This paper aims to deepen our understanding of the contingency and complex interrelations between multidimensional intellectual capital (IC), technology-based knowledge management (KM), and innovation outcomes in the rapidly changing business environment. More particularly, we investigate causal recipes for high innovation performance consisting of traditional IC components (human capital, structural capital, relational capital), the three more recently emerging IC dimensions (renewal capital, entrepreneurial capital, trust capital), and digital KM practices. This study adopts neo-configurational perspective and fuzzy-set qualitative comparative analysis (fsQCA) to explore multiple conjunctural causations of innovation performance using survey data collected from 102 publicly listed enterprises in Taiwan. Although the four identified archetypes (causal recipes) indicate that all IC dimensions and digital KM are potential collaborators contributing to high innovation performance, they also emphasize the critical role of digital KM in leveraging relational and trust capital for superior innovation performance. Human, structural, entrepreneurial, and renewal capital seems to be a supporting chorus for open and collaborative innovations in the digital era.

Innovation has always attracted the interest of practitioners, academics, and policymakers, playing a critical role in boosting changes and economic growth (Ding, 2022). Therefore, exploring innovation drivers is an important research topic for scholars (Zheng et al., 2021; Ding, 2022). Knowledge and innovation have been intertwined, as knowledge is a key driver of innovation (Ritala et al., 2023). Intellectual capital (IC), consisting of all the knowledge-based resources companies utilize for gaining competitive advantage (Kianto et al., 2023) and its role in innovation performance has been one of the most intriguing topics in the knowledge-based literature (Agostini et al., 2017; Faraji et al., 2022).

Given the growing perceived importance of the digital transformation of businesses (Chae et al., 2018) practitioners must understand to what extent digital technology can be deployed to fully utilize the firm's IC to create a superior organizational performance (Hamad, 2018; Gupta et al., 2023). Advanced technology has been shown to build and maintain collaborative and co-creative environments (Koch & Windsperger, 2017); increase the data abundance, diversity, and completeness of available knowledge; facilitate knowledge processes (e.g. Chae et al., 2018; Hamad, 2018; Martínez-Navalón et al., 2023); and is a catalyst for innovation organizational practices (Kraus et al., 2023). Thus, we are working from the assumption that the role of technology in boosting organizational performance is mainly due to the improved knowledge-handling capacities it brings to the organization (Hamad, 2018). Following Martínez-Navalón et al. (2023), we conceptualize digital KM as the conscious and intentional managerial and organizational activities aimed at using information communication technologies (ICTs) for managing knowledge within and outside organizational boundaries (Hamad, 2018).

However, the existing literature suffers from the following deficiencies. First, most studies that explore the effects of IC on innovation performance consider only traditional IC components, such as human capital, structural capital, and relational capital (Kianto et al., 2023; Cabrilo, 2015). Although this appears to be an emerging standard (Inkinen, 2015), in this study it will be expanded with more recent dimensions such as entrepreneurial capital (Cabrilo & Dahms, 2020; Cesaroni et al., 2015; Buenechea-Elberdin et al., 2017; Inkinen et al., 2017), renewal capital (Cabrilo & Dahms, 2020; Cesaroni et al., 2015; Buenechea-Elberdin et al., 2017; Ritala et al., 2023), and trust capital (Hussinki et al., 2017b; Cesaroni et al., 2015; Cabrilo et al., 2020). This six-partite IC taxonomy is more comprehensive (Inkinen, 2015) and enables a more fine-grained analysis of multidimensional IC (Inkinen et al., 2017).

Second, there is a mismatch between theory and methods regarding knowledge dynamics (Bratianu, 2023) and complex organizational outcomes such as innovation performance (Ding, 2022; Kraus et al., 2018). Many studies have employed symmetric and regression-based statistical techniques to explore the effects of single factors, although complex business phenomena rarely have a single cause. Therefore, interpreting innovation should be based on the configuration thinking (Pustovrh & Jaklič, 2014; Ding, 2022) that considers causal conditions not as adversaries in the struggle to explain variation in the outcome but as potential collaborators contributing to the outcome (Ragin, 2008). The main questions when considering innovation performance should not be which variables have the most substantial effects, but rather which combinations of conditions (causal recipes) generate high innovation performance (Ding, 2022). This is also very important when considering multidimensional IC, as value created by organizational knowledge-based resources has no relationship with different IC dimensions independently, but rather is associated with an integrated bundle of such knowledge assets (Inkinen, 2015).

Third, IC and digital KM present static and dynamic approaches to organizational knowledge reflecting the dual nature of knowledge, knowledge stocks and knowledge flows (Kianto et al., 2014; Wang et al., 2016). Thus, in the existing literature, their effects on innovation performance have been mostly explored in isolation from each other (Cabrilo & Dahms, 2018). However, IC is a static, passive, and potentially value-generating intangible asset (Dumay, 2016) that needs dynamic knowledge-based capabilities to leverage IC for value creation (Cabrilo & Dahms, 2018). KM is a force to transform IC potential into value and only knowledge stocks-and-flows, representing IC and KM, synergistically create organizational value. In the digital era, technology has become an inevitable tool to manage knowledge stocks-and-flows within and outside the organizational boundaries (Katemukda et al., 2018; Hamad, 2018; Cabrilo et al., 2020). Therefore, we combine a comprehensive set of six IC dimensions that covers most types of organizational knowledge-based resources reported in the recent IC literature (Inkinen, 2015) and digital KM to explore combinations of the most relevant knowledge-based antecedents that generate high innovation performance in digital era.

Finally, the idea that knowledge-based resources and processes (i.e. IC and KM) used in business activities can simultaneously bring benefits in three key areas of sustainability, economic, social and environmental, is rational but insufficiently explored in previous literature (Kianto et al., 2023; Vale et al., 2022). Collaborative and coordinated efforts to combine the competencies of multiple agents in innovation ecosystem to increase the economic, societal and environmental wellbeing is precisely where the concepts of IC, sustainability, circular economy (CE), and open innovation (OI) converge (Bogers et al., 2020; Kianto et al., 2023; Bigliardi & Filippelli, 2021). OI represents a change in innovation paradigm proposing that companies should simultaneously use external and internal sources of knowledge to facilitate and accelerate innovation (Tsai et al., 2022). CE promotes innovations that optimize the production and consumption to achieve a balance between economy, society, and environment, and therefore CE is a promising approach for achieving sustainable development (Jesus & Jugend, 2023). CE success relies on collaboration among various stakeholders across value chains, and open innovation is a tool to open organizations to the collaboration and knowledge flows. Although OI and CE facilitates each other (Jesus & Jugend, 2023), the intersection between these two concepts is still poorly investigated (Bigliardi & Filippelli, 2021).

This study fills mentioned research gaps as follows. We address the following research question: Which combinations of antecedents consisting of multidimensional IC and digital KM will be associated with high innovation performance? We look at 102 public listed enterprises from Taiwan, and using fuzzy set Qualitative Comparative Analysis—fsQCA (Misangyi et al., 2017) to analyze seven antecedents of high innovation performance: human capital, structural capital, relational capital, entrepreneurial capital, renewal capital, and trust capital, and digital KM.

First, we draw on a combination of thus-far isolated IC, KM, and technology literature streams to build a holistic knowledge-based research model. Thus, we add to the understanding on how both aspects of organizational knowledge, knowledge stocks (multidimensional IC) and technology-supported knowledge flows (digital KM) jointly support innovation process and deepen understanding of overall organizational knowledge-based value creation. So far, IT integration has mostly been researched in the KM literature (e.g. Hussinki et al., 2017a; Hamad, 2018; Deng et al., 2023). Second, this study contributes to the theoretical discussion by investigating how the three novel IC dimensions (entrepreneurial, renewal, and trust capital) in combination with traditional IC dimensions (human, structural, and relational capital) and digital KM practices drive innovation performance (Inkinen et al., 2015, 2017). The composition of IC is unpacked by investigating six IC components to clarify causal recipes for high innovation performance. Third, this study adopts configurational analysis to unravel causal complexity of innovation performance (Ding, 2022). Instead of testing explanatory variables competing in isolation, we identify causal recipes for high innovation performance, in terms of configurations of interconnected explanatory variables that jointly explain innovation performance (Castro et al., 2013; Woodside, 2013; Fiss, 2011). Finally, by addressing joint effects of knowledge and technology driven resources and capabilities on innovation, we contribute to better understanding of transition from linear to circular economy, as a lack of technology, employees’ information, and knowledge about designing, developing, and producing environmentally sustainable products (Kumar et al., 2019; Eisenreich et al., 2021; Jaeger & Upadhyay, 2020) have been identified as the main barriers to the adoption of circular economy in existing literature (Jesus & Jugend, 2023).

The remainder of this article proceeds as follows. Section 2 introduces an integrated conceptual framework to unravel the multiple driving forces of innovation performance. In this section, we explain multidimensional IC and digital KM as knowledge-based drivers of high innovation performance and in each case formulate a proposition. We do not use the term ‘hypothesis’ as we do not measure the correlation between an antecedent and high innovation performance, but rather examine the combinations of antecedents linked to high innovation performance (Verbeke et al., 2019). Next is the methodology section. Afterward, the results are discussed. In the sixth section, the discussion and conclusions are drawn.

Literature reviewMultidimensional IC as a driver of innovation performanceIC exists in all organizations as a stock of knowledge-based resources that an organization potentially can use in its value creation process (Kianto et al., 2023). Most IC research has leaned on the classical tripod of IC components (Wang et al., 2016; Cabrilo & Dahms, 2018), a foundation laid down by the first-generation gurus of the field (e.g. Edvinsson & Malone, 1997; Sveiby, 1997). This tripod divides knowledge-based resources into human, structural, and relational capital, the value vested in an organization's individuals; organizational structures and processes; and relationships and networks (Kianto et al., 2023). Criticism of the traditional three-dimensional model of IC is that it offers only a rough categorization and does not permit clear understanding of IC components (Inkinen et al., 2017). Thus, recent studies have expanded the standardized organizational IC model divided into three components (Inkinen, 2015; Rehman et al., 2022a, 2022b) with new dimensions such as entrepreneurial capital, renewal capital, and trust capital (Buenechea-Elberdin et al., 2017; Hussinki et al., 2017b; Cabrilo & Dahms, 2020; Cabrilo et al., 2020; Cesaroni et al., 2015).

