This article assesses the impact of welfare state systems on the performance of economies in creating the appropriate conditions for innovation and increased competitiveness. Since the 1970s, welfare systems have been regarded as disruptive influences on economic growth. This situation was exacerbated by the intensification of globalization and the emergence of new economies, which led to the need for initiatives to promote innovation and competitiveness, not least in the EU with so many different types of welfare state. To investigate the impact of welfare state systems on innovation performance and competitiveness, we used the European Innovation Scoreboard (EIS), which is based on a variety of indicators, as well as various essential indicators proposed by EU2020 innovation, such as the number of patents and the level of education and employment. The results obtained from the performance of five welfare state clusters of European countries have shown that the most comprehensive welfare states, primarily those in the Nordic countries, have been the most successful in achieving innovation goals and have long been ranked as innovation leaders in Europe. Moreover, public resource allocation for innovation leads to a more comprehensive agenda, including employment promotion, gender equality goals, and sustainability concerns. Welfare costs seem not to reduce competitiveness. And it is competitiveness itself that encourages the development of advanced social security systems.

The competitiveness of advanced economies and their innovation performance during rapid globalization processes have become an issue of debate. The dominant considerations have been the magnitude of technological advances, the size of external markets, and the changing dynamics of consumption patterns (Dahlman, 2007; Huang & Sharig, 2015). Striving to improve international competitiveness has been mainly an issue for larger firms and individual companies. It was not viewed as an arena where public authorities could make a difference (Rodrik, 2018). By emphasizing the harmful effects of spending on economic growth, welfare institutions were depicted as part of the threat to a well-functioning economic order (Mars, 2007). The role that welfare institutions and social safety nets played as positive assets were overlooked. Namely, by designing and developing appropriate welfare programs, they could create the conditions for stimulating innovation in companies and the business sector (Lindert, 2004; Crouch, 2015).

However, recent developments reveal a gradual paradigm shift to consider the significant contribution of welfare programs to long-term economic growth and innovative national capabilities (Mares, 2007; Meinhard & Potrafke, 2012; European Union, 2013; Huber et al., 2013; Hajighasemi, 2019; Koo et al., 2020; Terzić, 2020). This shift has become more apparent during the rapid economic restructuring caused by globalization, especially in those economies with a tradition of effective social policy (Morel et al., 2012; Crouch, 2015; Farnsworth & Irving, 2018; Wehner et al., 2006). In advanced economies, mainly in northern Europe, welfare states, since their first beginnings, have seen one of their main tasks as promoting economic innovation, growth, and rapid industrial development (Hajighasemi, 2004; Hajighasemi & Oghazi, 2021; Hort, 2014). This view has gained ground as the more generous welfare economies experienced tremendous success in tackling economic crises and showed themselves more robust and resilient than states with less comprehensive welfare systems (Starke et al., 2013; Kuhnle, 2019).

Following this paradigm shift, doubts centered on the disruptive functions that welfare institutions can have on the dynamic functionality of the economy are expected to dissipate. As this shift became embedded, proponents of an effective social policy (Morel et al., 2012; Hudson & Kühner, 2009) stressed the significance of economic growth as the decisive factor in expansion. Moreover, belief in the durability of welfare programs found increasing support within the financial establishment.

Among the advocates of an effective social policy, welfare programs have been lauded for their contribution to economic growth. What has been highlighted are the positive effects that welfare spending has had as a significant stimulus to economic growth (Lindert, 2004). The focus has been on the demand side, emphasizing consumption generated by the income increase resulting from welfare spending (Onaran & Stockhammer, 2016). In their justification of welfare institutions’ intervention in the economy, the advocates of productive social policy highlight the supply-side argument to a greater and more apparent extent than previously. For example, they point to the contribution of welfare institutions in promoting innovation and technological development and, therefore, to increased competitiveness. According to several scholars (Estevez-Abe et al., 1999; Hall, 2015; Hajighasemi, 2019), welfare states have played a significant role in shaping the innovative potential of advanced economies and, in this way, have helped to facilitate innovation and economic growth.

While the potential impact of welfare state regimes on innovative performance has been highlighted previously, there is still a lack of empirical evidence in assessing this impact at the country level (Crouch, 2015; Rodrik, 2018). Moreover, according to the Neo-Schumpeterian approach, the ability of countries to stimulate innovation activities can be expected to bring economic growth and prosperity (Hanusch & Pyka 2007; Witt, 2016). Therefore, the primary purpose of this paper is to assess the impact of social welfare systems on innovation performance and competitiveness in selected European countries. In this regard, the underlying hypothesis of the present study is whether specific clusters can be established among representatives of European welfare states cocerning the impact of welfare states on innovation outcomes. The outcomes of innovation activities, as both inputs and outputs, and enterprise promotion are regarded as indicators that reflect – and, to some extent, measure – the appropriateness and supportiveness of welfare systems in creating business-friendly environments and institutions.

This paper consists of the following sections. Section 2 presents the background and motivation for the present article. Section 3 develops a conceptual framework for competitiveness in the global economy and the need for innovation–promotion efforts to advance the welfare state. Based on this framework, Section 4 presents the operationalization of innovation indicators for advanced welfare state economies and an analysis of the logic behind the European Innovation Scoreboard (EIS) and the EU 2020 Innovation Indicator. Section 5 outlines the methodology and results of the creative outputs and outcomes of welfare state clusters within European countries. Section 6 discusses the contribution of welfare states to innovation outcomes in advanced economies and suggests further research directions.

Background and motivation: an intensified need for innovation strategiesThe concept of innovation is considered complex and multidimensional, including a wide range of attributes, such as the aim, type, nature, means of innovation, social context, and stages of innovation (Baregheh et al., 2009; Zulu-Chisanga et al., 2016). Moreover, this concept can be viewed as an outcome, a process, and a mindset (Kahn, 2018). In general, innovation includes an element of novelty and something different from previous solutions that contribute to the growth of companies, markets, and societal prosperity (Gopalakrishnan, 2000; Bielińska-Dusza & Hamerska, 2021). Innovation performance is driven by internal factors, such as corporate size, equity incentives, internal pay dispersion, and management characteristics. But external factors, such as a competitive environment and national policies, are considered less important (Wei et al., 2020).

The intensified need for innovative strategies in response to globalization is related to the emerging economies – namely, China, India, and Eastern Europe. These economies represented the beginning of a new era of emerging markets (Buysse & Vincent, 2015). Access to a large and increasingly well-educated – but still low-cost – labor force gave the emerging economies an advantage that challenged the established European economies. While the advanced economies grew on average by 1.6% per year in the 2000s, these emerging markets enjoyed robust annual growth rates of around 5%. With this rapid expansion, their share of world GDP, expressed in terms of purchasing power parity (PPP), grew from 32% in 2000 to 44% in 2014, whereas the advanced economies declined from 59% to 46% in the same period (Buysse & Vincent, 2015).

In the newly developed economies, economic growth led to a structural change in their production. Up to the mid-1990s, the overwhelming bulk of their output consisted of goods and services requiring low technological expertise. However, since then, the picture has dramatically changed. Emerging economies, such as China, began to produce increasing amounts of high value-added components seen as the exclusive preserve of advanced economies (Lewin, 2016; Zhou et al., 2016). The number of middle-class consumers has expanded dramatically and, thus, the potential for growth in consumption in the emerging economies looks promising over the longer term (Gaur & Delios, 2015). This situation can be contrasted with the advanced economies, which have been compelled to undergo structural change to sustain the high levels of productivity required to maintain competitiveness. Nevertheless, such advanced economies as those in the EU still have some crucial advantages that keep them competitive with lower-cost producers. The preservation of this supremacy demands continued competitiveness. This competitiveness rests on retaining the capacity to create high value-added, knowledge-based goods and services. However, maintaining their technological advantage will continue to be a critical factor (Dahlman, 2007; Vakulenko et al., 2019). The acceleration of the rate of technological change and the requirement to participate effectively in globalization would seem to be the factor to give advanced economies an advantage over the fast-growing economies.

