In the current corporate context, information on corporate risks plays an essential role in the decision-making process and in an adequate assessment of different organizations.

The current study examines the main risks disclosed by the largest Spanish companies and analyses the factors underlying this disclosure, particularly those linked to corporate governance.

The content analysis performed shows that Spanish companies reveal relatively little information on risks. Their disclosure mainly focuses on the divulgation of the basic characteristics of the financial risks involved.

Likewise, the results obtained emphasize the complexity of the voluntary revelation of risks. While an extended management board might improve the provision of more detailed information about the risks required by the current regulation, it tends to adopt a conservative policy of reporting concerning the voluntary disclosure. Moreover, we show the relevance of transparency as a deterrent for providing voluntary information by larger companies, due to the concerns about negative strategic repercussions.

En el actual entorno empresarial, la información corporativa sobre riesgos desempeña un papel esencial en el proceso de toma de decisiones y en una adecuada valoración de las diferentes organizaciones.

El presente estudio examina los principales riesgos revelados por las mayores empresas españolas y analiza los factores subyacentes a esta revelación, especialmente aquellos vinculados al gobierno corporativo.

El análisis de contenidos realizado muestra que las empresas españolas apenas informan sobre sus riesgos. Su revelación se centra principalmente en características básicas de riesgos financieros.

Asimismo, los resultados obtenidos subrayan la complejidad de la revelación voluntaria de riesgos. Mientras que un consejo de mayor tamaño puede facilitar la provisión de información más detallada sobre los riesgos requeridos por la actual regulación, este tiende a adoptar una política más conservadora y prudente de revelación en lo que respecta a la divulgación voluntaria. Además, se evidencia la relevancia de la transparencia como elemento disuasivo a la hora de proporcionar información voluntaria por parte de las grandes empresas, como consecuencia de las preocupaciones por las repercusiones estratégicas negativas.

The increasing complexity in business strategies, operations and regulations in the corporate context has fostered certain trends that emphasize the need for organizations to provide a higher volume of information in order to promote transparency, improve the quality of divulgation and reduce information asymmetries. These changes have meant that the usefulness of the information provided by the traditional financial statements to their potential users is less and less valuable, leading to a higher demand of relevant information and an effort by standard regulators to improve its quality and timeliness.

The deficiencies detected in financial statements have been also underscored by different authors and accounting bodies (AICPA, 1994; FASB, 2001; ICAEW, 1998, 1999, 2002; Lev & Zarowin, 1999), suggesting the need to include new informative elements in them to fulfil the purpose of being useful to users in the decision-making process.

Amongst the issues that can be improved in the scope of corporate communication, the disclosure of risks that companies face in their operations stands out especially. Corporate risks can be defined as the possibility of a negative future impact on the economic position of the company (GASC, 2000); in other words, the loss of wealth expressed in a reduction of future earnings, cash flows, market share or any other variable that reflects a negative impact. In the current context, risk management has become an essential part of organizations’ internal control and corporate governance, and a basic element of the business sphere. Nevertheless, there exists a lack of transparency in the disclosure of information on risks, due to the absence of norms and uniform measures (Lajili & Zeghal, 2005), among other factors.

It is widely believed that improved understanding of business risks by investors and other users of corporate reporting should lead to better stewardship of companies and to a more efficient allocation of resources (ICAEW, 2011). This information can be useful for investors to assess the quantity, duration and certainty of future cash flows and to determine the companies’ risk profiles, market value and accuracy in the forecasts on stock prices (Abraham & Cox, 2007; Beretta & Bozzolan, 2004; Helliar & Dunne, 2004; Linsley & Shrives, 2001). In this sense, the information on risks can contribute to manage change (Abraham & Cox, 2007), reduce the cost of capital (ICAEW, 2011; Linsley & Shrives, 2001, 2006), report on the future path of the business model (Cabedo & Tirado, 2004; ICAEW, 1999) and allow companies to communicate the message that they wholly understand their own risks and have developed practices to manage them (Abraham, Solomon, & Stevenson, 2007).

As Cabedo and Tirado (2007, p. 42) underscore, there is some degree of unanimity as to the need for reporting on corporate risks, although this consensus disappears when discussing whether the release should be compulsory or voluntary. Nowadays, except for the regulation of financial risks, most of the disclosure is voluntary. Several theories of the firm support the disclosing of voluntary information. According to the Agency Theory, the release of voluntary information is an essential factor in the decision-taking process and can work as a control system over managers’ activities on behalf of shareholders and other stakeholders (Jensen & Meckling, 1976). In addition, in accordance with the Theory of Political Costs, companies would disclose voluntarily information because it could lead to reducing political costs (e.g. taxes) and obtaining certain advantages (e.g. subsidies). In the same vein, the Theory of Signals holds that the divulgation can be regarded as a signal to capital markets, so that information asymmetries can be reduced, financing costs are optimized and corporate value increases (Baiman & Verrecchia, 1996).

However, the Theory of Proprietary Costs emphasizes the potential harm that could stem from the use of the information provided, given that this information would be public not only for current and potential investors, but also for competitors. There are also other potential disadvantages that could result from voluntary disclosures (Gray et al., 1990): threats of takeovers or mergers, possibilities of intervention by government agencies and taxation authorities, and possibilities of claims from employees or trade unions or from political or consumer groups. The information would also be available for other interested users, such as governments, trade unions, consumer associations, clients or suppliers, thereby leading to likely increases in pressures on the firm (e.g. demands related to prices or salaries). Therefore, the divulgation of corporate information is the result of a trade-off between the incentives to disclose and the drawbacks stemming from that disclosure.

Along this line, Dobler (2007) looks into the issues related to the credibility of the information as a disincentive to disclosure. He argues that there are three potential explanations for a more restricted report on risks: (1) executives may not report because they do not have specific enough information about their risks; (2) they cannot reveal them credibly; (3) they can withhold information owing to the threats of commercial harm. In addition to the inherent unreliability, the Institute of Chartered Accountants in England and Wales (ICAEW, 2011) has also stressed that, in some circumstances, costs may exceed perceived benefits, leading to uninformative disclosures.

Concerning previous literature, some studies (ICAEW, 1998, 1999, 2002; Linsley & Shrives, 2005; Schrand & Elliott, 1998; Solomon, Solomon, Norton, & Joseph, 2000) have shown that companies are providing insufficient information, characterized by a lack of coherence (Linsley & Lawrence, 2007), brevity and excessive focus on past risk (Abraham & Cox, 2007), and with a main approach to financial risks (typically associated with the use of financial derivatives). However, in addition to the financial risk, organizations have to cope with corporate risks or changes in the global economic climate that may affect their values adversely.

Therefore, taking into consideration the widely-accepted perception that companies are not providing sufficient information on risks and their management, and the call to undertake better disclosures, the aim of this study is: (1) to analyse the main risks disclosed by Spanish companies, either compulsory or voluntary; and (2) to analyse some factors both linked to corporate governance and evidenced as relevant in previous empirical studies, which can boost or deter the divulgation of this kind of information. In addition to voluntary information, we also assess the extent of disclosure regarding compulsory information, given that it is not similar to reveal just simple features in search for strict compliance of the current regulation or to include a further step of disclosure by providing abundant data, ranging from vague and generic disclosure to quantitative estimations and more specific data. Although compulsory, this latter choice would imply “a strategic touch”, going deeply into the information provided, with more content and detail.

We thus proceeded to analyse the disclosure of risks undertaken by the largest Spanish companies (excluding financial and insurance companies), quoted on the Madrid Stock Exchange, during the period 2007–2009. These companies show a high degree of visibility in markets and, consequently, they have strong incentives to report on their risks. Firstly, we performed a content analysis, creating a disclosure index that compiles both the volume of information revealed and its quality in relation to a set of risks whose disclosure is compulsory, mainly financial risks (credit, liquidity and market risks) and other risks whose revelation is voluntary, such as non-financial risks (operational, business, environmental, new investments, reputation, country risks). We then studied the influence of some factors on this revelation, using panel data methodologies in order to control for the unobserved heterogeneity.

Previous papers have concluded that the divulgation of voluntary information is determined by factors such as: the presence of independent directors (Abraham & Cox, 2007; Chen & Jaggi, 2000; Schellenger, Wood, & Tashakori, 1989), Board activity (Banghoj & Plenborg, 2008), Board stock ownership (Lim, Matolcsy, & Chow, 2007), as well as the corporate size (Amran, Manaf, & Che, 2009; Beretta & Bozzolan, 2004; Linsley & Shrives, 2006), leverage (Ahmed & Courtis, 1999; García-Meca & Sánchez, 2006; Rodríguez Domínguez, Gallego Álvarez, & García Sánchez, 2008, 2009), profitability (Chen & Jaggi, 2000; Marston & Polei, 2004) and the industrial sector (Gallego Álvarez, García Sánchez, & Rodríguez Domínguez, 2008; Watson, Shrives, & Marston, 2002).

