This paper discusses how contingent convertible bonds (CCB) influence the risk-taking behaviour of managers. A methodology to measure the impact is presented. The results show that the decision of issuing CCB to finance company assets sets incentives to managers to increase risk, if it is not adjusted to the compensation system. However, if the remuneration of managers is adjusted simultaneously with the issuance, e.g. with internal debt, the drawbacks of the sole compensation with stock options can be equalised. Furthermore, it was found that CCB does have an impact on the risk-taking behaviour, while CCB does not change the incentive to increase the company value at all.

Se analiza cómo los bonos convertibles contingentes (CCB) influyen las conductas deriesgo de los directivos. Se presenta una metodología para medir el impacto. Los resultados muestran que la decisión de emitir los CCB para financiar la empresa incentiva alos directivos a conductas más arriesgadas, si no se ajusta el sistema de compensación. Sin embargo, si la remuneracíon de los directivos se ajusta simultáneamente con laemisión, p.ej. con deuda interna, los inconvenientes de una única compensación con opciones se compensarían. Además, hemos encontrado que los CCB no cambian losincentivos para aumentar el valor de la empresa en general.

In the aftermath of the financial crisis of 2008 the remuneration of managers of financial institutions became a widely discussed topic. In November 2013, the Swiss voted against a ceiling of manager compensation and the European Union is still undecided on whether or not it should cap variable bonus payments to the double of mangers’ fixed salary. Bonuses and other compensation features are used by shareholders to control the management. Since shareholders seek higher profit and force risk to increase, shareholders try to transfer this preference onto the managers. Recent innovations of financial instruments, such as contingent convertible bonds, can decrease the attractiveness of risk for shareholders.

Contingent convertible bonds (CCB), also known as CoCo-Bonds or CoCos, are subordinated bonds conditional on a certain event. In case the event happens, CCB instantly convert to equity or are written-down. An example of a trigger event could be the equity-ratio of a bank falling below a certain threshold (Flannery, 2005, 2010). CCB are designed to strengthen the financial stability of banks and may imply that in times of a financial crisis governments do not have to bailout banks because the conversion lowers the pressure of leverage (Flannery, 2010). Although there are a lot of similar financial instruments,1 this paper puts its focus on CCB.

Since the first issuance of CCB by the British bank Lloyds in 2009, many other banks are willing to use this new instrument to back their equity-ratio.2 In times of historically low interest rates, buyers are attracted by CCB's high yield. The Spanish Banco Santander joined the group of CCB issuer consisting of BBVA, Bankia, Banco Popular, and other European banks in May 2014. If Banco Santander's TIER-1 capital ratio falls below 5.125% (trigger point) bondholders are paid in equity.

Due to the issuance of new financial instruments, moral hazard is more likely to arise. In this context “moral hazard” means the exploitation of unobservable actions in an agency situation (Arrow, 1974; Fama, 1980). Generally, in firms or in banks particulary, one form of moral hazard is the asset-substitution or risk-shifting problem (Jensen and Meckling, 1976). As a matter of fact, a shareholder has limited liabilities and is consequently able to increase own wealth by shifting from lower risk to higher risk assets. In other words shareholders’ gains (agent) are the losses of bondholders (principle). In an extreme scenario this could lead to acceptance of negative net present value projects, justified by higher volatility (Jensen and Meckling, 1976; Gavish and Kalay, 1983). Once CCB are issued, the preference of shareholders becomes less riskier or more riskier depending on the conversion rate and the trigger event. If shareholders are better situated after conversion, CCB provide an additional capital buffer and hence an extra appeal for risk. On the contrary, if CCB holders are equally or even better situated after conversion, the risk preference of the shareholders shifts to a more prudent one (Maes and Schoutens, 2012; Berg and Kaserer, 2014). Besides the conversion rate, the trigger position can influence the risk-taking incentive as well (Koziol and Lawrenz, 2012). Thus, the CCB parameters (i.e. trigger point and conversion rate) must be aligned properly to decrease the asset-substitution problem, but still with respect to other moral hazard problems.3

Until now, research has concentrated on the impact of CCB on the incentives of risk-taking for shareholders. So far, researchers have not elucidated which implications the issuance of such instruments might have on the management of firms. Therefore, we attempt to illuminate the impact of CCB on the risk-taking behaviour of managers. To our knowledge, this paper is the first to provide a model to encounter influence of CCB on management.

