This study tries to extend previous works on behavioral corporate finance by examining the interaction between investment cash flow sensitivity and various CEO characteristics in either the existence or inexistence of managerial optimism. Using a Q-investment model and departing from a sample of 475 annual observations, our results highlight that CEO's financial education, CEO's ownership and their optimism bias can explain distortions in corporate investment policy since they affect investment cash flow's relationship.

Este estudio trata de ampliar los trabajos previos sobre el comportamiento de la financiación corporativa, mediante el examen de la interacción entre la sensibilidad del flujo de caja de inversión y las diversas características de los directores ejecutivos (CEO), en términos de existencia o no existencia de un optimismo gerencial. Utilizando un modelo de inversión Q, y partiendo de una muestra de 475 observaciones anuales, nuestros resultados subrayan que la formación financiera, la titularidad, y las tendencias del optimismo de los CEO pueden explicar las distorsiones de las políticas de inversión corporativa, ya que estas afectan a la relación del flujo de caja de inversión.

The relationship between corporate decisions and CEO's characteristics has been largely ignored in standard financial theory. The investment cash flow relationship has been mainly explained by agency costs (Jensen & Meckling, 1976) and asymmetric information problems (Myers & Majluf, 1984). A key feature in the standard theory is that agents are fully rational and so that they are able to make optimal decision that maximize firm value (Oliveira, 2007).

A wave of critics emerges with what commonly called behavioral corporate finance. This approach argues that managers are frapped by some psychological and emotional biases (Baker, Ruback, & Wurgler, 2012; Fairchild, 2005, 2007; Ben Mohamed, Fairchild, & Bouri, 2014). Managers are normal (Statman, 2005) and so they can act in a suboptimal way (Heaton, 2002). In a seminal paper, Heaton (2002) initiates a debate concerning the effect of managerial optimism on corporate policy. He evokes the case of optimistic managers and how the optimism bias can conduct to investment cash flow sensitivity relationship.

Malmendier and Tate (2005a, 2005b), Lin, Hu, and Chen (2005), Huang, Jiang, Liu, and Zhang (2011), Campbell, Jhonson, Rutherford, & Stanley, 2011 and Ben Mohamed et al. (2014) empirically tested the investment cash flow sensitivity under managerial optimism and found that optimism bias can increase investment cash flow sensitivity and so explains why firm doesn’t achieve optimal investment strategy and why it can’t trade at its optimal value. However, some other characteristics of CEO's can also explain the investment cash flow sensitivity (Malmendier & Tate, 2005a). The young literature on behavioral corporate finance is mainly concentrated on the effect of managerial optimism on corporate decisions while only Malmendier and Tate (2005a) paper evokes such potential effect.

This study tries to extend previous works on behavioral corporate finance by examining the interaction between investment cash flow sensitivity and various CEO characteristics in either the existence or inexistence of managerial optimism. Especially, we investigate the effect of manager's financial background, his/her technical education, tenure, ownership and managerial optimism.

The choice of this subject is highly motivated by the fact that empirical studies that are related to this topic, have adopted relatively old data. Malmendier and Tate (2005a) adopt a panel of American firms during the period 1980 to 1994. Taking into account the dynamic effect, especially of the psychology of managers and investors, it is legitimate to reconsider the effect of managerial optimism and other characteristics of top managers on the sensitivity of investment to cash flows. We must also re-examine this relationship in order to generalize previous empirical findings. In fact, this subject remains marginalized in the financial literature.

In this paper, we will discuss in some depth the effect of CEO's personal characteristics; namely the nature of his/her education, his/her ownerships, and tenure and optimism bias on investment cash flow sensitivity. We will also jointly investigate the effect of managerial optimism and these characteristics on investment cash flow relationship in order to take into consideration the potential interactions between these variables, a thing that may arises when we test the common effect.

The rest of paper is organized as follows. After this introduction, in section 2, we present theoretical background and we develop our hypothesis. Section 3 introduces our methodology and models. Section 4 describes our data. Section 5 reports our empirical findings. Section 6 provides discussions. Section 7 discusses the managerial implications of our results. Finally, section 8 concludes.

