As a new enterprise development model, digitization is of great significance to the development of economy and society. Using the data of relevant listed companies from 2012 to 2020, the panel measurement model is used to investigate the relationship between digital transformation and enterprise performance to further reveal the internal law of whether digital transformation helps to stimulate innovation momentum. The results show that digital transformation has greatly improved the performance of enterprises, and it can stimulate the momentum of enterprise innovation. Reducing costs, increasing revenue, improving efficiency, and encouraging innovation are the main paths for digital transformation to enable the development of enterprises, among which the policy effect of enterprise innovation is the most significant. This research is of great significance to improve the user demand orientation of enterprise innovation and research and development, as well as to realize the high-quality innovation and development of enterprises.

Since the 19th Chinese Communist Party National Congress, the development of digital economy has been highly valued. The party's Central Committee regards it as an important component of supply-side structural reform, high-quality economic development, and the transformation of kinetic energy. Consequently, it provides macro-guidance and technical support for the transformation and upgrading of Chinese enterprises (Li, 2017). The development of the digital economy has a long history. As early as the 2008 financial crisis, the digital economy has been brewing and developing. Especially in recent years, the digital economy has become the central driving force of high-quality economic development supported by relevant information technology (Wang, 2018). In 2016, the digital economic growth rates of the United States, Japan, and the United Kingdom reached 6.8%, 5.5%, and 5.4%, respectively, which were much higher than the gross domestic product (GDP) growth rates of the same year. With the continuous promotion of the digitization of China's traditional industries, the digital transformation of traditional industries is also developing steadily, and the digital economy presents a prosperous development trend. From 2005 to 2018, the overall development scale of digital economy in China increased from 1.29 trillion yuan to 31.3 trillion yuan, and the proportion of GDP in the integration part of digital economy increased from 7% to 34.8%. By 2018, the number of employed people brought about by digital economy integration had reached 191 million.1

With the development of the digital economy, an increasing number of enterprises have responded to the trend and have been able to experience digital transformation with the help of emerging technologies. According to the China Digital Construction and Development Report (2019) released by the China National Internet Information Office, the total amount of China's digital economy was 31.3 trillion yuan in 2018, representing 34.8% of the proportion of the GDP. By sorting out the disclosure announcements of listed companies from Wind, we found that more than 600 main board enterprises in China had kindly verify implemented digital transformation. The average annual growth rate of these enterprises is more than 150%, covering almost all industries. At present, does the digital transformation of enterprises help to improve their innovation effectiveness? What implementation method or path do these enterprises follow? These problems have not been conclusively resolved in a unified manner in the academic community. The analysis of these problems is of great significance to the high-quality development of Chinese enterprises.

Literature reviewThere is no consensus on the meaning of digital transformation in academic circles. Fitzgerald, Kruschwitz, Bonnet and Welch (2014) interpreted it as the use of digital technology (e.g., social media, embedded devices, etc.) for major business transformation, such as improving user experience, simplifying operating modes, and creating new business models. Reis (2018) believes that digital transformation is the use of new digital technologies to achieve major business transformation and affect all aspects of users' lives. Mergel, Edelmann and Haug (2019) defined digital transformation as a demand to maintain competitiveness by using new technologies to provide products and services online and offline in the Internet era through expert interview and summary. In addition, Vial (2019) reviews and summarizes 282 works and regards digital transformation as a process whereby organizations seek to change their value creation path due to the impact of digital technology, as well as manage structural changes and obstacles that simultaneously have a positive and negative impact on the organization. Schallmo, Williams and Boardman (2020) and Verhoef et al. (2021) believe that digital transformation uses digital technology to analyze and compile the collected data into operable information for evaluation, decision-making, development of new digital business models, helping enterprises create value, and improving performance and influence. In short, digital transformation can be understood as "enterprise plus technology plus data", and this has the characteristics of model innovation, value creation, and new economic form.

At present, there are few studies on whether digital transformation can improve enterprise performance, and the research conclusions also differ. Some studies have found that the application of traditional digital technology has no significant impact on enterprise performance (Curran, 2018); However, some scholars hold a positive view on this issue through qualitative and quantitative analyses (Moretti & Biancardi, 2020; Qi & Xiao, 2020; Taques, López, Basso & Areal, 2021). Some scholars have pointed out that the higher the quality of digital transformation, the higher the production efficiency of the organization (Andriushchenko, Buriachenko & Rozhko, 2020; Ribeiro-Navarrete, Botella-Carrubi, Palacios-Marqués & Orero-Blat, 2021). Digital technology improves enterprise product and service quality, uses big data technology to analyze the personalized needs of users, reshapes the value creation mechanism of stakeholders in the traditional business model, and expands the breadth and depth of enterprise users through new participants (Kraus, Schiavone, Pluzhnikova & Invernizzi, 2021).

