Central banks in G7 countries shifted to unconventional policy measures in the aftermath of the Financial Crisis, when faced with economic slack, financial instability and fiscal trouble. This shift ended a spell of rules-based time consistent monetary policy that started in the mid-1980s. I argue that substantial economic, political and financial risks put pressures on the continued support for a monetary regime. Central banks may be forced to adopt policies with no option to reset those options later on. I demonstrate with duration models – on a sample of industrialized and emerging economies from 1970 to 2012 – that the policy switch to inflation targeting happened after episodes with high inflation and public debt, reflecting broad support for stability-oriented monetary (and fiscal) policy. More generally, changes in monetary regimes occur after a crisis. High inflation makes central banks pursue active monetary policies, while they forsake those same policies in the wake of fiscal or financial crises.

Los Bancos Centrales de los países pertenecientes al G7 dieron un giro hacia políticas menos convencionales a raíz de las consecuencias de la crisis financiera, cuando se enfrentaron a la desaceleración económica, la inestabilidad financiera y las dificultades fiscales. Este cambio ha finalizado un período de políticas monetarias de larga duración basadas en normas que se iniciaron a mediados de los años ochenta. Expongo que los considerables riesgos económicos, políticos y financieros añaden una presión al apoyo continuo de un régimen monetario. Los bancos centrales pueden verse obligados a adoptar políticas sobre la marcha sin ninguna opción de restablecer aquellas opciones más adelante. Demuestro con modelos de duración –en una muestra de economías industrializadas y emergentes de 1970 a 2012– que el giro de políticas hacia las metas de inflación ocurrió despu’es de episodios con alta inflación y deuda pública, lo que refleja el amplio apoyo a las políticas monetarias (y fiscales) orientadas hacia la estabilidad. A rasgos generales los cambios en los regímenes monetarios se producen después de una crisis. La inflación alta supone que los bancos centrales aspiren a políticas monetarias activas, mientras que renuncian a esas mismas políticas al iniciarse una crisis fiscal o financiera.

From the mid-1980s until the recent financial crisis, most developed economies have enjoyed a remarkably long period of economic stability. This Great Moderation owes much to benign economic circumstances, but many economists would attribute an important role to the anti-inflationary stance of monetary policy (Clarida, Gali, & Gertler, 2000; Lubik & Schorfheide, 2004). A rules-based policy, like inflation targeting that can credibly commit to some nominal anchor and maintain such a policy over time is seen as key to macroeconomic stability. The success of such a policy is proven by curbing economic volatility, and bringing down inflation to low and stable levels (Svensson, 2010).

The economic turmoil starting with the Financial Crisis has questioned this view (CEPR, 2013). Losses on subprime loans in US banks triggered an unwinding of uncovered debt positions. This snowball debt-effect brought down major financial institutions in both the US and Europe. The ensuing financial crisis called for policy intervention out of the deep pockets of the tax payer. Massive public aid in support of the financial sector, together with falling tax revenues and spending on recovery plans to withstand the economic fall-out of the financial collapse, shifted the burden of private debt to a large extent to public debt, and unleashed a sovereign debt crisis. Low and declining inflation has urged central banks in G7 countries to introduce unconventional policy measures. High debt and low inflation have made many a government look to financial repression to place public debt at lower rates in the banking sector.

This unraveling of the policy framework has put monetary policy strategies under considerable stress. Unconventional policies are a radical policy change compared to normal monetary practice. Although central banks argue that exit-strategies out of massive asset purchases do not entail inflationary risks, it does put central bankers at risk of assuming tasks normally attributed to fiscal policy. Doing so creates a substantial political risk and could undermine the political support for inflation targeting. Transparency about its actions and political accountability is crucial for a central bank pursuing inflation targeting. Blurring that task with other policy objectives could lead to a political turn. The temptation to overrule the central bank might be even stronger because of the fiscal consequences of the Financial Crisis. High and rising public debt questions the ability of a central bank to commit to low inflation. Several types of economic models would argue that a central bank faced with rising public debt is not able to maintain a credible inflation anchor.1 Fiscal austerity to maintain low deficits has in many countries led to political changes already. Central banks might also find the usual monetary transmission impaired when returning to ‘business as usual’. Financial repression by governments might distort the incentives of banks favouring investment in government bonds markets. These policies make it harder for a central bank to deliver under the typical inflation targeting framework.

Inflation targeting has moreover been criticised for contributing to the Great Recession. With an excessive focus on inflation abatement, inflation has fallen to levels that make it impossible to further react with the interest rate instrument to changing circumstances. A conventional response to economic slack is impossible when monetary policy reaches the zero lower bound. Furthermore, the single-minded focus of central banks on anchoring expectations of low inflation, and not on controlling the transmission to the banking sector led to the build-up of financial imbalances in the banking sector (Whelan, 2013).

Looking at these economic, political and financial circumstances, inflation targeting seems ripe for a change. Most empirical work on time variation in monetary policy behavior supposes that changes occur either exogenously – due to some shock – or are endogenously driven by past changes in inflation or output. These approaches have been successful in characterizing different policy regimes over time (Chung, Davig, & Leeper, 2007; Davig & Leeper, 2007; Favero & Marcellino, 2005). However, other factors driving policy change are not explicitly modeled. While there is much empirical and theoretical work on the choice of exchange rate regimes (Klein & Shambaugh, 2010), only Carare and Stone (2006) and Rose (2007) look at how monetary regimes underwent regime changes due to economic, political or financial conditions.

The aim of this paper is to examine the timing of policy changes, and the duration of different policy regimes. I focus on the adoption of different monetary regimes – and inflation targeting in particular – in a large sample of industrialised and emerging economies over the period 1970-2012. The main finding is that inflation targeting is a regime whose adoption was favoured by previous crises. In particular, high inflation and high public debt prepared the ground for reforms to monetary policy and the eventual adoption of inflation targeting. The end of monetary regimes is also interesting to examine. Yet, even with the Financial Crisis, no central bank has formally abandoned inflation targeting. When I test the timing and duration of more generally defined monetary policy regimes, then policy switches are more likely after a fiscal or a financial crisis. High inflation make central banks pursue active monetary policies, while they forsake those same policies in the wake of fiscal or financial crises.

The plan of this paper is as follows. In the next section, I relate regime changes in monetary policy to economic and political conditions. In Section 3, I test the timing and duration of inflation targeting regimes, and broaden the analysis to other monetary regimes in Section 4. I draw policy implications for stability-oriented policies in the final section.

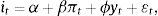

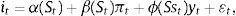

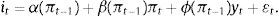

2Regime changes in policyDiscussion of regime change in monetary policy is most easily cast with a simple policy rule, or Taylor rule, which has the central bank adjust the short-term nominal interest rate in response to fluctuations in inflation and some measure of output

with it the short-term nominal interest rate controlled by the central bank, πt the inflation rate, and ¿ i.i.d. N(0,μ) is an exogenous policy disturbance. A policy rule of this kind has been used in an extensive empirical literature to describe various types of monetary policy. Changes in regimes can be examined in this framework by letting the reaction coefficients in (1) depend on changes in some underlying state. The most straightforward way to do so is to rewrite (1) aswhere the state St is a discrete valued random variable that evolves stochastically and independently of the endogenous economic variables. This state St makes policy shift according to different regimes. A large body of evidence characterizes changes in the state-dependent coefficients of the switching rule in (2) (Davig & Leeper, 2007). There is much evidence of changes from active monetary policy regimes, in which central banks combat inflation, to more lenient regimes, in which monetary policy gives in to inflationary pressures. Such a distinction lays at the root of characterizing the inflation targeting policy as the active policy that prevails since the mid-1980s in most industrialised economies.While in the simple Taylor rule, shocks only happen for some exogenous reason, in (2) policy can be subject to changes in regime. This shock to the policy regime is still determined outside the model, and not explained by policy behaviour itself. This seeming inconsistency makes Davig and Leeper (2007) propose to let the coefficients of the policy rule depend on past inflation:

In this case, reactions of central banks depend not just on all exogenous shocks ¿t that modify the inflation process, but in addition also on any policy action itself that may modify the expectations of the inflation process. I.e., any shock to inflation has two effects. The direct effect of the shock implies a reaction of the central bank, just as in (1), when agents place zero probability on a regime change. The indirect impact is to change agents’ beliefs on the policy regime in place. Expectations formation effects occur as rational expectations of future policy reactions, derived from past reactions of the central banks, induce agents to believe in changes in policy in the future.

The consequence for central bankers is that besides the usual policy tool to react to economic conditions, it has another instrument to influence expectations of agents on future policies. Beliefs open up a wide range of possible actions for policymakers to announce policies. A central bank must credibly commit to a change in action in the future, and induce agents to believe the central bank will act then. Inflation targeting is an example of a policy that aims to keep inflation at a target level not only by acting upon inflationary pressures, but also by building the institutions (central bank independence) to credibly commit to that target over time and thereby shaping expectations of how monetary policy will react.

The existence of anticipated regime changes gives central banks additional tools to influence the efficacy of their own policies in the future. The downside is that a central bank may chose policies that seem optimal and time-consistent in the given set of conditions, but that given the development of the economy may not be believed to be credibly maintained in the future. Time-inconsistency does not grow out of a failure to stick to a policy to keep inflation low, but out of conditions in which agents may not hold the belief anymore that the central bank is able to stick to that policy. The expectation effect goes beyond the usual credibility effect of announcing policies as policymakers should not just act and announce to be acting in a way that is consistent over time, but should also be seen as able to stick to that commitment at all future times. Being able to do so depends on more conditions than just central bank policy.

