Central and local governments in China are investing heavily in the development of Electric Vehicles. Businesses and governments all over the world are searching for technological innovations that reduce costs and increase usage of “environmentally friendly” vehicles. China became the largest car producer in 2009 and it is strongly investing in the manufacturing of electric vehicles. This paper examines the incentives provided by Chinese governments (national and local) and the strategies pursued by BYD, the largest Chinese EVs manufacturer. Specifically, our paper helps to show how government support in the form of subsidies combined with effective strategies implemented by BYD helps to explain why this emerging industry has expanded successfully in China. Our study is based on primary data, including interviews with company headquarters and Brazilian subsidiary managers, and secondary data.

Electric vehicles (EVs) are already a reality in the international market. Cars driven purely by battery now account for significant portions of the vehicle fleets of developed and some of the developing countries. The proliferation of these vehicles that are replacing engine combustion alternatives, with either purely electric car or some hybrid form of propulsion, has attracted the attention of researchers seeking to understand the factors that have been most instrumental to the development of this industry, which until only recently developed at a very slow rate without much progress. In a review of the evolution of the industry in the last four decades, Chan (2011) states that the successful production and marketing of EVs depends on overcoming many challenges, including:

- •

Availability of products with displacement of autonomy at an affordable cost.

- •

Availability of efficient and easy to use infrastructure.

- •

Availability of business model to leverage the cost of batteries.

Searching to overcome its strong dependence on oil, the Chinese government is supporting the development of alternatives forms of clean energy. Chinese governments and businesses in tandem have sought different forms of partnerships to meet the challenge of increasing technological advancements to reduce costs and increase usage of “environmentally friendly” vehicles. This paper examines the strategies pursued by BYD, the largest Chinese EVs manufacturer, tracking its evolution and the factors that contributed to the rise of this company on the world stage. Specifically, our paper helps to show how effective strategies implemented by BYD combined with government support in the form of subsidies help to explain why this company has expanded in exponential terms in China in recent years. Our objective is to use the case of BYD to identify the factors that contribute to the effective adoption and development of this industry in the context of a developing country. Our study is based on in-person interviews undertaken by the authors with the management of both, the Chinese Headquarters and the Brazilian Subsidiary.

The rest of this article is structured in six sections. First, we provide an overview of EV development in China. Next, we briefly review some of the key findings from the literature on EVs in China. In Section ‘The case of BYD and its expansion strategy’, we provide an overview of BYD from a startup in 1995 to its main characteristics and main strategies in 2015. We show how BYD has benefitted from government subsidies in Section ‘Chinese government subsidies for the EV industry’. The final section makes some concluding remarks on future directions for research on the development of the EV industry.

An overview of EV development in ChinaAccording to IEA (2015), Japan and the US are the biggest consumers of EVs. Although consolidated rankings on the production of these vehicles are not yet available, industry experts agree that Japan, South Korea, Germany and China have shown the most significant technological advances. This is because the top 10 leaders in the development of battery production are from these countries. Five are Japanese companies: AESC, Mitsubishi/GS Yuasa, Hitachi, Panasonic and Toshiba. Two are South Korean: LG Chem and Samsung SDI. There is also one joint venture company between Germany and South Korea: SK Continental E-Motion. BYD is the only Chinese firm among the top 10.

In studies developed by Fournier, Hinderer, Schmid, Seign, and Baumann (2012) and Castro, Barros, and Veiga (2013), batteries and their electronic components have been identified as the key technological challenge to be overcome in the successful development of the EV industry considering the entire production chain. This is even more difficult because batteries are the least durable component of EV cars. There are four types of batteries vying to be the standard for the EVs industry: LAB (lead acid); Li-Ion; NiMH (nickel metal hydride) and sodium, also known as ZEBRA, Zero-Emission Battery Research Activity, which is fully recyclable and which tends to be cheaper than lithium-based batteries (Castro & Ferreira, 2010).

Batteries have different degrees of durability. That is, the life of a battery varies depending on the technology used, the type of use and storage conditions. The factors that affect the durability of batteries are extreme temperatures, the excessive time to recharge and complete discharge of the batteries. Currently, manufacturers estimate the lifetime of a battery at 150,000km and a durability of 5 years.

Recent initiatives of governments and major car companies have prioritized the search for alternatives to oil as a means of vehicle propulsion. A typical example of such an initiative was the development of the Toyota Prius hybrid vehicle, until recently, a world leader in sales in the category (Carrillo-Hermosilla, Del Río, & Könnölä, 2010; Sexton & Sexton, 2014). In addition to hybrid cars, there are other less known initiatives in the development of Battery Electric Vehicles (BEVs). The strategies being pursued and the challenges facing companies to explore this new emerging industry are only now beginning to be studied.

Japanese carmakers Mitsubishi and Nissan launched the pure electric compacts “i.MiEV” and “Leaf” in recent years (Gass, Schimidt, & Schmid, 2014). In 2008, Chinese BYD (Build Your Dreams) launched the e6 sedan crossover. Considering that these and similar initiatives represent an effective solution for oil shortage problems. According to Gao, Wang, and Wu (2008), the potential for development of the electric car industry in China is due to its own national characteristics and global stance regarding energy demands. However, according to Shen, Han, and Wallington (2014), it will be very unlikely for EVs to significantly reduce greenhouse gas emissions because electric power generation is still heavily dependent on thermal power plants that employ fossil fuels.

