The proof of existence of market clearing equilibrium is the cornerstone of Neo-Classical theory. While it is generally portrayed as a barter framework, the proof actually assumes an accepted system of credits and debits; a system of privately issued IOU's, or what is the same thing commitments by private agents to deliver a certain quantity of a given commodity at a given equilibrium price. In other words, the proof presupposes the existence of ‘inside money’. Yet a system of generalized exchange with pure inside money is not compatible with the main principles of Neo-Classical monetary theory including that inflation is always and everywhere a monetary phenomenon, the exogeneity of money and also the neutrality of money. This explains the importance and necessity of introducing ‘outside money’ in general equilibrium. Focussing mainly on Patinkin's ‘invalid dichotomy’ and the real balance effect, and to a lesser extent, on overlapping generation models, I try to show that these attempts have been unsuccessful. In both cases the integration of monetary and value theory amount to collapsing all individuals into a single one. This negates the very economic problem (i.e., multiple exchanges) that gave rise to general equilibrium theory and to the impending requirement to prove the existence of market clearing equilibrium.

La prueba de existencia del equilibrio general es la piedra angular de la teoría neoclásica. Si bien se presenta, generalmente, como un marco basado en el trueque, la prueba de existencia del equilibrio general asume de hecho un sistema aceptado de créditos y débitos; un sistema de promesas de pago emitidas por los privados o, lo que es lo mismo, compromisos por parte de los agentes privados de entregar una cierta cantidad de un determinado bien a un precio de equilibrio dado. En otras palabras, la prueba de existencia del equilibrio general presupone la existencia de ‘dinero interno’. No obstante, un sistema de intercambio generalizado no es compatible con los principios de base de la teoría monetaria neoclásica, incluyendo el hecho de que la inflación es siempre, y en todas partes, un fenómeno monetario, el dinero exógeno, y también la neutralidad del dinero. Esto explica la importancia y necesidad de introducir ‘el dinero externo’ en el marco del equilibrio general. Centrándonos en la ‘dicotomía invalida’ de Patinkin y el efecto de los saldos reales, y en menor medida en los modelos de generaciones traslapadas, tratamos de demostrar que los esfuerzos de integrar el dinero externo en un marco de equilibrio general han sido infructuosos. En ambos casos, la integración de la teoría monetaria y de la teoría del valor equivale a colapsar todos los agentes en uno solo. Esto es lo que niega el propio problema económico (i.e., el problema de intercambio múltiple) que dio lugar a la teoría del equilibrio general y al requisito imperante de probar su existencia.

The proof of the market clearing equilibrium is the cornerstone of mainstream (Neo-Classical) Neo-Walrasian economic theory.1 All models are explicitly or implicitly based upon it. The proof of existence and the assumptions on which it is based have not been exempt from criticism. One of the most important is that the proof of existence does not need the existence of money.

In a Neo-Walrasian world even of the temporary equilibrium variety transactions are planned for by the deus-ex-machina.2 Prices are determined and transaction plans are made compatible before trading begins. Price information is costless and complete and quantities are only of relevance for the auctioneer.

The addition of money to the model is viewed as unnecessary. It does not serve any particular purpose. It is simply an inessential addition to the Neo- Walrasian construct: “there is nothing we can say about the equilibrium with money that we cannot say about the equilibrium of non-monetary economy” (Hahn, 1973, p. 160).

This interpretation is from my point of view incorrect. As made clear by some of the main general equilibrium theorists, in particular Gerald Debreu (1921-2004), the proof of existence of general equilibrium requires an accepted system of credits and debits. It requires a system of privately issued IOU's,3 that is commitments by private agents to deliver a certain quantity of a given commodity at a given equilibrium price. In other words, the proof of the existence of general equilibrium presupposes the existence of ‘inside money,’ credit balances of the private sector based on its own debt.

But an exchange based economic system with pure inside money is not compatible with the main principles of Neo-Classical monetary theory. Since by definition, in a system of inside money, money is both an asset and a liability to the private sector, inside money is said to be in zero net supply within the private sector. As a result inflation cannot be demand-driven and considered purely monetary phenomenon; money supply cannot be said exogenous, and the neutrality of money cannot be ensured. In fact, inside money deprives Neo- Classical economics from having a monetary theory. A Neo-Classical monetary theory requires by necessity the introduction of ‘outside money’ (whether it be commodity or simply fiat money).

Moreover, the fact that in a general equilibrium framework, inside money precedes the existence of outside money sharply contradicts most Neo-Classical accounts (both ‘historical’ and logical accounts) of the existence of money and its evolution. According to these outside money always comes into existence prior to inside money. Moreover inside money appears as a consequence and logical result of outside money.

The required incorporation of outside money is generally, and perhaps mistakenly so, presented as the integration of money and value theory (the determination of equilibrium relative prices and quantities in the absence of money, i.e., in a barter economy). In reality, it is the integration of outside money to a system purely driven by inside money in order to rationalize the basic points of Neo-Classical monetary theory and make it consistent with the premises of general equilibrium.

A representative attempt at integrating ‘money and value,’ that of Patinkin (1989a [1956]) involved appending a quantity theory equation into a real determined general equilibrium system. Patinkin (1922-1995) claimed that the integration of money and value theory led to an internal contradiction termed the ‘invalid dichotomy.’ The invalid dichotomy asserts that appending a quantity theory equation to a general equilibrium system leaves the price level indeterminate. In order to solve this problem Patinkin introduced the real balance effect (the Pigou effect). The real balance effect restored the required consistency between the real and monetary sectors only by assuming that all economic agents in the economy are one and the same.

A more recent attempt spurred by the overlapping generations approach to modeling trying to introduce explicitly the notion of outside money as a medium of exchange arrives exactly at the same solution. The compatibility of money within an overlapping generation model involves assuming a single agent transferring money to him/her from one period to the next.

A one agent economy makes the whole exercise, even proof of general equilibrium, pointless. In this sense, introducing outside money to preserve the main principles of Neo-Classical monetary theory within a Neo-Walrasian framework involves negating the very act of multiple exchanges that gave rise to general equilibrium theory and the requirement of the market clearing proof. The solutions provided not only have proved to be futile but, more importantly, highlight the impossibility of introducing outside money into a generalized system of exchange driven by inside money.

The paper is divided into six sections. The first discusses the proof of market clearing general equilibrium. The second focuses on the distinction between inside an outside money. The third and fourth section center on Patinkin's integration of monetary and value theory. The fifth section examines critically the overlapping generation approach to integrate money and value. The last section concludes.

Neoclassical theory and moneyOne of the most significant contributions of Neo-Classical theory in its intertemporal (Neo-Walrasian) version is the proof of the existence of general equilibrium. It is in fact the cornerstone of the theory and provides the justification and rational for free market policies. It was originally developed by Arrow and Debreu (1954) and McKenzie (1954).4 This consists, in a nutshell, in proving that in a given type of economy, namely a private ownership economy, there exists a price vector such that the actions of its say, h agents (with given consumption and production sets, and preferences), is compatible with the total existing resources. At this market clearing or equilibrium price vector no agent wishes to make additional trades. This can be stated formally using a net notional aggregate demand approach.5

Let, zhi(p) be the net notional aggregate or excess demand of agent h for good i such that, zhi(p)=xhi(p)−x¯hi6. The sum of zhi over all agents yields the net aggregate or excess demand for good i, zi(p)=∑hzhi(p). The compatibility of aggregate plans implies the existence of a price vector, p* ≥ 0, such that zi(p*)≤0;ifzi(p*)zi(p*)<0 then p* = 0.

The conditions for the compatibility of plans at the price vector p* is based on the following assumptions: 1) for every p ≥ 0 and a scalar λ > 0, zi(λp) = zi(p) (homogeneity of degree zero in prices for excess demand functions; 2) for p≥0, ∑ipizi(p)=0 (Walras Law); 3) zi(p) is continuos over p ≥ 0 (continuity of the excess demand functions in the relevant price interval.7

The proof of existence does not require the introduction of a generalized and accepted means of exchange. Nor does it require a theory of a generalized and accepted means of exchange. Indeed, these considerations do not enter into the configuration of the model, its description or in the determination for the existence proof of equilibrium.

