The aim of this paper is to study the possible change in the individual behaviour of the Spanish taxpayers about the willingness to declare capital gains, Lock-in effect, as a consequence of variations in the marginal rate. To do this, a two stages model is proposed to analyze which variables affect both the probability, and the amount, of capital gains declarations. The empirical analysis was performed using the Spanish annual personal income tax return sample from IEF-AEAT (Institute of Fiscal Studies and the Tax Department) for the periods 2006 and 2007, corresponding to the years before and after the reform that introduced a Dual Income Tax in Spain, with a flat tax rate for capital gains tax. The main results show that a 1% increase in the capital gains tax rate reduces the probability of declaring capital gains by around 7.51% (2006) and 8.19% (2007), and the amount of capital gains by around 3.91% (2006) and 5.79% (2007).

The well-known Lock-in effect on the realization of capital gains (Lock-in) is caused by the rate taxation on these incomes.1 Specifically, there is an inverse relationship between the marginal rate and the realization of capital gains, as shown in theory, taxpayers had a lower desire to realize such gains when the marginal rate payable on these gains was higher. Therefore, investors can temporarily paralyze the realization of capital gains in order to lower their tax bill, which can lead to welfare loss in three ways. Firstly, investors would not be able to carry out an adequate diversification of their investment portfolios as a result of the tax treatment given to each investment (Auerbach, 1988). Secondly, there is a decrease in potential in terms of State tax collection, as these gains are not realized and therefore do not give rise to taxation (Feldstein, Slemrod, & Yitzhaki, 1980). Thirdly, high marginal rates can cause a possible lock-in effect on the realization of future investments (Daunfeldt, Ulrika, & Niklas, 2010; Jacob, 2013; Meade, 1990).

In the last century, modern societies have shown a greater interest in financial markets, thereby increasing the percentage of individual shareholders and therefore promoting potential capital gains. This phenomenon has made the capital gains tax take on special relevance for investment, as well as for financial investment and planning decisions (Jacob, 2013).

Previous studies obtained a negative correlation between the realization of capital gains and the marginal rate applied to them, as economic theory shows, although the results have certain differences. On the one hand, they emphasize the analyzes conducted with cross-sectional data, in which the transitional effect of the behaviour of realization of capital gains is studied, whose results show a greater than one elasticity (Daunfeldt et al., 2010; Feldstein et al., 1980; Jacob, 2013; Minarik, 1981); while on the other hand, in studies based on time series data the permanent effect of taxation is estimated, achieving elasticity values between −0.1 and −0.9 (Auerbach, 1988; Ayers, Craig, & John, 2007; Burman & Randolph, 1994; Gillingham & Greenlees, 1992; Jones, 1989).

Furthermore, the personal income tax of Spanish individuals (hereinafter PIT) underwent a major reform in 2007, both in its structure and main elements. In particular, the reform by Law 35/2006 implements a dual tax rate, which represents an important quantitative change to taxation of capital gains. These have changed to a progressive tax rate if capital gains are generated in a period shorter than one year, and a proportional rate of 15%, for those gains generated in a period of time longer than one year; to a proportional rate of 18% regardless of the time taken to be generated. This change in taxation of such income causes a change in its effective rate, and therefore, it is expected to produce effects on the behaviour of taxpayers regarding their realization and amount. Therefore, we consider it appropriate to examine how taxpayers behave to changes in the marginal rate of capital gains caused by changing from a progressive rate and/or fixed rate to a fixed rate regardless of the time when those gains were generated, as a result of the application of the dual reform, both in its realization and quantification.

In addition, an important aspect of this study is the inclusion of micro-data of PIT for the years 2006 and 2007, prepared jointly with the State Agency for Tax Administration (AEAT) and the Institute of Fiscal Studies (IEF), which has the information in the tax return form made by the taxpayer; unlike most research done on the taxation of capital gains, which uses data at business or stock market level to study the possible lock-in effect of capital gains. The advantage of this database is that it allows us to obtain information on the capital gains declared by the taxpayer, as well as the marginal rate which would correspond to each fiscal year, in addition to relevant socio-economic information at individual level. Furthermore, the empirical estimation is performed using a two-stage model in order to avoid sample selection errors. To do so, in the first stage, the probability of obtaining capital gains depending on the marginal rate applied by each taxpayer is calculated and subsequently the factors that influence the amount of capital gains are analyzed, with special relevance on the marginal rate.

After this introduction, the main differences are described in the second section, in terms of taxation, which the implementation of the reform of 2007 on taxation of capital gains involves. Below, the model used in the empirical analysis is described. The fiscal micro-data are presented in the fourth section. The results are given in the fifth section, and finally, the work ends with the conclusions in the sixth section.

Taxation of capital gains in 2006 and 2007As mentioned in the introduction, the taxation of capital gains suffered a wide change in setting the tax rate applying to this type of income. Therefore, under current legislation for fiscal year 2006, Law 46/2002, it can be obtained that capital gains in a period shorter than one year (short-term capital gains), were taxed in the general tax base, together with other income (income from work, economic activities and returns on capital assets), by applying the appropriate progressive rate.2 By contrast, those gains which were generated in a period longer than one year (long-term capital gains) were taxed in the special tax base at a proportional rate of 15%.3 Therefore, this situation generated clear incentives to maintain capital gains for longer than a period of one year, thus benefiting from the proportional tax rate, since the corresponding progressive rate would in any case always be superior.

