Like the Great Depression of the 1930s, the current great recession triggered strong criticism of economists and economics. It is contended here that economists’ majority opinion rightly recommended that, in the face of collapses of aggregate demand, countercyclical fiscal and monetary policies, built-in stabilisers and a regulatory system to maintain free trade were appropriate remedies. Economists may have under-estimated the stability of markets and the tightness of prudential regulation for reducing the severity of potential crises. But their assessments anyway are likely to be discounted if powerful industry lobbies judge they will constrain profits, rather than boost them. These propositions are developed in a comparison of the two Great Recessions in the United States, the United Kingdom, France and Germany.

Como la Gran Depresión de los años 30, la actual gran recesión está siendo el blanco de muchas críticas por parte de economistas y financieros. En este artículo se afirma que la mayoría de las opiniones de los economistas señalaron, con razón, que los remedios adecuados ante quiebras de demanda agregada eran políticas fiscales y monetarias anticíclicas, estabilizadores integrados y un sistema reglamentario para mantener el libre comercio. Es posible que los economistas hayan subestimado la estabilidad de los mercados y la severidad de la regulación cautelar para reducir la gravedad de las crisis en potencia. De todos modos, sus valoraciones pueden ser descartadas si los poderosos lobbies industriales consideran que limitarán sus beneficios en lugar de incentivarlos. Estas propuestas se desarrollan utilizando una comparación de las dos grandes recesiones en los Estados Unidos, el Reino Unido, Francia y Alemania.

The Great Depression or its absence has been decisive in reformulations of macroeconomics in the last century. Keynes’ General Theory and liquidity trap doctrine, together with the advocacy of fiscal policy, were a response to the sustained US slump after 1929. The apparent buoyancy of western market economies after the Second World War, and perhaps the effectiveness of activist macroeconomic policy, added plausibility to the monetarist counter-revolution with its emphasis on the primacy of monetary policy.

The 1987 US stock market crash, the Latin American debt crisis, the failure of Long Term Capital Management and the bursting of the dot com bubble were all absorbed without apparent lasting damage.1 Some doubts did creep in; the stagnation of the Japanese economy from the 1990s and the East Asia crisis of 1997 raised questions about by-now conventional nostrums.2 In particular Rajan's identification of the increasing importance and possible perverseness of finance management incentives in spreading the risk of a meltdown in retrospect seems especially perceptive.3 But it has been the severity and duration of the present world recession that precipitated the biggest wave of criticism (inter alia from Her Britannic Majesty4) of the inadequacies of economics and economists, supposedly responsible for prevention and cure.

The contention here is that in important respects such concerns are misplaced. Actually, the long run influence of the economics profession – insofar as they carry weight with policy makers – has probably been fundamental in alleviating what might have been, and might still be, an economic crisis worse than that of the 1930s. Financial crises, albeit on a smaller scale, have been a regular feature of private enterprise economies – in nineteenth century Britain they occurred approximately every decade; their timing is hard to predict but they seem to be intrinsic to dynamic market economies.

Techniques of financial innovation and malpractice have become more complex since the period between the World Wars, and globalisation now more closely links national financial networks and economic activity more generally. Hence, the US in 1929 is the model for the more widespread financial crisis of 2008; from this we may infer that without the central bank and government interventions in the later recession, the crisis would have been as severe as in the 1930s’ United States. The comparatively small fall in outputs in the recent recession then must be attributable to the counter-cyclical monetary and fiscal policies implemented from 2008, ultimately inspired by economists, along with the built-in stabilisation of government budgets. True, the possibility, or the susceptibility to policy remedies, of massive aggregate demand collapses was denied by sections of the economics profession, but clearly they were not influential when the recent crisis arrived.

The less resolved difficulty has been that, as society evolves, core economic problems change and learning lessons from what has not gone wrong is more challenging than appreciating the reasons for disasters. The staid British and French financial systems of the late 1920s proved robust to the collapse of the speculative frenzy in the United States. Subsequently they converged on the deregulated US model of the 1920s, the defects of which US policy makers of the 1930s had attempted to remedy.

While economists may not be counted on to predict the timing of crises, they might be expected to offer guidance on arrangements to reduce their severity. Of course it is entirely possible that such guidance if offered will be ignored unless it conforms to the interests of the most powerful lobbyists. The outgoing Governor of the Bank of England in 2013 condemned Britain's banks for putting tremendous pressure on politicians ‘at the highest level’ to reduce the required strengthening of their balance sheets.5 But a broad stream of economics has emphasised effectiveness of competition in free unregulated markets, with firms maximising shareholder value, for creating a stable and steadily growing economy. The Washington consensus underestimated the scope of financial innovation for creating speculative bubbles, while lacking appreciation of the magnitude of the international shock from allowing large financial institutions to fail. Consequences were the dismantling in the US of regulatory structures put in place in the 1930s and the deregulation of finance in Britain and France in recent years. With hindsight this looks to have been excessively sanguine.

A major non-event of the current recession is the collapse of world trade. In the earlier crisis a welter of restrictions and prohibitions on imports caused great hardship and precipitated extremist political changes – Japan and Argentina are just two examples. Economists generally preach the virtues of free trade; they supported the General Agreement on Tariffs and Trade and then the World Trade Organisation, both of which were established to avoid another international debacle like that of the 1930s. Trade during the present Great Recession testifies to their success.

The remainder of this paper substantiates these points. The following Section 1 explains the patterns of output over the two Great Recessions in the US, the UK, France and Germany. Then the onsets of the two depressions are compared to show the role of financial crises with their contrasting initial impacts in the two periods. Section 3 outlines the second debt and liquidity crisis phase of both recessions, accounting for their duration, at least in Europe. The paper then considers the policies implemented or their absence in both periods, beginning in Section 4 with monetary policy and fiscal policy in Section 5. Section 6 considers prudential re-regulation after each crisis. Then Section 7 discusses labour markets, wages and unemployment in the two slumps in the light of Real Business Cycle Theory. The two slumps in the international sphere are the subject of Section 8.

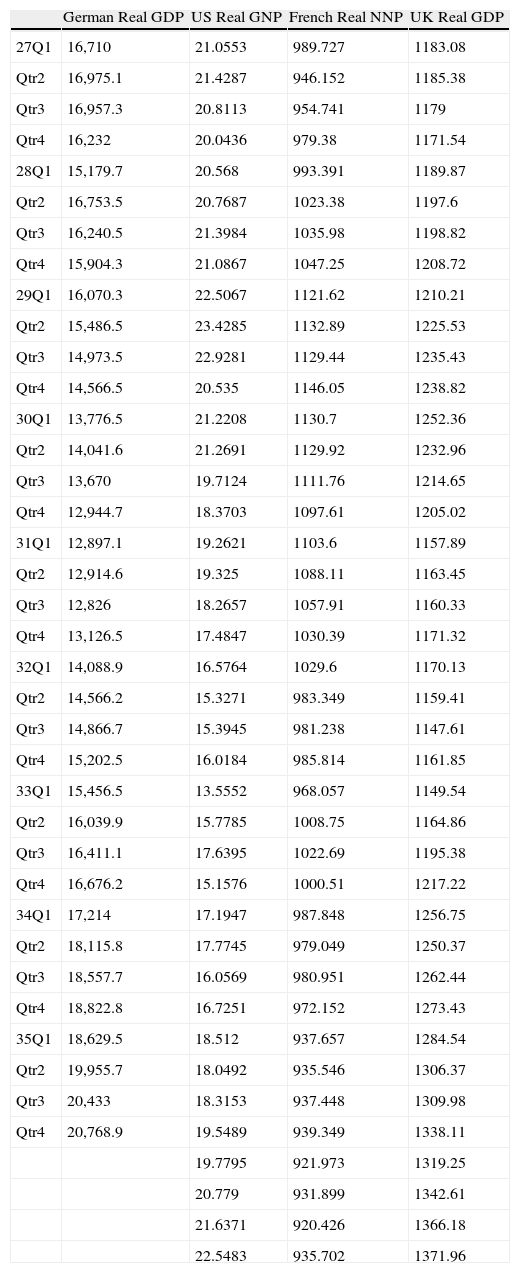

1Output in the two great recessionsThe first notable point of comparison is that paths of output differed markedly between economies in the two recessions. Business cycle measurers generally prefer quarterly series of output, but until recently most historical reconstruction – on which we are dependent for the Great Depression series – has been restricted to annual data. In the present exercise we construct quarterly series for the four economies of interest using monthly output data created in earlier research.6 A recession, depression or economic crisis is measured by the magnitude of the initial contraction of economic activity and the time taken to recover the previous peak. Higher frequency output series appear to give greater peak to trough falls in the great recessions.

