The highly controversial lease standard-setting project that will replace the standards currently in place, establishes a new approach that includes the recognition of all assets and liabilities associated with lease contracts on the balance sheet, regardless of their classification. The complex standard-setting process and the heated debate among stakeholders makes the analysis of the lobbying phenomenon an important matter for study. The aim of this paper is to find explanatory factors that predict the behaviour of corporate groups with respect to the lease standard-setting process. To achieve this objective, we scrutinize the submission of comment letters by 306 non-financial listed companies in response to the discussion paper (DP 2009) and two exposure drafts (ED 2010 and ED 2013) elaborated jointly by the IASB and the FASB by distinguishing among three degrees of intensity in lobbying activities, depending on participation in the different discussion periods. Our empirical study is conducted through a multivariate analysis that shows the intensity of lobbying by considering participation in the three consultation periods. The results show that the intensity of lobbying is associated with size, profitability, age, industry and managerial ownership. The evidence can be used to predict lobbying behaviour. The research has implications for standard setters and contributes to prior lobbying research.

El proyecto de NIIF de arrendamientos, elaborado conjuntamente por el IASB y el FASB, ha sido objeto de una gran controversia debido a que propone el registro de los activos y pasivos derivados de los contratos de arrendamientos en el balance, con la única excepción de los contratos a corto plazo. En este artículo se presenta un estudio empírico para identificar los factores explicativos de la intensidad de la participación en el proyecto de las entidades cotizadas no financieras a través de las cartas de comentarios. Para ello, se analizan las cartas de comentarios presentadas por 306 sociedades cotizadas no financieras, en respuesta a los 3 documentos publicados hasta el momento de la emisión definitiva de la norma por los reguladores (DP 2009, ED 2010 y ED 2013) y se realiza un análisis multivariante. Los resultados muestran que el grado de intensidad de la participación de las empresas se ve influido por características corporativas como el tamaño, la rentabilidad, la antigüedad, el sector económico y la propiedad de acciones o participaciones de los directivos. La investigación tiene implicaciones para los emisores de normas y contribuye a la línea de investigación del lobby.

This paper aims to find explanatory factors that predict the behaviour of corporate groups with respect to the lease standard-setting process. To that end, we scrutinize comment letters submitted by 306 non-financial listed companies in response to the discussion paper –DP 2009 (IASB, 2009)– and two exposure drafts –ED 2010 (IASB, 2010) and ED 2013 (IASB, 2013)– elaborated jointly by the IASB and the FASB. In particular, our analysis distinguishes three degrees of lobbying intensity that depend on participation in the different discussion periods.

The setting of accounting standards is commonly viewed as a political or economic process rather than a technical one (Zeff, 2002). In this context, two private sector organizations, the IASB and the FASB, have established a formal process for issuing accounting standards in which transparency and participation are key elements to achieve legitimacy.

Building on the prior scholarship of Georgiou (2004, 2010), Orens, Jorissen, Lybaert, and Van Der Tas (2011) distinguish between different methods of exercising pressure: formal versus informal and direct versus indirect. With regard to formal methods, the most accessible avenue of participation for interested parties is to submit comment letters, which have been considered a proxy for lobbying as a reflection of invisible actions (Hansen, 2011; Holder, Karim, Lin, & Woods, 2013). Consequently, for our purposes, we identify as a lobbyist every writer of a comment letter submitted to the lease DP 2009, ED 2010 or ED 2013.

The lease accounting proposal was chosen as the subject of this study for several reasons, which makes it special because there are few projects with the same conditions. First, this project's character is global in nature because it was conceived as part of the convergence project of the IASB and the FASB. The lease accounting standard was a high-priority project for both standard setters and was introduced to the common agenda in 2006 after the SEC (2005) required a change in lease accounting upon finding $1.25trillion in off-balance sheet operating leases. As a result of the regulatory process, IFRS 16 (IASB, 2016) was issued in January 2016, with some divergence regarding certain aspects of its content.