However, these factors have not been analysed in relation to the corporate information on risks in a context of corporate governance like the one in Spain, characterized by a low proportion of quoted firms and high ownership concentration in non-financial firms, financial institutions and family businesses. Also, the members of the Board manage and monitor at the same time (Rodríguez Domínguez, Gallego Álvarez, & García Sánchez, 2011).

This study contributes to extending our knowledge about how Spanish companies are disclosing their risks, regarding both the amount and the quality of the risks revealed, and how the information is disclosed through quantitative and qualitative measures. Likewise, this analysis is located within the line of research linked to the disclosure of corporate information. It thus allows us to contrast the arguments of the theories of Agency, Signals, Political Costs and Proprietary Costs, at the same time that it obtains some practical implications that can be useful to accounting standard setters and managers responsible for corporate disclosure.

It is worth emphasizing that this work is one of the first exploratory studies undertaken in Spain, to our best knowledge. This topic has received greater attention in other countries, such as the United Kingdom (e.g. Linsley & Lawrence, 2007; Linsley & Shrives, 2000, 2005, 2006; Woods & Reber, 2003), the United States (Linsmeier, Thornton, Venkatachalam, & Welker, 2002; Roulstone, 1999), Germany (Kajüter, 2001; Kajüter & Winkler, 2003), Italy (Beretta & Bozzolan, 2004) or Canada (Lajili & Zeghal, 2005). It also links two research lines in Spain, such as corporate disclosure and corporate governance, which, in other contexts, have provided many empirical studies such as those mentioned above.

In short, the results emphasize the complexity of the voluntary revelation of risks. Whereas an extended board may facilitate the provision of more detailed information about the risks required by the current regulation, it tends to adopt a conservative policy of reporting concerning the voluntary disclosure. Moreover, we evidence the relevance of visibility as a deterrent of providing voluntary information for larger companies, as a consequence of the concerns about negative strategic repercussions.

The study is structured in six sections. After this introduction, Section 2 describes the Spanish regulation on the disclosure of corporate risks, as well as previous empirical studies related to the reporting on risks. Section 3 is devoted to explaining several drivers that can influence corporate disclosure, and proposes the research hypotheses. Section 4 presents the methodology. The empirical results from the statistical description are explained in Section 5, while those from the multivariate analysis are shown and discussed in Sections 6 and 7. We then conclude with some of the most relevant implications derived from the findings.

2Current situation in the disclosure of risks: Spanish regulation and previous studiesFirstly, we describe the Spanish regulation that establishes the framework for the disclosure of information on corporate risks. We then review some of the main studies that have analysed the disclosure of risks in an international sphere, emphasizing the most relevant findings.

2.1Spanish regulations on the disclosure of risksThe importance of corporate disclosure on risks has increased recently due to the current business context, characterized by the presence of constant changes which lead to higher uncertainty about the future evolution of corporations. Likewise, the financial scandals have implied that risk disclosures are increasingly required by different stakeholders.

Some regulatory bodies have issued norms that regulate the reporting on risks and thereby oblige managers to cope with that requirement of information. Despite the duty of revealing these risks, these norms just require the divulgation of financial risks, being discretionary the revelation of other types of risks, such as strategic, business, and environmental risks. However, these risks are also important and their knowledge is essential for shareholders and other stakeholders, helping to obtain higher extent of trust and to improve the knowledge on the company. Hence, stakeholders can take more accurate decisions and mitigate uncertainty.

In the Spanish case, the Capital Firms Law establishes the obligation of disclosing information on risks derived from the use of financial instruments in the Management Report, in line with the international harmonisation based on regulations issued by the European Union. Along this line, regarding risks, the IFRS # 7 regulates the disclosure of information about risks generated by the use of financial instruments and indicates the types of financial risks on which companies must report: credit, liquidity and market risks, giving the opportunity of revealing other types of financial risks.

In the Spanish context, the Capital Firms Law (article # 262) globally states that the Management Report must include:

- -

A description of the main risks and uncertainties faced by the organization;

- -

Information about exposures to credit, liquidity and cash-flow risks in the use of financial instruments;

- -

A description of the objectives, policies and procedures in the management of financial risks used by the company in order to cope with them.

Additionally, the Spanish regulation does not require reporting of information on risks other than those linked to the use of financial instruments.

2.2Main empirical studies about risk disclosureSeveral studies have analysed the amount and quality of the corporate risks revealed by companies in their countries. Given that the disclosure of information is mainly determined by local standards, the studies tend to focus on their specific national scope.

The main initial studies emerged in the US context (Linsmeier et al., 2002; Roulstone, 1999), generally focusing on financial risks and, more particularly, analysing the relationship between risk disclosures and interest rates, currency rates and stock prices. They deal with the risks associated with capital markets, according to the SEC's requirements, leaving the door open to the disclosure of other type of risks on behalf of managers and directors.

In Europe, the context most researched is the United Kingdom (Linsley & Lawrence, 2007; Linsley & Shrives, 2005, 2006; Woods & Reber, 2003). In this regard, there is a coincidence in the fact that firms tend to reveal financial risks more extensively, followed by strategic risk and integrity risk. Most UK companies provide null or scarce information on specific business factors, mainly showing back-forward information and apparently without making any effort to show how past events have affected a specific aspect of risk. In this sense, Linsley and Lawrence (2007) underscore that the level of readability about risk disclosures is difficult or very difficult, impeding an effective communication. However, according to the results obtained by Abraham et al. (2007), those companies which provide information usually report measurable and quantitative information, quite specific in relation to their sector and activities set, and consequently, useful to investors in order to understand better the risk profile of companies.

On the European continent, Kajüter (2001), Kajüter and Winkler (2003) and Beretta and Bozzolan (2004) have investigated the divulgation of corporate information on risks in Germany and Italy, respectively. In the German context, Kajüter (2001) and Kajüter and Winkler (2003) detect a quite reduced revelation of forward information on risks, evidencing some managers’ reluctance to provide that information. Likewise, they find that most companies do not adopt a systematic approach to risk disclosures. Similar results can be found in Italy (Beretta & Bozzolan, 2004), where the release is focused on past and current risks, rather than future risks, although they tend to reveal more strategic aspects, compared to other contexts.

Oliviera, Rodrigues, & Craig (2011a) have carried out a review of previous literature about descriptive studies, concluding that the risks disclosure is not clear enough, the minimum compulsory requirements are not fulfilled and the effectiveness of market discipline is being affected.

Other studies have examined the Canadian (Lajili and Zeghal, 2005) and Malaysian (Amran et al., 2009) contexts. In both studies, the conclusions are similar: the revelation of risks is almost entirely qualitative in nature and lacks an appropriate degree of specificity. However, the most frequent revealed risks vary: in Canada, the disclosure focuses on financial risks, while in Malaysia, strategic risk is the one most disclosed.

Most studies (e.g. Beretta & Bozzolan, 2004; Beattie, McInnes, & Fearnley, 2004; Linsley & Shrives, 2006) show that organizations are generally reluctant to quantify the effect of specific issues of risk in their disclosures. Along this line, given that the revelation of quantifications in risk estimations may lead to directors being more monitored, directors may want to avoid provoking judgemental attention. This would lead to a higher propensity to describe and discuss risks in the annual reports without providing quantified estimations of the potential results.

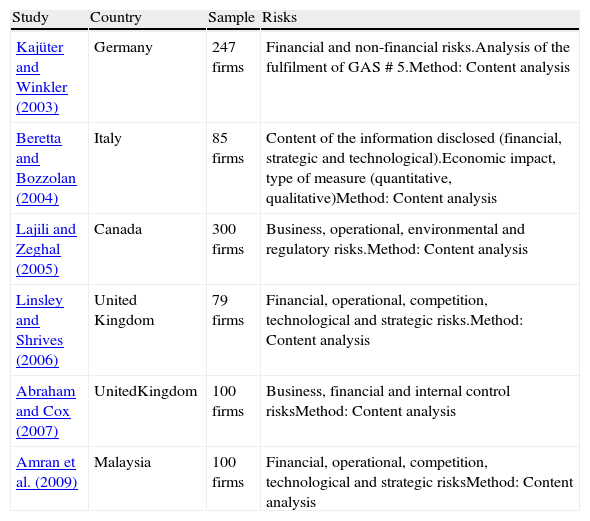

Finally, Table 1 summarizes the main studies, with their analytical approach.

