The ongoing issues that follow climate change require the implementation of relevant strategies and instruments to accelerate countries’ efforts toward environmental sustainability. Thus, the pursuit of environmental sustainability has become a global imperative as countries increasingly adopt measures to enhance their environmental, social, and governance (ESG) performance. Moreover, an effective system of financial support is needed. This paper aims to assess the impact of green finance on the environmental dimension of ESG performance in European Union (EU) countries from 2008 to 2020. The study applies the following methods: (1) a spatial Durbin model to examine the relationship between green finance and environmental performance within the EU context and (2) entropy methods to assess the environmental dimension of ESG performance. The findings reveal that green finance initiatives play a significant role in driving positive environmental outcomes within a country's ESG performance. By channeling financial resources toward environmentally friendly projects and businesses, green finance facilitates the transition to a low-carbon and resource-efficient economy. It enables the implementation of renewable energy projects, energy efficiency improvements, sustainable infrastructure development, and ecosystem preservation efforts. These initiatives contribute to reducing greenhouse gas emissions, mitigating climate change risks, conserving natural resources, and protecting biodiversity.

In the face of ongoing climate change and its accompanying challenges, countries worldwide are increasingly recognizing the urgent need for strategies and mechanisms to propel their way toward environmental sustainability (Ones & Dilchert, 2012; Kharazishvili et al., 2020; Hamid et al., 2021; Opoku et al., 2022; Ahmed et al., 2022; Letunovska et al., 2022; Zeeshan Zafar et al., 2023; Pudryk et al., 2023; Chen et al., 2023; Dzwigol et al., 2023a). Scholars (Chen et al., 2021; Arefieva et al., 2021; Miśkiewicz et al., 2022; Kwilinski et al., 2023e; Kwilinski, 2023; 2024a; 2024b) emphasize that these countries are progressively adopting measures aimed at enhancing their environmental, social, and governance (ESG) performance, acknowledging that environmental stewardship is a critical component of overall sustainability. Nevertheless, to effectively bolster these aspirations, a robust financial system that supports green initiatives is essential. Considering these studies (Formankovaа et al., 2018; Chygryn et al., 2020; Moskalenko et al., 2022a; Kwilinski et al., 2023g), green finance (Chien et al., 2022; Lu et al., 2023; Liu et al., 2022), as a multifaceted and dynamic tool, is designed to channel financial resources toward projects and businesses committed to environmentally sustainable practices (Xue et al., 2022). It serves as a catalyst for transitioning economies toward a low-carbon and resource-efficient future. The initiatives it supports encompass a broad spectrum of renewable energy projects (Dźwigol et al., 2019; Brych et al., 2021; Dzwigol, 2022a; Kwilinski et al., 2022a; 2022c), improvements in energy efficiency (Kwilinski et al., 2022b; Ziabina & Navickas, 2022; Chygryn et al., 2022; Ghaffar & Sardar, 2023), sustainable infrastructure development (Otali et al., 2022; Razzaq et al., 2022; Baloch et al., 2023; Akbas & Iyisan, 2023; Brodny & Tutak, 2023; Baloch, 2023; Sabbar, 2023), and concerted efforts to preserve ecosystems (Dzwigol et al., 2019a; 2020b; 2021; Dzwigol & Dzwigol-Barosz, 2020). These initiatives, collectively, yield manifold benefits, including the reduction of greenhouse gas emissions, the mitigation of climate change risks (Polcyn et al., 2022; Taghizadeh-Hesary et al., 2022; Kwilinski et al., 2023a; 2023b), and the conservation of vital natural resources. D'Orazio (2023) examined the effects of climate finance policies (such as the Paris Agreement (Savaresi, 2016) and the EU's Sustainable Finance Action Plan (Moslein & Sorensen, 2018)) on financial markets, particularly the expansion of the green bond market. Štreimikienė et al. (2023) emphasized the need for improvements in several policy areas, including standardizing disclosure rules, establishing international economic activity classifications, and encouraging the use of climate-aligned financial metrics. Progress in these areas requires both international cooperation and actions at the national level to facilitate a transition to a low-carbon economy. Hafner et al. (2020) outlined the correlation between sustainable development and finance for EU countries, concluding that investments made through green finance are more likely to contribute to long-term economic resilience. By focusing on sustainability, EU countries reduce their vulnerability to the volatility of non-renewable resources and environmental disasters (Carfora et al., 2022; Žarković et al., 2022). This approach enhances overall economic stability and preparedness for future challenges. Several studies (Flannery & May, 2000; Shkarlet et al., 2019; Dacko-Pikiewicz, 2019; Butko et al., 2019; Miśkiewicz, 2019; Trushkina et al., 2020; Dzwigol, 2020a; 2023; Adedoyin et al., 2021; Trzeciak et al., 2022; Zhanibek et al., 2022; Dzwigol et al., 2023b; Letunovska et al., 2023) have shown that knowledge and digitalization play pivotal roles in bridging the gap between green finance and ESG performance at the country level. The integration of digital technologies enables the efficient monitoring, reporting, and assessment of environmental initiatives and ESG performance metrics. Knowledge dissemination (Dzwigol et al., 2019c; Kwilinski et al., 2020a; 2022b; Szostek, 2021; Dzwigol-Barosz & Dzwigol, 2021; Kharazishvili & Kwilinski, 2022; Karnowski & Rzońca, 2023), particularly in the form of sustainable practices and eco-friendly technologies, fuels innovation and fosters a deeper understanding of the interconnectedness between financial decisions and environmental consequences (Flannery & May, 2000; Dzwigol et al., 2019b; Kwilinski et al., 2020b; 2022b; Dzwigol-Barosz & Dzwigol, 2021; Adedoyin et al., 2021; Kharazishvili & Kwilinski, 2022; Karnowski & Rzońca, 2023).

The European Union stands at the forefront of the global sustainability discourse, driven by its advanced green finance markets and stringent environmental policies. Understanding how green finance contributes to these goals can shed light on effective practices and guide future efforts. This study delves into the intersection of finance and sustainability, a key area for achieving long-term environmental goals. By focusing on the EU, a leader in sustainability initiatives, the research provides a benchmark for other regions aiming to enhance their green finance strategies. Additionally, the study's outcomes influence global discussions and policies on environmental sustainability. Research in this area is essential to bridge the knowledge gap regarding the effectiveness of green finance in achieving tangible environmental benefits. The EU's ambitious targets for reducing carbon emissions and promoting sustainable development require robust evidence on the impact of green financial instruments. This research validates the role of green finance in meeting these targets and suggests improvements where needed. This study contributes to the existing literature by offering empirical evidence on the impact of green finance on environmental outcomes within the EU context. It enriches the academic discourse with data-driven insights and expands our understanding of how financial mechanisms can support sustainability. This contribution is particularly significant given the dynamic nature of green finance and the evolving regulatory landscape.

The originality of this research lies in its comprehensive approach to assessing the impact of green finance using empirical econometric models. Unlike previous studies that may have focused on theoretical frameworks or case studies, this research employs robust quantitative methods to provide concrete evidence of green finance's efficacy. Moreover, it considers regional specificities within the EU, offering a nuanced perspective that accounts for diverse economic and environmental conditions. Preliminary findings suggest that green finance significantly enhances environmental sustainability and ESG performance. Green bonds and other financial instruments are effective in mobilizing capital towards sustainable projects, resulting in measurable environmental improvements. The study also highlights the importance of policy support and regulatory frameworks in maximizing the impact of green finance.

