This study uses text mining technology to construct an index of digital transformation and discusses the impact of digital transformation on enterprise innovation and its mechanisms from theoretical and empirical perspectives. It also analyzes whether digital transformation can significantly enhance enterprises’ value through innovation. The findings are presented as follows: first, digital transformation has a positive and significant impact on enterprise innovation, and this finding holds true when we conduct robustness testing and endogeneity processing. Second, the influence of digital transformation on enterprise innovation varies significantly according to enterprise size, ownership, and industry. Third, risk-taking plays an intermediary role between digital transformation and innovation. Fourth, the innovation incentive effect of digital transformation has a value enhancement function with a two-year lag, while it lacks a value enhancement function in the current year, following year, or next three years. In the modern era of innovation-driven and cross-border integration, this study deepens the theoretical understanding of innovation-driven and digital transformation. It also promotes the deeper integration of real and digital economies in practice.

With the development of emerging technologies, such as artificial intelligence, blockchain, cloud computing, and big data, data have become the seventh factor of production after land, labor, capital, knowledge, technology, and management (Wang et al., 2020; Siachou et al., 2021; Alnuaimi et al., 2022). Data are “the oil of the future society” and the new driver for economic and social development. China's 2035 Vision Outline proposed the development of a digital economy by building a “digital China” and promoting the deeper integration of real and digital economies. China's digital economy is developing steadily, and its pace of digitization has accelerated substantially. A white paper on the development of China's digital economy (2021) issued by CAICT reports that, in 2020, the added value of China's digital economy reached 39.2 trillion yuan, up from 14.2% of the gross domestic product (GDP) in 2005 to 38.6% of the GDP in 2020, and 2.4% higher in 2020 than in the same period in the previous year. The digital economy has led to profound changes in enterprises’ external environment, and digital technologies have substantial effects on organizational form, mode of production, operation, management, and sales methods (Nambisan et al., 2017; Verhofe et al., 2021; George & Schillebeeckx, 2022). Enterprises occupy the “main position” vis-à-vis industrial digitization, and the ability to successfully seize the development opportunities ensuing from the construction of the digital economy and transformation is related not only to the direction of enterprises’ strategic development, survival, and collapse but also to whether China can reach new heights and seize new development opportunities in the new digital economy era. Therefore, enterprises should seek to grasp the new opportunities and challenges engendered by the digital economy and technological revolution by increasing investment in digital construction. This is not only a requirement for innovation-driven development in the new era of digital economies but also the focus of China's “creation strategy” (Kusiak, 2017; Furr & Shipilov, 2019; Hilali et al., 2020).

In December 2020, China's 14th Five-Year Plan proposed the implementation of an innovation-driven development strategy, improvement of the national innovation system and mechanism, and enhancement of enterprises’ technological innovation capabilities. Throughout the development trends of the global economy, this innovation-driven model, with digital transformation at its core, has flourished. Digital transformation based on innovation-driven development has become a realistic choice for most enterprises, and it has also become a hot topic in the realms of government, business, and academia. Studies on digital transformation and enterprise innovation have focused on three main dimensions. The first is the impact of information technology or systems on enterprise innovation. Some studies trace this problem to the historical root of the paradox of information technology production efficiency and extend the problem to the absorption and diffusion of knowledge using new-generation information technology (Schwarzmuller et al., 2018; Yeow et al., 2018), which affects enterprise innovation. Some scholars regard new-generation information technologies as infrastructure, as they believe that information systems can improve enterprises’ abilities to absorb knowledge, especially explicit knowledge, thereby promoting innovation (Vial, 2019; Peng & Tao, 2022; Zhang et al., 2022). The second focus of the literature is on the Internet and enterprise innovation. The Internet has enabled greater access to and dissemination of information, thus improving enterprises’ innovation performance. By “connecting everything,” innovation based on the Internet business model can target customers’ personalized and differentiated needs at a deep level, resulting in improved enterprise innovation ability (Furr & Andrew, 2019; Ghezzi & Cavallo, 2020). The third focus is on digital transformation and innovation. Ferreira et al. (2019) survey 938 enterprises in Portugal and find that digital transformation can promote enterprises’ service and process innovation. However, there seems to be no consensus in the literature on the effects of digital transformation on innovation. In addition, few studies have examined the effects of digital transformation on enterprise innovation. There is no in-depth research on how digital transformation affects enterprise innovation, which typically does not match the innovation effects brought about by digital transformation (Nambisan et al., 2017; Kuester et al., 2018; Simsek et al., 2019; Baiyere et al., 2020). This leads to two basic theoretical questions: Is digital transformation conducive to promoting enterprise innovation? If so, what is its specific mechanism? These problems, which arouse great concern for governments, businesses, and academia, constitute the basis of the issues examined herein.

This study employs A-share enterprises listed in China's Shanghai and Shenzhen exchanges from 2013 to 2019 as the research sample to analyze the impact of digital transformation on enterprise innovation and its mechanism from theoretical and empirical perspectives and to examine whether digital transformation can significantly enhance enterprises’ value through innovation. This study makes the following theoretical and practical contributions: first, this study uses text mining technology in combination with policy documents, research reports, and enterprise annual report information to construct enterprises’ digital transformation indicators. In addition, this study considers the scope of digital transformation keywords obtained through text mining technology and invites digital transformation experts to supplement the keywords created via text mining to measure enterprises’ digital transformation more comprehensively. This provides a reference for measuring enterprise digital transformation and evaluating its economic benefits. Second, this study uses a mediation effect model to identify and test the path of “digital transformation–risk-taking–enterprise innovation” and opens the “black box” of the impact of digital transformation on enterprise innovation. It not only expands research on the economic effects of digital transformation and their mechanisms but also enriches research on the factors influencing enterprise innovation, which meets the needs of high-quality innovation-driven development in the context of the digital economy era. Third, most studies on the factors influencing enterprise risk-taking focus on the internal characteristics of the enterprise and external environment. This study starts with the digital transformation of enterprises and theoretically analyzes and empirically tests the impact of digital transformation on enterprise risk-taking. This provides a new explanation for the factors influencing enterprise risk-taking. Fourth, this study examines the heterogeneous effects of digital transformation on enterprise innovation based on enterprise- and industry-level characteristics and empirically provides a more refined understanding of the economic benefits of enterprise digital transformation and the formulation of differentiated policies. Fifth, this study analyzes the impact of digital transformation on enterprise innovation and the value enhancement function of the innovation incentive effect of digital transformation. These findings deepen our understanding of the enterprise innovation chain in terms of research content and have profound policy implications for further deepening digital construction and maximizing the use of digital dividends to stimulate enterprises’ innovation potential. The remainder of this paper is organized as follows: Section 2 presents the theoretical analysis and hypotheses. Section 3 presents the data sources and research design. Section 4 empirically tests the influence of digital transformation on enterprise innovation. Section 5 tests the influence mechanism of digital transformation on enterprise innovation. Section 6 explores the value enhancement function of the influence of digital transformation on innovation incentives. Finally, Section 7 presents the conclusions and implications of this study.