Second, the lease accounting proposal is highly controversial and has resulted in substantive differences of opinion among constituents. This heated debate is reflected in the international media and in the substantial number of comment letters received by standard setters. During the lease standard-setting process, DP 2009, ED 2010 and ED 2013 received 302, 788 and 655 comment letters, respectively, a number surpassing the average for other projects (Barral Rivada, 2014). Additionally, the effective date of the final standard was delayed several times. The ongoing debate over the pros and cons of the new lease accounting standard has become an important matter that has attracted the attention of accounting academia, professionals and the media (see, e.g., The Economist, 2013; The New York Times, 2013). The new lease approach aims to help users’ decision-making processes, but companies are concerned about its costs and consequences.

Third, the lease standard introduces important accounting modifications from a conceptual and practical perspective. Accounting for operating leases has evolved from a complete lack of registration of assets and liabilities to a capitalization model. All leases that are not freely cancellable by both parties (with the exception of short-term leases) would be reflected in the balance sheet. Both standard setters strongly support the adoption of a “right-of-use” model rather than an ownership model (Biondi et al., 2011). However, other critical issues have hindered the achievement of consensus during the process, such as the definition of a lease, recognition of expenses on the lease income statement, renewal periods and contingent payments.

The new approach might have significant economic consequences because it affects companies’ financial statements across all sectors; however, industries with more intensive exposure to operating leases would naturally face greater consequences (e.g., Fito, Moya, & Orgaz, 2013; Fülbier, Silva, & Pferdehirt, 2008). Scholars such as Beattie, Edwards, and Goodacre (1998), Goodacre (2003), in addition to companies such as PwC (2010), have examined the impact of capitalized operating leases and have shown that some financial ratios would be substantially affected. However, other authors reveal that the amount of off-balance-sheet assets and liabilities resulting from operating leases have been adjusted by analysts and are already included in stock prices and interest rates (see, e.g., Altamuro, Johnston, Pandit, & Zhang, 2014; Krische, Sander, & Smith, 2012), thus reducing concerns about the recognition of assets and liabilities from lease contracts. Nonetheless, transparency would increase if companies calculated the adjustments directly (Nailor & Lennard, 2000).

Our findings show that the intensity of lobbying is positively associated with firm size, firm profitability, firm age, and industries that are traditionally more intensively involved in leases. Moreover, the results suggest that such intensity is negatively associated with managerial ownership. The results are consistent with positive accounting theory regarding firms’ motivations to lobby (Watts and Zimmerman, 1978) and with rational choice theory proposed by Sutton (1984). Moreover, the outcomes are consistent with those streams in the accounting literature that predicted the economic effects of the lease proposal.

This paper adds a new perspective by examining the explanatory factors that determine lobbying intensity in terms of comment letters in the lease accounting standard-setting process. Drawing on the framework that explains the drivers for lobbying in accounting standards, this paper uses determinants such as size, firm age and managerial ownership to explore the lobbying intensity. The intensity of lobbying is measured by the attendance of submitting a comment letter and with qualitative variables such as the length of comment letters and the percentage of answered questions. The results show that the attendance of comment letters works differently than the length of comment letters and the percentage of questions answered. Thus, the proxy to measure lobbying behaviour might cause variance in the results, an issue that should be considered in future research. The combination of alternative variables helps extend the previous evidence on lobbying behaviour.

Moreover, this study also reveals that previous findings identifying factors that influence a company's decision to lease and the characteristics that explain preferences for off-balance-sheet financing may be related to companies’ attitudes towards lobbying in this case. Thus, the results provide a complete picture of firms’ participatory behaviour in the lease accounting standard-setting process. This study therefore represents a new step in predicting the behaviour of preparers in lease accounting, which is one of the most controversial project (Barral Rivada, Madueño, & Sobrino, 2014; Fito et al., 2013; Molina & Mora, 2015, Arimany, Fito, & Orgaz, 2015).

The structure of this paper is as follows. The second section presents the theoretical framework and hypothesis. The third section describes the methodology and variables. The fourth section contains the sample selection and descriptive analysis. The fifth section presents the results and discussions. Finally, the sixth section presents the conclusions.

Theoretical framework and hypothesisPositive accounting theory is an accepted accounting framework that is used to explain company behaviour, particularly lobbying activities. From an economic perspective, accounting regulatory changes can affect the financial situation of companies involved in other contracts. These changes might also lead to unintended effects and redistribution of wealth among different actors, which is consistent with agency theory.

