The objective of this research is to identify whether products, processes, organizational and marketing practices, introduced or implemented by companies, can be considered to be innovations. Closed-ended questions concerning the type of innovation introduced or implemented were contrasted with the descriptions of innovations developed among a sample of 1770 companies in the manufacturing, service and commerce sector, as well as the mining and quarrying sector. Companies were classified into five groups according to the type of innovation that was introduced or implemented: (i) companies that understand the concept of innovation; (ii) companies that understand the concept of product innovation; (iii) companies that understand the concept of process innovation; (iv) companies that understand the process of organizational innovation, and (v) companies that understand the concept of marketing innovation. The results show that eight out of 10 companies understand what it means to innovate with companies in the manufacturing sector being the ones that best understand this concept. Likewise, the type of innovation that is best understood throughout all sectors is marketing innovation. At the same time, companies present three errors at the time of identifying their innovations: companies that think they have innovated but have not done so, companies that think they have not innovated but actually have, and companies that think they innovated in a specific type of innovation, but instead innovated in another.

In recent decades, innovation has become an inevitable term in business strategy, government agendas and academic thinking. Product innovation, process innovation, organizational and marketing innovations (OCDE, 2005); technological and non-technological innovations (Nelson, 1993; OCDE, 2005); radical and incremental innovations (Henderson & Clark, 1990); disruptive innovation (Christensen & Raynor, 2003), open innovation (Chesbrough, 2006; Huizingh, 2011); and social innovation (Mulgan, 2006; Mulgan, Tucker, Ali, & Sanders, 2007) are types of innovations used to describe the commercial exploitation of ideas (Edwards, Delbridge, & Munday, 2005) that turn into reproducible scale goods which, when sold or implemented intelligently, solve problems and generate economic benefit.

Innovation, as a concept, is still under construction. Its nature and context have evolved, yet its analysis and measurement are still at an early stage. Each country or region has developed its own methodologies and surveys to measure this phenomenon, that is, they have come up with different ways of understanding what innovation is and have created a diversity of ways of measuring it. The first innovation surveys were applied between the 80s and 90s. The results of these surveys guided the need to propose a coherent set of concepts and tools that, in turn, led to the publication of the first edition of the Oslo Manual in 1992. In 1997 the second edition was published and in 2005 the third (OCDE, 2005). Since its first version until today there have been changes to the manual. The first edition talks about technological innovation in product and process (IPP) in the manufacturing sector, the second is extended to the service sector and in the third edition non-technological organizational and marketing innovation is included.

Similarly, what is understood as innovating or innovation, differs according to the function of the sector as well as the type of company or type of organization (Arundel, O’Brien, & Torugsa, 2013). There is a difference in the usage of the term “innovation” among academia, business and government, which tend to confuse the term to mean something new, a novelty, an invention, technology or improvement, among others. Whenever innovation surveys are conducted, it is assumed that respondents understand the characteristics of each category of innovation – product, process, organizational and marketing – even though the interpretation that it is “new or significantly improved” to a company remains subjective (Arundel et al., 2013). The differences in how companies interpret the concept of innovation can substantially affect comparability across countries (Arundel et al., 2013). That is, countries where businesspeople do not understand what it means to innovate or the different innovation characteristics, they can overestimate or underestimate the level of innovation they have achieved. They can also think that their innovations are more technological – product and process, when they have actually achieved organizational or marketing forms of innovation.

In 2011 and 2012 the OECD and several countries participating in the CIS Task Force conducted a cognitive test to determine how company managers understand the basics of innovation. Preliminary results showed that managers often see innovation as a requirement of a substantially creative effort for the company or for a substantial increase in sales (Arundel et al., 2013). Arundel et al. (2013), contrasted the open-ended question related to the description of innovation in contrast with the closed-ended question related to introduced innovation, from the innovation survey conducted with 1591 Tasmanian and Australian companies. The results showed that 19.2% of companies that reported as being innovative were really not. In the same survey, 35.3% of the companies that reported as being non-innovative, described actual innovation, that is to say, they developed innovation but were not able to identify it as such.