In addition, capital losses of a given year could be compensated with the gains of the same fiscal year and even with capital losses corresponding to the four previous years.4

However, the entry into force of Law 35/2006 implied the introduction of major changes in the structure of the Spanish PIT. More specifically, it is moving towards the structure of dual models, establishing two distinct bases. On the one hand, the general base which includes most of the income taxed by PIT, subject to a progressive rate,5 and on the other hand, the savings base that taxes both the income generated by investment capital and equity gains6 at a proportional marginal rate of 18% regardless of the period in which these two returns were generated, so there is no differentiation between short and long term equity gains. This type of dual model differs from the pure dual structure defined by Sørensen (1994, 1998), which does not specifically tax all capital income (assets, non-financial investment capital and equity gains from non-transfer assets) at a proportional rate, as well as not aligning the proportional marginal tax rates and the minimum of the progressive rate and regarding income from economic activities, it does not differentiate the part of the income from the working source and the income from capital. However, with this reform, the previous incentive to maintain capital gains over a period exceeding one year disappears and is also detrimental to capital gains realized over a period of time longer than one year, taxing them 3 percentage points higher (15–18%). Reduction or amortization coefficients applicable to the resulting capitals are also removed, which is a relevant issue, as depending on the year in which the asset was acquired, it could get a reduction of up to 100% of the resulting gain.

Therefore, from the entry into force of the new law, capital gains obtained once this regulation was implemented, cannot benefit from these reduction coefficients. However, these reduction or amortization coefficients can be applied to the portion of the capital gains that were generated from the purchase date until January 19, 2006,7 not being applicable to the rest of the period.

Finally, an important issue which led to this reform was the announcement with time in advance to reorganize and plan the taxpayer's assets and equity elements prior to the reform and increase in tax rates in many cases. Specifically, the Law was published on November 29, 2006, with prior announcement. Therefore, this effect produces a possible reorganization and transformation among different sources of income as stated by some authors (López-Laborda, Vallés, & Zárate, 2014).

Empirical modelEach fiscal year, taxpayers can choose to realize or not capital gains, and therefore are taxed or not for realizing them. This choice is an issue of censorship in the empirical estimation, so the probability of realizing gains has to be estimated for any taxpayer in the first stage and then the factors and to what extent they affect the amount of gains realized have to be determined, if performing the realization effectively occurs. The so-called two-stage models can incorporate these two sequences. The implementation of the two stage model proposed by Heckman (1979) enables to solve two problems in the estimation. On the one hand, data censorship and on the other hand the data sample selection caused by restricting the sample in the second stage only to those taxpayers who declare a capital gain. The proposed model by Heckman consists of estimating a “probit” model in the first step, to obtain the probability of realization of capital gains, and from the results of this estimation, in the second stage capital gains effectively realized are regressed depending on some determinants.

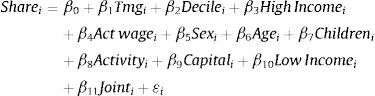

Following the proposal of Jacob (2013) the estimation of the probit model would be as follows in Eq. (1):

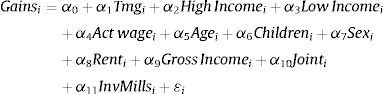

where Sharei represents the probability of realizing capital gains at some point in time for each taxpayer “i” and X′i is a vector of independent variables which affect this probability.From the results obtained in the previous step, a regression model is estimated using Ordinary Least Squares8 in order to obtain the elasticities on the realization of capital gains, introducing the Inverse of Mills ratio to isolate the sample selection problem of the previous regression.

if Sharei=1where the dependent variable Gainsi represents the monetary value of the capital gains realized for any taxpayer “i”; Z′i includes a set of variables that affect the amount of realization of capital gains. Finally, InvMills includes information of the 1st stage, avoiding bias in the selection.DatabasesTo carry out the empirical study we used Annual Samples of PIT for the years 2006 and 2007, the years before and after the reform in Spain. The processing of the annual samples is the result of the collaboration between the Tax Agency and the Spanish Institute for Fiscal Studies. The unit of analysis is personal income tax returns, with a geographical area covering the entire territory of the Spanish common system of taxation. In total, the database contains 964,489 (1,351,8029) with 352 observations (358) variables, for 2006 (2007), representing a total of 17,840,783 (18,702,875) tax returns, where in each case the contents of the variables are the values corresponding to the boxes of the tax returns submitted each year shown on model 100.

The variables10 that were incorporated into the analysis are detailed below. In the first place, a dummy variable Share was defined as an approximation of those taxpayers with private participation in some assets and consequently, with some probability of realizing capital gains at some point in time. Following the proposal by Jacob (2013), this variable takes value 1 if the following conditions are met: that the taxpayer‘s tax return shows income from capital11; if the taxpayer obtains returns on capital assets,12 thus including the possibility of selling property assets; and finally, if the taxpayer makes capital gains in the short or long term. In all other cases this variable is zero.