However, the durability of this technological hegemony is being questioned increasingly by scholars (Williamson & Raman, 2013; Huang & Sharif, 2015), who believe that emerging economies are catching up with developed economies. There is much to indicate that China, for example, is positioning itself to assume global leadership in technology in the coming decades (Huang & Sharif, 2015). The latest official statistics on research and development (R&D) indicate that China's R&D expenditure has more than doubled in the last two decades, from 0.89% of GDP in 2000 to 2.1% in 2019, which is the same level as the EU (OECD, 2021).

Given the above, the impact of economic and technological innovations on the life and economies of humans has been fully recognized, supporting the Neo-Schumpeterian approach that innovation is a driver of economic growth and prosperity (Hanusch & Pyka, 2007; Witt, 2016). The ability of countries to stimulate innovation activities can bring new employment opportunities, higher salaries, lower prices, better quality, per capita growth, and raised living standards across the board. Innovative strategies can help developing countries catch up with more advanced economies at high speed and generate sustainable profit. Therefore, the demand for innovative strategies to deliver a positive impact is high, and welfare-enhancing innovation processes deserve special attention.

Related literature overviewIn this section, we first present a discussion on how competitiveness can be achieved. There are two streams of research claiming that competitiveness can be achieved either through cost reductions or increased innovation. This is followed by a review of the studies investigating the impact of social expenditure on economic performance. The section ends with a review of studies dealing with debates on innovation capacity, financial restructuring, and economic performance in different welfare state systems.

Competitiveness through cost reductions or increased innovationAt the global level, the main challenge to the advanced economies seems to have been the emergence of the fast-growing economies. However, at the EU level, the primary threat is from the poor-performing economies of Southern Europe. These countries and Ireland suffer from a competitiveness problem that makes their labor too expensive and delivers low productivity. Consequently, decisive measures are needed to increase competitiveness (European Investment Bank, 2016). To respond to the challenges posed by globalization and maintain their international competitiveness, EU member states could opt for short-term solutions that focus on more effective and capital-intensive production methods to reduce labor costs.

A devaluation is no longer an option because the poorly performing countries in the EU use the same currency and are, therefore, obliged to do what the monetary union imposes. The only way to overcome the “competitiveness gap” would seem to be measured by adjusting labor costs. According to Black (2010), to become competitive, the poorly performing EU member states need a downward adjustment in relative wages, particularly against the leading economies in the eurozone, such as Germany. This process is known as internal devaluation. It means that labor costs – defined as the full cost of a worker's total compensation – must be reduced to increase labor productivity. The nominal wage rate and all other labor-related costs to the firm must be reduced (Felipe & Kumar, 2011). These costs are comprehensive and include a range of payments related to labor services, such as social security, severance or redundancy pay, employers’ contributions to pension schemes, accident and life insurance and, in some cases, payroll taxes and “fringe benefits” (Felipe & Kumar, 2011).

A reduction in social expenditure is perceived as another short-term tactic that can increase cost competitiveness and contribute to the zero-growth rate in social goods and social services expenditure. This prescription is based on the idea that the high labor costs in most advanced economies are mainly due to a dramatic expansion of the social security system. It is assumed that increased labor costs are the primary reason why profit-maximizing firms tend to move their activities to countries with less extensive social security systems. In parallel with this process, as the industrialized economies open up their markets to products and services from low-wage economies where social security systems have lower standards, the governments in countries with well-developed social security systems will find it increasingly difficult to maintain their advanced welfare standards.

In contrast to cost reduction, innovation activities can also achieve competitiveness. Several studies at the country level have established a cause–effect relationship between stimulation of innovation activities and competitiveness growth. They confirm the importance of the “innovation paradigm” on national competitiveness (Ciocanel & Pavelescu, 2015; Dima et al., 2018). For example, it was established that a 10% increase in innovation performance leads to a national competitiveness increase of +4.63 points in European countries (Ciocanel & Pavelescu, 2015). Another study in the European context supports the results of the previous research and shows that investment in innovation and education creates higher value-added goods and services and increases the economic success of countries in the competitive world economy (Dima et al., 2018). Green innovations and technologies are also seen as essential factors in competitiveness at the country level (Apak & Atay, 2015). All these studies demonstrate that innovative performance helps countries adapt to globalization processes and technological change. Therefore, cost reduction or increased innovation to stimulate competitiveness are two important factors requiring sound knowledge and well-grounded decisions if countries are to achieve balance.

The impact of social expenditure on economic performanceA process of cuts in welfare services and benefit schemes was launched in most EU member states with established welfare systems after the enlargement of the EU in 1995. This phenomenon was known as a “race to the bottom” because competitive pressures arising from globalization were eroding social security. The aim was to improve the competitiveness of the advanced industrial nations against the new industrial countries. However, one of the outstanding social achievements of industrialized countries, which ensured a reasonable income for all citizens, was gradually being eroded (De Grauwe & Polan, 2005). The impact of the social protection system's expenditure on economic performance and competitiveness in the major industrial countries is one of the most revealing indicators of the operation of race-to-the-bottom dynamics. This indicator is important because the levels of social protection vary across industrial countries. It should be possible to argue that the more a government spends on social security, the weaker its economic performance and competitiveness will be – and the more a country should be forced to embrace the race-to-the-bottom dynamic. However, comparative studies (Pfaller & Gough, 1991; Hermann et al., 2008; Alper & Demiral, 2016) on the relationship between social expenditure and competitiveness do not confirm this hypothesis. Countries that have gone furthest in developing extensive and expensive social security systems are, in almost all cases, the most advanced economies, while those countries that have fallen behind or chosen not to invest in advanced social protection are, in many cases, suffering financial difficulties. In terms of competitiveness, the countries with high levels of social spending, such as the Nordic countries, belong to the category that performs better than the countries that invest least, such as those in Southern Europe.

Innovation capacity and economic restructuring in different welfare systemsA helpful general definition of competitiveness is the degree to which [a country] can, under free and fair market conditions, produce goods and services, which meet the test of international markets, while simultaneously maintaining and expanding the real incomes of its people over the longer term (OECD, 1992: 237). If some economic sectors in a country become uncompetitive, the ensuing financial restructuring may involve cuts. Transitional costs might be high, and the level of unemployment could rise. In addition to the domestic restructuring of the economy, enterprises in industrial societies benefit from a wide choice of locations for their businesses. Consequently, national markets are exposed to constant competition and are compelled to act to attract or retain enterprises. As Garelli (2006) stressed, relying on an ability to be aggressive in world markets by focusing on the country's export performance and increasing foreign direct investment cannot secure competitiveness. Markets also need to be attractive to wealth creation activities, which can, in turn, jeopardize the stable development of living standards among the population. Balancing these economic imperatives with a nation's social requirements that result from its history, values system, and traditions is crucial in achieving sustainable and long-term competitiveness. In other words, because social security increases labor costs through higher taxation and different kinds of contributions, critiques of generous social security benefits highlight state welfare as a crucial factor in suppressing production and reducing competitiveness.

The second dimension of competitiveness focuses less on the cost aspects and stresses factors such as the capacity to innovate and develop new products and technologies (Dodgson, 1996; Clark & Guy, 2010). These capacities are related to the human capital of nations. They include the labor force's quality and level of motivation, both “blue collar” and “white collar,” and in the private and public sectors. The quality of human capital and reason in a labor force is mainly influenced by the quality of the education system and the rewards that employees can obtain from a good education (De Grauwe & Polan, 2005).

