The aim of this paper was to analyze the contribution of intangible assets in the value creation of companies, using the methodology proposed by Gu and Lev (2003, 2011). The database used was collected in Datastream with information covering the period from 2001 to 2010. The main results indicate that: (i) the variables RD and SGA and RD, SGA and CAPEX represent intangibility proxies for the software and hardware sector, respectively; (ii) comprehensive value explains the market value for the two sectors; and (iii) the intangibility indices ICBV and RI and MtCV, ICM and RI present a positive and significant relationship with shareholder return for the software and hardware sector, respectively. The principal implication of the paper is having found a positive and significant relationship between comprehensive value and market value. Accordingly, if this variable really explains the market value, it is a solution to a problem that afflicts accountants, which is how to account for intangibles in the balance sheet.

El objetivo de este trabajo fue analizar la contribución de los activos intangibles en la creación de valor de las empresas utilizando la metodología propuesta por Gu y Lev (2003, 2011). La base de datos utilizada fue recogida en Datastream con información que abarca el período de 2001-2010. Los principales resultados indican que: (i) las variables RD y SGA y RD, SGA y CAPEX representan proxies de intangibilidad para el sector del software y hardware, respectivamente; (ii) el comprehensive value explica el valor de mercado para los dos sectores, y (iii) los índices de intangibilidad ICBV y RI y MtCV, ICM y RI presentan una relación positiva y significativa con el rendimiento para los accionistas en el sector del software y hardware, respectivamente. La principal consecuencia de este artículo fue obtener una relación positiva y significativa entre el comprehensive value y su valor de mercado. Si esta variable realmente explica el valor de mercado, se trata de una solución a un problema que afecta a los contables, que es cómo contabilizar los activos intangibles en el balance general.

Intangibles are being studied by various areas of knowledge. Many scholars believe that knowledge has played an important role in the value creation of companies and represents a source of sustainable competitive advantage for them. Bontis (2002) observed that concern about the topic is present in economics, sociology, and psychology, administration (information technology, human resource administration, and management research). For this reason, according to Barney (1991), to understand the sources of sustainable competitive advantage it is necessary to build a model based on the statement that the resources of the company are immobile and heterogeneous. Thus, Barney (1991, 2008) proposes the model known as VRIO (Value, Rarity, Imitability and Organization). The author assures readers that for a company to have a potential sustainable competitive advantage, its resources must be: valuable, in the sense that it exploits opportunities and/or neutralizes threats; rare among the current companies and potential competitors; imperfectly imitable; and there cannot be any strategically equivalent substitutes for these resources.

Several studies provide empirical evidence for the hypothesis of the potentiality of intangibles in the generation of future economic benefits for companies (value creation and economic performance). Hall et al. (2001) found positive relationships between the quantity of patents and the market value of the company. Villalonga (2004), in turn, investigated the influence of intangible resources on the superior performance of North American companies and found in his research that intangibles play an effective role in sustainable competitive advantage, thus generating superior economic performance, as foreseen by the resource-based view (RBV). Lee and Chen (2009) observed that research and development expenditures lead to two types of effect on the company's value creation. In their study they observed that low or moderate levels of R&D expenditure lead to negative returns from shares while on the other hand, high levels of R&D expenditures lead to positive returns. According to Miller and Mathisen (2008), advertising expenses should be considered capital investments as they generate future economic benefits, thus increasing the company's market value. Indeed, in the study conducted by Yeung and Ramasamy (2008), the results revealed that companies with strong brands are more profitable and also present sufficient evidence in the significant relationship between brand and company performance in the stock market.

Andriessen (2004), supported by the work of Bontis (2002) and Bontis, Dragonetti, Jacobsen, and Ross (1999), selected five important schools of thought for the study of intangibles. The intellectual capital community is interested in the definition and measurement of intellectual capital, one of the forms of intangibles.

Andriessen (2004) brought up 12 methodologies that seek to provide a response to the problems of definition and measurement (Bounfour, 2002; Brooking, 1996; Edvinsson & Malone, 1997; M’Pherson & Pike, 2011; Mouritsen, Larsen, Bukh, & Johansen, 2001; Pike & Roos, 2000; Pulic, 2000a, 2000b; Roos, Roos, Dragonetti, & Edvinsson, 1997; Sullivan, 1998a, 1998b, 1998c; Sveiby, 1997; Viedma, 2001). The accounting community is interested in the accounting of intangibles in the financial statements, on the basis that traditional financial accounting does not present a satisfactory response for the market value of companies that is very different from the value expressed in traditional financial statements (Gu & Lev, 2003; Hall et al., 2001; Lev, 2001; Standfield, 2001; Stewart, 1997). Andriessen (2004) brought up seven methodologies that develop studies along this line of research. The performance measurement community incorporated the concept of intangibles to lend greater credibility to the focal points of performance measurement and according to Andriessen there are 2 methodologies that work with this concern (Kaplan & Norton, 1992, 1996a, 1996b, 2001; Stewart III, 1994). The valuation community, arising from financial studies, seeks to improve measurements (from the perspectives of the discounted cash flow and real options) of the highly uncertain values that originate from intangibles. Andriessen (2004) verified three methodological focuses that work along this line of research (Dixit and Pindyck, 1998; Khoury, 1998; Reilly & Schweihs, 1999). The human resources community, with a representative in the survey conducted by Andriessen (2004), seeks to reactivate human resources accounting techniques that developed in the 1960s and 1970s (Sackman, Flamholz, & Bullen, 1989).

Gu and Lev are representatives of the accounting area, as they are interested in approximating the book values of a company to the market value. From this point of view they are close to the line of thought of normative accounting, which is concerned about establishing rules for the accounting of intangibles (Córcoles, 2010; Epstein and Jermakowicz, 2009).

The theoretical line of thought, arising from economics, which sustains the arguments of Gu and Lev (2003, 2011), is the neoclassical theory. They base their theories on the empirical observation that the traditional production function, where only capital and labor are responsible for value creation, is unable to explain production, introducing a third factor, intangible assets. In the original version, the value generated by a company could be explained by a Cobb-Douglas production function in the form: Q1=ALIαCiβ, where Q represents the value added, L the labor, C the capital, A is the total productivity of the production factors, α and β represent the elasticities of value added in relation to labor and to capital, respectively. As the traditional production function was unable to explain the value added using just two production factors, it was enlarged to take into account a third production factor. The importance of this third factor for the explanation of shareholder will be evaluated in this paper.

Gu and Lev seek to provide an answer for a gap that exists in the area of research on intangibles: which is the best way of conceptualizing and measuring intangibles? It is emphasized that there are numerous proposals in the various areas dedicated to the study of intangibles, as highlighted above, but there is no consensus on a hegemonic methodology accepted by the majority of researchers dedicated to the topic.

In the next sections we present the methodology proposed by Gu and Lev (2003, 2011) to calculate intangibles, followed by the methodology used in the article with information about the data and research hypotheses, then the analysis of results of the models studied here, and finally the closing comments in the conclusion section.

2Theoretical benchmarkAccording to Gu and Lev (2003, 2011), intangible capital is driven by several factors including innovation, human capital, organizational process, relations between customers and suppliers, etc. As there is no public information available for all these drivers, the authors limit the analyses of intangibles to those variables that are available by companies. In the authors’ opinion, the drivers of intangibles are: R&D expenditures (creation of patents, business knowledge), advertising expenses (brand creation), general and administrative expenses including information technology and consulting services, and investments in intangibles (goodwill and other intangibles).

Gu and Lev (2011) assert that the literature on the valuation of intangibles features three categories that measure these assets: market value approach, accounting valuation approach and component valuation approach. According to the authors, the market value approach measures the value of intangibles through the difference between the company's market value based on the share price and on the book value or the value of Tobin's Q. Although easy to apply, it is not satisfactory (Gu & Lev, 2011). The second type of approach, the accounting valuation approach, refers to the abnormal profitability of the company to asset intangible assets. The third methodology focuses on the individual valuation of the components of intangible assets, including innovation capacity, brands, research and development, etc.

