The technological improvement coupled with the growing use of smartphones has, among other functions, facilitated purchase and payment transactions through the mobile phone. This phenomenon occurs worldwide and provides individuals more flexibility and convenience in carrying out their daily activities. This article aims to evaluate the intention of adopting a future mobile payment service from the perspective of current Brazilian consumers of mobile phones, based on the Unified Theory of Acceptance and Use of Technology (UTAUT). The survey was carried out with mobile customers of a telecommunications company that operates in southeastern Brazil, with a valid sample of 605 respondents. Using structural equation modeling, 76% of behavioral intention was explained through performance expectation, effort expectation, social influence and perceived risk. Perceived cost was found not statistically significant at the level of 5%. This result serves as a guide to participants in the payments market to develop a service for mobile payments of good performance, easy to use, secure and promotes the action of the social circle of the individual at a fair price, in other words, that meets needs and expectations of today's mobile phone users. As well as serves as a stimulus to the development of communication and marketing strategies that highlight these positive attributes and awaken the intention of adoption of the service by the wider range of people as possible.

Understanding the impacts caused by technological innovations in people's lives is something that stimulates the interest of many social science researchers over time. When these innovations are linked to individual mobility,1 they bring benefits to the social and professional life. As examples of transformative mobile technologies, we have mobile telephony and the Internet itself, whose importance to contemporary society is the target of many researches.

Mobile communication services are considered portable ubiquitous technologies, and the users have a close personal relationship with the devices involved. The cell phone, especially the smartphone, is the centerpiece in this context and the target of the convergence of communication and entertainment functions.

These mobile services are associated to other technologies ranging from network infrastructure to software and communication equipment (Jarvenpaa & Lang, 2005; Rao & Troshani, 2007). Flexibility, mobility and efficiency are among the attributes that solve everyday problems or satisfy the wishes of their users (Rao & Troshani, 2007).

Companies related to the sectors of communication and payments are focused on good business opportunities that are a result of the fulfillment of these concerns and needs (Bitner, 2001; Overbr, 2014; Rao & Troshani, 2007). Among the services offered today, such as access to information, entertainment and transaction permissions (ticket booking, tracking orders, banking services and verification of records), there is a trend called ‘mobile payment’ (or m-payment). This process is aimed at the purchase, payment or transfer of values done through the mobile device without the need for cash or the participation of banking institutions (Bitner, 2001; Dahlberg, Mallat, Ondrus, & Zmijewska, 2008; Diniz, Albuquerque, & Cernev, 2011; Overbr, 2014; Rao & Troshani, 2007; Zhong, 2009). Mobile devices such as cell phones or smartphones serve as a means by which payments can be initiated, enabled and/or confirmed (Karnouskos & Fokus, 2004).

Among the main drivers to develop this business model in Brazil, are the modernization of operations related to that market and the high penetration rate of mobile telephony, with a density around 132 accesses to the network for each 100 inhabitants at the end of 2012 (ANATEL, 2012; TELECO, 2014), i.e. more than 1 cellphone per person. In addition, there is the incentive of governmental policies of recent years, as the provisional measure 615 of 5/17/2013, which launched the foundation for the regulation of arrangements and non-financial payment institutions and of federal financial inclusion policies, such as: regularization of microfinance, mobile payments and micro finance institutions, among others (BACEN, 2010).

From this context, this study seeks to clarify the relationship between important background factors before the intention of adoption of mobile payment, aiming to assess the purpose of adopting this service by current Brazilian users of mobile telephony.

This article is part of a research set on consumer behavior, where different authors, through varied models and factors have sought to explain the behavior of individuals in face of technological innovations. The present study uses the UTAUT theory as a starting point to answer the question proposed.

This work comes from the observation of the growing interest in Brazil and in the world for mobile payment services, along with the researchers’ belief that to meet the technological challenges and structure the market, you have to assess the intention of the consumers in adopting such a service.

Since it is a new service in the Brazilian context, it is necessary, notwithstanding the positive points for the main players involved, to assess consumers’ reaction, attitude, interest and intent in adopting a future mobile payment service. In this sense, the work extends the number of publications found on the theme in Brazil (two – SPELL base between 2010 and 2014) and contributes to the formation of the business strategies of the sector.

The article is organized as follows: first, the introduction and theoretical reference are presented; followed by the methodological aspects, including data collection and definition of the scales. In the following section, the results are presented and analyzed. Finally, the final considerations are drawn up.

Theoretical frameworkThe first subsection incorporates the main authors and general concepts associated with consumer behavior, and then, in second subsection, be present a retrospect of the development of theories and factors of intent associated with the adoption and use of technology. In third subsection, some of the latest researches on mobile payments and their results are presented. Finally, last subsection specifically addresses the (UTAUT) theory used as the foundation to answer the research problem.

Introduction to studies on consumer behaviorHoward and Sheth (1969) explained consumer behavior based on rationality, on the organization of the decision-making process and external impacts that stimulate the individual to purchase. Commercial and social stimuli (inputs) promote the reaction of individuals regarding choices or purchases (results).

The stimuli, characterized by the expectations generated by the marketing area, such as performance, ease of use, pricing, quality, among others, move consumers to collect and process information about the goods, perceive risks and costs and synthesize the learning step. Later, the individual looks at all alternatives and a mental predisposition is awakened, favorable or unfavorable, the attitude, and then the intention of adoption appears. That feeling, linked to environmental (social influence) and individual (motivation, value) influences will determine the decision to purchase (Engel, Blackwell, & Miniard, 1986; Solomon, 2002).

The degree of personal involvement in the decision-making process is a reflection of the perceived risk and the importance given to the object of the decision, considering the needs, interests, and personal values of individuals (Assael, 1998; Blackwell, Miniard, & Engel, 2008; Coulter, Price, & Feick, 2003).

Studies have been conducted over time in an attempt to identify the most relevant factors in the behavior of adoption and use of new technologies.