The findings of this research have profound policy implications. Policymakers can leverage the insights to refine and enhance green finance initiatives, ensuring they are aligned with sustainability goals. The study underscores the need for supportive regulatory environments and incentives to foster the growth of green finance markets. Additionally, it suggests that regional specificities should be considered in policy formulation, advocating for tailored strategies that address unique economic and environmental contexts within the EU. In conclusion, this research not only underscores the critical role of green finance in advancing sustainability but also provides actionable insights for policymakers. By demonstrating the tangible benefits of green financial mechanisms, it lays the groundwork for more effective and targeted sustainability policies within the EU and beyond. Thus, this paper aims to explore the relationships between green finance, environmental sustainability, and ESG performance, offering a deeper understanding of the transformative potential of financial mechanisms in shaping a more sustainable future for countries within the EU and, by extension, for the global community. Thus, this study fills the theoretical gap in the development of an approach to exploring the pivotal role of green finance in influencing the environmental dimension of ESG performance in European Union (EU) countries by employing a combination of spatial Durbin modeling (to examine the relationship between green finance and environmental performance) and entropy (to assess the environmental dimension of ESG performance) methods.

The paper has the following structure: a literature review exploring the relationship between green finance and the environmental dimension of ESG performance; a materials and methods section outlining the methods, variables, and sources used to test the research hypothesis linking green finance and the environmental dimension of ESG performance; a results section explaining the empirical findings on testing the research hypothesis; a discussion comparing the obtained findings with those of previous investigations; and a conclusion summarizing the research findings, policy implications, limitations, and directions for future investigations.

Literature reviewTheoretical studies on green finance and ESG performanceThe theoretical underpinning of the relationship between green finance and ESG performance is strongly supported by scholars such as Panchenko et al. (2020), Dzwigol (2021; 2022b), Karnowski & Miśkiewicz (2021), and Moskalenko et al. (2022b). These studies collectively emphasize that a nation's ESG performance is fundamentally contingent on a substantial allocation of green finance, which is instrumental in fostering green infrastructure, progressive technologies, and energy-efficient projects. Roy (2023) further reinforced this narrative by asserting the growing prominence of ESG measures as indispensable components of sustainable investment that are crucial for the realization of sustainable development goals. This theoretical stance is complemented by the insights of Macchiavello and Siri (2022), who advocated for a synergistic approach by merging the EU's Digital Finance/Fintech Action Plan with the Sustainable Finance Strategy. Such an integration, they argue, is potent in addressing the dual challenges of sustainability and ESG disclosure, a need starkly highlighted by the economic perturbations induced by the COVID-19 pandemic. This body of theoretical work collectively posits that green finance is not only a financial conduit but also a multifaceted catalyst that propels nations toward comprehensive ESG performance. Khan et al. (2022), focusing on five regions (South Asia, Southeast Asia, China, Middle Eastern countries, and European countries), assessed the impact of green finance on environmental sustainability, paying specific attention to factors such as regional GDP, innovation levels, and air quality. This reveals that the development of green finance exhibits regional variations, emphasizing the significance of these regional factors in influencing green finance. Khan et al. (2022) emphasized the importance of increasing green finance in renewable energy sources, research and development, and public‒private partnerships to reduce CO2 emissions and promote environmental sustainability, ultimately advocating for cross-border trade in renewable energy to mitigate global CO2 emissions.

Scholars (Waddell & Brown, 1997; Hamann & Acutt, 2003; Clark et al., 2018; Muhammad et al., 2023) have emphasized that green finance often involves collaboration among various stakeholders, including governments, financial institutions, businesses, and civil society. These partnerships foster a more holistic and integrated approach to addressing environmental challenges (Waddell & Brown, 1997; Hamann & Acutt, 2003; Clark et al., 2018; Muhammad et al., 2023). Public‒private partnerships, for instance, can mobilize significant resources for large-scale sustainable infrastructure projects (Waddell & Brown, 1997; Hamann & Acutt, 2003; Clark et al., 2018; Muhammad et al., 2023). Using data from 2001 to 2019, Wu (2023) employed advanced modeling techniques to highlight the significant and positive effects of green finance on the economic performance (measured by gross domestic product (GDP)) of selected OECD economies.

Empirical works linking green finance to ESG performanceRoy (2023) proposed an ESG-based credit rating model that employs the fuzzy BWM and fuzzy TOPSIS-Sorting methods to evaluate firms, with financial factors carrying the most weight (43%), followed by environmental factors (24%), social factors (19%), and governance factors (14%). This model, with an 84.31% accuracy rate and 87.5% true positive rate, offers a valuable tool for national financial institutions and regulators to promote sustainable investments. Empirical studies substantiate the theoretical frameworks with concrete data and analysis. Ma et al. (2023) explored the intricate dynamics between green finance, renewable energy investment, green economic recovery, and environmental performance. The authors found that countries, particularly nonemerging countries equipped with advanced technologies or robust sustainability strategies, exhibit markedly enhanced environmental performance. This empirical evidence underscores the pivotal role of green finance in steering nations toward sustainable growth and environmental stewardship. Similarly, using data from 30 Chinese provinces over the period 2004–2019, Deng & Zhang (2023) examined the impact of environmental regulation intensity and green finance development on regional environmental sustainability. They reveal a pattern of spatial clustering in sustainability and posit that more stringent environmental regulations, coupled with robust green finance, exert positive effects at both the national and provincial levels, with the western region of China experiencing the most profound impact. Afshan et al. (2023) introduced a nuanced approach, employing the quantile autoregressive distributed lag (QARDL) model, to dissect the influence of green finance, eco-innovation, and strict environmental policies on China's ecological footprint. The findings depict a complex, quantile-dependent association between these variables, offering rich insights for policy formulation. Qadri et al. (2023) delved into the complex interplay between green finance, trade openness, foreign direct investment, and environmental sustainability in Pakistan, uncovering diverse and nonlinear connections among these factors. Based on time-series data for 1986 to 2018, Tran (2022) confirmed the long-term relationships (cointegration) among green finance, economic growth, renewable energy consumption, energy imports, and CO2 emissions and suggested unidirectional causality from renewable energy consumption and green investment to CO2 emissions. Kemfert & Schmalz (2019) highlighted the role of national and European policy frameworks, including public institution investments and divestment strategies, in promoting green finance, which affects GDP. Scholars (Lee, 2020; Tolliver et al., 2021; Umar & Safi, 2023) have highlighted the critical role of green finance and R&D (which are measured by green innovation) in achieving sustainable development and reducing environmental pollution. Their findings (Lee, 2020; Tolliver et al., 2021; Umar & Safi, 2023) demonstrated a long-term relationship among green finance, R&D, environmental policy stringency, GDP, exports, imports, and carbon emissions, with green finance and innovation significantly reducing carbon emissions. Kwilinski et al. (2023a) confirmed that as urbanization rates rise and trade openness increases, the need for effective environmental policies becomes evident. Green finance could be directed toward eco-friendly urban development and sustainable trade practices, ultimately impacting the environmental dimension of ESG performance. EU countries are increasingly recognizing that sustainable urbanization and trade, underpinned by green finance, are crucial components in their pursuit of environmental goals and holistic ESG performance. Udeagha & Breitenbach (2021) analyzed the impact of trade openness on CO2 emissions in the Southern African Development Community from 1960 to 2014 and found that while trade openness improves environmental quality through technology and economic restructuring, it can also heighten emissions due to industrial and energy factors. It advocates for harmonizing trade policies with environmental and technological initiatives to enhance the region's environmental sustainability. Lagoarde-Segot (2020) and La Torre et al. (2021) discussed how the EU's green bond market, an essential component of green finance, has significantly contributed to funding sustainable projects across member states. This aligns with the EU's Action Plan on Sustainable Finance, which aims to reorient capital flows toward sustainable investment to achieve sustainable and inclusive growth. Bauer (2022) examined the evolution of responsible investing, emphasizing its transformation from a niche to a mainstream investment solution propelled by both market dynamics and a genuine shift toward recognizing environmental and social risks. Bauer (2022) underscored the complexity of balancing financial and nonfinancial objectives within the EU's legal and regulatory frameworks, particularly highlighting the challenges of integrating sustainability into investment strategies while managing inherent trade-offs. Bauer advocated for authenticity in the responsible investment sector, urging a transparent and sincere approach to aligning financial services with sustainability objectives, in line with evolving EU regulations and societal expectations. Schoenmaker (2021) analyzed the integration of environmental sustainability into the European Central Bank's (ECB) financial operations, aligning with the broader EU objectives of enhancing ESG performance. It proposes a ‘medium tilting’ strategy for the ECB's asset and collateral framework to pivot toward low-carbon assets, effectively addressing the inherent market bias toward carbon-intensive firms. This approach not only aims to reduce carbon emissions in the ECB's portfolio by more than 50% but also strategically aligns with the EU's commitment to environmental sustainability by incentivizing carbon-intensive companies to adopt greener technologies. This shift can potentially transform the financial landscape by integrating ESG considerations into monetary policy, reflecting the EU's dedication to fostering a sustainable, low-carbon economy.

