Malaysia's success story has been highlighted by the remarkable social transformation and poverty reduction accompanying rapid economic growth. Some three decades ago, more than half of the population was poor, the number of illiterates was high, and the average person could only hope to live until the age of 48. The proportion of poor people is currently down to 5.6 percent, 90 percent of adults are literate, and life expectancy is up to 68 years. Although Malaysia's population has increased from approximately 10 million in the 1960s to about 28 million in 2010, the number of poor people has dropped significantly during this period. This paper attempts to determine the empirical relationship and importance of growth for poverty reduction in Malaysia. The results show that growth explains much, but not all, about the evolution of poverty. Economic growth is necessary but not sufficient for poverty reduction, especially if the objective is rapid and sustained poverty reduction. This study proposes that if a policy's objective is focused on poverty alleviation, poverty reduction as well as economic growth should be simultaneously taken into account as the final target.

La historia del éxito de Malasia se ha visto evidenciada por la sorprendente transformación social y la disminución de la pobreza que han acompañado al rápido crecimiento económico. Hace unos treinta años, más de la mitad de la población era pobre, las tasas de analfabetismo elevadas y el ciudadano medio sólo podía esperar llegar a los 48 años. La proporción de población pobre actualmente se ha reducido al 5,6 por ciento, el 90 por ciento de los adultos cuenta con una educación y la esperanza de vida alcanza los 68 años. Aunque la población de Malasia se ha visto aumentada de los aproximadamente 10 millones en los años 60 a los 28 millones registrados en 2010, el número de ciudadanos pobres ha decaído de forma significativa durante este periodo. Este artículo pretende determinar la relación empírica y la importancia del crecimiento en la mitigación de la pobreza en Malasia. Los resultados demuestran que el crecimiento tiene mucho que decir, aunque no todo, en la evolución de la pobreza. El crecimiento económico resulta necesario, aunque no suficiente, para paliar la pobreza, sobre todo si el objetivo es una reducción rápida y sostenida. Este estudio propone que, si el objetivo de una política se centra en paliar la pobreza, tanto la reducción de la misma como el crecimiento económico acabarán siendo parte simultáneamente del objetivo final.

1. Introduction

Since independence in 1950s Malaysia has been recognized as one of the more successful countries in fighting poverty. Poverty has decreased tremendously from 52.4 percent in the 1970s to about 3.6 percent in 2009. This decline has been attributed or associated to many factors, including economic growth. It is widely believed that economic growth measured in terms of GDP growth is directly related to poverty reduction. In other words, a high growth of GDP can more often than not help to lessen poverty. GDP growth therefore has a close relationship with the poverty levels in any country. In fact, most economists believe that economic growth benefits nearly all citizens of a country, if not equally, at least in reducing poverty. The extent to which these benefits are felt by various groups is reflected as a change in the distribution of income. If economic growth raises the income of everyone in a society in an equal proportion, then the distribution of income will not change. However, if economic growth raises the incomes of certain groups in a population, there will be a change in the distribution of income. This can be seen when certain groups in a population become richer or poorer.

This paper attempts to determine the empirical relationship and importance of growth for poverty reduction in Malaysia. The paper is organized as follows. Section 2 presents selected literature review. Section 3 explains the data and methodology used. Section 4 discusses the empirical results. The last section draws discussions and conclusions from the empirical analysis.

2. Selected literature review

Early studies found that an increase in poverty as a result of economic growth is a very rare and exceptional combination. Economic growth has not typically had a significant negative impact on the relatively poor (Ravallion, 1995). A study by Fields (1989) suggested that of 18 countries with data on poverty over time, in only one case was economic growth not accompanied by a fall in poverty. Moreover, Fields found that more rapid economic growth tended to bring greater declines in poverty.

A study by Roemer and Gugerty (1997) on 26 developing countries demonstrated that economic growth benefits the poor in almost all the countries in which substantial growth has taken place. Indeed, economic growth appears to be one of the best ways to reduce poverty. The poor do better in countries that grow quickly, even if income distribution deteriorates slightly. Countries which have experienced rapid economic growth over the last thirty years, such as Hong Kong, Korea, Malaysia, and Indonesia, have seen the per capita income of the bottom 20% and 40% of the population grow significantly. Another conclusion of this study is that income distribution changes very slowly, and that a policy that aims at redistributing income at the expense of economic growth may have very low payoffs in terms of poverty reduction.

Warr (2001) conducted a study on the relationship between changes in the headcount measure of absolute poverty incidence and the rate of economic growth in South Asia (India), East Asia (Taipei, China), and four countries in Southeast Asia (Indonesia, Malaysia, the Philippines and Thailand). Using data covering the period from the 1960s to the 1990s, he found that the relationship between the change in absolute poverty incidence and economic growth per person is significant and approximately the same for all six economies. The study also shows that the growth rate of real GDP per person has a significant influence on the rate of poverty reduction.

Income growth per capita is the main source of reduction in poverty in most countries. This has been supported empirically by the studies of Tendulkar and Jain (1995), and Ravallion and Datt (1996). Dollar and Kraay (2000, 2001, 2002) showed data from over 70 countries supporting the view that high growth rates of real gross domestic product (GDP) per capita are associated with a more rapid reduction in poverty. The role of economic growth in poverty reduction has also been supported by Deaton and Dreze (2001), Bhagwati (2001), and Datt and Ravallion (2002). Furthermore, in a study on economic growth and poverty reduction in Kazakhstan using provincial data, Agrawal (2008) found that provinces with higher growth rates achieved a faster decline in poverty. Reduction in poverty was largely due to growth, which led to increased employment and higher real wages.