Within national surveys on innovation, it is common to assume that businesspeople understand each of the definitions of innovation – product, process, organizational and marketing – in the same manner (Arundel, Colecchia, & Wyckoff, 2006; Arundel et al., 2013). Nevertheless, in some cases, managers believe that if they do not develop I+D activities they are not innovating, which rules out new organizational or marketing initiatives within their concept of innovational practices. As opposed to that thought, businesspeople can sometimes consider innovation to be the single purchase of new machinery, which does the same as the one previously used. The same thing happens with the concept of “novelty,” which is understood to mean as something that is new to a company, but is not for another. According to Arundel et al. (2013), there is a lack of research on how businesspeople interpret the concept of innovation. For Edwards et al. (2005) there is a relatively poor understanding of innovation among companies.

Having established this concept, the objective of this research is to identify whether products, processes, organizational and marketing practices that are introduced or implemented by companies truly represent innovation. The article contains a literature review identifying what is and not considered to be innovation presented in section one. Methodological procedures are presented in the second section followed by analysis and discussion in the third section. Finally, conclusions and future predictions are developed and presented in the fourth section.

Literature reviewInnovation: what it is and what it is notIn order to identify what innovation is and what it is not, it is important to first define it. An innovation is the introduction of something new or of a significantly improved product (good or service), of a process, a new marketing method or a new organizational method, in the internal practices of a company, the organization of the workplace and external relationships (OCDE, 2005). According to this definition, companies can introduce or implement four types of innovation – product, process, organizational and marketing. Nonetheless, there are other types of innovations used to describe the same phenomena. For example, Schumpeter (1934) explains that there are innovations relating to new products, new production methods, new supply sources, new forms of exploiting new markets and new ways of organizing businesses.

Other authors argue that innovation is the transformation of knowledge for commercial value, that is, the development of new applications with the purpose of bringing novelty to the economic area (Gunday, Ulusoy, Kilic, & Alpkan, 2011). The first confusion precisely originates when definitions are mixed or people do not know all of the existent perspectives. Table 1 shows the relationship between the different types of innovation classified by the OCDE and four innovation perspectives.

Innovation perspectives.

| Type of innovation | Perspective 1 | Perspective 2 | Perspective 3 | Perspective 4 | ||

|---|---|---|---|---|---|---|

| Technological innovation | Non-technological innovation | Radical innovation | Incremental innovation | Disruptive innovation | Open innovation | |

| Product | ● | ● | ● | ● | ● | |

| Process | ● | ● | ● | ● | ● | |

| Organizational | ● | ● | ● | |||

| Marketing | ● | ● | ● | |||

According to the first perspective, innovation is presented as technological and non-technological (Nelson, 1993; Nelson & Rosemberg, 1993; OCDE, 2005). Technological innovation is referred to as the introduction of new and significantly improved products and processes, but based on intensive I+D applications (Hölzl & Janger, 2014). Non-technological innovation includes new organizational or marketing practices applied in a company for the first time, but with minimal or no I+D activity. In some cases, technological innovations are easier to identify given that they come from varied and consistent episodes that are sequentially and continually organized. These include: invention, dissemination and implementation (Edwards et al., 2005). For non-technological innovations there is a barrier in translating ideas into concepts and concept models from the very beginning. This barrier is caused due to the difficulty of establishing sequential processes for development.

In the second perspective, innovation is thought of as radical or incremental (Henderson & Clark, 1990). New products and processes are considered to be radical innovations while new versions or significant changes in already existing products and processes have the status of being incremental innovations. Additionally, if innovation is created based on technological pressure and scientific research, it will be classified as radical innovation, and if it is determined based on the market capacity, it will be determined as incremental innovation (Schumpeter, 1934; Tohidi & Jabbari, 2012).

The third perspective classifies innovation as disruptive (Christensen & Raynor, 2003), which, very much like radical innovation, is only applied to new products and processes. Lastly, the fourth perspective refers to open innovation (Chesbrough, 2006; Chesbrough & Appleyard, 2007; Huizingh, 2011). This perspective presents a mechanism for the development of new products, processes, and organizational and marketing practices.

