The analysis of the keys to competitiveness in the tourism sector has an unquestionable justification for its importance in the Spanish economy and its global growth prospects. The need for a better understanding of the keys to the competitiveness of the tourism firm is also fuelled by the magnitude of the challenges that it faces and by the sector structure, characterised by a notable weight of family-owned businesses. The objective of this research lies precisely in developing a diagnosis of the return on capital of the tourism sector and the determinants of its evolution in the family business (FB) vs non-family business (NFB). Specifically, this study focuses on the analysis of both firm's economic and financial profitability. The objective indicators of the results can come either from the company itself or from two secondary sources: SABI (Iberian Balance Sheet Analysis System) and INFORMA D&B. The economic and financial analysis of the Spanish tourism firm with objective data developed in this study is based on a sample of 738 firms (from an initial sample of 1019 organisations).

Ample justification for an analysis of the keys to competitiveness in the tourism sector can be found in its importance to the Spanish economy (Vacas & Landeta, 2009; Vera & Marchena, 1996) and its prospects for growth at world level (Lee & Brahmasrene, 2013; Su & Lin, 2014). The need for better knowledge of the keys to the competitiveness of tourism businesses is all the greater because of the size of the challenges they face and the structure of the sector, combining the presence of chains with a considerable international profile (Mariz-Pérez & García-Álvarez, 2009; Rufín, 2006) with a fragmented segment of supply dominated by small establishments (Hernández-Maestro, Muñoz-Gallego, & Santos-Requejo, 2009) with a great deal of expertise in their activity but management falling short of the parameters of professionalisation and best practice. Family-owned businesses are clearly predominant in both segments of supply.

Family tourism businesses have often passively watched increasing competition and failed to meet new challenges arising from the emergent competition, technological change and the remodelling of demand (Aramberri, 2009), making few strategic movements to respond to the process of change. Stagnation and the absence of a well-defined strategic approach could, then, considerably damage the future prospects of Spanish family tourism businesses, putting them in an inferior position to competitors in the form of chains and other organisations with a corporate ownership structure.

The diagnosis of the performance of Spanish tourism businesses and the factors determining their progress are also vital for helping private agents to develop strategies generating economies of scale, sufficient synergies and the differentiation capacity to put their competitive position on a level with the competition. However, despite the importance of family businesses in tourism in Spain, research in this area has been carried out only incidentally (Getz & Carlsen, 2005).

The aim of this research lies precisely in determining the competitiveness of the tourism sector based on an analysis of its economic-financial results, comparing family businesses (FB) with non-family businesses (NFB). We consider that a family business is a firm where a family exerts power over the organisation and its strategic direction through ownership, management, or board positions (Pieper, Klein, & Jaskiewicz, 2008).

This study represents a considerable advance on the existing literature because of the lack and controversial nature of empirical studies of the growth and business profitability of FB (Astrachan, 2010; Benavides Velasco, Guzmán Parra, & Quintana García, 2011; Garcia-Castro & Aguilera, 2014), and most specifically tourism FB (Andersson, Carlsen, & Getz, 2002), despite their importance over the past decade.

Two streams of research can be identified in the family business literature. One stream compares and contrasts family and non-family firms in terms of performance implications. Along these lines, prior empirical research has found positive (e.g. Allouche, Amann, Jaussaud, & Kurashina, 2008; Block, Jaskiewicz, & Miller, 2011; Chu, 2009; Lindow, Stubner, & Wulf, 2010; Miralles-Marcelo, Miralles-Quirós, & Lisboa, 2014; Wagner, Block, Miller, Schwens, & Xi, 2015), negative (Cucculelli & Micucci, 2008; Sacristán-Navarro, Gómez-Ansón, & Cabeza-García, 2011), insignificant (Chrisman, Chua, & Litz, 2004; Miller, Le Breton-Miller, Lester, & Cannella, 2007; Westhead & Howorth, 2006) and even quadratic (De Massis, Kotlar, Campopiano, & Cassia, 2013; Kowalewski, Talavera, & Stetsyuk, 2010; Poutziouris, Savva, & Hadjielias, 2015) relationships between family involvement in business and firm performance. Another stream of research investigates how the specific characteristics of family business affect firm performance, especially those related to ownership, governance structure, management and succession (Block et al., 2011; De Massis et al., 2013; Garcia-Castro and Aguilera, 2014; Mazzi, 2011; Miralles-Marcelo et al., 2014; Villalonga & Amit, 2006). The results are also highly inconsistent (see e.g. Garcia-Castro and Aguilera, 2014; Mazzi, 2011; Poutziouris et al., 2015; Sacristán-Navarro et al., 2011). To this inconsistency in the literature is added the scarcity of empirical studies of FB in the tourism sector (Getz & Carlsen, 2005).

These contradictory results can be explained by a number of interplaying factors, including the differences in the definition of family firms, sampling techniques, definition of variables, methodologies, study periods and institutional settings considered by researchers (Miller et al., 2007; Sacristán-Navarro et al., 2011; Wagner et al., 2015). To these factors are added the difficulties in collecting data on this group from secondary public sources (Benavides Velasco et al., 2011).

The interest in this research is not merely descriptive, given that the idea is to make use of the knowledge extracted to improve the understanding of the strategic tools deployed by FB and to suggest lines of action which both tourism authorities and Spanish family tourism businesses themselves might develop to improve their medium- and long-term performance.

The desire for better knowledge of FB based on the theoretical framework offered by strategic management, following the pioneering call of Sharma, Chrisman, and Chua (1997), and later widely reaffirmed (e.g. Chrisman, Chua, & Sharma, 2005; Chrisman, Steier, & Chua, 2008) is the starting point inspiring the research on the competitiveness of FB in a good part of the current literature constituting the initial theoretical framework.

This study focuses, then, on the expost dimension of competitiveness involving the development of a sustainable competitive advantage that maintains or improves participation in the market at the same time as achieving better financial results (Camisón, 2014). Specifically, this study focuses on analysing the economic and financial profitability of the company.

The objective indicators of results used can come either from the company itself or from two secondary sources: the SABI (Iberian Balance Sheet Analysis System) and INFORMA D&B. The analysis of the indicators from the primary study involved working with a sample of 1019 businesses, which was reduced to 738 businesses when the objective data from the secondary sources indicated was used.

The profitability study is carried out based on a comparative analysis of the average FB and NFB, both weighted by relative size. This comparative analysis is implemented at different times to find out how the businesses represented develop over time. For this purpose, the years 1998, 2001, 2004, 2007 and 2008 have been chosen as cut-off points. This longitudinal analysis will provide an initial approach to the sensitivity of the economic-financial situation and the profit and loss accounts of Spanish family and non-family tourism businesses to changes in the economic cycle.

A second analysis of the economic-financial indicators is drawn up based on individual data from FB and NFB from the sample intended to reveal the statistically significant differences in the selected variables between the two groups. The differences in economic-financial return between the two types of firms will be analysed. The expost analysis of competitiveness is completed in this way with indicators based on self-assessment by management in relation to competitiveness, captured through the same primary study.

Importance and singularity of family businessesThe FB model plays an important role in most capitalist economies due to its contribution to the creation of jobs and wealth (Bhattacharya & Ravikumar, 2001; Carrigan & Buckley, 2008). The leading role played by FB in the economy has led to a growing interest in researching them. Along these lines, a considerable volume of studies have analysed their impact on economic performance (e.g. Garcia-Castro and Aguilera, 2014; Mazzi, 2011; Poutziouris et al., 2015; Sacristán-Navarro et al., 2011). However, the empirical evidence on the better performance and competitiveness of FB compared to NFB is controversial.

A first line of research focuses on examining the influence of family ownership and/or management on performance. Despite the growing literature in this respect, the results on its impact are confused. On one hand, some studies have reported a positive relationship between family involvement and performance (e.g. Allouche et al., 2008; Block et al., 2011; Chu, 2009; Lindow et al., 2010; Miralles-Marcelo et al., 2014; Wagner et al., 2015). Allouche et al. (2008), based on a sample of 1271 listed companies in Japan, demonstrate that family firms outperform non-family firms in terms of financial indicators (Return On Assets – ROA, Return On Equity – ROE, Return On Invested Capital, ROIC). Chu (2009) found that the influence of family ownership on performance (measured with ROA and Tobin's q) is positive for SMEs in Taiwan. Lindow et al.’s (2010) study based on a sample of 171 German family firms also shows that family firms play an important role in the achievement of strategic fit and, in turn, superior financial performance (measured with the ROE, ROA and subjective measurement). Although it is a weak effect, Wagner et al. (2015) also found that family firms show superior financial performance compared to non-family firms, on the basis of a meta-analysis. These authors also find size and conceptual definitions as important moderators of the relationship. The importance of controlling the definition of family firm and the nature of the sample is also pointed out in the study by Miller et al. (2007). Block et al. (2011), using a panel dataset of 419 firms, state that family and founder ownership are associated with superior performance (measured by Tobin's q). However, they did not find significant support for the effect of family and founder management on performance. Miralles-Marcelo et al. (2014), using a panel dataset of Spanish and Portuguese firms, show that family control has a positive impact on firm performance (measured using Tobin's Q and ROA), which is positively moderated by firm's size and age.

Some studies have also demonstrated a negative relationship between family involvement and financial performance. Cucculelli and Micucci (2008), using a sample of 3548 Italian manufacturing firms, find that keeping management in the family has a negative impact on the firm's performance (ROA and ROS). Sacristán-Navarro et al. (2011), using a panel of 118 non-financial Spanish companies, show that family management hampers profitability (measured as a proxy of firm performance defined as the profitability ratio ROA). However, these authors did not find any influence of family ownership on performance.

To these two types of effect are added other studies that found no statistically significant associations between family ownership and performance in terms of sales growth (Schulze, Lubatkin, & Dino, 2003); short-term sales growth (Chrisman et al., 2004), considering several performance indicators as growth sales revenues, number of people employed, firm's exported sales, total gross sales exported, profitability, and a subjective measure of average performance (Westhead & Howorth, 2006), and in terms of sales, sales growth and Tobin's q (Miller et al., 2007). Sciascia and Mazzola (2008) ran regression analyses on data drawn from 620 privately owned family firms in Italy finding no association between family ownership and performance, captured through a self-reported measure taking into account the firms’ sales growth, revenue growth, net profit growth, return on net asset growth, reduction of debt/equity ratio, return on equity growth, and dividend growth. Instead, these authors found that family involvement in management has a negative quadratic (inverted U-shaped) effect on performance. This effect points out that performance decreases as family involvement increases and that the decrease is greater at higher levels of involvement. Kowalewski et al. (2010), using a panel data of 217 public companies, also found an inverted U-shaped relationship between the proportion of family ownership and financial performance (measured with the ROE and ROA). De Massis et al. (2013) also confirm these results by conducting an empirical analysis on 494 small-to-medium size private family firms in Italy. Specifically, they find support for the existence of a U-shaped relationship between the degree of family ownership dispersion and firm performance, measured as ROA. Using a panel dataset of UK companies listed on the London Stock Exchange (LSE), Poutziouris et al. (2015) also demonstrate an inverted U-shaped relationship between family ownership and firm performance (measured with accounting ratios and Tobin's q). Specifically, their results show that performance increases until family shareholding reaches thirty-one percent.

The lack of homogeneity in the result of previous studies suggests that the relationships between family business and corporate performance are complex and even moderated or mediated by factors not included in previous analysis. In this vein, some of these studies highlight positive aspects of family firms within the stewardship and agency perspectives, whereas others emphasise negative ones.

The positive aspects include the culture transmitted in the organisation, the reputation of the business based on the track record of the family over generations, long-term orientation or greater trust between members and stakeholders (Audretsch, Hülsbeck, & Lehmann, 2013; Gallo & Amat, 2003; Miller & Le Breton-Miller, 2005; Whiteside, Aronoff, & Ward, 1993).