According to Gu and Lev (2011), the methodology that they propose adds to the existing literature an estimate of the comprehensive value of companies’ intangible assets. Their methodology differs from existing methodologies through the foundations of the economic theory of value creation. Accordingly, Gu and Lev (2003, 2011) base their methodology through the hegemonic microeconomic model studied in modern times, the neoclassical production function. With the empirical finding that capital and labor alone are unable to explain value creation, there was a search for additional factors that could be incorporated into the production function to exhaust the factors responsible for value creation. Gu and Lev's option was to incorporate into the function a factor denominated intangibles. It should be stressed that the discussion starts to be driven at the most appropriate way of measuring the contribution of capital and of labor since the contribution of intangibles is the surplus left after the capital and labor contribution is deducted.

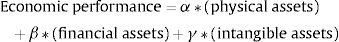

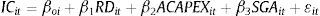

Therefore, Gu and Lev (2003, 2011) base their proposal on an enlarged production function. In the simple production function, the factors that are included to achieve levels of production are capital and labor. The enlarged production function considers intangibles as a production factor, as expressed in the equation:

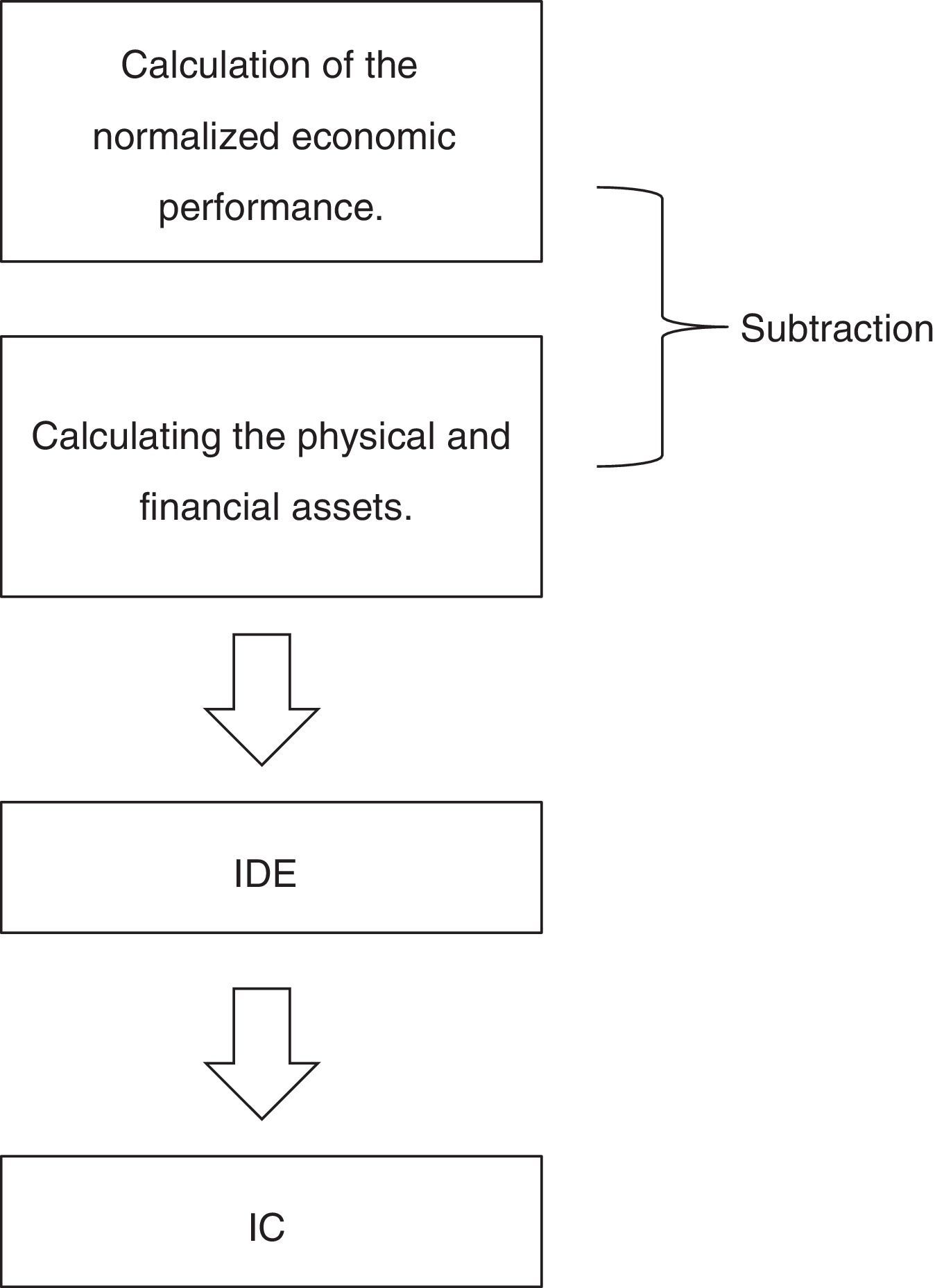

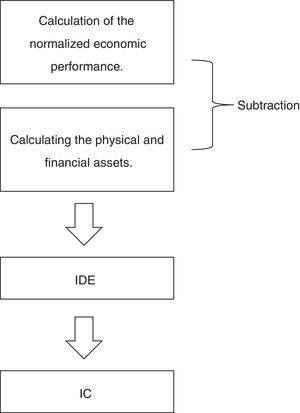

This equation expresses the fact that value creation (measured by the value added, i.e., the sum of profits and salaries in a simple economy) can be explained by the contributions of labor and capital. The empirical observation that these two factors alone did not explain the production of an economy led economists to include a third factor in the equation. This factor encompasses what it is not the contribution of capital and of labor and is generally designated intangibles, where α, β and γ represent respectively the contributions of physical assets, of financial assets and of intangible assets. The algebraic manipulation of the equation shows that the value of intangibles can be obtained by subtracting the economic performance from the normal returns of the physical and financial assets. The result is the contribution of intangible assets, designated “Intangibles-Driven-Earnings”, IDEs. Five steps are necessary to calculate the contribution of intangibles.

- 1)

Calculation of the normalized economic performance. The normalized earnings (we will use EBITDA, earnings before interest, taxes, depreciation and amortization as a Proxy for economic performance) as it represent the company's gross value creation (in other words, before any deduction, and before any distribution to the stakeholders). To compose this variable the author recommends the use of past and prospective earnings. The reason is simple: intangibles increasingly act on the generation of future earnings. It is recommended to use the same number of years for the past and the future (3–5), whereas the higher weights should be reserved for the future.

- 2)

The second step consists of calculating the physical and financial assets. Physical assets are defined as property, plant and equipment (Gu and Lev, 2003). Financial assets are defined as cash on hand, shares, and financial instruments (Gu and Lev, 2003). To calculate the contributions of physical and financial asset the author uses data already available in the economic literature. The rate of return of 7% for physical assets was based on the studies by Nadiri and Kim (1996) and Poterba (1997). For the financial assets, the rate of 4.5% was based on the 10-year average return of the US treasury (JUERGEN 2001). The values of the physical and financial assets should be restated using appropriate discount rates for restated values.

- 3)

The third step consists of the estimation of IDEs. To obtain this amount the contribution of financial (β) and physical (α) assets, multiplied by the respective values of the physical and financial assets, are then subtracted from the company's Estimated Economic Performance. The result of this subtraction is the contribution of the intangible assets, which is defined by the authors as IDE (Intangibles-Driven-Earnings).

- 4)

The fourth step consists of the calculation of prospective IDEs for three future periods (Gu & Lev, 2003). The first period is composed of years 1–5, calculated in the previous stages. The second period covers years 6–10 and the projection of the IDEs is based on applying a linear growth (or decay) rate to the IDE obtained in year five, until the growth rate reaches 3%. The third period extends infinitely from year 11, and it is assumed that the IDE will grow annually at a rate of 3%, which is the growth rate expected from the economy.

