The paper explores some mechanisms of corporate governance (ownership and board characteristics) in Spanish listed companies and their impact on the likelihood of financial distress. An empirical study was conducted between 2007 and 2012 using a matched-pairs research design with 308 observations, with half of them classified as distressed and non-distressed. Based on the previous study by Pindado, Rodrigues, and De la Torre (2008), a broader concept of bankruptcy is used to define business failure. Employing several conditional logistic models, as well as to other previous studies on bankruptcy, the results confirm that in difficult situations prior to bankruptcy, the impact of board ownership and proportion of independent directors on business failure likelihood are similar to those exerted in more extreme situations. These results go one step further, to offer a negative relationship between board size and the likelihood of financial distress. This result is interpreted as a form of creating diversity and to improve the access to the information and resources, especially in contexts where the ownership is highly concentrated and large shareholders have a great power to influence the board structure. However, the results confirm that ownership concentration does not have a significant impact on financial distress likelihood in the Spanish context. It is argued that large shareholders are passive as regards an enhanced monitoring of management and, alternatively, they do not have enough incentives to hold back the financial distress. These findings have important implications in the Spanish context, where several changes in the regulatory listing requirements have been carried out with respect to corporate governance, and where there is no empirical evidence regarding this respect.

Este trabajo analiza algunos mecanismos de gobierno corporativo (propiedad y características del Consejo de Administración) en las empresas cotizadas españolas y su impacto sobre las probabilidades de fracaso empresarial. Usando la técnica del emparejamiento, se lleva a cabo un estudio empírico con 308 observaciones, la mitad de ellas fracasadas y la otra mitad no fracasadas entre 2007 y 2012. Sobre la base del estudio de Pindado et al. (2008), se ha usado un concepto amplio de fracaso empresarial. Empleando modelos logísticos condicionales, y adicionalmente a otros estudios previos sobre fracaso empresarial, nuestros resultados confirman que en situaciones de dificultad previas a la quiebra, la propiedad de los consejeros y la proporción de consejeros independientes ejercen un impacto similar sobre la probabilidad de fracaso empresarial a otras situaciones de fracaso más extremas. Nuestros resultados van más allá al evidenciar una relación negativa entre el tamaño del consejo y la probabilidad de fracaso empresarial. Interpretamos estos resultados como una forma de creación de diversidad y mejorar el acceso a la información y a los recursos, especialmente en contextos donde la propiedad está altamente concentrada y los grandes accionistas tienen un gran poder de influencia en la composición de la estructura del consejo. Sin embargo, los resultados confirman que la concentración de la propiedad no tiene un efecto significativo sobre la probabilidad de fracaso empresarial en el contexto español. Interpretamos que los accionistas mayoritarios son pasivos con respecto a una mayor vigilancia de la gestión y alterativamente, no tiene suficientes incentivos para frenar las dificultades financieras. Estos resultados tienen importantes implicaciones en el contexto español donde se han propuesto cambios en los requerimientos relativos al gobierno corporativo y donde no hay evidencia empírica a este respecto.

A retrospective analysis of the economic and financial crisis during 2007–2013 period highlights the important consequences of businesses’ financial distress on stakeholders (i.e. financial creditors, managers, shareholders, investors, employees, government regulators and society in general). So, more than ever, the revision of financial distress prediction models and the development of models adapted to particular characteristics of countries have an important role in order to prevent and manage these situations. In this regard, the crisis has highlighted two important issues: (a) the inability of the agencies credit ratings, governments and financial creditors to anticipate and prevent firms’ financial distress situations (Enron 2001 or Lehman Brothers 2008, among others); and (b) the importance of effectiveness of corporate governance mechanisms in crisis contexts (Husson-Traore, 2009).

The analysis of the causes of financial distress and the development of robust and stable models of financial distress prediction are far from a new issue. In fact, from 1960s the numerous financial distress or bankruptcy prediction models developed are an extension to seminal works of Beaver (1966, 1968), Altman (1968, 1982) or Ohlson (1980), among others. The empirical debate about financial distress has focused on explanation power of financial and accounting information (Altman, 1968, 1982; Beaver, 1966, 1968; Ohlson, 1980; Zmijewski, 1984) applying diverse statistical methods (linear discriminant analysis, logistic analysis, probit analysis). However, several researchers argue that economic and financial data alone do not provide sufficient predictive power of future insolvency, being therefore necessary to include variables representative of ownership and/or corporate governance characteristics in order to improve the predictive power of models (Chang, 2009; Chen, 2008; Deng & Wang, 2006; Fich & Slezak, 2008; Lee & Yeh, 2004; Simpson & Gleason, 1999; Wang & Deng, 2006).

In fact, from 1980s there is a large body of literature that highlights the importance of corporate governance and its influence on the likelihood of financial distress or bankruptcy (Chang, 2009; Chaganti, Mahajan, & Sharma, 1985; Daily & Dalton, 1994a,b; Deng & Wang, 2006; Donker, Santen, & Zahir, 2009; Fich & Slezak, 2008; Lajili & Zéghal, 2010). This is explained, according to the postulates of Agency Theory, by the fact that conflict of interests on the relationship between management and other stakeholders, by delegating roles, is more severe in crisis because managers will choose a short-term strategy that results in higher private benefits, at the prospect of losing their jobs (Donker et al., 2009). This managers’ behavior leads to an ethical conflict with shareholders because they prioritize their personal aims against the overall company objective, which is to maximize the value of shares and ensure the company survival in the future. Despite the extension of previous literature, it has been limited to certain context (U.S., Taiwan and China) and on bankruptcy or legal processes of financial distress (ex-post models). However, the corporate governance mechanisms, ethics codes and legal systems to control financial distress situations differ from one country to another, reasons why the extension of analysis to other geographic context and to other financial distress situations different to bankruptcy contributes to complement the existing literature. Particularly, the special characteristics of corporate governance in Spain (ownership concentration, unitary board system and voluntary good governance practices) likely raise serious agency conflicts in financial distress situations. In this sense, the analysis of relationship between corporate governance and companies’ financial distress for Spain provides evidence for this type of contexts, where overall analysis of this issue is still lacking.

Accordingly, the development of corporate financial distress’ explanation and forecast models, based on ownership, corporate governance and accounting variables, would make a significant contribution to financial and corporate governance literature. In this sense, the questions answered by this research are: Are the ownership concentration and directors’ ownership affecting the likelihood of financial distress in Spain? Which of the board characteristics affect the financial distress likelihood in the Spanish market?

In order to answer these questions, the general objective of this work is to validate the relationship between corporate governance mechanisms (ownership and board characteristics) and the likelihood of financial distress for Spanish listed companies where overall analysis of this issue is still lacking. To this end, we used companies’ data between 2007 and 2012, and applied conditional logistic regression analysis. Using an approximation to Pindado, Rodrigues, and De la Torre's (2008) study, we considered a company as “distressed” when it meets some of the following conditions: (a) its earnings before interest and taxes, depreciation and amortization (EBITDA) are lower than its financial expenses for two consecutive years; and/or, (b) a fall in its market value occurs between two consecutive periods. So, we used a broad concept of business failure beyond the bankruptcy, previously recognized as indicators of business failure (see Manzaneque (2006) for a major revision), in order to overcome previous literature limitations on this question (Mora, 1994).