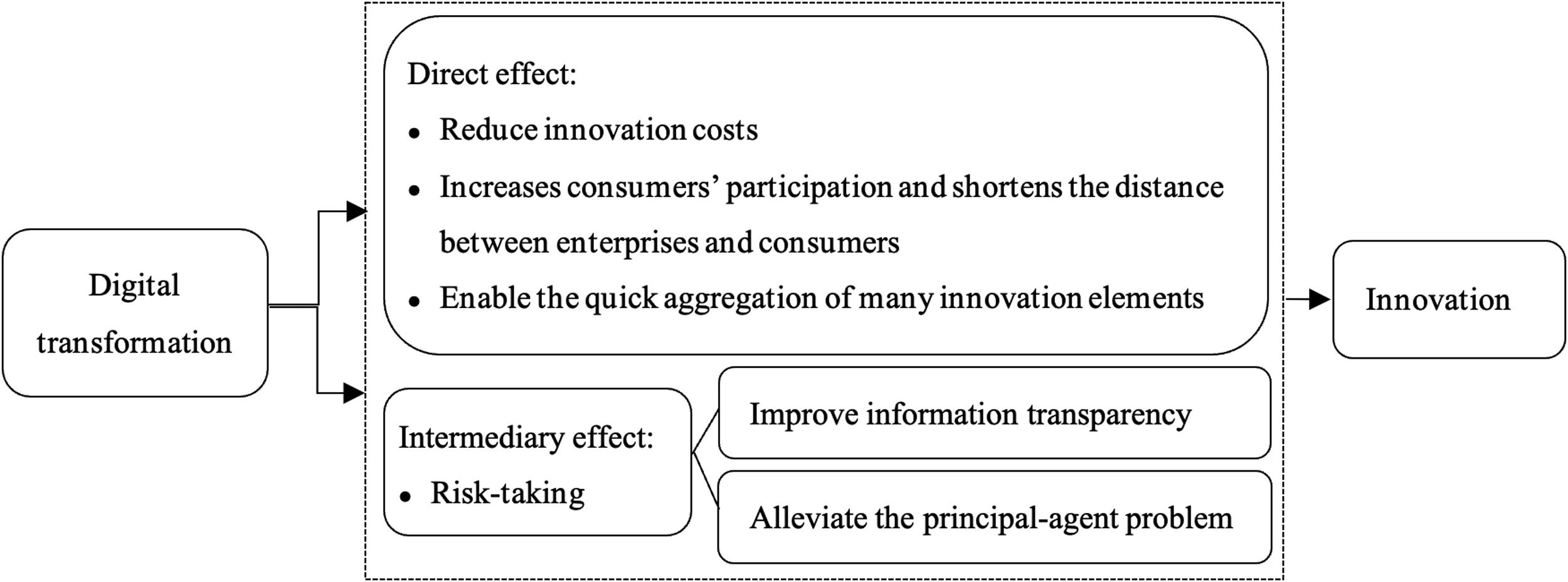

Theoretical analysis and hypothesis developmentDigital transformation and enterprise innovationDigital transformation can reduce enterprises’ transaction, operation, agency, and marginal costs; increase consumers’ participation in the innovation process; and aggregate various innovation elements (Yoo et al., 2010; Li, 2020; Wijenayaka, 2022).

- (1)

Digital transformation can reduce transaction, operation, agency, and marginal costs, thus promoting enterprise innovation. First, digital transformation can reduce transaction costs. New-generation technologies can break the constraints of time and space by allowing information to spread explosively, thereby reducing transaction costs caused by information asymmetry (Huang et al., 2017; Ferreira et al., 2019; Matarazzo et al., 2021). Second, enterprises can reduce the operational costs of innovation by using new-generation digital technologies to transform and upgrade their old technology and operational processes. In addition, control systems based on data analysis improve the timeliness and accuracy of decision-making (Loebbecke & Picot, 2015; Gölzer & Fritzsche, 2017; Guo et al., 2022). Third, enterprises can reduce the agency costs of innovation through digital transformation, which can improve the timeliness and openness of information dissemination, thereby increasing enterprise information disclosure and reducing the agency costs of innovation (Ilvonen et al., 2018; Solberg et al., 2020; Sousa-Zomer et al., 2020). Fourth, digital transformation can reduce the marginal costs of innovation, as it reduces information transmission costs to almost zero, and the intermediate-link and depreciation costs are relatively low. Therefore, the marginal cost of each additional product is either low or even zero. Reducing the cost of innovation motivates enterprises to invest more in research and development (R&D), accelerate product upgrading, and promote enterprise innovation.

- (2)

Digital transformation increases consumer participation in the innovation process and shortens the distance between enterprises and consumers. Accordingly, enterprises can better understand consumers’ potential and differentiated needs and make more effective decisions related to new product development. This decision-making process reduces the possibility that enterprises’ innovative products will not meet consumers’ needs and will not be fully accepted by the market (Kusiak, 2017; Li et al., 2018; Heredia et al., 2022). First, enterprises use intelligent marketing scenarios, models, and methods to achieve online and offline integration. The construction of online channels has increased consumers’ participation in the innovation process, and enterprises can directly reach consumers, win consumers’ loyalty more efficiently, understand consumers’ diverse needs more deeply, make decisions related to new product development on this basis, and improve the efficiency of enterprise innovation (Abrell et al., 2016; George & Schillebeeckx, 2022). Second, the application of digital technologies enables enterprises to capture and respond quicker to changes in consumer demand, thereby realizing rapid product iteration and continuous optimization and promoting enterprise innovation (Bajari et al., 2015; Boone et al., 2019). Extreme, differentiated, and personalized consumer demands are emerging in large numbers. Only by obtaining and responding to these demands in a timely manner can enterprises gain a foothold in the market. The application of digital technologies enables enterprises to meet consumer needs more quickly, tap customers’ potential and differentiated needs, adjust product innovation strategies in a timely manner according to the differences and dynamic changes in users’ demand preferences, identify market opportunities for new products and services, and improve innovation efficiency (Boone et al., 2019; Matarazzo et al., 2021).

