This work consolidates a research effort to analyze 70 years of economic development in the region of the Paraíba do Sul River, in the south of the state of Rio de Janeiro, Brazil. The paper follows the trajectory of the leader company, steelmaker Companhia Siderúrgica National, and its relations with other local actors, such as government and universities. The research question investigates if the steel market is still the company's core business and its evolution in the competitive global production network. This work introduces a different exploratory approach, analyzing productive networks using an industrial district typology and the linkages based on the Triple Helix of university–industry–government. The literature review and case study show the first transition, after the privatization process in the nineties, transforming a state-owned company with a focus in the national market into a transnational corporation with business on four continents. The second transition, from the steel market to a globally integrated production chain of mining and steel is underway. The region's configuration migrated from a company town in a state-centered model to a central-radial arrangement. The second migration to a satellite platform is in progress. Regarding technology development, the company's strategy changed from in-house research and development to buying technology. There is a recent effort to recreate interaction space with universities.

Companhia Siderúrgica National (CSN) was incorporated by the Brazilian government during the Second World War as a symbol of the country's industrialization process in the twentieth century. Founded on April 9, 1941 by a decree of Brazilian dictator Getúlio Vargas, CSN started its operations on October 1, 1946, at a site bordering the Paraíba do Sul River in the current city of Volta Redonda, in the south of the state of Rio de Janeiro. Initially, the company produced coke, cast pig iron, and long products (Bedê, 2004; Lima, 2010).

The decision to build the mill in the region was related to its equidistance from the leading consumer centers in the country (Rio de Janeiro and São Paulo), concentrating half of Brazil's GDP. Volta Redonda was a living laboratory from the Vargas period (1930–1945), where the government experimented with theories about driving the country's economic development.

The company, over the past 70 years, has attracted many suppliers and service providers to the region. Comprehensive services and educational sectors have been developed to provide trained people and expertise. These create a dynamic of regional development (Lima, 2010). The privatization process in the nineties and the new private management redirected the company's strategy and reconfigured the set of relationships along the production chains (Santos, 2010; Lima, 2010; Fagundes, Garcia, Motta, & Armond-de-Melo, 2014; Fagundes, Ferreira, Motta, & Leal Junior, 2016). Some works have identified a loss in the regional development dynamic (Ferreira, 2012; Monteiro & Lima, 2015). Others have indicated the maturing process of Brazilian capitalism and the transformation of CSN into a global player (Amaral, Motta, Lima, Fagundes, & Schocair, 2016).

Thus, the object of this paper is to analyze the economic development of the Middle Paraíba do Sul Valley Region (MPR-RJ, an abbreviation created by Ferreira, 2012). There are many ways to do that, but it was choosen discuss the trajectory of the key company. Other works have made a similar effort, looking at the region (Amaral, Ferreira, & Teodoro, 2011; Ferreira, 2012; Lima, 2010) and aspects of CSN's trajectory (Amaral et al., 2016; Bedê, 2004; Fagundes et al., 2014, 2016; Santos, 2010). This work introduces a different approach, analyzing productive networks (Markusen, 1988, 1995) and Triple Helix (3H) linkages (Etzkowitz & Leydesdorff, 2000) and discussing innovation and competitiveness. The analysis of the period helps understand the dynamics of development through the relationship with stakeholders'spheres of academia, industry and government, and their effort to compete in the international arena.

The original research question was to understand if the steel business is still the core business of CSN and what the company's position is in the global production network and steel market. This question is relevant per se and leads to investigation of the company's and region's evolution over time. The second part of the study is related to CSN's efforts in research and development (R&D), as a way to break with technology dependence in an emerging country and be competitive on the global stage.

This work does not have a specific hypothesis or assumption. Insead, it provides a general overview of the company's trajectory, based on exploratory research approach supported by theories such as networks of production and 3H. The paper has seven parts: introduction, literature review, a brief presentation of CSN's trajectory, statements of people from the university and government in the region, discussion, and final comments.

Theoretical basisThis item presents concepts to analyze the company's and region's trajectory.

Production networks, industrial districts, and regional economic developmentThe international integration in the nineteenth century can be considered superficial, based on transactions by independent companies. In the twentieth century, accelerated integration through transactional production networks, distributed in complex geographic areas (Dicken, 2011). More than that, in the past 35 years, a new techno-economic paradigm has emerged in the industrialized economies due to the enhancement of the knowledge base, particularly the diffusion of information and communication technologies (ICT) (Harvey, 1992).

The relations of production undergo constant change, caused by cultural, environmental, political and social influences. These changes create a climate of uncertainty for producers, governments, and consumers. The impact on the business environment is the search for strategies to sustain business in an increasingly competitive, comprehensive and demanding market (Dicken, 2011).

