In the context of Industry 4.0, advancements in computer technology and the digital revolution have profoundly impacted global economic growth. As digitalization assumes an increasingly critical role, this study innovatively integrates digital capital as a fundamental input, alongside labor and traditional capital, into non-parametric production technologies to evaluate the Luenberger-Hicks-Moorsteen total factor productivity(TFP) indicator. This approach provides a novel perspective on productivity growth in China during the digitalization era. Furthermore, a new input-based decomposition of the productivity indicator is proposed to identify the driving forces behind China's rapid economic expansion. The factors influencing productivity change and its decomposition components are further analyzed. Utilizing panel data from 30 provinces in China covering the period from 2012 to 2021, the findings reveal that overall productivity growth in China increased by 2.73 % during the sample period, with contributions of 64.97 % from labor and 35.01 % from digital capital. Conversely, the contribution rate of non-digital capital to TFP growth was -0.02 %. This suggests that China's economic growth is primarily driven by labor, followed by digital capital, while the influence of traditional capital is diminishing. Furthermore, the regression results underscore the significant contribution of digital economy development to TFP growth.

Stable and sustainable economic growth is a crucial objective of macroeconomic development for every country, as it enhances the quality of life for residents and maintains social stability. As the world's second-largest economy, China has experienced rapid economic development, achieving an average growth rate of nearly 10 % over the past 20 years, primarily due to the deepening of reform and opening up. The country's share of the global economy has surged from 6.4 % in 2000 to 18.14 % in 2022 (World Bank, 2021). However, this rapid development has also revealed several challenges, including a decline in demographic dividends (Zhang, Wei & Ma, 2021), extensive industrial development models (Wang & Feng, 2021), and deteriorating environmental quality (Ren, Hao, Xu, Wu & Ba, 2021). These issues have compelled China to alter its current economic development model, optimize its economic structure, and seek new sources of momentum to stimulate economic growth (Zhang, Hao, Lu & Deng, 2018). Additionally, the global pandemic caused by the novel coronavirus pneumonia epidemic has intensified the pressures of the worldwide economic recession, hindering the recovery process. China's industrial and supply chains are also facing increased strain due to non-economic factors (Duan et al., 2021). Since the 18th National Congress of the Communist Party, the Chinese economy has transitioned from a phase of high-speed growth to one focused on high-quality development. It is therefore urgent to identify new sources of momentum to promote high-quality economic development and move to a stage with a more advanced form, a more complex division of labor, and a more reasonable structural evolution. At present, China is in a critical period of economic transformation and upgrading. Therefore, it is essential to explore the motivations and new engines for China's sustained economic growth, which is a significant issue that must be addressed in the pursuit of achieving its high-quality goals.

Industry 4.0 offers new insights for China to address its current productivity growth challenges. Despite experiencing rapid economic expansion in recent years, China's productivity remains lagging behind that of developed nations. The concept of Industry 4.0, which originated in Germany in 2011, represents the advent of the fourth industrial revolution. It involves the integration of digital technologies into manufacturing and industrial processes (Lopes de Sousa Jabbour, Jabbour, Foropon & Godinho Filho, 2018a). At the core of Industry 4.0 lies “data”, which drives the development of four fundamental technologies: cyber-physical systems, the Internet of Things, big data, and cloud manufacturing (Lopes de Sousa Jabbour et al., 2018a). These digital innovations have not only enhanced business performance but also initiated profound transformations across all sectors of the economy and society (Hanelt, Firk, Hildebrandt & Kolbe, 2021). Moreover, the digital economy, which is based on data as a crucial production factor, has emerged as a powerful economic paradigm, demonstrating significant potential and serving as a catalyst for China's economic resurgence and high-quality development. Moreover, digital technologies provide effective tools for implementing the principles of a circular economy, thereby promoting sustainable economic development (Lopes de Sousa Jabbour, Jabbour and Godinho Filho, 2018b).

Since the 18th National Congress of the Communist Party, the Chinese government has prioritized the digital economy and elevated it to a national strategy. As indicated in the 53rd Statistical Report on China's Internet Development released by China Internet Network Information Center, as of December 2023, the number of Chinese Internet users reached 1.09 billion, with an Internet penetration rate of 77.5 %. Leveraging both technological innovation and model innovation, the total scale of the digital economy amounted to 50.2 trillion yuan, accounting for 41.5 % of the GDP in 2022 (CAICT, 2023). As a production factor, data has been instrumental in driving the growth of productivity and the transformation of production relations in China. The integration of data with traditional industries has ushered in significant changes across a range of sectors, enabling a more efficient mode of economic operation. Therefore, the digital economy has emerged as a pivotal force, providing support for economic development. It is positioned to play a crucial role in China's economic recovery and transformation (Zhang et al., 2021).

This objective of this research is to address the following questions: How can regional economic development be accurately measured? What are the key drivers behind China's economic growth? To what extent do labor, traditional capital, and digital capital contribute to the productivity improvement? This study employs non-parametric estimation methods and Luenberger-Hicks-Moorsteen (LHM) total factor productivity (TFP) indicators to investigate the extent of digital contribution to China's economic development and identify the driving forces behind Chinese rapid growth. Utilizing provincial panel data from 2012 to 2021, the research aims to assess China's trajectory of TFP growth and delve into the factors influencing the LHM TFP indicator. Furthermore, we explore the impact of the digital economy on this novel TFP and its decomposition terms using fixed effects and the Tobit model. These findings hold significant implications for China's effort to build a modern economic system and promote sustainable economic and social development.

The following are the potential innovations of this study. First, we selected 30 Chinese provinces as samples and incorporated digital capital as a production factor into the assessment of TFP at the macro level. In addition, unlike the existing literature that decomposes TFP into technical efficiency change, scale efficiency changes, and technological progress, this study, based on the LHM TFP indicator, proposes a novel decomposition of the TFP indicator in terms of input-driven forces. Finally, the proposed model is applied to analyze China's economic growth and its driving force at the provincial level during the 2012–2021 period.

The remainder of this study is organized as follows: Section 2 reviews the existing literature on the digital economy and TFP. Section 3 illustrates the novel method regarding the decomposition and growth of the LHM TFP indicator after introducing the production technology and the directional distance function. Section 4 presents the data and empirical results. Finally, Section 5 presents a summary of the conclusions and policy implications.

Literature reviewDigitization and its link to the economyThe concepts of “digital economy”, “information economy”, “knowledge economy” and “new economy” are interconnected (Lazović & Duricković, 2014). Currently, the digital economy has become a relatively stable concept with a global consensus that aligns with the evolving trends and characteristics of the global economy. The digital economy is a new economic form that succeeds the agricultural and industrial economies in its evolutionary trajectory. The concept of the digital economy was first proposed by Tapscott (1996), yet no unified definition has been established. For example, Negroponte (1996) described the digital economy as "bits instead of atoms". With the ongoing development and innovation of information technology, scholars have gradually expanded and refined the concept. Li, Kim, Lang, Kauffman and Naldi (2020) defined the digital economy as the expansion of digital business and economic opportunities driven by high technology. Additionally, Chen (2020) distinguished between a narrow and broad understanding of the digital economy: the narrow sense pertains to economic activities related to information and communication technology (ICT), while the broad digital economy includes the integration of digital inputs into other sectors. Oloyede, Faruk, Noma, Tebepah and Nwaulune (2023) provided a synthesis of existing research on the concepts of the digital economy, proposing that it encompasses all economic, social, and governmental activities that utilize information and communication technologies to enhance human life.

Additionally, a number of organizations and governments have also articulated definitions of the digital economy. Barefoot, Curtis, Jolliff, Nicholson and Omohundro (2018) defined the digital economy as the “Internet and related information and communication technology (ICT)”, which is adopted by the U.S. Bureau of Economics. The G20 Digital Economy Development and Cooperation Initiative, 2016 proposed that the digital economy be defined as a series of economic activities that utilize digital knowledge and information as primary production factors, modern information networks as a substantial operational space, and the effective use of ICT as a crucial driver of productivity enhancement and economic structure optimization.

The existing literature on the digital economy mainly focuses on the conceptualization of definitions, the formulation of accounting methods, the analysis of economic cooperation, etc. With regard to empirical analysis, some scholars have used a variety of methods to explore the impact and evolution of digital technology and the economy from diverse perspectives. At the micro level, Škare and Soriano (2021) employed the company-level dynamic panel data of 15 EU countries from 2009 to 2018 and found that the digital level of the country or industry markedly enhanced firm agility. However, Usai et al. (2021) employed principal component analysis (PCA) and multiple linear regression, concluding that the impact of the use of digital technology on corporate innovation is inconsequential. At the macro level, Myovella, Karacuka and Haucap (2020) used the generalized method of moment (GMM) based on panel data from 74 countries over the period from 2006 to 2016, thereby revealing that digitization has a positive impact on a country's economic growth. Yuan et al. (2021) developed econometric approaches and found that the development of the digital economy facilitated technological innovation based on panel data from the G7 economies from 1990 to 2017. Guo et al. (2023) explored that the digital economy is conducive to the advancement of high-quality economic development in China, particularly through enhancing human capital and facilitating green technological innovation.

