The complexity of the innovation process and the difficulty faced by organizations when performing their required activities to stay active and competitive have led to a large number of companies to work in a network. This network enables the sharing of risks and resources, provides access to information and solutions, and facilitates research and development among other means of innovation with regard to products and processes. In this context, this paper mainly analyzes the setting for interorganizational cooperation for innovation in the Brazilian panorama between 2003 and 2011 based on data from the Innovation Research, known as PINTEC, elaborated by the Brazilian Institute of Geography and Statistics (IBGE). Through documental research, within a qualitative framework, secondary data were used, which were obtained from the PINTEC reports on cooperation among companies in Brazil, to construct a panorama of the cooperative scenario during the selected timeframe. The analysis revealed that, for the analyzed timeframe, Brazilian companies had most of their cooperative activities with the public with whom they maintain direct contact, such as their clients or consumers and suppliers. Furthermore, it revealed that actors such as universities or research institutes are not considered to be important for cooperative relationships or as information sources. As such, it can be inferred that cooperative activities for innovation are incipient and are not considered as strategic activities by organizations in the Brazilian panorama.

The growth in competition among organizations and the complexity of the business environment have led companies from the most diversified sectors to search for means of using, in a more effective way, the resources at their disposal as well as to acquire new resources necessary for the innovation process and fundamental for present-day companies (Tidd & Bessant, 2015).

In this context, companies have found that working and cooperating in a network are alternatives to better explore their resources and complement their internal capacities to create the necessary knowledge for a better adaptation to the environment where they act and to promote innovation in all its forms (Pellegrin, Balestro, Antunes, & Caulliraux, 2007; Tether, 2002).

In the Brazilian scenario, one of the instruments used to follow and measure the business development and the paths of innovation in the country is the Innovation Research (PINTEC),1 conducted by the Brazilian Institute of Geography and Statistics (IBGE). Considering three-year periods, PINTEC analyzes the consequences of innovation under several aspects for each triennial, following the guidelines of the Oslo Manual, which proposes directives for collection and interpretation of data about technological innovation, used in several countries (IBGE, 2013).

Accordingly, PINTEC emphasizes the consequences of innovation in the country and helps to define the path for actions promoting innovation at regional and national levels. As PINTEC unites a historical set of data about the innovation panorama in Brazil, we opted to use PINTEC reports to document the situation of cooperative relations among companies for innovation. We considered the information sources used by the companies involved in this research, cooperation developed among different companies, and perceived importance of the accomplished partnerships by the participating companies.

According to PINTEC reports, the innovation in Brazil has reached better levels. According to PINTEC data, observed by De Negri (2012), the index for innovation in the Brazilian industry increased from 31.52% in the 1998–2000 triennial to 38.11% in the 2006–2008 triennial. In its latest report, PINTEC states that the 2009–2011 triennial had an innovation index of 35.56%, indicating a decline in relation to the previous triennial.

This data, together with the fact that Brazil ranks 70th in the Global Innovation Index (GII) for 2015,2 demonstrate that even when showing better performance with regard to innovation, the country is still far from being characterized as innovative.

Considering these points, we infer that the innovation indexes in the country are still small when compared with those of other countries (GII, 2015). This leads to a difficulty faced by Brazilian companies with regard to innovation and becomes a problem to be investigated. Another aspect that calls for our attention regarding to cooperative networks is the low amount of studies developed and published in the Brazilian scenario, according to studies by Vitorino, Sacomano, Silva, and Giuliani (2012), Andrighi, Hoffmann, and Andrade (2011) and Balestrin, Verschoore, and Reyes (2010).

In this scenario of transformations in the profiles of organizations, we ask “What are the main characteristics of the cooperative environment among companies in Brazil?”

Attempting to answer this question, we defined the main goal of this research: to analyze the setting of interorganizational cooperation for innovation in the Brazilian panorama between 2003 and 2011 based on the PINTEC data. As such, the following categories were created for analysis: ‘information sources’, the ‘objects of cooperation’, and the ‘perceived importance of cooperative relations’.

This research is justified since studies on cooperative networks in the current Brazilian setting are still scarce and have few theoretical and empirical studies to characterize the cooperative environment and actions conducted by companies (Vitorino et al., 2012).

From these considerations, this paper is organized as follows: The section ‘The dynamics of cooperation for innovation’ briefly reviews the literature regarding interorganizational cooperation and innovation. The section ‘Methodological procedures’ describes the methodological procedures adopted for conducting this research, comprising the collection and analysis of data from the last three PINTEC reports in light of the available literature. The section ‘Data analysis and discussion’ presents the data and discussions regarding cooperative relations in Brazilian companies between 2003 and 2011, focusing on aspects identified in the literature and through data obtained in innovation reports from PINTEC. Finally, The section ‘Final considerations’ presents conclusions for this study, indicating perceived characteristics in the domestic setting of cooperation for innovation.

The dynamics of cooperation for innovationInnovation has been widely discussed and understood as a factor that positively influences companies to be competitive and countries to develop economically (Bes & Kotler, 2011; IBGE, 2013; Tomlinson, 2010). To remain active and competitive in the current economic setting, organizations need to innovate their processes, products, services, marketing or follow other ways of innovating that are yet to be developed.

According to definitions by the OECD (2005, p. 55), the following can be stated: An innovation is the implementation of a new or significantly improved product (goods or services), or process, or a new marketing method, or a new organizational method in business practices, in the workplace organization or in foreign relations.

In this context, according to the records of the OECD (2005), innovation may assume different postures by each company where it is implemented. While some organizations invest in the creation of new products and/or processes, for example, others will conduct continuous improvements in their products and internal processes. Both are innovating (OECD, 2005).

When innovation is based on a technological novelty or a market shift that leads to the creation of new markets, it is called a radical innovation. Further, the innovation process that encompasses improvements to existing products and/or processes is called incremental innovation (Tidd & Bessant, 2015).

In this manner, a relevant point for innovation concerns the access to and acquisition of information needed for organizational processes that can be found in the most diverse sources (Guedes, Priolo, Destefani, & Strauhs, 2014; Quandt, 2012). Relevant information for the innovative process may come from internal and external sources in such a way that relations between companies and individuals are fundamental elements in this process, in addition to the identification of these information sources (Faria, Lima, & Santos, 2010; Tidd & Bessant, 2015; Tomlinson, 2010).