However, since general equilibrium analysis is undertaken in notional, ex-ante terms, the compatibility of all plans of all agents over a range of commodities requires necessarily the existence of an accepted system of credits and debits. This is made explicit by Debreu (1959). Since the Arrow-Debreu (1954) and other ‘classic proofs’ follow the same logic as that of Debreu (ibid.) to prove the same objective and moreover share the same theoretical core, they also require an accepted system of credits and debits. Debreu (ibid., p. 28) puts the point in the following way. (…) it is assumed that the economy works without the help of a good serving as a means of exchange. Thus the role of prices is as follows. With each commodity is associated a real number, its price. When an economic agent commits himself to accept delivery of a certain quantity of a commodity, the product of that quantity and the price of the commodity is a real number written on the debit side of his account. This number will be called the amount paid by the agent. Similarly a commitment to make delivery results in a real number written on the credit side of his account, and called the amount paid to his agent.

From the description provided by Debreu, all economic agents record their exante transactions in balance sheets with their respective debits and credits. The sum of these credit and debits should equal to zero for the whole if all actions by all agents are indeed compatible.

Even though in this model there is no single good serving as means of exchange, exchanges are undertaken on the basis of private issued IOUs, that is commitments by private agents to deliver a certain quantity of a given commodity at a given equilibrium price. In other words, transactions in this Debreu type economy (and by extension in other proof of existence exercises including Arrow-Debreu, 1954; McKenzie, 1954; and Arrow and Hahn, 1971 [1991]), are undertaken on the basis of private debt (or which is the same thing on the basis of credit).8

In these types of models all agents redeem their promises (pay their debts). That is, agents trust one another and default is not contemplated. It can be argued as Gale does (1982, pp. 234-235) that the treatment of time (all transactions take place at a single instance) and uncertainty (there is no uncertainty) in general equilibrium with complete markets such as in Debreu (1959), or Arrow-Debreu (1954) or McKenzie (1954) type analysis require that agents trust one another.9 It can also be argued (Dubey, Geanakoplos and Shibik, 2005, p. 1) that trustworthiness follows from the particular specification of the budget constraint (“agents never promise to deliver more goods than they personally own”).10

Since in an equilibrium with trust there is ‘no distinction between contracts and their execution’ (as put by Gale, 1982, footnote 4 above) there is nothing in the model that prevents the privately issued IOUs from circulating as ‘transferable, negotiable instruments.’11 Transferable and negotiable IOUs or private debt can be considered inside money.

Inside and outside money12In Neo-Classical monetary theory the term inside money refers to credit balances of the private sector which are based on the debt of the private sector.

Any change in the asset side of the private sector's consolidated balance sheet is matched exactly by a corresponding liability change (Fry, 1995). Since inside money is at the same time is both an asset and a liability to the private sector, inside money is said to be in zero net supply within the private sector.

Inside money is contra posed to outside money, which refers to money created outside the private sector, money balances that ‘are matched by net claims on the public sector or foreign assets’ (Goodhart, 1991, p. 287). By definition outside money is not in zero net supply within the private sector. In practical terms, outside money refers to fiat money or some other type of other asset backed by another asset that is not that is not in zero net supply within the private sector of an economy (Lagos, 2008). At a general level, this includes “whatever government liabilities are used to buy and sell goods by the public to purchase and sell goods and services plus those assets used by banks to settle inter-bank transactions” (Anderson, 2006). This tends to correspond roughly to high powered money (monetary base) or central bank credit.13

Outside money is the core and central concept of ‘money’ in Neo-Classical monetary theory. It is consistent with its main tenets including that the money supply is exogenous, that inflation is always and everywhere a monetary phenomenon, that it is inefficient because it is akin to a tax on money balances, and that as a result the control of money supply is fundamental for price stability and, that moreover, this is welfare improving. This in turn leads by chain reasoning to the type of problems and issues that are central to the current Neo-Classical monetary debate, such as credibility and reputation.14 Outside money is required, within the logic of Neo-Classical theory, to render the price level determinate.

Inside money is a different animal. In a pure inside money model, since assets and liabilities cancel each other out in the aggregate, inflation cannot possibly be ‘a monetary phenomenon’ due to an ‘excess money supply.’ More importantly it leaves the door open to argue that inside money can be consistent with the idea of endogenous money.

Assume, as non-mainstream economists do (i.e., Post Keynesian economists) that any borrower issues an IOU to a bank and the bank accepts the liability of the borrower and credits the borrower a bank deposit. If the borrower uses the bank deposit to pay for goods and services or cancel a debt, the borrower simply transfers the spending power to another agent. Here, the IOU creates the loan and the loan creates the deposit (or the asset entry). The repayment of the loan extinguishes the demand deposit and the IOU. In the same way as in a pure inside money story, liabilities and assets cancel out and there can never be ‘an excess supply of money’. Money is in ‘zero net supply within the private sector.’ Money is created and destroyed in the process of exchange of goods and services without any need to be ‘backed’ by another asset (say gold or money). As Lavoie (2006, p. 57) puts it: ‘All that is required is a credible borrower, with appropriate collateral.’ This initiates the process.

The importance of outside money for Neo-Classical economics is reflected in the well known story about the evolution of money, which proceeds from barter to outside money and then to inside money. Within the logic of the story, outside money not only precedes the existence of inside money but also outside creates inside money. That is, inside money would not exist without the prior existence of outside money.

An illustrative example is provided by Gurley and Shaw (1960). According to both the process of financial development evolves in three stages (the story obviates the transition from barter to monetary exchange). The first stage consists of an economy endowed with a rudimentary financial sector. There is only one financial asset outside money (commodity money or money backed by government debt). In a second stage, inside money is introduced (pp. 72-73). Gurley and Shaw consider first a model of pure inside money and then a model combining outside and inside money. In the second model financial assets include money balances and primary securities which are “homogeneous bonds issued by business firms” (p. 95). Bonds are purchased by the government with newly created money or by consumers. Consumers can acquire bonds, money issued by the government or both. Firms do not acquire money balances and firms liabilities (bonds) are reflected in consumer's asset side. Finally in a third stage, the security differentiation model (pp. 116 and ff), they include a whole range of different financial claims issued by different financial and non-financial institutions. This complex of securities increases the efficiency of the financial system.

This story of financial development provided in Gurley and Shaw (1960) is present in all mainstream money descriptions and stands in stark contrast to the implicit money story found in Neo-Walrasian general equilibrium theory. In the later inside money precedes outside money and in fact it shows that outside money is an unnecessary artefact. However, at the same, as explained above, outside money is required in the model. Without outside money there is no theory of inflation, and more generally no Neo-Classical theory of money. Many, if not most, policy recommendations fall to the ground as these are anchored precisely around the theory of money. Hence, the importance and necessity of introducing outside money and make it compatible with the Neo-Walrasian general equilibrium framework.

This has come to be known in the literature as the integration of money and value theory, where by value theory it is meant the determination of relative prices by the real forces (preferences, technology and endowments) under the assumption of barter.

But by the logic of our argument, this is incorrect. Neo-Walrasian general equilibrium models presuppose the existence of inside money, that is, of a set of private debts that are as ‘transferable, negotiable instruments’, which are in zero net supply within the private sector (since by definition one agent's liability is another agent's asset). Thus the so called integration of money and value is actually the introduction of outside money in a framework where inside money already exists and where exchanges are based on credit.

One of the most representative attempts at integrating ‘money and value theory’ is that of Patinkin's Money, Interest and Price. An Integration of Monetary and Value Theory (1989a [1956]). I also examine the work of Patinkin for the sake of logic of continuity to that of Debreu. In his Theory of Value (ibid, p. 36, n. 3), while stating that his approach did not contemplate the introduction of money (i.e., outside money) in the theory of value, Debreu makes reference to the work of Patinkin in this area.