On the other hand, the potential negative effects of family influence refer to altruism and family nepotism (Bloom & Van Reenen, 2007; Pérez-González, 2006; Schulze et al., 2003), entrenchment (Gomez-Mejia, Nuñez-Nickel, & Gutierrez, 2001), free-riding (Schulze et al., 2003), the consumption of unearned perks (Chrisman et al., 2004) and expropriation of minority shareholders (e.g., Miller et al., 2007), that can lead to agency problems that damage performance. Equally, some studies highlight certain behaviour and characteristics of FB which would be incompatible with entrepreneurial orientation. These might include more conservative behaviour, lack of differentiation, low levels of innovation and a high level of risk aversion (Naldi, Nordqvist, Sjöberg, & Wiklund, 2007; Ward, 1986; Zahra, 2005). Although FB initially show entrepreneurial behaviour (Nordqvist, Habbershon, & Melin, 2009), maintaining this entrepreneurial orientation is a real challenge as time goes on (Casillas, Moreno, & Barbero, 2010; Cruz & Nordqvist, 2012; Kellermanns, Eddleston, Barnett, & Pearson, 2008; Naldi et al., 2007). There are also studies that indicate that FB have serious problems that lead to their average life expectancy being cut short (Craig & Moores, 2006; Neubauer & Lank, 1998, p. 44), finding it difficult to achieve a third generation of family control.

In order to shed light on these conflicting findings, and considering that differences in performance among family firms are even higher than those between family and non-family business (Chua, Chrisman, Steier, & Rau, 2012), another strand of the literature focuses on analysing which of the specific explanatory variables defined by the structure of ownership and control and management of FB, and internal and external moderating variables, influence economic performance. This body of research fits in with the main foundations of the Resource Based View (RBV), that define the specific resources and capacities of FB deriving from family-business interaction as a result of the involvement in the business of the owner family – its capital, governance structure and management system. This involves the interaction of systems between the family as a whole, the people who make it up and the business (Habbershon & Williams, 1999).

On the basis of RBV, agency theory and stewardship theory studies like those by Anderson and Reeb (2003), Westhead and Howorth (2006) and Maury (2006) find that family involvement is an effective form of control, providing incentive structures resulting in fewer agency conflicts, and costs, leading to better financial and market value performance by family businesses. Specifically, Anderson and Reeb (2003), using the Standard & Poors 500 firms, show that when a family member serves as CEO, performance (measured with ROA and Tobin's q) is better than with an outside CEO. Westhead and Howorth (2006), analysing data from privately held family firms in the United Kingdom, show that firms with high levels of family ownership and management were not significantly associated with superior performance indicators. However, their research provides evidence that the family firms with larger teams of directors and managers have greater levels of growth in sales and revenues. Maury (2006), analysing a sample of 1672 non-financial firms in Western Europe, also found that active family control increases profitability (measured with ROA and Tobin's q) compared to non-family firms. Lee (2006), based on a sample of 403 firms, confirms that family businesses tend to obtain higher employment and revenue growth when founding family members are involved in management. The findings obtained by Barontini and Caprio (2006) and Sraer and Thesmar (2007) are also consistent with these results, highlighting the benefits of the family's involvement in management.

Other studies, like that by Barth, Gulbrandsen, and Schøne (2005), analysing 438 Norwegian firms, have found that family-owned and managed firms are less productive in terms of added value than non-family firms. However, they show that family-owned firms managed by a person hired from outside the owner family are just as productive as non-family-owned firms, not finding support for the hypothesis that concentrated ownership necessarily affects productivity. This study points out that professional managers hired in the market are more efficient in operating the firm. On the basis of a panel data from 180 of publicly traded Chilean firms from 2000 and 2003, Silva and Majluf (2008) show that family ownership does have an impact on performance, which may be positive or negative depending on voting rights concentration. At higher concentration, family ownership subtracts value from the firm and their contribution is more negative when they become highly involved in management. The opposite is true when concentration is low. Villalonga and Amit (2006), using proxy data on all Fortune-500 firms, demonstrate that the presence of descendants as CEOs has a negative impact on performance (using Tobin's q) and conflicts with minority shareholders.

Meanwhile, O’Boyle Jr, Pollack, and Rutherford (2012), using a meta-analysis, find that there is no direct, significant relationship between family involvement and a firm's financial performance. Instead, they analyse the effects of potential moderators. The conceptual moderators they include are: public vs private, firm size and cultural context. They also include the following methodological moderators: family involvement, firm performance, publication and publication quality, and year of publication. Their analysis of potential moderators provided no evidence that these moderators were statistically or practically significant. Garcia-Castro and Aguilera (2014) use data from the OSIRIS database to carry out methods from set theory. Their results also confirm that the effects of family involvement in business (measured as industry-adjusted ROE) are not direct but rather subject to substantial complementarity and substitution effects among the components of family involvement related to governance (family board and family chairman), ownership (family ownership), management (family CEO) and succession (succession). Craig, Dibrell, and Garrett (2014), using a sample of 359 firms, found evidence that the family effect on performance (measured through sales growth, market share growth and return on sales) is mediated by culture, strategic flexibility and innovativeness.

Finally, there are studies profiling non-linear relationships between the features of governance and the corporate structure of the business and its financial results. Specifically, Naldi, Chirico, Kellermanns, and Campopiano (2015), using a sample of 128 Swedish family firms, predict an inverted U-shaped relationship between the number of family advisors and family firm performance (measured through ROA). They also found that the generation which controls the firm moderates this effect so that family advisors have a positive relationship with performance in first-generation family firms and an inverted U-shaped relationship with performance in later-generation family firms.

It is therefore appropriate to wonder whether the FB model is a guarantee of competitiveness and growth in the modern tourism sector, characterised by a high level of competition, internationalisation and the development of new commercial, technological, human, organisational and management requirements.

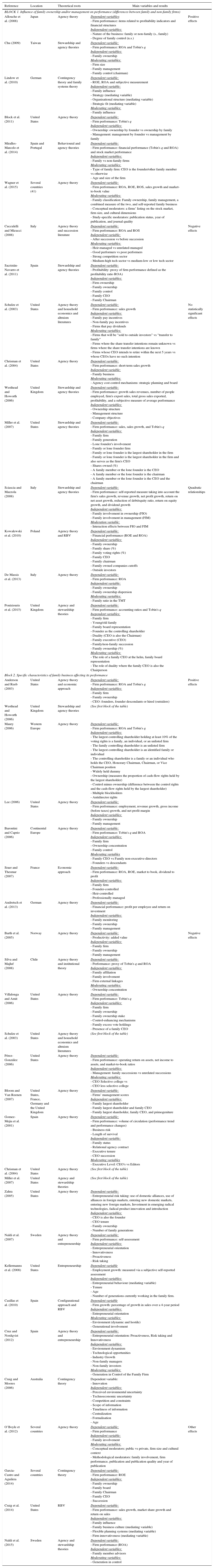

Table 1 presents a summary of the empirical studies analysed. The table gathers, on the one hand, the papers related to the differences in performance between FB and NFB and, on the other hand, the papers that analyse the specific characteristics of FB affecting its performance. This second block of papers posits that there may be important differences among FB due to the specific characteristics of each FB, regarding their ownership and governance structure, family involvement in management and control-enhancing mechanisms. Some of these studies also point out some internal and external moderating variables that influence economic performance of FB.

Summary of the analysed empirical studies.

| Reference | Location | Theoretical roots | Main variables and results | |

|---|---|---|---|---|

| BLOCK 1. Influence of family ownership and/or management on performance (differences between family and non-family firms) | ||||

| Allouche et al. (2008) | Japan | Agency theory | Dependent variables: - Firm performance: items related to profitability indicators and financial structures Independent variables: - Nature of the business: family or non-family (s., family) - Degree of family control (n.s.) | Positive effects |

| Chu (2009) | Taiwan | Stewardship and agency theories | Dependent variable: - Firm performance: ROA and Tobin's q Independent variables: - Family ownership Moderating variables: - Firm size - Family management - Family control (chairman) | |

| Lindow et al. (2010) | German | Contingency theory and family systems theory | Dependent variable: - ROE, ROA and subjective measurement Independent variable: - Family influence - Strategy (mediating variable) - Organisational structure (mediating variable) - Strategic fit (mediating variable) Moderating variables: - Family influence | |

| Block et al. (2011) | United States | Agency theory | Dependent variable: - Firm performance: Tobin's q Independent variables: - Ownership: ownership by founder vs ownership by family - Management: management by founder vs management by family | |

| Miralles-Marcelo et al. (2014) | Spain and Portugal | Behavioural and agency theories | Dependent variable: - Firm performance: financial performance (Tobin's q and ROA) and stock market performance Independent variables: - Family vs non-family firms Moderating variables: - Type of family firm: CEO is the founder/other family member vs otherwise - Age and size of the firm | |

| Wagner et al. (2015) | Several countries (41) | Agency theory | Dependent variable: - Firm performance: ROA, ROE, ROS, sales growth and market-to-book value Moderating variables: - Family classification: Family ownership, family management, a combined measure of the two, and self-reported family business - Conceptual moderators: a firms’ listing on the stock market, firm size, and cultural dimensions - Study-specific moderators: publication status, year of publication, and journal quality | |

| Cucculelli and Micucci (2008) | Italy | Agency theory and succession literature | Dependent variable: - Firm performance: ROA and ROS Independent variable: - After succession vs before succession Moderating variables: - Heir-managed vs unrelated-managed - Good performers vs poor performers - Strong competition sector - Medium-high tech sector vs medium-low or low tech sector | Negative effects |

| Sacristán-Navarro et al. (2011) | Spain | Stewardship and agency theories | Dependent variable: - Profitability: proxy of firm performance defined as the profitability ratio ROA) Independent variables: - Firm ownership - Family ownership - Family control - Family CEO - Family Chairman | |

| Schulze et al. (2003) | United States | Agency theory and household economics and altruism literatures | Dependent variable: - Firm performance: sales growth Independent variables: - Family pay incentives - Non-family pay incentives - Firms that pay dividends Moderating variables: - Firms that will be “sold to outside investors” vs “transfer to family” - Firms where the share transfer intentions remain unknown vs firms where the share transfer intentions are known - Firms whose CEO intends to retire within the next 5 years vs whose CEOs have no such intention | No statistically significant effects |

| Chrisman et al. (2004) | United States | Agency theory | Dependent variable: - Firm performance: short-term sales growth Independent variable: - Family business Moderating variables: - Agency cost control mechanisms: strategic planning and board | |

| Westhead and Howorth (2006) | United Kingdom | Stewardship and agency theories | Dependent variable: - Firm performance: growth sales revenues, number of people employed, firm's export sales, total gross sales exported, profitability, and a subjective measure of average performance Independent variables: - Ownership structure - Management structure - Company objectives | |

| Miller et al. (2007) | United States | Stewardship and agency theories | Dependent variable: - Firm performance: sales, sales growth, and Tobin's q Independent variables: - Family firm - Family generation - Lone founder's involvement - Family or lone founder firm - Family or lone founder is the largest shareholder in the firm - Family or lone founder is the largest shareholder in the firm and also serves as the firm's CEO - Shares owned (%) - A family member or the lone founder is the CEO - A family member or the lone founder is the chairman - A family member or the lone founder is the CEO and the chairman | |

| Sciascia and Mazzola (2008) | Italy | Stewardship and agency theories | Dependent variable: - Firm performance: self-reported measure taking into account the firm's sales growth, revenue growth, net profit growth, return on net asset growth, reduction of debt/equity ratio, return on equity growth, and dividend growth Independent variables: - Family involvement in ownership (FIO) - Family involvement in management (FIM) Moderation variable: - Interaction effects between FIO and FIM | Quadratic relationships |

| Kowalewski et al. (2010) | Poland | Agency theory and RBV | Dependent variable: - Financial performance (ROE and ROA) Independent variables: - Family ownership - Family share (%) - Family voting rights (%) - Family CEO - Family chairman - Family owned companies cutoffs - Outside investors | |

| De Massis et al. (2013) | Italy | Agency theory | Dependent variable: - Firm performance: ROA Independent variable: - Family ownership - Family ownership dispersion Moderating variables: - Family ratio in the TMT | |

| Poutziouris et al. (2015) | United Kingdom | Agency and stewardship theories | Dependent variable: - Firm performance: accounting ratios and Tobin's q Inependent variables: - Family firm - Young/old family - Family board representation - Founder as the controlling shareholder - Duality (CEO is also the Chairman) - Family executive (CEO) - Family/non-family succession - Family ownership (%) Moderating variables: - The role of a family CEO at the helm, family board representation - The role of duality where the family CEO is also the Chairperson | |

| Block 2. Specific characteristics of family business affecting its performance | ||||

| Anderson and Reeb (2003) | United States | Agency theory and economic approach | Dependent variable: - Firm performance: ROA and Tobin's q Independent variables: - Family firm - Family ownership - CEO: founders, founder descendants or hired (outsiders) | Positive effects |

| Westhead and Howorth (2006) | United Kingdom | Stewardship and agency theories | (See first block of the table) | |