Companies generally possess stocks of information and knowledge, which can be incorporated in routines, processes, or even distributed within the organization, needed for their performances; however, this can become a limiting factor of their performance and innovation if not adequately treated (Silva, 2000).

According to Quandt (2012), Tether (2002), Tomaél (2005), Tomlinson (2010), Verschoore and Balestrin (2008), performing in a network enables participating companies to access relevant data and information, as well as facilitates better conditions for information and knowledge sharing among companies, which may be beneficial for the innovative process of participating companies.

This aspect confers that the import of information about external environments enables the organization to internally create new knowledge from the sharing of external ideas and information, with internal resources at their disposal (Tidd & Bessant, 2015; Tomlinson, 2010).

The information and knowledge sources, usually widespread, tend to make networks as the locus of innovation and not the individual organization as the central element in this process (Pellegrin et al., 2007).

The interaction with stakeholders from external environments is a fundamental element in the innovation and acquisition of information and knowledge process (Lundvall, 2001; Tidd & Bessant, 2015). In addition to the search for information, Tidd and Bessant (2015) highlighted that contact with other companies and individuals enables the identification and generation of new ideas that can be used by the company.

In this context, innovation is moved by the capacity of organizations to establish relations, either with other organizations or with individuals, as well as to identify opportunities and take advantage of them at the right moment (Tidd & Bessant, 2015; Tomlinson, 2010). The innovative process involves various agents, or actors, in such a way that it can be viewed as a cooperative process (Tether, 2002).

Cooperation among companies arises as an opportunity for them to combine their skills with the skills of other companies for innovation (Carvalho, 2009; Silva, 2000; Zeng, Xie, & Tam, 2010).

The reasons that enables organizations to conduct cooperative activities, strategic alliances and innovation as a network, according to available literature, are countless; however, at a basic level, companies enter cooperative agreements for innovation because (i) they do not possess the necessary resources for the innovative process and (ii) to share and reduce the risks associated with the innovative process (Tether, 2002). When two or more organizations understand the possibility to reach their goals jointly and obtain mutual gains, the cooperation between them will flourish. As such, it can be stated that the interorganizational collaboration derives from the deliberate development of relations among autonomous organizations for the accomplishment of individual and collective goals (Balestrin & Verschoore, 2009, p. 40).

Other factors that contribute to that reality are peculiarities in each sector, size and age of companies (Tether, 2002), possibility for complementarity of resources and knowledge (Johnson, 2012), search for legitimacy and the possibility of holding influence over other companies (Balestrin, 2005), access to solutions (Verschoore & Balestrin, 2008), geographical concentration of companies of the same sector or complementary sectors by adopting a network strategy (Quandt, 2012), state induction and public policies centered on regional development (Pellegrin et al., 2007), etc.

The aforementioned cooperation among companies has always existed, although in a rather unstructured and mostly informal manner (Balestrin, 2005; Balestrin & Verschoore, 2009). However, studies on cooperation among companies started receiving more attention in the academic international business communities from the 1990s (Balestrin et al., 2010).

“More recently, the global technological expansion amplified the connective capacity for organizations as well as the possibilities for joint action” (Balestrin & Verschoore, 2009, p. 24). As such, organizations as cooperative networks unite projects with common goals, interlinked with the intent of developing mutual gains without, however, seeing each participant lose his management autonomy (Balestrin & Verschoore, 2009). In Brazil, however, studies on cooperative networks are more recent. However, they have resulted in works that contribute to the domain of interorganizational cooperation (Balestrin et al., 2010).

In competitive and complex environments, the norm for most current organizations, the chances for an organization to individually achieve all the necessary actions for its business to be running smoothly are poor; therefore, many companies join interorganizational networks (Carvalho, 2009; Lundvall, 2001). According to Tidd and Bessant (2015), the need for interaction with the external environment and other organizations becomes pressing and urgent in companies that believe in innovation as a strategy.

The scope of interorganizational cooperative activities is varied in this setting. Differing activities may be comprehended, such as strategic alliances, joint ventures, research and development (R&D), training and certification, supply and access to information, forming of associations (Balestrin, 2005), regional clusters, supply chains, product development consortiums, among other situations (Tidd & Bessant, 2015).

From the consulted literature, some elements characterize the environmental dynamics that favor the way in which organizations act as a network: market growth, increased competition, resource scarcity, needs for information and knowledge (Andrighi et al., 2011; Balestrin et al., 2010).

In addition to these factors, performing in a network enables organizations to “specialize their central competencies”, thereby preserving the reach of their performance in the market (Tigre, 2006, p. 216).

According to DeBresson and Amesse (1991), collaboration networks can help to combine different elements, knowledge, and resources that may lead to widespread innovation. This relation must be beneficial for all parties in the cooperative network (DeBresson & Amesse, 1991).

Nascimento and Labiak (2011, p. 24) indicated the current socioeconomical dynamics that practically demand companies to adopt cooperation in the current context: […] companies are compelled to establish relationships among themselves and with other organizations – universities, research and development institutes, etc. – due to their interest in surpassing their individual limitations […] and share the risks of innovation, essential to the process of economic development.

Côrtes, Pinho, Fernandes, Smolka, and Barreto (2005) suggested that cooperative actions do not replace internal competencies and capacities. In contrast, they complement and feed off each other to generate other cooperative actions. Furthermore, they suggested that as companies consolidate the markets where they act, the need grows for the establishment of new connections and cooperative relations (with clients, suppliers, consulting companies, among other actors), in addition to relations established with companies with whom they are already involved and academic institutions with whom they may keep contact to maintain their innovation dynamics.

As per the literature analyzed by Freeman (1991), DeBresson and Amesse (1991), Silva (2000), Balestrin and Verschoore (2009), Carvalho (2009), Nascimento and Labiak (2011), Pellegrin et al. (2007), Torres-Freire and Henriques (2013), among others, cooperative relations are fundamental for innovation; however, they are difficult to be accomplished and maintained as they depend on behavioral factors of the individuals involved in the process as well as the organizational characteristics and the creation of trust among the participating companies of the collaboration networks.

The target audiences with whom one can innovate vary among internal sectors, as do R&D departments and/or other company sectors (Faria et al., 2010), and external audiences. The actors involved in the productive chain of an organization includes the universities and research institutes, consumers and clients, the government, and/or other groups of interest for a company (Tether, 2002).

