The effect of natural resources (NR) on growth has been a topic widely discussed in the economics literature. The evidence shows a predominant negative impact of this, but this can be neutralized if countries adopt a more knowledge-intensive industrial structure. This paper seeks to explore the key factors for growth in natural resource-driven countries under a knowledge economy perspective, providing new evidence that corroborates how a development path based on NR is plausible when some conditions are present. Performing cluster and panel data analyses, our findings reveal the essential role of openness and Foreign direct investment (FDI) to access foreign technologies as key driving factors. Meanwhile, the case of Chile confirms the importance of intangibles for a country's growth, and demonstrates that a weak innovation capability can become a serious blockage for sustained progress despite the successful advance in other dimensions.

El efecto de los recursos naturales en el progreso de los países ha sido ampliamente discutido en la literatura económica. Predomina un impacto negativo en el crecimiento, que puede ser neutralizado por medio de estrategias conducentes a una estructura y especialización industrial más intensiva en conocimiento. Este trabajo analiza los determinantes del crecimiento en países que han avanzado sin abandonar los recursos naturales como motor de su economía. Desde una perspectiva de economía del conocimiento, se presentan nuevas evidencias acerca de cómo una senda de desarrollo basado en los recursos naturales es posible si existen determinadas condiciones. Haciendo uso de técnicas de cluster y análisis de panel, el acceso a tecnologías foráneas a través de la apertura y la inversión extranjera directa (IED), resulta ser un elemento clave. Además, el estudio del caso de Chile confirma la importancia de los intangibles y la capacidad de innovación para evitar un bloqueo del progreso económico.

The recent world financial crisis has brought back the attention to old questions among economists, accentuating the interest on how to reach a sustainable economic progress. In the knowledge economy, the most traditional economic approaches seem to be failing to support growth in the long term, even affecting cultural and social arrangements. As Rodrik (2008) pointed out, there are many paths to achieve development and a lot of factors are involved in the process, and several combinations of them are possible. Some elements are always critics for any trajectory, while others have different performance depending on a set of complementary variables and applied strategies. In this regard, natural resources (NR) traditionally have been considered an important factor for countries’ progress; however, these have been also seen as responsible of social, environment and economic collapses, in spite of their importance as productive resources (Frankel, 2010).

Seminal work on NR and growth by Sachs and Warner (1995, 1999, 2001) indicated that resource-abundant economies tend to grow slower than economies without important resource endowments. This negative picture can be observed in countries such as Angola, Nigeria, Zambia, Sierra Leone, Venezuela, among others, in contrast to some successful cases such as Norway, Canada and Australia, where, even today primary resources remain relevant for the economic performance (Sæther, Isaksen, & Karlsen, 2011; Ville & Wicken, 2012). Then, some of the questions emerging from these contrasting facts are: Why natural resources generate such different effects? What factors are most influential in the NR performance? What trajectory is described by successful NR-driven countries? What are the key elements for policy making? These questions are discussed in this paper in order to assist policy makers and entrepreneurs to deal with the challenges of NR production. Thus, the main purpose here is to identify the determinants of growth in NR-driven countries, since the literature does not offer clear and concluding evidence on how these natural endowments may serve as a lever for progress. To achieve this aim, the research is conducted under the lens of the knowledge-based economy framework which provides new tools to understand economic development in the knowledge era.

The analytical strategy of this research is developed in three steps. First, a cluster analysis is performed to detect what set of countries follow a positive growth path driven by NR sectors. Secondly, an empirical growth model, using panel data methodology, allow us to identify the pillars of growth in NR-based economies. Finally, a dynamic growth analysis is applied to the Chilean case, following to Fagerberg, Srholec, and Knell (2007) model, along with a convergence evaluation. Chile is selected as a representative emerging NR-based country to analyze economic dynamics in deep and to suggest future policies, although the findings can be extended as implications for other nations with a similar industrial structure.

The findings show the existence of a relevant set of countries that share a successful growth path characterized by a strong dependence on NR-based industries. The econometric estimations confirm that NR can positively affect growth of specialized economies (NR-driven). This empirical analysis reveals the importance of the international dimension as a channel for accessing embodied and disembodied technologies via FDI and trade. In addition, a positive effect of local innovative capabilities is detected as a determinant factor, indicating that not only absorptive capacities, but also innovative capabilities, are required in these economies for keeping in the path of a sustainable development.

The study of the Chilean growth dynamics shows a loss of vitality. In terms of convergence, this fall is due to the weak technology capability, the insufficient institutional quality and the short productive investments. Thus, our empirical analysis done following a Knowledge Economy perspective corroborates the identification of a potential growth path based on NR and intellectual capital.

The structure of the paper is as follows. After this introduction, Section 2 contains the literature background. Section 3 presents the research objectives and methodology. The discussion of analytical results is contained in Section 4, and Section 5 contains the concluding remarks.

2Literature backgroundThe causes of failure in many natural resource-based countries have been an issue that has traditionally focused the attention of economic research. Seminal works by Sachs and Warner (1997, 2001) opened an important discussion about the impact of NR on growth and its explanatory factors. Some pioneering contributions argued that NR negatively affected economic performance as consequence of a mix of economic and social causes. Findings showed that NR-based economies grew more slowly than their potential, or fall definitely into recession (Mehlum, Moene, & Torvik, 2006). These findings were explained as a result of economic imbalances that are consequence of an excessive public spending, macroeconomic instability and a high concentration of exports. In addition, Dutch disease (Corden & Neary, 1982) is described as another consequence of NR exploitation due to the currency appreciation problem as well as the industrial concentration in resource sectors, which ultimately impacts the manufacturing export competitiveness, even deriving into deindustrialization processes (Manzano, 2012).

These economic effects of NR activities and its causes, have also been related to social issues. Scholars observed a strong relationship between commodity production and social conflicts. NR-rent seeking was considered in the origin of the fights, since groups in conflict try to preserve the property of those profitable endowments as a financial tool for their acts (Rosser, 2006). As Ross (2004) indicated, this situation appears more frequently when there are social inequalities and weak institutions, especially insufficient rule of law, high corruption levels and the presence of terrorist activities, as the World Bank indicators collect (Kaufmann, Kraay, & Mastruzzi, 2003). In these cases, governments are unable or unwilling to change this path, and hence crisis and instability are maintained for decades deteriorating even more the quality of institutions. This leads to a vicious circle, where NR exploitation damages institutions, while weakened institutions adversely affect the economic performance of NR. Thus, institutional quality seems to be both the responsible and the result of NR exploitation. As Acemoglu, Robinson, and Woren (2012) argued institutions are key for growth, but the extractive ones cause failure while inclusive institutions support sustainable progress.

The third dimension that has also been considered is the potential effect of NR on the environment, because negative impacts can be derived from NR exploitation causing problems on development if some cautions are absent in the extraction process. Given the finite nature of non-renewable resources, their exploitation reduces the reserves affecting growth (WTO, 2010). Although this scarcity can be compensated by technical progress in exploration, extraction, and substitution (Van der Ploeg, 2011), these innovations also improve productivity increasing profits and exploitation activities (Stavins, 2011), and a vicious circle could begin. Moreover, in renewable resources, such as forestry and fishery, the extraction rates can be higher than those of self-regeneration, causing scarcity and environmental degradation. Thus, both degradation and depletion end up being a constraint to development, requiring strong regulatory measures to reduce or mitigate their effects, for which good institutions are essentials.

Recent pieces of the literature point out the potential role of NR for growth, when there is an adequate combination of them with human capital (HC) (Iizuka & Soete, 2011; Manzano, 2012), good institutions (Frankel, 2010; Mehlum et al., 2006) and an intensive use of high technologies and knowledge that can create windows of opportunity for diversification and development (Lindkvist & Sánchez, 2008). Moreover, Hauser, Loiskandl, and Wurzinger (2011) indicate that the integration of social factors is also required to achieve positive results in terms of sustainable development.

These arguments are at the core of the Knowledge Economy (KE) framework which postulates that intangible assets are determinants for development. In the KE, intangibles are as important as physical assets, and the exploitation of technologies becomes more significant than raw materials production or low labor costs for nations’ competitiveness (Corrado, Hulten, & Sichel, 2009; Edvinsson & Kivikas, 2004). In such an economy, sustainable competitive advantages are driven by the creative, innovative and sophisticated use of knowledge and intellectual assets (Mokyr, 2010). Innovation increases competitiveness of firms, industries and nations, and brings disruptive change into the production process and markets, breaking both the economic determinism of the neoclassic approach and the potential resource curse described by the literature.

The dynamics and relevance of knowledge for the economy, define the analytical framework of the Evolutionary Theory, which understands innovation as the core engine of growth. Meanwhile, knowledge is understood as a complex entity that cannot be analyzed in purely codified terms since it is often tacit, interactive and systemic, being difficult to be measured. Knowledge breaks the stability, continually upsets equilibrium, being embodied in both people and organizations (Castellacci, 2006; Dosi & Nelson, 2010; Nelson & Winter, 1982). According to this theory, there is no a theoretical optimum and the economy is in permanent disequilibrium, since the possibilities for economic action are always changing through a complex process of co-evolution and transformation in which the dynamic relationships between technological, economic and institutional changes play a determinant role (Castellacci & Natera, 2013).

Under this perspective, the creation and absorption of knowledge can be done in all the sectors of the socio-economic system, being not exclusive of high-tech ones. These processes can then be oriented to the traditional activities as well. As a result of this perspective, it is plausible to conceive new opportunities of diversification that can be generated for increasing the value added of low-tech and resource-based industries, the consequence being a truly reinvention of these sectors. The issue is that, unlike neoclassical postulates, traditional industries (such as those based on NR) could takeoff – or advance – by creating and incorporating innovations into the system of production and management, which may result in new products and services. This wealth creation would be supported on the intangible assets of NR-based sectors, as well as those provided by related and supplier industries through potential spillover effects. Thus, new opportunities may emerge in primary sectors by investing in intangibles within the sector, and in this way, would avoid GDP slowdowns and fostering the development (Manzano, 2012; Ville & Wicken, 2012).