According to the most recent classification of IC (Inkinen, 2015; Inkinen et al., 2017), IC consists of the human skills, expertise, attitudes, and motivation; the structural features of production embedded in organizational processes, culture, databases, patents and IPs; the relationship networks the organization is able to draw upon; the renewal capital in terms of capacity for learning and development; the trust embedded in its internal and external relationships; and the extent to which it is able to enable and motivate entrepreneurial activities of its actors. This definition of intellectual capital is based upon a broader understanding of knowledge, as not only the explicit outcomes of knowledge-intensive work such as patents, formulae and actualized products, but also as the tacit potential of organizational actors to e.g. flexibly react to unexpected situations and rapidly changed customer demands.

Innovation performance includes overall organizational achievements related to change, improvement, and renewal efforts in different aspects of innovativeness targeting products and services, processes, organizational practices, and business models (Cabrilo et al., 2020). Traditional types of innovations in the literature are product innovation covering both goods and services, and process innovation (Edwards-Schachter, 2018). While a product innovation refers to the introduction of new or significantly improved products and services, a process innovation is the implementation of a new or significantly improved process in R&D, manufacturing, logistics, and/or other value chain processes (Gunday et al., 2011) with the aim to achieve lower costs and/or higher product quality (Reichstein & Salter, 2006). Marketing innovation refers to new marketing strategies and techniques that open new markets and satisfy customer needs better (Tidd & Thuriaux-Alemán, 2016). Innovation management practices refer to any structured administrative efforts to renew and change the organizational routines, procedures, mechanisms, systems to facilitate the innovation process (Tidd & Thuriaux-Alemán, 2016) and include project management, management of human talents to innovate and collaborate, and management of intellectual property among other management practices (Pertuz & Pérez, 2021; Gunday et al., 2011). Finally, business model innovation includes changing one or multiple business model elements simultaneously or changing the interactions between these elements (Ramdani et al., 2019). Each of these different innovative abilities contributes to the overall innovation performance and success in innovation (Gunday et al., 2011; Wirtz et al., 2016; Visnjic et al., 2016). Therefore, innovation performance is defined in this study as a composite construct based on different innovative performance indicators pertaining to the products/services, production methods and processes, management and marketing practices, and business model innovations (Cabrilo & Dahms, 2018; Cabrilo et al., 2020).

Below, we explain how each of mentioned IC dimensions contribute to innovation performance.

Human capitalHuman capital (HC) includes employees’ expertise, skills, capabilities, engagement, and motivation (Inkinen, 2015; Inkinen et al., 2017). As it is embedded in employees, companies do not own HC nor control it in a very strict sense (Cabrilo & Dahms, 2020). Engaged and motivated employees with specific-domain expertise, experience, and autonomy in decision-making are more likely to generate and implement innovative ideas and enhance organizational innovation performance (Castro et al., 2013). Thus, empirical evidence confirms that innovation is one of the most striking positive effects of human capital (Ding, 2022). However, there have also been studies showing that HC, instead of having a direct effect on innovation, drives other IC components, which, in turn, foster innovations (Buenechea-Elberdin et al., 2017; Cabrilo & Dahms, 2018). This also reveals that HC needs other IC components to be fully utilized in innovation. Therefore, from the configuration perspective we formulate our first proposition as follows:

Proposition 1

Human capital is an enabler of high innovation performance.

Structural capitalStructural capital (SC) refers to the non-human knowledge storehouses within organizations (Beltramino et al., 2020), in other words, knowledge contained in organizational processes, procedures, mechanisms, information systems, data bases, manuals, patents, and other intellectual property, and organizational culture (Beltramino et al., 2020; Rehman et al., 2022a). Previous studies demonstrate that SC is a significant predictor of innovation (Cabrilo & Dahms, 2018). It is logical that efficient processes and procedures and effective information systems that enhance creation, dissemination, and implementation of new ideas and accumulation of organizational knowledge, and organizational culture that promotes autonomy in decision making and engagement in innovation constitute important sources of innovation performance (Aramburu & Sáenz, 2011; Agostini & Nosella, 2017). SC provides the supporting infrastructure that enables HC to be more creative and build relationships with internal and external stakeholders that nurture innovation process (Beltramino et al., 2020).

Proposition 2

Structural capital is an enabler of high innovation performance.

Relational capitalRelational capital (RC) represents the value and potential embedded in relationships with internal and external stakeholders (Cabrilo et al., 2020). It includes both internal relations between employees as well as relationships with external stakeholders such as customers, suppliers, institutions, among others (Cabrilo & Dahms, 2018). This IC dimension encompasses actual and potential knowledge-based resources embedded within, available through, and derived from the network of firm's social relations (Inkinen, 2015). Strong and bridging network ties facilitate intra- and inter-organizational collaborative and collective activities and knowledge flows, thereby fostering improved innovation performance (Han & Xie, 2023) and collaborative innovations (Al-Omoush et al., 2022; Cabrilo et al., 2020). Thus, RC is an important source of new knowledge, novel ideas, and insights, and can accelerate innovation performance (Cabrilo et al., 2020; Han & Xie, 2023).

Proposition 3

Relational capital is an enabler of high innovation performance.

Renewal capitalRenewal capital (RENC) represents a human-based aspect of IC and comprises individual and organizational capacity for learning and growth potential (Ritala et al., 2023; Inkinen et al., 2017; Cabrilo & Dahms, 2020). RENC contains the firm's resources for renewing what it knows and can do through learning (Kianto et al., 2010). These resources support organizational growth and long-range research and development (Rehman et al., 2022a). RENC signals a learning affinity, development potential, and organizational capacity to increase its knowledge base (Cesaroni et al., 2015; Buenechea-Elberdin et al., 2017). High RENC enables an organization to build on previous knowledge and create new knowledge, and therefore facilitate innovations continuously. In most previous studies, the organizational ability to learn and acquire new knowledge is strongly related to innovation performance (Cabrilo & Dahms, 2020; Kucharska & Rebelo, 2022). In essence, innovation is a question of renewing and improving organizational knowledge through learning. RENC is the IC element that most directly affects innovation and a key antecedent of innovation (Ritala et al., 2023; Buenechea-Elberdin et al., 2017; Cabrilo & Dahms, 2020). Believing that an organization with high renewal capital is more likely to innovate (Hussinki et al., 2017b), we posit our next proposition to be:

Proposition 4

Renewal capital is an enabler of high innovation performance.

Entrepreneurial capitalEntrepreneurial capital (EC) refers to employees’ ability to identify new business opportunities, and take risks in exploring new ideas, and actively seek for new solutions to problems (Buenechea-Elberdin et al., 2017; Cabrilo & Dahms, 2020; Chen et al., 2023). It is based on entrepreneurial self-efficacy, referring to beliefs in capabilities to perform entrepreneurial-oriented tasks and roles in organizational context (Newman et al., 2019). It has been proved that entrepreneurial self-efficacy together with the courage, initiative taking, and pro-activeness, play a crucial role in employee's engagement in entrepreneurial and innovation behavior (Wei et al., 2020). Entrepreneurial behavior promotes exploration and new ways of thinking and cultivates learning and innovation (Inkinen et al., 2017). EC presents the level of entrepreneurial beliefs, attitudes, behavior, and competence of employees (Cabrilo & Dahms, 2020), organizational support and commitment to employees’ proactive and risk-oriented behavior (Castro et al., 2013; Cesaroni et al., 2015), aggressive and independent decision-making and entrepreneurial leadership that effectively direct the innovation activities by promoting creative and innovative behavior (Malibari & Bajaba, 2022). Organizations with high EC have strong beliefs about entrepreneurial outcomes and innovation, encourage and reward curiosity, exploration, and entrepreneurial spirit (Chen et al., 2023), and thus can improve their overall capacity to innovate, intensify innovative activities, and enhance innovation performance (Chen et al., 2023; Cabrilo & Dahms, 2020).

Proposition 5

Entrepreneurial capital is an enabler of high innovation performance.

Trust capitalTrust is a fundamental psychological cause of engagement in relationships or collaboration (Wang et al., 2014). Therefore, trust capital (TC), defined as the level of trust and confidence existing in organizational networks, both internally among employees and externally with stakeholders (Cabrilo et al., 2020), is an essential component of collaborative environments (Latusek-Jurczak & Prystupa-Rzadca, 2014). TC serves as a driver of social/relational capital strengthening intra-organizational and inter-organizational networks (Lyu et al., 2022; Wang et al., 2014) and facilitating exchange of knowledge within networks (Inkinen, 2015). The empirical IC literature with independent TC is very scarce (Cabrilo et al., 2020; Inkinen et al., 2015, 2017; Hussinki et al., 2017b), mainly because previous studies considered trust capital as a part of social or relational capital. However, trust is a cause for a collaborative behavior and knowledge exchange, but not a behavior by itself (Cabrilo et al., 2020). Trust contributes to cooperation, collaboration, and commitment (Wang et al., 2011), knowledge sharing (Kmieciak, 2021), collaborative learning (Dovey, 2009), and innovation performance (Inkinen et al., 2017). Trust makes organizational interactions stronger and increases the organizational ability to exploit existing knowledge within the organization and explore, identify, and absorb external knowledge, and integrate all available knowledge in the innovation process (Cabrilo et al., 2020; Zhang et al., 2018). Therefore, trust capital plays an important role in innovation, although it may enhance or hinder innovation adaptation, adoption, and realization (Mitcheltree, 2021).

Proposition 6

Trust capital is an enabler of high innovation performance.

Digital KM as a driver of high innovation performanceGlobal digitalization has increased the volume, velocity, and variety of data from different sources (Ha et al., 2021) making it essential for companies to use digital technologies to effectively manage organizational knowledge (Gupta et al., 2023). Digital knowledge management (KM) refers to implementing and using information communication technology (ICT) to effectively manage organizational knowledge (Martínez-Navalón et al., 2023) and facilitate knowledge processes digitally (Shaher & Ali, 2020). In simple words, it means using technology to search, acquire, create, store, transfer, codify, interpret, and apply the knowledge needed for business activities (Martínez-Navalón et al., 2023; Ferraris et al., 2019; Shaher & Ali, 2020).

Digital KM supports the assimilation of knowledge by building and organizing a knowledge stock (Joshi et al., 2010) that allows better knowledge interpretation (Moos et al., 2013). Moreover, high technology amplifies knowledge transfer (Alavi & Leidner, 2001) and knowledge application by speeding up the access to knowledge (Alavi & Tiwana, 2002). Technology facilitates knowledge exploration and exploitation through improved communication, collaboration, and absorptive capacity (Zhang et al., 2018), knowledge sharing (Deng et al., 2023) and helps companies to move from collecting big data about customers to creating knowledge partnership with customers (Lettner et al., 2022) and open innovation and digital business ecosystem (Natalicchio et al., 2017; Rong et al., 2021). All these processes significantly enhance innovation performance (Inkinen et al., 2015; Gupta et al., 2023). Advanced technology eliminates potential barriers to communication and collaboration that naturally occur between different parts in geographically dispersed companies, which enables integration of previously fragmented knowledge flows (Valdez-Juárez et al., 2018; Cecchi et al., 2022).