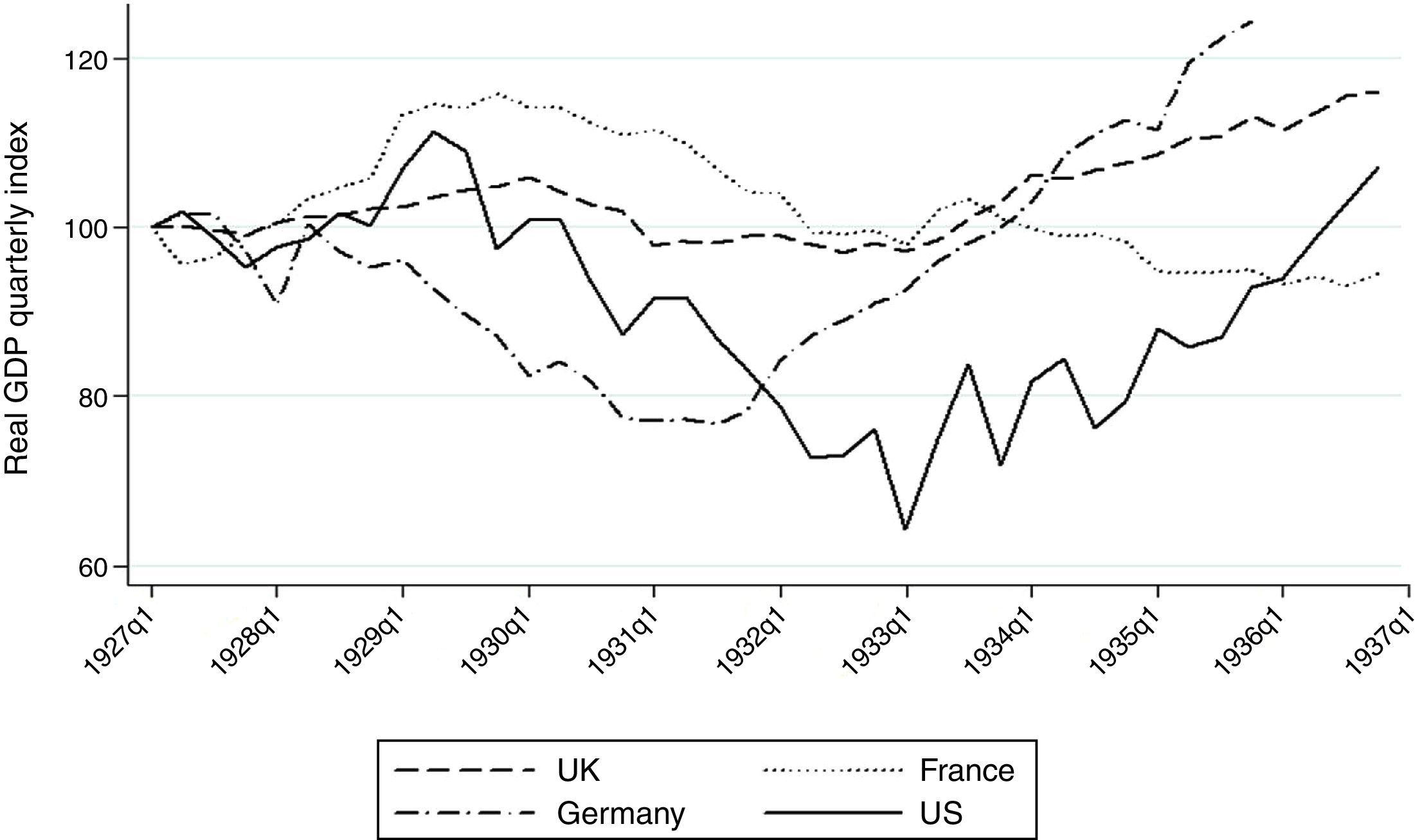

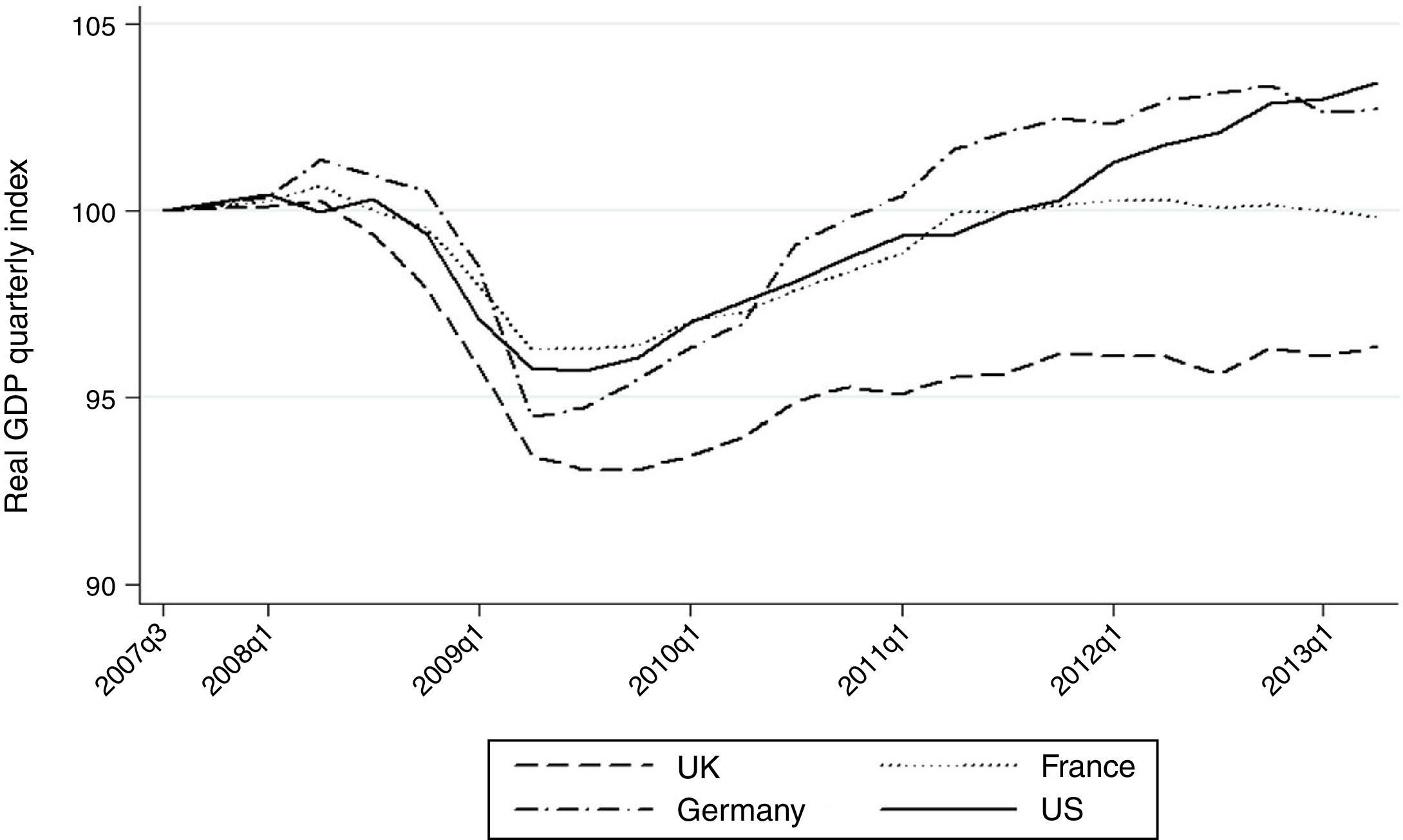

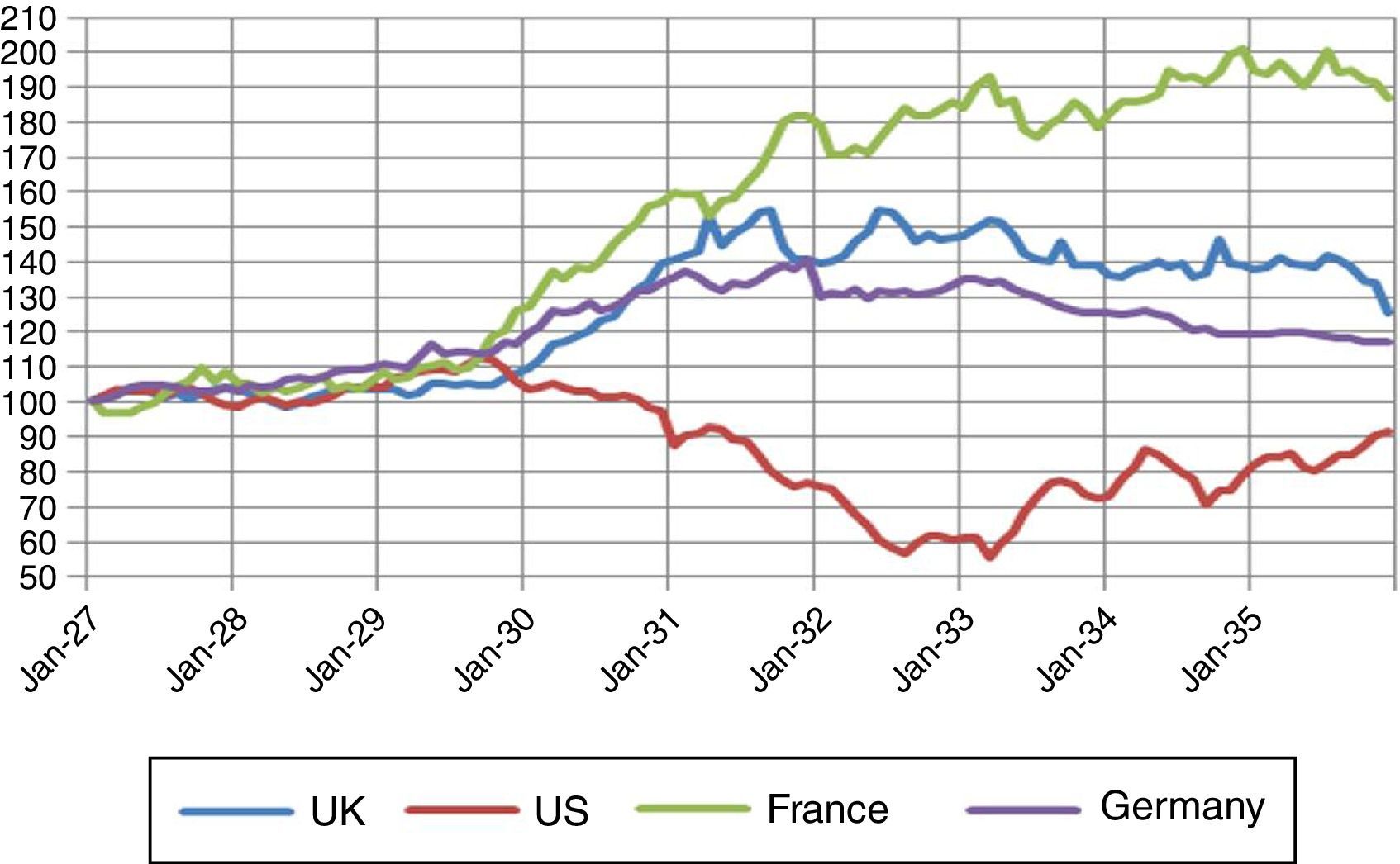

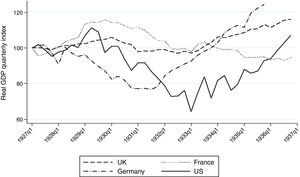

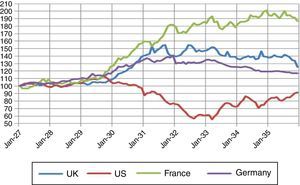

Fig. 1 begins in 1927 to emphasise the fragility of the interwar economies before the collapse, which contrasts with the apparent robustness of the economies leading up to the 2008 recession (Fig. 2). In the first recession German output peaks earlier than others, and both Germany and the US experience small dips before the major downturn in 1929. Comparing the course of quarterly real output for the three largest European economies, France, Germany and the UK, and for the United States, the two recessions show more similar experiences in the 2008 than in the 1929 depressions, thanks to globalisation.