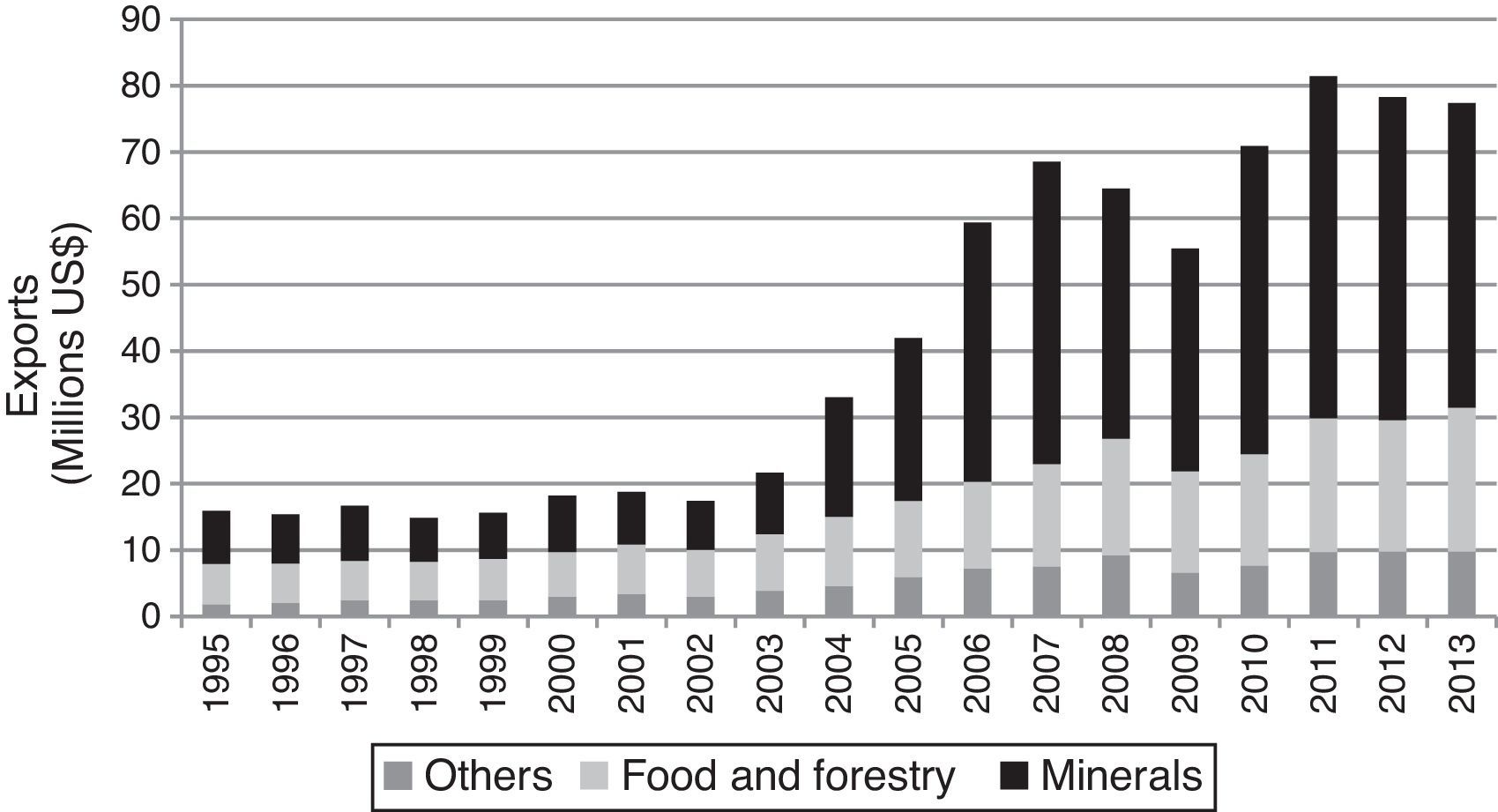

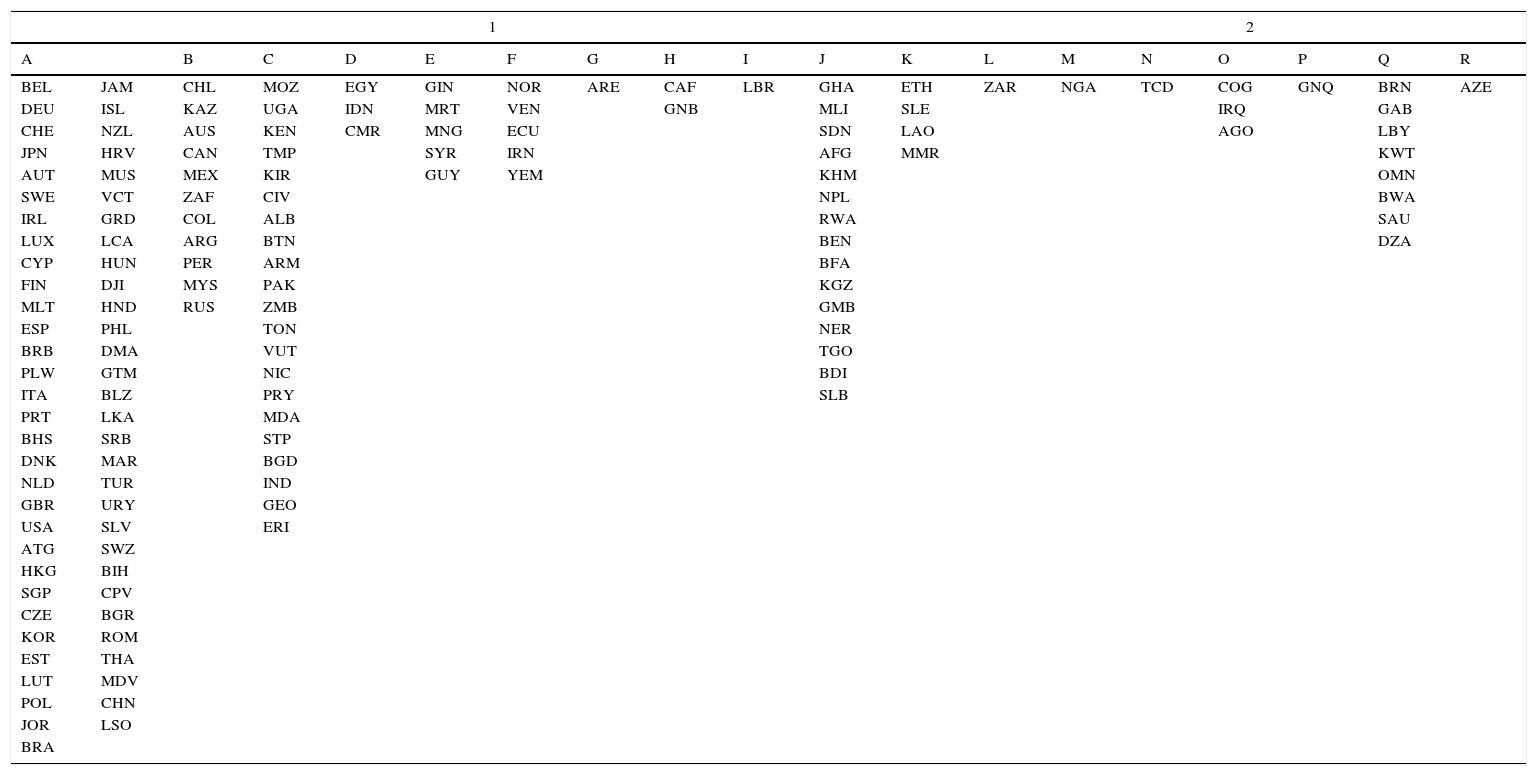

Several empirical studies are seeking to identify clues for NR-driven countries in the knowledge era. Successful evidence, such as Australia, Sweden, Norway and Canada, would indicate technical change as a key determinant aspect (Crawford et al., 2010; Ville & Wicken, 2012). The progress would be possible if a mix of good institutions, suitable policies and innovation capabilities are present into the system (Castellacci & Natera, 2013). Nonetheless, as Rodrik (2008) indicates, there is not only a successful combination of key variables. In this regard, Chile is an interesting case of a developing NR-based country, leader in its region and with a recommendable growth path for similar economies (Frankel, 2010). According to the World Bank (2015) countries’ classification, Chile is a high-income economy, reaching a GDP (per capita) in 2013 of US$ 15,732, almost double that in 1980. Chile is the most competitive economy in Latin America, and its successes are result of strong institutional setup, efficient government, macroeconomic stability and great openness to foreign trade (WEF, 2013). In addition, NR have also been part of this economic success – NR account for about 30% of the Chilean GDP. According to UNCTAD (2015), NR exports represent more than 80% of total country exports, with mining (mainly cooper) responsible for more than 60%, and renewable resources – food and forestry – around 25% (Fig. 1).