Summary of previous studies about risks disclosures.

| Study | Country | Sample | Risks |

| Kajüter and Winkler (2003) | Germany | 247 firms | Financial and non-financial risks.Analysis of the fulfilment of GAS # 5.Method: Content analysis |

| Beretta and Bozzolan (2004) | Italy | 85 firms | Content of the information disclosed (financial, strategic and technological).Economic impact, type of measure (quantitative, qualitative)Method: Content analysis |

| Lajili and Zeghal (2005) | Canada | 300 firms | Business, operational, environmental and regulatory risks.Method: Content analysis |

| Linsley and Shrives (2006) | United Kingdom | 79 firms | Financial, operational, competition, technological and strategic risks.Method: Content analysis |

| Abraham and Cox (2007) | UnitedKingdom | 100 firms | Business, financial and internal control risksMethod: Content analysis |

| Amran et al. (2009) | Malaysia | 100 firms | Financial, operational, competition, technological and strategic risksMethod: Content analysis |

According to Gul and Leung (2004), the policy of corporate disclosure stems from the Board of Directors. Therefore, corporate governance can influence voluntary revelation, such as the divulgation of information about risks. In light of this, we focus first on the analysis of several features of corporate governance.

In addition, there are other factors that may influence corporate disclosure, whose impact has been examined in previous literature. As a result, we have also studied the effect of corporate size, profitability, leverage and industrial sector on the disclosure of a higher volume of information about risks.

3.1Factors linked to corporate governanceAccording to previous literature, some features of corporate governance can have a significant effect on the disclosure of corporate information; these include size, independence and activity of the Board of Directors.

3.1.1Board sizeMost Good Governance Codes recommend that the Board should be made up of a reasonable number of directors, because effectiveness in the monitoring function may depend mainly on this factor (Gandía & Pérez, 2005). However, in spite of increasing the monitoring capacity, a high number of directors may be detrimental to organizational efficacy, given that it can extend the decision-taking process and the communication procedures (Jensen, 1993).

Consequently, the size that Boards should have in order to be effective is a widely discussed issue. On the one hand, an increase in the size, by including directors with new perspectives to analyse strategic issues, may provide corporate decisions with a higher quality, among them, those decisions related to corporate disclosure. Pearce and Zhara (1992), Dalton, Johnson, and Ellstrand (1999), Rodríguez Domínguez et al. (2011) find that Board size is positively related to the volume of information disclosed. On the other hand, other studies (Andres, Azofra, & Lopez, 2005; Eisenberg, Sundgren, & Wells, 1998) show that the presence of a higher number of Board members may imply a lower effectiveness as regards management monitoring, giving rise to agency problems. This decrease in Board effectiveness may lead to a lower tendency to reveal information about corporate activities owing to the absence of an adequate control mechanism (Andres et al., 2005; Eisenberg et al., 1998; Yermack, 1996).

Considering this evidence, we propose the following hypothesis:Hypothesis 1 There is a relationship between Board size and the disclosure of corporate risks, both compulsory and voluntary.

Board size is determined by the number of directors, both internal and external.

3.1.2Board independenceRegarding Board independence, Agency theory suggests that executive directors do not have sufficient incentive to disclose (including disclosure of risks), because their situation and behaviour in the company can thus be monitored more thoroughly (Leftwich, Watts, & Zimmerman, 1981). Also, Fama and Jensen (1983) hold that a higher proportion of independent (outside) directors on the Board may potentially lead to a more effective monitoring or control on behalf of the Board, limiting opportunism in the management and placing the Board in a better position to meet investors’ preferences concerning transparency and accountability (Eng & Mak, 2003). Moreover, Forker (1992) suggests that the quality of information may be improved by including independent directors on the board, which fosters the fulfilment of the compulsory requirements and allows investors to have deeper knowledge on the board's work. In this vein, Chen and Jaggi (2000), Lim et al. (2007), and Cheng and Courtenay (2006) find a significant relationship between financial disclosure and the proportion of independent directors.

However, this argument has been discussed in other studies, which suggest that outside directors (both independent and shareholders’ representatives) may not be sufficiently prepared for understanding the business activities or may not pay sufficient attention to the company owing to their simultaneous presence on different Boards (Baysinger & Hoskisson, 1990). Also, independent directors may be reluctant to disclose voluntary information that may provoke risks of lawsuits for the firm (Prado Lorenzo & GarciaSanchez, 2009; Prado Lorenzo, García Sánchez, & Gallego Álvarez, 2009). Along this line, Forker (1992), Ho and Wong (2001), Haniffa and Cooke (2005), García-Meca and Sánchez (2006) and Abraham and Cox (2007) find a non-significant association between voluntary revelation and a high percentage of independent directors.

Based on previous arguments, we posit the following hypothesis:Hypothesis 2a There is a positive relationship between the proportion of external directors on the Board and the disclosure of corporate risks, both compulsory and voluntary.

Another relevant issue that may influence Board effectiveness has to do with stock ownership by Board members. The separation of ownership and control seems to be a significant feature in order to issue voluntary information, given that managers tend to make their activities more transparent through the disclosure of information not required legally, thereby decreasing potential agency and moral hazard problems (García-Meca & Sánchez, 2006).

Several studies (Chau & Gray, 2002; Cooke, 1992; Ho & Wong, 2001) argue that the higher the Board stock ownership, the higher the amount of information disclosed to satisfy users’ needs. In contrast, a negative and significant relationship is predicted when insiders own most of the stock, given that these companies require disclosure of a lower level of voluntary information. In this vein, Lim et al. (2007) obtain a negative and significant association between insiders’ stock ownership and several types of voluntary revelation. Likewise, Oliviera, Rodrigues, & Craig (2011b) do not find any relationship between risks disclosures and ownership structure, mainly due to the high ownership concentration in the Portuguese banking sector.

Also, Jensen and Meckling (1976) hold that when executives own a significant amount of stock, their incentives are more closely linked to shareholders’ incentives; in other words, when executives have a significant participation in the company, they are more prone to exert control of corporate management effectively (Brickley & James, 1987). Nonetheless, the literature that links stock ownership by Board members and corporate performance suggests a likely entrenchment in companies with a high stock ownership in Board members. This fact would not favour the alignment of managers’ and shareholders’ interests and would allow executives to achieve their purposes against shareholders’ objectives (Rodríguez Domínguez et al., 2009).

Taking into consideration the review of the previous literature, we posit the following hypothesis:Hypothesis 2b There is a negative relationship between stock ownership by Board members and the disclosure of corporate risks, both compulsory and voluntary.

Another feature of corporate governance that may influence risk disclosures is the Board's activity. Considering the number of meetings as a measure of Board activity, a direct relationship is assumed between the meetings scheduled and the degree of fulfilment of Board obligations according to shareholders’ interests (Conger, Finegold, & Lawler, 1998). More frequent meetings may imply that the Board devotes more time to the development of corporate strategies and management monitoring (Reyes-Recio, 2000). Likewise, Board activity is relevant since it can reduce the problems of asymmetric information between the different types of managers and directors.

The Agency Theory supposes that Board activity has a positive effect on the divulgation of information. Along this line, Banghoj and Plenborg (2008) observe a positive relationship between the volume of information disclosed and the number of Board meetings. In contrast, Prado Lorenzo and GarciaSanchez (2009) and Rodríguez Domínguez et al. (2011) do not obtain a significant relationship among these factors, finding a negative association in the last study.

Following the theoretical arguments of the literature reviewed, we formulate the following hypothesis:Hypothesis 3 There is a positive relationship between the number of Board meetings and the revelation of corporate risks, both compulsory and voluntary.

Previous literature about corporate disclosure has emphasized the role played by some factors that may affect the extent of revelation; amongst them, several features stand out: corporate size, profitability, leverage and activity sector.

3.2.1Corporate sizeCorporate size is linked to different features that motivate the release of a higher volume of information, such as the increasing needs for external funds, transparency, the maintaining of a public image, etc. For instance, larger companies resort to capital markets in search of financing more frequently, which conditions the amount and quality of the information to be disclosed. According to Giner (1995), one of the main reasons behind providing information externally is the need for good relations with capital suppliers in order to achieve financing in the best conditions. In the same vein, Leftwich et al. (1981) obtain that the proportion of external capital tends to be greater for large companies, which are more prone to disclose in order to meet lenders’ information needs (Jensen & Meckling, 1976).

Also, the largest companies are more visible in markets and society as a whole, with a higher coverage by analysts, and are more sensitive about their public image. This situation would lead to an increasing number of potential users, creating in turn a greater demand for information, and pressure on the company to release it.

Several studies have found a positive relationship between corporate size and the amount of information about risks: Giner (1997), Chen and Jaggi (2000), Beretta and Bozzolan (2004), Linsley and Shrives (2006), Amran et al. (2009), Oliviera et al. (2011b), among others. In addition, Ahmed and Courtis (1999) and García-Meca and Sánchez (2006) in their meta-analysis also detect a positive association between firm size and the revelation of voluntary information.