Literature gaps and future research directionsDespite the comprehensive insights provided by theoretical and empirical studies, there are still significant gaps in the literature that offer fertile ground for future research. Although extensive, the existing studies often lack a unified framework that cohesively integrates theoretical insights with empirical findings across various regional and economic contexts. Moreover, the rapidly evolving landscape of financial technologies and green finance strategies presents an opportunity for novel research avenues. Future studies could focus on how these advancements can be leveraged to further optimize ESG performance and address the nuanced interactions between green finance and different sectors of the economy. Additionally, longitudinal studies that track the evolution of these relationships over time, especially in response to changing environmental policies, economic conditions, and technological advancements, are needed. Addressing these gaps will not only enhance the academic discourse but also provide actionable insights for policymakers and industry stakeholders, guiding the global economy toward a more sustainable, resilient, and environmentally conscious future.

Based on the abovementioned findings, this study tests the following hypothesis:

H1

Green finance has a statistically significant impact on the environmental dimension of ESG performance in EU countries.

Materials and methodsTheoretical background and model specificationAccording to the literature review, the interplay between green finance and environmental sustainability has emerged as a pivotal area in contemporary economic research. Green finance, characterized by investments in sustainable, environmentally friendly projects and technologies, plays a crucial role in steering economies toward sustainable growth trajectories. This shift is pivotal for addressing global challenges such as climate change and resource depletion. The environmental, social, and governance (ESG) criteria serve as a comprehensive framework for assessing the sustainability and societal impact of an investment in a company or business. The relationship between green finance and the environmental dimension of ESG performance is significant for policymakers and investors alike, as it underscores the potential of green finance as a tool for environmental improvement. To empirically investigate this relationship, a panel data econometric model is employed. With its ability to capture both cross-sectional and time-series variations, panel data offer a robust framework for analyzing the dynamic interaction between green finance and environmental performance. The panel data econometric model was formulated with the following equation:

where ESGeit is the environmental dimension of the ESG performance of country i in year t, denoting the dependent variable; GFIit is the explanatory variable, which represents the level of green finance of country i in year t; Xit is the set of control variables of country i in year t; μi,λt are the regional and temporal effects; and εit is the error term.Estimation methodIn the context of the investigation, which has focused on EU countries, where these countries share a common economic and policy framework, regional interactions and spillover effects are prevalent. EU countries frequently influence one another through trade, environmental policies, and shared regulations. Traditional panel models may not adequately account for these interdependencies. A spatial econometric model facilitates the modeling of these spatial dependencies, which are especially relevant within a region such as the EU. Commonly utilized spatial modeling techniques include the spatial lag model (SLM), spatial error model (SEM), spatial autoregressive model (SAR), and spatial Durbin model (SDM) (Liu & Nie, 2022). Among these models, the SDM stands out for its capacity to integrate elements of both the spatial lag model and the spatial error model. This approach not only considers the spatial lag of the research unit but also introduces the lag term of the error into the independent variables. Specifically, the SDM can function as either a spatial lag model or a spatial error model, making it a preferred choice in contemporary spatial econometric analyses (LeSage, 2014). The foundational structure of the spatial Durbin model is presented as formula (2):

where Yit is the dependent variable; Vit are the explanatory variables; φi and δt are the spatial and temporal effects, respectively; εit is the error term; ρ,θ are the spatial regressive coefficients; and W is the spatial weight matrix.Referring to Eq. (1), the spatial Durbin model was reformulated as Eq. (3) to investigate the influence of green finance on the environmental aspect of ESG performance:

The spatial weight matrix primarily comprises three main categories (LeSage, 2014; Liu & Nie, 2022): the adjacency matrix, the geographic distance matrix, and the economic matrix. The adjacency matrix, the first type of matrix, is constructed by assessing whether each country shares adjacent administrative boundaries in their geographical location. When two areas share such a boundary, the corresponding coefficient in the matrix is set to 1; otherwise, it is set to 0. Additionally, in some instances, areas without directly adjacent units may still be influenced by nonadjacent areas. The second type of spatial weight matrix is the geographic distance matrix, calculated using the reciprocal of the square of the geographical distance between pairs of countries. The third category, the economic weight matrix, accounts for areas that, despite not being geographically adjacent or located far apart, exhibit significant similarities in industrial and economic development.

As in previous studies (LeSage, 2014; Liu & Nie, 2022), the geographic distance matrix (W1) was used to investigate the impact of green finance on the environmental dimension of ESG performance:

where i=1….n, j=1..n, and n=27.Before conducting the regression analysis, the Moran index was utilized to examine the presence of spatial autocorrelation in the environmental dimension of ESG performance. If spatial correlation is detected, it necessitates the establishment of a spatial econometric model; otherwise, nonspatial econometric methods are applied. In the process of model selection among SDMs, SLMs, or SEMs, a series of empirical analyses is undertaken. This process commences with the Hausman test, which aids in the determination of whether fixed effects or random effects should be chosen. The Hausman test plays a pivotal role in discerning the most appropriate approach to account for unobserved heterogeneity in the data, a factor critical for model precision. Following the Hausman test, the next critical step is the likelihood ratio (LR) test. This test is instrumental in evaluating whether the chosen model should incorporate a spatial fixed effect or a time fixed effect. This decision is of the utmost importance for capturing the unique characteristics and temporal dynamics that may influence the variables under examination. Furthermore, both the likelihood ratio (LR) test and the Wald test are used. These tests enable researchers to assess whether the initially chosen SDM can be simplified into either an SLM or SEM, potentially leading to reductions in model complexity while retaining robust explanatory power.