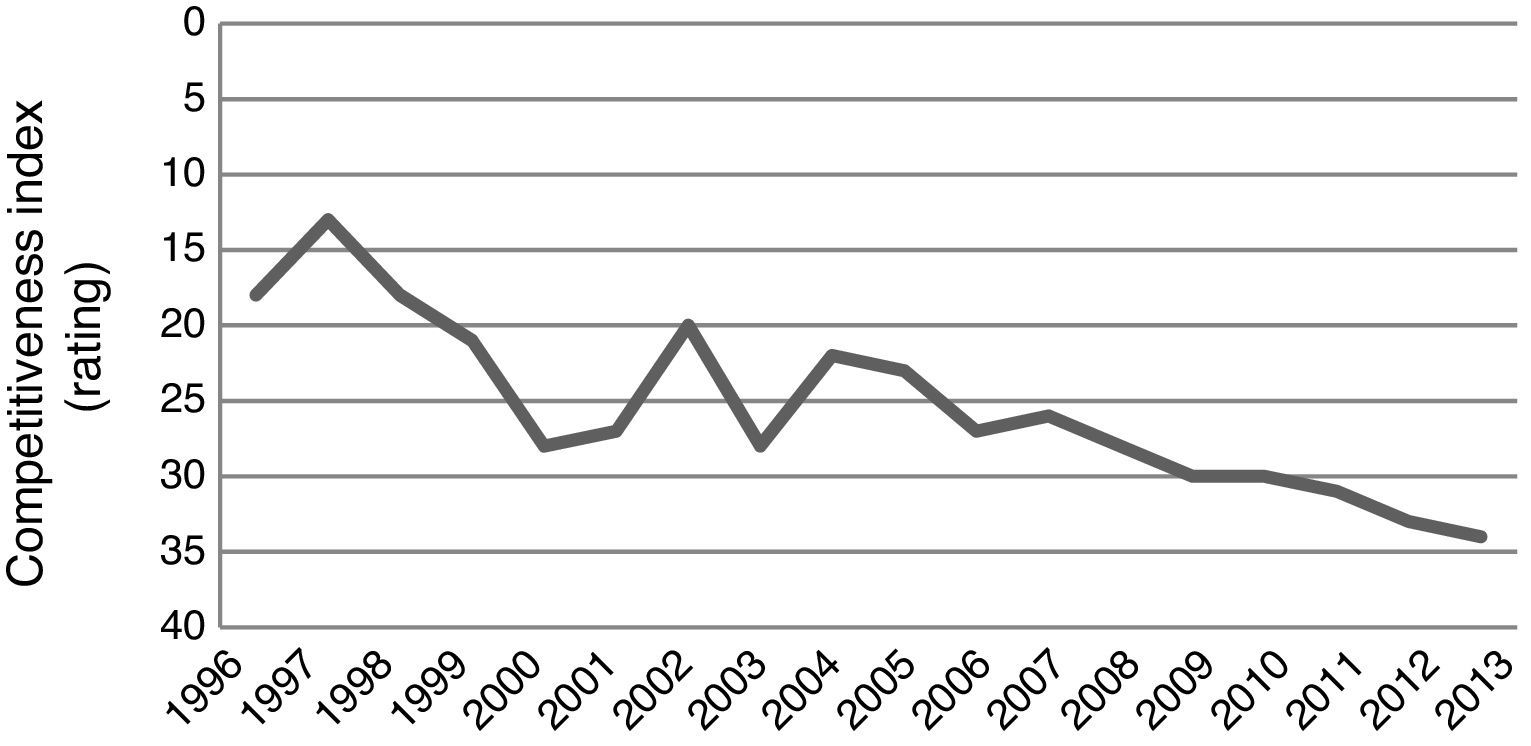

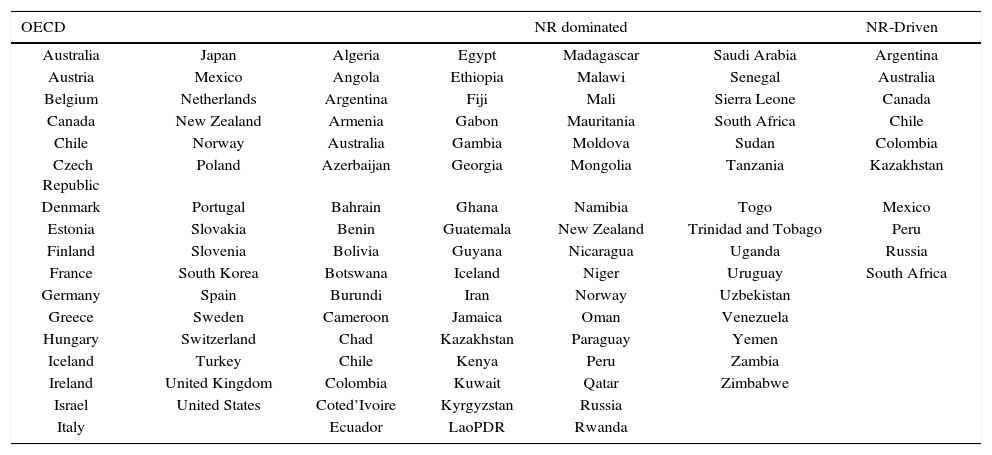

However, income is far behind developed economies, and some signs of middle income trap (MIT) have been identified (Pérez, 2012; Traub, 2013). This complex situation is also reflected in the fall in competitiveness index (Fig. 2) as result of structural failures and a strategy closer to an absorptive or “open innovation system” (Lee, Hwang, & Choi, 2012), instead of an endogenous innovation strategy.

3Research objectives and methodologyThe contrasting evidence revised in the previous section, suggests the existence of a high diversity of factors that determines the effects of NR specialization on the progress of countries, and how these evolve and change along time. Therefore, our main research purpose is to analyze in depth the keys aspects of growth in natural resource-driven countries in the knowledge economy.

Past lessons do not necessarily provide enough suitable clues for countries development, as the economic pillar has moved toward intangible assets and new interconnections are permanently emerging between them. For this reason, the first specific objective is to identify the pillars of prosperous economies based on NR industries. Unlike most studies on growth and NR that define the target sample using single rankings built with NR indicators, we applied a cluster analysis in order to identify countries that met two main conditions: outstanding economic performance measured by GDP per capita and its growth, and a high relevance of NR production in GDP, assessed through mineral rents and the added value of agriculture over GDP. Oil rents, an important source of wealth for many countries have not been included to avoid bias of oligopolistic behavior, as other empirical evidence shows. There are different ways to measure the distance between observations in a cluster analysis. In this regard, we have used hierarchical clustering methodology, while the distances were computed by average linkage. We then used squared Euclidean option, which is common for this type of analysis.

A large number of evidence comes to conclude that current sources of progress are immaterial factors, as the KE argued (David & Foray, 2002; Foray, 2004). Furthermore, traditional production variables – capital and labor – remain important for NR sectors, as they are capital intensive (e.g. mining) or labor demanding (e.g. agriculture). Therefore, we applied a growth model that integrates physical and intangible explanatory variables aiming to know the determinants of GDP growth in NR-specialized countries.

Following evolutionary authors, we use patents as an indicator of innovation capability, while schooling is taken as a proxy for human capacity. FDI, measured by the stock of inward FDI, and openness, by the weight of imports and exports on GDP, were introduced into the model as indicators of the international influence, because of their importance as a way to capture knowledge and technology from advanced countries (Bas & Kunc, 2009; Keller, 2004).

An index of institutions, developed according to WB methodology (Kaufmann et al., 2003), was added to introduce the effect of local context. This index is composed of six indicators (Rule of law; Corruption control; Voice and Accountability; Political stability and Absence of violence/terrorism; Government effectiveness; and Regulatory quality), that encompass a wide range of institutional elements.

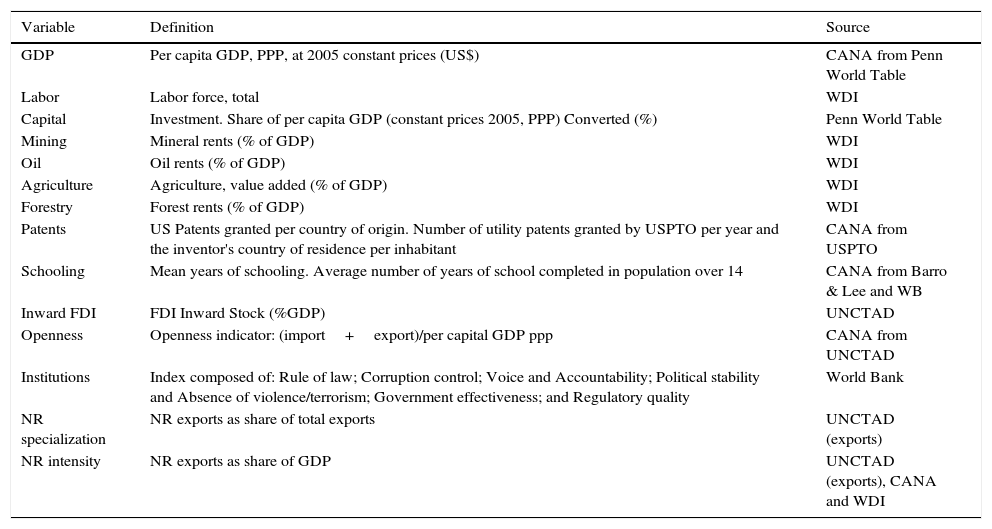

Finally, to identify NR impact on GDP, a specialization index was calculated as the ratio between natural resource exports and total exports. Unlike an intensity index that would be defined as the ratio between natural resource exports and GDP (Sachs & Warner, 1995, 2001), an specialization index offers a good measure for primary economies and its integration in international markets through trade,1 a common profile in developing countries. A complete description and source of variables is provided in Table 1.