However, the goals of cooperation may influence the activities developed by organizations, making it easier or more difficult if there is no comprehension of them on behalf of those involved (Zeng et al., 2010) or even if there is no coherence among goals of each organization present in the network (Balestrin, 2005).

On the other hand, regarding universities, Tether (2002) and Ieis, Silva, Bassi, and Poit (2013) noted that the process may be slow and that companies may face certain difficulties developing cooperative and innovative activities with such institutions. This is because universities do not always effectively correspond to corporate demands, which complicates the communication process among the actors and the formation of effective cooperative relations.

Furthermore, the interaction among distinct organizations may occur in an informal manner, through varied contacts and flows of information, or even in a formal and structured manner, through cooperation and innovation projects (OECD, 2005).

Observing the dynamics of interorganizational cooperation in the context of innovation involves several types of technical and scientific knowledge, requiring multidisciplinary approaches for a more effective comprehension of these processes.

In the Brazilian setting, considering that companies still face difficulties in conducting expressive innovative activities through cooperative relations (Andrighi et al., 2011; Balestrin, 2005; De Negri, 2012), the challenge is even greater, requiring more studies and discussions regarding the domestic setting for network innovation.

As such, understanding the processes of generating, spreading, and incorporating on behalf of the companies and other actors of the network becomes fundamental to study and develop public policy and private strategies for implementing innovation on behalf of the interested companies (IBGE, 2013).

The investigative focus for this project concerns issues related to cooperative relations among companies for innovation. In this light and based on the theoretical guidelines of PINTEC, one uses cooperation and innovation concepts to have the following positioning concerning cooperation: At PINTEC, the cooperation for innovation is defined as the active participation of the company in joint R&D projects and other innovation projects with any other organization (company or institution), which does not imply that the involved parties would gain immediate benefits. The simple hiring of services from other organizations without their active collaboration is not considered to be cooperation (IBGE, 2013, p. 24).

Regarding innovation, PINTEC considers product and process innovation as the implementation of new, or substantially improved, products or processes. A new product is one whose “fundamental characteristics (…) significantly differ from all other products previously manufactured by the company” (IBGE, 2013, p. 19). Regarding process innovation, it is linked with the introduction of “new or substantially improved methods of production or of product delivery” (IBGE, 2013, p. 19).

Furthermore, the PINTEC reports indicate the investigation of issues linked with the audiences with whom the companies conduct their cooperative activities for innovation, objects of such cooperative activities, sources of information used by companies, and perceived importance of the said sources.

In this context, PINTEC strives to evaluate the internal (R&D Departments and Other Company Areas) and external (other companies belonging to the same group, suppliers, consumers or clients, competitors, consulting companies or independent consultants, universities or other centers of higher learning, research institutes or technological centers, professional training centers and help centers, test, rehearsal and certification institutions, conferences, meetings and specialized publications, trade fairs and exhibitions, and computerized information networks) sources of information to the organization. As noted by Guedes et al. (2014), information sources play a fundamental role in the innovative processes since it is through them that one can acquire new information and knowledge necessary for the internal innovation processes of organizations.

In this context, the adopted procedures through which this project approaches the questions referent to the process of cooperation for innovation as well as the categories used for the study are presented in the following section.

Methodological proceduresTo achieve the proposed objectives, this study is methodologically planned out as a documental research, with a qualitative approach. It uses statistical data obtained from the innovation reports published by IBGE, through PINTEC reports, conducted with Brazilian companies to follow the dynamics of the innovation scenario in this country. The qualitative documental analysis was conducted from the literature review on interorganizational cooperation and innovation, together with the data presented in the PINTEC reports, in light of the selected literature.

Collection and data analysis proceduresSecondary data were used, collected, and scrutinized to compose a panorama of collaboration between companies for innovation, considering one of the questions investigated by the investigation research presented in the PINTEC reports. In this context, we identified five published reports, each presenting results for triennials analyzed by the IBGE.

In this research, the last three published reports were analyzed, considering the time periods of 2003–2005, 2006–2008 and 2009–2011, each report being based on data from three years. We incorporated the last three reports because from the 2003–2005 report, new categories of companies were included, such as those having high-intensity technological services (telecommunications, information technology, and research and development)3; all these sectors were not previously included in older versions of PINTEC. To maintain uniformity of data analysis, the three final reports were selected for containing the same business groups and not presenting discrepancies in relation to the two first reports.

Regarding the objectives, this research is descriptive, considering that it studies a specific sample and intends on extracting from it relevant contexts and meaning, however, without action on the analyzed externalities (Prodanov & Freitas, 2013). In this context, the collected data will be summed and analyzed on the basis of literature on network cooperation for innovation, as seen in the next section.

The innovation research as a source of data and unit of analysisConsidering innovation to be one of the propulsion elements of regional and national development, possessing knowledge about the scenario for innovation in Brazil is fundamental to identify the current situation and trace out strategies and public policies focused on the promotion of innovation.

The innovation research (PINTEC) was performed by the IBGE in partnership with the Ministry of Science, Technology and Innovation and the Project and Study Financier with the intent of understanding innovation in Brazil. PINTEC was firstly published in 2002, under the name Pintec 2000, covering the triennial 1998–2000. Since then, four more editions to the research have been published: Pintec 2003 (triennial 2001–2003), Pintec 2005 (triennial 2003–2005), Pintec 2008 (triennial 2006–2008), and Pintec 2011 (triennial 2009–2011). The Innovation Research (PINTEC) intends on composing sectorial indicators, domestic and regional, of the innovation activities in companies of the Industrial sector and of domestic indicators of innovation activities in companies of the electric and gas sectors and of selected services (editing and recording of music; telecommunications; activity from technology and information services; data processing; Internet hosting and other linked activities; architectural and engineering services; technical testing and analysis; and research and development), compatible with international recommendations in conceptual and methodological terms (IBGE, 2013, p. 12).

Within this context, PINTEC4 offers a panorama of innovation in Brazil, by triennials, indicating company postures regarding inherent aspects of the innovative process. Among the considered aspects, questions regarding the innovative process, the type of innovation, acquisition of knowledge, R&D, cooperative relations, information sources, among other aspects, are investigated.

