Entrepreneurs' innovativeness is an important factor affecting the performance of start-up companies. Based on social cognitive theory, this study analyzes the relationship between female entrepreneurs' innovativeness and entrepreneurial performance at a more localized level using a sample of 558 Chinese female entrepreneurs. The mediating variables are opportunity recognition and development and psychological capital; the moderating variable is gender stereotypes. The results reveal three important findings. First, female entrepreneurs' innovativeness was significantly and positively related to entrepreneurial performance. Second, opportunity recognition and development and psychological capital had significant mediating effects between female entrepreneurs' innovativeness and entrepreneurial performance. Finally, gender stereotypes had a negative moderating effect on female opportunity recognition and development. The study results provide a theoretical and practical reference for how women in entrepreneurial practice can improve their firm's performance and provide insights into female entrepreneurship theory research.

The COVID-19 pandemic disrupted and displaced companies, individuals, and markets (López-Cabarcos, Ribeiro-Soriano, & Piñeiro-Chousa, 2020). According to the Global Entrepreneurship Monitor (GEM) report (Global Entrepreneurship Research Association, 2021), this has contributed to a higher rate of business failure, and most men and women attributed it to fallout of the COVID-19 epidemic. However, it is concerning that the rate of female entrepreneurs closing their businesses in 2020 due to COVID-19 was 6.4% higher than that of men. Even under normal circumstances, it is a very serious challenge for female entrepreneurs to maintain a high business performance level (Vossenberg, 2013). Moreover, the failure rate of start-ups is higher in developing economies when compared to developed countries (Anwar, Clauss, & Issah, 2021). In the world's largest developing economy, Chinese firms have a 67% failure rate in their first year, compared to 85% in the first 10 years (Parnell, Long, & Lester, 2015). The issue of firm survival and performance has attracted significant research attention (Anwar & Ali, 2018; Guo, Cai, & Fei, 2019). Kungwansupaphan and Leihaothabam (2019) noted there is a lack of understanding and research on gender-related entrepreneurship issues in developing economies, especially women's entrepreneurial performance. Therefore, it is necessary to explore the key factors that influence the entrepreneurial performance of female entrepreneurs.

Innovativeness is one dimension of entrepreneurial orientation (EO), which reflects a firm's tendency to engage in and support new ideas in creative processes (Lumpkin & Dess, 1996), which leads to more business opportunities and thus easier profitability and improved entrepreneurial performance. Previous research explores the factors influencing entrepreneurial performance. For example, Lumpkin and Dess (2001) investigated how the two dimensions of entrepreneurially oriented initiative and competitive aggressiveness are related to entrepreneurial performance. Hughes and Morgan (2007) examined the impact of individual dimensions of EO at the organizational level in the context of high-tech industries. Kreiser, Marino, Kuratko, and Weaver (2013) showed that each EO dimension may display a non-linear relationship with firm performance. However, there is little research on whether the single dimension of entrepreneurial orientation has a unique role in driving entrepreneurial performance (Putniņš & Sauka, 2019), especially innovativeness. Simultaneously, previous research on EO focuses on the organizational level but overlooks the individual level (Gartner, 1985). Therefore, in contrast to previous studies, this study emphasizes the application of EO at the individual level, while examining the complex mechanisms by which entrepreneurs' innovativeness affects entrepreneurial performance. This addresses an important gap in the existing literature.

Furthermore, Gundry, Kickul, Iakovleva, and Carsrud (2014) found that the psychological capital of female entrepreneurs significantly impacts the firm's subsequent innovativeness and sustainability. Vaghely and Julien (2010) suggest that innovativeness is closely related to opportunity recognition and development, and that innovativeness is a cognitive attribute necessary to assess opportunities. Social cognitive theory suggests that behavior varies with two factors, namely, the person and the environment (Bandura, 1991) and that women face barriers in the socio-cultural environment when pursuing entrepreneurial careers (Bullough, Renko, & Abdelzaher, 2014). This can lead to lower female entrepreneurship rates and entrepreneurial performance compared with men (Santos, Roomi, & Liñán, 2016). Gender stereotypes are generally considered the most important environmental factor affecting female entrepreneurial failure (Liñán, Jaén, & Martín, 2020). This is especially true in China, which emphasizes an underlying patriarchal logic of male superiority over women (Peng, Hou, KhosraviNik, & Zhang, 2021).