Global production networks are complex structures with various links that form multidimensional multilayered lattices. Networks benefit from ICTs and advances in logistics systems to strengthen time/space relations on global, national and regional/local scales. It can happen dependently or independently one from another (Dicken, 2011). The organizational challenge is how to remain competitive in a business environment influenced by the internationalization of information, products and services while also improving the workforce and focusing on profitable investments (Lima, 2010).

The developed economies are places where the phenomenon of intensified competitiveness can be better observed because labor is relatively scarce and expensive (low birth rates combined with high skills), generating high productivity (Porter, 1998). Regarding developing economies, recently recognized as world powers, they have different competitive levels. They have a large low-cost workforce with reasonable qualifications that is relatively idle. The contrast in productivity and costs between economies and regions are key factors that attract and maintain companies in emerging countries. It is relatively easy to find places to build industrial plants with government subsidies and lower operating costs. This scenario is part of the trend for mobility of businesses and investments from developed economies to emerging ones (Markusen, 1995).

A particular challenge to the companies created or relocated to emerging regions is how to stay competitive. With improvement of local productivity and income, there is a consequent increase in costs, which creates a risk of capital migration to new emerging regions. As an alternative, national and subnational governments are investing in the concept of improving the “local climate for investment”, causing economists, business people, geographers and planners to seek alternatives to increase attractiveness.

These trends attract the attention of researchers to the field of “regional economic development”. Researchers from sociology, economics, geography and history have proposed several firm agglomeration concepts, such as Marshallian Districts, or its Italian variant (Becattini, 2002) or American variant (Saxenian, 2006); industrial clusters (Porter, 1998); and local productive arrangements or local productive and innovative arrangements and systems (Lastres & Cassiolato, 2005). One relevant concept is the industrial district (Becattini, Bellandi, & De Propris, 2011), defined as “…an area spatially delimited, with a new direction of economic activity and export specialization defined, it can be related to the natural resource base or certain types of industry or services” (Markusen, 1995, p. 1). This author also proposed a typology, summarized in Table 1, to analyze the phenomenon.

Typology of industrial districts.

| Types | Concept |

|---|---|

| Marshallian | Related to a region with a set of companies with small production scales, local capital, and local scope of operations, forming a vast web of relationships between them. There is a range of specialized services that make this agglomeration competitive nationally/internationally. It includes issues like trust, cooperation among actors, and the formation of local culture as elements of firms’ aggregation. |

| Central-radial (hub and spoke) | Comprised of companies whose sphere of action is regional (sometimes national) and that act through a key firm or economic axis, bringing suppliers and related activities. It exhibits a strong network (where small businesses are highly dependent). |

| Industrial platform satellite | It is a result of transnational firms’ strategies to seek locations outside of urban centers to produce, looking for low production costs. They use economies of scale but do not create a supply chain due to the heterogeneity of the products. Firms do not congregate together. They can be found in every country independently of the economic development level. There is an absence of connections and transactions with the region. |

| State-centered | Organized around some public entity, like a military base, university, R&D center, technology park, state-owned enterprise, or concentration of state agencies, among others. It tends to have a configuration close to a central-radial district where the leader organization is a major employer and defines the territorial organization. |

Source: Developed by the authors based on Markusen (1988, 1995).

A company town can be considered a particular case of an industrial district. It is a “mini-city” with a set of community facilities like houses, buildings, schools, hospitals and recreational areas, in short, a closed urban nucleus belonging to a company, which exercises control of people's inflows and outflows. These phenomena first appeared in Europe and the USA starting in the late nineteenth century, following the growth of production scales in modern capitalism, with concentration of capital and labor. These resulted in reconstruction of urban phenomena through denial of existing structures and creating new ones, through efforts and goals for economic viability of the projects to which they are linked. This helps to understand why most “company towns” were initially viewed as associated with economic progress and modernity. Some authors have studied the subject in the USA (Serbin, 1993 as cited in Lima, 2010). It is possible to find examples in Brazil. Some are known for eccentricity, ambition and failure (Fordlandia and Jari Project), while others have been successful (Carajás and Volta Redonda) (Santos, 2010).

The early literature on regional development has focused on analyzing the phenomena and supporting economic development policies. It deals with competitiveness, by analyzing the production factors and production scales. More contemporary literature introduces the innovation concept in the scene as a way to promote competitiveness in local spaces.

R&D and innovation: efforts, management and linkagesMost companies make investments in R&D as a way of achieving competitive advantage (Porter, 1998). The direct influence of innovation on economic development is also known and accepted (Fagerberg, Srholec, & Verspagen, 2009). At this process, there are ways of protecting technological development, such as the registration with official agencies (patents, trademarks and brands) or the general protection afforded to industrial/commercial secrets. By choosing to file a patent application, a company seeks to protect its inventions, keeping competitors from taking advantage of the R&D efforts (OECD, 2005).

There are several motivations for patenting, such as strengthened placement in the market to obtain investment return, legal protection against counterfeiters, the possibility of selling or licensing the invention, and an incentive for competition and the development of new technologies. Thus, patent data are useful indicators of R&D efforts (Fagundes et al., 2014, 2016).

