into digital infrastructure, including hardware, structural, application, and presentation layers. It can affect all aspects of the financial sector. However, the current research results are still primarily focused on topics related to technology and business inquiry and cannot solve more political or judicial issues such as credit investigation. In recent years, the financial system has also begun to tap the transformative potential of blockchain technology in its own field. The technical features, design details, application cases, and value distribution of blockchain itself provide expanded space for interdisciplinary research in finance, which is not confined to a specific discipline.

Regarding design and function, relevant concepts and theories from computer science, law, and psychology can provide references for these research efforts. In the future, cryptography and other computer subdisciplines will also become crucial in the blockchain system. When smart contracts involve collecting and exchanging credit investigation data, decision makers also need to use legal expertise when designing solutions to ensure the legality of contracts. Adding value to society and reducing application costs are the main drivers of the spread of blockchain technology. To promote the spread of blockchain technology, relevant research needs to investigate customers’ perceived costs and benefits. With the development of technology and the feasibility of more applications, theories related to group decision-making in psychology (such as group thinking or group polarization) can provide theoretical support for decision-making. Interdisciplinary collaboration offers great potential for future innovative research to improve public understanding of blockchain technology, business processes, and application value.

This study is supported by the following research funds: 1. Ningbo Soft Science Project in 2022, 2021R028; 2. Zhejiang Soft Science Research Plan of 2021, 2021C35029; 3. Zhejiang Wanli University College of Logistics and E-commerce Teaching reform, An innovative Research on the Teaching mode of interdisciplinary Integration based on DEA Method – Take Logistics Finance as an example.