The construction of the marginal rate variable (Tmg) shows certain methodological problems, as capital gains are taxed in two differentiated bases in both fiscal years. Therefore, we proceeded to calculate a marginal rate weighted depending on the percentage of capital gains that are taxed at one rate or another. In short, we adapted the proposal shown in Onrubia and Sanz (2009) with the following modifications:

where GANi represents the total capital gains declared by a taxpayer for a particular year, while GANGEN and GANESP/AHO are capital gains taxed in the general base and special savings base for 2006 and 2007, respectively. Finally TmgGEN and TmgESP/AHO include the marginal rates of the general base, the special and savings base.Additionally, a set of control variables was used. In particular, the following:

- -

High income: dummy variable that takes the value one if the taxpayer exceeds 100,000 euros of income and zero value in other cases.

- -

Low income: dummy variable that takes the value one if the taxpayer does not reach 10,000 euros of income, being value zero otherwise.

- -

Wage Activity: dummy variable that takes the value one if the taxpayer receives income from economic activities higher than those generated by income from personal work and will take the value zero in any other circumstances.

- -

Children: dummy variable that is equal to the unit if the taxpayer has at least one child, while it will be zero in the absence of children.

- -

Joint: it is a dummy variable that contains information about the type of income tax return, so that it takes the value one for joint taxation and zero for individual taxation.

- -

Rent: dummy variable whose value is equal to one if the taxpayer actually receives income from real estate and will be zero otherwise.

- -

Sex: variable dummy with a value of one in the case of the taxpayer being male and it will take the value of zero if it is a female.

- -

Age: it is a discrete variable which gives the age of the taxpayer.

- -

Decile: it is a discreet variable which takes values between 1 and 10 and represents the decile to which the taxpayer belongs to depending on his/her taxable income.

- -

Activity: dummy variable, which take the value one if the taxpayer obtains income from economic activities and zero otherwise.

- -

Capital: dummy variable, which is built as proxy of the taxpayer's wealth, so that it will take the value one if the taxpayer has capital income higher than 100,000 euros or zero otherwise.

- -

Net capital gains: continuous variable, which shows the value of taxpayers capital gains13.

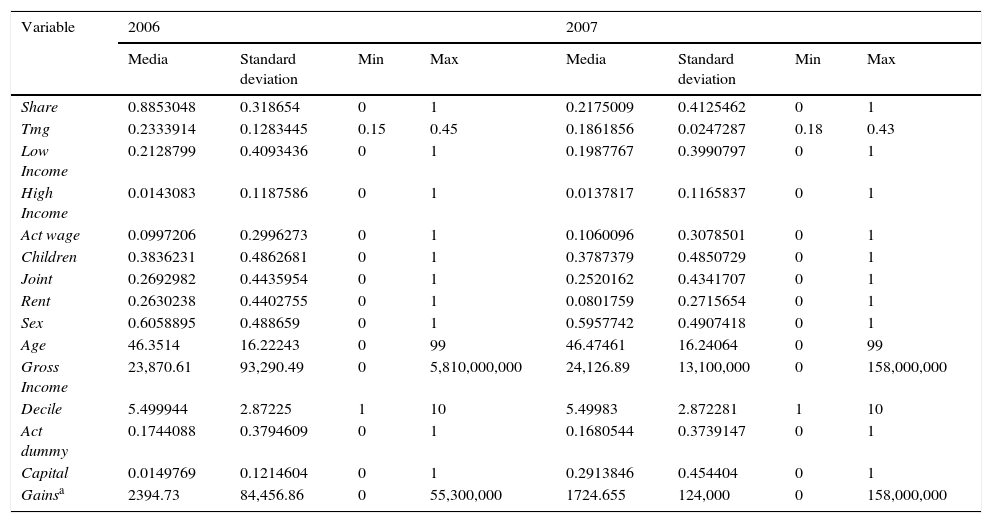

Tables A.1 and A.2 below show the main statistical descriptions and correlations between variables.

The proposed model for empirical estimation is as follows:

if Sharei=1The weighted marginal rate is included to analyze the impact of the realization of capital gains in qualitative and quantitative terms. Beforehand, it is expected that the coefficient relative to this variable is negative, i.e., that it negatively influences the decision of realization of capital gains at a given moment (Burman & Randolph, 1994). However, the realization of capital gains in turn depends on income (Auerbach, Burman, & Siegel, 2000; Poterba, 1987) and financial experience (Calvert, Campbell, & Sodini, 2009a, 2009b; Dhar & Ning, 2006), since those investors with a high degree of financial knowledge and with a high income tend to have a lower response to novices in finance (Jacob, 2013). On the other hand, financial knowledge may be related to individuals who do not have income from economic activities and with a low gross income. The absence of proxy indicators that allow us to calculate the financial expertise of the taxpayer, i.e., the individual‘s educational level, degree of work occupation or knowledge about investments, has led us to the use of Gross Income and the variable Capital as an approximation thereof, since some correlation between the two variables is observed in the financial literature (Dhar & Ning, 2006).

High income and low income are analyzed as control variables to determine the influence of the taxpayer‘s income level. In addition, Wage Activity is included in order to understand the significance of the difference in obtaining the source of income by the taxpayer.

Furthermore, the variables Joint and Children are included to analyze the effect that the family and household size have (Calvert et al., 2009a, 2009b); while Age represents the life cycle hypothesis, according to which adult individuals should be more likely to realize capital gains and of a greater amount than young people (Daunfeldt et al., 2010). Finally, the Sex variable is introduced as an explanatory factor of possible differences in behaviour of the realization of capital gains between men and women.