2Theoretical background and hypothesis developmentThe aim of this paper is to study the effect of CEO's personal characteristics and his/her ownership on corporate firms’ investment policy. Especially, we tend to advance another explanation for underinvestment and overinvestment problems by examining the link between investment cash flow sensitivity and CEO characteristics in either the existence or inexistence of managerial optimism.

2.1Managerial optimism and corporate investment cash flow sensitivityCEOs are in the center of corporate finance; the agency costs argue that managers are principal agents and so they play a central agent in firms (Jensen & Meckling, 1976). Andrews (1987) and Mintzberg (1973), among others, consider that CEO is typically the most powerful actor since he is an organization's leader.

Beyond the study of the effect of traditional variables such as markets imperfections, there are some research that are oriented to study the effect of CEOs’ personal characteristics on firm policy (Milbourn, 2003; Bertrand & Schoar, 2003; Malmendier & Tate, 2005a; Hackbarth, 2005; Parsons & Titman, 2008; Frank & Goyal, 2009; Graham, Harvey & Puri 2009; Malmendier & Tate, 2005b; Yudan, 2010; Lin et al., 2005 and Cronqvist, Makhija, & Yonker, 2012).

Heaton (2002), using a simple model of corporate finance, theoretically predicts that optimistic managers will see external financing as high costly because under their optimism bias, they will see stock markets undervalue their firm's shares. He predicts that corporate investment will be sensitive to the existence and level of internal cash flow. This will cause distortions in corporate investment policy since it will cause overinvestment in case of large internal cash flow, and underinvestment problems in case of short cash.

Empirical validations come from Malmendier and Tate (2005a, 2005b), Lin et al. (2005), Huang et al. (2011), Campbell et al. (2011) and Ben Mohamed et al. (2014). These results diverge to a common empirical result; optimism bias will push managers to make their corporate investment decisions under internal liquidity availability. The effect of managerial optimism on investment cash flow sensitivity should be positive and our first hypothesis can be formulated as follows:H1 CEO's optimism bias may affect investment cash flow sensitivity.

An original question in this level is to interrogate if there are other personal characteristics of CEOs that can also have an explanatory power on investment cash flow sensitivity. In the existence of such variables: how do they affect corporate investment when managers are also optimistic?

Holmstrom & Costa, 1986; Scharfstein & Stein, 1990 and Hirshlifer, 1993 suggest that CEOs’ careers can affect corporate capital investments. Barker and Mueller (2002) argue that managers’ career experience, in various functions, can be a primordial factor that can affect the corporate R&D investment.

Lin et al. (2005) focuse on CEOs’ professional background. In their study, they document a positive and significant coefficient between CEOs’ professional background and the intensity to invest in research and development activities. They support the hypothesis that stipulates that managers’ education can affect corporate investment. They report a positive and significant correlation between colleges educated CEOs and the probability to invest in innovation projects.

Investment cash flow sensitivity can be derived by CEOs education. In their work, Malmendier and Tate (2005a) distinguish between two forms of education; the financial education and the technical one. Finance education represents a dummy variable that takes one if CEO has undergraduate and graduate degrees in accounting, finance, business and economics. Technical education is a dummy variable that takes one if CEO has a graduate or undergraduate degrees in engineering, physics, operations research, chemistry, mathematics, biology, pharmacy and other applied sciences.

Malmendier and Tate (2005a) report a negative coefficient between corporate investment and internal cash flow in the special case where CEO has a financial education. This means that when manager has a good knowledge in terms of financial literature, investment strategies, implication of financing strategies among others, the probability that he will run an irrational behavior can be reduced. In contrast, according to their results, CEO with technical education may increase the investment cash flow sensitivity. This is because he lacks the financial esprit.H2 CEOs financial and technical education may affect investment cash flow sensitivity.