In contrast, Ravallion's (1997) study found that inequality in income distribution among the poor can increase poverty despite good underlying growth prospects (see also Lustig, Arias & Rigolini, 2002; Bigsten et al., 2003; Salvatore, 2004; Townsend, 2005). On globalization issues, Salvator (2004) stressed that globalization as a process has not enabled the poorest countries to participate in the tremendous benefits in terms of economy efficiency and growth in living standards that globalization has made possible, which resulted in an increase in inequalities between rich and developing countries and the poorest developing nations. In addition, Townsend (2005) reviewed a book entitled "The End of Poverty: How We Can Make It Happen In Our Lifetime", written by Jeffrey Sachs, an Economist from Harvard University, and found that benefits to the poor are not traced from source to beneficiary and there is no nationwide system of delivery. He added that a 'trickle-down' effect is not quantified.

Another reason is that the decomposition of the changes in poverty into growth and redistribution components suggests that the potential poverty reduction due to increased real per capita income has to some extent been counteracted by worsening income distribution (Bigsten et al., 2003).

According to Lustig et al. (2002), there are three different scenarios of identical average increases in per capita income; (i) the earnings of the top income quintile rose (the distribution worsened); (ii) everyone's income increased in the population (no change in the distribution); and (iii) the bottom quintile's income climbed (the distribution improved). The first scenario showed no absolute reduction in poverty and in the third scenario there will be a proportionally steeper reduction. These scenarios clearly confirmed that the efficiency of average growth in reducing poverty is heavily dependent on income distribution.

Furthermore, the reproducibility of the data used in cross-country comparisons of poverty measures is often questionable. This is due to the differences in household surveys, the living standard indicator used and real values of poverty lines. Some of these differences could lead to biased assessments of the impact of economic growth on poverty (Ravallion, 1995).

To conclude, several studies (Ravallion, 1995; Rodrik, 2000; Akbar, 2004) found that GDP growth is neither a necessary nor a sufficient condition to combat poverty, and Ravallion (1995) emphasized that not all poverty reduction issues are associated with economic growth. This observation therefore motivates the conduct of this study in Malaysia by looking into the relationship between growth and poverty incidence where the empirical evidence is still not clearly developed.

3. Data and methodology

Both annual time series data, which are Real Gross Domestic Product (RGDP) as a proxy to economic growth and the Poverty Rate (POV) from the period 1970 to 2009 in this study, were obtained from the Department of Statistics of Malaysia and the Central Bank of Malaysia. Both variables were transformed to logarithmic form. This research applied the ARDL bounds testing approach to cointegration, ECM based on ARDL framework and the Toda-Yamamoto approach for causality analysis.

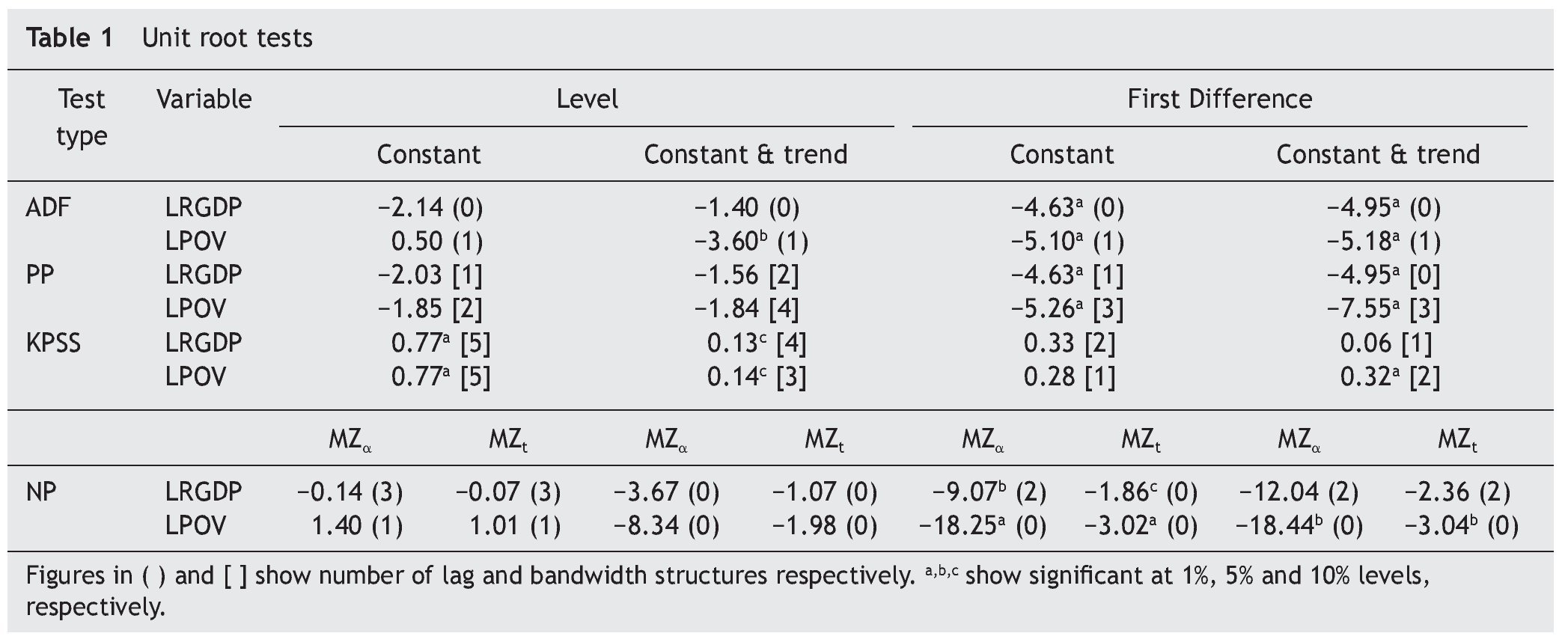

To check the stationarity of the series variables as well as the order of integration, unit root tests were conducted using Dickey-Fuller, DF or Augmented Dickey-Fuller, ADF (Dickey & Fuller, 1979), Phillips-Perron, PP (Phillips & Perron, 1988), Kwiatkowski-Phillips-Schmidt-Shin, KPSS (Kwiatkowski et al., 1992), and Ng-Perron, NP (Ng & Perron, 2001) tests. The optimal lag length was chosen based on the lowest SIC value.