The empirical relevance of these expectation effects is subject of some recent research that embeds Markov switching processes for policy in DSGE models. Bianchi and Ilut (2013) and Bianchi and Melosi (2013) argue that the Great Inflation of the seventies can be explained by a series of shocks to the long term component of government expenditure combined with the monetary policy regime in place. Anticipation of necessary changes in taxes and spending may imperceptibly raise inflation over prolonged periods as monetary policy was expected to be accommodative of the budget needs of the government. Bianchi (2013) shows that the announcements of the central bank to refrain from inflationary policies in spite of government plans, may be limited if promises are not lived up to, as future policy actions are discounted.

That regime change is driven by endogenously adjusting expectations on the future policy course should not come as a surprise to students of the literature on the political dynamics of reform (Alesina & Drazen, 1991; Jain & Mukand, 2003; Rodrik, 1996). Bad economic performance (high inflation and unemployment), unsustainable public debt positions, or a sudden crisis (exchange rate crisis, balance-of-payments crisis,...) open a window of opportunity for reform, as veto barriers are eliminated. A sufficiently credible reform should change expectations of how policy will react in future circumstances. One example of such a reform is inflation targeting itself. In many countries, the introduction of inflation targeting has been part and parcel of a wider reform of policies and institutions in search for a stability oriented framework for policies. Past inflation experiences may have convinced policymakers to change course. The Great Inflation paved the way for Paul Volcker to act against inflation. Tests of Markov switching rules as in (2) give some narrative evidence that regime changes are associated with such reforms (Davig & Leeper, 2007; Favero & Marcellino, 2005).

One particularly important change for monetary policy may come from fiscal conditions. There is a long line of research on how fiscal decisions impinge on the central bank's capacity to set monetary policy. The tenet of this literature is the game of chicken between central banks and governments: unable to deal with the fundamental political causes of high deficits, government forces the central bank to finance the sovereign. Treasury and central bank might be caught in a non-cooperative game (Dixit & Lambertini, 2003). According to the Fiscal Theory of the Price Level, monetary and fiscal policy should be set such that their joint actions preserve price stability. Following Leeper (1991), the combination of ‘active’ inflation-tackling monetary and ‘passive’ debt-tolerant fiscal policy does not fix the price level. For this reason, it should not come as a surprise that the switch to inflation targeting has come with more stable fiscal policies, and the introduction of fiscal rules. They are a similar class of reforms of the policymaking process with similar institutional settings (Kopits, 2001). There is some indirect evidence that monetary and fiscal policy changes are indeed not isolated events. Bianchi (2012) estimates fiscal and monetary rules in an SVAR model with endogenous change, and shows how the monetary/fiscal policy mix has evolved since the seventies from a combination of unsustainable fiscal policy and dovish monetary policy, to a regime in the nineties in which monetary policy is anti-inflationary and the fiscal authority accommodates monetary policy decisions.

The aim of this paper is to make the linkage from beliefs to regime changes more specific by testing what conditions make a monetary policy regime – in this case inflation targeting – more likely, and what determines the length of the period over which this policy choice can be kept. Empirical studies have mostly looked into the choice of exchange rate regime, driven by the debate of the “mirage” and “fear of floating” views on exchange rate regimes (Alesina & Wagner, 2006; Klein & Shambaugh, 2008). But exchange rate regime choice is not a monetary regime as such, as floaters have various alternative policy options.2 Just three papers look at monetary regimes, all of them at inflation targeting. Rose (2007) finds that relatively similar countries may adopt quite different monetary regimes, like inflation targeting or exchange rate fixes. Carare and Stone (2006) examine inflation targeters and find that economic and financial development is the main reason for switching to inflation targeting. Evidence on the reasons for shifts in monetary policy are limited to a few papers. An IMF report (Schaechter, Stone, & Zelmer, 2000) lists the necessary elements for adopting an inflation targeting regime, based on the experience of a large set of emerging markets. Most of these elements repeat the economic conditions we discussed so far. In particular, fiscal positions should be sound and the macro-economic environment stable. Schaechter et al. (2000) stress also political conditions as central banks should be given independence and receive from the government a clear mandate to achieve price stability. Central banks need to be transparent about their policies to build accountability and credibility. This requires a functioning democracy with anchored longer term preferences for certain types of stability-oriented policies. But operational capacity is important as well: a well-developed financial system is necessary to let monetary decisions transmit to the real economy. Central banks should understand the channels between policy instruments and inflation, and have a sound methodology for producing inflation forecasts.

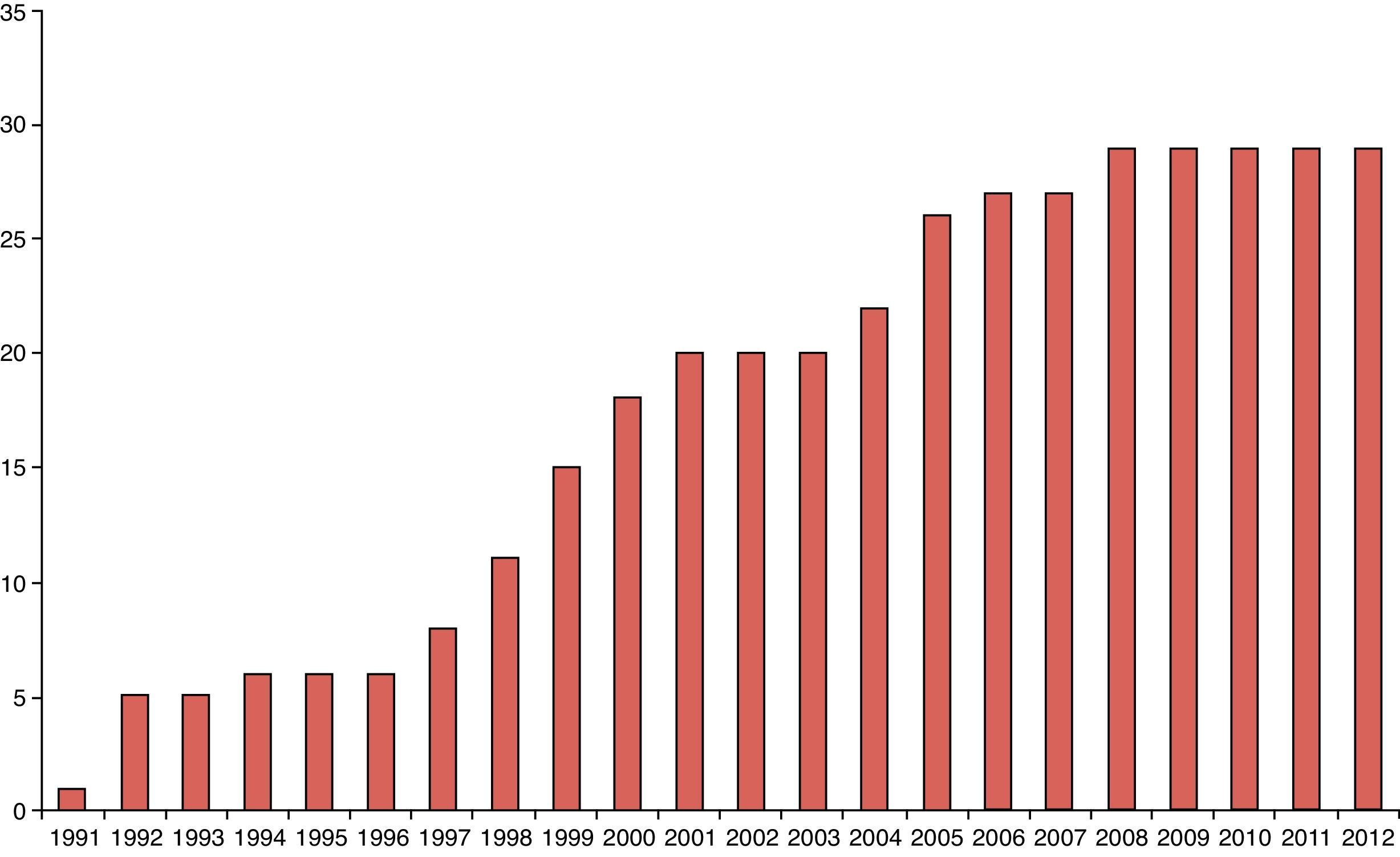

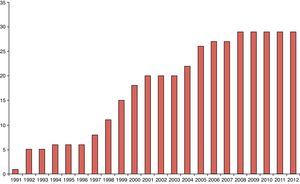

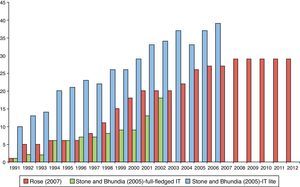

3Inflation targeting regimes3.1A classificationIn order to identify years in which a central bank follows an inflation targeting regime, we use the classification of Rose (2007). This is an elaboration by Rose (2007) of the information on monetary regimes provided in the IMF's Annual Report on Exchange Arrangements and Exchange Restrictions. It is a dummy variable equal to 1 if in a given year a country's monetary policy framework can be characterized as inflation targeting, and zero otherwise. Table 1 displays the 29 countries that pursue inflation targeting, with their respective starting years. Inflation targeting has become an ever more popular choice since New Zealand first adopted the policy in 1990 (Fig. 1).

