This paper proposes an empirical method to estimate the value of the neutral interest rate in the U.S. and investigates whether the non-conventional monetary policy that has been in effect since the 2008 recession should continue. Specifically, a procedure is established based on a Cointegrated Vector Autoregression (cvar) model that enables us to conclude that the expansionary monetary policy could continue for at least three more years. Our estimates suggest that the neutral real rate, consistent with full employment and the inflation target in the U.S., will remain negative until 2018. This trend will continue until 2019, when the nominal neutral rate will reach a level of 2%, which remains below the pre-crisis level of 4%. In fact, it seems that the neutral rate has permanently shifted toward a lower level associated with the new fundamentals of the U.S. economy.

Este artículo propone un método empírico para estimar el valor de la tasa de interés neutral de Estados Unidos (ee.uu.) e investiga si la política monetaria no convencional que ha estado en vigor desde la recisión de 2008 debe continuar. Específicamente, se establece un procedimiento basado en un modelo de vectores autorregresivos cointegrado (cvar) que nos permite concluir que la política monetaria expansiva podría continuar por lo menos tres años más. Nuestras estimaciones sugieren que la tasa real neutral, consistente con el pleno empleo y el objetivo de inflación de ee.uu., continuará siendo negativa hasta 2018. Esta tendencia continuará hasta 2019, cuando la tasa neutral nominal alcanzará un nivel de 2%, la cual permanecerá por debajo del nivel previo a la crisis, 4%. De hecho, pareciera que la tasa neutral se ha desplazado hacia un nivel menor asociado con los nuevos fundamentos de la economía norteamericana.

Full-time senior researcher at the Instituto de Investigaciones Económicas (iiec) of the Universidad Nacional Autónoma de México (unam, Mexico). This article is a collateral result of both papiit IN301715 project and papime PE304914 project.