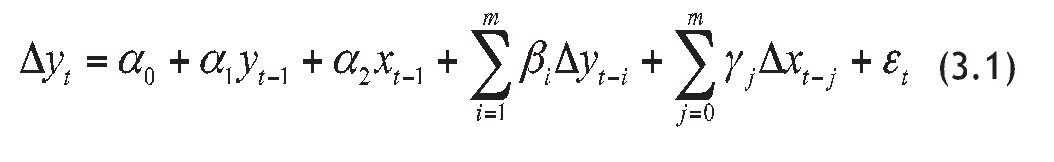

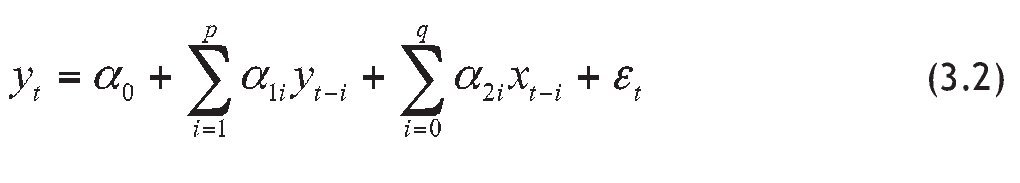

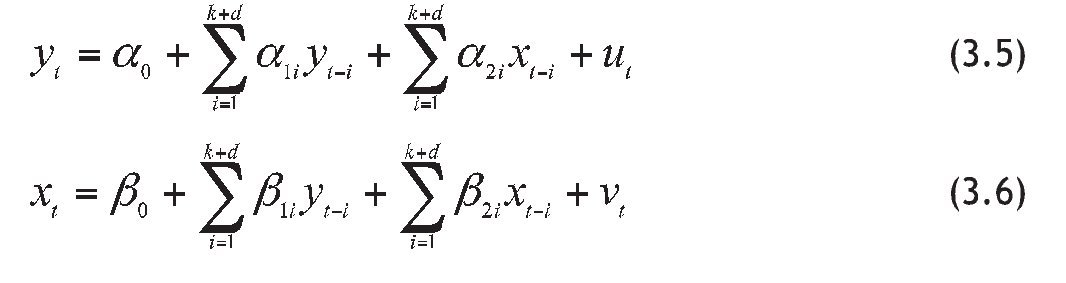

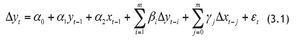

This study used the Autoregressive Distributed Lag (ARDL) bounds testing approach for cointegration by Pesaran, Shin and Smith (2001) to check for the long-run movement of the variables as well as to consider the robustness of the results. The ARDL bounds testing approach is given as follows:

where, α0 is the drift component, and εt is the white noise error. Following Pesaran et al. (2001), two separate statistics are employed to 'bounds test' for the existence of a long-run relationship: an F-test for the joint significance of the coefficients of the lagged levels in Eq, (3.1) (so that, H0 : α1 = α2 = 0), and a t-test for the null hypothesis H0 : α1 = 0 (see also Banerjee, Dolado & Mestre, 1998). Two asymptotic critical value bounds provide a test for cointegration when the independent variables are I(d) (where, 0 ≤ d ≤ 1): a lower value assuming the regressors I(0), and an upper value assuming purely I(1) regressors. If the test statistics exceed their respective upper critical values we can conclude that a long-run relationship exists. If the test statistics fall below the lower critical values, we cannot reject the null hypothesis of no cointegration. If the statistics fall within their respective bounds, inference would be inconclusive. This technique is considered appropriate and robust for a small or finite sample size (Pesaran et al., 2001). In addition, for long-run relations analysis, we have considered the general form of the conditional ARDL(p,q) model as follows:

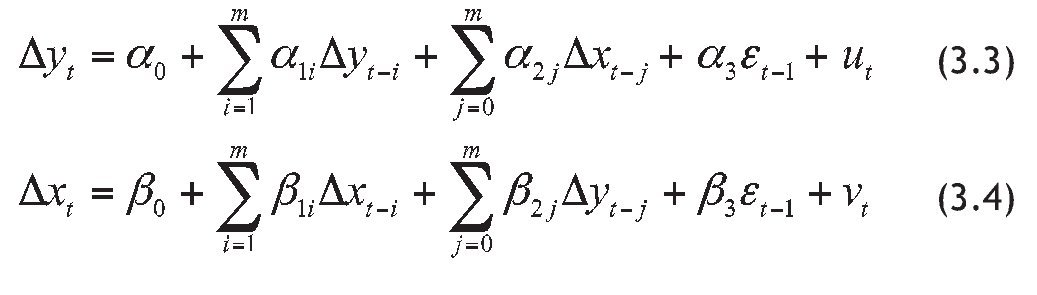

After determining the existence of the long-run cointegration relationships, the causal relations issue in this study is tested by applying the Error Correction Model based on ARDL (ECM-ARDL) and the Toda-Yamamoto procedure. By applying the ECM-ARDL approach, in the case where yt and xt are stationary variables I(0), Eq. (3.3) and Eq. (3.4) without the error correction term can be estimated using the least squares method in level form. However, if yt and xt are non-stationary variables, I(1) and are not cointegrated, the ECM model such as Eq. (3.3) and Eq. (3.4) without the error correction term in the first difference form can be used, whereas Eq. (3.3) and Eq. (3.4) in the ECM-ARDL framework can be used in the case where yt and xt are I(1) and cointegrated.

where,εt-1 is the error correction term or cointegrating vector obtained from cointegration tests. xt is Granger cause to yt if all a2j in Eq. (3.3) are significant without taking β2j in Eq. (3.4) into account. On the other hand, yt would Granger cause to xt if all β2j in Eq. (3.4) are significant without taking a2j in Eq. (3.3) into account. A bilateral causal relationship exists between yt and xt if allα2j and all β2j are significant. Coefficients α3 and β3 are referred to as error correction coefficients because both coefficients show a number of variables in yt and xt reacting to the cointegrating error which is yt-1 - α0 - α1xt-1 = εt-1 or yt¿1 - β0 - β1xt¿1 = εt-1.