Although most studies demonstrate that ICT supports IC management and facilitates knowledge processes (Castaneda & Toulson, 2021; Raymond et al., 2016), technology seems to be more useful in managing explicit rather than tacit knowledge. Technology cannot fully replace the richness of face-to-face and informal social interactions proved to be essential for the generation and transfer of tacit knowledge, especially in the case of building new relationships without trust (Cecchi et al., 2022). Abidi et al. (2023) found that online meeting tools during Covid-19 pandemic did not contribute to tacit knowledge sharing within knowledge workers worldwide, while Cecchi et al. (2022) introduced the idea of “tacit knowledge half-life”, explaining that technology may support tacit knowledge sharing only in preexisting teams and over a short period of time. Although there have been studies confirming that more technology may create rigidity that stifles innovation activities (Dahms et al., 2020), we believe that advanced technology drives innovation through effective knowledge flows (e.g. Cabrilo et al., 2020; Koch & Windsperger, 2017; Katemukda et al., 2018; Gupta et al., 2023).

Proposition 8

Digital KM is an enabler of high innovation performance.

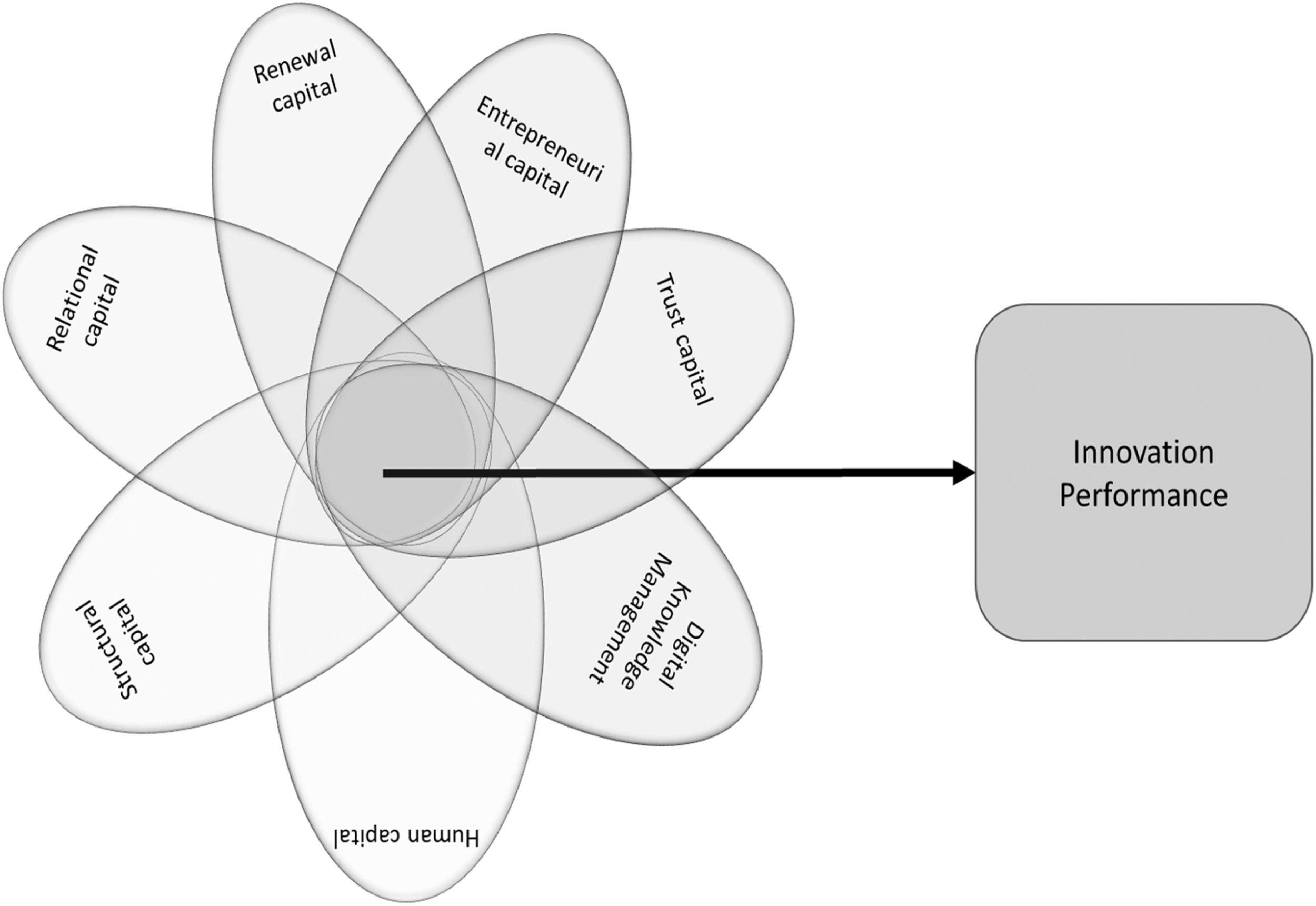

Conceptual framework has been illustrated in Fig. 1.

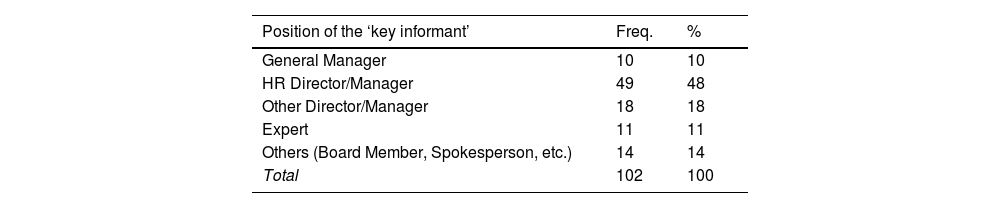

Research methodologyResearch designData collection and sampleOur sample was based on firms listed on the Taiwan Economic Journal (TEJ) database comprised of cross-industry Taiwanese companies. Taiwan is recognized globally as a leader in technological and scientific infrastructure, exemplifying a robust capacity to foster digital innovation technologies. This proficiency spans three critical dimensions of digital transformation: knowledge, technology, and future readiness, as highlighted in the 2023 IMD World Competitiveness Ranking. This ranking places Taiwan among the top nations due to its high assessments, which indicate substantial technological advancement and remarkable innovation performance (Huang & Hou, 2019). These attributes make Taiwan an ideal locale for exploring the synergistic effects of Intellectual Capital (IC) and Digital Knowledge Management (KM) on organizational innovation performance. Such a research context offers invaluable insights into how advanced economies integrate and leverage digital transformation strategies to enhance competitive advantages and drive sustainable growth. We targeted firms with over 200 employees, as larger firms are more likely to engage with complex digital KM systems and demonstrate substantial innovations across multiple dimensions. This criterion narrowed the number of companies from the TEJ database to 1716. Additionally, we adopted the key informant approach and tailored the survey specifically for top management members, who are the most informed sources regarding strategic-level questions (Wang et al., 2016; Hussinki et al., 2017b; Cabrilo et al., 2020). Acknowledging the challenges in accessing executive populations, we aimed to establish personal contacts with firms and executives to increase the response rate, a method also recommended in previous studies (Najafi-Tavani et al., 2018; Cycyota, 2002).

The data collection team, based at a university in Taiwan, was thoroughly briefed on the project and trained on how to conduct the survey before initiating contact with companies. Initially, the team contacted companies via phone to establish personalized connections, clarify the survey's purpose, and obtain the email addresses of top management team members. Following the methodology of Najafi-Tavani et al. (2018), who explored innovation capabilities and networks through surveys, we inquired whether companies had introduced new products or services to the market or had improved their business processes, management, or marketing practices within the last year. Overall, 580 companies confirmed their engagement in innovative activities related to products/services, processes, and/or practices over the previous year, expressed their willingness to participate in the survey, and provided personal contacts of key informants.

For data equivalence reasons, we used forward and backward translation procedures to translate initial English questionnaire into Mandarin. The questionnaire was pilot tested through a mixed panel of practitioners and academics. The pilot test resulted only in minor wording changes. The final version was distributed via email and after several rounds of reminders we achieved a total of 102 usable responses, which is equivalent to a response rate of 17.6 %. Sample characteristics are presented in Table 1.