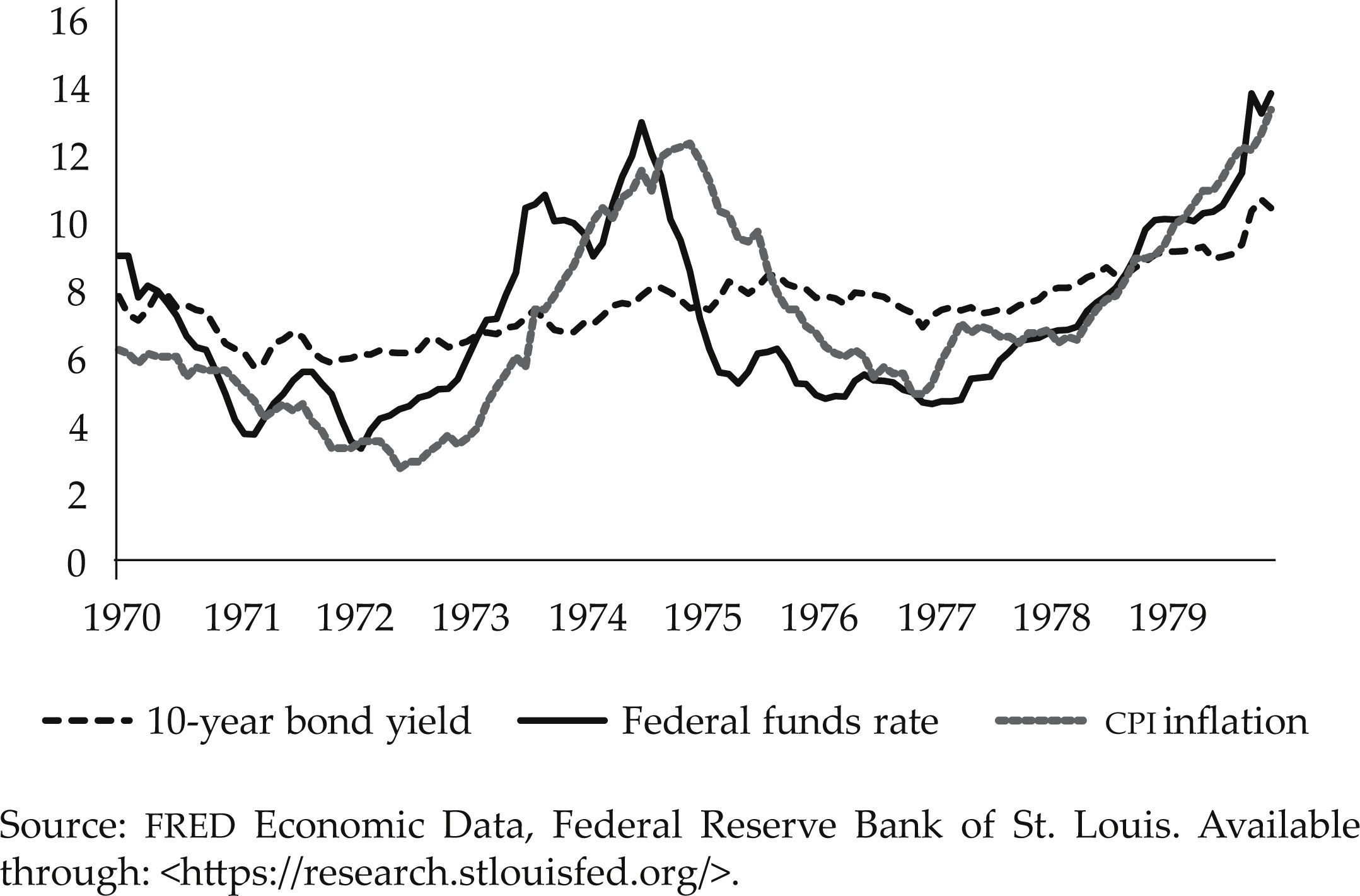

A press release from the fed (Yellen, 2015, 27th March) reported that the real equilibrium federal funds rate was below its historical average (4%). The release also stated that the normalization of the U.S. economy would be performed gradually as long as the prognosis of the fundamentals of the U.S. economy indicated that this approach was appropriate.

In an estimates update of Laubach and Williams (2003), the nominal neutral rate was 1.21% and the neutral real rate was –0.271% until the third quarter of 2015.

A good practice is to determine the rank and type of deterministic polynomial because the statistical distribution of the rank differs among the possible choices of deterministic component in the model.

Clarida (2015) uses the neutral interest rate estimated by Laubach and Williams in conjunction with the parameter suggested by the Taylor rule to interpret and assess the fed's monetary policy during the period 2000-2017.

Los autores pertenecen a la Dirección General de Investigación Económica del Banco de México. Los comentarios expresados aquí, así como las conclusiones que de ellos se derivan, son responsabilidad exclusiva de los autores y no reflejan necesariamente la opinión del Banco de México.

Véase la quinta sección, p. 16.

Véanse las Minutas del Federal Open Market Commmittee, órgano colegiado encargado de la toma de decisiones de política monetaria en Estados Unido, correspondientes a la reunión de política monetaria del 27 y 28 de octubre de 2015 y el Reporte de Política Monetaria publicada por la Junta de Gobierno de la Reserva Federal en febrero de 2016.

Véanse, por ejemplo, Barsky, Justiniano y Melosi (2014); Cúrdia et al. (2015); Hamilton et al. (2015); Kiley, 2015; Del Negro et al. (2015); Lubik y Mathes (2015), y Johannsen y Mertens (2016), entre otros.

Véase la quinta sección, p. 15; las cursivas son nuestras.