Thus, this study explores the unique action mechanism between innovativeness and entrepreneurial performance based on a moderated two-mediator model using opportunity recognition and development and psychological capital as mediating variables, and gender stereotypes as the moderating variable. This study examines the mechanisms by which the innovativeness of Chinese female entrepreneurs affects entrepreneurial performance, and thereby fills existing research gaps.

This paper attempts to answer the following questions.

RQ1. Does female entrepreneurs’ innovativeness directly affect entrepreneurial performance?

RQ2. Through what mechanisms does female entrepreneurs’ innovativeness affect entrepreneurial performance? More specifically, what are the mediators of innovativeness’ effect on entrepreneurial performance?

RQ3. Do gender stereotypes moderate female entrepreneurs’ entrepreneurial performance?

Literature review and research hypothesesInnovativeness and entrepreneurial performanceInnovativeness refers to how entrepreneurs support change and thus provide firms with a competitive advantage (Kreiser, Marino, Dickson, & Weaver, 2010), including support for new products, services, and technology development (Fan, Qalati, Khan, Shah, Ramzan, & Khan, 2021). Innovativeness can promote activity development that change social and economic structures (Piñeiro-Chousa, López-Cabarcos, Romero-Castro, & Pérez-Pico, 2020). On the one hand, the innovativeness of entrepreneurs enables firms to continuously introduce new products and services, and they can adapt to market needs, allowing firms to enter markets quickly (Covin & Wales, 2019). In turbulent markets, innovative products or services can help SMEs (small and medium enterprises) improve performance (Rhee, Park, & Lee, 2010).

On the other hand, entrepreneurs' innovativeness can facilitate new technology development (Linton, 2019), and firms can create products or services with higher profit potential (Rauch, Wiklund, Lumpkin, & Frese, 2009) and gain a larger market share, thus enhancing entrepreneurial performance (Parida, Pesämaa, Wincent, & Westerberg, 2017).

On this basis, Nair (2020) argues for the positive effect of innovativeness on female entrepreneurs’ success. Gundry et al. (2014) find that female entrepreneurs' innovativeness increases the firm's market value, and strongly influences the sustainability of firm development. Therefore, we hypothesize that:

H1: Female entrepreneurs' innovativeness positively affects entrepreneurial performance.

Mediating role of opportunity recognition and developmentOpportunity recognition and development represent entrepreneurs’ ability to recognize opportunities to meet market demands by creatively combining resources and leveraging them to generate higher profits for the firm (Ardichvili, Cardozo, & Ray, 2003). Opportunity recognition and development are important predictors of SME's success and sustainability in emerging economies (Guo, Tang, Su, & Katz, 2017).

In SMEs, business owners and managers play a greater role than employees (Anwar, Clauss, & Issah, 2021). This is because entrepreneurs’ actions can broadly impact the products and services offered and even regional socioeconomic development (Valliere, 2013). Entrepreneurs' innovativeness helps firms seize and develop new opportunities by offering new products or services in the current market (Berry, Bolton, Bridges, Meyer, Parasuraman, & Seiders, 2010). At the same time, entrepreneurs’ ability to identify and develop new opportunities can significantly improve entrepreneurial performance (Wasdani & Mathew, 2014). Thus, entrepreneurs' innovativeness can, to some extent, enhance entrepreneurs’ ability to identify and develop opportunities. This helps the entrepreneur focus more on market and customer needs and solve problems to bolster company success (Shrader & Hills, 2003). Therefore, this study argues that female entrepreneurs' innovativeness enhances their ability to recognize and develop opportunities, which in turn positively affects entrepreneurial performance. Therefore, we hypothesize that:

H2: There is a mediating role of opportunity recognition and development between female entrepreneurs' innovativeness and entrepreneurial performance.