| Maury (2006) | Western Europe | Agency theory | Dependent variable: - Firm performance: ROA and Tobin's q Independent variables: - The largest controlling shareholder holding at least 10% of the voting rights is a family, an individual, or an unlisted firm - The family controlling shareholder is an unlisted firm - The largest controlling shareholder is an identified family or individual - The controlling shareholder is a family or an individual who holds the CEO, Honorary Chairman, Chairman, or Vice Chairman position - Widely held dummy - Ownership (measures the proportion of cash-flow rights held by the largest shareholder) - Control minus ownership (difference between the control rights and the cash-flow rights held by the largest shareholder) - Multiple blockholders - Antidirector rights | |

| Lee (2006) | United States | Agency theory | Dependent variable: - Firm performance: employment, revenue growth, gross income (before taxes) growth, and net profit margin Independent variables: - Family ownership - Family management | |

| Barontini and Caprio (2006) | Continental Europe | Agency theory | Dependent variable: - Firm performance: Tobin's q and ROA Independent variables: - Family firm - Ownership concentration - Family control Moderating variables - Family CEO vs Family non-executive-directors - Founders vs descendants | |

| Sraer and Thesmar (2007) | France | Economic approach | Dependent variable: - Firm performance: ROA, ROE, market to book, dividend to profit Independent variables: - Family firm - Founder-controlled - Heir-controlled - Professionally managed | |

| Audretsch et al. (2013) | German | Agency theory | Dependent variable: - Financial performance: profit per employee and return on investment Independent variables: - Family monitoring - Family ownership - Family management | |

| Barth et al. (2005) | Norway | Agency theory | Dependent variable: - Productivity: added value Independent variables: - Family firm - Family ownership - Family management | Negative effects |

| Silva and Majluf (2008) | Chile | Agency theory and institutional theory | Dependent variable: - Performance: proxy of Tobin's q and ROA Independent variables: - Family affiliation - Family involvement - Firm external linkages Moderating variables: - Ownership concentration | |

| Villalonga and Amit (2006) | United States | Agency theory | Dependent variable: - Firm performance: Tobin's q Independent variables: - Family firm - Family ownership - Family ownership stake - Control-enhancing mechanisms - Family excess vote holdings - Presence of a family CEO | |

| Schulze et al. (2003) | United States | Agency theory and household economics and altruism literatures | (See first block of the table) | |

| Pérez-González (2006) | United States | Agency theory | Dependent variable: - Firm performance: operating return on assets, net income to assets, and market-to-book ratios Independent variables: - Management: family successions vs unrelated successions Moderating variables: - CEO Selective college vs - CEO less selective college | |

| Bloom and Van Reenen (2007) | United States, France, Germany and the United Kingdom | Agency theory | Dependent variable: - Firms’ management scores Independent variables: - Family largest shareholder - Family largest shareholder and family CEO - Family largest shareholder, family CEO, and primogeniture | |

| Gomez-Mejia et al. (2001) | Spain | Agency theory | Dependent variable: - Firm performance: volume of circulation (performance trend and performance changes) - Business risk - Length of survival Independent variable: - Family status - Relational agency contract - Executive tenure - CEO succession Moderating variables - Executive Level: CEO's vs Editors | |

| Chrisman et al. (2004) | United States | Agency theory | (See first block of the table) | |

| Miller et al. (2007) | United States | Agency and stewardship theories | (See first block of the table) | |

| Zahra (2005) | United States | Agency theory | Dependent variable: - Entrepreneurial risk taking: use of domestic alliances, use of alliances in foreign markets, entering new domestic markets, entering new foreign markets, Investment in emerging radical technologies, fadical product innovation and introduction Independent variables: - CEO is also the founder - CEO tenure - Family ownership - Number of family generations | |

| Naldi et al. (2007) | Sweden | Agency theory and entrepreneurship | Dependent variable: - Firm performance: self-assessment Independent variables: - Entrepreneurial orientation - Innovativeness - Proactiveness - Risk taking | |

| Kellermanns et al. (2008) | United States | Entrepreneurship | Dependent variable - Employment growth: measured via a subjective self-reported assessment Independent variables: - Entrepreneurial behaviour (mediating variable) - Tenure - Age - Number of generations currently working in the family firm. | |

| Casillas et al. (2010) | Spain | Configurational approach and RBV | Dependent variable - Firm growth: percentage of growth in sales over a 4-year period Independent variables: - Entrepreneurial orientation Moderating variables: - Environment (dynamic and hostile) - Generational involvement | |

| Cruz and Nordqvist (2012) | Spain | Agency theory and entrepreneurship | Dependent variable: - Entrepreneurial orientation: Proactiveness, Risk taking and Innovativeness Independent variables: - Environment dynamism - Technological opportunities - Industry Growth - Non-family managers - Non-family investors Moderating variables: - Generation in Control of the Family Firm | |

| Craig and Moores (2006) | Australia | Contingency theory | Dependent variable: - Innovation Independent variables: - Perceived environmental uncertainty - Technoeconomic uncertainty - Competition and constraints - Scope of information - Timeliness of information - Centralization - Formalisation - Age | |

| O’Boyle et al. (2012) | Several countries | Agency theory | Dependent variable: - Firm performance Independent variable: - Family involvement Moderating variables: - Conceptual moderators: public vs private, firm size and cultural context - Methodological moderators: family involvement, firm performance, publication and publication quality and year of publication | Other effects |

| Garcia-Castro and Aguilera (2014) | Several countries | Contingency theory | Dependent variable: - Firm performance: ROE Independent variables: - Family ownership - Family board - Family Chairman - Family CEO - Succession | |

| Craig et al. (2014) | United States | RBV | Dependent variable: - Firm performance: sales growth, market share growth and return on sales Independent variables: - Family influence - Family business culture (mediating variable) - Flexible planning systems (mediating variable) - Firm innovativeness (mediating variable) | |

| Naldi et al. (2015) | Sweden | Agency and stewardship theories | Dependent variable: - Firm performance (ROA) Independent variables: - Family member advisors Moderating variables: - Generation in control | |

Although there are few studies dealing with the analysis of FB in the area of tourism (Andersson et al., 2002; Getz & Carlsen, 2005), investigating it in this context is particularly relevant, and possibly even more so in the case of Spain. The Spanish tourism sector has traditionally been dominated by this type of business. Despite the fact that the growth experienced by this sector has led to the appearance of businesses and chains without family links, family-owned individual establishments and chains continue to be very important, and they are a key element in all segments of the Spanish tourism market. This fact contrasts with the situation at international level, where the big corporate chains are becoming increasingly important.

The tourism sector offers great opportunities for FB; for example, the fact that a tourism FB incorporates host-guest interaction can generate unique customer experiences and satisfaction (Andersson et al., 2002; Getz & Carlsen, 2005). In this way, families can form part of the tourism experience (Wanhill, 1997, 2000), increasing the value of this service. Equally, the connection between tourism activity and free time, specific lifestyles or the fact that a location is desirable for a person can lead to a family establishing a tourism business (Ateljevic & Doorne, 2000; Getz & Carlsen, 2000).

Despite the considerable importance of FB in the tourism sector, the literature on the topic is scarce if compared with studies in other industries (Getz & Carlsen, 2000; Chrisman et al., 2008). It must also be recognised that the bulk of this literature on tourism FB is not exclusively based on research into issues related to family businesses as such, but rather as a secondary element associated with small businesses (Getz, Carlsen, & Morrison, 2004). This small size of tourism FB is noted as one of the factors explaining the lack of studies related to economic performance and business growth. In addition, empirical research on tourism FB seems to focus on analysing the business owners’ characteristics and attitudes (Andersson et al., 2002; Getz & Carlsen, 2000; Getz & Peterson, 2005), managerial strategies (Craig & Lindsay, 2002), and other non-economic objectives of the owners more related to lifestyle, socioeconomic wealth and diversification in other businesses (Getz & Carlsen, 2000; Getz & Peterson, 2005) as well as location and legacy goals (Andersson et al., 2002).

According to Getz et al. (2004) these differences between research on the tourism sector and other economic sectors is explained above all by the lack of entry barriers preventing new entrepreneurs and business people with little business preparation or training investing in the tourism sector (Getz et al., 2004). The small size of certain tourism businesses (cafes, bars, restaurants, etc.) implies low levels of capital and operating costs and the possibility of them being run by few people, which can encourage the creation of an FB (Getz & Carlsen, 2000). We can therefore consider that in tourism FB the business is more focused on the family than on economic objectives.

The concept of family businessesIt is difficult to define the term FB because, rather than a universally adopted definition, a wide variety of concepts and measurements have emerged in this respect (Miller et al., 2007). Sometimes, this conceptual disparity may be the result of the researcher's aims while on other occasions it may be caused by the restrictions of the empirical source used (e.g. Galve & Salas, 2003).

Some authors have tried to determine common characteristics of the different definitions of FB. Along these lines, Handler (1989) identified three dimensions: a family share in the ownership, the consideration of the family and the business as interdependent subsystems, and the family group's desire for continuity taking the form of generational transfer. Based on these three dimensions, Shanker and Astrachan (1996) proposed classifying FB in three levels representing increasing family involvement in the organisation. In this way, FB could be defined with a broad, intermediate or restrictive concept:

- -

Broad concept: considering only the “ownership structure” dimension. In this case, a business with the founder or his/her descendants holding majority ownership and controlling strategic decisions is understood to be an FB. This concept requires part of the share capital to be family capital and, in addition, a majority of the capital with voting rights must be in the hands of the family, so the members linked by family relationships have enough voting power to decide the organisation's strategy.

- -

Intermediate concept: in this case, firms simultaneously meeting two criteria are considered as FB: firstly, their majority ownership must be in the hands of the family, which means its members have the voting power to control strategic decisions (this requirement also defines the broad concept of FB). Secondly, the family owners must have a degree of direct participation in the implementation of the strategy and the running of the business, which requires at least one member of the family to belong to senior management.

- -

Restrictive concept: this considers that FB must meet the two above requirements while there must be different generations of the family coexisting within the organisation.

The three concepts have their own advantages and disadvantages, so it is difficult to choose between them. For example, the broad concept – the most open one – can fail to take into account other characteristic features of FB, as it is limited to a single dimension. Meanwhile, the intermediate concept is more restrictive, as it would exclude businesses that have opted to separate control of ownership from management control. Finally, unlike the restrictive concept, these two concepts – broad and intermediate – allow first-generation FB in their definition with the idea that a desire for continuity does not necessary require generational change.

The evaluation of FB has been developed based on the typology we have mentioned, constructed by Shanker and Astrachan (1996). Specifically, the measurement of FB adopted in this study for exploiting the results is based on the broad concept. Given the difficulty when it comes to adopting a clear criterion for conceptualising FB, some authors opt to leave it to the judgement of the person answering a questionnaire to decide whether or not the business is a family one (e.g. Dibrell & Moeller, 2011; Gallo, Tàpies, & Cappuyns, 2004; Neubaum, Dibrell, & Craig, 2012). This criterion is also used in studies on FB in tourism: specifically, Getz and Carlsen (2000) champion this method and use it in their study for its advantages because it is easy for the person answering the question to understand and so as not to impose a restrictive definition.

Despite the level of subjectivity inherent in this form of discriminating between FB and NFB, it seems reasonable that an affirmative response to the question whether the business is a family one implies that the family participates in the business either in a formal or informal way, which would, in most cases, correspond to the broad definition. This form of differentiation would include all businesses conducting themselves and behaving as FB. Along these lines, Chua, Chrisman, and Sharma (1999) maintain that it seems more reasonable to use inclusive definitions than exclusive ones. These authors believe it is quite unreasonable to use a definition that excludes a large number of FB when the businesses themselves insist, or a large group of academics believe, that they are FB. Recent studies like those by Sabah, Carsrud, and Kocak (2014), Basco and Voordeckers (2015) or López-Delgado and Diéguez-Soto (2015) also use broad concepts of FB, preferring less exclusive definitions.

Data and descriptive analysisSample and dataThe database consists of a total of 1019 tourism businesses, of which 748 are FB and 271 NFB. The data is obtained using the questionnaire technique, a tool regularly used in studies of competitiveness (Camisón, 1997, 2001), through personal interviews, subsequently completed with data from the SABI (Iberian Balance Sheet Analysis System) and INFORMA D&B databases.