The need to reduce greenhouse gas emissions and achieve energy efficiency improvements is constant targets of studies and researches in the automotive sector, especially in China. In recent years, studies from the perspective of life-cycle energy consumption of electric vehicles in China and greenhouse gas emission have been a significant concern drawing the attention of scholars including Shen, Han, Chock, Chai, and Zhang (2012); Zhang, Wang, Hao, Fan, and Wei (2013); and Lin et al. (2013). Despite the studies and the progress made, a major obstacle facing the global EV industry is the high production cost of the batteries that drive electric cars – a factor accounting for approximately 50% of the total cost per unit produced (Kimble & Wang, 2012).

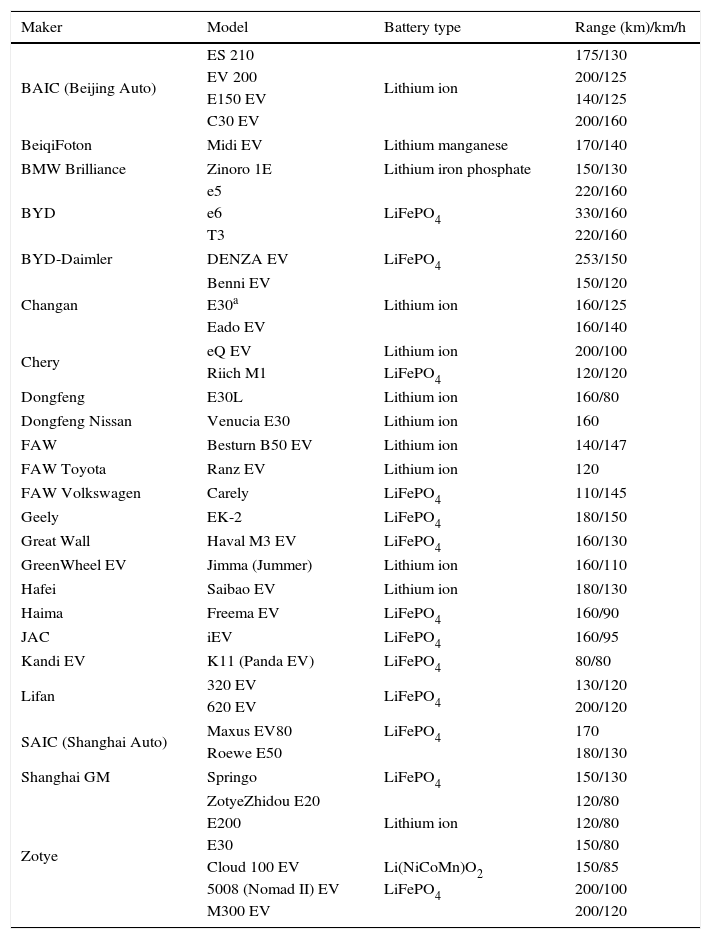

With China's economic success and the resulting increase in its population's purchasing power, the country has become one of the world's largest consumer markets (Starrs, 2013). The expansion of the Chinese economy in recent decades, however, has also caused a negative environmental impact that is currently raising concerns from both the Chinese government authorities and the international community (Vennemo, Aunan, Lindhjem, & Seip, 2009). From this perspective, Chinese leaders set out to foster the development of New Energy Vehicles (NEV) (Liu & Kokko, 2013). These vehicles, powered by renewable energy, can counter the ills caused by the rise in consumption and pollution from fossil fuel cars purchased by China's growing middle class. Thus, several automobile manufacturers operating in the Chinese market (see Table 1), started developing electric vehicle models.

New energy vehicles makers in China.