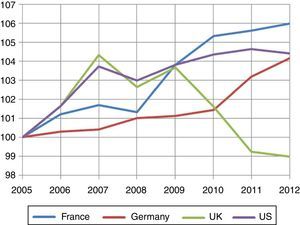

Output collapsed much less in the more recent crisis generally, either because of the nature of the shocks or because of more active or effective policy. The relative positions of the economies have been reversed in the current recession, in that the US and Germany are emerging more strongly whereas in the earlier depression their two troughs were proportionately the deepest. Certainly in the present recession Germany suffered a severe dip, but the economy recovered very strongly and quickly.

In the Great Depression the US experienced the deepest peak-trough fall. The greatest victim of the four in the recent collapse is the UK and the duration of the recession promises to be longer than that of the United States. Yet the proportionate fall of UK GDP to the trough of output in the interwar depression was easily the most modest of the four. France like the UK is also trapped below 2007 output levels and it should be remembered that for all four economies the recovery measured in output per capita is likely to take longer than that measured simply in output. It will be shown that Britain's lack of robustness in the second period differed from the earlier slump because the more recent crisis originated in the domestic financial sector, and the policy response needs to take this into account.

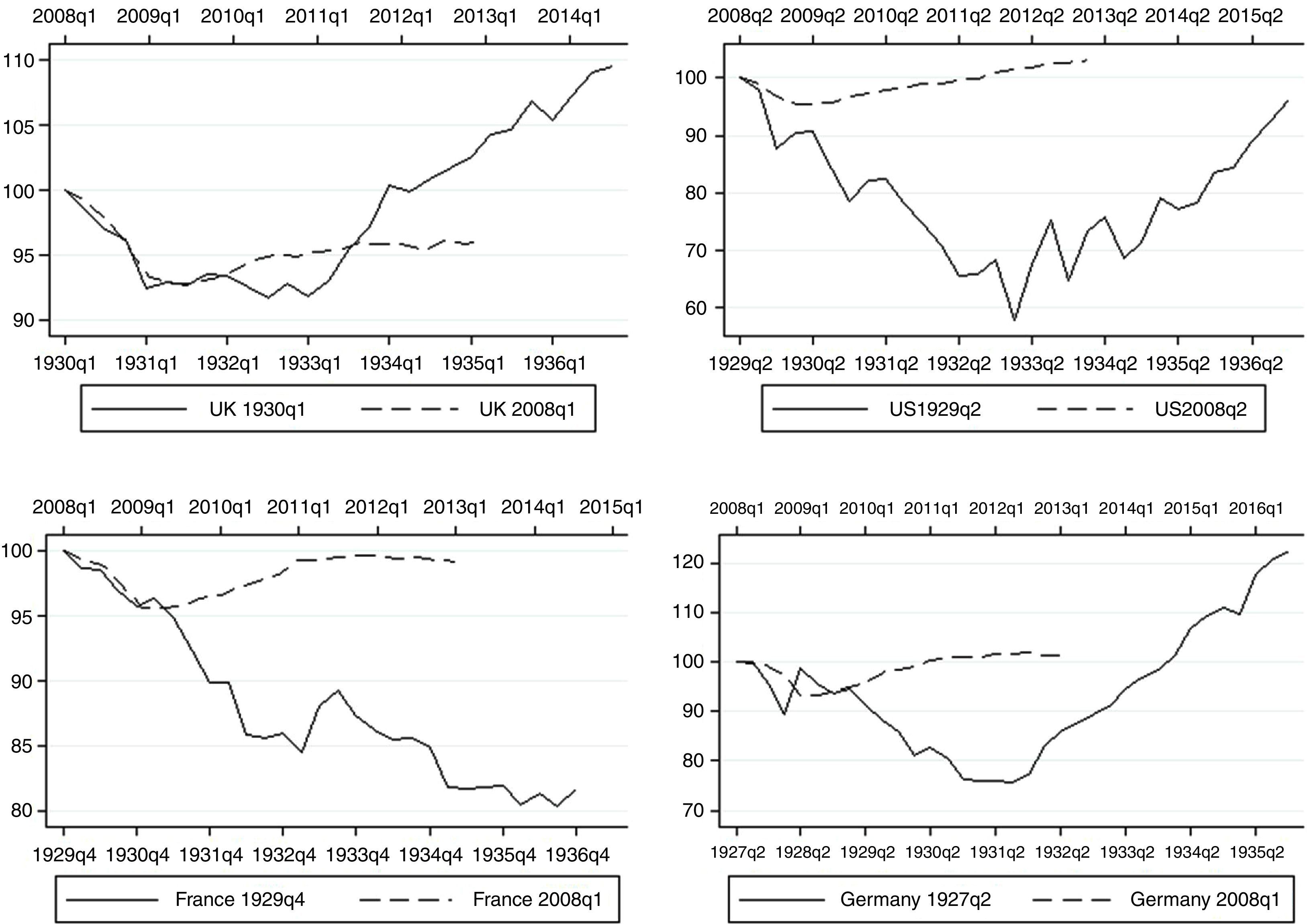

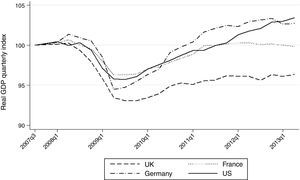

To appreciate the variety in national economic experience we now consider the indices across recessions. Fig. 3 shows almost identical peak-trough falls for the UK, but the European debt crisis in the second period to date caused less of a subsequent decline than did that of 1931. Leaving the gold standard in September 1931 ensured the recession lasted until 1933, whereas the upturn occurred in the seventh quarter of the present recession. On the other hand for almost two years UK real output has stagnated at about 4 percent below the pre-recession peak, whereas in the comparable phase of the Great Depression output jumped by 7 percent.

As with Britain, the French output declines in the two recessions initially follow each other closely (Fig. 3). But the French fall is less than that of the British in the more recent downturn, and the catastrophic decline in the earlier slump is a radical contrast to the contemporaneous strong British upswing. Germany's output decline (Fig. 3) of perhaps one quarter in the Great Depression was extraordinary and so was the strength of the recovery, reversing the ranking of French and German outputs per head. In the present recession, the GDP fall was less even than that in the 1927 decline – though substantial by comparison with other economies. Output exceeded the 2008 quarter 1 peak three years later.

The extraordinary depth and duration of the US Great Depression contrast with the present recession, when output has been rising steadily, if slowly, from the trough in the eight quarter, exceeding the pre-recession peak in the 17th quarter in Fig. 3. This might be interpreted as a striking achievement of the more active contemporary economic policy, if the shocks in the two periods were comparable. How comparable they were is addressed in the following sections.

2The onsets of the great recessionsIn Europe the interwar Depression became Great with the 1931 banking and exchange rate crisis, but in the US the stockmarket collapse in 1929, a uniquely large shock, was a vital trigger. US banks increasingly supplied brokers with the credit to make loans to speculators buying securities and counting on rises in the Wall Street stock market.7 In September 1929 the Dow-Jones Industry share price index reached a monthly peak of 691, having risen by a factor of 6 in the previous three years. It then fell to a trough of 46 in July 1932.8 Neither such rises nor such falls have been seen since; the biggest subsequent appreciation has been in the decade culminating in the dot com boom, when the index rose by a factor of five, and falls have at the worst halved the value of the index. Holding companies formerly servicing their bond payments with dividends helped the interwar decline as they defaulted. But essentially it was the unwinding of the speculative trading on margins that drove the collapse.

With the bursting of this speculative bubble, investment and consumption fell, through the operation of a wealth effect and the collapse of lending as collateral depreciated. By January 1931 domestic spending dropped by about five percent in response to share prices.9 Although this fall was almost as much as the peak to trough of GDP per capita in the US 2007 recession, it was only the beginning of the earlier Great Depression, for there were eventually wider repercussions.

In the UK, while buying shares during 1929 using bank finance for a massive amalgamation of steel companies, Clarence Hatry's organisation was caught by a fall in the share prices and attempted to cover themselves by fraudulent stock issues. On 20 September 1929 when the matter came out, share trading on the London stock market in Hatry's group was suspended.10 But, critically, there was nothing like the US financial meltdown in the UK; banks did not fail and the money supply held up. In fact in marked contrast to Wall Street, the London stock market index peaked as late as January 1930.11

Buoyed up by the confidence engendered by the return to gold in December 1927, French industrial production reached a peak in early 1930 at 44% above the 1913 level of industrial output.12 Whereas France obtained a form of financial stability between 1927 and 1928, Germany's political and financial balance remained precarious and its commercial banking vulnerable. US investment was pulling out of Germany from 1928, attracted by the higher returns on Wall Street. By 1929 the ratio of bank own capital to deposits was 1.10 compared with British practice of 1:3 and liquidity ratios were 3.8%.13 Lack of sustained post-war recovery kept alive the humiliations of the Versailles Treaty, while the renegotiation of the settlement with the Young Plan of 1929–30 probably undermined economic policy. The German government wanted to end the occupation of the Rhineland and was prepared to accept almost anything by way of reparations renegotiations – probably because they did not fully understand what they were accepting.