Another interesting personal characteristic of a CEO is his tenure. Miller (1991) finds that it can also have an explanatory power on corporate investment. He affirms that CEOs with long tenure can lose touch with their organizational environment and so they may do not make changes and invest in risky projects in order to keep their firms evolving over time. According to Hirshleifer (1993), CEO with short tenure can influence corporate investment policy. He argues that such CEO will have strong incentives to opt for short-term outcomes to build their reputation. Following this logic, the manager tenure may have an impact on investment cash flow sensitivity. One may formulate more than one possible prediction. When CEO has a long tenure, he can exploit internal funds to finance his investment projects. He can use excessively internal cash flow to invest even in projects with negative present value. One may ask why. We can find a logic answer from Jensen (1986); mangers may use free cash flow to under invest in order to escape from shareholders control and in more general to avoid the corporate governance mechanisms effects. As it prescribed by Shleifer and Vishny (1989), we predict a positive relationship between the CEOs’ tenure and the investment cash flow sensitivity phenomenon. The entrenchment can incite managers to behave an irrational form. CEOs may abusively use internal funds to increase firms’ activities perimeters. Especially, CEOs with long tenure can increase the sensitivity of corporate investment to internal financing because: (I) internal financing sources are less costly than issuing new equity or concluding a debt contract; and (II) long tenure allows them to harmonize the board members and other sources of control. With long tenure, mangers may arrive to weaken or neutralize corporate governance mechanisms’ control exerted against them. This can allow them to expose their firms facing investment cash flow sensitivity.

Malmendier and Tate (2005a) report a positive coefficient between firms’ investment and CEOs tenure. This means that a long tenure increases the dependence of investments to cash flows.H3 CEOs with long tenure may increase investment cash flow sensitivity.

Following the previous literature, we define; the “Tenure” as the number of years the CEO has held that position (Wu, Chen, & Ren, 2005; Malmendier & Tate, 2005a). Such measure is available in the Thomson Financial data base and SEC data base.

2.4CEOs ownership and investment cash flow sensitivityWe focus on the effect of CEOs ownership in the study of the relationship between firms’ investment and internal cash flow availability. In the free cash flow theory, Jensen (1986) shows that at increasing share stakes managers’ interests become aligned with those of the firms’ shareholders and remain such for very high level of insider ownership.

Morck, Shleifer and Vishny (1988) argues that if the managerial ownership becomes sufficiently high the investment cash flow sensitivity will decrease. Pawlina et al. (2005) affirm that the investment cash flow sensitivity is likely to initially decrease with increasing managerial ownership as co-ownership is expected to turn the management's focus to shareholder value maximization. We formulate our hypothesis about the potential effect of CEOs’ ownership as follows:H4 CEOs’ ownership is negatively associated with investment cash flow sensitivity.

The measure of CEOs’ ownership is the percentage of managers’ participation in firms’ capital. We can find in Thomson Financial data base such details with precision.

3MethodologyIn this paper we follow a similar methodology applied by previous research in investment cash flow sensitivity. We use Q-investment model as is well documented both in standard and behavioral corporate finance literature. (Fazzari, Hubbard, & Petersen, 1988; Chirinko & Schaller, 1995; Hubbard, Kashyap, & Whited, 1995; Calomiris & Hubbard, 1995; Hubbard, 1998; Kaplan and Zingales (1997, 2000); Cleary, 1999; Allayannis & Mozumdar, 2004; Malmendier and Tate (2005a, 2005b), W. Huang et al., 2011; Campbell et al., 2011) although critic of the Tobin's Q-model is still dominated and it represents a common empirical model to test investment cash flow sensitivity.

Investment cash flow sensitivity under manager's irrationalities converges into the application of Q-investment model (Ben Mohamed, Baccar, & Bouri, 2013). This is because our aim in this new area of behavioral finance is to explain investment distortions and so it is crucial to apply the same methodology in order to compare empirical results (Malmendier & Tate, 2005a,b) and to strengthen conclusions and the possibility for generalizing.