Patinkin's work is to be understood as an attempt to provide an interpretation of the Classical School of economics within a Neo-Walrasian framework.15 He sustained that the Classical theory dichotomized an economic system into a monetary and a real sector and that this was invalid. In a nutshell, according to classical monetary theory, when the money supply doubles the price level also doubles. But according to classical real theory, this cannot happen because the demands for the different goods and services do not budge. These depend on relative prices which remain constant when as a result of the increase in money supply all individual prices change proportionately. Hence, Patinkin concluded that the dichotomy was ‘invalid.’

As will be analyzed in the following two sections, Patinkin's solution to the invalid dichotomy16 and thus the integration of value and money was unsuccessful. It showed ultimately that the only way outside money can be made compatible with general equilibrium Neo-Walrasian theory is to assume that there is only a single individual, which makes pointless and in fact negates the whole general equilibrium exercise of coordinating exchange of different individuals with different tastes under conditions of free competition and endowments with a given technology.

Bringing in outside money into Neo-Walrasian theoryPatinkin's Neo-Walrasian money story starts with an economy where each individual begins with an initial “collection of goods, which like the manna (…) has descended upon him ‘from the heavens”’ ([1956], p. 4Patinkin, 1989b).

Agents base their decisions on real as opposed to nominal magnitudes and by definition are free from money illusion.17

The absence of money illusion is necessary to guarantee that even when money is introduced from the ‘outside’ it will remain neutral and will not affect any agent's optimizing decisions. According to Patinkin in Classical monetary theory the absence of money illusion is identified with the zero degree homogeneity postulate of demand functions. As a result, demand functions and excess demand functions depend only on relative prices.

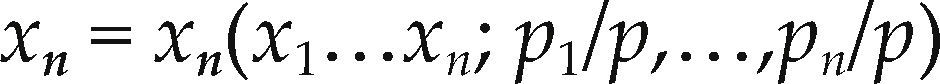

Following Niehans (1978, pp. 6-8), Harris (1985, pp. 56-62) and Patinkin (1972), this can be set out formally by expressing the demand for commodities in nth markets (x1…xn) as a function of relative prices (p1/p,…,pn/p):

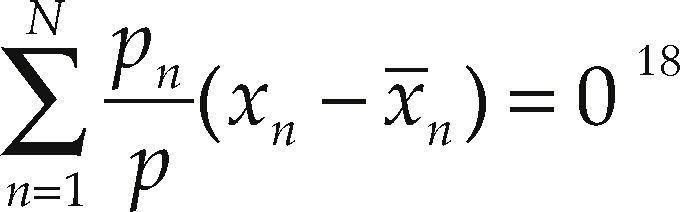

The excess demand for all commodities (demand for commodities (xn) less their endowment (x¯n) is equal to 0:18

The demands for all commodities depend only on relative prices and all excess demands satisfy the equilibrium conditions (excess demands are equal to zero). Note also that any increase in the price level p and all quantities and relative prices remain unchanged. Thus nominal changes have no bearing on real quantities and money is neutral.19

Patinkin equates this economy with a barter economy. However, this is from my point of view a mistake. As explained earlier the determination of market clearing equilibrium when there is no outside money requires a system of credits and debits, that is, the existence of inside money.20

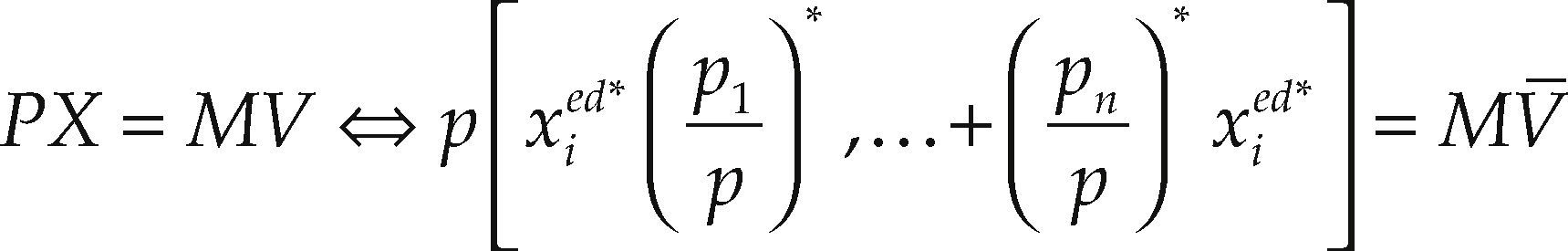

The monetary side or monetary market is then introduced through a quantity theory equation. Money appears in the story in the ‘same miraculous way’ that commodities were distributed to the different agent's in the economy (Patinkin, 1972, p. 14). The quantity theory formulation considers that the circulation velocity of money is constant):21

The * denote the equilibrium relative prices and quantities determined by the subset of real Equations [1] and [2]. Hence, the relative prices are determined in the real subsector and (for a constant velocity of money and a given quantity of money) the absolute price level is determined in the monetary sector [3].

According to Patinkin, the integration of the real and monetary sides leads to a dichotomization of the pricing process. Relative prices are determined in the real sector of the economy by the excess demand functions; while the absolute price level is determined in the monetary side of the economy, by the quantity theory equation.

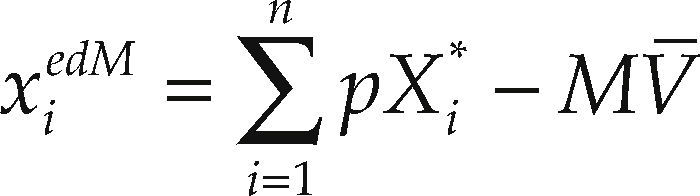

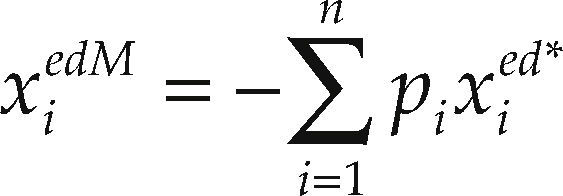

Patinkin contends that the system comprised of Equations [1] to [3] is inconsistent. Using Equation [3] the excess demand function for money can be written as:

Equation [4] states that the excess demand for money is homogenous of degree 1 in p and M. Yet at the same time, the excess demand for money function can be derived from the real subset of equations by applying Walras's Law.

The excess demand for money function is derived as a function of the excess demand for goods. Formally:

Equation [5] is homogeneous of degree 1 in all the different nominal prices (in the pis) or of degree zero in the respective relative prices. Hence, the excess money demand function of Equation [5] derived from Walras's Law is contradictory with the excess demand function in Equation [4] derived from the quantity theory.

Patinkin (1972) argues that this is an invalid dichotomy, for it leads to contradictory implications about the determinacy or alternatively, stability of the absolute price level.’ One example, by no means the only one, is to assume starting from a position of full equilibrium, an exogenous increase in the money supply, which would, other things being equal, translate in an equiproportional increase in the price level (i.e., fulfilling the homogeneity of degree one in prices). However, the excess demand functions, being homogenous of degree zero in prices, would not be affected. The increase in money supply and prices would not generate any excess demand to push the price level upwards. Thus how can a change in the price level occur without a change in the excess demand functions, i.e., without a change in demand conditions in the real sector when, in fact, these demand conditions are created in the monetary sector?

The real balance effectHis approach to solve this problem consisted in allowing individual and market excess demand functions for commodities to be dependent not only on relative prices, and income, but also on real balances (i.e., the real value of initial money holdings). Thus by introducing real balance into the excess demand functions an increase in the quantity of money, by increasing money holdings and for a given price level, real balances, will affect the demand for commodities, “just as any other increase in wealth”(Patinkin, 1972, p. 20). This effect of the change in the real quantity of money on the demand for commodities is known as the ‘real balance effect.’22

According to Patinkin (1989a [1956], p. 18), the dependence of the excess demand function for commodities on real balances “is simply the obverse side of the familiar demand for money (…) for to say than an individual adjusts his money balances so as to maintain a desired relationship between them and his planned expenditures on commodities is at the same time to say that he adjusts these expenditures so as to maintain a desired relationship between them and his money balances.” As a result, when real balances for an individual increase above their desired level this will translate into an increase in spending, and an individual excess demand for commodities. Similarly, when real balances fall short of their desired level, the individual in question will seek to restore the desired level of real balances and this will produce an individual excess supply of commodities.

