In many cases, a deficient strategic planning in new companies has led entrepreneurs to take inadequate initial decisions that, in the long term, reflect consequences in the failure of many new businesses. The objective of this article is to propose an executive flight simulator, which will help to identify and evaluate the different development strategies for resources of a new manufacturing company, under the four perspectives of the balanced scorecard, educating the user on the impact that these would have in the main performance indicators. The simulator is designed utilizing the focus of system dynamics to be used didactically in master's degree programs in administration, by entrepreneurs or in executive development programs.

Una deficiente planeación estratégica en las empresas de nueva creación ha generado muchas veces que las decisiones iniciales de los emprendedores no hayan sido las adecuadas y que, a la larga, las consecuencias se vean reflejadas en el fracaso de muchos nuevos negocios. El presente artículo tiene como objetivo proponer un simulador de vuelo ejecutivo que permita identificar y evaluar distintas estrategias de desarrollo de recursos de una nueva empresa manufacturera bajo las 4 perspectivas del marcador balanceado, sensibilizando al usuario en el impacto que estas tendrían en los principales indicadores de desempeño. El simulador está diseñado utilizando el enfoque de dinámica de sistemas, para ser utilizado didácticamente en programas de maestría en administración, emprendedores o de desarrollo ejecutivo.

One of the main problems faced by today's entrepreneurs is the design and implementation of successful strategies (Domenge & Belausteguigoitia, 2009) that allow them to create a relatively sustainable competitive advantage, identifying the way to invest or assign their scarce financial resources in the most appropriate manner. These strategies, due to their holistic nature, should consider the main strategic resources that the company could require in all its functional areas (human, technological, operative, and marketing), as well as the manner and speed to get them, developing and accumulating them in a complementary (Sterman, 2007) and balanced manner (Warren, 2005).

Another problem for entrepreneurs is the evaluation of the expected impacts derived from their possible strategies, visualized in an understandable and synoptic manner, reflecting the values of different performance indicators considered to evaluate or compare said strategies with regard to the expected objectives, such as the Net Present Value (NPV) of each one of them.

The identification of the relations that exist between the strategic resources available to the entrepreneur, their balanced development strategy, and the performance indicators that provide their possible impacts, comprise the bases of an Executive Flight Simulator (EFS) that could be of use for the entrepreneur when evaluating and educating itself regarding the design and determination of the most convenient strategy for their new enterprise.

In recent years, the trend to make business plans a part of the initial planning of a new business has increased, due to – among other reasons – the fact that it is a requirement to request a line of credit or to invite funding or strategic partners. This action results in a static document comprised by the addition of data, which does not allow entrepreneurs to understand the structure of the dynamic system within which the company will operate (Bianchi, Winch, & Grey, 1998).

Business planning in a learning context enables entrepreneurs to anticipate future growth scenarios and, therefore, to understand the proper timing to begin constructing relevant strategic resources that will allow the company to move toward subsequent desired scenarios. When complemented with an EFS, the traditional business plan may be considered a learning tool that allows entrepreneurs – among other things – to detect the growth limits of the business related to the lack of resources (Bianchi et al., 1998; Bianchi, 2002). The learning approach in the development of the business plans enables for the reconsideration of the mental models (Senge, 1994) of the entrepreneur, through the generation of new visions regarding the behavior of the business in the future, as consequence of current (Bianchi, 2002) and better informed decisions.

Learning through experience is a feedback process that, many times, is time consuming and expensive. With this method, decisions are made that affect real results, information from the feedback is collected and then used to review what is understood from the process and from the decisions being made to reach the objectives (Sterman, 2000). The EFS are a practical way to analyze and make more informed decisions regarding the future of the business. The high competitive levels and the demands of the market force entrepreneurs to be more prepared and to have better knowledge to be able to face the challenges of launching a business. Due to the fact that a new company should be continually learning and growing, the EFS provide a medium for the entrepreneur to be aware through immediate feedback on the impact of his strategies, making it possible to analyze the individual and combined effects that they could face as a result of the decisions taken on the resources of the company. Similarly, the interactive systems, among which are the simulators, help improve the planning and control processes, and play the part of a practice field for entrepreneurs before they carry out an action in the real world. Simulators enable entrepreneurs to improve the understanding of the system as a whole, improve the communication between everyone involved, help exploit the experience of the entrepreneur and their perception of the business, identify the policies that affect long and short-term performance, and improve continuous interaction (Bianchi et al., 1998; Bianchi, Bivona, & Landriscina, 2000).

This article proposes an EFS that includes decisional variables regarding the development of different resources under the four perspectives (Kaplan & Norton, 1992) of the balanced scorecard (BS). The purpose of the aforementioned EFS is, for the students of an entrepreneurial strategic subject (whether they are students of a bachelor or master's degree or executives or entrepreneurs), to be able to apply their knowledge and experience in the design of an adequate growth strategy for a new manufacturing company, considering the limitations that their own resources could represent among themselves when they are not balanced in their development, and considering the restrictions that could arise when developing some of them more than others.

The learning objectives of the EFS proposed in this document are:

For the student to:

Identify the main performance indicators to use in the evaluation of the impacts that they would have their strategic decisions of resources development.

Identify their resources under the four perspectives of the BS.

Explain the relations between the resources and the performance indicators.

Propose and evaluate growth strategies that will adequately develop their resources, identifying their impact in the performance indicators considered in the model.

The process generally followed by potential entrepreneurs is hard, complicated and, in a few cases, disappointing. Entrepreneurs—individuals who believe they have the necessary skills to start a business, those who see the opportunity to launch a business and who will not be dissuaded from starting a business for fear of failure (GEM, 2012)—go through a series of iterative stages in their entrepreneurial project. These include an initial vision that is somewhat clear of the new company that they desire to create and the plan or strategy of how they are going to achieve this, up to the different practical activities or initiatives that they are going to carry out in order to achieve a successful implementation of the strategy.

Entrepreneurial activities comprise a dynamic decision process. Based on available information, knowledge, talent and experience, entrepreneurs decide to explore a previously identified opportunity. The process of value creation of a company begins in the culture, leadership and mentality of the entrepreneur, the implementation of his creativity and the development of innovative ideas, looking to obtain a competitive advantage from the identification and administration of certain strategic resources, that, at a long- or medium-term, will lead to the creation of wealth (Pina, 2007).

Strategic planning allows the entrepreneur to explore possible future scenario for the growth and development of the business, understanding the right time to build the entrepreneur's resources (i.e., trained personnel, organizational structure, manufacturing systems, reputations and value of the brand, development of client portfolio, etc.) that will enable the company to have a sound development. The aforementioned growth can also be externally analyzed, considering the tendencies of the company's environment and defining the value of what the company offers, according to the characteristics of its current and potential market's demand. The better the understanding of the entrepreneur of the structure and functioning of its operating system (his company and his environment), the better the chances of being successful. Therefore, the companies need to be in continuous learning, as a pre-requisite for a sound development (Senge, 1994).

The entrepreneur and the management of resourcesThe strategic analysis of the resources can be based on the Resource Based View, RBV- (Rugman & Verbeke, 2002), which is an organization theory focused on the identification and development of the resources and capabilities controlled by the organization as sources of competitive advantage. The resources are all the tangible and intangible assets that the company fully or partially controls and which may be used to conceive and implement its strategy (Barney & Hesterly, 2012; Carroll, 1993; Warren, 2008). The capabilities are a subset of the resources of the company and are defined as the tangible and intangible advantages that allow the company to obtain all the advantages of the rest of its resources.

There are several classifications for the resources in the company or organization: Barney and Hesterly (2012) classify them into four categories: financial resources, including all the money that the company uses to develop and implement its strategies; physical resources, which are all the physical technologies used in the company, such as the facilities and equipment, the geographical location and the access to raw materials; human resources, including the experience, training, and relations of all the workers of the company; and organizational resources, comprised by the structure of the organization, the planning process, the coordination systems, culture, incentives, and reputation.

Another approach, more focused toward the entrepreneur, is by Dollinger (2008), which defines six types of resources, known as the “PROFIT Factors” scheme:

Physical resources, those tangible assets used for the production and administration of the company, including machinery and equipment, geographical location and raw materials.

Reputation resources, comprised by the perceptions of the company that the people in the work environment have, and it also includes the reputation at a product level, such as the loyalty of the brand or at a corporate level, such as a global image.

Organizational resources, considering the entire structure of the company, its processes and systems.

Financial resources, all monetary assets, as well as representing the ability to request a loan, the ability to create new capital, and the amount of money generated by internal operations. The administration of the financial resources (the organization, the processes, and routines), that help use the resources in a more efficient manner, is what generates a sustainable competitive advantage, given that money is a static and inherent resource, but the skill to manage said resource is dynamic, complex, and creative.

Intellectual and human resources, including the knowledge, training, and experience of the entrepreneur and his team. These types of resources comprise the creativity, vision, and intelligence of the members of the organization, as well as the social abilities and personality of the entrepreneur.

Technological and operational resources of the processes, knowledge generated from experience and research and development, which is generally protected with patents, licenses, and copyright.

According to Barney and Hesterly (2012) and Warren (2008), the resource-based theory proposes that a sustainable competitive advantage is created when the company possesses and utilizes resources and skills that follow the VRIO scheme. This means that these are: Valuable: it helps the organization implement its strategy, enabling it to take advantage of or exploit an opportunity or neutralize a threat in its environment; Rare: it is not available to the competition or very few companies control the resource; Inimitable: the resource is difficult to duplicate or it is very costly; and those used by the Organization: the company is organized (policies and processes) to fully exploit the competitive potential of its resources and skills. The most important and valuable human resource of a business is the entrepreneur, as each one of them has special characteristics, histories, personality, experiences, and unique social relations (Dollinger, 2008; Timmons, 2009).