Within the OCDE's own classification, all four types of innovation have their specificities according to their reach and level of innovational novelty. In relation to their reach, innovations can be new or significantly improved (Table 2), nevertheless, the status of “significantly improved” is only found on products and processes. According to the level of novelty, this is not applied to new organizational or marketing practices.

Reach and level of novelty and innovation.

| Type of innovation | Reach of innovation | Level of novelty | ||

|---|---|---|---|---|

| New to the company | New to national market | New to the international market | ||

| Product | New good | ● | ● | ● |

| Significantly improved good | ● | ● | ● | |

| New Service | ● | ● | ● | |

| Significantly improved service | ● | ● | ● | |

| Process | New process | ● | ● | ● |

| Significantly improved process | ● | ● | ● | |

| Organizational | New organizational practice | N/A | N/A | N/A |

| Commercialization | New marketing practice | N/A | N/A | N/A |

When companies develop different kinds of innovations, it becomes difficult for businesspeople to classify it in any of the four existent types, and even more complicated to define their reach and level of novelty. For example, the concept of “new to the company” needs to be carefully explained given that companies can be misinterpreting the level required for something to really be a novelty or an innovation (Arundel et al., 2013). These interpretational problems come up more frequently when it comes to the innovation of services. According to the OCDE (2005) product innovation involves new or significantly enhanced features of the service offered to consumers. Service innovation is a process that involves the usage of methods, equipment and/or new or significantly improved knowledge to provide the service; and product innovation and process innovation involve significant improvements, at the same time, the characteristics of the service offered and the methods, equipment and/or knowledge used for this feature.

Nevertheless, there are changes that are not considered to be innovations. Table 3 presents what is not considered as innovation by any of the four types.

What is not considered to be an innovation.

| Not considered as product innovation: | Not considered as process innovation: |

| • Modifications and minor improvements | • Minor changes or improvements |

| • Improvements on common or habitual procedures. | • An increase in the production or service capacity due to the introduction of new manufacturing systems or logistical systems that are similar to those already in use. |

| • Regular stationary changes | |

| • Adapting to the needs of a specific client that doesn’t present significantly different characteristics from the products manufactured for other clients. | |

| • Changes in the design that do not actually modify function, previously set usage or technical characteristics of a good or service. | |

| • And services acquired for other companies. | |

| Not considered marketing innovations: | Not considered organizational marketing: |

| • Changes in the design or packaging of a product placement, sales or pricing that are based in marketing methods that have been used by the company. | • Changes in business practices, workplace organization or external relations that are based on organizational methods already in use within the company. |

| • Seasonal, regular or ordinary changes in marketing instruments. | • Changes in management strategy, unless it is accompanied by the introduction of a new organizational method. |

| • The usage of marketing methods already applied to enter a new geographical market or a new market segment. | • Mergers or acquisitions of other companies. |

To identify whether a product, process, organizational or marketing practice is an innovation, Greenhalgh and Rogers (2010) have established five stages for the innovation decision-making process. These stages include knowledge, persuasion, decision, implementation and confirmation. At the knowledge stage, an individual recognizes innovation, but has limited understanding to be able to comprehend and learn from information regarding such innovation. In the persuasion stage, a person is interested in the innovation and actively seeks information and details on it. In the decision stage, an individual decides to adopt or reject innovation. In the implementation stage, innovation is applied and an individual tries to reduce the uncertainty of the consequences of such. In the confirmation stage, an individual seeks support for decision-making and is ready to use innovation. When a company knows and applies these five stages in the innovation decision-making process, the risk of considering something that is not as innovation as such is reduced.

What in one company is considered to be an innovation might not be considered as such in another. This situation can originate among economic sectors, companies of different sizes, different types of organization and ultimately between different countries and regions. The fact that businesspeople may be unaware of the different perspectives and concepts related to innovation does not mean that they do not innovate. Sometimes the company is more concerned with solving problems intelligently, which, as a result, yields new products that define whether what is being developed represents an innovation and what type of innovation it might be. According to Arundel et al. (2013), There are three types of perception errors that come about when companies report and describe their innovation within surveys.