The third important dimension that affects competitiveness is the quality of domestic institutions. The stronger the legal and social institutions in a society and the more significant the contribution of these institutions in securing the population's living standard and the workforce's skills, the more the level of productivity will increase. Labor markets with optimum social security benefits preserve and protect the help of those who may be placed in a vulnerable position due to imbalances and distortions in the labor market. Thus, solid social institutions can prevent social discontent and conflict, which damage economic prosperity in the long run (De Grauwe & Polan, 2005).

In studying the competitiveness of countries open to the world economy, it would be misleading and inaccurate to assume that actual performance in the international market, as indicated by market share or current account balances, is an accurate measure of the actual economic capacity of nations. The long-term position is determined by the quality of the institutions that make countries competitive. The factors that affect the competitiveness of nations are crucial. Taking these as the point of departure, the sustainability of economic systems can be studied. This feature is regarded as the source of economic growth and, therefore, essential to the survival of welfare institutions. This approach contrasts with the race-to-the-bottom approach, which aims to improve the competitiveness of economies through cuts in the public sector and social spending.

However, this has been shown not to be the decisive factor in economic competitiveness. A comparison of the competitiveness rankings of OECD countries and their social spending shows a negative correlation between the two variables. In other words, countries that spend the most significant proportion of their GDP on social needs also score best on competitiveness (De Grauwe & Polan, 2005). This is explained by the positive impact they have on each other. Presumably, a country with a high level of competitiveness can generate a higher GDP, which in turn allows it to spend more on social needs. High levels of social spending generally have a positive impact on economic performance because the level of social expenditure influences the productivity of the labor force.

Another crucial factor that increases the demand for social spending is the increase in external shocks due to growing levels of trade and exchange, which increase the risk in open economies (Rodrik, 1998). This, in turn, increases the need for the state to protect citizens from crises caused mainly by economic imbalances. This could explain why, despite the calls by supporters of globalization for extensive cuts in social expenditure, industrialized nations have been cautious and have avoided a race to the bottom on social security. On the contrary, the advanced economies that have chosen to spend most generously to meet welfare needs have been the most competitive (Schwab, 2016).

Innovation capacity and economic performance debates in welfare statesThere is a consensus among scholars that the critical contributory factor to the future competitiveness of advanced economies is their innovative capacity (Furman et al., 2002; Gans & Stern, 2003; Doyle & O'Connor, 2013). This is crucial because, over time, the ability to generate increased production from additional capital investment declines in most economic sectors. Consequently, through this iterative process, the economy's competitiveness will be determined by the ability of the corporate sector to develop and commercialize innovative technologies over the long term (Furman et al., 2002). The innovation capacity and innovation intensity of economies vary, related to factors such as the nation's Common Innovative Structure (CIS), Cluster Specific Environment (CSE), and the quality of the linkage between its CIS and its CSE (Doyle & O'Connor, 2013). This nation-based approach to identifying factors that promote innovation activity is interesting because it provides a policy-centered focus on how best to consider the long-term choices that affect innovation capacity (Doyle & O'Connor, 2013). By studying the variations in innovation outcomes at the national level, a comparison of innovation performance – and on to innovation capacities and the innovative “success” of different countries (or of the other welfare states) – can be made.

The nation's CIS refers to the features of an economy's innovation infrastructure that provide no particular benefit to any sector or cluster but aim to support innovative activities generally in the economy. The model in Furman et al. (2002:906) identifies three main factors in the quality of the common innovative infrastructure: i) the aggregate level of technological sophistication, or its accumulated knowledge base; ii) the talent pool of workers appropriate for generating new knowledge; and iii) those universal factors that can help the innovation potential of a country and an economy. Among the latter is the state of higher education and the overall condition of academic research, the level of property rights protection, and access to R&D tax credits. In addition to these essential elements of infrastructure, a broader list of potentially relevant variables is suggested by Gans and Stern (2003):

- •

Investment in basic research

- •

Tax policies affecting corporate R&D and investment spending

- •

The supply of risk capital

- •

The aggregate level of education in the population

- •

The pool of talent in science and technology

- •

Information and communications infrastructure

- •

The protection of intellectual property

- •

Openness to international trade and investment

- •

Overall sophistication of demand

The typical innovative structure that is supposed to increase creative capacity is assumed to facilitate the correct conditions for firms to bring about innovation and create new technologies. For this to happen, a specific innovation environment is required in a country's industrial clusters, where firms have the opportunity to invest and compete. As Porter (1990) emphasized, such a microeconomic environment is the basis for new-to-the-world innovation. National innovative capacity depends on the strength of the linkages between these two factors – an everyday innovation infrastructure and specific clusters. To achieve a more productive flow of creative output from a given innovation infrastructure, mechanisms or institutions are needed, such as a vibrant domestic university system or established funding sources for new ventures that can encourage the commercialization of new technologies in particular clusters (Furman et al., 2002). Access to a pool of scientists and engineers, to basic research, and, in some cases, to advice from local universities are often prerequisites for successful innovation, ever active within a well-developed cluster (Doyle & O'Connor, 2013).

Assessment of innovation indicators in advanced welfare state economiesA measure of innovation is a value that can include different statistical and mathematical methods and can be based on a variety of indicators and measures (Bielinska-Dusza & Hamerska, 2021). This article focuses on the innovativeness of the economies in European countries based on the EU2020 innovation, proposed by the High-Level Panel on the Measurement of Innovation, and the European Innovation Scoreboard (EIS).

EU2020 innovation: a focus on the impact of activitiesTo measure aspects of innovation outputs and outcomes, the High-Level Panel on the Measurement of Innovation (2013) proposes a composite indicator of four components: patent applications, the economic significance of knowledge-intensive sectors, the trade performance of knowledge-intensive goods and services, and employment in fast-growing firms in innovative sectors (Janger et al., 2017). The four proposed indicators are briefly discussed below.

The first component, patent applications (PTC) per billion GDP, is suggested by most scholars (e.g., Acs & Audretsch, 1989: Bronzini & Piselli, 2016; Janger et al., 2017) as a proxy for creative output, mainly because of the availability of patent data. While acknowledging that patents are proxies for knowledge and knowledge-generating processes, such as R&D, some argue that they are less informative on the implementation and outcomes of innovation (Moser, 2013; Janger et al., 2017). Given that patent technologies do not always lead to use, too much reliance on patent counts can overestimate innovation output. Patents are often used by firms active in technology-driven sectors. In contrast, a considerable proportion of innovation outputs, particularly in the service sector with a low propensity to patent, are not included in registered patent figures (Arundel & Kabla, 1998).

The second component, knowledge-intensive activity (KIA), refers to the economic significance of knowledge-intensive sectors. It measures the number of employees in knowledge-intensive industries as a proportion of total business sector employment. An activity is knowledge intensive if one-third of the employees have a higher education degree. Improvement in the score on this indicator is achieved if a national economy successfully employs a larger share of employees in knowledge-intensive industries. The shortcoming of this component is the underestimation that arises from increased employment levels in sectors that are not considered knowledge intensive but are highly innovative.

The third component is the competitiveness of trade performance in knowledge-intensive goods and services (COMP). It measures the share of employees in these sectors. The indicator refers to the percentage of high-tech goods and knowledge-intensive services in total exports.

The fourth component, employment dynamism in fast-growing firms in innovative sectors (DYN), collates information on the innovativeness of sectors, their knowledge intensity, and the number of employees in fast-growing firms as a percentage of total employees in these sectors.

The indicators used by EU2020 innovation can measure the economic outcomes of member states, but they fail to capture all of the important economic activities of a country. Sectors that, on average, are less innovative and less knowledge intensive but crucial for the economic development of a country or region might work according to path-dependent evolution and structural upgrading (Dosi &Nelson, 2010; Janger et al., 2017; Bloom et al., 2016). The outputs in these sectors should also be included in economic outcomes.