The design of the strategy, under the resource-based approach, contemplates the decisions that affect the profit and loss rates of each resource in time, explaining the amount of each resource at any given point in time, this is the stock-and-flow concept of Akkermans and Oorschot (2005). The performance of the system depends on the levels of the resources and these, in turn, depend on the input and output of each resource. What guides the flow of the resources and their development or evolution (or possible involution) are mainly the decisions of the managers, external factors, the impacts or contributions of each resource on the performance indicators (sensibility), and the existing relative levels between them (Warren, 2008).

The resources are built by the flow of inputs at the level of the resource being considered (for example: new clients, hires, new products or services, technology, production capability) and by the losses suffered due to errors, the actions of third parties, decisions taken (clients that turn to the competition, employees that quit or that are fired, the loss of brand awareness, discontinued products, depreciation). The entrepreneur determines the strategy based on the asset-stock accumulation, this being the characteristic of the resources to increase and decrease throughout time. This characteristic is critical for the strategic performance of the company and is also known as integration in the control theory (Ogatta, 2009). The current amount of a resource is the cause of the initial amount of the following period plus what is added and taken in the same period (Warren, 2005).

The increase and decrease of a resource will also depend on the level of other resources (Warren, 2008), which could limit one another, causing inefficiencies, restrictions, and a decrease in productivity. For example, in a consulting firm, the number of senior consultants will depend on the number of junior consultants and on their promotions. Another example is the level of production in a manufacturing company, which depends as much on the physical capacity installed as on the number of employees. In this last example, the relative level of each resource is important because if it is unbalanced, then there will be a waste of the resource in a greater degree. This situation may also be analyzed when developing the resources, given that if a balance is found at t moment, then when developing them in the future, at time t+n, it is possible that one of them will develop faster than the other (one being delayed in its development), reaching a situation or state of disequilibrium and, therefore, becoming less efficient or productive.

Other examples of interdependent development in terms of resources are: development and launching of new products with their multiple stages, from the conception of the idea until its launching; the training of the personnel with training stages or levels; in general, resources with a certain useful life that depend on their own level, on their shelf life, on their regeneration speed, and on the levels of the other resources that affect the input and output flows (life cycle of the product, technology, company, etc.); the levels of adoption of a certain product by type of client (Rogers, 1962); the distribution chain with its relative levels between stages from the production up to the client and the whip effect (Juego de la cerveza, Sterman, 2000); the standard of living of a population that depends on resources such as education level, safety, food, etc. Therefore, the dynamic systems make evident the “complementary” nature between resources, both tangible and intangible. Complementarity refers to the way in which the resources are created and interact between themselves, conditioning the global development of the system at its relative levels (Sterman, 2007; Warren, 2008).

The dynamic systems do not limit their analysis to the resources that the company “owns or controls”. To affect performance, a company only needs to have limited access to the resources that it needs. A consequence of this is that the clients become a part of the system, even though they do not belong to the company and it cannot control them either directly or completely.

The balanced scorecardThe complexity of an organization requires that the managers are able to design a strategy and monitor the performance in different areas simultaneously. The Balanced Scorecard is a tool that provides a reference framework to design the strategy and translate it into action. It includes financial measures that show the results of the actions taken and complements them with operational measures that consider the client, the internal processes, innovation, and human resources (Kaplan & Norton, 1992). One of the characteristics of the BS is that it works to bridge different areas, both financial and non-financial (Akkermans & Oorschot, 2005).

The BS allows to observe the company from four perspectives: the learning and growth perspective, reflected on the ability of the company to learn, innovate and improve the products and processes that already exist, and to introduce new products; the perspective of internal processes or internal operations done to elaborate the products or to offer the services to satisfy the needs of the consumer; the perspective of the client, oriented toward the creation of value and differentiation; and the financial perspective that provides the performance indicators of the strategy, its implementation, and its executions from the monetary, growth, yield, and risk point of view.

The BS facilitates the determination of a future perspective, to define a structured vision and to establish a path to reach it (a strategic map), developing the existing resources or those classified according with the four perspectives, as well as to design a board with the objectives and actions (implementation) quantifiable in the short and medium term.

The BS can be captured in a systems dynamics model (Bianchi et al., 2000; Warren, 2008) that provides an understandable and measurable representation of the value creation process through time for a business, identifying the necessary resources from its four perspectives, as well as the time and speed of their creation or development, in addition to the necessary actions or decisions and their corresponding impacts measured through the development indicators, which are also defined in the four perspectives scheme. The use of BS supports the importance of understanding the relations of cause and effect and the resources and performance measures between the components of the company's strategy. All these have an impact on the financial performance measures (Capelo, 2009).

The BS may help an organization in several ways, promoting growth with a clear approach, clarity of objectives and goals, organizational alignment, monitoring the performance evaluating the efficiency in the achievement of objectives, and identifying responsibilities and responsible parties in the expected results (Gumbus & Lussier, 2006). The strategic decision makers can use tools such as the BS, which will help them define strategies by identifying their resources from the four perspectives and which will keep them informed on the progress of their implementation (Ritchie-Dunham, 2001).

The learning environmentThe Interactive Learning Environments (ILE) are the means by which the learning goals are achieved through the active interaction of the participant and the focal system (Domenge, 2009; Domenge & Vidal, 2015). In particular, EFSs are a type of ILE designed to be used on a computer within the structure of an interactive game, based on virtual simulators from real systems, which utilize a friendly interface between the system and the decision maker (Kopainsky, Alessi, Pedercini, & Davidsen, 2009; Maier & Gröbler, 2000). These systems offer an active learning environment for the achievement of a set of tasks and objectives, providing the necessary support to learn and apply one or more specific concepts (Aleven, Stahl, Schworm, Fischer, & Wallace, 2003; Choi & Hannafin, 1995).

An EFS is any attempt to represent a real or imaginary environment or system in a computational simulation model. A simulator has two main purposes: scientific and educational (Davidsen, 2000). The design and use of a simulator entails one or more reasons whereby the real system is not directly being experimented on. Some of these reasons are: cost, time, risk or lack of access to the resources. Scientific simulators provide an outlook on the real system, this in turns enables developers to establish and improve the existing theory for a better development of the system. Educational simulators are designed as a means of virtual learning regarding the structure and functioning of a system through the evaluation of the results obtained from actions or decisions made, through the feedback generated by the simulator in real, accelerated or slowed time (Rieber, 1996).