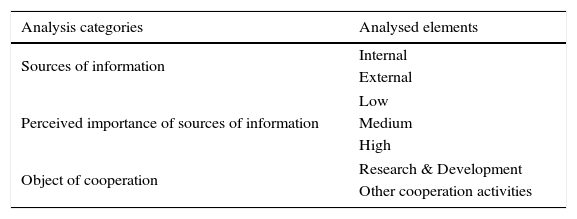

Intent on complying with the objectives of this research, the selected unit of analysis within the documents corresponds to the items relative to cooperative relations, one of the items evaluated by the research and central to this study. Analysis categories for this study were set as (i) sources of information; (ii) perceived importance of sources of information; and (iii) object of cooperation, according to Table 1.

After having established these categories, the data analysis was done initially from simple descriptive statistics through creation and presentation of collected data, followed by content analysis with inferences.

Data analysis and discussionIn this section, the data obtained from innovation reports released by the PINTEC conducted by IBGE are analyzed and the three latest published reports are considered, referent to the triennials of 2003–2005, 2006–2008, and 2009–2011. The parameters set out for the analysis are the cooperative relations among different companies with the end goal of innovating, supported by the analysis categories demonstrated in Table 1.

Cooperative relations among Brazilian companies – domestic scenario between 2003 and 2011In the PINTEC, cooperation among companies is viewed as the active participation of the company in joint R&D projects or other innovation projects with another organization. Starting here, the investigation regarding interorganizational cooperation followed in the domestic scenario based on the PINTEC data (IBGE, 2007, 2010, 2013).

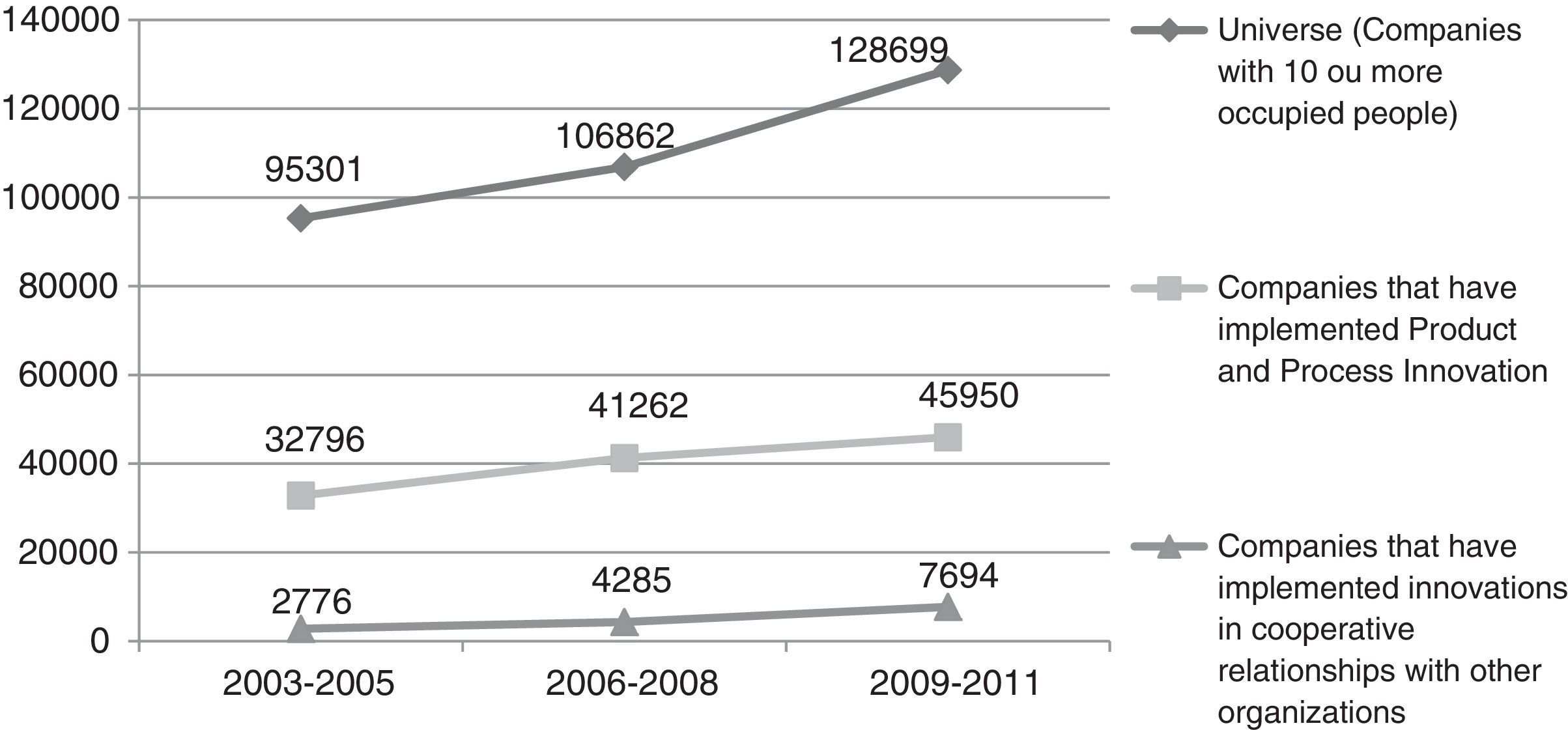

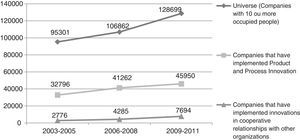

Comparing the dynamics of cooperation in the domestic scenario between 2003 and 2011, as presented in Graph 1, data for the number of identified companies with innovation potential was observed for each year. During the triennial 2003–2005, 95.301 companies participated in the PINTEC; 106.862 companies participated in 2006–2008; and 128.699 companies participated in 2009–2011 (IBGE, 2007, 2010, 2013).

Companies that innovated with cooperative relations: 2003–2011.

Source: Authors, based in PINTEC data (IBGE, 2007, 2010, 2013).

From the total participating companies, PINTEC investigated how many of these actually had innovation activities (product development, process development, product and process improvements, among other activities). It was shown that the number of companies that innovated in the country increased, and this figure expanded from approximately 33.000 companies in the triennial 2003–2005 to approximately 46.000 companies between 2009 and 2011. Using these data, PINTEC attempted to identify the number of companies that innovated through cooperative relations with other organizations, indicating an increase in results from 8.43% (2.776) of companies that innovated in 2005 to 16.74% (7.694) in 2011, as shown in Graph 1.

