Despite business investment prompts economic growth, it is necessary to ask what financial problems eventually arise at the national level when investment is carried out, and what banking policies may be enacted to avert them. One of the main arguments of this work consists in the role potentially played by commercial banks whenever these policies are conducted. Monetary institutions should recognize a fundamental difference between distributive payments and those transactions that are at the origin of new income. We argue that a reform of the system of national payments would prevent monetary disorders from triggering any divergence between global demand (households’ purchasing power) and global supply (output).

A pesar de que la inversión de las empresas estimula el crecimiento económico, es necesario identificar los posibles problemas que surgen a nivel nacional al realizar la inversión, así como las políticas bancarias necesarias para evitarlos. Los bancos comerciales desempeñarían un papel fundamental si dichas reformas se pusieran en marcha. Uno de los argumentos principales de este documento se refiere a la labor realizada por los bancos comerciales a la hora de implantar dichas políticas. Las instituciones monetarias tendrían que reconocer la diferencia fundamental entre pagos distributivos y aquellas transacciones que originan nueva renta. Sostenemos que una reforma del sistema de los pagos nacionales impediría los desórdenes monetarios, que desencadenarían una divergencia entre la demanda global (el poder adquisitivo de los hogares) y la oferta global (el producto nacional).

We will make here a study of a theoretical economy by using monetary flows matrices and stocks (or balance-sheet) matrices – hence we will follow the so-called stock-flow-consistent (SFC) approach. As noted by Godley and Lavoie (2007: 6), a ‘cardinal principle’ must be applied in the study of macroeconomic flows, namely that ‘all rows and all columns sum to zero, thus ensuring, as the phrase goes, that “everything comes from somewhere and everything goes somewhere”’. Godley and Lavoie, having built the ‘transaction flow matrix’, extend the approach to include a ‘balance sheet matrix’ (see Godley and Lavoie, 2007: 7–8). We will first consider the flows of wages and profits between productive firms and the households only, strictly complying with the assumptions that (i) banks are a mere intermediary agent between income earners and firms, and that (ii) taxes and public spending are nil.

We shall state that, given an analysis of monetary flows, transactions appear to take place in a perfectly ordered way. In fact, both for profit distribution and its investment, the sum of the data in the columns and that for the rows are nil. On the other hand, a question will be raised then concerning the analysis of real stocks. We shall not build a balance-sheet matrix. Nevertheless, comments will be made regarding the net worth of the economy, in which a representation will be given of monetary flows, real flows, and real stocks. A monetary disorder will be stressed. Namely, no distinction is made in daily banking practice between production-based and distributive payments: this leads to the creation of a fixed capital the value of which is not accounted for in banks’ balance sheets.

We will advocate then a reform of the system of national payments based on Schmitt (1966, 1984), Cencini (2015), and Cencini and Rossi (2015). We will call for the creation of commercial banks’ departments taking account of purely monetary transactions, of deposits (or income) levels, and of fixed capital (or investment) levels.

2Flows and stocks: monetary and realLet us return to ‘Studies in profit and capital formation: an alternative theory of distribution’ (Carrera, 2015), published by this Journal. In a first period, wage or consumption goods are produced the value of which is 100money-units (m.u.). In a second time, company's profit is invested in the production of capital or instrumental goods. Wages expenditure in the first period amounts to 100m.u. Only 80m.u. are finally spent, though. A profit of 20m.u. is in fact made (and immediately spent to cover the costs of production of goods left unsold) by the company. A real goods stock is formed, corresponding to a temporary capital of 20m.u. In the second period, profit is invested by the company in the production of capital goods, which are acquired by the company in the payment of wages. The purchase of capital goods takes place at a price equal to their production cost. In exchange for the capital goods obtained by the company, workers obtain the previously unsold stock of wage goods. Income is thus fully spent (a detailed analysis can be found in Carrera (2015) and in our Appendix A).

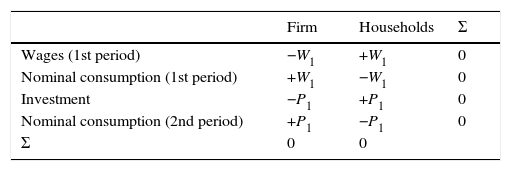

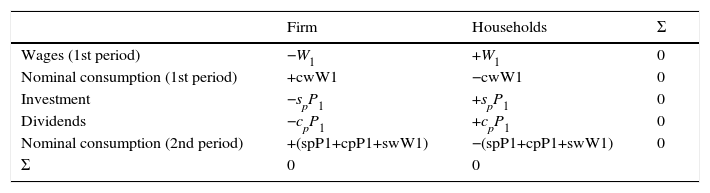

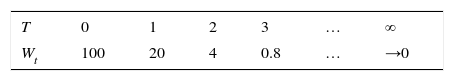

We shall look at the case in which income earners spend their income (wages, W) entirely (i.e. the saving rate from wages, sw, is nil, and the consumption-wages ratio, cw, is equal to unity) and in which company profit, P, is entirely invested in the production of capital goods (i.e. the saving rate from profit, sp, is equal to unity, and the dividends-profit ratio, cp, is equal to zero). Monetary transactions taking place in this case are shown in Table 1. Wages during the first period represent a company outflow and a household income. When households spend wages on purchasing wage goods, the company registers a monetary income and households register an operation opposite in kind. Flows do not show that, in this operation, a partial distribution of income has taken place; neither do flows show that the remaining part of income has been distributed to the company as profit. Now, the payment of new wages, during the second period, is registered exactly as for the payment of wages during the first period, since it is a new outflow for the company (an income for households). Transactions concerning consumption during the second period (which we assume takes place at cost price) are registered as for consumption during the first period.

Table 1 shows that the total sum for company and household transactions (the columns) and the sum for reciprocal individual payments (the rows) are equal to zero. The total income for the system has been destroyed and there is no debit-credit relationship between company and households.

An important observation should be made. The transactions we have registered in Table 1, relative to profit investment, are the same as those we would register in the case in which profit were entirely distributed among shareholders in the form of dividends. This means that an analysis of monetary flows allows for no distinction to be observed between activities related to income distribution and activities related to income (or value) creation, such as investment.

Table 2 shows monetary transactions related to investment and the payment of dividends, for the case in which wage income is not entirely spent (i.e. the saving rate from wages is positive, but lower than unity) and profit is partially distributed (i.e. the saving rate from profit is positive, but lower than one).

Transactions flows matrix: partial income expenditure and partial profit expenditure.

| Firm | Households | Σ | |

|---|---|---|---|

| Wages (1st period) | −W1 | +W1 | 0 |

| Nominal consumption (1st period) | +cwW1 | −cwW1 | 0 |

| Investment | −spP1 | +spP1 | 0 |

| Dividends | −cpP1 | +cpP1 | 0 |

| Nominal consumption (2nd period) | +(spP1+cpP1+swW1) | −(spP1+cpP1+swW1) | 0 |

| Σ | 0 | 0 |

As with Table 1, Table 2 shows that the sum of transactions in the columns and of those on the rows are also null. An analysis of monetary flows reveals no payment-related problems either in the case of dividend payments or in the case of investment. We shall continue with a comparative analysis of monetary flows, real flows and real stocks of wage goods and capital goods.

We begin with an analysis of dividend payment and then, go on to analyze the investment of profit in the production of capital goods.

2.1.1Profit distributionWe now want to resume our study, in which income is completely spent by households. Let us suppose that profit is completely distributed as dividends among shareholders.