To undertake this study we chose market value as a measure of this factor, assuming that companies with higher market value are more prone to disclose information owing to their higher visibility and greater political costs, compared to those companies with lower market value.

3.2.2ProfitabilityThe link between profitability and voluntary disclosure is especially complex. The main disclosure theories tend to indicate that there is a positive relationship. In accordance with Agency Theory, the managers of profitable companies use information to obtain personal advantages, such as ensuring the stability of their positions and increasing their levels of compensation. From the perspective of the Theory of Signals, profitability can be considered an indicator of the quality of the investment. Therefore, if a high level of profitability is achieved, there will be a greater incentive to disclose information and reduce the risk of being viewed negatively by markets. According to this theory, profitable companies reveal information in order to stand out from other less successful corporations, obtain funds at the lowest cost and avoid any decrease in stock prices. In addition, the Theory of Political Costs supports the disclosure of voluntary information, so as to justify the returns obtained (Giner, 1997).

Many studies in previous literature have found a positive relationship between performance and amount of disclosure (Ahmed & Courtis, 1999; Chen & Jaggi, 2000; Marston & Polei, 2004). In contrast, Giner, Arce, Cervera & Ruiz (2003), Prencipe (2004), Rodríguez Domínguez et al. (2008, 2011), Oliviera et al. (2011b), Watson et al. (2002) and Giner (1997) have obtained a likely negative relationship, since higher profitability could spur rival companies to enter into the company's market. Consequently, it is essential to consider the influence of competitive costs, which tend to increase when profitability increases.

To measure profitability, we have used the Return on Assets, the ratio of operating income to total assets.

3.2.3LeverageThe level of leverage is another factor associated with a higher amount of information, especially as a result of agency conflicts that may arise. In this sense, companies with more debt have greater agency costs, because there is a possibility of transference of wealth from debtholders to stockholders. By increasing the amount of information disclosed, corporations can reduce their agency costs and conflicts of interest between owners and creditors.

Moreover, as leverage increases, the demand for additional information requested by creditors also rises, because they will attempt to find out how likely the company is to meet its financial obligations. In terms of stockholders, voluntary information is a mechanism used to monitor management and evaluate the company's financial health, given that the risk of financial distress increases with rising leverage.

In contrast, Watson et al. (2002) indicate that, although managers can decrease the monitoring costs by increasing the level of disclosure of voluntary information, when the debt surpasses a specific level, the disclosure of information can be adversely affected owing to the fear of unfavourable forecasts and lenders’ pressure stemming from increasing risks. Along this line, several studies have shown negative or non-significant results in this relationship (Abraham & Cox, 2007; Amran et al., 2009; Giner, 1997; Petrova, Georgakopoulos, Sotiropoulos, & Vasileiou, 2012; Watson et al., 2002).

Concerning previous studies, García-Meca and Sánchez (2006) point out in their meta-analysis that a high level of indebtedness leads to more disclosure of voluntary information. Likewise, Rodríguez Domínguez et al. (2008, 2011) and Ahmed and Courtis (1999) show that there exists a positive association between leverage and the amount of information and risks disclosed.

To measure leverage, we have opted for the ratio of total debt to total assets.

3.2.4Industrial sectorIndustry has been one of the variables often used to explain the quantity of information provided by corporations. Companies that do business in the same industry are believed to adopt similar guidelines on the information they disclose. They face the same level of business complexity and industry instability and volatility (Boesso and Kumar, 2007). If a company fails to adopt the same disclosure strategy as other corporations in the same industry, the market could interpret this as bad news (Watts & Zimmerman, 1986, p. 239). Likewise, industry membership may affect the political vulnerability of firms, and therefore companies in industries that are more politically vulnerable may use voluntary disclosure to minimize political costs, such as regulation, or the break-up of the entity/industry (Oyelere et al., 2003).

The results obtained in the previous literature are far from reaching a clear conclusion. While some works have found that industry membership contributes to explaining the amount of voluntary information disclosed (Bonsón & Escobar, 2004; Gul & Leung, 2004; Oyelere et al., 2003), especially in the information technology sector or in high growth industries (Xiao, Yang, & Chow, 2004), other studies have not shown a statistically significant relationship (e.g. Craven & Marston, 1999; Giner et al., 2003; Giner, 1997; Larrán & Giner, 2002). In the specific case of information about risks, Amran et al. (2009) find that companies from the infrastructure and technology sectors are more prone to the disclosure of risks. On the other hand, Beretta and Bozzolan (2004) do not detect that the amount of disclosure depends on the industry in which the company does business.

The sectors considered are divided into manufacturing companies and consumer goods and services.

This set of variables (corporate size, profitability, leverage and sector), which are regarded as relevant according to previous studies linked to corporate disclosure, would complement the study of the variables focused on corporate governance, being included as control variables in our study.

4Research methodsBased on the objectives and hypotheses proposed, in this section we explain the sample and present both the methods used to test the hypotheses and the estimation model.

4.1SampleIn order to research the hypotheses, we select the Spanish companies listed on the Madrid Stock Exchange in the years 2007, 2008 and 2009. Hence, this sample includes the whole set of firms, excluding insurance and financial firms, containing 99 year-observations (six of the original companies were deleted because of lack of data about corporate governance).

We opt for this sample given that it is the set containing the largest Spanish companies and the most important ones on the Spanish Stock Market. Consequently, these companies have more incentive to disclose information about risks, because they must keep stockholders, lenders and potential investors informed as to their capacities, strengths and weaknesses in relation to their risks, thereby reflecting an image of transparency and market confidence. The largest corporations are more visible, and therefore the absence of information is likely to reflect a conscious choice.

The data are obtained from the Annual Reports and the Management Reports of each company for the years 2007, 2008 and 2009. Data are also extracted from the Madrid Stock Exchange website and the Spanish equivalent to US SEC (Comisión Nacional del Mercado de Valores; CNMV). Most of the financial data used to develop the economic variables are obtained from the AMADEUS database.

4.2Elaboration of a disclosure indexWhen coping with disclosure, one of the most challenging limitations has to do with measuring the extent of corporate disclosure, especially when it refers to voluntary information (Healy & Palepu, 2001). As Bravo Urquiza, Abad, and Trombetta (2009, p. 254) points out, in most disclosure studies a measure of the levels of information disclosed is used, under the assumption that quality or transparency of disclosure is captured. In this line, one of the basic techniques to study the information provided is the content analysis; more specifically, the study of the relationship between information disclosed and other factors is mainly undertaken through disclosure indices (Ortiz & Clavel, 2006, p. 90). This procedure is widely used among the approaches for analysing corporate disclosure, jointly with subjective analyst ratings, thematic content analysis, readability studies, and linguistic analysis studies (Beattie et al., 2004), and has become generalized in research (Beretta & Bozzolan, 2004; Botosan, 1997; Bravo Urquiza et al., 2009; Bukh, Nielsen, Gormess, & Mourtisen, 2005; Cabedo & Tirado, 2009; Giner, 1997).1

These indices develop a numerical indicator that represents the quantity of information reported by companies (García-Meca & Martínez, 2004). This indicator would be a quantitative summary of a set of items that reflect how many pieces of information (items) are disclosed on the reports analysed. The items may be designed as dummy variables (value 1: disclosure; value 0: non disclosure) or may be valued according to the nature of the information assigning a higher value to quantitative information (Botosan, 1997; Bravo Urquiza et al., 2009). Hence, these indices are particularly useful for categorizing text items and when a large amount of qualitative data needs to be analysed, especially when the information is more qualitative and narrative, such as in the divulgation of risks. Another important advantage derived from these indices is the potential use of statistical techniques to analyse the factors influencing the disclosure (García-Meca & Martínez, 2004).

As the first step in this research, we create a disclosure index, which, as exposed above, is one of the main ways of evaluating the informative transparency of the firms in a sector or country (Bonsón & Escobar, 2004; García-Meca & Martínez, 2004). Previous studies about risks disclosures adopt a similar approach (see Table 1).

The types of risks analysed are compulsory risks and voluntary risks. For the analysis of compulsory risks, we take those that are compulsory to disclose according to Spanish regulations: credit, liquidity and market risks. Although their disclosure is obligatory, we have included them in the analysis, given that companies may just mention them to comply with regulation or may extend the revelation and disclose additional information with strategic purposes. Concerning the voluntary risks, we mainly follow the classification set up in (Cabedo & Tirado, 2004, 2009), by considering:

- -

operational risks, those stemming from error or failings in established procedures;

- -

business risks: the ones taken on in order to create competitive advantages and added value for shareholders; it refers to the possible impact that the loss of these company competitive skills might have, with the consequent influence on the possible future loss of company wealth;

- -

environmental risks, derived from the relationship between companies’ activities and the environment, which can lead to potential lawsuits for firms;

- -

reputation risks, those stemming from the impact of companies’ activities on their public image;

- -

country risks, derived from the possibility of adverse and unpredictable changes in the current policies and regulations, which may negatively affect the economic or business conditions in the markets in which the company operates (e.g. possible introduction of excessive taxes, the possibilities of public expropriations or nationalizations of assets, etc.)