The first questionnaire was designed in August 2009. This final questionnaire was subjected to a progressive perfection process to make it easier to understand and more effective in collecting the desired information, as well as shorter and quicker to apply. After four successive versions, the design of the questionnaire was finally completed at the end of October 2009. Meanwhile, before beginning the application of the final questionnaire to collect data, its design was pre-tested between five academics specialising in the fields of tourism and strategy. This pre-test took place in the first two weeks of November 2009. The resulting questionnaire was also administered to eight managers from businesses of different sizes and segments in the tourism sector and their comments and improvement proposals were considered in the final design of the questionnaire.

To avoid the risk of automatic, unconsidered answers, the order of the answers was varied so that, in some cases, the order of desirability was descending and in others ascending; control items were included where the sense of affirmation was contrary to the rest of the scale, and questions on the same topic were included in different formats and locations to check the reliability of the response.

Concerning the interviewees, it was considered that business owners and company chief executives or managing directors were the ideal people to answer the questionnaire. To correct the recognised problems suffered by questionnaires as a means of obtaining data and seeking to raise the response rate and the quality of the information, a set of recommended procedures for research with questionnaires was used, involving a modified version of Dillman's “total design method” (Dillman, 1978). This method has a long tradition in the field of strategy (Conant, Mokwa, & Varadarajan, 1990). The fieldwork continued from December 2009 to March 2010.

The sample can be considered an acceptable reflection of the Spanish tourism sector at an overall level. Concerning the size, the sample design was distributed as follows: 62.71% microbusinesses (including 54.8% microbusinesses where there is at least one employee as well as the owner and another 7.9% forms of self-employment); 25.22% small businesses, 9.62% medium-sizes businesses and 2.45% large businesses. By the type of tourist activity carried out, 30.03% are accommodation businesses, 37.88% catering companies, 11% intermediary firms (travel agencies, tour operators, etc.), 3.93% transport organisations and 17.17% make up what is known as the complementary offer. As for geographical location, although the tourism offer is dispersed, it is distributed asymmetrically over Spanish territory, concentrated in the strongest tourism centres. Our sample has considered the following zones around which the largest tourism offer is concentrated. In terms of importance, our database is divided as follows: Balearic Islands (19.63%), Canary Islands (19.33%), Andalusia (19.23%), Catalonia (16.58%), the Valencian Community (10.30%), Madrid (8.15%) and the other regions (6.78%).

Variables and measuresThe objective indicators of results used can come either from the business itself or from two secondary sources: The SABI (Iberian Balance Sheet Analysis System) and INFORMA D&B. As not all businesses deposit their annual accounts with the Companies Register and a certain number of others did not agree to provide precise data directly, the economic-financial analysis of Spanish tourism businesses with objective data from external sources developed in this study refers to a sample of 738 businesses (from an initial sample of 1019 organisations). Of these 738 businesses, 73.44% are FB, while 26.56% are NFB.

The profitability study is carried out based on a comparative analysis of the average FB and NFB, both weighted by relative size. This comparative analysis is executed at different times to find out how the businesses represented develop over time. For this end, the years 1998, 2001, 2004, 2007 and 2008 have been chosen as cut-off points.

A second analysis of the economic-financial indicators is drawn up based on individual data from FB and NFB from the sample intended to reveal the statistically significant differences in the selected variables between the two groups. Specifically, the differences in the gross profit per service unit, economic performance, financial performance and return on sales (see Table 3) between both types of firm will be analysed. These indicators gathered in Table 3 are the ones derived from the primary study using the questionnaire technique. The expost analysis of competitiveness is completed, in this way, with indicators based on self-assessment by management in relation to competitiveness captured through the same primary study. Self-assessment based on management perception is a common procedure in strategic research. Although this procedure is not without its risks, including the overestimation by management of their action and the position of the organisation they run, so we might consider this data as an upper limit possibly above the actual figures (De Vries, 1987; Jackall, 1988), the literature has empirically shown the convergence of objective and subjective measurements both on aspects of organisational performance and concerning other internal and external business variables.

ResultsReturn on capital indicatorsReturn on capital or investment is often the indicator used to assess the efficiency of the management of a business. As a first approach, it can be defined as the relationship (normally expressed as a percentage) between the company's profits and the corresponding investment or capital invested.

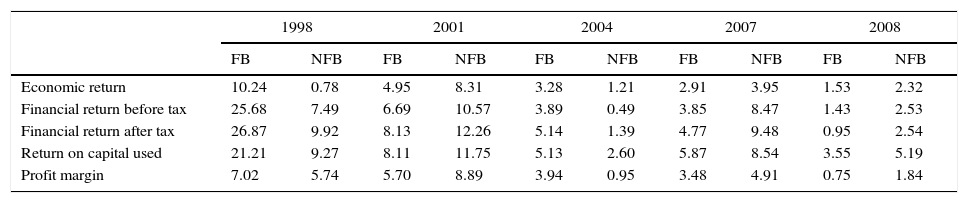

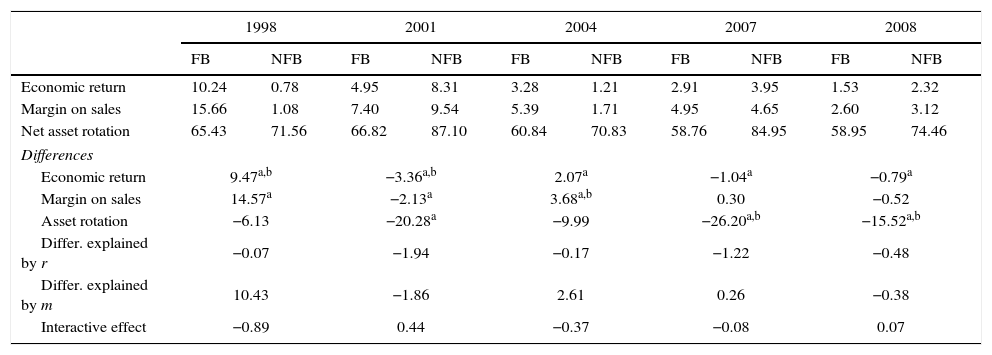

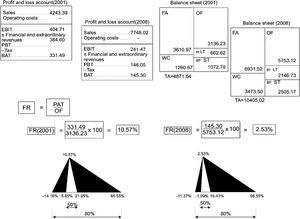

Table 2 includes the values of some of the most common indicators of return on capital, applied to the empirical study. As can be seen, the return on capital from FB is significantly higher in all ratios calculated in 1998 and 2004, while in 2001 and between 2004 and 2008, NFB outperform them in all these indices. The differences are not related to the point in the economic cycle or the magnitude of the ratios. Although the comparison in the two most recent years seems to point firmly towards better economic-financial performance by NFB, showing greater competitiveness, the variability of the results means it is advisable to interpret them prudently, developing a deeper analysis of their development and the factors that determine it.

Development of return on capital (%) in family and non-family tourism businesses (1998–2008).

| 1998 | 2001 | 2004 | 2007 | 2008 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| FB | NFB | FB | NFB | FB | NFB | FB | NFB | FB | NFB | |

| Economic return | 10.24 | 0.78 | 4.95 | 8.31 | 3.28 | 1.21 | 2.91 | 3.95 | 1.53 | 2.32 |

| Financial return before tax | 25.68 | 7.49 | 6.69 | 10.57 | 3.89 | 0.49 | 3.85 | 8.47 | 1.43 | 2.53 |

| Financial return after tax | 26.87 | 9.92 | 8.13 | 12.26 | 5.14 | 1.39 | 4.77 | 9.48 | 0.95 | 2.54 |

| Return on capital used | 21.21 | 9.27 | 8.11 | 11.75 | 5.13 | 2.60 | 5.87 | 8.54 | 3.55 | 5.19 |

| Profit margin | 7.02 | 5.74 | 5.70 | 8.89 | 3.94 | 0.95 | 3.48 | 4.91 | 0.75 | 1.84 |

Economic return=EBIT/TA.

Financial return=ordinary profit/pre-tax loss/own funds.

Financial return after tax=ordinary profit/loss after tax/own funds.

Return on capital used=(Ordinary profit/pre-tax loss/+financial costs)/(own funds+fixed assets).

Profit margin=ordinary profit/loss before tax/operating revenues.

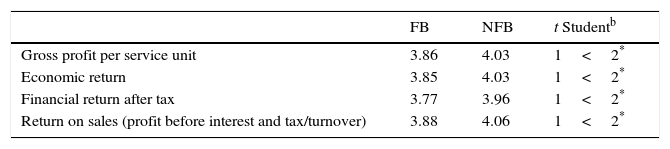

The assessment of economic-financial performance from the perspective of management self-assessment confirms the conclusions already anticipated based on the analysis of objective data. The gross profit per service unit and return on turnover, as well as return on (economic and financial) capital, are significantly better in NFB (Table 3).

Economic-financial performance of Spanish tourism businesses: family vs non-family businesses – a comparative analysis.a

| FB | NFB | t Studentb | |

|---|---|---|---|

| Gross profit per service unit | 3.86 | 4.03 | 1<2* |

| Economic return | 3.85 | 4.03 | 1<2* |

| Financial return after tax | 3.77 | 3.96 | 1<2* |

| Return on sales (profit before interest and tax/turnover) | 3.88 | 4.06 | 1<2* |

Evaluation of average performance of the business in the last three years compared to the average for its competitors, considering a 1–7 strength scale, where 1 is much worse and 7 much better and depending on the perception and information the person surveyed has available.

Despite this variety of indicators, the two most commonly used indices for discovering operational efficiency are economic return and financial return. The two indices are necessary because they complement the information on different facets of the business: while economic return reflects the operational efficiency of the business as a whole, financial return evaluates how it is translated into profits for shareholders.

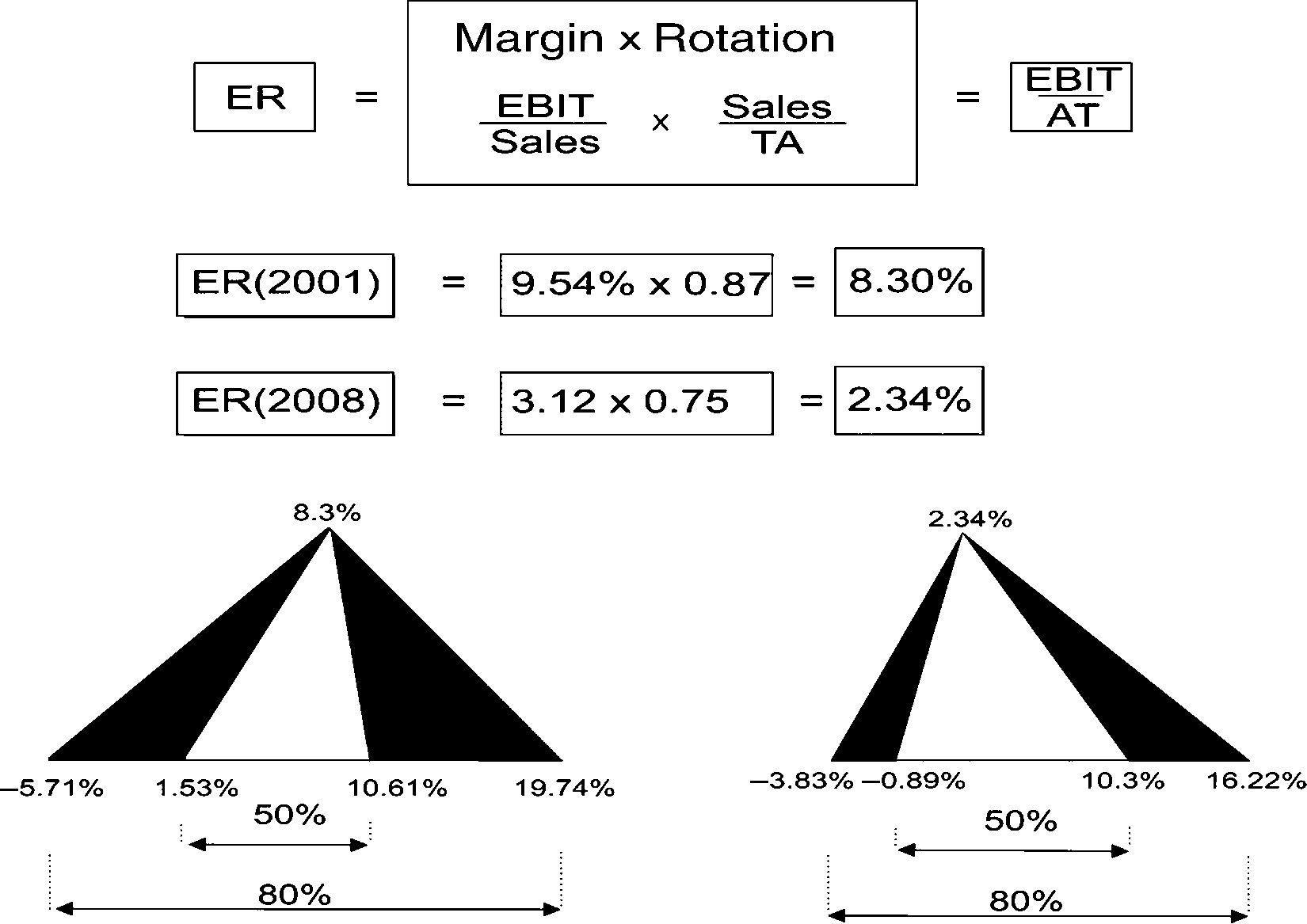

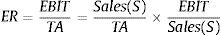

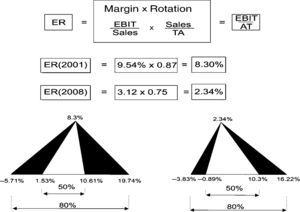

Economic returnEconomic return (ER) is that generated by the business using its financial resources on productive assets, regardless of its financial structure. Economic return comes from a quotient between the profit generated by the business and the investment committed to it. Broken down it can be expressed as follows:

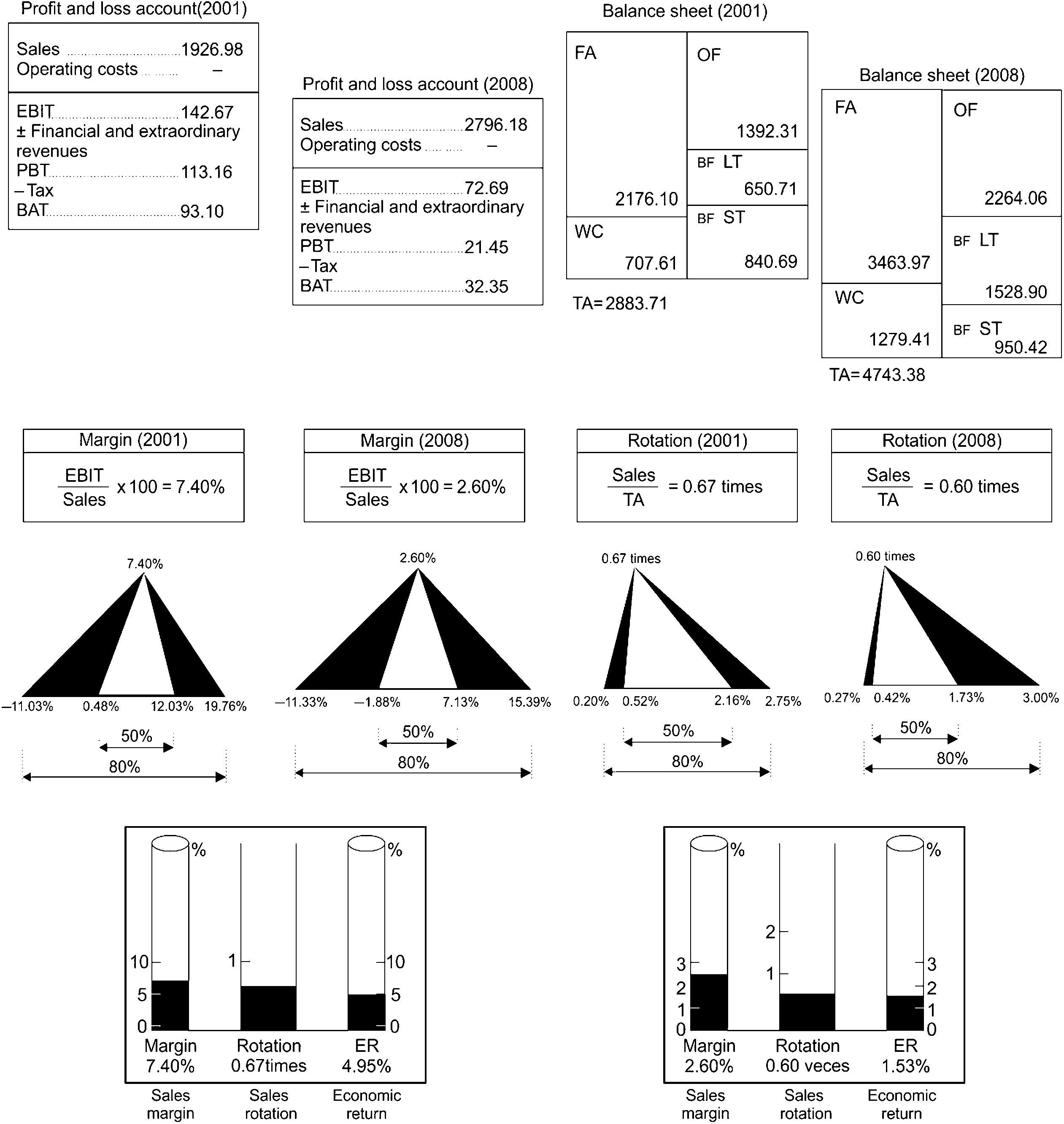

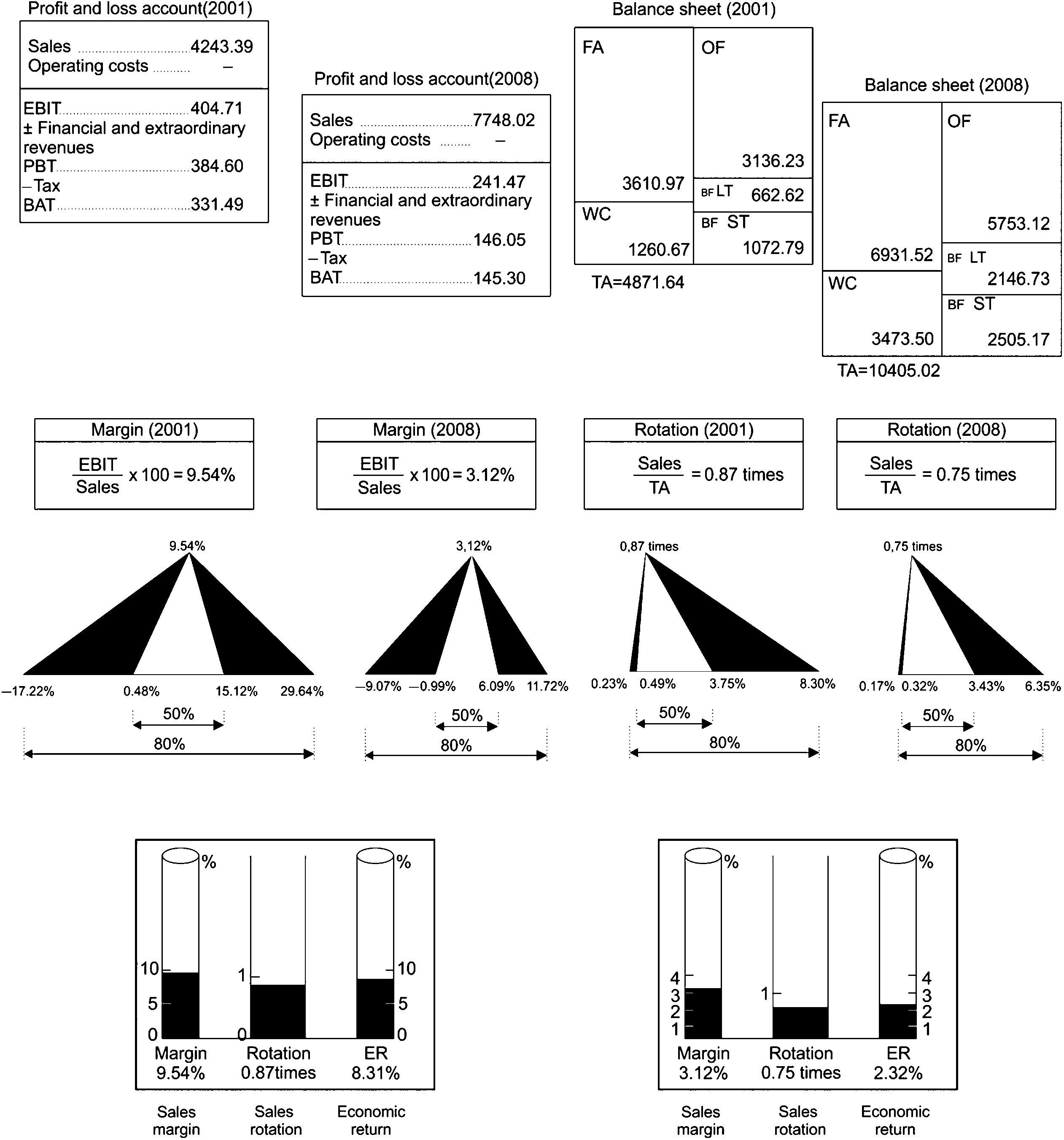

The first conclusion (Table 4) is that, during the first decade of this century (with a few interruptions) significant differences appear in economic return between FB and NFB, destroying the solid advantage that FB seemed to have at the end of the nineties. In any case, the trend of this indicator is generally downward and with fluctuations; this points to a deterioration in the capacity of both groups to transform resources profitably. Although the economic cycle has had much greater effects on the FB group, leaving its economic return at 1.5%, while NFB exceed this by more than half (2.3%), both are small percentages that are below the risk-free rate for Europe.

Development of economic return (%) in family and non-family tourism businesses (1998–2008).

| 1998 | 2001 | 2004 | 2007 | 2008 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| FB | NFB | FB | NFB | FB | NFB | FB | NFB | FB | NFB | |

| Economic return | 10.24 | 0.78 | 4.95 | 8.31 | 3.28 | 1.21 | 2.91 | 3.95 | 1.53 | 2.32 |

| Margin on sales | 15.66 | 1.08 | 7.40 | 9.54 | 5.39 | 1.71 | 4.95 | 4.65 | 2.60 | 3.12 |

| Net asset rotation | 65.43 | 71.56 | 66.82 | 87.10 | 60.84 | 70.83 | 58.76 | 84.95 | 58.95 | 74.46 |

| Differences | ||||||||||

| Economic return | 9.47a,b | −3.36a,b | 2.07a | −1.04a | −0.79a | |||||

| Margin on sales | 14.57a | −2.13a | 3.68a,b | 0.30 | −0.52 | |||||

| Asset rotation | −6.13 | −20.28a | −9.99 | −26.20a,b | −15.52a,b | |||||

| Differ. explained by r | −0.07 | −1.94 | −0.17 | −1.22 | −0.48 | |||||

| Differ. explained by m | 10.43 | −1.86 | 2.61 | 0.26 | −0.38 | |||||

| Interactive effect | −0.89 | 0.44 | −0.37 | −0.08 | 0.07 | |||||

p≤0.05.

The comparison of the economic results of FB and NFB results not only gives information about the value of the economic return but also the origin of the differences and whether they lie in dissimilarities in margin or rotation. In expressing the calculation of economic return, the first factor of the product is sales rotation and the second return on sales. Economic return is therefore determined by two indirect effects: the rotation effect r and the margin effect m. Asset rotation is a measure of the productivity of capital – effectiveness in the use of assets determining the revenues obtained for each monetary unit of investment. Margin is a valuation of organisational and technological efficiency determining costs and, consequently, return on sales: the profit achieved per monetary unit sold.

The analytical breakdown of the components of economic return, for which precise information is provided in Table 4, sheds more light on the causes of these differences. This judgement cannot be homogenised for the whole period studied, because the records show an unequal development of these components within the FB group during this time. In the first year of the cycle, the FB generated a margin on sales significantly greater than the NFB (14.6 points difference), which, combined with an asset turnover 6 points lower, is translated into a notably higher economic return (10.24% compared to 0.78%). This situation changes for the rest of the decade under study. The FB maintained their advantage on margin, with ups and downs, although the distance was notably reduced due to their falling margin, as it did not exceed 7.4% again, ending at 2.6% in 2008. However, this greater margin is not now translated into better economic return because the asset rotation for NFB becomes quite high (with the distance ranging between 10 and 26 points), more than compensating for the disadvantage in margin. The internationalisation of more activities leads to a growth of investment in fixed assets, the denominator of the rotation ratio, which explains the lower productivity of the FB's capital. It must also be noted that in 2008 the margin on sales for FB remains below that for NFB, a scenario not seen since the beginning of the century reflecting the considerable punishment inflicted by the change in economic situation on the first group's profit and loss accounts.