Eq. (4) contains control variables that affect the probability of being a potential taxpayer with capital gains (Campbell, 2006; Jacob, 2013; Van Rooij, Lusardi, & Alessie, 2011). Specifically, the Decile variable is included to control the probability that effectively a capital gain will be realized in terms of income and wealth, so that those individuals who are in a high decile of income distribution show a higher probability to maintain their assets than those who are in lower deciles of income distribution (Campbell, 2006). Moreover, economic activities (Activity) has been taken into account as a proxy of having businesses and/or companies.

On the other hand, the variable Renti reflects the fact that the taxpayer “i” obtains returns on capital assets, and therefore beforehand, we expect there is a greater chance to keep the assets in the portfolio and not realize capital gains or realize them at a lower amount. The literature shows how most investment portfolios of households are made up of capital assets and bank assets (Campbell, 2006). Although it is worth noting that in the particular case of the configuration of Spanish household portfolios, the participation of capital assets as the main investment source stands out significantly (Domínguez-Barrero & López-Laborda, 2012).

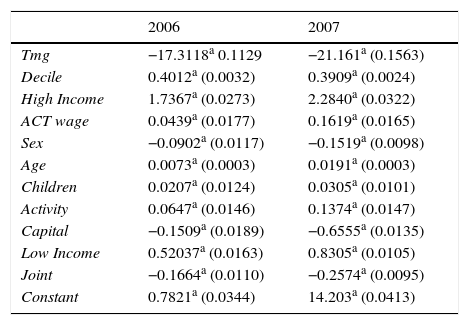

ResultsThis section presents the main results. The following Table A.3 shows the estimated probability of realization of capital gains for both 2006 and 2007 periods, following the proposal of Eq. (3). Each column represents the estimated coefficients based on the probit model for each fiscal year, thus reflecting the determinants on the decision to realize any capital gain by the taxpayer. Among the main factors that have a positive influence on the decision for both years are: the Decile variable, obtaining income (high income and low income), Age, number of Children, the importance of the business activity (Activity) and the percentage of income from economic activities in relation to wage income (Wage Activity). By contrast, among the variables that influence negatively are Sex, obtaining gains from Capital and submitting a Joint income tax return.

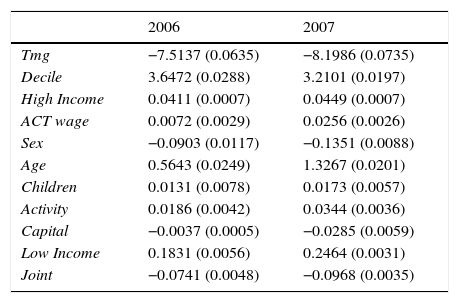

The elasticities obtained from the estimation of the probit selection model are presented in Table A.4. The highest value corresponds to the taxpayer's marginal rate variable in relation to realizing capital gains or not, being slightly higher in 2007 (−8.19%) compared to 2006 (−7.51%), therefore, taxpayers had a higher sensitivity to the realization of capital gains in 2007. This phenomenon, which goes against the initial approach of the theory, shows that the lower the tax rate, the lower the sensitivity or elasticity, and can be explained by the increase in the proportional marginal rate these capital gains had in 2006 (15%) to 2007 (18%); and the announcement of the reform well in advance so that taxpayers could carry out adequate tax planning, as well as changes made in the reductive or amortization coefficients. Next, the Decile Variable is highlighted, which shows that how belonging to a higher decile leads to a greater realization of capital gains, although there are no major differences between the two years. The remaining variables have relatively low elasticities, the most important being the Age variable, which showed a distinct influence between the two years, this difference may suggest that the impact of the Life Cycle Theory on consumption and savings has greater impact in the year 2007. That is, the higher the age, the higher the probability of realizing capital gains with a fixed tax rate on capital gains, which is characteristic of a model of dual taxation on income, compared with varying rates.

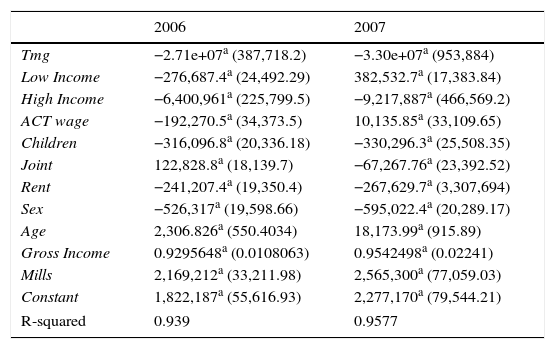

Below, in Table A.5 the results of the OLS estimation are shown for both years, 2006 and 2007. Since the main objective of this paper is to analyze how the tax rate affects capital gains, we will start presenting the estimated results for the marginal rate. The coefficient associated with the weighted marginal rate is negative, therefore, it is indicating that of the individuals who have decided to realize capital gains, the amount realized is lower when the taxation of capital gains is higher, being this phenomenon more pronounced in 2007 than in 2006. This result is consistent with previous literature both in the USA (Auerbach & Siegel, 2000; Auten & Clotfelter, 1982; Bogart & Gentry, 1995; Burman & Randolph, 1994) as in more recent studies in Europe, highlighting the case of Sweden (Daunfeldt et al., 2010) and Germany (Jacob, 2013).