- •

Type 1 error: a company that classifies itself as innovative describes its innovation; however, what has been described is not innovation.

- •

Type 2 error: a company describes its activities and classifies itself as non-innovative; however, what has been described is actual innovation.

- •

Type 3 error: a company that classifies itself as innovative describes its specific type of innovation – product, process, organizational or marketing; however, what is described does not match the type of innovation reported. For example, a company reported that it had introduced a new product to the market, but when describing the characteristics of innovation, what it actually described was a new process.

Of the three types of errors identified, only the Type 1 error shows that the company failed to innovate. In the case of the Type 2 error, the company cannot identify itself as innovate, and for the Type 3 error, the company knows that it innovated, but it was wrong in classifying the type of innovation introduced or implemented. However, the three types of errors indicate that a company does not completely understand the concept of innovation. This shows that innovation surveys can be underestimating or overestimating the innovation rate of companies (Arundel et al., 2013). Fig. 1 presents interpretation errors of companies when they report as having innovated and described their most important innovation.

For Arundel et al. (2013) companies that make a Type 2 error believe that changes in processes, and organizational or marketing methods are not considered innovations. This group of companies mistakenly thinks that innovation requires substantial in-house development (Arundel et al., 2013). Consequently, companies that do not have formal I+D departments mistakenly believe they do not perform innovation activities and as such do not innovate.

Although businesspeople have definite difficulty identifying what is and what is not innovation, the perception degree error can vary according to the function of the economic activity, the size of the company, and of its distance to the technological border according to the I+D functions it develops. For example, Knowledge intensive business services – KIBS, also have a better understanding of the concept of innovation than those surveyed in other sectors (Arundel et al., 2013). Likewise, companies in the service sector probably have the greatest difficulty in defining whether their innovation is a new service or a new marketing practice, or in extreme cases, they consider innovation to be something that it is not.

In the manufacturing sector, innovation tends to be more closely related to inventions in the service sector (Iorgulescu & Răvar, 2013). Likewise, managers of big companies tend to refuse the Oslo Manual's definition. To them, when a product or process is new to the company, it is not considered to be an innovation (Arundel et al., 2013). Another form of identifying if something is considered an innovation is to determine de innovation's performance, which, according to Wang and Lin (2012) is defined as the degree in which a new product complies with its financial and market objectives.

The role of managers and businesspeople in development of innovations extends further than a simple identification of new products or processes and their adaptability to the activity and mission of their own organization (Iorgulescu & Răvar, 2013). Managers must develop this skill long before working at companies, that is to say, at university. For Karahoca and Kurnaz (2014), universities have a high perception of innovation, and propitiate the development of innovative projects in their institutional or work environments. Also, higher education institutions have a key role in the development of people who have a high innovation perception, which is why academics should contribute and support innovation in the educational aspect as well as internally for companies through publications, projects and management and innovation courses (Karahoca & Kurnaz, 2014).

There are external barriers (consumer resistance, lack of government support, lack of external financing, technological turbulence, inadequate infrastructure, restrictive local culture) and internal (restrictive mindset of businesspeople, lack of skills, insufficient resources, weak organizational structure) that hinder the innovation process (Hölzl & Janger, 2014; Sandberg & Aarikka-Stenroos, 2014). These restrictions may also be considered as factors that affect a businessperson's understanding of what is considered to be an innovation, especially when it relates to external barriers. These barriers arise when the company interacts with other companies, agencies or institutions within the innovation system, aiming to develop innovative activities (Hölzl & Janger, 2014).

Lastly, issues such as lack of funding for innovative activities, lack of technological knowledge, lack of market opportunities for innovation, and lack of connectivity in the innovation system that prevent innovative collaboration and a lack of skilled labor (Hölzl & Janger, 2014), are factors that, besides being barriers to innovation, can affect the understanding of the concept of innovation for any company.