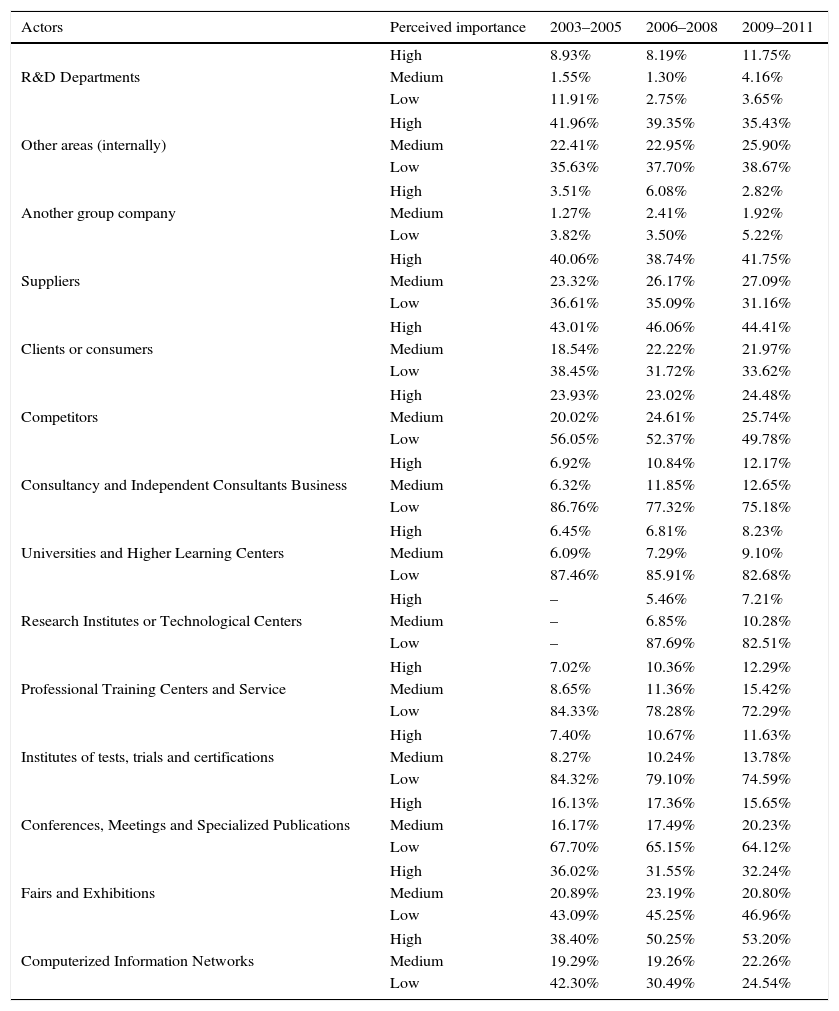

Another point focused on by PINTEC concerns with information sources that were used by participating companies in this research. Based on the data presented by innovation reports from PINTEC referent to the triennials 2003–2005, 2006–2008 and 2009–2011, it can be inferred that internally, organizations prioritize other areas of their company instead of necessarily only the R&D departments (Table 2). This suggests that the perception of the importance of internal information sources on behalf of the researched companies presents the following percentiles 41.96% in 2005, 39.35% in 2008, and 35.43% in 2011 regarding “other areas” against 8.93%, 8.19%, and 11.75% (Table 2), respectively, linked with “R&D departments”. This becomes a question to be pondered since the R&D departments should contribute to the development of innovative actions and activities.

Relationship importance of information sources of Brazilian companies: 2003–2011.

| Actors | Perceived importance | 2003–2005 | 2006–2008 | 2009–2011 |

|---|---|---|---|---|

| R&D Departments | High | 8.93% | 8.19% | 11.75% |

| Medium | 1.55% | 1.30% | 4.16% | |

| Low | 11.91% | 2.75% | 3.65% | |

| Other areas (internally) | High | 41.96% | 39.35% | 35.43% |

| Medium | 22.41% | 22.95% | 25.90% | |

| Low | 35.63% | 37.70% | 38.67% | |

| Another group company | High | 3.51% | 6.08% | 2.82% |

| Medium | 1.27% | 2.41% | 1.92% | |

| Low | 3.82% | 3.50% | 5.22% | |

| Suppliers | High | 40.06% | 38.74% | 41.75% |

| Medium | 23.32% | 26.17% | 27.09% | |

| Low | 36.61% | 35.09% | 31.16% | |

| Clients or consumers | High | 43.01% | 46.06% | 44.41% |

| Medium | 18.54% | 22.22% | 21.97% | |

| Low | 38.45% | 31.72% | 33.62% | |

| Competitors | High | 23.93% | 23.02% | 24.48% |

| Medium | 20.02% | 24.61% | 25.74% | |

| Low | 56.05% | 52.37% | 49.78% | |

| Consultancy and Independent Consultants Business | High | 6.92% | 10.84% | 12.17% |

| Medium | 6.32% | 11.85% | 12.65% | |

| Low | 86.76% | 77.32% | 75.18% | |

| Universities and Higher Learning Centers | High | 6.45% | 6.81% | 8.23% |

| Medium | 6.09% | 7.29% | 9.10% | |

| Low | 87.46% | 85.91% | 82.68% | |

| Research Institutes or Technological Centers | High | – | 5.46% | 7.21% |

| Medium | – | 6.85% | 10.28% | |

| Low | – | 87.69% | 82.51% | |

| Professional Training Centers and Service | High | 7.02% | 10.36% | 12.29% |

| Medium | 8.65% | 11.36% | 15.42% | |

| Low | 84.33% | 78.28% | 72.29% | |

| Institutes of tests, trials and certifications | High | 7.40% | 10.67% | 11.63% |

| Medium | 8.27% | 10.24% | 13.78% | |

| Low | 84.32% | 79.10% | 74.59% | |

| Conferences, Meetings and Specialized Publications | High | 16.13% | 17.36% | 15.65% |

| Medium | 16.17% | 17.49% | 20.23% | |

| Low | 67.70% | 65.15% | 64.12% | |

| Fairs and Exhibitions | High | 36.02% | 31.55% | 32.24% |

| Medium | 20.89% | 23.19% | 20.80% | |

| Low | 43.09% | 45.25% | 46.96% | |

| Computerized Information Networks | High | 38.40% | 50.25% | 53.20% |

| Medium | 19.29% | 19.26% | 22.26% | |

| Low | 42.30% | 30.49% | 24.54% | |

With regard to the external sources of information of organizations, based on Table 2, it can be inferred that “clients or consumers” and “suppliers” are groups of actors perceived by participating companies as highly important sources of information. “Clients or consumers” reached 43.01% in 2005, 46.06% in 2008, and 44.41% in 2011. The “suppliers” group showed indexes of 40.06% in 2005, 38.74% in 2008, and 41.75% in 2011, demonstrating that audiences with whom organizations maintain direct contact are also the most used information sources by participating companies in this study.