Public expenditure under the Social Democrats from 1926 had soared. Taxation of income and capital was heavy but even so this was inadequate to meet the state's needs, especially when the economy turned down. Taxes depressed profits and contributed to low investment.14 In February 1929 the German Minister of Finance announced he could not meet his March payments. Short term domestic borrowing was no longer adequate. At that point a foreign exchange drain on the Reichsbank began. After further panics, some French bankers intervened to restore confidence and the Finance Minister managed to borrow from New York $50m for one year at the high interest rate of 8.25%.

The narrative suggests that Britain and France were not subject to the same financial shocks as the US, and Germany's position was threatened by unsound government policies which made the economy vulnerable to withdrawal of US funds. Therefore in the absence of the US financial crisis, the British and French economies would probably have escaped the downturn. The position in 2008 was very different. Credit and credit growth were far more pervasive and important.15 In Britain and France on the eve of the crisis the largest three banks held respectively assets worth almost 340% and 260% of GDP. In 1995, the percentage for both countries had been less than 80. Moreover, UK deposit money bank assets reached over 200% of GDP, compared to 70% in the US.16

Nonetheless, the signs of crisis appeared first in the US. Towards the end of 2006, large numbers of mortgages came to the end of introductory low interest rates; ‘sub-prime’ borrowers therefore experienced greater difficulty servicing their debts. At the same time, US house prices began to drop. With zero or minimal equity in their houses sub-prime owners could walk away without financial cost. Their defaults put pressure on the institutions holding the mortgage-backed CDOs. By summer 2007 there were widespread doubts about the solvency of the huge US mortgage finance agencies Fannie Mae and Freddie Mac. When they received support from the US Treasury, market pressure shifted to other organisations. Mishkin dates the beginning of the crisis to August 7, 2007, when the French bank BNP Paribas suspended redemption of shares held in some of its money market funds – which underlines the internationalisation of the crisis through bank assets.17

The collapse of Bear Stearns was a prelude to the general breakdown of Wall Street investment banking in September 2008, especially of Lehman Brothers, perhaps because the support for Bear Stearns itself was mistaken.18 This ad hoc bailout is likely to have convinced markets that the problem in the credit markets was worse than they expected. The alternative of a comprehensive recapitalisation of the financial system on the other hand would have helped to restore confidence and unfreeze the credit markets, as it eventually did.19 Losses by AIG – a large US insurer – then required US government support of US $85 billion in return for a 79.9% stake. Merrill Lynch, which held proportionately similar volumes of distressed assets as Lehman Brothers, was acquired by the Bank of America at an enormous discount on the 2007 value.

The failure of Lehman Brothers radically increased market stress internationally. In the United Kingdom, Bradford & Bingley was partly nationalised, Alliance & Leicester was taken over by Banco Santander and Lloyds TSB acquired HBOS. Part of the problem was bank under-capitalisation and excessive distributions. In the middle of 2008 major UK banks had assets of just over £6 trillion and equity capital of around only £200 billion. With increasing risks of default this was quite inadequate. In 2009 the Bank of England reported that if banks had distributed one-fifth less of their discretionary earnings in bonuses or dividends between 2000 and the slump of 2008, they would have held around £75 billion of additional capital, more than that provided by the public sector to prop up the banks during the crisis.20

Another contributor was imprudent acquisitions. In May 2007, led by the Royal Bank of Scotland (RBS), a consortium including Santander and Fortis Bank bid against Barclays with an offer – made up of 79% cash – worth €71.1bn euros (£48.2bn) for the Dutch bank ABN Amro. By October 2007 the RBS-led team had won the battle for ABN Amro, but it was a Pyrrhic victory. RBS was obliged to ask shareholders for £12 billion of new capital after £5.9bn of write-downs in April. This was not enough to keep the bank afloat and in November 2008 the British government took a 58% stake in the bank for £15bn as part of a huge capital-raising exercise. The following January the Government launched a second bank rescue plan, increasing its stake in RBS to cover losses for 2008, with the majority for write-downs incurred from the ABN Amro acquisition. In February 2009 RBS reported the biggest annual loss in British corporate history, and £24.1bn over the preceding year.

Germany, with her three largest banks holding assets as a proportion to GDP of about half of the French, remained directly undisturbed by the financial crisis, although the fall off in international demand hit her export industries. The timing, duration and recovery of Germany's recession as shown in Fig. 2 all reflect an immunity from financial collapse; Germany therefore entered the recession later than the other three economies, spent less time in the trough and accelerated out most rapidly.

3The second phase of the two recessionsThe severity and duration of the two recessions owed much to the second wave of crises, although the US was less affected by the Eurozone crisis of 2010 than Britain. In the 1931 the first phase of the downturn took its toll of undercapitalised and insufficiently liquid banks, and, in Europe, of central banks with insufficient exchange rate reserves. Underlying problems in Europe were the mistakes of the 1919 Versailles Treaty and the restored gold standards of France and Germany. The corresponding source of difficulty in the later period was the creation of the large Eurozone in 1999. Market perceptions that no member government of the large Eurozone would be allowed to default, or depreciate its currency, ensured that all were enabled to borrow at the low interest rates hitherto only available to Germany, where stability and low inflation had been guaranteed by the Bundesbank. In consequence southern Europe accumulated debt that, when the 2008 recession came, they were likely to have difficulty repaying.

One of the more extraordinary series collected by the US Federal Reserve is the annual number of US bank failures. These failures quadrupled at the end of 1930 and confidence in the US banking system began to evaporate.21 Over the next two years, the flight from bank deposits and bank lending reduced the US money supply. Consequently prices dropped by more, and unemployment rose as demand collapsed.22 In Germany lack of confidence in government policies by mid-1930 precipitated a flight from the Mark by small bank depositors to escape tax and inflationary consequences of the budget deficit.23 On 11 May 1931 the Austrian Kredit Anstalt bank was officially declared insolvent, triggering bank runs in central Europe. A run on German gold reserves began in June; the gold cover of Reichbank notes fell from 59.9% on 31 May to 48.1% on 15 June.24 A German company (Nordwolle) that had borrowed substantially from the Danatbank (Darmatadter und Nationalbank Kommandit-Gesellschaft) to speculate on the price of wool then failed and on 13 July the German banks agreed to close because they believed the Reichsbank would not take their bills.25 Three days later Germany introduced foreign exchange controls and a partial bank moratorium was declared until August.

In the UK on 31 July the officially sponsored May report criticised the sustainability of the UK budget deficit, triggering gold withdrawals from the country. In September, while the governor of the Bank of England was convalescing, the UK left the gold standard and sterling fell heavily against the dollar and the franc. Germany switched regimes both economically and politically, pursuing increasingly autarkic development. France stuck with her pegged gold standard exchange rate and deflated to maintain it.

Clearly this second wave grew from the collapse of demand in the first phase of the Great Depression. But the French and British banking systems remained robust, despite the failure of the French Oustric bank on 31 October 1930 that brought down the Tardieu government and a number of smaller banks in Paris and the provinces. Indeed, much of the international chaos of this second wave might have been averted if the Bank of England had ensured sufficient foreign exchange reserves to maintain the par value of sterling – so US Federal Reserve Governor Meyer believed.26

As discussed in the following sections, from 2007 very vigorous interventions by US monetary and fiscal authorities appear to have forestalled a second round of the crisis in the United States, but Europe threatened to relive 1931 in 2010. In the later slump cheap finance had encouraged both public and private borrowing on a massive scale in southern Europe, which had not undertaken comparable supply side Hartz reforms to those of Germany. This boosted German exports to southern Europe, but eventually triggered concerns about the viability of these debts, and forced readjustment, which blunted the German upswing and British recovery. In early 2010, the outbreak of European sovereign debt troubles struck the weakened financial system. Triggered by Greece's public debt problems, concerns about fiscal sustainability spread through the euro area, to other southern European countries and Ireland, then more widely – and euro area interbank markets ceased lending again.27

With independent currencies the financial crises would have seen a sudden reversal of capital flows to southern Europe. Instead, the availability of Eurosystem credit instead permitted a more gradual adjustment of current accounts.28 The downside is that the costs of the eventual essential adjustment appear to be forced by the European Union, which, unfairly in this case, reduces its popularity. Perhaps the relative mildness of France's recent recession (Fig. 2) is also to be explained by the balance in favour of financing rather than adjustment that the Eurosystem permits. But whether the adjustment is actually taking place is a contentious matter. Southern European countries since the Lehman crisis in September 2008, it has been claimed, were simply supplied with finance for current account deficits and debt redemption by their central banks.29 Central banks of northern Europe lent central banks of southern Europe funds via the ECB's internal accounts of about 800 billion euros by March 2013. Effectively, money was printed in the South – the Target2 balances – to buy goods in the North. If this is so, a second major financial shock is being deferred in Europe, rather than ameliorated.

4Monetary policyThe foregoing two sections have demonstrated that the 1929 and 2008 recessions were both triggered by major financial crises, the conditions for which were prepared by flawed institutional environments. Commercial bank regulation and behaviour – lending for high risk speculation with inadequate equity – in Germany and the US created instability in the financial system with which the central banks could not cope in the first period.

Monetary policy was regarded as the principal policy instrument in 1929 but was much less proactive than in the later period and was dominated by the need to stay on the gold standard, until this was abandoned in the 1930s. In Germany, France, and United States central bank regulations created an unsatisfactory environment. They partly explained why Germany could not reduce interest rates and contributed to the unwillingness of the Bank of France and the Federal Reserve to pursue sustained monetary expansion when needed. Nonetheless, the US Federal Reserve could have launched very substantial open-market operations in the crucial period, but did not.30 This is supported by the finding that US open-market operation policies that were pursued did not trigger adverse market reactions, as measured by the forward exchange rate.31

The French 1928 Stabilization Law was designed to insulate the Bank of France from pressure to monetise government debt. French regulations were distinctly unusual in their requirement for one-to-one gold backing of increased note issues. Immediately after stabilisation French monetary policy seems to have been out of control of the Banque de France. In 1930, a Bank of England official reported ‘The Bank of France cannot take the initiative because of its statutes and the commercial banks will not’.32 Similarly the Reichsbank was bound by a 1924 law which limited its ability to discount by a 40 per cent gold cover ratio and the Hague Treaty of 1930 reiterated the need to keep the gold commitment, breaching it would have violated Germany's international obligations. Only when Britain abandoned the gold standard was she able to lower interest rates; within eighteen months recovery and a building boom were underway.