Inflation targeting regime with starting year, classification by Rose (2007).

| Country | Year | Country | Year | Country | Year |

|---|---|---|---|---|---|

| New Zealand | 1990 | Brazil | 1999 | Philippines | 2002 |

| Canada | 1991 | Mexico | 1999 | Guatemala | 2005 |

| Chile | 1991 | Poland | 1999 | Slovak Republic | 2005 |

| Israel | 1992 | Colombia | 2000 | Armenia | 2006 |

| Australia | 1993 | South Africa | 2000 | Indonesia | 2006 |

| Finland | 1993 | Switzerland | 2000 | Romania | 2006 |

| Sweden | 1993 | Thailand | 2000 | Turkey | 2006 |

| United Kingdom | 1993 | Hungary | 2001 | Ghana | 2007 |

| Spain | 1995 | Iceland | 2001 | Albania | 2009 |

| Czech Republic | 1998 | Norway | 2001 | ||

| Korea, Rep. | 1998 | Peru | 2002 |

I use duration models to analyze the effect of economic, political and financial conditions on the adoption and duration of inflation targeting regimes. I estimate empirical hazard models to explain the dynamics of adoption by central banks of inflation targeting. Consider a regime that started in some period t. Given the starting period and a set of conditioning variables, Zt, there is a probability q(t|Zt) that the regime ends in period t but with a certain probability p(t|Zt) the regime continues beyond period t. The hazard rate, λ(t|Zt) is the ratio of these two probabilities, q′(t|Zt)/p(t|Zt). A low hazard rate indicates that the regime is unlikely to finish soon. Following Beck, Katz, and Tucker (1998), this function can be estimated using a standard binary choice model such as a probit, as I treat the panel of countries/regimes as discrete time duration data. The likelihood function of a static discrete choice model for pIT,t is then

If the hazard rate is conditional on the covariates Zt as well as survival, thenOne possible distribution function for h(•) is a probit model, λi=Φ(Xiβ). I estimate a probit model for the chance of adopting inflation targeting in any specific year pIT,t by a set of characteristics Zt:3A probit model assumes that the probability of continuing or exiting a regime at any point in time is always the same (a constant hazard rate) and is equivalent to the use of an exponential parametric model in a continuous duration model. The consequence of ignoring time dependence in the regimes are strongly underestimated standard errors (Poirier & Ruud, 1988). As the choice of the previous period determines to a large extent the choice of the monetary regime, we must correct the probit estimator for time dependence. The standard errors of the probit estimator are corrected using robust standard errors clustered on the country. To further model the time dependence, I include in (6) time as an additional covariate in the model. Additionally, one may want to account for the length of each regime. A spell counter can be included with a dummy variable for each regime. These temporal dummies are the discrete time duration model equivalent of the continuous time baseline hazard function. With many spells, these dummies are problematic, as the dummy variable may jump from period to period. Beck et al. (1998) suggest using cubic splines to smooth the temporal dummies, reducing the necessary degrees of freedom. I include in (6) just two cubic splines.The data consist of annual observations on 206 countries from 1970 to 2012. I test whether the hazard ratio depends significantly on the three sets of economic and financial variables described in Section 2. First, I test whether past inflation or economic performance has influenced the decision to adopt inflation targeting. I include the inflation rate and the output gap as measures of both variables. In order to account for possibly very bad economic performance, I test whether past crises had an impact on the adoption decision. I use as a series the total number of crises, which counts the number of budget, balance of payments, currency, stock market or bank crises from Reinhart and Rogoff (2009). Second, the outlook for fiscal policy is an important driver for monetary policy decisions, and high public debt might force the central bank to adjust its policies. I include the public debt ratio in (6). Third, I test whether the general level of economic development is a good predictor of inflation targeting, as it has been argued that only industrialised countries might be operationally able to handle a more demanding monetary regime. For the same reason, financial development is an important precondition according to the IMF report (Schaechter et al., 2000). I include real GDP per capita and measures that reflect the openness of the capital account and the level of stock market capitalisation.4

Estimation of (6) should take account of the endogenous effect of the decision to adopt inflation targeting. First, there is by now a large body of literature that discusses whether inflation targeting has economic effects. The results are not very conclusive as some studies find an impact of the adoption of this policy on inflation and the economic outlook (Lin, 2010; Vega & Winkelried, 2005), while others do not (Ball & Sheridan, 2005; Lin & Ye, 2007). Second, the establishment of an independent central bank mandated to target inflation also modifies strategic interactions with fiscal policy. Combes, Debrun, Minea, and Tapsoba (2014) argue that adoption of inflation targeting should give incentives to preserve central bank independence by further restraining fiscal discretion. The reason is that the introduction of a deficit or debt limit, adherence to a fiscal rule, etc. all sustain the monetary target (Freedman & Otker-Robe, 2010; Roger, 2009).5Minea and Tapsoba (2014) find evidence supporting such a discipline-enhancing effect of inflation targeting on fiscal policy, notably in developing countries. The problem with these findings is that the timing of policy reforms is hard to discern. Combes et al. (2014) argue that monetary reforms mostly precede fiscal reforms. Yet, discipline-enhancing fiscal policy may have paved the way for adoption of another monetary regime by reducing direct dependence on monetization, or the indirect reliance of governments on the domestic financial sector to channel private savings to public bonds (Bernanke & Woodford, 2004). A third reason for an endogenous response is that a stability oriented policy like inflation targeting may have reduced the likelihood of crises, in particular the ones related to the currency regime or the balance of payments (as most inflation targeters are floaters). Fiscal crises become less likely too for the reasons just mentioned. Finally, over time, a stable monetary policy may spur economic and financial development. Lower economic volatility is known to raise growth. Although there is no existing evidence on the impact of inflation targeting on the financial sector, the banking system is likely to grow more stably in the absence of monetary shocks, so that financial intermediation becomes stronger.

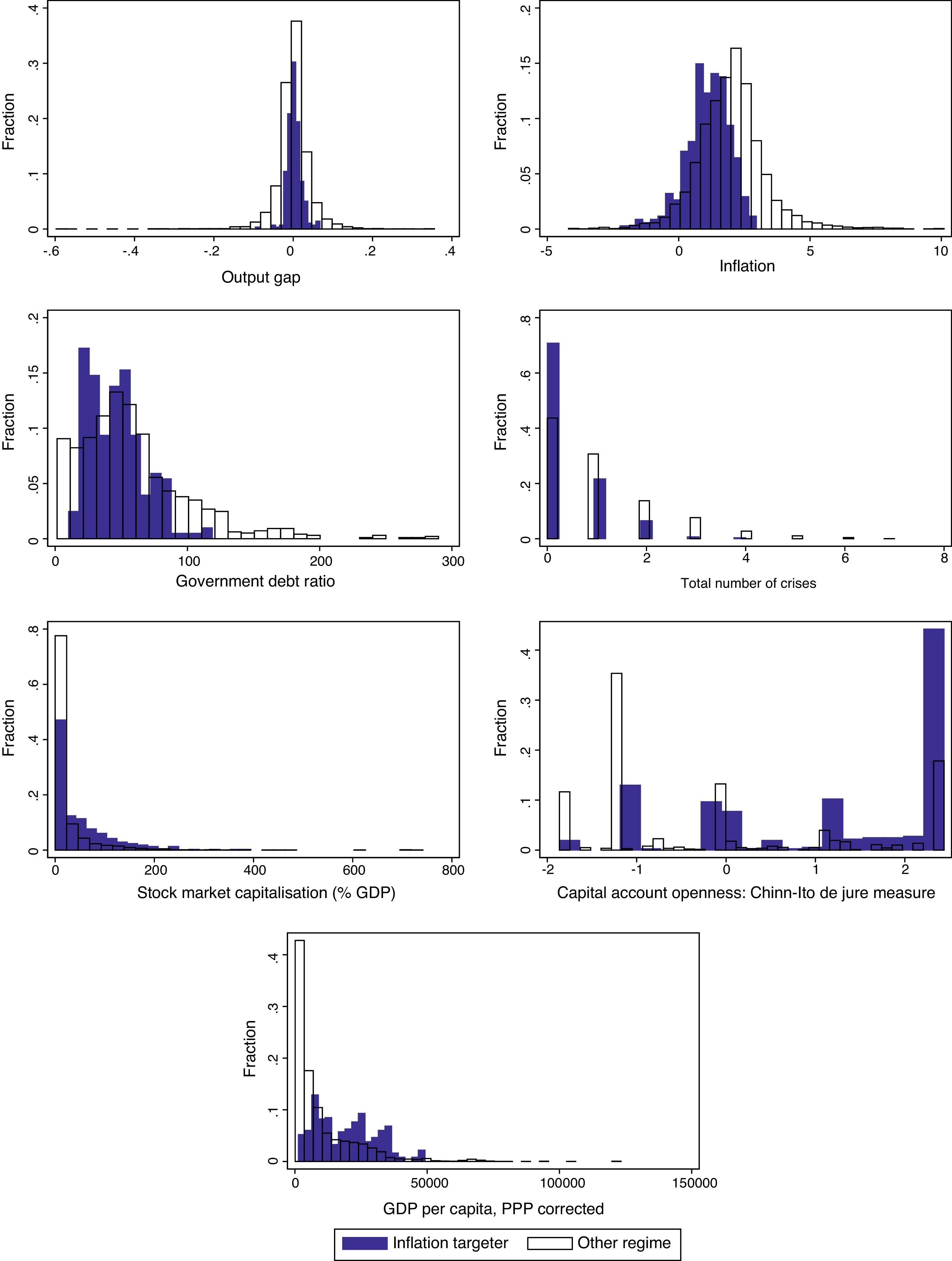

Some evidence for these endogenous responses comes from Fig. 2. I plot the histogram for inflation targeters versus alternative monetary regimes for all country-years for the seven variables included in 6. While there is no perceptible difference in cyclical performance, inflation is lower (although a t-test would reject the significance of this difference). The histograms also suggests that the public debt ratio, and the total number of crises, are lower for inflation targeters, but this again is not a significant effect. Inflation targeters are definitely significantly different in terms of general economic as well as financial development. Inflation targeters have a significantly higher GDP per capita, and better developed stock markets and more open capital accounts.