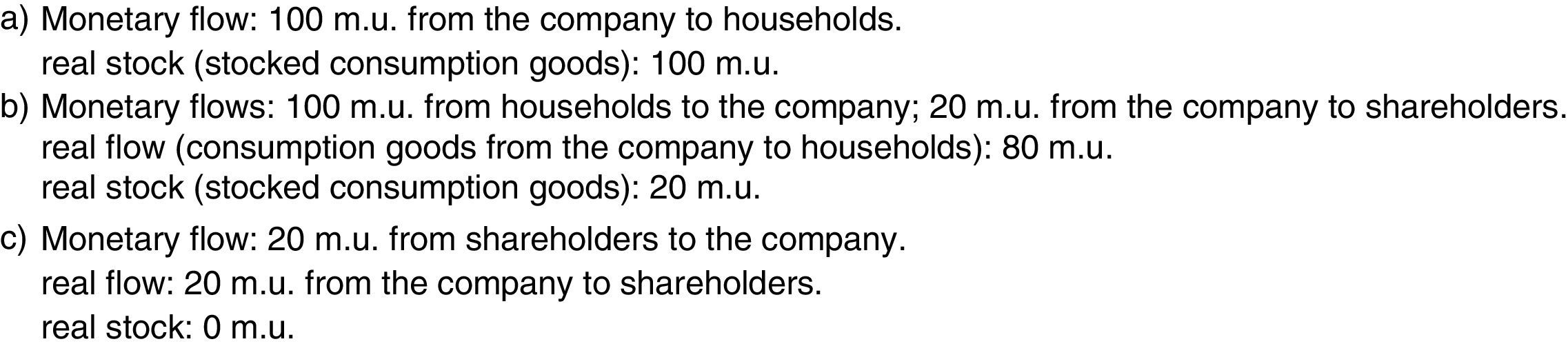

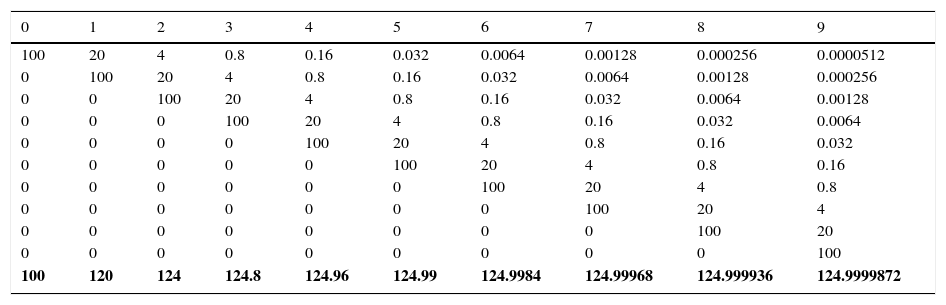

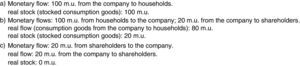

Fig. 1a shows a monetary flow, during the first period, of 100m.u. from the company, F, to households, W. The real stock of wage goods has a value of 100m.u. On the other hand, Fig. 1b represents a money flow of 100m.u. from W to F. A money flow of 20m.u. should also be noted from F to shareholders and a real outflow of 80m.u. from F to W. Fig. 1c gives a monetary flow of 20m.u. from shareholders to F, thanks to which there is a real outflow of 20m.u. from F to shareholders.

During these two periods, the company and those entitled to income have sustained monetary outflows of (100+20)m.u., while their monetary inflows are of (100+20)m.u. Therefore, there is a perfect match between monetary outflows and monetary inflows. If, instead, we analyze the value (production cost) of wage goods, we conclude that real outflows are of (80+20)m.u. The real stock at the end of period two amounts to 0m.u. An analysis of stocks in the case of profit distribution (the payment of dividends) shows no divergence between supply and demand.

2.1.2Profit investmentFinally, we shall undertake an analysis of the formation of capital goods. We shall return to the case studied above, supposing, however, that dividends are nil and that profit is therefore entirely invested.

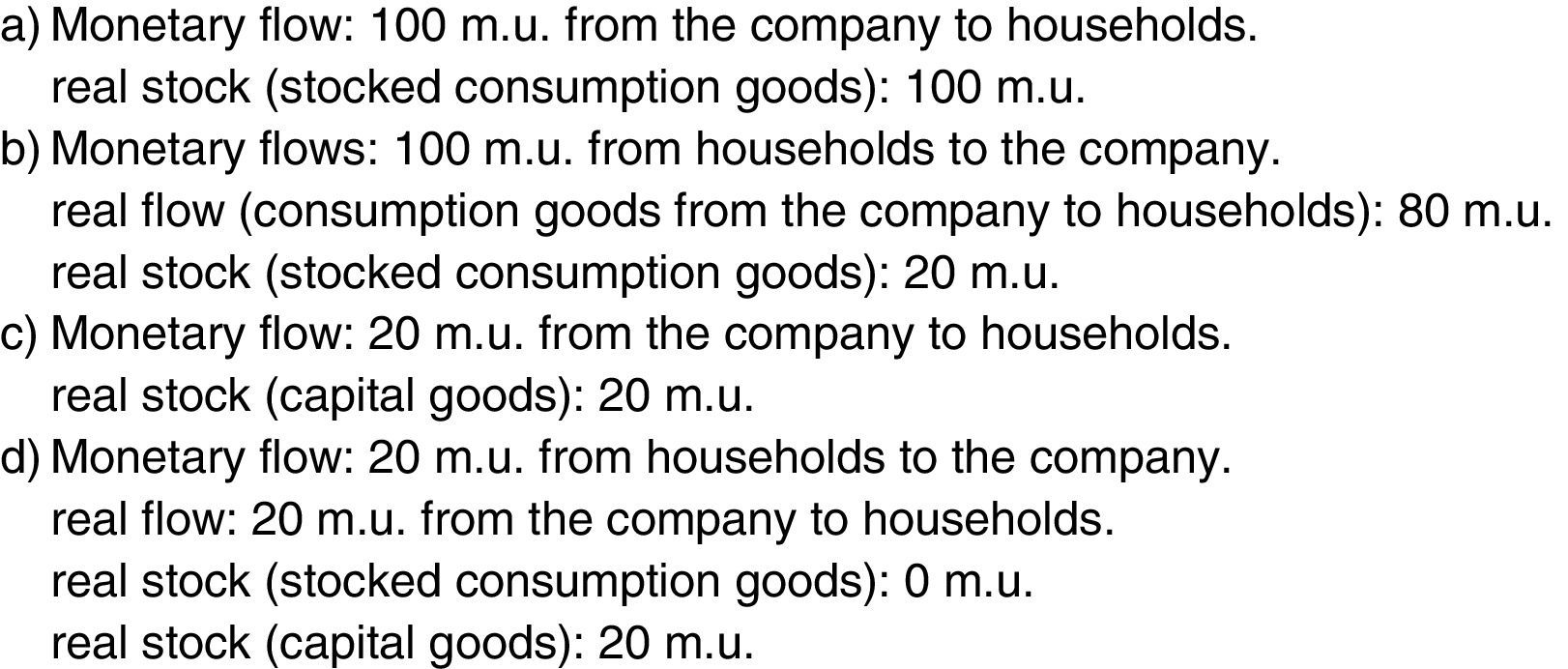

Fig. 2a shows a monetary flow of 100m.u. (the payment of wages during the first period) from the company, F, to households, W. A real stock of wages goods is formed, with a value of 100m.u. On the other hand, Fig. 2b shows the expenditure of wages in purchasing a part of the product. A monetary flow of 100m.u. from W to F takes place. A real flow of 80m.u. from F to W indicates a definitive expenditure of household income for the same amount. Fig. 2c shows a monetary flow of 20m.u. from F to W during the second period: a payment of wages has been made relative to the creation of a new product with a value of 20m.u. (real stock). Finally, Fig. 2d represents a monetary flow of 20m.u. from W to F and a real flow of 20m.u. from F to W, corresponding to the value of wage goods left unsold at the end of the first period and which have been sold at the end of the second period.