The demand for real balances will depend on both subjective and objective factors. The subjective factors refer to the habits of the individual regarding ‘thrift and hoarding, book credits and the use of checks.’ The objective factors include ‘the frequency and of receipts and payments, their regularity, and correspondence between times and amounts.’23

The difference between an individual's desired and actual real money holdings (real balances) give rise to the notion of excess demand function for money. Since by definition the decision to hold a certain level of real money balances is simultaneous to that of consuming a given a set of commodities, it follows that the excess demand for money is equal to the value of excess supply for commodities (Patinkin, ibid., pp. 24-26).

By extension, this equality can be shown to exist also at the market level. That is at the market level, an excess demand for money function can also be defined so that the equality between the excess demand for money function and excess supplies of commodities can still hold. However and most important, the validity of this analogy requires both in the short and long run equilibrium analysis the exclusion of distribution effects.

In practice in the short run, equilibrium analysis (understood as an exercise of comparative statics ‘examining the forces that bring the economy to the equilibrium position that corresponds to the initial distribution of money endowments.’) amounts to assuming that (i) all individuals in a given market are endowed with the same purchasing power and must spend the same fraction of wealth (real balances) on the available set of goods; and that (ii) the marginal propensity to spend out of wealth (real balances) and income on each good is the same for all individuals in the same market.

Patinkin (ibid., pp. 44-45) makes the condition (i) explicit and condition (ii) implicit when analyzing the effects of an increase in the quantity of money in commodity markets. As he puts it: Let there (…) be some external force which, say, suddenly doubles the initial money holdings of each individual of the economy (…) it can be readily seen that that the equilibrium set of prices corresponding to the doubled quantity of money is one in which each and every price is doubled (…) relative prices and real wealth corresponding to this new set are the same as they were in the original position (…) the amounts of market excess demand for each commodity and for real money holdings must respectively also be the same in this position —that is zero (…). If the system is stable, and if to every set of conditions there corresponds a unique equilibrium, the economy must reach the new equilibrium position just described.24

The extension of the analysis to the long run requires according to Patinkin only the fulfilment of condition (ii). That is, the proportionality between money (wealth effect) and prices is independent of the distribution of initial increase in money among agents. As he puts it (Ibid, p. 57): “There is, however, one noteworthy difference between the short and long-run analyses, namely that the doubling of the price level (…) is independent of the way the new quantity of money is injected into the economy” and also (p. 53): “(…) the movement toward long-run equilibrium generates a unique distribution of initial balances among the individuals in the economy (…). The initial balances of the individuals in their position of long-run equilibrium are not among the given conditions of the analysis but among the dependent variables determined by the analysis itself.”

Yet, the whole analysis whereby a position of long-run equilibrium is reached with independence of distribution effects is based on an analysis of two individuals that have the same Engel curve for real balances (p. 51). In other words, despite statements to the contrary, long-run analysis explicitly assumes the fulfilment of both conditions (i) and (ii) above.

Since both of these conditions are fundamental in understanding the implications of Patinkin's analysis for the argument presented in this paper it is worth examining them in more detail.