According to Watts and Zimmerman (1978, 1986), three factors explain managers¿ motivation to undertake certain accounting choices and practices: (a) the political cost hypothesis; (b) contractual arrangements related to debt; and (c) costs associated with information production and bookkeeping that are linked to manager compensation. The first factor predicts that managers have incentives to use different accounting methods eluding visibility (e.g. reducing earnings) to avoid attracting political attention (e.g., larger, more profitable firms). The second factor predicts that companies with higher debt ratios are more likely to make accounting choices that increase the earnings and avoid debt covenant violation. The third factor assumes that managers tend to maximize their wealth via compensation agreements that are tied to accounting numbers.

Building on this framework, empirical research has generally found that the likelihood of submitting a comment letter is associated with larger companies (Ang, Sidhu, & Gallery, 2000; Georgiou, 2005; Jorissen, Lybaert, Orens, & Van der Tas, 2012; Katselas, Birt, & Kang, 2011; Larson, 1997), companies with substantial debt covenants and/or high leverage (Georgiou, 2005; Koh, 2011) and companies with certain corporate governance characteristics such as the percentage of management's ownership (Kelly, 1985; Koh, 2011). However, the likelihood of submitting a comment letter and corporate characteristics should be explored deeply as little evidence exists to date.

According to the economic theory of democracy, a rational entity assigns resources to lobbying only when benefits outweigh costs, which is similar to the process of allocating a vote in a political system (Sutton, 1984). This cost–benefit function, which has its origins in classical microeconomic theory and is usually represented by signalling models based on assumptions, also relies on agency theory (Jensen & Meckling, 1976).

Based on previous theories, we assume that companies who become involved in the lease standard-setting process by submitting comment letters have invested in transferring information to standard setters with the aim of ultimately influencing the outcome and reaping benefits. They are signalling themselves as lobbyists through a transactional information strategy based on corporate political activities theory. Independent of the corporate position described in the comment letter – which may be interpreted subjectively – the investment is greater when the company is committed during all phases of the project.

In summary, positive accounting theory and the economic theory of democracy provide arguments to explain lobbying. The decision to engage in lobbying in the early stages of the regulatory process (i.e., in the standard-setting process between the first discussion document and the definitive publication of the accounting standard) depends on the firm's effectiveness at influencing issues during their provisional status and on the proposal's economic impact. In this context, the IASB-FASB lease project led to a public strong debate among companies that would potentially be affected by the proposed changes. This study formulates six hypotheses based on the principal lobbying theories.

Hypothesis 1: firm sizeEarly researches based on positive accounting framework, use size as a proxy to measure political visibility. The argument is that large firms are more politically visible compared to small firms and consequently large firms have high incentives to make accounting choices that reduce their earnings to avoid adverse political attention.

Sutton (1984) argues that lobbyists make rational choices based on a cost-benefit function. Therefore, a large company has a greater incentive to lobby than a small company because the first one has more resources to invest in lobbying activities and more ability to influence a regulator and to benefit from the outcome. According to Koh (2011, 5), “larger firm size is generally seen as a proxy for the higher likelihood that a firm's proportion of benefits obtained from lobbying is usually large enough to offset the lobbying costs”.

Building on this framework, empirical studies on lobbying show a positive relationship between size and the tendency to participate in the standard-setting process (e.g., Ang et al., 2000; Georgiou, 2005; Jorissen et al., 2012; Katselas et al., 2011; Kosi & Reither, 2014; Larson, 1997; Santos & Santos, 2014). In the particular context of the lease accounting project, firms are affected by the political cost hypothesis (Fito et al., 2013; Goodacre, 2003; Gosman & Hanson, 2000). Changes in lease accounting could disproportionately affect large firms, and they also have more capacity to absorb lobbying costs. Consequently, we introduce the firm size variable, and we expect a positive relationship between size and the tendency to engage in lobbying behaviour.H1 Larger firms are more likely to lobby more intensively than small firms regarding the lease accounting standard-setting process.