Retrospect on studies of acceptance and use of technologyThe search for understanding of the acceptance process and intended use of technological innovations guided works in the 1990s. In that context, variables related to the expectations, individual and environmental influences were incorporated (Agarwal & Prasad, 1997; Bagozzi & Lee, 1999; Davis, Bagozzi, & Warshaw, 1989).

From the years 2000, studies related to the Internet and mobile devices and services gained more attention (Bitner, 2001; Garfield, 2005; Gouveia & Coelho, 2007; Im, Hong, & Kang, 2011; Jarvenpaa & Lang, 2005; Limeira, 2001; Oye, Iahad, & Rahim, 2014; Zhou, Lu, & Wang, 2010).

Gouveia and Coelho (2007) analyzed the purchase decision factors and adoption of mobile electronic services of potential consumers. According to these authors, the expectation of economic profitability, low initial cost, social prestige, time and effort economy and the immediate and guaranteed reward must be especially present in the process of development and promotion of these technological services. The perception of compatibility of innovation with needs, values and technological experiences passed on from potential adopters also proved to be important.

Still on the topic of adding value to consumers, more specifically of mobile location services, Zhou, Lu and Wang (2010) resorted to the integration between the UTAUT perspectives and privacy risk to examine the adoption of this service and understand its low use among users of the two main telecom operators in China (China Mobile and China Unicom). The results showed that the intended use of that service was associated with the performance expectation, enabling conditions and the risk of loss of privacy perceived by the consumers.

Through an integrated model between the ECM – Expectation-Confirmation Model and the TAM – Technology Acceptance Model, Chong (2013) made a specific examination of the intentions of continuity of use of the m-commerce for Chinese consumers. Such combination allowed the inclusion of important variables on intended use of information technology such as confidence, cost and perceived satisfaction.

The author took into account the actual experience of using m-commerce to confirm or refute the initial expectations of the users of the service. He showed that consumer satisfaction is a relevant driver of continuity of use, but that trust is the most important factor in determining the intention of continued use by the users. For relatively new services, consumers want security and privacy. The results about the effect of perception of ease of use pointed to an effort of continuous learning by the users.

Regarding costs, the author understood that service providers have to analyze their forms of pricing in the light of the competition and the availability of free applications. The findings also support the idea that positive emotional reactions, such as pleasure and fun, would increase the continuity of intended use.

Finally, his study showed that the initial expectations of the consumers change with the experience of use of technology, considering the ease, usefulness, pleasure provided, confidence and the perception of a fair and reasonable price.

In a work with academics, Oye et al. (2014) showed the relevance of UTAUT in anticipation of acceptance and use of information and communication technologies by the staff of a University of Nigeria (ADSU – Adamawa State University). The case studied showed the intention to use technologies that are easy to use and promote better professional performance. The results highlighted the expectation of effort and social influence as the main predictors and put time and technical support as the main barriers to the acceptance and use of technology.

In another work, Martins, Oliveira, and Popovic (2014) developed a conceptual model that combines the Unified Theory of Acceptance and Use of Technology (UTAUT) with the perceived risk to explain behavioral intention and Internet Banking Use Behavior. The survey was conducted with students and former students of a Portuguese University and concluded about the importance of the performance expectation, effort expectation, social influence and risk factors in the prediction of Intention.

In the same line of analysis, Shafinah, Sahari, Sulaiman, Yusoff, and Ikram (2013) selected studies and models (TAM, TAM2, UTAUT and C-TAM-TPB) to determine behavioral intention aiming to identify the main determinants of intention of use of mobile services. They showed that the constructs perceived usability and perceived ease of use were the most used basic factors to discover behavioral intentions of users of m-services. These factors are also present in the model proposed by Venkatesh, Morris, Davis, and Davis (2003).

Over time, the theoretical models attempting to explain individual behavior regarding technological innovation were applied in new contexts and different stages of the consumer decision process. We highlight the recurring use of the UTAUT model in the last 10 years.

Recent research on adoption and usage of mobile paymentThe most common possibilities of use of mobile payment appear in various payment scenarios. As examples we have payments for digital content (e.g. call tones, logos, news, music or games), tickets, parking tickets, shipping fees or access to electronic payment services to pay bills or invoices. As for the payments for products, it can be used in vending machines or terminals installed at points of sale (POS) (Dahlberg et al., 2008).

Dahlberg et al. (2008) reviewed the literature on mobile payments services. The authors found that the contemporary works on mobile payment were predominantly related to technology and consumer perspectives. They suggested as a critical theme, the research of the portfolio of payment instruments and services, whose lack of clarity in the relationship between mobile payments and traditional methods requires deepening. They also considered that the mobile service aimed at B2B commerce is little explored and that more theory based on empirical research is needed to improve the current understanding of mobile payment service markets. Finally, the researchers felt that business models related to these services need to evolve from limited proprietary solutions to cooperative and standardized solutions to achieve success.

A model for acceptance of the use of mobile payment was developed by Lu, Yang, Chau, and Cao (2011) to investigate whether the confidence of Chinese consumers in relation to Internet payment services could influence the initial trust in outsourced mobile payment services. The interaction of these beliefs with positive and negative factors affecting the adoption of these services makes up the decision-making model in the process of adoption of innovations. The authors concluded that initial confidence directly and indirectly affects the intentions of consumers in the use of mobile payment services. On the other hand, perceptions of cost and risk reduce this same intention. Furthermore, the study showed significant differences in the magnitude of these effects among students and workers.

In turn, Yang, Lu, Gupta, Cao, and Zhang (2012) sought to identify the determinants of pre-adoption of mobile payment services and explore the temporal evolution of these factors before and after the adoption of the service. In a holistic perspective, emphasis was given on behavioral beliefs, social influences and personal characteristics.

The authors performed a survey of 483 potential and 156 current users of the service in China. At the end, for potential users, they confirmed the significant influence of the factors analyzed, with habit compatibility being the most relevant of the behavioral beliefs. For current users, perceived cost was not significant for determination of behavioral intention, contrary to the understanding of other authors (Featherman & Pavlou, 2003; Lu et al., 2011; Martins et al., 2014; Yang et al., 2012). On the other hand, the relative advantage was the most important factor, followed by perceived risk and compatibility. Overall, the authors found that there is variation in behavioral intention throughout the stages of pre and post adoption.