- (3)

Digital transformation can enable the quick aggregation of many innovation elements and promote enterprise innovation. However, the integration of internal and external innovation elements is accompanied by information asymmetry and high search costs. New-generation information technologies can create conditions for enterprises to build cooperative networks in specific links or processes and even to reallocate resources and aggregate funds and talents worldwide (Ferreira et al., 2019; Kohli & Melville, 2019). First, digital transformation can overcome time and space constraints, thereby improving the efficiency of an enterprise's resource allocation (Yoo et al., 2012; Sousa-Zomer et al., 2020). Second, digital transformation can expand the breadth and depth of knowledge. With digital transformation, enterprises can evaluate, absorb, and utilize new information more effectively, which is beneficial to their various innovative activities (Simsek et al., 2019; Sandberg et al., 2020). Third, digital transformation can enable the construction of communication platforms to enable internal R&D teams to communicate and cooperate within and even across industries (Nambisan et al., 2017; Siachou et al., 2021).

Therefore, this study proposes the following hypothesis:

H1: Digital transformation can promote enterprise innovation.

As previously mentioned, digital transformation can significantly promote enterprise innovation, but what path does it follow? Risk-taking is the most important part of enterprise strategic decision-making, reflecting enterprises’ willingness and inclination to pay a price in the pursuit of profit, which is further reflected in decision-making regarding venture capital projects (Simon & Houghton, 2003; Hanelt et al., 2021; Al-Mamary & Alshallaqi, 2022). Venture capital projects have a high degree of uncertainty, and decision makers must master relevant information to avoid risks. According to principal–agent theory, management's self-interested behavior and risk aversion tendencies are caused by information asymmetry and reduce enterprise risk-taking. The information effect brought about by digital transformation can increase management's enthusiasm, alleviate the above mentioned problems, and improve enterprise risk-taking. The specific analysis is presented as follows: first, with the support of a variety of new technological models, enterprises can deal with massive amounts of data at a lower cost and improve the breadth and depth of information absorption (Chania et al., 2019; Ghezzi & Cavallo, 2020), reduce management processing and access costs for critical decision information, decrease management's risk aversion, and enhance enterprises’ risk-taking. Second, enterprises can use text mining technology to convert unstructured information into structured information so that they can promptly obtain external key information and capitalize on various investment opportunities by quickly obtaining vital information for management, and they can avoid missing out on investment opportunities due to information asymmetry (Baiyere et al., 2020; Caputo et al., 2021). The use of new-generation technologies can also reduce information search costs, thus restraining management's opportunistic behavior. Mobilizing management's enthusiasm and reducing management's conservativeness regarding investment decisions enhance enterprise risk-taking.

In summary, this study proposes the following hypothesis:

H2: Digital transformation can promote enterprise risk-taking.

Enterprises’ choice of innovation projects is affected by many factors, and the level of risk is a key consideration in their innovation decision-making, as it directly affects their willingness to innovate (Li & Tang, 2010; Chrisman & Patel, 2012). The impact of risk-taking on enterprise innovation is mainly reflected in the choice of risky innovation projects. While enterprises that undertake innovative projects experience long investment cycles and high risk, enterprises with low risk-taking levels generally lack innovation motivation. This risk-averse attitude is not conducive to the promotion of enterprise innovation. In the pursuit of higher returns, enterprises with higher risk-taking levels are more likely to invest in higher-risk projects to actively seek opportunities for innovation, which is conducive to corporate innovation (Simon & Houghton, 2003; Lou et al., 2022). The higher an enterprise's level of risk-taking, the more tolerant its managers will be of innovation risks and uncertainties, and the greater their confidence will be in undertaking high-risk innovation projects. Managers actively pursue and seize existing innovation investment opportunities, actively introduce new technologies, and acquire new knowledge to cope with changes in the external environment, thereby improving enterprise innovation (Brettel & Cleven, 2011; Goranova & Ryan, 2014). Enterprises with high risk-taking levels can optimize resource allocation; use resources effectively; allocate resources to innovative projects with high uncertainty, long cycles, and high risk; and stimulate innovative R&D behavior (Brown & Osborne, 2013; Mao & Zhang, 2018). Thus, digital transformation enhances the risk-taking willingness of enterprise management, and ultimately improves enterprises’ risk-taking levels. The higher the enterprise's risk-taking level, the greater the acceptance and recognition of innovation, the more positive the innovation attitude, the stronger the innovation motivation, and the greater the willingness to increase innovation R&D investment, thereby enhancing enterprise innovation. Therefore, this study hypothesizes that the level of risk-taking mediates the relationship between digital transformation and enterprise innovation, that is, enterprises’ digital transformation affects their level of risk-taking and thus their innovation. Accordingly, this study proposes the following hypothesis:

H3: Risk-taking plays an intermediary role between digital transformation and enterprise innovation.

In summary, this study proposes an intermediary effect model for the impact of digital transformation on enterprise innovation, as shown in Fig. 1.

Research designSample selection and data sourcesThis study uses Chinese Shanghai and Shenzhen A-share listed companies from 2013 to 2019 as the research sample. Since 2013, with the development and progress of the new generation of digital technologies, such as the Internet, big data, and artificial intelligence, an upsurge in the digital transformation of enterprises has occurred, making this study possible. The sample data are screened and processed according to the following criteria. ① Securities, banks, and other financial listed companies are excluded. ② Listed companies classified as ST, *ST, or PT because of abnormal financial systems during the sample period are excluded. ③ Listed companies with missing variables during the sample period are excluded. In addition, this study uses a 1% tail reduction for all the continuous variables and ultimately employs 15,949 data points from 4057 companies as the research sample. The data mainly include digital transformation, using annual report information on Chinese listed companies in both the Shanghai and Shenzhen markets from 2013 to 2019, for which text mining is used to construct an index of enterprise digital transformation, and enterprise innovation, risk-taking, and other variable data, which are obtained from the China Stock Market & Accounting Research database.

