The aim of this paper is to analyse whether institutional factors determine the level of corporate governance compliance among major listed companies in emerging markets of Latin America, a region characterized by a poor legal system, highly concentrated ownership structures, and capital markets relatively less developed. The paper used an unbalanced panel data consisting of 826 observations of the highest ranked companies on the stock exchange indices of Argentina, Brazil, Chile and Mexico during the period 2004–2010.

The results provide strong empirical evidence that board independence, ownership concentration and stakeholder orientation affect positively corporate governance ratings, while board size decreases corporate governance compliance in Latin American countries. The study fills a gap in the Latin American literature, providing useful information for determining policies on corporate governance and, in general, for managers and investors of listed companies in Latin America.

Corporate Governance [CG] is a relevant issue in academic writing and finance and accounting fields due to the chain of financial scandals around the world. CG monitors the effectiveness of management and ensures legal compliance by preventing irregular and improper behaviour. In this sense, leading global institutions such as the Organization for Economic Cooperation and Development [OECD], the International Finance Corporation [IFC] and the World Bank, strongly emphasize the development of different regulations, guidelines and good governance codes around the world. OECD affirms that CG “has implications for company behaviour towards employees, shareholders, customers and banks”. A corporation's corporate governance structure is an important criterion when investors make investment decisions (Epps & Cereola, 2008). In the case of emerging markets, compliance with good CG practices is an effective substitute when legal environments and regulatory frameworks are weak and highly concentrated ownership structures predominate.

In this context, companies that improve their CG practices could be able of protecting shareholders rights and increase the confidence of investors (La Porta, López-de-Silanes, Shleifer, & Vishny, 2000). As a result, different ratings on CG [CGR] have been proposed by institutions and academics around the world. The construction of a rating or index is beneficial as it integrates the various elements of a firm's governance system into one number. Although there is no standardized system to measure the compliance on CG, prior research has been developed several CGR mostly for Anglo-Saxon and continental European countries (Gompers, Ishii, & Metrick, 2003; Klapper & Love, 2004). The main objective of the CGR is to assess and compare the companies’ governance score regarding the accepted standards issued by regulatory bodies in a particular institutional context (Al-Malkawi, Pillai, & Bhatti, 2011).

Regarding to factors that affect the CG compliance, prior studies have recognized the institutional framework in emerging countries (Aguilera & Jackson, 2010). Institutional theory integrates a wider understanding related to cultural dimensions and formal factors of the firm in a modern society (Davis, 2005). Therefore, CGR may be notably influenced by institutional factors such as culture, legal structures and financial markets (Creed, DeJordy, & Lok, 2010; Peng, Li Sun, Pinkham, & Chen, 2009; Suddaby & Greenwood, 2005). On the other hand, agency theory points out the conflict of interest between management and owners due to separation of ownership and control. To minimize this divergence and reduce agency costs, this theoretical approach suggests the adoption of internal and external mechanisms of CG by companies (Haniffa & Hudaib, 2006; Tariq & Abbas, 2013). In this study, institutional and agency theories are adopted as the main reference frameworks to empirically describe the factors that affect the CG compliance in Latin American listed companies. Formal factors at the macro level (legal system and government initiatives such as CG codes) and at inter-organizational level (board structure, ownership concentration or leverage) play an important role by adopting of CG practices (Boliari & Topyan, 2007; Campbell, 2007).

Latin America is characterized by poorer CG and inferior legal system, highly concentrated ownership structures, and capital markets relatively less developed in comparison to more developed OECD economies (Blume & Alonso, 2007). The conflict of interest between major and minority shareholders reduces overall shareholder value and increases the expropriation of minority shareholders. Our motivation stems from the growing relevance of CG for investor confidence in the region and the absence of prior research in Latin America, which partly stems the scarcity of relevant data (Kabbach de Castro, Crespi-Cladera, & Aguilera, 2012). We pay attention in the institutional context, efficiency and legitimacy of CG mechanisms in an international business environment. In this sense, the question in this study is how institutional and agency theories could identify those formal and informal factors that promote CG compliance in Latin American listed companies?

We contribute to the literature in several ways. First, we propose a CGR which is based on the institutional and regulatory framework of the region. Second, we support our results using a sample of 826 non-financial firms in fourth largest stock exchanges of the Latin American region (Argentina, Brazil, Chile and Mexico), over the period 2004–2010. Third, we identify institutional formal and informal factors may be significant to CG compliance through GMM method addressing the reverse causality problem using suitable lagged values of the explanatory variables as instruments (Blundell & Bond, 1998; Pindado, Requejo, & de la Torre, 2014). Finally, this study may provide useful information for determining policies on corporate governance and, in general, for managers and investors in listed companies. To the best of our knowledge, this is the first study that focuses on Latin America emerging countries combining the institutional and agency theories in a context characterized by a weak legal system and a lower shareholder protection.

The rest of the study is organized as follows. The authors, first presents a review of relevant literature and develop the study hypotheses. Secondly, the data and construction of the CGR are presented. Thirdly, we describe the data and methods of analysis. Fourthly we discuss the main results. Last section concludes.

Literature reviewThe compliance on CG can be looked upon from different theoretical perspectives, for instance economic, legal, social and applied finance (Ariff & Ratnatunga, 2008; Tariq & Abbas, 2013). The theoretical foundation can be found in agency theory which points out that higher ownership concentration results in a conflict between majority and minority shareholders, with several well-known cases of expropriation (Jensen & Meckling, 1976). The major problem of this conflict is that minority shareholders are not protected against expropriation by majority and it is mainly due to weak legal structure (enforcement) of countries. Agency theoretical framework has tried to explain the relationship between shareholders and management, seeking the interest's alignment of managers and shareholders with CG mechanisms (Lopes & Walker, 2012). However, agency theory is limited and does not explain the multi-dimensional complexity and character of the CG phenomenon in an international business context (Adegbite, 2015). The conceptual framework of institutional theory is much broader and deeper than agency theory, since accounts for the deeper and resilient aspects of socio-cultural structure, and integrates the process by which organizational schemas, rules, norms, and routines are established as guidelines for corporate behaviour (Scott, 2004). Furthermore, this theoretical approach is most suitable to explain CG practices in contexts characterized by small stock market, a higher level of ownership concentration in the hands of a few shareholders, and a strong link between CG structures and institutional development (Baixauli-Soler & Sanchez-Marin, 2011). Globerman and Shapiro (2003) observed that formal institutions – regulation, financial markets, transparency and accountability – strengthen the governance structure and attract more foreign investment. However, in these countries, informal institutions play an important role when formal mechanisms prove to be inadequate (Estrin & Prevezer, 2011). The above has caused an increase in the adoption of good governance practices as part of firms’ strategy to increase investors’ confidence. In the case of emerging markets, the institutional conditions may explain variations in the level of business activity and corporate practices (De Clercq, Danis, & Dakhli, 2010).

The adoption of corporate practices and principles co-evolving with institutions might become institutionalized. Institutionalization implies a certain degree of internalization and cognitive belief in the practice which is quite distinct from decoupling practices (Terjesen, Aguilera, & Lorenz, 2015). The Latin American model of CG is characterized by undeveloped capital markets, weak institutional environments, highly concentrated ownership structures, and lower protection of investors (Chong & López-de-Silanes, 2007; Djankov, La Porta, Lopez-de-Silanes, & Shleifer, 2008). The proliferation of governance codes and adoption of best practices in Latin America – especially in the larger economies of Argentina, Brazil, Chile and Mexico which capture 70% of regional market capitalization (S&P, 2010) – and the creation of institutions like the Latin American Corporate Governance Roundtable as a joint initiative of the International Monetary Fund [IMF], the World Bank, and state and private actors from Latin and OECD countries, promotes a new era on CG in the region (Diamandis & Drakos, 2011). The guidelines issued by the OECD, codes of good governance and the regulations issued in each of these countries have all contributed to raising the CG compliance in issues related to the board of directors, shareholder rights, conflicts of interest, ownership structure and support committees of the board.