The paper is structured as follows: the second section provides a literature review on the topic; Section 3 explains the theoretical model, while Section 4 presents the results and Section 5 concludes.

2Literature reviewIn literature covering these problems on the side of the shareholders is called owner-manager, caused by the presumed alignment between management and shareholders. Shareholders want their agents to control the firm on their interest, therefore shareholders set incentives for the management in form of compensation. Jensen and Murphy (1990) suggest three points to get managers to maximise the firm value: (1) managers should buy shares of the firm; (2) salaries, bonuses, and stock options should be structured such to encourage better performance; and (3) poor performance should be punished. Since a large proportion of remuneration is equity-based, we conjecture that managers preferably seek to increase the share value instead of the firm value. It can be shown that options and stock options increase in value as well when one increases volatility. Henceforth, managers will seek a level of risk (i.e. assets’ volatility) which serves them most (Hilscher and Raviv, 2014). In addition, stock options lead to another moral hazard between shareholders and managers. Because of stock options, manager may even exacerbate the risk preference of the owners (Bebchuk and Fried, 2003; Bebchuk and Spamann, 2010).

The consequences of the risk-taking incentive of equity-based compensation were explored quite profoundly. Typically, researchers observe compensation portfolio's sensitivity to the underlying firm stock (Delta) and to firms’ volatility (Vega) to derive results.4John and John (1993) found that a reduced Delta leads to lower agency costs of debt. Houston and James (1995) report no evidence of the risk-taking incentive of managers compensation. This is supported by the results of Fahlenbrach and Stulz (2011) who find no significant importance of the Vega during 2007–2009 (including the financial crisis in 2008) in their sample. Furthermore, Chen and Ma (2011) conclude that a greater part of stock options in managers’ compensation portfolio leads to lower risk-taking. Other studies, in particular Guay (1999), Rajgopal and Shevlin (2002) and Hanlon et al. (2004), find a positive relation between granted stock options and firm's risk.5Cohen et al. (2000) indicate that managers shift risk to a higher extend in case of a high Vega compensation. Furthermore, the authors assume managers to control the risk by firm's leverage. Coles et al. (2006) agree and conclude risk is controlled by “more investments in R&D, less investments in property, plant, and equipment, […] and higher leverage”. The observation of Chen et al. (2006) and DeYoung et al. (2013) also shows that stock options lead to more risk-taking.6 Both papers distinguish between total, systematic, and idiosyncratic risk. Armstrong and Vashishtha (2012) find managers with a high Vega compensation are more likely to increase only systematic risk than idiosyncratic risk, which is favoured by shareholders.