Variable definitionsIndependent variable: digital transformation (Digital)Digital transformation involves many aspects of organizational change. In this study, digital transformation is defined as in-depth changes in the internal structure, process, business model, and employee capabilities of enterprises using new-generation digital technologies, such as the Internet of things, big data, cloud computing, and artificial intelligence (Hess et al., 2016; Ilvonen et al., 2018). This study identifies keywords through text analysis and uses Python to capture keywords related to digital transformation in the annual reports of Chinese listed companies in Shanghai and Shenzhen. The frequency of digital transformation keywords, that is,LN[(∑i=175keywordoccurrencefrequency+1], is used to measure enterprises’ degree of digital transformation.

LN[(∑i=175keywordoccurrencefrequency*numberofwordsinkeyword)/Numberofwordsinenterpriseannualreport+1] is used for the robustness test. In addition, experts on digital transformation are invited to supplement the keywords created from the text analysis in this study to measure enterprise digital transformation indicators more comprehensively. Finally, a robustness test is performed with 127 keywords substituted for the 75 enterprise digital keyword measures.

Dependent variable: enterprise innovation (INV)This study measures innovation from the perspectives of innovation input and output. Innovation input is expressed by R&D intensity, measured as the ratio of an enterprise's annual R&D expenses to its total assets. Innovation output is expressed as the natural logarithm of the number of patent applications plus one, and the natural logarithm of the number of patents granted plus one.

Mediating variable: risk-taking (Crt)Prior studies have used two main methods to measure corporate risk-taking: earnings volatility and stock return volatility. Determining earnings volatility requires the use of corporate financial indicators. However, stock return volatility can eliminate this restriction and accurately reflect a company's risk-taking situation. Therefore, this study adopts stock return volatility to measure enterprises’ risk-taking, using stock daily return volatility, stock weekly return volatility, and stock monthly return volatility to measure enterprises’ risk-taking. The formula used is given as follows:

Control variablesThe control variables used in this study are mainly indicators of corporate characteristics, capital structure, and corporate governance. These indicators affect both the independent and dependent variables in the model. If these variables are not controlled for, the estimation results may be biased. The control variables are enterprise size, number of employees, age, asset–liability ratio, return on net assets, market concentration, management shareholding ratio, institutional investor shareholding ratio, profitability, total compensation (of directors, supervisors, and senior executives), concurrent positions, number of independent directors, shareholding concentration, and equity checks and balances. This study also controls for the impact of industry and annual factors on firm innovation. Table 1 presents the definitions of the main variables in this study.

Definitions of the main variables.

Data source: organized according to the data in this paper

The descriptive statistics of the main variables used in this study are listed in Table 2. The mean value of digital transformation for enterprises is 2.929, the minimum value is 0, the maximum value is 7.0917, and the variance is 1.3571. These results indicate obvious differences in digital transformation across enterprises. Additionally, some companies have not yet undergone digital transformation. The mean value of the innovation input of enterprises is 0.0217, the minimum value is 0, the maximum value is 1.0701, and the variance is 0.0273, indicating apparent differences in innovation input across enterprises. The mean value of the number of patent applications is 0.5755, the minimum value is 0, the maximum value is 9.6738, and the variance is 1.4448. The mean value of the number of patent grants is 0.7392, the minimum value is 0, the maximum value is 8.3973, and the variance is 1.5079. These results indicate notable differences in innovation output across enterprises. Among the control variables, there are differences in the values of corporate characteristics, capital structure, and corporate governance across enterprises, indicating that the innovation of these control variables may be affected.

Descriptive statistical analysis of variables.

Data source: Arranged based on the data of this study.

This study constructs the following models to verify the impact of digital transformation on enterprise innovation. The subscripts i and t in Model (2) represent the enterprise and year, respectively. Invi,t represents enterprise innovation, which includes innovation input and output. It represents the digital transformation of enterprises, Controli,t is the enterprise control variables, ∑Year is the annual fixed effect, ∑Ind is the industry fixed effect, and εi,t is the random error term. The size and direction α2 reflect the impact of digital transformation on enterprise innovation.

This study verifies the mechanism of the impact of digital transformation on enterprise innovation using Models (3) and (4). These models test the intermediary factor, risk-taking, which includes the stock daily return volatility, weekly return volatility, monthly return volatility, and other variable definitions from Model (2). If the following conditions are simultaneously satisfied, then risk-taking plays an intermediary role between digital transformation and innovation: β2 in Model (3) is significant, δ2 and δ3 in Model (4) are significant, and δ2 in Model (4) is lower than β2 in Model (3).

Empirical test and result analysisDigital transformation and enterprise innovationModel (2) is used to test Hypothesis 1 empirically to verify the impact of digital transformation on enterprise innovation. The regression results are presented in Table 3. As shown in Column (1) of Table 3, the influence of the coefficient of digital transformation on enterprise innovation input is 0.0050, which is significant at the 1% level, indicating that digital transformation has a significant positive impact on enterprise innovation input. As shown in Columns (2) and (3) of Table 3, the influence coefficients of digital transformation on the number of patent applications and the number of patent grants are 0.0594 and 0.0758, respectively. Both are significant at the 1% level, indicating that digital transformation positively affects enterprise innovation output. These findings support Hypothesis 1, that is, digital transformation has a positive and significant impact on enterprise innovation.

Digital transformation and enterprise innovation.

Note: *, **, and *** indicate levels of significance of 10%, 5%, and 1%, respectively.

Data source: organized according to the data in this paper.

To clarify the heterogeneous impact of digital transformation on enterprise innovation, this study conducts a subsample test based on the scale and property rights of the enterprise as well as the technology and competition levels of the industry in which the enterprise is located.