To correct the coefficient estimates in (6) for endogeneity, I adapt the probit estimator to a two-stage instrumental variable procedure where the first step is an OLS regression of the endogenous variables on a set of instruments assumed to influence regime choice only through their impact via these variables. I use as instruments a set of political indicators that have been found in other studies to explain financial development and growth (Acemoglu, Johnson, Robinson, & Thaicharoen, 2003; Carare & Stone, 2006). I use an overall indicator of democracy, based on the polity-index (Henisz, 2000), and also employ several indicators that measure quality of governance along six different dimensions. The World Bank Governance Indicators measure accountability, political stability, government effectiveness, regulatory quality, rule of law and control of corruption.

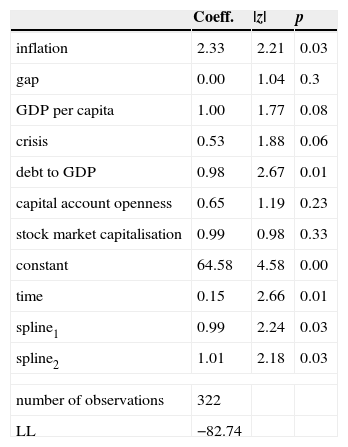

3.3Results3.3.1The adoption of an inflation targeting regimeTable 2 reports the exponentiated coefficients of the logit model, together with the z-statistics and the associated p-value. Past inflation experiences are an important driver in the choice to adopt inflation targeting. Higher inflation makes it more likely a country will shift monetary policy. This result – together with the evidence from Fig. 2 - suggests that adoption of inflation targeting has as a purpose the reduction of inflation. Economic performance does not play a role, so it is not the case that the choice is made under the pressure of an economic crisis, with large drops in GDP. This is not to say that crises do not matter: the Reinhart and Rogoff (2009) measure of the total number of economic crises has a positive impact on the switch to inflation targeting, albeit the effect is only marginally significant.

Inflation targeting regime, IV probit model.

| Coeff. | |z| | p | |

|---|---|---|---|

| inflation | 2.33 | 2.21 | 0.03 |

| gap | 0.00 | 1.04 | 0.3 |

| GDP per capita | 1.00 | 1.77 | 0.08 |

| crisis | 0.53 | 1.88 | 0.06 |

| debt to GDP | 0.98 | 2.67 | 0.01 |

| capital account openness | 0.65 | 1.19 | 0.23 |

| stock market capitalisation | 0.99 | 0.98 | 0.33 |

| constant | 64.58 | 4.58 | 0.00 |

| time | 0.15 | 2.66 | 0.01 |

| spline1 | 0.99 | 2.24 | 0.03 |

| spline2 | 1.01 | 2.18 | 0.03 |

| number of observations | 322 | ||

| LL | −82.74 | ||

What is important is the fiscal outlook: countries with a higher debt to GDP ratio are quite more likely to adopt inflation targeting. This evidence seems to counter the argument that countries must put fiscal policy in order to let inflation targeting. However, it is fully in line with evidence in Combes et al. (2014) or Minea and Tapsoba (2014) that the switch may serve to put further constraints on fiscal policy. A fiscal crisis increases the likelihood of adopting an inflation targeting regime. This gives support for the reform story.

The role of financial conditions is more ambiguous. Countries that are more open to capital flows are not more likely to choose an inflation targeting regime; nor is the development of the financial market a predictor for the choice of the monetary regime. Table 2 further shows that adoption of inflation targeting was not more likely in countries that were on average wealthier. This disproves the claim that countries with a higher GDP per capita and a more developed banking system adopt inflation targeting more easily.

In summary, the main prerequisite is the experience of economic instability urging policymakers to reconsider policies. The aim is to put high inflation and high debt under control.6

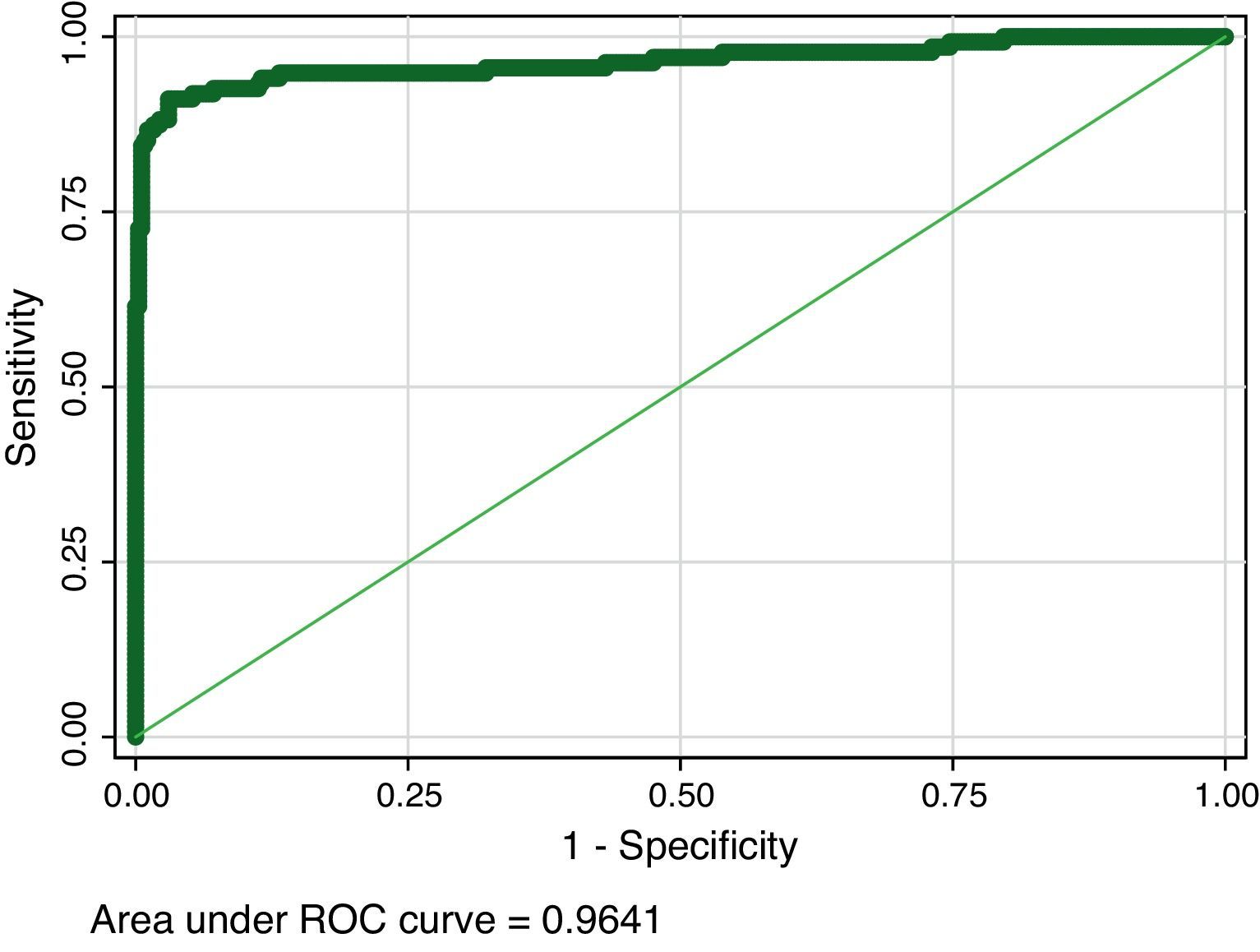

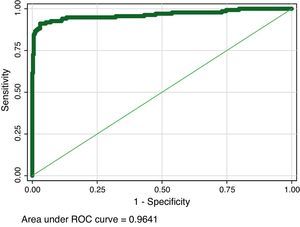

The fit of the discret time duration model can best be assessed with the Receiver Operating Characteristic (ROC) curve. The ROC curve plots the fraction of true positives out of the total of actual positives, called the sensitivity (the probability of correctly predicting a 1), against the fraction of false positives, called the true negative rate or 1 minus the specificity (the probability of correctly predicting a 0). Increasing the threshold will reduce the probability of making one type of error at the expense of increasing the other type of error. A perfectly random variable would lie on diagonal, with an area under the ROC curve of 0.50. A perfectly discriminating variable would always correctly predict positive and false occurrences, and the curve would lie on the upper axes, and have an area under the ROC curve equal to 1. The closer the ROC curve to the upper axes, the better its discriminating power. Fig. 3 shows the ROC curves for the probit model (6). The curve quite closely fits the axes, and the surface under the curve is 0.96. The fit of the probit model is quite strong, and the covariates explain well the choice to adopt inflation targeting as a monetary regime.