- 5)

The fifth step consists of determining the stock of intangible capital obtained by the deduction of the prospective IDEs using a rate that reflects the degree of risk of the IDEs; as they are a product of intangibles, the rate needs to be above average. Gu and Lev (2003) are not very precise in their explanation of the determination of this rate. We used a rate of 7.5% in this paper. The procedure for calculating the contribution of intangibles is demonstrated through Fig. 1.

Gu and Lev (2003) also defined the comprehensive value of companies, which encompasses the tangible and intangible part, aiming to correct the differences observed in the book value of these companies. Comprehensive value is defined as the sum of the book value and of the intangible capital explained previously. As a result, Gu and Lev (2003) formulated a series of new company performance appraisal indices, based on public information: Intangible Capital Margin (ICM): (Intangible Capital/Sales); Intangible Capital Operating Margin (ICOM): (IDE/Operating Income−EBIT); Comprehensive Value (CV): (Intangible Capital+Book Value); Return on Investment of R&D: (RI)−(Intangible Capital/Investments in R&D); Market-to-Comprehensive Value (MtCV): (Market Value/Intangible Capital); values close to 1.00 indicate the importance of the intangibles and the closeness of this indicator to the company's market value and Intangible Capital to Book Value (ICBV): (Intangible Capital/Book Value). This will indicate to what extent the company or sector analyzed is based on intangible assets. These indicators were transformed into hypotheses by means of an association with shareholder value creation, represented by the total shareholder return.

Gu and Lev method for measurement of intangible.

Source: Adapted from Gu and Lev (2003, p. 34).

The goal of this survey was to analyze the contribution of intangible assets, through intangible driven earnings (IDE), intangible capital (IC) and intangibility indices, in the value creation of companies, using the methodology proposed by Gu and Lev (2003, 2011). The variables used in this survey are basically secondary data extracted from the Thomson Reuters Datastream database. Listed companies from the software sector (classified in services) and from the sector of equipment and technology for computing (classified in industry), with valid data for the years 2001–2010, were selected to form the sample group of this survey. The use of only two sectors in the sample is a limitation of the survey. Accordingly, a comparison between other sectors as well as comparisons of countries should be studied in an attempt to validate the models studied here.

The statistical procedure used was that of static panel data, mainly with unbalanced data, and all the models were run in the Stata 11 software. Another limitation of the survey was the statistical procedure used. Thus the use of the statistical procedure of dynamic panel data analysis is suggested for future surveys.

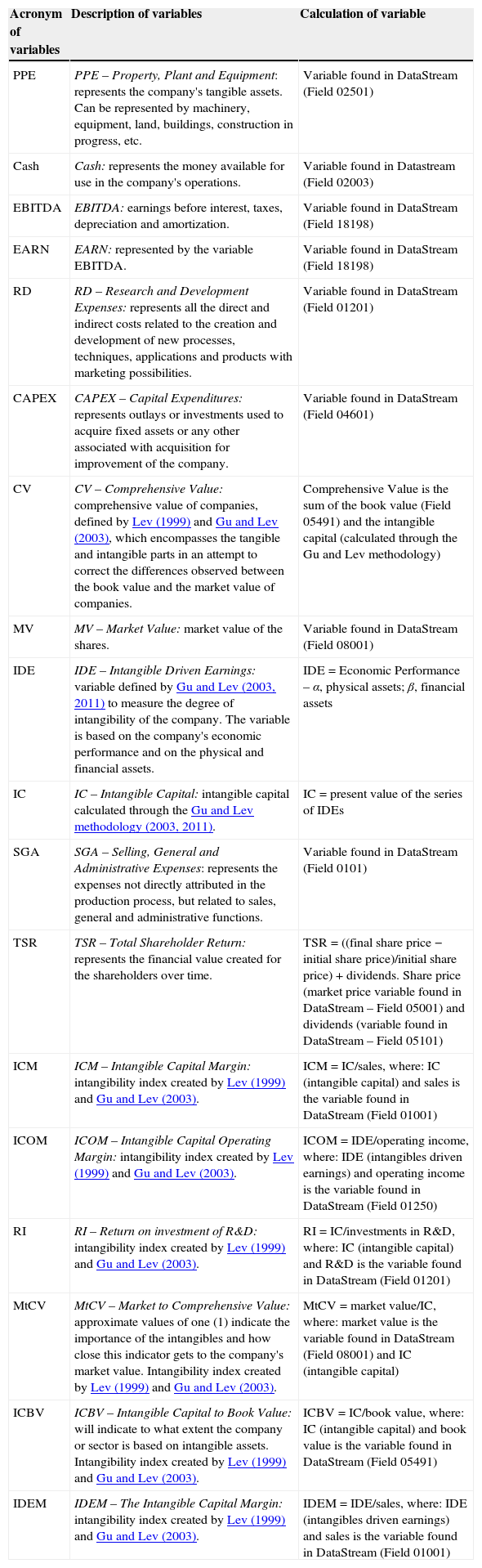

For the analysis of the descriptive statistics, correlations and analyses of static panel data, the authors considered variables for the years 2003–2007, a five-year period, since the data from the periods of 2001 and 2002 and 2008 to 2010 were used to construct the Intangibles Driven Earnings (IDEs) and the Intangible Capital (IC). The variables collected directly in Datastream and the variables created to test the hypotheses are presented in Table 1.

List of variables taken from the Datastream base and variables indicating intangibility.

| Acronym of variables | Description of variables | Calculation of variable |

|---|---|---|

| PPE | PPE – Property, Plant and Equipment: represents the company's tangible assets. Can be represented by machinery, equipment, land, buildings, construction in progress, etc. | Variable found in DataStream (Field 02501) |

| Cash | Cash: represents the money available for use in the company's operations. | Variable found in Datastream (Field 02003) |

| EBITDA | EBITDA: earnings before interest, taxes, depreciation and amortization. | Variable found in DataStream (Field 18198) |

| EARN | EARN: represented by the variable EBITDA. | Variable found in DataStream (Field 18198) |

| RD | RD – Research and Development Expenses: represents all the direct and indirect costs related to the creation and development of new processes, techniques, applications and products with marketing possibilities. | Variable found in DataStream (Field 01201) |

| CAPEX | CAPEX – Capital Expenditures: represents outlays or investments used to acquire fixed assets or any other associated with acquisition for improvement of the company. | Variable found in DataStream (Field 04601) |

| CV | CV – Comprehensive Value: comprehensive value of companies, defined by Lev (1999) and Gu and Lev (2003), which encompasses the tangible and intangible parts in an attempt to correct the differences observed between the book value and the market value of companies. | Comprehensive Value is the sum of the book value (Field 05491) and the intangible capital (calculated through the Gu and Lev methodology) |

| MV | MV – Market Value: market value of the shares. | Variable found in DataStream (Field 08001) |

| IDE | IDE – Intangible Driven Earnings: variable defined by Gu and Lev (2003, 2011) to measure the degree of intangibility of the company. The variable is based on the company's economic performance and on the physical and financial assets. | IDE=Economic Performance – α, physical assets; β, financial assets |

| IC | IC – Intangible Capital: intangible capital calculated through the Gu and Lev methodology (2003, 2011). | IC=present value of the series of IDEs |

| SGA | SGA – Selling, General and Administrative Expenses: represents the expenses not directly attributed in the production process, but related to sales, general and administrative functions. | Variable found in DataStream (Field 0101) |

| TSR | TSR – Total Shareholder Return: represents the financial value created for the shareholders over time. | TSR=((final share price−initial share price)/initial share price)+dividends. Share price (market price variable found in DataStream – Field 05001) and dividends (variable found in DataStream – Field 05101) |

| ICM | ICM – Intangible Capital Margin: intangibility index created by Lev (1999) and Gu and Lev (2003). | ICM=IC/sales, where: IC (intangible capital) and sales is the variable found in DataStream (Field 01001) |

| ICOM | ICOM – Intangible Capital Operating Margin: intangibility index created by Lev (1999) and Gu and Lev (2003). | ICOM=IDE/operating income, where: IDE (intangibles driven earnings) and operating income is the variable found in DataStream (Field 01250) |

| RI | RI – Return on investment of R&D: intangibility index created by Lev (1999) and Gu and Lev (2003). | RI=IC/investments in R&D, where: IC (intangible capital) and R&D is the variable found in DataStream (Field 01201) |

| MtCV | MtCV – Market to Comprehensive Value: approximate values of one (1) indicate the importance of the intangibles and how close this indicator gets to the company's market value. Intangibility index created by Lev (1999) and Gu and Lev (2003). | MtCV=market value/IC, where: market value is the variable found in DataStream (Field 08001) and IC (intangible capital) |

| ICBV | ICBV – Intangible Capital to Book Value: will indicate to what extent the company or sector is based on intangible assets. Intangibility index created by Lev (1999) and Gu and Lev (2003). | ICBV=IC/book value, where: IC (intangible capital) and book value is the variable found in DataStream (Field 05491) |

| IDEM | IDEM – The Intangible Capital Margin: intangibility index created by Lev (1999) and Gu and Lev (2003). | IDEM=IDE/sales, where: IDE (intangibles driven earnings) and sales is the variable found in DataStream (Field 01001) |