Existing studies have shown that the digital transformation of entity enterprises can improve the performance of enterprises by reducing costs, improving efficiency, and encouraging innovation. First, digital transformation helps reduce enterprise operating costs. The characteristics of digital technology such as connection, sharing, and openness determine that enterprises can effectively dis-intermediate (Adamides & Karacapilidis, 2020; Nambisan, 2017) to weaken the adverse impact of information asymmetry among trading parties and reduce the costs of information search, negotiation and signing, transaction supervision, and those post conversion (Chen, 2020). Meanwhile, by integrating digital technology into business links, enterprises can reduce the cost of resource matching and channel operation in the fields of procurement, marketing and logistics, and even meet the personalized needs of customers at a very low cost, thus significantly improving the problem of "double high" of cost and energy consumption in the past (Horváth & Szabó, 2019). Second, digital transformation helps to improve enterprise operation efficiency. The structured and unstructured information contained in emerging digital technologies widens the data mining space (Liu & Xu, 2015), accelerates the response speed of enterprise customers' long tail demand, promotes industrial specialization and collaborative operation, and facilitates the overall operation efficiency of enterprises (Xiao et al., 2020). Finally, digital transformation is conducive to promoting enterprise innovation and upgradation. In the digital technology-enabled industrial development period, the vitality of data and information elements has been continuously stimulated, the innovative resources and capabilities confined to the department have been released, the trend of continuous learning and dynamic cooperation has been rising, and the old and new enterprises will be deeply integrated in resources, technology, products, experience, and customers to promote the outbreak of the "multiplier" creation effect of enterprises (Ode & Ayavoo, 2020; Zheng, 2017), thus providing incremental contribution to value discovery and value creation (Galindo-Martín, Castaño-Martínez & Méndez-Picazo, 2019).

The contributions of this study are mainly as follows: first, from the perspectives of reducing enterprise innovation costs, optimizing and even reconstructing enterprise innovation processes, and strengthening the user demand orientation of enterprise innovation, this study analyzes and evaluates the realization path of the digital transformation of the enterprise innovation system to improve its innovation kinetic energy to enrich the theoretical research results related to digital transformation. Second, using the relevant data of Chinese listed companies from 2012 to 2020, we empirically test the improvement effect of digital transformation on enterprise innovation performance, and verify whether this effect obeys the law of marginal decline. Thereafter, this paper further analyzes the specific role of the economic enabling effect of the digital transformation of the enterprise innovation system in reducing costs, increasing benefits, improving efficiency, and stimulating innovation, and it explores the feasible digital transformation path to help the supply-side structural reform, enable the high-quality development of enterprises, and stimulate the kinetic energy of enterprise innovation.