An analysis of monetary flows (in- and out-) indicates no differences with regard to the previous case (just as we expected from a reading of the transaction flows matrices).

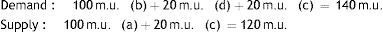

However, an analysis of real outflows and real stocks is more interesting. Real outflows for the company corresponds to wage goods worth (80+20)m.u. The remaining real stock (of capital goods) for the company has a value of 20m.u. Thus, productive activity has given rise to a supply of capital goods, no trace of which is to be found in bank balance sheets and which cannot be studied through an analysis of monetary flows alone. In bank balance sheets, failing to distinguish between transactions of distributive and productive natures hinders the creation, when dealing with a supply of 120m.u., of a demand for an equal amount. While the distribution and expenditure of profit in acquiring wage goods are not responsible for any discrepancy between supply and demand, the case of investment is anomalous. If, on the one hand, it is true that the investment of profit is necessary to increase economic well-being, it is also true that current banking techniques allow demand to be higher than supply, in contrast with the Keynesian identity between global demand (C+I) and global supply (Y). In the example studied so far, levels of demand and supply were, respectively, as follows:

We shall need to examine the matter more thoroughly, in view of proposing a banking policy that (i) enables to distinguish between transactions of a distributive nature and those that arise whenever income is created and destroyed definitively, and (ii) ensures that no changes in economic activity take place with respect to the present.

3Monetary disorders: early explanationsSince labor lies at the origins of value, national income necessarily amounts to total wages. It is therefore paradoxical to conceive income as the sum of wages and profit. ‘In its reality, national product is already global and no additional summing is required; the product “comes into being” as an undivided whole; its division logically follows after; put briefly: wages and profit are divisions of income, and not, properly speaking, its elements. The concept is subtle, but clear. Income is not made up of “bricks” (separate wages and profit) that precede the building (income); quite the opposite, the building (the product corresponding to labor) is created as a single piece, and its compartments relate to income already formed’ (Schmitt, 1966: 284, our translation). To be precise, gross profits are income obtained, by substitution, by companies from those initially entitled to distributed wages. […] However, the part for wage-earners is not identical to the part for nominal wages in the national income. Nominal wages include everything. But wage-earners keep only the income they are able to convert into goods and lose the income intercepted by companies (Schmitt, 1966: 295, our translation).

When profits are made out of the buying and selling of products on the goods market, ‘then the only capital that can exist turns out to be derived from the transfer of a portion of wages’ (Schmitt, 1984: 174, our translation) to companies in the form of profit, a flow that is ‘simultaneously’ present on the labor and goods markets. Profit is a capital that is at once both financial and material, since monetary profit is the financial aspect of a real profit consisting of those products that are stocked by firms, ‘to the exact extent wage incomes are transferred to companies’ (Schmitt, 1984: 174, our translation).

If profit is distributed to shareholders, it is temporary capital, which, at the moment of consumption, is transformed back into income, and finally spent on the product market: in this case, income is destroyed and the goods, as their value is equal to the income spent, are no longer stocked by companies.2 If profit derived at the end of the first period is not invested in a new production, but fully distributed, profit-holders will spend it in the purchase of the stock of goods left unsold in period one: in this case, no capital goods are produced, and income is entirely destroyed. Nevertheless, this case is hypothetical, as companies need profits precisely to invest at least a share of them in the production of capital or instrumental goods: a portion of profit is invested by the company in the production of capital or investment goods.

Following Schmitt, the value of capital-goods3 is equal to profit that is invested by the company, i.e., profit that is not spent by shareholders in the purchase of wage goods, but used to pay the wages to workers who produce capital goods. When profit formed in a period is later invested in the production of capital goods, the value of capital goods will be exactly equal to the amount of that investment. Workers’ bank accounts as a whole–including all categories of workers, such as capitalists, managers, craftsmen, etc.–are credited with new wages to the amount of x money units. Wages are then spent by wage-earners to purchase the goods left unsold in the previous period, at cost price, i.e., at a price equal to their value. In this case, invested profit is a fixed capital, no longer temporary: ‘financial saving becomes permanent’ (Schmitt, 1984: 175, our translation). Investment takes place because the new wages are paid ‘starting from previous wages intercepted by companies’ (Schmitt, 1984: 175, our translation). In this case, following Schmitt (1984: 175), although savings are in this case definitive, because capital goods ‘finally escape households’ consumption’, ‘[t]he bi-univocal relationship of financial capital and physical capital is still fully respected’. The ‘coexistence’ of saved capital and real capital hence takes place: ‘[b]y using Hicks's expression, financial capital is “incorporated” (“embodied”)’ in capital goods (Schmitt, 1984: 175, our translation).4

Suppose, for the sake of simplicity, that profit made in period 1 is fully invested in the production of capital goods. However, here we modify the case argued so far, supposing that the wages level in period 2 is kept equal to the level of the first. We now suppose that profit to the value of 20 money-units made in the first period finances the payment of the wages corresponding to the production of capital goods and that new wages of 80 money-units are paid following a new production of wage goods. The total amount of wages paid in the second period to the workers is thus of 100 money-units.

Now, in period 1, the cost of production of the goods unsold and stocked in the company is fully covered by profit. The monetary profit of the company coincides with its real profit, i.e., stocked goods. In this case, profit is invested in the temporary purchase of wage goods stocked by the company. In line with previous observations, this investment corresponds to a temporary capital: in fact, the company's purchase of unsold wage goods is not definitive. Corporate profit, in fact, is not distributed as dividend, but rather it is a wage income transferred to the company, i.e., corresponding to a portion of wages initially paid. This portion is temporarily ceded by income earners to the company. Therefore, the portion of workers’ income that has become profit is transformed immediately into temporary capital. Those workers who, at a later stage, produce new goods are provided with the accumulated stock of goods. Capital goods correspond to those products that are produced by workers whose wages are paid through profits; the part of goods produced by workers whose wages are paid out starting from a new credit line, instead, are wage goods. By introducing the hypothesis that employment (in terms of the level of wages and not in terms of the number of workers) is kept the same as the previous level period, households’ bank accounts are credited with 100 money-units. Workers employed in the production of wage or consumption goods receive wages amounting to 80 money-units, while workers producing capital goods receive 20 money-units wages.5 80 money-units correspond to the value of new wage goods: the new consumption goods are the real content of the new wages paid out starting from a new line of credit. 20 money-units are instead paid out starting from the profit made in the first period: these wage units are actually a portion of wages initially paid to workers (starting from the initial credit line of 100m.u.) and correspond, in money, to the stock of goods deposited in the company in period 1. Hence, a twofold payment takes place starting from the same income of 20m.u. Profits are formed on the product market in period p0, but are spent on the labor market in a subsequent period, which is symptomatic of a disorder. The money-units resulting from the payment of new wages of 20m.u. are void of real content (and are accordingly called ‘empty money’ by Schmitt): the new capital goods will never be purchased by income earners and will never be the real content of wages paid out in the second period to workers employed in the production of capital goods. The reason why capital goods cannot be the real content of new wages is simple. The use or expenditure of corporate income, i.e., profit, in the payment of new wages implies that the company purchases new (capital) goods.6 The purchase of capital goods through the expenditure of profit in the payment of a portion of the new wages allows the company to take the capital goods away from income earners’ demand. A capital is thus formed that is fixed, since it can no longer belong to income earners. This implies that 20 money-units with no real content have been created. An income of 80 money-units has been created, instead, thanks to the association between money and wage goods, an event that is the repetition of the productive process that took place at the beginning of the first period. Starting from this new income of 80 money-units, a new profit can be formed, distributed or invested. Having already studied this process, we suppose that no further profit is formed in period 2.7

On the one hand, when profits are redistributed by the company to shareholders, capital-time is transformed into income at the moment it is spent in the purchase of the goods stocked in the company. In this case, profit covers the cost of production of wage goods, of which it is the monetary aspect, until they are finally sold.

On the other hand, when profits are invested by the company in the production of capital goods, capital-time becomes fixed capital: households’ income is no longer available, but definitively saved for the company's benefit. Instrumental or capital goods are indeed purchased by the company through the investment of profit. When wages are paid by drawing on profit, payment does not take place starting from nominal money, but from an income: for this reason, i.e., because income is spent on a payment, such expenditure coincides with the company's purchase of instrumental or capital goods. According to Cencini (2015), labor is “commanded”: since the money paid out to workers has not been ‘filled’ by any real content, workers have worked exclusively for the good of the company.

If profit is distributed, it is spent on the product market (therefore in the purchase of consumer goods) so that the sum of expenditures on the product market is ‘equal to the sum of expenditures’ (Schmitt, 1984: 213, our translation) on the market for productive services (namely the amount of wages paid for the production of consumption goods). If, for instance, profits are fully distributed, the expenditure of income equals consumption, with no possibility for money payments to be void of real content.

The investment of profit gives rise to a different phenomenon: ‘the sum of expenditures on the products market is higher (in an amount equal to investment) than the sum of the corresponding expenditures on the market of productive services’ (Schmitt, 1984: 213–214, our translation). In the case in which profits are fully invested in the production of capital goods, for instance, bearing in mind the case analyzed so far, the new payment of wages of 20 money-units creates an excess demand of the same amount. It would be ‘naive to think that the expenditure of the investment is a real addition to consumption’ (Schmitt, 1984: 210–211, our translation). Investment is in fact an addition of a nominal character, because nominal emissions resulting from net investment are added to ‘full’ emissions: wages, once converted into invested profit, are an emission of money corresponding to capital goods that will not be “consumed” by income-earners. It is for this reason that Schmitt claims that investment should be a ‘“catégorie-gigogne” [“nested category”] of consumption’, in the same way as profit is a “catégorie-gigogne” of wages. The effect of the emission of nominal money associated to fixed capital is that of ‘depriving the set of income earners of the ownership of capital’ (Schmitt, 1984: 215, our translation). However, as Schmitt (1984: 198) puts it, the net investment of profit creates a “benign” emission of monetary units void of real content, followed by the reabsorption of excess demand.8 In spite of the emission of nominal money void of its real content, when wages are paid through the expenditure of profit, these wages are later spent by workers to purchase the stock of goods previously left unsold, and deposits are destroyed. Things start to change radically in the subsequent period, when the use of instrumental goods requires fixed capital to be amortized. Subject to wear and tear, and because of obsolescence, instrumental goods must be replaced by amortization goods. As proven by Schmitt (1984), the current structure of national payments is such that amortization reconstitutes the previous capital stock and, simultaneously, leads to an increase in the value of capital over time. This generates a ‘vicious’ inflationary money emission. In light of these facts, it must be observed that, given the current structure of payments systems, it is true that ‘vicious’ inflation – as well as deflation – is linked to fixed-capital amortization, but its origin goes back to the very formation of fixed capital. It must be noted that inflation is ultimately brought about by a net investment of profit – in the production of capital goods – that is pathological in nature. Once bank bookkeeping is adapted to the logical, economic laws of capital formation, investment will be more sound. We thus advocate a reform of national payments systems: records would be kept of the financial relationship between fixed capital and companies – or, generally speaking, society; capital amortization would take place in an orderly way.

Yet one fact is crystal-clear. Today, income-earners create instrumental capital that escapes them. Fixed capital is definitely purchased, through the expenditure of profit, by a company defined by Schmitt as ‘depersonalized’, since the economic ownership of capital escapes society as a whole. This is clearly a manifestation of a monetary disorder. Companies, in fact, according to Cencini and Rossi (2015), should act for the good of society, they should be an agent designated to the making and management of profit in order to create a capital that belongs to society as a whole. Since every production is the result of labor alone, every production should belong fully to society as a whole. But nowadays capital escapes the economic ownership of society and income earners work to produce it, sacrificing a portion of their income for the benefit of the ‘depersonalized’ company, an abstract entity: one recalls thereby the enslavement of men to capital theorized by Marx (1867 [1982]), although it is evident that the class struggle is not the solution to the problem. The economic analysis described so far clearly shows that, in contemporary monetary economies, as stated, in a certain sense, by Kaldor, this division of society into classes is debatable, since it is preferable to analyze income formation and distribution in terms of typologies. Namely wages, income(s), and rents: profits in primis.

There is no doubt that capital is indispensable in modern economies, since it increases the value-in-use and hence the material wealth of society as a whole. The role of the normative analysis that follows is to avoid that capital is taken out of society's hands and thus to avoid inflationary processes.

4Money, income, and capital: bank policyThe monetary circuit theory developed by Schmitt (1966, 1984) points out the need to introduce a subdivision into three banking departments that relate to the logical subdivisions between money, income and fixed capital. Thus, the three departments are respectively those for money (Department I), income (Department II or Saving Department), and investment (Department III or Fixed Capital Department). As the accounting period between one balance and the next, we shall take the calendar month (i.e. we assume that wages are paid monthly). For simplicity's sake, we shall set aside other intermediate entries for the money and income departments, focusing exclusively on the payment of wages. We shall therefore record entries for Department I relating exclusively to the payment of wages in the first and second periods. Money is the means of all transactions, including the initial transaction in which income is formed. ‘Distinguishing between money and savings departments helps to avoid the risk of loans being financed through monetary creation, allowing bank operators to be aware, at any given moment, of the amount of income that may be lent’ (Cencini, 2015: 240, our translation). Let us state it once more. The Money Department is needed to avoid inflation's occurrence, since it prevents money creation (void of any real content) to finance loans (purchases) to bank clients. Record of deposits is kept instead in the Income or Financial Department. Money, full of real content, is registered as a temporal capital that constitutes income-holders’ credit toward the bank. In other words, once income is formed, it is registered within the banking system and remains temporally available in the financial market. Whenever consumers decide to purchase goods and services, a portion of income will be spent on the products market, and deposits will thus be destroyed for the same amount. It is in the Fixed Capital Department, instead, that all income invested in the production of capital goods is recorded – as company credits toward the bank. In particular, this department impedes invested profit from being available on the financial market. Profit, once made by the company, is always registered in this department. Only invested profit is definitively fixed into it, though. The portion of profit that is distributed as dividends or paid as interest leaves Department III, and is again available in Department II. This means that dividends and interest are converted back into income that will be spent on the products market.

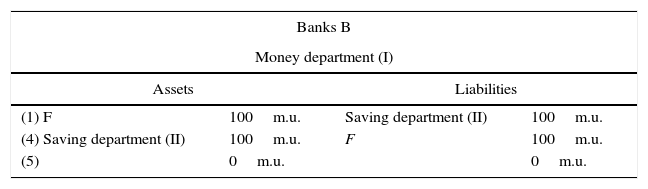

4.1Income creation and destructionLet us proceed step by step. Table 3 gives the entries (in the first and second departments) relating to a simple case in which wages are entirely paid and spent (i) before the closure of the accounting period (that is, a month, if wages are paid monthly as in our numerical example) and (ii) without profit being distributed to the company. The first two entries (1 and 2) concern the creation of workers’ income (W stands for ‘workers’). Wages payment entails the creation of 100m.u., registered on the assets side of the money department, and 100m.u. income on the liabilities side of the Saving (or Income) Department. Meanwhile, the Money Department and the Saving Department are debited-credited. The two following entries (3 and 4) concern instead the definitive expenditure of income. The payment of income-holders is registered within the assets of the Saving Department, while the company's credit is registered on the liabilities side of the Money Department. At the same time, the Saving Department and the Money Department are debited-credited between each other. This makes possible for the company and the income-earners to settle their dual debt-credit relationship. Money and income are hence destroyed (balances 5 and 6).

Income creation and total expenditure: bookkeeping.

| Banks B | |||

|---|---|---|---|

| Money department (I) | |||

| Assets | Liabilities | ||

| (1) F | 100m.u. | Saving department (II) | 100m.u. |

| (4) Saving department (II) | 100m.u. | F | 100m.u. |

| (5) | 0m.u. | 0m.u. | |

| Banks B | |||

|---|---|---|---|

| Saving department (II) | |||

| Assets | Liabilities | ||

| (2) Money department (I) | 100m.u. | W | 100m.u. |

| (3) W | 100m.u. | Money department (I) | 100m.u. |

| (6) | 0m.u. | 0m.u. | |

Source: Author's elaboration from Cencini and Rossi (2015).

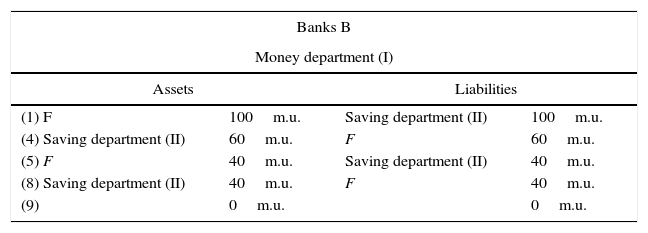

Entries in Table 4 concern a case similar to the preceding one, in which income is not entirely spent before the end of the accounting period. Supposing that workers have spent 60% of their wages, without profit creation having taken place, payments for the two departments indicate a persistent company debt of 40m.u., workers’ credit for the same amount, and credit-debit for the two departments equal to 40m.u. The first four entries are identical to the first four in the previous case. The balances, however, differ. In fact, the new balances of the two departments (entries 5 and 6) show that, out of initial income, a 40m.u. income has not been destroyed yet. Transactions from 7 to 10 show that, in the current practice, income lasts over time, in the form of capital, up to the moment of its final expenditure.

Income creation and partial expenditure: bookkeeping.

| Banks B | |||

|---|---|---|---|

| Money department (I) | |||

| Assets | Liabilities | ||

| (1) F | 100m.u. | Saving department (II) | 100m.u. |

| (4) Saving department (II) | 60m.u. | F | 60m.u. |

| (5) F | 40m.u. | Saving department (II) | 40m.u. |

| (8) Saving department (II) | 40m.u. | F | 40m.u. |

| (9) | 0m.u. | 0m.u. | |

| Banks B | |||

|---|---|---|---|

| Saving department (II) | |||

| Assets | Liabilities | ||

| (2) Money department (I) | 100m.u. | W | 100m.u. |

| (3) W | 60m.u. | Money department (I) | 60m.u. |

| (6) Money department (I) | 40m.u. | W | 40m.u. |

| (7) F | 40m.u. | Money department (I) | 40m.u |

| (10) F | 40m.u. | W | 40m.u. |

Source: Author's elaboration from Cencini and Rossi (2015).

We note that the entries studied in the two preceding cases do not involve the fixed capital department: entries in this department take place only for profit formation, the payment of dividends and those for interest, and the formation of working or instrumental capital. The next Sections show the role of the fixed capital department in the process of capital formation.

4.2Profit and dividendsWe shall analyze here profit formation and its distribution to shareholders. We consider the entries in the Money Department concerning the payment of wages only. For the sake of exposition, we shall simplify the entries shown in the previous section. We shall focus on those transactions that involve the Saving and the Fixed Capital Departments. Entries from (1) to (6) regard the payment of wages. Wages payment implies the creation of 100m.u. and an income of the same amount: as previously observed, this implies the debit-credit of the first two departments (entries 1 and 2).

Let us suppose that, by the end of the accounting period, wages are not spent yet: saved up income is lent to firms, which invest it in the formation of a stock. This means that the relationship between the two departments cease to exist (entries 3 and 4). The balance of the first department is null, since income is entirely spent in the formation of a stock; the balance of the Saving Department amounts instead to 100m.u. (entries 5 and 6).

Now, let us analyze spending on wages and profit formation. We will omit entries relative to the Money Department, for the sake of simplicity. Entry (7) regards the debit-credit of income-holders and the company in the financial book (Department II) of the bank. This entry is important for two reasons. First of all, it shows a 80m.u.-income expenditure for the final purchase of a goods stock valued at the same amount. Further, this entry shows a company profit of 20m.u. Entry (8), which is the Saving Department balance, shows the existence of company deposits (as a liability in the bank financial book) and the existence of a real stock stored in the company (registered as an asset in the same book).

A new department must come now to the fore. In fact, profit has to be recorded in Department III. However, we are still unaware of whether it will be invested entirely or whether it will be at least partially distributed. The deposit of profit in a proper department implies mutual entries (9 and 10) in both the Saving and the Fixed Capital Department. The balance of the second department is thus shown in entry 11.

Let us suppose shareholders receive dividends for 5m.u. It is therefore necessary to credit shareholders (financial department) and subtract the 5m.u. corresponding to dividends from Department III. Entries (12) and (13) regard the financial department and Department III respectively. Profit, initially amounting to 20m.u., has been partially distributed to shareholders, whose deposits have hence increased by 5m.u. They will spend dividends in purchasing a fraction of the stock (valued at 5m.u.) stored in the company. Profit reduction is equivalent to an increase of households’ deposits for an equal amount. The balance for the third department is therefore shown in entry 14. The available profit for investment in the production of capital goods or fixed capital is therefore equivalent to 15m.u. Now, if shareholders spend dividends in the purchase of unsold goods to a value of 5m.u., we record the operation as in entry 15. Shareholders’ spending implies a destruction of income. The balance for Department II is thus shown in entry 16.

The balance for the financial department shows that, in the economy, the product left unsold and stored in the company has a value of 15m.u. Company's profit is recorded in Department III.

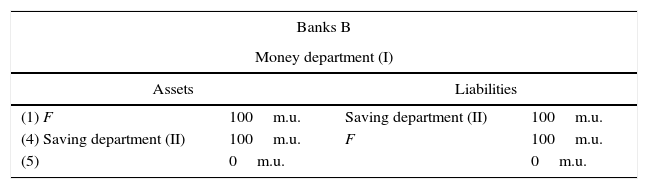

In Table 5, we give the whole set of entries registered in the first period.

Profit and dividends: bookkeeping.

| Banks B | |||

|---|---|---|---|

| Money department (I) | |||

| Assets | Liabilities | ||

| (1) F | 100m.u. | Saving department (II) | 100m.u. |

| (4) Saving department (II) | 100m.u. | F | 100m.u. |

| (5) | 0m.u. | 0m.u. | |

| Banks B | |||

|---|---|---|---|

| Saving department (II) | |||

| Assets | Liabilities | ||

| (2) Money department (I) | 100m.u. | W | 100m.u. |

| (3) F | 100m.u. | Money department (I) | 100m.u. |

| (6) F | 100m.u. | W | 100m.u. |

| (7) W | 100m.u. | F | 20+80m.u. |

| (8) Product | 20m.u. | F | 20m.u. |

| (9) F | 20m.u. | Fixed capital department (III) | 20m.u. |

| (11) Product | 20m.u. | Fixed capital department (III) | 20m.u. |

| (12) Fixed capital department (III) | 5m.u. | Shareholders | 5m.u. |

| (15) Shareholders | 5m.u. | Product | 5m.u. |

| (16) Product | 15m.u. | Fixed capital department (III) | 15m.u. |

| Banks B | |||

|---|---|---|---|

| Fixed capital department (III) | |||

| Assets | Liabilities | ||

| (10) Saving department (II) | 20m.u. | F | 20m.u. |

| (13) F | 5m.u. | Saving department (II) | 5m.u. |

| (14) Saving department (II) | 15m.u. | F | 15m.u. |

Source: Author's elaboration from Cencini and Rossi (2015).

We have so far described accounting entries and their payment at the end of the first period. We shall now proceed with an analysis of entries in the second period, during which the profit of 15m.u. is invested by the company: the payment of new wages takes place and, through the expenditure of wages, income-owners are able to acquire unsold goods from the first period, stored in the company and with a value of 15m.u. At the end of the second period, the company will simultaneously be debited for income and credited with fixed capital.

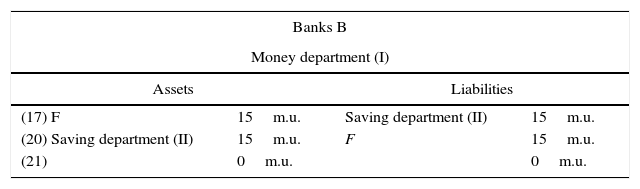

4.3Profit investmentThe Money Department is always involved – i.e. whenever a payment takes place – money being always created and immediately destroyed. As previously stated, in this study, we chose to consider entries in Department I just as far as wage payments are concerned. Profit investment falls into such a type of payment. Let us study now profit investment. Entries (17) and (18) are related to the new payment of wages, amounting to 15m.u. The first two departments are thus involved in monetary and financial transactions.

Supposing that the spending for new wages is for the moment null, at the end of the accounting period we make the following entries (19 and 20) in the money and income departments, since money does not survive the accounting period. The balance for the first department at the end of the second accounting period is null (entry 21). Income still survives. To be precise, in the form of capital, as a temporal capital that will be finally spent as soon as consumption will be effective. Hence, the balance of the financial department is as follows (entries 22a–b). The spending of new wages in the acquisition of the product left unsold at the end of the first period is recorded as follows (entry 23). The final balance for the second department is therefore as recorded in entry 24. At the end of the second period, there is no longer any consumption good stored in the company and the fixed capital is not lost to society.

In Table 6, we give the accounting entries for the second period.

Investment: bookkeeping.

| Banks B | |||

|---|---|---|---|

| Money department (I) | |||

| Assets | Liabilities | ||

| (17) F | 15m.u. | Saving department (II) | 15m.u. |

| (20) Saving department (II) | 15m.u. | F | 15m.u. |

| (21) | 0m.u. | 0m.u. | |

| Banks B | |||

|---|---|---|---|

| Saving department (II) | |||

| Assets | Liabilities | ||

| (16) Product | 15m.u. | Fixed capital department (III) | 15m.u. |

| (18) Money department (I) | 15m.u. | W | 15m.u. |

| (19) F | 15m.u | Money department (I) | 15m.u. |

| (22a) Product | 15m.u. | Fixed capital department (III) | 15m.u. |

| (22b) F | 15m.u. | W | 15m.u. |

| (23) W | 15m.u. | Product | 15m.u. |

| (24) F | 15m.u. | Fixed capital department (III) | 15m.u. |

Source: Author's elaboration from Cencini and Rossi (2015).

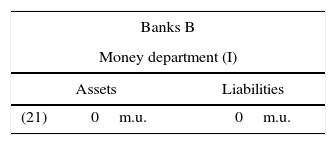

The balances of the three departments for the two periods are shown in Table 7.

The periods’ balances: bookkeeping.

| Banks B | |||

|---|---|---|---|

| Money department (I) | |||

| Assets | Liabilities | ||

| (21) | 0m.u. | 0m.u. | |

| Banks B | |||

|---|---|---|---|

| Saving department (II) | |||

| Assets | Liabilities | ||

| (24) F | 15m.u. | Fixed capital department (III) | 15m.u. |

| Banks B | |||

|---|---|---|---|

| Fixed capital department (III) | |||

| Assets | Liabilities | ||

| (14) Saving department (II) | 15m.u. | F | 15m.u. |

Source: Author's elaboration from Cencini and Rossi (2015).

Two types of payment characterize monetary economies of production: those payments thanks to which income is formed (or, conversely, destroyed), and those that channel the distribution of income from one agent to another. Bank systems, however, have no knowledge about whether actual payments belong to one category or the other. We argued that, as soon as investment is effective, the confusion of the two kinds of payments inevitably leads to a nominal divergence between national demand (deposits) and national supply (output). We argued then that a reform of national payments system must be implemented. More precisely, we advocated the creation of bank departments, where record is kept of money creation/destruction, income (deposits), and investment (fixed capital or invested profit). Attention has been particularly paid to the relationship between the second and the third department, i.e. those of saving and fixed capital. We argued that a capital department is needed for a couple of reasons. On the one hand, a capital department is needed to avoid the formation of a deposit, resulting from the expenditure of profit in wages payment, still available on the financial market. This would prevent inflation from surging. On the other hand, a capital department would be used to keep record of fixed capital, which is definitive societal saving, physically owned by companies. Given that investment gives rise to a production-based income, the third department would allow production-based incomes (otherwise said, wage-incomes) to be distinguished from distributed incomes (such as profit).

Up till now, we have studied the process of profit formation over a short time lapse and by considering a single company F. The study is easily understood if we consider the case in which an economic system is created. However, the analysis is not limited to such a case and may be applied to all real world examples in which several companies interact among themselves. Rather than an attempt to describe all of them – an obviously impossible task – some examples might serve to comprehend the matter. They might especially help in understanding the distinctions between the macroeconomic and the microeconomic dimensions. Despite the simplicity of the following examples, infinite, more complex, examples could be studied as desired. Nevertheless, the reasoning remains the same in all scenarios. Their lesson is therefore universal. This highlights the fact that the analysis in question, valid in the case of a single company, also holds true for a multi-company scenario, and, above all, it includes the entire set of companies existing in the same monetary system: in this context, therefore, the object of inquiry for the political economist is the industrial system taken as a whole.

The physical production of each company acquires economic attributes at the very instant wages are paid. Following Schmitt's reasoning, each single economic production is a macroeconomic magnitude, due to the fact that it increases national income each time it takes place. ‘Wages payment (the only macroeconomic cost of production) […] is the only [payment] through which physical goods become the object of a bank deposit. Whereas all other payments imply income expenditure, the payment of wages causes the formation of a positive income that is the result of the union of money and output, and thanks to which the physical product is the object of wages deposited as banks’ liabilities’ (Cencini, 2015: 101, our translation). ‘As soon as production outcome is not conceived of just as a physical object, but as the union between the physical product and its numerical-monetary form (as product-in-the-money), it becomes clear that the whole product is a net product. […] [P]roduction is a macroeconomic event, since it increases the income of those who carry out it, and also the income of the whole economic system to which they belong’ (Cencini, 2015: 103, our translation).

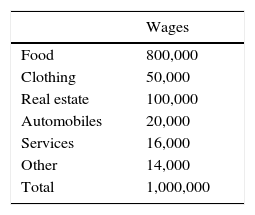

Let us therefore suppose an economy where a number of companies do exist, each company being specialized in a specific industrial sector. Companies are specialized in food, clothing, real estate, automobiles, services, and other goods (Table A.1).

Supposing that households (income earners) spend all their income in the purchase of food, the food company makes a profit of 200,000 money-units. In fact, the food company's earnings amount to 1 million money-units, while wage-costs total 0.8 million money-units. All other companies, instead, face costs for 0.2 million monetary-units, and have no gain. Still, an observation shall be made. As soon as the food company's earning is distributed to shareholders, it can be spent in purchasing the goods produced by the other companies. If clothes, houses, cars and services are sold at their production cost, shareholders will purchase the whole produced stock. Companies entirely cover their productions costs (wages).

From a macroeconomic viewpoint, total wages amount to 1 million money-units, which is the production cost of all companies, taken as a whole. Namely, this is the cost of production of the representative or macroeconomic company that would exist if we were to consider all companies as individual branches of a unique firm. The profit made by the food company is also arrived at by setting a selling price of 1.25 million money-units over production costs of 1 million money-units. A proportion may be of help:

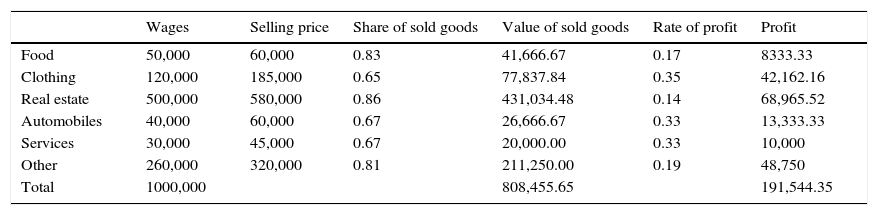

Hence, x (the selling price) equals 1,250,000 m.u.Now, another example might help make things even clearer. Suppose that income-earners spend the totality of their wages. Also, suppose that companies sell a percentage of production and stock the remaining part, this meaning that companies make profits. The rate of profit for each company differs from the rates of profit for the others, this meaning that the macroeconomic or selling price of the entire product cannot be found as the sum of each company's selling prices. This study case is summed up in Table A.2. By using the data in the first two columns, total profit can be calculated as the sum of each company's profits.

Wages, prices, and profit in a multi-company economy.

| Wages | Selling price | Share of sold goods | Value of sold goods | Rate of profit | Profit | |

|---|---|---|---|---|---|---|

| Food | 50,000 | 60,000 | 0.83 | 41,666.67 | 0.17 | 8333.33 |

| Clothing | 120,000 | 185,000 | 0.65 | 77,837.84 | 0.35 | 42,162.16 |

| Real estate | 500,000 | 580,000 | 0.86 | 431,034.48 | 0.14 | 68,965.52 |

| Automobiles | 40,000 | 60,000 | 0.67 | 26,666.67 | 0.33 | 13,333.33 |

| Services | 30,000 | 45,000 | 0.67 | 20,000.00 | 0.33 | 10,000 |

| Other | 260,000 | 320,000 | 0.81 | 211,250.00 | 0.19 | 48,750 |

| Total | 1000,000 | 808,455.65 | 191,544.35 |

It should be evident now “that macroeconomic” magnitudes […] are not obtained by aggregation; they are sets in the mathematical sense. Each product, however “small”, is a set; the product of every individual is macroeconomic, the sum of products gives a macroeconomic result quite simply because each product is already a macroeconomic magnitude. This means that the product is the result of a net creation […]. Each product thus increases the wealth of society as a whole, even if it appears in the possession of a single “individual” (Schmitt, 1986: 129).

Given global wages and companies’ incomes, the economy profit rate, π, approximately amounts to 0.19. If we were to conceive companies’ products (food, clothes, real estates, automobiles and so on) as the products of a single firm, the macroeconomic or selling price of the whole product would amount to 1,236,926.23m.u., as given by the following formula: p=∑W/(1−π).

We analyze here the payment of wages over a single time-period and over infinite periods. We seek to find the price of domestic output, as divided into wage and capital goods. In order to do so, we assume constant rates of saving of wages and profits, by extending the logic of the two-time study carried out in this work to infinite periods.

Let us suppose that, thanks to the intermediation of banks, income-earners’ deposits are credited with wages for 125 money units (m.u.), following a production of consumption and capital goods. Also, suppose that the value of capital equals one fifth of total product value, i.e. 25m.u. As soon as the company sells consumption goods (the value of which is 100m.u.) at a price of 125m.u., a profit of 25m.u. is made. Company's proceedings are such that productive costs – of both consumption and capital goods – have been fully covered. In particular, it is thanks to profit that the company covers the costs of production of capital goods. When wages are spent, a profit forms; when wages are paid, profit is spent (Schmitt, 1984: 479).

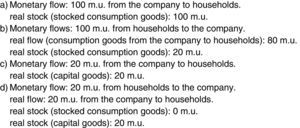

Let us suppose that wages are always fully spent in the purchase of consumption goods, and profit is always fully invested in the productions of capital goods (sw=0; sp=1). Income earners’ expenditure of 100m.u. wages in the purchase of wage goods at a price of 125m.u. gives rise to a monetary profit of 20m.u. with corresponding physical goods temporarily stocked in the company. Profit is then invested by the company. Income earners are credited with new wages following the production of investment goods. As we assumed a constant price/value ratio, the 20m.u. stock is sold then at a price of 25m.u. A stock worth 4m.u. is still left unsold, and company's bank deposits are credited with 4m.u. Supposing that a new production of investment goods takes place, income earners are credited with 4m.u. Repeating the reasoning infinite times, wages payment takes place over infinite time-periods. Wages will follow a decreasing trend approaching zero (see Table A.3).

The process follows a geometrical progression. In particular, total investment over the infinite horizon has a value amounting to 25m.u. Wages follow an exponential decay. In particular, wages follow a trend expressed by Wt=W0e−λt, where t=1, 2, 3, …, +∞. In our study case, λ=1.6094. For instance, 4=100e−2λ; λ=(ln25)/2=1.6094. Total output value over the infinite horizon (125m.u.) is: YTOT=∑n=0∞W0qn=W0((1−qn)/(1−q)), where q=e−λ=π. π is the profit rate, and e is Euler number.

We have dealt so far with one single payment of wages, starting from which an infinite number of other wages payments has followed (through profit investment over infinite time-periods). In real-world economies, the creation of a net wage-income takes place every period, thanks to the credit lines granted by the banking system to firms. In fact, it is thanks to credit lines that companies, without disposing of previous funds, pay wages to their employees. This amounts to saying that a process of income distribution and investment starts every time an initial payment of wages is made. Table A.4 might help understand this issue.

Deposits growth (per month, in money-units): an upward bound.

| 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

|---|---|---|---|---|---|---|---|---|---|

| 100 | 20 | 4 | 0.8 | 0.16 | 0.032 | 0.0064 | 0.00128 | 0.000256 | 0.0000512 |

| 0 | 100 | 20 | 4 | 0.8 | 0.16 | 0.032 | 0.0064 | 0.00128 | 0.000256 |

| 0 | 0 | 100 | 20 | 4 | 0.8 | 0.16 | 0.032 | 0.0064 | 0.00128 |

| 0 | 0 | 0 | 100 | 20 | 4 | 0.8 | 0.16 | 0.032 | 0.0064 |

| 0 | 0 | 0 | 0 | 100 | 20 | 4 | 0.8 | 0.16 | 0.032 |

| 0 | 0 | 0 | 0 | 0 | 100 | 20 | 4 | 0.8 | 0.16 |

| 0 | 0 | 0 | 0 | 0 | 0 | 100 | 20 | 4 | 0.8 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 100 | 20 | 4 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 100 | 20 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 100 |

| 100 | 120 | 124 | 124.8 | 124.96 | 124.99 | 124.9984 | 124.99968 | 124.999936 | 124.9999872 |

Source: Author's elaboration.

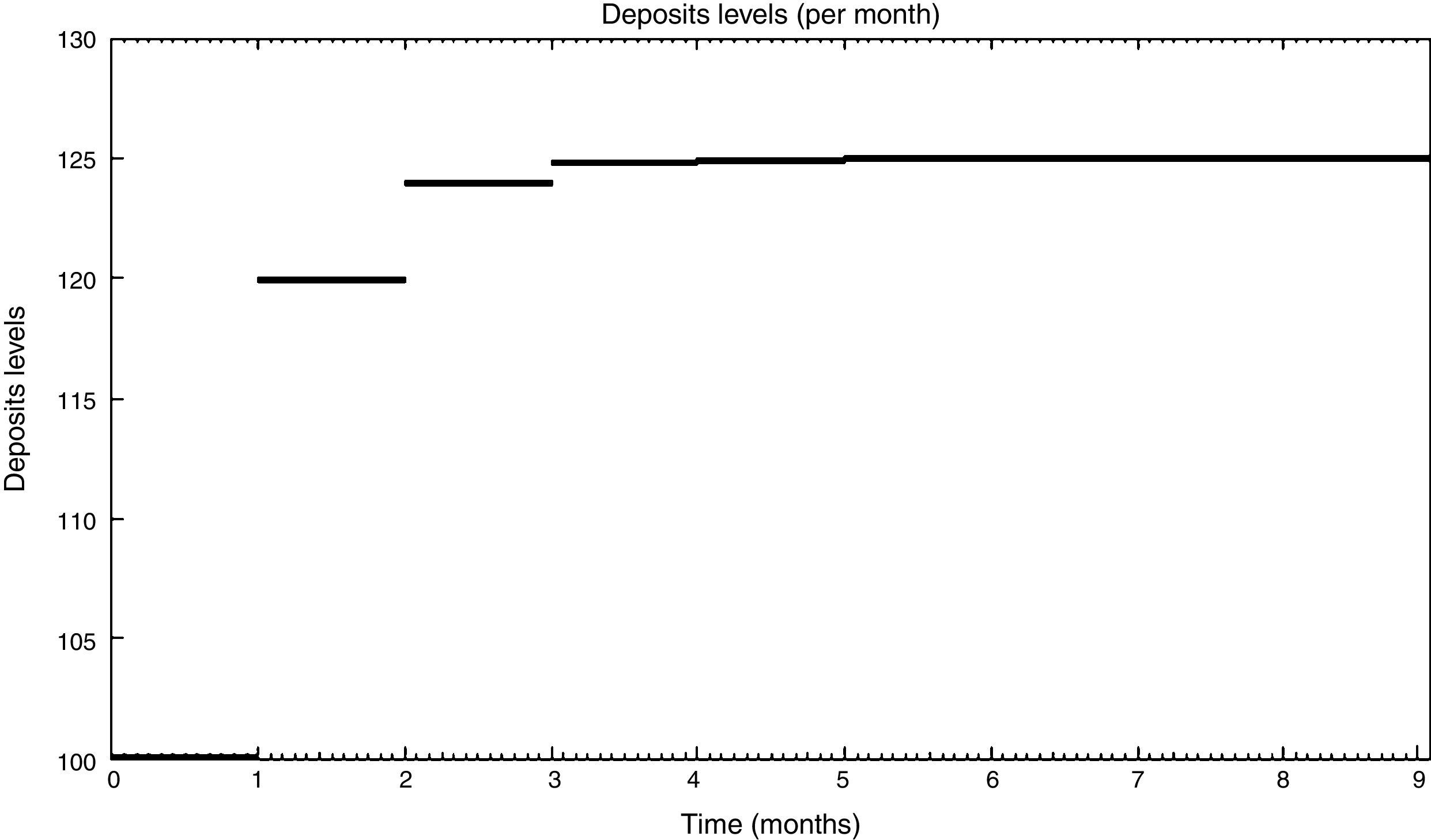

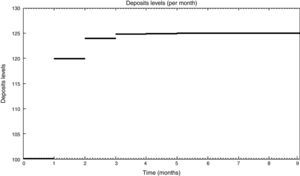

Let us consider ten time-periods (from t=0 to t=9), supposing that each time-period is equal to the solar month. Every month, thanks to banking intermediation, 100m.u. wages are paid for the production of consumption goods. We also suppose that the profit rate is constant and equal to 0.2, and that profit is always fully invested in several productions of fixed capital. This means that, besides wages payment for the production of consumption goods, every month further wages payments also take place for the production of capital goods. The overall process leads to a monthly increase in the deposits level (as shown in the last row of Table A.4): in particular, deposits approach the upward bound of 125m.u.

For the sake of clarity, observe also Fig. A.1, which shows the deposits levels over 10 time-periods. At the beginning (t=0), the first payment of wages gives rise to deposits amounting to 100m.u. (nominal wages measure a physical stock of consumption goods). The following month, wages for 100m.u. are paid for a new production of consumption goods. Meanwhile, 20 money-units are paid for the production of capital goods. The total deposits level equals 120m.u. A similar reasoning can be extended to an infinite number of time-periods. It is of particular interest, indeed, that, after the first four months, the deposits level already approaches the upper limit.

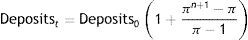

In particular, the deposits level at time t can be identified as follows:

where π is the profit rate.The two analyses of wages payments in one period and over infinite time-periods do coincide. In particular, values and prices always match, either when a one-period analysis is made or when different productions are carried out over infinite time-periods. In the former analysis, the price of consumption goods (125m.u.) includes the price of capital goods (25m.u.); the price of total output is thus equal to the value of total output (total wages). In the latter case as well, the price of consumption goods (125m.u.) includes the price of capital goods produced over infinite time-periods; hence, the initial price equals the value of the infinite productions of capital goods that take place over the infinite horizon.

We are thankful to Alvaro Cencini and Sergio Rossi for useful comments, to Michael Paysden for helping us translate an earlier draft of this paper, and to Simona Cain for helping edit the final text. The usual disclaimer applies.

From the perspective of the profits analyzed here, profit distributed to a company is not necessarily distributed to capitalists, but to any other individual, including workers and that part of society not directly employed (an example might be the families of company shareholders).

It must be pointed out that the term “capital goods” refers to the economic type of goods, namely a commodity, a machine, any product or service that is produced through the investment of macroeconomic profit, regardless of the physical form and the quantity of the capital goods in question.

This analysis thus coincides with the synthesis formulated by Hicks (1977: 152): ‘each capital is a fund (or saving) and a material (or stock)’ (Schmitt, 1984: 171, our translation).

The fact that workers are divided into two categories is not a necessary hypothesis. To make matters clearer, we have hypothesized that some workers produce capital goods, whiles others produce wage goods. However, in real economies workers’ duties are decided according to ability and not according to the typology of goods or services produced on the basis of income type – wages or profit – necessary for the production of given goods or services. Moreover, we should make it clear that our use of the term ‘income type’ is improper: we speak of ‘wages incomes’ to mean wages paid starting from a credit line; on the other hand, by ‘profit’ we mean the part of wages transferred to the company, or set of companies, and which represents its, or their, income.

This phenomenon was originally described by Schmitt (1984, our translation) as ‘depense gigogne’, a “nested spending or outlay”.

A controversial debate among the theorists of the monetary circuit regards the possibility for profit to be re-created more than once, time after time. See our Appendix B.

Schmitt states (1984: 192) that two cases of “benign” emission or inflation exist: (i) when bank loans to consumers are in part financed by the simple creation of money and not by pre-existing income; (ii) the net investment of profit in the production of capital goods.