| Maker | Model | Battery type | Range (km)/km/h |

|---|---|---|---|

| BAIC (Beijing Auto) | ES 210 | Lithium ion | 175/130 |

| EV 200 | 200/125 | ||

| E150 EV | 140/125 | ||

| C30 EV | 200/160 | ||

| BeiqiFoton | Midi EV | Lithium manganese | 170/140 |

| BMW Brilliance | Zinoro 1E | Lithium iron phosphate | 150/130 |

| BYD | e5 | LiFePO4 | 220/160 |

| e6 | 330/160 | ||

| T3 | 220/160 | ||

| BYD-Daimler | DENZA EV | LiFePO4 | 253/150 |

| Changan | Benni EV | Lithium ion | 150/120 |

| E30a | 160/125 | ||

| Eado EV | 160/140 | ||

| Chery | eQ EV | Lithium ion | 200/100 |

| Riich M1 | LiFePO4 | 120/120 | |

| Dongfeng | E30L | Lithium ion | 160/80 |

| Dongfeng Nissan | Venucia E30 | Lithium ion | 160 |

| FAW | Besturn B50 EV | Lithium ion | 140/147 |

| FAW Toyota | Ranz EV | Lithium ion | 120 |

| FAW Volkswagen | Carely | LiFePO4 | 110/145 |

| Geely | EK-2 | LiFePO4 | 180/150 |

| Great Wall | Haval M3 EV | LiFePO4 | 160/130 |

| GreenWheel EV | Jimma (Jummer) | Lithium ion | 160/110 |

| Hafei | Saibao EV | Lithium ion | 180/130 |

| Haima | Freema EV | LiFePO4 | 160/90 |

| JAC | iEV | LiFePO4 | 160/95 |

| Kandi EV | K11 (Panda EV) | LiFePO4 | 80/80 |

| Lifan | 320 EV | LiFePO4 | 130/120 |

| 620 EV | 200/120 | ||

| SAIC (Shanghai Auto) | Maxus EV80 | LiFePO4 | 170 |

| Roewe E50 | 180/130 | ||

| Shanghai GM | Springo | LiFePO4 | 150/130 |

| Zotye | ZotyeZhidou E20 | Lithium ion | 120/80 |

| E200 | 120/80 | ||

| E30 | 150/80 | ||

| Cloud 100 EV | Li(NiCoMn)O2 | 150/85 | |

| 5008 (Nomad II) EV | LiFePO4 | 200/100 | |

| M300 EV | 200/120 | ||

According to data from the China Association of Automobile Manufacturers released by the China Auto Web (2015), EV sales increased 324% in 2014 as compared to 2013. Production reached 78,499 units, 4.5 times higher than the figure in that year. Car manufacturers in the country produced a total of 48,000 pure electric cars and 30,000 plug-in hybrids. Of all EVs sold in 2013, 71% are sedans, 27% buses and 1% trucks. According to the Association, the market should double its size to approximately 200 thousand units in 2015.

A brief review of the literature on EVs in ChinaBased on statistics from the China Association of Automobile Manufacturers, Yang (2010), affirms that the country became the world's leading automotive market in 2009. According to this researcher, the Chinese government started providing incentives of around US$ 15 billion for the industry to strengthen its commitment to encourage EV development, generate jobs, and reduce urban pollution and dependence on oil imports.

The Chinese government has sought to stimulate the production of electric vehicles and is concerned with regulating the sector. According to Wang and Kimble (2011), it established the first standards and regulations in 2009, when it published a roadmap for the development of the battery industry – Access Regulations for New Energy Vehicle Manufacturers and Products. The government's concern, additionally to the regulatory framework, lies in overcoming the obstacles arising from the low EV production due to the lack of efforts to seek ways to reduce costs – and expand the potential market for such vehicles. Kimble and Wang (2013) also consider infrastructure, i.e., charging stations, an important technological challenge for the feasibility of electric cars in China.

Infrastructure needs represent a challenge to both government authorities and private agents. According to Wu, Ma, Mao, and Ou (2015) public authorities choose to build home charging stations within communities, but these investments raised conflicts with property management companies. Based on a two-period imperfect information game theory model to study the moral hazard of this conflicting relationship, the authors find that the optimal choice for governments is to constantly improve the incentives mechanisms and strive to reduce or eliminate the conflict of interest. Therefore, they recommend that the Chinese government should focus on long-term returns that will be derived from increasing dissemination of EVs.

Searching for the rationale and impacts of the EVs in China, Hao, Ou, Du, Wang, and Ouyang (2014) studied the ownership cost analysis of the battery electric passenger vehicles vis a vis their counterpart conventional passenger vehicle models. They investigate the existing government subsidies for the production of EVs. They conclude that in the short term, China's subsidies are very necessary; however, in the long term, with the decrease of the manufacturing cost of batteries, the ownership costs are projected to decrease despite the phase-out mechanism of government subsidies. For these authors, batteries of passenger vehicles could become less or not reliant on subsidy to maintain cost competitiveness by the next five years. Furthermore, they also consider that by now subsidies are not enough for the EVs market to take off and further technological improvements regarding the limited electric range and reductions of the battery costs are essential for the further development of this market.

In an incipient market, subsidies have proven to be critical for the development of new technologies and to foster demand. Worldwide we have several examples of this common practice. In the US, currently the biggest consumer market for EVs, government incentives began in 2004–2006 focusing primarily on the demand side, through rebates, tax credits and fee waivers (Diamond, 2009). In Japan, one of the pioneers in this industry, the same idea was used to improve demand by giving buyer's preferential conditions since 1999, but no support was provided to companies for the development of EVs (Phol & Yarime, 2012).

In France, government incentives have been driven by concerns focusing on energy and environmental issues, especially the reduction of greenhouse gas emissions. With the coordination of PREDIT – National Program of Research and Innovation in Transportation, cooperative research projects have been developed involving car manufacturers, major suppliers, industrial firms from other sectors (oil sector) and public institutions (the French Oil Institute). Public laboratories and universities received 23% of 2002–2007 total funding to invest in projects concerning electric and hybrid motors with a strong emphasis on the development of batteries (Oltra & Jean, 2009).

In other cases, governments are raising barriers to discourage demand cognizant of the necessity for carbon emissions reduction. In Denmark, conventional petrol or diesel cars are subject to high registration fee. As a result, energy companies, transport companies, regulators and public authorities have been more willing to adopt electric cars (Christensen, Wells, & Cipcigan, 2012). By 2014, sales of EVs reached the highest worldwide market share representing 2.5% of total global sales.

Considering public awareness and acceptance of alternative fuel vehicles in China, Zhang, Yu, and Zou (2011) found that the timing of a consumer's purchases of an EV is influenced by whether he holds an academic degree, annual income, the number of vehicles, government policies, the opinion of peers and tax incentives. They also found that the willingness to pay for an EV is influenced by individual characteristic including the owner's age, number of family members, number of vehicles, the opinion of peers, maintenance costs and safety.