Total factor productivity (TFP) and its modelingOne of the most important and direct methods of accounting for economic growth is TFP, which can be understood as an increase in output that is not explained by inputs such as labor and capital (Hulten, 2001; Kerstens, Shen & Van de Woestyne, 2018). Currently, scholars have conducted extensive research on TFP. The calculation of total factor productivity has been a prevalent topic in academia.

There are multiple methods utilized to evaluate total factor productivity (TFP), which can be primarily classified into two categories (Ang & Kerstens, 2020; Lovell, 2016). The initial category encompasses price-based assessments, such as the Fisher and Tornqvist indexes, which utilize price data to determine input and output and necessitate dependable price data (Shen, Baležentis & Ferrier, 2019). The second category comprises measurements based on the production function, which is mainly divided into parametric (Cechura, Kroupova & Rudinskaya, 2015) and nonparametric methods (O'Donnell, 2012). The parametric method is primarily the stochastic frontier analysis (SFA) approach, which provides statistical inference. However, it requires assuming the form of the function in advance, which may violate technical axioms (Baležentis, Blancard, Shen & Štreimikienė, 2021). The nonparametric approach uses the linear programming model to compare the relative efficiency between the decision-making units (DMUs). Without setting the production function previously, it is sufficient to assume the fundamental axioms of production theory. Moreover, it is a more convenient method for describing multi-input and multi-output production technology and is therefore widely utilized in study on performance (Gouveia, Henriques & Costa, 2020; Shen, Baležentis, Chen & Valdmanis, 2018).

In order to analyze TFP using the nonparametric method of the distance function, scholars have primarily employed the Malmquist, Luenberger, Malmquist-Luenberger, and Hicks-Moorsteen indexes. The Malmquist index, as proposed by Caves, Christensen and Diewert (1982), is the most widely used index for assessing TFP. Färe, Grosskopf, Lindgren and Roos (1994) employed the decomposition method of Nishimizu and Page (1982) to decompose the Malmquist index into two components: technological changes and efficiency changes. Additionally, they utilized the relationship between the distance function and radial efficiency to streamline the calculation process. Subsequently, Bjurek (1996) put forth the Hicks-Moorsteen index, defined as the ratio of the Malmquist output to input index. The index is multiplicatively complete and does not necessitate the inclusion of price data (O'Donnell, 2012).

However, since the Malmquist and Hicks-Moorsteen productivity indexes are based on ratio data, they cannot be identified with zeros in the data set. The issue can be circumvented by employing difference-based indicators, such as Luenberger's (1992) directional distance function, which consider simultaneously reductions in input and increases in output (Ang & Kerstens, 2017, Ang & Kerstens, 2020). Chambers (2002) defined the Luenberger productivity indicator as a directional distance function based on difference, which can measure changes in productivity. However, it is not additively complete, as O'Donnell (2012) has noted. Briec and Kerstens (2004) put forth the Luenberger-Hicks-Moorsteen (LHM) productivity indicator, which incorporates both output and input directional distance functions. In contrast to ratio-based indexes, difference-based indicators can be defined even when there are zeros in the numerator or denominator (Ang & Kerstens, 2020; Balk, Färe & Grosskopf, 2004; Shen et al., 2019). Moreover, this indicator is additively complete (O'Donnell, 2012) and does not necessitate the inclusion of price data (Ang & Kerstens, 2020). Ang and Ramsden (2024) further pointed out that the decomposition of LHM TFP indicators may yield indeterminate components of technical change and scale efficiency. They used the Bennet indicator, which is considered an approximate LHM productivity indicator that also requires price information.

On account of its superior theoretical properties, a number of scholars have employed LHM in empirical research across a range of disciplines. Shen et al. (2019) applied the additively complete LHM to calculate the TFP of the agricultural sector in 30 provinces in China, subsequently decomposing it into technical efficiency change, scale efficiency change, and technological progress. Mocholi-Arce, Sala-Garrido, Molinos-Senante and Maziotis (2021) employed the LHM to assess the TFP of water companies and determined that the decline in LHM TFP was primarily attributable to an increase in input.

Digital economy and TFPIn the era of Industry 4.0, the digital economy has become a powerful driver of national economic development. Many scholars have examined the relationship between the digital economy and total factor productivity (TFP). Pan, Xie, Wang and Ma (2022) examined the impact of the digital economy on TFP, using a dual approach and a sample of 30 Chinese provinces from 2012 to 2018. Their results demonstrated that the digital economy significantly increased TFP. Zou, Liao and Fan (2024) applied DEA to measure the Malmquist productivity index for 285 prefecture-level cities in China, further investigating the impact of the digital economy on urban TFP. This study reveals that the digital economy positively impacts urban TFP, with this influence extending through spatial spillover effects to the neighboring cities. Li, Zhang and Li (2024), using panel data from Chinese listed companies spanning from 2011 to 2021, employed the Levinsohn-Petrin semi-parametric estimation method to calculate the TFP of these firms. The study further explored the impact of the digital economy on the TFP of firms, demonstrating that the digital economy significantly supports TFP growth at the micro level. The majority of existing studies highlight the positive contributions of the digital economy across various scales and levels. However, some scholars have identified potential negative consequences. For example, Zhao, Peng, Wen and Wu (2023) utilized panel data from 281 prefecture-level cities in China (2003–2018) and applied a slack-based DEA model to assess green efficiency. Their findings indicate that the digital economy might hinder improvements in green efficiency.

The existing literature on the interaction between the digital economy and TFP employs a two-stage measurement approach. In the initial stage, TFP is estimated using labor, capital, and, where relevant, energy inputs. The second stage examines the influence of the digital economy on TFP. In the context of the digital economy, data has become a pivotal factor driving productivity advancements, reshaping production and consumption patterns, and is increasingly regarded as a novel production input. Nevertheless, there is a gap in the existing research, in that no studies have explicitly incorporated digital inputs or digital capital into TFP measurement.

SummaryIn the existing literature concerning digitization, scholars mainly concentrate on defining its conceptual boundaries, developing methodologies for its measurement, and analyzing its effects. However, there is a lack of studies that conceptualize the digitization as a fundamental factor of production, akin to labor and capital, in evaluating its contribution to overall economic growth. Furthermore, for the accounting and decomposition of TFP, the predominant approach among scholars tends to be the Malmquist index. It is subsequently divided into technological progress, efficiency changes, and scale efficiency changes to understand the underlying causes of economic growth. The previous literature has provided valuable insights into the factors that drive economic growth. However, few scholars delve into explanations of TFP changes from factor-based perspectives, particularly in consideration of the contribution of digitization as a pivotal emerging factor of production in the era of Industry 4.0.

Therefore, this paper calculates the Luenberger-Hicks-Moorsteen (LHM) TFP indicator and decomposes it completely into labor-driven productivity change, traditional capital-driven productivity change, and digital capital-driven productivity change. This study aims to provide a fresh perspective on the dynamics of China's economic growth.

MethodologyProduction technologyTo evaluate TFP growth with digital factors, this paper introduces both digital and non-digital inputs into the production technology. The decision-making units (DMUs) are defined as provinces in China that create the production set. The N types of inputs can be defined as x=(x1,...,xn)∈R+N, including the labor force and capital stock. Inputs are used in the produce M types of outputs y=(y1,...,ym)∈R+M, such as GDP. The classical production possibility set is defined as follows:

In order for the aforementioned production technology to be deemed economically viable, it must satisfy the following fundamental assumptions. The set of assumptions should be consistent with the actual production process but should not impose any unnecessary constraints on the technology (Färe, 1988).

Following Briec and Kerstens (2004), the following assumptions are imposed:

The A1 (no free lunch) axiom means that inaction is allowed and that no output can be generated without input. This is in line with the real world. If it is not assumed, DMU may produce output without inputs, thus resulting in inaccurate efficiency results and distorted benchmarks. For example, a farm is unable to produce any crop without the utilization of land.

The A2 (closedness) axiom indicates that the production possible set is closed. It means the production set encompasses all feasible combinations of inputs and outputs within the production system. Without this assumption, the boundary of the technology set cannot be constructed with clarity, and the optimal solution of the optimization problem may not be found.

The A3 (boundedness) axiom shows that limited inputs cannot allow unlimited outputs. This means that the quantity of output that can be generated from a specific amount of inputs is limited. The removal of this axiom allows benchmark DMU to produce an unlimited amount of outputs using limited inputs, which is unrealistic as a benchmark for other DMUs. A2 and A3 ensure that the production set is compact.

The A4 (strong disposal of inputs and outputs) axiom indicates that more inputs can lead to fewer outputs. Specifically, at a given level of inputs, it is possible to produce fewer outputs, and conversely, more inputs may yield the same level of outputs. This assumption is intuitive and aligns closely with real-world production practices. Almost all production technologies meet this assumption (Ghiyasi & Cook, 2021).

The A5 (convexity) axiom states that the production set is convex, meaning any convex combination of observed production plans is also feasible. This assumption plays a crucial role in the expansion of the production technology possibility set, rendering it particularly useful when dealing with small datasets. Although it is a strong assumption as it overlooks factors such as switching cost and time, it might result in an unrealistic optimal benchmark for a given DMU. However, it offers mathematical convenience without compromising the accuracy of the results (Bogetoft & Otto, 2010).