While the impact of equity-based pay, such as stock option plans, on the risk-taking incentive is quite well known, little attention has been paid on debt-based remuneration instruments, so called “inside debt”. Jensen and Meckling (1976) already mentioned inside debt could remedy some, if not all, agency cost of debt, because managers would no longer take action at an expense of debt holders. Other authors suggest inside debt to be a part of the compensation portfolio of managers alongside with stock options and other equity-based instruments (Bebchuk and Spamann, 2010; Krawcheck, 2012). While some researchers support an equally-weighted portfolio, others favour a larger part of equity-based payment for its better incentive scheme in absence of financial distress (e.g. Jensen and Meckling, 1976; Edmans and Liu, 2010). Furthermore, managers paid with inside debt would pay more attention on the firm value in times of financial distress. While equity-based pay only happens if the firm is solvent, inside debt pay-out is also contingent of the firm value in case of bankruptcy (Edmans and Liu, 2010).7 Actually, inside debt is very common. Pensions and deferred compensation have properties of debt because both are liabilities of the firm towards their managers and contingent to bankruptcy (Sundaram and Yermack, 2007; Bolton et al., 2011). Depending on the special properties of the pension plans, e.g. if pensions are senior to bonds, pensions may not be counted as debt and even lead to an inverse incentive scheme (Anantharaman et al., 2013). Nevertheless, all existing publications on the impact of inside debt on risk-taking used pensions or deferred compensation as a proxy for inside debt. It is concluded consistently that payment with inside debt reduces risk-taking incentive of managers (Sundaram and Yermack, 2007; Wei and Yermack, 2011; Cassell et al., 2012; Cen, 2012). Other empirical research observe market's reaction on announcements of inside debt pay of managers. It is shown that firms which pay managers with inside debt have a lower credit default swap spread and therefore are assumed to be less risky (Bolton et al., 2011; Wei and Yermack, 2011).8Tung and Wang (2012) investigate bankers’ compensation during the financial crisis and find that debt-based remuneration is negative correlated to risk-taking.

After the global financial crisis in 2008, a high-level expert group of the EU concluded that banks’ managers should be compensated not only with equity-based instruments, but also in parts of bail-in bonds, e.g. CCB (Liikanen et al., 2012). In 2011, the British bank Barclays initiated a contingent capital plan as part of the compensation of their board's members. A deferred cash bonus is partly released on specific dates as long as the TIER-1 capital ratio is equal to or exceeds 7%. The Swiss UBS also pays their executives with CCB contingent on an equity ratio above 10% and a positive after-tax profit. As these examples show the payment with CCB is already reality. The previously rewarded CCB compensation does not convert into equity, but cut off all or parts of the cash bonuses. If managers are paid in bonds, they would act more likely on the behalf of debt holders in times of a stable financial situation. After conversion, i.e. in a situation of financial distress, managers now paid with shares instead of bonds would act on the behalf of the shareholders in times when it is needed the most (Kaal, 2012a). But this should be observed with caution. If managers are no longer representing debt holders’ interests, the asset-substitution problem will arise.9 Therefore, Gordon (2010) proposes a kind of reverted CCB as a remuneration instrument. Its holders enjoy the advantages of shares. In case of financial distress shares convert into debt and this leads to managers to act more conservatively after conversion.

While compensation with CCB is relevant, properties of CCB need to be examined in detail such that CCB set the desired incentives to managers. As for CCB as financial instruments, CCB as payment for managers have two main design parameters: the trigger and the conversion rate. Toshniwal (2011) and Kaal (2012a) note that if manager have substantial influence on the design of the inside CCB, then there is a potential moral hazard, depending on the given compensation structure of the managers.

3ModelFor determination of the impact of CCB on the risk-taking incentives of managers, we adopt a Merton (1974) like theoretical structural model.10 This model makes the following assumptions:

- •

perfect capital market is supposed,

- •

the asset or firm value (Vt) at time t follows a geometric Brownian motion with drift, managers can influence firm's volatility (σ) over the selection of projects or the leverage of the firm (Cohen et al., 2000),

- •

the firm value V is financed by equity (E), debt (D) and CCB (C),

- •

debt and CCB are zero bonds and mature at time T, and

- •

the risk free rate (r) is given.

At the time-to-maturity the firm can pay out the shareholders only if Vt is greater than the sum of the notionals of debt (ND) and CCB (NC), where debt is senior to CCB. If positive, the difference between firm value and debt is left for shareholders, for which reason the equity can be interpreted as a call option on the firms assets. Because CCB are conditional on a trigger, they convert at time T to equity, if VT lies below a certain threshold P. Eq. (1) sets the pay-out for shareholders at time-to-maturity (ET) depending whether CCB convert or not.