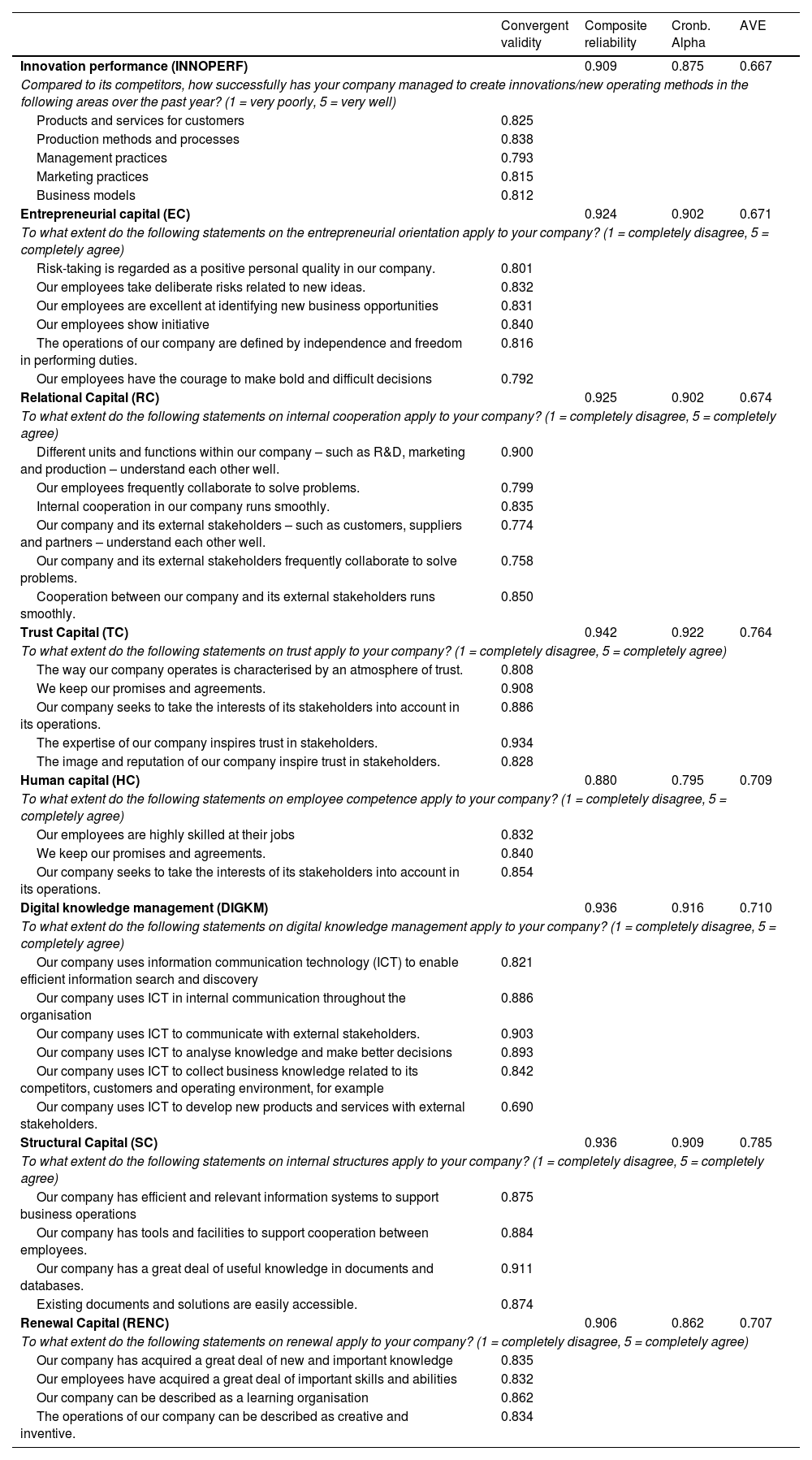

Measurement of constructsFor comparability of our findings with previous studies we used well-established scales to measure our constructs. Accordingly, our innovation performance (INNOPERF) construct has been adapted from Weerawardena (2003) but used in many previous international studies (Buenechea-Elberdin et al., 2017; Cabrilo & Dahms, 2018). Respondents compared their company's success to the competitors’ in terms of creating innovations pertaining to products/services, production methods and processes, management and marketing practices, and business model elements and interactions. Although perceived performance measures are subjective and may be a limitation, these measures tend to correlate positively with objective measures (Cabrilo & Dahms, 2018). Internal and external relational capital constructs have been adopted by Cabrilo et al. (2020), and for the purpose of this study have been aggregated into one general relational capital construct (RC). Renewal capital (RENC) construct has been adapted from Kianto et al. (2010), entrepreneurial capital (EC) from Buenechea-Elberdin et al. (2017), and trust capital (TC) from Hussinki et al. (2017b). Digital KM (DIGKM) was adapted from Inkinen et al. (2015).

All measures were based on a five-point Likert scale, and respondents were asked to assess how the different statements on IC dimensions and digital KM were applied in their organizations (1-strongly disagree, 5-strongly agree). For innovation performance measures, respondents compared different innovative abilities with competitors on a five-point Likert scale (1-far below, 5-far above). The full constructs are provided in Table 2.

The measurement model and constructs.

| Convergent validity | Composite reliability | Cronb. Alpha | AVE | |

|---|---|---|---|---|

| Innovation performance (INNOPERF) | 0.909 | 0.875 | 0.667 | |

| Compared to its competitors, how successfully has your company managed to create innovations/new operating methods in the following areas over the past year? (1 = very poorly, 5 = very well) | ||||

| Products and services for customers | 0.825 | |||

| Production methods and processes | 0.838 | |||

| Management practices | 0.793 | |||

| Marketing practices | 0.815 | |||

| Business models | 0.812 | |||

| Entrepreneurial capital (EC) | 0.924 | 0.902 | 0.671 | |

| To what extent do the following statements on the entrepreneurial orientation apply to your company? (1 = completely disagree, 5 = completely agree) | ||||

| Risk-taking is regarded as a positive personal quality in our company. | 0.801 | |||

| Our employees take deliberate risks related to new ideas. | 0.832 | |||

| Our employees are excellent at identifying new business opportunities | 0.831 | |||

| Our employees show initiative | 0.840 | |||

| The operations of our company are defined by independence and freedom in performing duties. | 0.816 | |||

| Our employees have the courage to make bold and difficult decisions | 0.792 | |||

| Relational Capital (RC) | 0.925 | 0.902 | 0.674 | |

| To what extent do the following statements on internal cooperation apply to your company? (1 = completely disagree, 5 = completely agree) | ||||

| Different units and functions within our company – such as R&D, marketing and production – understand each other well. | 0.900 | |||

| Our employees frequently collaborate to solve problems. | 0.799 | |||

| Internal cooperation in our company runs smoothly. | 0.835 | |||

| Our company and its external stakeholders – such as customers, suppliers and partners – understand each other well. | 0.774 | |||

| Our company and its external stakeholders frequently collaborate to solve problems. | 0.758 | |||

| Cooperation between our company and its external stakeholders runs smoothly. | 0.850 | |||

| Trust Capital (TC) | 0.942 | 0.922 | 0.764 | |

| To what extent do the following statements on trust apply to your company? (1 = completely disagree, 5 = completely agree) | ||||

| The way our company operates is characterised by an atmosphere of trust. | 0.808 | |||

| We keep our promises and agreements. | 0.908 | |||

| Our company seeks to take the interests of its stakeholders into account in its operations. | 0.886 | |||

| The expertise of our company inspires trust in stakeholders. | 0.934 | |||

| The image and reputation of our company inspire trust in stakeholders. | 0.828 | |||

| Human capital (HC) | 0.880 | 0.795 | 0.709 | |

| To what extent do the following statements on employee competence apply to your company? (1 = completely disagree, 5 = completely agree) | ||||

| Our employees are highly skilled at their jobs | 0.832 | |||

| We keep our promises and agreements. | 0.840 | |||

| Our company seeks to take the interests of its stakeholders into account in its operations. | 0.854 | |||

| Digital knowledge management (DIGKM) | 0.936 | 0.916 | 0.710 | |

| To what extent do the following statements on digital knowledge management apply to your company? (1 = completely disagree, 5 = completely agree) | ||||

| Our company uses information communication technology (ICT) to enable efficient information search and discovery | 0.821 | |||

| Our company uses ICT in internal communication throughout the organisation | 0.886 | |||

| Our company uses ICT to communicate with external stakeholders. | 0.903 | |||

| Our company uses ICT to analyse knowledge and make better decisions | 0.893 | |||

| Our company uses ICT to collect business knowledge related to its competitors, customers and operating environment, for example | 0.842 | |||

| Our company uses ICT to develop new products and services with external stakeholders. | 0.690 | |||

| Structural Capital (SC) | 0.936 | 0.909 | 0.785 | |

| To what extent do the following statements on internal structures apply to your company? (1 = completely disagree, 5 = completely agree) | ||||

| Our company has efficient and relevant information systems to support business operations | 0.875 | |||

| Our company has tools and facilities to support cooperation between employees. | 0.884 | |||

| Our company has a great deal of useful knowledge in documents and databases. | 0.911 | |||

| Existing documents and solutions are easily accessible. | 0.874 | |||

| Renewal Capital (RENC) | 0.906 | 0.862 | 0.707 | |

| To what extent do the following statements on renewal apply to your company? (1 = completely disagree, 5 = completely agree) | ||||

| Our company has acquired a great deal of new and important knowledge | 0.835 | |||

| Our employees have acquired a great deal of important skills and abilities | 0.832 | |||

| Our company can be described as a learning organisation | 0.862 | |||

| The operations of our company can be described as creative and inventive. | 0.834 | |||

We have taken various steps to address common method bias and multicollinearity. Ex ante, in order to avoid participants guessing our model, we distributed the constructs randomly across the questionnaire. Furthermore, our model also includes factual data such as firm size and industry from the TEJ database. After the data collection, we conducted a Harman's one factor test (Podsakoff et al., 2003). The results showed the emergence of four factors, with the largest explaining only 30.6 % of the total variance. We investigated the variance inflation factors in our model to test for multicollinearity and can report that no variance inflation factor value was above the threshold of 5 (Hair et al., 2014). Common method bias and multicollinearity are not seen as a major threat to the interpretation of our results.

AnalysisConstruct validityWe used PLS-SEM to create a measurement model to test for convergent and discriminant validity as part of confirmatory factor analysis procedure. Accordingly, we first assessed the reliability and validity of the constructs. Convergent validity ensures that the statements of the questions given to the firm managers are sufficiently correlated with the expected latent variable. In a second step, we assessed discriminant validity as an indicator for, or lack of, correlation between the respective latent variables. The results of our measurement model are in line with the general conventions in the field (e.g. Fornell & Larcker, 1981). The PLS-SEM model can be found in the appendix for details.

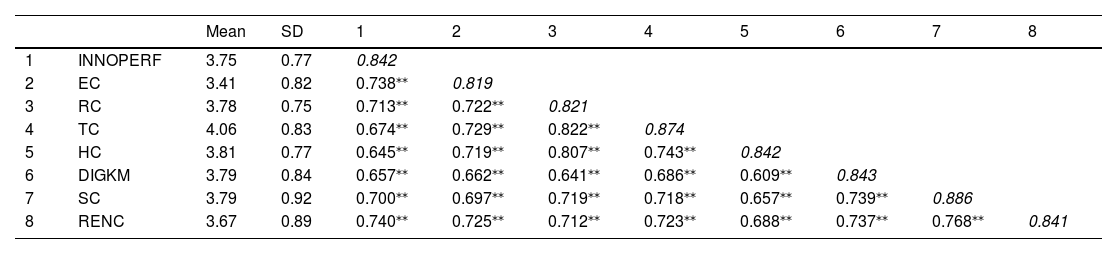

The full results of the study are presented in Table 2. Table 2 shows the measurement model and the full constructs. It provides information about the convergent validity of the constructs, as well as the composite reliability, Cronbach's alpha values, and the average variance extracted. We did not drop any items from the initial constructs, because all of the factor loadings in Table 2 are well above the threshold for a significant factor loading of 0.5 (Hair et al., 2012). The composite reliability and Cronbach's alpha for all items are also above the required 0.7 thresholds (Hair et al., 2012). The composite reliability values range from 0.880 for human capital to 0.942 for trust capital. Table 3 shows the discriminant validity of the latent constructs, as well as the descriptive statistics. The square roots of the average variance extracted are shown on the diagonal in italics, and the bivariate correlations between the constructs are shown off-diagonal. All of the correlation coefficients between the variables in Table 3 are positive, with the strongest positive relationship between relational capital and trust capital. The results in Table 3 largely confirm that IC dimensions enhance innovation performance mostly through their combinations and interactions (Inkinen, 2015). One way to overcome this is to examine complex phenomena such as multidimensional IC as clusters of interrelated conditions by using fsQCA (Pappas & Woodside, 2021).