Latin American countries have adopted voluntary practices of CG to cover for the limitations of the regulatory framework. Good governance codes and laws prevailing in the region have been based on the “White Paper” and GC principles of the OECD. These CG codes have promoted transparency and market efficiency, the protection of shareholders and effective board of directors monitoring. Particularly, Argentina, Brazil and Mexico have opted for soft laws, through the principle of “comply or explain”. Chile has focused on hard laws and legal enforcement which aim to strengthen the board of directors, auditing committee functions, shareholders rights and reduce conflicts of interest, however there are inefficient self-regulation practices concerning the capital markets (Lefort & González, 2008).

Recent studies have adopted the institutional-agency theories to analyse the factors that influence on CG compliance in different contexts. For instance, Seal (2006) proposes an institutional theory of agency, which may defined as the analysis of managerial behaviour in giant, widely owned corporations where managerial action is influenced by institutionalized practices that affect corporate practices and performance. This combination of theories establishes managerial behaviour has been influenced and legitimized by the dominant discourse of CG – the agency theory. Institutional theory is defined as a set of formal and informal rules that affect business activity (North, 2005). In this regard, both formal (e.g. government initiatives, laws; Campbell, 2007) and informal institutions (e.g. corporate culture and strategy; Boliari & Topyan, 2007) are regarded as antecedents to action by defining the CG practices. According to DiMaggio and Powell (1983), institutional theory indicates that firms tend to incorporate external norms and rules into their operations and structures in order to gain legitimacy and social acceptance. Thus, it can be argued that companies may gain acceptance and legitimize their operations by engaging in CG compliance (Ntim, Lindop, & Thomas, 2013). Thereby, all forms of institutions that manage human interactions via cognitive, normative, and regulative processes influence organizational decision-making (Trevino, Thomas, & Cullen, 2008).

Hypothesis developmentInstitutional theory emphasizes that legal rules and norms form an important element of national institutional systems (Filatotchev, Jackson, & Nakajima, 2013). The groundbreaking work by La Porta, López-de-Silanes, Schleifer, and Vishny (1998) argue that a common element in differences between countries is the degree of investor protection against abuses by the management team and majority shareholders. The degree of law enforcement creates cross-country differences. For instance, civil laws give investors weaker legal rights than common laws do. The difference in legal protections of investors might help explain why firms are financed and owned so differently in different regions. Shleifer and Vishny (1997) conclude that a very high ownership concentration may be a reflection of poor investor protection. Differences in legal systems have implications for transparency on CG practices, directly or indirectly, with firms in common-law countries disclosing more CG information than those located in civil-law countries (Li & Moosa, 2015). Institutional theory argues that firms tend to incorporate external norms and rules in order to gain confidence and legitimacy in the market (Scott, 1987). Various studies have sought to measure the degree of enforcement, and Leuz, Nanda, and Wysocki (2003) suggested it can be measured through three variables: (a) the efficiency of the judicial system; (b) an evaluation of the rule of law; (c) an index of corruption. Kaufmann, Kraay, and Mastruzzi (2011) proposed a series of governance indicators including the dimensions of regulatory quality, the rule of law and the control of corruption. The Worldwide Governance Index [WGI], on the other hand, published by the WGI (2014), includes six dimensions for 213 economies, assessed for the period 1996–2010: (1) accountability; (2) political stability and absence of violence; (3) governmental effectiveness; (4) regulatory quality; (5) the rule of law; (6) the control of corruption. Hence, our first hypothesis is that:Hypothesis 1 There is a positive relation between the WGI and the CGR in Latin American countries.

The dimensions of CG contained in the codes of good governance and regulatory framework constitutes formal factors that may influence managerial decisions related to the compliance level on CG (Ho & Wong, 2001).

- Size of the board: The board should comprise a reasonable number of directors; its size directly affects its functioning and supervisory capacity (Gandía, 2008). Larger boards enjoy greater diversity and tend to have more experienced members, which affects the CGR (Gallego Álvarez, García Sánchez, & Rodríguez Domínguez, 2009; Laksamana, 2008). Various studies corroborate the presence of a positive relationship between board size and the level of CG compliance (Barako, Hancock, & Izan, 2006; Hussainey & Al-Najjar, 2011).Hypothesis 2a Board size has a positive impact on CGR in Latin America.

- Composition of the board: External (non-executive) directors are not part of the company's management team and so are in a better position to monitor management performance (Donnelly & Mulcahy, 2008). They have an added incentive to facilitate supervision by shareholders because their own reputation depends on the corporate performance (Fama & Jensen, 1983); moreover, they are the most effective agents for maximizing shareholder value (Rouf, 2011). Most studies affirm there is a positive relationship between the independence of the board and CGR (Abdelsalam & Street, 2007; Kent & Stewart, 2008; Samaha & Dahawy, 2011).Hypothesis 2b There is a positive relationship between the proportion of independent directors and CGR in Latin American countries.

- COB-CEO duality: COB-CEO duality refers to the situation in which the same person holds both positions in a company. According to Haniffa and Cooke (2002), separation between the two positions helps improve the quality of supervision and reduces the advantages gained by withholding information, while the concentration of power is associated with reduced transparency and lower quality of CG information (Laksamana, 2008).Hypothesis 2c There is a negative relationship between COB-CEO duality and CGR in Latin America.

- The presence of women on the board: In recent years the issue of gender diversity in business has received considerable research attention. Women provide viewpoints, experiences and work styles that differ from those of their male counterparts (Torchia, Calabró, & Huse, 2011). Among the variables that have been associated with the presence of women on the board is the level of CG transparency, thus increasing the board's capacity to supervise the process of CG transparency and compliance (Gul, Srinidhi, & Ng, 2011). Several studies have suggested that gender diversity is associated with a higher quality of boardroom debate and more effective communication (Hillman, Shropshire, & Cannella, 2007; Huse & Solberg, 2006), thus facilitating greater availability of information to investors.Hypothesis 2d The proportion of women on the board is positively associated with the CGR in Latin America.

- Ownership structure: An important factor shaping the CG system is the company's ownership structure, defined as the degree of concentration that determines the distribution of power and corporate control, or as the proportion of voting shares owned directly or indirectly by senior management, board members or their relatives (Owusu-Ansah, 1998). When the ownership structure is diffuse, greater supervision is needed in order to maintain fair access for minority shareholders. Companies with widely dispersed ownership tend to disclose more information in order to reduce the costs of control by shareholders (Haniffa & Cooke, 2002). Furthermore, this transparency on CG is increased when there are external shareholders (Donnelly & Mulcahy, 2008). Some studies have reported a negative relationship between ownership concentration and the level of information disclosure (Barako et al., 2006; Gandía, 2008; Vander Bauwhede & Willekens, 2008, among others). In companies with large individual shareholders or a high concentration of ownership, information is transferred directly through informal channels, or there may simply be a greater alignment of interests, thus reducing the need to make information public.Hypothesis 2e There is a negative association between ownership concentration and CGR in Latin American countries.