Fig. 1 shows an example of an equity pay-out profile. In this example, V0, ND, NC, and P. Hence, P represents a threshold or trigger point of 5% capital ratio. In case CCB are are normal debt, it can be seen that equity pay-out is zero if the firm value is less than the sum of all debt. In case of the existence of CCB in the capital structure (black dotted line), the pay-out to shareholders is prolonged, due to the conversion of the CCB.11

As the pay-out structure of equity (Eq. (1)) behaves like a call option on the firm's assets and under the given assumptions, the value of equity can be calculated as a combination of a standard call and a binary option, representing the influence of the CCB. Hence, it is explicitly given by

where Φ(·) denotes the standard normal distribution function and

To evaluate the risk-taking incentive, it is assumed that the managers of the firm are paid with manager options (MO) with a strike price K. If there is only one share, the manager option can be evaluated at time (t=0) as:

As a possible addition to the remuneration, managers can be paid with inside debt, e.g. with CCB. The manager's CCB (MC) can be valued as a binary option for which pay-out is dependent on a specific threshold (PMC):

Both stock options and manager's CCB are combined in an remuneration portfolio (PF), consisting of α parts manager CCB and 1−α parts stock options:

where α∈[0, 1].Due to the dependence of the portfolio on equity, the impact of the CCB in the capital structure can be shown upon the remuneration. As a drawback of this modelling, the managers CCB are not part of the capital structure, i.e. they are expected to have no influence on the capital structure.

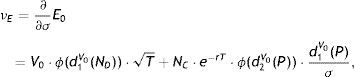

To measure the incentive of risk-taking of managers, Vegas are calculated (Vega of the stock option and of the manager CCB) as the following:

where ϕ(·) denotes the standard normal density function.Furthermore, deltas are computed as well to measure the alignment of the management with the shareholders:

4ResultsThe following scenario is created to measure the impact of CCB on management12: the total assets are set to V0=100, the par value of the normal debt is ND=85, the par value of the CCB is NC=5, the threshold or trigger value is set to P=95 which represents a 5% capital ratio, the risk-free rate is r=0.05, the firm's volatility is σ=0.05, and the time-to-maturity T=0.25. The remuneration parameters are: strike price of the stock option K=100 and the threshold or trigger value of the inside CCB is PM=95, which represents a capital ratio of 5%.