Descriptive statistics and bivariate correlations.

| Mean | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | INNOPERF | 3.75 | 0.77 | 0.842 | |||||||

| 2 | EC | 3.41 | 0.82 | 0.738⁎⁎ | 0.819 | ||||||

| 3 | RC | 3.78 | 0.75 | 0.713⁎⁎ | 0.722⁎⁎ | 0.821 | |||||

| 4 | TC | 4.06 | 0.83 | 0.674⁎⁎ | 0.729⁎⁎ | 0.822⁎⁎ | 0.874 | ||||

| 5 | HC | 3.81 | 0.77 | 0.645⁎⁎ | 0.719⁎⁎ | 0.807⁎⁎ | 0.743⁎⁎ | 0.842 | |||

| 6 | DIGKM | 3.79 | 0.84 | 0.657⁎⁎ | 0.662⁎⁎ | 0.641⁎⁎ | 0.686⁎⁎ | 0.609⁎⁎ | 0.843 | ||

| 7 | SC | 3.79 | 0.92 | 0.700⁎⁎ | 0.697⁎⁎ | 0.719⁎⁎ | 0.718⁎⁎ | 0.657⁎⁎ | 0.739⁎⁎ | 0.886 | |

| 8 | RENC | 3.67 | 0.89 | 0.740⁎⁎ | 0.725⁎⁎ | 0.712⁎⁎ | 0.723⁎⁎ | 0.688⁎⁎ | 0.737⁎⁎ | 0.768⁎⁎ | 0.841 |

Note(s): Diagonals in italic are the square roots of the average variance extracted and off-diagonal are the bivariate correlations between the constructs.

Fuzzy-set qualitative comparative analysis (fsQCA) is a relatively recent addition to the management and innovation performance literature (Greckhamer et al., 2018; Kraus et al., 2018; Ding, 2022). The main benefit of fsQCA over traditional symmetric methods such as regression analysis is that it allows researchers to investigate alternative multidimensional solutions without a priori assumptions of their nature (Woodside, 2013) and avoid traditional multicollinearity problems caused by using regression models (Ding, 2022). For example, in this study IC dimensions influencing innovation performance are highly correlated, indicating that regression analytical model is not suitable, being unable to isolate completely the effects of one IC dimension from another. These advantages that fsQCA has in exploring the net effects have led to a growing interest in the method in the field of innovation and knowledge management (e.g., Nguyen et al., 2019; Cabrilo & Dahms, 2018; Ding, 2022).

In a first step, the variables need to be transformed into conditions, a process referred to as calibration. In the absence of theoretical anchor points that could provide guidance for the calibration process, this study adopts the direct calibration method and the factor scores to specify three variables’ anchors: the benchmark for full membership, crossover point, and full non-membership (Ding, 2022). Accordingly, a z-score of 1 is classified as being fully in, −1 of being fully out and 0 as 0.5 cut-off point. In other words, if a firm shows the expected value, i.e. a z-score of 0, it is considered as neither in nor out of a set. We added 0.001 to cases that fell directly on the 0.5 cut-off point to avoid dropping cases (Fiss, 2011).

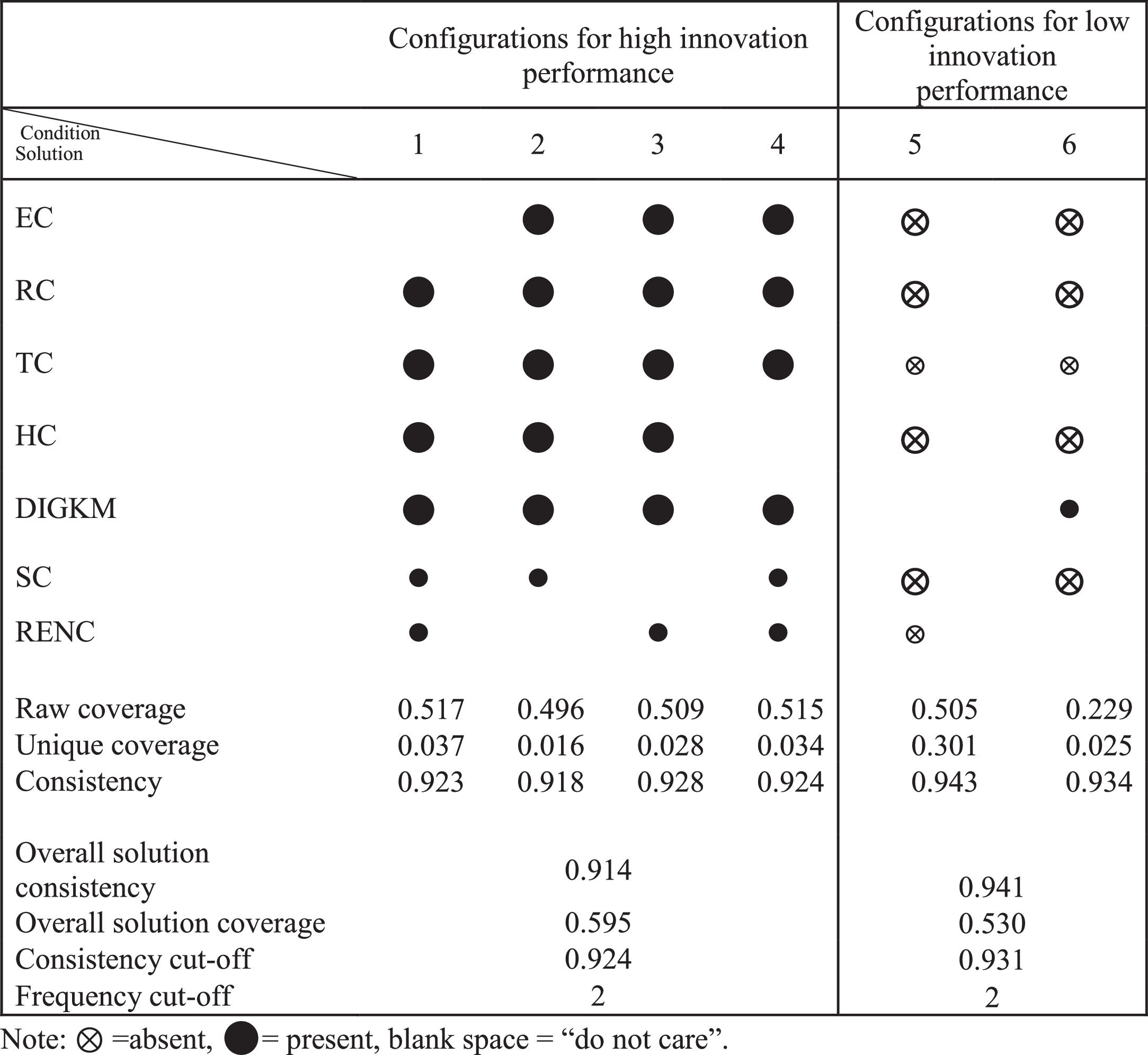

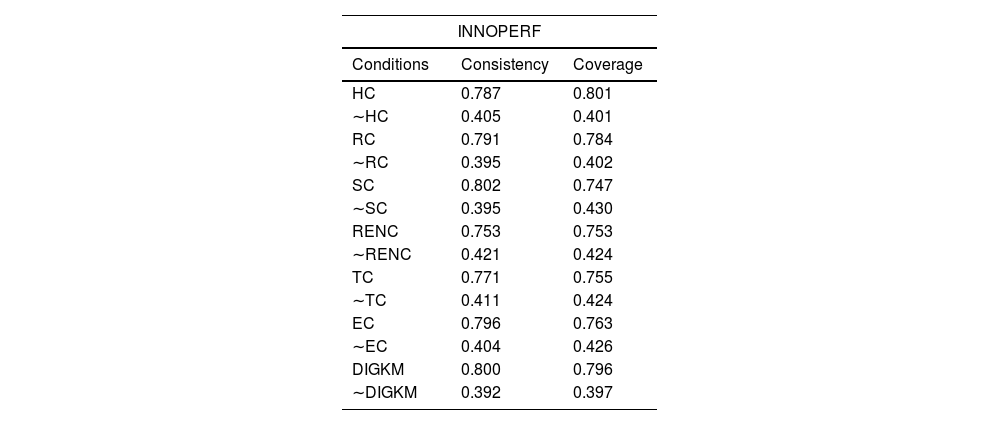

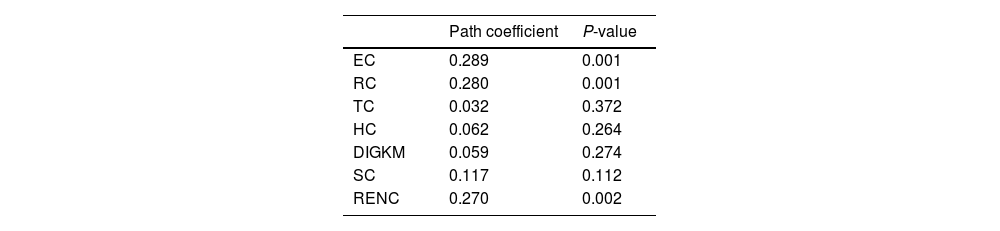

Following the calibration, a necessary condition analysis was conducted to identify conditions that might be necessary, as opposed to only sufficient on their own, to explain the outcome. The full results are presented in Table 4. None of the conditions reached a consistency value greater than 0.9, either in its presence or absence. Therefore, we can conclude that none of the single conditions taken individually is necessary to achieve high innovation performance.

Following the necessary condition analysis, we continue with our fsQCA to analyze the sufficient conditions. To do so, fsQCA provides causal combinations of the outcomes in the form of truth tables. We used a cut-off point of 3 as a case frequency threshold; this allowed us to retain 92 % of the cases, which is well above the 80 % threshold suggested by Greckhamer et al. (2018). We use ≥0.80 as a benchmark for raw consistency. We excluded configurations with a proportional reduction in inconsistency (PRI) of less than 0.75.