The A6 axiom indicates that the technology is under variable returns to scale (VRS). It implies that the production technology could exhibit varying economies of scale, such as increasing, constant, or decreasing returns to scale. For example, small firms may operate efficiently at a relatively small scale, while large commercial firms might have different efficiency considerations due to their size and scope. This assumption helps better reflect the complexities of real-world production processes. Compared to constant returns to scale (CRS), VRS is a relaxing assumption and enlarges the technology set, which leads to higher inefficiency scores for a specific DMU in terms of results.

Directional distance functionThe distance function is a widely utilized measurement and representation of production technology (Briec, Fukuyama & Ravelojaona, 2021). Two types of distance functions are commonly applied in the literature, namely, the Shephard distance function and the directional distance function (DDF) (Abad, 2015). Accordingly, productivity indexes are often based on the combination of the Shephard distance function, for instance, the Malmquist index and the Hicks-Moorsteen index. Productivity indicators are normally constructed by using the DDF (Abad & Ravelojaona, 2017; Chambers, Chung & Färe, 1998; Chung, Färe & Grosskopf, 1997), which explores the potential of reduction/expansion along the directions of inputs/outputs (Yang, Wei, Li, Huang & Chen, 2018). This paper employs the TFP indicator, which is based on the combination of eight different directional distance functions.

The general DDF (D) for expanding outputs and reducing inputs can be defined as follows:

where g=(gx,gy) is the direction vector of inputs and outputs of evaluated DMUs. δ and ϕ are inefficiency scores for inputs and outputs, respectively. These scores can be explained as the distances between the optimal point on the frontier and the evaluated DMUs (provinces): possible improvements in inputs and outputs through reductions (δ) and expansions (ϕ), respectively.Moreover, a radial measure is introduced when δ is equal to ϕ, namely, all inputs and outputs share identical decreases/increases as the evaluated DMUs approach the production frontier. Alternatively, a non-radial measure could be applied by employing specific scores for inputs and outputs. Specifically, as three inputs and one output are used in empirical analysis, the inefficiency scores for inputs can be further separated into three elements: labor force (δL), capital stock (δK) and digital input (δD). An average weight is imposed on each input, and the overall inefficiency score for the inputs is defined as follows:

Luenberger-Hicks-Moorsteen productivity indicatorBased on the aforementioned DDF, the LHM productivity indicator is applied to measure TFP growth in China, incorporating a digital factor. The change in TFP is evaluated by continuously measuring the distance between the DMUs and the frontier in period t and period t+1, and the average value represents the LHM TFP indicator. Then, the LHM TFP indicator is determined by the mean of two parts (Shen et al., 2019).

The LHM productivity indicator based on period t can be defined as the distance between the Luenberger output quantity indicator and the Luenberger input quantity indicator (Briec & Kerstens, 2004), which is defined as follows:

where the Luenberger output quantity indicator (Dt(xkt,ykt;0,gyt)−Dt(xkt,ykt+1;0,gyt+1)) measures the change in outputs from ykt to ykt+1 when the input xkt is constant (gxt=0) based on the technology in period t, and the Luenberger input quantity indicator (Dt(xkt+1,ykt;gxt+1,0)−Dt(xkt,ykt;gxt,0)) evaluates the change in inputs from xkt to xkt+1 with constant output (gyt=0) for period t (Shen et al., 2019). These two indicators generalize the Malmquist productivity input and output index (Briec & Kerstens, 2004). Correspondingly, for the period t+1, the LHM productivity can be obtained by:The LHM TFP indicator can be obtained by calculating the arithmetic mean of TFPLHMt and TFPLHMt+1, which is a comprehensive measurement method that avoids arbitrary choice of base period (Shen et al., 2019). An indicator value exceeding zero indicates an improvement in TFP and a forward movement of the production frontier. Conversely, a value below zero indicates a decline in TFP and a backward movement of the production frontier (Molinos-Senante et al., 2019). The TFP indicator is calculated as follows:

A novel input-oriented decomposition of the TFP indicatorThe commonly used decomposition method divides TFP into three categories: technical efficiency change, scale efficiency change and technological progress (Ang & Kerstens, 2017; Mocholi-Arce et al., 2021; Shen et al., 2019). To examine the driving forces of TFP gains with respect to each input, we propose a novel input-oriented decomposition for the TFP indicator (see Eq. 4). An average weight (13) is assigned to each sub-TFP indicator, as it is designed for each driving force (three inputs). For instance, the driving force of the labor force (TFPLt,t+1) in TFP growth can be computed by score (δL) instead of the total score (δ) in the TFP indicator as follows:

Similarly, the driving force of capital stock (TFPKt,t+1) in TFP growth can be defined as follows:

Correspondingly, the driving force of digital input (TFPDt,t+1) in TFP change is given by the following:

The above three parts can be aggregated to obtain the TFP indicator (TFPt,t+1), which is equal to the value calculated by Eq. (7):

Estimation strategyThe measurement of the TFP indicator needs to evaluate eight different intertemporal DDFs, which mainly use parametric methods (e.g., SFA) and nonparametric methods (e.g., DEA). Since the nonparametric method does not require to set the functional form in advance and is more convenient to describing the multi-input and multi-output production technology, this paper applies DEA to estimate the frontier. Moreover, it is assumed that the technology is under VRS to reduce heterogeneity. Take Dt(xkt+1,ykt;gxt+1,0) and Dt(xkt,ykt+1;0,gyt+1) as examples, as in Eqs. (12) and Eq. (13), respectively:

where δ and φ represent the potential reduction of inputs and the potential expansion of outputs, respectively. The objective function is to maximize both the decrease in inputs and the increase of outputs. λ are the activity variables. If DMUs reference the k-th sample, then λk is greater than 0. The condition∑k=1Kλk=1 means VRS are assumed.Data and resultsDataThis paper aims to measure the growth and driving factors of total factor productivity incorporating digital inputs in China. The above directional distance function is estimated to measure China's TFP by constructing balanced panel data for 30 Chinese provinces, municipalities, and autonomous regions (hereafter, provinces) from 2012 to 2021. Due to the unavailability of data, the selected sample does not encompass Xizang, Hong Kong, Macao, and Taiwan. The indicators selected in this paper include three inputs and one output. The input indicators comprise non-digital capital, digital capital, and labor force. The output indicator is the GDP. The data were obtained from the National Bureau of Statistics of China. The following is a specific description of the selected indicators.

The input indicators conclude three variables, as follows:

Non-digital capital input (K) is represented by the capital stock of 30 provinces. The most commonly used method for estimating capital stock is the perpetual inventory method, proposed by Goldsmith, 1951. The economic infrastructure capital stock (Kt) in year t can be obtained using current investment (It), the depreciation rate (δt), and the previous capital stock (Kt−1), which is expressed as Kt=(1−δt)Kt−1+It.

Labor input (L) is represented by the total number of employees. While labor hours or human capital that consider the quality would be preferable for describing labor input, such data are difficult to obtain. Following Chen, Zhang, He and Yuan (2019) and Tao, Wang and Zhu (2016), this study selects the total number of employees as a substitute indicator of labor input.

Digital capital input (D) is represented by the number of computers utilized by the enterprise. The digital economy is characterized by the computer-assisted digitalization of data (Williams, 2021). While some studies attempted to construct a comprehensive index of the digital economy (Guo, Song, Yu & Zhang, 2024; Lyu, Ge & Zhang, 2023), there is a distinction between the concept of the digital economy and that of digital capital. In a manner analogous to the contributions of labor and capital stock, digital capital serves as a special input that drives the development and expansion of the digital economy. However, it is still lacking in terms of reference to evaluation metrics at the macro level.

In this study, we employ the number of computers utilized by all enterprises as a proxy for digital capital inputs in each province, following the initial definition of digital capital proposed by Ragnedda's (2018). This definition refers to the accumulation of digital competencies and technologies,. While computers represent merely one dimension of digital capital—alongside software, telecommunications, and IT services—there is a strong correlation between computer usage and digital capital. This relationship stems from the pivotal function that computers perform in the operations of contemporary enterprises. As the primary producers of goods and services in any country, enterprises rely heavily on computers to drive efficiency and innovation. Computers facilitate the utilization of software for data input, processing, and output throughout all stages of the production and sales process. Computers are indispensable for data processing, internal communication, and various operational tasks, thereby significantly improving operational efficiency and resource management.

Previous studies have extensively discussed the role and influence of computers. From the perspective of the firm, Brynjolfsson and Hitt (2000) demonstrated that computers contribute significantly to business performance and economic growth, expanding beyond their computational capabilities. The benefits exceed their investment share disproportionately. Dedrick, Gurbaxani and Kraemer (2003) reviewed the impact of IT investments on productivity and economic growth, highlighting that previous studies often used investments in computer hardware as a proxy of IT capital. Similarly, Mahr and Kretschmer (2010) used the number of computers to represent the level of information technology and found that computer usage could increase a firm's value added. Therefore, the number of computers used within the enterprise is selected as a proxy for digital capital at the provincial level. It is important to note the limitations of this proxy. Computers alone do not capture the full scope of digital capital, which also includes software, telecommunications, and IT services. This limitation may underestimate the positive impact of digital capital on productivity.

