The purpose of this paper is to examine determinants of financial information disclosure by Tunisian companies. The methodology is based on qualitative approach, using the cognitive mapping technique. To take into account the specificities of the Tunisian economic, we felt that it is essential to conduct a qualitative analysis in the light of which we can identify the factors motivating the disclosure of financial information. The qualitative analysis is based on the census via a set of cases carried out in several Tunisian companies to understand their perceptions regarding the determinants of financial disclosure.

El objetivo de este artículo es examinar los determinantes de la divulgación de la información financiera por parte de empresas tunecinas. La metodología se basa en un enfoque cualitativo mediante la técnica de mapas cognitivos. Si se quiere tener en cuenta las particularidades de la economía de Túnez, es esencial llevar a cabo un análisis con el que sea posible identificar los factores que motivan la divulgación de la información financiera. El análisis cualitativo se basa en el censo con una serie de casos dirigidos en varias empresas tunecinas para comprender sus percepciones con respecto a los determinantes de la divulgación de la información financiera.

Several studies have been conducted on the extent of disclosure in general and several attempts have been made to explain the different levels of financial information disclosure based on the different characteristics of the firm such as size, status trading and industry type. Indeed, several theories have been used to explain disclosure in general.

This study is to analyse financial information disclosure of Tunisian firms. We felt that it is essential to conduct a qualitative analysis in the light of which we can identify the factors motivating the disclosure of financial information.

Second, given the determinants identified by qualitative analysis, we will perform an analysis by the technique of cognitive mapping to visualize the relative importance of each concept (determinants of financial information disclosure) regarding the disclosure. To do this, we will illustrate, in a first section, the determinants through a review of previous studies. In a second section, we present the methodology based on a qualitative approach to understand the importance of the determinants that drive Tunisian companies to disclose financial information. The main results and interpretations will be presented in the third section before concluding.

2Literature review2.1Determinants of financial information disclosureSeveral studies have been conducted on the extent of disclosure in general and several attempts have been made to explain the different levels of financial information disclosure based on the different characteristics of the firm such as size, status trading and industry type. Indeed, several theories have been used to explain disclosure in general.

These theories include agency theory, the signal theory, the theory of diffusion of innovations and cost-benefit analysis. Since the first study in 1999, the main variables analyzed were mainly focused around the size of the company, or the status of trading the business of the company. This does not preclude that other factors such as profitability, legal concerns and competition, scoring, environment, the liquidity of the ownership structure, leverage, the type of listener, trading on foreign markets and regulation, were also analyzed by some researchers. However, their effect and frequency were not as important as the company size except where the context factors of the study had impact on the results. In the same theoretical framework, it is assumed that listed companies publish more information than unlisted companies to reassure investors and obtain, therefore, better financing conditions for a minimal cost of capital. The sector is also a determining factor in the decision of financial disclosure. In fact, the industry or the type of industry can be more or less economically sensitive, exposing firms to the costs of different importance.

According to the theory of political costs and the theory of signals belonging industrial policy can affect the vulnerability of the firm. Firms in the same industry are trying to adopt the same level of disclosure. Also, if a firm belonging to a particular industry does not go as fast as other disclosure requirements, this could be interpreted as a bad signal that the firm hides bad news.

2.2Characteristics of the firmMany studies have examined the relationship between firm-specific characteristics and voluntary disclosure level Jensen and Meckling (1976), Fama and Jensen (1983) studied the association between company's firm size, debt ratio, owner ship and auditor firm size and the level of disclosure.

Alsaeed argued that firm size, profitability and auditor firm size influence the level of voluntary disclosure.

A number of studies over the past decades have successfully tested the influence of firm's characteristics on the financial information disclosure. Most researchers have found a positive relationship between firm's characteristics and financial information disclosure. Several reasons have been advanced in the literature in an attempt to support this positive association. Information disclosures may be used to decrease agency costs, to reduce information asymmetries between the company and the providers of funds, and to reduce political costs. The reasons for large firms’ tendency to disclose more information are explained: accumulation and disclosure cost of information is not high compared to smaller firms; management of larger corporations is likely to realize the possible benefits of information disclosure, such as greater marketability and greater ease of financing; smaller corporations may feel that full information disclosure may endanger their competitive position. In addition, since larger firms are more exposed to public scrutiny than smaller firms, they are inclined to disclose more information. Large firms are likely to be more complex and complexity requires more disclosure. Many previous studies have supported a positive association between firm size and voluntary disclosure level.