Learning from history, the Federal Reserve responded to the emergence of the later US crisis with a cut in the discount rate (the rate at which the Federal Reserve lends to banks) in August 2007. The Federal Open Market Committee began to ease monetary policy in September 2007, reducing the target for the Federal Funds Rate by 0.5 percentage point. As the severity of the recession became apparent the Committee reduced the target for the Federal Funds Rate by a cumulative 3.25 percentage points by the Spring of 2008. This was a uniquely rapid and substantial policy response.33

However, it was probably the Fed's ‘unconventional’ policies that were most needed. The Federal Reserve's credit easing approach focused on the mix of loans and securities that it held and on how this composition of assets affected credit conditions. Credit spreads were much wider and credit markets more dysfunctional in the United States than during the earlier Japanese experiment with quantitative easing, which focussed on bank reserves. The Fed therefore bought mortgaged backed securities as well as longer term US Treasury securities, it lent against AAA-rated asset-backed securities collateralized by student loans, auto loans, credit card loans, and loans guaranteed by the Small Business Administration, and the Fed bought highly rated commercial paper at a term of three months.

Other central banks everywhere also responded to the crisis by reducing policy interest rates. In open-market operations, they also supplied additional longer-term funding for banks, against a wider than usual range of collateral, and through concerted international action. The Bank of England introduced a scheme to enable financial institutions to exchange illiquid assets for UK Treasury bills, intended to improve liquidity and raise confidence. Using ‘quantitative easing’ the Bank of England created money to buy gilts from institutions. The hope was that these investors would then buy other assets with their funds, such as corporate bonds and shares, thereby bidding up their prices. If it worked, this would lower longer-term borrowing costs and encourage the new issues of shares and bonds. Between March and November 2009, the Monetary Policy Committee authorised the purchase of £200 billion worth of assets, mostly UK Government debt or “gilts”. By July 2012 they had agreed total asset purchases of £375 billion, or about one quarter of GDP.

These policies at first seemed to work. In the second half of 2009 there was a strong rise in asset prices internationally. The recovery in the UK stock market was one of the strongest ever. Banks were able to increase their capital ratios; the major UK banks raised more than £50 billion in additional core Tier 1 capital in six months. Core Tier 1 capital ratios, averaging 9.6%, exceeded pre-crisis levels by 2009, but remained low by historical standards – especially in view of the expected fines and compensation coming due from London Interbank Rate, money laundering and Payment Protection Insurance scandals.

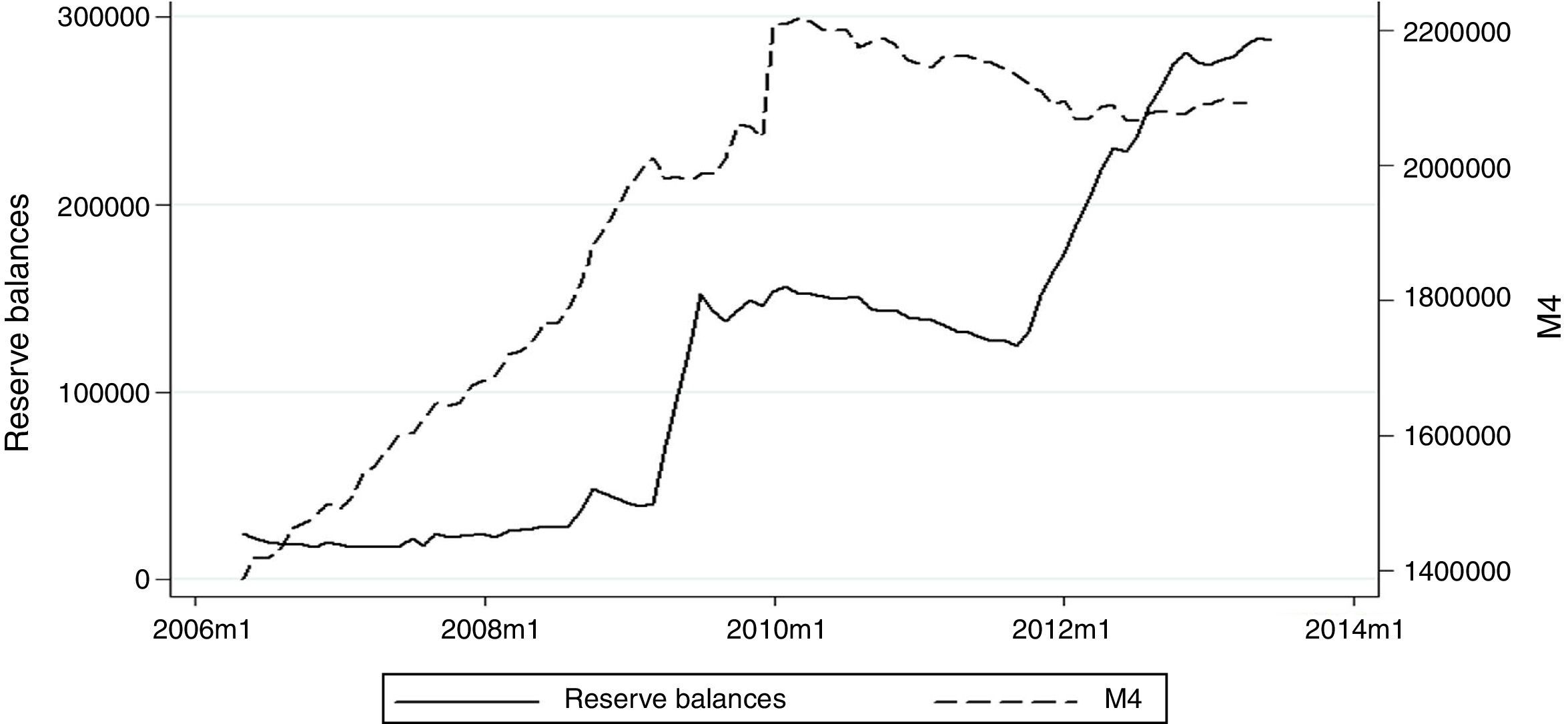

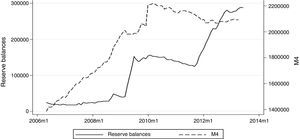

Although proactive policies brought relief in 2009, thereafter the UK economy stagnated. UK banks reduced lending. The monetary base rose strongly in the summer of 2009 and from the Spring of 2012 in response to successive doses of ‘quantitative easing’. But commercial banks increased their reserves held with the Bank of England rather than making loans (Fig. 4). Nominal money supply M4 therefore stagnated, and, as prices continued to rise, fell in real terms. The Bank of England was ‘pushing on a string’.

The European Central Bank (ECB) faced a more difficult task than the Bank of England or the Federal Reserve System because it was obliged to set a single discount rate for relatively strong economies such as Germany, and weaker ones, which included France and southern Europe. Whereas the Bank of England dropped its discount rate to 0.5% in March 2009, the ECB only lowered its own discount rate to 2% in January 2009, to 1% in December 2011, and to 0.5% in May 2013. The ECB adopted a similar policy to the Bank of England of buying state bonds from the commercial banking system to inject liquidity. German policymakers preferred that a permanent rescue fund instead be established to recapitalise southern Europe's banks, but this did not constrain the ECBs ‘quantitative easing’.

The lesson had been learned by policy makers from the earlier Great Depression that monetary policy in the current recession needed to be expansionary, especially by central bank purchases of longer term securities (quantitative easing) when interest rates were as low as they could reasonably be reduced. Yet Keynes’ concern about monetary policy ineffectiveness in the 1930s appears to be warranted by the accumulation of UK commercial bank reserves, generated by quantitative easing after 2009, instead of lending the money for investment to promote recovery.

The standard Mundell-Fleming model accommodates the current era of very low official interest rates and expansive monetary policy (that in the British case failed to expand aggregate demand for two years), with the ‘liquidity trap’. Graphically, this horizontal section of the LM curve reflects the inability of monetary base expansion to increase broad money because the banks prefer to hold reserves rather than to make loans. In these circumstances – with accommodating monetary policy – fiscal expansion can boost aggregate demand with a multiplier effect, without being choked by higher interest rates. Ultimately the demand expansion could encourage more bank lending and so an expansion of broad money, and the fiscal stimulus could then be withdrawn.

The conclusions of more sophisticated New Keynesian models are much the same.34 But a dynamic framework leads to the additional conclusion that open-market operations, even including “quantitative easing”, will be ineffective if they do not change expectations about the future conduct of policy; in this sense, a liquidity trap is possible. Nonetheless, a credible commitment regarding future policy – such as to a low and fixed nominal interest rate even if and when prices rise – can in theory largely mitigate the distortions created by liquidity trap (or the ‘zero lower bound’).35 In view of these shortcomings a more active fiscal policy was necessary as discussed in the following section.