The modified Granger causality test that is considered to be more competent and has a greater ability for features of the cointegration process was proposed and introduced by Toda and Yamamoto (hereinafter TY) in 1995, with the main purpose of overcoming problems relating to invalid asymptotic critical values when causality tests are conducted on a non-stationary variable series. According to Toda and Yamamoto (1995), the TY approach basically involves an estimate on the VAR (k+dmax) model, an addition where k is the optimal lag length in the original VAR system and dmax is the maximum integration level for variables in the VAR system. The TY approach uses a modified Wald (MWald) test for zero constraint on parameters in the VAR (k) model. As for the remainder of the autoregressive parameters with lag, dmax is assumed as zero and left in the VAR (k+dmax) model. This test has an asymptotic chi-square distribution with limited k degree of freedom when VAR (k+dmax) is estimated. The modified TY approach in the bivariate format is as follows:

where, α, and β are unknown parameters, k is the optimal lag length and d is the maximum integration level towards a variable series in the system. Moreover, u and v are error terms and are assumed as white noise. Lag length k is initially selected based on AIC. However, the length of lag k is later added with more lags depending on the probable integration level (d) for the variable series yt and xt. The significance test is carried out on variables in the VAR system only up until lag (k), not including the additional (d) lag in determining the causal relationship between yt and xt in the VAR system.

4. Results

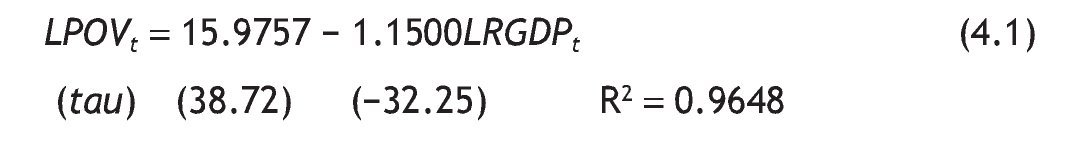

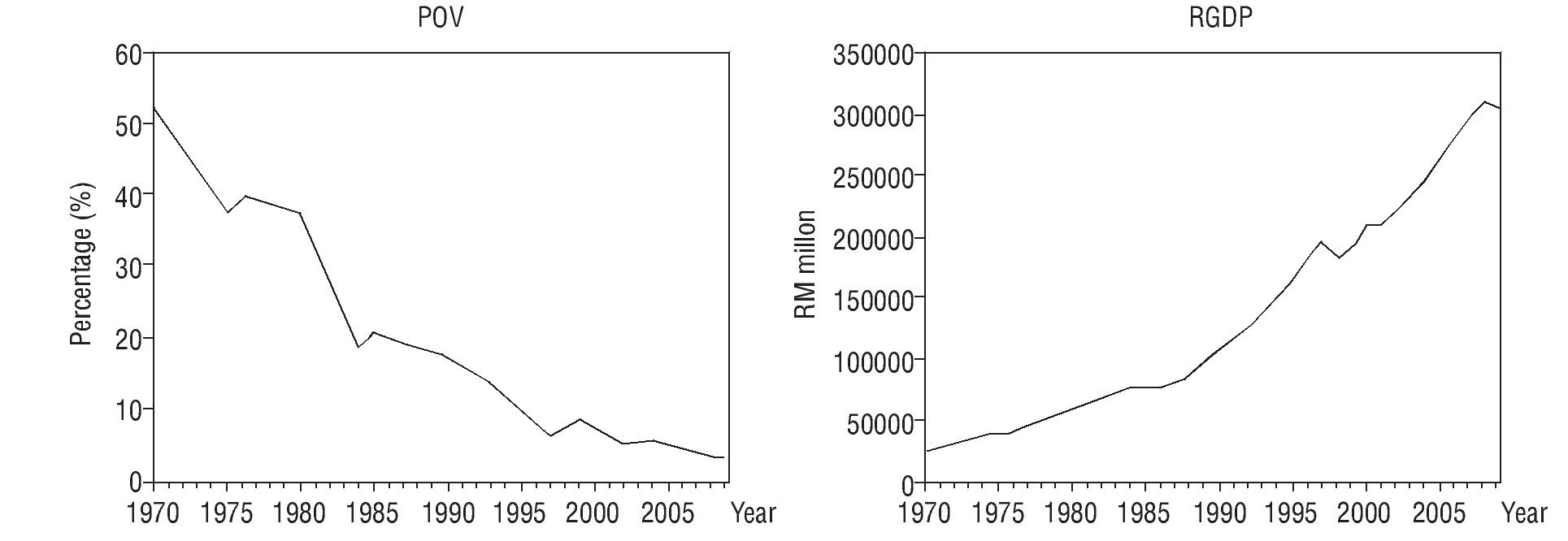

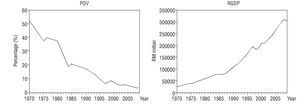

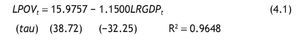

Figure shows that both variable trends tend to move in opposite directions over time from 1970 to 2009. Using traditional standard regression (OLS), the relationship between the POV and the RGDP is shown in the following estimated equation:

Figure. Poverty rate and real GDP.

Eq. (4.1) shows that the coefficient for RGDP is significant at 1 percent significance level, suggesting that there is a negative relationship between the POV and the RGDP. If the RGDP increases by 1 percent, the POV will decrease by about 1.15 percent. Nevertheless, this traditional regression comes up against certain problems associated with stationarity issues. A unit root test should therefore be conducted first to ensure the stationarity of the series variables.

