The Chinese government aims to use environmental policy measures to improve society's overall green total factor productivity (GTFP) and create a new development pattern in which the economy and the environment are equally important. Based on the perspective of indirect financing, this study divides 272 prefecture-level industry–finance cooperation cities in China from 2015 to 2021 into 109 resource-based cities and 163 nonresource-based cities; we use the PSM-difference-in-differences (DID) model to explore their impact on GTFP. The research results are as follows. First, industry–finance cooperation significantly promotes GTFP. Second, although the nonresource-based cities have insignificant industry–finance cooperation, resource-based cities have significantly positive industry–finance cooperation. Third, from the perspective of indirect financing, industry–finance cooperation can effectively improve GTFP. Fourth, the reliability of the conclusions is verified by successively using the parallel trend test, the placebo test, the dynamic time window test, the counterfactual test, and the elimination of other policy interferences. Based on the above findings, the Chinese government must always adhere to the important “comprehensive regulation and measures according to local conditions” policy and fully use “information technology and green credit.”

The central contradiction in Chinese society has recently been transformed into “the contradiction between the people's ever-growing needs for a better life and unbalanced and insufficient development.” China's pollutant emissions ranked first in the world in 2009 (Lin et al., 2019), and environmental pollution has become one of the essential causes of major social conflicts (Liu and Kalirajan, 2024; Qiu et al., 2022b). Therefore, the Chinese government clearly stated that promoting total factor productivity through supply-side structural reforms is necessary to ensure the coordination and unity of economic development and ecological environment construction; however, traditional total factor productivity does not reflect the impact of environmental pollution on social welfare and sustainable economic development. Therefore, scholars have proposed green total factor productivity (GTFP), a comprehensive indicator considering economic development and ecological environment construction.

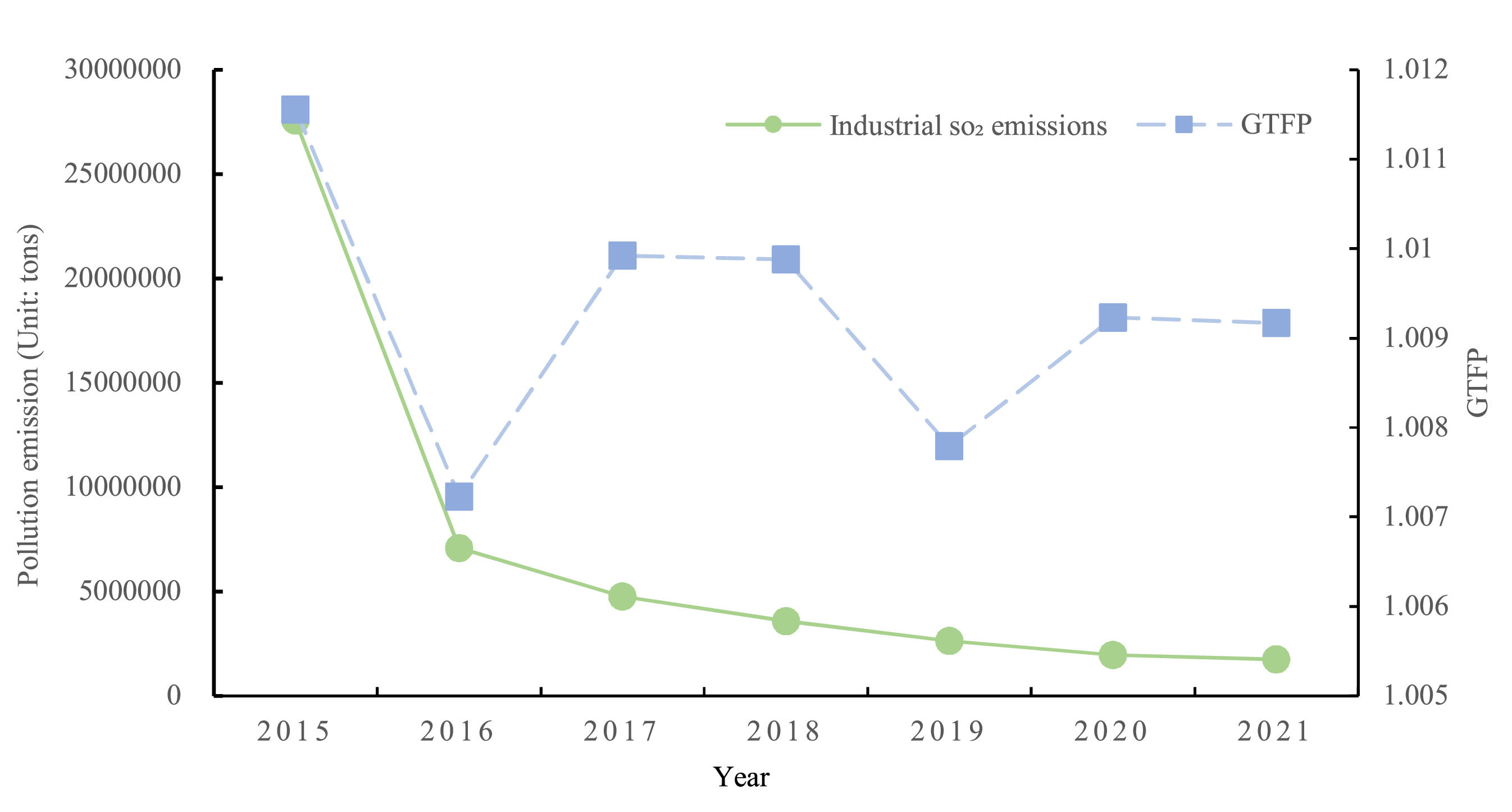

China's industrial policy, implemented in the 1980s, has made remarkable contributions to the country's rapid economic growth (Cao et al., 2023, 2024; Han et al., 2014; Huang et al., 2023; Zhang & Feng, 2024; Zhang & Zhang, 2023), but it has also caused increasingly serious environmental pollution problems. For example, in 2015, China's industrial sulfur dioxide emissions were 27.5571 million tons (see Fig. 1). With the slogan "clear waters and green mountains are golden mountains and silver mountains," the emission of industrial sulfur dioxide respectively decreased to 1.7518 million tons; however, GTFP decreased from 1.011 in 2015 to 1.009 in 2021 (see Fig. 1). This change may be due to the failure of existing industrial policies to effectively promote technological progress. Furthermore, improving the ecological environment will be at the expense of rapid economic growth in the case of low-production technology. Given this, China's Ministry of Industry and Information Technology and four other departments launched the pilot project of industry–finance cooperation in 2016, aiming to improve the financing environment of real enterprises and GTFP and complete the upgrading of production technology.