- Family-controlled firms: According to the agency theory, family controlled firms create agency costs. The risk of wealth expropriation from minority shareholders is higher when ownership is concentrated and held by family members (Barontini & Caprio, 2006). In this sense, CG compliance in family firms may become inconsistent with wealth maximization. The combination of ownership and control in family firms could generate and excessive role by the owner through its leadership, which could lead to problems of management entrenchment. Faccio and Lang (2001) argue that family firms present a poor performance compared to no family firms, while San Martin-Reyna and Duran-Encalada (2012), anticipate problems associated with family firms and composition of directors. Family owners could favour family interests over the firm's interests (e.g. minority shareholders) and have incentives to be engaged in opportunistic behaviours, because of loyalty towards the family (Schulze, Lubatkin, Dino, & Buchholtz, 2001). Thus we set the following hypothesis.Hypothesis 2f Family-controlled firms obtain a lower corporate governance rating (CGR) than non-family firms in Latin American listed firms.

Institutional theory suggests that a firm's right to exist is legitimized if its value system is consistent with that of the larger social system of which it is part of, but threatened when there is actual or potential conflict between the two value systems (Suchman, 1995). Diverse interest groups influence decision-making and the values adopted by the firm (Donaldson & Preston, 1995). Bradley, Schipani, Sundaram, and Walsh (1999) identified two types of culture in companies: community or stakeholder-oriented culture, with a broad range of members having a legitimate interest in corporate activities, and shareholder-oriented culture, with a contractual outlook, in which companies are viewed as tools for creating shareholder value, and in which other stakeholders have less legitimacy and influence over management. In line with Simnett, Vanstraelen, and Fong Chua (2009), in this study we consider the stakeholder vs. shareholder orientation as a dimension of organizational culture. Under this approach, Smith, Adhikari, and Tondkar (2005) revealed that companies with a stakeholder-oriented approach disclose more information as part of their strategic management approach in order to strengthen relations with stakeholders, while Basu and Palazzo (2008) suggest that companies could improve the credibility of their communication by exposing transparency to questioning through stakeholders. In the same line, Jansson (2005) argues that the stakeholder orientation depends of the governance and ownership structure of the firm and the legal environment.Hypothesis 3 The CGR is higher in firms with a stakeholder orientation than in those oriented towards shareholders.

Research on the relationship between CG transparency and innovation has been limited (Miozzo & Dewick, 2002). According to O'Sullivan (2000, p. 1), innovation is performed with the aim of increasing product quality and/or lower production costs. Innovation can provide the critical component of a firm's competitive strategy. Gill (2008) found that those companies that follow innovation as a strategy disclose more information to signal commitment to the project, potentially inducing a rival's exit. Inside directors are generally associated to innovative strategies, because they have a better knowledge of the company. As a consequence, detailed information is required to make effective strategic decisions and monitoring (Zahra, 1996). Competitive pressure might be alleviated when firms that innovate disclose more corporate information to induce rivals to wait and imitate instead of simultaneously invest in innovation (Pacheco-De-Almeida & Zemsky, 2012). By considering than Latin American countries are characterized by a higher inside director's rate (Black, Gledson de Carvalho, & Gorga, 2010), we argue that innovation strategy influences the CGR leading to the following hypothesis:Hypothesis 4 Firms with an innovation strategy obtain higher CGR than firms with a no innovation strategy.

The object of this study is to analyse the CG ratings of those major listed companies in Argentina, Brazil, Chile and Mexico. For the sample of firms in these four countries, we selected the most representative of each country. According to Kitagawa and Ribeiro (2009) the purposes of analysis, we excluded those in the banking and insurance sectors, because these are more strictly regulated and are subject to greater scrutiny in terms of corporate information disclosure (Garay & González, 2008). The information needed to construct the index of CG and the set of explanatory variables used was obtained from the annual reports and websites of the selected companies, by means of content analysis. The content analysis could be used to identify the different CG categories as reported by sample firms to distinguish the different levels of compliance, depending on the nature of its business and global environment. Given the qualitative nature of CG disclosure, we perform a content analysis focusing on the volume and intensity of disclosure using the number of words and sentences with to different items of CG categories and sub-categories in order to integrate the CGR (Lajili & Zéghal, 2005).

For clustering purposes, the companies were ranked according to the Global Industry Classification Standards [GICS], which are widely accepted in the business and academic worlds (Bhojraj, Lee, & Oler, 2003). Outliers, or extreme values, for the financial variables were identified and analysed, and values above the 99th percentile were assigned the value of this percentile. Values below the first percentile for each variable were truncated in the same way (Braga-Alves & Shastri, 2011).

Initially, 155 companies were considered, but 20 belonging to the financial sector were excluded as were a further seven for which there was insufficient information for analysis. Thus, the final study sample was constituted of 128 companies. Regarding the number of observations included in this empirical study covering the time period from 2004 to 2010, data were obtained for 101 companies in 2004, 111 in 2005, 116 in 2006, 123 in 2007, and 125 in 2008, 2009 and 2010. A total of 826 observations were obtained for the whole period of analysis. Table 1 shows the composition of the study sample by country. The predominant sectors in these countries are related to materials, consumer staples and utilities.

Study sample for the period 2004–2010.

| Country | Year | Total observations | ||||||

|---|---|---|---|---|---|---|---|---|

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | ||

| Argentina | 8 | 8 | 9 | 10 | 10 | 10 | 10 | 65 |

| Brazil | 41 | 46 | 49 | 52 | 53 | 53 | 53 | 347 |

| Chile | 24 | 28 | 29 | 31 | 32 | 32 | 32 | 208 |

| Mexico | 28 | 29 | 29 | 30 | 30 | 30 | 30 | 206 |

| Total observations | 101 | 111 | 116 | 123 | 125 | 125 | 125 | 826 |

Several indices on CG have been developed for Anglo-Saxon and continental European countries (Gompers et al., 2003; Klapper & Love, 2004). According with institutional theory, the legal and institutional context of each country is a key factor in the selection of the elements of an index (Hossain & Hammami, 2009). This study proposes a CGR that evidently reflects the nature of emerging Latin American institutional framework, using a combination of information required by the rules and codes of good governance in the selected countries. For instance, codes of good and regulatory framework in Argentina, Brazil and Mexico and Chile. In this study, we glean support for the index from the OECD principles, the codes of good governance in each country, and previous studies in the region.

The overall CGR composed by 43 items, with a maximum value of 100, was obtained by summing four sub-indices: (1) composition and performance of the board, (2) shareholders rights, (3) ethics and conflicts of interest and (4) other information related with CG. In compiling the overall index, each sub-index is weighted as 53, 18, 16 and 13%, respectively (Lefort & González, 2008). Each sub-index was in turn comprised of a series of factors with the same weights (for more detail see Table 2). The composition and performance of the board sub-index captures board independence, mission, functions, structure and effectiveness. Autonomy is established through various factors of board independence, including the COB-CEO duality and the presence of support committees (nominating, remuneration, corporate governance, auditing). Furthermore this sub-index also contains measures of board remuneration, selection, removal or re-election procedures, and disclosure of profile or curriculum of directors including the document that establishes the norms of conduct for the board members. However, most of the items in this category (at least 14 out of 24) are allocated to measures that reflect board independence.