The mediating role of psychological capitalPsychological capital refers to an individual's self-efficacy during growth and development (Luthans, Youssef, & Avolio, 2006) and is a positive psychological state characterized by hope, self-efficacy, resilience, and optimism (Avey, Luthans, & Youssef, 2010). Le and Lei (2018) argue that psychological capital “is an intangible and valuable asset of a company” that contributes to the efficiency and success of an organization

Innovativeness is a major source of individual self-efficacy (Bacq & Alt, 2018), and increased self-efficacy facilitates increased psychological capital levels (Douglas & Prentice, 2019). Luthans and Youssef (2004) suggest that the most effective way to develop an individual's psychological capital is to allow them to experience success. The actual performance achieved by the firm increases entrepreneurial confidence, resulting in a high psychological capital level (Luthans & Youssef, 2004). Furthermore, their innovativeness is usually considered a positive driver of entrepreneurial performance (Putniņš & Sauka, 2019). Therefore, female entrepreneurs' innovativeness has an important impact on the psychological capital level.

Psychological capital applies positively oriented human resource strengths and psychological competencies to achieve valuable and sustainable results and to develop competitive advantages that improve job performance (Luthans & Youssef, 2004). Envick (2005) claimed that those responsible for managing a business must demonstrate high psychological capital levels to ensure entrepreneurial success. According to the conservation of resources theory, individuals strive to acquire, retain, protect, and nurture the resources they value and tend to avoid resource loss (Lee & Ok, 2014). Psychological capital is a positive psychological resource and people are motivated to work actively to protect it (Luthans et al., 2006), which can improve entrepreneurial performance. Also, a study by Huang, Zhang, Wang, Li, and Li (2022) concludes that psychological capital is a core element that influences female entrepreneurship. Therefore, we hypothesize that:

H3: Psychological capital plays a mediating role between innovativeness and entrepreneurial performance in female entrepreneurs.

Moderating effect of gender stereotypesGender stereotypes are socially shared perceptions of typical characteristics of women and men that can influence people's career evaluations (Broverman, Vogel, Broverman, Clarkson, & Rosenkrantz, 1972). Gender stereotypes contain information about beliefs and norms that distinguish men from women (Gupta, Turban, & Pareek, 2013), and social stereotypes that describe men and women differ (Wood & Eagly, 2002).

Entrepreneurial characteristics are generally considered masculine (Schein, 2001). As a result, women are subjected to more inherent barriers to entrepreneurship. It has been shown that gender stereotypes are the main reason that women have lower levels of knowledge and skills required for entrepreneurship (Liñán et al., 2020); therefore, female entrepreneurs may have less access to capital and face more risks, undermining their ability to identify and exploit new market opportunities (Liñán et al., 2020).

At the same time, under the influence of gender stereotypes, society and culture discriminate against women (Liñán et al., 2020), which can create psychological barriers that prevent women entrepreneurs from reaching their full potential (Martiarena, 2020). This makes it more difficult to be innovative. According to stereotype threat theory (Steele, 1997), when gender stereotypes impede the behavior of negatively stereotyped social groups – that is, women – they develop greater stress and anxiety, which can reduce their self-efficacy, thereby weakening their psychological capital. Hence, gender stereotypes negatively impact women's pursuit of entrepreneurial career paths. Therefore, we hypothesize that:

H4a: Gender stereotypes negatively moderate the role between innovativeness and opportunity recognition and development among female entrepreneurs.

H4b: Gender stereotypes play a negative moderating role between innovativeness and psychological capital in female entrepreneurs.

The theoretical model of this study is shown in Fig. 1.