Definition of variables and indicators included in the model.

| Variable | Definition | Source |

|---|---|---|

| GDP | Per capita GDP, PPP, at 2005 constant prices (US$) | CANA from Penn World Table |

| Labor | Labor force, total | WDI |

| Capital | Investment. Share of per capita GDP (constant prices 2005, PPP) Converted (%) | Penn World Table |

| Mining | Mineral rents (% of GDP) | WDI |

| Oil | Oil rents (% of GDP) | WDI |

| Agriculture | Agriculture, value added (% of GDP) | WDI |

| Forestry | Forest rents (% of GDP) | WDI |

| Patents | US Patents granted per country of origin. Number of utility patents granted by USPTO per year and the inventor's country of residence per inhabitant | CANA from USPTO |

| Schooling | Mean years of schooling. Average number of years of school completed in population over 14 | CANA from Barro & Lee and WB |

| Inward FDI | FDI Inward Stock (%GDP) | UNCTAD |

| Openness | Openness indicator: (import+export)/per capital GDP ppp | CANA from UNCTAD |

| Institutions | Index composed of: Rule of law; Corruption control; Voice and Accountability; Political stability and Absence of violence/terrorism; Government effectiveness; and Regulatory quality | World Bank |

| NR specialization | NR exports as share of total exports | UNCTAD (exports) |

| NR intensity | NR exports as share of GDP | UNCTAD (exports), CANA and WDI |

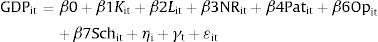

We use panel data technique for the econometric estimations because it permits to deal with country fixed effects. The estimation is carried out using both static and dynamic panel data in order to assume a possible endogenous structure, as a consequence of the path-dependent trajectory and the cumulative process of capabilities (Dosi, 1988). Difference and System GMM specification, developed by Arellano and Bover (1995) are performed, which takes the regressors in levels and differences as instrumental variables, making it possible to use all the available moment conditions and thus providing a better estimation. The general specifications would adopt the following forms:

where GDP, ln per capita Gross Domestic Product (GDP); β1GDPit−1, lag of dependent variable (ln per capita GDP in t−1); K, ln Capital, investment; L, ln Labor; NR, ln Natural resources, specialization; Pat, ln Patents; FDIIS, ln FDI, inwards; Op, ln Openness; Sch, ln Schooling; Ins, Institution index. The subscript refers to the country i in period t, ηi and γt represent individual and time effects, respectively; ¿it: random error term.In a next step, we incorporate different variables that capture the interaction with NR; this is, NR and institutions, patents, FDI and schooling (NR×Ins; NR×Pat; NR×FDI; NR×Sch, respectively) to identify the compound effect of intangibles factors and NR that allows us to know the joint effect on GDP.

The third step of this research was to study the dynamics of growth in a specialized and developing country such as Chile, where NR have not only been an income generator engine but have also played a levering role for development. This country is rather a good case of economic growth success based on NR, than an example of economic success according to the KE framework, now facing a complicated crossroads. Chile has been successful applying neoclassic principles and incorporating technological innovations from developed countries to its NR industries. Thus, Chile has followed an absorptive or “open innovation system” strategy (Lee et al., 2012), through a “Developmental Network State” approach (Negoita & Block, 2012), instead of an endogenous innovation strategy.

Therefore, the second specific objective is to know the dynamics of Chilean growth and the convergence of the key determinant factors, seeking not only to look into the past, but also to detect some clues for a sustainable strategy that would be also suitable for other NR-driven countries. We used the methodology presented by Fagerberg et al. (2007) to characterize the growth dynamics of Chile and to classify it into one of the four categories: catching up, losing momentum, moving ahead and falling behind. Unlike these authors, we take several periods of a same country – Chile – in order to try to understand its growth evolution, dynamics and its economic performance. To complement this analysis, a convergence study (β convergence) is performed to asses in depth the gap reduction of each key component of the Chilean economy and the evolution, in order to offer policy recommendations. For this evaluation, distance between countries was calculated according to Li and Liu (2005):

where GAP is the GAP between the leader and the economy analyzed i in the time t, Dmax is the data from leader economy; Dit is the data from economy analyzed (i) in the time t. Analyzed variables are GDP, schooling, FDI, openness, investment (stock), institutions and patents.Meanwhile, the convergence (Sala-i-Martin, 2000) is estimated as follow:

where A is the GAP between country i and the leader, in the time t; β is the convergence coefficient; t: time, α: intersect of the model.β coefficient indicates if a country reduce the gap with the frontier economy. We used Canada and Australia as NR leaders, and additionally the Chilean data are also compared with the US because this is one of the most developed nations and its historic trajectory also shows a NR-specialized path. Statistical information has been obtained from different international sources such as WDI, UNCTAD, and CANA (Castellacci & Natera, 2011) databases, for the period 1980 to 2011. The sample is composed by a set of 145 countries.

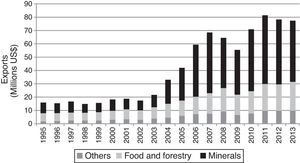

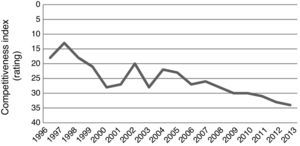

4Results and discussionThe cluster analysis used to identify countries that describe a growth trajectory based on NR, resulted in two relevant groups. These groups (A and B) include most of the developed and emerging countries with high or medium-high income (a complete list of countries integrated in each cluster can be seen in Annex 2). Among them, Cluster B is made up of NR-driven and prosperous countries (upper middle and high income countries according to the World Bank classification). This group of countries formed by nations with an outstanding economy and a productive structure highly dominated by primary industries (named NR-driven) is made up of Argentina, Australia, Canada, Chile, Colombia, Kazakhstan, Mexico, Peru, Russia, Malaysia and South Africa. Unlike previous studies, this statistical tool has clustered in one group apparently very different countries, located in distinct regions and continents, with dissimilar cultures and ethnic origins, and contrasting political and governance regimes. This situation agrees with Mehlum et al. (2006) who argue that origin or geographical location is not a determinant of growth, unlike institutional quality, openness and NR. Furthermore, in the NR-driven cluster there are developed and developing countries, which would indicate that NR may have a dual role: driving (big push effect) and supporting growth.

4.1Determinants of growth in NR-driven countriesAccording to the results of the previous analysis, those countries grouped in different clusters would be driven conduct under distinct growth strategies, probably supported on a diverse combination of resources. The model estimation accounts for the growth determinants in NR-specialized and successful economies, that is the set of NR-Driven countries2 on the one hand and, the OECD sample (mainly high income and developed nations) on the other. A third group, named NR-dominated, was also incorporated into the analysis to try to identify the possible differences existing within NR-based economies. This set of countries (NR-dominated) is integrated by economies where NR exports represent more than 50% of total exports (see Annex 3 for group composition) although they do not necessarily show a positive economic growth path.

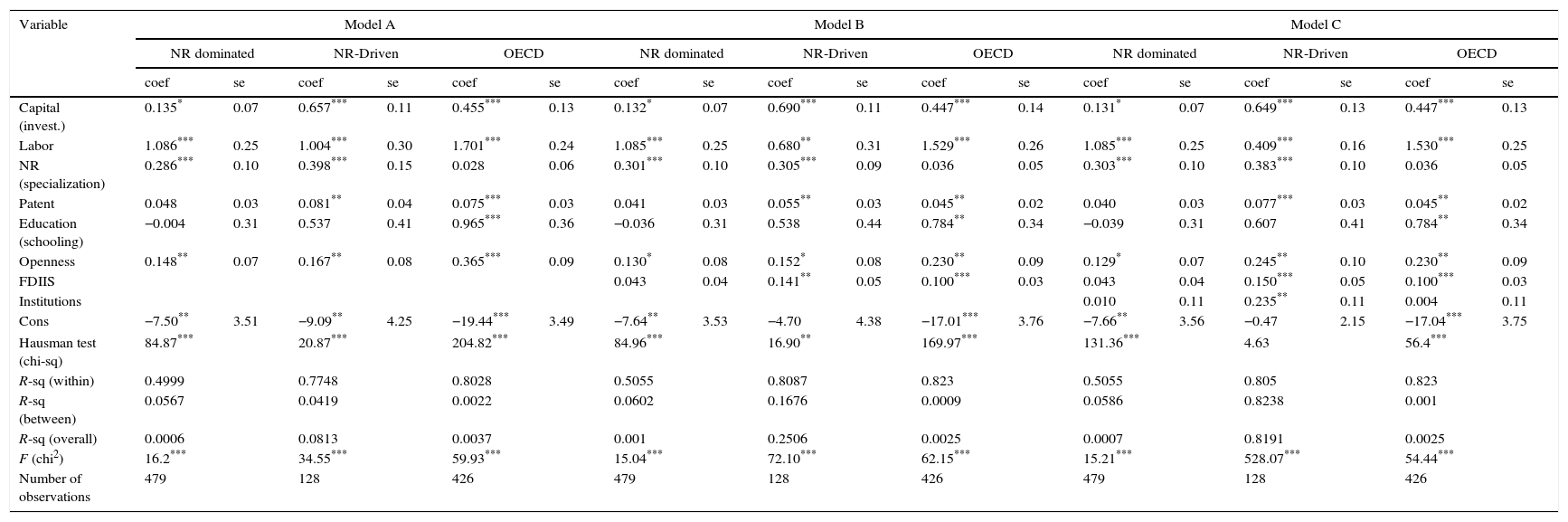

The results of empirical model show (Table 2) that conventional production factors – capital and labor – have a positive growth effect in all the samples, but natural resources show different behaviors. In NR-driven and NR-dominated economies, primary resources positively affect GDP, by contrast, its role in OECD countries is not significant, a result consistent with previous evidence. In fact, theoretical and empirical contributions predict that NR can have different impacts depending on a set of complementary factors and the strategies carried out to exploit and manage these endowments, affecting institutions, environment and the industrial structure (Lederman & Maloney, 2007; Mehlum et al., 2006). However, doubts persist about the determinants of this process. Regarding this, the institutional frame and the economic context would be the responsible of NR performance. In addition, some authors argue that the causes are interconnected and have multiple dimensions. Our analysis (Model A) clearly shows the existence of a positive relationship with openness and the importance of international trade on GDP, due to the fact that exports permits to take advantages from the access to foreign goods markets at competitive prices.