Heterogeneity test based on firm size and property right attributesThe heterogeneity of the promotion effect of digital transformation on enterprise innovation is examined for enterprises of different sizes. This study divides the sample into small, medium, and large enterprises according to the Measures for the Classification of Large and Medium-Sized Enterprises in Statistics (2017) by the National Bureau of Statistics of China. The results of the grouped regression, shown in Table 4, indicate that digital transformation significantly impacts enterprise innovation, irrespective of enterprise size. Therefore, there is no enterprise-scale threshold for promoting digital transformation in enterprise innovation, and small and medium-sized enterprises (SMEs) can also benefit from it. At present, the digital transformation of large enterprises is progressing relatively smoothly, as multi-dimensional, multi-level, and multi-chain digital transformation and innovation are being realized in production, R&D, operation, marketing, management, and other areas, promoting not only the rapid development of the enterprise itself but also the innovation and development of industries, the economy, and society. However, the vast majority of SMEs are distributed in the middle and low ends of traditional industries and value chains, are in the exploratory stage of digital transformation, lack transformational thinking, have a weak foundation for digital technology application, and have insufficient management and digital capabilities. These factors hinder SMEs’ digital transformation processes. Digital technology can improve the automation and intelligence levels of enterprises’ production and manufacturing processes, improve production efficiency, facilitate the combination of production and sales, and improve enterprise innovation. Therefore, SMEs should accelerate the process of digital transformation to reshape their industrial processes and decision-making mechanisms, thereby improving their efficiency.

Heterogeneity test based on firm size.

Note: ⁎⁎⁎, and ⁎⁎⁎ indicate levels of significance of 10%, 5%, and 1%, respectively.

Data source: Arranged based on the data of this study.

The heterogeneity of the promotion effect of digital transformation on enterprise innovation in different property rights is examined by dividing the sample into state-owned, private, and foreign-owned groups. The results of a grouped regression are shown in Table 5. The results indicate that the positive impact of digital transformation on enterprise innovation is more significant in private than in state-owned enterprises. This result may be because the state entrusts private enterprises with fewer political tasks and social responsibilities, making these enterprises more attentive to the use of new-generation digital technologies for internal and external information exchanges. This facilitates digital transformation, reduces innovation costs and risks, and promotes enterprise innovation. Therefore, compared to state-owned enterprises, the positive impact of digital transformation on enterprise innovation is more significant in private enterprises.

Heterogeneity test based on property rights attributes.

Note: ***, and ⁎⁎⁎ indicate levels of significance of 10%, 5%, and 1%, respectively.

Data source: organized according to the data in this paper.

We examine the heterogeneity of the promotion effect of digital transformation on enterprise innovation across industries’ technological levels. This study divides the sample into high- and low-tech industry enterprises according to the Technology Industry (Manufacturing) Classification (2013) issued by the National Bureau of Statistics of China. The results of the grouped regression are shown in Table 6. Evidently, digital transformation has a more significant role in promoting innovation among high-tech industry enterprises than among low-tech ones. This study argues that the main orientation of the production and operation of high-tech industry enterprises lies in technological innovation and that digital technology innovation and transformation, which occupy a central position in the era of the digital economy, are naturally key areas of high-tech industry enterprises. Additionally, digital transformation requires strong innovation foundation support, and a strong information infrastructure can provide high-tech industry enterprises with strong support for digital transformation, which is conducive to building a digital ecosystem in the industry and enhancing the relationships between enterprises in the industry and the market. Interactions between enterprises reduce the cost of external knowledge acquisition, promote the digital integration of external innovation resources, reduce the cost of enterprise innovation, and improve enterprise innovation, thereby increasing the positive effect of digital transformation on enterprise innovation. In contrast, the orientation of production and operation of low-tech industry enterprises is not based on technological innovation, as the development and decision-making orientation of such enterprises are not sensitive enough to digital transformation, and their information infrastructure and digital business ecosystem are relatively undeveloped. Digital transformation is unable to effectively integrate external innovation resources; reduces enterprises’ sensitivity to internal and external interactions, which weakens the promotion effect of digital transformation on innovation; and finally makes the positive effect of digital transformation on enterprise innovation less substantial than that for high-tech industry enterprises.

Heterogeneity test based on industry technology level.

Note: *, **, and *** indicate levels of significance of 10%, 5%, and 1%, respectively.

Data source: organized according to the data in this paper.

The heterogeneity of the promotion effect of digital transformation on enterprise innovation is examined according to industries’ competition levels. This study divides the sample into low-, medium-, and high-competition industry enterprises according to the market concentration of the industries in which the enterprises are located. The results of a grouped regression are shown in Table 7. Accordingly, digital transformation has a positive and significant impact on enterprises’ innovation in all three groups. From this perspective, the degree of industry competition does not affect digital transformation's ability to promote innovation. In both the free competition and monopolized markets, digital transformation can significantly and positively impact corporate innovation. Thus, regardless of the competitiveness of the industry to which an enterprise belongs, it should actively promote digital transformation, encourage the application of digital technologies, and form technological innovation through the use of digital technologies, thereby promoting technological progress and productivity improvement.

Heterogeneity test based on industry competition level.

Note: *, **, and *** indicate levels of significance of 10%, 5%, and 1%, respectively.

Data source: organized according to the data in this paper.

In this section, we construct a substitution variable for digital transformation. The LN[(∑i=175keywordoccurrencefrequency*numberofwordsinkeyword)/Numberofwordsinenterpriseannualreport+1] 75 keywords are used for the robustness test, and the test results are shown in Panel A of Table 8. In addition, to measure the digital transformation of enterprises more comprehensively, the researchers asked experts on digital transformation to supplement the keywords created through text analysis, and 127 keywords were generated. These 127 keywords replace the previous 75 for the robustness test. The results are shown in Panels B and C of Table 8. As shown, the substitute variables of digital transformation, namely, Digital12, Digital21, and Digital22, all have a positive impact on innovation input and output, indicating that the original conclusion is robust and reliable.

Robustness test: replacing the independent variable.

Note: *, **, and *** indicate levels of significance of 10%, 5%, and 1%, respectively.

Data source: organized according to the data in this paper.

Because digital transformation and innovation are enterprises’ decision-making behaviors, endogeneity problems may exist. To address these issues, this study selects digital transformation data with one and two lag periods for regression. Table 9 shows the regression results for Panels A and B. As shown, the effects of digital transformation on enterprise innovation input and output are positive and significant, whether for one or two lag periods, and decrease with an increase in the number of lag periods. This result suggests that the positive effect of digital transformation on economic benefits marginally diminishes over time. In summary, digital transformation can promote enterprise innovation with superimposed characteristics over a long period, thereby stimulating the rise of enterprise innovation to a greater extent. This finding supports the core hypothesis of this study.

Endogeneity problem handling: lag period regression.

Note: *, **, and *** indicate levels of significance of 10%, 5%, and 1%, respectively.

Data source: organized according to the data in this paper.