Another way to analyze innovation efforts is to study the networks created. The Triple Helix (3H) approach indicates that the proximity/intensity of linkages between knowledge producers (university and R&D centers: U), knowledge users (industry: I), and economic and social regulators (government: G) are critical to improving the conditions that favor innovation. In the 3H framework, the academia is raised to a similar position as industry and government, as a triad of institutional spheres with similar and overlapping activities. The new role of academia occurs due to the growing importance of new knowledge creation in the current economy, which has brought a new mission to the U (“the second academic revolution”). This new role integrates the missions of education and research, assuming that universities will have an entrepreneurial attitude, incorporating economic development to their academic goals (Etzkowitz, 2008).

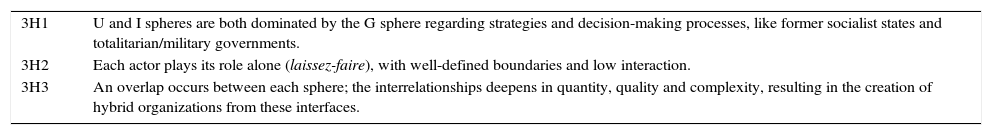

In recent years, some Brazilian universities have been assuming new roles, helping to put knowledge into action by establishing organizational mechanisms of knowledge/technology transfer and performing a strategic role in economic development (Etzkowitz, Mello, & Almeida, 2005). So, the 3H approach is also useful to explain/promote regional development, not only by analyzing the production factors available but also the relationships between the actors. The U–I–G linkages can take many configurations or stages, as seen in Table 2.

UIG linkage configuration.

| 3H1 | U and I spheres are both dominated by the G sphere regarding strategies and decision-making processes, like former socialist states and totalitarian/military governments. |

| 3H2 | Each actor plays its role alone (laissez-faire), with well-defined boundaries and low interaction. |

| 3H3 | An overlap occurs between each sphere; the interrelationships deepens in quantity, quality and complexity, resulting in the creation of hybrid organizations from these interfaces. |

Source: Developed by the authors based on Etzkowitz and Leydesdorff (2000).

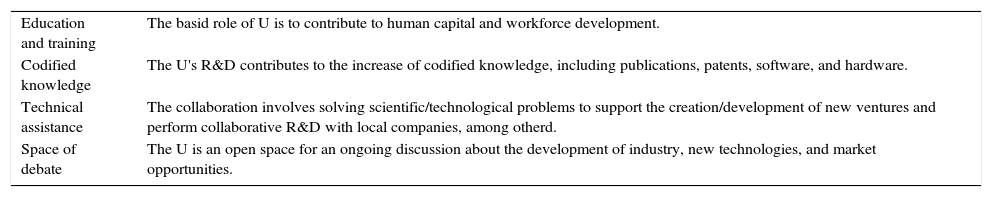

The 3H3 configuration gives rise to so-called hybrid and consensus spaces. Regional economic development entities, like science and technology parks, are common results of the linkages at this stage (Amaral et al., 2011). The actors remain independent but have strong ties, engendering multifaceted social networks that determine new ways of working. Academia adopts a more business-like behavior (entrepreneurial), licensing patents or creating mechanisms and structures to support the creation of technology-based companies from their laboratories and graduate programs. Firms internalize some activities similar to the academic context, such as knowledge sharing and employee training (Etzkowitz & Leydesdorff, 2000). Regarding the U–I interactions, there are four categories, as seen in Table 3, that contribute to increasing collaboration, enhancing the innovation processes and promoting economic development.

U-I types of collaboration.

| Education and training | The basid role of U is to contribute to human capital and workforce development. |

| Codified knowledge | The U's R&D contributes to the increase of codified knowledge, including publications, patents, software, and hardware. |

| Technical assistance | The collaboration involves solving scientific/technological problems to support the creation/development of new ventures and perform collaborative R&D with local companies, among otherd. |

| Space of debate | The U is an open space for an ongoing discussion about the development of industry, new technologies, and market opportunities. |

Source: Developed by the authors based on Lester (2005).

This study is exploratory and descriptive. An extensive literature review was conducted, as briefly presented in “theoretical basis” section. Regarding the technical procedure, this is a case study about a company that personifies regional development. CSN's trajectory is well documented (“CSN's trajectory” section), but the other actors are less studied (“the region and local actors” section). The case study joins results from three complementary research initiatives, performed in the last ten years by academics in the region (Fagundes et al., 2014, 2016; Ferreira, 2012; Lima, 2010, 2013). These research efforts include secondary sources (reports/documents, papers/dissertations/theses, and books) and interviews (with CSN's current and former employees and managers; civil servants; businesspeople; among others). For this study, the authors had access to the transcriptions of previous interviews and performed new ones to complement the panorama about other organizations and allow/discuss the analyses (“Discussion” section).