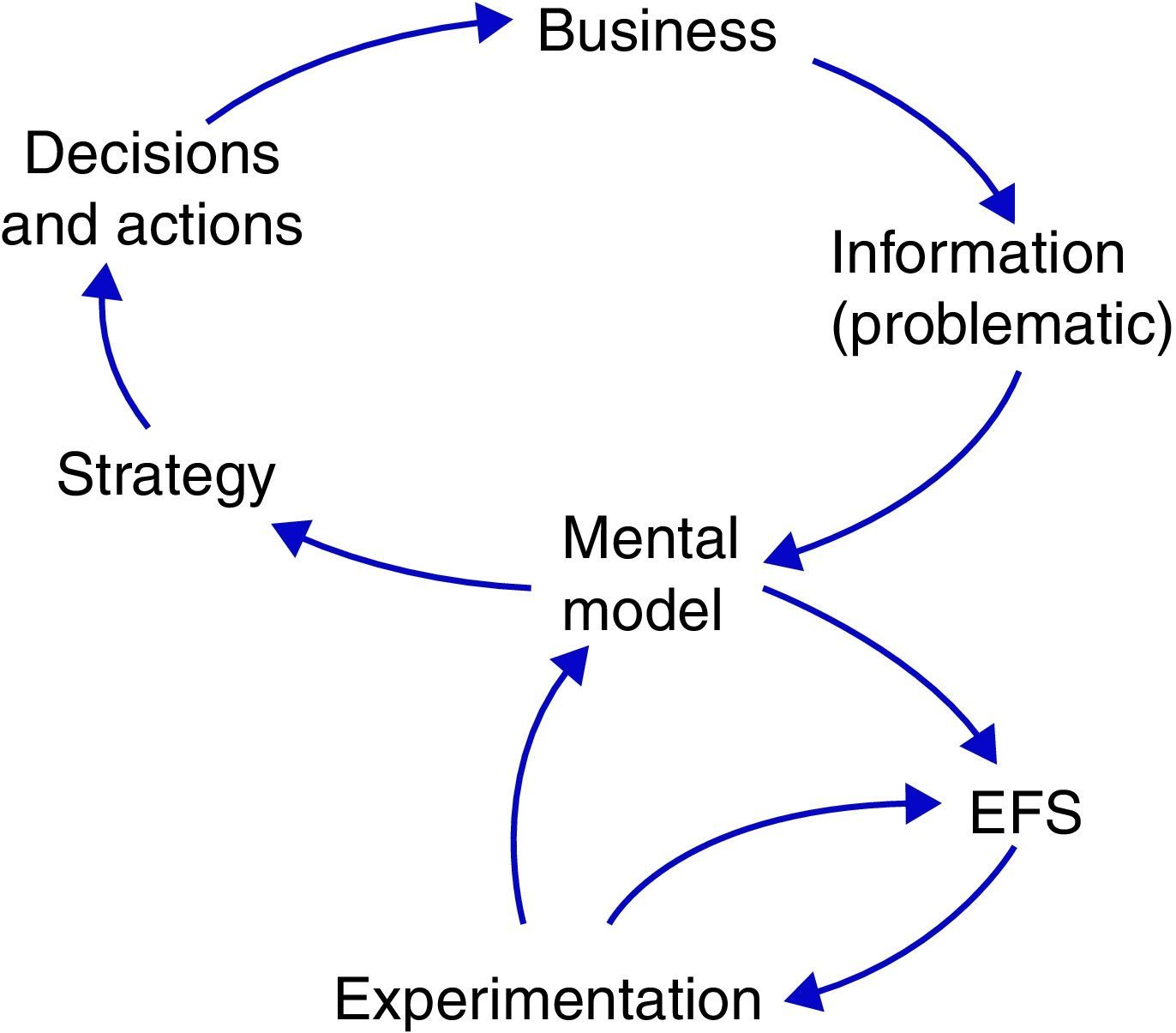

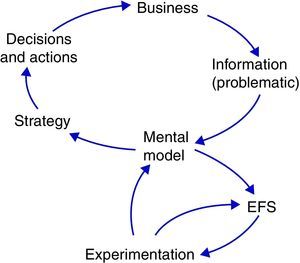

The EFS are means to provide learning in entrepreneurship education, representing “practice fields” or experimentation for the decision makers in the company (Fig. 1) creating an effective learning cycle as they close the gap between the design and strategy implementation and their corresponding effects. The EFS allow to iteratively modify the mental model (Senge, 1994) of the strategist, which in turn allows to conceptually understand the structure and functioning of the system (company and environment) in which it finds itself (bottom part of Fig. 1), by experimenting and evaluating the impacts of different strategies before deciding on the most preferable.

When using an EFS, two types of feedback and learning are presented, the Single-loop and the Double-loop (Bianchi, 2002). The first is the type of basic learning in which the feedback of the impact of decisions is based on the experience with the real system, and is interpreted by the existing mental models. Learning operates in the context of the current decision rules, strategies, culture and institutions (upper part of Fig. 1). In the double-loop learning, feedback from the real world can also stimulate changes in the mental models, but said learning involves new concepts of a situation and lead to new objectives and decision rules, and not only new decisions (Lane, 1995; Sterman, 2000). Double-loop learning allows the decision maker to evaluate the consistencies of their mental models, as one of the most significant risks is to make decisions without having questioned the consistency of the mental model (Bianchi et al., 1998, 2000; Bianchi, 2002).

EFSs generate a dynamic environment that presents one or more situations that require decisions, creating cycles and new situations with new problems to be solve and decisions to make (Wawer, Milosz, Muryjas, & Rzemieniak, 2010). EFSs represent an effective learning method on different business aspects and are considered one of the most interesting learning methods, as it leads the user to get involved and commit to his decisions as he makes progress in the interactive use of the simulator, immediately monitoring results, accelerating the learning process and quickly acquiring experience, experimenting new behaviors, and developing certain abilities and skills related to the decision making process (Lane, 1995; Saad, 2013). The simulator facilitates the learning process, as it constantly allows, immediately and iteratively, to review and evaluate different strategies proposed by the participant, making decisions in accordance to the new information generated by the simulator in a series of scenarios.

The EFS makes it possible to connect the knowledge from the different areas involved in a business in a holistic and systematic manner; it causes a strong motivation to use active learning or experience learning (similar to Kolb's learning spiral, 2014: concrete experience, observation and reflection on the experience, formation of abstract concepts for mental models based on reflection, test or validation of the new concepts, and repetition); it combines strategic and analytical thinking and allows developing the ability for teamwork, improving interpersonal communication and working under pressure. The process of learning by simulation leads to the improvement of the mental models of the participants and helps them reach a shared vision of reality (Bianchi et al., 1998).

On the other hand, EFSs have several disadvantages, as stated by Wawer et al. (2010): the simulator is a model of reality, i.e., it is created with certain simplifications that arose from a selective abstraction of the real system; decisions are made without any responsibility, so the results reflected in the simulator do not have an effect on the real-life situation, which could have an influence on the behavior of the players, differing from what could happen in reality.

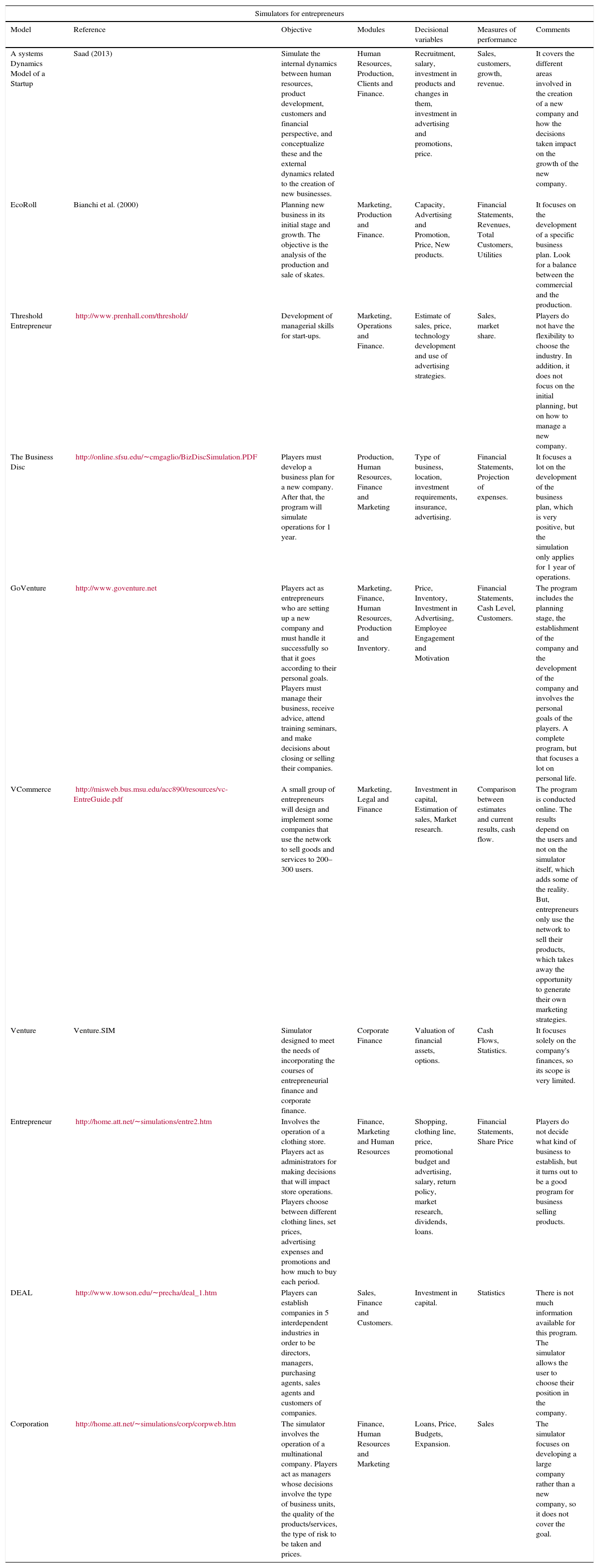

Within the literature regarding EFSs there are different developments that have been of use for the planning and evaluation of strategies regarding a type of company in particular, companies in general (MIT Business Strategy Games; Blue Ocean Strategy Simulation, BOSS), as well as in certain operational areas such as marketing (Markstrat), operations (Sterman, 2000), and human resources (Warren, 1997). Annex 1 shows a table with different simulators that have been made as learning tools for decision makers and entrepreneurs. This table shows a summary of the objective presented for each simulator, the modules that intervene, the decisional variables that were taken into consideration for the development of the same, and the performance measures of the model. Some of these EFSs are designed to simulate specific functional areas such as finances, human resources, sales or a combination of these, considering the sales or the different elements of the financial statements as final performance measures. These EFSs do not take into consideration a global classification of the resources as the BS does, nor do they explicitly highlight the balanced development of resources according to their cause and effect relations and sensibility with the performance measures.

The simulators can be used as part of the strategic planning and learning process of a company, and they help strategists distinguish between the feedback structure of the system (company) and how to modify said existing system to affect its behavior, aiming to achieve the previously established objectives. The planning can be conceived as a means of learning and the EFS as a vehicle that provides support and a better understanding of the business system in question (Bianchi et al., 1998) for a better-informed decision making. EFSs contribute to the development of the Learning Organization concept in a company. A concept which, since the beginning of the 90s, (Senge, 1994) has been recognized as an important element in strategy, evolution, development, resilience, and organizational change.

The proposed EFSAccording to the approach indicated in the introduction of this document, the proposed EFS has four didactical objectives aimed at the students of entrepreneur programs in matters of strategic planning, meaning the goal is for the students to be able to: (1) Identify the performance indicators to be used; (2) Identify their available resources under the BS approach; (3) Explain the relations between their resources and the performance measures; and (4) Propose and evaluate growth strategies that will adequately develop their resources, identifying their impact on the performance measures considered in the model.