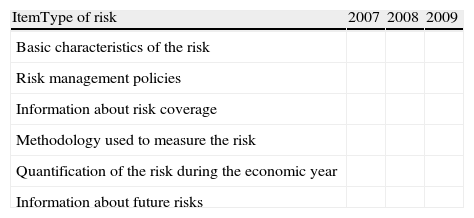

In the calculation of the disclosure index, we design the items that will form the bases for the weighting of the information of risks revealed by companies (see Table 2). For each of the risks mentioned above, its disclosure content is measured through five items: basic characteristics of the risk; Risk management policies; Information about risk coverage; Methodology used to measure the risk; Quantification of the risk during the economic year; Information about future risks. The final purpose is to observe how Spanish companies reveal their risks, that is, to measure the amount and quality of the information provided in their Annual Reports.

The information about risks (compulsory and voluntary) is obtained from the Annual Reports and Management Reports for each company and each year. We revise the obligatory and voluntary risks in order to determine: (1) the potential factors influencing risks disclosures, with a special focus on factors linked to corporate governance; (2) the most revealed aspects in each type of risk; (3) whether Spanish companies just disclose the compulsory information in accordance with current legislation or they reveal other risks voluntarily, in line with a strategic use of the corporate reporting.

We shall now explain the content of each item, by showing an example taken directly from the companies examined. Firstly, item 1 addresses the basic and essential characteristics of the risk. This example is taken from the Annual Consolidated Report of Repsol, 2009, page 77: “The credit risk is defined as the possibility of failing to comply with its contractual obligations by a third party, leading to losses for the company. The credit risk is measured and controlled by client or individual. The company has their own systems for the continuous credit evaluation of all their debtors and the implementation of risk limits, aligned with the best practices”.

As for item 2 (disclosure of policies concerning risk management), an example can be taken from the Annual Report of Sacyr, 2008, page 269: “To manage the liquidity risk resulting from the negative working capital, the company has implemented renegotiations of its credit policies and debts with a short-term expiry with sufficient anticipation. However, owing to the difficulties in obtaining liquidity by financial institutions, this renegotiation is slower than in other events, although the expiry dates with the most solvent institutions are being renewed normally” (my translation).

Item 3 has to do with the way in which companies cover their risks. An example can be seen in the Annual Consolidated Report of Acerinox, 2008, page 26: “To address the risk linked to commodity volatility, this company puts into practice a coverage of 85 per cent of the group's sales (all sales in Europe, America and South Africa) through the application of an extra of alloy that allows transfer of the nickel fluctuations in the London Metal Exchange to the client in the period during the period in which the order is being produced. Due to this coverage, a 10 per cent reduction in of the value of the nickel on the London Metal Exchange involves a reduction in the gross margin of 1 per cent” (my translation).

For item 4, related to the disclosure of the methodology implemented to measure the risks, we extract this paragraph from the Annual Consolidated Report (Management Report) of Acciona, 2008, p. 72, as an example: “With the purpose of analysing the effect of a potential variation of interest rates in the Group accounts, we have performed a simulation assuming an increase and a decrease in interest rates of 50 basic points at December 31, 2009 and 2008. This sensitivity analysis regarding up and down variations of 0.5% in the Euribor levels leads to an increase or a decrease in the financial expenses by interest payment of 29,998 and 77,410 thousands € in the Income Statement in 2009 and 2008, respectively. When performing this analysis at December 31, 2008, the figures derived from integrating Endesa Group were not taking into account, given that this latter sensitivity analysis was performed through the Value-at-Risk method” (my translation).

Item 5, referring to the disclosure of risks in a quantitative form, can be explained through this example (Annual Consolidated Report, Telefónica, 2009, page 55): “Owing to the direct exposure of its dependent companies, Telefonica analyses exposure to the currency risk at group level. Let us take an example to analyse the sensitivity of losses or earnings stemming from currency rates to the changes in these rates. If the currencies from South America reduce their values by 10 per cent with respect to US dollar and the EU euro, Telefonica estimates that the impact on the Income Statement in 2010 would be 46 million euro. However, Telefonica carries out dynamic monitoring to reduce this potential impact” (my translation).

Item 6 – the disclosure of information about future risks – can be observed in the Annual Consolidated Report of Endesa, 2008, page 93: “Endesa's potential liability for accidental pollution or other damages to third parties has been insured up to 150 million euro. Also, Endesa has insured its potential environmental liability for up to 100 million euro, deriving from the situations considered in Act 26/2007. If Endesa were sued for damage to the environment or any other type of damage in relation to its operations (except for nuclear facilities), and amounts that surpass its insurance coverage are claimed its activity, financial situation and net income could be adversely affected”.

To complete the calculation of the disclosure index, the following step is to weigh each item for each type of risk and for each company in the sample. The necessary information is taken from the Annual Consolidated Reports and the Management Reports in the years 2007, 2008 and 2009. Given that the interest of this study is not focused solely on analysing whether a specific piece of information is revealed or not, but rather aims to study the degree of disclosure and its quality, we use a score from 0 to 3.

- -

A score of 0 (zero) indicates that the company does not report on the item concerning the type of risk evaluated.

- -

A score of 1 indicates that risks are revealed in a generic and vague way, without including additional details.

- -

A score of 2 indicates that more specific data are provided in the disclosure of the item as regards the type of risk assessed.

- -

A score of 3 indicates that the company supplies quantitative estimations and a high degree of detailed information.

In an initial stage, the coding process is undertaken by two researchers in order to ensure the highest objectivity and consistency when scoring the reports’ content.

As we have shown above, the risks analysed in an individualized way are: (a) compulsory risks: credit, liquidity and market risks; (b) voluntary risks: operational, business, environmental, reputation, and country risks.

To conclude the measure of the disclosure index for compulsory risks, we sum the scores of each item for each company, by type of risk; then we sum the scores of the different types of risk to achieve CRDI (Compulsory Risks Disclosure Index). Similar procedure is applied to obtain VRDI (Voluntary Risks Disclosure Index), by adding the scores of each item for the companies analysed to obtain a score for each type of risk studied, in an initial stage, and summing the scores from different types of risks, in a further step.

4.3ModelOnce the disclosure index is determined, we proceed to test the different hypotheses proposed. In this regard, we analyse the influence of certain factors linked to corporate governance, and, more specifically, to the functioning of the Board of Directors, that may impact risk disclosures. Also, we control for the effect of a set of variables, whose impact on corporate disclosure is evidenced by previous studies (corporate size, profitability, leverage, industry).

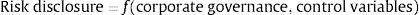

With this goal in mind we propose model (1), in which the amount and quality of the information related to the disclosure of risks would be a function of corporate governance (CG) factors and some control variables.

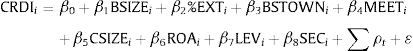

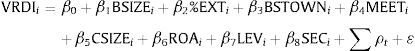

In order to estimate the model (1) empirically, we obtain the following models:

Model (2):

Model (3):

- -

CRDIi is the index of compulsory risks disclosed,

- -

VRDIi refers to the index of voluntary risks revealed,

CG variables

- -

BSIZEi is the Board size, measured by the number of directors,

- -

%EXT is the proportion of external directors on the board,

- -

BSTOWNi is the stock ownership possessed by the Board members,

- -

MEETi is the number of meetings of the Board in a year,

Control Variables

- -

CSIZEi is the corporate size, measured by the market value,

- -

ROAi is the company's profitability, measured by the ratio of operating income to total assets,

- -

LEVi is the ratio of total debt to total assets,

- -

SECi is the company's sector, taking the value 1 for the manufacturing companies and value 2 for consumer goods and services.

- -

Σρt are the temporal dummies, included to control for temporal effects in 2007, 2008 and 2009.

Models 2 and 3 are estimated through panel data methodologies. These techniques allow us to control for the firm effect, whose influence on this panel may be relevant, thereby providing more consistent findings. Therefore, the unobserved heterogeneity in our sample is controlled for. Moreover, the dependent variables can just take a specific interval of values (e.g. CRDI scores can range from 0 to 54; that is, 3 types of risks×6 items×3 maximum score). Given that they are censored, we use tobit regressions. The tobit model is appropriate for estimating linear relationships between variables when there is either left- or right-censoring in the dependent variable. In our model, cases are top-coded and low-coded, because of the scores that disclosure indices can provide. Combining both features, we proceed to estimate the model through a tobit regression for panel data.