Rating of corporate governance.

| I. Composition and performance of the board |

| Mission of the Board (OECD, 1999) |

| Main functions of the Board (OECD, 1999) |

| Board independence |

| Is there or not COB-CEO duality? If only one person holds both positions (Garay & González, 2008; OECD, 1999; Leal & Carvalhal-da-Silva, 2005) |

| Board structure (external and independent members) (Gandía & Andrés, 2005; Garay & González, 2008; Leal & Carvalhal-da-Silva, 2005; OECD, 1999) |

| Size of the board (between five and nine members as an international recommendation of good governance) (Gandía & Andrés, 2005; Garay & González, 2008; Leal & Carvalhal-da-Silva, 2005; Lefort & Walker, 2005) |

| Rules of organization and operation of the board and its committees (Gandía & Andrés, 2005) |

| Functions and activities of each member of the board (Gandía & Andrés, 2005) |

| Selection, removal or re-election procedures (Gandía & Andrés, 2005) |

| Is there a document that establishes the norms of conduct for the board members? (Gandía & Andrés, 2005) |

| Are relationships between directors and shareholders of reference disclosed? (Gandía & Andrés, 2005) |

| Shareholding of the directors (Gandía & Andrés, 2005) |

| Conditions determining the independence of the board (Gandía & Andrés, 2005) |

| The company disclosed the profile and/or curriculum of the board members (Gandía & Andrés, 2005) |

| Does the company disclose whether any independent director occupies a steering position in other companies? (Gandía & Andrés, 2005) |

| Remuneration of the CEO and board members (Gandía & Andrés, 2005; Garay & González, 2008; Leal & Carvalhal-da-Silva, 2005; OECD, 1999) |

| Support committees for the board (Garay & González, 2008; Leal & Carvalhal-da-Silva, 2005; Lefort & Walker, 2005; OECD, 1999) |

| Does the company have a nominating committee? |

| Does the company have a remuneration committee? |

| Does the company have a corporate governance committee? |

| Does the company have an auditing committee? |

| Are there other additional support committees mentioned above? |

| Main functions of the committees support on the board |

| Integration of support committees: Number of executive and independent members |

| II. Shareholders rights |

| Description of shareholder voting process (Garay & González, 2008; Leal & Carvalhal-da-Silva, 2005) |

| Pyramidal structures that reduce the concentration of control (Garay & González, 2008; Leal & Carvalhal-da-Silva, 2005) |

| Resolutions adopted at the last Annual General Meeting held (Gandía & Andrés, 2005) |

| Information about the notice of the meeting (Gandía & Andrés, 2005) |

| Information of the agenda (Gandía & Andrés, 2005) |

| Information about the text of all resolutions proposed for its adoption (Gandía & Andrés, 2005) |

| Shareholder agreements to reduce the concentration of control (Garay & González, 2008; Leal & Carvalhal-da-Silva, 2005) |

| If the company is listed on other international markets (Lefort & Walker, 2005) |

| III. Ethics and conflicts of interest |

| Information related to conflicts of interest and related party transactions (Leal & Carvalhal-da-Silva, 2005) |

| If the company is free of any penalty for breach of good governance rules in the stock market on the last year (Garay & González, 2008) |

| Detail of the percentage ownership of the company from significant shareholders (Gandía & Andrés, 2005) |

| Company operations with its directors and managers and to what extent such transactions are made in competition (Gandía & Andrés, 2005) |

| Significant transactions that have occurred between the company and significant shareholders (Gandía & Andrés, 2005) |

| Does any member of the board held other positions on the boards in companies belonging to the same group (Leal & Carvalhal-da-Silva, 2005) |

| Composition of its shareholders (Gandía & Andrés, 2005; Lefort & Walker, 2005) |

| IV. Other related information with corporate governance |

| Does the company use the international accounting principles (Garay & González, 2008; Leal & Carvalhal-da-Silva, 2005; OECD, 1999) |

| Does the company use the services of a recognized auditing firm (Big 4)? (Garay & González, 2008; OECD, 1999) |

| Is the information provided in English? |

| Sanctions against the management for breach of their corporate governance practices (Garay & González, 2008; Leal & Carvalhal-da-Silva, 2005) |

| Financial situation and performance (Garay & González, 2008; Leal & Carvalhal-da-Silva, 2005; OECD, 1999) |

| Practices of good governance (Garay & González, 2008; Leal & Carvalhal-da-Silva, 2005; OECD, 1999) |

Shareholders rights comprise the second sub-index, the purpose of which is to identify the mechanisms that encourage the alignment between board of directors and managers interests with those of shareholders. For instance, description of shareholding voting process, pyramidal structures that reduce the concentration of control, information of the agenda, shareholders agreements and resolutions proposed for its adoption. The sub-index related to ethics and conflicts of interest attempts to measure conflicts of interests and related party transactions, company operations with its directors and managers, significant transactions between the company and significant shareholders and ownership composition. The final sub-index deals with other related information with CG. It attempts to measure a company's public commitment with good corporate practices. The use of international accounting principles, the services of a recognized auditing firm, sanctions against the management for breach of their CG practices, financial performance disclosure, and practices of good governance, score well in this category. The index allows each element to be equally important and does not distinguish subjective selection of the most influential characteristics (Berglöf & Pajuste, 2005). Nevertheless, we compute a weighted sum of the four dimensions in our calculations.

Model specification and measurement of the variablesThe following multiple regression model was applied to test our hypotheses. The dependent variable is the proposed CGR. The independent and control variables were determined on the basis of previous studies and are detailed in Table 3.

whereWGIit=legal system

BSit=board size

BIit=board independence

Dualit=COB-CEO duality

Genit=gender

Ownit=ownership concentration

Famit=family-controlled firm

Stkit=stakeholder orientation

Stgit=innovation strategy

∑k=1kδkxitk=set of control variables

λi=fixed effects at company level

¿it=error term

Definition and measurement of the study variables.

| Variable | Definition | Expected sign | Source |

|---|---|---|---|

| Dependent variable | |||

| CGTI | CG transparency index (43 items) | Garay and González (2008); Leal and Carvalhal-da-Silva (2005); Chong and López-de-Silanes (2007); Black et al. (2010); OECD (1999) | |

| Independent variables | |||

| Formal institutional variables | |||

| Country-level variables | |||

| WGI | Worldwide Governance Index | + | Kaufmann et al. (2011); Leuz et al. (2003) |

| Corporate governance dimensions | |||

| Board_Size | Size of the board: natural logarithm of the number of board members | + | Pham, Suchard, and Zein (2011); Ezat and El-Masry (2008), Kent and Stewart (2008); Barako et al. (2006) |

| Board_Ind | Independence of the board: proportion of external board members to the total number of board members | + | Ezat and El-Masry (2008); Samaha and Dahawy (2011); Kent and Stewart (2008); Willekens et al. (2005); Abdelsalam and Street (2007) |

| Duality | COB-CEO duality: Dichotomous variable that takes the value 1 if both positions are held by the same person and 0 otherwise | − | Samaha et al. (2012); Haniffa and Cooke (2002); Laksamana (2008); Eng and Mak (2003); Ezat and El-Masry (2008) |

| Gender | Percentage of female members of the board | + | Huse and Solberg (2006); Hillman et al. (2007); Gul et al. (2011) |

| Own | Ownership concentration: Percentage of ordinary shares held by the ten largest shareholders | − | Samaha et al. (2012); Donnelly and Mulcahy (2008); Barako et al. (2006), Vander Bauwhede and Willekens (2008), Gandía (2008) |

| Fam | Family firm: Dichotomous variable that takes the value 1 if family members holding at least 20% of the equity of the company, and 0 otherwise | − | Chi, Hung, Cheng, and Lieu (2015) |

| Informal institutional variables at the company level | |||

| Stakeholder | Dichotomous variable that takes the value 1 if the company has a stakeholder orientation and 0 if it has a shareholder orientation | + | Simnett et al. (2009); Bradley et al. (1999); Smith et al. (2005) |