2.3Industry typeIt has been indicated by several prior studies that industry type affects the level of IC disclosure since stakeholders’ expectations as well as scrutiny from the public and special interest groups differ across various industries. Various methods in previous research had been used to capture industry effects on IC disclosure. For instance, Guthrie and Petty (2000) employed the 2-digit industry classification code provided by the Australian Stock Exchange (ASX) to classify their sample into six industry clusters. Through comparison amongst the clusters, they found that no individual industry reported IC to a greater extent than any other. Firer and Williams (2003) focused on IC disclosure in finance, electrical and IT (information technology) industries and found that there was only a moderate industry effect. Nevertheless, Oliveira, Rodrigues, and Craig (2006) observed a statistically significant effect through classifying industry into intangible intensive industries and intangible non-intensive industries.

2.4Agency theoryThe agency theory explains disclosure as a mechanism to reduce the costs derived from conflicts between owners (principals), managers (agents) and creditors. Jensen and Meckling (1976) argue that in negotiating prices creditors anticipate the possibility of shareholders trying to expropriate their wealth, for example, by increasing business risk after issuing debentures. Since the increase in financing costs induced by such expectation must be finally assumed by the firm, it is possible that it will try to reduce it by: a) agreeing on some restrictions or covenants Schipper (1981) and b) eliminating the cost of the information needed for creditors to reduce their uncertainty and control managers; i.e. by disclosing information. In a similar way, inasmuch as the interests of shareholders and managers are different, the agency theory forecasts that there is a greater probability for the latter to act to the expense of the former, and so they will disclose the information needed for the principals to control agents and for them to demonstrate that they are acting correctly Malone, Fries, and Jones (1993) and Hossain, Lin Mei, and Adams (1994). From the agency theory it can be deduced that the benefits expected from an increase in disclosed information will be greater in those firms in which the reduction of agency costs are greater: those with a greater debt, with more atomized shareholders and with a larger size. In general, empirical studies do not support the agency theory. The relationship expected between indebtedness and information disclosure has not been confirmed. Numerous research studies, like Chow and Wong-Boren (1987), García and Monterrey (1993), Wallace, Naser, and Mora (1994), Hossain and Arman (1995), Meek, Roberts, and Gray (1995), Raffournier (1995) and Depoers (2000) reject such hypothesis in different countries and sectors. The study of the relationship between disclosure and shareholder atomization has provided mixed results. Thus, whereas Mckinnon and Dalimunthe (1993) and Malone et al. (1993) found significant associations; Depoers (2000) rejected such relationship. Wallace and Naser (1995) included among the indirect costs of disclosure any reduction in future cash flows that may result from the loss or reduction of the firm's competitive advantages (what has been called “proprietary cost theory”). One of the disadvantages would be the entry of new competitors, which could be favoured by disclosed information. If entry barriers reduce such risk, it is probable that they allow for an increased disclosure.

Labour pressure may also influence information disclosure, since labour representatives could use it in the negotiation of working conditions. Deegan and Hallam (1991) and Scott (1994) found a significant negative relationship between labour pressure and disclosed information.

2.5Signal theoryThe signaling theory was borne at the beginning of the 1970 and is based on two main research contributions: Arrow (1972) and Schipper (1981).

To overcome the classic theory limitations, above all, the hypothesis of perfect competition, Schipper (1981) analyses the workforce market with the aim of drawing some general conclusions about information economics.

The author's reasoning is simple: seeking for a job, an unemployed person has something to gain from sending signals to the market, thus keeping his talents in the public eye in order to prevail over other unemployed persons.

According to this reasoning, research on disclosure to financial markets posits that the most profitable companies have something to gain from signalling their competitive advantage through more and better communications Verrecchia (1983), Dye (1985), Trueman (1986), Jung and Kwon (1988), Miller (2002). Empirical data, however, are inconclusive and, in some cases, contradictory: few studies confirm the above mentioned hypothesis Singhvi (1968), Singhvi and Desai (1971), Lang and Lundholm (1993); other studies find no correlation between the disclosure level and a company's profitability McNally, Eng, and Hasseldine (1982), Lau (1992); or, even more telling are those studies that show the correlation to be inverse Belkaoui and Kahl (1978), Wallace and Naser (1995).