Another element that arises together with the growth of positive perception, according to the viewpoint of participating companies, is composed by “computerized information networks”. This indicates that the tools of information and communication technologies, with their information systems and other instruments for data transmission and information sharing, have been conquering their own space in the business environment and have become more common in the Brazilian companies with each passing day, as noted by Guedes et al. (2014).

Companies are altering their patterns for information searching; recently, the ease of access to information via the Internet has brought with it new possibilities for use of information via the digital means, which justifies why companies would consider “computerized information networks” as a highly relevant source of information (Guedes et al., 2014).

The participants of this study still consider “fairs and exhibitions” and “competitors” as highly important sources of information, as presented in Table 2.

A fact that is prominent is that “universities and higher learning centers” as well as “research institutes or technological centers” are not considered to be sources of information of high importance for the participating companies in the PINTEC. This is concerning as universities are traditionally considered to be creative institutions and holders of scientific and technological knowledge capable of facilitating the development of organizations (Johnson, 2012).

With regard to information sources, considering that only four groups of external actors (in a universe of 11 groups of external actors and 3 internal actors) possess high indexes of perceived importance, it is possible to verify that the sources of information are elements that are not being explored strategically and effectively by Brazilian companies since information sources may systematically contribute to the innovative process (Tether, 2002; Zeng et al., 2010).

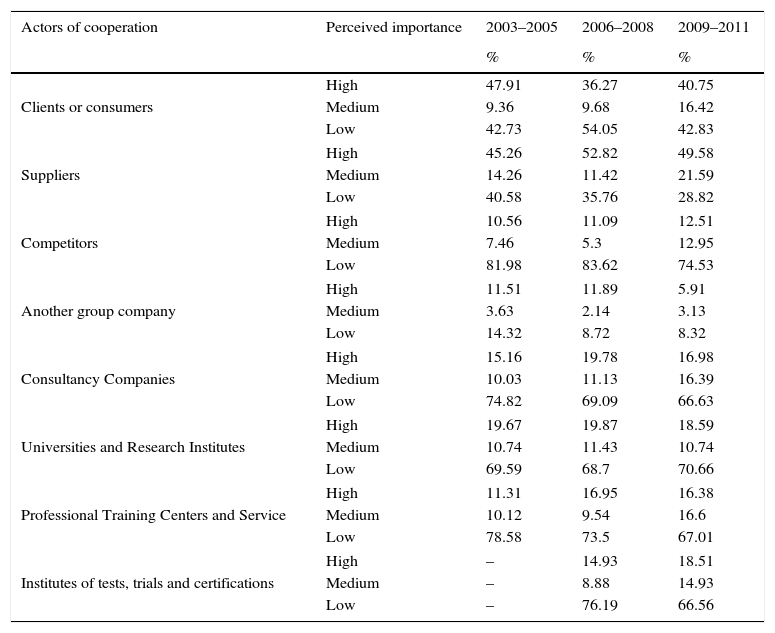

Based on these notes, the perception of the importance level with which participating companies dedicate to the actors with whom they maintain cooperative relations was investigated to better understand the dynamics of cooperation among Brazilian companies between 2003 and 2011. Based on the PINTEC data (IBGE, 2007, 2010, 2013), it was possible to create the Table 3.

Cooperative relations by degree of importance of the partnership: 2003–2011.

| Actors of cooperation | Perceived importance | 2003–2005 | 2006–2008 | 2009–2011 |

|---|---|---|---|---|

| % | % | % | ||

| Clients or consumers | High | 47.91 | 36.27 | 40.75 |

| Medium | 9.36 | 9.68 | 16.42 | |

| Low | 42.73 | 54.05 | 42.83 | |

| Suppliers | High | 45.26 | 52.82 | 49.58 |

| Medium | 14.26 | 11.42 | 21.59 | |

| Low | 40.58 | 35.76 | 28.82 | |

| Competitors | High | 10.56 | 11.09 | 12.51 |

| Medium | 7.46 | 5.3 | 12.95 | |

| Low | 81.98 | 83.62 | 74.53 | |

| Another group company | High | 11.51 | 11.89 | 5.91 |

| Medium | 3.63 | 2.14 | 3.13 | |

| Low | 14.32 | 8.72 | 8.32 | |

| Consultancy Companies | High | 15.16 | 19.78 | 16.98 |

| Medium | 10.03 | 11.13 | 16.39 | |

| Low | 74.82 | 69.09 | 66.63 | |

| Universities and Research Institutes | High | 19.67 | 19.87 | 18.59 |

| Medium | 10.74 | 11.43 | 10.74 | |

| Low | 69.59 | 68.7 | 70.66 | |

| Professional Training Centers and Service | High | 11.31 | 16.95 | 16.38 |

| Medium | 10.12 | 9.54 | 16.6 | |

| Low | 78.58 | 73.5 | 67.01 | |

| Institutes of tests, trials and certifications | High | – | 14.93 | 18.51 |

| Medium | – | 8.88 | 14.93 | |

| Low | – | 76.19 | 66.56 | |

In this case and as noted in Table 3, the audiences with greater indexes with regard to the perception of the importance of relations are the “clients or consumers” (reaching figures of 47.91% in 2005, 36.27% in 2008, and 40.75% in 2011) and “suppliers” (with figures of 45.26% in 2005, 52.82% in 2008, and 49.58% in 2011), followed by “universities and research institutes” (with figures of 19.67% in 2005, 19.87% in 2008, and 18.59% in 2011) and “consultancy companies” (with figures of 15.16% in 2005, 19.78% in 2008, and 16.98% in 2011).