To ensure that the estimated coefficients are not biased due to omitted variable bias, measurement errors, or simultaneity, this study employs a robustness check using an alternative estimation approach—random effects and the system generalized method of moments (Sys-GMM). Both the random effects and Sys-GMM models address unobserved heterogeneity, which refers to the variation across entities (such as individuals, firms, or countries) that is not captured by the observed variables (Dong et al., 2023). Random effects models assume that this heterogeneity is uncorrelated with the explanatory variables, while Sys-GMM makes more flexible assumptions and uses first differences to remove the effects of time-invariant unobserved heterogeneity. This dual approach enhances the credibility and reliability of the findings.

Data and variable descriptionsExplained variableIn line with findings from previous research (Kwilinski et al., 2022a; 2022b; 2023a; 2023b; 2023c; Kwilinski, 2023), the following considerations informed the selection of indicators to represent the environmental dimension of ESG performance: 1. Agricultural land (AL). Sustainable agricultural practices and effective land management play pivotal roles in enhancing agricultural productivity while concurrently minimizing environmental impact; 2. Agriculture, forestry, and fishing (AFF). The adoption of sustainable practices within these sectors yields positive environmental outcomes; 3. CO2 emissions (CO2). Elevated CO2 emissions are detrimental to environmental performance because they contribute to pollution; 4. Energy intensity level of primary energy (EI). Continuous efforts to enhance energy efficiency result in reduced energy consumption, thereby contributing to environmental sustainability. Conversely, higher energy intensity levels lead to decreased environmental performance; 5. Food Production Index (FPI). The implementation of improved agricultural practices, including sustainable farming techniques and reduced food waste, fosters increased food production while mitigating environmental impacts; 6. Level of water stress – freshwater withdrawal as a proportion of available freshwater resources (WS). Elevated water stress levels have adverse implications for environmental performance and can manifest as ecosystem degradation, water scarcity, drought, saltwater intrusion, and land subsidence; 7. Methane emissions (ME). The enactment of measures to mitigate methane emissions from various sources, including agriculture and waste management, plays a crucial role in advancing environmental sustainability; 8. Nitrous oxide emissions (NOE). Efforts to reduce nitrous oxide emissions, particularly in the realm of agricultural activities, make meaningful contributions to environmental sustainability; 9. Forest area (FA). The expansion of forested areas and the promotion of sustainable forest management practices have positive influences on environmental performance; 10. Renewable energy consumption (RE) The promotion of renewable energy sources reduces dependency on fossil fuels, thereby bolstering environmental sustainability.

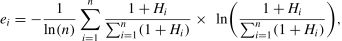

In this study, the entropy method was used to construct the environmental dimension of the ESG performance index. This method allows for a sophisticated evaluation of environmental performance, drawing upon principles from information theory. The construction of the environmental dimension of the ESG performance index involves several steps:

1. To facilitate meaningful comparisons and ensure that all the indicators are on the same scale, all the data were normalized:

Positive contributors:

Negative contributors:

where Emax,min,Eiare the maximum, minimum and current values of the i-th components of the environmental dimension of the ESG performance index and Hi is the normalized value.2. The next step involves computing the entropy and the weighting factor for each component of the index:

Determination of the entropy (ei) for the i-th component of the environmental dimension of the ESG performance index:

Computation of the weight (ωi) assigned to the i-th component within the environmental dimension of the ESG performance index:

Entropy quantifies the dispersion, variability, or unpredictability within environmental performance data. Entities with higher entropy scores are those with more diverse or uncertain ranges of environmental performance metrics.

3. Based on the calculated entropy values, the environmental dimension of the ESG performance index was calculated as follows:

Those with lower entropy scores are positioned at the top, signifying more consistent or predictable environmental performance, while those with higher entropy scores are further down the index, reflecting greater variability in their environmental metrics.

A statistical summary of the samples used for calculating the environmental dimension of the ESG performance index is provided in Table 1. The data for assessing the ESG performance index were obtained from the World Bank (2023).

Statistical description of the samples for the ESG performance index.

| Symbols | Mean | SD | Min | Max |

|---|---|---|---|---|

| AL | 41.452 | 15.932 | 7.366 | 67.250 |

| AFF | 2.208 | 1.182 | 0.212 | 6.302 |

| CO2 | 7.002 | 3.164 | 2.461 | 22.552 |

| EI | 3.604 | 1.079 | 1.011 | 6.770 |

| FPI | 97.583 | 8.114 | 70.430 | 118.630 |

| WS | 21.199 | 19.578 | 1.220 | 91.287 |

| ME | 0.988 | 0.502 | 0.436 | 3.495 |

| NOE | 0.611 | 0.375 | 0.099 | 2.070 |

| FA | 34.613 | 16.919 | 1.094 | 73.736 |

| RE | 19.696 | 11.766 | 0.220 | 54.161 |

Source: Developed by the authors.

In this study, “green finance” is quantified as the total expenditure from the annual budgets of the EU Member States, along with contributions from the European Commission and the European Investment Bank (Victor et al., 2022; Amighini et al., 2022). This quantification is specifically aligned with the collective goal of contributing to the international commitment of 100 billion USD for climate finance, a key target under the United Nations Framework Convention on Climate Change (UNFCCC). By measuring green finance in terms of contributions towards this specific commitment, the study aligns with an internationally recognized benchmark, ensuring that the financial measures used are not only relevant but also reflective of broader global priorities in climate finance (Sarkar, 2017; Roelfsema et al., 2018). Furthermore, the funds earmarked for the UNFCCC commitment are designated for climate-related projects and initiatives, which are likely to have a direct and measurable impact on environmental sustainability. This makes it a suitable metric for assessing the relationship between green finance and ESG performance.

The calculation of the environmental dimension of the ESG performance index is meticulously differentiated from the evaluation of the influence of green finance. While both areas intersect at the confluence of environmental and economic considerations, they serve distinct analytical purposes. The environmental facet of the ESG index is crafted as an all-inclusive measure, capturing the multifaceted progression of a country toward environmental sustainability. The index thus reflects the cumulative impact of a country's environmental policies and corporate practices. Conversely, the focus on green finance, specifically as an explanatory variable, provides a more focused investigation. This study seeks to quantify and elucidate the impact of environmentally oriented financial initiatives on ESG performance. In addition, it represents the financial commitment to sustainable development, extending beyond mere compliance with regulations to proactive investment in long-term environmental health. The delineation between ESG index computation and green finance analysis is deliberate. This approach is particularly relevant in the nuanced context of ESG, where financial flows toward sustainable projects are scrutinized for their real-world impact on environmental outcomes. In this sense, green finance is not only a metric of investment magnitude but also a potential catalyst for improved environmental practices and innovations. The analysis, therefore, not only measures current performance but also probes the capacity of green finance to shape future trajectories of sustainability within the ESG framework.

Сontrol variablesAccording to previous studies (LeSage, 2014; Liu & Nie, 2022; Kwilinski et al., 2023a; 2023b; 2023c), the selected control variables in this paper are as follows:

- 1.