| Strategy | Presence of an innovation or no innovation strategy: dummy variable that takes the value 1 if the firm adopts a strategy of innovation and 0 otherwise | + | Miozzo and Dewick (2002); O'Sullivan (2000); Gill (2008); Pacheco-De-Almeida and Zemsky (2012) |

| Control | |||

| Lev | Level of indebtedness=long-term debt/total assets | + | Xiao et al. (2004); Jaggi and Low (2000); Willekens et al. (2005); Ho and Wong (2001) |

| Age | Number of years since the company was founded | − | Hossain and Hammami (2009); Owusu-Ansah (1998) |

| Lnsize | Size of the company: natural logarithm of total assets | + | Hossain and Hammami (2009); Samaha et al. (2012) |

| ROA | Return on assets, measured as the proportion of net profits to total assets at the end of each year studied | + | Collet and Hrasky (2005); Gallego Álvarez et al. (2009) |

| Ind | Business sector (Standard Industrial Classsification) | ? | Gandía (2008) |

| Year | Dichotomous variable for each of the 7 years analysed | ||

Leverage. Companies with higher debt levels are generally under closer scrutiny by creditors, and have greater incentives to disclose more information about their management performance (Samaha, Dahawy, Hussainey, & Stapleton, 2012; Xiao, Yang, & Chow, 2004).

Age of the company. The age of the firm can influence the level of corporate transparency, as this represents the company's stage of development and growth (Owusu-Ansah, 1998). Under this premise, younger firms tend to disclose less information than more mature ones, for three reasons: (1) greater transparency can affect their competitive advantage; (2) the cost and ease of information processing and disclosure is greater; (3) the relative absence of such information. In our study, we expect to find a negative relationship between these two variables (Hossain & Hammami, 2009).

Size of the company. Most studies have found that company size positively affects the level of corporate information disclosure (Bassett, Koh, & Tutticci, 2007). Larger companies have certain characteristics that differentiate them from smaller ones, such as the greater diversity of products, more complex distribution networks and greater need for funding from capital markets (Gallego Álvarez et al., 2009).

Profitability. Managers disclose more detailed information to ensure the continuity of their positions and remuneration and as a sign of institutional confidence. Inchausti (1997) argues that more profitable companies make greater use of information in order to obtain a competitive advantage, while firms with poor performance may be less transparent. Previous studies mainly reflect a positive relation (Apostolos & Konstantinos, 2009).

Business sector. The business sector is another variable that has often been used to account for the amount of information provided by companies (Eng & Mak, 2003). Companies operating in the same sector are believed to disclose similar information in the market, to avoid sending a bad signal to investors (Watts & Zimmerman, 1986). Companies operating in more politically visible sectors have greater incentives to voluntarily disclose information in order to minimize any political costs (Collet & Hrasky, 2005). The studies that have reported a significant relationship between the business sector and the disclosure of information include Gandía (2008), Bonsón and Escobar (2006) and Nagar, Nanda, and Wysocki (2003).

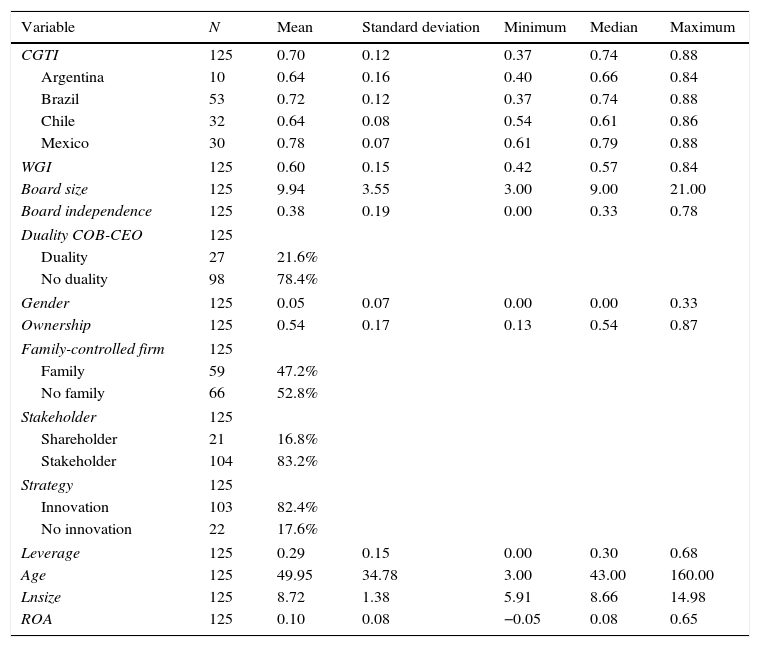

ResultsDescriptive analysis of the dataTables 4 and 5 summarize the descriptive data for the dependent and independent variables for 2004 and 2010 study periods.

Descriptive statistics on the dependent and independent variables (2004).

| Variable | N | Mean | Standard deviation | Minimum | Median | Maximum |

|---|---|---|---|---|---|---|

| CGTI | 101 | 0.53 | 0.17 | 0.12 | 0.56 | 0.81 |

| Argentina | 8 | 0.36 | 0.16 | 0.12 | 0.33 | 0.61 |

| Brazil | 41 | 0.48 | 0.18 | 0.12 | 0.49 | 0.79 |

| Chile | 24 | 0.53 | 0.10 | 0.37 | 0.50 | 0.72 |

| Mexico | 28 | 0.66 | 0.12 | 0.28 | 0.67 | 0.81 |

| WGI | 101 | 0.59 | 0.16 | 0.38 | 0.52 | 0.86 |

| Board size | 101 | 9.68 | 3.69 | 3.00 | 9.00 | 20.00 |

| Board independence | 101 | 0.33 | 0.22 | 0.00 | 0.33 | 0.73 |

| Duality COB-CEO | 101 | |||||

| Duality | 29 | 28.7% | ||||

| No duality | 72 | 71.3% | ||||

| Gender | 101 | 0.04 | 0.07 | 0.00 | 0.00 | 0.33 |

| Ownership | 101 | 0.57 | 0.18 | 0.15 | 0.55 | 0.99 |

| Family-controlled firm | 101 | |||||

| Family | 42 | 41.6% | ||||

| No family | 59 | 58.4% | ||||

| Stakeholder orientation | 101 | |||||

| Shareholder | 49 | 74.3% | 0.14 | 0.00 | 0.24 | 0.59 |

| Stakeholder | 52 | 25.7% | 35.34 | 1.00 | 42.00 | 154.00 |

| Strategy | 101 | |||||

| Innovation | 78 | 77.2% | ||||

| No innovation | 23 | 22.8% | ||||

| Leverage | 101 | 0.23 | 1.37 | 3.23 | 7.72 | 11.88 |

| Age | 101 | 48.31 | 0.08 | −0.13 | 0.10 | 0.38 |

| Lnsize | 101 | 7.83 | ||||

| ROA | 101 | 0.11 | ||||

Descriptive statistics on the dependent and independent variables (2010).