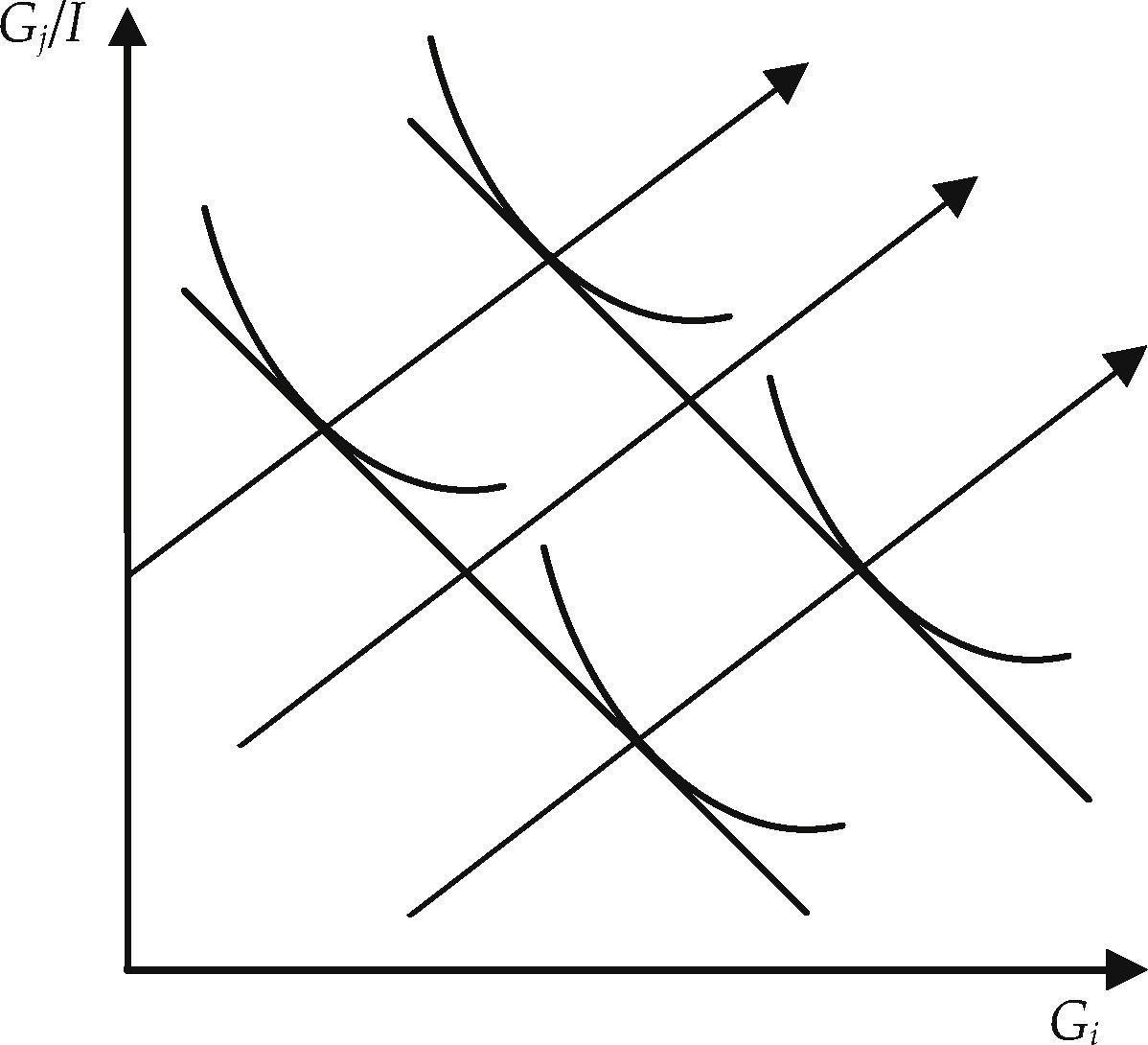

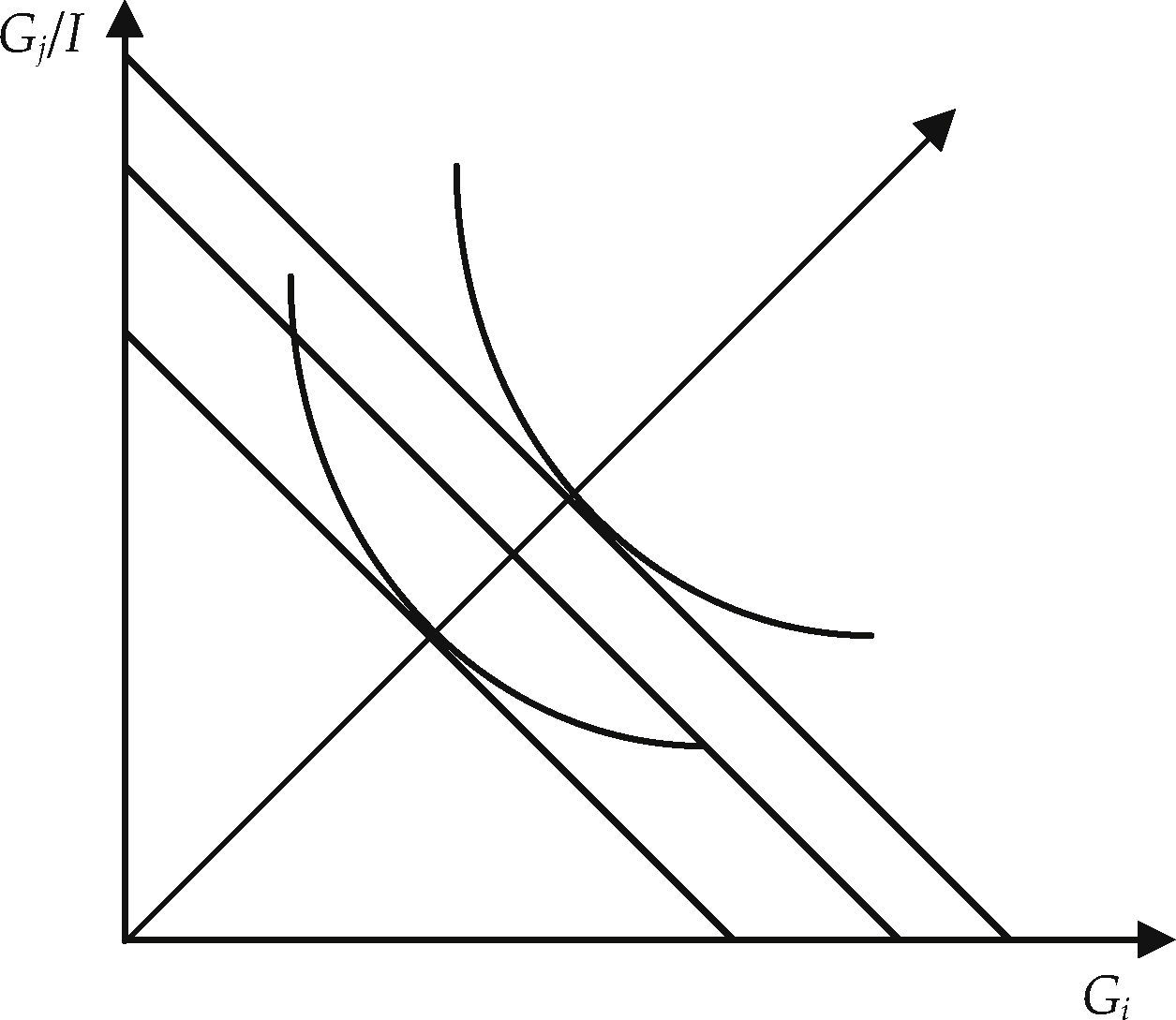

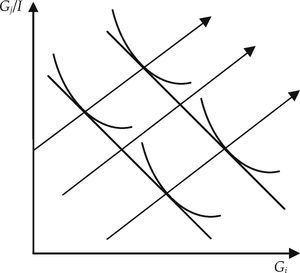

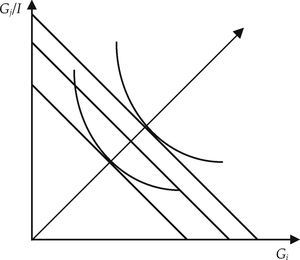

Condition (i) presupposes that all individuals in Patinkin's economy are characterized by linear and parallel Engel curves. That is he assumes that income effects are the same across all consumers and income levels. Condition (ii) is even stricter and presupposes that all individuals are characterized by linear Engel curves that pass through the origin. The latter condition implies in turn that individuals demand curves have unit elasticity with respect to income. Engel curves and the corresponding income expansion path reflecting conditions (i) and (ii) are illustrated in Figures 1 and 2 below.

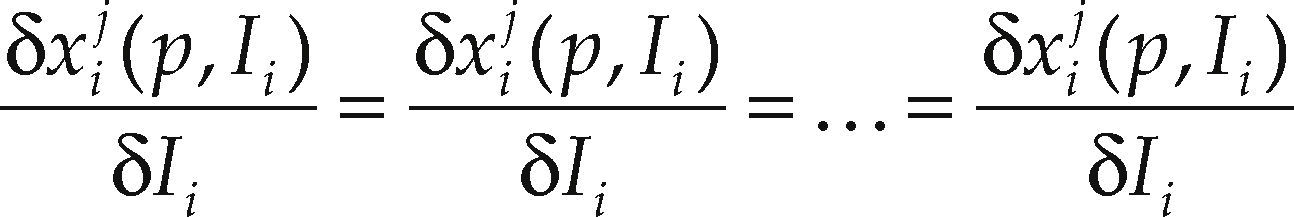

Formally, let j be a set of commodities and xk represent the consumption set of those j commodities. Let there be also n consumers so that a given price vector p andincome, I, i's consumerdemandisgivenby xik(p,Ii)=(xi1(p,Ii)...,xik(p,Ii)). Parallel Engel curves/income expansion paths as those illustrated in Figure 1 above imply that the income (wealth) effect is the same for all consumers at all income levels. That is:

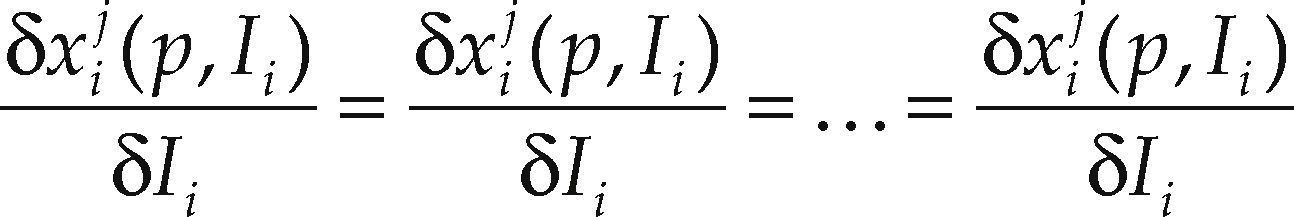

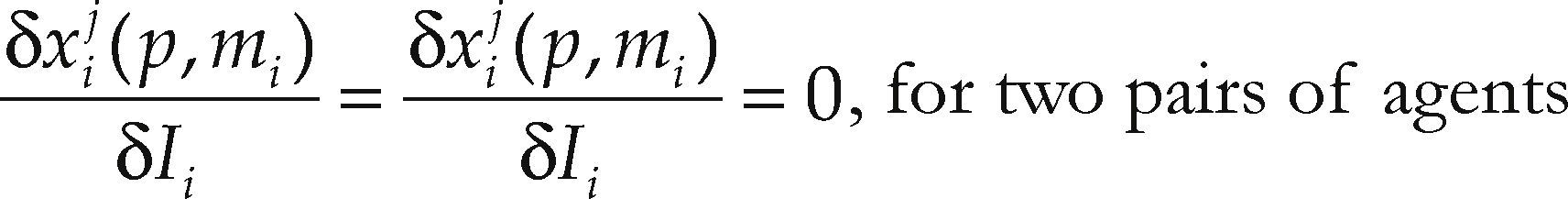

If Engel curves/income expansion paths as those illustrated in Figure 2, then all consumers are on the same Engel/income expansion path curve and the elasticity of consumption with respect to income (wealth) is equal to 1. That is:

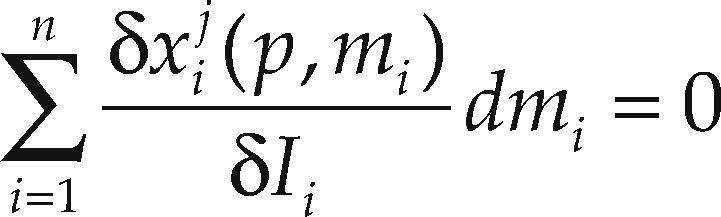

In both cases summing up [6] and [7] yields:

and in general:

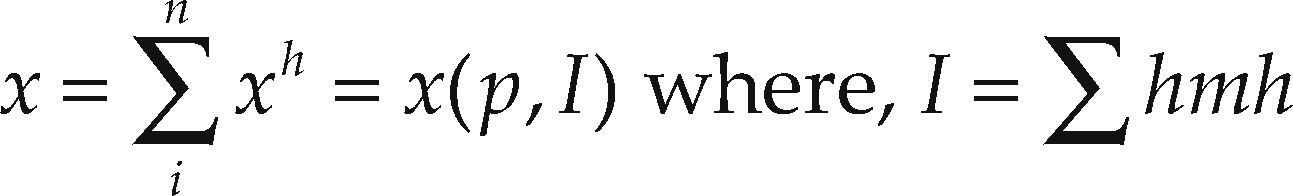

In turn property [9] above allows the aggregation across all agents (consumers, individuals), so that an aggregate demand can be generated by the demands of a single aggregate agent. That is:

Another way to look at the implications of property [9], is that it is consistent only with indirect utility functions of the Gorman form (Gorman, 1961) such as:

and the aggregate indirect utility function is:

Gorman indirect utility functions are restricted to, symmetric and homothetic utility functions or quasi linear utility functions.

Whether approached through the aggregation of individual aggregate demands or indirect utility, parallel Engel curves/income expansion paths (linear through the origin) imply that demand depends only on aggregate income (or wealth) and not on the way it is distributed among individuals.

Yet, by the fact that Patinkin either in his short run or long run assumes that all agents (consumers, individuals) have linear Engel curves that pass through the origin (Figure 2 above), he is assuming that all individuals are alike, that is they are one and the same. To put it more bluntly, Patinkin's economy consists of one single individual. A one single individual economy precludes the need to coordinate economic activities (as in general equilibrium theory) and even more important the very existence of trade or exchange. In short, a one individual economy negates the very existence of an economic problem and thus by extension the need for the existence of any theoretical apparatus to understand it or to dilucidate it.25

After patinkinThe response, debate and development following Patinkin's Money, Interest and Prices focussed mainly on the distinction between barter and non-barter, underscoring the fact that the main function of money was that of a medium of exchange. Early on it was pointed out (Hahn, 1965; Clower, 1967) that Patinkin's solution to the invalid dichotomy involved the possibility of barter and non-barter equilibria.26 Hence there was no reason in Patinkin's solution that justified the need for agents to make transactions on the basis of ‘money’ (considered mainly as a medium of exchange).27

Within the context of this interpretation of the work of Patinkin, Samuelson's (1958) overlapping generations approach was presented as a successful approach to the integration of monetary and value theory (Wallace, 1980). The approach is based on the fact that the rationale that justifies the introduction of money is the existence of ‘frictions.’ The introduction of agents (households) that have finite lives in generations that overlap is considered such a friction.

The overlapping generation models assume an infinite interval (from –∞to +∞) of time divided in discrete time periods. The time period from –∞ to 0 is history; its events are exogenous and determine the initial conditions. The objective is to understand how the economy evolves ‘into the infinite future.’ At each time period a new generation is born which lives for two periods so that at any time period two generations always overlap. There is only one good which is consumed (non-storable in the more simple versions). The good appears in a miraculous fashion and is given only to the younger generation. The older generation have no endowment. All the individuals are assumed to be alike in that they have the same initial endowments and the same utility functions (McCandless and Wallace, 1991; Champ and Freeman, 1994).

During any given period of time, the maximization of utility requires having some of endowment when young and when old. However, a member of the young generation would gain nothing by trading with other members (all possess the same of the same) and both will possess nothing when they are old. In a similar way, a member of the young generation cannot trade with a member of the old generation. The old want what the young possess but can’t provide anything the young want. The solution to this scenario is an autarkic equilibrium. In other words there is no trade.

The situation can be improved by trading. As put by Champ and Freeman (1994, p. 15): “In this autarkic equilibrium utility is low. Both the future generations and the initial old are worse off than they would be with almost any other feasible consumption bundle. A member of the future generation would gladly give up some of his endowment when young in order to consume something when old. A member of the initial old would also like to consume something when old.” The solution thus to improve overall utility is to introduce money as outside money given as a ‘gift’ to the old. Thus the young are given an endowment and the old money. This opens the possibility for exchange and the problem of the coincidence of wants is solved. In this approach, money does not have an utility of its own and is valuable to the extent that it allows individuals to gain access to the good endowment when they are old.

This type of approach rather than superseding Patinkin, brings us right back to him. It is very similar to Patinkin in its approach, structure and conclusions. Outside money is introduced without concern where it originates, either as a gift or an endowment. All individuals are alike and thus as a result, money is bound to be neutral. It is same individual spending a given quantity of outside fiat money. This is summarized by Benetti (1990, p. 126): “From the point of view of the attribute of money as a means of exchange, it is a theory of a one agent economy that transfers money from one period to the next (…).” Hence as in the case of Patinkin, overlapping generations models can introduce money by obviating the coordination issue which is the conceptual underpinning for general equilibrium theory and the proof of existence.

The same applies to the more modern versions of the overlapping generations model couched under ‘the representative agent.’ These models assume from the outset conditions which are restrictive as those of Patinkin and once the solution is worked out, money is introduced from the outside.

In these models the ‘representative agent’ can refer to an agent which is ‘representative’ of a category of agents with a given set of endowments. This conceptual category allows in practice to aggregate individuals (agents) into different ‘representative category’ agents according to different characteristics.

The fact that each representative agent category has different characteristics gives rise to trade (exchange).

Consider two categories of agents with two different sets of endowments represented by ‘two representative agents’, which can engage in trade in order to improve their utility/welfare. In order the make the analysis fully tractable the literature generally assumes that both these ‘representative agents’ have homothetic, intertemporally separable utility functions. In order to introduce outside money in a later stage, as in Patinkin, the agents are assumed to have homothetic utility functions (i.e., they have parallel income expansion paths. In the simplest analyses the utility function includes two periods but can be easily extended to n periods without altering the main message of the analysis.

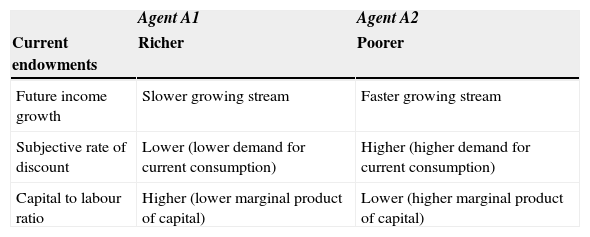

Table 1 summarizes the characteristics that underpin exchange in these models for a closed economy. Let there be an economy with two ‘representative agents’ A1 and A2. Both differ in terms of endowments. A1's endowment is greater than A2. That is A1 is richer than A2. As well, the richer agent (A1) has a slower future income stream than poorer agent (A2). Moreover, the richer agent (A1) has a lower demand for current consumption than the poorer agent (A2). Finally, the richer agent (A1) has a lower marginal product of capital (higher capital to labor ratio) relative to the poorer agent (A2).

A schema of exchange between a richer and poorer agent in a representative agent model.

| Agent A1 | Agent A2 | |

|---|---|---|

| Current endowments | Richer | Poorer |

| Future income growth | Slower growing stream | Faster growing stream |

| Subjective rate of discount | Lower (lower demand for current consumption) | Higher (higher demand for current consumption) |

| Capital to labour ratio | Higher (lower marginal product of capital) | Lower (higher marginal product of capital) |

Both have well behaved utility functions and pursue utility maximizing behaviour. As a result, given their different characteristics both agents can benefit by ‘smoothing’ their streams of future consumption. There arises an exchange between both in the form of a credit market that can lead to mutual beneficial gains. The richer agent (A1) gives up some of its current consumption against greater future consumption. Conversely, the poorer agent (A2) increases its current consumption by borrowing from the richer agent (A2), backing the borrowing by greater future income.