Positive accounting theory indicates that companies are more likely to lobby when regulatory changes might impact their reporting figures (Watts & Zimmerman, 1978). Georgiou (2004) argues that firms prefer not to participate in the process when the proposed standard does not have a substantial impact on their accounts. The new lease proposal intends to move towards a full capitalization model in which lessee companies would increase the amounts of assets and liabilities recognized as a result of capitalized operating leases; as a consequence, financial ratios such as leverage would be affected (Barral Rivada et al., 2014; Beattie et al., 1998; Bennett & Bradbury, 2003; Durocher, 2008; Fito et al., 2013).

Watts and Zimmerman (1986) also predict that managers will make accounting choices that would avoid debt covenants violations. Empirical studies have found that firms with higher leverage levels and financial constraints prefer to use leases instead of other types of debt (Eisfeldt & Rampini, 2009; Sharpe & Nguyen, 1995). Additionally, if operating leases are capitalized, it could affect debt covenant violations over the short term (Lee, Paik, & Yoon, 2014). Therefore, our next hypothesis assumes that companies with high leverage ratios are more likely to lobby over the long term than other companies, and we expect a positive relation between debt ratios and the tendency to lobby.H2 Firms with high leverage ratios are more likely to lobby more intensively than other firms regarding the lease accounting standard-setting process.

The literature on lease determinants considers profitability to be an important part of lobbying models. Although some studies do not find a relationship between lobbying and the profitability variable (Jorissen et al., 2012), other studies have found a positive relationship between lobbying and income volatility and/or profitability (Kosi & Reither, 2014; Sadrich & Annavarjulia, 2003, 2005; Santos & Santos, 2014). In this context, the prediction is that firms that are more profitable will be more likely to lobby because they have more resources to invest in lobbying (e.g., Kosi & Reither, 2014). Similarly, income volatility and/or changes in profitability can explain the probability of submitting a comment letter to avoid adverse effects on markets and stakeholders (Barral Rivada, 2014; Kosi & Reither, 2014).

From the perspective of financial strategy, profitability is found to be positively correlated with lease contracts in large companies (Morais, 2013). Regarding the proposed changes in lease standards, profitability ratios are expected to be reduced to a certain extent in some sectors (Durocher, 2008; Fito et al., 2013; Goodacre, 2003). Therefore, based on previous lobbying research that shows a positive relationship between lobbying and income variability or average return on assets during the period (Kosi & Reither, 2014; Sadrich & Annavarjulia, 2003, 2005; Santos & Santos, 2014), we introduce firm profitability into the study.H3 Profitable firms are more likely to lobby more intensively than non-profitable firms regarding the lease accounting standard-setting process.

The association between firm age and lobbying has been previously tested within the corporate political activities theory and the political cost hypothesis. Campos and Giovannoni (2007) show that firm age increases the likelihood that a firm will engage in lobbying behaviour. Hillman, Keim, and Schuler (2004) explains that age is a proxy for “visibility of the firm” (Hansen & Mitchell, 2000), “reputation” (Boddewyn & Brewer, 1994) and “experience” or “credibility” (Hillman & Hitt, 1999).

Among other things, “experience” means “previous experience in lobbying activities” that may influence the cost-benefit equation proposed by Sutton (1984). Thus, firms lobbying in the past might experience economies of scale in terms of lobbying (Kosi & Reither, 2014; Morck, Sepanski, & Yeung, 2001) because they made considerable investments the first time they lobbied and will thus experience low marginal costs for further lobbying in subsequent periods. Moreover, success with past lobbying activities might also motivate firms to lobbying in the future (Beresford, 2001; Kosi & Reither, 2014). Similarly, Weymouth (2012) suggests that older firms have the advantage of repeated interactions during previous years with politicians and regulators and that the costs of monitoring may thus decrease with the age of the firm. Therefore, we expect that the age of a firm may be positively associated with the intensity of lobbying.H4 Older firms are more likely to lobby more intensively than younger firms regarding the lease accounting standard-setting process.