The research on industry–finance cooperation mainly focuses on enterprise innovation (Chen and Xia, 2019; Dzhambova, 2024; Stice et al., 2023; Xiong and Gui, 2019; Yang et al., 2024), enterprise growth (Lin, 2010; Shen et al., 2019), asset appreciation (Wu et al., 2018), investment efficiency (Hu et al., 2019; Li et al., 2014), and financing constraints (Wan et al., 2015; Yang et al., 2023). At the same time, the GTFP literature mainly focuses on environmental regulation (Ambec et al., 2013; Wu et al., 2024; Zhang, 2021; Zhuo et al., 2022), Internet development (Amin et al., 2019; Hao et al., 2024; Popkova et al., 2022; Zhang et al., 2022b), and artificial intelligence (Zhao et al., 2022); however, no unified opinions exists on whether industry–finance cooperation can effectively improve GTFP. One view is that the industrial policy using industry convergence as an example is effective (Barkhordar et al., 2018; Criscuolo et al., 2012). Some scholars suggest that because different types of industrial policies will produce different effects (Schleich et al., 2017; Mao et al., 2023), different industrial policies need to be combined to effectively promote the coordinated development of the economy (Reichardt et al., 2016; Weber et al., 2012; Wang et al., 2019, 2020). Moreover, from the perspective of enterprise ownership change, industry–finance cooperation can significantly improve total factor production efficiency (Ongena et al., 2009; Yang, 2017; Zhu et al., 2014), upgrade production technology, and achieve the goal of GTFP improvement. Conversely, another view is that industrial policy is ineffective (Blonigen, 2016), and problems such as government corruption will make the industrial policy with industry–finance cooperation, for example, unable to effectively achieve its purpose of promoting GTFP (Chang, 2006). Furthermore, industry–finance cooperation will lead to the financialization of real enterprises and reduce their investment in productive innovation activities, thereby reducing the overall level of innovation in society (Wang et al., 2017), inhibiting GTFP improvement. The large profit gap between the real and virtual economies and the high risk of productive innovation activities may be the critical reasons for the inhibitory effect of industry–finance cooperation on GTFP. Therefore, to avoid the negative impact of industry–finance cooperation on GTFP, the market and government means should be effectively combined. Based on the perspective of the combination of market and government, this paper elaborates on the influence logic of industry–finance cooperation on GTFP. At the same time, in the empirical aspect, more scholars use the difference-in-differences (DID) model to study GTFP (Li et al., 2022; Zhang et al., 2020; Zhang et al., 2022a). Moreover, because the propensity score matching-DID (PSM-DID) model can better solve the defect, the traditional DID model must meet the “random grouping” requirement. Therefore, this paper uses the PSM-DID model to verify the relationship between industry–finance cooperation and GTFP.

Furthermore, the financing constraints faced by small- and medium-sized enterprises (SMEs) are also one of the reasons why the innovation level is low and GTFP cannot be significantly improved. The cooperation between industry and finance can solve the problem of financing constraints (Ma and Wang, 2017; Wang et al., 2016; Zhou et al., 2018). Simultaneously, with the continuous development of digital technology, indirect financing can break the limitation of time and space and provide diverse financial services to people in remote areas (Chen and Chen, 2018; Fu et al., 2018; Ren et al., 2019; Wang and Guo, 2022). Indirect financing can also alleviate the asymmetry between information, increase the allocation efficiency of financial resources (Wu et al., 2022), improve the ecological environment (Adams and Klobodu, 2018; Tamazian et al., 2009; Salahuddin et al., 2015), and significantly promote the improvement of GTFP (Cheng et al., 2023). Therefore, based on the perspective of indirect financing, this study starts from the market and government levels to analyze the impact of industry–finance cooperation on GTFP.

The contributions of this study include the following points. First, in terms of topic selection, although many empirical studies examine industry–finance cooperation, most are in the market context; however, little literature discusses the relationship between industry–finance cooperation and GTFP by combining the market and government. Second, for research methods, this study uses the PSM-DID model to empirically analyze the relationship between industry–finance cooperation and GTFP. Our sample is based on the panel data of 272 prefecture-level cities in China from 2015 to 2021, which avoids selectivity bias. Third, in terms of research perspective, although many studies have examined the pairwise relationship between industry–finance cooperation, indirect financing, and GTFP, the extant literature does not place the three into the same framework.

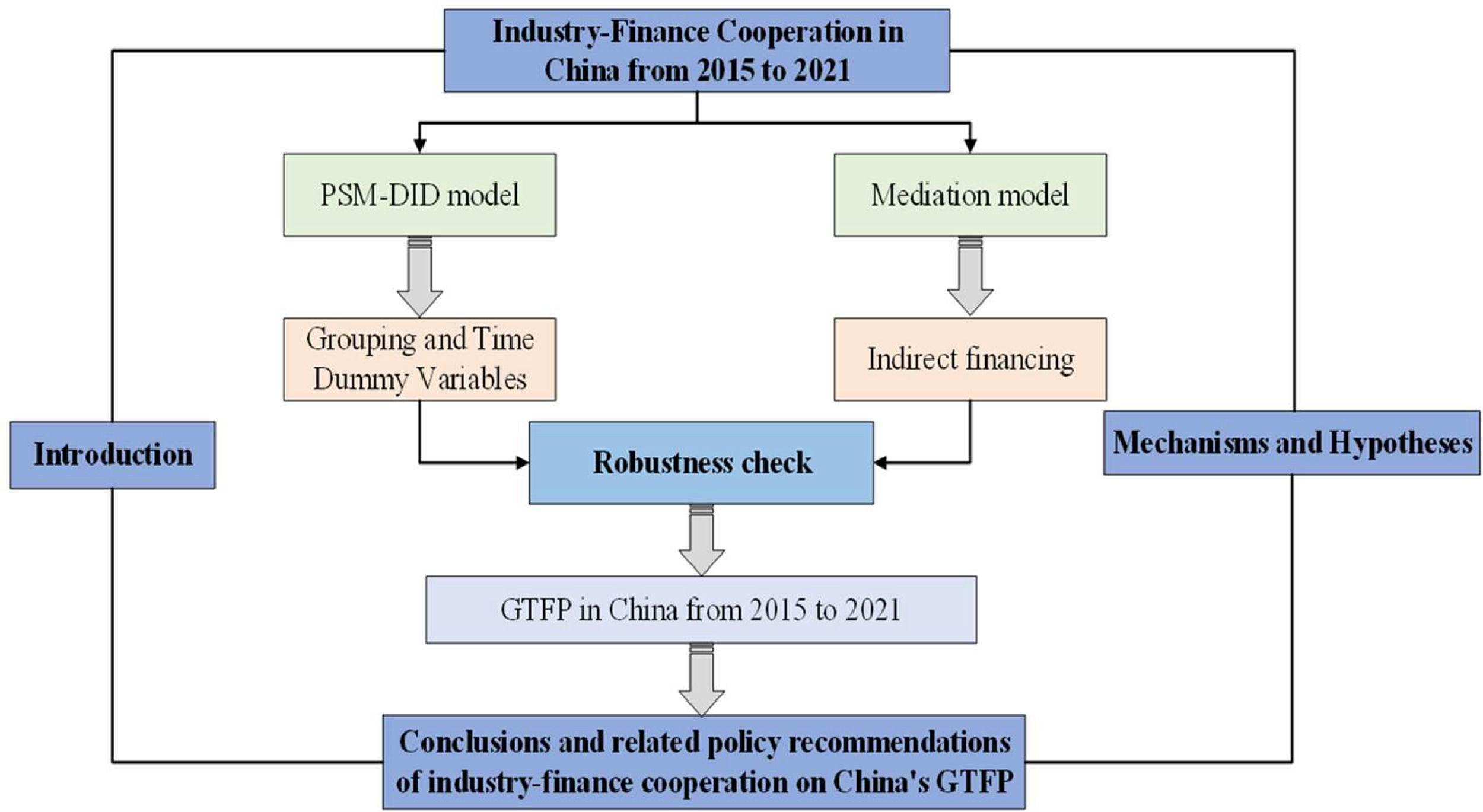

The remainder of this paper is structured as follows. Section 'Mechanisms and hypotheses' discusses the mechanism between industry–finance cooperation, GTFP, and indirect financing and presents the corresponding research hypotheses. Section 'Methods and data' briefly expounds the basic form of the PSM-DID model and introduces the calculation method of the relevant variables. The empirical results are discussed mainly in Section 'Results and discussion'. Section 'Conclusions and policy recommendations' briefly summarizes this study's conclusions and makes relevant recommendations.