From the entrepreneurs’ point of view, a vision of Brazilian executives on the national market of mobile payments was discussed by Barbosa and Zilber (2013), with emphasis on the adoption of this technology by consumers. The exploratory study also contextualized and described the participants of this universe, whose interviews led to the construction of importance-performance matrices for four solutions being deployed in Brazil. The authors identified, especially, the need for actions related to convenience, compatibility with current user habits and ease of use to boost adoption of this innovation.

Unified Theory of Acceptance and Use of Technology (UTAUT)Technology acceptance research produced several competing models, each with a set of different determinants. The work of Venkatesh et al. (2003) emerged with the aim of reviewing and discussing the literature of adoption of new information technology from the main existing models, comparing them empirically, formulating a unified model and validating it empirically.

Venkatesh et al. (2003) formulated and validated the Unified Theory of Acceptance and Use of Technology (UTAUT) from the integration of elements of eight prominent models related to the topic after empirical comparisons between them. The eight models were tested from a sample of four organizations for six months, with three points of measurement, and explained 53% of the variance in intent to use information technology. By contrast, the UTAUT formulated from four major constructs of intent to use and four key relationships moderators explained 70% of variation when applied to the same database. According to the research, the new model provided an important managerial tool for evaluation and construction of strategies for introducing new technologies.

The eight models revisited by Venkatesh et al. (2003) are the Theory of Rational Action (TRA), the Technology Acceptance Model (TAM/TAM2), the Motivational Model (MM), the Theory of Planned Behavior (TPB/DTPB), a model agreement between the Technology Acceptance Model and the Theory of Planned Behavior (C-TAM-TPB), the Model of PC Usage (MPCU), the Innovation Diffusion Theory (IDT) and the Social Cognitive Theory (SCT).

According to the UTAUT, the intended use of information technology (IT) can be determined by three points: expected performance, expected effort and social influence. Intent to use has influence over the actual behavior, with a view to the adoption of technology enabling conditions. The fourth construct, enabling conditions, specifically precedes use behavior (Venkatesh et al., 2003).

Given the large amount of citations in scholarly works since the formulation of the UTAUT model, a systematic review of these was performed by Williams, Rana, Dwivedi, and Lal (2011) in an attempt to understand its reasons, use, and adaptations of the theory. In addition, he reviewed variations of use and theoretical advances. A total of 870 citations of the original article were identified in academic journals, where we managed to get 450 complete articles.

The study by Williams et al. (2011) reveals the use of various external variables in conjunction with the constructs of the UTAUT in different selected studies. Regarding the use of UTAUT, the authors concluded that:

- -

Most of the articles that cited the model did so to support an argument and not to use it effectively;

- -

Many studies used it partially, sometimes utilizing only some of the constructs;

- -

A small number of articles employed all constructs, but without necessarily considering the moderator factors;

- -

There seems to be a trend of increased use of variables and external theories alongside the UTAUT for explanations regarding the adoption and use of technologies.

Such findings support the adaptation of the UTAUT model to show the relationship between important factors preceding the intent of adoption and use of mobile payment for a group of Brazilian users of mobile telephony.

Methodological aspectsWe performed a survey with clients of a Brazilian TELECOM operator with more than a million mobile phone customers mainly in the Midwest and Southeast regions of the country. All mobile phone users with the company were considered potential mobile payment users, regardless of the type of telephone service (pre or post-paid), banking relationship, income, age or previous mobile phone user experience. Today, this theme relates to the possibility of transformation of the daily routine of any individual, since they promote the facilitation of financial transactions and consumption in general through the phone.

The sampling procedure used was the non-probabilistic for convenience (Malhotra, 2001) due to the ease of access of researchers to the database of Telecom. 30,000 emails were generated randomly and sent to mobile phone users. 750 responses were collected, of which 605 were validated.

We applied a structured online questionnaire, based on the original work of Venkatesh et al. (2003) with the addition of cost and perceived risk (Shafinah et al., 2013). The scales were, in large part, translated, reviewed and validated by a translator. The reverse translation was dismissed due to the simplicity of the texts used.

The questionnaire was divided into three parts: the first, about the experiences and behavior of users of mobile telephony (12 questions); the second, with a measuring range of variables (24 questions, 23 of them being 7 point Likert type), and the third, with demographic data (6 questions), in a total of 42 questions.

The data collection took place in the period between 01 August and 22 September 2014. The online questionnaire was developed through Survey Monkey and the responses were managed by its report platform.

Minor adjustments were made during pre-testing, mostly for simplification and better drafting of statements and items of the scales.

Although the scales were adapted from already validated research, it needed to be validated by experts: two experts in mobile telephony, one in marketing campaigns of the TELECOM operator and five PhD researchers with remarkable experience in studies on consumer behavior.

Methods and techniquesStructural equation modeling (SEM) was used to test the model (Hair, Babin, Money, & Samouel, 2005) and analyze the relations between latent variables: performance expectation, effort expectation, social influence, perceived cost and perceived risk and the dependent variable behavioral intention.