Panel data analysis of physical and intangible factors. Dependent variable GDP per capita (ln).

| Variable | Model A | Model B | Model C | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| NR dominated | NR-Driven | OECD | NR dominated | NR-Driven | OECD | NR dominated | NR-Driven | OECD | ||||||||||

| coef | se | coef | se | coef | se | coef | se | coef | se | coef | se | coef | se | coef | se | coef | se | |

| Capital (invest.) | 0.135* | 0.07 | 0.657*** | 0.11 | 0.455*** | 0.13 | 0.132* | 0.07 | 0.690*** | 0.11 | 0.447*** | 0.14 | 0.131* | 0.07 | 0.649*** | 0.13 | 0.447*** | 0.13 |

| Labor | 1.086*** | 0.25 | 1.004*** | 0.30 | 1.701*** | 0.24 | 1.085*** | 0.25 | 0.680** | 0.31 | 1.529*** | 0.26 | 1.085*** | 0.25 | 0.409*** | 0.16 | 1.530*** | 0.25 |

| NR (specialization) | 0.286*** | 0.10 | 0.398*** | 0.15 | 0.028 | 0.06 | 0.301*** | 0.10 | 0.305*** | 0.09 | 0.036 | 0.05 | 0.303*** | 0.10 | 0.383*** | 0.10 | 0.036 | 0.05 |

| Patent | 0.048 | 0.03 | 0.081** | 0.04 | 0.075*** | 0.03 | 0.041 | 0.03 | 0.055** | 0.03 | 0.045** | 0.02 | 0.040 | 0.03 | 0.077*** | 0.03 | 0.045** | 0.02 |

| Education (schooling) | −0.004 | 0.31 | 0.537 | 0.41 | 0.965*** | 0.36 | −0.036 | 0.31 | 0.538 | 0.44 | 0.784** | 0.34 | −0.039 | 0.31 | 0.607 | 0.41 | 0.784** | 0.34 |

| Openness | 0.148** | 0.07 | 0.167** | 0.08 | 0.365*** | 0.09 | 0.130* | 0.08 | 0.152* | 0.08 | 0.230** | 0.09 | 0.129* | 0.07 | 0.245** | 0.10 | 0.230** | 0.09 |

| FDIIS | 0.043 | 0.04 | 0.141** | 0.05 | 0.100*** | 0.03 | 0.043 | 0.04 | 0.150*** | 0.05 | 0.100*** | 0.03 | ||||||

| Institutions | 0.010 | 0.11 | 0.235** | 0.11 | 0.004 | 0.11 | ||||||||||||

| Cons | −7.50** | 3.51 | −9.09** | 4.25 | −19.44*** | 3.49 | −7.64** | 3.53 | −4.70 | 4.38 | −17.01*** | 3.76 | −7.66** | 3.56 | −0.47 | 2.15 | −17.04*** | 3.75 |

| Hausman test (chi-sq) | 84.87*** | 20.87*** | 204.82*** | 84.96*** | 16.90** | 169.97*** | 131.36*** | 4.63 | 56.4*** | |||||||||

| R-sq (within) | 0.4999 | 0.7748 | 0.8028 | 0.5055 | 0.8087 | 0.823 | 0.5055 | 0.805 | 0.823 | |||||||||

| R-sq (between) | 0.0567 | 0.0419 | 0.0022 | 0.0602 | 0.1676 | 0.0009 | 0.0586 | 0.8238 | 0.001 | |||||||||

| R-sq (overall) | 0.0006 | 0.0813 | 0.0037 | 0.001 | 0.2506 | 0.0025 | 0.0007 | 0.8191 | 0.0025 | |||||||||

| F (chi2) | 16.2*** | 34.55*** | 59.93*** | 15.04*** | 72.10*** | 62.15*** | 15.21*** | 528.07*** | 54.44*** | |||||||||

| Number of observations | 479 | 128 | 426 | 479 | 128 | 426 | 479 | 128 | 426 | |||||||||

Models A, B and C were estimated from general Eq. (1).

Model B also shows that internationalization is a mandatory aspect for development in NR-based countries. In addition to openness, FDI shows a positive and significant relationship with GDP growth in both OECD countries and NR-driven countries, because it not only provides capital to host country but also it is a recognized as a source of foreign knowledge and technology (Keller, 2004) these being essential resources for this type of economies.

In NR-Driven and OECD, intangibles become relevant assets to support development path, as demonstrated Wright (1990) for USA, Blomström and Kobbo (2007) for Sweden, Smith (2007) for Finland; Sæther et al. (2011) and Ville and Wicken (2012) for Norway; Negoita and Block (2012) for Chile. Our results also confirm that, in NR-Driven countries, innovation capability is positively related with growth. From this result, it is plausible to argue that catching up strategies should be then, combined with local innovation and the development of own technologies and knowledge, in order to reduce the dependence on foreign knowledge for the improvement of local productivity (Mastromarco & Ghosh, 2009).

In advanced economies, education takes a more active role as it is shown by the estimation of Model B for OECD. In the case of NR-Driven economies, it is not clear that education is not positively related to development, but this result would rather reflect that these nations have not yet managed to overcome the threshold which becomes essential, as argued by Mehlum et al. (2006). Moreover, labor indicator would be absorbing part of its effect.

This analysis also demonstrates the crucial role of institutions for growth, even more than the rest of intangible analyzed, and similar to openness. In fact, when specialized economies transit to higher development stages, institutions become a determinant aspect of economic growth, because good institutions avoid corruption, social and economic instability, reduce risk of social conflicts, and maintain a rational and balanced industrial policy (Acemoglu et al., 2012; Van der Ploeg, 2011). In particular, corruption control, democracy and transparency are essential, because currently these industries require social acceptance and stability. Special attention should be paid on NR profits. There is evidence that demonstrate how interest groups could push government to meet their particular wishes, instead of orienting NR revenues in productive investments or to develop capabilities for future wealth creation. A good option being that NR profits can be aimed at improving innovation capabilities through a better education level, advanced scientific facilities and R&D investments, or be invested in transversal and promissory technologies for NR industries. In addition, the networks should be strengthened as a tool to generate greater synergies between actors and spillover effects (Negoita & Block, 2012). Meanwhile, in the case of OECD, the indicator of institutions is not significant and this can be interpreted according to the short variation of the variable values across countries, as these nations have already achieved high and stable levels of institutional quality.

Findings also reveal that RN may have a positive impact on GDP and these would serve as a “big push”, being also possible to accept that they may provide an ongoing support for growth. In order to achieve that goal, it is plausible to think that national strategies have to combine traditional resources (capital, labor and NR) with intangible assets, the latter including the ability to absorb knowledge and foreign capital, together with local innovation capability within an inclusive institutional framework.

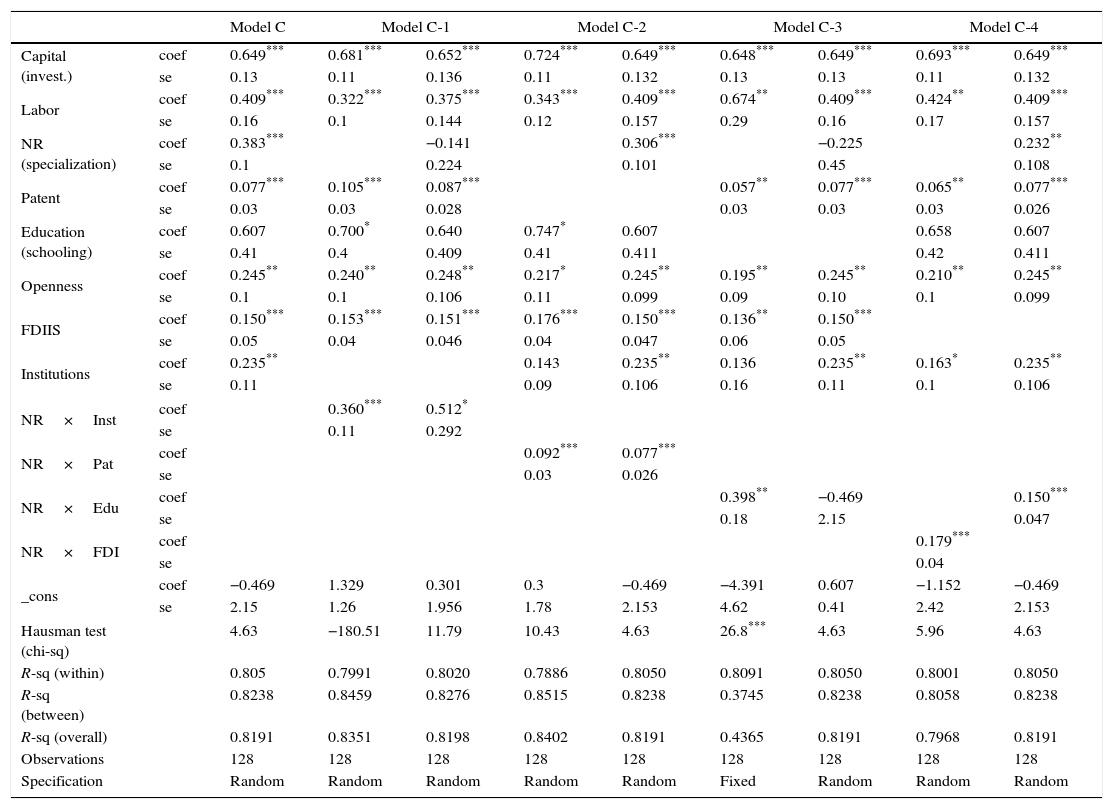

In order to verify the combined effects of intangibles and NR on GDP in countries driven by NR, we introduce variables that reflect the joint action of NR with institutions, patents, education and foreign direct investment. Due to problems of multicollinearity (see footnote 1 in Table 3), the models are presented with and without NR variable. The results (Table 3) corroborate that the capability for innovation, absorptive capacity and FDI show a positive relationship with growth in NR-Driven economies. In addition, institutions and NR are positively related to GDP in these countries, confirming the findings of authors such as Gylfason and Zoega (2006); Mehlum et al. (2006); Giménez and Sanaú (2007) and Frankel (2010). In fact, although the capital coefficient is higher, the coefficient of NR in the models takes significant and high values, similar to labor.