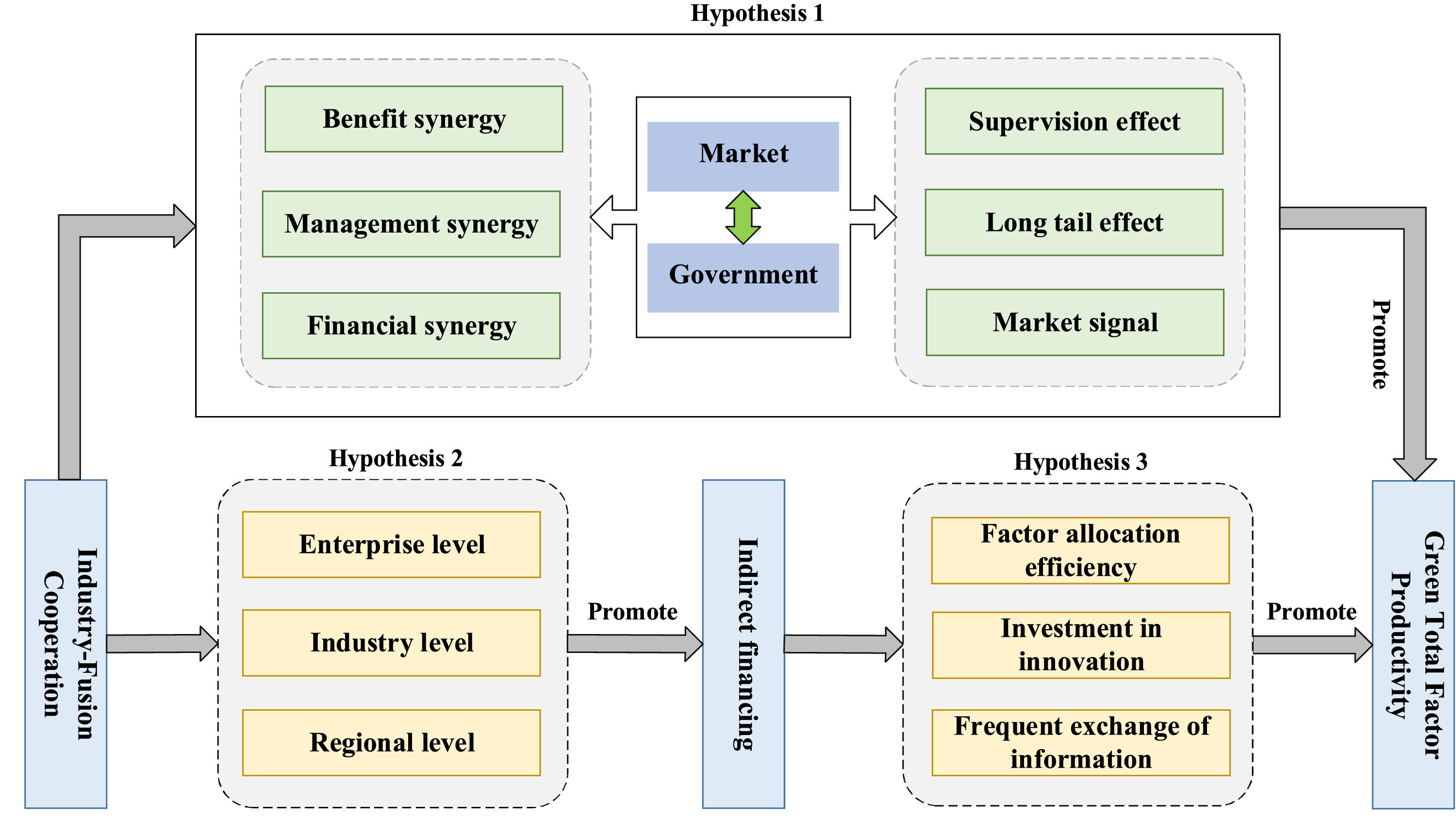

Mechanisms and hypothesesThe influence mechanism of industry–finance cooperation on GTFPThe cooperation between industry and finance mainly completes upgrading production technology through benefit synergy, management synergy, and financial synergy to improve GTFP. First, from the perspective of benefit synergy, in the case of entity enterprises participating in financial enterprises, the cooperation between industry and finance can promote the gradual convergence of interests between entity enterprises and financial enterprises, ease the disputes between the two, and thereby reduce transaction costs. The reduction of transaction costs between real enterprises and financial enterprises increases the investment desire of financial enterprises, enabling real enterprises to complete their financing goals and promoting the improvement of GTFP. When a real enterprise holds more shares of a financial enterprise, it can influence the decision-making of the board of directors of the financial enterprise to a greater extent, making it easier for the financial enterprise to pass the risk assessment of innovative projects. In this case, the interests of the entity enterprise and the financial enterprise are more consistent, and the entity enterprise can disclose the technological innovation that reflects its comparative advantage to a certain extent. Disclosing this information can alleviate the information asymmetry between enterprises, thus alleviating their financing constraints (Myers et al., 1984). Furthermore, even if a real company only holds a small share of financial companies, it can more easily gain the trust of financial companies, reduce transaction costs between companies, and obtain loan support from financial institutions. Second, from the perspective of management synergy, the cooperation between industry and finance makes the relevant functions of some departments of real enterprises overlap with those of financial enterprises, which prompts real enterprises to reduce such costs. Reducing production costs can benefit enterprises by allowing them to concentrate funds to upgrade production technology and maintain their competitive advantages while improving GTFP (Sirower et al., 1997). Finally, from the perspective of financial synergy, industry–finance cooperation will further reduce production costs through reasonable tax avoidance, ensure the smooth development of innovation activities, and improve GTFP. In the case of entity enterprises participating in nonlisted financial institutions, each subsidiary has different capabilities, and its marginal profit and marginal cost also differ. Therefore, entity enterprises can make tax payments under the optimal profit scale by stabilizing the profit scale of each subsidiary, thereby achieving the goal of reasonable tax avoidance. Given this, the cooperation between industry and finance will reduce the difficulty of loans for enterprises, reduce the production costs of enterprises, and reasonably avoid the tax costs of enterprises through benefit synergy, management synergy, and financial synergy, thus completing the technological upgrading and achieving the goal of GTFP improvement.

Nonetheless, relying solely on the market's industry–finance cooperation model can easily lead to problems such as over-investment and under-investment. In the early stage of China's economic development, real enterprises tended to complete productive expansion through extensive development methods to obtain excess profits. Financial companies have also relaxed financing constraints on real companies because of their optimistic economic forecasts, which has led to problems such as excessive investment. Moreover, as China's economy gradually enters the “new normal” stage, the profit gap between the real and virtual economies continues to expand. To improve the existing profit level, state-owned enterprises use their good relationship with financial enterprises to obtain loans and lend to SMEs through asset securitization and other methods (Demir, 2009). This behavior crowds out the productive investment of state-owned entity enterprises and leads to the continuous expansion of the credit chain. When financial institutions tend to issue loans to large enterprises, the credit chain expansion further increases SMEs’ financing costs, resulting in insufficient investment in society (Orhangazi, 2008). Moreover, the industry–finance cooperation model under the market background can only solve the problem of financing constraints of large enterprises. At the same time, SMEs with inherently insufficient capital cannot obtain sufficient funds through equity participation or the establishment of financial departments.

Therefore, as the “visible hand,” the government must supplement and improve the market. Establishing a pilot project for industry-fusion cooperation can accurately reflect this perspective. It can better inherit the advantages of industry–finance cooperation under the market background and compensate for the market's shortcomings. First, industry–finance cooperation will give full play to its supervisory effect. Industry–finance cooperation can curb the extensive development model of real enterprises through environmental regulations and other means and solve problems such as excessive investment and environmental pollution. Second, due to the difficulty of reviewing small and micro enterprises and the low amount of a single loan, financial institutions are reluctant to lend to small and micro enterprises, thus hindering their long-term development; however, industry–finance cooperation can effectively exert its long tail effect. With the support of digital information technology, financial enterprises can more easily complete basic tasks such as loan enterprise reviews. Decreasing the review difficulty will reduce the business cost of financial enterprises, increase their desire to invest in small and micro enterprises, resolve problems such as insufficient investment, and improve GTFP. Finally, industry–finance cooperation can also form a market signal. Because industry–finance cooperation aims to create an environmentally friendly development model, investors are more inclined to invest in green innovation projects based on this market signal. The adjustment of investment tendency will broaden the direct financing channels for SMEs engaged in production and innovation activities, thereby improving the overall GTFP level of society.

Based on the above analysis, this study puts forward the research hypothesis H1: From the market and the government perspective, industry–finance cooperation significantly promotes GTFP.