Thus, the data suggest that universities, higher education, and research institutions are, generally, not being considered to be target audiences with high-importance levels, which reinforces the perception of existing distancing among universities and companies. Surpassing this barrier could help develop technical and scientific knowledge required for innovation, thereby contributing to improve indexes of innovation in the domestic panorama.

Traditionally, “clients or consumers” and “suppliers” compose the closest chain of relations of a company, as the organization depends on these groups to perform their activities and commercialize the result of their efforts, according to Tether (2002).

As shown in Table 3, “universities and research institutes” are not seen as organizations with a high level of importance for partnerships and cooperative relations on behalf of the researched companies. Ieis et al. (2013) noted that universities and research institutes cooperate in innovative activities on a greater scale with state-owned companies; however, private companies – the focus of this paper – search among their closest partners (“clients or consumers” and “suppliers,” among others) for partnership relations.

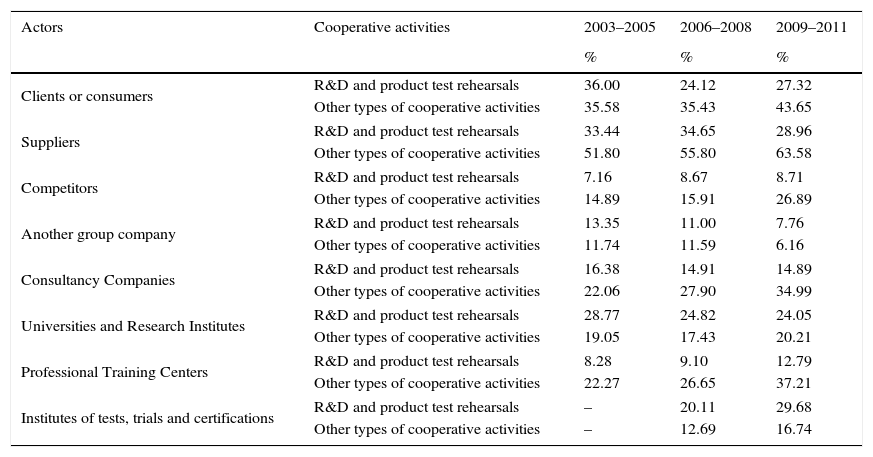

Regarding the objective of partnerships and collaborative relations among companies participant in this research, “R&D and product test rehearsals” show up in the second plan. As shown in Table 4, most relations are focused on other types of cooperative activities and not just R&D.

Cooperative relations for cooperation object: 2003–2011.

| Actors | Cooperative activities | 2003–2005 | 2006–2008 | 2009–2011 |

|---|---|---|---|---|

| % | % | % | ||

| Clients or consumers | R&D and product test rehearsals | 36.00 | 24.12 | 27.32 |

| Other types of cooperative activities | 35.58 | 35.43 | 43.65 | |

| Suppliers | R&D and product test rehearsals | 33.44 | 34.65 | 28.96 |

| Other types of cooperative activities | 51.80 | 55.80 | 63.58 | |

| Competitors | R&D and product test rehearsals | 7.16 | 8.67 | 8.71 |

| Other types of cooperative activities | 14.89 | 15.91 | 26.89 | |

| Another group company | R&D and product test rehearsals | 13.35 | 11.00 | 7.76 |

| Other types of cooperative activities | 11.74 | 11.59 | 6.16 | |

| Consultancy Companies | R&D and product test rehearsals | 16.38 | 14.91 | 14.89 |

| Other types of cooperative activities | 22.06 | 27.90 | 34.99 | |

| Universities and Research Institutes | R&D and product test rehearsals | 28.77 | 24.82 | 24.05 |

| Other types of cooperative activities | 19.05 | 17.43 | 20.21 | |

| Professional Training Centers | R&D and product test rehearsals | 8.28 | 9.10 | 12.79 |

| Other types of cooperative activities | 22.27 | 26.65 | 37.21 | |

| Institutes of tests, trials and certifications | R&D and product test rehearsals | – | 20.11 | 29.68 |

| Other types of cooperative activities | – | 12.69 | 16.74 | |

According to Verschoore and Balestrin (2010), a few companies upon entering cooperative networks understand and wait for, at a first moment, cost reduction of certain activities, the increase in the number of suppliers, the increase in the number of clients, the increase of investment and sales, among other elements.

Cavalcante and De Negri (2011) indicated that a few factors that contribute to the increase in cooperative activities and the perception of the importance of collaboration among different companies come from public policies centered on innovation. However, according to them, the domestic policies for financing as well as legislation focused on innovation have contributed to more companies been empowered to work toward innovating.

The benefits originated from collaboration between companies for innovation are numerous. Beginning from the sharing of risks for certain deals to the complementarity among competencies of each company, cooperation and collaboration among actors of different institutions has the potential to help companies develop and innovate in its most varied forms.

Generally, it is confirmed that the number of companies that started to enable cooperative activities with other organizations increased (Graph 1). This is a positive element for the domestic scenario, given that innovation requires interaction among companies to enable the circulation of information and knowledge, thereby aiding in creating new knowledge that may lead to multiple innovations (Faria et al., 2010; Tidd & Bessant, 2015; Tomlinson, 2010).

In this context, sources of information become centerpieces in the innovation process. However, based on the PINTEC data (IBGE, 2007, 2010, 2013), it can be inferred that the sources of information are insufficiently explored by Brazilian companies (Table 2).

According to IBGE (2013), during the innovative process, organizations require differing information that may be acquired in the most diverse places, from internal sources, such as the R&D sectors and/or other company areas, to the most diverse external actors who may aid with information and knowledge that may be useful to enhance further innovation and create new knowledge (Faria et al., 2010; Tidd & Bessant, 2015).

As noted by Guedes et al. (2014), the identification of information sources used by companies may be a way to know part of the innovation environment of companies.

Through data obtained from the last three PINTEC reports (IBGE, 2007, 2010, 2013), it can be inferred that cooperation among different institutions has been reaching expressive numbers. However, some elements are related to the perceived low importance of information sources (Table 2) since out of 11 groups of external actors to the company, 9 possess high indexes of “low importance” and only 2 (“competitors” and “customers” or “consumers”) are considered to be “highly important” by the participating companies.

“Universities or higher education centers” and “research institutes or technological centers,” for example, are audiences whom companies do not view as being highly important information sources.