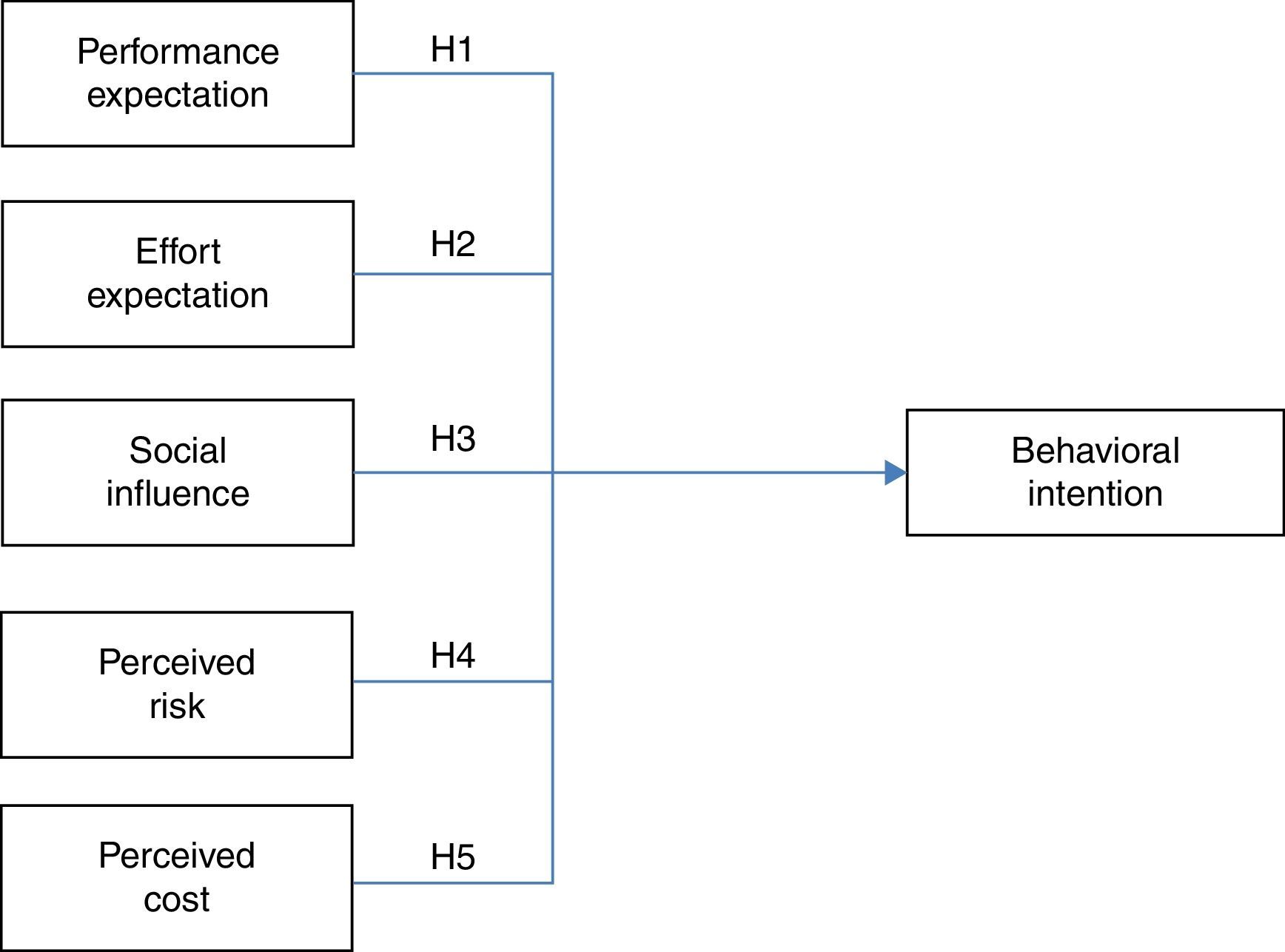

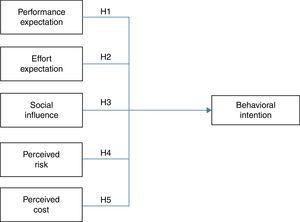

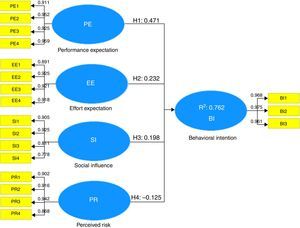

From the theoretical basis the following assumptions were built:H1 Performance expectation has significant and positive relationship with the intention of adopting mobile payment. Effort expectation has significant and positive relationship with the intention of adopting mobile payment. Social influence has positive and significant relationship with the intention of adopting mobile payment. Perceived risk has negative and significant relationship with the intention of adopting mobile payment. Perceived cost has negative and significant relationship with the intention of adopting mobile payment.

Fig. 1 presents the model with its assumptions and constructs proposed in the present work.