MethodsSampleThis research employed a questionnaire survey among female entrepreneurs (business founders or co-founders) in four regions, including the National Bureau of Statistics' division of China's economic regions (East, Central, West, Northeast), to test the research conceptual model. And due to the impact of COVID-19, we carried out questionnaire research by combining online and offline methods.

Data were collected between May and December 2021, and to seek reliable information, the questionnaire explicitly guarantees confidentiality. A total of 600 questionnaires were distributed and 580 valid questionnaires were returned, with a return rate of 96.67%, through a “snowball” approach introduced by local women entrepreneurs' associations, women's entrepreneurial organizations, and respondents. The criteria for rejecting 12 sets of invalid questionnaires were: (1) the specified options were not selected; (2) for more than 90% of the questions, the participant chose the same answer, and (3) more than 1/3 of the questions were not answered. Please refer to Appendix 1 for the specific sample information.

MeasuresInnovativeness. Since few scholars have studied the individual-level innovativeness of female entrepreneurs, based on Lumpkin and Dess's (1996) work on the connotations of innovativeness, we drew on the work of Anwar et al. (2021) and Dai, Maksimov, Gilbert, and Fernhaber (2014) on the measurement of organization-level innovativeness and set the individual-level innovativeness questions to include three items, such as: “I can quickly come up with many creative ideas.” The Cronbach's alpha coefficient was 0.818.

Opportunity Recognition and Development. Based on Ardichvili et al. (2003) concepts, this study categorized entrepreneurial opportunity recognition and opportunity development as opportunity recognition and development. The scale developed by Asante and Affum-Osei (2019) was used for entrepreneurial opportunity recognition; the scale developed by Chen and Liu (2020) was used for entrepreneurial opportunity development, including six questions such as, “I can accurately predict market prospects.” Cronbach's α coefficient was 0.897.

Psychological Capital. Based on Luthans, Luthans, and Luthans's (2004) elaboration on the connotations and dimensions of positive psychological capital, we drew on Mao, He, Morrison, and Andres Coca-Stefaniak's (2020) measurement scale, which includes four question items, such as: “I think I can achieve success.” Cronbach's α coefficient was 0.893.

Gender Stereotypes. Based on Gupta et al. (2013) work on the connotations of gender stereotypes, we adapted the GEM measurement scale, including three items, for example, “Because I am female, people think I am less competent.” Cronbach's α coefficient was 0.869.

Entrepreneurial Performance. Entrepreneurial performance was measured using objective measures (Gao, Ge, Lang, & Xu, 2018), including four indicators such as market share and sales growth rate. Cronbach's α coefficient was 0.807.

Control Variables. Previous studies have shown that demographic variables and enterprise development stage variables affect female entrepreneur performance. Thus, according to previous studies, age, education level, marital status fertility status, and enterprise development stage were set as control variables.

Statistical approachSPSS v.22 and Amos v.24 were used for statistical analysis. First, the reliability of each variable was tested by confirmatory factor analysis. Second, a two-step structural equation modeling procedure was used to first evaluate the measurement model and then compare the fit of the baseline model with the alternative model through structural equation modeling to determine the optimal model for this study (Anderson & Gerbing, 1988). Finally, the Bootstrap method of bias correction was used to test for mediating effects and mediating effects with moderation.

ResultsCommon method bias testTo control for common method bias, this paper adopted Harman, 1960 single-factor test and found that the first principal component extracted by factor analysis explained only 17.89% of the variance, which was below the 50% threshold suggested by Hair (1972). Additionally, we compared the proposed model with one that loaded all variables onto a single factor (Podsakoff, MacKenzie, Lee, & Podsakoff, 2003), and the results showed that, compared with the baseline model (Table 1), the fit indices of the single factor (χ2/df = 17.807, RMSEA = 0.174, GFI = 0.606, AGFI = 0.513, CFI = 0.537, IFI = 0.539, TLI = 0.483) were not satisfactory. This indicated that the majority variation cannot be explained by a single factor, and therefore, the common method variance in this study is not severe.

Fitting comparison of different factor models.