| Variable | N | Mean | Standard deviation | Minimum | Median | Maximum |

|---|---|---|---|---|---|---|

| CGTI | 125 | 0.70 | 0.12 | 0.37 | 0.74 | 0.88 |

| Argentina | 10 | 0.64 | 0.16 | 0.40 | 0.66 | 0.84 |

| Brazil | 53 | 0.72 | 0.12 | 0.37 | 0.74 | 0.88 |

| Chile | 32 | 0.64 | 0.08 | 0.54 | 0.61 | 0.86 |

| Mexico | 30 | 0.78 | 0.07 | 0.61 | 0.79 | 0.88 |

| WGI | 125 | 0.60 | 0.15 | 0.42 | 0.57 | 0.84 |

| Board size | 125 | 9.94 | 3.55 | 3.00 | 9.00 | 21.00 |

| Board independence | 125 | 0.38 | 0.19 | 0.00 | 0.33 | 0.78 |

| Duality COB-CEO | 125 | |||||

| Duality | 27 | 21.6% | ||||

| No duality | 98 | 78.4% | ||||

| Gender | 125 | 0.05 | 0.07 | 0.00 | 0.00 | 0.33 |

| Ownership | 125 | 0.54 | 0.17 | 0.13 | 0.54 | 0.87 |

| Family-controlled firm | 125 | |||||

| Family | 59 | 47.2% | ||||

| No family | 66 | 52.8% | ||||

| Stakeholder | 125 | |||||

| Shareholder | 21 | 16.8% | ||||

| Stakeholder | 104 | 83.2% | ||||

| Strategy | 125 | |||||

| Innovation | 103 | 82.4% | ||||

| No innovation | 22 | 17.6% | ||||

| Leverage | 125 | 0.29 | 0.15 | 0.00 | 0.30 | 0.68 |

| Age | 125 | 49.95 | 34.78 | 3.00 | 43.00 | 160.00 |

| Lnsize | 125 | 8.72 | 1.38 | 5.91 | 8.66 | 14.98 |

| ROA | 125 | 0.10 | 0.08 | −0.05 | 0.08 | 0.65 |

In the countries analysed, the CGR increased during the study period; the average value was 0.36 (median 0.33) in 2004 in Argentina, while in Brazil it was 0.48 (median 0.49). For firms in Chile, the average was 0.53 (median 0.50), and in Mexico, 0.66 (median 0.67). Mexico presented the highest index value, followed by Chile, Brazil and Argentina. In 2010 the index showed an increase in the four countries under analysis. For instance, Argentina averaged 0.64 (median 0.66), Brazil 0.72 (median 0.74), Chile 0.64 (median 0.61), and in Mexico, 0.78 (median 0.79). The results suggest a favourable evolution of the formal institutional environment in the region, since the codes of good governance and regulations have increased and revised several times. Differences between countries are mainly due to the codes of good governance of each country, which require of different levels and dimensions of corporate transparency.

Regarding the institutional formal factors, legal system recorded an average value of 0.59 for the WGI, with Chile obtaining the highest value, followed by Brazil, Mexico and Argentina. The explanatory variables related to CG dimensions include the size and composition of the board. The firms analysed had an average of 9.6 directors in 2004 and 10 in 2010. Although there was no significant variation in the average board size during the study period, we did find that the rules and codes of good governance within each country applied diverse criteria regarding this parameter (recommending 5–9 members in Brazil, a minimum of 7 in Chile, and between 3 and 15 in Mexico, with no recommendation being made in Argentina). Regarding board composition, for the region as a whole the average number of external directors was 0.33 in 2004 and 0.38 in 2010. In Argentina, the corresponding values were 0.20 (median 0.18) in 2004 and 0.31 (median 0.32) in 2010. In Brazil, these values were 0.25 (median 0.21) in 2004 and 0.34 (median 0.33) in 2010. According to Black et al. (2010), the independence of the board is a notoriously weak area in Brazil, with most company boards being composed of representatives of the controlling group. Chile presented an average value for independent directors of 0.38 (median 0.33) in 2004 and 0.38 (median 0.33) in 2010. Finally, Mexican firms had an average of 0.46 (median 0.47) in 2004 and 0.49 (median 0.50) in 2010, and so these companies had the highest proportion of independent directors in our study group, perhaps because the code of corporate governance in this country stipulates a minimum proportion of independent directors (25%), whereas the other countries specify neither their number nor their proportion.

COB-CEO duality was found in 28.7% of the firms analysed in 2004 and in 21.6% in 2010, occurring most frequently in Argentina and Mexico. In these emerging economies in Latin America, there is a growing presence of women on boards of directors. Nevertheless, the total numbers remain far from significant; the highest level of female participation is found in Brazil, but the regional average was barely 4% in 2004 and 5% in 2010.

A clear ownership concentration is observed in the region, although this has been declining in the analysed period. Among the companies examined, the average proportion of shares held by the top ten shareholders was 57% (median 51%) in 2004 and 55% (median 54%) in 2010. With respect to family-controlled variable, we observe that 41.6% of the firms are controlled by families, compared with 58.4% of non-family firms. In 2010, the percentage of family firms increased to 47.2% while non-family companies decreased to 52.8%.

With regard to informal factors, we observed an institutionalization of corporate culture towards a stakeholder orientation. Thus, only 51.5% of these companies were basically stakeholder oriented in 2004, while in 2010 this figure had increased to 83.2%. This trend reflects growing interest among companies in considering a broader range of participants, and this in turn has a bearing on levels of corporate transparency. In respect of the corporate strategy followed by studied firms, predominates innovation strategy (77.2%) compared with no innovation strategy (22.8%) in 2004, while in 2010 the adoption of innovation strategy increased to 82.4% compared with no innovation strategy (17.6%).

Regarding the control variables, the average level of leverage in the region was 23% in 2004 and 29% in 2010, and higher among companies in Brazil, Chile and Mexico. The average age of these firms, from their founding, was 48.31 years in 2004 and 49.95 years in 2010. Firm size, measured by the natural logarithm of its assets, was highest in Brazil, followed by Mexico and Chile. The regional average was 7.83 in 2004 and 8.72 in 2010. Finally, the descriptive statistics for the variable measuring financial performance [ROA] showed that the best performance was obtained in Argentina, followed by Mexico, Brazil and Chile. The overall average for these countries was 0.11 in 2004 and 0.10 in 2010.

Bivariate analysis (correlation matrix)The potential multicollinearity among the explanatory variables was analysed to obtain the variance inflation factor [VIF] and level of tolerance. Table 6 (Panel A) shows the Pearson coefficients for all the study variables. This correlation analysis shows that the CGR is positively and significantly correlated with board size, board independence, COB-CEO duality, stakeholder orientation, size of the firm and year of study (p<0.01, two-tailed test); and leverage (p<0.05, two-tailed test).

Correlations and collinearity diagnostics.

| Panel A: Pearson correlation coefficients | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CGTI | WGI | Board size (Ln) | Board composition | COB-CEO duality | Gender | Ownership | Family-controlled firm | Stakeholder | Strategy | Leverage | Age | Size company | ROA | Industry type | Year | |

| CGR | 1.000 | |||||||||||||||

| WGI | −0.205** | 1.000 | ||||||||||||||

| Board size (Ln) | 0.400** | −0.318** | 1.000 | |||||||||||||

| Board composition | 0.269** | −0.026 | 0.199** | 1.000 | ||||||||||||

| COB-CEO duality | 0.103** | −0.305** | 0.214** | 0.215** | 1.000 | |||||||||||

| Gender | −0.028 | −0.125** | −0.046 | −0.122** | −0.069* | 1.000 | ||||||||||

| Ownership | −0.156** | 0.069* | −0.139** | −0.220** | −0.150** | 0.118** | 1.000 | |||||||||

| Family-controlled firm | 0.003 | 0.028 | −0.019 | 0.155** | 0.200** | −0.073* | 0.221** | 1.000 | ||||||||

| Stakeholder | 0.159** | 0.116** | −0.014 | −0.008 | −0.077* | 0.086* | 0.098** | −0.024 | 1.000 | |||||||