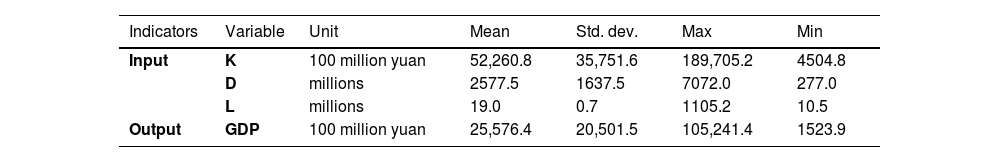

The output indicator is reflected by GDP. The regional GDP is selected as the substitute variable for output, which is deflated with 2011 as the base period to exclude the inflation factor. The descriptive statistics of each variable are shown in Table 1.

Empirical resultsAfter evaluating TFP indicator based on panel data for China's 30 provinces from 2012 to 2018, an analysis of the results was conducted to present meaningful information about changing trends and driving factors of TFP growth in China.

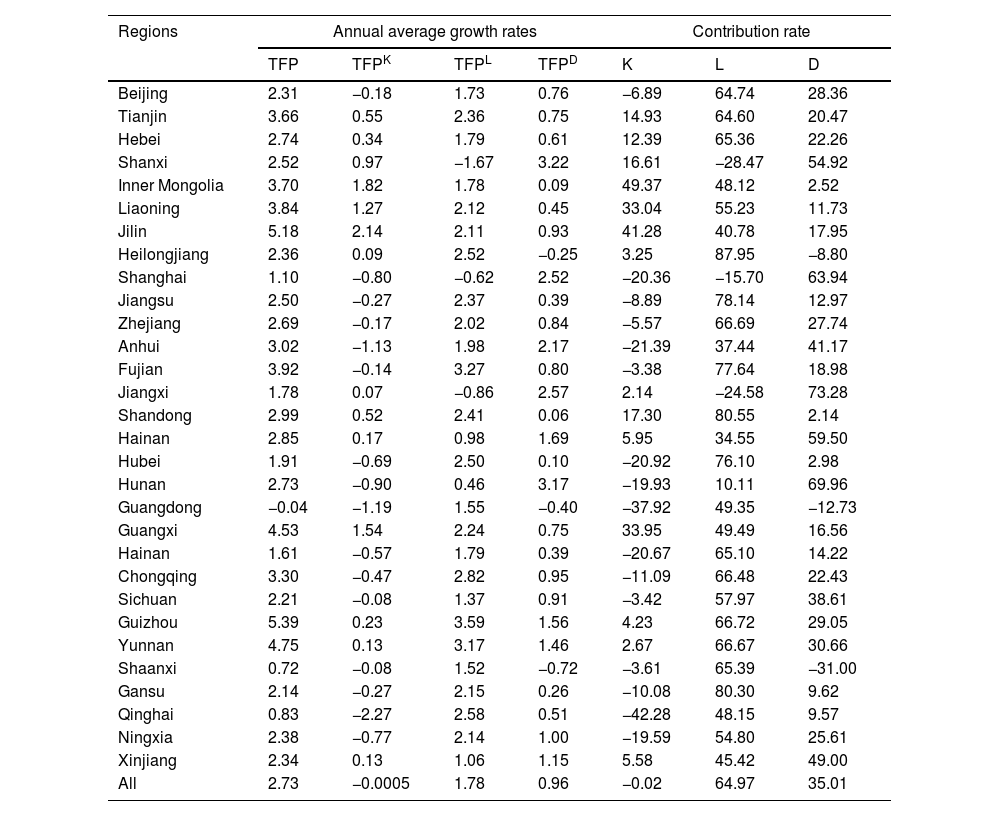

Table 2 illustrates the decomposition of TFP growth driven by different input factors and their respective contributions. Overall, the change of China's TFP is mainly driven by labor, with a contribution of labor reaching 64.97 %. Subsequently, digital capital exerts a significant influence, accounting for a contribution rate of 35.01 %. The contribution of non-digital capital input in the sample period (2012–2021) is negative (−0.02 %). The possible reasons for these results are given as follows.

Annual average growth rates of LHM TFP indicator, decomposition and contribution rate (2012–2021, %).

| Regions | Annual average growth rates | Contribution rate | |||||

|---|---|---|---|---|---|---|---|

| TFP | TFPK | TFPL | TFPD | K | L | D | |

| Beijing | 2.31 | −0.18 | 1.73 | 0.76 | −6.89 | 64.74 | 28.36 |

| Tianjin | 3.66 | 0.55 | 2.36 | 0.75 | 14.93 | 64.60 | 20.47 |

| Hebei | 2.74 | 0.34 | 1.79 | 0.61 | 12.39 | 65.36 | 22.26 |

| Shanxi | 2.52 | 0.97 | −1.67 | 3.22 | 16.61 | −28.47 | 54.92 |

| Inner Mongolia | 3.70 | 1.82 | 1.78 | 0.09 | 49.37 | 48.12 | 2.52 |

| Liaoning | 3.84 | 1.27 | 2.12 | 0.45 | 33.04 | 55.23 | 11.73 |

| Jilin | 5.18 | 2.14 | 2.11 | 0.93 | 41.28 | 40.78 | 17.95 |

| Heilongjiang | 2.36 | 0.09 | 2.52 | −0.25 | 3.25 | 87.95 | −8.80 |

| Shanghai | 1.10 | −0.80 | −0.62 | 2.52 | −20.36 | −15.70 | 63.94 |

| Jiangsu | 2.50 | −0.27 | 2.37 | 0.39 | −8.89 | 78.14 | 12.97 |

| Zhejiang | 2.69 | −0.17 | 2.02 | 0.84 | −5.57 | 66.69 | 27.74 |

| Anhui | 3.02 | −1.13 | 1.98 | 2.17 | −21.39 | 37.44 | 41.17 |

| Fujian | 3.92 | −0.14 | 3.27 | 0.80 | −3.38 | 77.64 | 18.98 |

| Jiangxi | 1.78 | 0.07 | −0.86 | 2.57 | 2.14 | −24.58 | 73.28 |

| Shandong | 2.99 | 0.52 | 2.41 | 0.06 | 17.30 | 80.55 | 2.14 |

| Hainan | 2.85 | 0.17 | 0.98 | 1.69 | 5.95 | 34.55 | 59.50 |

| Hubei | 1.91 | −0.69 | 2.50 | 0.10 | −20.92 | 76.10 | 2.98 |

| Hunan | 2.73 | −0.90 | 0.46 | 3.17 | −19.93 | 10.11 | 69.96 |

| Guangdong | −0.04 | −1.19 | 1.55 | −0.40 | −37.92 | 49.35 | −12.73 |

| Guangxi | 4.53 | 1.54 | 2.24 | 0.75 | 33.95 | 49.49 | 16.56 |

| Hainan | 1.61 | −0.57 | 1.79 | 0.39 | −20.67 | 65.10 | 14.22 |

| Chongqing | 3.30 | −0.47 | 2.82 | 0.95 | −11.09 | 66.48 | 22.43 |

| Sichuan | 2.21 | −0.08 | 1.37 | 0.91 | −3.42 | 57.97 | 38.61 |

| Guizhou | 5.39 | 0.23 | 3.59 | 1.56 | 4.23 | 66.72 | 29.05 |

| Yunnan | 4.75 | 0.13 | 3.17 | 1.46 | 2.67 | 66.67 | 30.66 |

| Shaanxi | 0.72 | −0.08 | 1.52 | −0.72 | −3.61 | 65.39 | −31.00 |

| Gansu | 2.14 | −0.27 | 2.15 | 0.26 | −10.08 | 80.30 | 9.62 |

| Qinghai | 0.83 | −2.27 | 2.58 | 0.51 | −42.28 | 48.15 | 9.57 |

| Ningxia | 2.38 | −0.77 | 2.14 | 1.00 | −19.59 | 54.80 | 25.61 |

| Xinjiang | 2.34 | 0.13 | 1.06 | 1.15 | 5.58 | 45.42 | 49.00 |

| All | 2.73 | −0.0005 | 1.78 | 0.96 | −0.02 | 64.97 | 35.01 |

Firstly, the enhancement of human capital quality, such as human health, may be a crucial factor in achieving the potential development capacity of the Chinese economy, thereby promoting its sustained growth (Zhang et al., 2021; Zhao & Zhou, 2021). As a country with the largest population in the world, China possesses a relatively sufficient labor supply. Since the implementation of reform and opening up policy, China has become the world's factory, providing vast opportunities for labor and business. Due to the opportunity to move freely, workers can transcend the limitations of geographical and industrial boundaries. Consequently, a considerable labor force from remote areas is available to enter provinces facing labor shortages. As a result, the labor force has become the primary driver of the TFP growth of China's economy.

The digital capital contribution rate is the second most significant factor, after the labor contribution rate. This is mainly because digital knowledge and information have been used as a novel production factor to encourage the transformation and upgrading of industries (Yuan et al., 2021). They are deeply integrated with various industries and serve to reduce the transaction costs of economic entities (Umar, Rizvi & Naqvi, 2021), thereby greatly improving the efficiency of economic operation. The results suggest that China's economic growth cannot maintain rapid growth if it only relies on the input of traditional capital and labor.

The contribution of non-digital capital, amounting to −0.02 %, differs from previous findings. For instance, Deng, Song, Jiang and Pang (2023) concluded that Chinese economic growth was mainly driven by capital input from 1985 to 2020, using a nonparametric model. The difference in results can be attributed to two primary factors: first, we separate digital capital from non-digital capital as an independent input element within the productivity evaluation framework; second, the sample period in this study is relatively limited, spanning only from 2012 to 2021. Deng et al. (2023) also concluded that the pulling power of capital for economic growth has declined since 2012. In recent years, the phenomenon of overcapacity has resulted in the diminished significance of non-digital capital's role in driving TFP.