The influence mechanism of industry–finance cooperation on indirect financingFirst, from the perspective of enterprises, financial institutions tend to set higher risk levels for SMEs due to their lack of asset collateral, increasing the severity of their financing constraints. However, the cooperation between industry and finance will reduce the loan risk of SMEs and transaction costs and encourage financial institutions to issue loans to them (Lu et al., 2012). Specifically, with the support of digital technology, industry–finance cooperation will make full use of the convenience of government departments to collect and disclose information on the productive activities of SMEs. Improving information disclosure will reduce the risk level of SMEs and the transaction costs between SMEs and financial institutions. Afterward, industry–finance cooperation will provide small and medium enterprises with suitable loans through financing platforms to solve their financing constraints (Ghisetti et al., 2015). Compared with large companies, industry integration can improve the ability of indirect financing of SMEs.

Second, from an industry perspective, industry–finance cooperation can better promote the improvement of indirect financing capabilities in highly competitive industries. In the market context, monopolistic industries with lower competition have a higher market share and more substantial bargaining power for commodities. Therefore, monopoly industries can control and adjust the quantity and price of circulating products, obtain higher profits, and avoid falling into a "cash flow predicament"; however, industries with higher levels of competition are more vulnerable to threats from competitors. Such industries need sufficient funds for productive expansion to maintain their leading position; therefore, the promotion effect of the industry–finance cooperation on indirect financing can be more reflected in industries with increased competition.

Finally, from a regional perspective, industry–finance cooperation can improve the indirect financing level of the society as a whole by optimizing the redistribution of capital. Under the influence of the “siphon effect,” enterprises in central and western China face more serious financing constraints. However, with the assistance of local governments, industry–finance cooperation will guide the transfer of capital from the eastern coastal areas to the central and western regions by building a financing platform, thereby optimizing the redistribution of capital and improving the level of indirect financing for enterprises.

Based on the above analysis, this study puts forward the research hypothesis H2: Whether at the enterprise, industry, or regional level, industry–finance cooperation has a significant role in promoting indirect financing.

The influence mechanism of indirect financing on GTFPFirst, in terms of factor allocation efficiency, indirect financing mainly adopts green credit to improve capital utilization efficiency, thereby improving society's overall GTFP. Specifically, financial institutions set higher loan interest rates for “three high” companies, which reduces their financing scale. Reducing the financing scale will inhibit the productive expansion of “three high” enterprises, forcing them to invest funds in green innovation activities (Zhang et al., 2011). Conversely, for environmentally friendly enterprises, financial institutions set lower loan interest rates and longer repayment periods to ensure the smooth development of their green innovation activities (Qiu et al., 2023). Therefore, under the guidance of green credit, indirect financing can improve society's overall factor allocation efficiency by adjusting the loan interest rates of “three high” enterprises and environment-friendly enterprises, thereby improving GTFP (Li et al., 2018).

Second, in terms of investment in innovation, indirect financing, with the support of digital information technology, expands the scale of financial institutions’ funds and resolves the predicament of insufficient funds for the promotion of GTFP. With the support of digital information technology, financial institutions can absorb idle funds in remote areas more efficiently and satisfy the preferences of various investors by enriching the types of financial products they offer. Consequently, financial institutions expand the scale of funds with the support of digital information technology (Gomber et al., 2017; Li et al., 2020). Further analysis shows that because financial institutions have more sufficient funds, enterprises that were initially facing financing constraints can obtain more loans, which is conducive to solving the problem of insufficient funds for enterprises’ productive innovation activities and improving the overall GTFP of society.

Finally, regarding the frequent exchange of information, financial institutions will tend to issue loans to green investment projects and promote the improvement of GTFP through technological upgrading. With the continuous improvement of economic development, the public gradually realizes the importance of ecological environment construction, so they are more inclined to buy environmentally friendly products. At the same time, in the contemporary era of increasingly frequent information exchanges, it is easier for financial institutions to accurately analyze the purchasing behavior of the public through information technology and to judge that green and sustainable projects have larger profit margins. Therefore, the investment willingness of profit-seeking financial institutions will shift from extensive scale expansion to green innovation to improve the utilization efficiency of indirect financing and then improve GTFP through upgrading production technology.

Based on the above analysis, this study proposes research hypothesis H3: Indirect financing has a significant role in promoting GTFP in three aspects: factor allocation efficiency, investment in innovation, and frequent exchange of information. The mechanism analysis diagram is as follows (see Fig. 2).

Methods and dataEconometric methodologyBenchmark regression modelThe traditional DID model requires the samples to meet the "random grouping" assumption, while the pilot cities for industry–finance cooperation need a solid industrial foundation, a high level of industrial chain, and rich financial resources. Therefore, the relationship between industry–finance cooperation and GTFP cannot be empirically analyzed using the traditional DID model; however, the PSM-DID model can effectively resolve the above problems (Heckman et al., 1997). Specifically, the PSM-DID model first uses the PSM method to find the control group samples similar to the experimental group; thus, the samples meet the “random grouping” assumption and balance requirements. After that, the PSM-DID model uses the basic DID model to empirically analyze the relationship between industry–finance cooperation and GTFP (Rosenbaum et al., 1983). The specific measurement model is as follows:

Here, i represents the prefecture-level city, and t represents the year. timei,t is the time dummy variable—if t is 2015 and 2016, then timei,t = 0; if t is 2017–2021, then timei,t = 1. cityi,t is a grouping dummy variable. When i is the control group, cityi,t = 0; when i is the experimental group, cityi,t = 1. Xk,i,t represents the control variable. αi and μt denote fixed effects for region and year, respectively. εi,t denote random disturbance terms. Lastly, Fig. 3 illustrates the overall research framework.

The design of the mediation modelThis study explores the impact of industry–finance cooperation on GTFP from factor allocation efficiency of indirect financing, investment in innovation, and frequent exchange of information. First, based on factor allocation efficiency, industry–finance cooperation will give full play to its supervisory effect and examine the pollutant emissions of enterprises by implementing follow-up supervision and other measures. Such inspections can optimize the allocation of the whole society's factors and promote the improvement of GTFP. Second, from the perspective of investment in innovation, industry–finance cooperation will fully absorb idle funds from society and expand the scale of financial institutions’ funds with the support of digital information technology. Afterward, the industry–finance cooperation association will issue loans to enterprises engaged in innovation activities in the form of “point-to-point” to increase the capital investment in productive innovation activities and then achieve the goal of improving GTFP. Finally, from the perspective of frequent exchange of information, with the assistance of local governments, industry–finance cooperation will promote green and environment-friendly lifestyles, increase the public's desire to buy green products, and expand the profit margins of environment-friendly products. The expansion of profit margins of environmentally friendly commodities will encourage financial institutions to invest in them, thus promoting the promotion of GTFP in society. This study proposes the following mediation model to test the above theories:

Here, IFi,t is the indirect financing of region i in year t.

DataExplained variableAs a comprehensive indicator for economic development and ecological environment construction, GTFP is mainly calculated through input and output indicators (Hu and Yang, 2011; Li, Peng, & Ouyang, 2013). Among them, the input indicators are divided into labor input, capital input, and energy input. The labor input is the average number of employees in the prefecture-level cities, the capital input is the capital stock obtained using the perpetual inventory method, and the citywide electricity consumption data measure the energy input. In addition, output indicators are mainly divided into expected output and undesired output. The expected output is each city's gross domestic product (GDP), and the environmental pollution index represents the undesired output. Specifically, this study uses the entropy method to calculate the comprehensive environmental pollution index according to pollutant discharge indicators such as industrial wastewater discharge, industrial waste gas discharge, and industrial solid waste discharge.