Given that increased growth and the creation of new, highly productive jobs appear to be the goal of all economies, not least those in the European Union, R&D and innovation have become the main strategies of advanced economies, including at the European level through the Europe 2020 strategy. Innovative products and services were intended to promote industrial competitiveness, job creation, labor productivity, and the efficient use of resources. Factors that could contribute to innovation require comprehensive targeted investment – for example, in the education sector, and especially tertiary education in science and technology. Such investment would then secure dividends from the human capital considered a prerequisite of a knowledge-based society. For instance, the Europe 2020 strategy set a target for member states to invest the equivalent of 3% of GDP in financing R&D activities.

The European innovation scoreboardThe EIS consists of four major areas and contains ten dimensions of innovation, to which detailed criteria are assigned. There are 27 indicators obtained from different sources, such as Eurostat and the Scopus database (European Commission, 2021). The four major areas are:

The human resources dimension: These are indicators of measures that aim to facilitate the availability of highly skilled and educated people in an economy. The indicators captured in this dimension are an investment in tertiary education, postgraduate studies, and doctorates but also in the education and training of the workforce as life-long learning. Active research systems and international scientific publications, an innovation-friendly environment, and opportunity-driven entrepreneurship are also aspects included in this area.

Investment in research by firms and government: Innovative projects need financing and support. While some indicators measure investment by firms in R&D activities and their efforts to upgrade the workforce's skills, others concentrate on the level of public support for research activities from universities and government research organizations.

Innovation activities in the business sector: Innovation activities include different aspects of the actions of a firm, from those introduced by firms into the market to others aimed at innovating the structure of the organization, production processes, or the quality of the product. Some indicators aim to cover all of these aspects. In contrast, others measure collaboration efforts between innovating firms, research collaborations between the private and public sectors, and private sector financing public sector R&D activities.

The impact of innovation activities: Employment and sales are the two major factors that impact the innovation measures captured by the indicators. The employment impacts constitute employment in knowledge-intensive activities and jobs in fast-growing firms operating in innovative sectors. Sales impact measures the economic effects of innovation, mainly through exporting medium- and high-tech products and knowledge-intensive services.

By calculating the Summary Innovation Index using the 27 indicators, states can be classified into one of four groups: i) innovation leaders if their performance is above 125% of the EU average; ii) strong innovators if their performance is between 95% and 125% of the EU average; iii) moderate innovators if their performance is between 50% and 95% of the EU average; and iv) modest innovators if their performance is below 50% of the EU average.

The innovative outputs and outcomes of welfare state clusters within EuropeThis section describes the research methodology utilized in this study and the obtained results that demonstrate the innovative outputs and outcomes of welfare state clusters in European countries.

MethodologyAlthough there is no well-established tradition of empirical studies on the impact of welfare state systems on innovation performance and competitiveness, and the issue of indicators for innovation performance still represents a challenge, we can rely on comparable data and well-established indicators drawn from the Eurostat, European Commission, and European Patent Office databases. Two important methodological considerations must be studied when assessing the innovative outcomes of different welfare states in European countries. Variables should be selected that facilitate a comparison between the innovative outcomes of welfare states. Secondly, the grounds for selecting welfare states should be included in the comparison.

The variables associated with innovative outcomes were derived from the EU 2020 innovation indicator. However, these four variables are regarded as insufficient because they are too oriented toward technology and are not representative of all economic activity. The comparison was therefore supplemented by the most recently published EIS scores, which provide a comparative assessment of the research and innovation performance of the EU member states. In both cases, the comparison was made between the most recently reported values for the variables. In the case of the EIS, the collection and comparison of data on country performances are carried out according to a standard method by the social research and training center at the European Commission. The comparison of the indicators selected by the EU2020, by contrast, was undertaken by the author. The data used was drawn from a single source, Eurostat, to ensure comparable values. Comparing values for a given year provides only a snapshot of welfare state performance. It does not take account of the historical development of innovation performance in welfare states. Given that the aim is to show the innovation outcomes of different welfare states, a comparison of performance in a specific year can meet this paper's needs.

The selection of welfare states was based on the welfare state division initially described by Esping-Andersen (1990), which had three models: Central European, Anglo Saxon, and Nordic. Later, two further models were added, at least at the European level: the Mediterranean and the Eastern European (Hajighasemi, 2019). Only five countries each were selected from the Central European and the Eastern European categories, which are the largest in number. The selection was based on their size and influence within the welfare category. Three countries were selected from the Mediterranean and Nordic clusters. Ireland is the only representative of the Anglo-Saxon collection in the EU.

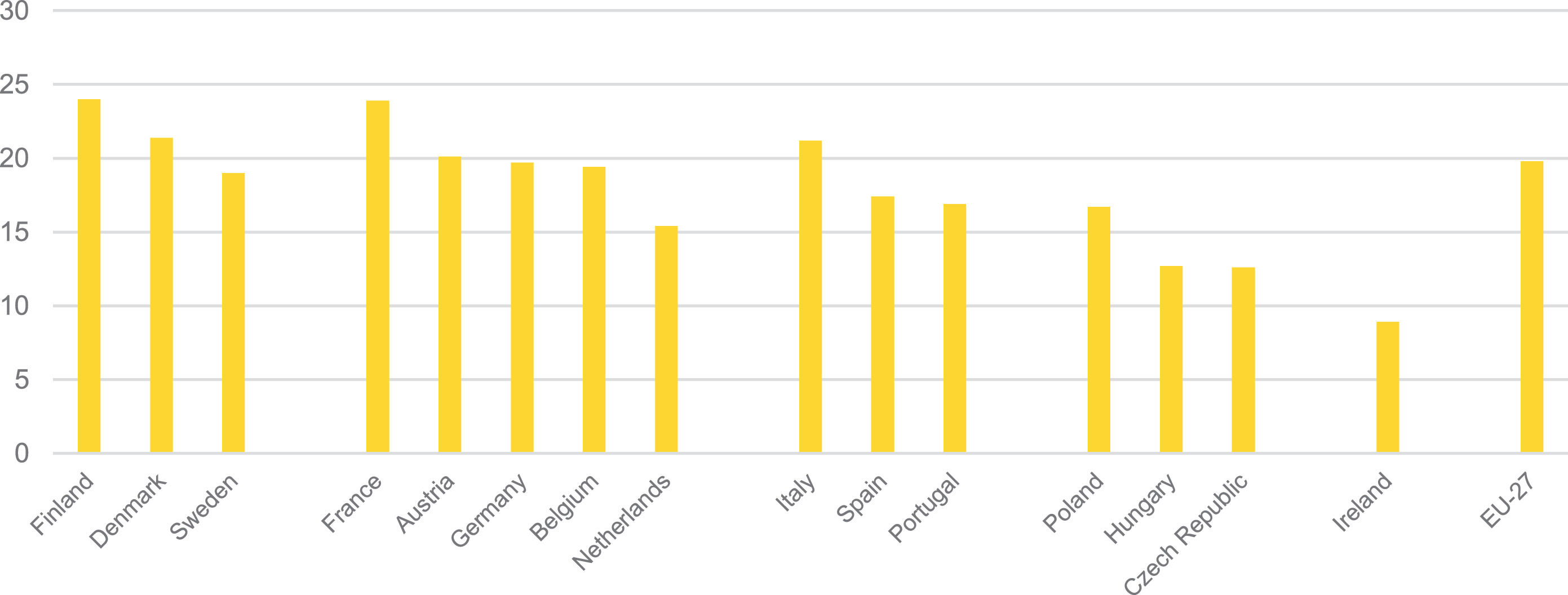

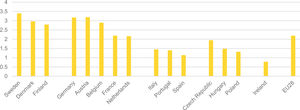

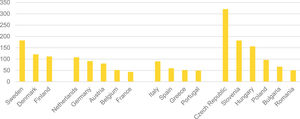

The significance of welfare states in the innovation debate comes from public investment in creating favorable conditions for innovation capacity in an economy (Hall & Howell-Moroney, 2012; Kwon et al., 2009; Saiz, 2001). The private sector supports innovation-promoting initiatives through individual firms’ investments in innovation, and the public sector through the education system and the support for research and development. The objective is to strengthen the foundations for innovation in industry and service provision. The social protection system provides security for the population, which assists the development process. Fig. 1 shows the differences between the various welfare clusters in terms of total government expenditure on social protection in 2019. The differences between the Nordic and Central European countries were modest, but the differences between the Eastern European countries and Ireland were large. The Mediterranean countries fell somewhere in between.