Our study contributes to the literature in different ways. Previous literature analyzes the effect of corporate governance on firms’ bankruptcy (Deng & Wang, 2006; Lajili & Zéghal, 2010; Mangena & Chamisa, 2008) and the obtained results document a negative and significant effect between board ownership and a strong corporate governance system on business failure likelihood. In the same line of the above studies, our results confirm that in difficult situation previous to bankruptcy, the roles of board ownership and board independence are similar to those exerted in more extreme situations as is the bankruptcy case. That is, following the Agency Theory assumptions, the ownership of directors and independence of board members, as factors that reduce principal-principal conflict of interests that arises between majority and minority shareholders and are common in concentrated contexts as the Spanish market, are important to reduce the likelihood of failure. Our results go one step further to offer a negative relationship between board size and the likelihood of financial distress. We interpret this result as a form of creative diversity and improve the access to the information and resources, especially in contexts where the ownership is highly concentrated and large shareholders have a great power to influence in the board structure. Moreover, regarding ownership structure, the results show that neither non-institutional nor institutional shareholders’ ownership has any effect to reduce the likelihood of business failure in the Spanish context. These results are contrary to those of previous literature that support a negative relationship between ownership concentration and business failure likelihood (Donker et al., 2009; Elloumi & Gueyie, 2001; Mangena & Chamisa, 2008; Parker, Gary, & Howard, 2002). We argue that dominant shareholders in a concentrated ownership context limit the role of board's ownership to control management risky decisions. These findings have important implication in the Spanish context, where several changes in the regulatory listing requirements have been carried out with respect to corporate governance and where there is no empirical evidence regarding this.

The rest of the article proceeds as follows: “Literature review and hypotheses development” section presents a review of previous literature about the research issue and describes our hypotheses; “Methodology” section describes the process followed for sample selection and data capture, the statistical methodology and the study model specification; “Results” section reports the results and further analysis; and, the final section includes the conclusions.

Corporate governance and financial distress. Literature review and hypotheses developmentThe relationship between corporate governance and financial distress is a matter of interest to different stakeholders. Proof of this is the intense literature that has been developed on this subject and we refer this below.

OwnershipThe conflict of interests between management and other shareholders is more severe in financial distress situations. Management could make decisions aimed to obtain short-term personal benefits rather than to overcoming the financial distress, due to the insecurity of their jobs (Donker et al., 2009). Under these circumstances, the level of ownership of large shareholders and/or directors could contribute to reduce the management-shareholders conflict of interests.

The problems associated to ownership concentration (free ride and expropriation) have been widely discussed in previous literature (Claessens, Djankov, Fan, & Lang, 2002; La Porta, Lopez-de-Silanes, Shleifer, & Vishny, 2000; Shleifer & Vishny, 1986). However, the situation is different when we analyze the effect of ownership concentration on corporate failure. In this situation, large shareholders could suffer great losses due to their participation in a financial distressed company. In this sense, they are expected to exercise an important monitoring function on opportunistic management behavior. In other words, large shareholders have sufficient incentives to maximize firm value by reducing information asymmetries and helping to overcome the agency problems and, ultimately, to the company recovery (Claessens et al., 2002).

Contrarily, some studies argue that in concentrated context, as is the Spanish case, ownership concentration may create information asymmetries between large and minority shareholders (Jensen, 1993). So, large shareholders may have influence on management and, therefore, guide it into their private benefit regardless of the interests of minority shareholders (La Porta et al., 2000). In this case, minority shareholders could suffer expropriation of their wealth, and consequently, financial distress’ likelihood of companies will increase (Lee & Yeh, 2004).

According to this, the effect of ownership concentration on financial distress likelihood is unclear. However, following Lee and Yeh's (2004) study in ownership concentration context we expect that greater ownership concentration increases the likelihood of financial distress (Donker et al., 2009; Elloumi & Gueyie, 2001; Mangena & Chamisa, 2008; Parker et al., 2002). In other words, we analyze whether the ownership concentration increases the shareholders’ problems to monitor management and the likelihood of financial distress:H1 Firms with high ownership concentration have high likelihood of financial distress.

Along with this, some studies analyze the effect of institutional investors (banks, insurance firms, pension funds, mutual or trust funds) on firm survival. They point out their effectiveness as corporate governance mechanism to monitor management (Blair, 1995; Daily, 1995) and their focus on long-term performance rather than the short-term or annual term as management does (Donker et al., 2009). So, it is expected that in a concentrated ownership context, where other corporate governance mechanisms may be ineffective, the institutional investors take an active role to control the management. Contrarily, other authors point out lack of expertise of institutional investors to advising management (Gillan & Starks, 2000) and their incentives to act passively against management when they have business relationships (Donker et al., 2009), as factors that can affect their monitoring effectiveness. According to these arguments, the empirical evidence is also mixed. Daily and Dalton (1994b), Firth, Chung, and Kim (2005) and Mangena and Chamisa (2008) found a negative relationship between institutional investors and financial distress likelihood. Contrarily, Donker et al. (2009) report a positive association of both variables. Based on that, we investigate two alternative hypotheses regarding the impact of institutional ownership concentration on the likelihood of financial distress.H2a Firms with high institutional ownership concentration have less likelihood of financial distress. Firms with high institutional ownership concentration have greater likelihood of financial distress.

Furthermore, following the arguments of convergence theory the participation of the board of directors in shareholding is also a powerful incentive to achieve the alignment of their interests with those of other shareholders (Shleifer & Vishny, 1997), that is, maximizing the value of shares. In this regard, Jensen (1993) argues that many business problems occur because the members of the board typically do not have large holdings of shares in the company where they work. This situation discourages managers to take decision in order to maximize the value of shares, negatively affecting the creation of business value. This argument is corroborated by the study of Fich and Slezak (2008) who reported a negative relatinship between the proportion of shares held by the board and the probability of business failure. At the same line, Wang and Deng (2006) and Liu, Uchida, and Yang (2012) argue that management holding shares is linked to long-term value generation. So, on a sample of Chinese companies, they found that those firms with greater management's ownership had greater likelihood of survival in difficult situations. So, we hypothesize that:H3 Firms with high board ownership have less likelihood of financial distress.

The ability of the board to act efficiently has been regarded as a determinant of businesses’ financial distress. So, weak or poor corporate governance increases the probability of opportunistic behavior of management or controlling shareholders to act in their own interest, extracting wealth from other shareholders (Johnson, Boone, Breach, & Friedman, 2000; La Porta et al., 2000) and increasing the likelihood of financial distress. Consequently, the role of board composition and structure (board independence and board size) on business financial distress should be examined.

Board independenceThe board independence is usually proxy through the separation of the roles of the Chairman and the Chief Executive Officer and the number of independent directors on the board.

Separation of the roles of the chairman and the chief executive officerSome researches argue that the separation of the roles of the Chairman and the Chief Executive Officer is required to ensure the independence and effectiveness of the board (Baysinger & Hoskisson, 1990; Jensen, 1993) and consequently to increase the board monitoring effectiveness (monitoring hypothesis). Contrarily, other researches defend duality or accumulation of powers of two figures in a single person (CEO duality) in post to achieve strong leadership and control unit, facilitating the transmission of information, reducing coordination costs and avoiding the emergence of potential conflict of interests between the two positions (Donalson & Davis, 1991; Davis, Choorman, & Donaldson, 1997).