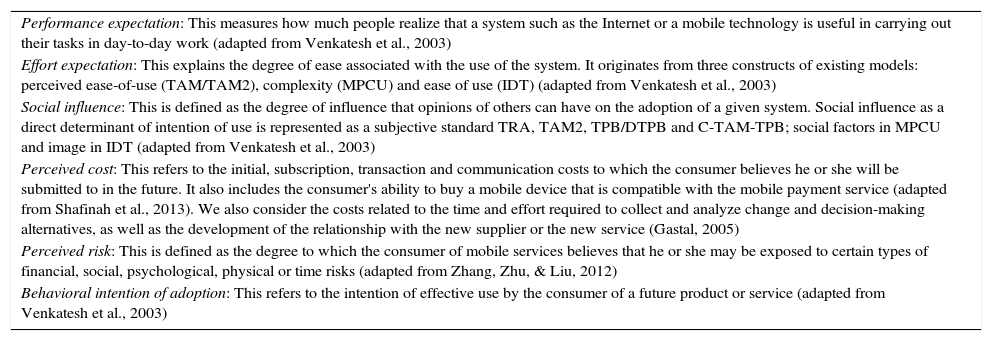

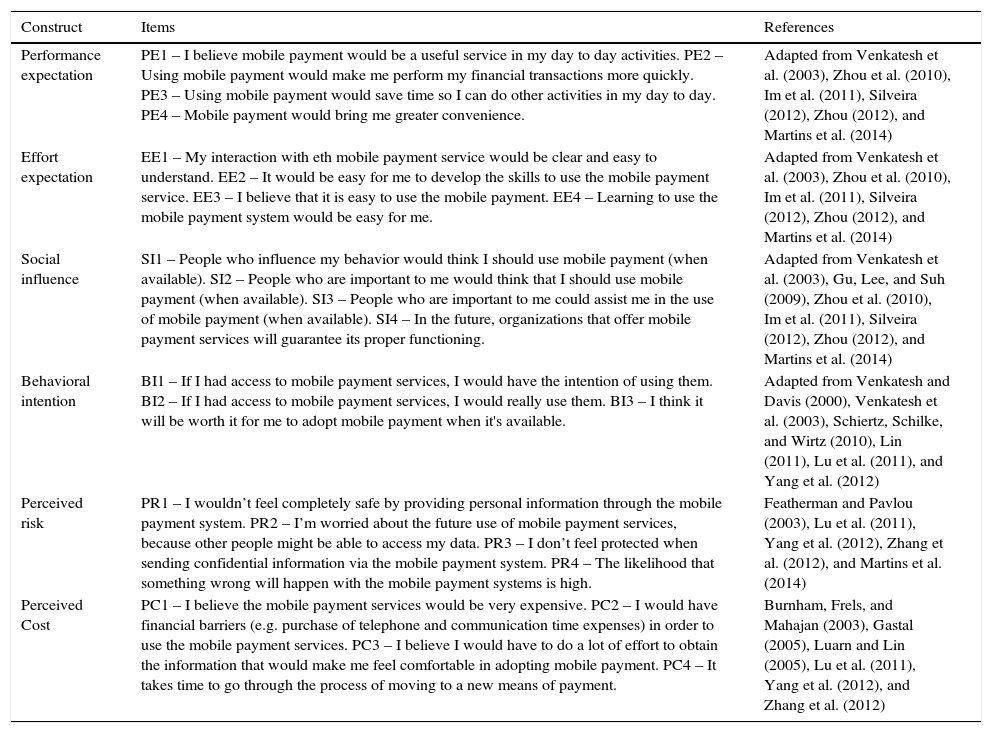

The definition of each construct is presented in Table 1.

Definitions of the constructs.

| Performance expectation: This measures how much people realize that a system such as the Internet or a mobile technology is useful in carrying out their tasks in day-to-day work (adapted from Venkatesh et al., 2003) |

| Effort expectation: This explains the degree of ease associated with the use of the system. It originates from three constructs of existing models: perceived ease-of-use (TAM/TAM2), complexity (MPCU) and ease of use (IDT) (adapted from Venkatesh et al., 2003) |

| Social influence: This is defined as the degree of influence that opinions of others can have on the adoption of a given system. Social influence as a direct determinant of intention of use is represented as a subjective standard TRA, TAM2, TPB/DTPB and C-TAM-TPB; social factors in MPCU and image in IDT (adapted from Venkatesh et al., 2003) |

| Perceived cost: This refers to the initial, subscription, transaction and communication costs to which the consumer believes he or she will be submitted to in the future. It also includes the consumer's ability to buy a mobile device that is compatible with the mobile payment service (adapted from Shafinah et al., 2013). We also consider the costs related to the time and effort required to collect and analyze change and decision-making alternatives, as well as the development of the relationship with the new supplier or the new service (Gastal, 2005) |

| Perceived risk: This is defined as the degree to which the consumer of mobile services believes that he or she may be exposed to certain types of financial, social, psychological, physical or time risks (adapted from Zhang, Zhu, & Liu, 2012) |

| Behavioral intention of adoption: This refers to the intention of effective use by the consumer of a future product or service (adapted from Venkatesh et al., 2003) |

The structural equation model is formed by the junction of two models, the measurement and the structural model (Hair, Black, Babin, Anderson, & Tatham, 2009).

After the analysis of the relationships represented in theoretical model, the proportion of variability (R2) of the dependent construct behavioral intention was evaluated.

The method chosen to estimate the SEM was the partial least squares (PLS), for being more flexible (Chin, 1998) and the Smart PLS 3.0 software was used for the evaluation of the theoretical model proposed. We followed the two phases proposed by Henseler, Ringle, and Sinkovics (2009):

The first, the assessment of the measurement model, verified the reliability of the internal consistency of the constructs through composite reliability (Chin, 1998), which must have values greater than 0.7. Then we analyzed the Convergent Validity to analyze the unidimensionality of the constructs by means of average variance extracted (AVE), with a minimum value of 0.5 (Fornell & Larcker, 1981). Finally, discriminant validity was assessed by the method of crossed load values (Henseler et al., 2009) to verify that the square roots of the AVE's were larger than the correlations between the constructs.

The second phase, the assessment of the structural model, started from obtaining the coefficient of determination (R2) achieved in the relationship between the independent variables and the dependent variable (behavioral intention) to indicate its variability, which is explained by the dependent variables. Its value ranges from 0 to 1 and the closer to 1, the greater the proportion explained.

The Kolmogorov–Smirnov test was used to determine whether the variables presented evidence of univariate normal distribution.

ScalesTable 2 summarizes the items related to each construct of the proposed model and studies that served as reference for their adaptation.

Measuring scales and references for the proposed constructs.

| Construct | Items | References |

|---|---|---|

| Performance expectation | PE1 – I believe mobile payment would be a useful service in my day to day activities. PE2 – Using mobile payment would make me perform my financial transactions more quickly. PE3 – Using mobile payment would save time so I can do other activities in my day to day. PE4 – Mobile payment would bring me greater convenience. | Adapted from Venkatesh et al. (2003), Zhou et al. (2010), Im et al. (2011), Silveira (2012), Zhou (2012), and Martins et al. (2014) |

| Effort expectation | EE1 – My interaction with eth mobile payment service would be clear and easy to understand. EE2 – It would be easy for me to develop the skills to use the mobile payment service. EE3 – I believe that it is easy to use the mobile payment. EE4 – Learning to use the mobile payment system would be easy for me. | Adapted from Venkatesh et al. (2003), Zhou et al. (2010), Im et al. (2011), Silveira (2012), Zhou (2012), and Martins et al. (2014) |

| Social influence | SI1 – People who influence my behavior would think I should use mobile payment (when available). SI2 – People who are important to me would think that I should use mobile payment (when available). SI3 – People who are important to me could assist me in the use of mobile payment (when available). SI4 – In the future, organizations that offer mobile payment services will guarantee its proper functioning. | Adapted from Venkatesh et al. (2003), Gu, Lee, and Suh (2009), Zhou et al. (2010), Im et al. (2011), Silveira (2012), Zhou (2012), and Martins et al. (2014) |