CSN's trajectoryThis item presents CSN's trajectory in four parts. A fifth part was included to discuss technology development. Themes like labor relations or relationships between the company and social entities will not be treated here due to space and focus [see Lima (2010) and Monteiro and Lima (2015) for specific literature].

Symbol of Brazilian development (1945–1980)From CSN's creation, as a result of the Brazil–US agreement during World War II, until the seventies, CSN promoted two expansion programs to increase production capacity. The first one, completed in 1974, reached capacity of 1.6 million metric tons of crude steel per year and expanded the line of products. The second cycle was finalized in 1977 when production capacity reached 2.4 million tons of crude steel (Bedê, 2004; Lima, 2013; Morel, 1989). The company emerged as the largest steel mill in Latin America and one of the pillars of Brazilian economic development, since steel is essential to other industries like automobiles, civil construction, shipbuilding and home appliances.

The company's decisions and investments were defined by the Ministry of Mines and Energy as part of the development plans by the federal government. In the seventies, CSN established an R&D center to learn how to use foreign technology and develop new solutions. Lines of more developed products (tinplated and specialized steels) were created (Lima, 2010).

In 1954, Volta Redonda became a separate municipality (split off from Barra Mansa), and the city was considered a national security area by the military government starting in the mid-sixties. American engineers helped to design a planned city with neighborhoods for workers, engineers, and managers (Bedê, 2004; Morel, 1989; Santos, 2010).

Crisis and privatization (1980–1994)This was a challenging period marked by labor strikes, high inflation, political instability and economic shocks. In the political sphere, the position became dominant that the state should withdraw from economic activities, leaving only its core functions, a Neoliberal vision called the Minimum State. This change process created a movement toward trade and financial openness, accelerating economic restructuring and internationalization of production (Diniz & Crocco, 2006; Ferreira, 2012). In the same period, the developed economies experienced a process of industrial restructuring and globalization of production chains, in contrast to the Fordist paradigm (Harvey, 1992).

CSN completed the third upgrade in the plant in 1989, reaching 4.5 million tons of crude steel produced per year. The company reorganized the plant to conform to the new production scales (CSN, 1990). However, the company lost money and was considered a problem for the Brazilian Treasury. The new democratic regime (“Nova República”) after the period of military rule (1964–1985) even considered closing CSN because the expenses were excessive and the profits were low (Lima, 2010).

Instead, it was privatized in 1993 after a restructuration process. The new controlling group was composed of Grupo Vicunha, a Brazilian textile holding company, Banco Bamerindus (later HSBC, now Bradesco), Banco Bradesco and Vale (former state-owned Companhia Vale do Rio Doce) (CSN, 1994; Lima, 2010).

From 1945 to 1994, the trajectory of CSN and Volta Redonda was tighthly bound, in a company town arrangement. The company was the central leverage of development, providing benefits to employees, controlling labor relations, and having central influence on the city's formation and regional development (Lima, 2010).

The end of the “company town” (1994–2002)The new private company suffered from the lack of experience in the steel business of the new owners and several conflicts between the stakeholders (owners, labor union, and local government). An extensive revision of the company's strategy led to a rupture with the city. CSN as a state-owned company had a bloated organizational structure with inefficiencies and vices. In 1993, it had nearly 40,000 direct and outsourced employees. The company reduced the workforce to just over 20,000 in the following years. It closed some inefficient subsidiaries and renegotiated or canceled contracts with suppliers. The effect was a crisis in the city of Volta Redonda, with increasing bankruptcies of businesses and other effects (Lima, 2010).

During eight years, until 2002, there was an extensive process of rethinking the company and modernize it in technical and managerial aspects. Initially, the private owners assumed the management and carried out economic restructuring. Since the new private owners had little knowledge of the steel business, the results were not the best ones, and in sequence, a group of careers employees occupied high-level management positions. However, they kept the same practices of the state-controlled company. The owners then hired a team of professional managers, led by the economist Maria Silvia Bastos Marques as CEO, to manage the company from 1996 to 2002. During this period, as a result of capital unwinding between CSN and Vale in 2000, control was centralized in Benjamin Steinbruch, head of Grupo Vicunha (the major shareholder), who had been chairman of CSN's board of directors since 1993 (CSN, 2003).

Along the years, technological modernization efforts were practiced at CSN (see section “technology development”). Several factors allowed the implementation of the new management and organizational structure, facilitating the integration of knowledge between units. This included provision of internal/external training and hiring of professionals from abroad, and partnerships with suppliers (to improve processes) and customers (for the development of new steel specifications). The participation of the workforce in problem solving was also increased, such as the organization of groups to address anomalies and standardization. Finally, projects were started with universities, led by the R&D center, to acquire new knowledge and increase the variety of specifications, such as steel for electrical purposes, the automobile industry and two-piece cans (Fagundes et al., 2014, 2016).