The importance of the differences in margin and rotation is also explained in Table 4, where the figure achieved for economic return for FB is expressed with the same asset rotation as for NFB, preserving the advantage in margin (difference explained by r), along with the difference between the economic return of FB and that of NFB if the former had the margin of the latter and the rotation level was maintained (difference explained by m). We can see that, instead, FB's lower economic return obeys the difference in productivity of capital; even in the years (1998 and 2004) when FB's economic return is greater, this is due exclusively to the margin and capital rotation partially cutting this advantage.

Economic return is affected by the capital intensity required by the business (Cuervo, 1993, p. 366). Businesses requiring great investment taking a long time to mature (normally classed as capital-intensive activities) generally show low rotation and big margins. Because of this, their strategy usually focuses on margin. Automation slows the rotation speed of the available capital. As technical progress increases the productivity of work by replacing labour with capital, the need for capital expands, with two consequent effects: an increase in fixed costs damaging elasticity in the cost structure and higher growth in the overall value of the balance sheet in the expansion capacity of sales. On the other hand, businesses positioned in non-capital-intensive activities – strongly competitive and with low margins – usually focus their strategy on rotation. The nature of the competitive strategy is equally reflected in the economic return curve in the sense that businesses with cost leadership strategies show low margin and high rotation, while businesses with differentiation strategies maintain themselves by increasing margin and improving their return (Cuervo, 1993, p. 366).

Therefore, this analysis of the determinants of economic return suggests that the FB in the Spanish tourism sector are more orientated towards differentiation strategies and the NFB towards minimum cost strategies. However, the average FB in the tourism sector does not appear to be close to any of these models because of its lack of relief in the two aspects. The sustainability of a differentiation strategy in FB is questionable due to their low margin on sales, which also shows a downward trend. The low return on sales shows that tourism FB have little market power and do not translate their desire for differentiation into imposing high prices on their customers. Nor does the productivity of FB's capital induce much optimism. Spanish tourism FB currently have an average investment of almost double their turnover. By contrast, NFB appear better positioned to exploit cost advantages with high rotation, although they also surpass FB for year-on-year average margin, so their differential potential cannot be ignored.

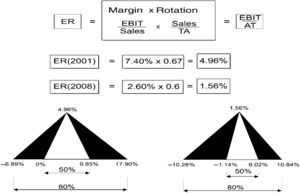

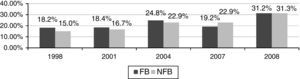

Figs. 1 and 2 make it possible to analyse the homogeneity of both groups around the average value of the factors driving economic return based on the dispersion limits that include 50% and 80% of businesses.

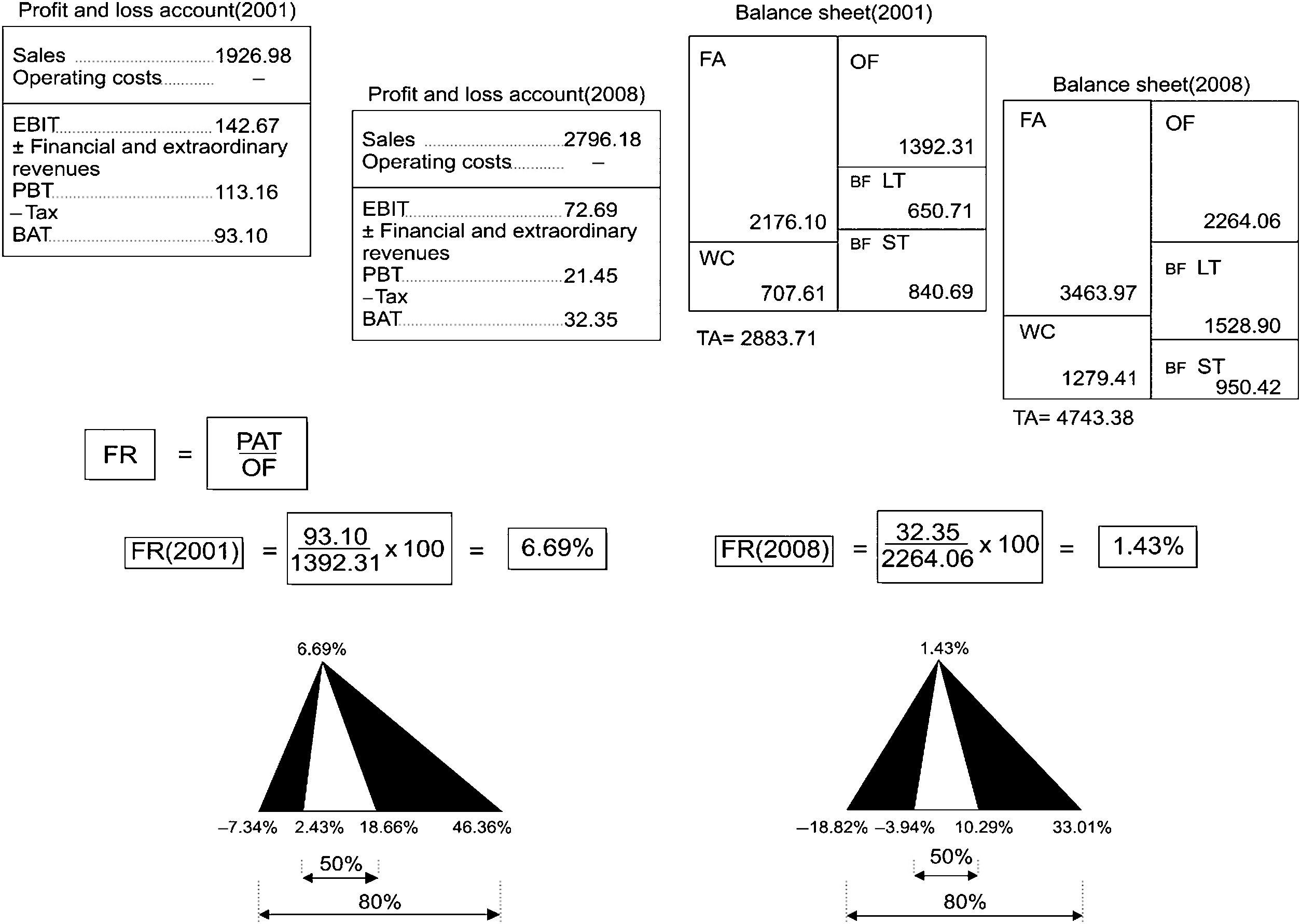

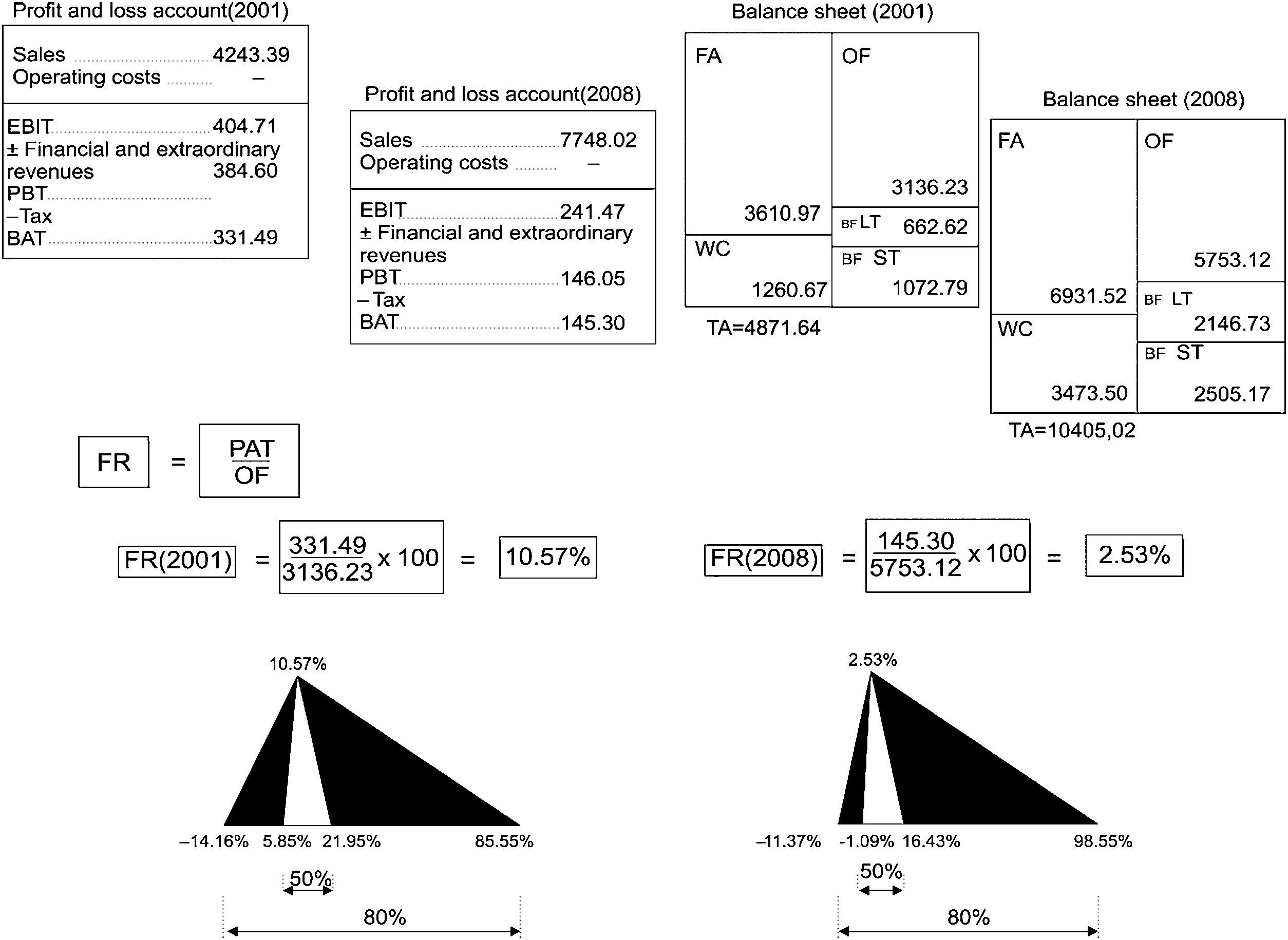

Concerning FB, Fig. 1 indicates that the worsening of margin has been accompanied by a significant reduction in dispersion and the lowering of its limits. While in 2001 50% of FB had an economic return ranging between 0.48% and 12.03% (a difference of 12.51 points), in 2008 the range narrowed to 9 points (ranging between −1.88% and 7.13%); for 80%, the contraction is less notable (4 points) and occurs due to the reduction in businesses with higher economic return. Rotation underwent fewer changes in its dispersion, with a consistent slight reduction in the index.

NFB show more varied behaviour (Fig. 2). The dispersion limits at 50% have narrowed from a distance of 15.6 points in 2001 (0.5–15.1%) to 7.1 points in 2008, with the contraction greater due to the upper limit falling from 15.1% to 6.1%. If we focus on the 80% limits, the narrowing is even stronger (26 points), although in this case the variation is reduced at both extremes. Concerning rotation, as with the FB, the lower reduction has also meant that less dispersion is lost. While 80% of NFB lay in a band of 8.5 points in 2001 (0.23/8.30), in 2008 the range was reduced to 6.5 points (0.17/6.35), particularly because of the fall in cases with high rotation. At the moment, an approximate practical rule for Spanish tourism businesses wishing to have a reasonably profitable position in the sector would consist of achieving a margin on sales of 3.5–10.4% combined with an asset rotation between 1.9 and 3.3. These limits have been fixed based on the central values of the dispersion bands at 50% and 80% of both components.

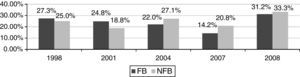

Although the variation band for margins on sales and asset rotation has narrowed, it is wide enough to show heterogeneous strategic behaviour between FB and NFB, although the thrust during the period under study has been towards greater homogeneity. In fact, if we look at the dispersion of economic return (Figs. 3 and 4), we see that the range of variation has hardly changed: 50% of FB lie between zero and 9.85%, a band narrowing slightly from −1.1% to 6% in 2008; as for NFB, half the group has remained in a band of 11–12 points (between −1% and 11%). If we look at the dispersion of 80% of the family and non-family offer, the band is wider, as might be expected, and has narrowed slightly (from 24 to 20 points, approximately).