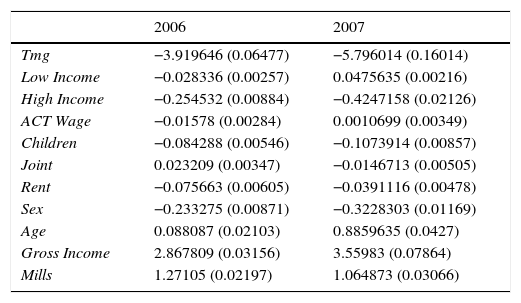

The elasticity of the weighted marginal rate is −3.91% (−5.79%) for 2006 (2007). This implies that a 1% increase in the taxation of capital gains reduces the amount of realization of capital gains by 3.91% (5.79%) respectively. Clearly, we can see how there is a difference between the two years, mainly due to taxation of capital gains in both tax systems, which causes increased sensitivity in the amount of realization of capital gains in 2007 compared to 2006. This result seems to indicate that the tax rate and fiscal changes resulting from the reform explain to a large extent the variations in the amount of capital gains carried out by the taxpayer. The estimates of the marginal rate elasticity with respect to capital gains have higher values compared to the transitional elasticities obtained by Auten and Clotfelter (1982), Burman and Randolph (1994), Auerbach and Siegel (2000) and Ayers et al. (2007) for USA. Similarly, the results are also higher than those reported in the range of elasticities of time series studies (Auten & Cordes, 1991; Bogart & Gentry, 1995) and cross-sectional studies using tax data (Daunfeldt et al., 2010). However, they lie within the intervals provided by Jacob (2013) in which an approximation is carried out and with data similar to that followed in this work.

With regard to non-tax variables, we find that income has a positive and significant effect on the realization of larger amounts of capital gains, that is, with increasing income the taxpayer tends to realize a higher capital gain, being this effect higher in 2007, resulting elasticity of capital gains with respect to taxable income the most important factor, after the marginal rate. However, those taxpayers who have low incomes made smaller amounts of capital gains, although in 2007 the effect was the opposite. On the other hand, those taxpayers who obtain a very high income (more than 100,000 euros) show a negative effect on capital gains, and this effect was again higher in 2007. The possibility of getting rents influences both periods negatively and getting higher income from business activities than work income implies a negative (positive) elasticity in 2006 (2007). In sum, the results obtained are the expected ones, based on the literature (Auten & Clotfelter, 1982; Burman & Randolph, 1994; Daunfeldt et al., 2010).

Household characteristics that present positive elasticities with respect to the amount of capital gains realized are Age and Joint for the 2006 financial period. On the contrary, in the 2007 period the variables Sex14, Children – are lower in relation to other studies (Jacob, 2013) – and Joint have negative elasticities, which are all less than 1%. A comparative analysis of the results obtained in previous studies shed some disparity between those made in the USA (Auten & Clotfelter, 1982; Burman & Randolph, 1994) and European ones, the latter being closer to the results of this work (Daunfeldt et al., 2010).15

Finally, the inverse of the Ratio of Mills has a positive and statistically significant coefficient different from zero, which implies that the empirical model does not have sample selection problems and consequently, the parameter estimates do not produce a bias for both 2006 and 2007.

ConclusionsThe effect of the tax rate on the realization of capital gains has generated great interest in the United States (see among others: Auerbach & Siegel, 2000; Auten & Clotfelter, 1982; Bogart & Gentry, 1995; Burman & Randolph, 1994) and more recently in Europe, in the case of Sweden (Daunfeldt et al., 2010) and in the case of Germany (Jacob, 2013).

The main objective of this paper is to analyze the lock-in effect that the tax rate could cause on the probability of realization or not of capital gains and its amount if it occurs, declared in income tax return, after the reform carried out on this tax in 2007, at which time a model of dual income tax was first introduced in Spain. This tax design structure taxes independently almost all capital gains at a fixed rate of 18%, unlike the previous model that taxed differentiating the period of time in which they were generated, more than one year at a fixed rate of 15%, less than one year at a progressive rate (15–45%). The database used in the work corresponds to the annual samples of taxpayers’ PIT, which collects taxpayers’ tax for the pre and post reform years 2006 and 2007. The existence and the possible use of tax data enables to obtain very reliable results, collecting the set of total respondents and the possibility to analyze how this tax will affect their behaviour both on the realization or not of capital gains and the amount.

The results of the work suggest that a high taxation level of capital gains is associated with a lower amount in the realization of capital gains, once individuals have decided to realize them, as stated by the theory. Specifically, the elasticities obtained after the reform show how the effect of taxation on capital gains increased compared with the previous year, in which the marginal rate influenced more prominently in the amount of realized capital gains. In addition to the changes that have taken place on marginal rates, changes in reductive and amortization coefficients are considered relevant changes as a possible explanation for the results. The results also confirm previous studies in both the United States and Europe and suggest that high taxes on capital gains generated a greater Lock-in effect on capital gains, both in their realization and amount.

As for non-tax variables, the positive influence of taxable income and age is highlighted, as well as obtaining rents and income from economic activities. On the contrary, being female and the number of children has a negative influence. These results are those expected with respect to the theory. However, they have certain differences with those obtained in USA, although they are closer to studies at European level.