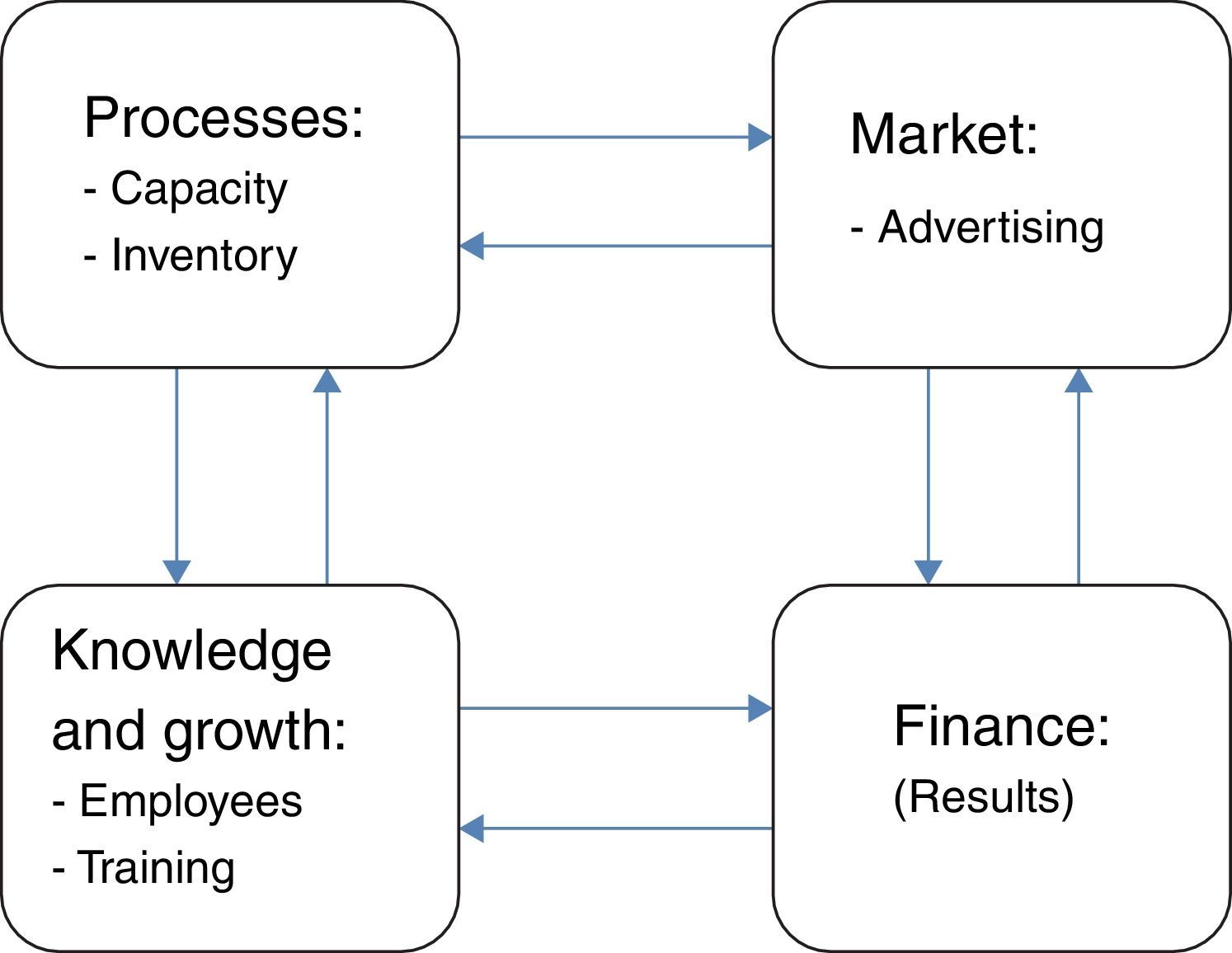

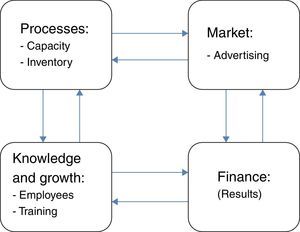

The first and second objectives—the identification of the performance indicators and the identification of available resources in the company under the BS perspective—are illustrated in Figure 2, which shows the four blocks that comprise the structure of the EFS. The blocks correspond to each of the four perspectives of the BS. Each block indicates the decisional variables that the EFS considers, and which are directed toward the resources included in the EFS. Performance indicators are fundamental in the financial results (NPV and utilities). The resources to develop are: employees, productivity training, production capability, inventories, and publicity. The levels of the resources can also be used as performance measures, given that they indicate the performance of each of them throughout time.

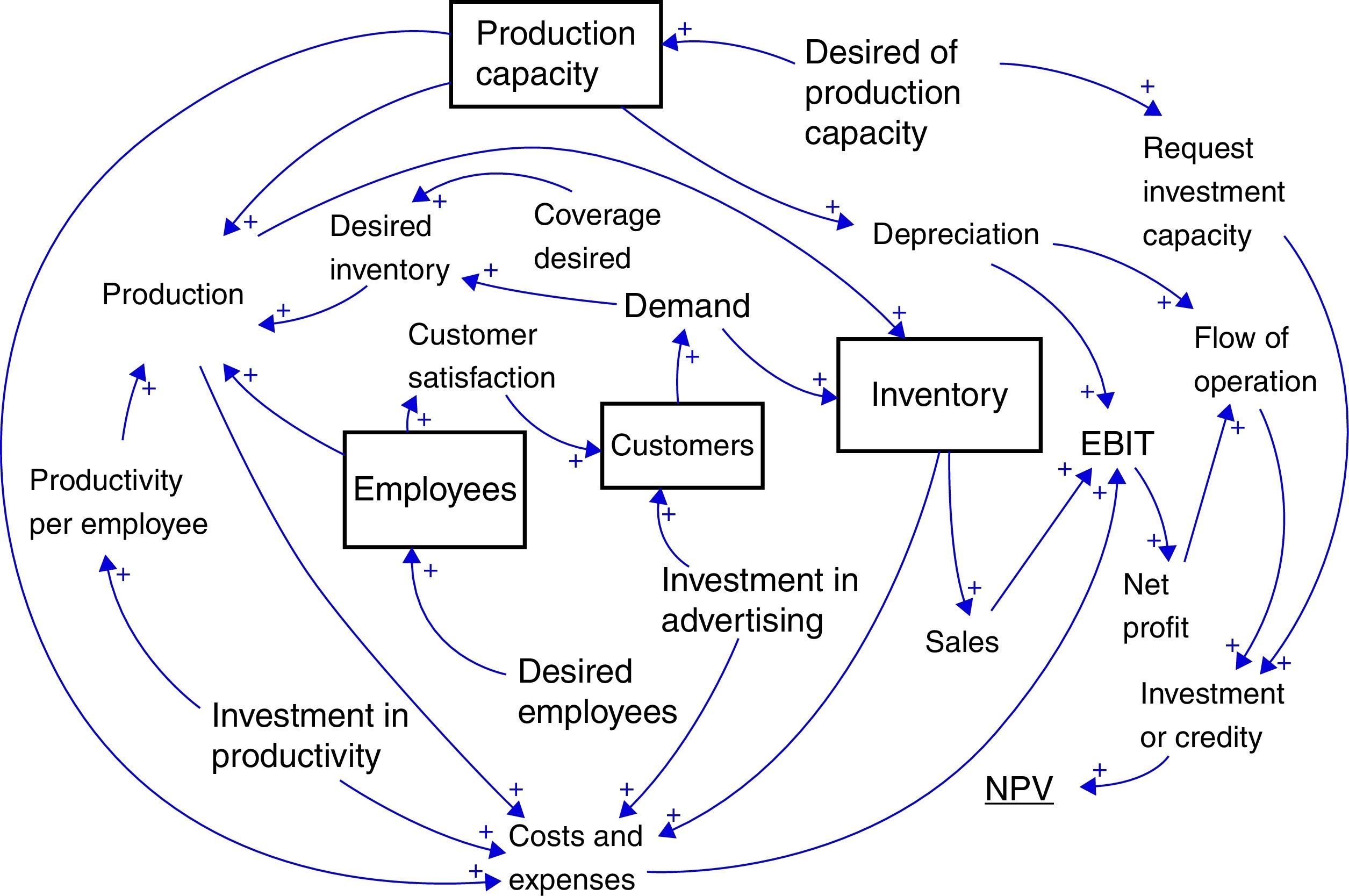

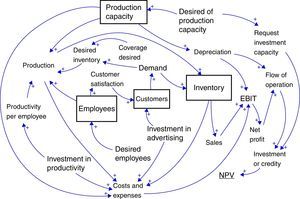

The third objective, the relations between the resources and the performance measures, is presented in the path diagram of Figure 3. Included in this are the decisional variables, the resources considered, and the main performance measure, that is, the Net Present Value (NPV) of the flows generated per period.