This section uses Models (3) and (4) to test the mediation effect, that is, to verify the mediating effect of risk-taking between digital transformation and enterprise innovation. Model (3) takes risk-taking as the dependent variable, including stock daily return volatility (Crt1), stock weekly return volatility (Crt2), and stock monthly return volatility (Crt3). Digital transformation is an independent variable, and the regression results with a series of control variables added are shown in Columns (1), (2), and (3) of Table 10. The influence coefficients of digital transformation on stock daily return volatility, stock weekly return volatility, and stock monthly return volatility are 0.0305, 0.0338, and 0.0344, respectively, all of which are significant at the 1% level. The impact of digital transformation on risk-taking is positive and significant. Hypothesis H21 is therefore supported.

Mechanism test of digital transformation on enterprise innovation.

Note: *, **, and *** indicate levels of significance of 10%, 5%, and 1%, respectively.

Data source: organized according to the data in this paper.

Model (4) considers corporate innovation as a dependent variable and then sequentially adds the independent variables of digital transformation, intermediary variable of risk-taking, and control variables. Table 10 shows the regression results in Columns (4)–(12). The intermediary variable in Columns (4), (7), and (10) of Table 10 is stock daily return volatility. Its influence coefficients on the intensity of R&D investment, number of patent applications, and number of patent grants are 0.0111, 0.0886, and 0.0565, respectively, all of which are positive and significant at the 1% level. The influence coefficients of digital transformation on the intensity of R&D investment, number of patent applications, and number of patent grants are 0.0047, 0.0567, and 0.0741, respectively, which are positive and significant at the 1% level. Compared with the results shown in Table 3, the influence coefficients of digital transformation on R&D investment, number of patent applications, and number of patent grants have decreased. Therefore, stock daily return volatility partially mediates digital transformation and corporate innovation.

Similarly, the intermediary variable in Columns (5), (8), and (11) in Table 10 is the stock weekly return volatility, and the intermediary variable in Columns (6), (9), and (12) in Table 10 is the stock monthly return volatility. The stock monthly return volatility partially mediates digital transformation and corporate innovation. Thus, risk-taking plays an intermediary role between digital transformation and enterprise innovation. Therefore, Hypotheses H22 and H23 are supported.

Digital transformation and enterprise innovation: analysis of the value enhancement functionThis study confirms that digital transformation can enhance enterprise innovation, which aims to gain competitive advantages and add value (Chemmanur & Tian, 2018). However, what about the value enhancement function of digital transformation innovation? This study hypothesizes that digital transformation can fully tap information related to supply, production, sales, and management; promote the efficient conversion of innovation achievements into new products and processes; meet market demands with maximum effectiveness; and increase market competitiveness. All these factors contribute to increasing enterprise value. Therefore, this study further analyzes whether digital transformation can significantly enhance enterprise value through innovation. This section examines the value enhancement function in the short and long terms.

Digital transformation and innovation current value enhancement functionThe current value enhancement function of the enterprise innovation channel mainly verifies whether the innovation incentive effect of digital transformation can be converted into enterprise value in the current period. This includes whether the innovation output of the enterprise has a value-enhancing function in the current period, and whether the implementation of digital transformation promotes the current value enhancement function of innovation output. This study constructs the following Model (5):

TobiQi,t in Model 5 represents the value of the enterprise, and γ2 measures the impact of the innovation output of the enterprise on the current value of the enterprise, including the number of patent applications and patent grants. If γ2>0, the enterprise's innovation output has the function of current value enhancement. If γ2<0, the enterprise's innovation output has a current value-inhibiting enhancement. γ3 measures the impact of digital transformation on the relationship between innovation output and the enterprise's current value. If γ3>0, the implementation of digital transformation promotes the current value enhancement function of innovation output. If γ3<0, the implementation of digital transformation does not promote the current value enhancement function of innovation output. The regression results in Table 11 show that the regression coefficient of innovation output is not significant, regardless of the number of patent applications or patents granted. Therefore, innovation output does not enhance an enterprise's current value. Additionally, the regression coefficient of the multiplication of digital transformation and innovation output is not significant, indicating that digital transformation does not enhance the current value of the enterprise through innovation channels. A possible reason for this lack of value enhancement function in the current period is that it may take a certain amount of time to convert innovation patents into enterprise value.

Digital transformation and the innovation current value enhancement function.

Note: *, **, and *** indicate levels of significance of 10%, 5%, and 1%, respectively.

Data source: organized according to the data in this paper.

Studies posit that applying for and obtaining patents is the first step toward completing development work for enterprises. The transformation of patents into products that the market recognizes and generate markets value requires a series of post-development management measures, such as pilot testing, industrialization, and commercialization, all of which are time-consuming (Hsu, 2009; Giroud, 2013; Nanda & Rhodes-Kropf, 2013). The analysis above shows that it may take a certain amount of time for patents to generate market value. The long-term value enhancement function of the enterprise innovation channel mainly verifies whether the innovation incentive effect of digital transformation can be converted into enterprise value in the long term, including whether the innovation output of the enterprise has a long-term value enhancement function and whether the implementation of digital transformation promotes the long-term value enhancement function of innovation output. This leads to the construction of Model (6).

In the model, TobiQi,t+1, TobiQi,t+2, and TobiQi,t+3 represent the enterprise value in the following year, two years, and three years, respectively. The definitions of the other variables are the same as those in Model (4). The regression results for the digital transformation and innovation long-term value enhancement functions are shown in Table 12. These results indicate that when the dependent variable is the enterprise value in the next year and three years, the innovation output's regression coefficient is non-significant, which means that innovation output does not enhance enterprise value in the next year and three years. The regression coefficient of the multiplication term between digital transformation and enterprise innovation output is also insignificant, indicating that digital transformation does not enhance enterprise value in the next year and three years through innovation channels. When the dependent variable is enterprise value for the next two years, the regression coefficient of innovation output is significant. Thus, innovation output can enhance enterprise value over the next two years. Additionally, the regression coefficient of the multiplication term between digital transformation and innovation output is significant, indicating that digital transformation enhances enterprise value in the next two years through innovation channels. In other words, digital transformation positively affects the value-enhancing function of innovation output after two years.

Digital transformation and innovation long-term value enhancement function.

Note: *, **, and *** indicate levels of significance of 10%, 5% and 1%, respectively.

Data source: organized according to the data in this paper.