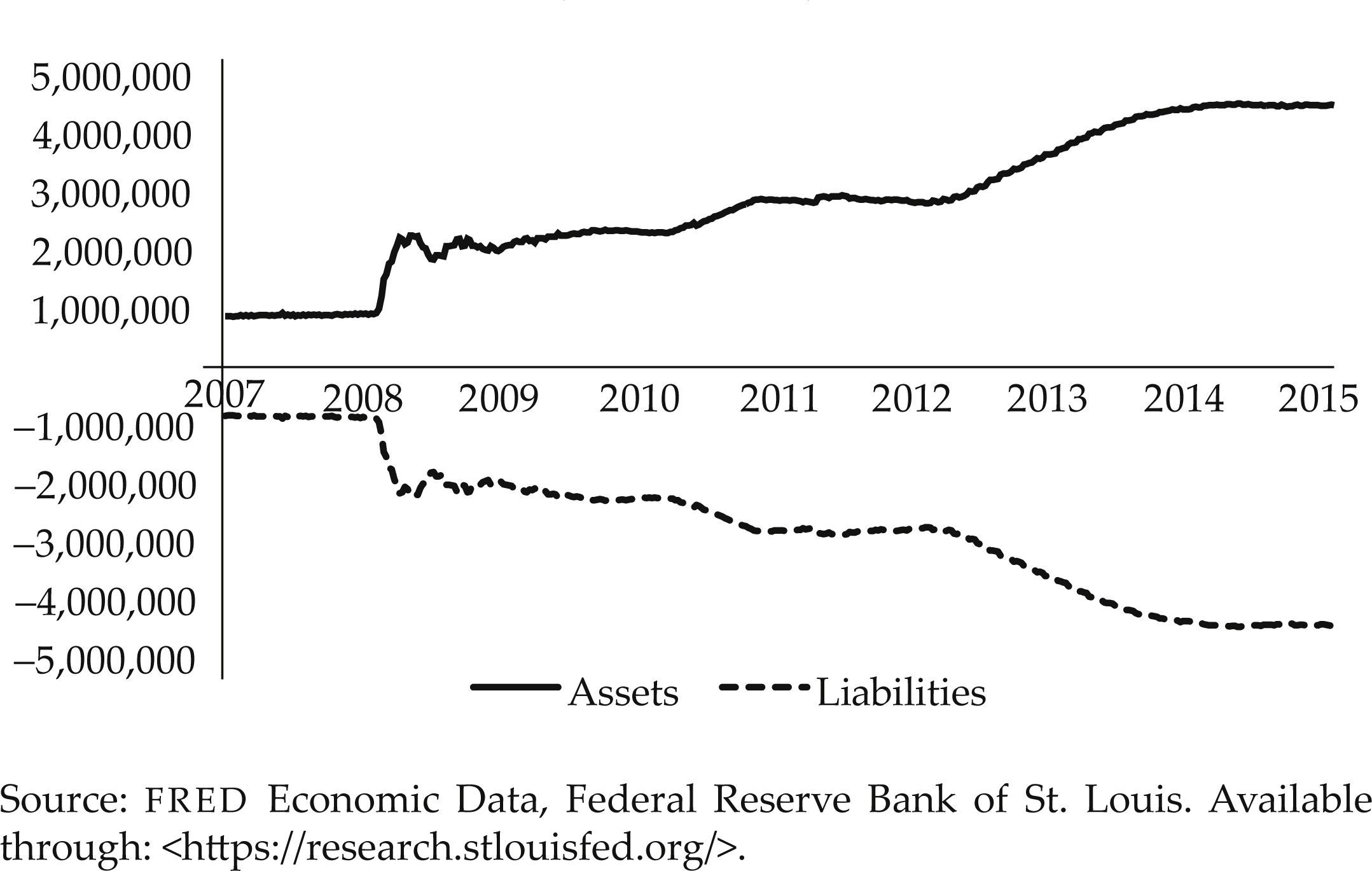

Small wonder Ben Bernanke prefers the term “credit easing” rather than “quantitative easing” (see Bernanke, 2013 and 2015).

On October 2014 the fomc decided to wrap up its lsaps program; the Fed's balance sheet has been trending marginally down ever since. Yet, Fed's balance sheet still was $4,423 trillion on June 8th, 2016.

The Fed's “Policy Normalization Principles and Plans”, announced by the fomc on September 17th, 2014, includes rate hikes when accommodative monetary policy is no longer needed and a reduction of the size of the Fed's balance sheet.