From the perspective of the provinces, there are significant differences in TFP growth and the contribution of the driving force among the regions. The seven provinces exhibiting the highest annual average growth rates of TFP are Guizhou, Jilin, Yunnan, Guangxi, Fujian, Liaoning, and Inner Mongolia, which are concentrated in the western regions of China. This finding may be attributed to the large-scale construction of data centers in these regions when digital capital is involved in TFP measurement. These provinces offer two key advantages: Firstly, they are sparsely populated, leading to low construction costs and abundant power resources for data centers. Second, the cold and dry climate conditions of these areas are conducive to reducing the cooling costs for data centers.

In addition, the implementation of national policies in the western region further supports these findings. The Western Development Plan, initiated in 2000, aims to bolster economic growth and reduce regional disparities by focusing on China's western provinces. In the initial decade of this policy, the emphasis was on improving infrastructure, restoring the ecological environment, and promoting education (Lu & Deng, 2011). In the second decade, while continuing to prioritize infrastructure and environmental protection, the strategy expanded to include the development of modern industries as a new objective. The plan's emphasis on infrastructure and resource optimization may foster an environment conducive to digital innovation and technological advancement, thereby driving regional economic growth (Xue, Tang, Wu, Liu & Hao, 2022). Since the implementation of this policy, the GDP and industrial structure of the western region have continuously improved, leading to the emergence of specialized industries such as Chongqing's electronic information sector and Guizhou's big data industry. Currently, leveraging its climate advantages and policy support, Guizhou has become China's comprehensive big data pilot zone, hosting several mega data centers. The digital economies of Sichuan and Chongqing have each surpassed one trillion yuan. Moreover, the presence of talent from western universities, combined with financial support and tax incentives from the Western Development Plan, has created ample potential for the growth of the digital economy in the region. The notable impact of the digital economy on the total factor productivity and technological progress in the western region is also highlighted in Zhang, Hu, Guo and Wang (2024).

Labor is the primary driver of TFP growth in over 20 provinces. The six provinces with the highest labor contribution rates are Heilongjiang, Shandong, Gansu, Jiangsu, Fujian, and Hubei, with rates exceeding 70 %. This indicates that labor is the main driving force for economic growth in these provinces with abundant labor endowments. Moreover, given the significant labor-driven growth experienced by these provinces, it is crucial to prioritize the enhancement of workforce quality and skill sets to ensure sustainable development and competitiveness. By allocating resources toward initiatives that enhance the quality of education, facilitate training opportunities, and promote skill development, these regions could optimize labor productivity and foster innovation.

Digital capital is the most important factor to promote TFP change in seven provinces. They are Jiangxi, Hunan, Shanghai, Hainan, Shanxi, Xinjiang, and Anhui, with contribution rates exceeding 45 %. In these provinces, due to the rapid growth of the digital economy, “digit” has become a significant driving source for economic growth. It is worth noting that Shaanxi, Guangdong, and Heilongjiang experienced negative digital-driven growth. Although Guangdong has the largest digital economy, its excessive reliance on extensive growth has led to issues such as low added value of digital products, serious product homogeneity, and weak core technical capabilities.

The productivity changes driven by non-digital capital are negative in over half of the provinces, such as Qinghai, Guangdong, and Anhui. This negative value reflects the issue of overcapacity in certain regions of China, indicating that these provinces possess an excessive number of capital input factors that surpass market demand. Consequently, traditional capital, rather than serving as a catalyst for economic growth, becomes a hindrance. This may be because in the early stage of China's reform and opening up, non-digital capital accumulation was a key factor in the rapid growth of China's economy (Zhang et al., 2021). However, during the sample period selected in this study, the role of non-digital capital in promoting TFP growth is moderately insignificant, even producing adverse effects.

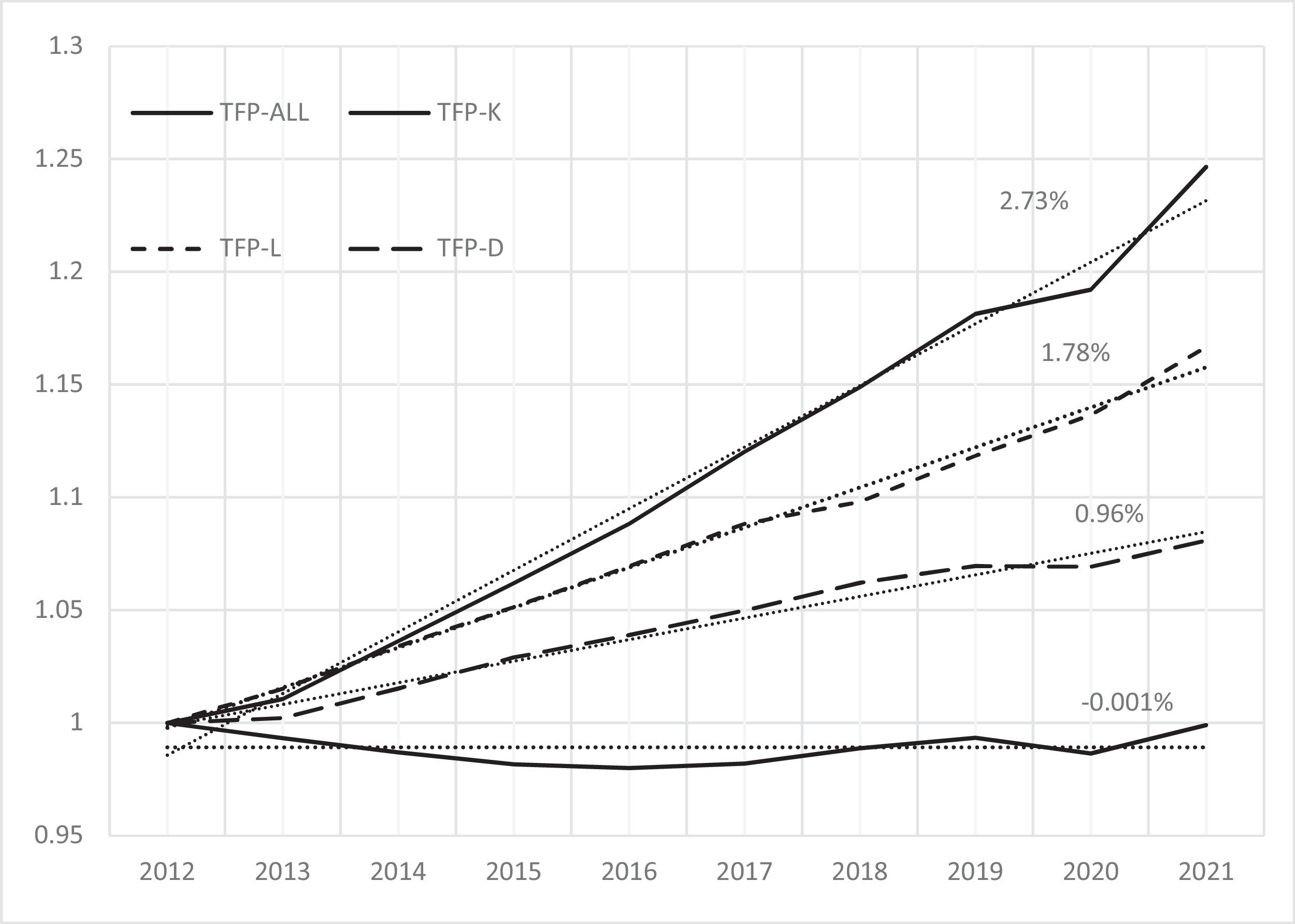

Fig. 1 shows cumulative productivity trends driven by different inputs. Since 2012, TFP has demonstrated a steady increase, with an average growth rate of 2.73 %. It's important to highlight that there was a slight decline in TFP in 2020, due to the economic impact of the epidemic. However, in 2021, TFP rebounded, resuming its growth trajectory. The slope of the TFP rate from 2020 to 2021 exceeded that of the average trend line, indicating a growth rate surpassing the average TFP growth rate (2.73 %).

From the perspective of decomposition, the average growth trend of the TFP indicator driven by labor is 1.78 %. Correspondingly, change in the TFP promoted by digital capital is only lower than that of the labor force, with an average growth trend of 0.96 %. Simultaneously, the TFP indicator driven by non-digital capital fluctuates quite slightly, with an average growth trend of −0.001 %. As shown in Fig. 1, the TFP change primarily relied on labor and digital capital from 2012 to 2021, which is consistent with the conclusions in Table 1. This may be explained by the fact that employees can relatively freely follow the market mechanism to move between industries within the labor market. In addition, with China's emphasis on the introduction of talent, the promotion effect of the labor force on China's total factor productivity cannot be ignored. Moreover, with the gradual improvement of new infrastructure1 projects and national policy support, the role of digital capital investment in stimulating TFP change has increased on an annual basis. Despite the rapid growth of China's economy in recent years, issues such as rising costs and overcapacity have emerged, resulting in limited effects of non-digital capital in promoting economic growth (Zhang, Liu & Huang, 2021).