| Behavioral intention | BI1 – If I had access to mobile payment services, I would have the intention of using them. BI2 – If I had access to mobile payment services, I would really use them. BI3 – I think it will be worth it for me to adopt mobile payment when it's available. | Adapted from Venkatesh and Davis (2000), Venkatesh et al. (2003), Schiertz, Schilke, and Wirtz (2010), Lin (2011), Lu et al. (2011), and Yang et al. (2012) |

| Perceived risk | PR1 – I wouldn’t feel completely safe by providing personal information through the mobile payment system. PR2 – I’m worried about the future use of mobile payment services, because other people might be able to access my data. PR3 – I don’t feel protected when sending confidential information via the mobile payment system. PR4 – The likelihood that something wrong will happen with the mobile payment systems is high. | Featherman and Pavlou (2003), Lu et al. (2011), Yang et al. (2012), Zhang et al. (2012), and Martins et al. (2014) |

| Perceived Cost | PC1 – I believe the mobile payment services would be very expensive. PC2 – I would have financial barriers (e.g. purchase of telephone and communication time expenses) in order to use the mobile payment services. PC3 – I believe I would have to do a lot of effort to obtain the information that would make me feel comfortable in adopting mobile payment. PC4 – It takes time to go through the process of moving to a new means of payment. | Burnham, Frels, and Mahajan (2003), Gastal (2005), Luarn and Lin (2005), Lu et al. (2011), Yang et al. (2012), and Zhang et al. (2012) |

The sample was identified as predominantly male (71.4%); composed by persons with an age average over 39; more educated, 59.3% with college degrees, and higher purchasing power, more than 90% from classes B and A.

As for mobile telephony use behavior, 58% are postpaid (contract) customers; long time mobile phone users (more than 5 years, 92%); smartphone users (74%) with experience in access and use of Internet services (74%), as well as other instant communication services (whatsapp and SMS). The vast majority said they already have made purchases over the Internet (94%) and access it frequently from their mobile device (66%). The respondents have bank accounts (97%), which seems consistent with their preference for payments through credit (69%) and for paying bills via internet or ATMs (55%). This profile suggests that the sample of the study brings individuals who are prepared for the use of various technologies and data transmission channels currently available for the operation of mobile payments. On the other hand, it also allows us to infer that this group is accustomed to mobile payment services, as well as credit and debit cards, which have more mature processes, i.e. stable, good performance and affordability.

It is important to point out that within that set of people accustomed to technological innovations, especially those related to mobile solutions, there is a portion of individuals with specific needs and expectations. About 25% still use traditional mobile phones and 26% have no access, have some difficulty in accessing or only occasionally access the Internet by cell phone; 26% prefer to pay their bills via bank slip, don’t buy through the internet or seek safer places, from the point of view of economic risk, to pay the traditional bills, such as banks or places that offer banking services (20%). Such a result shows a relevant segment of individuals who also need support on a possible launch of the service in focus.

The Kolmogorov–Smirnov test showed that the variables involved did not present the univariate normal distribution at the 0.05 level. This result does not hinder the study, since the PLS method is robust to non-normality of the data.