All of these studies relate profitability to the global level of disclosure. The general level of disclosure, however, depends on several factors (see the meta-analysis run by Ahmed and Courtis (1999)) making it difficult to isolate a single signaling effect Subsequent research on signaling mechanism. Ross, 1977, Thakor (1990) shows that the conflicting nature of the relationships between principal and agent causes the management to focus the signal they send to the market on a few focal points (Kreps and Sobel (1994)), which satisfy the users’ primary information needs. This is referred to as the decision usefulness approach.

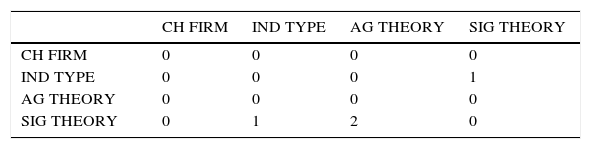

2.6Values of the causal relationshipsThe description of classical cognitive maps comes mostly from Nakumara, Iwai, and Sawaragi (1982) and Axelrod (1976). Generally, causal links (causal relations) between two concepts i and j have one of the eight values indicated in (Table 1 Adjacency matrix).

A causal map is a directed graph that represents an individual's (an agent, a group of agents or an organization) assertions about its beliefs with respect to its environment.

The components of this graph are a set of points (the vertices) and a set of arrows A (the edges) between these points. A point represents a concept (also called a concept variable in the sequel), which may be a goal or an action option of any agent. It can also represent the utility of any agent or the utility of a group or an organization, or any other concept appropriate to multiagent reasoning. An arrow represents a causal relation between concepts, that is, it represents a causal assertion of how one concept variable affects another. The concept variable at the origin of an arrow is called a cause variable and that at the end point of the arrow is called the effect variable.

We have already seen that there are three basic types of causal relationships: (+,-,0).

2.7Research methodolgy2.7.1Description of the empirical investigationTo meet the research objectives mentioned above, a survey was conducted among players in the company of Tunisia. I have chosen as exploratory approach using multiple case studies. The multiple case studies seek a better understanding of the phenomenon. They are to study a phenomenon in its natural setting by working with a limited number of cases. They are particularly interesting in the case of exploration of little-known phenomena. The case studies thus allow multiple accounts the specificities and characteristics of corporate governance. The data is from 10 firms. The decision to base my study on a sample of firms from various sectors is based on the assumption that a variety of issues will be addressed as well. The output is a cognitive map for actors reflecting their perceptions. The method used to create cognitive maps is the questionnaire.

2.7.2Presentation of the questionnaireThe questionnaire is divided into two parts: the first identifies the company and the second deals with corporate governance. For the second part, relating to corporate governance, we interview actors from the firm on stakeholder approach of corporate governance by providing a list of concepts for each approach with systematic exploration grids and matrices cross. Systematic exploration of the grid Figure 1 is a technique for collecting materials. Each player is encouraged to explore their own ideas or cognitive representations in relation to its strategic vision. The subject is asked to identify important factors that he said will have an impact on the key concept related to an approach to corporate governance.

Regarding the cross-matrix (Table 1, Adjacency matrix), it is also a technique of data collection and the basis for the construction of the cognitive map. The matrix is presented in the form of a table with n rows and n columns. Box of index (i,j) indicates the relationship between concept i and concept j.

The actors manipulate the key concepts and assign pairs of concepts depending on the nature and degree of proximity sensed between these concepts. Causal relationships can take on basic values+, – and 0.

2.7.3Proposal for modeling cognitive mapsWhen it is difficult to identify the goals, an integrated approach of performance provides a holistic view in which the performance is analyzed by the processes that lead, through the performances of the actors. These representation processes are two problems of implementation: the sharing of representations of actors and the identification of dominant representations in the organization in order to act upon them. The construction of this representation necessarily requires a model that allows understanding to act is “an action of intentional design and construction, for composition of symbols, patterns that would make a complex phenomenon intelligible perceived.

In this context, the use of cognitive maps seems relevant, because they can take into account the complexity and comprehensiveness of the system in which [the behavior] is embedded, while maintaining access to the analysis” Komocar (1994). The value of the tool is instrumental Audet (1994), it allows both improving their actions and making sense.