Economic context: GDP represents the overall economic activity and wealth of a country. A high GDP often implies increased industrialization and consumption, which can result in greater environmental impacts.

- 2.

Technology and innovation: Research and Development (R&D) captures a country's investment in technology and innovation. Such investments can lead to the development and adoption of more sustainable practices and cleaner technologies.

- 3.

Urbanization rate: Urban areas often exhibit distinct environmental characteristics. Urbanization can impact land use, infrastructure development, and resource consumption patterns. Countries with higher urbanization rates may experience different environmental challenges and solutions than predominantly rural nations.

- 4.

Trade openness: International trade can lead to the import and export of goods with varying environmental footprints. This may affect a country's production, consumption, and environmental policies. Including trade openness allows us to control for the global economic factors that may shape a country's environmental sustainability.

This research utilizes a panel dataset that encompasses 27 European Union (EU) countries covering the period from 2008 to 2020. The selection of data was contingent upon its availability. To eliminate the impact of heteroscedasticity volatility, this study employs the logarithmic transformation for all variables. The results of the descriptive statistics for the selected variables are shown in Table 2.

Variables, sources and descriptive statistics.

| Variable | Symbols | Source | Mean | SD | Min | Max | VIF |

|---|---|---|---|---|---|---|---|

| Green Finance | GFI | UNCTAD (2022) | 9145.863 | 15,734.58 | 3.000 | 84,826.00 | 4.34 |

| Gross Domestic Product | GDP | World Bank (2023) | 33,623.99 | 22,764.51 | 6862.758 | 123,678.70 | 1.76 |

| Technology and Innovation | R&D | World Bank (2023) | 3426.838 | 9123.234 | 2.000 | 49,240.00 | 3.45 |

| Urbanization Rate | UR | World Bank (2023) | 72.668 | 12.791 | 52.209 | 98.079 | 1.54 |

| Trade Openness | TO | World Bank (2023) | 127.369 | 66.632 | 45.419 | 380.104 | 1.61 |

Source: Developed by the authors.

Considering the results (Table 2), green finance (GFI) demonstrated substantial variability, with a mean value of 9145.863 and a relatively high standard deviation of 15,734.580, spanning from a minimum of 3.000 to a maximum of 84,826.000. Gross domestic product reveals significant diversity, featuring an average GDP of 33,623.990 and a notable standard deviation of 22,764.510, with values ranging from a minimum of 6862.758 to a maximum of 123,678.700. Technology and innovation (R&D) exhibit substantial variations, with an average R&D expenditure of 3426.838 and a considerable standard deviation of 9123.234, spanning from a minimum of 2.000 to a maximum of 49,240.000. The urbanization rate (UR) differs across the cases examined, with an average UR of 72.668 and a standard deviation of 12.791, ranging from a minimum of 52.209 to a maximum of 98.079. Trade openness (TO) varies among the entities, with an average TO of 127.369 and a standard deviation of 66.632, ranging from a minimum of 45.419 to a maximum of 380.104. These statistical insights provide a foundational understanding of the central tendencies and disparities within the dataset, offering crucial information about the characteristics of the variables employed in the analysis.

The results of multicollinearity tests ensure that the GFI is not only a proxy for ESG performance but also an independent variable influencing it. The variance inflation factor (VIF) results, as displayed in Table 2, reveal that all the scores are below the commonly used threshold of 5. This indicates that the level of multicollinearity within the model is not severe. The VIF for GF, representing green finance and analogous to the GFI, is the highest at 4.34 but does not cross the threshold that would suggest high multicollinearity. Consequently, this finding supports the interpretation of the GFI as an independent variable that influences the environmental dimension of ESG performance rather than simply serving as a proxy for it.

ResultsA graphical visualization of the ESG performance indices is shown in Fig. 1. The results of the analysis show that the ESG performance index increases among the selected countries, with the exception of Bulgaria, Hungary, Portugal, and Romania.

The Moran's I test results (Table 3) indicate strong positive spatial autocorrelation for the variable ESG (environmental, social, and governance) in the dataset from 2008 to 2020. The Moran's I values consistently range between 0.531 and 0.577, and the associated Z(I) statistics are consistently greater than 5, with p-values of 0.000 each year.

Outputs of Moran's I test.

| Year | Moran's I ofESGe | Z(I) | p-value |

|---|---|---|---|

| 2008 | 0.537 | 5.111 | 0.000 |

| 2009 | 0.544 | 5.156 | 0.000 |

| 2010 | 0.531 | 5.046 | 0.000 |

| 2011 | 0.547 | 5.185 | 0.000 |

| 2012 | 0.562 | 5.326 | 0.000 |

| 2013 | 0.572 | 5.427 | 0.000 |

| 2014 | 0.577 | 5.472 | 0.000 |

| 2015 | 0.568 | 5.385 | 0.000 |

| 2016 | 0.576 | 5.453 | 0.000 |

| 2017 | 0.572 | 5.421 | 0.000 |

| 2018 | 0.573 | 5.433 | 0.000 |

| 2019 | 0.572 | 5.426 | 0.000 |

| 2020 | 0.565 | 5.377 | 0.000 |

Source: Developed by the authors.

Spatial autocorrelation implies that neighboring regions tend to have similar ESG scores. In other words, areas with high ESG performance are often surrounded by areas with high ESG performance, and the same applies to areas with low ESG performance. The findings confirm that efforts to improve ESG performance may have spillover effects on neighboring regions. If a specific policy or investment initiative boosts ESG performance in one region, it may influence nearby regions to follow suit, creating a regional cluster of high ESG performance. Conversely, low-performing regions may need targeted interventions to break the cycle of poor ESG performance.

The results of the unit root test (Table 4) reveal that the variables are stationary. Both the Levin–Lin–Chu and Im–Pesaran–Shin tests yield p-values below the commonly chosen significance level of 0.05, indicating that these variables exhibit stable statistical properties. The Phillips–Perron test suggests that all variables exhibit significance upon the second difference.

Results of Unit Root Tests.

| Variable | Levin–Lin–Chu | Im–Pesaran–Shin | Phillips–Perron | |||

|---|---|---|---|---|---|---|

| statistic | p-value | statistic | p-value | statistic | p-value | |

| GFI | -6.722 | 0.000 | -8.122 | 0.000 | 33.861 | 0.000 |

| GDP | -2.420 | 0.008 | -1.978 | 0.024 | 4.505 | 0.000 |

| R&D | -2.901 | 0.002 | -0.502 | 0.308 | 1.517 | 0.065 |

| UR | 1.854 | 0.968 | 6.642 | 1.000 | 46.032 | 0.000 |

| TO | -1.865 | 0.031 | -1.261 | 0.104 | 1.639 | 0.051 |

| ΔGFI | -10.934 | 0.000 | -9.253 | 0.000 | 59.396 | 0.000 |

| ΔGDP | -11.788 | 0.000 | -7.997 | 0.000 | 23.343 | 0.000 |

| ΔR&D | -6.752 | 0.000 | -7.736 | 0.000 | 37.302 | 0.000 |

| ΔUR | -2.530 | 0.006 | -4.361 | 0.000 | 12.821 | 0.000 |

| ΔTO | -15.343 | 0.000 | -8.360 | 0.000 | 34.041 | 0.000 |

Source: Developed by the authors.