Finally, we mention the limitations of this study, mainly related to the database used because in the first place, it provides information about the gains and losses on a net basis, this is once capital gains and losses are compensated with each other. Secondly, there is no information about the wealth or asset portfolio composition of the taxpayer. Thirdly, it is not possible to differentiate long-term gains from short-term gains for fiscal year 2007. Finally, when working with fiscal data, it is also not possible to control tax evasion, which could condition the results obtained.

Descriptive statistics.

| Variable | 2006 | 2007 | ||||||

|---|---|---|---|---|---|---|---|---|

| Media | Standard deviation | Min | Max | Media | Standard deviation | Min | Max | |

| Share | 0.8853048 | 0.318654 | 0 | 1 | 0.2175009 | 0.4125462 | 0 | 1 |

| Tmg | 0.2333914 | 0.1283445 | 0.15 | 0.45 | 0.1861856 | 0.0247287 | 0.18 | 0.43 |

| Low Income | 0.2128799 | 0.4093436 | 0 | 1 | 0.1987767 | 0.3990797 | 0 | 1 |

| High Income | 0.0143083 | 0.1187586 | 0 | 1 | 0.0137817 | 0.1165837 | 0 | 1 |

| Act wage | 0.0997206 | 0.2996273 | 0 | 1 | 0.1060096 | 0.3078501 | 0 | 1 |

| Children | 0.3836231 | 0.4862681 | 0 | 1 | 0.3787379 | 0.4850729 | 0 | 1 |

| Joint | 0.2692982 | 0.4435954 | 0 | 1 | 0.2520162 | 0.4341707 | 0 | 1 |

| Rent | 0.2630238 | 0.4402755 | 0 | 1 | 0.0801759 | 0.2715654 | 0 | 1 |

| Sex | 0.6058895 | 0.488659 | 0 | 1 | 0.5957742 | 0.4907418 | 0 | 1 |

| Age | 46.3514 | 16.22243 | 0 | 99 | 46.47461 | 16.24064 | 0 | 99 |

| Gross Income | 23,870.61 | 93,290.49 | 0 | 5,810,000,000 | 24,126.89 | 13,100,000 | 0 | 158,000,000 |

| Decile | 5.499944 | 2.87225 | 1 | 10 | 5.49983 | 2.872281 | 1 | 10 |

| Act dummy | 0.1744088 | 0.3794609 | 0 | 1 | 0.1680544 | 0.3739147 | 0 | 1 |

| Capital | 0.0149769 | 0.1214604 | 0 | 1 | 0.2913846 | 0.454404 | 0 | 1 |

| Gainsa | 2394.73 | 84,456.86 | 0 | 55,300,000 | 1724.655 | 124,000 | 0 | 158,000,000 |

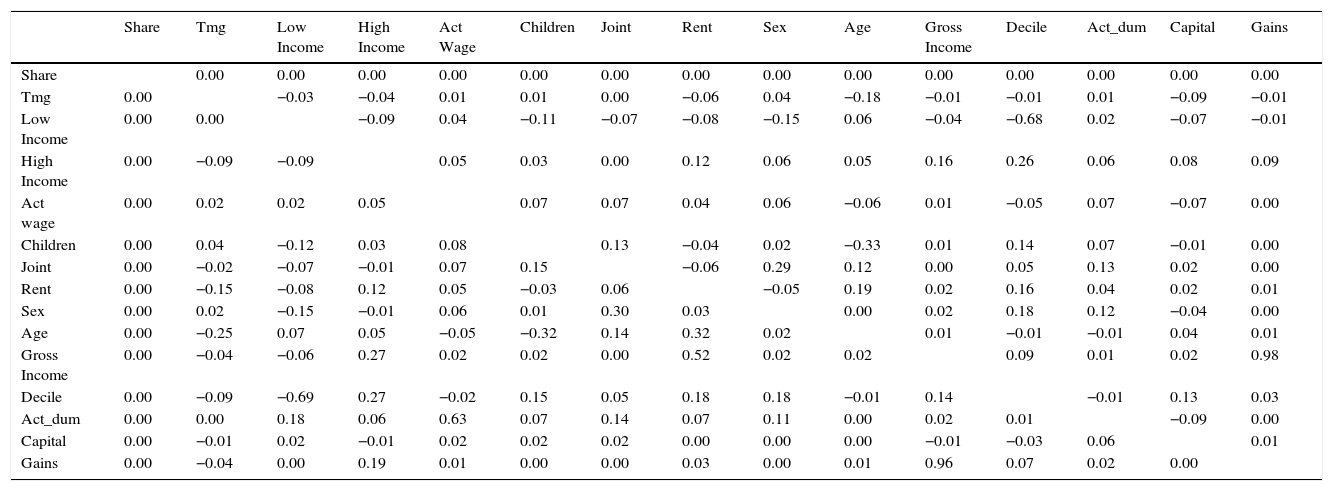

Correlations of variables 2006 and 2007.