Cognitive mapping is used as a tool for representation of an idiosyncratic schema, a pattern is “a cognitive structure that guides the cutting of reality, the interpretation of events, and action individuals”, pattern unique to each individual, causing it to have its own behavior.

2.7.4The construction of cognitive mapsWe will see at first step that allowed the construction of concepts, methodological approach that we discuss. Then we will examine how the cards were dealt.

2.8ConceptsWe addressed this issue by the representations constructed by players using the method of cognitive maps, a method that can be applied to poorly structured situations.

An analysis based on cognitive maps can understand this process of structuring, as this model is to build or rebuild the mental simultaneously modeling.

This construction takes the form of a structure, carrier for clarification. It helps to identify ways to implement to achieve a given goal, the same way it helps to identify the goals justifying the use of such means. Finally, it facilitates communication and negotiation. There are two major trends in the construction method of the cards: the determination of the concepts can be ex ante, or subsequent interviews with respondents for whom the cards are built. The emphasis is on describing the world from the experiences of people who experience it. Nodes and links are determined directly by the participants that advocate, not depriving the subject of representations: the questions should be invitations for the respondent verbalizes his thoughts on what he considers important subject of research. In addition, the researcher cannot force the subject to consider every possible link because the links must be made spontaneously or in response to open questions, so that the subject constructs its reality. In the normative paradigm, the universe is more or less determined.

3Materials and methods of structural analysisThis investigation was limited to the analysis of a collective cognitive map for all company, prepared on the basis of systematic exploration grids completed by the actors of the company. From cognitive maps, we could identify and qualify the designs are the actors of the field of corporate governance. The development and analysis of cognitive maps were made using the Mic-Mac software. Our initial investigation focused on two elements: the relative importance of concepts and analysis of the dynamics of influence / dependence concepts (or variables) in the cognitive universe of players in the company. The relative importance of concepts was evaluated from the MIC. Mic-Mac program allowed us to rank the concepts in order to “balance” and “dependency.”Thus arise the ideas that dominate in the cognitive universe of players.

4Presentation of variables4.1List of variablesCharacteristics of the firm

Industry type

Agency theory

Signal theory

4.2The inputThis step was to compile a matrix of direct influence between these variables in a scoring session. Matrix of direct influence (MID) which describes the relationship of direct influence between the variables defining the system and the Matrix Influences MIDP represents the potential direct influences and dependencies between existing and potential variables. The scoring has developed the input matrix “matrix of direct influences (MID). The influences are rated from 0 to 3, with the ability to report potential influences.

5Matrix of direct influences (MID)Matrix of direct influence (MID) describes the relationship of direct influences between the variables defining the system (See Figure 2).

The influences are rated from 0 to 3, with the ability to report potential influences: 0: No influence 1: Low 2: Average 3: Strong P: Potential

6Conclusion and implications of the researchEmpirical evidence finds that firm's characteristics are a significant determinant of financial information disclosure.

This plan visualizes the concepts (variables) structuring the cognitive universe of actors can be projected in terms of influences / dependencies. By the distribution of the scatter plot variables in this plan, particularly in relation to different quadrants, we can distinguish four major categories of variables. The first quadrant includes the most prominent concepts in the dynamics of thought of the actors.

For the actors of organization, the notion of “Characteristics of the firm” is the most dominant in their cognitions reflecting an intention that firm's characteristics is the determinant of financial information disclosure. In almost all disclosure studies, company size has featured as an important determinant of disclosure levels. The second quadrant contains the relay variables that are by definition both very influential and very dependent. In analyzing the plan influences / dependencies, there are players for the concepts or ideas illustrating the concepts of “industry type” and “agency theory”.

The third quadrant contains the dependent variables or resulting. They are both influential and very little dependent, therefore particularly sensitive. They are the results of which is explained by the variables and motor relay. Thus there are only one variable namely on trust. The fourth quadrant contains the variables that are simultaneously autonomous and influential little bit dependent. They are relatively excluded from the dynamics of thinking by the Tunisian company. The plan review influences / dependencies show the existence of a single variable that is addiction.

The research contributes to our understanding in several ways. First this is the first attempt to measure the extent of voluntary disclosure based on Tunisian firms. It also contributes to the literature on whether the firm characteristics that researchers have found to be significant in developed countries can be applied in a developing country like Tunisia.