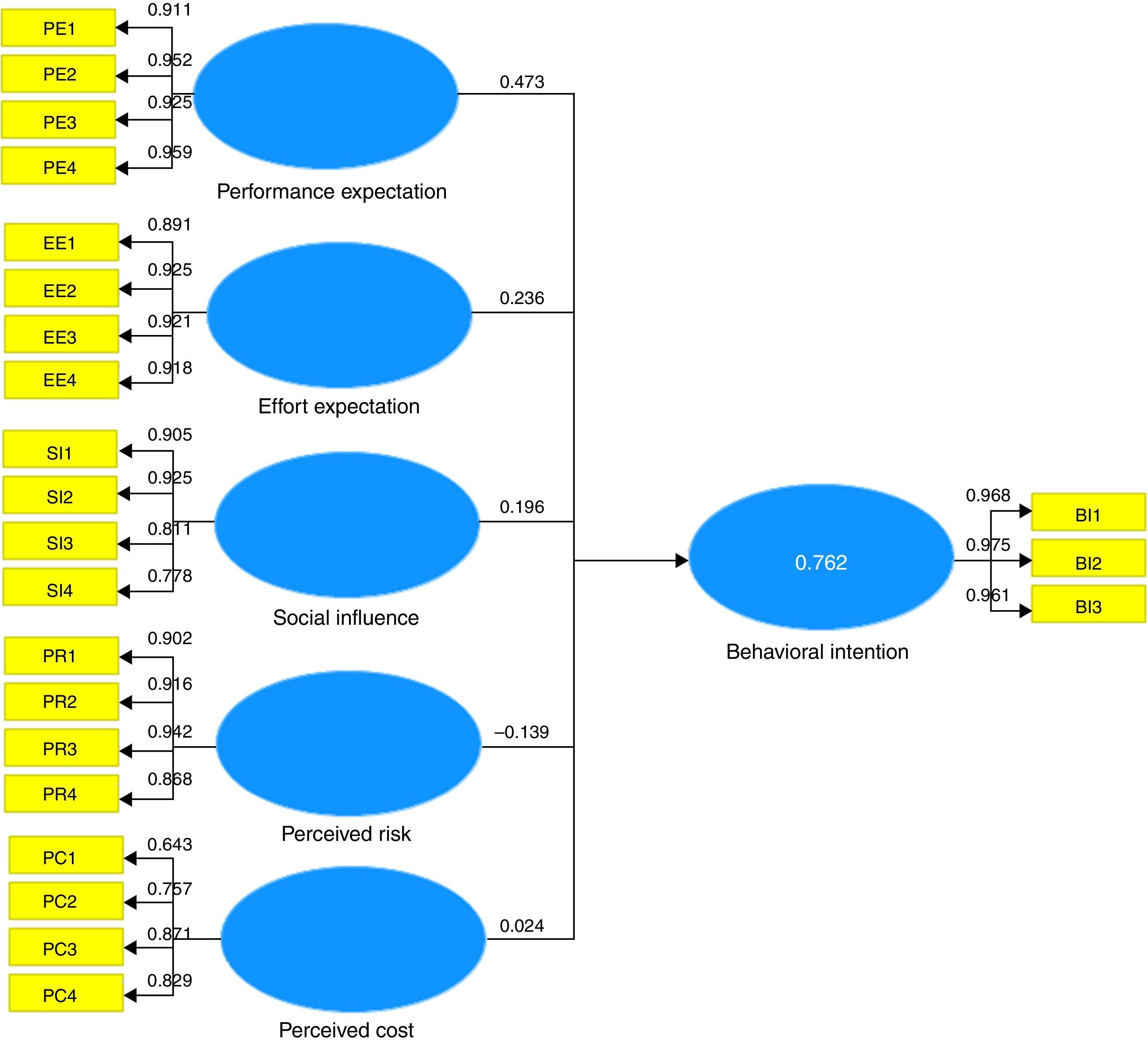

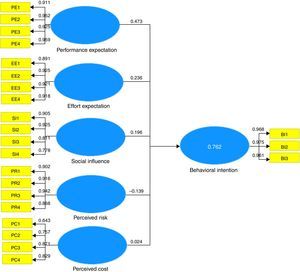

Theoretical model validationThe path diagram shows the relationship between latent variables of the model and behavioral intention. A strong relationship of items with their constructs was observed in the complete model estimated by the SmartPLS software, since the loads shown were factorials above 0.6 (Fig. 2).

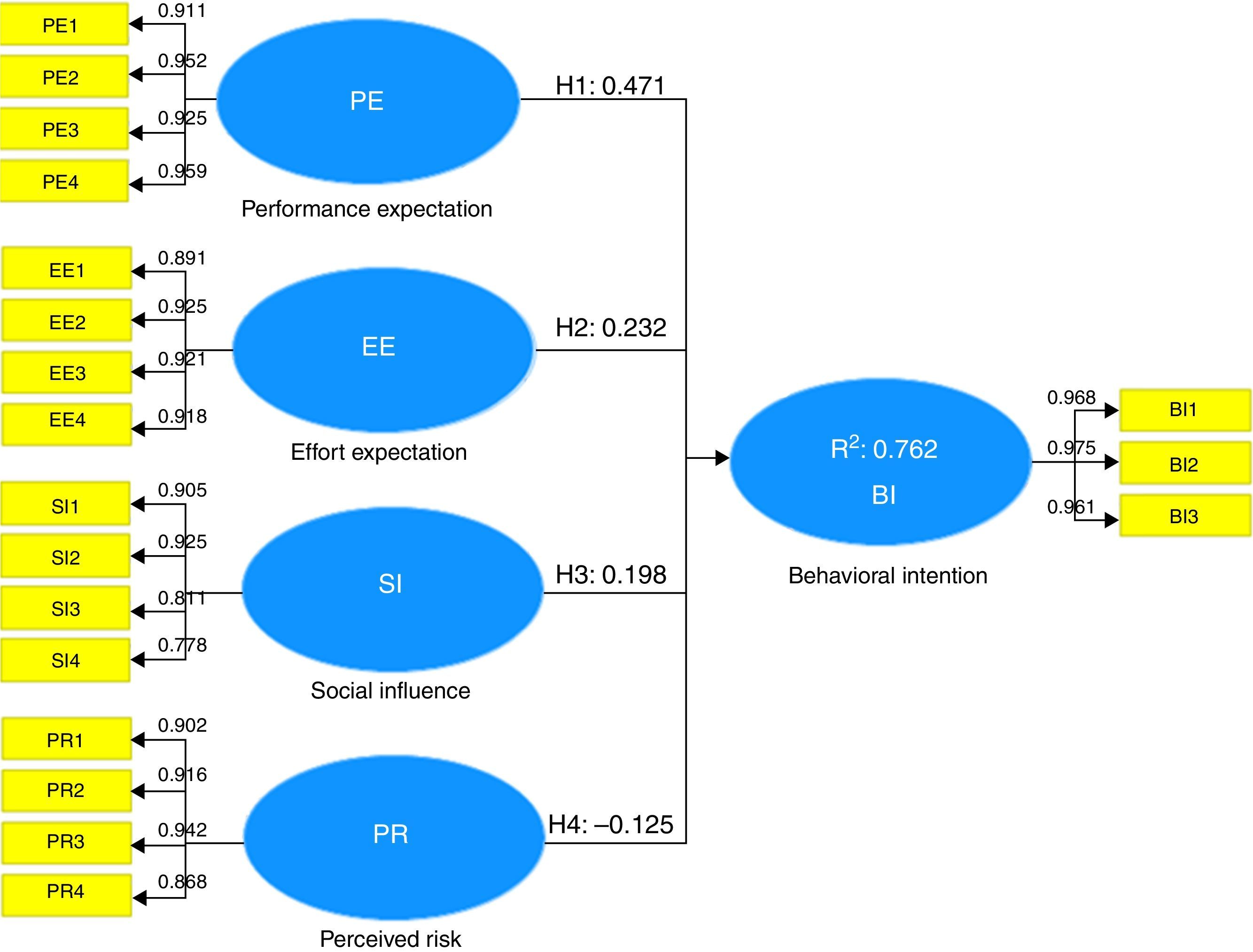

The significance of these loads was evaluated by the bootstrap technique with the same number of cases in the sample. The result of the test of significance of the theoretical model (p-value) revealed the need to remove the perceived cost construct, since its relationship with the variable behavioral intention was not significant (p value >0.05). With the removal of this variable the final model was obtained (Fig. 3).

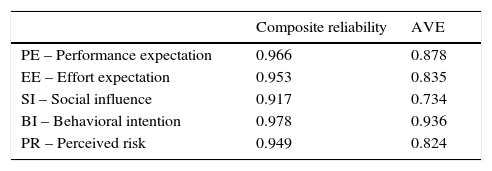

All the constructs presented higher values to the level proposed by Chin (1998) for evaluation of the measurement model, which is 0.7 for composite reliability (Table 3). Besides, they presented convergent validity, with AVE (average extracted variance) above 0.5 (Fornell & Larcker, 1981) and discriminant validity, with validation through the criterion of cross-loads, where each item showed greater factorial load for the construct to which it belongs.