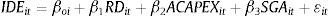

This study presents two novelties in relation to the articles of Gu and Lev (2003, 2011). The first is that we expanded the hypotheses in relation to the articles that we used as a reference. A first block of hypotheses is similar to the set of hypotheses tested by Gu and Lev (2003, 2011). The traditional hypotheses are:Hypothesis I The higher the investment in research and development (RD), capital expenditures (CAPEX) and selling, general and administrative expenses (SGA), the higher the degree of intangibility (IDE) of the company.

The higher the investment in research and development (RD), capital expenditures (CAPEX) and selling, general and administrative expenses (SGA), the higher the intangible capital (IC) of the company.

Hypothesis IIIThe higher the degree of intangibility (IDE), the variation in the degree of intangibility, the operational performance (EARN) and the variation in the operational performance (EARN), the higher the total shareholder return (TSR).

Hypothesis IVThe higher the Comprehensive Value (CV) the higher the company's market value (MV).

We consider the fourth hypothesis the most relevant of the studies by Gu and Lev, since if it is corroborated we can obtain an approximation for the market value of companies, particularly for unquoted ones. For the estimates to be more accurate, we need to expand the studies for all the sectors, as the values of the angular coefficients may be different for sectors with a high degree of intangibility in relation to those with a low degree.

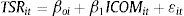

The second block of hypotheses (that represented the innovation of this study) consisted of testing the model of Gu and Lev (2003) for the intangibility indices proposed by the authors with value creation represented by total shareholder return. Gu and Lev created a series of indicators to measure intangibility; since intangible resources increasingly represent the largest portion responsible for value creation, a general hypothesis can be constructed.

The higher the intangibility (measured by an appropriate indicator), the higher the value creation. Using the indicators that Gu and Lev created we built a second block of hypotheses (we also present the equations that express the hypotheses).Hypothesis V The higher the Intangible Capital Margin (Intangible Capital/Sales), the higher the shareholder return.

The higher the Intangibles Driven Earnings Margin (Intangibles-Driven-Earnings/Sales), the higher the shareholder return.

Hypothesis VIIThe higher the Intangible Capital Operating Margin (IDE/Operating Income), the higher the shareholder return.

Hypothesis VIIIThe higher the intangible capital to book value, the higher the shareholder return.

Hypothesis IXThe higher the market to comprehensive value, the higher the shareholder return.

Hypothesis XThe higher the return on the investment in research and development, the higher the shareholder return.

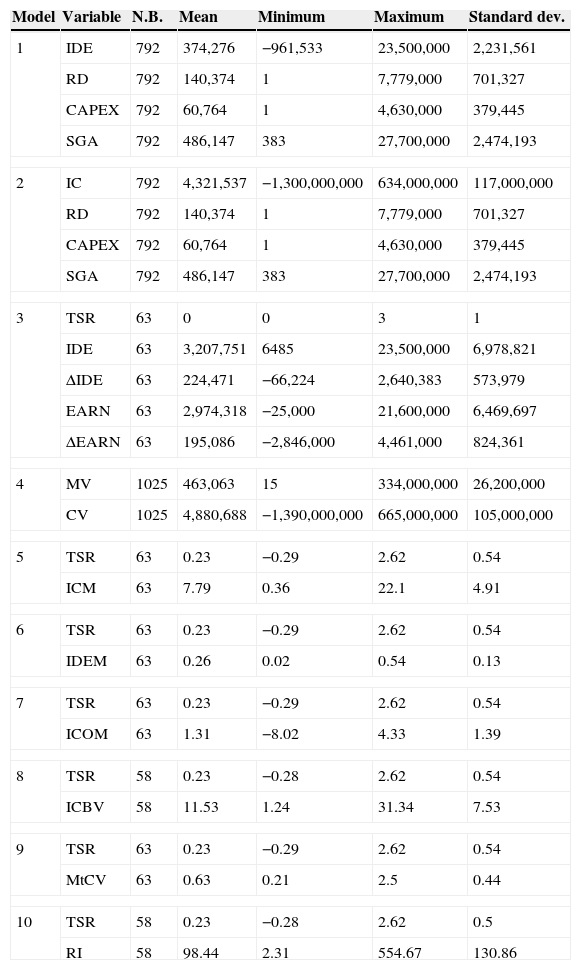

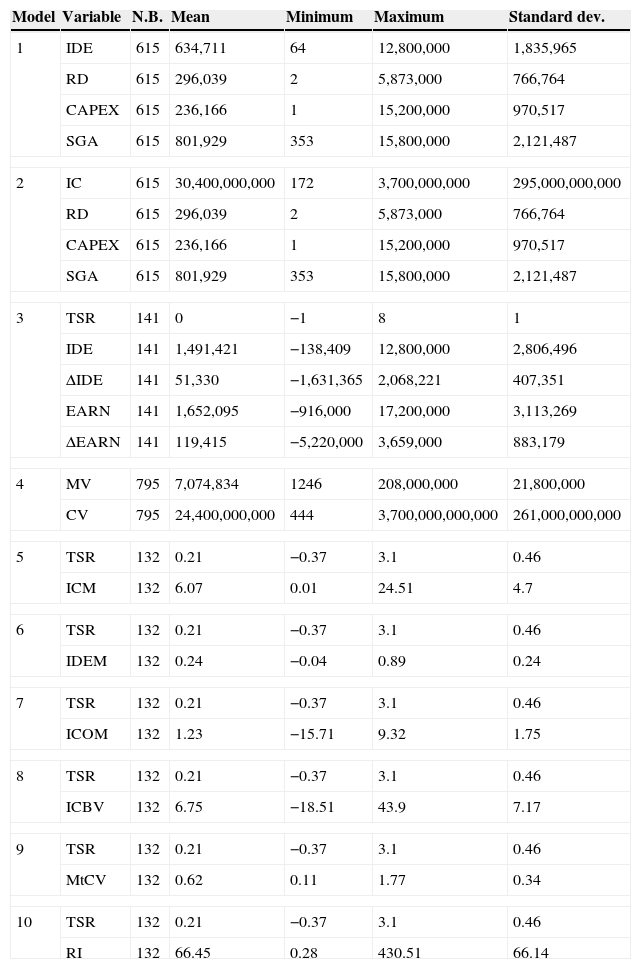

4Analysis of results4.1Descriptive analysisTables 2 and 3 present the descriptive statistics for the two sectors; as we ignore a segmentation by size, the variables (in thousands of dollars) present considerable dispersion, which violates the assumptions of the regression model (normality); accordingly, the results need to be analyzed with extreme caution and are only an indication of the corroborated relations that should be tested using a segmentation by size to lend more credibility to the conclusions.