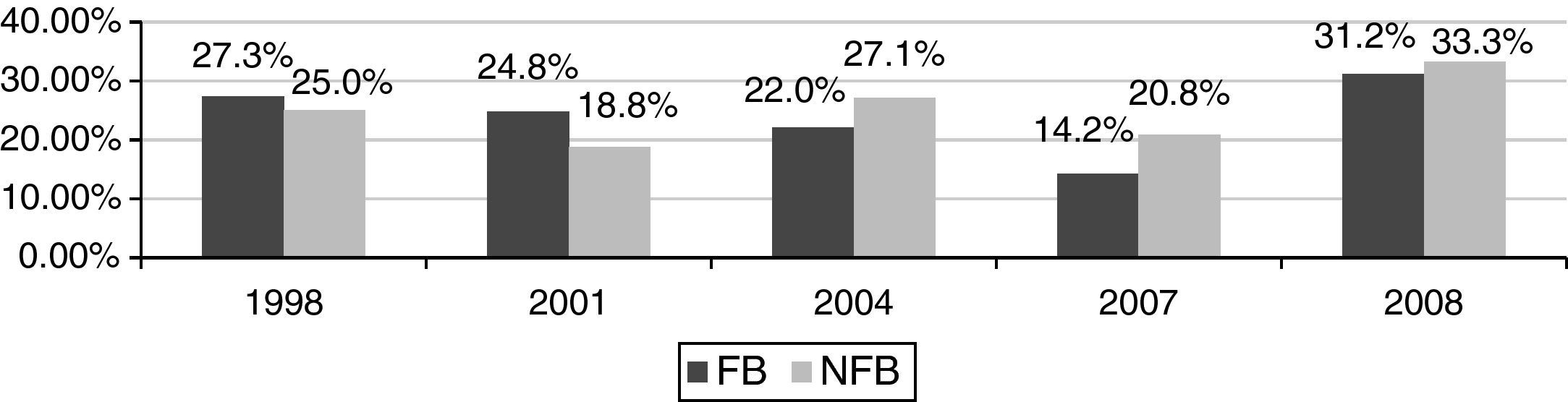

Although only slight, the contracting trend in the dispersion range, accompanied by the reduction in its maximum and minimum limits, is a sign of the worsening of economic return during the period analysed. The fact that the percentage of businesses with negative economic return has risen from 24.8% to 31.2% in FB and 18.8% to 33.3% in NFB between 2001 and 2008, strongly increasing in the last financial year after a decade of reduction, points to the same conclusion. The difference in the relative size of this group of firms with such low operating efficiency between FB and NFB is not relevant (Fig. 5).

We can say, then, that a return on total assets above 10.8% is excellent for FB, while NFB should aspire to exceed 16.2%. At a more modest level, the minimum acceptable level of achievement in this dimension of performance for each of these two groups should move above 3.6% in FB and 5.6% in NFB. These limits have been fixed based on the central values of the dispersion band at 50%.

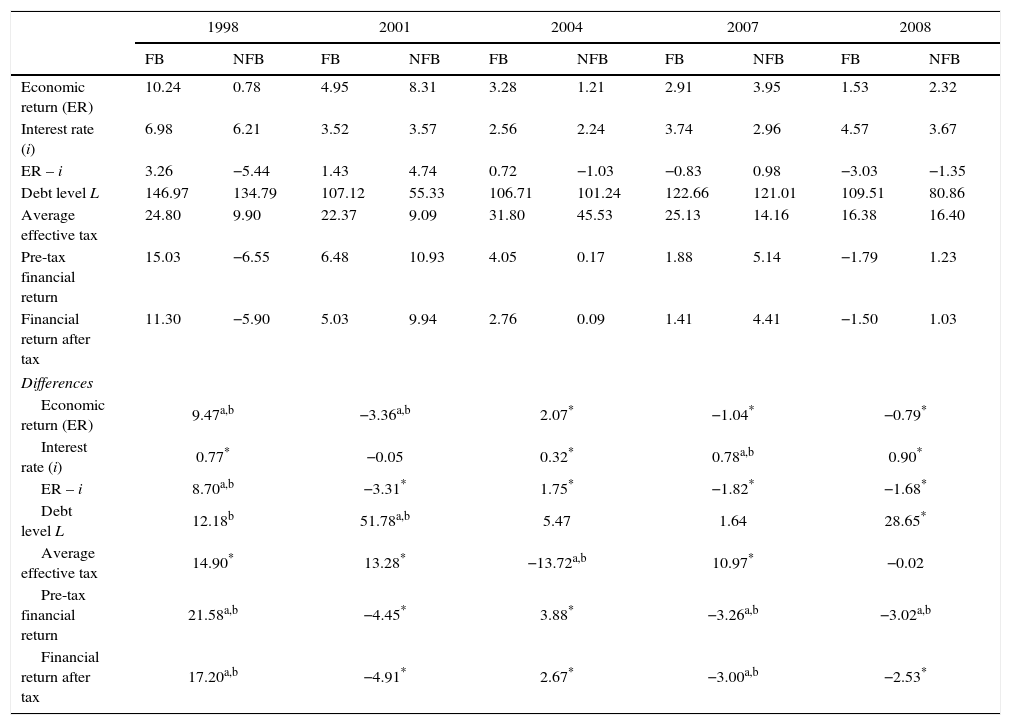

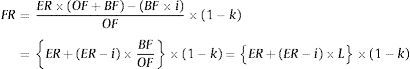

Financial returnThe financial or own funds return (FR) is obtained as the quotient between the ordinary profit or loss after tax and own funds. Financial return, then, relates the return the business obtains to its financial structure, a measure which, like economic return, is translated into profits for shareholders.

As there is a positive relationship between financial return and share price, which makes it possible to consider this (maximisation of the market value of shares) as the first indicator of the business's objective, changes in it should be watched carefully.

Financial return is influenced by the business's level of leverage (L), which is measured by the quotient between borrowed funds with cost (BF) and own funds (OF).

The pre-tax financial return for a business whose own funds amount to a sum OF, with borrowed funds (BF), whose average cost is i, and assuming an economic rate of return on assets of ER would be:

The leverage effect has two components: the leverage margin and the leverage factor. The leverage margin depends on value and the sign of the brackets (RE−i). The leverage factor is the product of the leverage margin and the debt level and determines whether the effect of the leverage margin on FR is strengthened or attenuated by multiplying it by the debt level.

The final shareholder return is limited by the fiscal effect, as it is reduced by the tax burden affecting the final profit for the financial year (k). So, financial return after tax would be:

Table 5 shows the values of the variables determining the financial return and the differences between FB and NFB. Although both groups have suffered periods when they have been incapable of making a profit on investment financed by debt, NFB have managed to maintain a positive financial return during the period under study except for the very beginning, while the FB have suffered the reverse process and their performance has worsened towards the end of the period, with negative financial return after tax of 1.5% compared to a positive 1.03% for NFB. However, incapability of making profits on investment financed with debt also negatively affects return on own funds, which has led to this problem persisting for FB over the last two years.

Development of financial return (%) in family and non-family tourism businesses (1998–2008).

| 1998 | 2001 | 2004 | 2007 | 2008 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| FB | NFB | FB | NFB | FB | NFB | FB | NFB | FB | NFB | |

| Economic return (ER) | 10.24 | 0.78 | 4.95 | 8.31 | 3.28 | 1.21 | 2.91 | 3.95 | 1.53 | 2.32 |

| Interest rate (i) | 6.98 | 6.21 | 3.52 | 3.57 | 2.56 | 2.24 | 3.74 | 2.96 | 4.57 | 3.67 |

| ER – i | 3.26 | −5.44 | 1.43 | 4.74 | 0.72 | −1.03 | −0.83 | 0.98 | −3.03 | −1.35 |

| Debt level L | 146.97 | 134.79 | 107.12 | 55.33 | 106.71 | 101.24 | 122.66 | 121.01 | 109.51 | 80.86 |

| Average effective tax | 24.80 | 9.90 | 22.37 | 9.09 | 31.80 | 45.53 | 25.13 | 14.16 | 16.38 | 16.40 |

| Pre-tax financial return | 15.03 | −6.55 | 6.48 | 10.93 | 4.05 | 0.17 | 1.88 | 5.14 | −1.79 | 1.23 |

| Financial return after tax | 11.30 | −5.90 | 5.03 | 9.94 | 2.76 | 0.09 | 1.41 | 4.41 | −1.50 | 1.03 |

| Differences | ||||||||||

| Economic return (ER) | 9.47a,b | −3.36a,b | 2.07* | −1.04* | −0.79* | |||||

| Interest rate (i) | 0.77* | −0.05 | 0.32* | 0.78a,b | 0.90* | |||||

| ER – i | 8.70a,b | −3.31* | 1.75* | −1.82* | −1.68* | |||||

| Debt level L | 12.18b | 51.78a,b | 5.47 | 1.64 | 28.65* | |||||

| Average effective tax | 14.90* | 13.28* | −13.72a,b | 10.97* | −0.02 | |||||

| Pre-tax financial return | 21.58a,b | −4.45* | 3.88* | −3.26a,b | −3.02a,b | |||||

| Financial return after tax | 17.20a,b | −4.91* | 2.67* | −3.00a,b | −2.53* | |||||

p≤0.05.

U Mann–Whitney.

Economic return (ER)=EBIT/total net assets.

Interest rate (i)=Financial costs/total debt with cost.

Debt level (L)=total debt with cost/own funds.

Effective average tax=Corporation tax/Ordinary pre-tax profit.

Pre-taxfinancialreturn=ER−(ER−i)×L.

Pre-taxfinancialreturn={(ER−i)×L}×(1−k).

Financial return for family or non-family Spanish tourism businesses has deteriorated still more notably than economic return. Three components have contributed to this unfavourable development. The first negative factor has been the fall in economic return itself. It has not been possible to compensate for the fall in this index with an appreciable reduction in the cost of debt. This has generated a constant reduction in the return achieved on financial investment with debt (above all in FB), making this negative. The third negative factor alludes to the dynamic of the financial leverage effect. In situations where the business manages achieving a greater return on its assets than the cost of its debt, it is positive to increase this leverage, because positive values increase financial return. But, in contexts like the one typifying Spanish tourism, businesses with a narrowing gap between economic return and the cost of debt, finally becoming negative, the multiplier effect is achieved by reducing the debt index in order to achieve a financial leverage effect of less than one. This appears to have been understood by NFB in 2008, while FB continued along the same lines.

Comparing FB with NFB, the figures indicate that the net return achieved by the owners of FB with investment financed with debt is notably lower than that reported for NFB (except for the initial situation and a slight turning point half way through the period). This disadvantage must be largely attributed to the economic return differential in favour of NFB, because the cost of debt does not show a great difference between the two. This negative effect is intensified by the greater level of debt among FB, which punishes pre-tax financial return; and by effective average taxation which, in general terms, is also greater, further expanding the differential in return on own funds after tax.

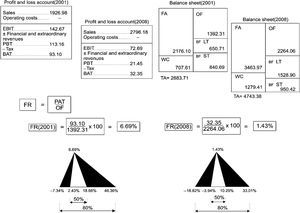

Figs. 6 and 7 illustrate the variation in financial return between 2001 and 2008. In them, a narrowing of the band grouping 50% of the businesses can be seen. The explanation of this, attenuating the dispersion shown in economic return, lies in the greater homogeneity of the sample concerning the cost of debt and the financial leverage effect.

A reduction of the group in the positive band can also be seen (Fig. 8). The percentage of FB with positive financial return has shrunk, from 81.6% to 68.8%. Among NFB, the quota of firms capable of achieving a return on own funds is significantly greater, although it has fallen from 83.3% to 68.7%. This percentage of businesses capable of achieving a return on own funds, which was greater than those with positive economic return, has ended up at the same level due to the punishment resulting from negative financial leverage.