| Share | Tmg | Low Income | High Income | Act Wage | Children | Joint | Rent | Sex | Age | Gross Income | Decile | Act_dum | Capital | Gains | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Share | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Tmg | 0.00 | −0.03 | −0.04 | 0.01 | 0.01 | 0.00 | −0.06 | 0.04 | −0.18 | −0.01 | −0.01 | 0.01 | −0.09 | −0.01 | |

| Low Income | 0.00 | 0.00 | −0.09 | 0.04 | −0.11 | −0.07 | −0.08 | −0.15 | 0.06 | −0.04 | −0.68 | 0.02 | −0.07 | −0.01 | |

| High Income | 0.00 | −0.09 | −0.09 | 0.05 | 0.03 | 0.00 | 0.12 | 0.06 | 0.05 | 0.16 | 0.26 | 0.06 | 0.08 | 0.09 | |

| Act wage | 0.00 | 0.02 | 0.02 | 0.05 | 0.07 | 0.07 | 0.04 | 0.06 | −0.06 | 0.01 | −0.05 | 0.07 | −0.07 | 0.00 | |

| Children | 0.00 | 0.04 | −0.12 | 0.03 | 0.08 | 0.13 | −0.04 | 0.02 | −0.33 | 0.01 | 0.14 | 0.07 | −0.01 | 0.00 | |

| Joint | 0.00 | −0.02 | −0.07 | −0.01 | 0.07 | 0.15 | −0.06 | 0.29 | 0.12 | 0.00 | 0.05 | 0.13 | 0.02 | 0.00 | |

| Rent | 0.00 | −0.15 | −0.08 | 0.12 | 0.05 | −0.03 | 0.06 | −0.05 | 0.19 | 0.02 | 0.16 | 0.04 | 0.02 | 0.01 | |

| Sex | 0.00 | 0.02 | −0.15 | −0.01 | 0.06 | 0.01 | 0.30 | 0.03 | 0.00 | 0.02 | 0.18 | 0.12 | −0.04 | 0.00 | |

| Age | 0.00 | −0.25 | 0.07 | 0.05 | −0.05 | −0.32 | 0.14 | 0.32 | 0.02 | 0.01 | −0.01 | −0.01 | 0.04 | 0.01 | |

| Gross Income | 0.00 | −0.04 | −0.06 | 0.27 | 0.02 | 0.02 | 0.00 | 0.52 | 0.02 | 0.02 | 0.09 | 0.01 | 0.02 | 0.98 | |

| Decile | 0.00 | −0.09 | −0.69 | 0.27 | −0.02 | 0.15 | 0.05 | 0.18 | 0.18 | −0.01 | 0.14 | −0.01 | 0.13 | 0.03 | |

| Act_dum | 0.00 | 0.00 | 0.18 | 0.06 | 0.63 | 0.07 | 0.14 | 0.07 | 0.11 | 0.00 | 0.02 | 0.01 | −0.09 | 0.00 | |

| Capital | 0.00 | −0.01 | 0.02 | −0.01 | 0.02 | 0.02 | 0.02 | 0.00 | 0.00 | 0.00 | −0.01 | −0.03 | 0.06 | 0.01 | |

| Gains | 0.00 | −0.04 | 0.00 | 0.19 | 0.01 | 0.00 | 0.00 | 0.03 | 0.00 | 0.01 | 0.96 | 0.07 | 0.02 | 0.00 |

Note: The variables corresponding to the 2006 correlations are below the diagonal and 2007 above.

Results probit.

| 2006 | 2007 | |

|---|---|---|

| Tmg | −17.3118a 0.1129 | −21.161a (0.1563) |

| Decile | 0.4012a (0.0032) | 0.3909a (0.0024) |

| High Income | 1.7367a (0.0273) | 2.2840a (0.0322) |

| ACT wage | 0.0439a (0.0177) | 0.1619a (0.0165) |

| Sex | −0.0902a (0.0117) | −0.1519a (0.0098) |

| Age | 0.0073a (0.0003) | 0.0191a (0.0003) |

| Children | 0.0207a (0.0124) | 0.0305a (0.0101) |

| Activity | 0.0647a (0.0146) | 0.1374a (0.0147) |

| Capital | −0.1509a (0.0189) | −0.6555a (0.0135) |

| Low Income | 0.52037a (0.0163) | 0.8305a (0.0105) |

| Joint | −0.1664a (0.0110) | −0.2574a (0.0095) |

| Constant | 0.7821a (0.0344) | 14.203a (0.0413) |

Elasticities of probit.

| 2006 | 2007 | |

|---|---|---|

| Tmg | −7.5137 (0.0635) | −8.1986 (0.0735) |

| Decile | 3.6472 (0.0288) | 3.2101 (0.0197) |

| High Income | 0.0411 (0.0007) | 0.0449 (0.0007) |

| ACT wage | 0.0072 (0.0029) | 0.0256 (0.0026) |

| Sex | −0.0903 (0.0117) | −0.1351 (0.0088) |

| Age | 0.5643 (0.0249) | 1.3267 (0.0201) |

| Children | 0.0131 (0.0078) | 0.0173 (0.0057) |

| Activity | 0.0186 (0.0042) | 0.0344 (0.0036) |

| Capital | −0.0037 (0.0005) | −0.0285 (0.0059) |

| Low Income | 0.1831 (0.0056) | 0.2464 (0.0031) |

| Joint | −0.0741 (0.0048) | −0.0968 (0.0035) |

Results OLS.