Descriptive statistics for the software sector.

| Model | Variable | N.B. | Mean | Minimum | Maximum | Standard dev. |

|---|---|---|---|---|---|---|

| 1 | IDE | 792 | 374,276 | −961,533 | 23,500,000 | 2,231,561 |

| RD | 792 | 140,374 | 1 | 7,779,000 | 701,327 | |

| CAPEX | 792 | 60,764 | 1 | 4,630,000 | 379,445 | |

| SGA | 792 | 486,147 | 383 | 27,700,000 | 2,474,193 | |

| 2 | IC | 792 | 4,321,537 | −1,300,000,000 | 634,000,000 | 117,000,000 |

| RD | 792 | 140,374 | 1 | 7,779,000 | 701,327 | |

| CAPEX | 792 | 60,764 | 1 | 4,630,000 | 379,445 | |

| SGA | 792 | 486,147 | 383 | 27,700,000 | 2,474,193 | |

| 3 | TSR | 63 | 0 | 0 | 3 | 1 |

| IDE | 63 | 3,207,751 | 6485 | 23,500,000 | 6,978,821 | |

| ΔIDE | 63 | 224,471 | −66,224 | 2,640,383 | 573,979 | |

| EARN | 63 | 2,974,318 | −25,000 | 21,600,000 | 6,469,697 | |

| ΔEARN | 63 | 195,086 | −2,846,000 | 4,461,000 | 824,361 | |

| 4 | MV | 1025 | 463,063 | 15 | 334,000,000 | 26,200,000 |

| CV | 1025 | 4,880,688 | −1,390,000,000 | 665,000,000 | 105,000,000 | |

| 5 | TSR | 63 | 0.23 | −0.29 | 2.62 | 0.54 |

| ICM | 63 | 7.79 | 0.36 | 22.1 | 4.91 | |

| 6 | TSR | 63 | 0.23 | −0.29 | 2.62 | 0.54 |

| IDEM | 63 | 0.26 | 0.02 | 0.54 | 0.13 | |

| 7 | TSR | 63 | 0.23 | −0.29 | 2.62 | 0.54 |

| ICOM | 63 | 1.31 | −8.02 | 4.33 | 1.39 | |

| 8 | TSR | 58 | 0.23 | −0.28 | 2.62 | 0.54 |

| ICBV | 58 | 11.53 | 1.24 | 31.34 | 7.53 | |

| 9 | TSR | 63 | 0.23 | −0.29 | 2.62 | 0.54 |

| MtCV | 63 | 0.63 | 0.21 | 2.5 | 0.44 | |

| 10 | TSR | 58 | 0.23 | −0.28 | 2.62 | 0.5 |

| RI | 58 | 98.44 | 2.31 | 554.67 | 130.86 | |

Descriptive statistics for the hardware sector.

| Model | Variable | N.B. | Mean | Minimum | Maximum | Standard dev. |

|---|---|---|---|---|---|---|

| 1 | IDE | 615 | 634,711 | 64 | 12,800,000 | 1,835,965 |

| RD | 615 | 296,039 | 2 | 5,873,000 | 766,764 | |

| CAPEX | 615 | 236,166 | 1 | 15,200,000 | 970,517 | |

| SGA | 615 | 801,929 | 353 | 15,800,000 | 2,121,487 | |

| 2 | IC | 615 | 30,400,000,000 | 172 | 3,700,000,000 | 295,000,000,000 |

| RD | 615 | 296,039 | 2 | 5,873,000 | 766,764 | |

| CAPEX | 615 | 236,166 | 1 | 15,200,000 | 970,517 | |

| SGA | 615 | 801,929 | 353 | 15,800,000 | 2,121,487 | |

| 3 | TSR | 141 | 0 | −1 | 8 | 1 |

| IDE | 141 | 1,491,421 | −138,409 | 12,800,000 | 2,806,496 | |

| ΔIDE | 141 | 51,330 | −1,631,365 | 2,068,221 | 407,351 | |

| EARN | 141 | 1,652,095 | −916,000 | 17,200,000 | 3,113,269 | |

| ΔEARN | 141 | 119,415 | −5,220,000 | 3,659,000 | 883,179 | |

| 4 | MV | 795 | 7,074,834 | 1246 | 208,000,000 | 21,800,000 |

| CV | 795 | 24,400,000,000 | 444 | 3,700,000,000,000 | 261,000,000,000 | |

| 5 | TSR | 132 | 0.21 | −0.37 | 3.1 | 0.46 |

| ICM | 132 | 6.07 | 0.01 | 24.51 | 4.7 | |

| 6 | TSR | 132 | 0.21 | −0.37 | 3.1 | 0.46 |

| IDEM | 132 | 0.24 | −0.04 | 0.89 | 0.24 | |

| 7 | TSR | 132 | 0.21 | −0.37 | 3.1 | 0.46 |

| ICOM | 132 | 1.23 | −15.71 | 9.32 | 1.75 | |

| 8 | TSR | 132 | 0.21 | −0.37 | 3.1 | 0.46 |

| ICBV | 132 | 6.75 | −18.51 | 43.9 | 7.17 | |

| 9 | TSR | 132 | 0.21 | −0.37 | 3.1 | 0.46 |

| MtCV | 132 | 0.62 | 0.11 | 1.77 | 0.34 | |

| 10 | TSR | 132 | 0.21 | −0.37 | 3.1 | 0.46 |

| RI | 132 | 66.45 | 0.28 | 430.51 | 66.14 | |

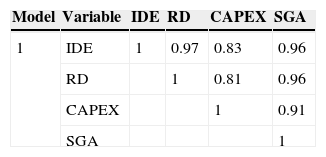

Tables 4 and 5 present the correlations for the two sectors. Interesting results are observed. In the software sector for the traditional hypotheses (models 1, 2 and 3 already tested by Gu and Lev) we observed high correlation between the independent variables: (i) model 1, RD with CAPEX correlation of 0.81; (ii) model 2, RD with CAPEX correlation of 0.81; (iii) model 3, IDE with EARN of 0.99 which entails the phenomenon of multicollinearity between the independent variables, which may give rise to a change of signal of the explanatory variable; (iv) model 4, which if corroborated presents an important contribution by Gu and Lev (2003, 2011) to the study of intangibles, as it proposes a Proxy for the market value of companies, relates the comprehensive value to the total shareholder return (presenting a positive correlation of 0.94); (v) the correlations of models 6–10 are related to the innovation of this study (testing of the intangibility indices proposed by Lev (1999) and Gu and Lev (2003). The dependent variable, total shareholder return (TSR), in general, presents low linear correlation with the independent variables: ICM (0.016), IDEM (0.038), ICOM (−0.13), ICBV (0.024), MtCV (0.34) and RI (−0.04). Due to the low correlations it would not be surprising if the new hypotheses of the intangibility indicators were not corroborated.

Correlation matrix for the software sector.

| Model | Variable | IDE | RD | CAPEX | SGA |

|---|---|---|---|---|---|

| 1 | IDE | 1 | 0.97 | 0.83 | 0.96 |

| RD | 1 | 0.81 | 0.96 | ||

| CAPEX | 1 | 0.91 | |||

| SGA | 1 |

| Model | Variable | IC | RD | CAPEX | SGA |

|---|---|---|---|---|---|

| 2 | IC | 1 | 0.53 | 0.43 | 0.52 |

| RD | 1 | 0.81 | 0.96 | ||

| CAPEX | 1 | 0.91 | |||

| SGA | 1 |

| Model | Variable | TSR | IDE | ΔIDE | EARN | ΔEARN |

|---|---|---|---|---|---|---|

| 3 | TSR | 1 | −0.11 | −0.11 | −0.11 | −0.03 |

| IDE | 1 | 0.81 | 0.99 | 0.51 | ||

| ΔIDE | 1 | 0.83 | 0.56 | |||

| EARN | 1 | 0.53 | ||||

| ΔEARN | 1 |

| Model | Variable | MV | CV |

|---|---|---|---|

| 4 | MV | 1 | 0.54 |

| CV | 1 |

| Model | Variable | TSR | ICM |

|---|---|---|---|

| 5 | TSR | 1 | 0.016 |

| ICM | 1 |

| Model | Variable | TSR | IDEM |

|---|---|---|---|

| 6 | TSR | 1 | 0.038 |

| IDEM | 1 |

| Model | Variable | TSR | ICOM |

|---|---|---|---|

| 7 | TSR | 1 | −0.13 |

| ICOM | 1 |

| Model | Variable | TSR | ICBV |

|---|---|---|---|

| 8 | TSR | 1 | 0.024 |

| ICBV | 1 |

| Model | Variable | TSR | MtCV |

|---|---|---|---|

| 9 | TSR | 1 | 0.34 |

| MtCV | 1 |

| Model | Variable | TSR | RI |

|---|---|---|---|

| 10 | TSR | 1 | −0.04 |

| RI | 1 |

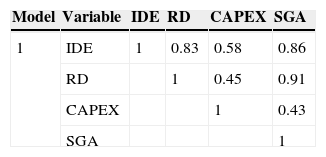

Correlation matrix for the hardware sector.