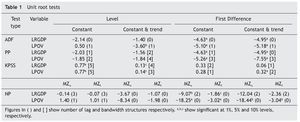

The results of the unit root tests based on ADF, PP, KPSS and NP are shown in Table 1. In general, all variables are said to be stationary at first difference (both constant and constant & trend), excluding the POV which is stationary at level based on the ADF test (constant & trend), but stationary at first difference if only constants are taken into account (both ADF and PP tests). KPSS statistics under the null hypothesis of stationarity also confirm that all variables tend to be stationary at first difference if only constants are taken into account, while for constant and trend, only the RGDP showed stationarity at first difference. POV on the other hand is not stationary either at level or first difference. The NP test (only MZa and MZt statistics are shown in Table 1) is more robust and produced some interesting results. Although statistics MZa and MZt both produced mixed results in certain cases, both statistics have a tendency to reject the null hypothesis of a unit root at first difference (with no concern for the assumption of constant and constant & trend). The results using MZa and MZt tend to support stationarity for all variables at first difference (constant and trend), except for RGDP, which is stationary under the assumption of constant with no trend only.

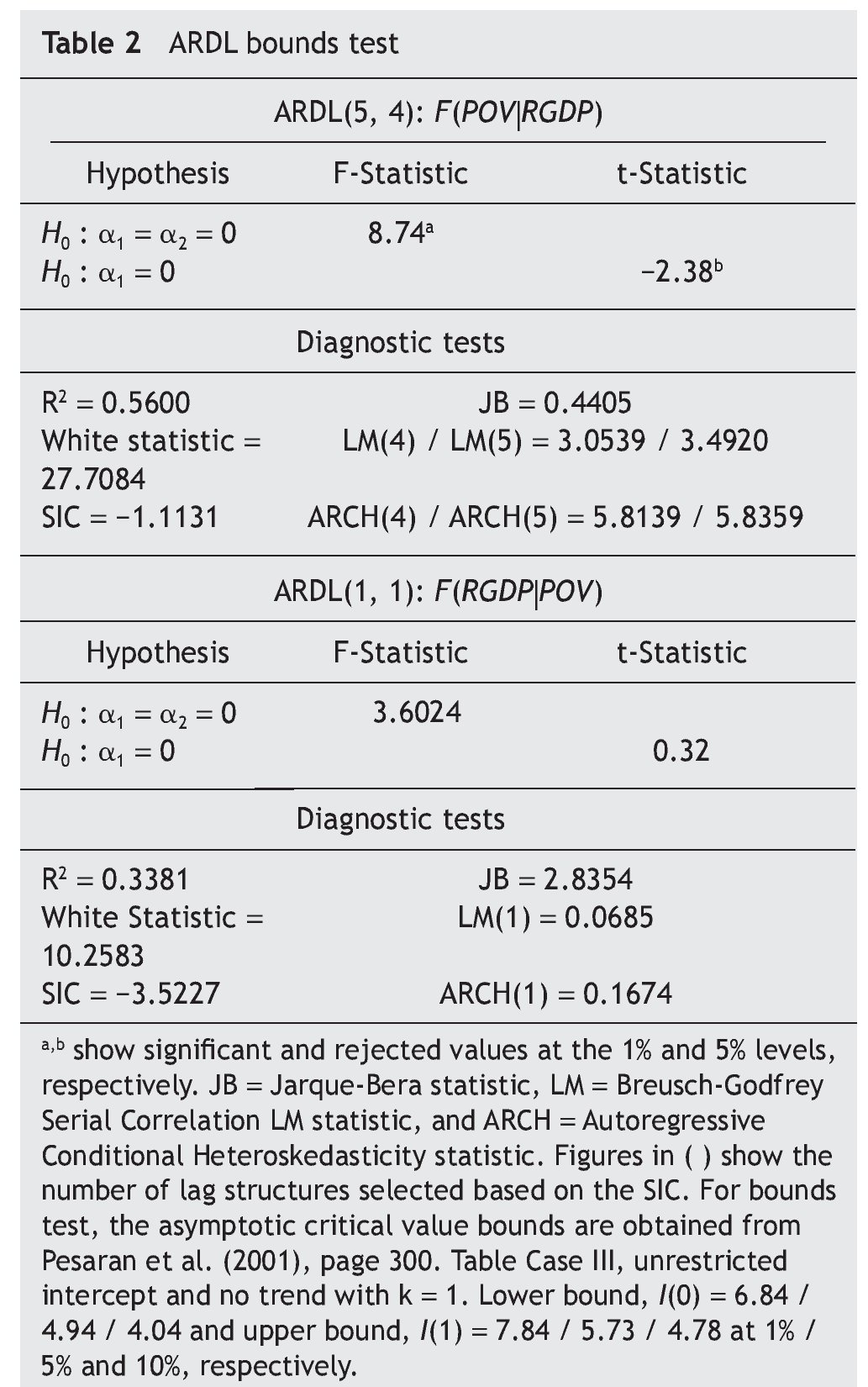

The existence of a long-run cointegration relationship is tested using the ARDL bounds testing. As in Table 2, the result shows that both of the variable series could cointegrate and tend to move together towards equilibrium in the long run (Table 2). This empirical decision proposes that both of the variables could be cointegrated in long-term periods.