By analogy the above model is extended to an open economy framework.28 The framework is basically the same as that of a closed economy with two agents with the difference that now there are two countries (country A1 and A2) with different levels of income. Countries A1 and A2 have the same characteristics as agents A1 and A2 of the previous closed economy example.

Once the analysis of exchange is worked out, outside money is introduced in the analysis and in this way it is made consistent with the analysis is ‘real’ terms.29

ConclusionThe Neo-Walrasian general equilibrium model is often portrayed as a barter model on which money can be added without altering any of its properties and results. Money is an inessential addition to the Neo-Walrasian model.

However, the basis for the existence of Neo-Walrasian theory, the market clearing equilibrium proof, requires in fact the existence of inside money. In this sense money is essential to its central core.

At the same time, inside money is at cross-purposes with the main tenents of Neo-Classical monetary theory, encapsulated in the quantity theory equation, which assumes that money supply is exogenous, that inflation is always and everywhere a monetary phenomenon and that money is neutral.30 Hence, the necessity to incorporate outside money in the model. In fact, the discussion of the role of money in general equilibrium tends to refer to outside money.

The integration of monetary and value theory, which is really the integration of outside money in a framework where inside money already exists, has been unsuccessful. Two representative attempts include those of Patinkin and the overlapping generation models.

Both cases illustrate the fact that the only way outside money can be made compatible with a Neo-Walrasian general equilibrium framework is by assuming the existence of a single agent. The single representative agent is the basis of the more modern New Keynesian DSGE models (Woodford, 2003). Yet, the representative agent story negates the very economic problem (i.e., exchange) that gave rise to general equilibrium theory. In other words, the very notion of outside money and the basic Neo-Classical principles of Neo-Classical monetary theory cannot coexist with a generalized exchange system.

The author is Senior Economic Affairs Officer at Economic Commission for Latin America and the Caribbean (ECLAC, Chile), The author wishes to thank the journal's anonymous referees for their valuable comments. The opinions here expressed are the authors’ own and may not coincide with those of the institution with which he is affiliated.

In what follows Neo-Classical theory is discussed within its Neo-Walrasian version. The main characteristics of the Neo-Walrasian approach include among others, that goods (commodities) are distinguished and specified by their physical attributes, spatial location, and time of delivery. All goods have a market and a price. Agents are price takers and are divided into two categories into producers (firms) and consumers. Consumers are defined by a consumption set, a utility function and an endowment of goods. Both agents have production and consumption plans that are complete. That is, both decide in time t, at the beginning of a given period, the types and amounts of goods to consume and produce through the rest of their useful lives. The specification of preferences (utility functions), technology, size of endowments and distribution of endowments constitute the required data “to establish the model of price formation as the outcome of the competitive resolution of individual utility maximization subject to the constraints of technology and endowments” (Eatwell, 1982). The focus of this paper is on exchange (consumers) and the issues arising from the inclusion of non-reproducible factors and reproducible means of production are not addressed.

Or in the words of Intrilligator the anthropomorphic representation of the market, i.e., the auctioneer. See Intrilligator (1971).

IOU stands for “I owe you” and refers generally to an informal document that acknowledges a debt that is owed. Generally an IOU is distinguished from a formal contract such as a promissory note due to the existence of some uncertainty regarding repayment and enforcement. However, in the case here analyzed, the assumption of perfect foresight and complete trust makes the IOU equivalent to a promissory note.

The 1954 paper was presented at an Econometric Society Meeting in December, 1952. According to Ingrao and Israel (1990), the paper was based on a previous paper by Debreu written in August of the same year. The existence theorem presented by Debreu in the latter paper was used by Arrow and Debreu. See, Debreu (1952, p. 887) and Weintraub (1995 [1983], p. 104). McKenzie's work published in 1954 was developed within the context of Graham's model for world trade. McKenzie (1959; 2002) further developed his work on the proof of existence of general equilibrium. Arrow and Debreu (1954) and McKenzie's (1954) existence proof relied on Kakutani's fixed-point theorem (“the most powerful tool for the proof of existence of an economic equilibrium”, Debreu, 1982, p. 698, and 1983). A simplification of the ‘complex equilibrium proof’ of Arrow-Debreu (1954) was provided in Debreu's seminal (1959) work, A Theory of Value.

There are several approaches to establish the existence of general equilibrium. The excess demand constructs an excess demand correspondence (or excess demand function) and then proving that, there exists a price at which excess demand can be zero. See, Debreu (1982); Arrow and Hahn (1971 [1991]), Farmer (1993), Allingham (1987). The excess demand approach also uses Kakutani's fixed point theorem.

Goods are distinguished by their physical properties, and location and date at which they will be available (Debreu, 1959; Arrow and Debreu, 1954).

See, Debreu (Ibid.), Benetti (1990), Allingham (1987), and Hahn (1965). Hahn (1965) also adds boundedness (that is, the net excess demand function for good i, zi(p), is bounded from below, and scarcity (that is, zi(0) > 0).

This is made implicit in Arrow and Debreu (1954) by the mere fact that their model, as all Neo- Walrasian constructs assume that (p. 266) “each commodity may be bought or sold for delivery at one of a finite number of distinct locations and one of a finite number of future time points.” The fact that there is no single medium of exchange and that transactions are undertaken on the basis of ‘credits and debits’ has some similarity to the credit theory of money espoused by Innes (1914), at least up to the point where the government is introduced. As put by Innes (Ibid, p. 12): “there is no such thing as a medium of exchange. A sale and purchase is the exchange of a commodity for credit. Credit and credit alone is money (…). A credit cancels a debt (…). By sale a credit is acquired, by purchase a debt is created. The object of commerce is the acquisition of credits (…). The issue of money is not an exclusive privilege of the government (…) money is one form or another is in fact, issued by banks, merchants (…). Debts due at a certain moment can only be off-set against credits which become available at that time (…).”

Gale (1982, p. 235) explains it in the following way: When commodities by definition have different delivery dates (…) agents are really writing contracts at the first date, the terms of which are to be fulfilled later (…). If one thinks of pieces of paper as ‘commodities’, there is nothing inconsistent in saying that all ‘commodities’ are exchanges at the first date (…). In terms of interpretation (…) it is only permissible to identify commodities with pieces of paper if it is assumed that that the contracts will be carried out (…). The Arrow-Debreu model concerns itself with trading at the first date only, because it assumes that a promise to deliver a commodity is as good as the thing itself (…) agents trust each other. In an equilibrium characterized by trust there is no reason to distinguish between contracts, agreements (…) and their execution. As put by Arrow and Hahn (1971 [1991], p. 33), a complete set of markets “telescopes the future into the present.” Dubey, Geanakoplos and Shibik (2005), in general equilibrium with incomplete markets ‘agents [still] keep all their promises by assumption.” Note that the last chapter of Debreu (i.e., 1959, chapter VII) deals with uncertainty. In that chapter the contract for transfer is made dependent not only on the physical properties, location and date, but also on “an event on the occurrence of which the transfer is conditional” (Debreu, ibid., p. 98). The prices corresponding to these ‘state contingent claims’ are known as Arrow-Debreu prices.

Dubey, Geanakoplos and Shibik (2005) sustain that, by assumption, there is also absence of default in Arrow-Debreu models with incomplete contingent markets. As in the case of complete contingent markets, the fact that agents honor their commitments, means that they trust each other.