MethodologyIn order to identify whether products, processes, and organizational and marketing practices that were introduced or implemented by companies are really innovations, data was used from the first survey on national innovative activities from Ecuador from 2009 to 2011. A questionnaire was applied to a representative sample of 3188 companies in the commerce, manufacturing, and mining and services sectors. A response rate of 88% was obtained; that is, the analysis was based on 2815 records. The data were collected in 2013 during a four-month period.

The survey form consisted of 51 closed-ended questions, 14 of which were directed to identify whether firms introduced or applied product innovations, processes, and organizational or marketing innovation. Additionally, the form had a section of observations where the respondent was asked to describe the innovations that had been introduced or applied in detail. In case these were not yet introduced or applied, the pollster placed summaries of the most relevant information in this section, which was previously identified during the information-gathering process.

Two science, technology and innovation experts analyzed and coded the observations section for the 2815 surveys. The experts did not have complete access to survey information, only the comments section. This was done so that their analysis would not be biased. Using the content analysis technique, the researchers analyzed each of the 2815 comments to determine whether or not a company innovated or not. If it innovated, the type of innovation – product innovation, process, organizational, marketing – was identified. Coding used by Arundel et al. (2013), was used to classify survey responses.

- (a)

Innovated: it met the requirements to be considered an innovation by implementing a new or significantly improved product, process, and organizational or marketing method, specifying the type of innovation introduced or implemented.

- (b)

Did not innovate: because it was an extension of existing activities (Example: buying more or the same type of equipment), or the company described something that is not considered innovation as stated in the Oslo Manual.

- (c)

Did not innovate: because innovation was not introduced to the market or was not established by the company.

- (d)

No information: insufficient information was provided to establish the status of innovation.

In the case of discrepancies, the answers were discussed among experts. In the analysis process 1080 observations were excluded for not having sufficient information to identify whether or not the company innovated or not; that is, the analysis was conducted with a sample of 1771 companies. Fig. 2 shows the structure of the sample depending on the company size and economic activity of the same.

If the description was an innovation, this was classified into one of four types of innovation (product, process, organizational and marketing). These categories were not mutually exclusive. According to its characteristics, innovation could have been assigned to more than one category.

Once the company was identified as having innovated or not, based on the comments analyzed, these data were compared with the original survey information. The objective of this procedure was to determine the consistency between the initial responses of businesspeople, with registered comments and observations. Thus, the results will be presented according to five scenarios:

- (a)

Companies that understand the concept of innovation: this refers to companies that, while being surveyed, responded that they had innovated or had not in any of the four types of innovation and that the description of innovation is consistent with its initial answer.

- (b)

Companies that understand the concept of product innovation: refers to companies that, while being surveyed, responded that they did or did not introduce a new product (good or service) and that the description of innovation was in line with its initial answer.

- (c)

Companies that understand the concept of process innovation: refers to companies that, while being surveyed, responded that they had or had not introduced an innovative process and that the description of innovation was consistent with its initial answer.

- (d)

Companies that understand the concept of organizational innovation: refers to companies that, while being surveyed, responded that they did or did not apply a new organizational practice and that the description of innovation was consistent with its initial answer.

- (e)

Companies that understand the concept of innovation in marketing: refers to companies that, while being surveyed, responded that they did or did not apply a new business practice and that the description of innovation was consistent with its initial answer.

The analysis of the results will be presented in aggregate form and by economic activity – Commerce, Manufacturing, Mining and Quarrying and Services, according to the scenarios described above.