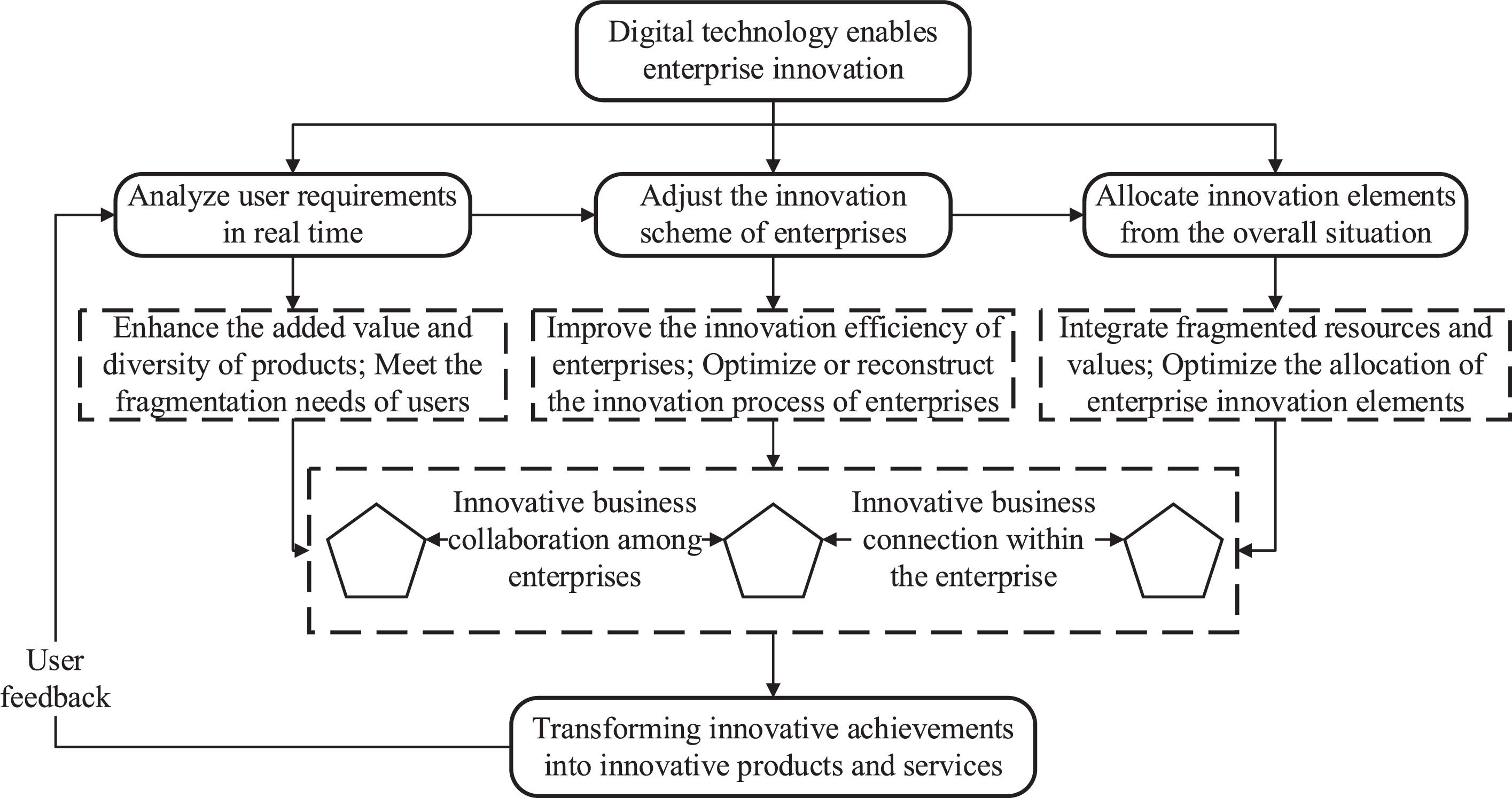

TheoryThe development of digital technology enables enterprises to analyze user needs in real time, and this helps enterprises to arrange innovation and production activities according to the differentiated and fragmented needs of users. The digital transformation of the innovation system is an important part of enterprise digital construction, and its essential goal is to improve the enterprise's innovative productivity and the market competitiveness of innovative products, reflect the user value-oriented development concept, increase the added value of products, and promote the construction of enterprise innovation digital ecosystem (see Fig. 1). The main way for digital transformation to enable enterprise innovation and development is to promote enterprises to reduce costs, increase revenue, improve efficiency, and stimulate innovation through the application of digital technology to achieve the overall goal of stimulating enterprise innovation momentum.

Digital transformation can break the boundary of enterprise collaboration and reduce the cost of enterprise innovationIn the traditional enterprise development theory, the enterprise is the basic unit in the industrial organization and a closed organization with clear boundaries. The enterprise boundary determines the business scope of the enterprise and limits the circulation of production factors to a certain extent. Transaction cost is an important factor affecting enterprise boundary. The easy integration of data elements ensures the transaction cost reduction effect created by the application of digital technology, further promotes the online cooperation of enterprises, and creates better conditions for enterprises to obtain external resources of the organization (Xiao & Qi, 2019). The internal logic of digital transformation to help enterprises reduce innovation costs mainly includes: first, digital technology optimizes the factor allocation of enterprises and improves the utilization of idle factors. Second, digital technology improves the ability of enterprises to analyze users' needs in real time and promotes the continuous optimization of the enterprise operation mode. Third, digital technology enhances the ability of enterprise information collection and sorting, and it improves the speed of response.