Total general government expenditure on social protection, 2019, % of GDP. Source: Eurostat (2021a). Expenditure on “social protection” includes all “social benefits” and social transfers that governments pay to households to alleviate social risks and needs, such as unemployment benefits, sickness benefits, the costs of the health system if it is financed by the government and pension payments. The figure shows the share of these expenditures as a percentage of GDP.

This section presents the innovation outcomes of the different welfare state clusters that are based on the total general government expenditures on social protection. The main results are based on the EU2020 indicators, which focus on innovation outcomes according to key indicators that cover both the economic and the social outcomes of innovation initiatives. While indicators, such as R&D activity, patent applications, and the extent of high-tech penetration in economies, reflect economic aspects, knowledge-intensive employment in high-tech sectors signifies the social outcomes of successful innovation performance. Finally, to provide a comprehensive picture of welfare states' innovation outcomes, the innovation index results based on 27 different indicators are presented.

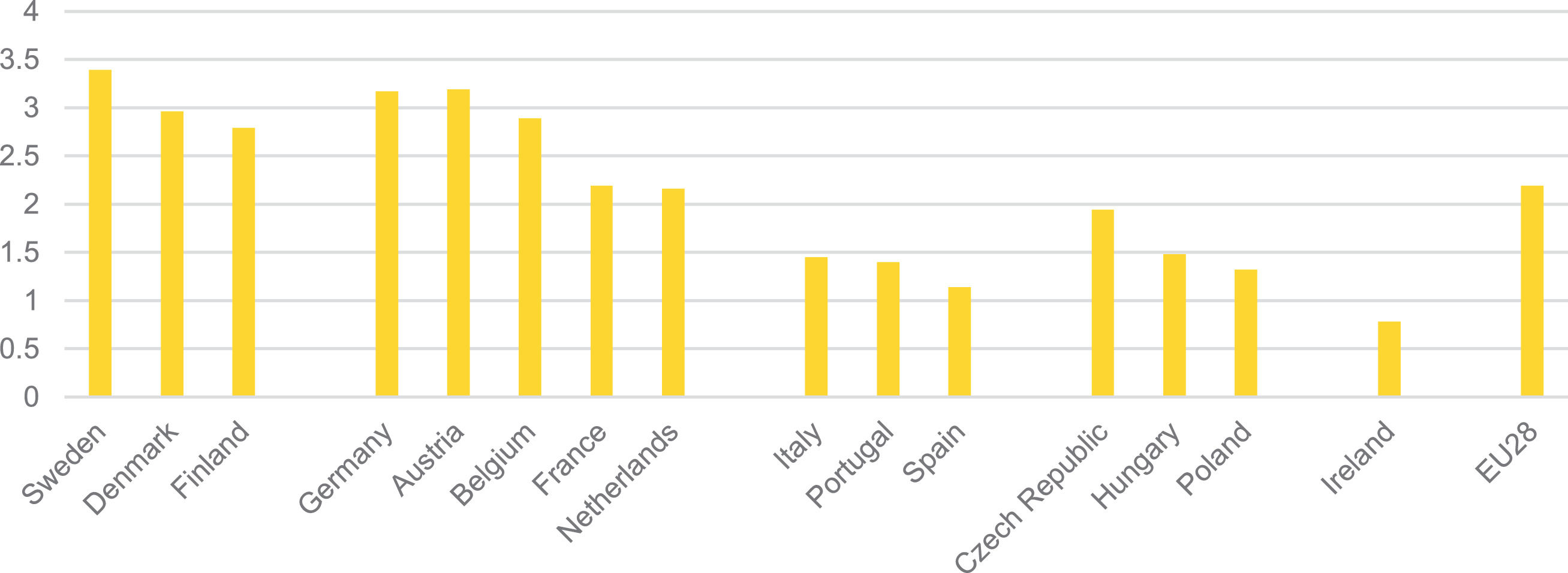

R&D activityAs the significant drivers of innovation, expenditure on, and the intensity of, R&D have been key indicators used internationally to assess national economies’ attitudes to science and technology innovation. At the EU level, R&D spending was the equivalent to 2.19% of GDP in 2019. This is an apparent increase compared to the 2009 level of 1.97%. Among the five welfare clusters in Europe, the Nordic countries are best placed, with Sweden having the highest R&D intensity (see Fig. 2). Germany, which has the largest economy in Europe, is also investing heavily. Eastern European and Mediterranean states all had R&D expenditure below 1.5% of GDP, although the Czech Republic stood out with a figure close to the EU average of slightly over 2%. Despite the low level of R&D intensity in Eastern Europe, some countries in the region (Poland and Czechia included) have shown significant increases in their R&D spending in recent years.

R&D expenditure as % of GDP, 2019 Source: Eurostat (2020a).