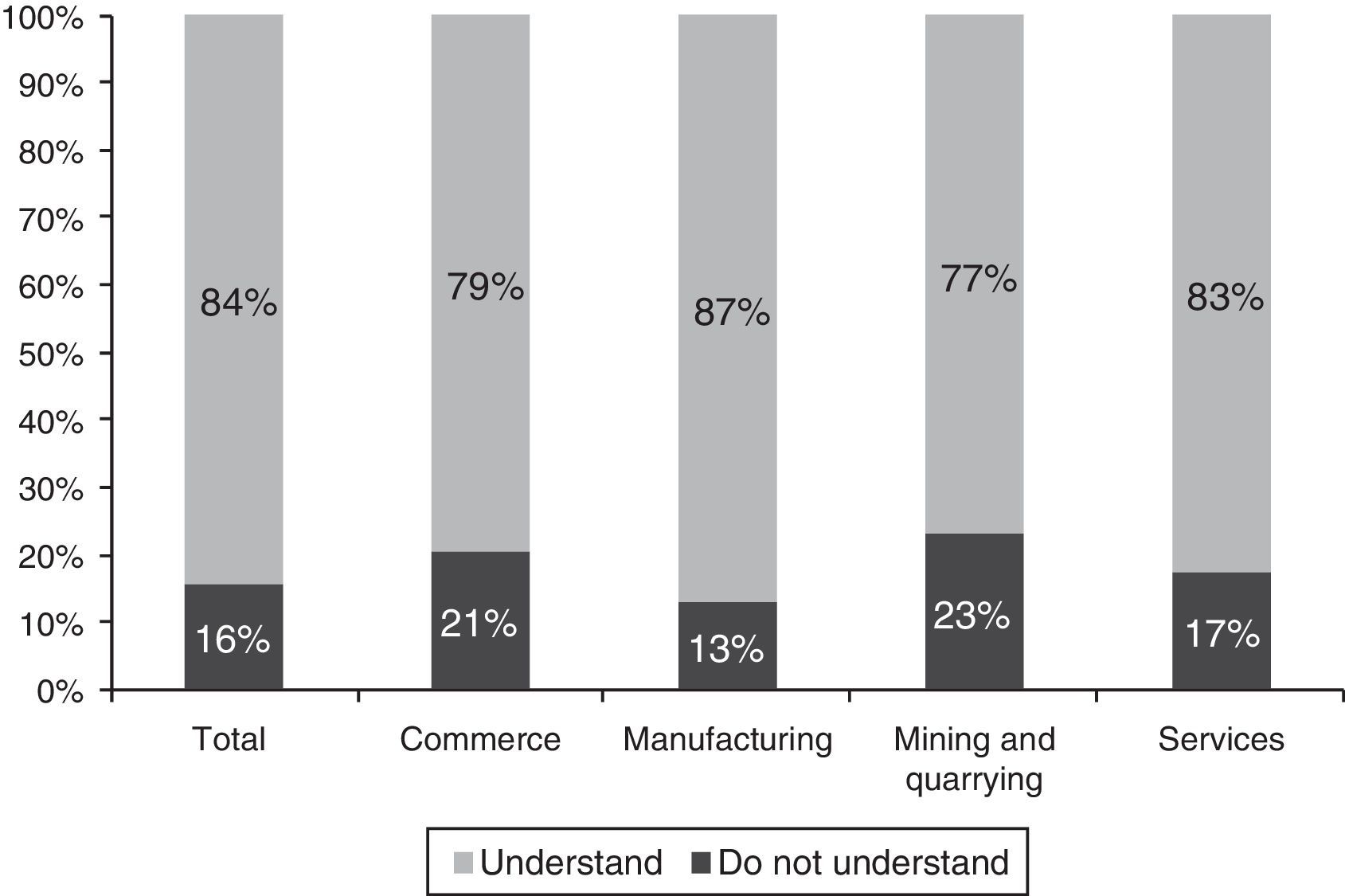

Analysis and discussionCompanies that understand the concept of innovationThe first scenario refers to companies that understand the concept of innovation, regardless of whether or not they have implemented any of the four types of innovation. At the aggregate level, eight out of 10 companies understand what innovation is and the types of innovation they can use to enter the market or implement within their organization (Fig. 3). Disaggregating the results by economic activity shows that manufacturing companies are the ones that have consolidated the concept of innovation — 87% of companies understand this. On the other hand, the mining and quarrying sector has the most difficulty identifying whether or not it has innovated, as only 67% of companies understand what it means to be innovative. As confirmed by Arundel et al. (2013), innovation surveys are best understood by manufacturing companies as opposed to service sector companies. In his study it is shown that only 12.9% of manufacturing firms that reported to having innovated, really did not. In second place was the industrial sector with 16%; and with the highest error rate is the services sector with 27.9%.