| Strategy | −0.084* | 0.030 | 0.011 | −0.025 | −0.016 | 0.059 | 0.048 | 0.024 | −0.020 | 1.000 | ||||||

| Leverage | 0.066 | 0.113** | −0.067* | −0.080* | −0.082* | 0.166** | −0.069* | −0.183** | 0.155** | 0.070* | 1.000 | |||||

| Age | 0.020 | 0.243** | −0.009 | 0.050 | −0.197** | 0.070* | 0.057 | −0.079* | 0.150** | 0.056 | 0.099** | 1.000 | ||||

| Size company | 0.272** | −0.140** | 0.145** | −0.051 | −0.056 | 0.188** | −0.037 | −0.324** | 0.188** | 0.061 | 0.272** | 0.139** | 1.000 | |||

| ROA | −0.10 | −0.167** | 0.068 | 0.004 | 0.013 | −0.018 | 0.098** | −0.050 | 0.017 | 0.046 | −0.127** | 0.071* | −0.038 | 1.000 | ||

| Industry sector | −0.054 | 0.089* | −0.056 | −0.132** | −0.204** | 0.191** | 0.237** | −0.222** | 0.037 | 0.027 | 0.136** | 0.008 | 0.137** | −0.107** | 1.000 | |

| Year | 0.374** | 0.019 | 0.044 | 0.078* | −0.04 | 0.018 | −0.056 | 0.032 | 0.215** | −0.023 | 0.128** | 0.039 | 0.210** | −0.106** | −0.010 | 1.000 |

| Panel B: collinearity diagnostics | ||

|---|---|---|

| Variance inflation and tolerance factors | ||

| Variable | VIF | Tolerance |

| (Constant) | ||

| WGI | 1.405 | 0.712 |

| Board size (Ln) | 1.239 | 0.807 |

| Board composition | 1.186 | 0.843 |

| COB-CEO duality | 1.292 | 0.774 |

| Gender | 1.140 | 0.877 |

| Ownership concentration | 1.316 | 0.760 |

| Family-controlled firm | 1.402 | 0.713 |

| Stakeholder | 1.129 | 0.886 |

| Strategy | 1.019 | 0.981 |

| Leverage | 1.218 | 0.821 |

| Age | 1.176 | 0.850 |

| Size company | 1.358 | 0.737 |

| ROA | 1.166 | 0.858 |

| Year | 1.128 | 0.887 |

| Industry type | 1.251 | 0.800 |

Correlation is significant at 0.01 level (two-tailed test).

1. The variables are defined in Table 3.

2. The coefficients are based on 826 observations.

3. Independent variable: CGR.

4. VIF=variance inflation.

The CGR is negatively correlated with the WGI and ownership concentration (p<0.01, two-tailed test); and corporate strategy and industry type (p<0.05, two-tailed test). We also observe that the highest value of the correlation between independent variables and CGR is 0.400 (board size). According to Gujarati (2003) correlations between the independent variables are not considered harmful to the multivariate analysis at least exceeding 0.80.

Panel B shows the coefficients for VIF and tolerance, which must be within the limits proposed by Xiao et al. (2004), i.e. less than 2 for VIF and above 0.60 for the tolerance level. In this line, Neter, Wasserman, and Kutner (1989) proposed that the VIF coefficient should not exceed 10, since that would indicate the presence of damaging multicollinearity. On the other hand, if the average VIF were substantially less than 1 this would indicate that the regression analysis might be biased (Bowerman & O’Connell, 1990). Our study obtained an average VIF of 1.228, which is in line with the values obtained by Hossain and Hammami (2009) and Shan and Mclver (2011), who confirmed that their model had no multicollinearity, with VIF values of 1.47 and 1.42 respectively. The VIF was within the recommended limits, while the correlation matrix revealed no major correlation problems among the variables.

Analysis of resultsTable 7 shows the multivariate analysis results for the proposed hypotheses. First, multiple regression analysis [OLS] with robust estimator (VCE) was performed, including the industry and the year of study as dummy variables, to incorporate their possible effects. Subsequently, we use the GMM system to account for endogeneity of all time-varying explanatory variables (Bloom & van Reenen, 2007; Pindado et al., 2014). We have adopted GMM to control for endogeneity and reduce the risk of obtaining biased results due to correlation between error term and explanatory variables. GMM relies on set of “internal” instruments (lags of explanatory variables), eliminating the need of external instrumental variables (Wintoki, Linck, & Netter, 2012). The multiple regression model (Model 1) was found statistically significant (p>0.000). The adjusted coefficient of determination (R2) indicates that 49.35% of the variation in the dependent variable is explained by the independent variables. The coefficients show that statistically significant formal institutional variables in the model are legal system (+), size of the board (+), independence of the board (+), and participation of women on the board (−). The significant informal institutional variables in the model are stakeholder orientation (+) and the innovation strategy (−). Finally, COB-CEO duality and ownership concentration are not significant in this model. Regarding the control variables, leverage (+), age of the company (−) and its size (+) are significant, while profitability does not present any association.

Formal and informal institutional factors on CGR.

| Independent variables | Model 1 | Model 2 |

|---|---|---|

| Pooled data (MCO). Robust estimator (vce) | Estimation with GMM | |

| WGI | 0.581*** | 0.083 |

| 0.200 | 0.107 | |

| Board size (Ln) | 0.069*** | −0.064** |

| 0.02 | 0.029 | |

| Board composition | 0.078*** | 0.071** |

| 0.023 | 0.034 | |

| COB-CEO duality | −0.010 | −0.010 |

| 0.011 | 0.017 | |

| Gender | −0.240*** | 0.040 |

| 0.071 | 0.077 | |

| Ownership | −0.029 | 0.107** |

| 0.025 | 0.040 | |

| Family-controlled firm | 0.001 | −0.034 |

| 0.01 | 0.031 | |

| Stakeholder | 0.034*** | 0.027*** |

| 0.010 | 0.009 | |

| Strategy | −0.034*** | −0.002 |

| 0.012 | 0.007 | |

| Leverage | 0.094*** | −0.012 |

| 0.035 | 0.032 | |

| Age | 0.010* | 0.029* |

| 0.005 | 0.018 | |

| Company size | 0.015*** | 0.001 |

| 0.004 | 0.009 | |

| ROA | 0.092 | −0.026 |

| 0.071 | 0.058 | |

| Constant | 0.085 | 0.147 |

| 0.144 | 0.093 | |

| Total observations | 826 | 451 |

| R adjusted squared | 0.4935 |

Corrected standard errors are shown in italics.

GMM-type: L(2/.).cgt. Chi2=0.000.

Continuing our analysis, the panel data highlighted problems of heteroscedasticity, endogeneity and correlation. To address these issues, we estimate the model using GMM method, because it is an instrumental variable estimator that embeds all other instrumental variables as special cases (Pindado et al., 2014). Model 2 shows that the positive, statistically significant relations were independence of the board (p=0.05), ownership concentration (p=0.05), stakeholder orientation (p=0.01) and age of the company (p=0.10). We could identify a negative relation between CGR and board size (p=0.05). No significant relationships were found between CGR and legal system, COB-CEO duality, gender, family controlled firm, strategy, leverage, company size and profitability.

The results obtained also suggest that CGR in the energy sector is higher than in other sectors. From 2005, significant differences began to appear in the levels of transparency in the countries analysed. These findings are supported by Archambault and Archambault (2003), who concluded that the decision to adopt and publish corporate information is influenced by informal factors such as culture, regulatory system and the corporate system. Berglöf and Pajuste (2005), on the other hand, suggested that companies’ corporate practices depend on the legal environment and practices prevailing in each country, company size and the concentration of ownership. Barako et al. (2006) carried out a longitudinal study using panel data methodology, and found a significant association between the level of corporate transparency and the CG attributes of the company, such as ownership structure and other characteristics. In the same vein, Samaha et al. (2012), studying firms in Egypt, argued that the proportion of independent directors and firm size are two factors that positively affect the level of CG compliance.