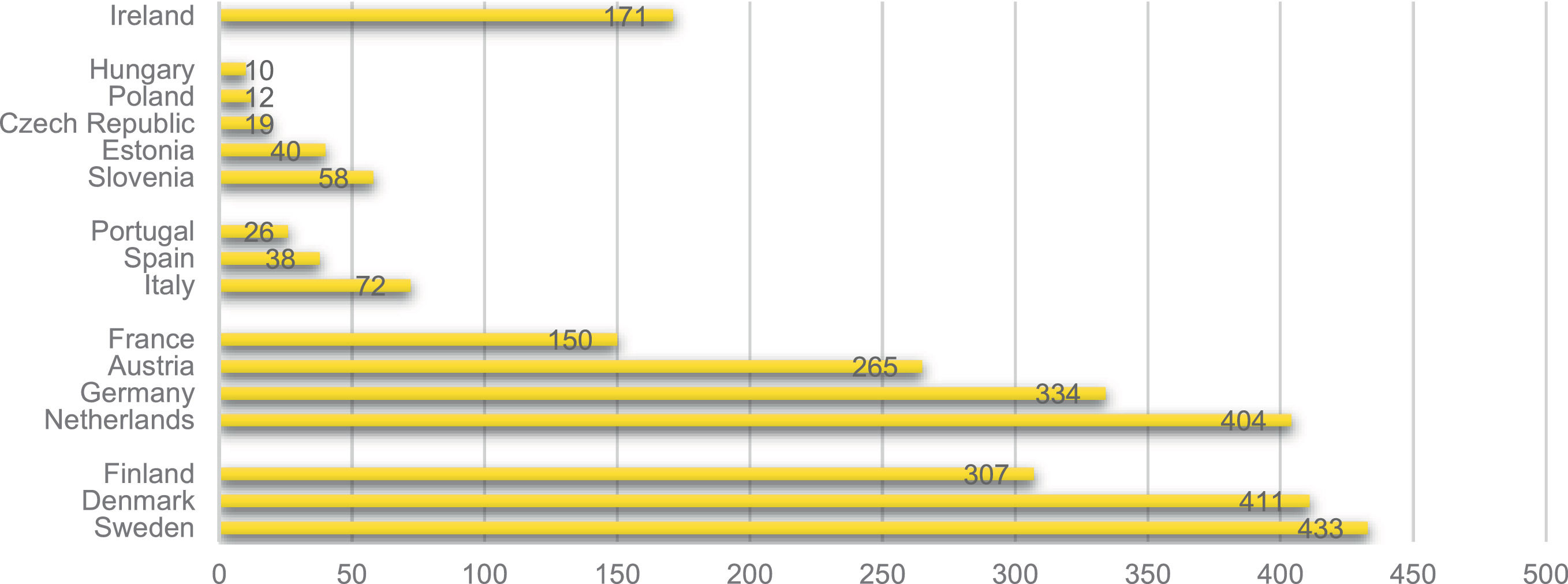

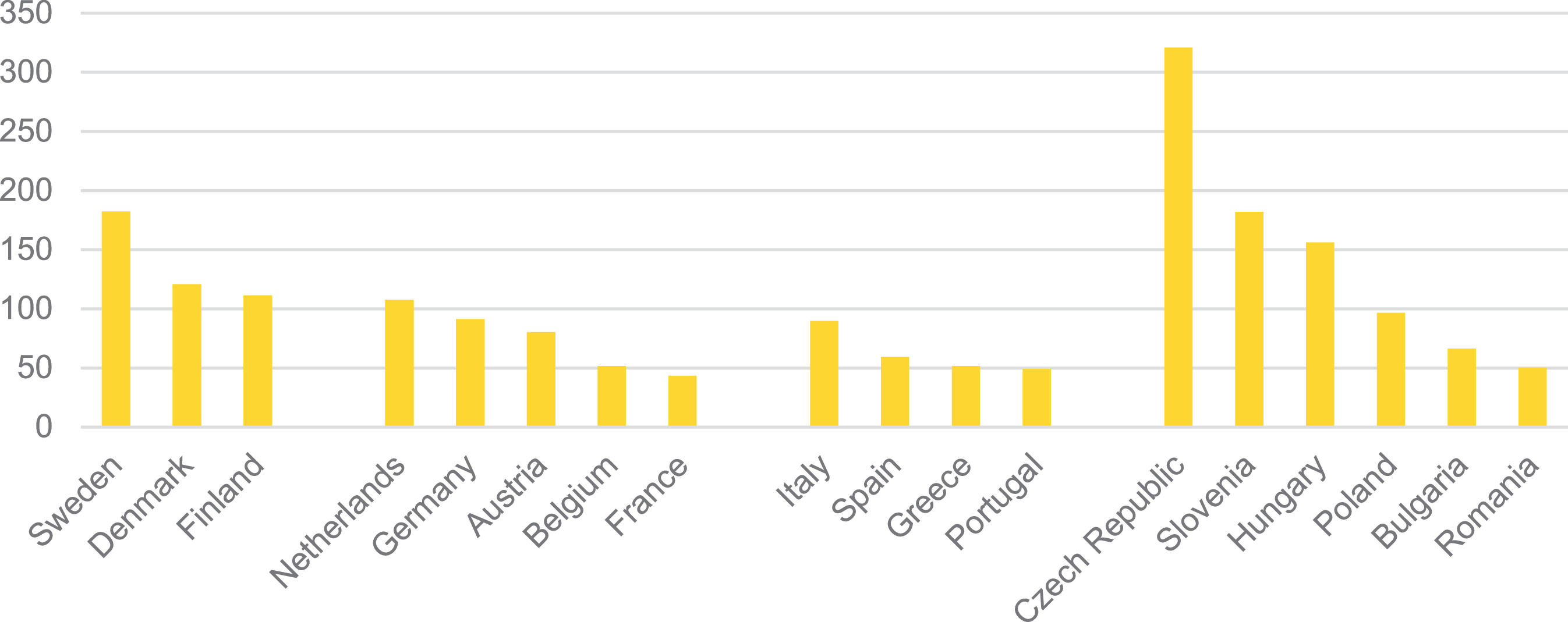

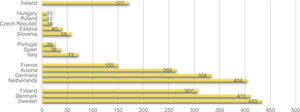

One of the most common indicators of innovative activity in advanced economies is the number of patent registrations. The figure can indicate technology maturity, heralding successful exploitation of technological knowledge for potential economic gain (Moser, 2013). Patent statistics have, therefore, been widely used to assess the inventive performance of economies. Germany has the highest number of patent applications among member states (almost one-third of the EU total), followed by France, which recorded less than half of Germany's total. Relative to population, however, Sweden reported the highest number of applications, followed by Denmark (see Fig. 3). There is a clear difference between welfare state clusters regarding the registration of patents. The division between Nordic Central European economies and Ireland, on the one hand, and Southern European and Eastern European economies, on the other, is noteworthy. Nordic countries perform best, closely followed by the Netherlands and Germany. In the lower groupings, Italy performs slightly better than the others, performing at almost one-tenth of the best-performing countries in the north.

Patent application to the EPO, 2014 (per million inhabitants. Source: European Patent Office (2020).