Note: n = 558; Model A: a four-factor model combining psychological capital, opportunity recognition, and development as potential factors; Model B: a four-factor model combining gender stereotypes and entrepreneurial performance as potential factors; Model C: a three-factor model combining psychological capital, opportunity recognition and development, gender stereotypes, and entrepreneurial performance as potential factors; Model D: a two-factor model combining psychological capital, opportunity recognition and development, gender stereotypes, and entrepreneurial performance as potential factors in a two-factor model; and Model E: combines all the variables into one potential factor.

Before conducting hypothesis testing, the scales’ reliability and validity were tested. First, the confirmatory factor analysis (CFA) results showed that all standardized factor loadings – path coefficients of latent and observed variables – were in the range of 0.555–0.927 and were significant (p < 0.001), indicating that the measurement terms had a good relationship with the factors and the validity was good. Then, to evaluate the indicators’ internal consistency, we estimated the composite reliability (CR) and average variance extracted (AVE) values of each potential variable. All variables had CR values ranging from 0.818 to 0.898, which were above 0.6, and AVE values ranging from 0.536 to 0.703, which were greater than 0.5 and met the requirements (Fornell & Larcker, 1981).

Second, by comparing and analyzing the five-factor baseline model (Innovativeness, Opportunity Recognition and Development, Psychological Capital, Gender Stereotypes, and Entrepreneurial Performance), and four-factor, three-factor, and one-factor alternative models, Table 1 demonstrates the fit of all models; the five-factor model fit better (χ2 = 437.87, df = 160, p < 0.00, χ2/df = 2.608, RMSEA = 0.054, TLI = 0.951, CFI = 0.958, SRMR = 0.0383) and outperformed the other competing models.

Additionally, the mean-variance extraction method was used to assess the convergent validity of each latent variable, and the results are shown in Table 2. The correlation coefficients of each variable were less than the square root of the corresponding AVE, which meant that the latent variables were correlated and differentiated from each other, thus, the discriminant validity of the scale data was ideal.

Matrix of variable means, standard deviations and correlation coefficients.

Note: ORD, Opportunity Recognition and Development; PC, Psychological Capital; GS, Gender Stereotypes; EP, Entrepreneurial Performance.

N = 558; M=Mean; SD= Standard Deviation;⁎⁎p < 0.01;*p < 0.05 (Two-tailed test).

Bold numbers are the square root of the AVE of each construct. Off diagonals are Pearson correlation of constructs.

The means, standard deviations, and correlation coefficients of variables for all participants are shown in Table 2. Innovativeness was significantly and positively correlated with opportunity recognition and development (r = 0.618, p < 0.01), psychological capital (r = 0.531, p < 0.01), entrepreneurial performance (r = 0.331, p < 0.01); entrepreneurial performance and opportunity recognition and development (r =0.389, p < 0.01) and psychological capital (r = 0.281, p < 0.01) were significantly positively correlated; opportunity recognition and development and psychological capital (r = 0.461, p < 0.01) were significantly positively correlated; and gender stereotypes and psychological capital (r = 0.085, p < 0.05) were significantly positively correlated. This correlation analysis was consistent with our theoretical expectations and provided preliminary support for our hypotheses.

Hypothesis testing analysisTable 3 summarizes the estimated coefficients in the mediated and moderated mediator models. We found a significant positive effect of innovativeness (Model 1a: β = 0.110, p < 0.05) on entrepreneurial performance, with H1 holding. Opportunity recognition and development (Model 1a: β = 0.249, p < 0.001), and psychological capital (Model 1a: β = 0.112, p < 0.05) also had a significant positive effect on entrepreneurial performance. The positive predictive effect of innovativeness on opportunity recognition and development was significant (Model 1b: β = 0.631, p < 0.001); the positive predictive effect of innovativeness on psychological capital was significant (Model 1c: β = 0.470, p < 0.001), and these results tentatively supported the hypothesis of mediating effects.

Results of the hypothesized moderating mediating effects (coefficients and standard errors).