Core explanatory variableIn terms of the year before and after the implementation of industry–finance cooperation, four departments, including the Ministry of Industry and Information Technology, launched the application for the pilot application of industry–finance cooperation in 2016, and at the end of 2016, announced the list of 37 “China's industry–finance cooperation pilot cities” including Beijing. Therefore, this study takes 2017–2021 as the implementation year of industry–finance cooperation and sets 2015–2016 as the period before the policy was introduced. Additionally, in the division of the experimental group and the control group, this study is based on the list of “China's Industry–finance cooperation pilot cities” announced at the end of 2016. After excluding the county-level city samples, 31 pilot cities, such as Harbin and Xiamen, were selected as the experimental group. The rest of the prefecture-level city samples were the control group.

MediatorIndirect financing mainly refers to the process of capital-shortage units and capital-sufficient units through financial institutions to achieve financial integration. Specifically, entities with sufficient funds deposit idle funds in financial institutions using deposits, purchase of securities of financial institutions, etc. After that, financial institutions can lend funds to capital-strapped units through loans, discounts, etc. Furthermore, the measurement method of indirect financing adopts the ratio of the balance of deposits and loans provided by financial institutions to GDP.

Control variablesFirst, the secondary production to GDP ratio refers to industrial upgrading. Second, human capital (HC), which is measured by the number of college students per 10,000 people. Third, per capita GDP (PGDP) is the ratio between the regional gross domestic product and the total population at the end of the year. Fourth, the marketization level (ML) is represented by the proportion of fiscal expenditure in GDP. Fifth, the urbanization rate is calculated by the ratio between the urban population and the total population at the end of the year. Sixth, the trade openness (TO) is the percentage of each prefecture-level city's total import and export to GDP.

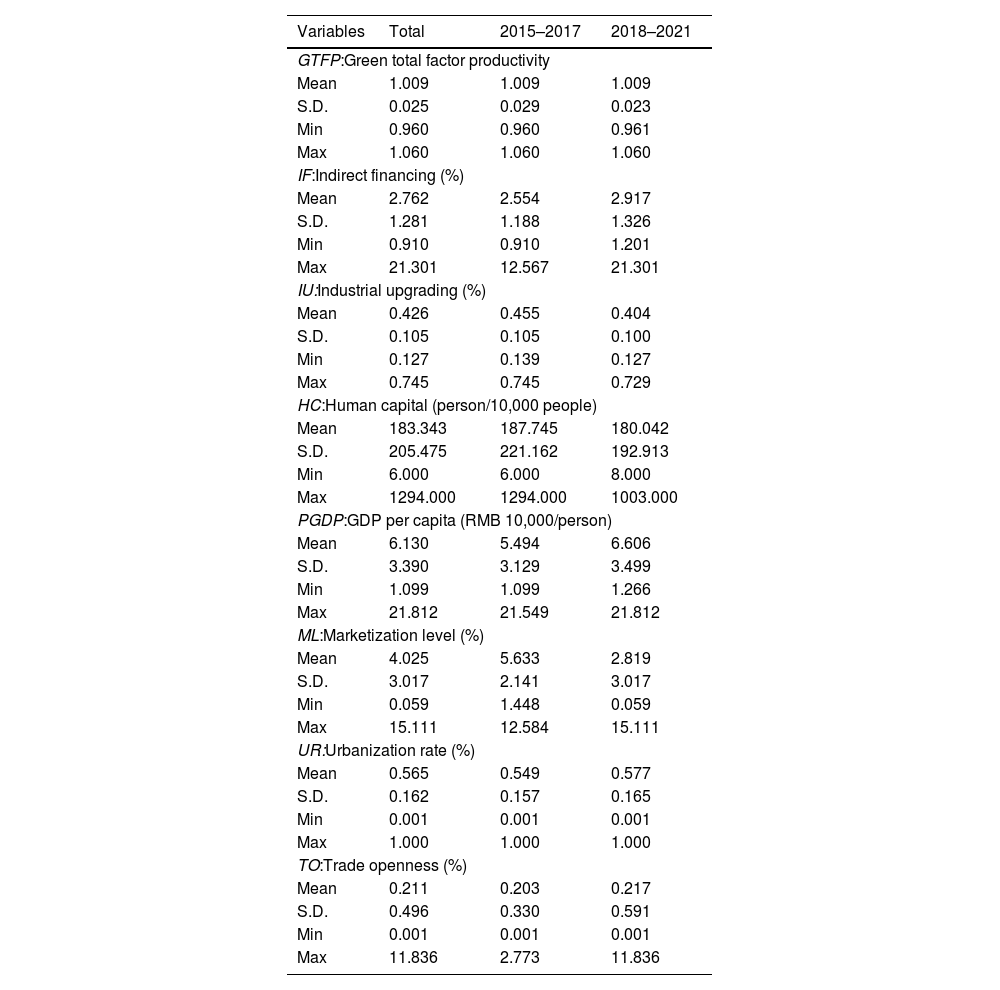

Data sourcesDue to the lack of data in Tibet, Hong Kong, and other regions, this study selected the panel data of 272 prefecture-level cities in China from 2015 to 2021. Moreover, the data used in this study are from the EPS database and “China Urban Statistical Yearbook.” Table 1 provides the names of the variables in this study, variable descriptions, and descriptive statistics. This study divided the data from 2015 to 2021 into two parts to examine the mean, standard deviation (SD), minimum (Min), and maximum (Max) for each variable. Although the mean for GTFP in 2015–2017 was not significantly different from the mean in 2018–2021, the SD for GTFP decreased significantly in 2018–2021, indicating a gradual decrease in the gap between GTFP in each city. For the control variables, the mean of ML decreased significantly, indicating that the national marketization level increased significantly. At the same time, with the gradual development of China's economy, the average PGDP has increased significantly.

Descriptive statistics.