In this study, we observed a significant inverse association between the level of CG transparency and independence on the board, and so hypothesis H2a, which predicted a positive relationship between these variables, is rejected. These results are in line with those found by Mak and Kusnadi (2005), who argue that larger boards inhibit the motivation and participation of their members in the strategic taking decisions process, and therefore its impact negatively on the CG compliance.

The results for the CG dimensions show there is a positive and statistically significant (5% level) between independence of their members with CGR; therefore, hypotheses H2b is accepted. These results are aligned with those reported by Samaha et al. (2012) who showed that CGR for listed companies in Egypt increases in proportion with the number of independent directors and company size. In this context, our study shows that diversity in the boards provide the experience and knowledge necessary for adequate performance of their functions, and tend to increase the level of CGR (Ezat & El-Masry, 2008; Gandía, 2008; Kent & Stewart, 2008; Willekens, Vander Bauwhede, Gaeremynck, & Van de Gucht, 2005). The presence of independent members on the board represents a means of control that improves its effectiveness, focusing its attention on the actions of the management team and on ensuring the shareholders’ goals are achieved, all of which is reflected in a higher level of CGR (Fama & Jensen, 1983). These consequences have also been reported for the level of CG transparency in other emerging countries (Ezat & El-Masry, 2008; Samaha & Dahawy, 2011).

With respect to ownership concentration, the results show a significant and positive influence on CGR, opposite our established premise. In this sense we have rejected the H2e which suggested a negative relation. According to Haniffa and Cooke (2002), the ownership concentration could reduce the freedom of the management team and lead to a more efficient behaviour such as CG compliance.

Hypothesis 3 regarding to stakeholder orientation has been accepted. Thus, firms with a stakeholder-oriented approach will tend to adopt more CG practices as part of their strategic management and as a process of continuous and interactive communication between the company and its stakeholders (Fasterling, 2012). The significant control variables in the model is the age of the company, with a positive impact on the CGR, a finding that is in line with the results of Hossain and Hammami (2009) and Owusu-Ansah (1998), who argued that younger firms publish less information to maintain their competitive advantage, and also because they have a shorter history to communicate.

Regarding the variables that were not statistically significant, we observed that the legal system is not a determinant factor in CGR in Latin American region. Jaggi and Low (2000) considered the legal system to be the most significant institution affecting business activity, while Bushman, Piotroski, and Smith (2004) observed a positive relationship between the level of CG compliance and the strength of the legal system. However, in Latin American case this variable is not significant.

The hypotheses rejected concerned the COB-CEO duality (H2c), gender of the board (H2d), the family controlled firm (H2f), strategy (H4), and the control variables of leverage, size and profitability, none of which accounted for the CGR. Previous studies have suggested that in the case of emerging or developing countries the results of this type of analysis could differ from those found in developed economies (Archambault & Archambault, 2003). On the other hand, COB-CEO duality and family controlled firms do not seem to affect the level of CG compliance, which is in line with the results obtained by Ho and Wong (2001), Eng and Mak (2003) and Haniffa and Cooke (2002).

ConclusionsThis study contributes to the literature pertaining to how formal and informal factors promote a higher CG compliance on listed companies of Latin American emerging markets. Most of prior research has focused on developed countries and they have associated institutional factors such as culture, legal system and financial factors with corporate and transparency practices, while agency theory suggest that internal and external dimensions of CG (board of directors, ownership concentration, legal system) could minimize the conflict of interest between majority and minority shareholders in countries where legal system and shareholders’ protection is poor (Creed et al., 2010; Peng et al., 2009; Tariq & Abbas, 2013).

This study obtained a comparative study of four emerging economies in Latin America (Argentina, Brazil, Chile and Mexico), and the results indicate a rising trend in CG compliance during the period 2004–2010. Our analysis shows that the variables that affect CGR in this region are the independence of the board, the ownership concentration, stakeholder orientation, and the age of the company. These results are consistent with the findings of Kent and Stewart (2008) and Samaha and Dahawy (2011) who affirm that independent directors promote a higher supervision and control in order to keep their reputation on the market. By contrast, larger boards influence negatively in the level on CG because a greater diversity of opinions may hinder a consensus to adopt corporate practices. Contrary to the proposed hypothesis, our results demonstrated that ownership concentration affect positively the CGR, since the region is characterized by a weak legal system and a poorer protection of shareholders, so ownership concentration becomes a control mechanism to substitute this absence and promotes the adoption of good governance practices (Gandía, 2008; Vander Bauwhede & Willekens, 2008). In the case of informal factors, stakeholder orientation motivates the credibility and transparency on corporate practices in weak legal environments (Basu & Palazzo, 2008). In the case of female presence in the board, family element and legal system were no significant in the analysis, since the institutional framework in Latin America differ from other countries previously studied, both normative and cultural aspects.

Our research also considered the endogeneity problem in the empirical analysis of CGR. The endogeneity problem in this issue is important, for it is highly likely that observable and unobservable institutional factors may affect CG compliance, and some of firm-specific characteristics could influence the rating on CG.

This study has the following limitations. First, the study variables, compiled from the companies’ annual reports, inevitably reflected the subjective judgement of the researchers, which could lead to errors of interpretation and of information compilation. Second, the proposed CGR was un-weighted. On the one hand, this presents the disadvantage that all the index items are awarded the same importance; however, to the best of our knowledge there is no established methodology to assign a single weighting criterion for such an analysis, and the use of an un-weighted index does reduce the problem of subjectivity. Third, we focused on obtaining information on CG and the study variables from three main sources: the companies’ annual reports, the CG reports and the companies’ websites; thus we did not consider press reports or other communiqués that may be issued by listed companies. Fourth, there is some subjectivity in the selection of the explanatory variables. Given the extensive literature in this field of research and the large number of variables that have been identified, we chose to include those appearing most frequently in previous studies. This limitation is mitigated by the use of panel data methodology and GMM system, which takes into account the problem of omitted variables. Fifth, our study considers only the listed companies with the highest rankings in four Latin American stock markets, and omits companies in other indices and non-listed companies. Nevertheless, we achieved a sufficient number of observations for panel data analysis to be applied.

Despite the above limitations, the results obtained constitute a benchmark for managers responsible for determining CG policies and legislation in the countries under study. These results reflect the current status of the region concerning CG and could help identify the dimensions and elements of CGR that favour regional convergence. Moreover, this paper opens up interesting areas for future research, highlighting the impact of certain ethical values and risk taking behaviour. It would be useful to extend this study to consider the influence of other cultural variables such as the nationality, age, education and experience of company directors or managers on the level of CG compliance, and to analyse other formal institutional factors such as directors’ remuneration, the composition of support committees and the frequency of board and support committee meetings. Another area of interest would be to analyse the impact of the rating and its sub-indices on measures of corporate performance or risk, or perhaps the impact of formal and informal institutional factors on these same measures. Furthermore, the study sample could be expanded to include companies listed on the continuous market. An important extension of our work would be to include other countries, both emerging and Anglo-Saxon and Continental countries, and thus incorporate a greater number of country-level variables. Another interesting line would be to carry out a longitudinal study by business sector, to determine the impact of formal and informal institutional factors on a specific area of activity, and at the same time, a larger number of countries might be included.