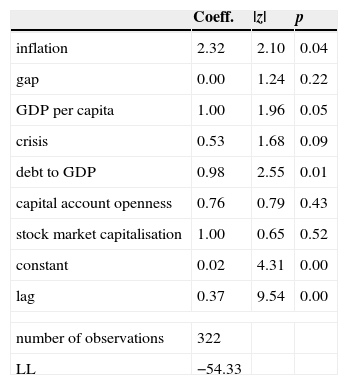

3.3.2Robustness checksI now check the baseline model on a number of aspects, viz. the specification, the definition of data, and the classification of the inflation targeting regime. In several papers, the dynamics of regime choice have been taken into account by adding a lag of the dependent variable to the model (Beck, Epstein, Jackman, & O’Halloran, 2002). This is not entirely correct as this supposes it is the realized lagged value of pIT,t that affects the current value of the dummy, whereas it really should be the underlying latent variable that shows persistence. Although this can be modeled with a full transition model (Jackman, 2000), this restricted transition model is often a good approximation when the regimes are rather persistent, as in the case of inflation targeting.

The results of the probit model are collected in Table 3. The persistence of the regime is shown by the very significant lag. Unsurprisingly, the estimates are rather similar to the ones of the baseline model in Table 2. High inflation and high public debt push for a regime change, and also crises are preparing the ground for a regime change. Financial development in itself does not make a central bank more susceptible to choose inflation targeting.

Inflation targeting regime (Rose, 2007), restricted transition model.

| Coeff. | |z| | p | |

|---|---|---|---|

| inflation | 2.32 | 2.10 | 0.04 |

| gap | 0.00 | 1.24 | 0.22 |

| GDP per capita | 1.00 | 1.96 | 0.05 |

| crisis | 0.53 | 1.68 | 0.09 |

| debt to GDP | 0.98 | 2.55 | 0.01 |

| capital account openness | 0.76 | 0.79 | 0.43 |

| stock market capitalisation | 1.00 | 0.65 | 0.52 |

| constant | 0.02 | 4.31 | 0.00 |

| lag | 0.37 | 9.54 | 0.00 |

| number of observations | 322 | ||

| LL | −54.33 | ||

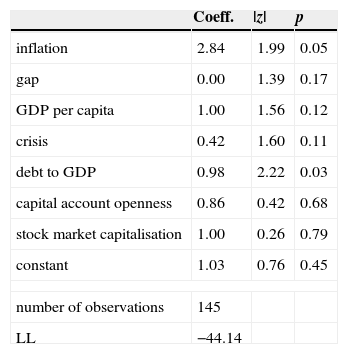

As the monetary regime is very persistent, we might gain precision in the probit estimates by focusing only the adoption of the inflation targeting regime. As proposed in Beck et al. (1998), one can model only the years where pIT,t=0 and drop all observations under the chosen regime (when pIT,t=1). Nothing is lost by focusing only on those transitions, i.e. on estimating models using only data until the first event is observed and dropping the ongoing events.7 Doing so does not alter substantially the previous findings (Table 4), which attests again to the persistence of the inflation targeting regime.

Inflation targeting regime (Rose, 2007), IV probit model on regime switch.

| Coeff. | |z| | p | |

|---|---|---|---|

| inflation | 2.84 | 1.99 | 0.05 |

| gap | 0.00 | 1.39 | 0.17 |

| GDP per capita | 1.00 | 1.56 | 0.12 |

| crisis | 0.42 | 1.60 | 0.11 |

| debt to GDP | 0.98 | 2.22 | 0.03 |

| capital account openness | 0.86 | 0.42 | 0.68 |

| stock market capitalisation | 1.00 | 0.26 | 0.79 |

| constant | 1.03 | 0.76 | 0.45 |

| number of observations | 145 | ||

| LL | −44.14 | ||

The present economic outlook does not matter importantly for the choice to adopt inflation targeting. This result is not a consequence of choosing a particular definition of the output gap as the fluctuation around HP-detrended real GDP. Alternative definitions of the output gap, such as the ones derived from detrending log real output with a deterministic trend, a Baxter-King filter, a Christiano-Fitzgerald filter or from growth rates, do not result in different coefficient estimates.8 Most likely, only in deep crises is there an urgent pressure to implement reform.

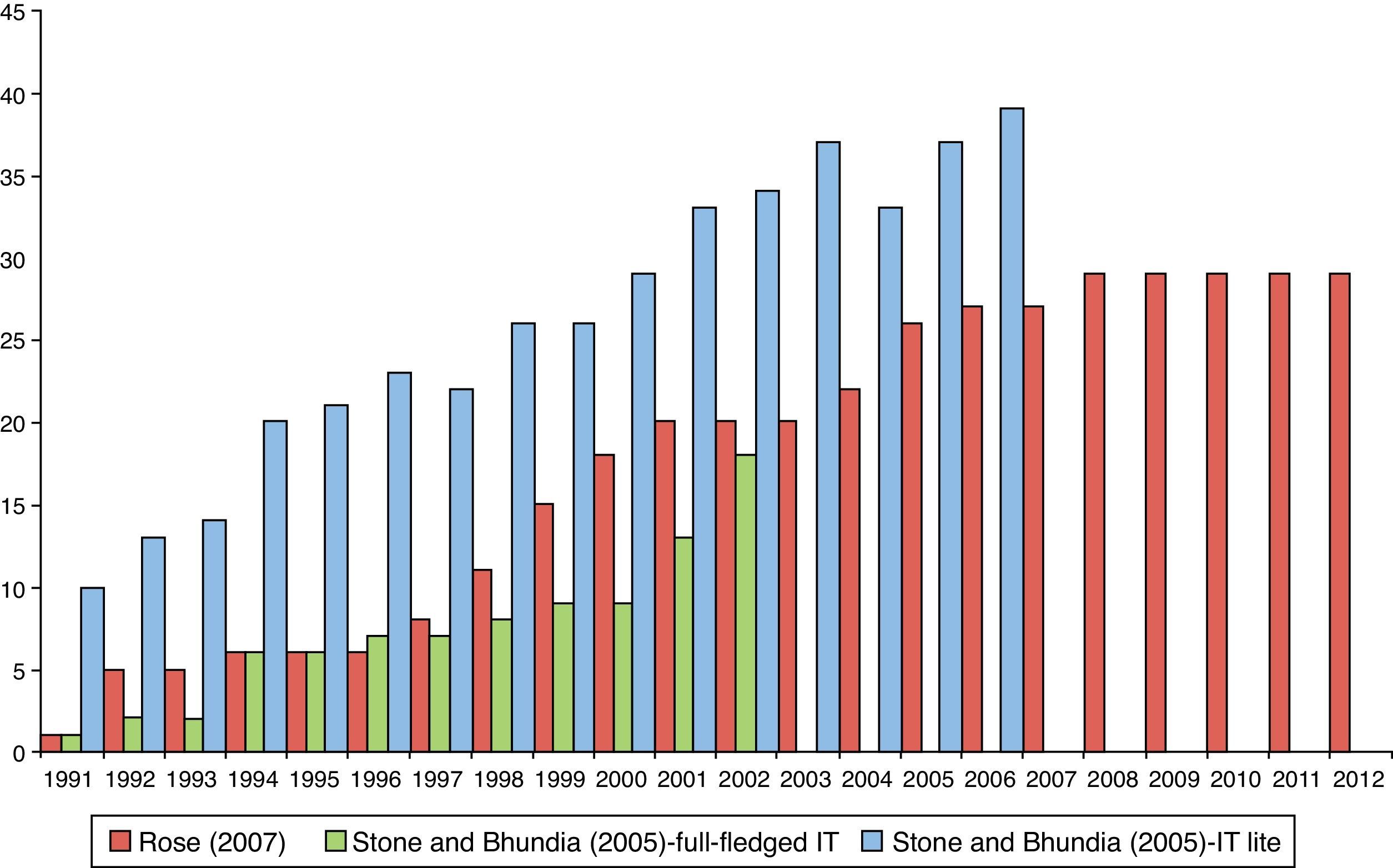

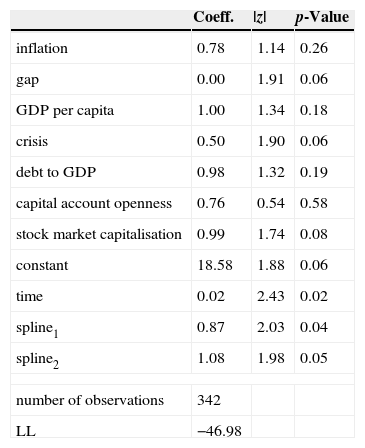

The classification of the monetary regime is based on an interpretation of the type of policies announced and implemented by central banks. There can of course be discrepancies between what central banks announce, and what they really do. Alternative interpretations of central bank policies can lead to other classifications. Stone and Bhundia (2004) provide the most extensive classification of monetary regimes. The interesting distinction their classification makes is between full-fledged inflation targeting - which they define as countries with an institutionalized commitment to an inflation target – and inflation targeting lite, which involves a more covert anchor for price stability. Unfortunately, their classification has been updated only till 2006, yet as most central banks have made their policy choice prior to the crisis, this limitation does not overly influence the findings. Up to 2006, we see that the evolution of the number of inflation targeters is similar as under the Rose (2007) classification (Fig. 4), yet there a couple of changes in and out of the regime. Although inflation targeting spreads to an ever larger group of countries, but this evolution comes to a halt since the start of the Great Recession. I repeat the same IV probit model with the Stone-Bhundia measure of full-fledged inflation targeters, using otherwise the same dataset. Results are not as significant as before, although the interpretation is rather similar as the sign and size of coefficients is of the same magnitude. Evidence is a bit more clearcut on the driving role of crises, which is borderline significant. The longer the prior spell, the more likely a central bank would be adopting inflation targeting (Table 5).