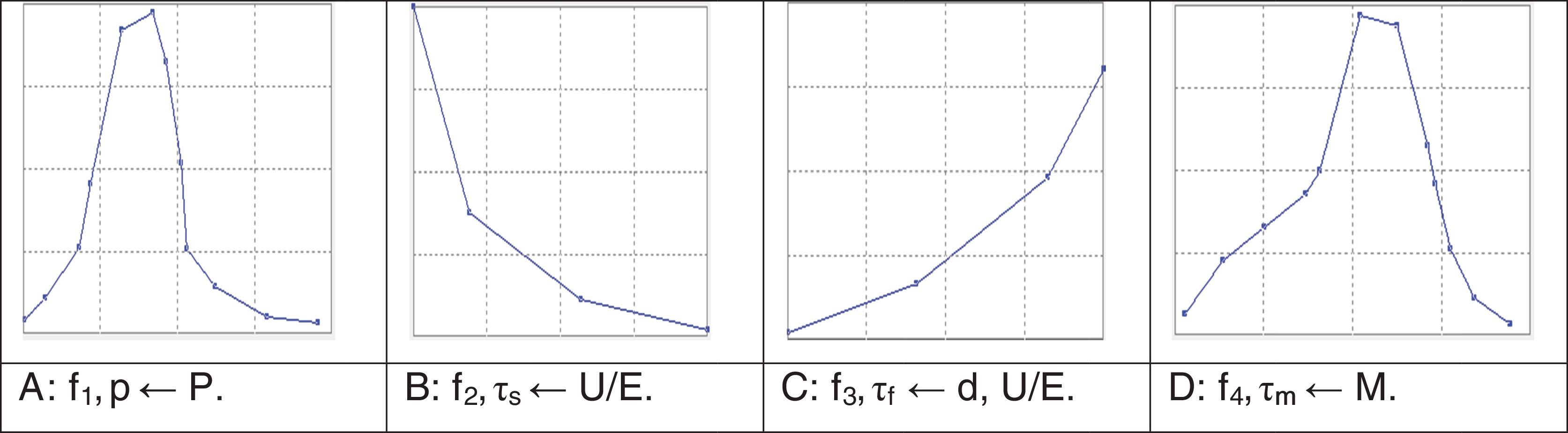

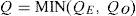

The structure of the model that comprises the EFS causally links the resources available to the company, the decisional variables for each of the four perspectives of the BS, and the performance indicator. The production Q is limited by the production capability of the employees QE and by the functional capability QO, Eq. (1). The capability of the employees QE depends on the number of employees E and productivity p per employee, Eqs. (2) and (3), which is a function f1 of the investment P dedicated to this context, Figure 4A.

The functional capability is limited by the installed KO functional capability and the desired inventory ID, Eq. (4).

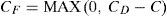

The desired inventory ID is a function of the demand D and of the missing inventory coverage CF, which in turn depends on the desired coverage CD minus the current coverage C. The desired inventory coverage CD is achieved in time TC, Eqs. (5)–(7).

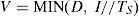

The inventory is comprised by the produced units Q minus the units sold V, which in turn depend on the demand D, on the stock, and on the time available to supply the orders TS, Eq. (8).

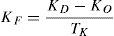

The missing production capability KF depends on the desired capability, the installed functional capability, and the time that it takes to build capability TK, Eq. (9).

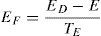

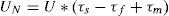

The remaining employees EF depend on the number of employees desired ED, the current employees E and the time that their hiring and training last TE Eq. (10).

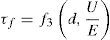

The model proposed considers an expected exogenous demand D. The administrator of the EFS can program different scenarios by manipulating the tendency variable (m) of the environment to estimate the tendency of the demand, following a linear function in relation to the number of net clients UN, Eq. (11). It is possible to gain or lose clients through the increases or decreases in three areas, Eq. (12): in the rate of satisfaction of client τs estimated through a proxy variable, number of clients among employees, Eq. (13), through the desertion rate τf, Eq. (14), and through the rate of marketing effort τm due to the investment M in this area, Eq. (15).

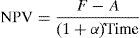

The NPV was defined as the final performance measure that assesses each strategy, considering the net flows F generated per period (including sales, fixed and variable costs, expenses, depreciation, taxes and investments), the amortization A of the debt per period that could have emerged from the proposed strategy, and the discount rate α, Eq. (16).

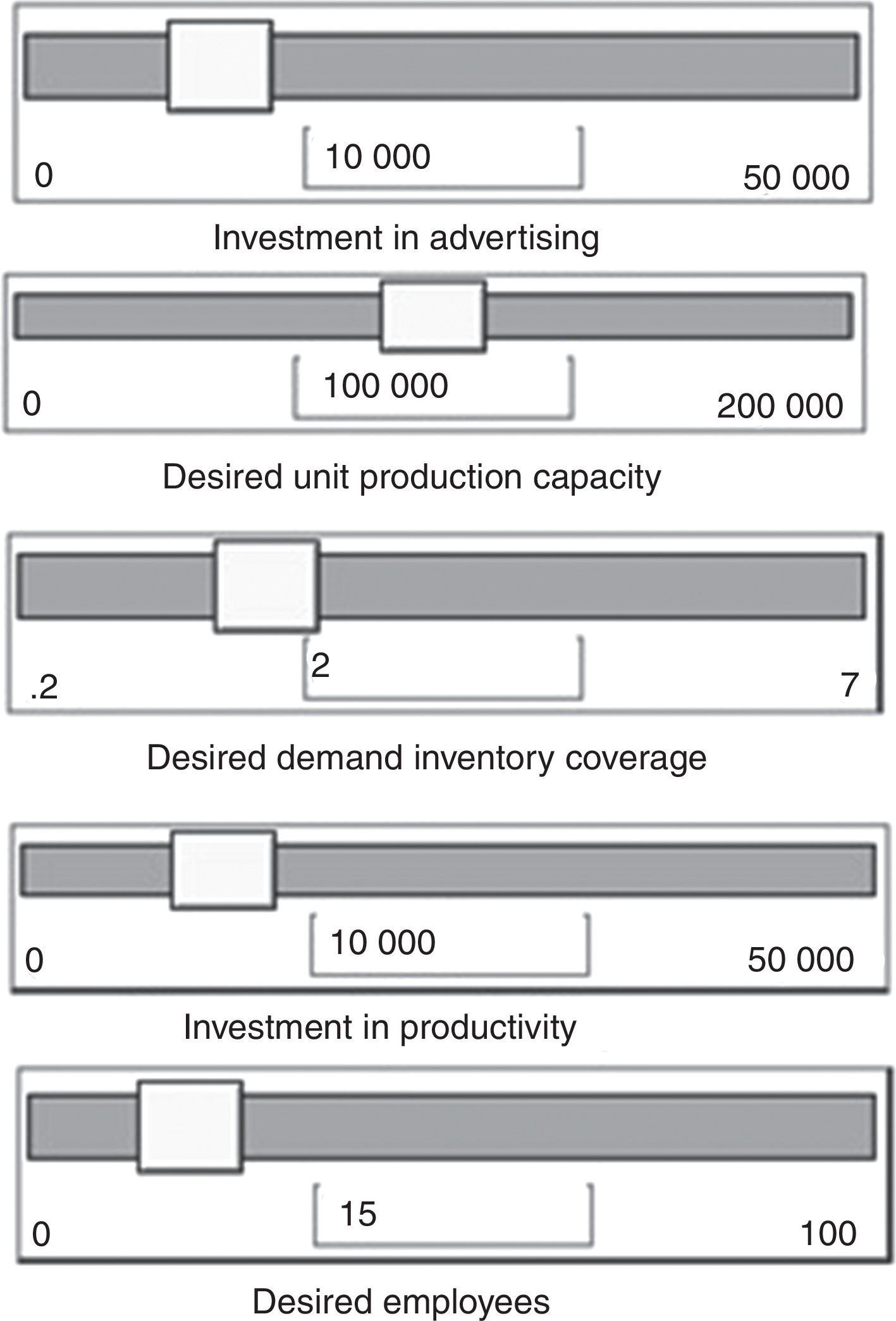

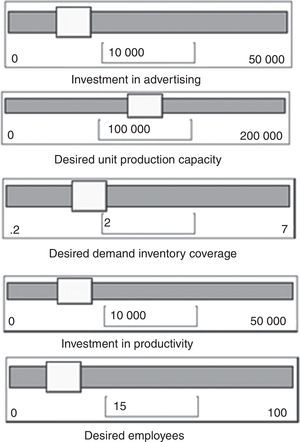

The EFS was designed under an evaluation perspective of balanced growth strategies for the resources of a manufacturing company with only one product; this comprises the fourth didactical objective. The decisional variables (in italics) in the model, which are the workforce that is desired to carry out the production process, are: the investment in publicity (market perspective), which affects the new clients through its capture rate; the desired production capability (process perspective), which represents the period of time during which the company wants to be covered in ordered to fulfill the demand and thus avoid a shortage of product; and the investment in productivity (learning perspectives), which directly affects the annual productivity of the employees and the desired employees.

It is expected for each participant to propose a base or reference strategy, and to subsequently experience or simulate different strategies in order to build up a mental model that will allow them to relate their resource development decisions with the performance indicator. The objective is not only to achieve a greater NPV, but for the participants to be educated on the relative impacts of their decisions (sensibility analysis on the relative development of the resources) as they experiment with the EFS, modifying their mental model regarding the structure and functioning of the model and considering the four perspectives of the BS. The model was built and simulated on the Vensim (Ventana Systems) software package based on the systems dynamic approach (Sterman, 2000).

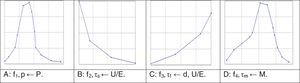

Investment P in productivity has a growing behavior up to a maximum point in which a decrease begins, as it is considered that there would be saturation, Figure 4A. The functions for τs, τd, τm are defined through the LOOKUP tool of Vensim. When increasing the level of satisfaction, the number of clients increases and desertion decreases, Figures 4B and C. When investing in the marketing effort M, the number of new clients increase until it becomes saturated and the effects decrease, Figure 4D.

The five decisional variables that reflect the strategy of the entrepreneur may be modified through an input control panel, Figure 5, considering the four perspectives of the BS.