Zhang et al. (2013) examined the impact of government policies on the acceptance of EVs measuring four important factors influencing consumer's decisions: the willingness to purchase, the purchasing time, the environmental awareness and psychological needs. These authors found that performance attributes, rather than financial benefits, are the most important variable to influence the consumer's decision to purchase an electric vehicle. These authors therefore argue that government policies have had a moderate effect regarding the purchasing intention, time and price.

Gong, Wang, and Wang (2013) outline Chinese Government efforts to disseminate the use of EVs under the widely called The Thousands of Vehicles, Tens of Cities (TVTC) Program. This pilot program, which also started in 2009, has been selecting and subsidizing Chinese cities to implement EVs as a way to disseminate the culture of this mode of transportation in the country. Thirteen medium- or large-sized cities that met the criteria were chosen to serve as pilot sites to the experience. In a short period, the number of cities scaled to 25, and in all of them, according to Zheng, Mehndiratta, Guo, and Liu (2012), public utility sectors such as buses, taxis, sanitation vehicles, postal fleets and official vehicles were prioritized. Tagscherer (2012) reviews this and other public policies that did not generally accomplish the expected results.

Despite the development of batteries with lengthened driving ranges, Earley, Kang, An, and Green-Weiskel (2011) argue that hybrid vehicles could serve as a bridging technology in China because of the high cost of technology and the difficulties to disseminate and popularize pure EVs. Hybrids have the positive attributes of traditional vehicles and are partly battery powered with smaller batteries and shorter charging times. They emphasize that it is vital that expectations from governments, automakers and infrastructure contractors be aligned. According to EV News (2015), by the end of 2013, there were just over 400 charging stations in China. Without coordination, the scaling up of the industry will be quite limited given the current level of available infrastructure.

Despite the need to overcome current technological challenges, two benefits can be perceived with the development of EV production in China. According to Li et al. (2015), EVs radiate less heat as compared to traditional vehicles and this difference could mitigate the effect known as the urban heat island, that is, the phenomenon that raises temperatures above normal in large cities like Beijing in warmer months. For these researchers, the resulting cooling from replacing all internal combustion vehicles for EVs could mean that city residents will reduce their usage of air conditioners, a major contributor to energy consumption. The costs and benefits of developing a particular new industry are always difficult to measure. But, as exemplified below by the BYD's 7+4 strategy and the amount of Chinese subsidies to this emerging branch of the automotive sector, it is fair to say that the benefits exceed the costs.