Notes: N = 558;

***p < 0.001

**p < 0.01

*p < 0.05 (two-tailed test); gender stereotypes and opportunity recognition and development all centralized; non-standardized coefficients shown.

Further, based on the study of Pai, Lai, Chiu, and Yang (2015), we further confirmed the mediating effect by running the Preacher-Hayes bootstrapping script to test for indirect effects. The results showed that innovativeness had a significant positive effect on entrepreneurial performance through opportunity recognition and development (Indirect Effect = 0.237, 95% CI = [0.154, 0.322]), and H2 was supported. Moreover, there was a significant indirect effect of innovativeness through psychological capital on entrepreneurial performance (Indirect Effect = 0.079, 95% CI = [0.013, 0.144]), and H3 was supported.

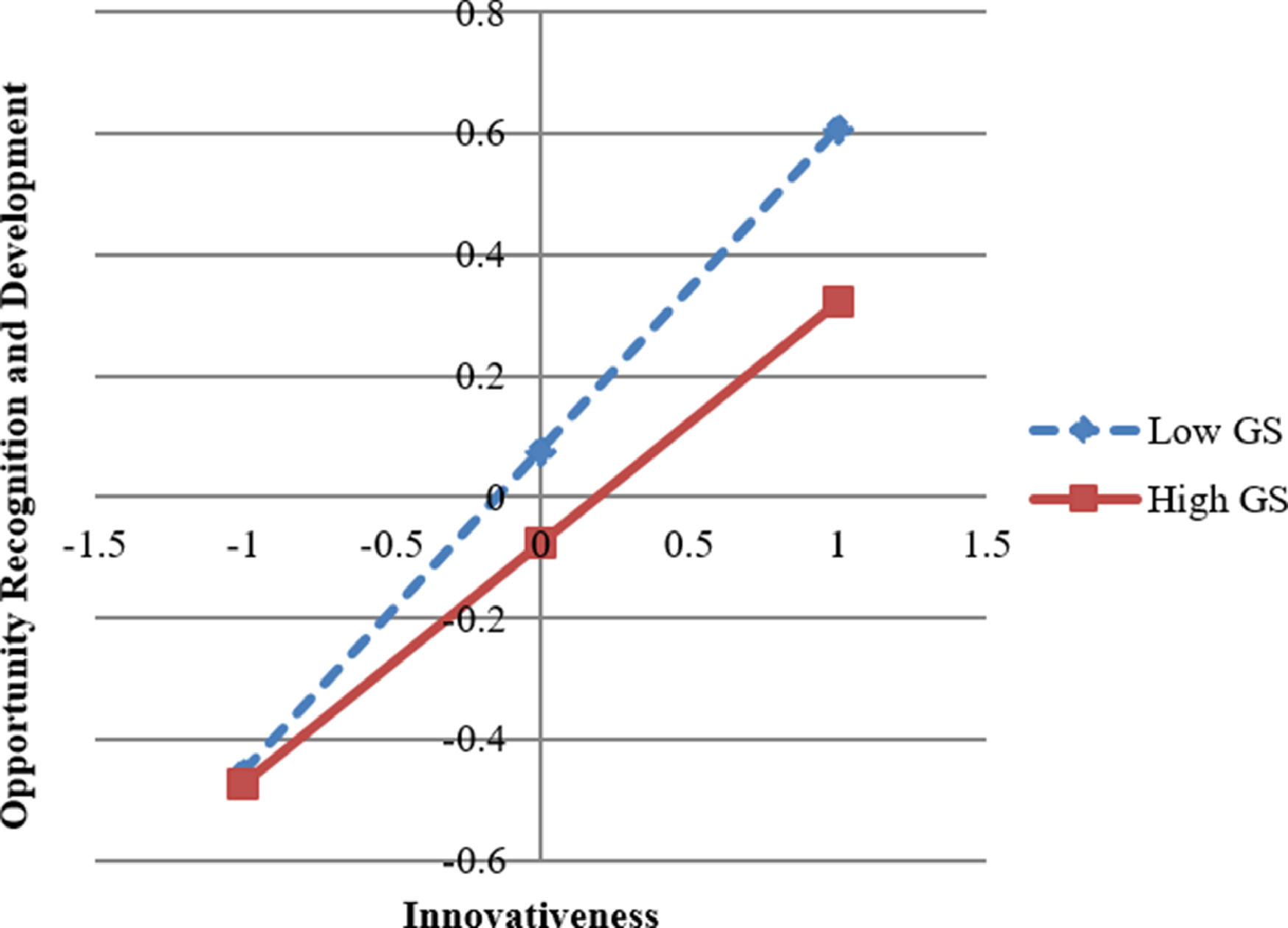

To test hypotheses H4a and H4b, we introduced gender stereotypes as moderators in the mediation model to predict opportunity recognition and development and psychological capital. Before testing the moderating variables, interaction terms were calculated after centering the independent and moderating variables to avoid multicollinearity. As seen in Table 3, the interaction term of innovativeness and gender stereotypes had a significant negative effect on opportunity recognition and development (β = -0.099, p < 0.01), but the interaction term of innovativeness and gender stereotypes did not significantly affect psychological capital. For interpretation ease, a simple slope analysis of the interaction effect (Ma, Lin, Chen, & Wei, 2020), with one standard deviation above or below the mean (Dawson & Richter, 2006), depicts the difference in innovativeness’ impact on opportunity recognition and development at different gender stereotype levels. As seen in Fig. 2, when the gender stereotype level was low (β = 0.532, p < 0.001), the positive effects of innovativeness and opportunity recognition and development were stronger than at the high gender stereotype level (β = 0.398, p < 0.001). Therefore, H4a was supported and H4b was rejected.

Furthermore, we examined the extent to which the mediating effect of opportunity recognition and development was influenced by gender stereotypes (see Table 4). To test this mediated model with moderation, we used the approach of Goel, Parayitam, Sharma, Rana, and Dwivedi (2022), to test for differences in conditional indirect effects at low and high moderator levels. As expected, when the gender stereotype level was low (-1SD) (β = 0.133, p < 0.001), the positive effect of innovativeness on opportunity recognition and development on entrepreneurial performance was stronger than at the high gender stereotype level (+1SD) (β = 0.01, p < 0.001).