According to Watts and Zimmerman (1978), companies that belong to those industries that are more affected by a regulatory change tend to lobby more than companies in other industries. Firms in the service industries use operating leases more intensively (Beattie et al., 1998), and these sectors include air transport services, retail (Goodacre, 2003; Gosman & Hanson, 2000), restaurants, hotels (Arimany et al., 2015), shipping, and truck and railway transport, and in addition to covering companies involved in the energy and utilities sectors (Adams & Hardwick, 1998).

Fito et al. (2013) simulate the impact of capitalization on the balance of commitments for operating leases on a sample of 52 Spanish listed companies and note that the impact of the 2008–2010 period was significant in some ratios; these authors also note that key sectors are impacted regarding energy and retail distribution of both goods and services. PwC (2013) believes that the oil industry will be particularly affected based on the definition of a lease because of the capital-intensive nature of the industry and because highly specialized equipment is not always owned. Therefore, we expect a positive relationship between industries that are traditionally more intensively involved in leases and lobbying in the long term.H5 Firms from industries that traditionally make more use of lease contracts are more likely to lobby more intensively than firms from other industries regarding the lease accounting standard-setting process.

Agency theory and the positive accounting literature both explain the relationship between the principal (ownership) and the agent (manager) in which the parties have different interests. Special attention has been paid to how governance mechanisms limit an agent's self-interested behaviour in the presence of asymmetric information (e.g., Jensen & Meckling, 1976; Kelly, 1985; Koh, 2011; Morck, Shleifer, & Vishny, 1988). The literature shows that public firms have higher agency costs than private firms because of greater ownership separation and dispersion. Ownership concentration has shown mixed results. The convergence-of-interest hypothesis predicts that increasing managerial ownership aligns the interests of managers with those of (other) shareholders, thus diminishing the agency problem (e.g., Jensen & Meckling, 1976). However, it is also possible to find the opposite effect (entrenchment) because owner-managers can use their equity positions to divert resources away from the firm, which results in increased agency costs (e.g., Morck et al., 1988).

According to the managerial risk-aversion hypothesis, companies in which CEOs and other executives have a larger share of ownership attempt to diminish the firm's exposure to risk through by exhibiting a tendency to use lease contracts that, for example, aim at reducing the obsolescence risk of property (i.e., Duke, Franz, Hunt, & Toy, 2002; Smith & Wakeman, 1985). However, changes in lease accounting do not have to affect insider managers’ risk considerations because these considerations reflect the characteristics of the contracts themselves rather than the recognition of assets or debt.

Little research to date has linked ownership structure with lobbying behaviour. For example, Kelly (1985) examines the importance of management's share ownership and concludes that firms that engage in lobbying have lower levels of management ownership than firms that do not lobby. Koh (2011) also uses this concept as a control variable to analyze the decision to lobby. Borghesi and Chang (2015) suggest that firms with a higher level of insider ownership invest less in the firms and lobby more because lobbying does not increase firm value over the long term.

In our sample, CEO ownership is lower than in previous samples because the percentage of managers that own more than 5% of shares is 8% on average. Based on the previous literature, we expect that the insider variable influences lobbying intensity. However, as the result of a high dispersion of ownership, we do not predict the sign of the relationship between lobbying in the lease accounting standard-setting process and the concentration of managerial ownership.H6 The managerial ownership concentration of firms influences their lobbying intensity regarding the lease accounting standard-setting process.

We build three measures based on the submission of comment letters in response to the discussion paper (DP 2009) and the two exposures drafts (ED 2010 and ED 2013) to examine lobbying intensity. Firms that submit comment letters in response to only one of the three documents of the lease standard-setting process are catalogued as Lobbyists to one document, firms that submit comment letters in response to two documents of the lease standard-setting process are catalogued as Lobbyists to two documents, and firms that submit comment letters in response to the three documents of the lease standard-setting process are catalogued as Lobbyists to three documents.

The most common models used to study the decision to engage in lobbying are probit models (see, e.g., Ang et al., 2000; Jorissen et al., 2012) and logit models (e.g., Francis, 1987; Koh, 2011), as they offer a binary dependent variable for lobbyists and non-lobbyists to identify the probability of submitting a comment letter, as well as the variables that determine this behaviour. Other authors have also conducted multinomial regressions in which the dependent variable takes three or more values with respect to the probability of lobbying based on different levels of participation intensity or not lobbying (Kosi & Reither, 2014; Santos & Santos, 2014). This methodology offers researchers more precision in categorizing the variable of interest than binary models, which address only two categories.