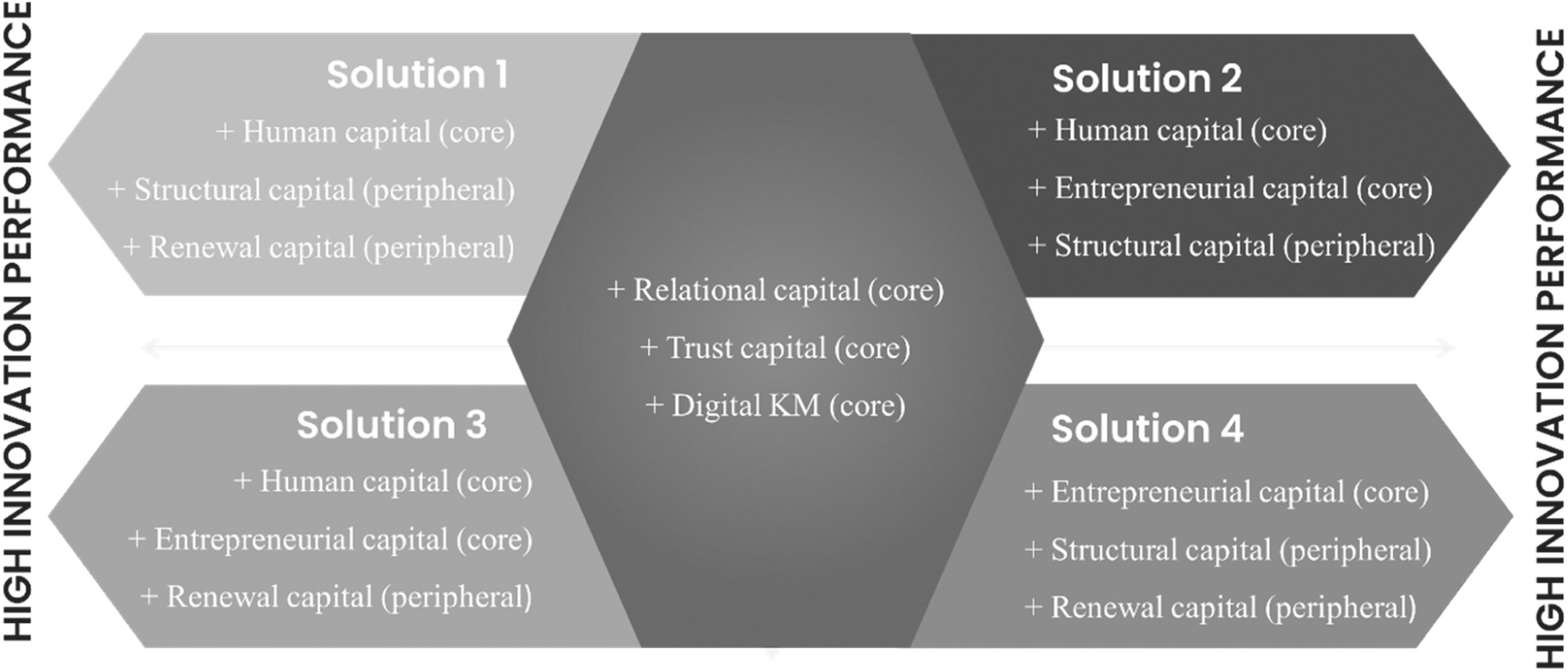

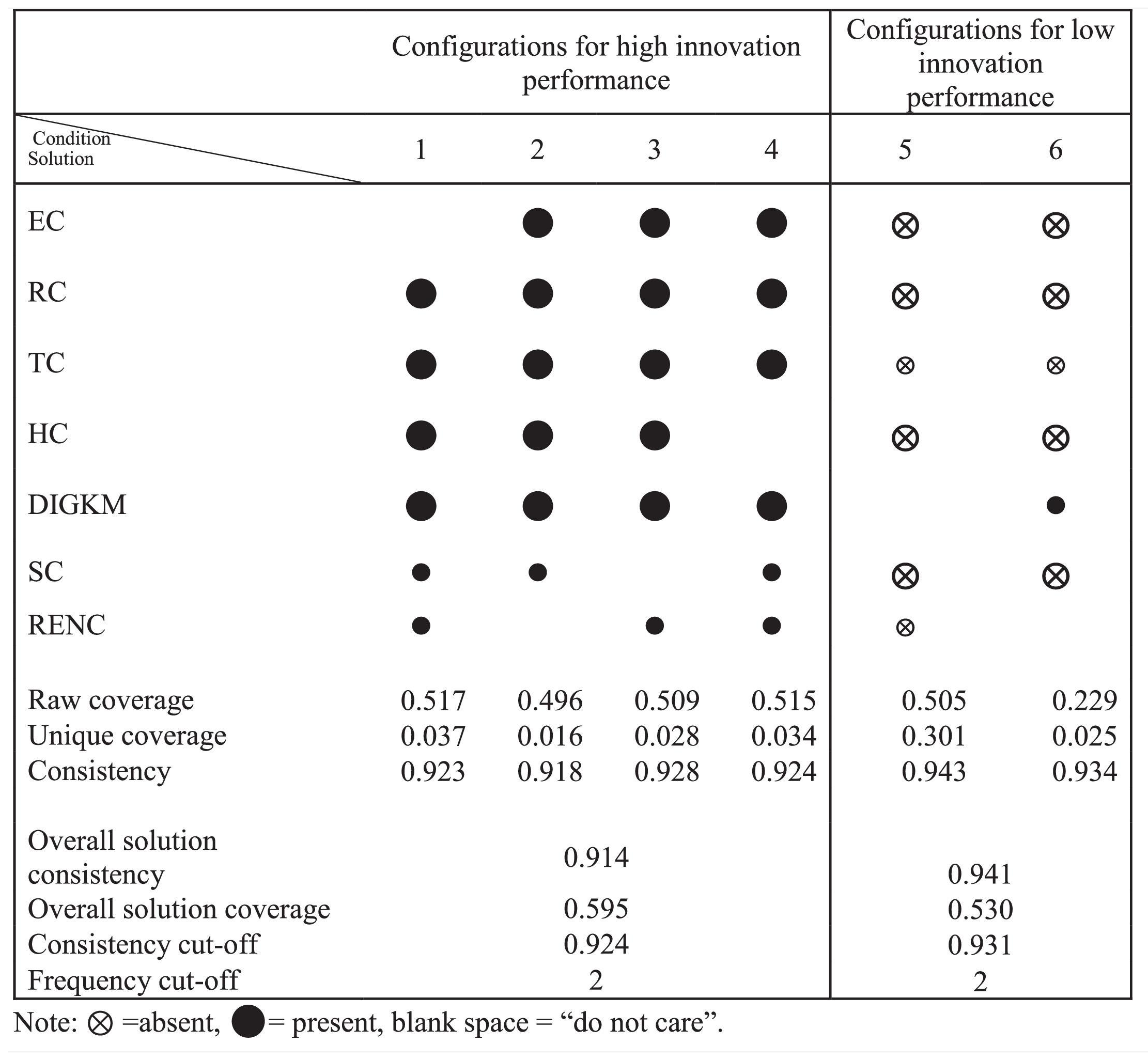

We concentrate on the intermediate solutions that emerged from the Boolean algorithm. The full results are presented in Table 5. The signs are interpreted as follows: ⊗ the condition is absent, • means the condition is present, and blank space means that the condition is irrelevant to achieve the outcome. Larger symbols indicate core conditions and smaller mean peripheral ones. Solutions 1 to 4 show configurations that lead to high innovation outcomes. Solutions 5 and 6 show configurations that lead to the absence of high innovation outcomes.

All configurations for high innovation performance have very similar raw coverage, ranging from 0.517 (configuration 1), 0.515 (configuration 4), 0.509 (configuration 3), and 0.496 (configuration 2). Raw coverage in fsQCA is the equivalent of the “R” value in traditional regression models (Pappas & Woodside, 2021). It is always more relevant for a discussion to consider the configurations with higher raw coverage.

DiscussionSolution 1 (Configuration 1) shows that companies can achieve high innovation performance through high human, relational, and trust capital, digital KM as core prerequisites, and high structural and renewable capital as peripheral conditions. The entrepreneurial capital condition does not matter for the innovation outcome in configuration 1. In this solution, companies with well-educated and trained employees with professional knowledge, skills, and personal experience, who are motivated and engaged in creative projects and innovation processes, in addition to strong and trustful networks with internal and external stakeholders, and effective digital KM, as well as with high structural and renewal capital as peripheral conditions achieve high innovation performance. This configuration confirms that although technology has momentum in innovation (Hamad, 2018), human beings are still the main source of novel insights, ideas, and solutions (Hamadamin & Atan, 2019; Aman-Ullah et al., 2022). It is also relevant that stakeholders perceive a company as reliable and trustworthy. Trust and technology-oriented KM makes the relationships long-term, smooth and low-cost (Lyu et al., 2022), enabling access to diverse knowledge within and from outside of the company's boundaries, promoting knowledge acquisition, optimizing knowledge allocation within the networks, and boosting innovation outcomes (Cabrilo et al., 2020; Han & Xie, 2023; Zhao et al., 2023). Companies can also increase their innovation capabilities by improving knowledge-based infrastructure and encouraging knowledge-friendly organizational culture (Aman-Ullah, 2022; Cabrilo & Dahms, 2018; Aramburu & Sáenz, 2011). Finally, a company with high renewal capital has great learning abilities meaning that the company can generate diverse new knowledge, combine, and recombine those in novel ways for innovation (Ritala et al., 2023; Zhao & Wang, 2020).

Solution 2 (Configuration 2) shows that high human, entrepreneurial, relational, and trust capital, digital KM as core conditions, and structural capital as peripheral conditions lead to high innovation outcomes. Renewal capital is the condition that does not matter in this configuration. This configuration adds entrepreneurial capital to the previous core conditions and emphasizes that for companies, especially in high-tech industries with fast changes and high innovation requirements, employees’ entrepreneurial attitudes and behavior are more beneficial for innovation performance than individual and organizational abilities to update existing knowledge. In this case, high-quality human capital is crucial for entrepreneurial orientation and behavior, as qualified and motivated employees can efficiently identify new business opportunities, take risks, and make difficult entrepreneurial decisions proactively (Yu et al., 2022; Chen et al., 2023; Buenechea-Elberdin et al., 2017). Moreover, companies that have trustful and reliable relationships with stakeholders usually tend to have an influencing position within business networks and, therefore can grab more opportunities (Aljanabi, 2018) and boost innovation (Cabrilo et al., 2020), especially if their knowledge exploration and exploitation capabilities are supported by IT-enabled KM (Raymond et al., 2020). In this configuration, structural capital, although playing a peripheral role, adds value to innovation performance and confirms that having efficient organizational processes and routines, effective information systems and knowledge bases, and organizational culture that promotes innovation constitute important sources for superior organizational performance (Aramburu & Sáenz, 2011).