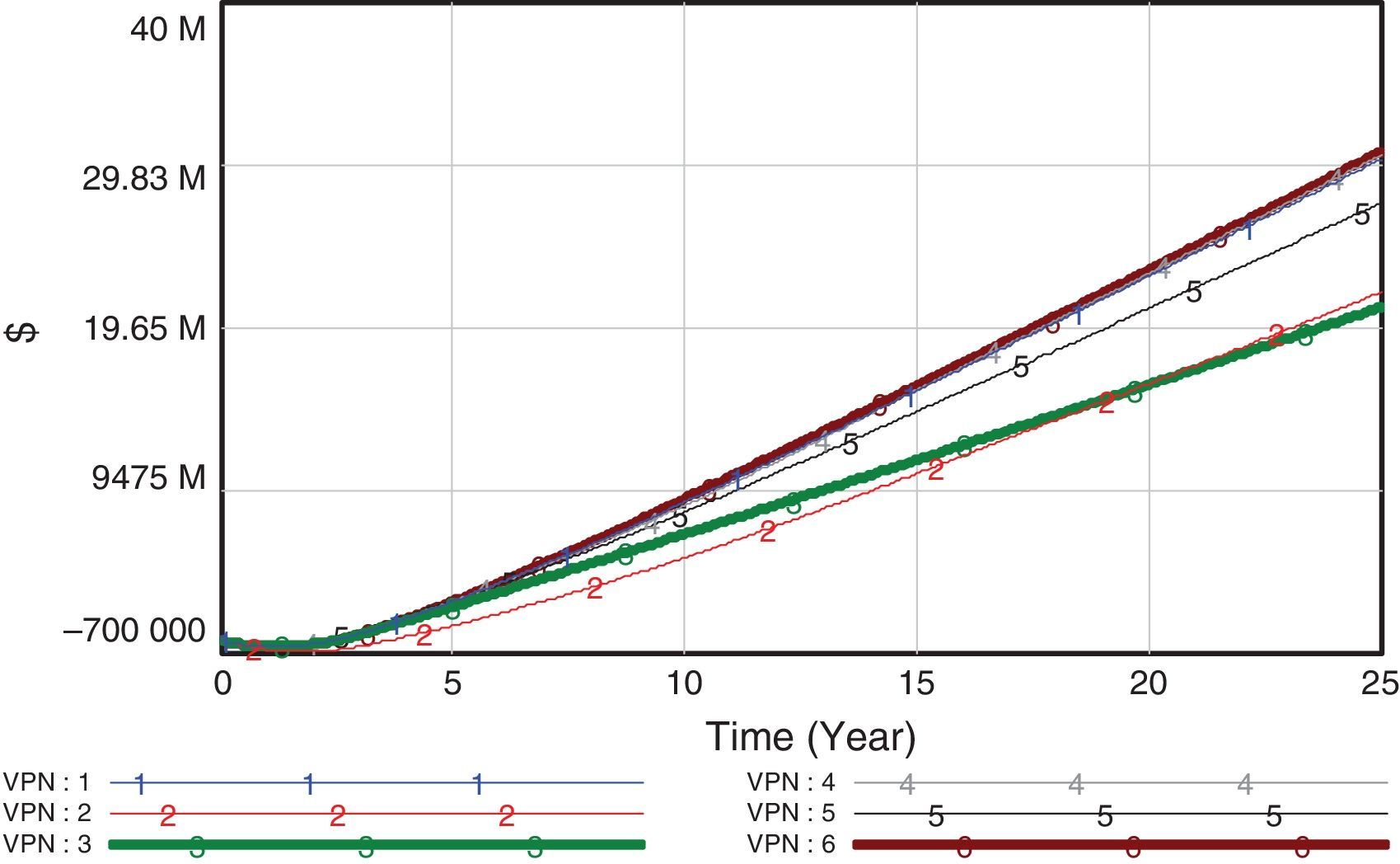

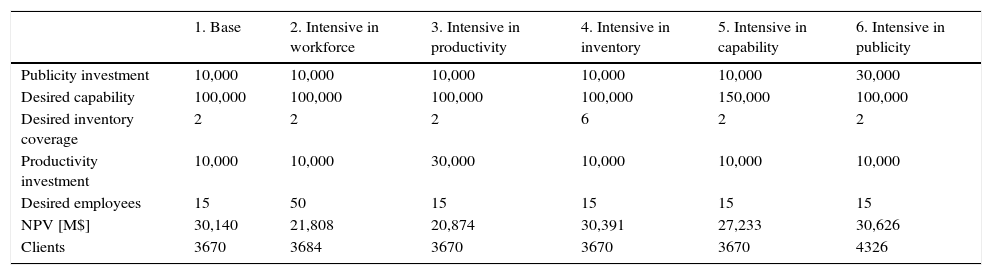

Six scenarios were simulated, considering extreme values from the five decisional variables, as shown in Table 1. The simulation context was of 25 years.

Scenarios that resulted from six strategies.

| 1. Base | 2. Intensive in workforce | 3. Intensive in productivity | 4. Intensive in inventory | 5. Intensive in capability | 6. Intensive in publicity | |

|---|---|---|---|---|---|---|

| Publicity investment | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 | 30,000 |

| Desired capability | 100,000 | 100,000 | 100,000 | 100,000 | 150,000 | 100,000 |

| Desired inventory coverage | 2 | 2 | 2 | 6 | 2 | 2 |

| Productivity investment | 10,000 | 10,000 | 30,000 | 10,000 | 10,000 | 10,000 |

| Desired employees | 15 | 50 | 15 | 15 | 15 | 15 |

| NPV [M$] | 30,140 | 21,808 | 20,874 | 30,391 | 27,233 | 30,626 |

| Clients | 3670 | 3684 | 3670 | 3670 | 3670 | 4326 |

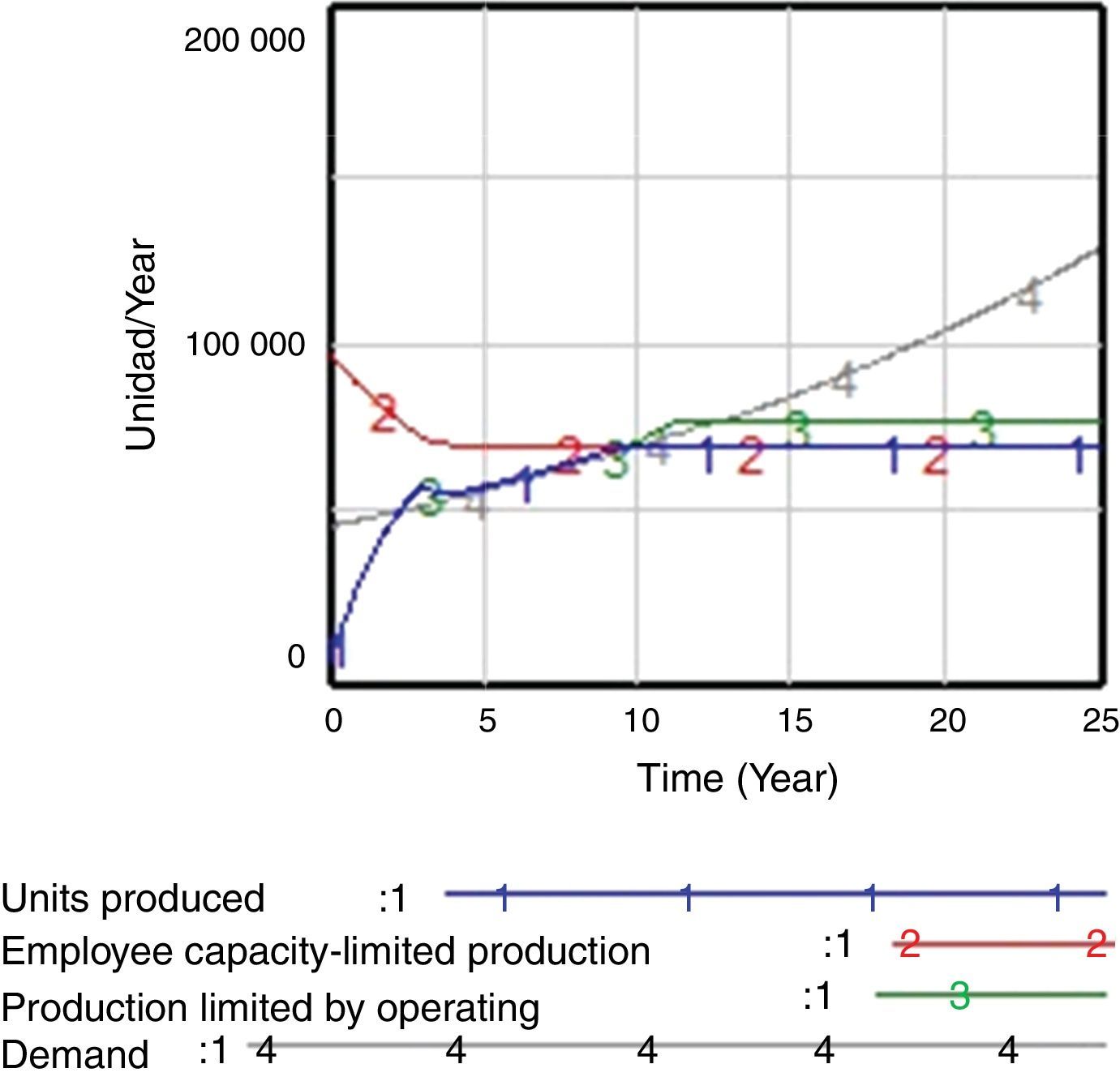

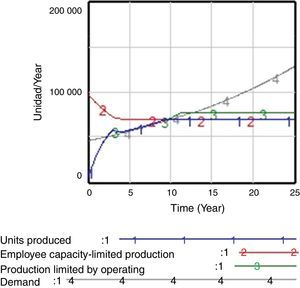

Figure 6 shows the behavior of the production and demand for the base scenario. The production for all scenarios is limited by the production capabilities or by that of the employees. The demand was fulfilled until period 12.