The empirical model is a modified Q-investment model. We depart from the standard Q-model of investment and we introduce the managerial optimism bias (Optimism), his/her education nature, ownership and tenure. We obtain a novel model that should be able to detect the sensitivity of investment (I) to internal funds (CF). Our model can be generated by expression (1)

Following previous empirical research on investment cash flow sensitivity, we measure the corporate investment in fixed assets by (I). It represents the dependent variable and measured by capital expenditure (CAPEX). Cash flows (CF) are computed as earnings before interest, taxes, depreciation, and amortization (EBITDA). Q is a proxy for firms’ opportunity growth; it is obtained by the ratio of market value to book value.

(Optimism) is our proxy of managerial optimism. It is a dichotomy variable that will be equal to one if CEOs are classified as optimistic and zero value otherwise. Our way for measuring managerial optimism is similar to the net buyer criterion used by Malmendier and Tate (2005a), Malmendier and Tate (2005b), Lin et al. (2005) and Ben Mohamed et al. (2014). The Optimism proxy is derived from CEOs internal transaction. As is initiated by Malmendier and Tate (2005a), we can use such information to classify managers as optimistic if they are net buyers of their firms’ stocks during their five years in tenure.

(FE) and (TE) are respectively financial education and technical education. These variables take one if the manager has a financial (technical) education and zero elsewhere. (Tenure) is the CEO's tenure. It is defined as the number of years the CEO has held that position. Finally, we concentrate on the study of the effect of the CEO's detention on his/her firms’ capital on investment cash flow sensitivity (Owner).

To make comparisons of our results with other previous results in both the standard literature of corporate investment and those from behavioral corporate finance, we keep the same common methodology in the study of interactions between firms’ investment and internal source of financing. We estimate a fixed effect panel data with OLS regressions. We run model (1) for the full sample.

We estimate our model in two ways. We firstly estimate the effect of CEOs personal characteristics in corporate investment, and then we re-estimate the same model with the coexistence of CEOs personal characteristics, managerial ownerships and optimism.

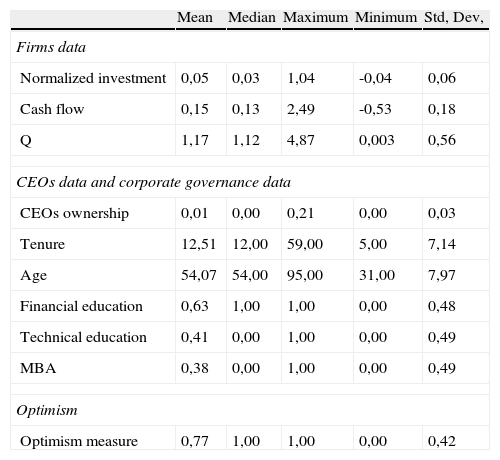

4Data descriptionOur dataset consists of 475 annual observations among the NYSE industrial firms which are financially constrained. We use the dividend ratio in order to classify firms as financially constrained or not (see Table 1). We use the Thomson Financial data base to extract insider transaction for these firms. Firms with no insider transaction availability are excluded. We also exclude firms that have less than five years. Finally, we exclude firms with missing data. Bond and Meghir (1994) use similar methodology to test the impact of financial constraint on investment cash flow sensitivity.

Summary of descriptive statistics.