Results of the analysis of mediating effects and mediating effects with moderation.

This study examines the non-linear effect of a single dimension of innovativeness on entrepreneurial performance in response to Nair (2020), which shows that female entrepreneurs' innovativeness contributes to firm performance. Our study revealed that female entrepreneurs’ innovativeness is an important factor influencing their opportunity recognition and development, and psychological capital, which was consistent with Putniņš and Sauka's (2019) finding that innovativeness positively drives entrepreneurial performance and that innovative entrepreneurs are more likely to identify opportunities and have higher psychological capital levels, thus improving business performance for sustainable business growth. Moreover, our findings suggested that female entrepreneurs’ innovativeness enhanced female opportunity recognition and development, which was consistent with the study by Vaghely and Julien (2010). Luthans, Avey, Avolio, and Peterson's (2010) research showed that psychological capital affects entrepreneurial performance, and our study suggested that this was equally applicable in the context of female entrepreneurship. Furthermore, our study showed that gender stereotypes had a negative moderating effect on women's ability to recognize and develop opportunities, which validated the findings of Gupta, Goktan, and Gunay (2014). However, it is worth noting that gender stereotypes did not significantly affect women's psychological capital levels and did not moderate the mediating effect of psychological capital between innovativeness and entrepreneurial performance, which was contrary to previous studies, which usually considered gender stereotypes as the main barrier to women's entrepreneurship levels (Martiarena, 2020). This suggested, to some extent, that with the development of contemporary social awareness and the increase in women's education levels, women's gender awareness is gradually increasing. And therefore, the influence of gender stereotypes on psychological capital is decreasing (Bhatia, & Bhatia, 2020). This should inspire future researchers as well as policy-makers to investigate what factors moderate the mediating effect of psychological capital between female entrepreneurs' innovativeness and entrepreneurial performance.