These learning mechanisms provided technical knowledge to CSN. Due to the increased range of specifications required by customers, the knowledge flow now occurs more dynamically, allowing the migration of knowledge from people of different areas. All these efforts reduced costs and increased the flexibility of new products made through new processes. This process was driven by the need to enhance competitiveness. However, this improvement process was not reflected in the output indicators of technological development, such as patents (Fagundes et al., 2016).

Global player (2002–2016)CSN currently has capacity to produce 5 million tons of crude steel yearly. The company reduced the number of direct employees to just over 8500 in 2005, as the result of automation processes and implementation of integrated management systems, leading to rethinking the whole productive process.

In 2008, the production of crude steel reached 5.8 million tons, and CSN had a record profit (US$ 2.8 billion) as a result of investments made to grow horizontally by incorporating production chains that have a connection with steel, such as mining and logistics (railroads and ports) (CSN, 2009). From 1994 to 2008, productivity per employee increased 600% (Amaral et al., 2016).

Since 2000, CSN's strategy has clearly changed, redirecting the business model to make the company a global competitor. To implement this, CSN made several investments. First, it bought equity stakes in several companies in Brazil, like MRS (logistic), Light (electricity), Sepetiba Tecon (port), Usiminas (steel). It also expanded internationally, by acquiring holdings in steel companies in the USA, Portugal and Germany. Second, CSN implemented a SAP's enterprise resource planning software (ERP) and other tools to enhance the production control process. Third, the company executed a technological upgrade of existing plants. Finally, the entrance in new market niches increasing the added value of steel (e.g., the creation of Galvasud to deliver stamped steel ready for the automotive industry). These investments means CSN is now engaged in five productive chains (steel, mining, logistics, cement, and energy), all of them to increase the power in the steel chain and to internationalize, to overcome foreign market barriers.

This integration combined with a more efficient management process has made the company in one of the lowest-cost steel producers in the world and one Brazilian firms. It leads several segments in the Brazilian steel market. Its production of iron ore has increased at astonishing rates year after year. The overall goal is to combine domestic and international sales, contributing to the maintenance of market shares.

The company has logistics structure (ports and railways) for production outflow. New investments (US$ 4 billion in 2013–2014) were made to expand logistics capacity and power generation (CSN, 2015). CSN also takes waste from steel production to a cement plant as part of its cost reduction strategy throgh synergy. This strategy has resulted in the horizontal growth of the corporation (Amaral et al., 2016). The steel business corresponds to 50% of the gross revenues, but mining has a higher profit margin (CSN, 2016).

Currently, CSN is a publicly held holding company, with 40 percent of its shares traded on the BM&F/Bovespa (São Paulo) and NYSE (New York). Since 2014, CSN has been affected by excess steel capacity in the world and the political and economic crisis in Brazil. The demand for steel (from the internal market) and iron ore (from China) has fallen and affected the financial structure of the company. In mid-2015, CSN sold some complementary assets (like the ports) to stop the drain on cash flow.

Technology developmentA study of CSN's patent data, using the FAMPAT database and Questel Orbit and Vantage Point programs, analyzed 336 applications filed from 1971 to 2009 (the most recent data available, presented in Fig. 1). CSN filed 274 of these and controlled companies filed 62. The average of applications filed from 1980 to 1995 was 16.5 per year, whereas in the period from 1996 to 2009 the numer was 5.07 (Fagundes et al., 2016). The privatization and changes in the technological development strategy influenced that reduction. The privatized company may have chosen to keep its trade secrets and buy technology already embedded in equipment and systems. Another reason for this decrease was the budget shortage allocated to R&D projects. The field with the most patent applications was materials (88 applications), which were constant from 1971 to 2009.

Table 4 shows the relations between CSN and other organizations in technological development. As seen, 12 universities have filed 56 patent applications together with CSN. This number is relatively small compared to the total number of filings (336).

Partners.

| Organization | Status | Filings | Organization | Status | Filings |

|---|---|---|---|---|---|

| CSN | Company | 274 | UNIFEI | University | 2 |

| PRADA | Subsidiary | 61 | UNIFRAX | Company | 2 |

| UFF | University | 14 | UTFPR | University | 2 |

| UFSCAR | University | 11 | COBRAPI | Company | 1 |

| UNIFOA | University | 8 | CONNECT | Company | 1 |

| UFRN | University | 7 | DELTA | Company | 1 |

| ETPC | Technical school | 4 | FIBRAFORM | Company | 1 |

| USP | University | 4 | FILSAN | Company | 1 |

| VCIBRASIL | Company | 4 | INAL | Subsidiary | 1 |

| IPT | Research institute | 3 | PLANEPAR | Company | 1 |

| PARQTEC | Research institute | 3 | STRAINLAB | Company | 1 |

| UFMA | University | 3 | UBM | University | 1 |

| IFSC | University | 2 | UFMG | University | 1 |

| UFPB | University | 2 | USS | University | 1 |

| UFS | University | 2 |

Source: Fagundes et al. (2014).