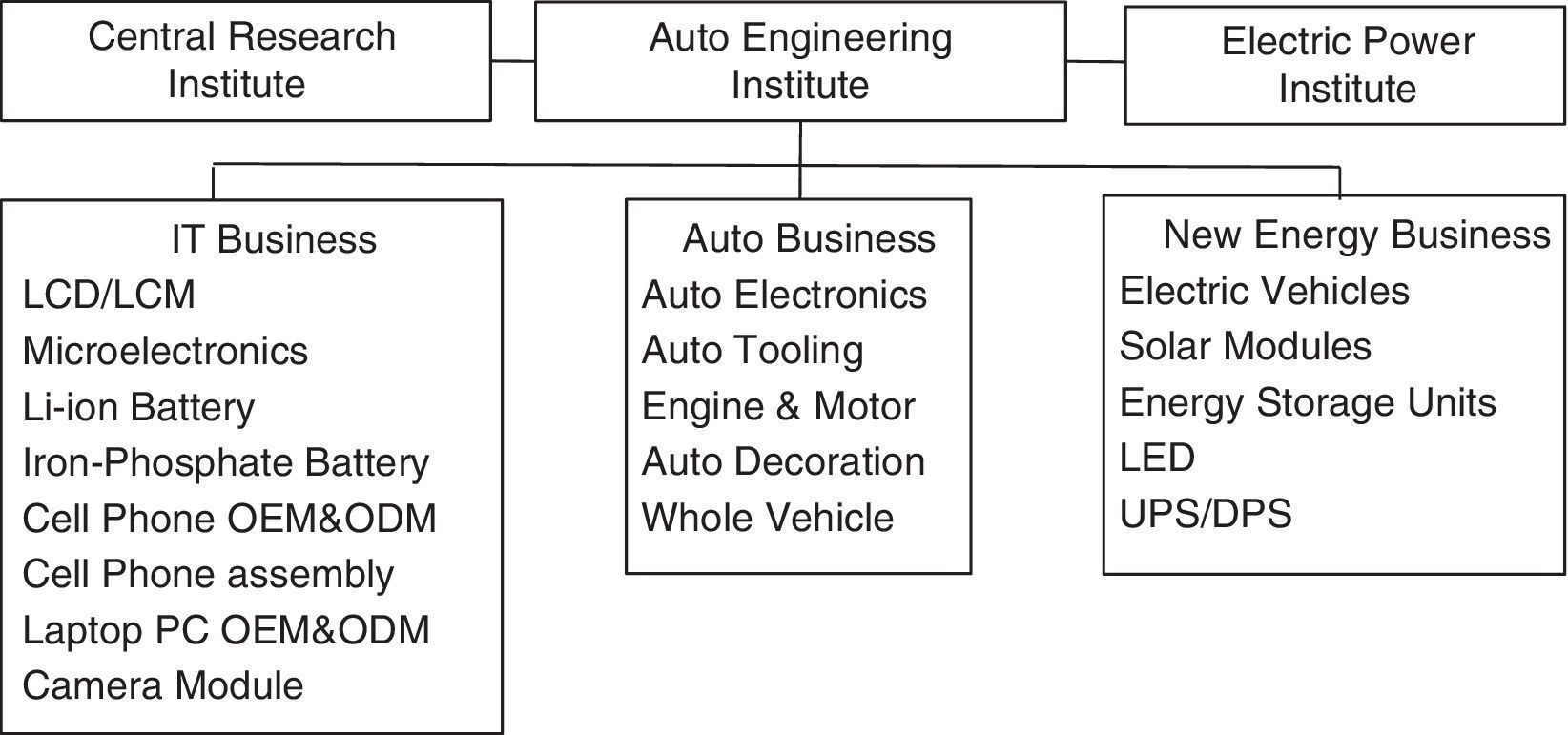

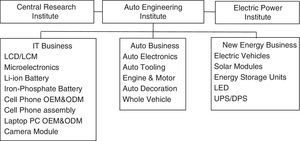

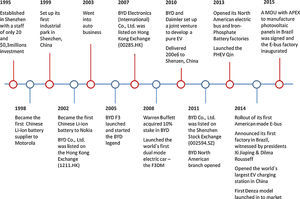

The case of BYD and its expansion strategyIn 1995, BYD Company Limited started operations with 20 employees and US$ 300,000 in initial investment. Since then, the company has grown at an average of 70% per year. Today, the Chinese company has a staff of 190,000 employees worldwide and around US$ 9.1 billion in sales. The company started its activities making mobile phone batteries and quickly moved on to making OEM handsets for the information technology industry. In 2003, it entered the auto and renewable energy sectors. The company's diversification is represented in Fig. 1.