Digital collaboration (including real-time sharing of some data among enterprises, seamless business connection, and rapid response) can be established not only in upstream and downstream enterprises but also in cross-industry enterprises. Digital connection breaks traditional boundaries, promotes data sharing among enterprises, facilitates cross-border integration among industries, and helps to form a digital ecological environment (Meyer & Williamson, 2012; Adner R, 2017). Digital ecology focuses on the actual needs of users. Through the continuous improvement of product added value by many participants, it provides users with a better experience. The value it creates exceeds the ability of any single enterprise. Digital ecology can meet the fragmented needs of users and has a prominent "long tail effect". The network protocol generated by the cooperation among participants can further increase the viscosity of users (Basole, 2009; Litvinenko, 2020). With the continuous diversification and personalization of user needs, the business diversification of participants has become another important factor to improve user value and enhance the vitality of digital ecology (Jacobides, Cennamo & Gawer, 2018).

Digital transformation can strengthen user demand orientation and improve enterprise innovation efficiencyIn the current industrial system, the development and production direction of products are completely determined by enterprises, and users cannot participate in the production decision-making process of enterprises, thereby resulting in the continuous shuttling of the value orientation between the supply and the demand side, and the continuous deepening of the mismatch between supply and demand in the product market (Frederiksen, 2006). The long-term imbalance between supply and demand will lead traditional industries to gradually move toward the structural trap of the industrial system in the long term, strengthen the innovation of enterprise operation mode, enable users to deeply participate in the product design and production links of enterprises through digital transformation, cultivate a digital industrial development system based on the new business model, and realize the transfer of market power from the supply to the demand side, which connotes an effective approach to exit the structural trap to realize industrial upgrading to the high value chain Sturgeon (2021).

Enterprises accurately gain insight into the core value needs of global users through digital technology, which not only significantly enhances the user product experience but also considerably improves the response speed of enterprises to the adjustment of user needs to facilitate the innovation efficiency of enterprises. First, digital transformation strengthens the connection between users and enterprises and promotes the realization of co-creation experience. Co-creating experience refers to the process whereby users and enterprises create value together in terms of transaction, selection, and price experience. It can effectively overcome the shortcomings of users' passive response (Yu et al., 2017). Second, the real-time analysis of user data by enterprises helps enterprises quickly and comprehensively grasp user needs; promote the innovative combination of industrial cooperation network, industrial chain and value chain; and further stimulate the multiplier effect in the enterprise development process (Teece, 2018). Finally, while strengthening the innovation cooperation of enterprises, digital technology can also promote the feedback and interaction between enterprises and users. Owing to the diversified needs of users, enterprises can focus on a specific product supply and iteration, strengthen competitive advantage, and improve supply efficiency. Digital technology enables real-time interaction and feedback between users and enterprises to improve the production efficiency of enterprises (Liu, Liu & Chen, 2019).