5Governments and fiscal stanceThe proactive fiscal policies of the second Great Recession are a tribute to the acceptance of Keynesian ideas, in marked contrast to the earlier crisis. The evidence from the later period indicates that fiscal expansion was needed in the first period in the US and Germany, and probably would have helped the UK in the current recession. Simulations show that fiscal policy combined with appropriate discount rates could have greatly ameliorated the collapses in incomes and output of the Great Depression.36

In the more recent Great Recession, the International Monetary Fund estimated that by 2009 fiscal policy may have contributed 2–2½ percentage points to PPP-weighted growth of nine large industrial countries in 2008 and perhaps provided 2–2¼ percentage points in 2009, together with ¼–½ percentage points in 2010.37

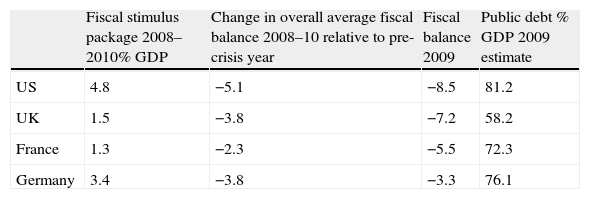

The US gave the largest fiscal stimulus, but then US automatic stabilisation was weak compared with Europe and growth deterioration was expected to be strong (Table 1). Despite the relatively low estimated public debt, the UK fiscal stimulus was quite weak, suggesting there was scope for a bigger boost. Germany went for an expansion of more than twice as much – regardless of the national reputation for parsimony – and the overall average deterioration in fiscal balance between 2008 and 2010 was the same as the UK's.

Fiscal policy in the great recession 2008–2010.

| Fiscal stimulus package 2008–2010% GDP | Change in overall average fiscal balance 2008–10 relative to pre-crisis year | Fiscal balance 2009 | Public debt % GDP 2009 estimate | |

| US | 4.8 | −5.1 | −8.5 | 81.2 |

| UK | 1.5 | −3.8 | −7.2 | 58.2 |

| France | 1.3 | −2.3 | −5.5 | 72.3 |

| Germany | 3.4 | −3.8 | −3.3 | 76.1 |

The US administration with Keynesian models believed their government-purchases multiplier was 1.57, and their tax multiplier was 0.99. Because 1.57 is larger than 0.99, they concluded it was better to spend money than to cut taxes (and this was the dominant fiscal policy elsewhere as well).38 In fact to a large extent this is the way that the automatic stabilising properties of the large twenty-first century government budgets operated, and no doubt reduced the severity of the downturn compared to that in the US in 1929. The other side of the coin is that automatic stabilisation, and discretionary fiscal expansion when tax revenues have fallen off, increases government borrowing and national debt. This raises concerns about future tax increases to service the extra debt, and higher borrowing charges, if the market believes there is a greater chance of the government being unable to fulfil its debt service obligations – as in Europe in 2010. These elements, along with supply constraints, could reduce fiscal multipliers below the levels necessary to be effective. On the other hand, if the level of economic activity is increased by fiscal policy, tax revenues will rise, reducing the accumulation of debt. If economic growth is restored, greater levels of debt can be serviced because of the greater tax revenues.

The characteristics of “New Neoclassical” models tend to reduce or eliminate the supposed effectiveness of fiscal policy and the size of multipliers. These models use inter-temporal budgeting and forward-looking expectations and remove rigidities in prices and wages, at least in the medium term. But credit constraints during financial crises, and the recessions they induce, reduce the agents’ opportunities for long period inter-temporal optimisation. In any event, substitution over time (in contrast to the inter-temporal income effect) still permits a temporary expenditure boost from fiscal policy even with unconstrained agents.39 Consistent with this view, expansive fiscal policies in Germany and the UK appear to have been more effective during the recent severe recession.40 Shocks to US government spending seem to have the largest temporary effects (compared to UK and German experience) in a recent study.41

Financial intermediation accounted for more than 8% of total UK GVA, with profits perhaps twice as much in 2008,42 and the percentages in the US were similar. The financial industry paid a good deal of tax on these earnings. In consequence tax receipts fell radically with the collapse of the sector. Government spending on the other hand rose, creating the largest peace time deficits seen in the UK and the US. These deficits were boosted by discretionary fiscal policy. From 1 December 2008 in the UK the VAT rate was temporarily cut by 2.5% until January 2010 – and was associated with an acceleration of retail sales growth. OECD figures show a UK deficit in 2009 of 10.8% of GDP and a US deficit of 11.9%.43 Thereafter these percentages fell but the US deficit to GDP ratio remained above that of the UK until 2012, as did unemployment.

In February 2008, the US Congress passed an Economic Stimulus Act giving temporary tax rebates for households and temporary accelerated depreciation for businesses, generating a one year rise in the deficit of just over 1 percent. A year later as the severity of the recession became more apparent, Congress gave another stronger fiscal stimulus through the American Recovery and Reinvestment Act, estimated to increase the deficit by almost 5 percent over the first two full budget years. Higher government spending included expanded unemployment compensation and aid to state and local governments.

By 2010, before the second wave of the crisis broke, Britain and Germany were concerned to rein in their spending. The German Federal Government announced in June 2010 plans to cut the Federal deficit by around 1.3% of GDP by 2014.44 A new government in the UK (with its larger budget deficits) set out plans for fiscal consolidation, as did France. France's proposed increases in the effective retirement age would not only deliver cost savings but also support aggregate demand by increasing lifetime income and consumption. But they were reversed by the new government in 2012 that also raised family benefit, capped petrol prices and increased taxes on the rich and companies.45 The tension between the need to constrain the growth of public debt without stunting recovery remained unresolved in Britain and France.

6Prudential re-regulationBoth crises prompted a regulatory response. Prudential regulation of banks in the US was sadly deficient in the run up to the Great Depression and during its course.46 Former President Herbert Hoover diagnosed the US banking system problems as too many small banks, too many regulatory jurisdictions, and an incorrect theory of discount rate and open-market operations held by the Federal Reserve.47 In addition, larger bank affiliates were speculating in stocks and engaging in stock promotion, indirectly using their depositors’ money, and ultimately losing it. All commercial banks were permitted to loan too much on long term mortgages and to over-invest in long term bonds.

The reform implemented by the US Banking Act of 1933, which introduced Federal Deposit Insurance to prevent future bank runs, was obviously needed. Another element of the Act was the four provisions often known as the Glass-Steagal Act (repealed in 1999). These prohibited commercial banks from participating in investment banking activities or collaborating with brokerage firms. The Securities Act of 1933 and the Securities Exchange Act 1934 established the Securities Exchange Commission and created a framework to provide the markets with more reliable information than had previously been available and with clear rules of honest dealing.48

About the later banking meltdown of 2008, both British and US legislators, as well as the Chair of the US Federal Reserve, reached similar conclusions.49 They were damning about the competence and morality of senior bankers, the shortcomings of regulation, the credit rating agencies and the market's ‘invisible hand’. Legislators in the US were, however, the more active. After the banking crisis the US Congress temporarily increased the Federal Deposit insurance limit to $250,000. With the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act, this increase became permanent from July 2010. The Act took steps towards regulating non-bank financial companies, such as hedge funds, and the most complicated derivatives. It increased the Federal Reserve's authority to regulate the economy. The Act also created a number of new agencies including the Consumer Financial Protection Agency.

In Europe bank capital adequacy had supposedly been ensured by the adoption of the Basel II recommendations in 2005, and their transposition into European Union law through the Capital Requirements Directive, effective from 2008. The recommendations required commercial banks, central banks, and bank regulators to rely more on credit risk assessments by private rating agencies, delegating regulatory authority to them. Yet the Basel capital requirements did not prevent banking crises because risk weightings of assets were inappropriate. The historical experience of mortgages did not take into account recent changes in the market that made them riskier.

Basel III subsequently attempted to remedy this problem and imposed higher minimum equity requirements to enhance the effectiveness of capital buffers.50 Other finance and banking reforms remained under discussion. Industrial lobbies will regard prudential regulation much less favourably than injections of taxpayers’ capital into their firms, or stabilising fiscal and monetary policies. The greater the delay of statutory reform after the slump, the easier resistance becomes, with the fading of the public memory of the debacle.

7Labour markets: employment and wagesIn contrast to Keynesian macroeconomics with a concern about demand management, Real Business Cycle (RBC) theory understands fluctuations as equilibria or market clearing outcomes with flexible prices.51 Hence the dominant shocks come from the supply side – with technological innovations shifting productivity. Cycles then arise from the build up or decumulation of capital and temporary labour supply responses. The elasticity of labour supply in this scheme is due to the work-leisure trade-off. It follows that monetary and fiscal policy are only relevant insofar as they affect the supply side. An RBC interpretation of the two Great Recessions therefore must take a very different view of the origins, as well as the effectiveness of monetary and fiscal policy resorted to by policymakers in the later period.

Is the RBC position borne out by labour market experience? Supply shocks in the labour market imply that real wages rise when employment falls, whereas adverse demand changes lower real wages as jobs disappear. Consistent with a massive demand shock, real wages fell catastrophically in the US in the early 1930s without restoring employment. But they rose in Western Europe (Fig. 5) as if there were increased leisure preference. Greater wage than price stickiness due to union power, so that prices fell faster than wages in Europe, may be the explanation. If so, greater unemployment should have emerged in Europe than in the US, assuming that Europe was subject to comparable shocks. The preceding argument is that for Britain and France the initial shocks were considerably less than that in the US.