| Model | Variable | IDE | RD | CAPEX | SGA |

|---|---|---|---|---|---|

| 1 | IDE | 1 | 0.83 | 0.58 | 0.86 |

| RD | 1 | 0.45 | 0.91 | ||

| CAPEX | 1 | 0.43 | |||

| SGA | 1 |

| Model | Variable | IC | RD | CAPEX | SGA |

|---|---|---|---|---|---|

| 2 | IC | 1 | −0.032 | −0.0239 | −0.0336 |

| RD | 1 | 0.45 | 0.91 | ||

| CAPEX | 1 | 0.43 | |||

| SGA | 1 |

| Model | Variable | TSR | IDE | ΔIDE | EARN | ΔEARN |

|---|---|---|---|---|---|---|

| 3 | TSR | 1 | −0.056 | 0.0036 | −0.071 | 0.0253 |

| IDE | 1 | 0.384 | 0.957 | 0.284 | ||

| ΔIDE | 1 | 0.183 | 0.314 | |||

| EARN | 1 | 0.32 | ||||

| ΔEARN | 1 |

| Model | Variable | MV | CV |

|---|---|---|---|

| 4 | MV | 1 | −0.022 |

| CV | 1 |

| Model | Variable | TSR | ICM |

|---|---|---|---|

| 5 | TSR | 1 | 0.15 |

| ICM | 1 |

| Model | Variable | TSR | IDEM |

|---|---|---|---|

| 6 | TSR | 1 | −0.023 |

| IDEM | 1 |

| Model | Variable | TSR | ICOM |

|---|---|---|---|

| 7 | TSR | 1 | 0.052 |

| ICOM | 1 |

| Model | Variable | TSR | ICBV |

|---|---|---|---|

| 8 | TSR | 1 | 0.093 |

| ICBV | 1 |

| Model | Variable | TSR | MtCV |

|---|---|---|---|

| 9 | TSR | 1 | 0.02 |

| MtCV | 1 |

| Model | Variable | TSR | RI |

|---|---|---|---|

| 10 | TSR | 1 | 0.22 |

| RI | 1 |

In the hardware sector for the traditional hypotheses (models 1–3 already tested by Gu and Lev) we observe correlations that diverge from the correlations found for the software sector: (i) model 1, RD with CAPEX correlation of 0.45 and a high correlation of RD with SGA (0.91); there is also a high correlation between IDE and SGA (0.86) indicating a high explanatory power for this variable; (ii) model 2, the correlation of RD with CAPEX (0.45) is much lower than that found in the software sector; (iii) model 3, IDE with EARN of 0.957, which entails the phenomenon of multicollinearity between and among the independent variables which could bring about a change of signal of the explanatory variable; (iv) model 4 presented high correlation (0.714) between MV and CV (comprehensive value), increasing our expectations regarding the explanatory power of CV as a proxy for intangibility; (v) the correlations of models 6–10 are related to the innovation of this study (testing of the intangibility indices). The dependent variable, total shareholder return (TSR), in general, presents low linear correlation with the independent variables: ICM (0.15), IDEM (−0.023), ICOM (0.052), ICBV (0.093), MtCV (0.02) and RI (0.22). Judging by the low correlations it would not be surprising if the new hypotheses of the intangibility indicators were not corroborated.