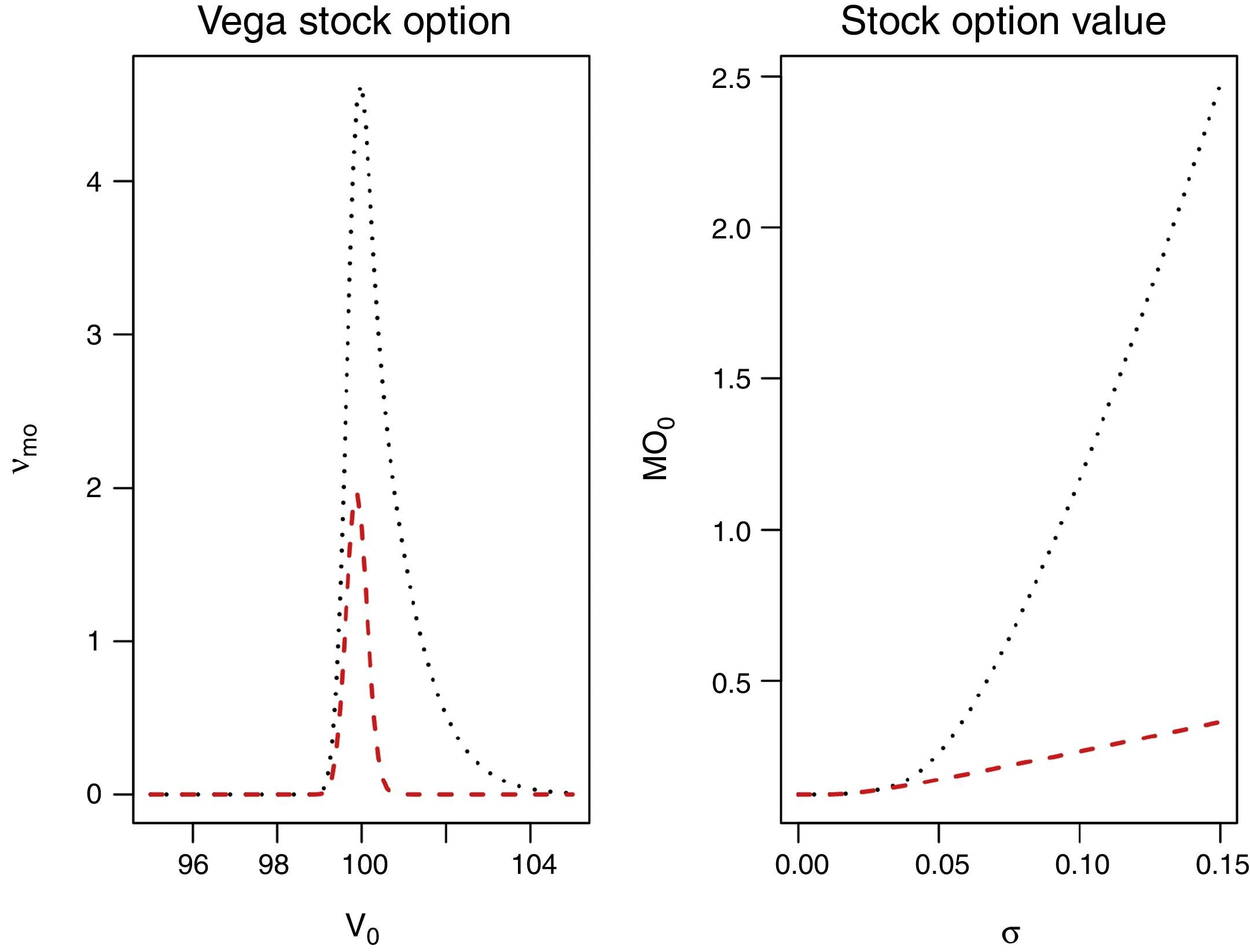

4.1Stock optionsOn the left-hand side of Fig. 2 one can see Vega of the stock option (νMO) as a function of the firm value with a fixed time-to-maturity (T=0.25). The black dotted line indicates the case where CCB are included in the financial structure, while the red dashed line shows the Vega when no CCB are issued.

In each case the highest sensitivity-to-volatility is around the strike price of the stock option (K=100). Only the level of the peak differs between both lines. On the right-hand side of Fig. 2 the value of the stock option is shown as a function of risk, by name the volatility of the firm's assets (σ). The slope of the line indicating CCB in capital structure is steeper than the one without CCB. Fig. 2 suggests that the issuance of CCB in the capital structure of a firm exaggerates the risk-taking incentive for managers. This finding supports Kaal (2012b), who anticipate manager to “shift their risk preference towards even higher risk profiles” when CCB are issued by the firm. Seeking to raise their own wealth, manages simply increase σ. It should be mentioned that this is independent from the dilution effect of the CCB, because the stock option relates to the equity as a whole. The higher peak of the Vega with CCB can be explained by the same argument. The independence leads to more equity when more risk is taken.

While Fig. 2 only shows the firm value corresponding Vega, one can explore the time-varying properties of managers’ option Vega with Fig. 3. The left plot of Fig. 2 illustrates a cross-section of Fig. 3 at T=0.25. When time-to-maturity rises, the sensitivity-to-volatility of the stock options around the strike price increases as well. Moreover, the spread around the strike price is widening in time, suggesting a greater bandwidth of risk-taking incentive.

One can see from both plots of Fig. 4 that the issuance of CCB has no effect on the Delta of the stock options. The left plot shows Delta as a function of the firm value (V0), while the right plot represents the value of the stock option as a function of V0.