Regarding the relationship between duality and processes business failure, the results of empirical studies developed about are also diverse. Daily and Dalton (1994b) and Simpson and Gleason (1999) reported a positive relationship between the dual power and the probability of bankruptcy, and Wang and Deng (2006) find a positive relationship only in the case of public administration-controlled companies. By contrast, the results of Simpson and Gleason (1999) show a negative relationship between the accumulation of the figures of Chairman and CEO and the likelihood of incurring a situation of business failure. For its part, Chaganti et al. (1985) found no relationship between these two factors. According to the monitoring hypothesis, we suggest that CEO duality increases the risk of financial distress.H4 Firms with CEO duality have high likelihood of financial distress.

Agency theory advocates the independence of the board as a measure to ensure an adequate control over the management. Thus, the work of outside directors will be to monitor and control potential opportunism and avoid selfish behaviors of management so that their decisions are consistent with the interests of shareholders (Fama & Jensen, 1983; Jensen, 1993; Jensen & Meckling, 1976). Also, the presence of outside directors reduces the possible existence of information asymmetries and agency costs between shareholders and management (Chang, 2009; Daily, 1995; Fich & Slezak, 2008). Thus, empirical evidence (Brickley, Coles, & Terry, 1994; Weisbach, 1988) shows that outside directors represent better the interests of the shareholders than inside directors. On the contrary, some authors argue that outside directors do not have the knowledge about the company and the sector, or do not have enough experience to perform their jobs well (Baysinger & Hoskisson, 1990; Estes, 1980).

Regarding the relationship between the presence of outside directors on the board and business failure, Gueyie and Elloumi (2001) and Wang and Deng (2006) conclude that firms with higher proportion of outside directors are less likely to fail due to the fact that they are more efficient in imposing the necessary measures to help overcome a possible failure situation (Fich & Slezak, 2008). Chang (2009) also indicates that the presence of outside directors on the board, in the long term, generates the development of efficient activities that will detect and monitor the possible emergence of opportunistic behavior by the management in order to avoid business failure. Meanwhile, Chaganti et al. (1985), Simpson and Gleason (1999) and Lajili and Zéghal (2010) find no relationship between the proportion of outside directors on the board and business failure. According to the agency theory, we hypothesize that the proportion of independent directors is negatively related to financial distress.H5 Firms with high proportion of independent directors have less likelihood of financial distress.

In this regard, in the previous literature, there are two different perspectives. On the one hand, previous studies (Chaganti et al., 1985; Goodstein, Gautam, & Boeker, 1994; Judge & Zeithaml, 1992; Yemarck, 1996) have revealed some problems related to the size of the board. In this sense, larger board may have problems with balance, resulting in greater discretion of its members to meet their particular interests to the detriment of the general interest of the company (Chaganti et al., 1985), involvement in issues business strategy of its members, something that would adversely affect business performance (Judge & Zeithaml, 1992; Yemarck, 1996), or lack of effectiveness when turbulent economic environments requires a change in strategic direction (Goodstein et al., 1994). From this point of view, smaller boards and larger percentage of independent or outside directors are more effective in the implementation of mechanisms for corporate control (Jensen, 1993), thereby decreasing the chances of the company to achieve unstable economic and financial situations (Fich & Slezak, 2008).

Moreover, in contrast to above studies, the resource dependence theory argues that larger boards offer various advantages associated with the company's ability to access the resources and information held by the directors and that might be needed to achieve the business objectives (Pearce & Zahra, 1992; Pfeffer, 1972). From this perspective, the size of the board would be negatively associated with the likelihood of business failure.

Accordingly, two different hypotheses have been tested:H6a Firms with high board size have less likelihood of financial distress. Firms with high board size have greater likelihood of financial distress.

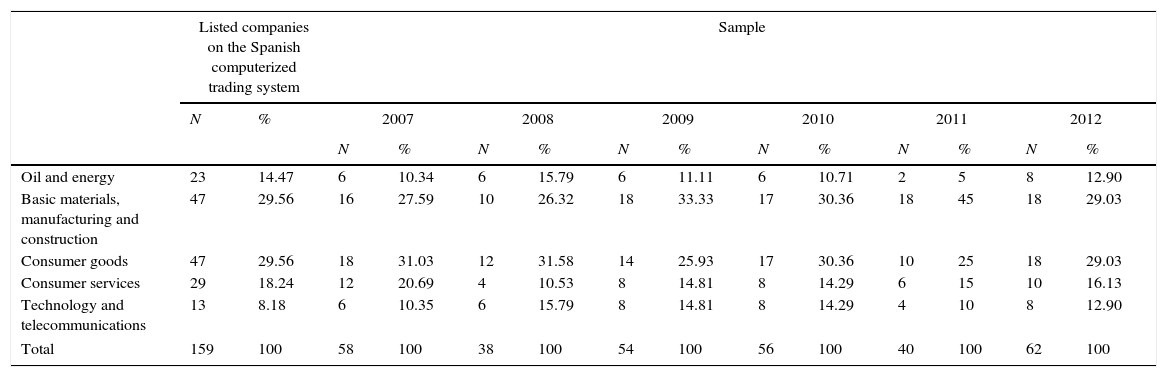

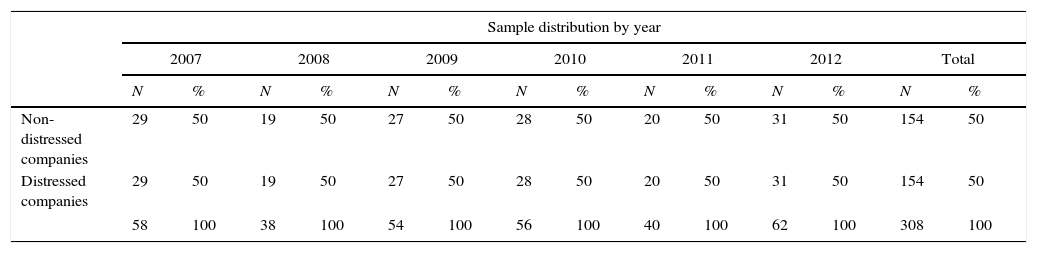

In order to test the hypotheses proposed, we collected data from the Spanish listed companies excluding financial companies, due to the different features that these businesses have in relation to the regulatory standards, financial reporting standards and compliance (Manzaneque, Merino, & Banegas, 2011a; Manzaneque, Merino, & Banegas, 2011b; Merino, Manzaneque, & Banegas, 2012). We studied the time period from 2007 to 2012, for two reasons: first, there were a large percentage of companies which published their Annual Report in all of those years, and, second, we found more companies which had more economic and financial problems during this period. We used a matched-pairs research design (Elloumi & Gueyie, 2001; Hosmer & Lemeshow, 1989; Mangena & Chamisa, 2008; Peasnell, Pope, & Young, 2001) for constructing our sample. We took all the firms that had a financial distress situation for the period 2007–2012 and identified 164 observations (firm/year) as financial distressed with complete corporate governance and financial data. According to the prior literature, each of these financial distress observations was matched with not financial distressed observations which have a similar size (total asset), same industry and the same accounting period (Beasley, 1996; Mangena & Chamisa, 2008; Peasnell et al., 2001). We removed 10 financial distress observations because no appropriate matching were found. The matching procedure resulted in a final sample of 308 paired observations where 154 are distressed and 154 non-distressed. We also conducted a paired t-test whose results show a correct matching-pair. The sample is representative of population because it collects a wide range of Spanish listed companies (see Tables 1 and 2).

Composition of the population and sample firms according to the industry type.

| Listed companies on the Spanish computerized trading system | Sample | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| N | % | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | |||||||

| N | % | N | % | N | % | N | % | N | % | N | % | |||

| Oil and energy | 23 | 14.47 | 6 | 10.34 | 6 | 15.79 | 6 | 11.11 | 6 | 10.71 | 2 | 5 | 8 | 12.90 |

| Basic materials, manufacturing and construction | 47 | 29.56 | 16 | 27.59 | 10 | 26.32 | 18 | 33.33 | 17 | 30.36 | 18 | 45 | 18 | 29.03 |

| Consumer goods | 47 | 29.56 | 18 | 31.03 | 12 | 31.58 | 14 | 25.93 | 17 | 30.36 | 10 | 25 | 18 | 29.03 |

| Consumer services | 29 | 18.24 | 12 | 20.69 | 4 | 10.53 | 8 | 14.81 | 8 | 14.29 | 6 | 15 | 10 | 16.13 |

| Technology and telecommunications | 13 | 8.18 | 6 | 10.35 | 6 | 15.79 | 8 | 14.81 | 8 | 14.29 | 4 | 10 | 8 | 12.90 |

| Total | 159 | 100 | 58 | 100 | 38 | 100 | 54 | 100 | 56 | 100 | 40 | 100 | 62 | 100 |

The table summarizes the frequency and percentage of each industrial sector on the population (listed companies on the Spanish computerized trading system, SIBE) and on the sample. Data about population have been retrieved from http://www.bolsamadrid.es.

Sample distribution by year.

| Sample distribution by year | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | Total | ||||||||

| N | % | N | % | N | % | N | % | N | % | N | % | N | % | |

| Non-distressed companies | 29 | 50 | 19 | 50 | 27 | 50 | 28 | 50 | 20 | 50 | 31 | 50 | 154 | 50 |

| Distressed companies | 29 | 50 | 19 | 50 | 27 | 50 | 28 | 50 | 20 | 50 | 31 | 50 | 154 | 50 |

| 58 | 100 | 38 | 100 | 54 | 100 | 56 | 100 | 40 | 100 | 62 | 100 | 308 | 100 | |

The table summarizes the frequency and percentage of non-distressed and distressed companies on the sample along the study period.

Also, we have estimated the maximum allowable error for a finite population test. The maximum error is small (e=4.6%, α=95%) leading to the consideration that the sample is representative of the population.

Spanish context has been chosen due to specific characteristics of corporate governance system in Spain: (1) is an example of ownership concentration and thus serves as a reference for analyzing the power of large shareholders in situations of financial distress (Claessens et al., 2002; Donker et al., 2009); (2) follows a “unitary board system” where both executive and non-executive directors are included in only one board (Board of Directors), so the level of independence to ensure the effectiveness of this organ is important; and (3) corporate governance practices are based on voluntary codes of conduct. Furthermore, it is an important context due to the increasing political pressure to encourage the level of corporate governance system efficiency and to be adjusted to the requirements and recommendations of the European Union on this issue.

The information about financial data has been taken from the Annual Accounts and the corporate governance information (ownership and board characteristics) from the Corporate Governance Annual Report. This information is available on the National Stock Exchange Commission (CNMV, Spain) web page.

Financial distress is defined as the lack of company's capacity to satisfy its financial obligations (Grice & Dugan, 2001; Grice & Ingram, 2001; Pindado et al., 2008). Thus, using an approximation of the Pindado et al. (2008, 997) concept of business failure, we consider as financial distress companies those that meet some of the following conditions: (1) its earnings before interest and taxes depreciation and amortization (EBITDA) are lower than its financial expenses for two consecutive years; and/or (2) a fall in its market value occurs between two consecutive periods. Other previous studies on business failure have used those proxies (see Manzaneque (2006) for a major revision). Under this approach, we have constructed a binary dependent variable that takes the value 1 if the company meets one of the above criteria and 0 otherwise.

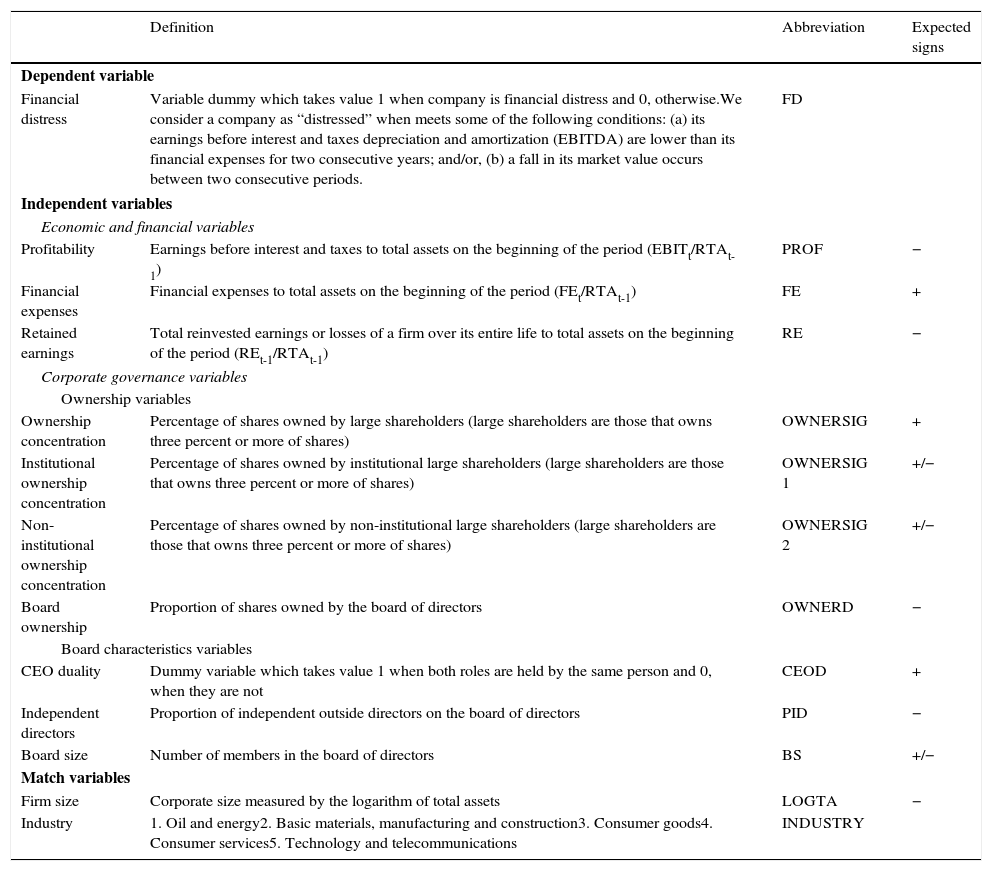

As independent variables, and following the previously exposed theoretical and empirical approaches, we use five independent variables related to ownership and board composition and structure: ownership concentration (OWNERSIG), board ownership (OWNERD), CEO Duality (CEOD), proportion of independent directors (PID) and board size (BS). These variables are described in Table 3.

Definition and expected signs variables.

| Definition | Abbreviation | Expected signs | |

|---|---|---|---|

| Dependent variable | |||

| Financial distress | Variable dummy which takes value 1 when company is financial distress and 0, otherwise.We consider a company as “distressed” when meets some of the following conditions: (a) its earnings before interest and taxes depreciation and amortization (EBITDA) are lower than its financial expenses for two consecutive years; and/or, (b) a fall in its market value occurs between two consecutive periods. | FD | |

| Independent variables | |||

| Economic and financial variables | |||

| Profitability | Earnings before interest and taxes to total assets on the beginning of the period (EBITt/RTAt-1) | PROF | − |

| Financial expenses | Financial expenses to total assets on the beginning of the period (FEt/RTAt-1) | FE | + |

| Retained earnings | Total reinvested earnings or losses of a firm over its entire life to total assets on the beginning of the period (REt-1/RTAt-1) | RE | − |

| Corporate governance variables | |||

| Ownership variables | |||

| Ownership concentration | Percentage of shares owned by large shareholders (large shareholders are those that owns three percent or more of shares) | OWNERSIG | + |

| Institutional ownership concentration | Percentage of shares owned by institutional large shareholders (large shareholders are those that owns three percent or more of shares) | OWNERSIG 1 | +/− |

| Non-institutional ownership concentration | Percentage of shares owned by non-institutional large shareholders (large shareholders are those that owns three percent or more of shares) | OWNERSIG 2 | +/− |

| Board ownership | Proportion of shares owned by the board of directors | OWNERD | − |

| Board characteristics variables | |||

| CEO duality | Dummy variable which takes value 1 when both roles are held by the same person and 0, when they are not | CEOD | + |

| Independent directors | Proportion of independent outside directors on the board of directors | PID | − |

| Board size | Number of members in the board of directors | BS | +/− |

| Match variables | |||

| Firm size | Corporate size measured by the logarithm of total assets | LOGTA | − |

| Industry | 1. Oil and energy2. Basic materials, manufacturing and construction3. Consumer goods4. Consumer services5. Technology and telecommunications | INDUSTRY | |

Conditional logistic regression analysis is applied to estimate the financial distress likelihood. Following Mangena and Chamisa (2008) we applied this methodology for two main reasons: (a) the conditional logistic regression overcomes the limitations of ordinary least squares (OLS) to estimate the parameters when the dependent variable is dichotomous, as is the case (Hosmer and Lemeshow, 1989; Tabachnick and Fidell, 1996); and (b) this methodology preserves the marched character of the sample (Hosmer and Lemeshow, 1989).

Following Pindado et al.’s, (2008) model, which includes only financial variables (profitability, financial expenses and retained expenses) our econometric model includes corporate governance too and it is expressed as follows (Model 1):

where: FD=Financial distress (measured as a dummy variable coded one if firm was considered as distressed and zero in other case); EBITt/RTAt−1=Profitability (earnings before interest and taxes to total assets on the beginning of the period); FEt/RTAt−1=Financial expenses (to total assets on the beginning of the period); REit/RTAt−1=Retained earnings (total reinvested earnings or losses of a firm over its entire life to total assets on the beginning of the period); OWNERSIGt=Ownership concentration (measured as the percentage of shares owned by shareholders with at least 3% holding); OWNERDt=Board ownership (measured as the percentage of shares owned by members of the board of directors); CEODt=CEO duality (measured as a dummy variable which takes value 1 when chair and Chief Executive Officer are the same person and 0, when they are not); PIDt=Proportion of independent outside directors on the number of members in the board of directors; BSt=Board size (measured as the number of members in the board of directors); dt=Time effect; ni=Individual effect; uit=Random disturbance.Also, we re-estimate the model with the split of OWNERSIG variable into institutional (OWNERSIG 1) and non-institutional ownership concentration (OWNERSIG 2) (Model 2) with the objective of studying the impact of institutional investors ownership concentration on the likelihood of financial distress.

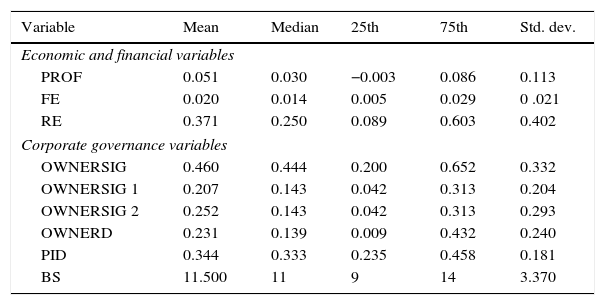

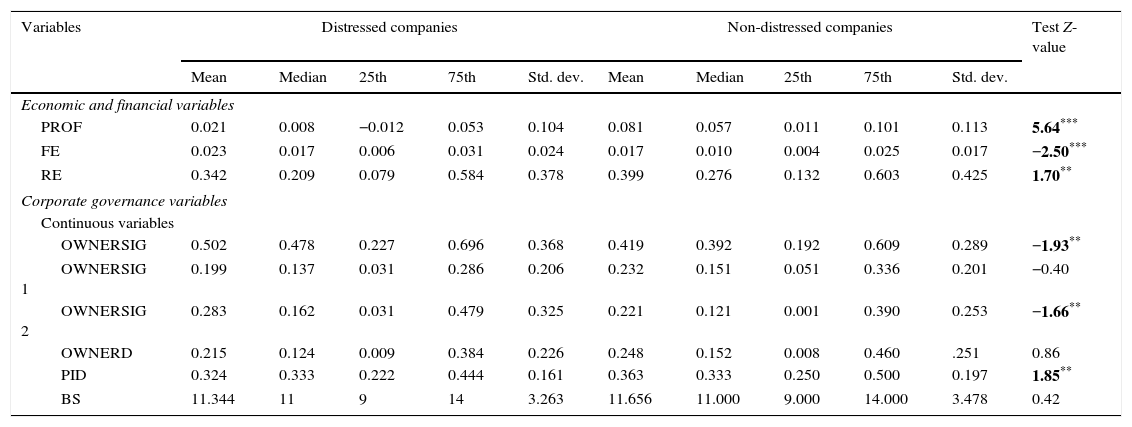

ResultsDescriptive analysis and univariate testTable 4 presents the summary descriptive statistics variables for the entire sample in order to analyze its characteristics. Table 5 provides the main statistics for both groups (distress and non-distressed observations) and the test of mean differences significance.

Sample statistics summary.

| Variable | Mean | Median | 25th | 75th | Std. dev. |

|---|---|---|---|---|---|

| Economic and financial variables | |||||

| PROF | 0.051 | 0.030 | −0.003 | 0.086 | 0.113 |

| FE | 0.020 | 0.014 | 0.005 | 0.029 | 0 .021 |

| RE | 0.371 | 0.250 | 0.089 | 0.603 | 0.402 |

| Corporate governance variables | |||||

| OWNERSIG | 0.460 | 0.444 | 0.200 | 0.652 | 0.332 |

| OWNERSIG 1 | 0.207 | 0.143 | 0.042 | 0.313 | 0.204 |

| OWNERSIG 2 | 0.252 | 0.143 | 0.042 | 0.313 | 0.293 |

| OWNERD | 0.231 | 0.139 | 0.009 | 0.432 | 0.240 |

| PID | 0.344 | 0.333 | 0.235 | 0.458 | 0.181 |

| BS | 11.500 | 11 | 9 | 14 | 3.370 |

| Companies | ||

|---|---|---|

| CEOD | Coded 1 | 62.00% |

| Coded 0 | 38.00% | |

The table summarizes the mean, median, percentile 25th, percentile 75th and standard deviation for entire sample. Variables are described in Table 3.

Mean comparison test for distressed and non-distressed companies.

| Variables | Distressed companies | Non-distressed companies | Test Z-value | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Median | 25th | 75th | Std. dev. | Mean | Median | 25th | 75th | Std. dev. | ||

| Economic and financial variables | |||||||||||

| PROF | 0.021 | 0.008 | −0.012 | 0.053 | 0.104 | 0.081 | 0.057 | 0.011 | 0.101 | 0.113 | 5.64*** |

| FE | 0.023 | 0.017 | 0.006 | 0.031 | 0.024 | 0.017 | 0.010 | 0.004 | 0.025 | 0.017 | −2.50*** |

| RE | 0.342 | 0.209 | 0.079 | 0.584 | 0.378 | 0.399 | 0.276 | 0.132 | 0.603 | 0.425 | 1.70** |

| Corporate governance variables | |||||||||||

| Continuous variables | |||||||||||

| OWNERSIG | 0.502 | 0.478 | 0.227 | 0.696 | 0.368 | 0.419 | 0.392 | 0.192 | 0.609 | 0.289 | −1.93** |

| OWNERSIG 1 | 0.199 | 0.137 | 0.031 | 0.286 | 0.206 | 0.232 | 0.151 | 0.051 | 0.336 | 0.201 | −0.40 |

| OWNERSIG 2 | 0.283 | 0.162 | 0.031 | 0.479 | 0.325 | 0.221 | 0.121 | 0.001 | 0.390 | 0.253 | −1.66** |

| OWNERD | 0.215 | 0.124 | 0.009 | 0.384 | 0.226 | 0.248 | 0.152 | 0.008 | 0.460 | .251 | 0.86 |

| PID | 0.324 | 0.333 | 0.222 | 0.444 | 0.161 | 0.363 | 0.333 | 0.250 | 0.500 | 0.197 | 1.85** |

| BS | 11.344 | 11 | 9 | 14 | 3.263 | 11.656 | 11.000 | 9.000 | 14.000 | 3.478 | 0.42 |

| Categorical variables | ||||

|---|---|---|---|---|

| Distressed Companies | Non-Distressed Companies | Chi-square value | ||

| CEOD | Coded 1 | 59.74% | 64.29% | 0.66 |

| Coded 0 | 40.26% | 35.71% | ||

This table compares mean values of economic and financial variables and corporate governance variables between two groups: Distress companies and non-distress companies. Mean differences are calculated as financial distress (1) and non-financial distress (0). A firm is classified as distressed companies when it meets one of the following conditions, first, its profitability is lower than its financial expenses for two consecutive years, or, second, a fall in its market value occurs between these two periods. For each variable, the table reports the number of observations and the values of the following statistics: mean, median, percentile 25th, percentile 75th, standard deviation and T test of difference of means (Chi-square value for categorical variables).

The bold text shows significant coefficients.

* Significant at the 10 percent level.

The results in Table 4 indicate that large shareholders control 46% of the shares, which means a concentrate ownership environment. At the same time, the great board ownership is noteworthy (23%), which indicates the alignment of interests between ownership and board of directors according to the convergence theory. Institutional and non-institutional investors have a similar mean participation in both shareholding (OWNERSIG 1, 0.207; OWNERSIG 2, 0.252). Regarding board composition variables, the results indicate that the mean proportion of independent directors is around 34% of total board members and its mean size is around 12 members. The CEO duality occurs in the 62% of the analyzed companies.

Table 5 reports descriptive statistics for distressed and non-distressed companies. Distressed companies tend to have smaller profitability – mean (median) of 2% (1%) compared with 8% (6%) – and retained earnings – mean (median) of 34% (21%) compared with 40% (28%) – than non-distressed companies. Contrarily, and according to the expected, distressed companies have more financial expenses, with a mean (median) of 2.3% (1.7%) compared to 1.7% (1%) for non-distressed companies. For corporate governance variables related to ownership, the results reveal a lower proportion of shares owned by large shareholders for non-distressed companies, with a mean (median) of 42% (39%) compared to 50% (48%) for distressed companies. By contrast, the board of directors’ ownership is greater for non-distressed companies with a mean (median) of 25% (15%) and 22% (13%), respectively. Regarding the participation of institutional and non-institutional investor, only the participation of non-institutional large shareholders is significant and greater for distressed companies (distressed companies OWNERSHIG 2 mean, 0.283; non-distressed companies OWNERSHIG 2 mean, 0.221). As for the variables related to board structure, the non-distressed companies tend to have more independent board (36.3% of member of the board), with a slightly large size (near to 12 members) and where they are more likely to have a same person as CEO and chairman (64.29%), than distressed companies (32.4% of independent member of the board, a mean board size of 11 members and CEO duality in 59.74% of cases).

The t test indicates that there are systematic differences between the distressed and non-distressed companies with respect to Profitability (PROF), Financial expenses (FE), Retained earning (RE), Ownership concentration (OWNERSIG), Non-institutional ownership concentration (OWNERSHIG 2), and proportion of independent directors (PID).

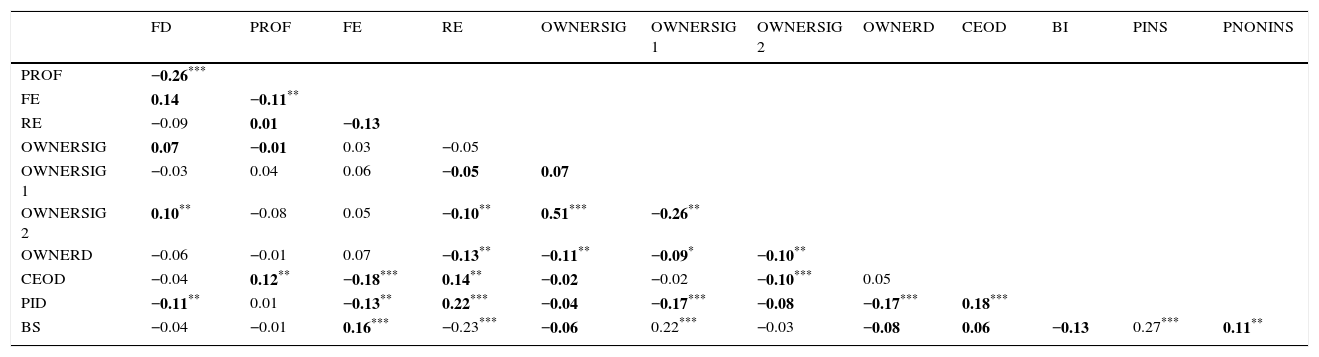

Additionally, we examine the multicollinearity between the independent variables through the Spearman's rho correlations (see Table 6). The results allow us to rule out the possible existence of multicollinearity between the variables in the studied model, and its consequences on the regression analysis, because although there are some significant correlations all are below 0.4 (Tabachnick and Fidell, 1996).

Correlation matrix.

| FD | PROF | FE | RE | OWNERSIG | OWNERSIG 1 | OWNERSIG 2 | OWNERD | CEOD | BI | PINS | PNONINS | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PROF | −0.26*** | |||||||||||

| FE | 0.14 | −0.11** | ||||||||||

| RE | −0.09 | 0.01 | −0.13 | |||||||||

| OWNERSIG | 0.07 | −0.01 | 0.03 | −0.05 | ||||||||

| OWNERSIG 1 | −0.03 | 0.04 | 0.06 | −0.05 | 0.07 | |||||||

| OWNERSIG 2 | 0.10** | −0.08 | 0.05 | −0.10** | 0.51*** | −0.26** | ||||||

| OWNERD | −0.06 | −0.01 | 0.07 | −0.13** | −0.11** | −0.09* | −0.10** | |||||

| CEOD | −0.04 | 0.12** | −0.18*** | 0.14** | −0.02 | −0.02 | −0.10*** | 0.05 | ||||

| PID | −0.11** | 0.01 | −0.13** | 0.22*** | −0.04 | −0.17*** | −0.08 | −0.17*** | 0.18*** | |||

| BS | −0.04 | −0.01 | 0.16*** | −0.23*** | −0.06 | 0.22*** | −0.03 | −0.08 | 0.06 | −0.13 | 0.27*** | 0.11** |

A firm is classified as distressed companies (FD) when it meets one of the following conditions, first, its profitability is lower than its financial expenses for two consecutive years, or, second, a fall in its market value occurs between these two periods. FD takes value 1 for distressed companies and 0 in other case. The number in the table is t-value.

The bold text shows significant coefficients.

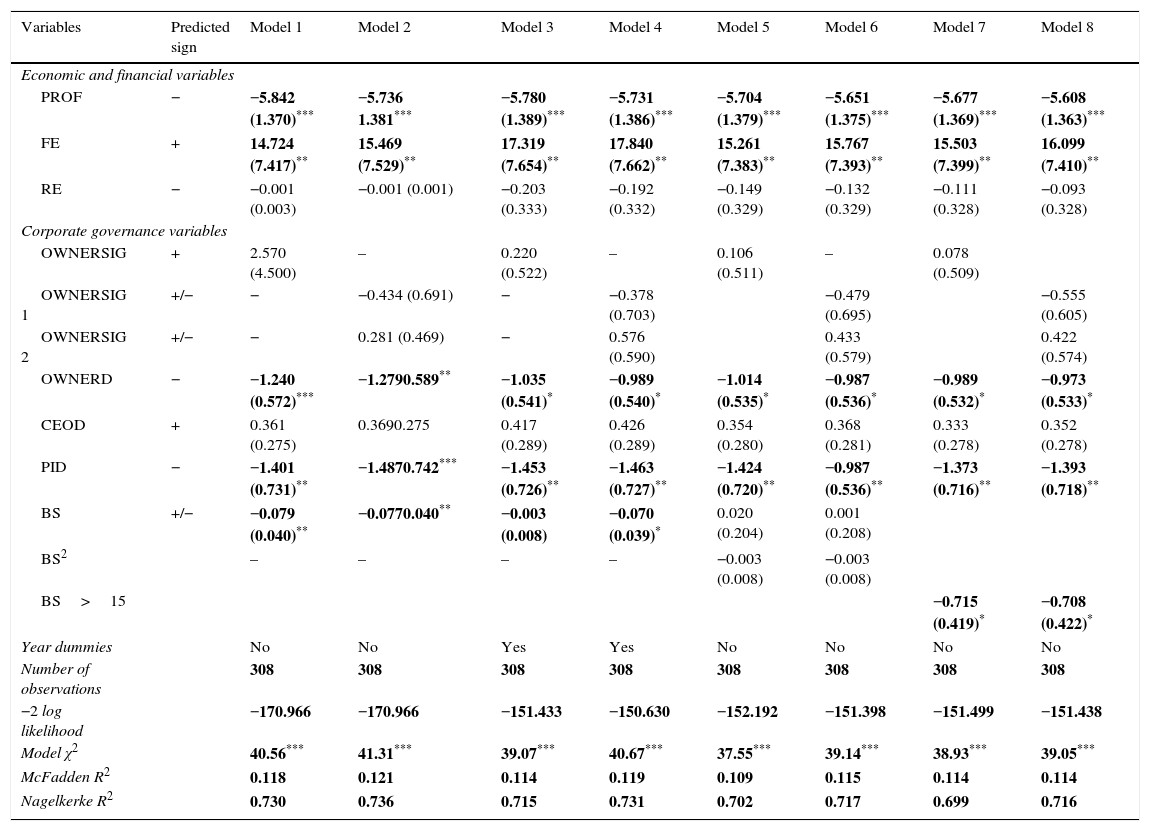

Table 7 presents the results obtained after the application of the conditional logistic-regression analysis. Two main models are presented (Models 1 and 2). In Model 1 we test the influence of economic and financial variables and corporate governance variables on the likelihood of financial distress. In Model 2 we re-estimate the above model with the split of ownership concentration variable into institutional and non-institutional investors participation in shareholding.

Conditional logistic regression models.

| Variables | Predicted sign | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 |

|---|---|---|---|---|---|---|---|---|---|

| Economic and financial variables | |||||||||

| PROF | − | −5.842 (1.370)*** | −5.736 1.381*** | −5.780 (1.389)*** | −5.731 (1.386)*** | −5.704 (1.379)*** | −5.651 (1.375)*** | −5.677 (1.369)*** | −5.608 (1.363)*** |

| FE | + | 14.724 (7.417)** | 15.469 (7.529)** | 17.319 (7.654)** | 17.840 (7.662)** | 15.261 (7.383)** | 15.767 (7.393)** | 15.503 (7.399)** | 16.099 (7.410)** |

| RE | − | −0.001 (0.003) | −0.001 (0.001) | −0.203 (0.333) | −0.192 (0.332) | −0.149 (0.329) | −0.132 (0.329) | −0.111 (0.328) | −0.093 (0.328) |

| Corporate governance variables | |||||||||

| OWNERSIG | + | 2.570 (4.500) | – | 0.220 (0.522) | – | 0.106 (0.511) | – | 0.078 (0.509) | |

| OWNERSIG 1 | +/− | − | −0.434 (0.691) | − | −0.378 (0.703) | −0.479 (0.695) | −0.555 (0.605) | ||

| OWNERSIG 2 | +/− | − | 0.281 (0.469) | − | 0.576 (0.590) | 0.433 (0.579) | 0.422 (0.574) | ||

| OWNERD | − | −1.240 (0.572)*** | −1.2790.589** | −1.035 (0.541)* | −0.989 (0.540)* | −1.014 (0.535)* | −0.987 (0.536)* | −0.989 (0.532)* | −0.973 (0.533)* |

| CEOD | + | 0.361 (0.275) | 0.3690.275 | 0.417 (0.289) | 0.426 (0.289) | 0.354 (0.280) | 0.368 (0.281) | 0.333 (0.278) | 0.352 (0.278) |

| PID | − | −1.401 (0.731)** | −1.4870.742*** | −1.453 (0.726)** | −1.463 (0.727)** | −1.424 (0.720)** | −0.987 (0.536)** | −1.373 (0.716)** | −1.393 (0.718)** |

| BS | +/− | −0.079 (0.040)** | −0.0770.040** | −0.003 (0.008) | −0.070 (0.039)* | 0.020 (0.204) | 0.001 (0.208) | ||

| BS2 | – | – | – | – | −0.003 (0.008) | −0.003 (0.008) | |||

| BS>15 | −0.715 (0.419)* | −0.708 (0.422)* | |||||||

| Year dummies | No | No | Yes | Yes | No | No | No | No | |

| Number of observations | 308 | 308 | 308 | 308 | 308 | 308 | 308 | 308 | |

| −2 log likelihood | −170.966 | −170.966 | −151.433 | −150.630 | −152.192 | −151.398 | −151.499 | −151.438 | |

| Model χ2 | 40.56*** | 41.31*** | 39.07*** | 40.67*** | 37.55*** | 39.14*** | 38.93*** | 39.05*** | |

| McFadden R2 | 0.118 | 0.121 | 0.114 | 0.119 | 0.109 | 0.115 | 0.114 | 0.114 | |

| Nagelkerke R2 | 0.730 | 0.736 | 0.715 | 0.731 | 0.702 | 0.717 | 0.699 | 0.716 | |

The variables are described in Table 3. Standard error is reported in parentheses. In bold, significant coefficients.

Significant at the 1 percent level.

McFadden R2 o Pseudo R2 is a measure of the goodness-of-fit of the model that is equivalent to the R2.

Pseudo R2=[(−2LLnull−(−2LLfull)]/−2LLnull,

where −2LL is the likelihood value and where the null model is the one including only the constant.

Nagelkerke is a test of goodness-of-fit distributed as R2.

Model χ2 is a statistical significance test, the model is significant if the probability is less than 0.05.

The results of Model 1 support the hypothesis of relationship between financial distress likelihood and board ownership (OWNERD), proportion of independent directors (PID) and board size (BS).

The coefficient indicates that board ownership (OWNERD) has a negative influence on financial distress likelihood, which is consistent with the findings of Deng and Wang (2006) for the Chinese market or Karamanou and Vafeas (2005) although contradicting that obtained by Mangena and Chamisa (2008). According to this result, ownership of shares by board members could be an appropriate measure of corporate governance in order to control the actions and interests thereof. In turn, the Agency Theory provides that stock ownership by directors encourage the alignment of their interests with those of shareholders. So, the hypothesis H3 is supported.

For the variable proportion of independent directors (PID) we obtain the same relationship, the estimated coefficient is negative and thus consistent with the expected sign. Companies with more proportion of independent directors have less likelihood to suffer a financial distress situation, thus accepting H5. This result is consistent with Wang and Deng (2006), Hiu and Jing-Jing (2008) and Mangena and Chamisa (2008), highlighting the importance of independent boards to monitoring and control management decisions, especially those affecting the company survival. The effect of Board size (BS) on financial distress likelihood is negative, supporting the hypothesis H6a. However, this result is contrary to that obtained by Lajili and Zéghal (2010) or Mangena and Chamisa (2008), those who do not find a relationship between board size and distressed companies. This is consistent with the argument of the Resources Dependency Theory (Pearce and Zahra, 1992; Pfeffer, 1972), according to which companies with more size board have the ability to control management and to access the resources and information. Also the board of directors may represent a broad range of interests and point of view, reducing the financial distress likelihood.

The coefficient of the variables ownership concentration (OWNERSIG) and CEO duality (CEOD) are not significant, and thus our hypotheses are not supported (H1, H4). In the first case, the coefficient is positive suggesting that the financial distress likelihood increases with ownership concentration. This would suggest that large shareholders are passive as regards an enhanced monitoring on management, alternatively, they do not have enough incentives to hold back the financial distress. So, our results are consistent with other empirical evidence (Elloumi and Gueyie, 2001; Lee and Yeh, 2004; Mangena and Chamisa, 2008; Parker et al., 2002). Second, the variable CEO duality (CEOD) shows the expected sign (positive) although results are not significant as in the Mangena and Chamisa (2008) study. This result is consistent with the Daily and Dalton (1994a) and Hiu and Jing-Jing (2008) studies.

In Model 2, when institutional (OWNERSIG 1) and non-institutional (OWNERSHIP 2) large shareholders variables are included in the financial distress prediction models, the results show that this aspect is not significant for the study context. So, contrary to the previous empirical evidence (Lee and Yeh, 2004; Mangena and Chamisa, 2008), institutional investors seem to be passive to monitoring the management activities in Spain; thus, the hypotheses H2a and H2b are not supported by the results. These results could be attributed to the fact that institutional investors do not have enough power or incentives to make the firms perform well (Edelen, 2001; Fich and Slezak, 2008).

Further analysisIn order to test the robustness of the results some further analyses have been developed. First, since the economic situation is different each year, this situation can also influence on firms’ failure likelihood (Foster, 1986; Lev and Thiagarajan, 1990). Models 3 and 4 (Table 7) have been developed including year dummies to control that effect. However, the results remain unchanged so, in this case, the different economic situation present in all years of the studied period have no influence on business failure.

Second, the literature supports the idea that more members on the board contribute to the diversity of criteria and improve its efficiency (Dalton, Daily, Johnson, & Ellstrand, 1999) and independence (Pearce and Zahra, 1992). Nevertheless it also accepts that large boards have greater coordination and information problems because there is less speed and efficiency in the decision-making process (Jensen, 1993; Lipton and Lorsch, 1992). According to that, some literature suggests a nonlinear relationship between board size and performance (among others, Yermack, 1996 and Karamanou and Vafeas, 2005) and consequently also with business failure likelihood. To test this possibility the BS squared variable has been included into the Models 5 and 6. In these cases the variable BS is positive but non-significantly related to business failure likelihood.

Finally, a dummy variable has been created to control those observations that have boards with more than fifteen members (Models 7 and 8), over the recommendation in Unified Code of Good Governance (Comisión Nacional del Mercado de Valores, 2006) to Spanish companies. The results show the same negative relationship between that new variable and business failure likelihood. In summary, these analyses suggest that our results are robust.

ConclusionsThis paper extends prior empirical research on financial distress and corporate governance mechanisms filings in geographical context like Canada, U.S., China and UK to Spain, where overall analysis of this issue is still lacking. Spanish companies’ ownership distribution and corporate governance system characteristics (ownership concentration, large directors’ ownership, widespread CEO duality practice and large board size) more likely raise the agency problems and, therefore, they could contribute to worsening situations of financial distress. We investigate the effect of Spanish corporate governance mechanisms on the likelihood of financial distress.

The results show that corporate governance mechanisms as board ownership, proportion of independent directors and board size reduce the financial distress likelihood. However, ownership concentration, institutional or non-institutional large shareholders and CEO duality have no significant impact on financial distress likelihood. So, our research offers some important implication for the empirical literature about how corporate governance mechanisms influence on financial distress likelihood. First, our study provides empirical evidence on the relationship between corporate governance mechanisms and financial distress likelihood for the Spanish context where it is non-existent. Second, this paper offers empirical evidence regarding the negative relationship between board size and financial distress likelihood. Often, emphasis has been put on the need to reduce the size of boards, though in this case the evidence shows that more size could contribute to a greater diversity of opinion or, alternatively, improved access to information and increased the ability to control the management. Thirdly, institutional investors are not shown to be effective as mechanisms of corporate governance in the study context, contrary to the results of other researches. This raises important issues regarding what factors condition the exercise of power by institutional investors and what kind of interests they are what keep on the company. This analysis could shed light on the factors that contribute to avoid the company financial distress.

Although our results have several implications for corporate governance and financial distress literature, there are some limitations and unobservable issues. First of all, due to the focus on our study we have some obvious internal and external control mechanisms as General Meeting of Shareholders, the shareholders’ activism, board training and professional experience, board diversity, the design of compensation contracts of directors or other measures of ownership concentration reflecting the effective shareholder control over the company. Second, the sample period is not long enough to study some issues as causality of variables and endogeneity problems. Third, we should go into detail about the reasons that lead to institutional investors to take a passive role in management control and monitoring to get over financial distress. Future research could analyze these issues to better understand the complexity of the financial distress process and their causes.

Conflict of interestThe authors declare no conflict of interest.

We appreciate the invaluable assistance of Professor Musa Mangena of Nottingham Trent University. His advice and suggestions have contributed significantly to the final outcome of this work.