Full-fledged inflation targeting regime (Stone & Bhundia, 2004), IV probit model.

| Coeff. | |z| | p-Value | |

|---|---|---|---|

| inflation | 0.78 | 1.14 | 0.26 |

| gap | 0.00 | 1.91 | 0.06 |

| GDP per capita | 1.00 | 1.34 | 0.18 |

| crisis | 0.50 | 1.90 | 0.06 |

| debt to GDP | 0.98 | 1.32 | 0.19 |

| capital account openness | 0.76 | 0.54 | 0.58 |

| stock market capitalisation | 0.99 | 1.74 | 0.08 |

| constant | 18.58 | 1.88 | 0.06 |

| time | 0.02 | 2.43 | 0.02 |

| spline1 | 0.87 | 2.03 | 0.04 |

| spline2 | 1.08 | 1.98 | 0.05 |

| number of observations | 342 | ||

| LL | −46.98 | ||

Rather than pursuing a probit model on the discrete time data, we could apply a duration model directly. Applying the duration model implies a loss of the time-variation on the covariates we include in (6), as we need to compute spell averages for the economic and financial variables in Zt.

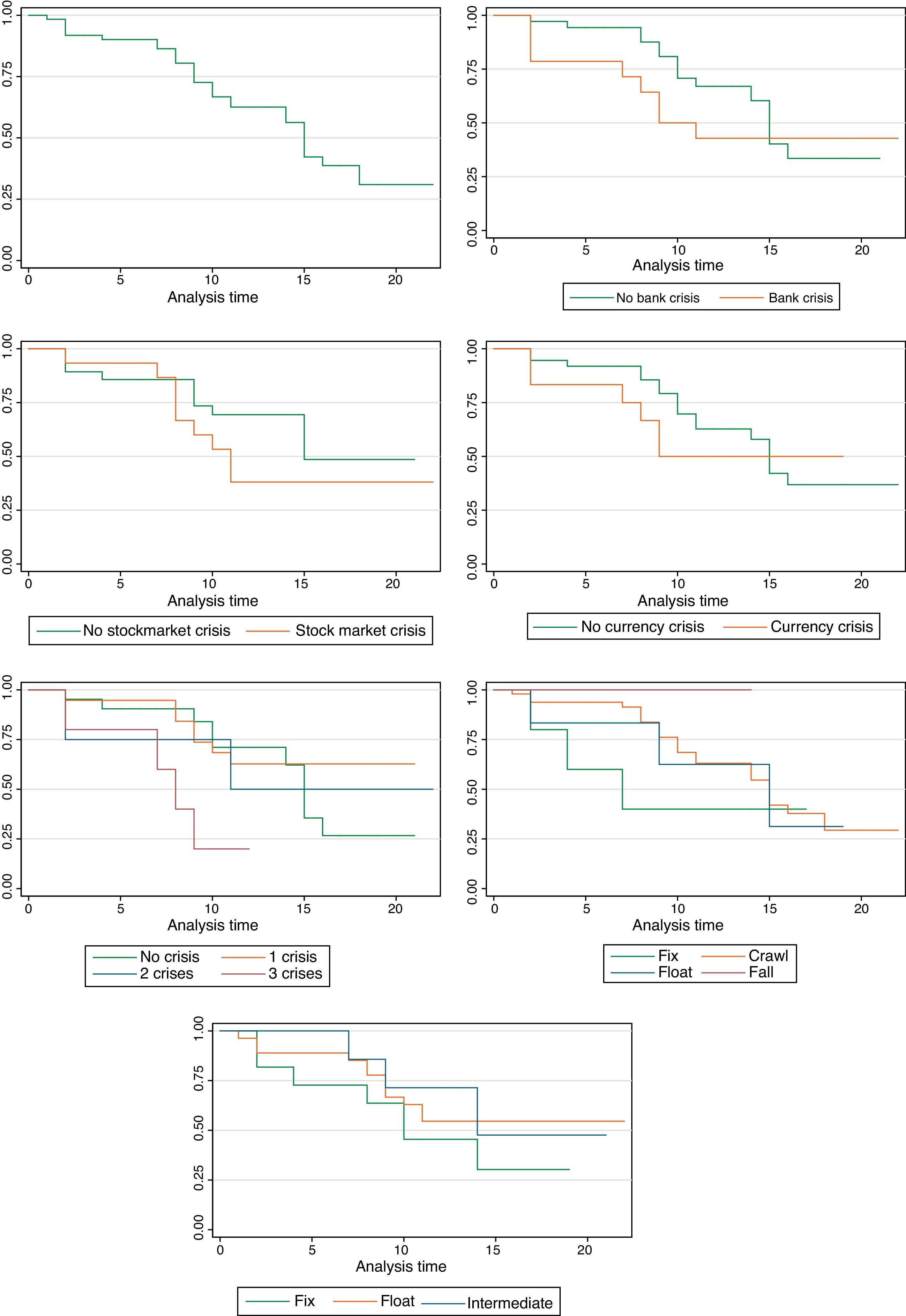

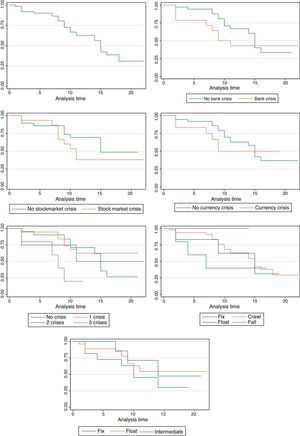

The duration of pre-inflation targeting regimes is summarized in Fig. 5. In its first panel, the figure shows the unconditional probability that a country will not switch to an inflation targeting regime beyond time t. This Kaplan-Meier survival function shows that with the passing of time, a country is getting gradually more likely to adopt inflation targeting, all else being equal.

More interesting is to see how the duration of the regime depends on some defining characteristics. The results in Tables 2–5 suggested that crises are a strong driver for the adoption of inflation targeting. In order to assess the importance of initial crisis conditions, I split the sample into episodes where the country was in a crisis or not, and check its effect on the adoption of inflation targeting. Fig. 5 compares the Kaplan-Meier survival functions of the two groups, and I report the χ2 statistic and its associated p-value for the log-rank equality test for the null of equality of survivor functions. Panels (b) to (d) of Table 5 show the results for the different crisis types that Reinhart and Rogoff (2009) define. The panels show that a bank, a currency or a stock market crisis speed up the decision to switch to an inflation targeting regime. This difference is never significant though, and the χ2 test statistic always rejects that the adoption rate is faster. Panel (e) displays the survival plots conditional on the total number of crisis a country experiences. Some countries did not experience any crisis, yet others experienced up to three different crises. Countries with a higher number of crises more speedily adopted an inflation targeting regime, and this difference is on the borderline of being significant at 5%.

Another relevant starting condition is the exchange rate regime inflation targeters pursue prior to adoption. A switch from a fix to inflation targeting seems improbable; however, not all inflation targeters are actually floaters (Rose, 2007). Panel (f) and (g) of Fig. 5 plot the Kaplan-Meier survival estimate for the regime classification of Levy-Yeyati and Sturzenegger (2003) and Reinhart and Rogoff (2009) respectively. The difference in the functions demonstrates that fixers are actually more likely to switch to inflation targeting than floaters or crawlers. The likely reason is that a few EU countries adopted inflation targeting after abandoning the EMS regime in 1993.

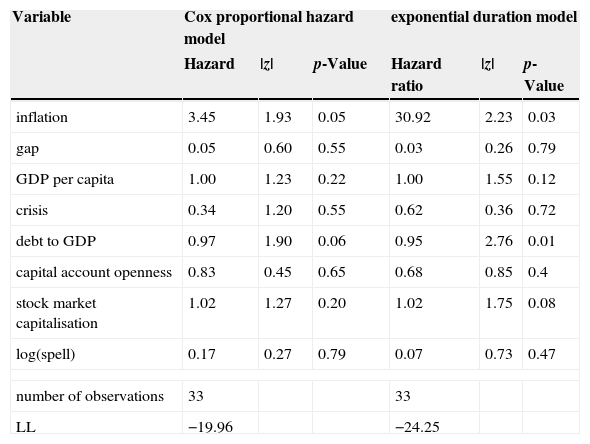

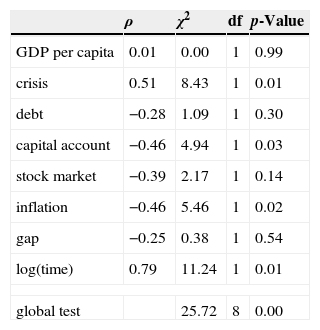

I now estimate the duration model, using the semi-parametric Cox proportional hazard function model. This model can be estimated without imposing any specific functional form on the baseline hazard function. In order to test duration dependency, I include the log of the spell length in the baseline regression. This provides a test of the hypothesis that sticking to another regime than inflation targeting becomes more difficult over time. The empirical results of the baseline model using the Cox proportional hazard model are reported in Table 6. This table shows the hazard ratio, the z-statistic as well as the p-value. Most of the results are just borderline significant (at 5 per cent), but show similar sign and size as for the discrete duration model. High inflation and a high public debt ratio are the most significant drivers of switching to an inflation targeting regime. The number of crises experienced by a country does not have a separate impact on this decision, and nor are its financial conditions. The length of time spent under an alternative monetary regime does not make it more probable that a switch occurs. I assess the goodness of fit of the Cox proportional hazard model in three ways. First, both the Harrell's C (0.90) and Gonen-Heller concordance statistic (0.85) indicate a clear separation of the countries with different regime choices, which shows that the specification explains well the choice of monetary regime. Second, I calculate the Cox-Snell residuals for each observation, and compare the distribution of these residuals to a standard exponential distribution with hazard equal to one for all t. The distributions are not significantly different from each other, thus indicating a good fit of the model.9 The more formal Therneau-Grambsch test of the proportional hazards assumption, based on Schoenfeld residuals, is shown in Table 7 for each covariate and in total. A p-value larger than 0.05 indicates a violation of the proportional hazards assumption. While globally, the assumption is not violated, for a few covariates there is a significant deviation (output gap, debt ratio, GDP per capita, and stock market capitalisation).