The results for the first-differenced variables consistently indicate stationarity across all three tests. This implies that the first differences of these variables are stationary, reflecting their stable patterns over time.

The LM tests provide definitive evidence of the rejection of the null hypothesis at the 1% significance level, indicating the imperative need to consider both spatial error and spatial lag effects (Table 5). Furthermore, both the Wald and LR (likelihood ratio) tests consistently repudiate the notion that the SDM degrades into SAR or SEM at the 1% significance level. This finding robustly reinforces the assertion that the utilized SDM represents a more appropriate and defensible model. Simultaneously, the results of the Hausman test endorse the fixed effects model and emphatically reject the null hypothesis linked to random effects.

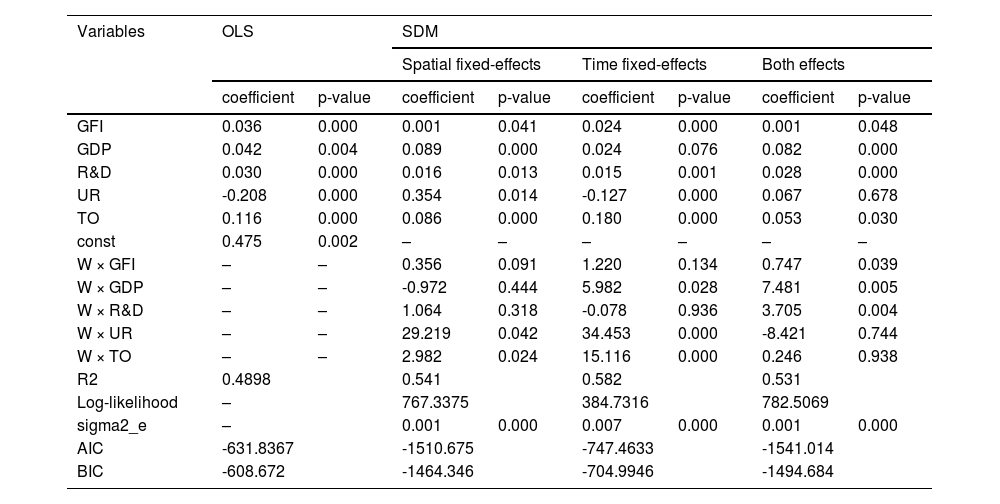

The results of the OLS model (Table 6) show that the GFI has a coefficient of 0.036, indicating that a one-unit change in green finance is associated with a 0.036-unit change in the ESG performance index. These coefficients are statistically significant, with low p-values (typically less than 0.05), suggesting their importance in explaining ESG performance.

The empirical results of OLS and SDM.

| Variables | OLS | SDM | ||||||

|---|---|---|---|---|---|---|---|---|

| Spatial fixed-effects | Time fixed-effects | Both effects | ||||||

| coefficient | p-value | coefficient | p-value | coefficient | p-value | coefficient | p-value | |

| GFI | 0.036 | 0.000 | 0.001 | 0.041 | 0.024 | 0.000 | 0.001 | 0.048 |

| GDP | 0.042 | 0.004 | 0.089 | 0.000 | 0.024 | 0.076 | 0.082 | 0.000 |

| R&D | 0.030 | 0.000 | 0.016 | 0.013 | 0.015 | 0.001 | 0.028 | 0.000 |

| UR | -0.208 | 0.000 | 0.354 | 0.014 | -0.127 | 0.000 | 0.067 | 0.678 |

| TO | 0.116 | 0.000 | 0.086 | 0.000 | 0.180 | 0.000 | 0.053 | 0.030 |

| const | 0.475 | 0.002 | – | – | – | – | – | – |

| W × GFI | – | – | 0.356 | 0.091 | 1.220 | 0.134 | 0.747 | 0.039 |

| W × GDP | – | – | -0.972 | 0.444 | 5.982 | 0.028 | 7.481 | 0.005 |

| W × R&D | – | – | 1.064 | 0.318 | -0.078 | 0.936 | 3.705 | 0.004 |

| W × UR | – | – | 29.219 | 0.042 | 34.453 | 0.000 | -8.421 | 0.744 |

| W × TO | – | – | 2.982 | 0.024 | 15.116 | 0.000 | 0.246 | 0.938 |

| R2 | 0.4898 | 0.541 | 0.582 | 0.531 | ||||

| Log-likelihood | – | 767.3375 | 384.7316 | 782.5069 | ||||

| sigma2_e | – | 0.001 | 0.000 | 0.007 | 0.000 | 0.001 | 0.000 | |

| AIC | -631.8367 | -1510.675 | -747.4633 | -1541.014 | ||||

| BIC | -608.672 | -1464.346 | -704.9946 | -1494.684 | ||||

Source: Developed by the authors.

In the context of the European Union, the analysis of ESG performance reveals intricate relationships between various economic indicators and sustainability metrics. Gross domestic product (GDP) and research and development (R&D) have statistically significant positive associations with ESG performance, boasting coefficients of 0.042 and 0.030, respectively, reflecting the EU's emphasis on innovation and sustainable economic growth as core components of its holistic approach to ESG standards. As GDP grows, governments and businesses have more resources to invest in environmentally friendly technologies and practices. They can allocate funds to develop renewable energy sources, improve energy efficiency, and reduce pollution. Moreover, with higher GDP, governments can afford to implement and enforce stricter environmental regulations. These regulations can set limits on emissions, require companies to disclose their environmental impact, and mandate sustainable practices. Stringent regulations contribute to better governance and ensure that businesses operate in a more socially responsible manner. Additionally, economic growth creates job opportunities. If these jobs are in sectors that prioritize sustainability and social responsibility, they can have a positive impact on ESG components by improving social well-being and reducing unemployment. R&D investments lead to technological advancements, which can include environmentally friendly and socially responsible innovations. Research and development often focuses on finding more sustainable ways of doing things. This can involve optimizing processes to reduce waste, energy consumption, and resource use. Furthermore, increased R&D fosters a culture of knowledge sharing and collaboration. This can lead to the dissemination of best practices related to ESG across industries, helping businesses adopt more responsible approaches to environmental, social, and governance issues. Conversely, the urbanization rate (UR) indicates a robust negative relationship, with a coefficient of -0.208, suggesting that higher urbanization rates in the EU might present challenges to maintaining high ESG performance, necessitating targeted urban sustainability initiatives. Urbanization often leads to increased industrialization, construction, and transportation in cities, resulting in higher pollution levels, increased energy consumption, and greater pressure on natural resources. To address these challenges, governments should implement urban sustainability policies, which include transparent city planning and measures to combat corruption. Encouraging community participation in urban planning and decision-making can promote more sustainable and socially responsible urban development.

Incorporating spatial dynamics within the EU, the spatial Durbin model (SDM) with spatial fixed effects underscores that GFI has a statistically significant positive relationship with ESG performance, echoing the EU's strategic investment in green finance to bolster sustainability. GDP continues to exert a potent positive influence on ESG performance, aligning with the EU's economic policies that integrate sustainability into the growth narrative. The positive impact of R&D and the significant positive relationship between urbanization rate and the EU's commitment to innovation and sustainable urban development are pivotal for enhancing ESG performance. Furthermore, trade openness (TO) significantly bolsters ESG performance, highlighting the EU's focus on sustainable trade policies, which should include measures to promote responsible trade, enhance environmental standards, improve social well-being, and strengthen governance mechanisms. When countries engage in international trade, they often seek to meet international environmental standards, reduce carbon emissions, and promote sustainable resource management. In addition, international trade can lead to the transfer of knowledge, technology, and expertise. This can benefit a country's social aspects by improving education, healthcare, and access to innovative solutions.