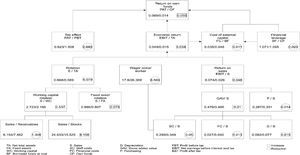

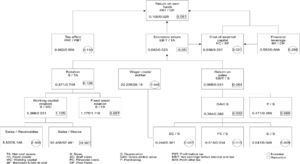

Determinants of the development of return on capital and productivityThe isolated analysis of economic return based on its two driving factors (margin and rotation) and productivity is not enough to discover the most deep-seated reasons for the changes in return and productivity on capital. Both factors are more deeply explained by a series of rotation and cost ratios based on more specific elements from the balance sheet and profit and loss account. Knowledge of these subsidiary ratios is important, so that management can identify sources for improving the effectiveness of the business, setting targets for each ratio, delegating responsibilities for achieving them and controlling the behaviour of the different functional areas under their supervision. In addition, based on simulation with alternative quantification for each area, it allows the calculation of the effect of the variation in any of the known ratios on the overall result, so the most effective decisions can be made.

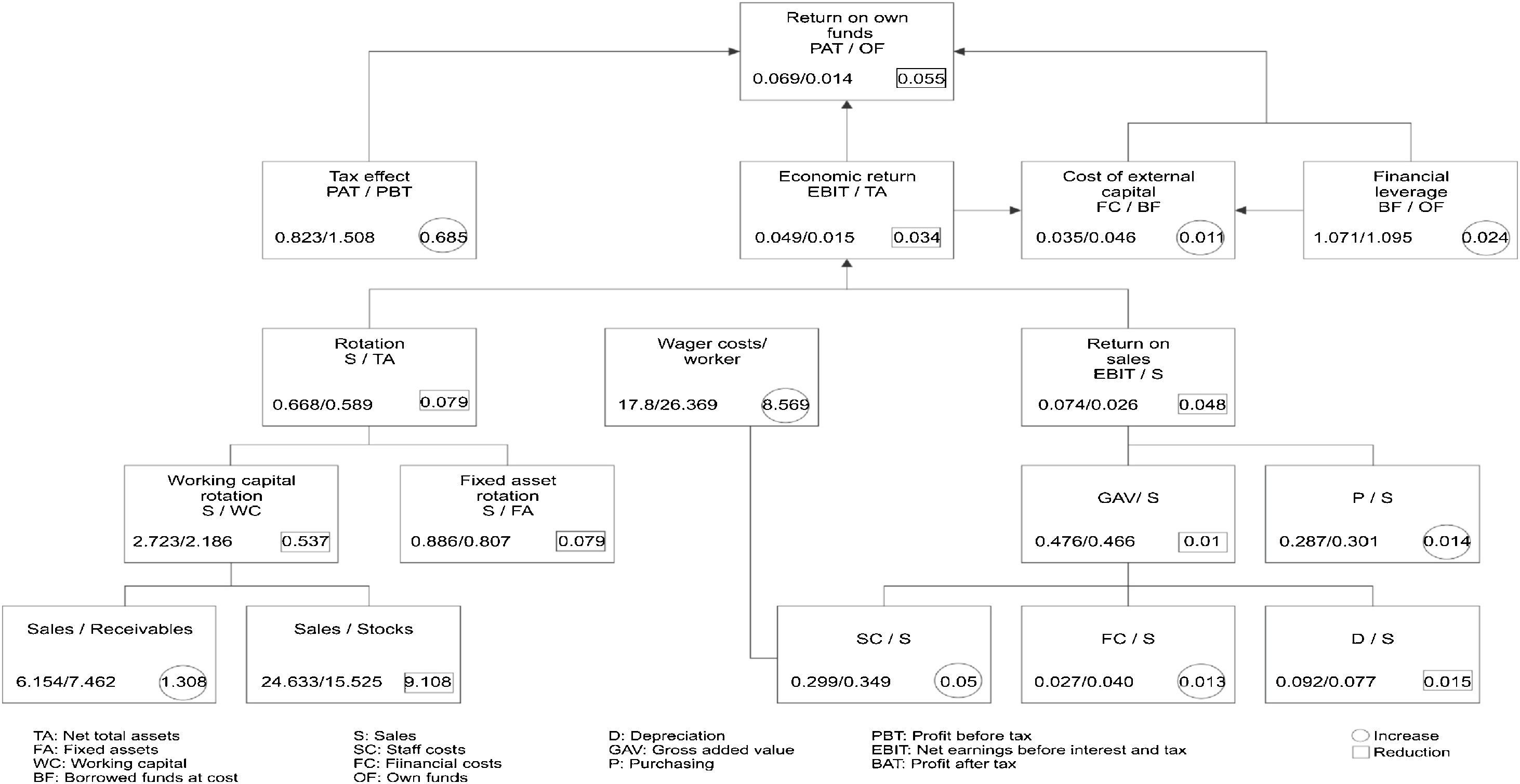

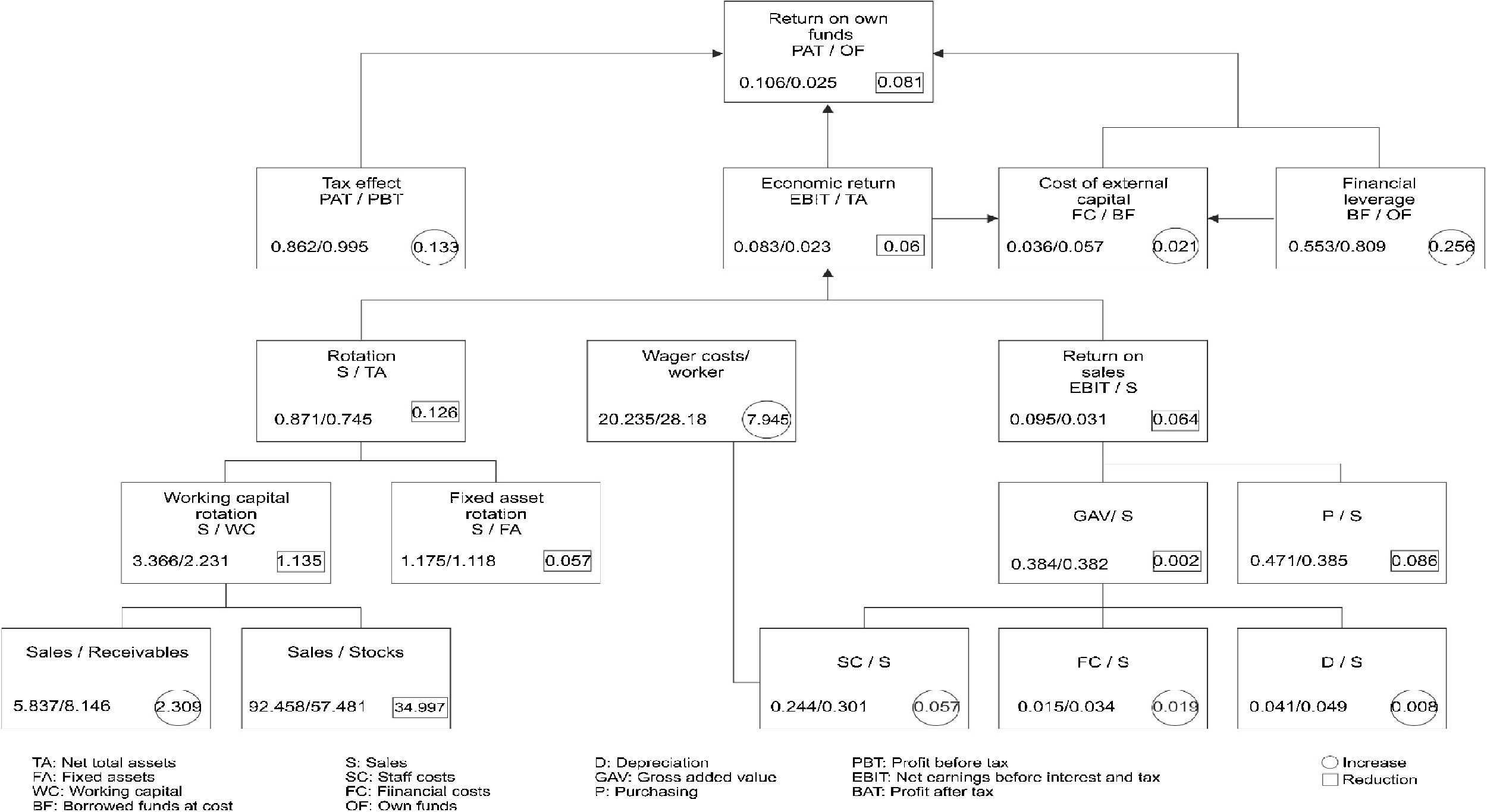

The most usual system for identifying and quantifying this set of operating factors is the pyramid structure for analysing return on capital, whether this is the Du Pont version with absolute figures or the ratio version first offered by Ingham and Harrington. Figs. 9 and 10 include the application of this analysis to the FB and NFB from the Spanish tourism sector.

The right-hand part of these diagrams identifies four main cost elements which together form total operating costs: materials (purchasing), staff, financial costs and depreciation. Each cost element is expressed as a percentage of sales. In FB, the total of the different cost items is 92.6% in 2003 and 97.4% in 2008, leaving margins on sales of 7.4% and 2.6% respectively. In the case of NFB, in the two years of reduction, the costs absorb 90.5% and 96.9%, leaving a margin on sales of 9.5% and 3.1% respectively.

This fall in return on sales has three sources in FB: an increase in material costs of 1.4 points, staff costs of 5.0 points and financial costs of 1.3 points. The expansion of staff costs is justified by the important increase in average annual cost per employee, which, between 2004 and 2008 increased by 8.6 points, moving from 17.8 to 26.4 thousands euros per worker. This increase in labour costs has not been compensated by an equivalent increase in labour productivity, which, in the period analysed, increased by only 4.75 points, remaining at 35.16 thousands euros per worker. This resulted in an increase in labour unit costs from 0.68 to 0.75. The increase in raw material costs has been lower, at 1.4 points, but it shows up a lack of progress in the improvement of the organisation and service provision. The third item contributing to increased costs is financial costs, driven up by the 2.4-point increase in financial leverage; a 1.1-point increase in the average cost of debt and the reduction in the rotation rate of working capital, together with the increase in working capital to be financed. The reduction in remunerated liabilities in favour of debt without explicit cost is unable to compensate for these. The only cost item halting the relative expansion is provision for depreciation, falling by 1.5 points from 9.2% to 7.7%.

The picture for NFB shows some significant differences explaining their greater return on sales, although it also undergoes a notable reduction. The first difference takes the form of the relative development of material costs, falling by 8.6 points to 38.5% of sales. It is interesting to highlight the fact that the cost for consumption of raw materials by NFB continues to be greater than that for FB by 8.4 points, but the trend of both groups is completely different and, as a result of this, the distance has reduced by 10 points in barely 5 years. This figure shows the improvement in technological efficiency and the organisation of working processes at NFB determining cost levels. This reduction originates in the technological renewal of the means of production, making it possible to achieve a saving in the labour factor and reduce material consumption based on better ways of working, cutting waste, defects and by-products. NFB have also suffered an increase in the other cost items included in Fig. 10, but their final efficiency continues to be greater. Staff costs have grown by a similar amount as at FB (5.7 points), but their share in sales is 4.8 points lower (30.1%), reflecting the slowdown in the expansion of the average annual cost per employee (less than 2 points). In the same way, financial costs grow by 1.9 points, but the amount relative to sales (3.4%) remains below FB.

The pyramid analysis developed in these diagrams shows that rotation in FB has fallen by 0.079 points to 0.59, significantly below the figure for NFB, which maintain a rate of 0.75 (after a fall of 0.126 points). The analysis of sales rotation points to the essential origin of the worsening of efficiency in production costs. The left-hand part of Figs. 9 and 10 locates four factors determining asset rotation: fixed assets, financial accounts, receivables and stocks.

A comparison of the development of these items between FB and NFB points to the same focuses, but with some differences. Working capital rotation has fallen by 0.54 points at FB during the period 2003–2008, leaving a ratio of 2.19. This rotation continues to be less than for NFB (2.23), although this group suffered a considerable reduction of 1.14 points, which must largely be attributed to the increase in the relative weight of stocks in assets (increasing from 12.56% to 15.04%, while in FB it has remained at around 10.5%). Despite this reduction in efficiency, NFB have maintained a clear advantage in management of working capital, above all through preserving very high stock rotation 57.48 times compared to just 15.53 at FB and more competent purchasing management translated into a sales/receivables ratio of 2.31 compared to 1.31 for FB. The overall effect, added to the improvement in management of payment collection from customers (for which NFB have an average period of 69 days compared to 144 for FB) must also have helped to halt the increase in financial costs for NFB, reducing the locking up of resources to be financed. In fact, the need for finance for the revolving fund continues to be approximately 5 points lower than for FB.