As pointed by Kiyotaki and Moore (2001), the absence of trust to repay debts is what prevents private IOUs from being liquid (i.e., not sticky), that is from being ‘transferable, negotiable instruments.’ The trust view of money has a long tradition in economics dating at least to Vaughan (1675) and including Locke (1691) and Thornton (1802 [1991]). For Vaughan (1675) the absence of trust requires a quid pro quo. The quid pro quo guarantees that agents will not default on the redemption of their promises and thus traces the existence of money as an externally issued medium of exchange to the absence of trust: “The first invention of money was for pledge and instead of a surety, for when men did live by exchange of their Wants and Superfluities, both parties could not always fir one another at the present; in which case the Corruption of Man's Nature did quickly grow to make it behooful, that the party receiving should have somewhat worthy to be esteemed for a Pledge, to supply the givers want upon the like occasion.” The trust view of money is fully developed in Simmel's (1906 [1990]) analysis of money. It is worth to quote from Simmel at length on this issue (p. 179): Without the general trust that people have in each other, society itself would disintegrate (…) money transactions would collapse without trust…it is not only a money economy, but any economy, that depends upon such trust (…). In the case of credit [as in the Debreu model], of trust in someone, there is an additional element which is hard to describe: it is most clearly embodied in religious faith. ‘To believe in someone’ (…) expresses the feeling that there exists between our idea of a being and the being itself a definite connection and unity, a certain consistency (…) an assurance and lack of resistance in the surrender of the Ego to this conception (…). Economic credit does an element of this supra-theoretical belief (…) it contains a further element of social-psychological quasi religious faith. Debreu's assumes that agents are ‘credible borrowers’. He supplants Simmel's ‘element of socialpsychological quasi religious faith’ with the main assumptions of general equilibrium theory which guarantee that agents ‘trust each other.’ Laidler and Rowe (1980) argue (p. 101) that according to Simmel ‘money is an essential part of the infrastructure of the market economy, a public good in the sense as, for example, the legal system.’ This also applies to transferable and negotiable IOUs, they are a public good.

The notions of inside and outside money were initially developed by Gurley and Shaw (1960) as they attempted to ‘develop a theory of finance encompassing the theories of money and financial institutions that include a banking theory.’ While both outside and inside money emphasize the medium of exchange property of money, it would seem that in the Debreu model, inside money is mainly a ‘medium of account’ but the IOU's have also the property of being media of exchange. In general mainstream economic textbooks prioritize money's function as a medium of exchange either by emphasizing at an analytical level that the medium of account function is ‘defined by an economy's dominant medium of exchange’ or highlighting its precedence from a historical perspective (Cowen and Kroszner, 1994, p. 9). A well known example of this approach is found in Menger (1892). Jevons (1896) is another illustrative example. However, as emphasized by Einzig (1951) there are clear historical examples that prioritize the medium of account function. As put by Einzig (Ibid, p. 356) “the need for a common denominator to facilitate barter must have been felt long before the increase in the volume and diversity of goods made the use of a medium of exchange imperative.”

This is defined for example in the case of Federal Reserve as (Brunner, 1989): “earning assets of the Central Bank consisting of government securities and advances to banks) + gold stock (Including SDR's) minus treasury cash (i.e., free gold) + treasury currency (mostly coin) + a mixture of other assets minus other liabilities (including net worth).”

A credible policy is one for which agents expect that it will have its intended effects). Reputation is based on known preferences by the public and preferences that are expected to remain invariant. Unpredictable policy making shortens agents planning horizon, increases their discount rates and changes in expectations can lead to sudden changes in relative prices.

The Neo-Walrasian re-interpretation of the Classics was initiated by Hicks (1939) and Lange (1945). See Rogers (1989).

One can also find it under the guise of the ‘theoretical problem of neutral money’ (as in Hayek, 1933).

The term money illusion was coined by Fisher (1928).

Niehans (1978) interprets this as a budget constraint and more precisely as an expression of Say's Law since formalizes the idea that “commodities are bought with commodities.” Since ‘money’ does not intervene in the process the system comprising [1] and [2] is portrayed as a ‘barter system.’

Note that the price level p can defined as a weighted average of the money prices of the different individual goods, i.e., Equation [3], p ≡∑i=1nθipiHarris, 1985, p. 28). When made explicit, the system has n+1 equations to determine n relative prices. Walras's Law solves the problem of over determination by asserting that the excess demand for the nth market is linearly dependent on the n–1 markets.

This actually questions the whole notion of barter and that a system of generalized exchange is a possibility under barter.

Harris and Niehans use a Cambridge type quantity equation. I follow here the formulation of Patinkin (1972).

See also Patinkin (1989b).

The wording o the subjective and objective factors follow Fisher (1911 [1985], p. 79) as Patinkin states (1989a [1956], p. 18, note 11) that his description of the objective and subjective factors are a special cases of those identified by Fisher. In the words of Patinkin, the subjective factors include: “the individual's evaluation of the inconvenience and /or risk of running short of cash.” The objective factors comprise, “the precise character of the random payment process and/or penalty costs.”

Note once again that the so-called ‘external force’ that doubles process ensures that money supply is exogenous.

At the same time it also avoids the wealth effects that give rise to the Sonnenschein-Debreu-Mantel theorem and its implications that the microeconomic assumptions of good behavior do not carry over to the aggregate macroeconomic level.

This remains the most common interpretations of Patinkin. On this point see Rogers (1989, p. 90). As pointed by Rogers, the fact that Patinkin's model was interpreted as a barter model was misleading. And from my point of view it also misled the following research program in Neo-Walrasian monetary theory. Another of the issues that became an important subject of debate was the possibility that the price of money be equal to zero. In Neo-Walrasian theory it is assumed that money has a positive price. However, in a finite horizon model, no agent will hold money at the end of the period so that every agent will try to get rid of the money in t–1. If agents have perfect foresight at the beginning of the period where trade commences the price of money would be zero and money considered a free good. Thus why would consumers hold money and why would they accept at the end of the period payment of interests in a media of exchange that is worthless? Yet one wonders whether this problem arises at all in a one agent economy as that depicted by Patinkin in his solution to the invalid dichotomy.

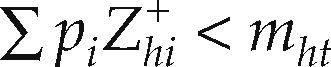

The lack of rationale for the existence of money is compensated by the addition of a Clower or finance constraint, which captures the function of money as means of exchange. The finance constraint was introduced to overcome the lack of transitivity in the process of exchange. This feature was captured in the aphorism: money buys goods and goods buy money but goods do not buy goods. The finance constraint captures thus the idea that agents’ purchases cannot exceed his money balances. It can be specified as: Where Zhi+ is the difference between net purchases and sales assuming or in other words agents excess demand, and mht is agents initial money endowment at time t. The value of notional purchases by agent h is set to be less or equal to the agent's monetary balances or endowments. However, the finance constraint makes sense in a world of incomplete and descentralized markets (Gale, 1982, p. 183). This implies that for an equilibrium solution to be found trade must continue after the first initial trading period. This in turn means that money has a role to play in sequence economies (Hahn, 1981, p. 3) which is an important rationale behind the overlapping generation models discussed below.

Obstfeld and Rogoff (1996) provide an illustrative example for an open economy. Their text book Foundations of International Macroeconomics is considered the workhorse of international macroeconomics for graduate courses.

In this type of model the main role of the external sector is to smooth out consumption over time. Increases in actual over permanent domestic income, result in positive transitory income which can be saved and invested abroad to earn a higher rate of return than if invested domestically. Contrarily, when actual income falls below permanent income and transitory income becomes negative, the level of consumption is maintained by increasing imports and foreign borrowing. Whatever the ultimate outcome, actual consumption is always maintained at a level consistent with that of permanent income, and capital is always allocated to its most profitable (efficient) use.

The non-neutrality of money is tantamount to accepting that agents ‘suffer’ from money illusion (they equate real with nominal magnitudes). The term was coined by Fisher (1928). Fisher defined it (Ibid, p. 4) as, “the failure to perceive that the dollar, or any other unit of money, expands or shrinks in value.” In turn, within the logic of Patinkin's framework it is equivalent to stating that demand functions are not homogeneous of degree 0 in prices pi and wi, that is, fi(pi,wi) ≠ fi(λpi,λwi) for any λ. Money illusion and hence the non-neutrality of money can rationalized within the logic of Neo- Classical theory, in the short-run, simply by postulating the existence of rigidities/imperfections (both nominal and real) within an intertemporal general equilibrium framework. However, rigidities and imperfections and hence money illusion cannot persist indefinitely over time. These are inconsistent with the basic presupposition of Neo-Classical economic theory, i.e. that agents pursue the maximization of utility/profits leading to optimal outcomes. When agents follow sub-optimal behavior, they eventually revise their decision making process in order to arrive at a better outcome.