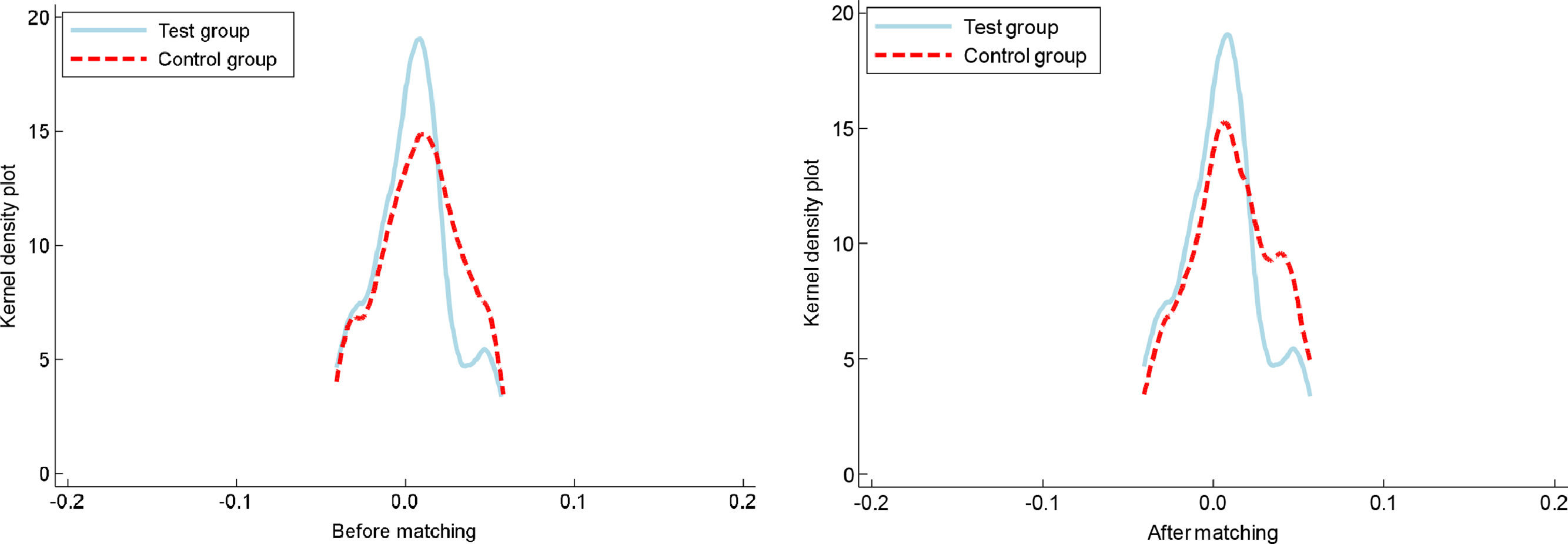

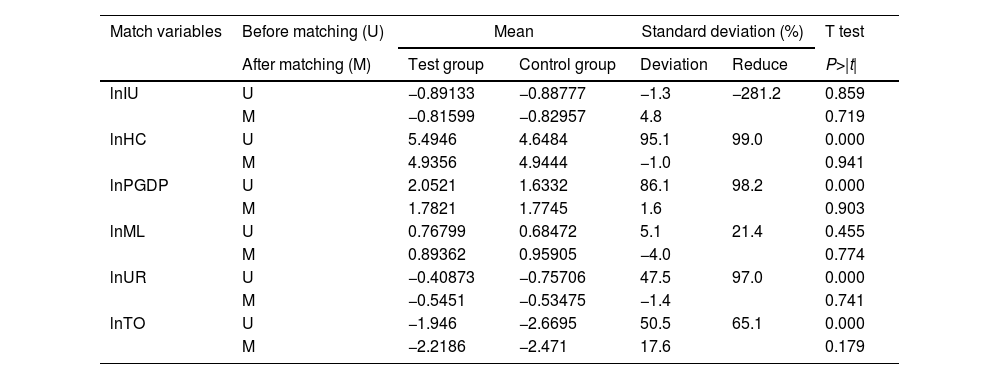

Whether the results of PSM are reliable determines whether the samples meet the requirements of balance, affecting the stability of the empirical results. Given this, this study carries out the following verifications. First, the PSM balance test is used to determine whether the results of the PSM satisfy the "conditional independence assumption" (see Table 2). Most matched variables (Matched) had standard deviations less than 20 in absolute value, indicating that the results of PSM were valid (Rosenbaum and Rubin, 1983). Second, since the T values of most of the matching variables are not significant after matching, the results of PSM conform to the null hypothesis that the means of matching variables after matching are equal; that is, the results of PSM are valid. Finally, to test the quality of the PSM results, this study compared whether the overlap of the nuclear density maps between the control group and the experimental group before and after matching increased (see Fig. 4). The test results show that the overlapping part of the nuclear density maps of the control and experimental groups increased significantly after matching; that is, the matching quality improved. Therefore, the results of PSM are more reliable. Through the PSM-DID model, this study can further verify the relationship between industry–finance cooperation and GTFP.

PSM balance test results.

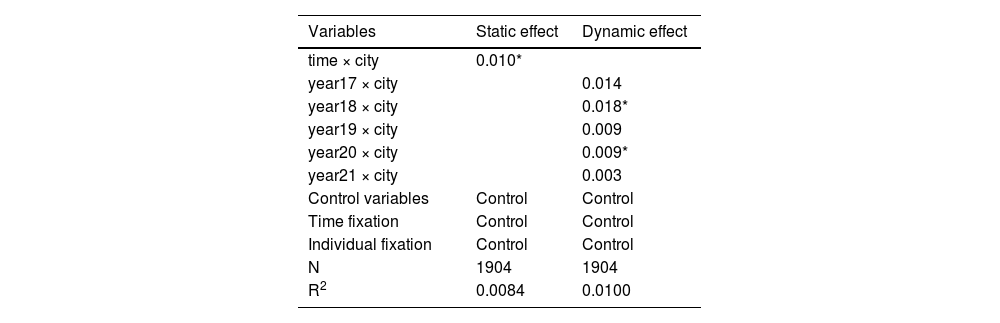

To accurately verify research hypothesis H1, this study adopts model (1) (a static fixed-effect model) and uses a dynamic fixed-effect model to empirically analyze the relationship between industry–finance cooperation and GTFP (see Table 3). The specific steps of the dynamic fixed-effect model are as follows. Since the start year of the industry–finance cooperation is 2017, we set 2017, 2018, 2019, 2020, and 2021 as year dummy variables that take the value of 1; the other years are 0. After that, the above dummy variables and grouping dummy variables (cityi,t) are used as interaction terms. If the coefficients are significant, industry–finance cooperation has a dynamic effect (Xuan et al., 2020). On the one hand, the static fixed effect shows that the industry–finance cooperation coefficient is significantly positive at the 10 % level, verifying research hypothesis H1. The promoting effect of industry–finance cooperation on shortening the credit chain may be an important reason for the above results. Differences in the attitudes of financial institutions toward risk-heterogeneous enterprises and the profit gap between real enterprises and the virtual economy are essential reasons for shadow banking, which crowded out the productive investment of large enterprises and enlarged the credit chain within the financial system. The expansion of the credit chain increases the financing cost of high-risk SMEs, reduces the productive investment of SMEs, and thus significantly reduces the productive innovation activities of the whole society. However, the cooperation between industry and finance will promote direct communication between financial and real enterprises by building a financing platform to shorten the credit chain. Further analysis shows that shortening the credit chain reduces SMEs’ financing costs, promotes the expansion of their production scale, indirectly narrows the profit gap between the virtual economy and the real economy, and reduces the participation of large enterprises in shadow banking. Moreover, the shortening of the credit chain can effectively alleviate systemic risks, increase the willingness of financial institutions to invest in innovative projects and improve society's overall GTFP. Therefore, industry–finance cooperation has a significant promoting effect on the GTFP. On the other hand, from the perspective of dynamic fixed effects, although industry–finance cooperation was formally implemented in 2017, its coefficient was not significantly positive at the 10 % level until 2018 (see Table 3). The time lag of the fusion work is one of the main reasons for this result. At the government level, the approval of administrative procedures needs a certain amount of time. At the same time, the deployment of personnel and materials related to industry–finance cooperation also needs some time to complete. Furthermore, at the enterprise level, due to the information asymmetry, the enterprise needs to spend a certain amount of time to grasp the information related to the industry–finance cooperation accurately and in detail. Given this, industry–finance cooperation did not effectively promote GTFP until 2018. In addition, the coefficient of industry–finance cooperation in 2020 is also significantly positive at 10 % (see Table 3), which may result from increased government support. Due to the outbreak of COVID-19 in 2020, most SMEs are at risk of capital chain rupture. In response, local governments have increased their support for SMEs. Therefore, the 2020 industry–finance cooperation can significantly improve GTFP.

Benchmark estimation results.

Note: Significance of the coefficients at 10 %, 5 %, and 1 % are indicated as *, * *, and * * *, respectively.