It can be assumed that the stock option has a positive influence on the incentive to increase the firm value only if V0 is already higher than the strike price of the stock option. This observation supports the policies of firms to pay their managers with stock options “at-the-money” and to reprice them if the firm value has dropped significantly.13

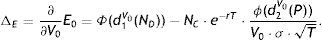

4.2Inside debtWhile the last subsection observed the behaviour of managers who are paid with stock options, this subsection focuses on the results when inside debt, especially CCB, is paid. It can be derived from Fig. 5 that the incentive for managers to increase risk is only relevant in times of financial distress.

The Vega hits its peak near the trigger point (P=95). The result only holds, if CCB do not convert instantly, but at time-to-maturity. Till then, managers could increase risk to pull firm value above the trigger point.14 Once the firm value is higher than the trigger, the manager will decrease risk near the trigger point to avoid the downside. The right plot also shows that more risk decreases wealth of managers. The use of CCB as capital instruments in the financial structure of the firm is not relevant to the risk-taking incentive of managers. Therefore, managers who are only paid with inside debt would try to decrease risk in order to increase their wealth. This confirms former research of inside debt.

The same conclusion can be drawn by taking different time-to-maturities into account (see Fig. 6). The risk-decreasing feature of inside debt is widening over time. If the firm is not in financial distress (i.e. V0>P=95) inside CCB have little to no effect, because managers’ CCB only change their value around the trigger point or if it is likely that the firm will be in distress at time-to-maturity.

Left-hand side of Fig. 7 plots the Delta, which only have a value around the trigger point. Hence, only if it is likely that the firm will recuperate from financial distress, Delta is positive and the inside debt provides an incentive to increase firm value. Furthermore, it is apparent from the right plot that the value of the manager's CCB only rises in this area and stays on the same level if the firm value increases. Both observations indicate that managers do not have an incentive to increase the firm value at all once the firm is out of the zone of financial distress.

As a result of the given observation, the sole remuneration of managers with inside debt not only decreases the incentive of risk taking, but also decreases the incentive to increase shareholder value. Hence, managers should neither be paid solely with stock options nor inside debt. A mixture of both in a compensation portfolio may lead to a satisfying result and will be discussed in the following subsection.

4.3Compensation portfolioAs defined in Eq. (5), the portfolio consists of α parts of inside CCB and 1−α parts of stock options. This can be seen in the four plots of Fig. 8. The top plots represent the Vega of the compensation portfolio with and without CCB in the capital structure and the bottom plots illustrate the associated portfolio values dependent on σ. One can see that α=0 and 1 result in the individual plots shown in Figs. 2 and 5, respectively. The comparison of the graphs under consideration of CCB in the capital structure leads to the conclusion that CCB exaggerate the risk-taking incentive for managers around the strike price of the stock options. Nevertheless, a bigger part of inside debt diminishes this effect and even leads to a risk aversion. A equally-weighted portfolio actually clears the risk-taking incentive, as considered by Sundaram and Yermack (2007).15

While in an equally-weighted portfolio managers have no incentive to increase risk, they still have an incentive to increase the firm value. In the absence of financial distress the Delta of the portfolio is always greater than zero as long as there is at least some remuneration with inside debt (see Fig. 9).16 Furthermore, the mixture of inside debt and stock options forestall the repricing of “out of the money” stock options, because even though options are “out of the money” managers still have an incentive to increase firm value due the impact of inside CCB.

5ConclusionThe results show that the decision of issuing CCB to finance firm's assets sets incentives to managers to increase risk, if the compensation is not adjusted simultaneously. However, if the remuneration of managers is adjusted at the same time with the issuance, e.g. with inside debt, the drawbacks of a compensation solely based on stock options can be equalised. While the CCB included in capital structure do have an impact on the risk-taking behaviour, they do not change the incentive to increase the firm value at all.