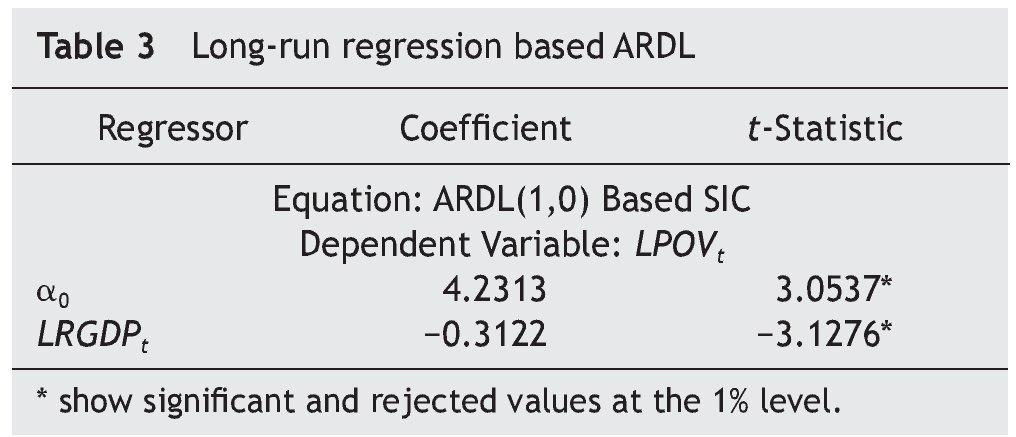

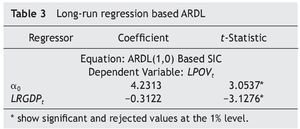

The estimated long-run relationship-based ARDL between POV and RGDP is shown in Table 3. The estimated coefficient for RGDP, which is ¿0.3122, is significant at 1% level, showing that there is a negative long-run relationship between POV and RGDP. In other words, RGDP has a negative effect on POV in the long run.