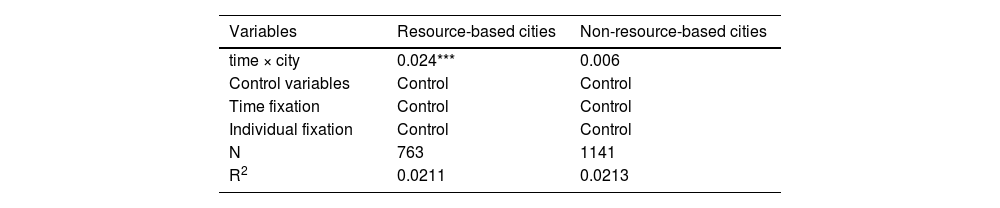

This study divides the sample of prefecture-level cities into resource-based and nonresource-based cities7 and draws the following conclusions (see Table 4): The coefficient of resource-based cities is significantly positive at the 1 % level. This result may occur because the resource-based industry is the pillar industry of a resource-based city (Qiu et al., 2022a), and the financial development level of resource-based cities is relatively low. Resource-based cities with resource-based industries as their pillar industries tend to take advantage of the low-cost advantage of fossil energy, such as coal, to take the road of extensive economic development, which makes it easier to step into the “resource curse” trap, and it is difficult to complete the GTFP upgrade alone. Although the local governments of resource-based cities try to force the “three high” enterprises to flow funds into productive innovation activities through environmental regulation, due to the shortage of internal funds, it is difficult for enterprises to complete the transformation of production technology and improve GTFP by themselves. However, industry–finance cooperation will actively use its long tail effect to absorb idle funds from society effectively and expand the scale of funds of financial institutions. Afterward, it will issue loans in a “peer-to-peer” form, alleviating resource-based enterprises’ “cash flow dilemma” and increasing capital investment in their productive innovation activities. At the same time, industry–finance cooperation will also form a market signal and increase investors’ desire to invest in green and innovative projects, thereby expanding the channels for direct financing of resource-based enterprises. Further analysis shows that expanding financing channels for green innovation projects can ensure that resource-based enterprises can obtain sufficient funds. Moreover, resource-based enterprises with sufficient funds can improve their marginal production efficiency by purchasing advanced equipment and taking independent research and development measures to reduce pollution emissions. Furthermore, nonresource-based cities in the eastern coastal area have a relatively high level of financial development, which can reduce the cost of productive innovation activities through existing financial tools and share their risks to achieve the goal of upgrading production technology. Conversely, for resource-based cities in the central and western regions with low financial development, in a purely market context, the high-risk characteristics of innovation activities make local financial institutions reluctant to issue loans to green investment projects; however, industry–finance cooperation will give full play to its role in government regulation. This action will encourage financial institutions in resource-based cities to invest in green and innovative projects, thereby reducing the difficulty of innovative corporate loans. Therefore, industry–finance cooperation has a more significant impact on GTFP in resource-based cities.

Results of heterogeneous effects.

Note: Significance of the coefficients at 10 %, 5 %, and 1 % are indicated as *, * *, and * * *, respectively.

To verify the correctness of the research hypotheses H2 and H3, we adopt model (2) and draw the following conclusions (see Table 5). The time × city × lnIF coefficient is significantly positive at the 5 % level. An important reason is that industry–finance cooperation has enriched the types of financial products and has a supervisory effect. By enriching the types of financial products, industry–finance cooperation meets the financing needs of different types of enterprises, thereby expanding the scale of indirect financing for society. “Small and micro easy loans” can ease the financing constraints of small and micro enterprises by calculating interest daily and repaying loans as needed; they can also accelerate their financing speed by taking the form of online processing. At the same time, for green and innovative entity enterprises, bank-insurance linkage products such as “cloud computing service insurance” reduce the risk of their productive innovation activities and expand their financing channels. Further analysis shows that industry–finance cooperation will give full play to its supervisory effect and ensure that funds are used to upgrade production technology, thereby improving GTFP. Specifically, before issuing loans, financial institutions will actively use digital information technology to review the business status of enterprises thoroughly and determine whether they can carry out productive innovation activities. Furthermore, after issuing loans, financial institutions will cooperate with local government departments to check whether the enterprise conforms to the green development mode of production. Therefore, in terms of indirect financing, industry–finance cooperation significantly promotes GTFP.

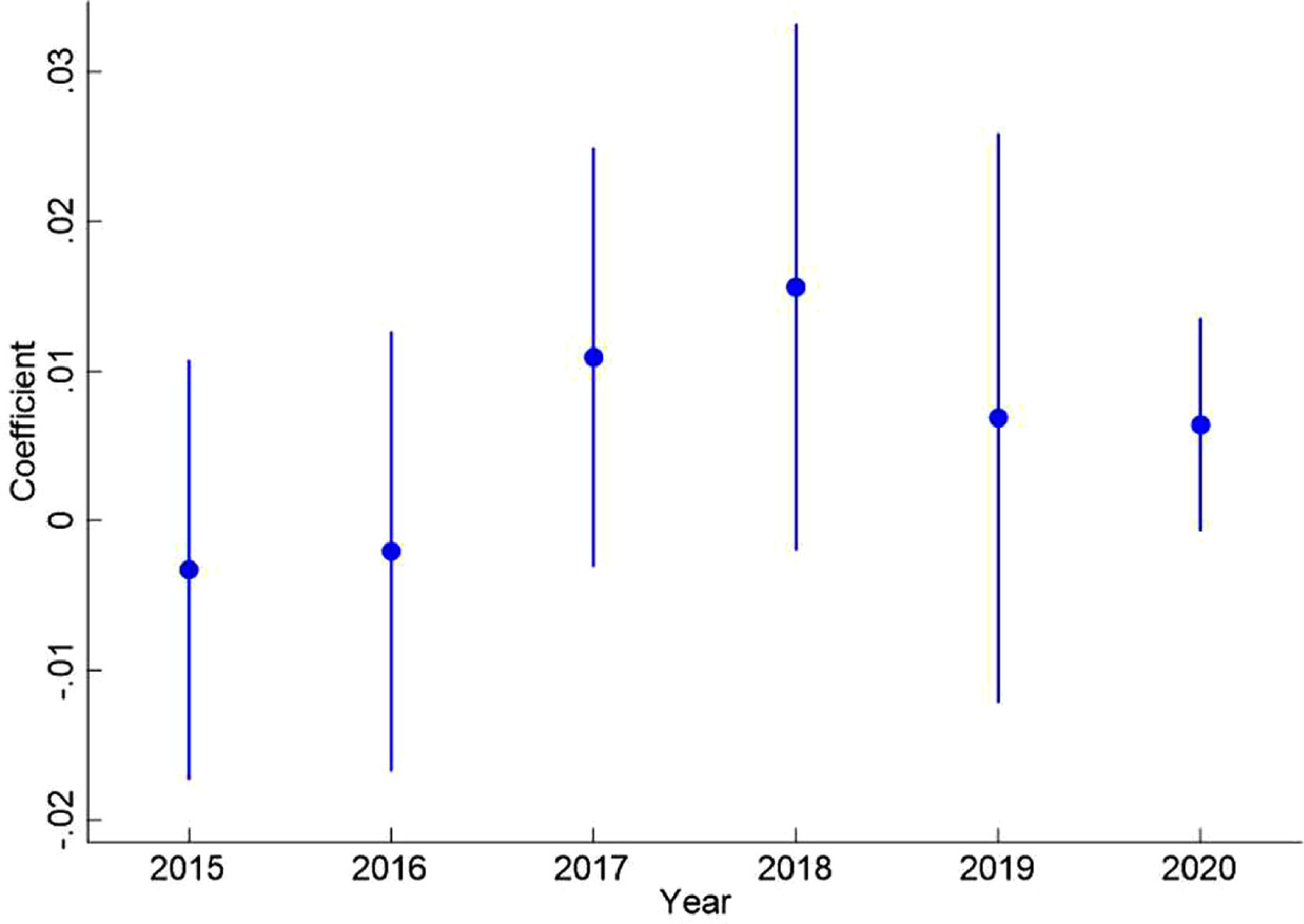

Robustness testParallel trend testThis study conducted the following parallel trend test (see Fig. 5) to ensure that the above conclusions are unbiased. Before the implementation of industrial–financial cooperation, the trend of GTFP change was not apparent. After the implementation of the policy, GTFP increased significantly; that is, the trend of GTFP change before and after the implementation of the policy. Therefore, this study believes the above conclusions align with the parallel trend assumption.

Placebo testThis study conducted the following placebo test (see Fig. 6) to exclude interference from other unknown factors with the above conclusions. The test results show that the absolute value of the t-value of most of the sampling estimated coefficients is within 2, indicating that most of the estimated coefficients of generatrix cooperation are insignificant in the placebo test. Therefore, the above results were considered relatively robust.

Dynamic time window testAlthough the previous article has analyzed the dynamic effect of industry–finance cooperation on GTFP, it only focuses on the impact effect after introducing the policy. It does not thoroughly compare it with that before introducing the policy. Therefore, this study takes 2017 as the time node of the policy introduction year and selects 1-year and 2-year time windows for the dynamic time window test (see Table 6). The test results show that the change in the time window does not change the significance and direction of the effect of industry–finance cooperation on GTFP; thus, the above research conclusions are reliable.