Inflation targeting regime, duration models.

| Variable | Cox proportional hazard model | exponential duration model | ||||

|---|---|---|---|---|---|---|

| Hazard | |z| | p-Value | Hazard ratio | |z| | p-Value | |

| inflation | 3.45 | 1.93 | 0.05 | 30.92 | 2.23 | 0.03 |

| gap | 0.05 | 0.60 | 0.55 | 0.03 | 0.26 | 0.79 |

| GDP per capita | 1.00 | 1.23 | 0.22 | 1.00 | 1.55 | 0.12 |

| crisis | 0.34 | 1.20 | 0.55 | 0.62 | 0.36 | 0.72 |

| debt to GDP | 0.97 | 1.90 | 0.06 | 0.95 | 2.76 | 0.01 |

| capital account openness | 0.83 | 0.45 | 0.65 | 0.68 | 0.85 | 0.4 |

| stock market capitalisation | 1.02 | 1.27 | 0.20 | 1.02 | 1.75 | 0.08 |

| log(spell) | 0.17 | 0.27 | 0.79 | 0.07 | 0.73 | 0.47 |

| number of observations | 33 | 33 | ||||

| LL | −19.96 | −24.25 | ||||

Therneau-Grambsch nonproportionality tests of hazard.

| ρ | χ2 | df | p-Value | |

|---|---|---|---|---|

| GDP per capita | 0.01 | 0.00 | 1 | 0.99 |

| crisis | 0.51 | 8.43 | 1 | 0.01 |

| debt | −0.28 | 1.09 | 1 | 0.30 |

| capital account | −0.46 | 4.94 | 1 | 0.03 |

| stock market | −0.39 | 2.17 | 1 | 0.14 |

| inflation | −0.46 | 5.46 | 1 | 0.02 |

| gap | −0.25 | 0.38 | 1 | 0.54 |

| log(time) | 0.79 | 11.24 | 1 | 0.01 |

| global test | 25.72 | 8 | 0.00 | |

For this reason, and as a robustness check on the Cox model, I estimate a parametric duration model with maximum likelihood imposing an exponential survival-time. The results again confirm the findings of the discrete time approximation with the IV probit model, which further corroborates our findings. High inflation and high public debt make it more likely that a country will switch to inflation targeting. Crises – of any type – do not spur further a switch. Financial development is only marginally affecting the decision to adopt inflation targeting. Finally, the length of the period prior to inflation targeting does not matter significantly in the choice to become an inflation targeter.

4Monetary regimes4.1Inflation targetingWe examined so far the preconditions for adoption of inflation targeting regimes. Data show that inflation targeting regimes are quite resilient, as they last on average 15 years. More importantly, according to the various classifications, no country has formally left inflation targeting. The few central banks to abandon this regime did so to adopt the euro. This exacerbates the problem of right censoring in estimating the hazard model and, more importantly, does not teach us anything on the reason for moving out of a certain regime.

Advocates of inflation targeting argue that the key elements of the policy can be rescued in spite of substantial changes in the actions the large central banks have taken in response to the Great Recession. In their view, quantitative easing, forward guidance and maybe even nominal GDP targeting are different ways of implementing an inflation targeting policy (Svensson, 2010). Many a central banker argues it would be sufficient to: (i) add financial instability as a concern for central bankers, and (ii) broaden the scope of inflation targeting to be flexible in response to output, to save the main elements of an inflation targeting regime (CEPR, 2013).

By contrast, the unconventional policy measures of the Federal Reserve, ECB and Bank of Japan have made opponents declare the death of inflation targeting (Frankel, 2012). In their view, there are two major threats to monetary policy continuing the kind of policies seen in the nineties. The first ‘outside’ threat is fiscal policy. Unsustainable debt positions due to financial bailouts combined with low growth might tempt governments to rely on central bank financing. The second ‘inside’ threat is that since the implementation of unconventional measures, open central-bank asset positions might eventually tempt central banks into fiscal action, undermining central bank independence. Woodford (2013) argues that forward guidance is a first step in that direction as monetary policy gives up on setting a clear and steady policy goal that is a key element of inflation targeting.

The former view considers as crucial that the key elements of inflation targeting remain in place, with some additions to central bank tasks like financial supervision. Understood in this way, inflation targeting is not so much a regime but a way of conceiving the role of a monetary policy anchor in a world with fiat currency. The precise way in which the goal of price stability is then achieved is less of a concern. The variety of policies that central banks put in practice to implement inflation targeting is illustrating this view. For this reason, studies that have found that inflation targeting does not have much effect on inflation and economic performance have coined it often as ‘window dressing’: inflation targeting did not do harm, but did not perform better than alternative monetary policies. The purpose of inflation targeting is essentially to add credibility to the pursuit of the goals of low inflation.

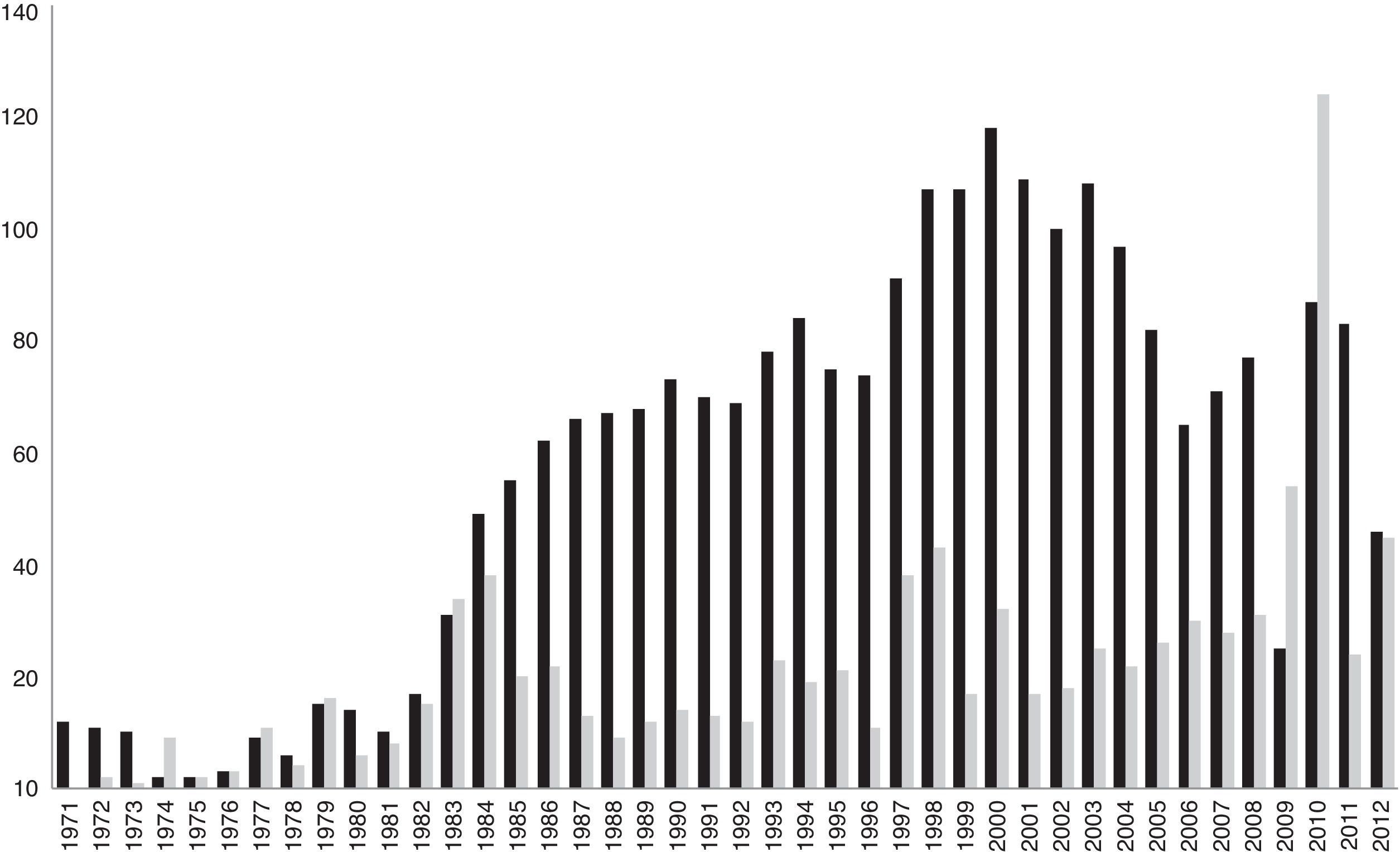

4.2Classifying monetary regimesInflation targeting has often come to be associated with the active inflation combating policies of the nineties. In its narrow sense, central banks have essentially abandoned this type of policy (CEPR, 2013). The classification by Rose (2007) does not distinguish this recent change in action by central banks. Although central banks have sticked to inflation targeting de jure, they did not do so with an active inflation combating policy as in the nineties. One way to characterize this change in policy action is by the change in policy coefficients of the Taylor rule, as in Favero and Marcellino (2005) or Davig and Leeper (2007). Data constraints for the 206 countries in the sample force me to take a simpler approach. I simply classify monetary policy either in an active anti-inflationary stance or a more inflation-indulgent stance by looking at the real interest rates. If the real interest rate is positive, monetary policy is hawkish on inflation, while a negative rate indicates a more dovish stance. There is a close correspondence of the behaviour of the real interest rate with the classification of active and passive monetary policies (Davig & Leeper, 2007).