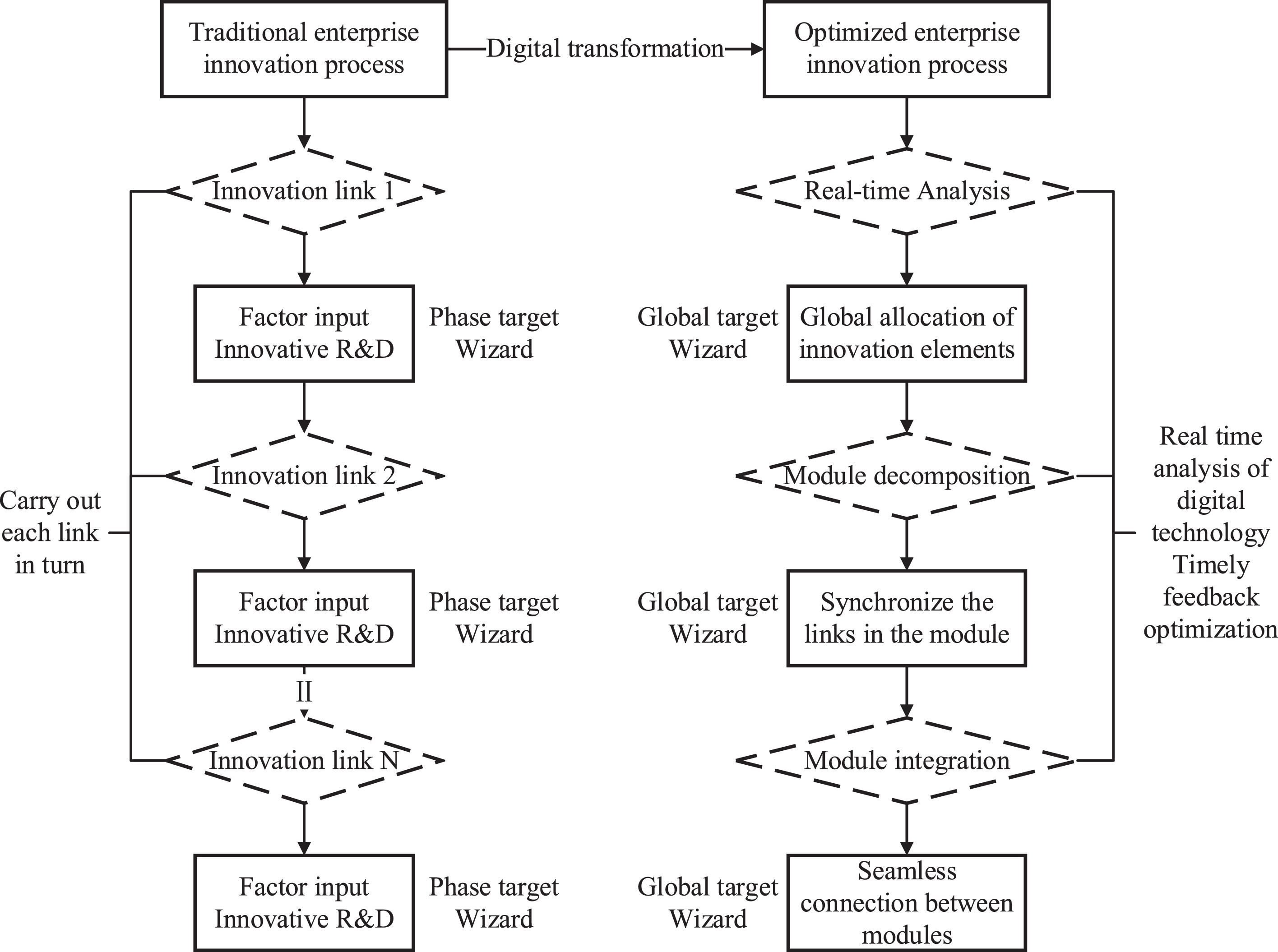

Digital transformation can optimize enterprise innovation process and stimulate enterprise innovation momentumThe popularization and application of digital technology can help enterprises optimize the configuration of various elements in different innovation links and improve the system cooperation efficiency of each innovation link. On the one hand, under the guidance of the results of machine algorithm analysis, the traditional production factors represented by land, capital, and labor will focus on the fields that can efficiently create user value. Meanwhile, the computer will constantly revise the analysis results according to the real-time collected data, give feedback in time, and adjust and optimize the configuration of production factors at the first time (Giusti, Alberti & Belfanti, 2020; Jiang, 2017). On the other hand, as a core production factor, the accumulation, screening, and quality control of user data have laid a foundation for enterprises to explore user value and judge the behavior of competitors. Through the analysis of user data, enterprises can help to enhance their ability to predict market trends and improve innovation output (Horváth & Rabetino, 2019; Pan, Xie & Wang, 2022).

Under big data thinking, a single data source can only provide limited data value, multi-source data are conducive to reducing the error of processing results, and multi-dimensional data expand the perspective of analysis. Therefore, the volume, multiple sources, and multiple dimensions of data are the premises to give full play to the value of data. The application of digital technology replaces the labor force in procedural business, but this does not typify the disappearance of labor value. Enterprises can improve labor skills through on-the-job training and re-education, and also allocate labor to the processing operations of non-procedural business. Because digital technology can only analyze existing data, it is impossible to interpret the organizational strategy in machine rationality, and it is difficult to sort the organizational activities according to the importance. Resource allocation based on machine algorithm has significant timeliness. Relying too much on machine knowledge will make the organization fall into strategic dilemma. Constrained by the established procedures, artificial intelligence will make errors in the judgment of abnormal signals, thereby increasing unnecessary management costs. Concentrating the labor force to non-procedural businesses will give better play to the advantages of subjective consciousness in dealing with acute events and then optimize or reconstruct the enterprise innovation process from the overall situation (see Fig. 2) to further stimulate the innovation momentum of enterprises.