In the analyses of the collaboration networks for technology development, 29 nodes were found, which involve CSN, its controlled companies, and 26 other organizations. The network's density is 24%, and it has few nodes and few links between these nodes, showing that technological development in the company has little external influence (Fagundes et al., 2014).

From 1982 to 2009, CSN applied for 335 patents or utility models, but this process was not linear. During this period it underwent several organizational changes that undermined the capacity for intellectual property management. The National Industrial Property Institute (the Brazilian patent and trademark office) granted only 93 patents (28%). Only 11 of them were the result of external collaboration, with four firms and four universities (Bazzo, 2010). This means that CSN seeks to develop its technological capacities in a “closed innovation” paradigm.

Since 2002, the network of cooperation has decreased in size, increased in density, and the network has continued to be under the company's influence/control. The number of partnerships and the number patent applications has also decreased. This scenario has two opposite perspectives. On one hand, CSN demonstrates a weakening of the internal innovative environment, by not having a context for learning/sharing knowledge/technology with external sources. On the other hand, this can reflect a change in the pattern of technological choices, demonstrating that the company has become more careful in selecting technologies (Bazzo, 2010).

The region and local actorsThe MPR-RJ's history is rich in events involving the rise, decline, resilience, and reinvention of the economy. In the twentieth century, the region faced a decline in coffee growing, but recovered with the establishment of CSN in the 1940s. From then, the local economy generally grew until the mid-1990s, when privatization of CSN unleashed a period of economic crisis in the region. However, it was not long before the region returned to economic growth through new investments, particularly in the automotive sector, and the revitalization of CSN as a private company (Ferreira, 2012).

According to the latest census data, the region has 855,643 inhabitants divided into 12 cities, and highway and train connections to São Paulo and Minas Gerais cross the area. In addition to CSN, MPR-RJ has a large number of industries in different segments, such as MAN Latin America, PSA Peugeot Citroën, Saint-Gobain Pipelines, Votorantim Steel, Galvasud, Michelin, Metalurgica Barra do Pirai, AMBEV, P&G, Du Pont, Hyundai Heavy Industries, Nissan, Jaguar Land Rover and BR Metals. Moreover, the region has many small and midsized companies in the metal-mechanical area (Amaral et al., 2016).

Structural change occurred in the 1990s in the sub-regions of MPR-RJ. While Volta Redonda and its surroundings suffered the consequences of CSN's privatization, the cities of Resende, Itatiaia and Porto Real (RIP) initiated a new cycle of industrialization, with the installation of automotive plants. In contrast to what occurred in Volta Redonda, this region began a new cycle of industrial development, with the arrival of Volkswagen in 1996 (currently MAN Latin America) and PSA Peugeot Citroën in 2001. A second cycle started in 2013 with the opening of plants owned by Hyundai (2013), Nissan (2015), and Jaguar Land Rover (2016).

From 2002 to 2014, due to the economic development experienced by Brazil, a set of investments from large industries began in the MPR-RJ, such as CSN's cement factory, opened in 2009, and a flat steel plant, started in 2015, both in Volta Redonda. Another flat steel plant was built by Votorantim in the city of Resende, starting production in 2009. Because of its location and infrastructure, the region has also attracted investments in logistics from companies like DHL (Itatiaia), Droga Raia (Barra Mansa), 3Corp Technology (Resende), and Fast Broker (Volta Redonda).

The industry organizationsThe Federation of Industries of Rio de Janeiro (FIRJAN), a group of business associations, is the key representative entity. It has a regional branch and supports industry with several training units operated in collaboration with the National Industrial Apprenticeship Service. The most representative business association is Metalsul, which congregates 130 metal-mechanic companies (including CSN) and leads a local productive arrangement project. It promotes an annual business fair and training activities through a local productive arrangement (Ferreira, 2012).

In 2013, the car manufacturers also tried to create a governance mechanism in RIP through an automotive cluster involving suppliers, FIRJAN and universities, but its role is not clear or consolidated yet.

The role of universitiesThere are two public universities in the MPR-RJ, as well as some private ones, but the public universities are responsible for the most of the R&D and outreach in Brazil. The oldest one is the current Pólo Universitário de Volta Redonda (UFF-PUVR), part of Universidade Federal Fluminense, which has its origins in a school of metallurgical engineering, created in 1961 to train engineers for CSN. Currently, UFF-PUVR has two campuses in the city and fourteen undergraduate courses, six master's degree programs, a doctoral program (in metallurgical engineering) and several extension and specialization courses. The pole has a faculty of 250 members who serve 8000 students.