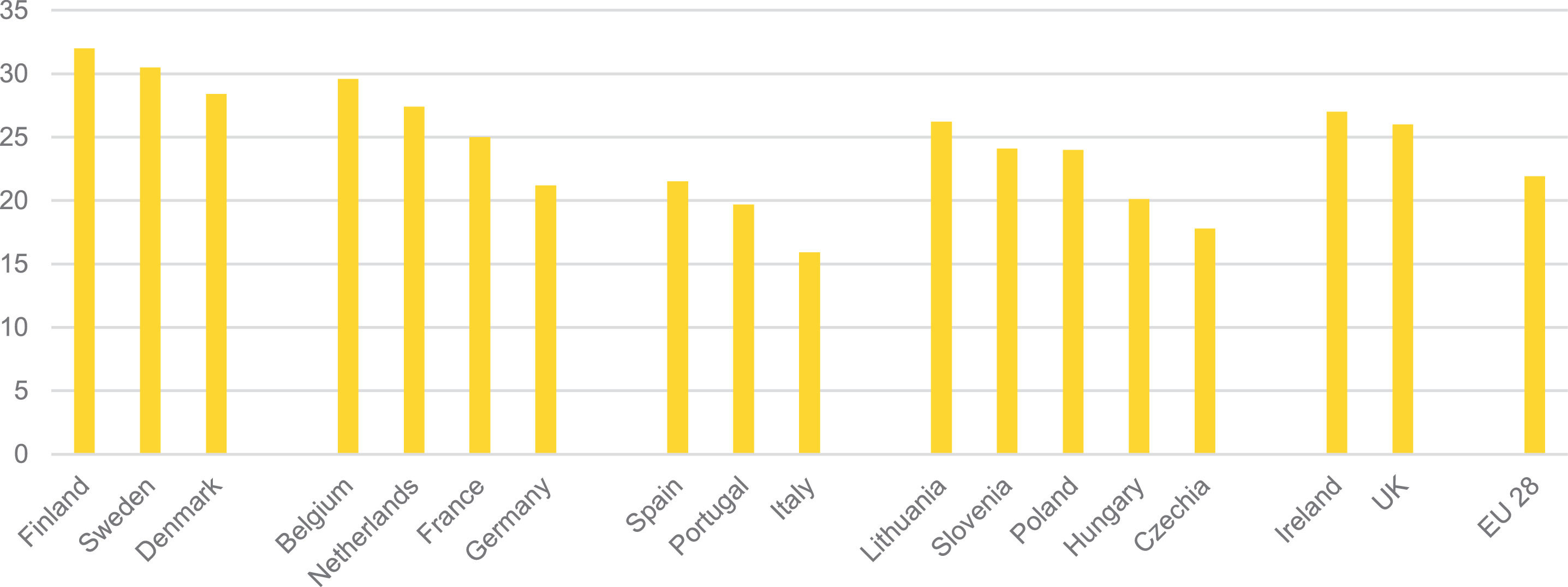

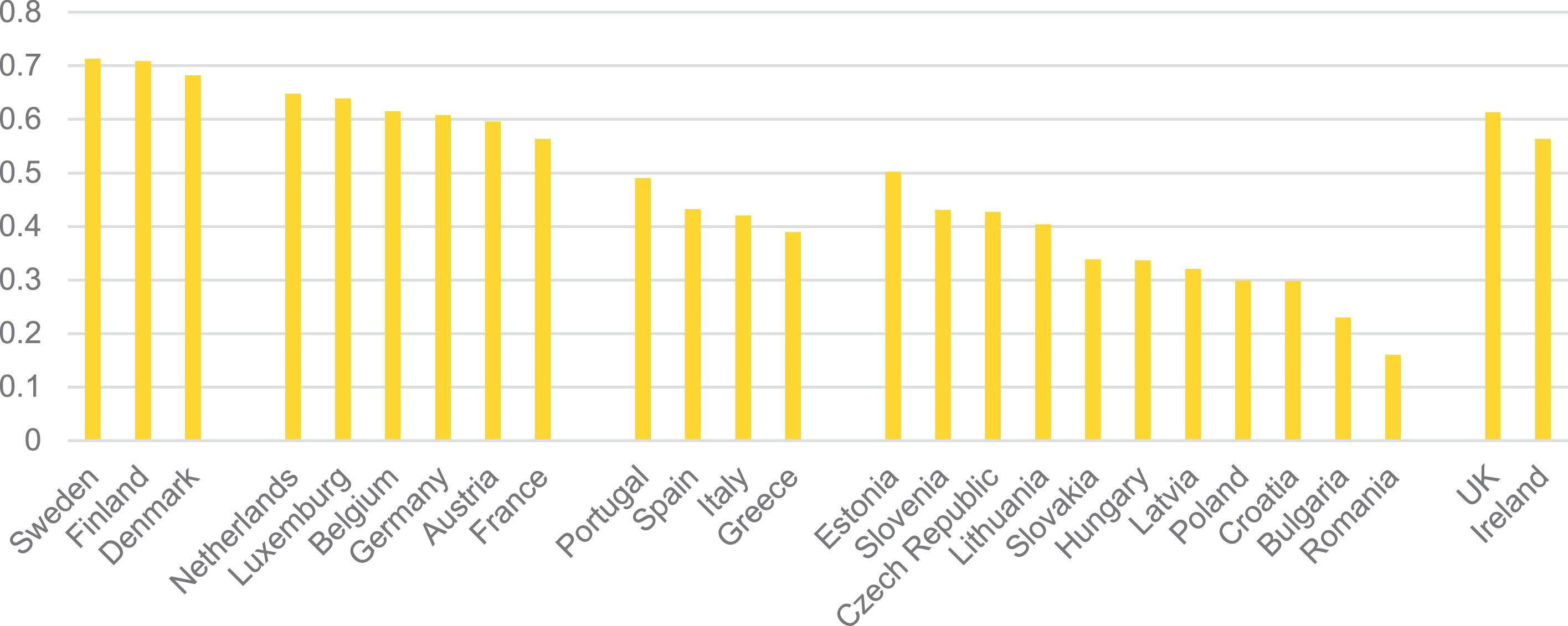

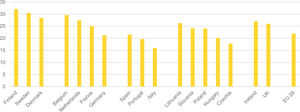

The number of patent applications – or even the number of inventions in new technologies – does not necessarily advantage a country's economy because it can contribute to cuts in the labor force by firms that tend to over-invest in automation to reduce labor costs and increase profits (Giménez, 2018). These productivity benefits can be considered positive but, given that they lead to increased unemployment, they can have a negative net effect on the welfare system and the country's economy. The level of employment for people with tertiary education in science and technology must increase if development is to continue. Knowledge-intensive activities are where university-educated employees account for more than one-third of the total number of employees (Eurostat, 2020b). A European countries’ performance (Fig. 4) shows that the Nordic welfare states are in the best position since approximately 30% of the workforce has tertiary education and works in science and technology. Central European countries are second to the Nordic countries, with fewer employees working in science and technology. The major countries in this cluster are Germany and France, the strongest economies in Europe; they lag with 21.2% and 25% of the labor force in this category, respectively. The situation is worse in Southern Europe, with Italy the bottom performer. In Eastern Europe, smaller states, such as Slovenia and the Baltic States, are on an upward curve, as is highly populated Poland. In contrast, Hungary and the Czech Republic are falling behind.

People who have tertiary education and work in science and technology occupation, 2019. Source: Eurostat (2020c).

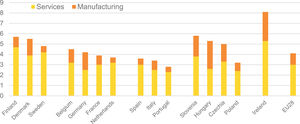

An unmistakable trend in European counties is the steady increase in the proportion of labor employed in high-tech sectors due to the developments in high-tech knowledge-intensive services, which grew by 1.8% of GDP between 2008 and 2018. High-tech manufacturing declined by 0.4% over the same period. Nonetheless, high-tech manufacturing performed better than the manufacturing sector, which recorded a 0.8% decline.

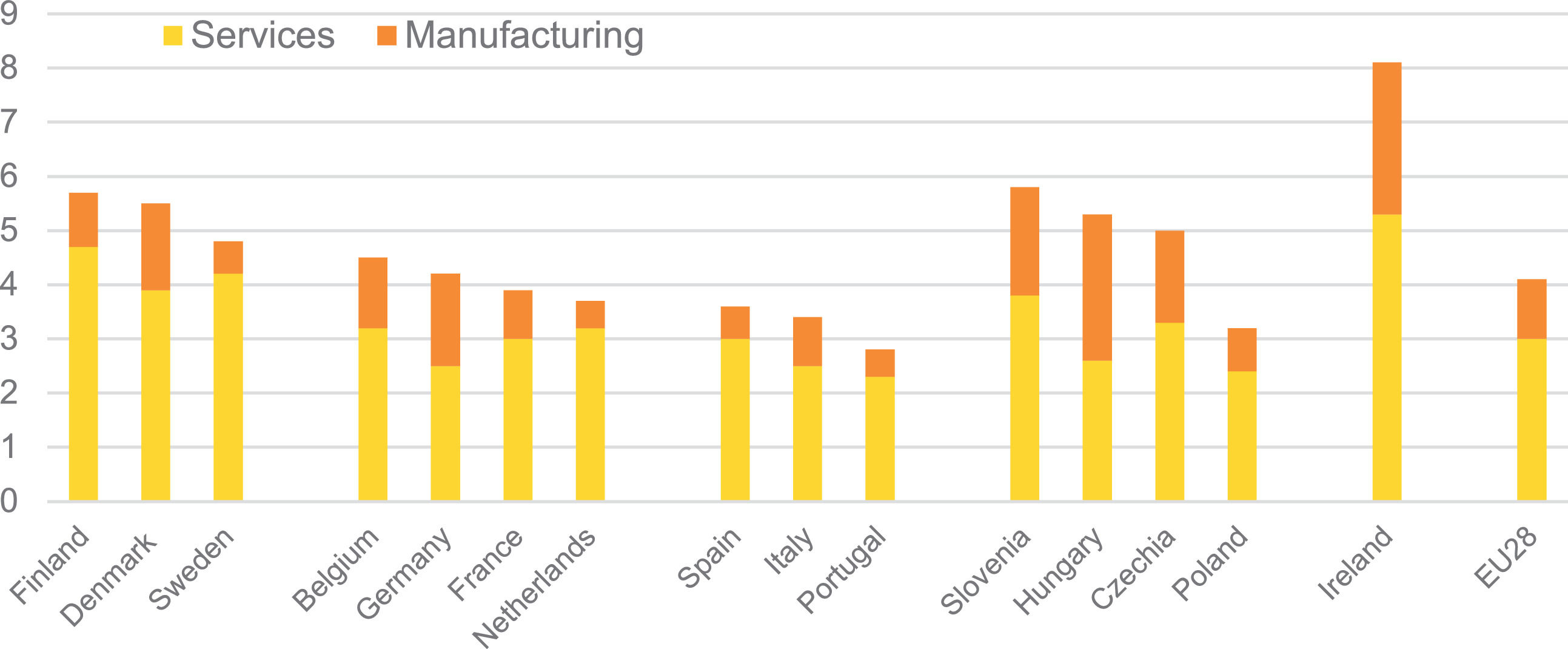

A comparison of employment in the high-tech sectors across the five welfare clusters (see Fig. 5) shows noticeable differences. Ireland stands out as an outlier in both categories, while the higher levels in the Nordic countries are mainly due to employment in high-tech knowledge-intensive services. The Eastern European countries have figures on a par with the Nordic countries, but with higher levels of high-tech manufacturing. The Central European countries have slightly lower shares of employment in high-tech sectors, and the Mediterranean states have the lowest levels.