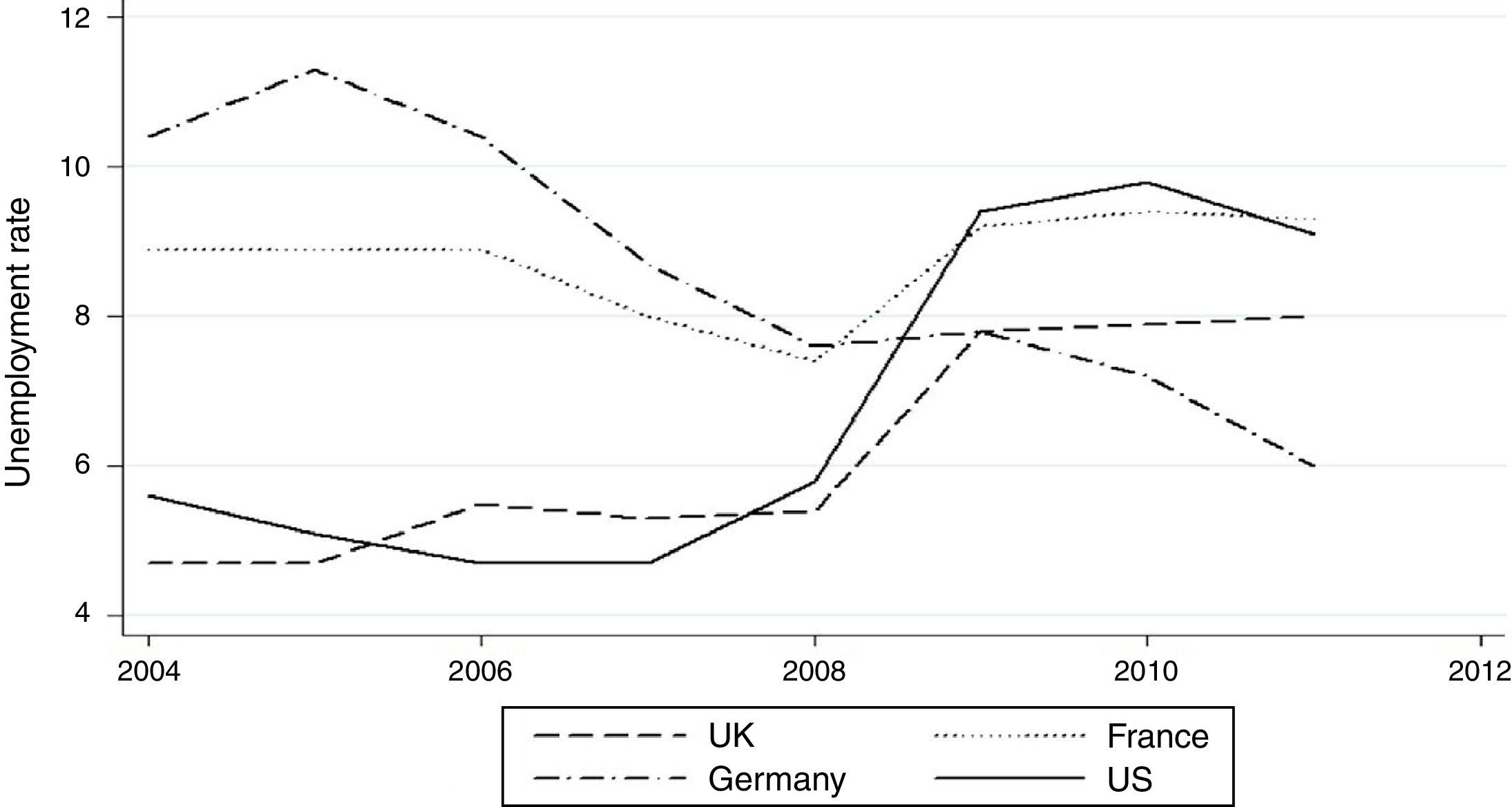

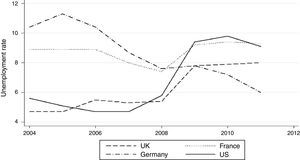

A similar divergence of national experiences occurred more recently. Between 2007 and 2011 unemployment rates in the UK and the USA increased by about one half (Fig. 6). Before the recession they had been well below the rates in France and Germany. Over the recession, unemployment apparently fell in Germany so that by 2011 the German rate was well below those of the UK and the US. French unemployment rose through to the first quarter; the harmonized rate was above that in the US in 2010. But the proportionate rise over the recession period was still less than that in the UK and the US.

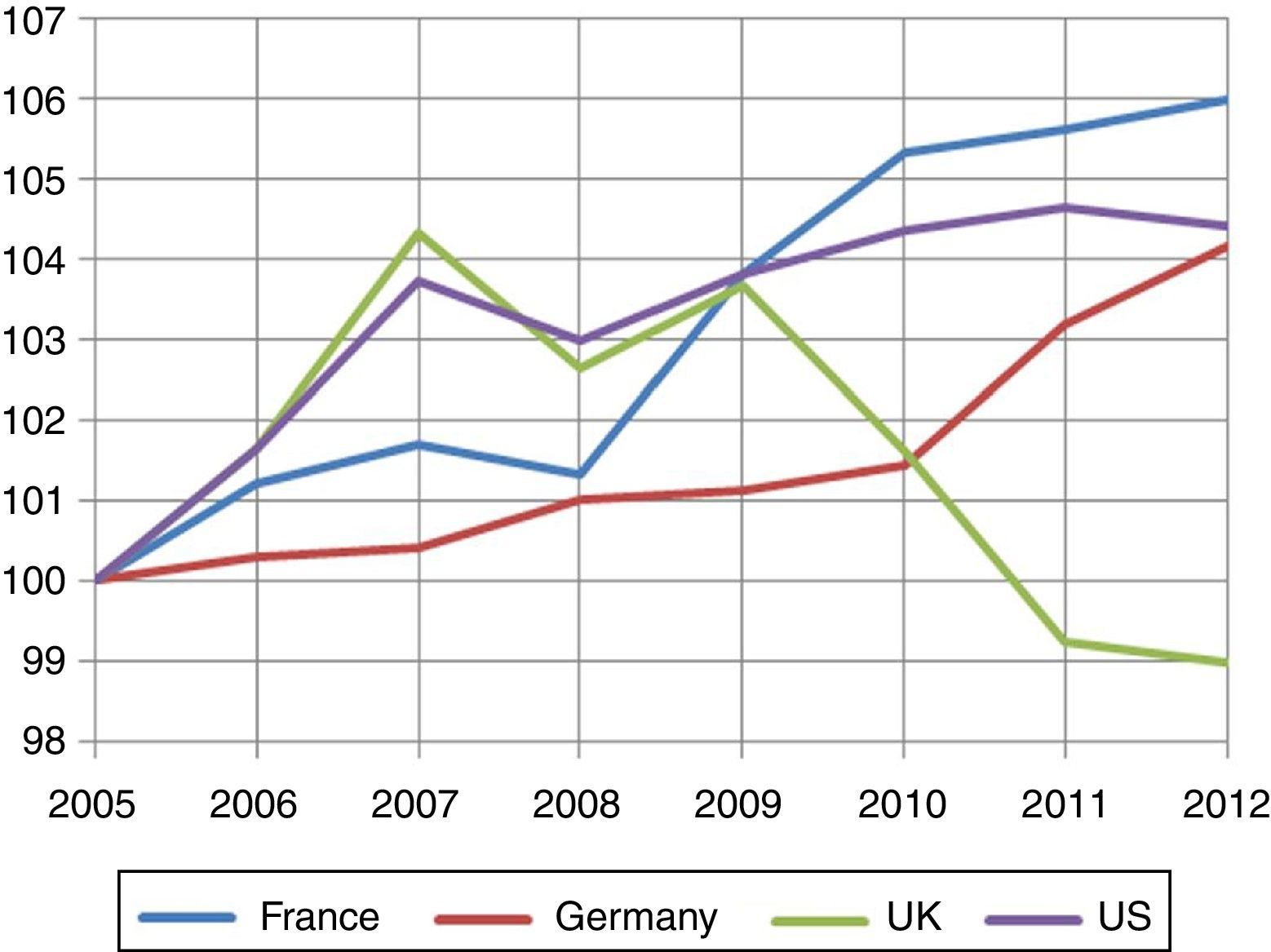

In the UK by 2012 wages had fallen back to their level ten years earlier without eliminating the increased unemployment, while those in the US, Germany and France rose (Fig. 7). On the other hand, unemployment in the UK was lower than that in France with rising real wages, and UK unemployment was falling. Stronger rises in UK prices as the exchange rate fell seem to explain the decline in real wages and the relatively good employment performance – though in RBC terms employment has not increased enough to assume that the pattern is generated by a reduced British leisure preference. Unfortunately in the absence of investment British productivity remained below what had been achieved before the crisis. Either national labour markets work differently, thanks to dissimilar institutions, or the shocks differ. Falling unemployment and rising wages in Germany from 2010 look like the effects of expanding demand, consistent with a Keynesian interpretation of the recession.

8Trade and exchange ratesThe collapse of world trade in the 1930s was a major contributor to economic hardship and the rise of political extremism. In turn trade wars dragged down trade by more than warranted by falling incomes. The final adoption of US Hawley Smoot trade tariff in June 1930 triggered higher tariffs in Canada, France, Italy and Spain, and many other countries. Average nominal US tariffs rose to 54 per cent by 1933 compared with 39 per cent in 1928. For all their damage to trade, trade policy instruments were not powerful means of achieving national economic targets, but they were easy to use.52

A lesson from the 1930s that bore fruit in this recession is the importance of avoiding national policies of trade destruction. In the present crisis world trade has remained comparatively buoyant, in part a tribute to the World Trade Organisation and in part a reflection of smaller fall in national incomes. Between 1929 and 1934 the real value of exports fell 22% and the current price value fell 43%. Yet between 2008 and 2012 the current price value of merchandise and commercial services export rose 14 and 13%, respectively.53 Certainly inflation would have reduced the real value of trade increases between these two recent years, but it is apparent that a 1930s style wave of protectionism has been avoided.

The depreciation of sterling mattered less to other economies in the second period both because sterling played a smaller role and the depreciation was less sudden. When sterling was forced off the gold standard in September 1931, the silver lining for the UK, though not for the rest of the world, especially France, was that the low interest rates permitted by abandoning the exchange rate peg eventually triggered a strong recovery, including a building boom. With a robust domestic financial system and monetary autonomy, monetary policy did work.

What facilitated UK recovery from the Great Depression, leaving the gold standard, in the form of euro exit would in principle benefit France today. As it is, France seems to be moving to replicate its 1930s experience. In the later period, weaker members of the Euro monetary union were unable to take advantage of a similar increase in competitiveness to that provided for Britain by the 22% trade weighted depreciation of sterling since 2007.54

9ConclusionThree key differences between the two periods are the current proactive national and international policies, the greater size of government and more pervasive finance in the second recession. The first two dampened the 2008 recession while the third exacerbated it.