In summary, the innovation incentive effect of digital transformation has a value enhancement function with a two-year lag. The innovation incentive effect of digital transformation does not have a value enhancement function over the next three years, which may be due to two factors. First, the competition for enterprise innovation is fierce, and after enterprise patents accumulate for a certain period, the marginal benefit of enhancing enterprise value begins to decrease. Second, the innovation incentive effect of digital transformation has a time-specific effect.

Research conclusions and implicationsResearch conclusionsBased on data from non-financial companies listed on the Shanghai and Shenzhen markets from 2013 to 2019, this study uses text analysis technology to mine the digital transformation keywords disclosed in annual corporate reports. This study considers the impact of digital transformation on enterprise innovation and its mechanisms from theoretical and empirical perspectives. Our findings are presented as follows: first, digital transformation has a positive and significant impact on the R&D intensity of enterprises, number of patent applications, and number of patent grants, that is, digital transformation significantly improves the innovation of enterprises. This finding remains valid after robustness testing and addressing endogeneity problems. Second, the heterogeneity tests reveal that the role of digital transformation in promoting enterprise innovation is greater in private enterprises than in state-owned enterprises. In addition, high-tech enterprises are better at digital transformation than non-high-tech enterprises. However, the size of an enterprise and the degree of monopolization in its industry are not constraining factors for digital transformation in terms of promoting enterprise innovation. Third, the internal logical chain of the impact of digital transformation on enterprise innovation is “digital transformation to risk-taking to enterprise innovation,” as risk-taking plays an intermediary role in promoting enterprise innovation through digital transformation. Fourth, with the help of innovation channels, the incentive effect of digital transformation and innovation has a value-enhancing function with a lag of two years, and it does not have a value enhancement function in the current, following, or next three years.

Theoretical significance and practical implicationsUnder the general trend of the rapid development of new-generation digital technologies, such as big data, the Internet of things, and artificial intelligence, the digital transformation of enterprises can be key to the realization of deeper integration of the digital and real economies. The conclusions of this study provide an alternate perspective on the digital transformation of enterprises in the context of the digital economy era and provide useful insights into the implementation of innovation-driven strategies.

Theoretical significanceFirst, this study constructs a digital transformation index and advances the literature on digital transformation using normative, empirical research. This study uses text mining technology, policy documents, and annual enterprise reports to construct an index of enterprise digital transformation, which can provide a reference for research methods to measure enterprises’ digital transformation and evaluate its economic benefits.

Second, it opens the “black box” of the impact of digital transformation on enterprise innovation and enriches the research on the economic effect and functional path of digital transformation. Studies on the effects of digital transformation on enterprises have mainly focused on reducing costs and improving operational efficiency. In addition, research on the impact of digital transformation on enterprise innovation concentrates on the effects of new-generation information technologies, systems, or Internet use. Research on the impact of digital transformation on enterprise innovation is at the effect level, lacking in-depth and detailed discussions of the internal mechanisms. Therefore, this study uses the intermediary effect model to identify and test the path from “digital transformation to risk-taking in enterprise innovation,” thus revealing the impact of digital transformation on enterprise innovation. This study remedies the lack of research on internal mechanisms that relate digital transformation to enterprise innovation. This study also enriches literature on the economic consequences and mechanisms of digital transformation.

Third, this study provides a new explanation for the factors influencing enterprise risk-taking. Research on the factors influencing enterprise risk-taking has mainly focused on the internal and external environments. Examples of internal factors include enterprise and manager characteristics and ownership structure, while the external environment comprises macroeconomies, cultural traditions, and legal systems. In summary, this study reviews the internal digital transformation of enterprises, tests both the theoretical and empirical impacts of digital transformation on risk-taking, and provides new explanations for factors that may influence risk-taking.

Practical implicationsFirst, the government should help enterprises to successfully carry out digital transformation in various ways. The government continues to increase investments in new digital infrastructure. The prerequisite for digital technology application and business model transformation is to have large-scale advanced digital infrastructure. New digital infrastructure investment has the characteristics of large investment, high risk, and long return periods. It is necessary for the government to proceed from the top-level design, lay out the construction of digital infrastructure, and actively guide stakeholders to jointly draw a single “map” and build a single network to avoid inefficient duplication of investment. In addition, the government should establish and improve support policies related to digital transformation. Digital transformation can significantly promote enterprise innovation and enhance enterprise value through innovation channels. To realize the positive economic effects of digital transformation more effectively, the government must continuously formulate and improve relevant support policies for enterprise digital transformation, guide enterprises to take advantage of digital technology to enhance enterprise innovation, and continue to feature digital transformation based on innovation-driven development as a key policy focus for supply-side reform, conversion of old and new kinetic energy, and high-quality development, thereby laying the foundation for the formation of a stable, efficient, and smooth national economic system. In addition, when the government formulates policies related to digital transformation, it should fully consider the heterogeneity of enterprises, reduce “one-size-fits-all” general policies, and adjust relevant policies in a timely manner according to enterprises’ attributes and industry characteristics. For example, the government should increase the guidance and support for SMEs, private enterprises, and low-tech and low-competition industry enterprises and formulate a financing guarantee system related to digital transformation.

Second, enterprises should place great importance on the role of digital transformation in promoting innovation, accelerating digital transformation, and promoting the in-depth application of digital technology in enterprise innovation. Digital transformation has become the most effective way for enterprises to develop today, and digitalization has become an important driving force for shaping innovative economic models and reconstructing the market. It is necessary for every enterprise to increase the pace of digital transformation and realize the deep integration of a new generation of digital technology with various traditional elements to improve enterprise innovation. Enterprises must attach great importance to the major transformative effects deriving from digital technologies and accelerate the digital transformation of enterprise organizational structure, production process, service process, and information exchange. They must also fully utilize the advantages of digital technologies in terms of cost reduction and resource allocation, effectively enhance enterprise innovation, and contribute to the high-quality development of China's economy. In addition, the digital transformation of enterprises should follow the principle of differentiation, as the digital transformation effects of enterprises with different ownership types and scales and from different industries vary significantly. Enterprises should thus start from their own needs and pain points and seek digital transformation solutions with characteristics that suit their own development stages and long-term goals. Enterprises should also formulate long-term innovation and development plans. By considering both innovation strategy and its actual situation, an enterprise can be effective in risk management, optimize resource allocation, and continuously and steadily promote its innovation activities. Enterprises can thus evaluate their own risk-taking ability in real time, improve the enterprise risk response mechanism, establish an effective innovation incentive mechanism and external supervision mechanisms to effectively restrain the shortsighted behavior of the management, and encourage management to make long-term decisions that enhance the value and competitiveness of the enterprise.