The comprehensive SDM, factoring both spatial and temporal fixed effects, offers an in-depth understanding of how these variables influence the ESG performance index across EU member states over time. The models’ R-squared values, ranging from 0.531 to 0.582, reflect a substantial explanation of the variance in the ESG performance index, resonating with the EU's multifaceted approach to ESG. The log-likelihood, sigma2_e, AIC, and BIC metrics affirm the models’ robustness, resonating with the EU's commitment to precision and reliability in policy modeling and decision-making, ensuring that sustainability initiatives are grounded in robust analytical frameworks.

Table 7 demonstrates the empirical results from two robustness tests using different econometric models: the random effects model and the system generalized method of moments (Sys-GMM).

The empirical results of robustness tests.

| Random effects | Sys-GMM | |||

|---|---|---|---|---|

| coefficient | p-value | coefficient | p-value | |

| ESGt−1 | – | – | 0.718 | 0.000 |

| GFI | 0.008 | 0.011 | 0.006 | 0.043 |

| Control variables | Yes | |||

| Constant | -1.722 | 0.000 | -1.108 | 0.001 |

| R2 | 0.212 | – | – | |

| AR (1) | – | – | -9.86 | 0.000 |

| AR (2) | – | – | -0.44 | 0.663 |

| Sargan test | – | – | 5.16 | 0.271 |

Source: Developed by the authors.

Both models indicate a statistically significant positive relationship between green finance (GFI) and the environmental dimension of ESG performance. The random effects model reveals a positive and statistically significant relationship, with a coefficient of 0.008 (p-value of 0.011) for the GFI, indicating that increases in green finance are associated with improvements in environmental ESG performance. The Sys-GMM model, which accounts for potential endogeneity and the dynamic nature of the data, corroborates these findings with a slightly lower GFI coefficient of 0.006 (p-value 0.043) and further demonstrates the significant influence of past ESG performance (coefficient 0.718, p-value 0.000) on current performance. The validity of the Sys-GMM model is supported by the nonsignificant Sargan test (p-value of 0.271) and the absence of second-order serial correlation (AR(2) p-value of 0.663), while the significant AR(1) indicates the expected first-order serial correlation in the differenced models. These results imply that higher levels of green finance are associated with better environmental outcomes in the context of ESG.

DiscussionThe empirical findings from both the OLS and SDM allow us to explain the relationships between key variables and the ESG performance index. These results have significant implications for understanding and improving environmental, social, and governance performance.

According to the OLS model, the positive coefficient of 0.036 for the GFI is particularly noteworthy. The statistical significance and low p-value of this coefficient underscore the relevance of green finance to explaining variations in ESG performance. This finding suggests that a focus on increasing green finance can lead to notable improvements in ESG performance within the studied context. Moreover, gross domestic product and research and development also exhibit statistically significant and positive associations with ESG performance. When accounting for spatial effects in the SDM with spatial fixed effects, the significance of green finance persists. Its positive relationship with the ESG performance index indicates that the influence of green finance goes beyond regional disparities, emphasizing its universal importance in driving ESG improvements. It should be noted that similar conclusions were reached in other studies (Waddell & Brown, 1997; Hamann & Acutt, 2003; Deng & Zhang, 2023). Moreover, as in previous studies (Chen et al., 2021; Miśkiewicz et al., 2022; Kwilinski, 2023), the findings of this study confirm the strong positive impact of GDP and R&D on ESG performance. The continuation of these relationships underscores the enduring significance of economic growth and innovation in shaping positive ESG outcomes, irrespective of spatial dependencies. The positive association between the urbanization rate and ESG performance in the SDM with spatial fixed effects suggests that urbanization contributes positively to ESG objectives when spatial effects are considered, which is consistent with prior investigations (Chen et al., 2021; Kwilinski, 2023; Kwilinski et al., 2023a). Trade openness continues to exert a significant positive influence on ESG performance in the spatial context, reinforcing the idea that international trade openness enhances ESG outcomes. Trade openness continues to exert a significant positive influence on ESG performance in the spatial context, reinforcing the idea that international trade openness enhances ESG outcomes. The EU's focus on sustainable trade policies includes measures to promote responsible trade, enhance environmental standards, and improve social well-being. Encouraging partnerships with other countries and regions may lead to shared knowledge and resources. Governments seeking collaborative initiatives on environmental protection, social development, and governance standards tend to achieve better ESG outcomes (OECD 2020; Udeagha & Breitenbach, 2021; Vargas-Santander et al., 2023).

In this study, the findings from the analysis conducted using a spatial Durbin model (SDM) with both spatial and temporal fixed effects provide a comprehensive understanding of the impacts of various variables on the ESG performance index. This approach takes into account both spatial and temporal dimensions, shedding light on the complex dynamics at play. The empirical findings from this study offer valuable insights into the factors influencing ESG performance, both in terms of the traditional ordinary least squares (OLS) model and spatial considerations within the SDM framework. These findings emphasize the importance of green finance, economic growth, innovation, and international trade in driving positive ESG outcomes. Specifically, the study highlights the significance of green finance as a critical driver of positive ESG outcomes. This finding suggests that policymakers should consider promoting and incentivizing green financing mechanisms to bolster sustainability efforts. Furthermore, economic growth emerges as another influential factor in enhancing ESG performance, suggesting that policies aimed at fostering sustainable economic growth can have positive effects on environmental, social, and governance aspects. Innovation is also identified as a key contributor to ESG performance, implying that policies promoting innovation through research and development incentives, technology transfer programs, and fostering a culture of innovation in the business sector can be beneficial. Additionally, international trade is highlighted as a factor linked to positive ESG outcomes, indicating the importance of trade policies that consider sustainability and fair labor practices in international supply chains. The robustness of the models used in this study indicates that these relationships between green finance, economic growth, innovation, and international trade and ESG performance persist over time and across different regions.

These results reinforce previous studies, solidifying the theoretical basis for these relationships. The SDM, accounting for spatial effects, demonstrates that the significance of green finance persists across different regions, indicating its universal importance. Urbanization and trade openness also positively impact ESG performance, integrating spatial dependencies and international dynamics into the theoretical framework.

Practically, these findings offer actionable insights for policymakers and businesses. Promoting and incentivizing green financing mechanisms can enhance sustainability efforts across the EU. Policies fostering sustainable economic growth, such as supportive environments for expansion, align with ESG goals. Incentives for innovation, such as tax credits for R&D, can further improve ESG outcomes. Trade policies incorporating sustainability criteria and promoting fair labor practices are crucial, with international partnerships enhancing ESG performance. The robustness of these models suggests consistent relationships between green finance, economic growth, innovation, and international trade with ESG performance over time and regions. Policymakers can design effective strategies to boost ESG outcomes by aligning economic policies with these drivers. The study's contributions underscore the roles of green finance, economic growth, innovation, and trade in driving ESG performance. These insights provide comprehensive guidance for policy formulation and business strategies aimed at enhancing environmental, social, and governance outcomes, contributing to a more sustainable and socially responsible future.