Influencing factors of TFPModel settingTo explore the influencing factors of TFP incorporating digital inputs, TFP,TFPL,TFPD and TFPK are employed as the explained variables. The digital economy was selected as the core explanatory variable to further explore the impact of the digital economy on China's TFP. The integration of digital technology with traditional industries promotes the digital transformation of industries, improves the utilization of resources, and drives improvements in production quantity and quality (Zou, Liao & Fan, 2024). In addition, the expansion of information channels can make communication and cooperation more convenient, thus improving production efficiency. The comprehensive digital economy indicators (abbreviated as dig) constructed by Pan et al. (2022) are used to represent the digital economy. These indicators consider three primary components: infrastructure, industrial scale, and digital spillover value, along with ten secondary elements, see Pan et al. (2022) for more details.

For the selection of control variables, we introduce the level of economic development(gdp), the degree of government support (gov), the industrial structure upgrading index(stru) and the intensity of firms' R&D investment (rd).

GDP per capita serves as an indicator of a province's level of economic development. To quantify this, we utilize the logarithm of GDP per capita, which is a widely accepted measure of economic development and wealth. A higher level of economic development typically correlates with improved infrastructure, education and investment in technology, which may contribute to higher performance. However, provinces with higher economic levels might also experience the overinvestment issue, potentially leading to potential inefficiencies and less TFP.

Government spending on science and technology may exert an influence on TFP. The degree of government support is measured by calculating the ratio of government fiscal expenditure on technology to total provincial expenditure. This ratio indicates the extent to which the government deems technology development to be a priority, which can be crucial for fostering an innovative environment. On the one hand, it can promote technological innovation within enterprises, thereby enhancing TFP. On the other hand, excessive government intervention may also breed corruption and rent-seeking issues, thereby inhibiting TFP growth (Wang, He & Zhang, 2021).

Shifts in industrial structure may impact TFP. We employ the ratio of the tertiary industry to the secondary industry, which captures the transition towards a service-oriented economy, a critical aspect of industrial upgrading. The optimization and upgrading of industrial structure, which facilitates the reallocation of resources from low-productivity sectors to high-productivity sectors, may boost TFP. Conversely, if the service sector becomes excessively developed, resulting in the hollowing out of industries, it could lead to a decline in TFP.

The level of research and development (R&D) expenditures by enterprises is also selected as a control variable. We utilize the ratio of R&D expenditures by large-scale industrial enterprises to their primary business income to gauge R&D intensity. This ratio directly reflects the commitment of firms to innovation and technological advancement. The ongoing accumulation of technology and knowledge assets ensures that scientific and technological advancements remain current, thereby augmenting TFP. Conversely, excessive input into scientific and technological expertise, along with prolonged cycles and high risk in technological innovation, may impede productivity growth in the short term.

All control variables are logarithmically transformed. The control variables were selected based on their direct relevance to economic development, government support, industrial structure, and innovation, all of which are critical to understanding and promoting TFP growth. Higher levels of GDP per capita, effective government support, optimized industrial structures, and intensive R&D investment are expected to collectively influence the productivity of labor, non-digital capital, and digital capital, thereby driving overall TFP growth. Thus, the specific model is set as follows:

TFPith represents the cumulative indication of TFP in the i th country at time t. When h=all, the explained variable is the cumulative overall TFP. Similarly, when h = L, h = K, and h = D, the explained variables are cumulative TFP changes driven by labor, non-digital capital, and digital capital, respectively.2β0i is the intercept term of the regression model, βj(j=1,2,3,4) represents the estimated coefficient of each explanatory variable, σi represents individual fixed effects in provinces, and εit is the random error term, which follows a normal distribution.

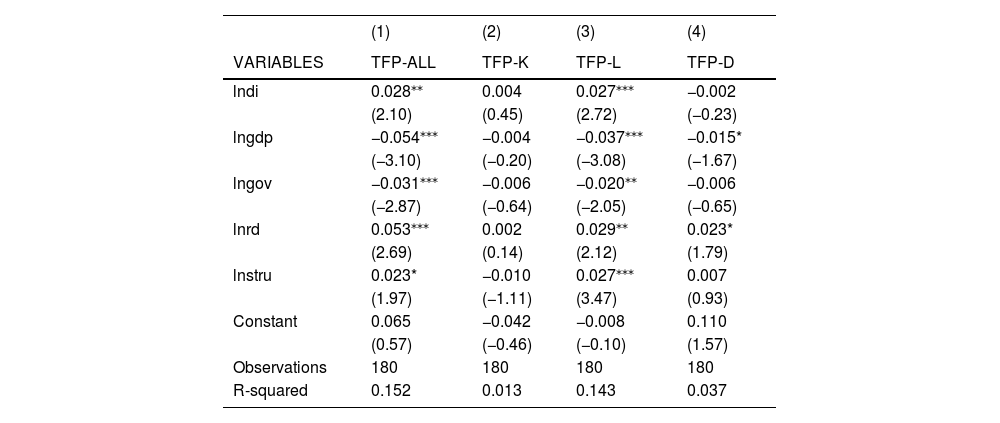

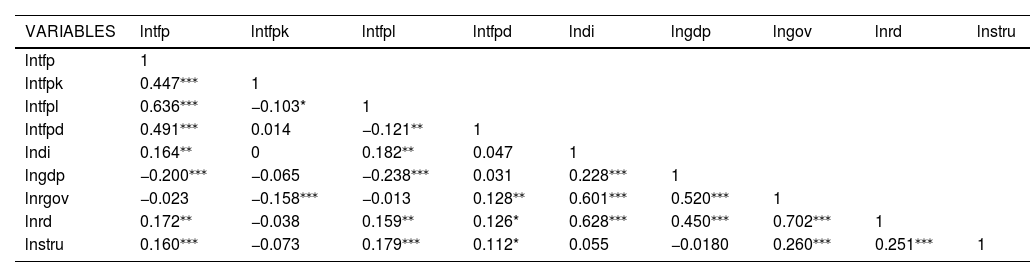

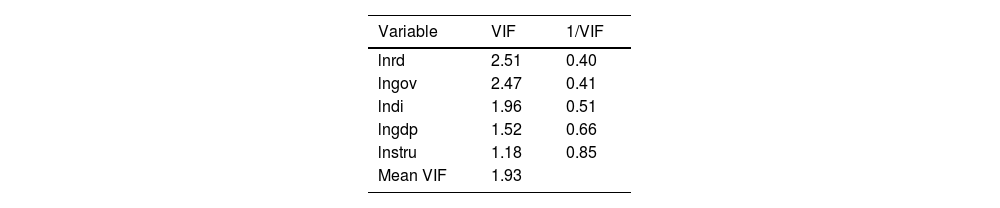

Benchmark regression resultsWe first conduct ordinary least squares (OLS) estimation, with the results presented in Table 3. To verify that the sample data meets the assumptions of OLS, Pearson correlation analysis and variance inflation factor (VIF) test are conducted. The results are shown in Tables 4 and Table 5, respectively. Referring to Male and Kopalle (2002), the correlation coefficients in the Pearson correlation matrix do not exceed 0.75, indicating no significant multicollinearity. Additionally, the highest VIF value observed is 2.51, significantly below the threshold of 10. It further confirms the absence of multicollinearity among the variables.

Benchmark results (OLS).

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| VARIABLES | TFP-ALL | TFP-K | TFP-L | TFP-D |

| lndi | 0.028⁎⁎ | 0.004 | 0.027⁎⁎⁎ | −0.002 |

| (2.10) | (0.45) | (2.72) | (−0.23) | |

| lngdp | −0.054⁎⁎⁎ | −0.004 | −0.037⁎⁎⁎ | −0.015* |

| (−3.10) | (−0.20) | (−3.08) | (−1.67) | |

| lngov | −0.031⁎⁎⁎ | −0.006 | −0.020⁎⁎ | −0.006 |

| (−2.87) | (−0.64) | (−2.05) | (−0.65) | |

| lnrd | 0.053⁎⁎⁎ | 0.002 | 0.029⁎⁎ | 0.023* |

| (2.69) | (0.14) | (2.12) | (1.79) | |

| lnstru | 0.023* | −0.010 | 0.027⁎⁎⁎ | 0.007 |

| (1.97) | (−1.11) | (3.47) | (0.93) | |

| Constant | 0.065 | −0.042 | −0.008 | 0.110 |

| (0.57) | (−0.46) | (−0.10) | (1.57) | |

| Observations | 180 | 180 | 180 | 180 |

| R-squared | 0.152 | 0.013 | 0.143 | 0.037 |

Standard errors in parentheses.