Panel data analysis of physical and intangible factors for NR-Driven countries. Dependent variable GDP per capita (ln).

| Model C | Model C-1 | Model C-2 | Model C-3 | Model C-4 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Capital (invest.) | coef | 0.649*** | 0.681*** | 0.652*** | 0.724*** | 0.649*** | 0.648*** | 0.649*** | 0.693*** | 0.649*** |

| se | 0.13 | 0.11 | 0.136 | 0.11 | 0.132 | 0.13 | 0.13 | 0.11 | 0.132 | |

| Labor | coef | 0.409*** | 0.322*** | 0.375*** | 0.343*** | 0.409*** | 0.674** | 0.409*** | 0.424** | 0.409*** |

| se | 0.16 | 0.1 | 0.144 | 0.12 | 0.157 | 0.29 | 0.16 | 0.17 | 0.157 | |

| NR (specialization) | coef | 0.383*** | −0.141 | 0.306*** | −0.225 | 0.232** | ||||

| se | 0.1 | 0.224 | 0.101 | 0.45 | 0.108 | |||||

| Patent | coef | 0.077*** | 0.105*** | 0.087*** | 0.057** | 0.077*** | 0.065** | 0.077*** | ||

| se | 0.03 | 0.03 | 0.028 | 0.03 | 0.03 | 0.03 | 0.026 | |||

| Education (schooling) | coef | 0.607 | 0.700* | 0.640 | 0.747* | 0.607 | 0.658 | 0.607 | ||

| se | 0.41 | 0.4 | 0.409 | 0.41 | 0.411 | 0.42 | 0.411 | |||

| Openness | coef | 0.245** | 0.240** | 0.248** | 0.217* | 0.245** | 0.195** | 0.245** | 0.210** | 0.245** |

| se | 0.1 | 0.1 | 0.106 | 0.11 | 0.099 | 0.09 | 0.10 | 0.1 | 0.099 | |

| FDIIS | coef | 0.150*** | 0.153*** | 0.151*** | 0.176*** | 0.150*** | 0.136** | 0.150*** | ||

| se | 0.05 | 0.04 | 0.046 | 0.04 | 0.047 | 0.06 | 0.05 | |||

| Institutions | coef | 0.235** | 0.143 | 0.235** | 0.136 | 0.235** | 0.163* | 0.235** | ||

| se | 0.11 | 0.09 | 0.106 | 0.16 | 0.11 | 0.1 | 0.106 | |||

| NR×Inst | coef | 0.360*** | 0.512* | |||||||

| se | 0.11 | 0.292 | ||||||||

| NR×Pat | coef | 0.092*** | 0.077*** | |||||||

| se | 0.03 | 0.026 | ||||||||

| NR×Edu | coef | 0.398** | −0.469 | 0.150*** | ||||||

| se | 0.18 | 2.15 | 0.047 | |||||||

| NR×FDI | coef | 0.179*** | ||||||||

| se | 0.04 | |||||||||

| _cons | coef | −0.469 | 1.329 | 0.301 | 0.3 | −0.469 | −4.391 | 0.607 | −1.152 | −0.469 |

| se | 2.15 | 1.26 | 1.956 | 1.78 | 2.153 | 4.62 | 0.41 | 2.42 | 2.153 | |

| Hausman test (chi-sq) | 4.63 | −180.51 | 11.79 | 10.43 | 4.63 | 26.8*** | 4.63 | 5.96 | 4.63 | |

| R-sq (within) | 0.805 | 0.7991 | 0.8020 | 0.7886 | 0.8050 | 0.8091 | 0.8050 | 0.8001 | 0.8050 | |

| R-sq (between) | 0.8238 | 0.8459 | 0.8276 | 0.8515 | 0.8238 | 0.3745 | 0.8238 | 0.8058 | 0.8238 | |

| R-sq (overall) | 0.8191 | 0.8351 | 0.8198 | 0.8402 | 0.8191 | 0.4365 | 0.8191 | 0.7968 | 0.8191 | |

| Observations | 128 | 128 | 128 | 128 | 128 | 128 | 128 | 128 | 128 | |

| Specification | Random | Random | Random | Random | Random | Fixed | Random | Random | Random | |

Note: Variables NR×inst and NR have high correlation (0.8). Similar situation occurs between NR×sch and RN (0.9).

Models C-1, C-2, C-3 and C-4 were estimated from general Eq. (1), plus variables of interaction.

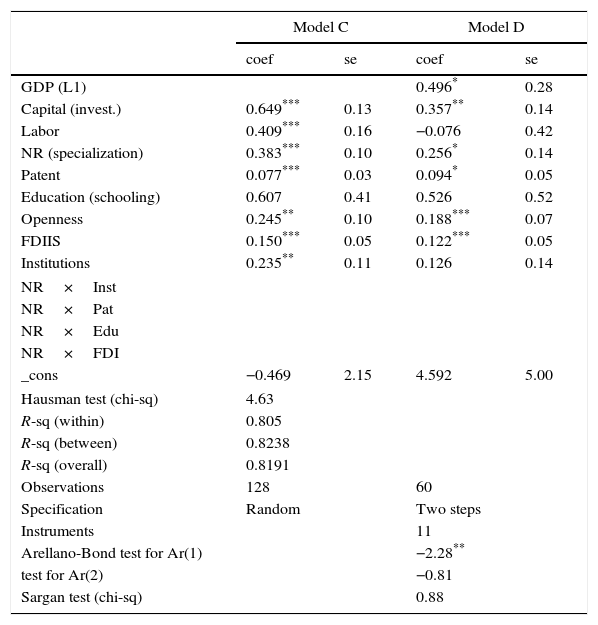

Finally, to test the potential endogenous process and as a test of robustness, we estimated the dynamic panel specification using the Difference and System GMM method for the sample NR-Driven (Table 4, Model D). The results show the same tendency as the static models do. However, the estimated coefficients of some variables, like labor and institutions, are not significant due to the strong effect of the lagging GDP as the path dependency literature described (Dosi, 1988). This comes to reflect the long-term nature of policies to achieve sustainable development. The high concordance among the results is remarkable and reflects the strong explanatory power of the proposed model that integrates intangibles as a key determinant of GDP.

Panel data analysis of physical and intangible factors for NR-Driven countries. Dynamic model. Dependent variable GDP per capita (ln).

| Model C | Model D | |||

|---|---|---|---|---|

| coef | se | coef | se | |

| GDP (L1) | 0.496* | 0.28 | ||

| Capital (invest.) | 0.649*** | 0.13 | 0.357** | 0.14 |

| Labor | 0.409*** | 0.16 | −0.076 | 0.42 |

| NR (specialization) | 0.383*** | 0.10 | 0.256* | 0.14 |

| Patent | 0.077*** | 0.03 | 0.094* | 0.05 |

| Education (schooling) | 0.607 | 0.41 | 0.526 | 0.52 |

| Openness | 0.245** | 0.10 | 0.188*** | 0.07 |

| FDIIS | 0.150*** | 0.05 | 0.122*** | 0.05 |

| Institutions | 0.235** | 0.11 | 0.126 | 0.14 |

| NR×Inst | ||||

| NR×Pat | ||||

| NR×Edu | ||||

| NR×FDI | ||||

| _cons | −0.469 | 2.15 | 4.592 | 5.00 |

| Hausman test (chi-sq) | 4.63 | |||

| R-sq (within) | 0.805 | |||

| R-sq (between) | 0.8238 | |||

| R-sq (overall) | 0.8191 | |||

| Observations | 128 | 60 | ||

| Specification | Random | Two steps | ||

| Instruments | 11 | |||

| Arellano-Bond test for Ar(1) | −2.28** | |||

| test for Ar(2) | −0.81 | |||

| Sargan test (chi-sq) | 0.88 | |||

The available literature on NR and growth has not provided sufficiently evidence about the causes and strategies in positive cases, keeping open some interesting questions for new research. Chile is an interesting case of study, because it shows an economic trajectory characterized by a notable GDP per capita increase and a steady growth over the past thirty years, while its industrial structure is clearly dominated by NR industries, producing primarily commodity.