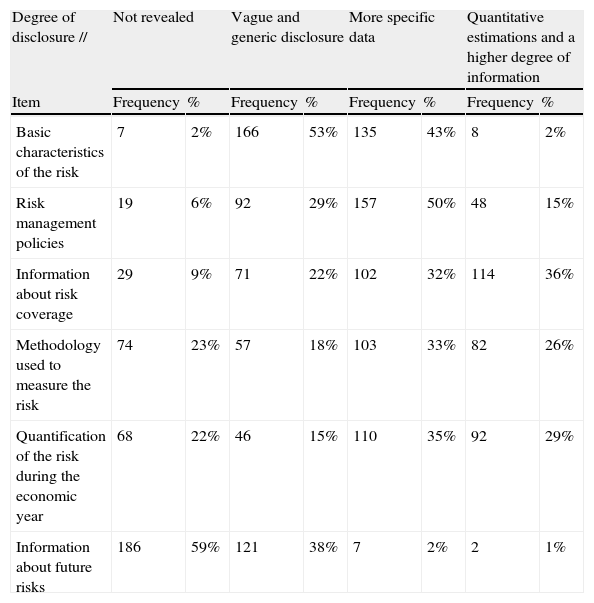

5Empirical results5.1Disclosure indices: compulsory risksTable 3 exhibits the frequencies in risk disclosures and their percentages as regards the items used for calculating the Compulsory Risks Disclosure Index. The figures reflect the content analysis performed over the sample referred to years 2007, 2008 and 2009, globally considered.2 The analysis shows that the issues most revealed are the basic characteristics of financial risks (just 2 per cent of the companies analysed do not disclose any item about this category). Also, half of companies report their policy of financial risks management providing specific data whereas 29 per cent include just generic disclosure. The information about risk coverage, methodological issues and quantifications is more disperse; for instance, concerning methodological aspects to measure the risk, 18 per cent of the sample companies reveal vague explanations, 23 per cent do not disclose any kind of information about this issue, 26 per cent provide a high level of disclosure including quantitative estimations and 33 per cent offer an adequate extent of revelation through specific data. However, the least revealed aspects are linked to information about future risks: 59 per cent of the companies do not mention them, 38 per cent make a vague and generic disclosure and just 1 per cent provide additional information.

Frequency of the items and percentage of companies revealing the items for Financial (Compulsory) Risks. Time period 2007–2009.

| Degree of disclosure // | Not revealed | Vague and generic disclosure | More specific data | Quantitative estimations and a higher degree of information | ||||

| Item | Frequency | % | Frequency | % | Frequency | % | Frequency | % |

| Basic characteristics of the risk | 7 | 2% | 166 | 53% | 135 | 43% | 8 | 2% |

| Risk management policies | 19 | 6% | 92 | 29% | 157 | 50% | 48 | 15% |

| Information about risk coverage | 29 | 9% | 71 | 22% | 102 | 32% | 114 | 36% |

| Methodology used to measure the risk | 74 | 23% | 57 | 18% | 103 | 33% | 82 | 26% |

| Quantification of the risk during the economic year | 68 | 22% | 46 | 15% | 110 | 35% | 92 | 29% |

| Information about future risks | 186 | 59% | 121 | 38% | 7 | 2% | 2 | 1% |

As can be observed, most companies divulge information regarding basic features, and policies and procedures of risks management, with some degree of specificity. However, as we go more deeply into specific and quantitative issues of risk (information about risk coverage, methodologies for measuring risks, risks quantifications), organizations show more disperse behaviour.

In summary, most of the companies reveal their compulsory risks in a generic way or, in a lesser degree, providing more specific data. Furthermore, many firms disclose their financial risks minimally. These results stress that Spanish companies just reveal those aspects that are strictly compulsory, without providing extensive information.

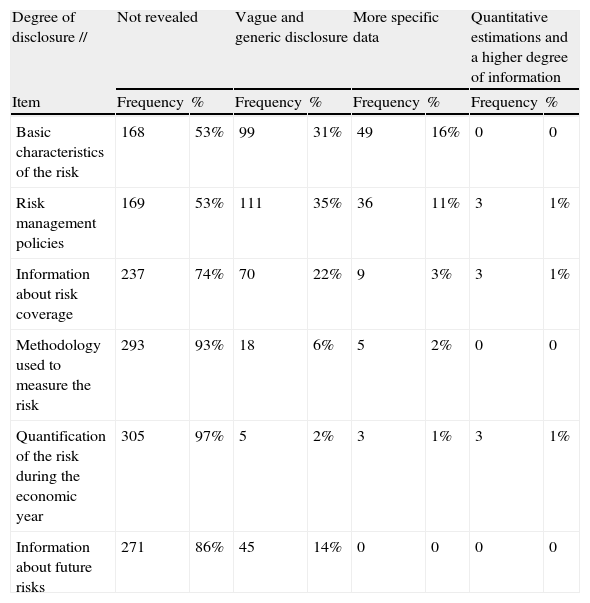

5.2Disclosure indices: voluntary risksTable 4 contains the frequencies of disclosing each item in voluntary risks, such as operational, business, environmental, reputation, country risks. These frequencies are obtained from the content analysis applied to the sample containing the years 2007, 2008 and 2009. Most of the largest Spanish quoted companies reveal very little about aspects related to these risks. The issues most revealed have to do with the basic features of the risk and policy of risk management, for which 47 per cent of the companies analysed disclose information, but mostly in a qualitative and generic way. Moreover, the least disclosed items are the quantification of risks during the current fiscal year (97 per cent of the companies do not reveal it) and the methods used to measure risks (93 per cent).

Frequency of the items and percentage of companies revealing the items regarding Voluntary Risks. Time period 2007–2009.

| Degree of disclosure // | Not revealed | Vague and generic disclosure | More specific data | Quantitative estimations and a higher degree of information | ||||

| Item | Frequency | % | Frequency | % | Frequency | % | Frequency | % |

| Basic characteristics of the risk | 168 | 53% | 99 | 31% | 49 | 16% | 0 | 0 |

| Risk management policies | 169 | 53% | 111 | 35% | 36 | 11% | 3 | 1% |

| Information about risk coverage | 237 | 74% | 70 | 22% | 9 | 3% | 3 | 1% |

| Methodology used to measure the risk | 293 | 93% | 18 | 6% | 5 | 2% | 0 | 0 |

| Quantification of the risk during the economic year | 305 | 97% | 5 | 2% | 3 | 1% | 3 | 1% |

| Information about future risks | 271 | 86% | 45 | 14% | 0 | 0 | 0 | 0 |

Therefore, most companies do not report information on voluntary risks and those that provide it do so in a very generic way. Based on the arguments held by the Theory of the Political Costs, among others, it is likely that Spanish companies scarcely reveal their voluntary risks due to strategic reasons, so that they prefer to be more prudent and conservative when disclosing their risks.

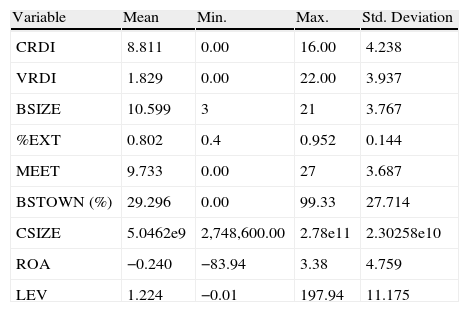

6Multivariate analysisTable 5 shows the main descriptive statistics. From the results obtained for the years 2007, 2008 and 2009, jointly considered, it can be observed that the scores obtained for compulsory risks in Spanish companies reaches the mean value of 9 points (with a maximum of 16 points); therefore, these companies disclose the information required without providing more specific data or a higher extent of information. As for the disclosure index in voluntary risks, there exists scarce revelation concerning these risks, exhibiting a mean score of 2 points, with a maximum score of 22 points. Additionally, the Boards have 11 members on average, with 9 meetings per year. Also, the proportion of external directors on Board reaches the 80 per cent.

Descriptive Statistics.

| Variable | Mean | Min. | Max. | Std. Deviation |

| CRDI | 8.811 | 0.00 | 16.00 | 4.238 |

| VRDI | 1.829 | 0.00 | 22.00 | 3.937 |

| BSIZE | 10.599 | 3 | 21 | 3.767 |

| %EXT | 0.802 | 0.4 | 0.952 | 0.144 |

| MEET | 9.733 | 0.00 | 27 | 3.687 |

| BSTOWN (%) | 29.296 | 0.00 | 99.33 | 27.714 |

| CSIZE | 5.0462e9 | 2,748,600.00 | 2.78e11 | 2.30258e10 |

| ROA | −0.240 | −83.94 | 3.38 | 4.759 |

| LEV | 1.224 | −0.01 | 197.94 | 11.175 |

CRDI is the index of compulsory risks disclosed; VRDI refers to the index of voluntary risks revealed; BSIZE is the Board size, measured by the number of directors; %EXT is the proportion of external directors on the board; BSTOWN is the stock ownership possessed by the Board members; MEET is the number of meetings of the Board in a year, as a proxy for the Board activity; CSIZE is the corporate size, measured by the market value; ROA is the company's profitability, measured by the ratio of operating income to total assets; LEV is the ratio of total debt to total assets.

Time period 2007–2009.

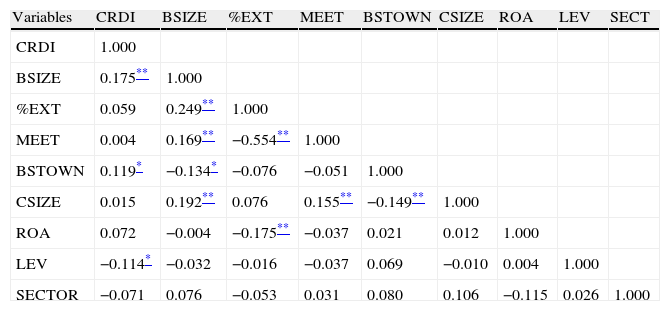

The correlations among the variables are displayed in Table 6 (Compulsory Risks) and Table 7 (Voluntary Risks). The variable ‘Board size’ shows the highest correlation with the dependent variable ‘Compulsory Risks Disclosure Index’ (0.175), followed by ‘Board stock ownership’ (0.119) and ‘Leverage’ (−0.114). However, their values are not high and we have not detected either high correlation or multicollinearity problems.

Bivariate correlation matrix. Dependent variable: Compulsory Risks Disclosure Index.

| Variables | CRDI | BSIZE | %EXT | MEET | BSTOWN | CSIZE | ROA | LEV | SECT |

| CRDI | 1.000 | ||||||||

| BSIZE | 0.175** | 1.000 | |||||||

| %EXT | 0.059 | 0.249** | 1.000 | ||||||

| MEET | 0.004 | 0.169** | −0.554** | 1.000 | |||||

| BSTOWN | 0.119* | −0.134* | −0.076 | −0.051 | 1.000 | ||||

| CSIZE | 0.015 | 0.192** | 0.076 | 0.155** | −0.149** | 1.000 | |||

| ROA | 0.072 | −0.004 | −0.175** | −0.037 | 0.021 | 0.012 | 1.000 | ||

| LEV | −0.114* | −0.032 | −0.016 | −0.037 | 0.069 | −0.010 | 0.004 | 1.000 | |

| SECTOR | −0.071 | 0.076 | −0.053 | 0.031 | 0.080 | 0.106 | −0.115 | 0.026 | 1.000 |

CRDI is the index of compulsory risks disclosed; BSIZE is the Board size, measured by the number of directors; %EXT is the proportion of external directors on the board; BSTOWN is the stock ownership possessed by the Board members; MEET is the number of meetings of the Board in a year, as a proxy for the Board activity; CSIZE is the corporate size, measured by the market value; ROA is the company's profitability, measured by the ratio of operating income to total assets; LEV is the ratio of total debt to total assets; SECT is the company's sector.

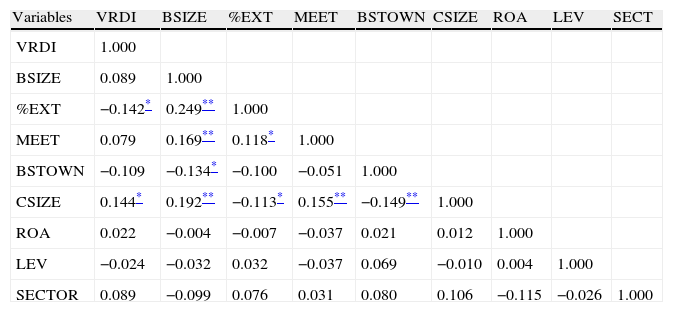

Concerning the correlations shown in Table 7, the variable ‘Corporate size’ exhibits the highest correlation with the dependent variable ‘Voluntary Risks Disclosure Index’ (0.144), followed by ‘Proportion of external directors’ (−0.142) and ‘Board stock ownership’ (−0.109). Again, their values are not high.

Bivariate correlation matrix. Dependent variable: Voluntary Risks Disclosure Index.

| Variables | VRDI | BSIZE | %EXT | MEET | BSTOWN | CSIZE | ROA | LEV | SECT |

| VRDI | 1.000 | ||||||||

| BSIZE | 0.089 | 1.000 | |||||||

| %EXT | −0.142* | 0.249** | 1.000 | ||||||

| MEET | 0.079 | 0.169** | 0.118* | 1.000 | |||||

| BSTOWN | −0.109 | −0.134* | −0.100 | −0.051 | 1.000 | ||||

| CSIZE | 0.144* | 0.192** | −0.113* | 0.155** | −0.149** | 1.000 | |||

| ROA | 0.022 | −0.004 | −0.007 | −0.037 | 0.021 | 0.012 | 1.000 | ||

| LEV | −0.024 | −0.032 | 0.032 | −0.037 | 0.069 | −0.010 | 0.004 | 1.000 | |

| SECTOR | 0.089 | −0.099 | 0.076 | 0.031 | 0.080 | 0.106 | −0.115 | −0.026 | 1.000 |

VRDI refers to the index of voluntary risks revealed; BSIZE is the Board size, measured by the number of directors; %EXT is the proportion of external directors on the board; BSTOWN is the stock ownership possessed by the Board members; MEET is the number of meetings of the Board in a year, as a proxy for the Board activity; CSIZE is the corporate size, measured by the market value; ROA is the company's profitability, measured by the ratio of operating income to total assets; LEV is the ratio of total debt to total assets; SECT is the company's sector.

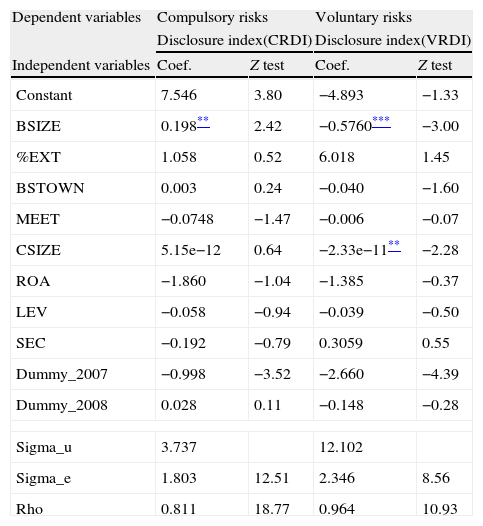

After estimating the models proposed through a panel data methodology, we obtain the results presented in Table 8. Similar findings are obtained in both models, except for the variable Board size. In the model explaining the compulsory risks disclosure index, there is a significant variable out of the eight proposed, Board size, with a positive effect on the index (significant at 5 per cent). In the model explaining the voluntary risks disclosure index, two variables turn out to be significant: Board size (significant at 1 per cent) and Corporate size (significant at 5 per cent), with negative impact on the disclosure. The remaining variables are not significant from a statistical perspective.

Results from regressions (models 2 and 3).

| Dependent variables | Compulsory risks | Voluntary risks | ||

| Disclosure index(CRDI) | Disclosure index(VRDI) | |||

| Independent variables | Coef. | Z test | Coef. | Z test |

| Constant | 7.546 | 3.80 | −4.893 | −1.33 |

| BSIZE | 0.198** | 2.42 | −0.5760*** | −3.00 |

| %EXT | 1.058 | 0.52 | 6.018 | 1.45 |

| BSTOWN | 0.003 | 0.24 | −0.040 | −1.60 |

| MEET | −0.0748 | −1.47 | −0.006 | −0.07 |

| CSIZE | 5.15e−12 | 0.64 | −2.33e−11** | −2.28 |

| ROA | −1.860 | −1.04 | −1.385 | −0.37 |

| LEV | −0.058 | −0.94 | −0.039 | −0.50 |

| SEC | −0.192 | −0.79 | 0.3059 | 0.55 |

| Dummy_2007 | −0.998 | −3.52 | −2.660 | −4.39 |

| Dummy_2008 | 0.028 | 0.11 | −0.148 | −0.28 |

| Sigma_u | 3.737 | 12.102 | ||

| Sigma_e | 1.803 | 12.51 | 2.346 | 8.56 |

| Rho | 0.811 | 18.77 | 0.964 | 10.93 |

CRDI is the index of compulsory risks disclosed; VRDI refers to the index of voluntary risks revealed; BSIZE is the Board size, measured by the number of directors; %EXT is the proportion of external directors on the board; BSTOWN is the stock ownership possessed by the Board members; MEET is the number of meetings of the Board in a year, as a proxy for the Board activity; CSIZE is the corporate size, measured by the market value; ROA is the company's profitability, measured by the ratio of operating income to total assets; LEV is the ratio of total debt to total assets; SECTOR is the company's sector.

Model3: CRDIi=β0+β1BSIZEi+β2%EXTi+β3BSTOWNi+β4MEETi+β5CSIZEi+β6ROAi+β7LEVi+β8SECi+∑ρt+¿.

Model4: VRDIi=β0+β1BSIZEi+β2%EXTi+β3BSTOWNi+β4MEETi+β5CSIZEi+β6ROAi+β7LEVi+β8SECi+∑ρt+¿.

The results indicated in Table 8 allow us to accept the hypothesis 1 tested (with positive effect for compulsory risks and negative impact for voluntary risks), at the same time we evidence a negative influence of corporate size on the disclosure about voluntary risks. Our findings do not confirm the remaining hypotheses.

7Discussion of findingsRegarding the discussion of our findings, our results from the first model confirm that Board size positively influences the revelation of information about compulsory risks. The Board encourages that not only the information that is required by law is revealed, but it also must reach a high extent of informative content. Therefore, the diversity in the members’ perspective derived from an increase in the Board size would imply higher quality in corporate decisions and an increase in the quality of the information required by the current regulation. These findings are in line with Pearce and Zhara (1992), Dalton et al. (1999) and Rodríguez Domínguez et al. (2011).

On the contrary, in the second model, our results show a negative relationship between Board size and the disclosure of voluntary risks. Whereas the Board fosters a higher quality in the disclosure of information that is indeed required (not restricted just to a strict compliance), it is more reluctant to reveal information which is not required beforehand. The disclosure of voluntary information about risks is a complex decision, and it is difficult that the Board agrees on it, giving rise to doubts about the suitability of the decision. The higher the Board, the higher the probability of internal dissensions, as a consequence of the complexity of the decision; in this context, it is likely that the Board takes a prudent and conservative position regarding disclosure. On the other hand, the compulsory disclosure is not called into question. These findings are in accordance with previous empirical evidence, such as Eisenberg et al. (1998) and Andres et al. (2005), for whom an increase in the size of the board may decrease its effectiveness; this could lead to a lower predisposition to disclose information.

The model explaining the disclosure of voluntary risks also indicates a negative relationship between corporate size and the disclosure. Given that we are dealing with large companies with high visibility in the business context, an excessive revelation of risks may have negative repercussions that adversely affect market valuations. They are more sensitive about their public image, with a higher coverage by analysts. In this context, these firms are reluctant to reveal information and are more prone to take a conservative policy as for disclosure, avoiding the inclusion of detailed and voluntary divulgation of risks in their corporate reports.

Therefore, we detect that the reporting on risks is rather superficial, without providing a detailed description of the risks with the strategic repercussions involved. This affects both the risks that must be disclosed according to current regulations and especially those that can be reported voluntarily as a part of the strategic disclosure of corporate information. This scarce voluntary disclosure may make it difficult to evaluate the companies’ internal situation. Our findings also stress the complexity of the decision about voluntary disclosures on risks and the relevance of public visibility as a deterrent in this revelation.

8ConclusionsThe need for a higher degree of disclosure of corporate information about risks has emerged recently, as a consequence of a corporate context of increasing complexity in business strategies, operations and regulations. Nevertheless, the main regulations focus almost exclusively on risks derived from the use of financial instruments (e.g. credit risks or currency risks), at the same time that previous studies show a lack of divulgation of quantitative information on risks in different countries.

Faced with this context, we have performed this study in order to analyse the main risks, both compulsory (mainly financial risks) and voluntary (e.g. business risks), disclosed by the largest Spanish companies, and to determine the influence of some factors linked to corporate governance on risk disclosure, controlling for the impact of other corporate variables. To undertake this study, we selected the Spanish companies listed on the Madrid Stock Exchange during the years 2007, 2008 and 2009.

In a first step, the methodology employed was based on a disclosure index. The analysis performed in this sample confirms that, in accordance with the results in other countries, most of the largest Spanish companies reveal mainly the basic features of their obligatory risks, as well as their management policy; as for the methods used to measure them and their risk coverage, companies show a more disperse behaviour; in contrast, the issues least revealed have to do with future risks. To summarize, most companies report their compulsory risks in a generic and vague way and, to a lesser extent, provide more specific data, without supplying a sufficient volume of quantitative information. It is worth emphasizing that most companies report very little about the risks that may be voluntarily disclosed, with those companies that reveal non-financial risks and providing more information being in the minority.

Concerning the hypotheses tested, after developing models based on panel data methodologies, our results show a positive relationship between the compulsory divulgation of risks and Board size. Hence, this study confirms that an increase in the size of the Board may imply that the broad set of perspectives in their members provide corporate decisions with higher quality, thereby influencing the corporate reporting. As for compulsory disclosure, the Board is more prone to reveal not just the minimum requirements by law, but to provide a higher extent of information.

On the other hand, we evidence a negative relationship between the Board size and the voluntary disclosure about risks, stressing the complexity in this disclosure decision. Larger boards may be more reluctant to disclose information that is not strictly required by the current regulations, focusing on the negative consequences of this reporting.

Our findings also show a negative and significant link between corporate size and the voluntary reporting on risks. Given that large companies are especially visible, an excessive disclosure may have negative repercussions in strategic terms and may adversely affect companies’ valuations. In this context, these companies tend to adopt a prudent and conservative position, avoiding a detailed disclosure.

Finally, we do not find any significant relationship between the proportion of external directors, the Board activity, Board stock ownership, profitability, leverage and sector, on one hand, and the disclosure of risks, on the other. The variable sector, which is relevant in many disclosure studies, does not exhibit a significant impact on risk disclosure. Although the lack of significance is also found in other works (e.g. Beretta & Bozzolan, 2004; Craven & Marston, 1999; Giner et al., 2003; Giner, 1997; Larrán & Giner, 2002), the risks borne by some sectors are widely believed to lead to a higher degree of disclosure; therefore, the analysis of its potential effect should be extended in future research, by studying specific sector.

The results obtained stress the lack of disclosure; moreover, most disclosure is focused on financial risks, with a low degree of revelation, mainly based on generic information. Spanish firms comply with the disclosure of risks required by the norms and regulation, but at a lower level without going into detail about risks. Furthermore, the voluntary reporting on risks is rather scarce. Consequently, the disclosure of this type of information should be encouraged, given that most empirical studies have found that including risk measures in a firm's financial statements improves the quality of financial information and reduces investor uncertainty.

Likewise, it is necessary to analyse the reasons behind this absence of information, which may stem from the following: (1) companies are not sufficiently aware of the importance of a higher degree of disclosure; (2) there are not enough incentives for disclosure; (3) systems of risk management are not sufficiently developed or implemented; or (4) disclosure costs are specially high.

Owing to the scarce information voluntarily provided by companies, the role played by standard setters as agents that encourage the disclosure of information about risks is more important than ever, as this will improve the current system of accounting information in order to make it useful to investors, stockholders and debtholders in their analyses and decision-taking processes. Consequently, accounting bodies should adopt a pro-active attitude, requiring companies to disclose risks in an understandable and detailed way that covers the current need for additional information. Therefore, renewed and concerted efforts are needed to encourage companies to provide information about the key risk factors in their business models.

This study contains some limitations. Firstly, the methodology used has meant additional limitations, given that the implementation of a disclosure index involves some subjective work regarding the selection and weighting of the items (Bravo Urquiza et al., 2009; García-Meca & Martínez, 2004; Linsley & Shrives, 2006; Marston & Shrives, 1991), as well as some potential problems related to the design of the disclosure index.

Likewise, in future research a longer time period could be approached. Also, the analysis can be extended to other contexts of corporate governance, different from those analysed in the current study, in different geographic areas across Europe; therefore, it would be worth performing this analysis from a multinational perspective. An interesting topic deriving from this research would be to study in depth the relationship between risk disclosures and capital costs, to learn of managers’ perspectives as to their incentive to disclose and to analyse the strategies implemented by investors to cope with risk disclosures. Also, the economic effects derived from the disclosure of this type of information may be analysed in future studies.

Conflict of interestThe authors have conflict of interest to declare.

We would like to thank you for the comments received in the 35th Annual Congress of the European Accounting Association (Ljubljana, 2012) and the XV Meeting of Asociación Española de Profesores Universitarios de Contabilidad ASEPUC (Cádiz, 2012), as well as the contribution and suggestions made by Isabel M. García-Sánchez, from the University of Salamanca.

A broad review of studies that employ indices to measure coverage of disclosure can be found in Bravo Urquiza et al. (2009).

It is worth stressing that all the analyses shown are performed over the time period of 3 years (2007, 2008 and 2009). The measurement on a yearly basis does not offer additional information and was not included by space reasons.