| Mean | Median | Maximum | Minimum | Std, Dev, | |

| Firms data | |||||

| Normalized investment | 0,05 | 0,03 | 1,04 | -0,04 | 0,06 |

| Cash flow | 0,15 | 0,13 | 2,49 | -0,53 | 0,18 |

| Q | 1,17 | 1,12 | 4,87 | 0,003 | 0,56 |

| CEOs data and corporate governance data | |||||

| CEOs ownership | 0,01 | 0,00 | 0,21 | 0,00 | 0,03 |

| Tenure | 12,51 | 12,00 | 59,00 | 5,00 | 7,14 |

| Age | 54,07 | 54,00 | 95,00 | 31,00 | 7,97 |

| Financial education | 0,63 | 1,00 | 1,00 | 0,00 | 0,48 |

| Technical education | 0,41 | 0,00 | 1,00 | 0,00 | 0,49 |

| MBA | 0,38 | 0,00 | 1,00 | 0,00 | 0,49 |

| Optimism | |||||

| Optimism measure | 0,77 | 1,00 | 1,00 | 0,00 | 0,42 |

We use world-scope data base to compute firms’ investment, cash flow and others information. Data concerning the CEOs optimism measurement derive from Thomson Financial data base. We use exactly insiders transactions data base; CEOs transactions. This data base offers details for CEOs internal transactions that can be used as a strong measure of managerial optimism. The CEOs internal transactions are largely used in the investment cash flow sensitivity under managerial irrationality Malmendier and Tate (2005a, 2005b), Lin et al. (2005) and Campbell (2011). Campbell (2011) uses the same data base to construct a proxy for managerial optimism in the study of CEOs forced turnover. Only CEOs with a minimum of five years in their actual post are included. This criterion is imposed by previous literature in this field.

Additional data bases are implied here, SEC (Security Exchange Commission) Thomson officers and directors data are used in order to handily collect information about CEOs. The most interesting thing in these sources is that they contain a short biography of CEOs including information about their financial and technical career, tenure, whether or not they have a MBA degree. CEOs ownership is generated by Thomson Financial Data base.

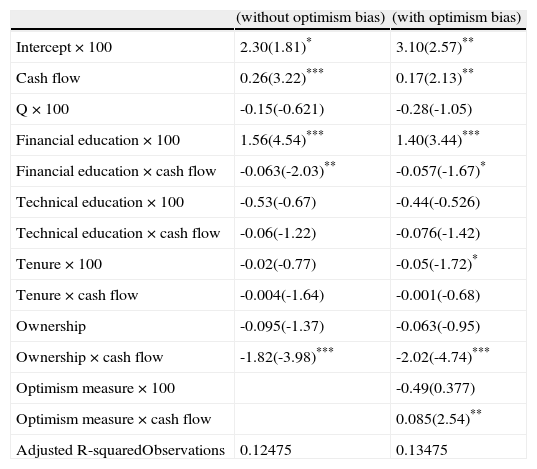

5ResultsOur results report a positive and highly significant coefficient between corporate investment and internal funds (0.26, t-statistic =3.22). Even with the introduction of managerial optimism in our fixed effect panel regression this result is robust and the coefficient of investment to cash flow is (0.17) and significant at the one percent level (t-statistic=2.13). This means that the existence and the level of internal sources of financing can be considered as a solid determinant of the corporate investment policy (see Table 2).

OLS regression of investment on CEOs’ personal characteristics and CEOs’ ownership using a Q-investment model.

| (without optimism bias) | (with optimism bias) | |

| Intercept×100 | 2.30(1.81)* | 3.10(2.57)** |

| Cash flow | 0.26(3.22)*** | 0.17(2.13)** |

| Q×100 | -0.15(-0.621) | -0.28(-1.05) |

| Financial education×100 | 1.56(4.54)*** | 1.40(3.44)*** |

| Financial education×cash flow | -0.063(-2.03)** | -0.057(-1.67)* |

| Technical education×100 | -0.53(-0.67) | -0.44(-0.526) |

| Technical education×cash flow | -0.06(-1.22) | -0.076(-1.42) |

| Tenure×100 | -0.02(-0.77) | -0.05(-1.72)* |

| Tenure×cash flow | -0.004(-1.64) | -0.001(-0.68) |

| Ownership | -0.095(-1.37) | -0.063(-0.95) |

| Ownership×cash flow | -1.82(-3.98)*** | -2.02(-4.74)*** |

| Optimism measure×100 | -0.49(0.377) | |

| Optimism measure×cash flow | 0.085(2.54)** | |

| Adjusted R-squaredObservations | 0.12475 | 0.13475 |

***,** and * denote that results are significant at the 1%, 5% and 10% levels.

The CEOs backgrounds, especially the financial education of managers can decrease the investment cash flow sensitivity. The coefficient of financial education to cash flow and investment is negative and significant at the second percent level (-0.06, t-statistic=-2.03). Even when re-estimate the model including managerial optimism measure, we find similar result. This coefficient is equal to (-0.05) and significant at the ten percent level (t-statistic= -1.67).