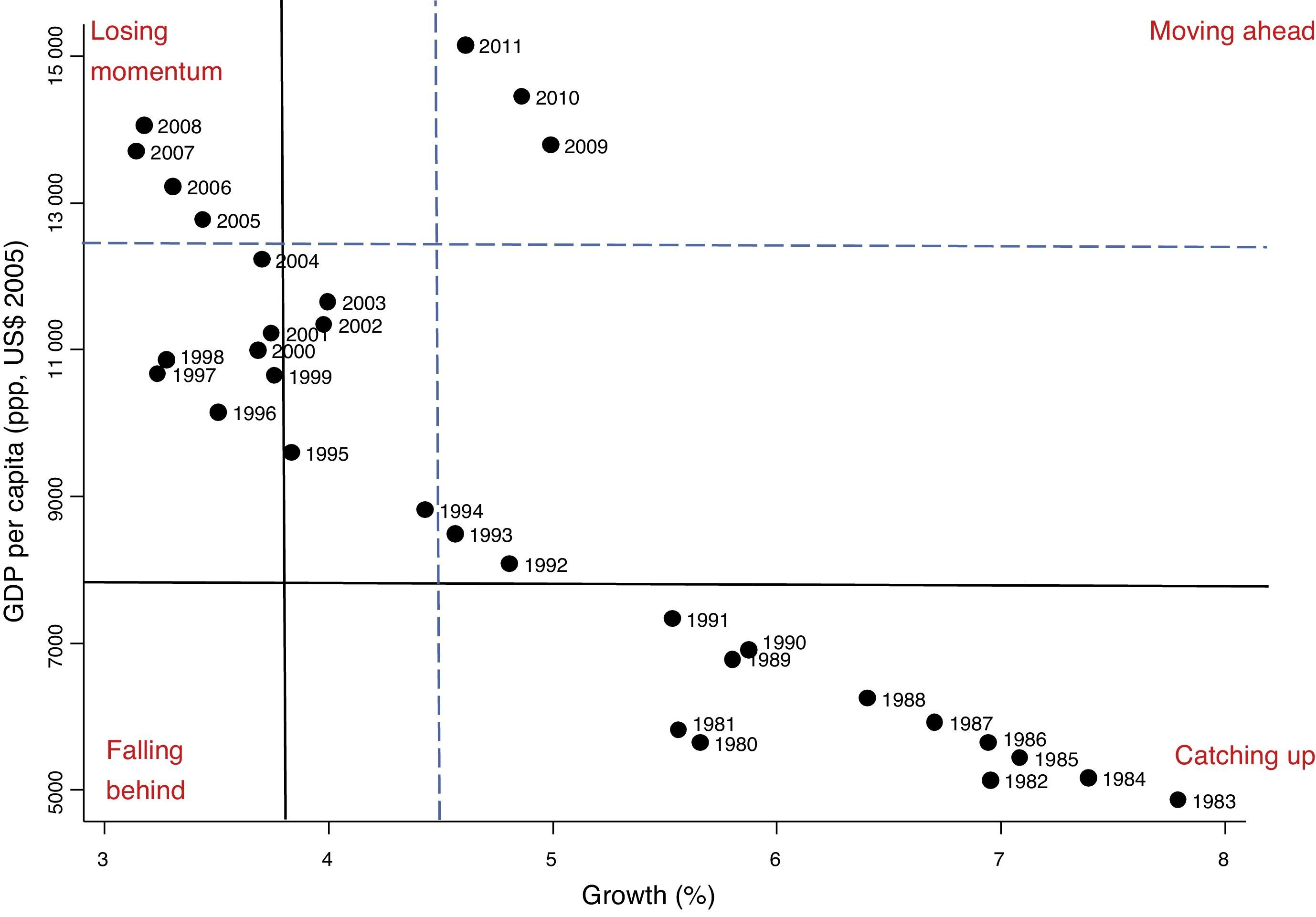

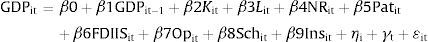

Despite of these remarkable results, a deeper analysis of its growth dynamics shows an almost continuous fall during the period 1983–2011 (Fig. 3), probably because Chile has followed a strategy based more on absorptive or “open innovation system” (Lee et al., 2012) instead of an endogenous innovation one based on the KE principles. Therefore, the second motivation to study this country is to reveal hidden facts about its growth path that could serve to obtain implications for other specialized economies.

Following the taxonomy presented by Fagerberg et al. (2007) on growth dynamics, the case of Chile clearly indicates a declining trend in its growth path that would confirm serious problems to sustain a high development standard. During the eighties the economy was in a catching up stage, while in the nineties and later it moved toward losing momentum. At the end of the reviewed period, new signs of positive dynamism are observed, probably because of high commodity prices (mainly cooper), rather than a real improvement of competitiveness, internal capabilities or structural changes. This is consistent with the competitiveness data reported by WEF (2013), indicating a constant and worrying drop in this indicator and confirming the low innovation capability of Chile.

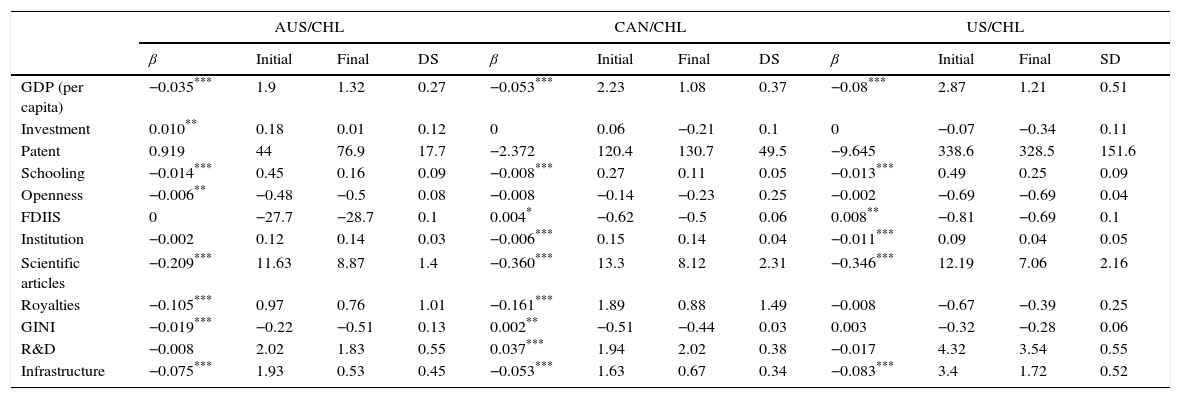

Meanwhile, the analysis of convergence indicates that one of the main Chilean weaknesses is the low innovation capability (Table 5), which it is common to several NR-Driven countries. In Chile, patent indicator achieves a level 70–130 times lower than in NR leading countries, this reflecting a lack of capacity to create knowledge, which also affects its absorption capacity. In addition, education quality is still poor as show international reports (OECD, 2014).

Convergence coefficients (β) between Chile (CHL) and leaders: Australia (AUS), Canada (CAN) and United States of America (US). Dependent variable GDP per capita (ln).

| AUS/CHL | CAN/CHL | US/CHL | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| β | Initial | Final | DS | β | Initial | Final | DS | β | Initial | Final | SD | |

| GDP (per capita) | −0.035*** | 1.9 | 1.32 | 0.27 | −0.053*** | 2.23 | 1.08 | 0.37 | −0.08*** | 2.87 | 1.21 | 0.51 |

| Investment | 0.010** | 0.18 | 0.01 | 0.12 | 0 | 0.06 | −0.21 | 0.1 | 0 | −0.07 | −0.34 | 0.11 |

| Patent | 0.919 | 44 | 76.9 | 17.7 | −2.372 | 120.4 | 130.7 | 49.5 | −9.645 | 338.6 | 328.5 | 151.6 |

| Schooling | −0.014*** | 0.45 | 0.16 | 0.09 | −0.008*** | 0.27 | 0.11 | 0.05 | −0.013*** | 0.49 | 0.25 | 0.09 |

| Openness | −0.006** | −0.48 | −0.5 | 0.08 | −0.008 | −0.14 | −0.23 | 0.25 | −0.002 | −0.69 | −0.69 | 0.04 |

| FDIIS | 0 | −27.7 | −28.7 | 0.1 | 0.004* | −0.62 | −0.5 | 0.06 | 0.008** | −0.81 | −0.69 | 0.1 |

| Institution | −0.002 | 0.12 | 0.14 | 0.03 | −0.006*** | 0.15 | 0.14 | 0.04 | −0.011*** | 0.09 | 0.04 | 0.05 |

| Scientific articles | −0.209*** | 11.63 | 8.87 | 1.4 | −0.360*** | 13.3 | 8.12 | 2.31 | −0.346*** | 12.19 | 7.06 | 2.16 |

| Royalties | −0.105*** | 0.97 | 0.76 | 1.01 | −0.161*** | 1.89 | 0.88 | 1.49 | −0.008 | −0.67 | −0.39 | 0.25 |

| GINI | −0.019*** | −0.22 | −0.51 | 0.13 | 0.002** | −0.51 | −0.44 | 0.03 | 0.003 | −0.32 | −0.28 | 0.06 |

| R&D | −0.008 | 2.02 | 1.83 | 0.55 | 0.037*** | 1.94 | 2.02 | 0.38 | −0.017 | 4.32 | 3.54 | 0.55 |

| Infrastructure | −0.075*** | 1.93 | 0.53 | 0.45 | −0.053*** | 1.63 | 0.67 | 0.34 | −0.083*** | 3.4 | 1.72 | 0.52 |

Significant at 1%.

Two steps. Robust standard errors. Negative coefficient means convergence. Convergence analyses were carried out from Eq. (4).

These findings would indicate that to cross the threshold and to drive the country toward a profile of higher income and development level, Chile must urgently implement strong policies to foster innovation activities in all fields, but above all those related to NR sectors. Some of the ways to achieve this goal are a higher promotion of collaboration networks, and making a greater effort to accumulate knowledge assets.

Institution quality in Chile is another aspect that requires more attention, as occurs in several NR-specialized countries. Although this indicator presents some limitations because the complexity for measuring this concept, the WB institution index offers suitable information about rule of law, corruption, transparency, political and social stability, government effectiveness, and regulatory quality. The coefficient (negative β) of this variable indicates a reduction of the gap, but important weaknesses remain. According to WB data (World Bank, 2015), these shortcomings are related to lower government effectiveness and the loss of government ability to define and implement policies to promote private business. This would indicate the need to enhance the institutional framework to avoid potential social conflicts, to provide more stability for investments, and to contribute to strengthen international and local networks. As Mehlum et al. (2006) argued good institutions are more relevant when the NR countries are closer to frontier, similar than the Chilean case.