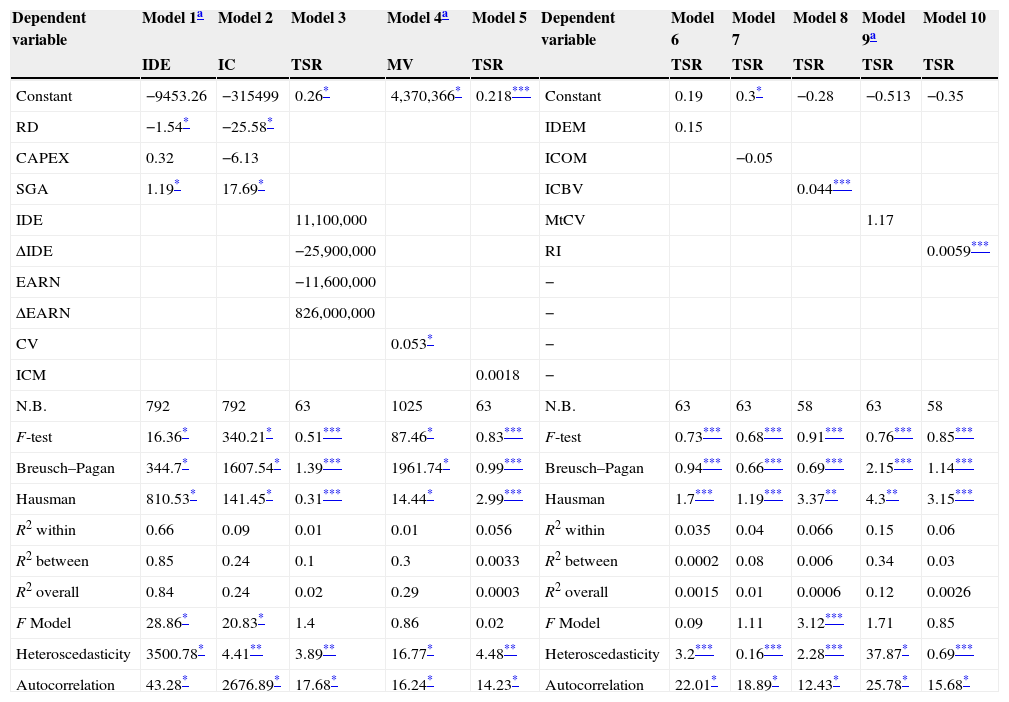

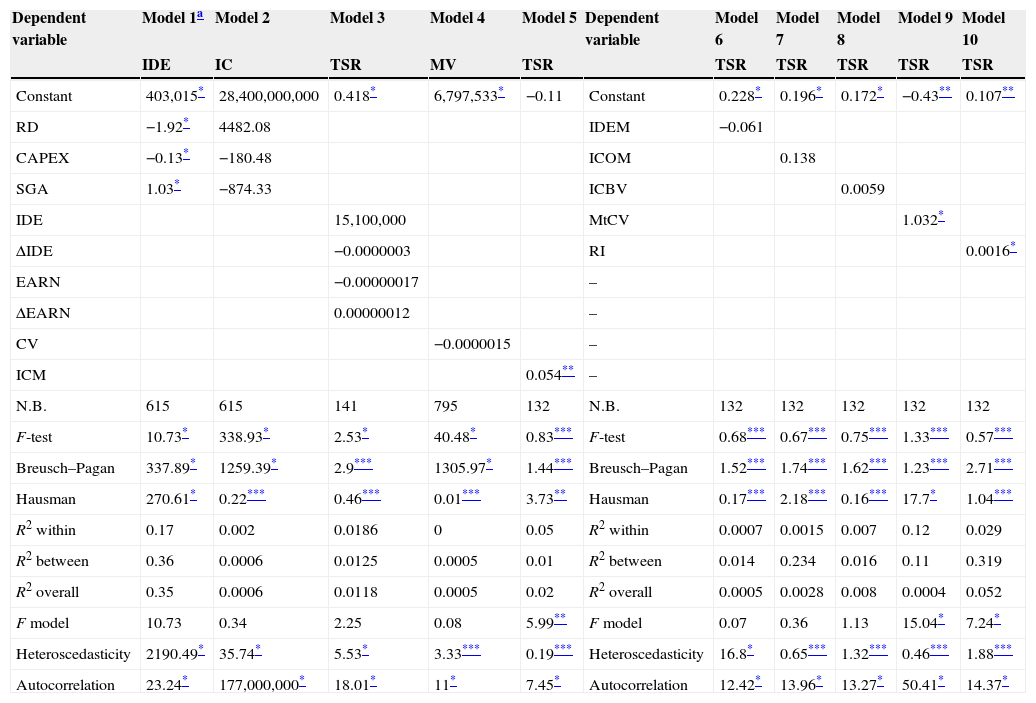

4.3Analysis of the hypothesesStatic panel data analyses were carried out for all the models. The results of the regressions associated with the ten hypotheses of this study (regressions for the two sectors) are presented in Tables 6 and 7. It is possible to observe in the tables the results of the angular regression coefficients, as well as the values of R2 within, R2 between, R2 overall, the F- and/or Chi-squared test statistic for general validity of the model, the value of the F, Breush–Pagan and Hausman tests (which allows us to decide between the pooled data grouping models, fixed or random effects models), the value of the Breusch–Pagan/Cook–Wesberg test statistic that allows us to observe the existence of heteroscedasticity and the Wooldridge test statistic to verify the existence of autocorrelation (Hsiao, 2003). To analyze the fixed effects models (with a significant result for the presence of heteroscedasticity in the Breusch–Pagan/Cook–Wesberg test), we used the model with robust variance according to the Newey–West estimator that corrects the effects of the presence of heteroscedasticity.

Results for the software sector.

| Dependent variable | Model 1a | Model 2 | Model 3 | Model 4a | Model 5 | Dependent variable | Model 6 | Model 7 | Model 8 | Model 9a | Model 10 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IDE | IC | TSR | MV | TSR | TSR | TSR | TSR | TSR | TSR | ||

| Constant | −9453.26 | −315499 | 0.26* | 4,370,366* | 0.218*** | Constant | 0.19 | 0.3* | −0.28 | −0.513 | −0.35 |

| RD | −1.54* | −25.58* | IDEM | 0.15 | |||||||

| CAPEX | 0.32 | −6.13 | ICOM | −0.05 | |||||||

| SGA | 1.19* | 17.69* | ICBV | 0.044*** | |||||||

| IDE | 11,100,000 | MtCV | 1.17 | ||||||||

| ΔIDE | −25,900,000 | RI | 0.0059*** | ||||||||

| EARN | −11,600,000 | − | |||||||||

| ΔEARN | 826,000,000 | − | |||||||||

| CV | 0.053* | − | |||||||||

| ICM | 0.0018 | − | |||||||||

| N.B. | 792 | 792 | 63 | 1025 | 63 | N.B. | 63 | 63 | 58 | 63 | 58 |

| F-test | 16.36* | 340.21* | 0.51*** | 87.46* | 0.83*** | F-test | 0.73*** | 0.68*** | 0.91*** | 0.76*** | 0.85*** |

| Breusch–Pagan | 344.7* | 1607.54* | 1.39*** | 1961.74* | 0.99*** | Breusch–Pagan | 0.94*** | 0.66*** | 0.69*** | 2.15*** | 1.14*** |

| Hausman | 810.53* | 141.45* | 0.31*** | 14.44* | 2.99*** | Hausman | 1.7*** | 1.19*** | 3.37** | 4.3** | 3.15*** |

| R2 within | 0.66 | 0.09 | 0.01 | 0.01 | 0.056 | R2 within | 0.035 | 0.04 | 0.066 | 0.15 | 0.06 |

| R2 between | 0.85 | 0.24 | 0.1 | 0.3 | 0.0033 | R2 between | 0.0002 | 0.08 | 0.006 | 0.34 | 0.03 |

| R2 overall | 0.84 | 0.24 | 0.02 | 0.29 | 0.0003 | R2 overall | 0.0015 | 0.01 | 0.0006 | 0.12 | 0.0026 |

| F Model | 28.86* | 20.83* | 1.4 | 0.86 | 0.02 | F Model | 0.09 | 1.11 | 3.12*** | 1.71 | 0.85 |

| Heteroscedasticity | 3500.78* | 4.41** | 3.89** | 16.77* | 4.48** | Heteroscedasticity | 3.2*** | 0.16*** | 2.28*** | 37.87* | 0.69*** |

| Autocorrelation | 43.28* | 2676.89* | 17.68* | 16.24* | 14.23* | Autocorrelation | 22.01* | 18.89* | 12.43* | 25.78* | 15.68* |

Results for the hardware sector.

| Dependent variable | Model 1a | Model 2 | Model 3 | Model 4 | Model 5 | Dependent variable | Model 6 | Model 7 | Model 8 | Model 9 | Model 10 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IDE | IC | TSR | MV | TSR | TSR | TSR | TSR | TSR | TSR | ||

| Constant | 403,015* | 28,400,000,000 | 0.418* | 6,797,533* | −0.11 | Constant | 0.228* | 0.196* | 0.172* | −0.43** | 0.107** |

| RD | −1.92* | 4482.08 | IDEM | −0.061 | |||||||

| CAPEX | −0.13* | −180.48 | ICOM | 0.138 | |||||||

| SGA | 1.03* | −874.33 | ICBV | 0.0059 | |||||||

| IDE | 15,100,000 | MtCV | 1.032* | ||||||||

| ΔIDE | −0.0000003 | RI | 0.0016* | ||||||||

| EARN | −0.00000017 | – | |||||||||

| ΔEARN | 0.00000012 | – | |||||||||

| CV | −0.0000015 | – | |||||||||

| ICM | 0.054** | – | |||||||||

| N.B. | 615 | 615 | 141 | 795 | 132 | N.B. | 132 | 132 | 132 | 132 | 132 |

| F-test | 10.73* | 338.93* | 2.53* | 40.48* | 0.83*** | F-test | 0.68*** | 0.67*** | 0.75*** | 1.33*** | 0.57*** |

| Breusch–Pagan | 337.89* | 1259.39* | 2.9*** | 1305.97* | 1.44*** | Breusch–Pagan | 1.52*** | 1.74*** | 1.62*** | 1.23*** | 2.71*** |

| Hausman | 270.61* | 0.22*** | 0.46*** | 0.01*** | 3.73** | Hausman | 0.17*** | 2.18*** | 0.16*** | 17.7* | 1.04*** |

| R2 within | 0.17 | 0.002 | 0.0186 | 0 | 0.05 | R2 within | 0.0007 | 0.0015 | 0.007 | 0.12 | 0.029 |

| R2 between | 0.36 | 0.0006 | 0.0125 | 0.0005 | 0.01 | R2 between | 0.014 | 0.234 | 0.016 | 0.11 | 0.319 |

| R2 overall | 0.35 | 0.0006 | 0.0118 | 0.0005 | 0.02 | R2 overall | 0.0005 | 0.0028 | 0.008 | 0.0004 | 0.052 |

| F model | 10.73 | 0.34 | 2.25 | 0.08 | 5.99** | F model | 0.07 | 0.36 | 1.13 | 15.04* | 7.24* |

| Heteroscedasticity | 2190.49* | 35.74* | 5.53* | 3.33*** | 0.19*** | Heteroscedasticity | 16.8* | 0.65*** | 1.32*** | 0.46*** | 1.88*** |

| Autocorrelation | 23.24* | 177,000,000* | 18.01* | 11* | 7.45* | Autocorrelation | 12.42* | 13.96* | 13.27* | 50.41* | 14.37* |

First we analyzed the software sector (Table 6): (i) model 1 presented as proxies for intangibility both research and development expenditures (RD) and selling, general and administrative expenses (SGA). However the strong correlation between the explanatory variables may have changed the RD signal; (ii) the same thing happens with model 2, where the two explanatory variables presented statistical significance to explain the stock of intangibles, but there may have been a change of signal of the RD variable; (iii) model 3 did not present significance for any of the explanatory variables; (iv) model 4, which we consider the most important, as it proposes a methodology to approximate the book value to the market value, presented statistical significance at 1%. We consider the result promising if it is corroborated for other sectors; (v) as concerns the intangibility indices the only indicators that presented explanatory power (at 10%, however) were ICBV and RI, a disappointing result. It was to be expected that ICBV would present explanatory power, since the stock of intangible capital (as well as the flow – model 4) had explanatory power over the market value (it is expected that the higher the market value, the higher the total shareholder return). The same applies to the variable RI, obtained from the division of the stock of intangibles by the research and development expenditures. The stock of intangibles explains the market value (model 4) and the RD expenditures exhibit high correlation with IDE. We did not manage to find a justification for the lack of statistical significance of the other intangibility indices (ICM, IDEM, ICOM; MtCV).