Solution 3 (Configuration 3) shows that high human, entrepreneurial, relational, and trust capital, digital KM as core conditions, and renewal capital as peripheral conditions synergize together to achieve high innovation outcomes. Compared to configuration 2, this solution reveals that structural capital can be substituted with renewal capital for high innovation performance. It signals that companies without strong actualized knowledge infrastructure (information systems, knowledge bases, intellectual property) can compensate for this deficiency by strong learning and development capacity. A higher capacity to acquire and create new and relevant knowledge, disseminate it throughout the organization and institutionalize it into learning practices (Cabrilo & Dahms, 2020), will further stimulate innovation processes (Hussinki et al., 2017a; Inkinen et al., 2015) in combination with other IC dimensions and technology-enabled KM. It may also be that low-tech companies need more intensively to learn to cope with change and maintain their competitiveness, therefore renewal capital is important IC dimension that has a significant additional effect on innovation (Buenchenea-Elberdin et al., 2017).

Solution 4 (Configuration 4) shows that companies can achieve high innovation performance through high entrepreneurial, relational, and trust capital, digital KM as core prerequisites, and high structural and renewable capital as peripheral conditions. Compared to solution 1, this configuration reveals that entrepreneurial capital can substitute human capital as a core condition for high innovation performance. This configuration reveals that employees’ entrepreneurial attitudes and behavior, openness to exploration, and risk-taking orientation can substitute for the absence of employees’ qualifications and competence in innovation processes (Cabrilo & Dahms, 2020). It also confirms that innovation can be driven by exploration, trials, and errors rather than experience and professional knowledge if complemented by strong and trustful internal and external networks (Yu et al., 2022) and IT infrastructure (Lee et al., 2015). By being open to exploration and engaged in searching for new opportunities, by anticipating change, and by taking risks, a company moves out of the comfort zone, conquers new and heterogeneous knowledge domains, and thus stimulates innovation (Buenechea-Elberdin et al., 2017; Cabrilo & Dahms, 2020; Lyu et al., 2022).

To this end, when relational and trust capital, and digital KM are present as core conditions, in order to achieve high innovation performance, they may be combined with either (i) strong human capital as a core, and structural and renewal capital as peripheral conditions (solution 1), or (ii) with strong human and entrepreneurial capital as core conditions and with structural capital (solution 2) or renewal capital (solution 3) as peripheral conditions, or (iii) strong entrepreneurial capital as a core condition with structural and renewal capital as peripheral conditions.

All identified causal recipes for high innovation performance are presented in Fig. 2.

Causal recipes for high innovation performance.

Overall, the high innovation performance outcome configurations reveal that strong and trustful internal and external networks and effective digital KM are crucial to high innovation performance, as these conditions are present as core conditions in all high innovation configurations (see Table 5). Globalized technological advancements have significantly increased the competitive pressure on companies, compelling businesses to adopt the most advanced technology to leverage their knowledge to ensure survival (Akpan et al., 2022; Aman-Ullah, 2022) through innovation. Trust helps companies to establish long-term and stable relationships with internal and external stakeholders (Lyu et al., 2022). Trustful interactions are agile and without knowledge flow barriers, which is crucial to transferring tacit knowledge (Ganguly et al., 2019), particularly in fostering innovation (Kucharska & Erickson, 2023). Trustful, stable, and long-term relationships with stakeholders guarantee equal quality and efficiency of knowledge flows (Lyu et al., 2022). Companies with advanced digital technology to manage organizational knowledge and solid and trustful networks have the free flow of heterogeneous knowledge (inbound and outbound knowledge flows), and the acquisition of heterogeneous knowledge can effectively stimulate innovation and thus enhance innovation performance (Lyu et al., 2022). Moreover, we empirically confirm that if any IC dimension ‘does not matter’ for high innovation performance (blank space for entrepreneurial, renewal capital, structural, and human capital, in configurations 1, 2, 3, and 4, respectively, in Table 5), a company must develop all other IC dimensions and digital KM to achieve high innovation performance.

Archetypical casesBy implementing the unique case analysis with fsQCA we further explain archetypes for four solutions.

For solution 1, we have archetypical cases of a resort hotel that delivers exceptional customer experience and a large international manufacturing company for automotive parts. Both companies are continuously developing and improving their products and services and have been dedicated to collaboration in innovations and customer satisfaction in order to meet high market demands. A company with high relational and trust capital, advanced digital KM, and strong supportive human, structural, and renewal capital is well-positioned for open and collaborative innovation and growth. Such a company is customer-centric and collaborative (relational and trust capital), agile and adaptable (renewal capital), leveraging technology and human expertise (human capital) to drive continuous improvement and competitive advantage. Well-defined and efficient processes are in place (structural capital), supported by digital KM tools that streamline external and internal knowledge flows.

For solution 2, the archetypical case here is the largest independent solid-state hard drive manufacturer in Taiwan. Here the focus is also on human and entrepreneurial core conditions that complement relational and trust capital, and digital KM capital for customer-centric, open and collaborative innovation strategies. However instead of channeling those assets through renewal capital (intensive exploration and experimentation with new alternatives), as in solution 3, in this case companies may implement exploitative innovation strategies to leverage structural capital, which includes patents, trademarks, and other intellectual property and efficient organizational knowledge infrastructure. A company with these attributes would likely be highly competitive, customer-oriented and innovative, with the capacity to thrive in a rapidly evolving marketplace such as semiconductor industry in Taiwan, as Taiwan is a global epicenter of semiconductor manufacturing.

For solution 3, we have archetypical firms of a company from semiconductor industry and a stainless-steel manufacturer in Taiwan, two internationally linked and exposed firms. Here, we have human and entrepreneurial core conditions as well as renewal capital as peripheral to complement relational and trust capital and digital KM. Innovation in such firms given their industrial context, requires extensive human expertise and abilities to mobilize all resources for new ventures (human and entrepreneurial capital) combined with the ability to constantly adapt to changing market and political conditions as expressed in renewal capital.

Finally, a life insurance company in Taiwan is an archetype of solution 4. While it has the core assets of relational and trust capital, and digital KM, as a regional insurance provider, it also relies on entrepreneurial, structural, and renewal capital. This could be because such firms deliver innovations through strong entrepreneurship that allows a quick response to changing customer needs and market dynamics. This is supported by structural capital (e.g. data analytics that helps insurance companies to develop more accurate pricing models and identify emerging risks), and intensive learning and training activities, as expressed in renewal capital. In this case, advanced digital technology may automatize certain routine and repetitive tasks traditionally performed by humans, which may change the role human capital naturally has in innovation process. In insurance industry, companies may use advanced technology to codify knowledge by documenting best practices, lessons learned, and market insights, which may be used in training and developing employees to substitute human capital and speed up innovation process.

The substitution effectsIt is also important to note that human capital and entrepreneurial capital may substitute each other as core conditions for high innovation performance (configuration 1 and configuration 4), as well as that structural and renewal capital may substitute each other as peripheral conditions for high innovation performance (configuration 2 and configuration 3). This may be explained by dominant types of innovation in these companies, as low-tech companies are more likely to develop incremental and low-risk rather than radical and high-risk innovations (Buenechea-Elberdin et al., 2017). For example, high-risk innovations require high entrepreneurial capital and high renewal capital, i.e. abilities for exploring and identifying new opportunities and more frequent renewal of the knowledge base (De Carolis & Saparito, 2006), found in configurations 3 and 4. However, renewal capital is very significant for innovation in low-tech companies (Buenechea-Elberdin et al., 2017), as it fosters the knowledge acquisition that further enables the company to fully exploit identified business opportunities (configuration 1).

The substitution effect between human and entrepreneurial capital in innovation can be attributed to industries. For example, in industries where human knowledge and expertise are crucial for new value creation, such as hospitality and customer service, or education, human capital might play a more significant role than entrepreneurial capital in innovation. In contrast, in industries where innovation and new ventures are critical for sustainable competitiveness, such as high-tech industries, entrepreneurial capital might be more important. These substitute effects also depend on corporate strategies as entrepreneurial capital often drives new business and venture creation, while human capital is essential for sustaining and growing existing businesses. Advanced technology can alter the balance and roles of human and entrepreneurial capital in innovation performance, as technologies such as artificial intelligence (AI) can reduce the need for certain human skills and expertise, while entrepreneurial capital might stay essential in innovation activities.

The substitution effect between structural and renewal capital may be explained by the type of innovation, as structural capital is more important in process innovation and business model innovation (Gunday et al., 2011), while renewal capital may play more significant role in product/services innovation, and innovation of management and marketing practices (Tidd & Thuriaux-Alemán, 2016). In addition, if a company has an extensive intellectual property (IP) as a part of structural capital, it can leverage these assets to sustain high innovation performance by exploitative instead of explorative innovation strategy (Visser and Scheepers, 2022). In that case the company does not need to have highly effective R&D and learning activities, i.e. renewal capital. On the contrary in rapidly changing markets, renewal capital and learning and development abilities may facilitate organizational adaptability and innovation performance (Ritala et al., 2023) and substitute the eventual lack of mature structural capital. For example, during Covid-19 pandemic, renewal capital was the most important driver of innovations, especially in health and pharmaceutical industries. For disruptive innovations, renewal capital may be more important than stable organizational infrastructure and efficient processes. Understanding the substitution effects between structural and renewal capitals can help organizations strategically balance their investments in short-term and long-term growth and adaptability.

Lastly, we also tested for low performance outcomes (see configurations 5 and 6 in table 5). That is because we want to understand causal asymmetry and if the absence of certain conditions also leads to the absence of the desired outcome (Greckhamer et al., 2018; Misangyi et al., 2017), in our case high innovation performance. Although, the resulting solutions provide a mixed picture, which indicates that it is not the absence of a certain condition that also leads to the absence of high innovation performance outcomes, we can argue that lack of IC, either all IC dimensions (human, structural, relational, entrepreneurial, renewal, and trust) (configuration 5) or almost all without renewal capital (configuration 6) that in this solution just does not matter, will most likely lead to low innovation performance, even if a company uses advanced technology to manage organizational knowledge (configuration 6). These configurations reveal that integration of digital technology in knowledge management cannot drive innovation performance alone without significant support of intellectual capital and diverse knowledge-based resources.