Empirical analysisAccording to the transmission mechanism of economic policy, policy is an important factor affecting the market. Giving play to the role of direction guidance, market supervision and resource allocation can easily engender a change in enterprise behavior. After analyzing and evaluating the internal mechanism of the digital transformation of the innovation system to promote the improvement of enterprise innovation kinetic energy from the perspectives of reducing the enterprise innovation cost, optimizing or even reconstructing the enterprise innovation process, and strengthening the user demand orientation of enterprise innovation, its role and influence path still need to be further determined through empirical analysis.

Data source and variable selectionTo further analyze the impact of the digital transformation of enterprise innovation system on its own innovation and performance, this paper selects real enterprises as the research object (He & Liu, 2019). Meanwhile, considering that most of the real enterprises in the A-share market are distributed in the main board market, this paper selects the relevant data of the main board listed companies in Shanghai and Shenzhen from 2012 to 2020 to conduct the empirical research. Among them, some initial data are from the China Stock Market & Accounting Research and Wind Databases, while other initial data are sorted out according to 45,732 disclosure announcements of listed companies. According to the research needs, further sample screening is carried out on the basis of the initial data, that is, the samples of information technology, finance, and non-entity listed enterprises are removed first, and then the samples with missing data are deleted.2

The final data sample includes 1578 samples of listed companies, including 527 with digital transformation and 1051 without digital transformation. Specifically, we select digital transformation (Digital) as the core independent variable and set it as a virtual variable (if the enterprise implements digital transformation that year, its value is 1, otherwise it is 0); the return on total assets (ROA), return on net assets (ROE), and innovation output (Innovation), as well as gross profit margin on sales (GPM), cost expense rate (CER), and total asset turnover (TAT) used to measure the overall economic performance of listed companies are selected as explained variables. In addition to the explained variables and core explanatory variables, we also select the asset liability ratio (DAR), nature of property rights (NPR), information level (NIQ), company size (Size), investment opportunity (Opportunity), listing age (Firm-age), appointment of chairman and general manager (Duality), board size (Board-size), shareholding ratio of major shareholders (Shareholder), and board independence (Bod-independence) are used as control variables. The descriptive statistics of all these variables are listed in Table 1.

Descriptive statistics of variables.

To clarify the role of digital transformation in promoting enterprise performance, this paper successively takes ROA and ROE as the explained variables, Digital as the core explanatory variable, and then adds several control variables into the panel data of Model 1 for empirical research. The benchmark regression results were obtained3 through STATA 16.1.

Model 1. (ROA and ROE were selected in proper order as the explained variables Y)

It can be seen from Table 2 that among the estimation results of the two panel data models, digital transformation plays a significant role in promoting the performance improvement of enterprises. At the 1% significance level, the result of the Hausman test rejects the original hypothesis, which shows that the fixed effect (FE) model is better than the random effect (RE) model. Therefore, this paper analyzes it according to the estimation results of the FE model. The estimation results of the FE model show that the estimation coefficient of the core explanatory variable digital is significantly positive, indicating that the impact of enterprise digital transformation on ROA and ROE is significantly positive, with the impact degrees of 0.012 and 0.027, respectively. Under the control of other relevant variables, enterprise digital transformation can indeed enable the high-quality development of the real economy. By further comparing the regression results of control variables, it is not difficult to find that enterprises with digital transformation can often find and grasp more investment opportunities, which are a powerful guarantee to improve the income of enterprises. The increase of enterprise asset liability ratio and the accumulation of listing years are two important factors limiting the growth of the ROA and ROE of listed companies. In addition, the expansion of enterprise scale and the shareholding of major shareholders in the above-mentioned companies contribute to the improvement of the ROA, but their impact on the ROE is not significant.

Benchmark regression results of the model.

| Variables | ROA | ROE | ||

|---|---|---|---|---|

| FE | RE | FE | RE | |

| Digital | 0.012⁎⁎⁎(4.57) | 0.008⁎⁎⁎(4.22) | 0.027⁎⁎⁎(4.13) | 0.023⁎⁎⁎(3.96) |

| CER | −0.307⁎⁎(−2.28) | −0.289⁎⁎(−2.31) | −0.318⁎⁎(−2.30) | −0.323⁎⁎(−2.22) |

| GPM | 0.187⁎⁎⁎(2.88) | 0.106⁎⁎(2.14) | 0.212⁎⁎⁎(3.03) | 0.098⁎⁎⁎(2.97) |

| TAT | 0.082*(1.77) | 0.074(0.97) | 0.113*(1.82) | 0.105*(1.88) |

| Innovation | 0.040⁎⁎⁎(7.58) | 0.036⁎⁎⁎(7.25) | 0.051⁎⁎⁎(8.26) | 0.047⁎⁎⁎(8.54) |