Third, enterprises should vigorously clear the intermediary transmission path of digital transformation and use its information effect to increase their level of risk-taking. The driving effect of digital transformation on enterprise innovation stems from the fact that the application of the new generation of digital technologies can improve information asymmetry, increase management's enthusiasm, reduce the conservativeness of management's investment decisions, and improve enterprises’ level of risk-taking. However, in the current Chinese market environment and financial system, there are still mechanisms that lead to information asymmetry between enterprises and external stakeholders. Thus, enterprises should strive to promote the efficiency of internal and external information transmission through a new generation of digital technologies, alleviate information asymmetry, and improve their level of risk-taking. Using this new generation of digital technologies, an enterprise can build an enterprise display platform; display information related to its products, business conditions, and future development prospects in multiple directions; transmit positive information to the market; and improve the efficiency of information exchange to reduce information asymmetry. In addition, enterprises can strengthen the supervision of internal managers through the new generation of digital technologies, avoid the problems of managers’ adverse selection and moral hazard, increase enthusiasm for management, reduce the conservativeness of management's investment decision-making, and improve their risk-taking.

Research limitations and future research prospectsAlthough the hypotheses proposed herein are supported, this study has certain research limitations. The first concerns the research object. Although the research sample used in this study includes Chinese enterprises of different types and from different industries, it is only from Chinese enterprises listed on the Shanghai and Shenzhen exchanges; the study does not devote attention to enterprises in other countries. With the advancement of a new generation of digital technologies, the penetration impact of digital transformation on enterprises will be further enhanced. In the future, research on the impact of digital transformation on enterprise innovation could sample enterprises from other Eastern or Western countries to understand the impact of digital transformation on enterprise innovation more comprehensively. The second limitation concerns the research scope. The impact of digital transformation on enterprises is far-reaching and multi-faceted, and this study focuses only on the impact of digital transformation on enterprises’ levels of risk-taking and innovation. In the future, research on the impact of digital transformation on enterprises could be extended to other aspects such as corporate culture and corporate brand-building. The third limitation concerns the mechanism. This study discusses only the risk-taking mechanism. Future research could focus on other mechanisms of the impact of digital transformation on innovation and further expand our understanding of how digital transformation affects enterprise development.

The Key Project of National Social Science Fund “Research on Financing Decision-Making of State-owned Enterprises to Create Sources of Major Original Technology” (22AGL018); The Youth Project of the National Social Science Fund of China “Research on the optimization and upgrading of regional industrial chain promoted by the development of digital economy in central cities of Yellow River Region” (21CJY008); The Youth Project of the National Social Science Fund of China "Research on the Influence of Market Allocation of Factors on the New Trend of 'Inverted U-shape' Evolution of Urban-Rural Income Gap" (20CJY017).

About the author: Meiyu Liu (1986- ), female, from Taian city, Shandong province, Associate professor of School of Business Administration, Shandong University of Finance and Economics. Management doctor, School of Business, Liaoning University. Research direction: Enterprise innovation, digital Transformation. Up to now, she has published more than 9 papers in SSCI and CSSCI journals, among which, as the first author or corresponding author, she has published nearly 7 papers in Chinese Rural Economy, Economic Management and other journals. And she has published 1 paper as the first author in Journal of Knowledge Management. As a major participant, she has participated in more than 9 national key projects, such as the National Social Science Fund of China, the National Natural Science Fund of China, etc., and has provided management consulting services for more than 20 central and local state-owned enterprises. Address: Room 9115, 1/F, Ganxun Building, Shandong University of Finance and Economics, No. 40, Shungeng Road, Jinan city, Shandong Province. Zip code: 250014. Mobile phone number: 15306411387. Email: lmy52105210@163.com.

Chengyou Li (1987- ) (Corresponding author), male, from Liaocheng city, Shandong province, professor and master supervisor of School of Finance, Shandong University of Finance and Economics. Postdoctoral candidate and economic doctor in theoretical Economics of the Center for Economic Research, Shandong University. Research direction: Rural economy, applied econometric analysis. Up to now, he has published more than 40 papers in SSCI and CSSCI journals, among which, as the first author, he has published nearly 20 papers in China Economic Review, Economic Modeling, Economic Research Journal and other journals. And he has published more than 20 papers as corresponding author or co-author in Journal of Knowledge Management, Environmental Impact Assessment Review, et al. Host 4 national level projects including National Social Science Fund of China, the Ministry of Education of Humanities and Social Science Project, China Postdoctoral Science Foundation. Address: Room 9115, 1/F, Ganxun Building, Shandong University of Finance and Economics, No. 40, Shungeng Road, Jinan city, Shandong Province. Zip code: 250014. Mobile phone number: 15275180316. Email: lichengyou1987@163.com.

Shuo Wang (1996- ), female, from Rizhao city, Shandong province, Ph.D. candidate of the Center for Economic Research, Shandong University. Research direction: Income distribution, applied econometric analysis. So far, she has published several articles in SSCI and CSSCI journals such as Journal of Knowledge Management, Economic Perspectives, and many articles are being reviewed by SSCI journals such as Journal of Innovation and Knowledge. Address: The Center for Economic Research, Shandong University, NO.27, Shanda South Road, Jinan City, Shandong Province. Zip code: 250100. Mobile phone number: 17853132083. E-mail: shweung@163.com.

Qinghai Li (1982- ), male, from Zaozhuang city, Shandong province, associate professor and master supervisor of School of Economics, Nanjing University of Finance and Economic. Research direction: Rural economy, applied econometric analysis. Up to now, he has published more than 50 papers in SSCI and CSSCI journals, among which, as the first author, he has published nearly 20 papers in China Economic Review and other journals. And he has published more than 20 papers as corresponding author or co-author in Economic Modeling, China Agricultural Economic Review, et al. Host 4 national level projects including National Social Science Fund of China, the National Natural Science Foundation of China, the Ministry of Education of Humanities and Social Science Project, China Postdoctoral Science Foundation. Address: School of Economics, Nanjing University of Finance and Economic, 3 Wenyuan Road, Xianlin University Town, Qixia District, Nanjing City, Jiangsu Province. Zip code: 210023. Mobile phone number: 15805165546. Email: zhongguopai@163.com.