Dynamic time window test results.

| Variables | 1 year | 2 years |

|---|---|---|

| time × city | 0.025* | 0.021** |

| Control variables | Control | Control |

| Time fixation | Control | Control |

| Individual fixation | Control | Control |

| N | 816 | 1360 |

| R2 | 0.0234 | 0.0146 |

Note: Significance of the coefficients at 10 %, 5 %, and 1 % are indicated as *, * *, and * * *, respectively.

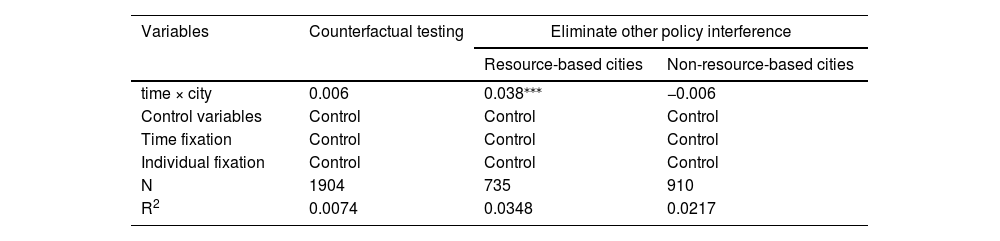

This study advances the policy implementation year to 2016 and conducts a counterfactual test using a model consistent with the benchmark regression (Hung et al., 2013) (see Table 7). The test results show that when the policy implementation year is 2016, the coefficients of the core explanatory variables are not significant. This result means the actual policy implementation year significantly improves GTFP; the above conclusion is stable.

Counterfactuals and elimination of other policy interference test results.

Note: Significance of the coefficients at 10 %, 5 %, and 1 % are indicated as *, * *, and * * *, respectively.

To improve the GTFP of the whole society, the Chinese government launched the pilot work of industry–finance cooperation and implemented the carbon emission trading system in 2013. Moreover, extant research shows that trading systems for carbon emissions can significantly improve economic and environmental benefits (Dong et al., 2019; Feng et al., 2021). At the same time, compared with industry–finance cooperation, the carbon emission trading system may be more able to improve GTFP in resource-based cities. Therefore, to exclude the impact of the carbon emissions trading system on GTFP and accurately identify the policy effects of industry–finance cooperation, this study excludes the pilot cities of the carbon emissions trading system to test the stability (see Table 7). The test results show that resource-based cities are still significantly positive, while nonresource-based cities are still insignificant; the above research conclusions are relatively stable.

Conclusions and policy recommendationsBased on the perspective of indirect financing, this study uses the PSM-DID model to analyze the relationship between industry–finance cooperation and GTFP based on the panel data of 272 prefecture-level cities in China from 2015 to 2021. Moreover, to consider the impact of city differences on the relationship between industry–finance cooperation and GTFP, this study also divides the data into 109 resource-based cities and 163 nonresource-based cities for heterogeneity analysis. The study results are as follows. First, industry–finance cooperation significantly affects GTFP. Second, although the industry–finance cooperation in nonresource-based cities cannot impact GTFP, the industry–finance cooperation in resource-based cities significantly promotes GTFP. Third, industry-integration cooperation—indirect financing—GTFP is an essential path for industry-integration cooperation to effectively improve the level of GTFP. Finally, the reliability of the conclusions is verified by successively using the parallel trend test, the placebo test, the dynamic time window test, the counterfactual test, and the elimination of other policy interferences. Given the above findings, this study puts forward the following policy recommendations.

First, from the national level, “promising government, efficient market” should be the direction of our government's efforts. The Chinese government must give full play to its functions, actively use industrial policies such as industry–finance cooperation, optimize the allocation of factors of the whole society, promote the formation of an “effective market,” and achieve the goal of improving GTFP. Achieving this goal, however, requires a significant improvement in the administrative capacity of the Chinese government. Therefore, while implementing industry–finance cooperation, the Chinese government should proceed from an overall perspective, deepen the government's institutional reform, and improve the government's administrative capacity. Specifically, the government's institutional reform should include innovative systems such as official property declaration, efficiently solving problems such as official corruption, avoiding resource misallocation, and improving factor allocation efficiency. In addition, the government's system reform also needs to solve the problems of redundant administrative approval and bloated government agencies.

Second, from the perspective of the differences between resource-based and nonresource-based cities, “overall regulation and measures according to local conditions” is the government's basic policy when implementing industry–finance cooperation. In terms of overall control, the Chinese government should continue to promote the “Western Development” strategy and actively use administrative means to promote the flow of production factors such as capital and labor to the central and western regions to solve the problems of insufficient capital and HC in resource-based cities in the central and western regions. At the same time, the Chinese government must also implement the industrial transfer policy effectively. Furthermore, in terms of adapting measures to local conditions, the development model based on environmentally unfriendly industries such as extractive industries has led to more serious environmental pollution problems in resource-based cities. Therefore, government departments must fully use policies such as industry–finance cooperation and actively implement environmental regulations, environmental governance subsidies, and other means to promote the improvement of GTFP.

Finally, from the perspective of indirect financing, “information technology, green credit” is an important means to ensure the realization of the industry–finance cooperation–indirect financing–GTFP path. Regarding information technology, government departments must complete the construction of financing platforms while implementing industry–finance cooperation, promoting the development of “point-to-point” exchanges between real and financial enterprises. Moreover, government departments should actively develop digital information technology to absorb idle funds in society more conveniently and expand the scale of funds available to financial institutions. Furthermore, in terms of green credit, financial institutions need to cooperate with the government's regulatory departments to check whether relevant enterprises have excessive pollutant discharge and other problems by implementing follow-up supervision and other measures. Moreover, government departments should impose high interest rates, public criticism, and other penalties for enterprises whose pollutant emissions exceed the threshold.

The author(s) disclosed receipt of the following financial support for the research, authorship, and/or publication of this article: This work was supported by the National Social Science Fund Youth Project (Grant numbers:22CJY033), the Xinjiang Uygur Autonomous Region Natural Science Foundation(Grant numbers:2021D01B28), the Xinjiang Uygur Autonomous Region Social Science Foundation (Grant numbers: 22CYJ011), the Science and Technology Program of Shaanxi Province of China (Grant numbers:2023-CX-KRX-030), the Social Science Fund of Shaanxi Province (Grant numbers:2023D049).

Dr. Wei Qiu is currently a full associate professor at School of Economics, Xinjiang University of Finance and Economics

Mr. Yaojun Bian is currently a Ph.D. student on economics at School of Economics and Management, Xinjiang University.

Mr. Siyu Ren is currently a Ph.D. student on economics at School of Economics, Nankai University

Ms. Jingxia Chai is currently a Ph.D. student on economics at School of Management and Economics, Beijing Institute of Technology (BIT)

Mr. Shang Gao is currently a Ph.D. student on Business Administration at School of Management and Economics, Beijing Institute of Technology (BIT)

Dr. Haitao Wu is a highly regarded scholar at the School of Management and Economics, Beijing Institute of Technology (BIT). His-research focuses on macroeconomics, business economics, ecological economics, and energy economics. With an impressive track record, he has authored over 80 peer-reviewed papers in renowned SCI/SSCI-indexed journals such as the Journal of Business Ethics (FT50), Environmental and Resource Economics (ABS/AJG 3), The Energy Journal (ABS/AJG 3), Energy Economics (ABS/AJG 3), Kyklos (ABS/AJG 3), Technological Forecasting and Social Change (ABS/AJG 3), Business Strategy and the Environment (ABS/AJG 3), and Journal of Environmental Management (ABS/AJG 3). Notably, he was selected as top 2 % of scientists (Stanford and Elsevier) and highly cited young scientist (Scilit).

Furthermore, he was honored with the Best Paper Award in Energy Economics in 2022. Dr. Wu's contributions have garnered significant attention, as evidenced by his H-index exceeding 40 and his papers being cited over 7000 times according to Google Scholar.

Nonresource-based cities mainly include 163 prefecture-level cities including Beijing, Chengdu, and Shanghai; resource-based cities mainly include 109 prefecture-level cities, such as Ordos and Panzhihua.