Of the five hypotheses developed for the model proposed, only H5, which posited that ‘perceived cost has negative and significant relationship with the intention of adopting mobile payment’ was not confirmed. All others, H1, H2, H3, and H4 were ratified, showing, according to this study, the four factors of the intention to adopt a future mobile payment service from the perspective of current Brazilian mobile telephony consumers.

Presentation and discussion of the resultsOn the whole, the constructs performance expectation; effort expectation; social influence and perceived risk explained 76.2% (R2) of the variance of intention of adoption of mobile payment.

After the elimination of the perceived cost construct of the fitted model, performance expectation indicated the positive relationship of greater weight (+0.471) with the intention of adoption of mobile payment. Perceived risk presented a negative relationship (−0.125), that is, the higher the risk perceived, the lower the intention of adopting the new product, which is in line with research that showed such variables as two of the main determinants of intention of adoption and use of the technology (Martins et al., 2014; Zhou, Lu, & Wang, 2010).

The perception of risk is present, but without great emphasis, given the maturity and security provided by traditional means of payment, such as credit and debit cards.

As to effort expectation (EE), the result also demonstrated its positive relationship with the behavioral intention (BI) in the study (+0.232). The same effect is found in the works of Chong (2013), Barbosa and Zilber (2013), Oye et al. (2014) and Martins et al. (2014), where it was singled out as one of the greatest determinants of intention to adopt the technology. However, it contrasts Gouveia and Coelho (2007), who did not show this variable as a relevant factor.

The analysis of the social influence factor (IS) also proved to be relevant and with a positive relationship in the prediction of behavioral intention (BI) (+0.198), in the same way that Gouveia and Coelho (2007), Oye et al. (2014) and Martins et al. (2014).

During validation of the theoretical model, we did not find statistical significance at the 5% level for the coefficient perceived cost (CP) in the context of this study, contradicting the results of the work of Chong (2013) and Oye et al. (2014) that point to the opposite direction. On the other hand, our study proved to be in line with the research of Yang et al. (2012). Anyway, the question of costs is associated with the added value of the technological services offered to consumers (Gouveia & Coelho, 2007).

What must be taken into consideration is that mobile payment as a process is still unavailable in large scale in Brazil, that is, the respondents do not have references to evaluate their costs. On this, it is suggested to maintain the perceived cost construct (PC) in the intention to adopt model in future work, given the importance of this variable, which was shown in use experiences (Chong, 2013).

Final considerationsThe article contributes academically in that it brings together, in the same model of intention to adopt, some of the most commonly used constructs in recent literature to predict the adoption of a future mobile payment service, from the perspective of a group of Brazilian mobile telephony consumers. Thus, there is the proposal of a new model for use in different contexts.

In practice, this paper provides information to the business sectors involved to assess the reaction of the market before a possible launch of the referred service and allows them to build their respective strategies of segmentation and communication, from the understanding of the factors that precede intention of adoption.

In another analysis, the data show two distinct segments, from which we understand that it is imperative to create complete and safe solutions for both user profiles, most likely with specific technological resources for both traditional phones and smartphones.

It is important to highlight the complexity of the payment business in Brazil, where there is still a regulatory environment being defined, added to fragmented technological solutions with the participation of different sectors of the economy. In this ecosystem, banks acquisition companies (responsible for the accreditation of business premises for acceptance of electronic payments), commercial establishments, electronic transaction processing companies, Telecom providers, retailers, consumers and support service providers coexist.

The development of mobile payment in Brazil depends on the understanding of the characteristics of this market and the preparation of the internal capacity of organizations interested in this business. There is interest from telecom operators in occupying a central position in this model, awakened by the high penetration rate of mobile telephony. The fact that there are more mobile devices than individuals enables Telecom carriers to dream of fulfilling the requirements of money transfer and payments for general users, particularly the self-employed and people without access to a bank account, either through their post or prepaid plans.

One of the potential market segments for mobile payment is that formed by users who do not have bank accounts: that portion of the population who uses cash, trust credit or other trading currencies. This would facilitate the purchase of their goods and services, since it makes the use of cash on a daily basis unnecessary.

Mobile payment offers benefits such as the opportunity to gain time, convenience and new consumer experiences to users of mobile telephony. On the other end, all players involved in the process of paying – mobile network operators, financial institutions (banks, card companies, payment processors), governments and technology (hardware and software) and service suppliers – can gain from the offer of this new service.

Limitations of the study and suggestions for future researchAs limitations, we can mention that the sample of potential users of mobile payment was restricted, for convenience, to customers of a single telecommunications operator concentrated in cities in the Midwest and Southeast. In addition, there is the possibility of using other relevant factors that enhance the adoption model used. However, even with such constraints, the study results are consistent with the author's expectations and consistent with the reference studies.

Future studies may use samples from other telecommunication companies and other regions of the country or even between different countries, which have deployed this technology or not, and check if the results remain consistent. Among the suggestions of comparative studies is the idea of using the complete model, i.e. including the perceived cost construct, in countries where the mobile payment method is already in operation to view the results related to this variable.

There is also the opportunity, quite promising, to focus the work with the same model proposed on the segment of individuals without banking accounts for comparison.

In addition, the study can be complemented with the evaluation of the impact of the factors prior to the intention of adoption of mobile payment: performance and effort expectations, social influence, perceived cost and risk, under the effect of moderating variables, such as those proposed by Venkatesh, age, gender, experience and willingness to use.

Conflicts of interestThe authors declare no conflicts of interest.

Mobility from Lat. mobilitas – quality or state of what is mobile or that obeys the laws of motion; mobility is the characteristic of being mobile – to go from one side to the other (Alves, 2006).

Peer Review under the responsibility of Departamento de Administração, Faculdade de Economia, Administração e Contabilidade da Universidade de São Paulo – FEA/USP.