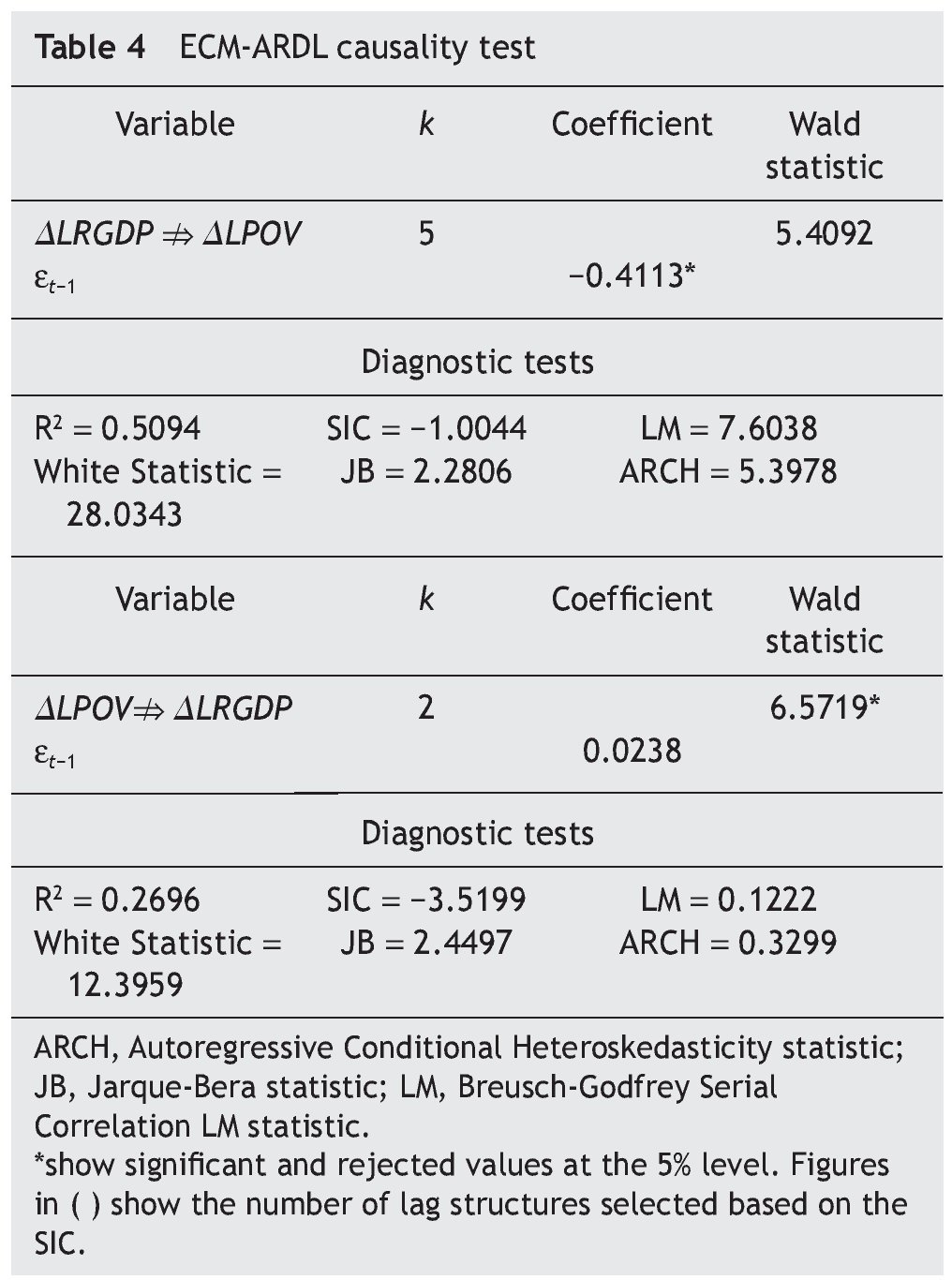

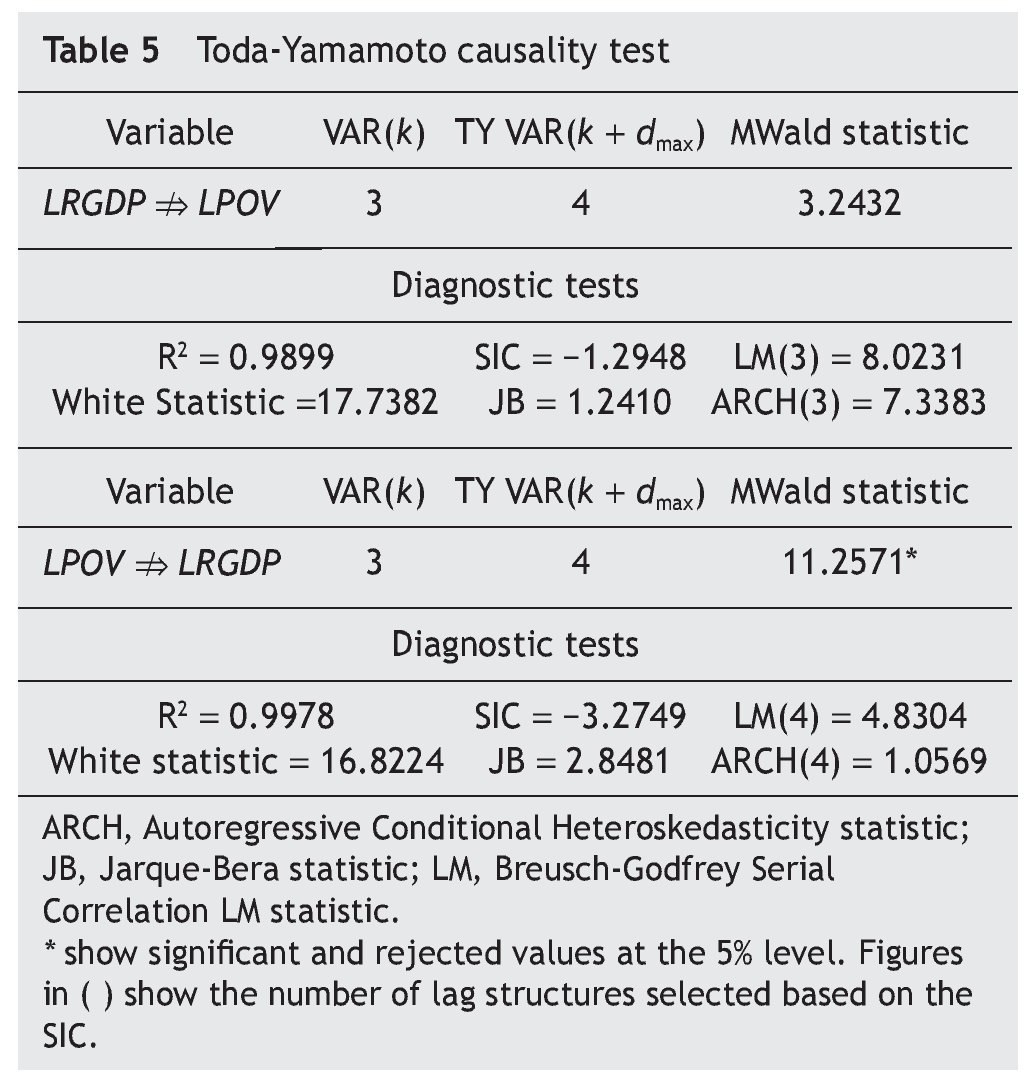

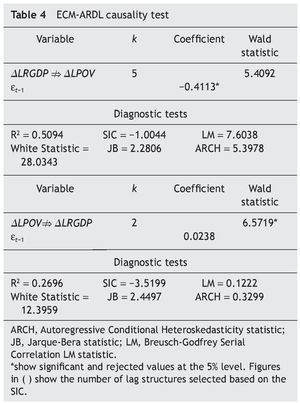

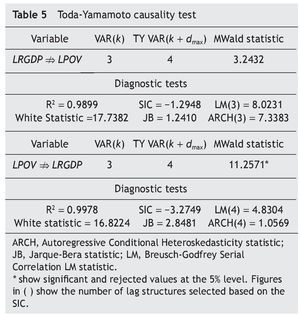

Causality tests based on the ECM-ARDL and TY approach revealed that there is only a one-way short-run causal relation between RGDP and POV from the POV to the RGDP (Table 4 and Table 5). Meanwhile, the error correction coefficient is also significant at the 5 per cent level, showing that RGDP and POV are responsive to the discrepancy in error correction from long-run equilibrium (Table 4). The negative sign of the adjustment coefficient speed is in accordance with convergence toward the long-run equilibrium. The imbalance between RGDP and POV is corrected or adjusted at an average pace of 0.41 or 41 per cent each year. The negative error correction coefficient value shows that RGDP will decrease by 0.41 as a reaction to the imbalance caused by shocks occurring in the long run.

Finally, diagnostic tests to assess the model adequacy were performed to determine whether the residuals of each model approximate white noise. The diagnostic test results confirmed the adequacy of the model (Table 2, Table 4 and Table 5).

5. Discussion and conclusion

Economists believe that economic growth benefits nearly all citizens of a country and therefore reduces poverty. If economic growth raises the income of everyone in a society in an equal proportion, then the distribution of income will not change. However, if the growth occurs without a reduction in poverty, income distribution could become unequal. It is possible that rapid growth could take place without any reduction in poverty, but this is unlikely, as many studies show. Indeed, it is also possible for income distribution to worsen somewhat while the income of the poor increases.

There is also the opinion that countries with higher rates of economic growth over the last 30 years have achieved greater reductions in poverty. Another view suggests that if someone wants to reduce poverty, special attention should be paid to economic growth. Is this true? But then it might not be the faster strategy to reduce the poverty rate. In the last decade, the former group insisted that growth in itself would eventually lead to rising income, including among the poor. But the latter side disagreed somewhat and emphasised the pattern of growth instead. For example, the Harvard Economist Dani Rodrik claimed in 2000 that growth is not only good for the poor, but also for economic growth.

A constant and 'mysterious' question in development economics is whether economic growth is enough by itself to reduce poverty. The fact that so many of the world's poor now live in middle income countries (which, by definition, have experienced a reasonable amount of economic growth) suggests that growth by itself is not enough to reduce poverty. The persistent problem of poverty in the developing world has led many to question the efficacy of economic growth and development as a means of poverty alleviation.

Sound macroeconomic policies and openness to the world economy may be important in reducing poverty. These policies operate mainly through their effect on economic growth: countries with better macroeconomic policies grow faster, and this growth eventually alleviates poverty (Roemer & Gugerty, 1997). In the late 1990s, the prevalent strategy was to reduce poverty by targeting basic social services. Development interventions were scrutinised for measurable evidence of direct impact on the poor. This seemed sensible: after all, what was the point of growth (and how could it last) if poverty remained entrenched?