Pearson correlation matrix.

| VARIABLES | lntfp | lntfpk | lntfpl | lntfpd | lndi | lngdp | lngov | lnrd | lnstru |

|---|---|---|---|---|---|---|---|---|---|

| lntfp | 1 | ||||||||

| lntfpk | 0.447⁎⁎⁎ | 1 | |||||||

| lntfpl | 0.636⁎⁎⁎ | −0.103* | 1 | ||||||

| lntfpd | 0.491⁎⁎⁎ | 0.014 | −0.121⁎⁎ | 1 | |||||

| lndi | 0.164⁎⁎ | 0 | 0.182⁎⁎ | 0.047 | 1 | ||||

| lngdp | −0.200⁎⁎⁎ | −0.065 | −0.238⁎⁎⁎ | 0.031 | 0.228⁎⁎⁎ | 1 | |||

| lnrgov | −0.023 | −0.158⁎⁎⁎ | −0.013 | 0.128⁎⁎ | 0.601⁎⁎⁎ | 0.520⁎⁎⁎ | 1 | ||

| lnrd | 0.172⁎⁎ | −0.038 | 0.159⁎⁎ | 0.126* | 0.628⁎⁎⁎ | 0.450⁎⁎⁎ | 0.702⁎⁎⁎ | 1 | |

| lnstru | 0.160⁎⁎⁎ | −0.073 | 0.179⁎⁎⁎ | 0.112* | 0.055 | −0.0180 | 0.260⁎⁎⁎ | 0.251⁎⁎⁎ | 1 |

Standard errors in parentheses.

Variance inflation factor test.

| Variable | VIF | 1/VIF |

|---|---|---|

| lnrd | 2.51 | 0.40 |

| lngov | 2.47 | 0.41 |

| lndi | 1.96 | 0.51 |

| lngdp | 1.52 | 0.66 |

| lnstru | 1.18 | 0.85 |

| Mean VIF | 1.93 |

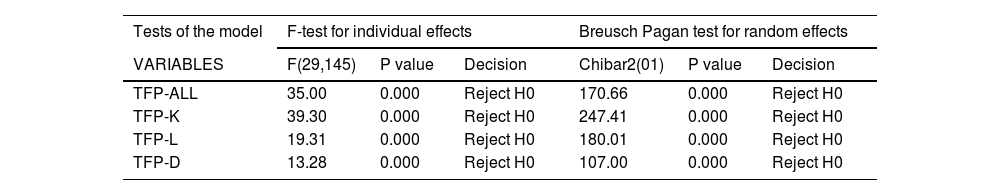

In the four regressions, the adjusted R2 values range from 0.04 to 0.11, indicating that the model exhibits a low goodness of fit. Subsequently, F-tests are applied in order to check for fixed effects, and the Breusch and Pagan Lagrangian multiplier tests are used for the significance of random effect. The results are shown in Table 6. Both tests reject the null hypothesis, indicating that individual effects are significant and need to be considered. In addition, the pooled OLS model ignores individual effects by assuming homogeneity across all provinces, leading to biased estimates.

Results of F-test and Breusch Pagan test.

| Tests of the model | F-test for individual effects | Breusch Pagan test for random effects | ||||

|---|---|---|---|---|---|---|

| VARIABLES | F(29,145) | P value | Decision | Chibar2(01) | P value | Decision |

| TFP-ALL | 35.00 | 0.000 | Reject H0 | 170.66 | 0.000 | Reject H0 |

| TFP-K | 39.30 | 0.000 | Reject H0 | 247.41 | 0.000 | Reject H0 |

| TFP-L | 19.31 | 0.000 | Reject H0 | 180.01 | 0.000 | Reject H0 |

| TFP-D | 13.28 | 0.000 | Reject H0 | 107.00 | 0.000 | Reject H0 |

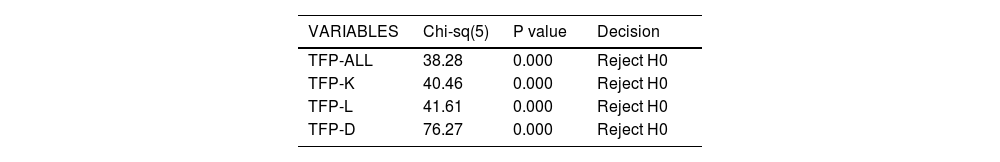

The Hausman test is a commonly employed statistical tool in empirical research, utilized to choose between fixed effects and random effects models. However, it may not be applicable in the presence of heteroskedasticity or serial correlation in the error term, nor in models that consider cluster-robust standard errors. Therefore, this study utilizes the Sargan-Hansen test, which provides a robust alternative for choosing between the fixed model effect model and the random effect model.

The Sargan-Hansen test results, presented in Table 7, indicate that the null hypothesis (that the random effects are appropriate) is strongly rejected for all explanatory variables, with p-values of 0 suggesting this rejection. Thus, we use fixed effect models with robust standard errors. It is important to note that the random effects model assumes that individual effects are uncorrelated with the independent variables, which is a rather strong assumption in real-world scenarios. However, the fixed effects model also has limitations, such as the potential influence of unobserved time-varying heterogeneity. As Collischon and Eberl (2020) pointed out, although no standard model could completely avoid the issue of unobserved heterogeneity, fixed effects models are more robust to biases compared to other models.

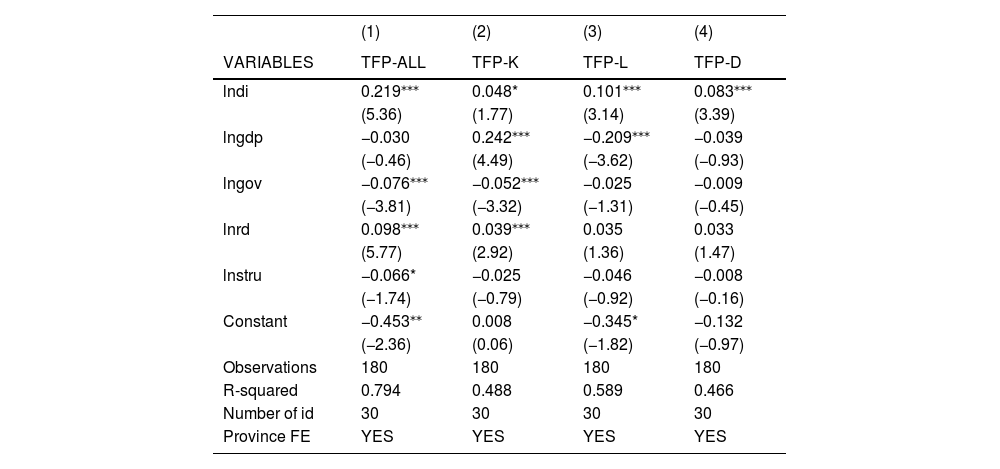

The results of the panel regression are shown in Table 8. The digital economy is significant at the 10 % level for TFP-ALL, TFP-K, TFP-L, and TFP-D, with positive coefficients. This suggests that the degree of digital development impacted positively on China's TFP. GDP per capita has a positive effect on capital-driven TFP growth while exerting a negative influence on labor-driven TFP growth. Furthermore, growth on government support and the transition to the tertiary sector exhibit a significant negative correlation with TFP growth, highlighting their suppressive effect. Conversely, firms' R&D expenditures emerge as a positive effect on TFP growth. In addition, we gradually add control variables to the model to test the robustness of the core variable coefficients, with detailed results provided in the Appendix.

Panel fixed effects regression results with robust standard errors.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| VARIABLES | TFP-ALL | TFP-K | TFP-L | TFP-D |

| lndi | 0.219⁎⁎⁎ | 0.048* | 0.101⁎⁎⁎ | 0.083⁎⁎⁎ |

| (5.36) | (1.77) | (3.14) | (3.39) | |

| lngdp | −0.030 | 0.242⁎⁎⁎ | −0.209⁎⁎⁎ | −0.039 |

| (−0.46) | (4.49) | (−3.62) | (−0.93) | |

| lngov | −0.076⁎⁎⁎ | −0.052⁎⁎⁎ | −0.025 | −0.009 |

| (−3.81) | (−3.32) | (−1.31) | (−0.45) | |

| lnrd | 0.098⁎⁎⁎ | 0.039⁎⁎⁎ | 0.035 | 0.033 |

| (5.77) | (2.92) | (1.36) | (1.47) | |

| lnstru | −0.066* | −0.025 | −0.046 | −0.008 |

| (−1.74) | (−0.79) | (−0.92) | (−0.16) | |

| Constant | −0.453⁎⁎ | 0.008 | −0.345* | −0.132 |

| (−2.36) | (0.06) | (−1.82) | (−0.97) | |

| Observations | 180 | 180 | 180 | 180 |

| R-squared | 0.794 | 0.488 | 0.589 | 0.466 |

| Number of id | 30 | 30 | 30 | 30 |

| Province FE | YES | YES | YES | YES |

Standard errors in parentheses.

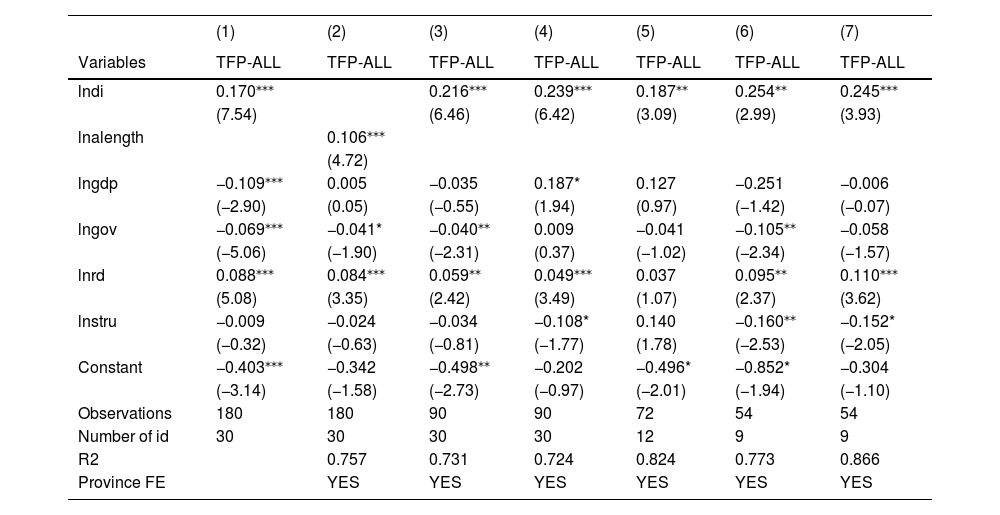

We conducted several robustness tests to validate our findings, including model replacement, core explanatory variable substitution, sample period segmentation, and subsampling.