ConclusionThis study investigates how asset bundles consisting of multidimensional IC and digital KM practices generate high innovation performance in Taiwanese companies. Following the recommendation made by various scholars to revisit linear models and past results established using symmetrical techniques in business studies (Pappas & Woodside, 2021; Kumar et al., 2022; Kraus et al., 2018; Ding, 2022), we develop a theoretical framework based on the neo-configurational perspective (Misangyi et al., 2017) that focuses on traditional IC components (human, structural, relational capital) and the three more recently emerging dimensions of entrepreneurial, renewal and trust capital, and digital KM, as main drivers of innovation performance. This approach allows the simultaneous consideration of multiple interdependent innovation antecedents, including their complementary and substitutability, which drive causally complex innovation performance.

We find different causal recipes or configurations that are ‘equifinally’ linked with high/low innovation performance. Each of these configurations reflects a complex combination of conditions. Therefore, we conclude that instead of a single and independent driver, it is more likely that a combination thereof is required to explain high innovation performance. Therefore, our findings significantly differ from previous literature that used a prevailing symmetric view and investigated the innovation drivers considered in this study mostly in isolation of each other (Buenechea-Elberdin et al., 2017; Hussinki et al., 2017b; Ritala et al., 2023; Lyu et al., 2022; Aman-Ullah et al., 2022). It also supports critics of symmetric thinking in that single and isolated factors are unlikely to explain the whole performance picture (Woodside, 2013; Kraus et al., 2018; Ding, 2022).

Our empirical analysis confirms that all IC dimensions and digital KM are potential facilitators of innovation performance, as they are all conditions in causal recipes for high innovation performance. Although this is in line with the prevailing IC and KM literature that confirm the effects of explored antecedents on innovation performance (Inkinen, 2015; Hussinki et al., 2017b), we add to this knowledge by revealing substitution effects between specific IC dimensions for example, human and entrepreneurial capital, and structural and renewal capital, for high innovation performance.

Our findings confirm that multidimensional IC and digital KM may facilitate transition to circular business models and circular economy (Vale et al., 2022; Bigliardi & Filippelli, 2021). Knowledge and technology-based resources and abilities intervene at every stage of the product lifecycle and enable companies to extend life of products, increase energy efficiency and improve waste management, collaborate and engage with different stakeholders, and align business practices with environmental standards and societal expectations (Jabbour et al., 2019; Bigliardi & Filippelli, 2021; Bressanelli et al., 2018).

We also find strong and trustful networks with stakeholders and effective technology-enabled KM to be crucial drivers of innovation performance, as these conditions are present in all configurations for high innovation performance. This finding highlights the importance of integrating digital technology in developing relational dynamics and networks (Kraus et al., 2018) to unlock the intellectual potential embedded in networks and facilitate intra- and inter-organizational cooperation, knowledge transfer, and open and collaborative innovation (Cabrilo et al., 2020). From the perspective of circular economy, our findings confirm the essential role of collaboration and digital technologies in pursuing circular oriented innovations (Jesus & Jugend, 2023; Bigliardi & Filippelli, 2021; Jabbour et al., 2019). The creation of a network of strong and trustful relationships and using digital technologies to facilitate inflows and outflows of knowledge across organizational boundaries (Cabrilo et al., 2020) drive open circular innovations (Eisenreich et al., 2021; Wu et al., 2021) helping companies to overcome the lack of knowledge and information flow, facilitate resource sharing, optimize resource usage, minimize waste, facilitate predictive maintenance models and efficient material flows within circular supply chains, extend product lifecycles and make their business models more sustainable (Bigliardi & Filippelli, 2021; Bressanelli et al., 2018).

By using fsQCA, we have investigated causal asymmetry and revealed configurations that cause low innovation performance. Causal recipes for low innovation performance indicate that lacking diverse knowledge resources will most likely lead to low innovation performance, even if a company uses advanced technology to manage organizational knowledge. Thus, we empirically show what many academics and practitioners know intuitively: there is no innovation without knowledge and learning.

ImplicationsOur findings provide important theoretical, methodological, and managerial contributions.

Theoretically, we use a framework that combines the technological perspective of KM and multidimensional IC, whose effects on organizational performance have so far been mostly researched and isolated from each other in the existing conceptual and empirical literature (Kianto et al., 2014; Inkinen et al., 2015; Hussinki et al., 2017b). In addition, this is one of the first studies considering six-partite IC and digital KM simultaneously as interdependent drivers of innovation performance. Therefore, this study is a step towards a more holistic and simultaneous understanding of the knowledge-driven causal recipes for innovation performance (Pappas & Woodside, 2021) and has significant theoretical implications since the model has not been previously validated nor applied in academic literature.

By taking a configurational rather than a symmetric approach, we also provide a methodological contribution by bringing explanatory power to IC and innovation theory. Our findings reveal that associations between innovation antecedents and innovation outcomes in a real-world setting are, in fact, asymmetrical and confirm the need to use asymmetrical techniques such as fsQCA in this kind of study (Kumar et al., 2022; Kraus et al., 2018; Woodside et al., 2020). This approach allows us to look beyond associations between single variables and a limited set of interaction terms and to understand equifinality and causal asymmetry in the context of multidimensional IC, digital KM, and innovation performance.

From a managerial perspective, this study provides guidelines for managers on integrating knowledge management technology to capitalize on multidimensional intellectual capital and facilitate innovation performance. Identified archetypical cases are also powerful tools for managers to navigate innovation complexity by specific set of knowledge-based drivers.

Finally, by addressing main barriers to develop and implement circular solutions, circular innovations and circular business models (Jesus & Jugend, 2023), we contribute to the circular economy field of research, guiding scholars and practitioners how to accelerate the transition towards a more sustainable and resource-efficient economic models based on knowledge and technology driven resources and capabilities.

Limitations and future studiesOur study also has limitations that might provide interesting avenues for future research. For instance, our sample is based on a data set collected from top management team members of companies with more than 200 employees. This was justified as we wanted to get an as broad as possible overview of the knowledge and technology-based contingencies that influence innovation performance. However, it would be very relevant to explore innovation configurations for digital startups and small and medium size enterprises (SMEs), as these entrepreneurial companies are at the forefront of global digital transformation leveraging knowledge-based resources and digital tools to disrupt traditional industries and create new ones through innovation (Secundo et al., 2020; Scuotto et al., 2017). It is important to move the focus in researching innovation drivers from so far extensively researched large companies to entrepreneurial firms (Felicetti et al., 2023) that play a key role in the exploration of new technological domains and market opportunities (Ferreira et al. 2019) and generating digital innovation (Kraus et al., 2019).

Conducted in Taiwan, recognized for its prowess in developing digital innovation technologies (IMD, 2023) and its effective strategies in recycling and circular economy initiatives (Wu et al., 2021), our study's context significantly shaped our findings. These regional strengths may limit the generalizability of our results to different geopolitical contexts. Hence, we recommend that future research explore the knowledge-based antecedents of innovation performance in emerging economies. Such studies could provide deeper insights into the unique innovation ecosystems and underlying drivers in these developing regions (Anand et al., 2021), enhancing the applicability of our conclusions across diverse economic landscapes.

It is also important to intensify empirical research that may reveal intersections and facilitating effects between IC, KM, innovation, and CE to foster the development of CE initiatives and CE economy. Future studies may investigate applied circular innovation approaches and circular innovation management (Eisenreich et al., 2021).

Lastly, we have focused only on organizational factors that affect innovation outcomes. Taking growing literature on innovation ecosystem into consideration (Gu et al., 2021), future studies should also consider different contextual factors (social, political, economic, and cultural factors) that constitute a breeding environment for birth and development of innovations (Felicetti et al., 2023) and have a significant impact on innovation performance at organizational level.

FundingThis study was funded by Ministry of Science and Technology, Taiwan (Grant number 107-2410-H-214-009, 107-2410-H-230-003, and 110-2410-H-230-003).

CRediT authorship contribution statementSladjana Cabrilo: Writing – review & editing, Writing – original draft, Data curation, Conceptualization. Sven Dahms: Writing – original draft, Formal analysis. Fu-Sheng Tsai: Writing – review & editing, Validation.

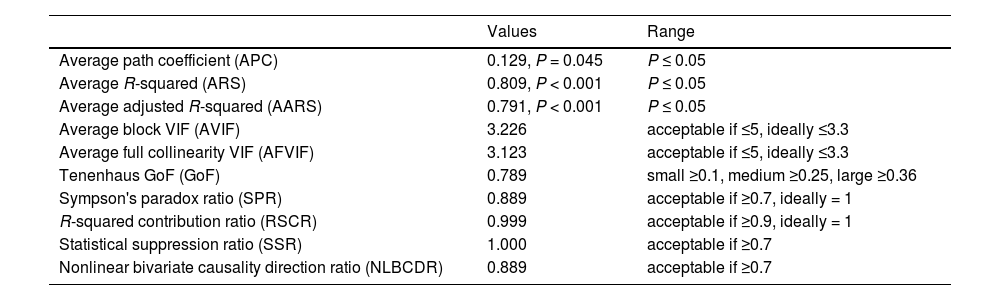

PLS-SEM results:

Model Statistics:

| Values | Range | |

|---|---|---|

| Average path coefficient (APC) | 0.129, P = 0.045 | P ≤ 0.05 |

| Average R-squared (ARS) | 0.809, P < 0.001 | P ≤ 0.05 |

| Average adjusted R-squared (AARS) | 0.791, P < 0.001 | P ≤ 0.05 |

| Average block VIF (AVIF) | 3.226 | acceptable if ≤5, ideally ≤3.3 |

| Average full collinearity VIF (AFVIF) | 3.123 | acceptable if ≤5, ideally ≤3.3 |

| Tenenhaus GoF (GoF) | 0.789 | small ≥0.1, medium ≥0.25, large ≥0.36 |

| Sympson's paradox ratio (SPR) | 0.889 | acceptable if ≥0.7, ideally = 1 |

| R-squared contribution ratio (RSCR) | 0.999 | acceptable if ≥0.9, ideally = 1 |

| Statistical suppression ratio (SSR) | 1.000 | acceptable if ≥0.7 |

| Nonlinear bivariate causality direction ratio (NLBCDR) | 0.889 | acceptable if ≥0.7 |