From 1961 to 1994, CSN was the key partner of UFF-PUVR, hiring graduates, encouraging its engineers to become teachers, and financing graduate courses in Brazil and abroad. Furthermore, the company invested heavily in laboratory construction and equipment purchase. These installations allowed the provision of technical services and execution of R&D projects aimed at solving technical problems. In parallel, CSN established an R&D center, near factory and one of the UFF-PUVR campuses, to act in a complementary way in relationships with other institutions, and incorporate the technical and scientific knowledge generated by the university. The relationship is quite atypical, perhaps one of the few recorded cases of reverse spin-off where the company originates a university. CSN also established a technical school to prepare workers (Amaral et al., 2016).

This relationship has changed since privatization. The linkage remains with a focus on education. Several of UFF's professors are former CSN engineers and managers. However, the formal partnership in R&D ended. Only in 2015 a new R&D agreement was signed (Amaral et al., 2016).

The Universidade Estadual do Rio de Janeiro (UERJ) created the Campus Regional do Médio Paraiba (CRMP) in 1992 after mobilization of the municipal government for its establishment in the city of Resende. The purpose of establishing this campus was to provide a skilled workforce and also to attract companies to the region. Currently, UERJ has about 1000 students enrolled in four undergraduate courses. The UERJ/CRMP campus is close to the automakers’ plants, and the land available attracted these companies to develop service facilities and collaborative R&D projects. MAN Latin America and Peugeot Citroën signed R&D agreements with UERJ in 2011 and 2012.

Qualification of people is the main focus of these public universities. Innovation is not a reality yet. The challenge is to extend this relationship established to R&D projects and business development.

The local governmentsFerreira (2012) mapped the relationship between local authorities and its role in the economic development of the region. Interviews were conducted with the secretaries of economic development of the four biggest cities (Barra Mansa, Itatiaia, Resende and Volta Redonda) to collect their perceptions about the economic structure of these municipalities, incentives for innovation, university–industry interaction activities, and the coordination between then.

The most relevant observation was the efficiency of the municipal governments to reach their economic development goals. The cities’ strategies aim to attract investment from abroad to the region. In recent years, several projects have been implemented (as already commented). Another action performed by all municipal governments is to improve the workforce skills, with an emphasis on operational and mid-level positions.

In Volta Redonda, the biggest and wealthiest city, economic development issues are limited by the lack of flat land. Most available areas are concentrated in the hands of a few owners, such as CSN. Although the government is the largest employer, with about 13,000 people, CSN is the economic engine, with the highest payroll, and contributes nearly 50% of the city's tax revenue.

There is evident awareness about the importance of articulation between municipal governments to promote the regional development, but the practical actions do not reflect that. The main challenge seems to be the inability to promote integrated regional development. The intra-regional collaboration processes involve a complex web of themes and interests, not always convergent. An organization to mediate this process is not easy to find, but the local players can build one, including the universities, which can be key actors in this process (Ferreira, 2012).

DiscussionThis item contains two complementary analyses, one from the viewpoint of production networks and the other addressing the university–industry–government (UIG) relationship.

In the first case, it is possible to comprehend the changes in the global steel production chain, shifting the focus from a mere comparison between models of state, national and transnational enterprises to observe the organization of a global network.

In the process of CSN's constitution and development, formal and informal networks were shaped in the MPR-RJ. The company attracted suppliers to surrounding areas, making a significant portion of purchases in the region and generating economic and social development. The workforce was mainly trained locally at all levels.

After privatization in 1994, there was a review of workforce needs and local sourcing of inputs. In the ensuing years, CSN let go of two-thirds of the workers. Procurement, previously concentrated in local suppliers, was redirected to global suppliers. The result for the MPR-RJ was a break in the pace of economic development during the nineties. However, the new millennium has been marked by a revival of the city of Volta Redonda, fostered by civil construction and services (medical and higher education sectors), less dependent on the company (Lima, 2013). From a business standpoint, CSN formed new networks. The previous state-owned company with focus on the domestic market becomes a competitive global player with business in four continents. Since 2002, CSN has purchased companies abroad and expanded its business into mining, cement and production of special steels (Amaral et al., 2016). There has been a strategic change in CSN's profile and economic geography.

Based on Markusen's typology of industrial districts, it is possible to suggest that after privatization the company migrated from state-centered to a central-radial configuration. In the last decade, there are signs of a new migration to a form that looks like an industrial platform satellite. Volta Redonda is no longer the center of decisions. Currently, CSN is a Brazilian transnational corporation headquartered in São Paulo, and the MPR-RJ is just a productive locus (Amaral et al., 2016). However, it is possible to argue also that Volta Redonda never ceased to be a company town. CSN is still the key emplower and taxpayer, and has control over most of the land in the city (Lima, 2013).

One factor that influences the phenomenon is the need and propensity for companies to train, empower, and invest in occupations/activities of interest. This orients the relationship with local/regional governments, whose discussions are limited to the maintenance of the company's interests (to remain attractive), such as availability of trained workers or space/land to receive suppliers and clients, or highways in satisfactory conditions to distribute products. In the long-term, the central-radial districts have a high dependence on the key companies to maintain the investment capacity. It takes an effort to establish recycling and innovation that keeps companies with mature activities competitive and also preserves profitability. In general, high wages and equal income distribution characterize regions in which such ventures flourish (Markusen, 1995).