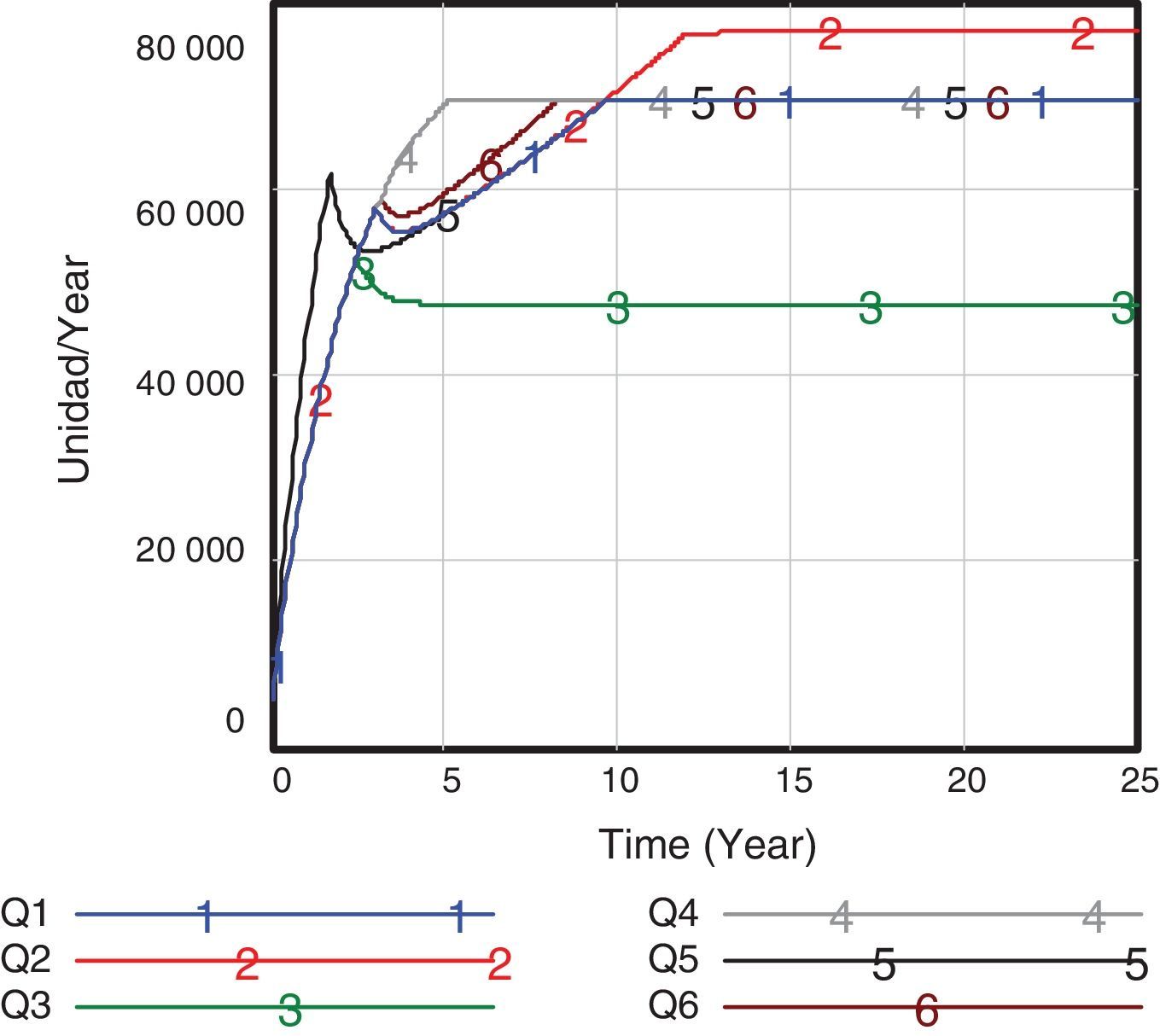

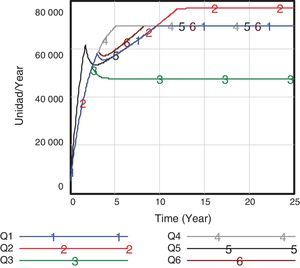

Figure 7 shows the production for the six scenarios considered. In the first couple of years there is a transition period caused by the combined effects of the adjustments in capacity, inventories, workforce and productivity, defined by their corresponding correction times. Production is obstructed in a different manner for each one of the scenarios due to the unbalanced development of the different resources considered in the EFS.

The intensive scenario in workforce is what is later reduced, due to the fact that at first there is an excess capacity in this area. This also explains that if there is investment made in productivity or employees—scenarios two and three—this investment goes to waste and its corresponding NPV decreases. In scenario five, production is not reduced. These limitations are due to the unbalanced growth between the different resources, a result of the strategies defined by the EFS user. If the capacity construction time is shortened, then the restriction that reduces production is loosened, making it possible to satisfy demand in a more adequate manner.

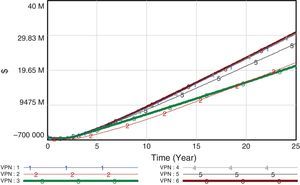

As shown in Table 1 and Figure 8, the lower NPVs correspond to scenarios three and two, which are intensive in the productivity and workforce areas. The greatest NPV corresponds to scenario six, which is intensive in publicity. In the first couple of years the flows are negative for all the scenarios, which means that it is necessary to go into debt to finance the strategies.

As progress is made in the simulation, the flows become positive and start growing, which enable the amortization of the acquired debt in previous periods and makes it possible to increase the retained earnings that resulted from the operation and from the yields obtained through their corresponding investments.

When simulating a seventh scenario, considering an aggressive strategy when investing in each resource the maximum amounts presented on each of the previous scenarios, an NPV lower than 9974M$ is obtained, due to the excess and imbalance in the relative development of the resources and the high costs that this entails. The maximum NPV of 33,829M$ is achieved with the strategy determined by [26,000; 104,000; 2.2; 13,000; 12], in accordance with the order of the decisional variables of the panel in Figure 4. This last NPV would be the objective to be accomplished by the participants after doing their sensibility analysis, simulating several of their proposed strategies.

Figures 6–8 help identify that the unbalanced development of the resources considered in the four perspectives of the BS, reduces or limits the total use of all these resources. These restrictions are the result of having invested excess financial resources in some resources while having a lack of these in others, deriving in the decrease of the performance indicator.