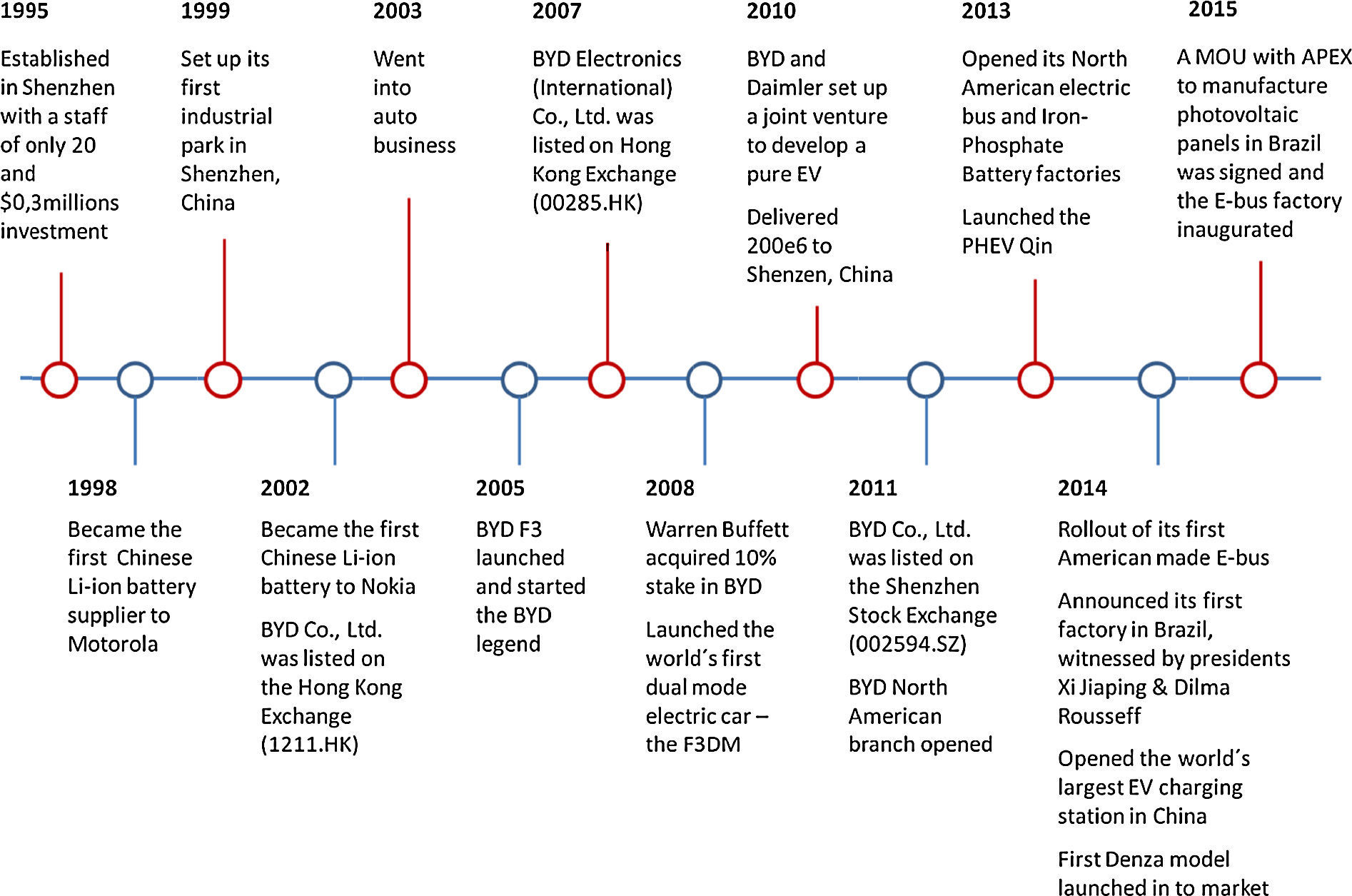

According to company executives, BYD is the largest manufacturer of pure electric vehicles worldwide. It manufactures plug-in electric vehicles (PHEV) and is also producing its second generation of dual hybrid vehicles, known as Dual Mode. The company's Qin model ranks as the first in sales in China and third worldwide. The company is a world leader in the production of iron phosphate batteries used in their EV models, as well as in a broad range of energy storage units with different applications. BYD entered in the automobile business in 2003, and five years later, in 2008, it launched its first PHEV, the F3DM sedan, and in 2010, its first BEVs, the crossover sedan e6 and the 12-m K9 bus, both to be used in public transportation. The Automotive Testing Technology International recognized the company's test facility as the “2013 Crash Test Facility of the Year”. BYD's business main expansion events are shown in Fig. 2.

BYD main accomplishments from 1995 to 2015.

The company is based in the city of Shenzhen, Guangdong Province, but it also has factories in Beijing, Xi’an, Shanghai and Changsha. In total, BYD currently has 20 factories producing from IT to EV components, 14 in China and 6 around the world: Russia, Syria, Egypt, Sudan, USA and Brazil. In Brazil, BYD has built a CKD bus assembly facility in the region of Campinas – São Paulo – and its buses have been tested in the Brazilian cities of Curitiba, Rio de Janeiro, Salvador, Brasília and Joinville. According to a BYD executive at Headquarters, this early international expansion is due to the fact that “… our technology is mature enough, but the EV market is not. We must explore BYD's advantage by being the first to start operating in the largest consumer markets (BYD, 2015a, 2015b).”

According to the company, the battery packs powering vehicles will also be made in Brazil. The company's core competency is its proprietary iron phosphate battery, which is environmentally friendly, safe, reliable and fully recyclable. It still retains over 70% capacity after 10,000 charging cycles, and goes through extremely harsh tests – flames, short circuit, prodding, striking, extreme heat, extrusion and overcharge. A company executive stated that “… it will not burn or explode even when put into the fire” (BYD, 2015a, 2015b). This core technology enabled BYD to develop an entire EV and Energy Storage product portfolio.

Currently, BYD's best-selling model is the e6, an all-electric, zero-emission, low-noise crossover sedan. Sales began in May 2010 in the Chinese city of Shenzhen, which started operating the world's first electrified taxi fleet. The battery pack that equips the model grants it 300-km autonomy. The battery's key feature is charging 80% in 30min using a fast charger. According to an executive interviewed at the Brazilian branch, manufacture of the e6 in Brazil will depend “… on incentives that may be created if the federal government sanctions a law removing taxes on “green vehicles” (BYD, 2015a, 2015b).

BYD Company Limited has devised what they denominate as a “7+4 strategy”, also known as Green Mobility Strategy, which consists of electrifying all transportation currently dependent on fossil fuels. The 7 refers to on-road transportation (urban transit, taxis, private cars, tourism and commuting coaches, garbage trucks, urban goods logistics and urban construction logistics) and the 4 refers to off-road environments (harbor, warehouse, mining and airport).

Along with the production of EVs, BYD also provides different charging solutions, like the BYD AC Power-Interface, Bi-Directional Charge/Discharge Technology, Elevated Charging Facility, Vertical Charging Carrousel, Dual Overhead Bus Charging Facility and EV Charging Tower Facility. These charging solutions, allied with the 7+4 strategy, embody one of BYD's “three green dreams”. The other two are mass Solar Power Generation with its high-tech solar panels and efficient Energy Storage Solutions. According to BYD, the idea is to create a Zero-Emission Energy Ecosystem that is self-sufficient and sustainable, relying on complete vertical integration to guarantee clean energy from efficient energy generation and storage to its final use.

In the solar power sector, the BYD “dream” consists of adding quality to Grid Parity by developing its Dual Glass PV Module 2.0 with an advanced solar cell technology that achieves an average efficiency of 18.0%. The BYD New Energy Total Solution comprises PV Module+Tracking System+Inverter+Energy Storage. Its solar panels have received prominent certifications such as UL, CE, TUV, IEC and PV Cycle, and the company also offers the key part of the reverse and the Insulated Gate Bipolar Transistor (IGBT).

The company's next “green dream” is streamlined energy storage for grid operations and renewable balancing. For grid operations, the company is working toward building smarter grids, discharging them during high power demand and charging during lower power demand with a shorter response time of just 4ms (which improves the transmission line and the equipment lifetime). China State Grid's 6MW/36MWH Project (energy storage station) and Chevron 4MWH Project in San Francisco (mobile energy storage station) are representative of the company's efforts to build this new platform, as well as providing home energy storage systems as an additional component.