Data show that companies focused on the development of intangibles – Commerce and Services – have greater difficulty in identifying if their new products are or are not innovative. In contrast, manufacturing companies have the lowest error rate, because they focus on the development of goods that do not have the intangible component, common in the services sector.

Companies that understand the concept of product innovationThe second scenario refers to companies that are familiar with the concept of product innovation, regardless of whether or not they introduced a new or significantly improved product or service to the market. Overall, it is shown that approximately 19% of companies have no clear definition of product innovation (Fig. 4); that is, they responded that they had introduced a product or service to the market, but the product was not an innovation or represented another type of innovation. According to Arundel et al. (2013), product innovation is relatively well-understood in all economic sectors; however, for industrial companies, there is confusion about the difference between innovation in goods and services. Furthermore, service innovation is least understood by the manufacturing sector (Arundel et al., 2013).

Disaggregating the results by economic activity, commerce and service companies are the ones that have greater difficulty in understanding this concept – 24% and 17% respectively. This situation could be explained in terms of innovation surveys initially created to be applied to manufacturing companies. Secondly, service sector surveys are relatively new, data collection instruments are still in the process of consolidation, and businesspeople find it difficult to differentiate between goods and service innovation. Thirdly, marketing of a new product among trading companies is not considered to be an innovation (OCDE, 2005); even though businesspeople consider it as such.

Companies that understand the concept of process innovationThe third scenario refers to companies that are aware of the concept of process innovation, regardless of whether or not they have implemented a new or significantly improved process within the organization. A similar trend to that of the other two previously analyzed scenarios is observed, where more than 80% of all companies understand the concept of process innovation (Fig. 5). Analyzing the data by economic activity show that companies in the commerce sector are the ones that consistently understand this concept, regardless of whether or not they have applied such innovation – 87% of companies understand it. On the other hand, companies in the mining and quarrying sector have the highest error rate, where only 73% of companies understand what is means to implement a new process that meets the criteria to be considered as innovation.

For this type of innovation, data show different error rates that impede the assembling of companies into two groups, one group that is exclusively focused on transformation and processing (manufacturing, mining and quarrying) and the other clearly linked to commercial activities (commerce and services). These differences between economic sectors reveal that process innovation is not necessarily better understood among transformational companies given that the instruments to measure this phenomenon were initially developed for these types of companies.

Companies that understand the concept of organizational innovationThe fourth scenario is related to the companies that have or have not yet applied a new organizational practice for the first time. Out of all the companies, approximately 16% do not understand what the implementation of a new organizational practice involves (Fig. 6). Approximately eight out of 10 companies have the concept of this type of innovation clear. A similar trend is shown among a variety of economic sectors; however, manufacturing companies are the ones that best understand this concept, which leads for them to know what implementing new organizational practices involves – 87% of these companies understand it.

The lowest error rate of manufacturing companies in relation to other sectors can be explained by two reasons. First, innovation surveys were initially designed for this sector and have been used the longest. Secondly, as the surveys are conducted, businessmen consolidate the concept of innovation further and develop the ability to distinguish between different types.

Companies that understand the concept of marketing innovationThe fifth stage relates to companies that have or have not applied a new marketing practice. Out of all the companies, 87% understand what applying a new marketing practice involves (Fig. 7), which is about nine out of 10 companies. Disaggregating the results by economic activity shows a high consistency of this definition throughout all economic activities, in which mining and quarrying companies, as well as service companies represent the sectors that best understand this definition – 94% and 89% respectively.

The data show that innovation in marketing is best understood both globally and by economic activity. Additionally, according to the description of innovation created by companies, the most-implemented marketing practice relates to the usage of advertising on the Internet, whether in social networks or creating a website.

Consolidating the results by economic sector and type of innovation, Table 4 shows the error rate for the four types of innovation. On the one hand, it was identified that process innovation has the lowest error rate in the trading sector (13%), organizational innovation in the manufacturing sector (13%), and marketing innovation in the mining sector (6%) and the service sector (11%). On the other hand, organizational innovation has the highest error rate in the commerce sector (21%), process innovation in the manufacturing sector (18%) and mining (27%), and product innovation among service companies (24%).