Firstly, we replaced the fixed effects model with a Tobit model. Given that cumulative TFP and its decomposition exhibit left-censoring at 1, its logarithmic values are also left-censored at 0. The results are presented in column (1) of Table 9. Secondly, we substituted the core explanatory variable by using the length of fiber optic cable per hectare as a proxy for the development of the digital economy, applying logarithmic transformation to this variable. The results are shown in column (2). Thirdly, we divided the sample period into two distinct intervals: 2013–2015 and 2016–2018, with results displayed in columns (3) and (4), respectively. Lastly, we performed subsample regressions by categorizing provinces into eastern, central, and western regions based on China's geographic divisions. The results are provided in columns (5) through (7).

Robustness test results.

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| Variables | TFP-ALL | TFP-ALL | TFP-ALL | TFP-ALL | TFP-ALL | TFP-ALL | TFP-ALL |

| lndi | 0.170⁎⁎⁎ | 0.216⁎⁎⁎ | 0.239⁎⁎⁎ | 0.187⁎⁎ | 0.254⁎⁎ | 0.245⁎⁎⁎ | |

| (7.54) | (6.46) | (6.42) | (3.09) | (2.99) | (3.93) | ||

| lnalength | 0.106⁎⁎⁎ | ||||||

| (4.72) | |||||||

| lngdp | −0.109⁎⁎⁎ | 0.005 | −0.035 | 0.187* | 0.127 | −0.251 | −0.006 |

| (−2.90) | (0.05) | (−0.55) | (1.94) | (0.97) | (−1.42) | (−0.07) | |

| lngov | −0.069⁎⁎⁎ | −0.041* | −0.040⁎⁎ | 0.009 | −0.041 | −0.105⁎⁎ | −0.058 |

| (−5.06) | (−1.90) | (−2.31) | (0.37) | (−1.02) | (−2.34) | (−1.57) | |

| lnrd | 0.088⁎⁎⁎ | 0.084⁎⁎⁎ | 0.059⁎⁎ | 0.049⁎⁎⁎ | 0.037 | 0.095⁎⁎ | 0.110⁎⁎⁎ |

| (5.08) | (3.35) | (2.42) | (3.49) | (1.07) | (2.37) | (3.62) | |

| lnstru | −0.009 | −0.024 | −0.034 | −0.108* | 0.140 | −0.160⁎⁎ | −0.152* |

| (−0.32) | (−0.63) | (−0.81) | (−1.77) | (1.78) | (−2.53) | (−2.05) | |

| Constant | −0.403⁎⁎⁎ | −0.342 | −0.498⁎⁎ | −0.202 | −0.496* | −0.852* | −0.304 |

| (−3.14) | (−1.58) | (−2.73) | (−0.97) | (−2.01) | (−1.94) | (−1.10) | |

| Observations | 180 | 180 | 90 | 90 | 72 | 54 | 54 |

| Number of id | 30 | 30 | 30 | 30 | 12 | 9 | 9 |

| R2 | 0.757 | 0.731 | 0.724 | 0.824 | 0.773 | 0.866 | |

| Province FE | YES | YES | YES | YES | YES | YES |

Standard errors in parentheses.

The robustness tests consistently show that the significance and direction of the coefficients related to the digital economy remain unchanged. This underscores the crucial role of digital technologies in enhancing productivity and driving economic development.

Conclusions and policy implicationsAt present, innovations in information network technology are emerging. The digitization, as a key production factor, is booming and has become a new engine for use by China to promote high-quality economic development and restore the economy after the epidemic. Based on the LHM total factor productivity indicator, this study calculates the growth and driving factors of the TFP indicator in 30 provinces from 2012 to 2021 to explore the reasons for rapid economic growth and analyze the new momentum for China. We obtain the following conclusions.

First, the changes in China's total factor productivity are primarily driven by labor and digital capital. During the sample period, labor contributed 64.97 % and digital capital contributed 35.01 % to the TFP growth. The impact of traditional capital input on China's economic growth gradually weakened in the sample period, with a contribution rate of −0.02 %. The results show that digital knowledge and information have become crucial production factors for promoting China's high-quality development. Relying solely on traditional capital and labor, China cannot achieve high-quality economic growth.

Second, China's total factor productivity steadily increased during the sample period, with an average growth trend of 4.19 %. Except in 2020, which was hit by the epidemic and saw a small decline in TFP. The average growth trend of the TFP indicator driven by labor is 2.41 %. Moreover, the contribution of digital capital, although significant, is slightly less than that of the labor force, with an average growth trend of 1.82 %. However, the TFP indicator driven by non-digital capital shows minimal fluctuation, with an average growth trend of −0.0005 %.

Third, the effects of digital input, non-digital capital, and labor on TFP growth vary across different provinces. Labor is the primary factor driving TFP growth in most provinces, followed by digital capital. Only two provinces have productivity growth that is primarily driven by non-digital capital.

Fourth, in the Industry 4.0 era, the development of the digital economy and R&D showed significantly increased China's TFP growth in a production method that uses digital as a key production factor.

According to the conclusions found in this paper, the following policy implications can be obtained:

Firstly, given that labor remains the primary driver of China's Total Factor Productivity (TFP) growth, it is imperative for China to enhance the influx of talent and elevate the quality of talent services, particularly in high-level scientific and technological domains. This step would further bolster technological innovation and the high-tech sector's advancement.

Secondly, given that the digital factor ranks as the second largest contributor to TFP growth, it is imperative to effectively harness and realize the vast potential of digital capital. Data holds no intrinsic value; it becomes valuable only through effective utilization. Enterprises should focus on enhancing industrial data development and fostering the deep integration of digital and traditional economies. This can be achieved by extracting useful insights from data and applying them to traditional factors such as land, labor, and capital, as well as by innovating data application scenarios in key sectors like industry, agriculture, finance, and commerce. In addition, the government should guide industry-leading enterprises in processing value-added data and opening it up in a structured manner. SMEs should be encouraged to collaborate across the industry chain and incorporate third-party data services, fostering the development of a digital enterprise community that promotes synergistic growth along the entire value chain. Meanwhile, public data is a significant component of regional data capital, characterized by its large volume and high quality. Public data in areas such as science and technology, healthcare, emergency management, meteorology, and urban operations should be made accessible.

Finally, since R&D has a positive impact on TFP, augmenting investment in the digital and technological innovation sectors is vital to propelling the growth of a digital economy steered by innovation. Encouraging enterprises to boost R&D spending in the digital sector and accelerating technological transformation are key strategies. Providing incentives like tax breaks and grants can stimulate R&D investment, while fostering collaboration between industry and academia and creating favorable regulatory environments can accelerate technology adoption. These initiatives will propel digital economy growth, driving productivity, job creation, and economic competitiveness.

While this paper provides valuable insights, several potential areas for improvement remain. First, the analysis covers the sample period from 2012 to 2021, observing changes in TFP over a decade. Expanding the sample period in future research could offer a more comprehensive view. Second, the study employs provincial data to explore changes and the driving force in China's total factor productivity. Future research could benefit from utilizing city-level or county-level data to provide a more detailed analysis of policy implications. Finally, the current proxy variable for digital capital, which is based on the number of computers used by firms, primarily reflects hardware investment and does not fully capture investments in software, telecommunications, and IT services. Future studies could enhance the analysis by incorporating more comprehensive proxies for digital capital.

CRediT authorship contribution statementKaixuan Bai: Writing – review & editing, Writing – original draft, Methodology, Formal analysis, Data curation. Zhiyang Shen: Writing – review & editing, Writing – original draft, Supervision, Project administration, Methodology, Formal analysis. Shuyuan Zhou: Writing – review & editing, Writing – original draft, Visualization, Funding acquisition, Data curation. Zihan Su: Writing – review & editing, Writing – original draft, Visualization, Formal analysis, Data curation. Rongrong Yang: Writing – review & editing, Writing – original draft, Visualization, Formal analysis, Data curation. Malin Song: Writing – review & editing, Writing – original draft, Methodology, Formal analysis, Conceptualization.

The authors acknowledge the research fund from the National Natural Science Foundation of China (72104028 and 71934001) and the financial support from the Beijing Institute of Technology Research Fund Program for Young Scholars. We thank for the financial support from the National Undergraduate Training Programs for Innovation and Entrepreneurship of Beijing Institute of Technology.

The "2020 State Council Government Work Report" proposed to strengthen new infrastructure construction, which includes 7 important areas: 5G networks, industrial internet, intercity transportation and rail system, new-energy vehicle charging stations, data centers, artificial intelligence, and ultrahigh voltage power transmission.