If economic growth is said to be good for the poor or to reduce the poverty rate, why is there still the problem of poverty in every country around the world? Even highly developed countries with advanced economies such as the US, the UK, Japan and so forth still experience the poverty problem. Poverty is still rampant, and the evidence based on the previous studies on which policy emphasis works is mixed. Though economic growth (based on theories and past literature reviews) can undoubtedly reduce poverty rates, the evidence in this study shows that reducing the poverty rate could also increase economic growth and not the other way round. As in Lustig et al.'s (2002) study, reducing poverty can help boost economic growth rates. The pro-growth actions and those directly targeted at improving the lives of the poor are very often mutually reinforcing. Therefore, the more complementarity is tapped, the more effective economic growth can be in reducing poverty.

To obtain better results, further research is needed to better understand the evident diversity in the impacts of growth on poverty and the role that policies have played. While good policy¿making for fighting poverty must obviously be concerned with the aggregate impacts on the poor, it cannot ignore the diversity of impacts underlying the averages, and it is here that good micro empirical studies can help. This diversity also provides potentially important clues as to what else needs to be done by governments to promote poverty reduction, on top of promoting economic growth. To conclude, this study proposes that if a policy's objective is focused on poverty alleviation, poverty reduction as well as economic growth at the same time should be taken into account as the final target.

Received December 9, 2011; accepted March 7, 2012

*Correspondig author.

E¿mail address:morikogid@gmail.com (M. Kogid).

References

Agrawal, P., 2008. Economic growth and poverty reduction: Evidence from Kazakhstan. Asian Development Review 24(2), 90-115.

Akbar, M., 2004. Is poverty rising in Pakistan. DAWN - Business, October 11, DAWN the Internet Edition [online; accessed Nov 11, 2011]. Available from: http://archives.dawn.com/2004/ 10/11/ebr3.htm.

Banerjee, A., Dolado J., Mestre R., 1998. Error-correction mechanism tests for cointegration in single-equation framework. Journal of Time Series Analysis 19, 267-283.

Bhagwati, J., 2001. Growth, poverty and reforms. Economic and Political Weekly 36(10), 843-846.

Bigsten, A., Kebede, B., Shimeles, A., Taddesse, M., 2003. Growth and poverty reduction in Ethiopia: Evidence from household panel surveys. World Development 31(1), 87-106.

Datt, G., Ravillion, M., 2002. Is India's economic growth leaving the poor behind? Journal of Economic Perspectives 16(3), 89-108.

Deaton, A., Dreze, J., 2001. Trade, growth and poverty. Finance and Development 38, 16-19.

Dickey, D.A., Fuller, W.A., 1979. Distribution of the estimation for autoregressive time series with a unit root. Journal of the American Association 74, 427-431.

Dollar, D., Kraay, A., 2000. Growth is good for the poor. World Bank, Washington, D.C.

Dollar, D., Kraay, A., 2001. Growth is good for the poor. Policy Research Working Paper 2587, Development Research Group. World Bank, Washington, D.C.

Dollar, D., Kraay, A 2002. Growth is good for the poor. Journal of Economic Growth 7(3), 195-225.

Fields, G.S., 1989. Changes in poverty and inequality in developing countries. World Bank Research Observer 4(2), 167-185.

Government of Malaysia, 2007. Malaysia Economic Statistics-Time Series. December. Department of Statistics, Malaysia.

Government of Malaysia, Central Bank of Malaysia [online]. Available from: http://www.bnm.gov.my/.

Kwiatkowski, D., Phillips P.C.B., Schmidt P., Shin Y., 1992. Testing the null hypothesis of stationarity against the alternative of a unit root. Journal of Econometrics 54, 159-178.

Lustig, N., Arias, O., Rigolini, J., 2002. Poverty reduction and economic growth: A two-way causality. Sustainable Development Department Technical Papers Series. Inter-American Development Bank, Washington D.C.

Ng, S., Perron, P., 2001. Lag length selection and the construction of unit root tests with good size and power. Econometrica 69, 1519-1554.

Pesaran, M.H., Shin, Y., Smith, R.J., 2001. Bound testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16, 289-326.

Phillips, P.C.B., Perron, P., 1988. Testing for a unit root in times series regression. Biometrica 75, 335-446.

Ravallion, M., 1995. Growth and poverty: Evidence for developing countries in the 1980s. Economic Letters 48, 411-417.

Ravallion, M., 1997. Can high-inequality developing countries escape absolute poverty? Economic Letters 56, 51¿57.

Ravallion, M., Datt, G., 1996. How important to India's poor is the sectoral composition of economic growth? World Bank Economic Review 10(1), 1-25.

Ravallion, M., Datt, G., 1999. When is growth pro¿poor? Evidence from the diverse experiences of India's states. Policy Research Working Paper 2263, Development Research Group and South Asia Region. World Bank, Washington, D.C.

Rodrik, D., 2000. Growth versus poverty reduction: a hollow debate. Finance and Development, IMF, Washington, D.C.

Roemer, M., Gugerty, M.K., 1997. Does economic growth reduce poverty? Technical Paper, Harvard Institute for International Development. March [online; accessed Nov 11, 2011]. Available from: http://pdf.usaid.gov/pdf_docs/PNACA656.pdf.

Salvatore, D., 2004. Growth and poverty in a globalizing world. Journal of Policy Modeling 26, 543-551.

Tendulkar, S.D., Jain, L.R., 1995. Economic reforms and poverty. Economic and Political Weekly 30(23), 1373-1375, 1377.

Toda, H.Y., Yamamoto, T., 1995. Statistical inference in vector autoregressions with possibly integrated processes. Journal of Econometrics 66, 225-250.

Townsend, P., 2005. An end to poverty or more of the same? Perspectives 365(April 16), 1379-1380.

Warr, P., 2001. Poverty reduction and economic growth: the Asian experience, Asia and Pacific forum on poverty: reforming policies and institutions for poverty reduction. The Asian Development Bank, Manila, February 5-9.