ConclusionsThis study highlights the significant impacts of green finance, economic growth, innovation, urbanization, and international trade on enhancing environmental, social, and governance (ESG) performance. Validated through both ordinary least squares (OLS) and spatial Durbin models (SDMs), the findings support previous research (Waddell & Brown, 1997; Hamann & Acutt, 2003; Khan et al., 2022; Deng & Zhang, 2023; Afshan et al., 2023; Qadri et al., 2023) and offer comprehensive insights essential for guiding policymakers and businesses in improving ESG performance. In line with these results, the findings of Li et al. (2023) underscore the importance of specific ESG factors in green finance investment decisions in China utilizing the fuzzy AHP and DEMATEL methods. Research by Ma et al. (2023) complements this by linking green finance, environmental sustainability, and green economic growth in G-20 economies, resonating with the multifaceted role of green finance identified in this study. Similarly, studies by Ng et al. (2020) and Udeagha & Ngepah (2023) highlighted the influence of financial development on ESG performance in Asian and BRICS economies, aligning with the global relevance of the findings. Moreover, research by Bakry et al. (2023) critically examined the long-term relationship between green finance, renewable energy, and environmental performance, enriching the understanding of the effectiveness of green finance and complementing the broader implications of this study. This study, along with previous investigations, provides a comprehensive justification of the pivotal role of green finance and related factors in promoting ESG performance across various global contexts. The results emphasize the need for cohesive financial and policy strategies to foster sustainable and wide-ranging improvements in ESG performance.

The policy implicationsThe empirical findings offer several policy implications for enhancing the environmental, social, and governance (ESG) performance index in European Union (EU) countries:

- 1.

EU member states should establish a unified approach to promoting green finance and sustainable investments, leveraging the collective strength of the European Union. By implementing standardized green finance policies, the EU ensures a consistent and well-regulated framework for environmentally conscious investments (Waddell & Brown, 1997; Hamann & Acutt, 2003; Clark et al., 2018; Muhammad et al., 2023). These policies encompass a range of measures, including tax incentives (Lagodiienko & Yakushko, 2021), low-interest green loans, and grants aimed at encouraging private and public sector investments in eco-friendly projects (Baltgailis & Simakhova, 2022). Furthermore, the EU should prioritize fostering financial incentives specifically tailored to support environmentally sustainable initiatives. These incentives can be directed toward renewable energy projects, energy-efficient technologies, sustainable agriculture, and conservation efforts. They should serve as powerful tools to stimulate investment in sectors that directly contribute to environmental protection and social well-being. Collaboration among EU member states is essential for harmonizing green finance practices, which, in turn, can lead to increased ESG performance on a regional scale. Through a collective effort, the EU can showcase its commitment to sustainable development and responsible financial practices, ultimately setting a global example for aligning financial systems with environmental and social goals (Formankova et al., 2018; Dzwigol et al., 2020b; Dzwigol & Dzwigol-Barosz, 2020; Moskalenko et al., 2022c; Khalatur & Dubovych, 2022).

- 2.

The EU's commitment to research and innovation, exemplified by initiatives such as Horizon Europe, should remain dedicated to the development of green technology and sustainability-focused projects. By allocating significant resources to research and development in these areas, the EU fosters innovation that not only bolsters environmental and social progress but also propels economic growth. By supporting cutting-edge research in fields such as renewable energy, clean technologies, and sustainable agriculture, the EU can be at the forefront of global efforts to combat climate change, promote eco-friendly practices and share knowledge (Melnychenko, 2019; Kwilinski, 2019; Dementyev et al., 2021). Moreover, the EU should encourage cross-sector collaboration among businesses, research institutions, and governments to accelerate the adoption of sustainable innovations. These partnerships facilitate the transfer of green technologies to practical applications, promoting broader-scale improvements in ESG performance. Ensuring that research and innovation projects align with ESG objectives is crucial for driving meaningful change and securing a more sustainable future for the European Union and the world.

- 3.

EU countries should prioritize sustainable urban planning and development as a fundamental part of their strategy for achieving ESG performance goals. This entails a holistic approach to city and infrastructure design that integrates environmental, social, and governance considerations (Kwilinski et al., 2023f). One key aspect is the development of energy-efficient infrastructure, which can significantly reduce the carbon footprint of urban areas. Promoting green transportation options is equally vital in the context of sustainable urbanization. EU member states should invest in public transportation, cycling lanes, and pedestrian-friendly infrastructure to reduce reliance on fossil fuel-powered vehicles. Encouraging electric vehicles and implementing clean energy sources for public transportation systems can further contribute to lowering emissions and improving air quality. In addition to mitigating environmental impacts, sustainable urbanization strategies enhance the quality of life for citizens by providing green spaces, reducing traffic congestion, and improving overall urban aesthetics. These measures align with the EU's broader goals of creating livable, healthy, and environmentally responsible cities.

- 4.

Collaborative efforts among EU member states to share best practices and ESG performance data are essential for mutual learning and progress in sustainability. The European Union, as a unifying body, plays a pivotal role in facilitating this knowledge exchange (Dzwigol, 2019a; 2019b; 2020; 2022; Dźwigoł & Wolniak, 2018; Kwilinski et al., 2020; Hakhverdyan & Shahinyan, 2022) and fostering cross-country initiatives. The EU can establish a platform for member states to regularly share their experiences, successful strategies, and lessons learned in the journey toward better ESG performance (Kwilinski et al., 2023c; Kwilinski, 2023). This collaborative approach enables countries to adapt and implement policies that have been proven effective elsewhere, saving time and resources. Furthermore, cross-country initiatives can be encouraged and coordinated at the EU level to address collective ESG goals. This could involve joint research and development projects, coordinated investments in sustainable infrastructure, or harmonized policies for sustainable finance. The strength of unity and collective action can significantly enhance the impact and effectiveness of these initiatives. By fostering cooperation and knowledge sharing among EU member states, the European Union could develop a supportive ecosystem where ESG performance improvements become a shared endeavor. This collaborative approach ensures that no country is left behind in pursuit of environmental, social, or governance goals, leading to a more sustainable and prosperous European future.

Despite these valuable findings, this study has several limitations that should be considered in future investigations. Thus, it is necessary to extend the timeframe for investigation. In addition, extending the number of countries from different parts of the world (Asia, the USA, Canada, etc.) allows us to increase the empirical justification of policy implications for improving ESG performance. Furthermore, considering previous studies (Trushkina, 2019; Hussain et al., 2021; Kwilinski et al., 2022; Szczepańska-Woszczyna & Gatnar, 2022; Szczepańska-Woszczyna et al., 2022; Dźwigoł & Trzeciak, 2023; Kwilinski et al., 2023d; 2023e; Us et al., 2022), the efficacy of governance and globalization could significantly affect ESG performance. In this case, future investigations should incorporate indicators that consider the efficacy of governance and globalization features.

FundingThis research was funded by the Ministry of Education and Science of Ukraine, 0121U100468.

Data availabilityThe data sets are available at the open data bases UNCTAD (2022), World Bank (2023).

CRediT authorship contribution statementAleksy Kwilinski: Conceptualization, Data curation, Formal analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing. Oleksii Lyulyov: Conceptualization, Data curation, Formal analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing. Tetyana Pimonenko: Conceptualization, Data curation, Formal analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing.