The sovereign debt crisis is often evoked as one of the main causes of the economic difficulties faced by net importing countries and as the rationale behind the austerity measures imposed on their residents. Nothing seems more evident than a country whose global, commercial and financial, imports exceed its global exports has to finance its deficit through a foreign loan. This inevitably leads to the formation of an external debt. Yet, things are less straightforward than they might appear, and a rigorous analysis is called for to verify whether any country’ sovereign debt is ever justifiable. The paper shows that it is because net global imports are paid twice that net importing countries run up a sovereign debt. The case of Spain is symptomatic and provides statistical confirmation of the pathological increase in the country's external debt.

La crisis de la deuda soberana suele considerarse como una de las principales causas de las dificultades económicas a las que se enfrentan los países importadores netos. Constituye asimismo la razón que justifica las medidas de austeridad impuestas a sus residentes. Nada parece más evidente que un país, cuyas importaciones globales, comerciales y financieras, exceden sus exportaciones globales, tenga que financiar su déficit mediante un préstamo extranjero. Lo que conduce inevitablemente a la formación de la deuda exterior. Sin embargo, la realidad es más compleja de lo que parece. De ahí que sea necesario un análisis riguroso que aclare si la deuda soberana de cada país está justificada. Este artículo muestra que no lo está, desde el momento en que los países importadores netos se encuentran con una deuda soberana debido al doble coste de las importaciones globales netas. El caso español es sintomático y aporta confirmación estadística del aumento patológico de la deuda exterior del país.

The aim of this paper is to show – starting from Keynes's analysis of what he called ‘the transfer problem’ and then referring to Schmitt's (2012, 2014, 2017) investigation – that countries incur a sovereign debt only as a consequence of a pathology affecting the present system of international payments. In particular, it will be shown that it is because net imports are paid twice – in real terms and, additionally, in monetary terms – that net importing countries run an external debt. The pathology is such that deficit countries have to make up for the difference between commercial and financial purchases and sales even though their residents have fully paid for their net imports.

To help understand the origin and nature of countries’ sovereign debts, the paper considers the case of Spain and provides statistical confirmation of the existence of a fully unjustifiable external debt that has caused a substantial increase in Spain's unemployment. Official statistical data show that Spain's external debt has increased far beyond what can be explained by the evolution of the economic ‘variables’ accounting for it.

The second part of the paper is devoted to showing that Schmitt's positive analysis leads to a normative proposal, i.e. to a reform capable of dealing with the pathological nature of countries’ sovereign debts. If implemented, the reform would enable each net importing country to avoid the formation of a new sovereign debt and allow it to gain the amount of national income paid by its residents for their net foreign purchases. Today, Spain loses part of its domestic income and incurs a sovereign debt. Thanks to the reform, Spain would gain the domestic income corresponding to its net imports, and would incur no sovereign debt. This would be made possible by guaranteeing the real payment of Spain's net imports through a transfer to the rest of the world (R) of an equivalent amount of its (Spain's) current output, which means, without failing to fully pay their due to the country's foreign creditors.

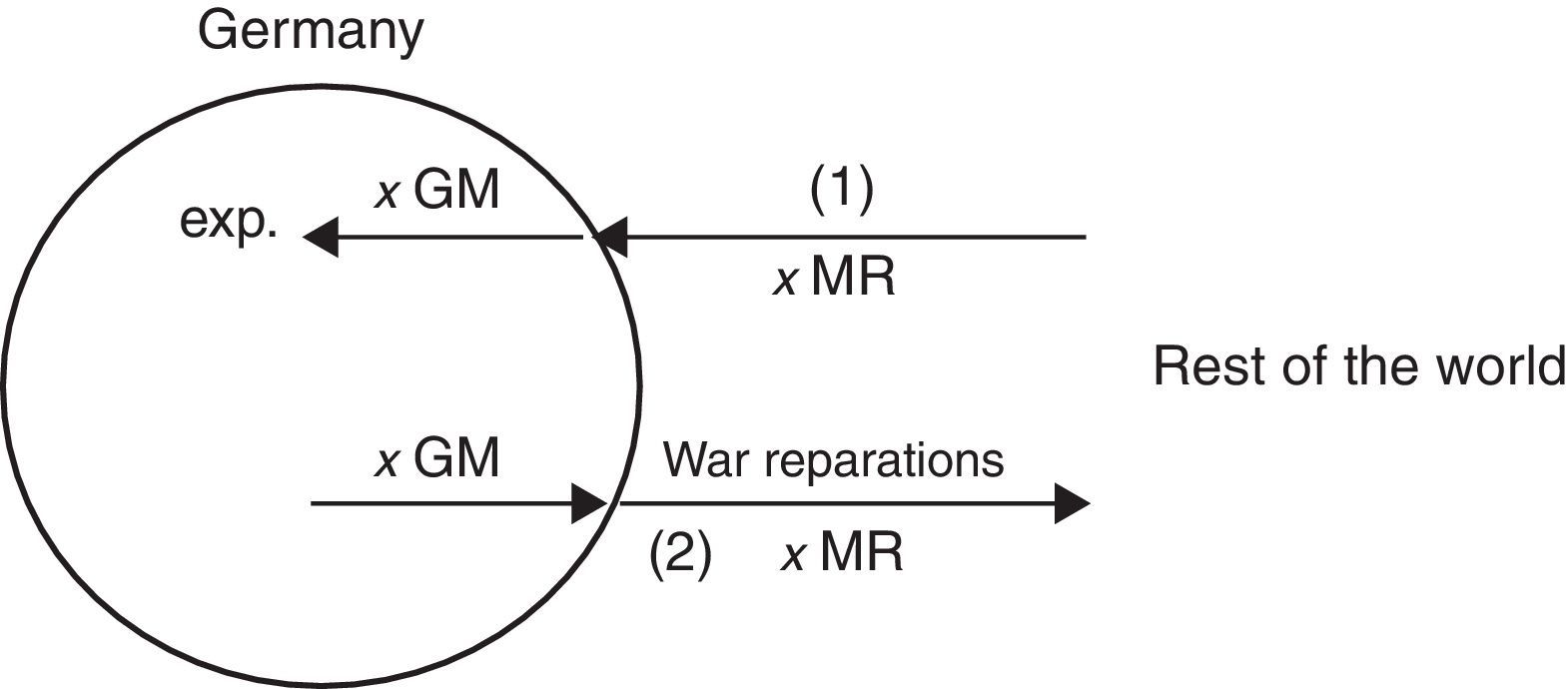

2From Keynes's ‘transfer problem’ to countries’ sovereign debtIn 1929 Keynes addressed the problem posed to Germany by the payment of war reparations at the end of the Great War and arrived at the astonishing discovery of a pathology that multiplied the cost of Germany's payment by two. He based his analysis on the necessity for Germany to find both the amount of domestic income covering for the real payment of war reparations, and, in addition, the amount of foreign currency needed to transfer the payment to the Allies. The first requirement was at the origin of what Keynes called the budgetary problem, while the second, which he named the transfer problem, was the cause of the duplication. In Keynes's own words, the budgetary problem was that of ‘extracting the necessary sums of money out of the pockets of the German people’ (Keynes, 1929a: 1), while the transfer problem was that of ‘converting the German money so received into foreign currency’ (Keynes, 1929a: 1).

The budgetary problem consisted in the need for German residents to pay war reparations in their own national income; the transfer problem consisted in the additional requirement for Germany to pay war reparations in a foreign currency. The transfer problem arose because of the need to convert the first payment, in domestic money, into a payment in foreign currencies. The question asked by Keynes concerned the cost of the conversion and one can formulate it as follows: is the cost of war reparations in German domestic currency in addition to the one in foreign currencies? That is, do the two payments, by Germany and by its residents, add up to one another? Keynes's answer was yes, and he explained the double charge affecting Germany by claiming that the payment in foreign currencies would have entailed the devaluation of the German currency. ‘For I hold that the process of paying the debt has the effect of causing the money in which the debt is expressed to be worth a larger quantity of German-produced goods than it was before or would have been apart from the payment of the debt’ (Keynes, 1929c: 405).

Keynes's fellow economists did not understand his deep intuition. In particular Ohlin and Rueff argued that in order to pay for war reparations Germany had merely to reduce its foreign borrowing and transfer abroad part of its ‘buying power’. The financial outflows would have had the effect of decreasing ‘the buying power in Germany and thus its importations of foreign goods’ (Ohlin, 1929a: 173), and of increasing ‘the buying power in the lending countries and, thus, their importation of German goods’ (Ohlin, 1929a: 173). Yet, the Swedish and the French economists failed to notice that Keynes's argument was with the failure of the system of international payments to provide a mechanism allowing for the cost-free conversion of payments between monetary sovereign countries, and not with the economic difficulties faced by Germany. They did not understand that international payments cannot reduce to inter-regional payments and that Keynes's analysis dealt precisely with the problem of converting domestic into international payments.

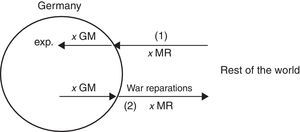

Let us propose a formal proof of Keynes's intuition by referring to the law of supply and demand applied to the currencies involved in the payment of German war reparations. Assume that the exchange rate between German national money, GM, and the money of the rest of the world, MR, is on a par: 1GM for 1MR, and that the amount to be paid in war reparations amounts to x MR (= x GM). The condition for Germany to be able to honour its external debt is to earn x units of MR. As Ohlin (1929a, 1929b) and Rueff (1929), Keynes (1929a, 1929b, 1929c) agreed with the need for Germany to increase its net exports in order to obtain the amount of MR required to pay for its war reparations. Let us therefore suppose German net exports to be equal to x MR, and analyse what happens to the German currency's exchange rate when the rest of the world pays Germany for its net foreign sales and, then, when Germany pays the Allies their due, Fig. 1.

The payment of German net exports by the rest of the world defines a demand of German currency in terms of MR. On the other hand, the payment of war reparations (which forces German residents to pay an amount of x GM in taxes) defines a demand of MR in terms of GM. Apparently, the two opposite demands balance each other and should have no effect on German national currency. Yet, this means to forget that the law of supply and demand exerts its effect according to the elasticity of supply: the lesser the elasticity of supply, the lesser the effect of a sudden increase in demand on prices and vice versa. The apposite question concerns therefore the degree of elasticity of the supply of German money when German banks are credited in MR and pay German exporters in GM.

As bankers would confirm, German banks pay their fellow exporters simply by entering a sum of GM on the liabilities side of their balance sheet, an entry that matches the one, of x MR, on the assets side. Known as the monetization of foreign currencies, this operation, which the German central bank takes over, defines an emission of GM and is costless for the German banking system. Hence, it is compulsory to infer that, with respect to the demand exerted in MR by the rest of world, the supply of GM is perfectly elastic: whatever the amount of GM required to monetize the MR obtained as payment of its net exports, Germany's banking system can instantly create it at zero cost. The implication for the exchange rate of the German currency is clear: GM's exchange rate with respect to MR remains unaltered.

However, things are radically different as far as the payment of war reparations by the German nation is concerned. Since German banks cannot create the slightest sum of MR, for Germany the elasticity of the supply of foreign currencies is zero. In no circumstance does the supply of MR automatically adjust to the demand exerted by GM. The German banking system has to find on the foreign exchange market the sum of MR needed to convert its payment to the Allies. It is true that the rest of the world credits the German central bank with a sum of MR following the payment, by R, of German net exports. Yet, it would be mistaken to believe that this means that Germany can use it for the payment of its war reparations without having to purchase it. Indeed, official reserves are immediately invested on the international market and in no case are they made available free of cost to the German government. This clearly means that the conversion of the payment made by German residents in GM (to Germany's Budget) into a payment in MR defines a net demand of MR in terms of GM, which an equivalent increase in supply cannot match. Because of the inelasticity of MR's supply, the increase in demand exerted by Germany in its national currency leads to its devaluation with respect to MR, which supports Keynes's claim about the additional cost of the payment of war reparations caused by the transfer problem.

Keynes was not able to convince his fellow economists, and his intuition remained somehow mysterious. Indeed, if devaluation was the necessary consequence of the payment of a country's net foreign purchases of commercial and financial goods (of which the payment of war reparations is only a particular case), a great number of countries should actually suffer from a constant and massive devaluation of their national currencies, which is not the case. What Keynes did not investigate was the possibility for the neutralization of the devaluating pressure by means of a foreign loan. Instead of purchasing on the foreign exchange market the foreign currency needed to pay for its net imports (commercial and financial), the deficit country can finance them by borrowing abroad the required sum of MR. Yet, it is hardly necessary to note that, while it avoids the devaluation of the deficit country's national currency, the resort to a foreign loan does not avoid the implications of Keynes's transfer problem. It is indeed clear that the deficit country can avoid the devaluation of its domestic currency only at the cost of incurring an external debt. This shows that Keynes's diagnosis of the transfer problem is but a first, important step towards that of an increasingly worrisome disorder: that of the external debt crisis. Let us dwell on this by following Schmitt's ground-breaking discovery of the pathological nature of countries’ sovereign debts (Schmitt, 2012, 2014, 2017).

3The pathological formation of sovereign debtsA privileged starting point is the balance-of-payments identity between global imports and global exports:

where IM represents the sum total of a country's imports or purchases of commercial and financial assets, and EX stands for its total exports or sales of commercial and financial assets.The founding principle of the balance-of-payment identity is that of double-entry bookkeeping. As claimed by Stern (1973: 2), in the balance-of-payments ‘[t]ransactions are recorded in principle on a double-entry bookkeeping basis. Each transaction entered in the accounts as a credit must have a corresponding debit and vice versa. […] It follows from double-entry bookkeeping that the balance of payments must always balance: total debits equal total credits’. Let us refer to the fact that – as Stern (1973) explicitly maintained, and Krugman and Obstfeld (2003: 314) among others successively reiterated – each transaction must be recorded as a credit and a debit. We immediately see that the required equality between total purchases and total sales is but a consequence of double-entry bookkeeping as applied to each transaction entering the balance-of-payments. In the IMF's official publications (International Monetary Fund, 2009), the IM=EX identity is introduced in the form of CA+KFA=0, where CA stands for ‘current account’ and KFA for ‘capital and financial account’, which emphasizes the need for net current account transactions to be matched by net capital and financial account transactions. Both forms are correct, and our choice of the former is justified by the desire to found the analysis of countries’ sovereign debt on the clearest and simplest concepts regarding international transactions and their relationship.

What we want to stress here is that the relationship IM=EX is central to international economics and defines a logical law countries have necessarily to comply with. It states that each country's foreign global purchases are always and necessarily equal to its foreign global sales or, in Schmitt's words, that countries too are subject to the law of the identity between each economic agent's sales and purchases (see Schmitt, 1975).

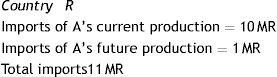

Let us consider the case of a country suffering from a positive sovereign debt. According to the majority of economists and experts of international economics, such a situation arises when a country's expenditures exceed its sales, so that it has to incur a debt to finance its net imports through a foreign loan. Let us make it clear from the outset: the problem is macroeconomic and concerns the country as a whole, as the set of its residents. Hence, the expression ‘sovereign debt’ stands for the external debt carried by the country itself following the external sales and purchases, commercial and financial, of both its public and private sectors. A very simple numerical example will prove useful. Consider a country, A, whose global imports are equal to 11MR (for example, billions of US dollars), and whose global exports are of 10MR, where MR stands for money of country R, the rest of the world. In order to finance its net imports of 1MR, country A has to obtain a foreign loan of that amount from R. It seems therefore obvious to infer that country A incurs an external debt, and that its residents will have eventually to accept the austerity measures required to honour it. Apparently, respect of the balance-of-payments identity entails the formation of A's sovereign debt, which leads to the unavoidable conclusion that country A has lived beyond its means.

This is however to forget that, by imposing the equality between A's total imports and its total exports, the balance-of-payments identity is inconsistent and at odds with the formation of an external debt of the country itself. In other words, once the identity is established, A's net imports are fully paid through equivalent exports, and no justification can be found for the existence of a positive sovereign debt. Let us analyse further our numerical example and verify what happens when A obtains a foreign loan from R.

According to the initial situation, R's imports of A's current output are only equal to 10MR, while its (R's) exports of domestic current output are equal to 11MR. The loan obtained from R has the effect of reducing to zero the difference, of 1MR, between R's total exports and its total imports. This is so, because the object of R's loan to A is a part, of value 1MR, of A's future output. Indeed, A will reimburse the loan, in a successive period, by giving up an equal amount of foreign currency earned through its exports of real goods. Since the period in which R's loan is granted to A, country R acquires the ownership over part of A's future production, and brings its total imports to the level of its total exports, 11MR.

We claim that, having paid the totality of its imports in real terms through an export of its current production and one of its future output, country A should not incur any external debt to R.

As a matter of fact, as implied by Keynes's intuition concerning the duplication of the cost of war reparations, country A's sovereign debt is the pathological result of a duplication due to the absence of a true system of international payments. Analogously with Keynes's argument, country A's net imports are paid by A's residents and additionally by their country. This is so because, in the present non-system of international payments, the transfer to R of the real payment of A's net imports carried out by its residents can only take place at a cost: the monetary payment adds up to the real payment and forces country A to incur an external debt totally unjustified and unjustifiable. Indeed, Schmitt (2014) proves that presently two foreign loans are required for the payment of A's net imports. One loan makes up for the real payment, whereas a second loan is necessary to carry out the monetary payment. What has gone unnoticed so far is that a single loan cannot have as its object both a sum of real goods and a sum of foreign currency.

Two equalities are crucial here:

- 1)

The sum of real values exported (commercial and financial) must be equal to the sum of real values imported (also commercial and financial);

- 2)

The sum of monetary payments must be the same for A and R.

Equality (1) is obtained through the export of a sum of A's future products; it results from the first loan of 1MR granted to A by the rest of the world. Equality (2) calls for a new loan of 1MR, which gives rise to A's sovereign debt. The first loan, designed by Schmitt (2014) as an ‘ordinary’ loan, finances A's future exports of real goods, and thus brings R's imports to the level of its exports. The second loan is macroeconomic, and provides country A with the amount of foreign currency (MR) it needs to make up for the difference between its expenditures and its receipts. In order to finance both its future exports of real goods and its actual net imports, country A has to borrow abroad. ‘Now, it is obviously inconceivable that the same loan of 1MR pays for, at the same time and for the same period, an export of 1MR and an import of 1MR of the same economy’ (Schmitt, 2014: 22). Two loans of 1MR each are required, of which only one is justified. The second loan is the consequence of the pathological system of international payments adopted so far, which does not provide countries with the international means of payment necessary to convey the payment, in real terms, of their net global imports. The first loan is an ordinary one and, as such, is included in A's balance-of-payments. It is perfectly in line with the balance-of-payments identity and is thus perfectly justified. In other words, the ordinary loan specifies a debt incurred by A's residents that does not in the least entail a positive, macroeconomic indebtedness of their country. On the contrary, the second loan is of a macroeconomic nature and, although incurred by country A's residents, defines a debt that rests on the country as a whole: a sovereign debt. ‘Sovereign debt is thus finally acknowledged in its precise nature: it is carried in addition to the debt that is naturally included in the balance of payments’ (Schmitt, 2014: 29).

When country A's residents borrow 1MR, they obtain from R the financing of an equivalent part of their future output: the loan will be reimbursed in a successive period through a real export of A's economy. This means that lenders of R become the owners of part of A's future production from the moment the loan is granted to A. In other words, economy A gives up immediately the ownership over part of its national output to be produced in the future, which is tantamount to saying that, through its loan, R finances part of A's future production. This is nothing other than the real payment of A's net imports. Yet, A's net purchases are still to be paid monetarily, because R's exporters have to be paid in MR. Given that the object of the first loan obtained by A's economy is part of its future product and not a sum of MR, a second loan of the same value is necessary for A to pay its net imports. It is this second loan that gives rise to A's sovereign debt. Finally, two loans of 1MR value each are required to settle A's net foreign purchases whose value is merely equal to 1MR. The second loan is totally unjustified and is the mark of the duplication arising today any time a country finances its net imports through a foreign loan.

Let us shortly go back to the balance-of-payments identity. Today, it is thanks to R's first loan that the identity is complied with. Through this loan, R's total imports are increased from 10MR to 11MR, because its effect is to give R the ownership over part of A's future production. This brings A's exports to the level of its imports, and defines the real payment (or the payment in real goods) of its initial net imports. At this point, the reader could remark that A has not yet reimbursed the loan obtained from R, which would justify the existence of a net debt of A to R. This argument is not correct, because it misses the fact that the amount of foreign currency, equal to 1MR, lent by R is still available in A. In particular, the amount obtained from R could be used to increase A's official and/or private reserves, in which case A's debt to R would be balanced by the credit of A's reserves towards the rest of the world. Having fully paid in real terms its net imports, A should indeed benefit from a positive inflow, of 1MR, which would match its external debt. It follows that, in itself, the balance-of-payments identity is never the cause of any positive sovereign debt. If things go wrong and countries incur sovereign debts it is because the present system of international payments is not in line with this identity: it forces indebted countries like A to use the foreign currencies obtained from R to pay additionally for their net imports. A's sovereign debt is precisely the result of the loss of the foreign currency that should have increased its official and private reserves.

The necessity of two foreign loans of 1MR value each results very clearly from the fact that A must at the same time reimburse the lenders of R and pay R's exporters. Since A will give up to R part of its future output, the foreign currencies obtained as a loan should be added to its international reserves of period p0. This not being the case, A loses both part of its future production and an equal part of its current output. The first loss is due to the reimbursement of the loan obtained from R, the second loss is due to the foreign debt that A incurs since period p0.

A distinction between periods helps to understand the problem. Let us suppose that economy A reimburses the loan obtained in the first period, p0, in the following period, p1, and that A's net imports in p1 are equal to the ones in p0. In order to reimburse R in period p1 A must give up part of the foreign currencies it earns through its exports. This means that, once it has reimbursed R, A has at its disposal the sum of 10MR−1MR=9MR. However, A's total purchases in p1 are of 11MR, the difference between A's total expenditures and its net entries in foreign currency are therefore equal to 2MR, twice the amount of its net imports.

Another proof of the pathological nature of countries’ sovereign debts proposed by Schmitt (2014) is based on the undisputable fact that residents of any deficit country, A, pay for the totality of their foreign purchases. Let us consider the case of Greece. Everybody seems to agree that the huge amount of Greece's sovereign debt is the unavoidable result of it having lived beyond its possibilities and having benefited from free lunches at the expense of the rest of the world in general, of Germany and other European countries in particular. Now, this would indeed be true only if Greece had never paid for its net imports, which is not the case. In reality, Greek residents have paid the totality of their imports, net imports included, in their own national money. Since Greek residents have lost part of their national income to cover for the real payment of their foreign purchases, there is no logical justification for the formation of the external debt of their own country. In the same way as Germany should not have run an external debt on top of its national product lost in war reparations, Greece should not carry the burden of a sovereign debt that adds up to the loss of national income suffered by its domestic economy.

Given the complexity of the argument and its relevance for the future of indebted countries, let us discuss further the double payment of net imports. What must be made clear from the outset is that the pathology denounced by Schmitt (2012, 2014), Cencini (2016, 2017), and Cencini and Rossi (2015) characterizes the present non-system of international payments and occurs any time a net importing country pays for its net foreign purchases through a foreign loan. A first and superficial analysis seems to corroborate the wide-held belief that the external debt incurred by deficit countries is perfectly justified, because of the foreign loans required to finance their net imports of commercial and financial goods. However, at closer examination it appears that countries’ residents pay for the entirety of their international transactions. Only two possibilities are therefore conceivable: either

- 1)

The domestic income spent by a net importing country's residents is earned by the country itself, or

- 2)

The domestic income paying for the residents’ net imports is lost to the country as a whole.

As everyone can immediately verify, the net importing country (its central bank, government, or Treasury) is not credited with the domestic income spent by its residents. If it were, it could be maintained that the country's external indebtedness derived from the foreign loan that finances its net imports is balanced by a net inflow of domestic income. This not being the case, it is compulsory to infer that net importing countries suffer at the same time from a loss of national income and an increase in their external debt.

The previous conclusion might sound weird and a critical reader could point out that, if it were true that net importing countries lose part of their national income every time their residents pay for their net imports (commercial and financial), deflation would have severely hampered their economies. The presence of deflation would be there to confirm the existence of the double payment we are so painstakingly trying to prove. The fact that deficit countries do not suffer from such a decrease in their current national income is therefore the clear proof that these countries do not have to pay twice for their net imports, and that their sovereign debt is entirely justified. Or is it? What is missing in this argument is an explanation of the way countries’ domestic economies recover the amount of national income lost by their residents in the payment of their net imports. Indeed, it is beyond dispute that countries do not earn the amount paid by their residents. If, lost through the payment of A's net imports, the amount of domestic income spent by the country's residents in the payment of their net imports is still available in A, it is because A has somehow recovered it. Now, what allows for the recovery of A's domestic income is the first loan obtained by A's economy from the rest of the world. To say that A can finance part of its future production through this loan or that it is able to recover the amount of domestic income lost in the payment of its residents’ net imports is not substantially different. In any case, the object of the first loan obtained from R is not an amount of MR, but rather an amount of MA that, by restoring the previous level of A's domestic income, allows for the financing of its future production. Whatever explanation we choose eventually, it leads to the conclusion that another loan is required in order for A to be able to pay, in money terms, its net imports. Country A must carry out the payment of R's exporters in MR, which makes it compulsory for A to incur another debt in order to obtain the required amount of MR.

As previously observed, the reason of the pathological formation of sovereign debts lies in the lack of a true system of international payments allowing for the automatic and cost-free transfer of the payments carried out by the residents of different countries. Such a system exists within any given country, so that the monetary payment is never added on top of the real payment. For example, if an economic agent a needs to pay an economic agent b, s/he has merely to find the income required, without having to worry about the money necessary to convey her/his real payment. Banks provide the necessary vehicular money at no cost, and the structure of the banking system is such that it guarantees the vehicular use of bank money. This is unfortunately not the case at the international level. Deficit countries must pay for the purchase of a means of payment (money) that a system of international payments should provide free of cost. The real payment of net imports is perfectly justified, no one denies it, but it is highly unjust that, on top of losing part of its national product, a country has to get indebted in order to obtain a mere numerical means of payment.

4A statistical confirmation: the case of SpainIt is no mystery that Spain is a heavily indebted country. Its gross external debt has constantly been raising and its debtor position (TARGET2 balances) with regard to the European Central Bank (ECB) reached 266’5 billion euros at the beginning of 2016 (ECB, 2016). Before analysing the situation of Spain starting from the official data published by the World Bank and the IMF, a few words are necessary to do away with an apparent contradiction between our claim that net importing countries, Spain included, pay twice their net imports, first in domestic income and, additionally, in MR, and the fact that Spain is a member of the euro-zone and so pays in euros for its net purchases from other member countries.

It is clear that if the euro were indeed a single currency, payments among euro-zone member countries would be of the same nature as the payments carried out by residents of different regions of the same country. ‘[I]t follows from the logic of the single currency that all Euro-denominated payment and securities transactions within the Euro zone (i.e. within the borders of the currency area) are ‘domestic” (Kokkola, 2010: 174). If this were the case, no sovereign debt between euro-zone member countries could ever arise, because their residents would carry out all their payments using the same unit of account and the same system of final settlements. Two observations lead, however, to a different and rather distressing conclusion. Both are factual and conceptual at the same time.

The first concerns the lack of a centralized system of payments whereby the ECB would ‘vehiculate’ or convey each payment between residents of different euro-member countries through the circular emission of a common currency (see Cencini, 2010, 2016). As it happens within any national banking system, payments between clients of different banks require the intervention of the central bank acting as monetary and financial intermediary. This implies both the emission of central bank money and the implementation of a real-time gross settlement mechanism founded on a system of multilateral clearing. Each payment has to go through a process that gives banks’ currencies a common form and allows for the settlement of interbank transactions in real terms. As clearly stated in the Blue Book published in 2007 by the ECB, in both the first and second version of TARGET (Trans-European automated Real-time Gross-settlement Express Transfer system) payments between residents of euro-zone member countries are carried out without the active intervention of the ECB. Because of the lack of a common form provided by a process of catalysis managed by the ECB, national currencies of euro-member countries are doomed to remain heterogeneous: despite appearances to the contrary, the euro is not yet the single currency people assume it is.

The second observation relates to the existence of huge amounts of debts incurred by euro-member countries and entered by the ECB as TARGET2 balances (Rossi, 2012). Thus, for example, in October 2016 Spain was running a deficit of 313’8 billion euros, while Germany had a credit of 708 billion euros (ECB, 2016). According to Sinn and Wollmershäuser (2012: 488), target balances are indeed symptomatic of the existence of debts between euro-member countries: ‘a country's target debt measures the accumulated balance-of-payments deficit with other Euro countries’. This would not be so, and ECB's experts would be right to claim that ‘TARGET2 balances of Euro zone NCBs [national central banks] reflect the uneven distribution of central bank liquidity within the Eurosystem’ (ECB, 2011: 39), only if the euro were proven to be the single currency of the euro-zone. Unfortunately, as confirmed by the absence of a true RTGS (real-time gross settlement) system, and by the existence of important differences in euro-member countries’ spreads, this is precisely what the Eurosystem is still lacking.

Hence, Spain's residents carry out their international payments in Spanish euros, Italian residents carry them out in Italian euros, Greek residents in Greek euros, and so on. It follows, that the general analysis introduced in the first part of this paper holds good for Spain not only with respect to its extra-European payments, but also for its external payments within the euro-zone.

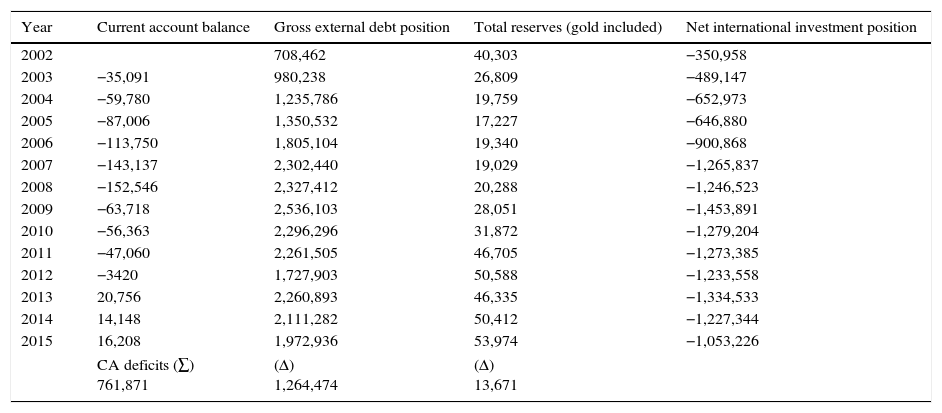

In order to carry out the statistical verification or refutation of any theoretical thesis one has first to establish the relevant statistical data and their reliability. In our case, the relevant data concern the amount of Spain's external debt and of all those balance-of-payments entries that can justify it. As for Spain's debt, the best official data at our disposal are those of the gross external debt position and these can be found in The World Bank Open Data collection of time series data of the World Bank. In Table 1 the reader can find the yearly data concerning Spain's gross external debt position from 2002 to 2015. The difference between the amount reached in 2015 and that of 2002 (end of the year), shows the increase in debt Spain had to endure in the period under exam.

Statistical data concerning Spain's external debt between 2003 and 2015 (in millions of US dollars).

| Year | Current account balance | Gross external debt position | Total reserves (gold included) | Net international investment position |

|---|---|---|---|---|

| 2002 | 708,462 | 40,303 | −350,958 | |

| 2003 | −35,091 | 980,238 | 26,809 | −489,147 |

| 2004 | −59,780 | 1,235,786 | 19,759 | −652,973 |

| 2005 | −87,006 | 1,350,532 | 17,227 | −646,880 |

| 2006 | −113,750 | 1,805,104 | 19,340 | −900,868 |

| 2007 | −143,137 | 2,302,440 | 19,029 | −1,265,837 |

| 2008 | −152,546 | 2,327,412 | 20,288 | −1,246,523 |

| 2009 | −63,718 | 2,536,103 | 28,051 | −1,453,891 |

| 2010 | −56,363 | 2,296,296 | 31,872 | −1,279,204 |

| 2011 | −47,060 | 2,261,505 | 46,705 | −1,273,385 |

| 2012 | −3420 | 1,727,903 | 50,588 | −1,233,558 |

| 2013 | 20,756 | 2,260,893 | 46,335 | −1,334,533 |

| 2014 | 14,148 | 2,111,282 | 50,412 | −1,227,344 |

| 2015 | 16,208 | 1,972,936 | 53,974 | −1,053,226 |

| CA deficits (∑) 761,871 | (Δ) 1,264,474 | (Δ) 13,671 | ||

As for the data liable to justify this increase, the most significant are those of Spain's current account (CA) deficit. The ones entered into Table 1 are those collected by the IMF and show a persistent deficit throughout the period 2003–2012 and a surplus for the following three years. The sum of Spain's net current account deficits from 2003 and 2015 explains part of the increase in its external debt during the same period.

Another pertinent data set concerns the variation in Spain's official reserves. Since central banks lend the foreign currencies entered in the reserve account without delay, an increase in this major component of countries’ official reserves defines an increase in their credits towards the rest of the world. Yet, as the data of Spain's external debt are those of its gross external debt position and given the negative sign of Spain's current account, it is clear that the increase in its official reserves gives necessarily rise to an equal increase in its gross external debt. The same is true for the other components of Spain's official reserves. Gold, for example, is an asset that the Spanish central bank can obtain only by purchasing it, a transaction that requires the expenditure of an equivalent amount of foreign currencies. Finally, the positive variation in Spain's official reserves, given by the difference between their amount in 2015 and in 2002 (end of the year), has to be included in the data accounting for the increase in Spain's gross external debt position in the period 2003–2015.

The last data relevant in our case are those of the Net International Investment Position (IIP) as collected and elaborated by the IMF. In particular, what we have to verify is whether from 2003 to 2015 Spain's IIP was positive or negative. The negative sign of the IIP shows, in fact, that in those years Spain was no net purchaser of foreign financial claims. This is to say, that during the period 2003–2015 Spain has benefited from net foreign loans, so that its net financial imports are not part of the cause of the rise in its external debt. To the extent that net foreign loans increase the country's inflows of foreign currencies, the variation of Spain's official reserves already account for them, which indicates that the increase in Spain's gross external debt position is justifiable up to the sum of its CA deficit and the increase in its official reserves.

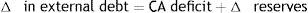

If no pathology had affected the payments of Spain's international transactions, the following equation would apply for the period 2003–2015:

Now, as results from Table 1, the sum of Spain's current account deficit, 761’9 billion dollars, and of the increase in its official reserves, 13’7 billion dollars, from 2003 to 2015 is far from explaining the increase in its gross external debt position, 1’264’5 billion dollars. On the contrary, the difference between the latter and the former gives the amount of the pathological increase in Spain's external debt.

Statistical data are subject to distortions due to exchange rate fluctuations. Despite cross verifications, increases in control, and the adoption of a shared methodology and protocol by international institutions, their reliability remains approximate. Because of this, one cannot provide a true statistical proof of the pathological duplication of Spain's external debt. Yet, the correspondence between the amount of the unjustifiable increase in Spain's external debt, 488’9 billion dollars, and that of its CA deficit, 761’8 billion dollars, is significant.

Although not comparable to a formal proof, the convergence between the unjustifiable increase in Spain's foreign debt and the amount of its net imports is a statistical confirmation of what Schmitt has established on logical basis. It confirms, indeed, that, in the present non-system, the payment of Spain's net global imports is at the origin of its sovereign debt, an external debt carried by the country as a whole whose nature is entirely pathological.

5Principles of a reform that would allow Spain to avoid incurring a sovereign debt without impending its external transactionsThe aim of a reform dealing with the sovereign debt crisis is clear: to allow Spain to pay only once for its net imports. One must find a way to enable Spain, or any other single country willing to follow its example, to carry out its external payments on its own without incurring a sovereign debt in the presence of a framework characterized by a non-system of international payments. In other words, one has to show that any single country can implement a mechanism capable of protecting it against the pathologies of the present non-system without any negative side effects for its foreign partners. Spain must pay its foreign economic correspondents their due, and it must do so without any need to reduce its foreign trade in the least because of the reform.

In his 2014 paper, Schmitt advocates a series of measures that, if implemented, would enable any net importing country not only to avoid getting indebted, but also to earn what it loses today in the double payment of its net imports. Let us summarize them here and offer a concrete example showing how they would work.

5.1The creation of a (sovereign) BureauThe pathologies affecting the non-system of international payments are of a macroeconomic nature, and derive from the lack of appreciation of this crucial aspect. It is therefore not surprising that Schmitt's first measure consists in creating a sovereign Bureau charged to represent the country as a whole. The aim of such measure is to transform domestic payments to the benefit of the rest of the world into payments carried out between residents. In particular, acting on behalf of the country's residents, the commercial banks would address to the Spanish Bureau the payments in domestic currency carried out to cover for the residents’ net imports. As a rule, the Bureau would collect all the payments made by the importers and see to the payment of exporters. It follows that the Bureau would obtain, as a net gain, the difference between the sum paid by Spanish importers and that paid to Spanish exporters – a difference equal to Spain's net imports. This should not come as surprise: by avoiding the double payment of net imports, the reform would prevent the loss of the domestic income spent by Spanish residents in the domestic payment of net imports.

5.2The Bureau would have to lend abroad a sum of MR equal to the value of the country's net importsThis second, all-important measure is difficult to understand. Indeed, Spain's Bureau has also to collect all the payments made by the rest of the world to the benefit of Spain, and to pay R's exporters, in MR, for their sales to Spain. Even after the reform, this would require Spain (its Bureau) to borrow abroad a sum of MR equal to the difference between Spain's purchases and sales. However, if the reform envisaged nothing else, no major change would occur with respect to the present situation. The payment of net imports would still be paid by Spain through a foreign loan, and the duplication discovered by Schmitt (2012, 2014) could not be avoided. Under these conditions, the gain of the Bureau would not be net and final, but would be lost to Spain, whose Bureau would be reduced to an intermediary incapable to avoid the appropriation by R of part of Spain's domestic income.

What is at the origin of the pathology that gives rise to countries’ sovereign debt is the payment of their net imports through foreign loans. Hence, what the reform has to neutralize is the loan the Spanish Bureau must obtain from abroad. This can be achieved thanks to the second measure envisaged by the reform, that is, thanks to the (counter) loan that the Bureau would grant to R. Let us make it clear at once that the two loans – from R to Spain and from Spain to R – are indeed two distinct loans, because the borrowers and lenders of each country are distinct residents. By lending to R, Spain ‘obtains, in financial assets, an external credit of 1 dollar [1MR] that compensates exactly the debt of 1 dollar [1MR] formed by the foreign borrowing of this sum. The result is the full success of the reform’ (Schmitt, 2014: 59). Thanks to the loan granted to R by the Spanish Bureau, the rest of the world would become the owner of part of Spain's current output, and would match its net exports by equivalent financial imports. Indeed, in the same way as Spain acquires the ownership over part of R's current production because of the loan it obtains from R, the rest of the world acquires the ownership over an equivalent part of Spain's current output because of the loan granted to R by the Spanish Bureau.

5.3The Bureau would have to invest into a new production the sum of domestic income it earnsWhat calls for this measure is the need to offset the decrease in employment that would arise if the Bureau were to spend or redistribute its net gain for the purchase of Spain's domestic output. The explanation is given by the fact that a net expenditure of foreign currency decreases the production of the national economy whose foreign imports are net. ‘The reason is that the value of 4 dollars [if 4 dollars are the amount of the country's net imports] spent to cover the difference between expenditures and receipts is no longer available for the selling of a domestic product’ (Schmitt, 2014: 98). To avoid the loss of domestic income suffered by Spain because of the duplication of the payment of its net imports, it is essential to create a Bureau and channel through it all the payments concerning Spain's external transactions. Yet, this is not enough. The Bureau has to invest its gain in domestic income, resulting from the payment of Spain's net imports by its residents, in order to increase Spain's domestic production, thus avoiding the decrease in employment due to the payment of its net imports.

That third measure would benefit both Spain and its foreign partners. Indeed, it is almost redundant to note that it is in the interest of the rest of the world to trade with a country that pays for all its net purchases and whose domestic economy does not suffer from a rise in unemployment every time it pays its due.

A related argument can help us explain the reason why the Spanish Bureau would have to invest its net gain in a new production. The aim of the reform is to avoid the very formation of Spain's sovereign debt, while making sure that the country pays its foreign creditors their due. The key to the solution is to conform the mechanism of international payments to the balance-of-payments identity between EX and IM. This is achieved by balancing Spain's net imports with the financial transfer of an equivalent part of Spain's current production. Yet, in order for that to occur without reducing Spain's employment, it is necessary to increase Spain's production through the investment of its Bureau's net gain. If Spain's Bureau did not invest its net gain of domestic income in a new production, Spain's domestic product would decrease as an effect of the payment of its net imports. Following the investment of the Bureau, Spain's production would remain at its previous level, because the new production would compensate the decrease due to the loan that would still be required for the payment of Spain's net imports, and the rest of the world would become the owner of a part of Spain's output equal in value to that exported to Spain.

A country alone cannot create a system of international payments. The reform suggested by Schmitt allows any country adopting it to avoid the shortcomings of a system like the present one, but not the need for the deficit country to borrow abroad the difference between its global imports and exports. As the next section will show, even though Spain's sovereign debt would no longer build up, the Bureau would have to borrow in each period a sum equal to Spain's net imports. Thank to the reform, the foreign debt ensuing from these ‘renewed’ loans would not increase period after period, because of the reimbursement that takes place in the periods following the ones in which those loans are allocated. In our numerical example, if Spain's net imports remain equal to 1MR for an indefinite number of periods, Spain's external debt would merely be reproduced in each period and remain equal to 1MR. Hence, the investment of the Bureau's net gain in an additional domestic production is necessary to avoid a decrease in the level of Spain's domestic income (i.e. an increase in unemployment) – a state of affairs caused by the amount it has to borrow in order to make up the difference between its global purchases and sales.

6The advantages of the reformAs already mentioned, the main advantage would be to avoid the loss of Spain's domestic income that accompanies the payment of its net imports. Today, Spain recovers the domestic income spent by its residents in the payment of their net foreign purchases only through a macroeconomic loan that defines the country's sovereign debt. Tomorrow, the Spanish Bureau would collect the net sum spent by Spain's residents and invest it domestically. At the same time, the Bureau would lend to R an amount of foreign currencies equal to the one borrowed from R, a measure that would make the formation of Spain's sovereign debt impossible in the first place. What is extremely important to observe is that none of the benefits that Spain would obtain from Schmitt's reform would damage the rest of the world, which, on the contrary, would obtain the full payment of its net exports and benefit from the advantage of having a reliable country as a foreign economic partner instead than an indebted one. Today, R gives up part of its current production in exchange for an equivalent part of Spain's future product, and faces the impoverishment its trading partner suffers from any time its imports exceed its exports. Tomorrow, Spain would fully pay R's net exports in the very period they take place, and both R and Spain would benefit from the very likely increase in trade (commercial and financial) favoured by a system in which the payment of net imports no longer entails the formation of countries’ (Spain's in our case) sovereign debt.

As the reader will have noticed, the reform would not benefit Spain two times: once by avoiding the loss of part of its domestic income and once by avoiding the formation of its sovereign debt. Spain would indeed benefit from both these advantages, however this is because they are the joined effect of a single achievement: the reduction of the payments of Spain's net imports to a single payment. The choice is between two alternatives: either

- 1.

Spain finances its net imports through a foreign loan (as it happens today), in which case it incurs a sovereign debt – to the benefit of the ‘financial bubble’ – because of the loss of the domestic income spent by its residents on the payment of their net imports; or

- 2.

Spain pays only once its net purchases by exchanging foreign goods against the ownership over part of its current production, in which case it neither suffers from a loss of its national income, nor incurs a sovereign debt.

Things would be radically different if the reform implied the non-payment of Spain's net imports. Yet, this is not at all the case. Indeed, according to the reform advocated here, Spain would pay for all its net imports, the only payment abolished being the second, pathological payment suffered by Spain to the benefit of the financial bubble. Hence, the reform would not harm the rest of the world in the least, because it would guarantee the full payment of Spain's creditors.

7An attempt at quantification: the amount of the gain that Spain would approximately derive from the reformStatistical data at our disposal being limited and approximate, the use of the conditional tense is compulsory with respect to the gain in domestic currency that Spain's sovereign Bureau would derive from the implementation of Schmitt's reform. The same caution is called for as far as Spain's sovereign debt is concerned. However, data concerning Spain's external debt are largely available (see Table 1), and it is safe to claim that the amount of unjustified increase in Spain's external debt from 2003 to 2015 (489 billion dollars) gives a hint of the debt that Spain would have avoided during that period. Moreover, by assuming that the average interest rate during the 13 years considered in Table 1 was around 3%, it is possible to quantify the gains that Spain would have obtained by not having to service its sovereign debt:

The figure advanced here does not provide more than an approximation of what Spain would have saved in interest payments if it had been able to avoid the formation of its sovereign debt in the period 2003–2015.

As for the gain in domestic income, in order to calculate its amount we would have to know:

- a.

The sum of Spain's net (commercial and financial) imports during a given period of time, and

- b.

The sum of Spain's reimbursement of the foreign debts incurred both previously and during the considered period.

It is clear, indeed, that both these sums together determine the amount of Spain's net expenditures. Since the net foreign expenditures of Spain's residents measure the gain of Spain's Bureau in domestic currency, it is necessary to add a. and b. in order to quantify that gain. Unfortunately, data concerning Spain's principal repayments are not officially available, and one can only guess what their amount could be if a series of conditions were to apply. Let us examine a hypothetical, plausible example by assuming that, in the period 2003–2015, Spain's external debt was repaid after a time interval of 6 years. Taking into consideration the fact that statistical data concerning Spain's gross external debt position before 2002 are not available, one can calculate the amount that Spain would have paid back (principal repayments) under this assumption from 2008 to 2015. Given the statistical data officially published, and considering the 6 years interval we have assumed, in 2015 the amount of Spain's principal repayment of its sovereign debt would have been 138 billion dollars (where 138 billion dollars is the amount of the unjustified or pathological increase in Spain's gross external debt in 2009). This is nothing more than the theoretical amount of its external debt that Spain would have paid back assuming that principal repayments were carried out in full 6 years after debt arose. More accurate calculations are required and experts of the Banco de Espãna should be able to provide the actual data of Spain's principal repayments necessary to carry them out.

As long as the reform applies in a situation where Spain would still have to reimburse its previous sovereign debts, the gain of the Spanish Bureau would be equal to the sum of its current net imports and of its principal repayments. As in 2015 Spain's current account balance was positive by 16 billion dollars, the gain of the Bureau would have been approximately of

Our statistical exercise merely aims to hint at the sums involved, in particular, of the significant amount the Spanish Bureau would derive from the implementation of the reform proposed by Schmitt (2014, 2017) and advocated here. Experts in analysing Spain's statistical data should be able to approximate the right figures to the best of their knowledge. In the meantime, the indicative amount calculated here is enough to give a rough idea of the potential benefits for Spain's Bureau.

It is easy to imagine the positive impact on Spanish unemployment if this amount of money had been invested by Spain's Bureau in the production of additional goods and services. Spain's domestic production would have increased accordingly, and the country would have paid its net global purchases by transferring to the rest of the world the ownership of a part of its domestic economy's output for the same value. Spain as a country would have been spared an external debt additional to the one incurred by its residents, and its sovereign debt would not have increased one iota.

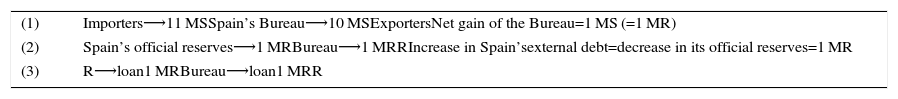

8A brief account of the practical way Spain would carry out the payment of its net imports after the implementation of the reformOne can provide the clearest presentation of all the payments involving Spain's Bureau by distinguishing between periods and assuming that the Bureau reimburses the external debt incurred in each period in the following one. Since the Spanish Bureau would be in charge of carrying out all the payments relating to Spain's international transactions, it is clear that the Bureau would represent the country itself and would be in very close contact with the Spanish central bank. Indeed, nothing prevents the Bureau from being a special branch of the central bank. Moreover, Spain's official reserves defining the financial assets of the country as a whole, as set of its residents, an integration of official reserves into Spain's Bureau or the possibility for the Bureau to use part of Spain's official reserves as a revolving fund is easily conceivable. Let us suppose once again that Spain's net imports, commercial and financial, are equal to 1MR in each period. If we assumed that periods are months, and if the reform were implemented at the beginning of the year, Spain's Bureau would have to borrow 1MR in January in order to pay for Spain's net imports. Rather than borrowing this sum from R, it is simpler to assume that it would borrow it from Spain's official or international reserves. Assuming that 1MR=1MS (Spain's domestic money), the result of the payments flowing in and out of the Spanish Bureau at the end of January is described in Table 2.

Even though the reform would not yet fully operate in January, the situation would be remarkably better than the one we have today. Indeed, the net gain of the Spanish Bureau, 1MR in Spain's domestic currency (1), would be entirely new, and would compensate for the increase in Spain's external debt due to the decrease in its official reserves (2) (since foreign reserve assets define a credit, it is clear that their decrease is tantamount to an increase in debt). The transaction represented in (3) is one of the key operations in Schmitt's reform. It would allow for the payment of Spain's net imports by transferring to R the ownership over part of Spain's current production. If it is true that, by lending part of its current domestic income to Spain, the rest of the world is paying for Spain's net imports, it is equally true that the loan granted by Spain to R would pay for an equivalent amount of R's imports. ‘[T]he credit of 1 dollar granted by the Bureau to non-residents consists, for R, in the external payment of an equal part of its own imports, exactly “symmetrical” to the imports of A [Spain] paid by the rest of the world’ (Schmitt, 2014: 61).

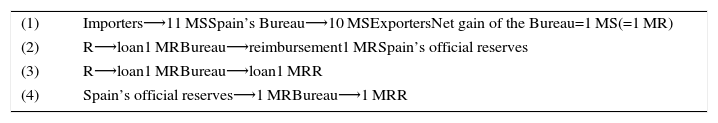

It is from February onward that the reform would work in full, because from then on the Bureau would pay back the loan obtained in the preceding period and would keep on lending an amount of foreign currency to R. The various payments involving the Spanish Bureau are those represented in Table 3.

- (1)

shows the net gain of the Spanish Bureau due to the difference between the amount paid by Spain's importers, in domestic income, and the one paid to Spain's exporters, also in MS.

- (2)

represents the reconstitution of Spain's official reserves thanks to a loan obtained from R. Indebted to Spain's official reserves because of the loan obtained in January, the Spanish Bureau would cancel its previous debt, but it would also incur a new debt to R. Yet, the situation for Spain, considered as a whole, would not define an increase in its external debt: the increase in credit of Spain's official reserves would balance the Bureau's indebtedness. What Spain's official reserves lend on the foreign exchange market would balance what R lends to the Spanish Bureau.

Transaction (3) would guarantee the compliance with the balance-of-payments identity without depending on Spain's future production, as is the case today. By balancing the external loan obtained by Spain from R with an equivalent loan granted by Spain to R, the implementation of (3) would suffice to avoid the very formation of Spain's sovereign debt. Indeed, from the reciprocal lending of Spain and the rest of the world ‘we derive that R owes A [Spain] exactly what A [Spain] owes R. As a consequence, if country R does not get indebted to country A [Spain], it is logical and perfectly correct and just that country A [Spain] does not get indebted to country R’ (Schmitt, 2014: 61).

The last transaction, (4), is required to enable Spain's Bureau to pay for its country's net imports of February. Despite the balance-of-payments identity, it remains true, in fact, that Spain's total imports, commercial and financial, in February amount to 11MR, while its total exports are merely equal to 10MR.

At the end of February, the situation would be as follows.

- a)

Spain's Bureau has a net gain of 1 MS

- b)

No sovereign debt forms for Spain

- c)

The rest of the world is fully paid for its net exports

- d)

Spain's external debt, measured by the decrease in its official reserves, is again equal to 1MR

If Spain's foreign transactions were to remain unchanged over a number of periods (months), its external debt would merely be reproduced: in the nth period, it would still be equal to 1MR. The result of the reform would be to enable Spain to pay for the totality of its net imports, without getting indebted and without suffering from a loss of domestic income. A mechanism that guarantees the full compensation of Spain's net imports by an equivalent financial transfer of its current output would achieve this. Moreover, in each period Spain's external debt of 1MR would have no effect on Spain's domestic economy, because the decrease in national income (increase in unemployment) it would entail would be counter-balanced by the increase due to the investment of the Bureau's net gain in a new, domestic production.

9ConclusionLet me conclude by comparing the present, pathological situation with the one that would result from the implementation of the reform advocated here.

In today's non-system of international payments, net external purchases are settled in real terms and, additionally, in monetary terms. Because of the lack of a true system, the monetary payment of Spain's net imports is added to the real payment. This is so because Spain's net imports are financed through a foreign loan, which implies that Spain balances its net purchases of R's current output through a sale of an equivalent part of its future production. Even though it has already fully paid, in real terms, for its net imports, Spain has still to carry out a monetary payment to the benefit of R's exporters.

The reform would change things radically. Charged to collect the payments of Spain's importers and to pay domestic exporters, the Spanish Bureau would prevent the loss of national income occurring today. At the same time, by lending to R the same amount it borrows from the rest of the world (but not from the same agents), Spain's Bureau would guarantee the payment of R's net exports in terms of Spain's current production and avoid the formation of a sovereign debt.

In the present non-system, Spain gives up part of its future output and, on top of it, has to incur an external debt in order to pay, monetarily, for its net imports. The reform would enable Spain to give up part of its current output and thus avoid financing the payment of its net imports through a net foreign loan. Today, Spain must purchase the ‘vehicular’ money (MR) necessary to convey the real payment of its net purchases. Tomorrow, the reform would avoid the conflation of the monetary with the real payment through a loan granted by the Spanish Bureau to the rest of the world.

Two great advantages would derive from the reform.

- 1.

The formation of a net gain, in domestic income, to the benefit of Spain's sovereign Bureau

- 2.

The non-formation of Spain's sovereign debt

Are these one too many? Is it not enough to give Spain the possibility to avoid getting indebted? Why should Spain's Bureau benefit from a net gain on top of it? Put the other way around: would it not be correct to say that, if the Spanish Bureau is the legitimate beneficiary of the net payment carried out by Spanish residents, it has also to carry the load of the payment of R in MR, and thus incur an external debt? The answer to all these questions is that both advantages are perfectly justified, and that none of them is to the detriment of R. Because of the loan granted by the Bureau to R, Spain would pay the rest of the world in full, and it would therefore be correct and just for Spain not to incur a sovereign debt. At the same time, precisely because it would have fully paid its net imports, it would be absurd if Spain were to lose the domestic income spent by its residents in the payment of their net imports. If this were to happen, Spain would have to borrow abroad in order to restore the previous level of its domestic income, and would thus incur the very external debt the reform is supposed to avoid. The gain of Spain's Bureau is the consequence of the fact that Spain would no longer lose part of its national income, necessary for avoiding the increase in unemployment that, otherwise, would inevitably accompany it. Moreover, the fact that the reform requires the productive investment of this gain, precisely to avoid a decrease in employment, is a clear sign that the Bureau's net gain is perfectly justified.

To summarize: the aim of the reform is to reduce to one the payment of Spain's net imports. The fulfilment of this aim requires the reduction to zero of the loss of Spain's national income. It is through a loan granted to R by the Spanish Bureau that Spain's net imports would be paid, thus making both the reduction in Spain's domestic employment, and the increase in its external debt totally unjustified.

Countries’ sovereign debts are entirely pathological and, thus, groundless, and so is the loss of domestic income that makes them unavoidable in the present non-system of international payments. The passage from disorder to order allowed by the reform would make it possible for Spain to pay its net imports to the full satisfaction of its creditors and, by the same token, to avoid getting indebted and reducing its level of employment. This would not only be true for the payment of Spain's current net imports, but also for its principal repayments. The reimbursement of the external debt previously incurred by Spain increases its net expenditures and, according to the reform, would increase its Bureau's net gain. Hence, principal repayments would no longer have a negative impact on Spain's economy, whose level of production (employment) would not decrease, thanks to the investment of the net gain of Spain's Bureau. The approximate amount of this gain for the period 2003–2014 gives a flavour of the substantial impact that the reform would have had on Spain's domestic economy. The pathological formation of countries’ sovereign debts has contributed to the growth of unemployment as well as to that of the financial bubble and the ensuing financial crisis. Schmitt's analysis opens a way out of this increasingly worrying situation. Let us hope that the governments of net importing countries (Spain?) will soon follow it to the great benefit of their population.