The managers’ financial education can reduce the irrational behavior of running investment cash flow sensitivity. An original explanation is that such result can be the fact that financial education offers to managers a theoretical background which makes them more rational and it will be an interesting future direction of research that focuses on the effect of CEOs personal characteristics and managers’ irrationality caused by behavioral biases.

The ownerships structure, namely CEOs’ ownership has a strong effect on investment cash flow relationship. The coefficient of this correlation is equal to (-1.82; t-statistic=-3.98)) in our first estimation and it is equal to (-2.02) and significant at the one percent level (t-statistic=-4.74) in the presence of managerial optimism. It is clear that a large managerial detention in his/her firm's may success to reduce corporate investment distortions. Our results also show that the technical education cannot be considered as possible determinant that can explain the influence of internal funds on firms’ investment. The CEOs tenures also have no effect on investment cash flow sensitivity among our firms. A possible explanation is that corporate governance mechanisms are stronger and are performing enough and then they can reduce manager irrationalities.

In sum, our results confirms previous finding of Malmendier and Tate (2005a) concerning the effect of the effect of CEOs’ financial education. However, they contradict their results concerning the impact of CEOs tenures and technical education. The restraint number of empirical studies in this area of research makes it difficult to compare between empirical findings and so it is impossible to generalize.

6DiscussionsHow managers’ psychological biases and CEOs’ personal characteristics affect their corporate investment policy? This is the main question of this study. We adopt a modified Q-investment model which includes a proxy for managerial optimism constructed in the basis of Malmendier and Tate (2005a) work. Our optimism measure is well documented in the majority of papers in this area of finance.

Running our model for the full sample, we support previous results by Malmendier and Tate (2005a), Malmendier and Tate (2005b), Lin et al. (2005), Huang et al. (2011) and Campbell et al. (2011). The optimism bias has a significant influence on firms’ investment policy. We demonstrate that optimistic managers, who are assumed to perceive always that market under-valuate their firms’ value, apply an investment cash flow sensitivity phenomenon. Such result can be exploited to advance an original explanation for the corporate investment distortions. Our results show also that CEOs financial education and his/her ownership are for interest to reduce investment cash flow sensitivity.

7Managerial implicationsOur study belongs to the wave of research papers that aims to explain the effect of CEOs personal characteristics on orienting firm policies. We empirically demonstrate that managerial optimism can increase investment cash flow sensitivity and it can explain observed distortions in corporate investment policy. Our results also show that some other CEOs personal characteristics can have great impact on firm investment decision since they influence on investment cash-flow relationship.

Firms should take care about their corporate governance structure which can influence managerial psychological biases as it theoretically predicted by Paredes (2005) and empirically validated by Ben Mohamed, Baccar, Fairchild and Bouri (2012) and Baccar, Ben Mohamed and Bouri (2013). Firms are invited also to advance managerial participation on their ownership structure, a thing that reduces corporate investment irrationalities. In sum, firms should take care about CEO personal characteristics that can also affect firms’ value and corporate policies since they can reduce the investment cash flow sensitivity and managers will invest in an optimal manner away from their financial constraint and the existence and level of internal liquidity.

8ConclusionThis paper is an essay to investigate the effect of managerial optimism and some other CEOs personal characteristics on orienting firm's investment policy. Departing from a sample of 475 large manufacturers American firms traded at the NYSE stock market and using an adjusted Q-investment model, we empirically demonstrate that the managerial optimism has a great impact on explaining why a firm may run investment cash flow sensitivity and then make its investment policy depending to its financing strategy. Our results also conclude that some other CEOs personal characteristics’ such as financial education and their ownership participation in their own firms can explain distortions in corporate investment decisions since they reduce investment cash flow sensitivity.