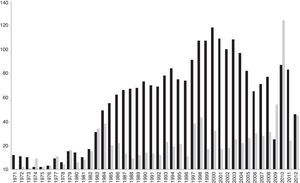

With this classification, there are many more switches in regimes. The average duration of an active regime is 5.8 years, and for a passive regime 7.6 years. The black bars in Fig. 6 show the number of countries that in any year have followed an active policy.10 Over time, the number of central banks pursuing a more active monetary policy has increased during the nineties. This tendency is reverting since 2001, and illustrates an often heard claim that monetary policy has become to soft on inflation since that period. There is not a close overlap between the inflation targeting regime and this classification. Some inflation targeting regimes are sometimes classified as passive regimes, like for example in the Financial Crisis in industrialised economies. Active monetary regimes are also not exclusively pursued by inflation targeters. Even central banks that follow other kinds of policies like exchange rate targeting, implement active policies. The biserial point correlation between the inflation targeting dummy and the active monetary policy dummy series is just 0.01.

This classification then allows me to test the probability of adopting, the duration, and the exit of the inflation targeting regime with the same discrete time duration model discussed in (6). I do so by following Beck et al. (2002) and estimate a Markov transition model separately for the adoption of and exit out of active monetary policies. This allows me to examine the potentially different role the covariates play in the case of adoption and in the case of exit. I use the same method as before by estimating an IV probit adding time and spline dummies to deal with potential duration dependence. In contrast to the previous specifications, I now add a variable reflecting the number of previous failures. Countries that often switch between regimes, may not be very likely to maintain a policy over a longer period. This undermines the credibility of a newly announced regime change.

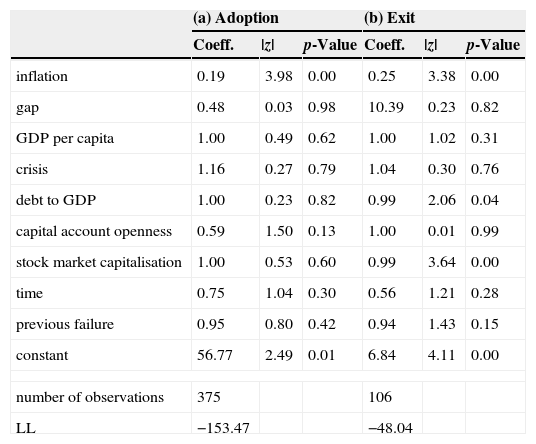

4.3ResultsTable 8 shows in its first panel the adoption of the active regime, and in its second panel the exit from the active regime. As for inflation targeting, the adoption of an active monetary regime is mostly given in by past inflation experience. High inflation urges a policy change. But inlike inflation targeting, none of the other covariates explains this choice.

Adoption of (a) and exit from (b) active monetary regime, IV probit model.

| (a) Adoption | (b) Exit | |||||

|---|---|---|---|---|---|---|

| Coeff. | |z| | p-Value | Coeff. | |z| | p-Value | |

| inflation | 0.19 | 3.98 | 0.00 | 0.25 | 3.38 | 0.00 |

| gap | 0.48 | 0.03 | 0.98 | 10.39 | 0.23 | 0.82 |

| GDP per capita | 1.00 | 0.49 | 0.62 | 1.00 | 1.02 | 0.31 |

| crisis | 1.16 | 0.27 | 0.79 | 1.04 | 0.30 | 0.76 |

| debt to GDP | 1.00 | 0.23 | 0.82 | 0.99 | 2.06 | 0.04 |

| capital account openness | 0.59 | 1.50 | 0.13 | 1.00 | 0.01 | 0.99 |

| stock market capitalisation | 1.00 | 0.53 | 0.60 | 0.99 | 3.64 | 0.00 |

| time | 0.75 | 1.04 | 0.30 | 0.56 | 1.21 | 0.28 |

| previous failure | 0.95 | 0.80 | 0.42 | 0.94 | 1.43 | 0.15 |

| constant | 56.77 | 2.49 | 0.01 | 6.84 | 4.11 | 0.00 |

| number of observations | 375 | 106 | ||||

| LL | −153.47 | −48.04 | ||||

By contrast, the exit from an active monetary regime is determined by a set of variables. First, failure to bring inflation under control spurs an exit to a passive regime again. Second, high public debt makes it much more likely that the central bank will switch policies. Absolute deficit or debt levels that end in a fiscal crisis make it much less likely that a central bank may adopt restrictive policies to combat inflation. Third, a high degree of stock market capitalisation makes it more probable to exit the active regime. There seems no obvious reason for this switch, but the explanation is probably that the burst of a financial bubble – preceded by strong rises in stock markets – urges monetary policy to be more relaxed in the aftermath. The crisis dummy is not significant for this reason. Finally, previous failures make it more likely a central bank will abandon the regime again, but this effect is just marginally significant. Staying longer in a regime does not make an exit more or less likely. The result implies that central banks might have gained credibility by sticking to the same regime for a longer period. These conclusions are not too different from the ones obtained for the inflation targeting regime, as it stresses the role of past inflation experiences in adopting regime, and the effect of financial crises and high public debt on exits from the regime. Fiscal, and also financial, stability therefore seems an important prerequisite for choosing active policies.

5Policy implicationsCentral banks in G7 countries shifted to unconventional policy measures in the aftermath of the Financial Crisis, when faced with economic slack, financial instability and fiscal trouble. This shift ended a spell of rules-based time consistent monetary policy that started in the mid-80s and in many industrialised economies became known as inflation targeting. In spite of claims by central bankers that current unconventional policies do not modify longer-term strategies, there are substantial economic, political and financial risks to the continued pursuit of inflation targeting. Policy choices that now look reasonable may over time constrain the action of policy-makers.

In this paper, I use duration models to test explicitly for the impact of economic, fiscal and financial conditions on the possibility of monetary regimes shifts. The policy switch to inflation targeting happened on the wave of discontent with high inflation and high public debt. Adoption of inflation targeting became more likely after a crisis. More generally, countries adopted active monetary regimes, like inflation targeting, with a broad support to control monetary and fiscal policies. By contrast, the exit from such policy is more likely after a financial annex debt crisis.

With the great recession, steps have been made to ensure fiscal sustainability, and some solutions to financial supervision problems have been implemented. Commitment to active monetary policy will require bolder steps to avoid the gradual fizzling out of those efforts on beliefs that policy cannot perform. Without bolder steps, policy may be stuck at the zero lower bound with no solutions to solve the fiscal and financial breakdown. Central banks may be forced to take more unconventional policy measures, of which they cannot return anymore to inflation targeting. They would have effectively painted themselves into a corner.

FundingThe present project has been funded by Startkrediet grant OZR2537 of the Vrije Universiteit Brussel.

Conflicts of interestThe authors declare no conflict of interest.

Under the unpleasant monetary arithmetic, a central bank is forced to accept the fiscal stance (Sargent & Wallace, 1981). The Fiscal Theory of the Price Level would see as the only solution to a situation in which a government cannot reduce debt, a jump in price levels to make intertemporal budget constraints hold (Leeper, 1991). Game-theoretic models of policy interaction stress the combined impact of policies and which policy bears the brunt of adjustment (Dixit & Lambertini, 2003).

A survey of recent papers is discussed in Klein and Shambaugh (2010) or Rose (2011).

Logit or cloglog models gave similar results.

Data on real GDP (measured in PPP terms) and population come from the Penn World Tables. I derive the output gap from a HP filter on log real output. Inflation is based on the GDP deflator (from the World Bank's World Development Indicators (WDI)). Reinhart and Rogoff (2009) classify years on the presence of a list of different types of crisis. The (central government) public debt ratio is from the World Bank's WDI. I measure capital account openness with the Chinn-Ito index. The development of financial markets is measured by the stock market capitalisation (as a ratio of GDP)(from IFS).

Combes et al. (2014) argues that low inflation rates reduce the Tanzi effect on tax income, and low inflation volatility makes the tax income more predictable. Improved tax collection improves fiscal performance.

Whether the policy choice had an impact is still under debate in the literature. See the discussion on the disinflationary effects of inflation targeting in Lin (2010), and on fiscal discipline in Minea and Tapsoba (2014).

We must drop now the time spell of the regime, as well as the spline dummies.