Theoretical contributionsThis study provided three theoretical contributions to the field. First, this study constructed a theoretical framework of innovativeness and entrepreneurial performance from the female entrepreneur's perspective. It also examines the impact of individual-level innovativeness on entrepreneurial performance from this perspective, enriching social cognitive theory in the female entrepreneurship field. Second, the in-depth study of innovativeness further improved entrepreneurship theory. The in-depth study of the sub-dimensions can inform theory by uncovering nuances of the sub-dimensions (Linton, 2019). This study empirically examined the direct and indirect roles of innovativeness, opportunity recognition and development, and psychological capital in promoting entrepreneurial performance. It also provided a more detailed theoretical framework for future entrepreneurship research and expanding entrepreneurship theory. Finally, when mentioning female entrepreneurship, it is not difficult to think of the impact of gender stereotypes. Through the statistical analysis of China's entrepreneurial data, this study was complementary and added to the current research on gender stereotypes in entrepreneurship studies. Our findings suggested that female entrepreneurial performance was indeed influenced by gender stereotypes, further expanding female entrepreneurship theory.

Managerial implicationsThis study had important practical implications for women's entrepreneurial practices. First, it found female entrepreneurs' innovativeness was an important influencing factor for women to improve their ability to recognize and develop opportunities and improve their psychological capital level. Therefore, female entrepreneurs should pay more attention to personal innovativeness. This includes actively using search functions and understanding market trends, improving the focus on research and development (R&D) activities, and launching new products (Parida et al., 2017). Second, female entrepreneurs should focus on enhancing psychological capital levels, which will reduce the effects of gender stereotypes and increase their likelihood of developing enterprises. Finally, to address the negative impact of gender stereotypes on entrepreneurial performance, we propose the following recommendations. Above all, society at large should focus on eliminating gender discrimination in entrepreneurship and establish a social and cultural concept of gender equality. This is fundamental to achieving equal entrepreneurship between men and women. Secondly, female entrepreneurs should focus on improving gender awareness and take active measures to improve psychological capital. Finally, fiscal and tax policies can help companies stimulate more active and substantial innovation activities (Huang, Li, Xiang, Bu, & Guo, 2022). When formulating policies, the government should pay attention to the real financial and tax problems faced by female entrepreneurs and provide policy support for them.

Limitations and future researchThis study had certain limitations that need to be addressed in future research. First, the data in this study were collected only from China. Future research could be expanded to multiple countries to further test our findings while providing more general insights into female entrepreneurs' innovativeness. Second, this study used cross-sectional data and lacked a longitudinal follow-up with the sample. Future longitudinal studies could examine the dynamic process by which female entrepreneurs’ innovativeness affects entrepreneurial performance. Third, in addition to economic level and gender differences, the socio-cultural environment may vary significantly across countries. This study was conducted in the context of the traditional Confucian culture in China, and the moderating effect of gender stereotypes may differ across countries with different cultural backgrounds.

ConclusionIn this paper, we studied the complex mechanism of the relationship between innovativeness and entrepreneurial performance of female entrepreneurs in China. Based on the survey data from 558 Chinese women entrepreneurs, the empirical results supported the theoretical study hypotheses concerning female entrepreneurs and entrepreneurial performance, their innovativeness, opportunity recognition and development, and psychological capital levels. At the same time, the study of gender stereotypes toward women recognized that these trends contribute to a negative regulatory role. This study contributes to improving female entrepreneurship performance through entrepreneurial innovativeness development and the growth of female entrepreneurship in practice.

Ping Li and Jing Wang as co-first authors. The phased results of the Key Project of the National Social Science Fund, “Research on Barriers and Policy Support Mechanisms for Female Entrepreneurship in the Digital Era” (20ASH012).