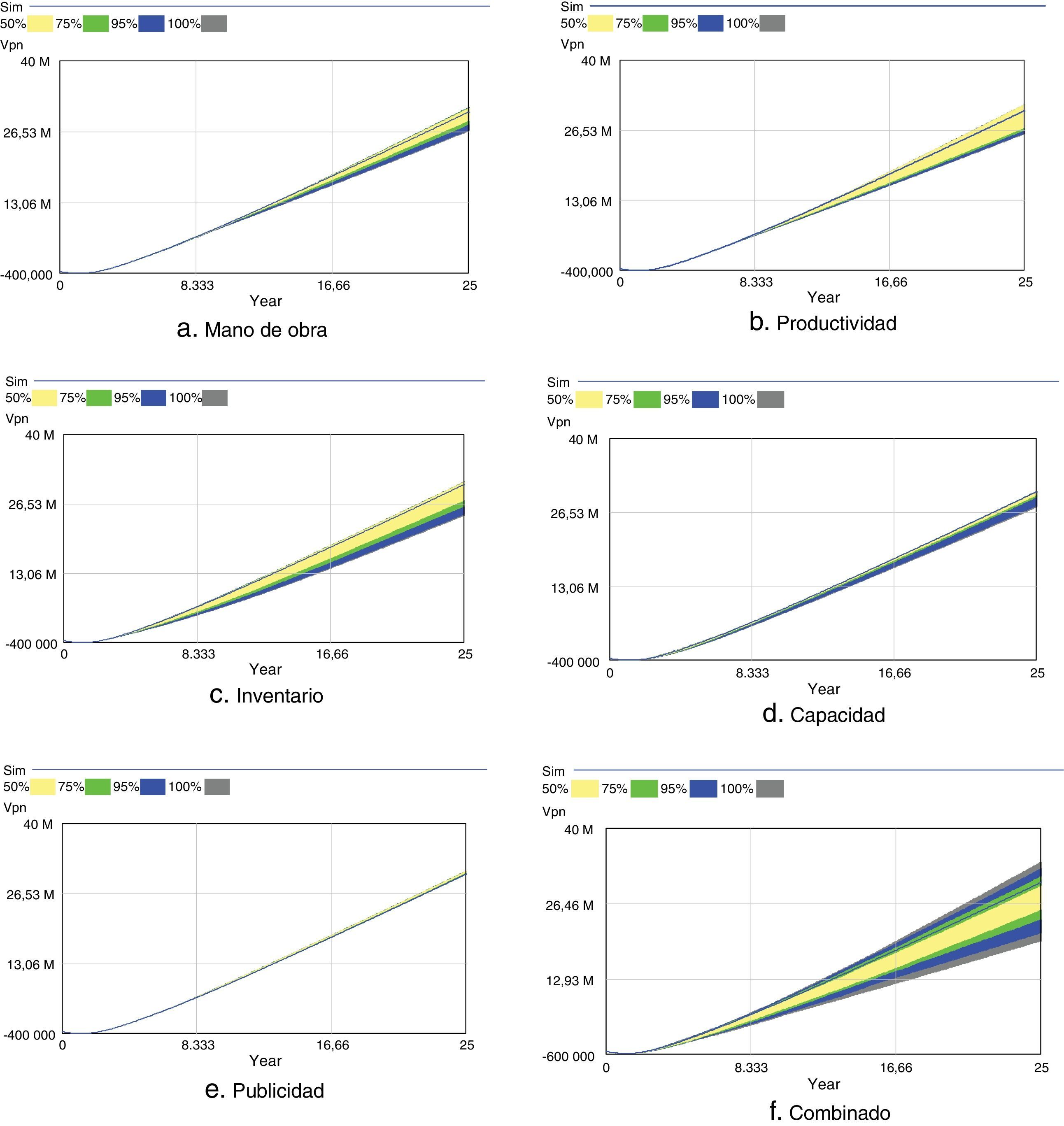

When using the EFS, it is possible to identify the impact that each of the resources has on the NPV through a sensibility analysis. It is worth recalling that the cause and effect relations of the resources and the performance measure are complex and non-linear. Figure 9 shows the sensibility graphs for each of the decisional variables (resource development), considering a variation of ±20% for each of them in relation to their corresponding initial value. This sensibility analysis allows the user to gain a sense of relative importance for each of the resources, and could be a guide for the user's decisions when prioritizing the development of certain resources in relation to others.

As can be observed in Figure 9e, the least sensible resource – the one with the least dispersion – is investment in publicity. The resource that shows the most sensibility is inventory coverage, Figure 9c. Figure 9f shows the sensibility of the five combined resources, which is higher than each of them individually.

According to Warren (2008, Ch. 4), the unbalanced development of resources in a company with multiple resources leads to a situation of inefficient growth, which is the result of a deficient strategic planning. The levels of the resources must be adequately built as they are interdependent in the company (see section “The entrepreneur and the administration of resources”). The development of a resource depends on the management decisions, their own level, and the relative levels of the other strategic resources of the company (Warren, 2008). In the case of companies with multiple resources (Grant, 2013, ch. 5 and 6), the lack of coordination capability, integration, and assignment of amounts and investment times, involve intangible aspects, such as the learning capability of the company and the organizational culture, as well as tangible and more formal aspects, such as the organizational structure, the assignment of positions and inter-functional responsibilities, the design of the administrative, incentive and information systems, and the evaluation and assignment of financial resources for the development of the different strategic resources. Resource development is a strategic activity that involves an adequate strategic planning, explicitly including the determination of the competitive advantage, as well as the contribution of each resource for the achievement of this, to the profitability of the company and the actions of the competition (Kunc & Morecroft, 2010).

ConclusionsThe creation of a new company represents a dynamic process, during which entrepreneurs evaluate their strategies according to the results that they have as their project evolves, taking into consideration that the best strategy to implement in their company will depend both on internal factors, such as the development of their resources, and external factors, such as the characteristics and tendencies of their environment and target market.

The proposed EFS could allow the entrepreneur to create awareness about the strategic planning process, looking to achieve a more informed decision-making than the traditional perspective, identifying and analyzing the main resources available and the causal relations with the strategic objectives and their performance indicators. By framing this analysis within the four perspectives of the BS that comprise the new business (human resources, processes, market, and finance), the entrepreneur is able to know and discuss with other interested parties the existing relations between these resources and their performance indicators, analyzing the possible effect of their decisions.

The EFS considers the accumulation of resources throughout time and allows modifying and evaluating different strategies as the strategists better understand their structure and functioning. The proposed EFS allows the connection of all areas involved in the business, with the possibility of modifying the mental model of the strategist from a holistic, systematic and balanced vision, which could also be of use as an explicit interactive learning method between the entrepreneur and other participants interested in the strategic planning process of their company project.

In accordance with the training objectives to be achieved using the EFS, it is possible to add more decisional variables to the EFS, such as the construction time of the production capability, the adjustment time of the inventory, the time to supply orders, and the hiring and recruitment time of new employees, among others. Adding these decisional variables would imply expanding the input control panel of the proposed EFS.

With the objective of implementing the proposed EFS, it is necessary to design a learning environment that is adapted to the profile of the participants or users, under the experience learning scheme (Domenge, 2009). It is recommended to develop a training case that will place the participant as a part of the team of strategists in a company, with the information that he will require regarding the industry in which he is working. The aforementioned training case will require information that shall enable the discussion and identification of the strategic resources of the company, as well as the causal relations with the performance indicators (NPV), as shown in the diagram of Figure 3. Finally, the recommendation is to include a series of strategic cases that will lead the users, through the use of the EFS, to identify the relative importance of developing the resources of the company in relation to their impact on the NPV, as well as to present a concrete strategy for its development.

We are grateful to the Asociación Mexicana de Cultura, A.C., for its support in the elaboration of this investigation.

| Simulators for entrepreneurs | ||||||

|---|---|---|---|---|---|---|

| Model | Reference | Objective | Modules | Decisional variables | Measures of performance | Comments |

| A systems Dynamics Model of a Startup | Saad (2013) | Simulate the internal dynamics between human resources, product development, customers and financial perspective, and conceptualize these and the external dynamics related to the creation of new businesses. | Human Resources, Production, Clients and Finance. | Recruitment, salary, investment in products and changes in them, investment in advertising and promotions, price. | Sales, customers, growth, revenue. | It covers the different areas involved in the creation of a new company and how the decisions taken impact on the growth of the new company. |

| EcoRoll | Bianchi et al. (2000) | Planning new business in its initial stage and growth. The objective is the analysis of the production and sale of skates. | Marketing, Production and Finance. | Capacity, Advertising and Promotion, Price, New products. | Financial Statements, Revenues, Total Customers, Utilities | It focuses on the development of a specific business plan. Look for a balance between the commercial and the production. |

| Threshold Entrepreneur | http://www.prenhall.com/threshold/ | Development of managerial skills for start-ups. | Marketing, Operations and Finance. | Estimate of sales, price, technology development and use of advertising strategies. | Sales, market share. | Players do not have the flexibility to choose the industry. In addition, it does not focus on the initial planning, but on how to manage a new company. |

| The Business Disc | http://online.sfsu.edu/∼cmgaglio/BizDiscSimulation.PDF | Players must develop a business plan for a new company. After that, the program will simulate operations for 1 year. | Production, Human Resources, Finance and Marketing | Type of business, location, investment requirements, insurance, advertising. | Financial Statements, Projection of expenses. | It focuses a lot on the development of the business plan, which is very positive, but the simulation only applies for 1 year of operations. |

| GoVenture | http://www.goventure.net | Players act as entrepreneurs who are setting up a new company and must handle it successfully so that it goes according to their personal goals. Players must manage their business, receive advice, attend training seminars, and make decisions about closing or selling their companies. | Marketing, Finance, Human Resources, Production and Inventory. | Price, Inventory, Investment in Advertising, Employee Engagement and Motivation | Financial Statements, Cash Level, Customers. | The program includes the planning stage, the establishment of the company and the development of the company and involves the personal goals of the players. A complete program, but that focuses a lot on personal life. |

| VCommerce | http://misweb.bus.msu.edu/acc890/resources/vc-EntreGuide.pdf | A small group of entrepreneurs will design and implement some companies that use the network to sell goods and services to 200–300 users. | Marketing, Legal and Finance | Investment in capital, Estimation of sales, Market research. | Comparison between estimates and current results, cash flow. | The program is conducted online. The results depend on the users and not on the simulator itself, which adds some of the reality. But, entrepreneurs only use the network to sell their products, which takes away the opportunity to generate their own marketing strategies. |

| Venture | Venture.SIM | Simulator designed to meet the needs of incorporating the courses of entrepreneurial finance and corporate finance. | Corporate Finance | Valuation of financial assets, options. | Cash Flows, Statistics. | It focuses solely on the company's finances, so its scope is very limited. |

| Entrepreneur | http://home.att.net/∼simulations/entre2.htm | Involves the operation of a clothing store. Players act as administrators for making decisions that will impact store operations. Players choose between different clothing lines, set prices, advertising expenses and promotions and how much to buy each period. | Finance, Marketing and Human Resources | Shopping, clothing line, price, promotional budget and advertising, salary, return policy, market research, dividends, loans. | Financial Statements, Share Price | Players do not decide what kind of business to establish, but it turns out to be a good program for business selling products. |

| DEAL | http://www.towson.edu/∼precha/deal_1.htm | Players can establish companies in 5 interdependent industries in order to be directors, managers, purchasing agents, sales agents and customers of companies. | Sales, Finance and Customers. | Investment in capital. | Statistics | There is not much information available for this program. The simulator allows the user to choose their position in the company. |

| Corporation | http://home.att.net/∼simulations/corp/corpweb.htm | The simulator involves the operation of a multinational company. Players act as managers whose decisions involve the type of business units, the quality of the products/services, the type of risk to be taken and prices. | Finance, Human Resources and Marketing | Loans, Price, Budgets, Expansion. | Sales | The simulator focuses on developing a large company rather than a new company, so it does not cover the goal. |

Peer review under the responsibility of Universidad Nacional Autónoma de México.