| DAR | −0.119⁎⁎⁎(−18.14) | −0.118⁎⁎⁎(−17.23) | −0.207⁎⁎⁎(−14.25) | −0.172⁎⁎⁎(−16.11) |

| NPR | 0.003(0.54) | −0.004⁎⁎(−2.08) | −0.003(−0.33) | −0.014⁎⁎⁎(−2.90) |

| NIQ | 0.002(0.91) | 0.003⁎⁎(1.82) | 0.005(1.31) | 0.011⁎⁎⁎(2.77) |

| Size | 0.007⁎⁎⁎(4.55) | 0.007⁎⁎⁎(6.37) | 0.006(1.42) | 0.018⁎⁎⁎(8.35) |

| Opportunity | 0.010⁎⁎⁎(12.13) | 0.012⁎⁎⁎(12.08) | 0.022⁎⁎⁎(8.98) | 0.024⁎⁎⁎(10.25) |

| Firm-age | −0.005⁎⁎⁎(−4.21) | −0.003⁎⁎⁎(−4.16) | −0.003⁎⁎⁎(−3.05) | −0.004⁎⁎⁎(−3.11) |

| Duality | 0.005(1.48) | 0.007⁎⁎(2.32) | 0.008(1.46) | 0.009(1.60) |

| Board-size | 0.002(0.23) | −0.004(−0.29) | 0.025(1.42) | −0.016(−1.50) |

| Shareholder | 0.018⁎⁎⁎(3.32) | 0.020⁎⁎⁎(3.11) | −0.017(−0.28) | 0.028⁎⁎⁎(3.35) |

| Bod-independence | −1.701(−0.65) | −3.116⁎⁎(−2.46) | −0.047(−0.11) | −8.097⁎⁎(−2.21) |

| Constant | −0.042(−1.51) | −0.038*(−1.91) | −0.033(−0.77) | −0.256⁎⁎⁎(−4.41) |

| Observation sample size | 14,202 | 14,202 | 14,202 | 14,202 |

| R2 | 0.217 | 0.205 | 0.084 | 0.079 |

| Hausman-Test | chi2(11)=92.15 | chi2(11)=104.26 | ||

| Prob>chi2=0.000 | Prob>chi2=0.000 | |||

Considering that there may be mutual causality and endogenous explanatory variables in the benchmark regression model mentioned above, this study uses the instrumental variable (IV) and lag regression analysis methods to test the robustness of the benchmark regression model, and it employs the last period data of digital transformation index as IVs to test the IV method. The results of the robustness test are shown in Tables 3 and 4.

Table 3 shows that taking the last period data of the core explanatory variable digital transformation as the IV, the Wald F-statistic is greater than 10, which indicates that the model has passed the weak IV test, and the IV is significantly and positively correlated with the ROA (ROE) at the 1% (5%) significant level, which shows that the promotion effect of digital transformation on enterprise performance has passed the endogenous and robustness test. Table 4 shows that upon selecting the data of digital transformation index by lagging 1 and 2 for the regression of the benchmark model, they still have a significant positive impact on the enterprise income, which also verifies that the benchmark regression result is robust.

Implementation path evaluation of digital transformation empowermentTo further clarify the internal realization path of the digital transformation of the innovation system to stimulate the development momentum of enterprises, based on the panel data model, this paper takes CER, GPM, TAT, and Innovation as the explanatory variables for model estimation by STATA 16.1 (see Table 5) to explore the specific role of the economic empowerment effect of the digital transformation of the enterprise innovation system in reducing costs, increasing benefits, improving efficiency, and stimulating innovation.

Impact path estimation results.

According to the estimation results presented in Table 5 (the estimation coefficients of digital in the four models are significant at the 1% level), the following conclusions can be apparently drawn: Digital has a significant negative effect on CER, indicating that digital transformation can effectively reduce the costs and losses in the process of enterprise innovation and production, thereby facilitating the supply-side structural reform of real enterprises at the micro level; Digital has a significant positive effect on GPM, indicating that digital transformation can effectively enhance the profitability of enterprises and help to improve the market competitiveness of enterprises; Digital has a significant positive effect on TAT, indicating that it can effectively improve the utilization efficiency of enterprises' own assets, that is, the empowerment of digital technology is an effective way to solve the problem of enterprise efficiency; Digital has a significant positive effect on TAT, indicating that digital transformation is conducive to the improvement of enterprise innovation level, and then fully stimulate the innovation enthusiasm and innovation ability of enterprises to promote the high-quality development of entity enterprises driven by innovation.

In general, reducing costs, increasing revenue, improving efficiency, and encouraging innovation are the main ways through which digital transformation can enhance supply-side structural reform, enable high-quality development of physical enterprises, and stimulate enterprise innovation momentum. In the estimation process of the abovementioned model, the existence of two-way or reverse causality will lead to the endogenous problem of the model. Owing to the two-way causality between Digital and Innovation, an endogenous test is required. Herein, the difference lag term of the endogenous explanatory variable is set as the IV, and the system generalized method of moment estimation method is used for the endogenous test of the model. The Sargan statistic is 0.684, which is higher than that of the endogenous test.

Effects of different policy stages on enterprise digital transformationAccording to the previous analysis, digital transformation has a significant role in promoting enterprise performance, and promoting enterprise innovation through enhancing digital transformation is an important way to realize this role. Thus, we analyze the impact of enterprise digital transformation in different public policy stages (see Table 6).

Impact of enterprise digital transformation in different public policy stages.

As can be seen from Table 6, in the industrialization policy stage, the enterprise performance is low, and the performance of cost, efficiency, and innovation output is not very good. In the information policy stage, the performance of enterprises that have completed digital transformation has improved significantly. From 2015 to 2016, the ROA and ROE indicators increased to 0.08 and 0.10, respectively. The GPM, CER, TAT, and Innovation of corresponding enterprises have been optimized to varying degrees, whereof innovation has the largest increase of 27.3%. The abovementioned shows that the enterprise performance is synchronized with the public policy trend of the digital economy, and the subsequent development changes positively. In the digital policy stage, the performance continued to be good. The ROA and ROE of enterprises that completed digital transformation rose to 0.11 and 0.12, up by 37.5% and 20.0%, respectively, compared with the previous stage; GPM increased by 7.1%; CER decreased by 1.9%; TAT accelerated by 3.6%; and Innovation increased by 25.0%. This shows that public policy with digitization as the core driving force ensures the continuous improvement of the performance of enterprises at all stages, and its effect on enterprise innovation is the most significant.

Conclusion and enlightenmentThrough theoretical and empirical research, this paper analyzes the impact mechanism and realization path of digital transformation on enterprise performance and its innovation kinetic energy, and it draws the following conclusions: first, digital transformation has a significant improvement effect on enterprise performance. Second, reducing costs, increasing revenue, improving efficiency, and encouraging innovation are the main ways for digital transformation to help supply-side structural reform, enable high-quality development of enterprises, and stimulate innovation momentum of enterprises. Third, the change of policy stage has a significant impact on enterprise performance. Under the digital public policy, innovation output is the core driving force for enterprise performance improvement. Based on the abovementioned conclusions, this paper draws the following enlightenment: to give full play to the role of digital transformation, enterprise decision makers should fully capitalize on the supporting role of digital technology in collecting and analyzing user needs in real time, allocate their own resources in line with consumer needs from a global perspective, continue to promote enterprise digital transformation, and achieve the objectives of reducing costs, as well as increasing and improving benefits. This entails the phased goal of encouraging innovation to facilitate supply-side structural reform and enable the high-quality development of real enterprises.

This work was supported by the National Social Science Fund Youth Project [Grant No. 19CTJ012]; the Major Program of National Fund of Philosophy and Social Science of China [Grant No. 19ZDA121]; the National Natural Science Foundation of China [Grant No. 71773041, 71973055, 72163008]; the MOE (Ministry of Education in China) Project of Humanities and Social Sciences [Grant No. 21YJA790069]; the Research Foundation for Advanced Talents of East China University of Technology [Grant No. DHBK2019379]; and the Social Science Foundation Project of JiangXi Province [Grant No. 19YJ15].

postal address: School of Economic and Management, East China University of Technology, Nanchang City, Jiangxi Province, China (Post Code: 330,000).

The used data from the China Digital Construction and development report (2019).

To eliminate the impact of outliers on statistical inference as much as possible, the data samples are subject to a 1% quantile reduction.

In the estimation process of the model, two FE and RE models are used for regression, and the optimal model form is determined according to the Hausman test.