| 2006 | 2007 | |

|---|---|---|

| Tmg | −2.71e+07a (387,718.2) | −3.30e+07a (953,884) |

| Low Income | −276,687.4a (24,492.29) | 382,532.7a (17,383.84) |

| High Income | −6,400,961a (225,799.5) | −9,217,887a (466,569.2) |

| ACT wage | −192,270.5a (34,373.5) | 10,135.85a (33,109.65) |

| Children | −316,096.8a (20,336.18) | −330,296.3a (25,508.35) |

| Joint | 122,828.8a (18,139.7) | −67,267.76a (23,392.52) |

| Rent | −241,207.4a (19,350.4) | −267,629.7a (3,307,694) |

| Sex | −526,317a (19,598.66) | −595,022.4a (20,289.17) |

| Age | 2,306.826a (550.4034) | 18,173.99a (915.89) |

| Gross Income | 0.9295648a (0.0108063) | 0.9542498a (0.02241) |

| Mills | 2,169,212a (33,211.98) | 2,565,300a (77,059.03) |

| Constant | 1,822,187a (55,616.93) | 2,277,170a (79,544.21) |

| R-squared | 0.939 | 0.9577 |

Elasticities (OLS).

| 2006 | 2007 | |

|---|---|---|

| Tmg | −3.919646 (0.06477) | −5.796014 (0.16014) |

| Low Income | −0.028336 (0.00257) | 0.0475635 (0.00216) |

| High Income | −0.254532 (0.00884) | −0.4247158 (0.02126) |

| ACT Wage | −0.01578 (0.00284) | 0.0010699 (0.00349) |

| Children | −0.084288 (0.00546) | −0.1073914 (0.00857) |

| Joint | 0.023209 (0.00347) | −0.0146713 (0.00505) |

| Rent | −0.075663 (0.00605) | −0.0391116 (0.00478) |

| Sex | −0.233275 (0.00871) | −0.3228303 (0.01169) |

| Age | 0.088087 (0.02103) | 0.8859635 (0.0427) |

| Gross Income | 2.867809 (0.03156) | 3.55983 (0.07864) |

| Mills | 1.27105 (0.02197) | 1.064873 (0.03066) |

Proof of this is the extensive literature on the subject: Ayers et al. (2007); Constantinides (1983); Dai, Edward, Douglas, & Harold (2008); Daunfeldt et al. (2010); Hendershott et al. (1991); Holt and Shelton (1962); Jacob (2013); Klein (1999); Reese (1998); Seltzer (1951).

The progressive rate corresponding to fiscal year 2006 is made up of five brackets, with a marginal rate which goes from 15% to 45% (15–24–28–37–45%).

Capital gains generated in a period shorter than one year could offset each other in 2006. They can also compensate with the rest of income that make up the General Tax Base with a limit of 10% of the positive balance of other income. Therefore, short and long term gains and losses could not be compensated with each other in 2006. In 2007, capital gains and losses not arising from the transfer of assets can offset up to a limit of 25% of the sum of returns of the General Tax Base. In 2007, capital gains and losses could be offset regardless of the time in which they were generated.

Capital gains generated by the transfer of the main residence, on the condition that the amount obtained would be invested in another main residence, were exempt both in 2006 and 2007.

The progressive rate for 2007 is composed of four brackets, 24–28–37–43%, although one of the most significant aspects of the reform is the change introduced in the personal minimum and family minimum, which changes from being a reduction in the tax base to a deduction in the gross tax payable.

There are some equity gains which are included in the general base, which among others are prizes obtained from games or raffles; subsidies or aid granted to the main residence or public subsidies for owners of Spanish Historic Heritage.

Fulfilling certain requirements under the ninth transitional provision of Law 35/2006 of PIT.

Other specifications were estimated, in particular a Multinomial Logit to analyze the realization of net capital gains compared to not realizing them or to obtaining net capital losses; but due to the characteristics of the database used, its estimation is not possible, since the number of taxpayers with capital losses is insufficient compared to those who obtain net capital gains.

The sample size is calculated for both years considering an error in the means of the Income variable of less than 1.1%, with a confidence level of 3 per thousand. For more information see Picos, Pérez, and González (2009, 2011).

Table I from the Annex shows the correlations for 2006 and 2007.

In 2007, there is an exemption for the first 1500 euros in dividends, in order to compensate for double taxation of dividends, which are not listed on the return form. The investment income includes a series of income such as: interests, dividends, other assets and insurance contracts. Following Jacob (2013), interests are included, so as not to exclude potential holders of financial assets that could generate a possible capital gain, because those taxpayers with income from capital have some probability to own shares, as households tend to distribute their assets among risk-free ones.

It refers to returns from rents, as well as allocations of incomes and losses specified in the PIT.

This variable shows a series of limitations due to the database limitations of the database used. In particular, it was necessary to include net equity gains, that is, once the losses were compensated. This limitation is due to no having separate information regarding equity gains and losses for 2007. However, due to the fact that you are taxed for this concept, it was thought convenient to opt for this definition.

In the case of the Sex variable, the result differs from that obtained in another work which analyzes the influence of this variable (Daunfeldt et al., 2010).

The main difference between both studies with respect to age can be explained by the different tax designs imposed by differentiated legislative treatment between USA, Sweden and Spain.