Contrary to RBC doctrine it is clear that the proximate cause of both slumps was massive financial collapses. In line with the recommendations established by Keynesian economics in the aftermath of the 1930s crises, from 2008 policy makers adopted a wide range of countercyclical fiscal and monetary policies, and allowed the built-in stabilisers of government budgets to work. In aggregate these must have been effective because the recent financial crisis resembled the US depression that began in 1929; but in 2008 many more countries were affected and finance was even more pervasive. With the same quality of economic management shown in the US from 1929 much of the western world would have been dragged down to the extent that the US was in the first Great Depression. As it was the recession after 2008, though historically severe, was mild compared to US experience in the 1930s.

Nonetheless, the current great recession triggered strong criticism of economists and economics, much of which was not warranted. Academic research is undertaken mainly by economists for academic economists, not to make the world a better place. What matters is the message that filters through to those who influence policy and the foregoing evidence suggests that broadly correct policies were adopted.

In one respect, however, there may be grounds for criticism. Economists may have under-estimated the stability of markets and the tightness of prudential regulation necessary for reducing the severity of potential crises. That no other Great Depression occurred for many years must have contributed to the formulation of much less interventionist models. Such complacency also may have encouraged pertinent changes in economic structure between the two recessions. Whereas the weakness of German and US banking in the 1920s aggravated the German and US slumps, the robustness of the British banking system ensured the British depression was relatively mild. In the more recent crisis the positions were reversed.

On the other hand, economists’ assessments are likely to be discounted anyway if powerful industry lobbies judge they will constrain profits, rather than boost them. Pressure groups, rather than economic theorising, may explain why bank bailouts and countercyclical monetary and fiscal policies were embraced with more enthusiasm than regulatory reform. An interesting case suggesting such influences at work is the magnitude of the German fiscal stimulus between 2008 and 2010, more than double that in the UK, and yet the prevailing economic ideology in Germany is for non-intervention and against ‘Keynesianism’.

The downside of greater government macro-policy effectiveness in the current recession is likely to be weaker public pressure for the essential radical reforms of private sector banking and finance and of prudential regulation than was apparent in 1933 and 1934, after the earlier debacle in the United States. Prompt action is likely to be more effective, as the US Dodd-Frank Act of 2010 shows. Essential radical banking reform in the UK – such as required higher equity ratios – will be difficult because of the bankers’ ‘back door’ to power and because the financial crisis was ameliorated by government policy. Taxpayer cushioning of the impact of financial meltdown conceals from the public the damage inflicted by the financial system, and the longer the deferral of action after the slump the weaker will be the pressure for reform.

SourcesOrganisation for Economic Cooperation and Development. http://www.oecd-ilibrary.org/economics/government-deficit_gov-dfct-table-en

Bank for International Settlements. http://www.bis.org/bcbs/basel3.htm

Securities and Exchange Commission. http://www.sec.gov/about/whatwedo.shtml

World Trade Organisation. http://www.wto.org/english/res_e/s tatis_e/i ts2013_e/its13_toc_e.htm

Bank of England Archives (BE)

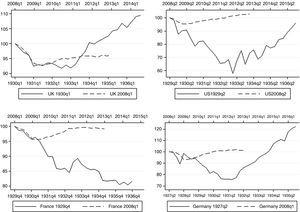

| German Real GDP | US Real GNP | French Real NNP | UK Real GDP | |

| 27Q1 | 16,710 | 21.0553 | 989.727 | 1183.08 |

| Qtr2 | 16,975.1 | 21.4287 | 946.152 | 1185.38 |

| Qtr3 | 16,957.3 | 20.8113 | 954.741 | 1179 |

| Qtr4 | 16,232 | 20.0436 | 979.38 | 1171.54 |

| 28Q1 | 15,179.7 | 20.568 | 993.391 | 1189.87 |

| Qtr2 | 16,753.5 | 20.7687 | 1023.38 | 1197.6 |

| Qtr3 | 16,240.5 | 21.3984 | 1035.98 | 1198.82 |

| Qtr4 | 15,904.3 | 21.0867 | 1047.25 | 1208.72 |

| 29Q1 | 16,070.3 | 22.5067 | 1121.62 | 1210.21 |

| Qtr2 | 15,486.5 | 23.4285 | 1132.89 | 1225.53 |

| Qtr3 | 14,973.5 | 22.9281 | 1129.44 | 1235.43 |

| Qtr4 | 14,566.5 | 20.535 | 1146.05 | 1238.82 |

| 30Q1 | 13,776.5 | 21.2208 | 1130.7 | 1252.36 |

| Qtr2 | 14,041.6 | 21.2691 | 1129.92 | 1232.96 |

| Qtr3 | 13,670 | 19.7124 | 1111.76 | 1214.65 |

| Qtr4 | 12,944.7 | 18.3703 | 1097.61 | 1205.02 |

| 31Q1 | 12,897.1 | 19.2621 | 1103.6 | 1157.89 |

| Qtr2 | 12,914.6 | 19.325 | 1088.11 | 1163.45 |

| Qtr3 | 12,826 | 18.2657 | 1057.91 | 1160.33 |

| Qtr4 | 13,126.5 | 17.4847 | 1030.39 | 1171.32 |

| 32Q1 | 14,088.9 | 16.5764 | 1029.6 | 1170.13 |

| Qtr2 | 14,566.2 | 15.3271 | 983.349 | 1159.41 |

| Qtr3 | 14,866.7 | 15.3945 | 981.238 | 1147.61 |

| Qtr4 | 15,202.5 | 16.0184 | 985.814 | 1161.85 |

| 33Q1 | 15,456.5 | 13.5552 | 968.057 | 1149.54 |

| Qtr2 | 16,039.9 | 15.7785 | 1008.75 | 1164.86 |

| Qtr3 | 16,411.1 | 17.6395 | 1022.69 | 1195.38 |

| Qtr4 | 16,676.2 | 15.1576 | 1000.51 | 1217.22 |

| 34Q1 | 17,214 | 17.1947 | 987.848 | 1256.75 |

| Qtr2 | 18,115.8 | 17.7745 | 979.049 | 1250.37 |

| Qtr3 | 18,557.7 | 16.0569 | 980.951 | 1262.44 |

| Qtr4 | 18,822.8 | 16.7251 | 972.152 | 1273.43 |

| 35Q1 | 18,629.5 | 18.512 | 937.657 | 1284.54 |

| Qtr2 | 19,955.7 | 18.0492 | 935.546 | 1306.37 |

| Qtr3 | 20,433 | 18.3153 | 937.448 | 1309.98 |

| Qtr4 | 20,768.9 | 19.5489 | 939.349 | 1338.11 |

| 19.7795 | 921.973 | 1319.25 | ||

| 20.779 | 931.899 | 1342.61 | ||

| 21.6371 | 920.426 | 1366.18 | ||

| 22.5483 | 935.702 | 1371.96 |

Krugman (1999, 2008), Saxonhouse and Stern (2003), and Eggertson and Woodford (2004).

On a visit to the London School of Economics in 2008, the Queen Elizabeth II of England, expressed surprise at the apparent failure of the economics profession to predict the financial crisis and the Great Recession.

In a series of papers beginning with Foreman-Peck et al. (1992). The monthly series are available at http://business.cardiff.ac.uk/welsh-institute-research-economic-development, under ‘data’, and the quarterly indices are in the appendix to the present paper. The correlation between the level of the monthly UK GDP index underlying the quarterly UK index and both of the more recent monthly UK GDP series between 1927 and 1936 is 0.967 (Mitchell et al., 2012).

Data available at http://business.cardiff.ac.uk/welsh-institute-research-economic-development, under ‘data’.

Elasticities in Table 8 (Foreman-Peck et al., 2000). With a short run elasticity of 0.06 and a long run elasticity of 0.07, the Dow-Jones drop from 691 to 168 (not the trough) is about a 76% fall. 0.76×0.06=4.56%, 0.76×0.07=5.3%. The estimated UK elasticities were similar but UK share prices did not show anything like the US volatility.

Data available at http://business.cardiff.ac.uk/welsh-institute-research-economic-development, under ‘data’.

Federal Reserve Bank of St Louis (FRED).

Mishkin (2011) op cit.

Surprisingly (as Temin points out) there is no direct statistical effect discernible of the bank failures on the US money supply, though the effects of gold movements are strong (Temin, 1989, Appendix B).

The present Chairman of the Federal Reserve showed that bank failures and other proxies for risk were highly correlated with the collapse in industrial production (Bernanke, 1983).

Bank of England (BE) ov4/19 25.7.30. F Rodd BIS to H.A. Siepmann.

Bank of England (BE): Germany OV4 1931.

If the Bank had borrowed a large sum in July, say a government loan with three years maturity of £300m (BE OV31/14 22.3.32). This may have been sufficient to tide the Bank over Britain's illiquid position in 1931, for there is prima facie evidence that the underlying causes of the international debacle were monetary and external to the UK and not fiscal or structural. Norman, the Bank Governor, appears to have been unuly optimistic in early April 1931 about the crisis receeding. Clarke (1967, p. 181).

For the period 2002 to mid-2007 there is no relationship between the cumulative current account deficit or surplus on the horizontal axis against the change in Target2 balances for the same period for the euro area countries. Target 2 balances are claims and liabilities of Eurozone central banks on and to the Eurosystem. So the eurozone financing system itself does not seem to have been responsible for the accumulation of current account deficits in southern Europe before the crisis (Cecchetti et al., 2012).

BE Bank of France monetary policy F Rodd 25.7.30 ov4/19.

Cimadono et al., op cit, Table 3.

Using a three-region version of the European Commission's QUEST model to gauge the impact of the consolidation package, one study found an improvement in the government balance and reduced public debt by 9% of GDP after10 years and 21% of GDP after 20 years, with real output 0.1% above the no-consolidation baseline after 10 years and 0.8% after 20 years (Roeger et al., 2010).

Supposedly, they were able to encourage speculation but not damp it down or boost economic activity.

House of Commons Treasury and Committee (2009), United States Senate and Senate Permanent Subcommittee on Investigations (2009), and Bernanke (2009).