The hardware sector (Table 7) did not present results similar to those of the software sector. As concerns the traditional hypotheses (models 1–4 of those proposed by Gu and Lev): (i) model 1 presented as proxies for intangibility research and development expenditures (RD) capital expenditures (CAPEX) and selling, general and administrative expenses (SGA). However, two of the variables (RD and CAPEX) presented negative signals, which is unexpected. The correlation between RD and CAPEX is not high; the strong correlation between SGA and RD may have changed the RD signal; (ii) models 2 and 3 did not present significance for any of the explanatory variables; (iii) as mentioned previously, the result of model 4 is the most relevant, and the result is similar to that of the software sector; the comprehensive value explains the market value; (iv) as concerns the intangibility indices the results diverge from those found for the software sector. The only indicators that presented explanatory power at 1% were MtCV, ICM and RI, a disappointing result. We did not manage to find a justification for the lack of statistical significance of the other intangibility indices (IDEM, ICOM, ICBV). The comparison with the software sector indicated that the intangibility indicators are not repeated when we carry out a sectoral analysis.

We believe that the result of model 4 is the most relevant, as if it is corroborated for more sectors and countries it will lend considerable credibility to the methodological proposal of Gu and Lev (2011) who claim to have a solution for approximating the book values (found in financial statements) to the market value of a company. This calls for a broader study, involving all the sectors to assess the impact of the angular coefficients at the sectorial level, as well as at the level of size.

A criticism made of the Gu and Lev model is related to the arbitrariness of the choice of the discount rate for intangible capital. We conducted a sensitivity analysis varying the discount rate from 7.5% (the value that we used) to 15%. The results remained the same (not presented here as they produce an excessive increase in the article size), which we consider a promising result since the managers can work with variation intervals for the idiosyncratic risk that they believe their companies to have and nonetheless find a Proxy for the market value, a methodology that can be applied to unquoted companies.

5ConclusionIntangible and knowledge assets have become a key requirement for companies to present a sustainable competitive advantage. Drucker (1994) declared that the so-called Knowledge Society has knowledge that creates value for companies through productivity and innovation as a fundamental resource. According to Stewart (2004) the new economy is based on knowledge and on communication and no longer on the natural and physical resources of the old industrial organization.

Accordingly, service companies present different characteristics from manufacturing companies. The main difference between them is the focus on intangibles. Service companies present a higher degree of intangibility when compared with manufacturing companies that present a higher degree of tangibility. To that end, Low and Kalafut (2002) argue that the largest parts of the value of service companies depend on highly qualified professionals with a high level of knowledge.

Therefore, this article compared the proposal for measuring intangibles of Gu and Lev for the sectors of software (classified in services) and equipment and technology for computing (classified in industry) in the United States. The idea of comparing the sectors arose from the discovery in two previous articles of a discrepancy in the results mainly for the indices proposed by Gu and Lev to measure intangibility and their impact on value creation. The database used was Thomson-Reuters collected in Datastream, with information covering the period from 2001 to 2010. Gu and Lev (2011) present a proposal that aims to calculate a variable, comprehensive value, which encompasses the tangible and intangible assets of the company and are therefore a Proxy for their market value. If this variable explains the market value, it is a solution to a problem that afflicts accountants, which is how to account for intangibles in the balance sheet. They also propose two other variables, one that is a proxy for the flow of intangibles (Intangibles-Driven-Earnings – IDE), and another that is a proxy for the stock of intangibles (Intangible Capital –IC). They present a set of hypotheses that relate traditional variables linked to intangibility (research and development expenditures, selling, general and administrative expenses, and investment in fixed capital) with the flow (IDE), stock of intangibles (IC) and intangibility indicators that explain the shareholder return. We observed differences between the sectors, reinforcing the conviction that the sectors are important to explain differences in the intangibility indices. For the software sector the model presented research and development expenditures (RD) and selling, general and administrative expenses (SGA) as proxies for intangibility. However, the strong correlation between and among the explanatory variables may have changed the RD signal. The same thing happens with the model where the two explanatory variables presented statistical significance to explain the stock of intangibles, but there may have been a change of signal of the RD variable. The model that sought to explain the contribution of the flow and of the stock of intangibles in the determination of the total shareholder return did not present significance for any of the explanatory variables. We believe that the result of the model that explains the market value by the sum of stocks of tangibles and intangibles is more relevant, as if it is corroborated for more sectors and countries it will lend considerable credibility to the methodological proposal of Gu and Lev (2011), who claim to have a solution for approximating the book values (found in financial statements) to the market value of a company. This calls for a broader study, involving all the sectors to assess the impact of the angular coefficients at the sectoral level, as well as at the level of size. As concerns the intangibility indices, the only indicators that presented explanatory power (at 5%, however) were ICBV and RI, a disappointing result. It was to be expected that ICBV would present explanatory power, since the stock of intangible capital (as well as the flow – model 4) had explanatory power over the market value (it is expected that the higher the market value, the higher the total shareholder return). The same applies to the variable RI, obtained from the division of the stock of intangibles by the research and development expenditures. The stock of intangibles explains the market value (model 4) and the RD expenditures exhibit high correlation with IDE. We did not manage to find a justification for the lack of statistical significance of the other intangibility indices (ICM, IDEM, ICOM; MtCV). The comparison with the hardware sector enabled us to verify that there are no repeated results. The hypothesis test for the hardware sector showed that as far as traditional hypotheses are concerned (models 1–4 of those proposed by Gu and Lev) the model presented research and development expenditures (RD), capital expenditures (CAPEX) and selling, general and administrative expenses (SGA) as proxies for intangibility. However, two of the variables (RD and CAPEX) presented negative signals, which was unexpected. The correlation between RD and CAPEX is not high; the strong correlation between SGA and RD may have changed the RD signal. The other two models did not present significance for any of the explanatory variables. As mentioned previously, the result of the model that relates the sum of intangibles and tangibles to the company's market value is the most relevant and the result, similar to that of the software sector, is promising, as we achieved statistical significance. As concerns the intangibility indices, the results diverge from those found for the software sector. The only indicators that presented explanatory power at 1% were MtCV, ICM and RI, which is a disappointing result. We did not manage to find any justification for the lack of statistical significance of the other intangibility indices (ICM, IDEM, ICOM; ICBV). The comparison with the software sector indicated that intangibility indicators are not repeated when we carry out a sectoral analysis. Like every study that seeks to corroborate hypotheses using econometric models, this study presents some limitations. The first concerns the sample, as we selected companies available in the two sectors analyzed (nonrandom sample). The second concerns the variable chosen to represent value creation, which is total shareholder return; in future studies we need to consider other variables such as profitability, Tobin's Q and the price to book (Carton & Hofer, 2006). Another limitation is due to the use of static panels that do not capture the effect of lagged variables. Two other limitations are due to the arbitrary choice of weightings and the arbitrary choice for the contribution of the physical and financial assets. For the calculation of economic performance, we arbitrarily assign weights to the annual EBITDAs. The contributions of the physical and financial assets for calculation of the Intangibles-Driven-Earning (IDE) were sought in the existing literature and may not reflect changes in the structural conditions of the economy. The discount rate used to calculate the Intangible Capital (IC) was also arbitrary. To verify whether the results remained the same, we varied the discount rate of the idiosyncratic risk in the range of 7.5–15% and verified that the results were the same. Thus the methodology appears promising for the theoretical line of thought that seeks models to record the value of intangibles, particularly for unquoted companies.

The authors acknowledge the financial support of CNPq and Mackpesquisa, which enabled the research.