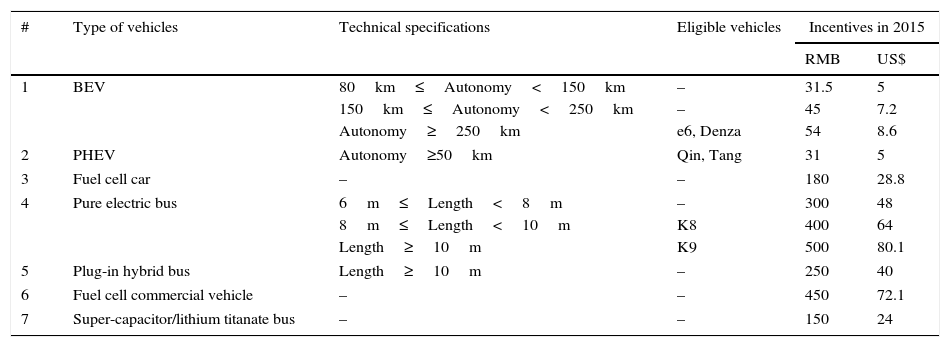

Chinese government subsidies for the EV industryThe support of local and central governments in China has been central to BYD's expansion. The electrified transportation dream and the 7+4 EV strategy are supported by subsidies, which stimulate the production and commercialization of different types of EVs. Table 2 refers to the incentives that the central government provides for the purchase of electric vehicles among them the purchase of the pure electric BYD e6.

Central government incentives and eligible BYD models.

| # | Type of vehicles | Technical specifications | Eligible vehicles | Incentives in 2015 | |

|---|---|---|---|---|---|

| RMB | US$ | ||||

| 1 | BEV | 80km≤Autonomy<150km | – | 31.5 | 5 |

| 150km≤Autonomy<250km | – | 45 | 7.2 | ||

| Autonomy≥250km | e6, Denza | 54 | 8.6 | ||

| 2 | PHEV | Autonomy≥50km | Qin, Tang | 31 | 5 |

| 3 | Fuel cell car | – | – | 180 | 28.8 |

| 4 | Pure electric bus | 6m≤Length<8m | – | 300 | 48 |

| 8m≤Length<10m | K8 | 400 | 64 | ||

| Length≥10m | K9 | 500 | 80.1 | ||

| 5 | Plug-in hybrid bus | Length≥10m | – | 250 | 40 |

| 6 | Fuel cell commercial vehicle | – | – | 450 | 72.1 |

| 7 | Super-capacitor/lithium titanate bus | – | – | 150 | 24 |

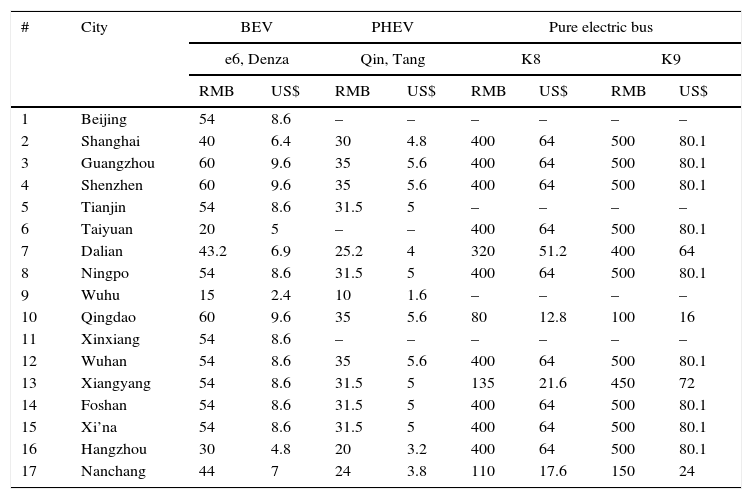

In addition to central government incentives, many major Chinese cities encourage the production and marketing of pure electric and/or hybrid vehicles in their districts. Typically, tax incentives are given to local automakers, which are based in the city itself or its province. Gong et al. (2013) argue that local governments should end protectionist measures in the electric vehicle segment. Existing policies and incentive programs create subsidies only to areas where vehicles are produced, which may be warding off investors from other Chinese regions as well as international automakers. There is some limited evidence that this is changing. In the case of BYD, various local governments in different localities offer incentives for those purchasing the company's BEV and PHEV models as can be seen in Table 3.

Incentives of local governments to market models of BYD (in thousands).