As a state-owned company, CSN helped to create the culture of the city, nicknamed “The Steel Town”. This cultural phenomenon remains today and suggests the idea of an orphan company town or a business divorced from society.

Regarding the UIG linkages, it is reasonable to classify the 1945–1993 period as 3H1, where the government encompassed the other spheres and defined the objectives of the actors. In this case, it was a kind of “state” 3H, where the federal government created and owned the company and the university, and then the company managed the local relations, participating in the four collaboration categories proposed by Lester (2005). After privatization, the relationship became distant, like a 3H2. Several confluence areas between the three spheres were disrupted and renegotiated. The local university lost its primacy and CSN constituted new UI bilateral relations outside the MPR-RJ.

Since 2005, the local university has gone through a process of creating a new dynamic, occupying new spaces and remaining relevant in the MPR-RJ, as an entrepreneurial university. In this process, new linkages are being created, such as where the government acts to plan regional economic development and to qualify workforce for the new economic cycles based on the configuration of the satellite platform and services industry (Amaral et al., 2016). This configuration creates demand for the university (supporting the transfer of industries) but also limitations (in general, transnational groups bring technology from their parent companies). Thus, there are opportunities for small local adjustments, not generating the endogenous capacity to innovate, perpetuating the needs of capital and technology (Lester, 2005).

The interest of the company in the university is scattered, maintaining contractual relations with various actors to solve specific problems, without fidelity to a region, as in Lester's education and training and technical assistance categories. The current production model is capital intensive, with a high level of firm concentration. The manufacturing process technology is mature, and CSN now searches only for incremental innovation in processes to improving productivity. The expenditure on technology development is small and concentrated in purchasing equipment and searching for new market applications and niches. In 2015, CSN and UFF signed a new agreement for PUVR-UFF to provide technical assistance to Volta Redonda's steel plant (Amaral et al., 2016) (Fig. 2).

Final remarksIn this article, an analysis about trajectory of economic development in a region in the state of Rio de Janeiro was made. This effort was conducted by looking at the leader company and the university–industry–government linkages during 70 years. The research method was based on a literature review to support a case study with data from secondary sources (previous studies and CSN documents) and primary sources (interviews) with actors from the three helices.

This study supports the notion that from the founding date until the eighties, CSN focused all its efforts on integration and enhancement of the steel production plant. These efforts were necessary to support other industrial segments in the Brazilian internal market. In 2000, the company changed its strategy and ceased to be strictly domestic and started to have global characteristics. CSN invested in acquisitions, modernization of production process management, and especially in new market segments to increase the added value of steel production. CSN is now a holding company working in five different businesses (steel, mining, logistics, cement and energy), with international markets. Indeed, it is now one of the largest and most prominent holding companies in Brazil.

The data show the first transition of the company, from local/national to a transnational corporation. What is still open is the configuration. A new transition from steel to mining is underway, but the result is not clear, because of the interdependence between the two businesses and the recent economic crisis in Brazil.

In the final analysis, the company has migrated from the state-centered model to a central-radial industrial district model. Regarding the university–industry–government linkages, it was found a state-centered arrangement (3H1) and migration to a laissez-faire configuration (3H2) in the nineties. Recent efforts have been made to create interaction spaces (3H3), but they are not significant yet.

This work can be a good starting point for students and researchers due to its compliation of other research about the MPR-RJ and CSN. It is also relevant to business people, policymakers and academics for discussion of regional development initiatives. Several possibilities for further research can be mentioned, such as analysis of the impact of the Brazilian economic crisis and the Chinese economic deceleration since 2013 (how it affects CSN and the MPR-RJ), alternative strategies to regional development in a knowledge economy, or strategies for companies’ and regions’ insertion in a global value chain.

Conflicts of interestThe authors declare no conflicts of interest.

Acknowledgments and funding sourcesThe authors acknowledge CSN by access to documents and data, and Universidade Federal Fluminense (UFF) for providing structure for the development of the field research. This work received support from the Fundação Carlos Chagas de Apoio à Pesquisa no Estado do Rio de Janeiro (FAPERJ), through grants E-26/111.474/2014 and E-26/112.494/2012; the Conselho Nacional de Desenvolvimento Científico e Tecnológico (CNPq), grant 442841/2014-0; and the Coordenadoria de Aperfeiçoamento de Pessoal de Nïvel Superior (CAPES), grant 99999.003850/2015-03. None of these funding sources were involved in the execution of the research activities.

Peer Review under the responsibility of Departamento de Administração, Faculdade de Economia, Administração e Contabilidade da Universidade de São Paulo – FEA/USP.