Employment rate in high-tech knowledge-intensive services and manufacturing, EU 28, 2018. Source: Eurostat (2020d).

Entrepreneurship activities refer to the share of new enterprises and total early-stage entrepreneurial activity. The impact of public support for innovation activities is crucial in this category. At the EU level, it is widely known that policy makers explicitly pursue policies to increase entrepreneurship. Promoting the adoption of different innovation strategies to introduce products, processes, and organizational and marketing innovations in small and medium-sized enterprises is indispensable (Hajighasemi, 2019). A review of the outcomes of entrepreneurship activities in the EU (see Fig. 6) shows that the move in different clusters varies considerably. Most differences are between the recent joiners in the Eastern European welfare cluster, who have a high level of enterprises per million inhabitants, and those in the Mediterranean and, to some extent, the Central European collections. The Nordic countries perform almost in line with the Eastern European states. There are differences between the countries in terms of innovation support. While newer member states have mainly invested in acquiring machinery, equipment, software, buildings, knowledge, and training, established welfare models have invested in R&D and the introduction of innovation to a greater extent (Grabowski & Staszewska-Bystrova, 2020).

The number of enterprises per 1000 habitants, 2017. Source: Eurostat (2020e).

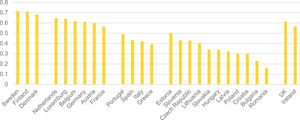

The European innovation scoreboard 2020 highlights two major trends. First, the overall innovation performance of European countries improved between 2012 and 2019 by, on average, 8.9%. Second, since 2012, there has been a convergence of EU member states because most countries that were lagging – mainly those in Southern and Eastern Europe – performed best in this period.

A comparison of the clusters (see Fig. 7) shows an obvious pattern. With Sweden at the top, the Nordic welfare states, accompanied by the Netherlands and Luxembourg from the Central European clusters, are innovation leaders. Most countries in the Central European cluster and Ireland are strong innovators. Moderate innovators make up the Mediterranean and the Eastern European clusters with the exceptions of Portugal and Estonia, who are strong innovators. Two Eastern European countries, Bulgaria and Romania, bring up the rear.

The innovation performances of the the European Welfare States according to the European Innovation Scoreboard (EIS), divided into 5 welfare state clusters. European Commission (2021).

The objective of this article has been to study the impact of welfare state systems on innovation performance and competitiveness in advanced economies. In the era of globalization, with the competitiveness challenges facing developed economies, growth opportunities and employment creation strategies strongly depend on the ability to innovate and succeed in the global market. While corporations are perceived as the apparent agents of innovation, the only variable that could impact the prevailing balance of the competition is the welfare state institution. Given this underlying hypothesis, our paper has studied the effects of welfare states on innovation outcomes among representatives of the five clusters of welfare states in European countries.

The main finding is that, contrary to the widespread belief that welfare spending can undermine innovation potential (Mars, 2007), welfare institutions can harness a country's innovative potential and contribute to its long-term growth. The more comprehensive the welfare system and the more it invests in education at both the basic and the academic levels – by including public financing of research foundations, the promotion of training, and lifelong learning programs for the labor force – the better the country will perform on innovation. These results support the Neo-Schumpeterian argument regarding the importance of stimulating innovation activities to achieve economic growth (Hanusch & Pyka, 2007; Witt, 2016). In contrast to corporate innovation investment strategies, the public intervention has embraced a more comprehensive agenda, including employment promotion, environmental concerns, and gender equality goals. This can be seen in various models designed by public sector actors at the EU level. By selecting indicators beyond corporate profit promotion, such as the EU2020 innovation indicators, aspects of social advantage can be included in measuring innovation success.

Another notable finding is that the performance of welfare states in promoting innovation expressed as clusters of welfare states differs widely. Countries within a cluster of welfare systems often move closer in innovation performance. This leads to the conclusion that the characteristics of the welfare states are of crucial importance to innovation outcomes. This strengthens the existing link between innovation outcomes and institutional or public support of innovation-promoting measures in society. These findings have important policy implications. While welfare policies and innovation performance are discussed in different contexts, our results show that welfare policies and innovation performance should be examined in tandem with specific cultural clusters.

A further finding is a link between a welfare state's comprehensiveness in its investment in education and research and its position in the EIS ranking of welfare states. The Nordic countries are the most comprehensive welfare states and occupy the top positions as innovation leaders, followed by the Central European welfare states. The Eastern European countries, with the lowest levels of social protection expenditure, finish at the bottom as the most modest innovators.

This indicates that high welfare costs in themselves do not reduce competitiveness. This may partly be because economic success generates a larger GDP and, hence, higher incomes among the population increase expectations of an advanced social security system. Consequently, wealth resulting from a high level of competitiveness creates the opportunity for states to invest in the social security system and welfare services. Competitiveness paves the way for the development of an advanced social security system.

While this explanation assumes that economic reasons are behind the high level of competitiveness and that the social security system is the outcome of long-standing success in the economic sphere, an opposing view would find that improvements in a country's competitiveness are highly dependent on dynamic factors related to policy change. This approach regards the social security system as a political project created to provide good relations in the labor market, which are the basis for achieving better competitiveness. Through social security benefits, social services, transfer payments, education systems, health care, and laws that improve living conditions, the advanced welfare states guarantee the dignity and security of their workforces. In turn, this prevents a social conflict in welfare societies. Alongside well-functioning government institutions, this enables workers to feel secure and creates a feeling of belonging to the state and social institutions. In such a stable social climate, there may be an increased readiness to implement significant structural change at the individual, industrial, and economic levels. A well-functioning social system creates “risk-taking social capital,” which ultimately improves a nation's productivity (De Grauwe & Polan, 2005). Thus, a complementarity of markets and government is necessary to achieve and sustain a relatively conflict-free society.

While the present study has important results, it has some limitations that can be eliminated in further research. First, we did not explicitly include cultural dimensions in the research design of our study. Future analysis can focus on how national culture affects the relationships between welfare systems, innovation performance, and competitiveness. This would provide additional insights into the question under investigation. Second, the present study does not provide a simple mechanism by which welfare social systems affect innovation performance and competitiveness of countries. The analysis and the literature review point to a strong link between welfare social systems and innovation performance. Therefore, countries that plan to activate their innovative activities should pay greater attention to welfare policies. Finally, while economic and social indicators provide some understanding for policy makers regarding key patterns in available data, they suffer from substantial shortcomings, including how these indicators are developed, aggregated, and interpreted (Diener et al., 2009). A variety of innovation performance indicators and measures are under continuous development (Bielinska-Dusza & Hamerska, 2021; Janger et al., 2017). Those indicators and measures can also be used in further research to support or challenge the present study's findings.