| # | City | BEV | PHEV | Pure electric bus | |||||

|---|---|---|---|---|---|---|---|---|---|

| e6, Denza | Qin, Tang | K8 | K9 | ||||||

| RMB | US$ | RMB | US$ | RMB | US$ | RMB | US$ | ||

| 1 | Beijing | 54 | 8.6 | – | – | – | – | – | – |

| 2 | Shanghai | 40 | 6.4 | 30 | 4.8 | 400 | 64 | 500 | 80.1 |

| 3 | Guangzhou | 60 | 9.6 | 35 | 5.6 | 400 | 64 | 500 | 80.1 |

| 4 | Shenzhen | 60 | 9.6 | 35 | 5.6 | 400 | 64 | 500 | 80.1 |

| 5 | Tianjin | 54 | 8.6 | 31.5 | 5 | – | – | – | – |

| 6 | Taiyuan | 20 | 5 | – | – | 400 | 64 | 500 | 80.1 |

| 7 | Dalian | 43.2 | 6.9 | 25.2 | 4 | 320 | 51.2 | 400 | 64 |

| 8 | Ningpo | 54 | 8.6 | 31.5 | 5 | 400 | 64 | 500 | 80.1 |

| 9 | Wuhu | 15 | 2.4 | 10 | 1.6 | – | – | – | – |

| 10 | Qingdao | 60 | 9.6 | 35 | 5.6 | 80 | 12.8 | 100 | 16 |

| 11 | Xinxiang | 54 | 8.6 | – | – | – | – | – | – |

| 12 | Wuhan | 54 | 8.6 | 35 | 5.6 | 400 | 64 | 500 | 80.1 |

| 13 | Xiangyang | 54 | 8.6 | 31.5 | 5 | 135 | 21.6 | 450 | 72 |

| 14 | Foshan | 54 | 8.6 | 31.5 | 5 | 400 | 64 | 500 | 80.1 |

| 15 | Xi’na | 54 | 8.6 | 31.5 | 5 | 400 | 64 | 500 | 80.1 |

| 16 | Hangzhou | 30 | 4.8 | 20 | 3.2 | 400 | 64 | 500 | 80.1 |

| 17 | Nanchang | 44 | 7 | 24 | 3.8 | 110 | 17.6 | 150 | 24 |

As seen in Table 3, the e6 model has a local incentive of US$ 8646 in Beijing. Besides the cash incentive, the Beijing Administration plans to increase the number of recharging stations in the city from 20 to 100 to provide consumers with more locations to recharge their electric cars. Reducing battery manufacturing costs and expanding EV charging infrastructure remain as challenges for widespread use of electric cars in China. The priority to expand fleets of electric vehicles cannot rely on subsidies indefinitely, a fact that BYD (2015a, 2015b) recognizes in stating that “phasing out EV subsidies must be gradual, considering market maturity and consumption of its sustainable solutions”.

With or without government subsidies, Lu, Rong, You, and Shi (2014) consider that project demonstration is one of the major components to increase public awareness and stimulate stakeholders’ role transformation, especially regarding the need to make further infrastructure investments and expand energy supplies. Since the beginning of several large-scale demonstration projects, the EV industry in China has made great progress. Public procurements, arising mainly from public transportation projects, have been subsidizing the expansion of the industry given the high production costs for companies until a more optimal scale is reached.

BYD case has included as a part of its strategy the need to improve the public and government awareness in China as well as other countries and cities around the world on the potential benefits from the development and expansion of the EV industry. BYD (2015b) has been expanding its national as well as international presence. It has signed cooperation agreements with the taxis fleet of Montevideo, Uruguay (with 50 vehicles until August 2015) and Bogota, Colombia (with 45 EVs since 2012) to help promote consumer and public authority awareness of the industry. It has also entered into partnerships with the public sector to introduce electric buses as part of the public transportation system. The company has deployed EV operated buses in Campinas, Brazil (10 buses until July 2015), Kuala Lumpur, Malaysia (15 fully electric buses until June 2015) and London, UK (starting in October 2015).

Conclusion and policy implicationsCreating a substitute for internal combustion vehicles is a major technological challenge even more so for firms and governments in developing economies. The Chinese auto industry has been seeking to improve technologies used in electric cars just as the Japanese consumer electronics industry improved the technology in the 1970s and 1980s. Efforts are being made to develop the main components of the electric car: the battery, its management and powertrain systems. Moreover, Chinese firms and governments are also investing in this venture and contributing to the expansion of the incipient infrastructure, i.e., charging stations, as these are essential if EVs are to become more widely adopted in transportation in China.

Bakker, Maat, and van Wee (2014) study the strategies of relevant stakeholders regarding the development and commercialization of EVs for the case of Netherlands. They identified some conflicts of interest among different stakeholders that seem to be present in the case of Chinese stakeholders. To keep the momentum for electric vehicles expansion, conflicts must be reduced at the same time that cooperation among different partners must be deepened. BYD is a case in point of a company that is investing in supplying solutions and not just products. While producing EVs, the company is also producing the most expensive part of these vehicles – the batteries and infrastructure equipment. At the same time, the company is also investing in developing solar technology in order to ensure that its technologies are ecologically sustainable.

Even with central and local government subsidies, BYD's EV production and marketing is still in an embryonic stage. However, given the exponential growth of the sector in China and the rest of the world, BYD is progressively seeking to deepen the technological developments that the industry demands, particularly in battery production. Expanding its solar energy sector is also helping to search for solutions suitable to satisfy consumer demands and environmental problems. The company is also rapidly internationalizing its EV operations, as stated by one of the executives, to explore the pioneering advantages in this emerging automotive segment both in China and abroad.

Research on the internationalization strategies in the emergent EVs industry being pursued by fast movers like BYD deserves to be further investigated. Future research should be directed at more in-depth case studies analyzing the company's performance in local and foreign markets. Specifically, further research is needed to understand if the vertical integrated structure of production of EVs that has driven the company's expansion in the Chinese market is able to continue as government subsidies are reduced. In foreign markets, case studies of BYD's investments could help to identify which factors (the gains from local production, the reduction of costs for batteries, the expansion of infrastructure, etc.) are most critical for the consolidation of the EVs segment. Beyond BYD, further research is also needed on what other Chinese companies as well as global automakers are doing to leverage the development of the EVs industry. These questions are a promising research agenda that should be pursued in the near future.

Conflicts of interestThe authors declare no conflicts of interest.

This research was undertaken with support from the National Council for Scientific and Technological Development – Brazil (CNPq), process n. 470382/2014-7. The authors acknowledge CNPq for the financial support and BYD management for their collaboration.

Peer Review under the responsibility of Departamento de Administração, Faculdade de Economia, Administração e Contabilidade da Universidade de São Paulo – FEA/USP.