Lastly, when analyzing companies regardless of activity it appears that the best understood type of innovation by businesspeople is marketing innovation. Only 13% of companies do not understand this type of innovation. On the other hand, the kind of innovation that is least understood is product and process innovation, both with 19% error.

It is observed that approximately eight out of 10 respondents understand what it means to innovate, whether or not it is through the introduction of a new product to the market or the application or non-application of a new production process, or organizational or marketing practice. Regarding respondents who do not understand what is means to innovate; this lack of knowledge can be classified into three types of errors:

Type 1 error, companies that said they innovated but really did not. The results show that innovative companies are not clear on what the different types of innovation are, particularly relating to the concepts of non-technological innovations – organizational and marketing. This problem is more serious for small companies (Arundel et al., 2013).

Type 2 error, companies that said they had not innovated but actually did. One of the main causes of this error between non-innovators occurs because companies do not perceive changes in production, and organizational and marketing methods as innovations (Arundel et al., 2013). This shows that there is confusion among non-innovators as to what actually constitutes innovation. This is due to the fact that companies mistakenly think that innovation requires substantial in-house development (Arundel et al., 2013) and high I+D activity. For Arundel et al. (2013), 35.3% of companies who self-reported as being non-innovative, reported valid innovation in the open-ended questions. This suggests that innovation surveys may fail to correctly identify a substantial number of innovative companies (Arundel et al., 2013).

Type 3 error, companies that said they innovated in a specific type of innovation but really innovated in another. When it comes to answering the open-ended questions, companies state that their most important innovation is different to the innovation reported at the beginning of the questionnaire. In addition to that, a high percentage of innovative companies in the industrial and service sectors misinterpret the differences among the various types of innovation (Arundel et al., 2013). Similarly, organizational innovation is the most misunderstood within the service sector, while marketing innovation is the least understood among industrial companies (Arundel et al., 2013).

Additionally, evidence of what is not innovation has been found, but businesspeople suspect the following may be actual innovations: (i) the acquisition of accounting systems, which are considered to be part of the organizational innovation process; (ii) acquisition of new machinery, which does the same as the previous machinery and is considered as process innovation; (iii) Acquisition of better quality goods, which is considered as product innovation, and (iv) commercialization of new goods, which is considered as product innovation when the company's activity is in the wholesale marketing and retail sectors. For Arundel et al. (2013), the smallest error rates across sectors were in product innovation, indicating a more consistent understanding of this type of innovation.

ConclusionsThe objective of this research was to identify whether products, processes, organizational practices and marketing innovations, introduced or implemented by companies, are really an innovation. Regarding the concept of innovation, without differentiating on types, the results show that eight out of 10 companies understand what it means to innovate, with manufacturing companies being the best to understand the concept. With regard to product innovation, the manufacturing sector is the best to understand this kind of innovation. As for process innovation, wholesale and retail companies best comprehend what implementation of a new or significantly improved production process means. And organizational innovation is best understood by manufacturing companies. Finally, the kind of innovation that is best understood by all sectors analyzed is marketing innovation.

Innovation is a phenomenon that should be studied not only from a quantitative perspective, in relation to the number of products introduced, the number of patents filed or granted or the I+D expenditure incurred. It is also necessary to bring about new perspectives for analysis so as to understand how and why organizations innovate and better comprehend what businesspeople think in regards to innovation. This study contributes to this new analytical scheme, with a more cognitive approach to this phenomenon.

Future research should look to analyze this phenomenon by company size and by level of technological intensity, given that scale and technology are significant but not decisive in introducing innovations factors. Regarding the limitations presented throughout this research, the exclusion of 1080 observations is highlighted due to the absence of valid information. Such exclusion could have affected the results broken down by economic activity or sector.

Conflicts of interestThe authors declare no conflicts of interest.

Peer Review under the responsibility of Departamento de Administração, Faculdade de Economia, Administração e Contabilidade da Universidade de São Paulo – FEA/USP.