Because these results are derived from a model, some of the assumptions have to be reflected cautiously. We assume that managers are only paid with either stock options, inside debt, or a portfolio containing a mixture of both. We do not consider other forms of performance-based compensation. A possible extension of the model could involve compensation with shares or even salaries.17 Furthermore, the basic assumptions of the option pricing model do not fit the reality, where neither stock returns are log-normally distributed nor the volatility is constant. Whether CCB convert in the model is decided at time-to-maturity (European option characteristics) or not, but times of financial distress and time-of-maturity of the CCB are not necessarily the same.18 Although we observe the time-varying influence on Vega, further research of sensitivity of the incentives regarding time is needed. As mentioned before, the remuneration in the model is not connected to the capital structure. Further research to examine the backlash of the remuneration due its dilutive effects is suggested. Also, it is uncertain if managers are able to influence volatility of asset returns. More likely, managers control risk by investment decisions and leverage, which are only two of many determinants of firms’ assets volatility.

Eventually, CCB decrease the asset-substitution problem, but increase managers’ risk-taking incentives. Therefore, the incentive of shareholders to give incentives has changed with the transformation of the capital structure (Calcagno and Renneboog, 2007). Hence, stock options might be no longer shareholders’ first choice for managers’ remuneration.

We thank Tobias Berg, Hermann Locarek-Junge, Antonio Roldan-Ponce, Johannes Steinbrecher, and an anonymous Reviewer for comments, ideas, hints and remarks

While Duffie (2010) proposes a forced issue of shares on a trigger event, Kashyap et al. (2008) suggest a capital insurance, where an insurance company pays a certain amount in case a threshold is broken.

See Berg and Kaserer (2014) for an overview until 2013.

For instance the debt-overhang problem (Myers, 1977, 1984; Myers and Majluf, 1984).

Delta and Vega are part of the so called option Greeks, which represent first and higher order partial derivatives of the option price with respect to one or more parameters of the option price.

The subject of the aforementioned was not the risk-taking incentive of the manager, but the lowering of the agency cost of equity due to the assumed risk aversion of managers without equity-based compensation.

Both concentrate research on the banking sector and find stock option plans are more common in banks than other industries.

This is quite questionable, because managers who may lead the firm into bankruptcy would even get paid for that.

Gerakos (2010) finds that either pension commitments are used to remedy the asset-substitution problem or CEOs are more likely to accept contracts with firms of good solvency. Therefore, it is not clear, if inside debt leads to low credit default swap spreads or if managers accept inside debt because of the low spreads.

Therefore the cut-off of the cash bonuses after triggering can be seen as a digital option, which has a fixed pay-out if the underlying price is above the strike price.

Some of the further modification are motivated by a former version of Berg and Kaserer (2014) (August 2012).

Berg and Kaserer (2014) call this type of CCB “Convert-to-Steal”.

These are the same values Berg and Kaserer (2014) used in a former version of their paper (August 2012) to analyse the risk-taking incentive of CCB on shareholders.

The repricing seems to stand in completely contradiction to the principles of shareholder value (Sautner, 2005).

If CCB do not convert instantly, managers have time to manoeuvre until time-to-maturity. In reality, CCB either convert instantly, leaving managers no choices, or the conversion-decision is depended on the next financial statement of the firm, with short period of time for managers to react.

Sundaram and Yermack (2007) conclude “if the debt-to-equity ratio of the manager's holdings is less than the firm's debt-to-equity ratio, the manager has an incentive to increase risk, and vice versa”. The authors define the debt-to-equity ratio as the relation between debt- and equity-based parts of the compensation portfolio of a manager.

As shown above, the issuance of CCB in the capital structure has no impact on the Delta of the compensations instruments. For that reason, we do not distinguish between Delta with and without CCB.

Salaries, for instance, could be modelled by a binary option, with a strike price representing a firm value at which the manager would be dismissed.

Berg and Kaserer (2014) use a Monte-Carlo based approach to include the possibility of conversion during the observed period.