Investment in fixed (and productive) capital is also a strategic factor for these sectors, as they are capital-intensive and require important inflows of physical assets. Despite the fact that the investment gap has increased during the entire period, Chile has narrowed it in the nineties as a result of foreign capital through FDI and other foreign investments, and also due to the reinvestment of NR revenues (Álvarez & Fuentes, 2006; García, 2006; Pérez, 2012). Signs of broadening the gap are found at the end of the period, although the gap values are still around zero. Thus, it is interesting to pay attention to this variable in order to detect the causes of the reduction of Chilean attractiveness for business, and to try to correct them.

Overall, the convergence analysis confirms the success of opening policies implemented since the seventies, becoming a core stone of Chilean economy. Chile is leader in inward FDI among NR-Driven economies, which has permitted to finance important productive infrastructures, the incorporation of foreign technology and know-how, and to open new markets for its exports (Negoita & Block, 2012).

In sum, this study reveals some of the main barriers that Chile should face in order to return to the growth path, maintaining NR sectors as pillars of its economy. As the KE and evolutionary theory point out, intangibles are key aspects for wealth creation, even in NR sectors, and innovation is a crucial tool for growth. This dimension is precisely where Chile has the greatest weaknesses becoming a major concern for the future. In deeded, technology creation (patent indicator) not only not reduce the gap, but increased from 50 to 76 times the distance with Australia, and from 120 to 130 times with Canada.

Although the country will continue using foreign sources of knowledge, as the technology gap theory proposes, the main opportunities can come from local innovation, although they will be larger if they are developed also in the frame of international networks of collaboration. Therefore, openness and FDI can be seen as a way to incorporate knowledge while international networks could provide a source of technologies and human capital. Although, a higher impact of these elements in the dynamic of local innovation systems would require actions that enhance endogenous capabilities for a higher absorption as well.

5ConclusionsThis paper combines several analytical techniques to study the key factors for growth in NR-Driven economies from the knowledge economy perspective. The cluster analysis performed has permitted to identify a group of countries made up by upper-middle and high income economies and with an industrial structure dominated by NR. Unlike previous studies, this technique allowed us to obtain a more robust group of NR-Driven countries to seek a potential new development path. This set of nations does not have a geographic, ethnic, or political pattern, reason why other factors are responsible for their growth, an argument that has been defended in this paper.

The econometric estimations of the growth model show that natural resources may generate a positive impact if traditional production factors are appropriately combined with others of intangible nature. In fact, capital and labor remains key factors of growth in NR-Driven economies, as neoclassic literature argues, but intangible assets are identified as essentials too. The findings confirm that NR have a positive effect on GDP in some countries while in others, such as OECD members, their impact is not significant.

In accordance with the KE approach, a growth path based on RN and Intellectual capital is identified. Accordingly, a positive relationship between innovation capabilities and GDP advance was detected in countries with a NR-Driven development trajectory. This would indicate that the presence of absorptive capacity for catching up strategies are important for specialized economies and also the capability of creating technologies and knowledge, mainly in advanced stages of development.

This empirical study also reveals the essential role of openness and FDI as a channel to access foreign technologies and knowledge. This can be understood as a mechanism that may facilitate the international diffusion of technologies, with a potentially positive impact on development in resource-specialized economies. Nonetheless, international networks, along with advanced human capital, are key elements to build absorptive capacities and innovation capabilities, these being critical for these economies. Moreover, a good institutional quality positively affects GDP of NR-Driven economies, because better institutions allow countries to overcome potential negative pressures and achieve a political, social and economic stability that promote investments and progress. In addition, good institutions provide a favorable long-term framework to carry out innovation activities.

These results come to justify the design of a comprehensive framework for understanding the economic evolution of nations and the possibilities for defining a different development strategy based on the strengths of intangibles without leaving completely aside their natural resource-intensive industries. This strategy should be conceived as integrative of a higher level of investments in knowledge assets because these resources could provide a “big push” and also support sustainable growth.

The case of Chile clearly represents an example of NR-Driven country that has progressed exploiting its NR endowments and implementing suitable policies of openness and institutional and economic reforms. However, these measures have been insufficient to support a long-term economic development, as was evidenced by the growth dynamics analysis. The causes of this slowdown would be in immaterial factors, confirming the relevance of intangibles resources for NR-Driven economies. The study of the Chilean case confirms the relevance of intellectual capital in growth strategies in NR-specialized countries, while a relevant path of action would be the transformation of activities related to NR exploitation in an endogenous process that would integrate and strengthen knowledge-based assets into the NR industry. If NR-economies do not assume the task to invest in these elements, the risk will be that their economic development will be blocked and could fall into the NR curse.

International openness, FDI and capital investment have been the main factors involved in the gap reduction (GDP per capita) of Chile with leading economies. The results of the convergence analyses also indicate that among the current main weaknesses of Chile are an inadequate institutional quality, the social inequality and the lack of technological capability. This latter aspect is a matter of great concern because the distance is not only very large with the leaders, but also it is increasing over time. Particular strategies that could be implemented are those oriented to the promotion of smart specialization in NR sectors and to increase the potential for spillover, in order to enhance the participation in international innovation networks, and to build long-run public-private partnerships. To facilitate these targets, some factors to which governments can pay more attention to enhance innovation capability are those related to education (as source of innovation capabilities), R&D investments, entrepreneurship, public-private and firm-science networks, science-based employment, and advanced scientific infrastructure.

Further research will be ideally devoted to analysis at both firm and sector levels, in order to provide more key aspects to policy makers and entrepreneurs. An analysis with micro-data would allow us to include directly innovation variables and to deeply analyze spillover effects. In addition, a deeper study of education and institutions would be reasonable in order to detect more clues of the accumulative process of innovation capability building. Finally, this study has some limitations, most of them common in economic research. One of them is that although all the indicators are justified and the estimations’ results are robust, the use of several proxies for the study of technological and intangible factors can be also seen as a limiting factor. Meantime, although panel data techniques allow us to analyze the determinants of GDP in NR-Driven countries, the causality effect is not possible to be exactly determined with this methodology.

Conflicts of interestThe authors declare no conflicts of interest.

| 1 | 2 | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | |

| BEL | JAM | CHL | MOZ | EGY | GIN | NOR | ARE | CAF | LBR | GHA | ETH | ZAR | NGA | TCD | COG | GNQ | BRN | AZE |

| DEU | ISL | KAZ | UGA | IDN | MRT | VEN | GNB | MLI | SLE | IRQ | GAB | |||||||

| CHE | NZL | AUS | KEN | CMR | MNG | ECU | SDN | LAO | AGO | LBY | ||||||||

| JPN | HRV | CAN | TMP | SYR | IRN | AFG | MMR | KWT | ||||||||||

| AUT | MUS | MEX | KIR | GUY | YEM | KHM | OMN | |||||||||||

| SWE | VCT | ZAF | CIV | NPL | BWA | |||||||||||||

| IRL | GRD | COL | ALB | RWA | SAU | |||||||||||||

| LUX | LCA | ARG | BTN | BEN | DZA | |||||||||||||

| CYP | HUN | PER | ARM | BFA | ||||||||||||||

| FIN | DJI | MYS | PAK | KGZ | ||||||||||||||

| MLT | HND | RUS | ZMB | GMB | ||||||||||||||

| ESP | PHL | TON | NER | |||||||||||||||

| BRB | DMA | VUT | TGO | |||||||||||||||

| PLW | GTM | NIC | BDI | |||||||||||||||

| ITA | BLZ | PRY | SLB | |||||||||||||||

| PRT | LKA | MDA | ||||||||||||||||

| BHS | SRB | STP | ||||||||||||||||

| DNK | MAR | BGD | ||||||||||||||||

| NLD | TUR | IND | ||||||||||||||||

| GBR | URY | GEO | ||||||||||||||||

| USA | SLV | ERI | ||||||||||||||||

| ATG | SWZ | |||||||||||||||||

| HKG | BIH | |||||||||||||||||

| SGP | CPV | |||||||||||||||||

| CZE | BGR | |||||||||||||||||

| KOR | ROM | |||||||||||||||||

| EST | THA | |||||||||||||||||

| LUT | MDV | |||||||||||||||||

| POL | CHN | |||||||||||||||||

| JOR | LSO | |||||||||||||||||

| BRA | ||||||||||||||||||

| OECD | NR dominated | NR-Driven | ||||

|---|---|---|---|---|---|---|

| Australia | Japan | Algeria | Egypt | Madagascar | Saudi Arabia | Argentina |

| Austria | Mexico | Angola | Ethiopia | Malawi | Senegal | Australia |

| Belgium | Netherlands | Argentina | Fiji | Mali | Sierra Leone | Canada |

| Canada | New Zealand | Armenia | Gabon | Mauritania | South Africa | Chile |

| Chile | Norway | Australia | Gambia | Moldova | Sudan | Colombia |

| Czech Republic | Poland | Azerbaijan | Georgia | Mongolia | Tanzania | Kazakhstan |

| Denmark | Portugal | Bahrain | Ghana | Namibia | Togo | Mexico |

| Estonia | Slovakia | Benin | Guatemala | New Zealand | Trinidad and Tobago | Peru |

| Finland | Slovenia | Bolivia | Guyana | Nicaragua | Uganda | Russia |

| France | South Korea | Botswana | Iceland | Niger | Uruguay | South Africa |

| Germany | Spain | Burundi | Iran | Norway | Uzbekistan | |

| Greece | Sweden | Cameroon | Jamaica | Oman | Venezuela | |

| Hungary | Switzerland | Chad | Kazakhstan | Paraguay | Yemen | |

| Iceland | Turkey | Chile | Kenya | Peru | Zambia | |

| Ireland | United Kingdom | Colombia | Kuwait | Qatar | Zimbabwe | |

| Israel | United States | Coted’Ivoire | Kyrgyzstan | Russia | ||

| Italy | Ecuador | LaoPDR | Rwanda | |||