With regard to the importance of cooperative relations (Table 3), a fact that stands out is that groups of actors such as “suppliers” and “clients or consumers” have reached high indexes in the perception of the participants in this study, which is clear evidence of partnerships of direct cooperation with the audiences with whom companies interact with most frequently and a tendency for horizontal cooperation (Tomlinson, 2010). This might be due to the fact that for future cooperative relations, as seen in the literature and highlighted by Balestrin and Verschoore (2009), Nascimento and Labiak (2011) and Tidd and Bessant (2015), the creation of trust and bonding among the actors involved is essential, and this is facilitated if the contact among companies is more frequent, as in the case of clients and suppliers.

However, other audiences, such as “universities and research institutes” have percentiles lower than 20% with regard to the perception of high importance in cooperative relations. This distance among universities and companies is a concern for the domestic scenario, considering that science and technology produced in universities could contribute to the development of widespread innovation in the business scenario. However, the existing cultural barrier between the academic and business environments still prevents a more effective partnering relation among those entities (Tether, 2002).

This leads us to believe that cooperative relations for innovation in the Brazilian scenario still occur in an incipient and unstructured manner and are not viewed as a strategic and relevant activity in the innovation process.

This fact that cooperation and interaction with both internal and external actors to the company is an essential element in the innovative processes should sound like an alert, as noted by Tether (2002), Torres-Freire and Henriques (2013) and Tidd and Bessant (2015). In this context, the partnership and cooperative relations as part of a network have the potential to aid organizations in developing their activities to complement their competencies with other companies and strive to keep active and competitive in the market.

Taking these notes and the data found in the PINTEC reports (IBGE, 2007, 2010, 2013), it can be inferred that the cooperative and innovative scenario in Brazil is not structured in a way that will result in allowing the country to internationally compete in terms of innovation rate of its companies.

Final considerationsAnswering the question about research that was initially proposed, it was possible to understand that there was an increase in the number of companies that began to conduct cooperation activities geared toward innovation between 2003 and 2011 in the Brazilian setting. Moreover, it can be inferred that most companies consider these cooperative activities to be important and maintain cooperative relations with the audiences with whom they maintain most direct and effective contact. In this paper, the “clients or consumers,” “suppliers,” and the “competitors” are important actors, as presented in Table 3, and it indicates a greater incidence of horizontal relations of cooperation.

On the other hand, it can be inferred that institutions/actors such as “universities and research centers” still do not present good results when used as information sources and even as important partners in the time for cooperation. As presented in Table 3, perception indexes of high importance were reached of only 19.67% in 2005, 19.85% in 2008, and 18.59% in 2011. This becomes a topic to be investigated since institutions of higher education and research centers may significantly contribute to the creation and development of new knowledge, and these have not been used by Brazilian organizations with such efficiency.

Another relevant point is the perception of companies regarding the high importance of “computerized information networks” (38.40% in 2005, 50.25% in 2008, and 53.20% in 2011, presented in Table 2). It is possible to see the entrepreneurial dynamism encompassing computerized elements, such as information systems and the access to information via the Internet, as relevant factors for acquiring information relevant to their business. As such, it is possible to understand that the tools of information and communication technology earned a favorable place in contemporary companies.

In this context, considering the data analyzed, it was possible to see that the Brazilian scenario for interorganizational cooperation is growing; however, companies prioritize their cooperative relations with actors with whom they maintain close business relations, such as “clients or consumers” and “suppliers,” leaving other groups of actors that could have contributed to the development of organizational innovation in a secondary position.

Finally, we confirmed that interorganizational cooperation becomes a means of action in response to new demands and requirements of a business environment that is consistently more competitive and complex; in this case, organizations must conduct their activity as well as anticipate market demands and continually adapt to them, either by creating new knowledge through cooperative relations with different organizations or through innovation reached through its multiple aspects.

Based on the exposed discussions and results, this study contributes to the perception of theoretical and empirical gaps with regard to cooperative relations of Brazilian companies, providing evidence of a scenario with potential for cooperation and innovation; however, this does not explore the strategic possibilities of interorganizational cooperation.

We highlight the fact that new studies are needed for focusing on the motives that take Brazilian organizations to cooperate with audiences with whom they maintain closest contact (“clients and consumers” and “suppliers”). Furthermore, studies must be conducted, approaching the distancing between universities and companies, to understand the position of Brazilian companies to not opt for universities and higher education institutions with regard to search for partners for cooperative activities.

Conflicts of interestThe authors declare no conflicts of interest.

Peer Review under the responsibility of Departamento de Administração, Faculdade de Economia, Administração e Contabilidade da Universidade de São Paulo – FEA/USP.

Innovation Research, known as PINTEC, mainly aims at the construction of sectorial, regional, and national indicators for the innovation activities of companies in the industrial sector and of national indicators of innovation activities in companies from the electricity and gas sectors and selected services (editing, recording and music editing, telecommunications, information technology services activities; data processing, internet hosting and other related activities; architectural and engineering services, tests and technical analysis; research and development), compatible with international recommendations in conceptual and methodological terms.

The study was conducted by the Cornell University by the Post-Graduate Business School (INSEAD, in France) and by the World Intellectual Property Organization. The countries that were prominent the most in promoting a favorable environment for innovation are singled out in the report. The research encompassed indicators related to innovation, politics, economy, and other important factors in the development of new technologies and services. One hundred forty-one countries were analyzed, and they received evaluations from 1 to 100 in the total index. The five first places in the ranking belong to Switzerland, United Kingdom, Sweden, Holland, and the United States, with scores of 68.30, 62.42, 62.40, 61.58, and 60.10, respectively, against 34.95 of Brazil. The report is available at https://www.globalinnovationindex.org/userfiles/file/reportpdf/GII-2015-v5.pdf.

The editions previous to 2003 from PINTEC presented solely results referent to the extractive industries and transformation sectors. In the 2003–2005 edition, the document name was changed to Technological Innovation Research. In the first two editions, the nomenclature was adopted for the report corresponding to the triennial 2009–2011, which became simply known as Innovation Research, maintaining international standards and recommendations (IBGE, 2013).

Further information about the procedures adopted at Pintec can be consulted at http://www.pintec.ibge.gov.br/index.php?option=com_content&view=category&layout=blog&id=2&Itemid=2.