To test our hypothesis, we use a univariate methodology (Kruskal–Wallis test) and also a multivariate discrete choice model to explain the decision to submit a comment letter to the lease project and its determinants. The model takes the following form:

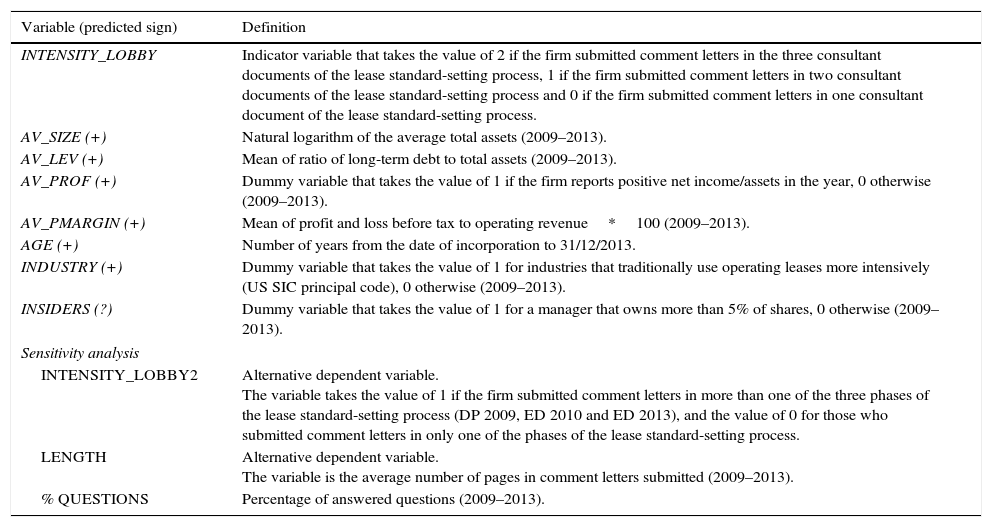

As we explain in the first paragraph, the dependent variable is the intensity of lobbying. In other words, companies that submitted comment letters in all three phases of the lease accounting standard-setting process are considered lobbyists in the long term, and such companies might spend more resources because they expect to receive more benefits from their actions. Table 1 provides more details regarding the measure.

Variable descriptions.

| Variable (predicted sign) | Definition |

|---|---|

| INTENSITY_LOBBY | Indicator variable that takes the value of 2 if the firm submitted comment letters in the three consultant documents of the lease standard-setting process, 1 if the firm submitted comment letters in two consultant documents of the lease standard-setting process and 0 if the firm submitted comment letters in one consultant document of the lease standard-setting process. |

| AV_SIZE (+) | Natural logarithm of the average total assets (2009–2013). |

| AV_LEV (+) | Mean of ratio of long-term debt to total assets (2009–2013). |

| AV_PROF (+) | Dummy variable that takes the value of 1 if the firm reports positive net income/assets in the year, 0 otherwise (2009–2013). |

| AV_PMARGIN (+) | Mean of profit and loss before tax to operating revenue*100 (2009–2013). |

| AGE (+) | Number of years from the date of incorporation to 31/12/2013. |

| INDUSTRY (+) | Dummy variable that takes the value of 1 for industries that traditionally use operating leases more intensively (US SIC principal code), 0 otherwise (2009–2013). |

| INSIDERS (?) | Dummy variable that takes the value of 1 for a manager that owns more than 5% of shares, 0 otherwise (2009–2013). |

| Sensitivity analysis | |

| INTENSITY_LOBBY2 | Alternative dependent variable. The variable takes the value of 1 if the firm submitted comment letters in more than one of the three phases of the lease standard-setting process (DP 2009, ED 2010 and ED 2013), and the value of 0 for those who submitted comment letters in only one of the phases of the lease standard-setting process. |

| LENGTH | Alternative dependent variable. The variable is the average number of pages in comment letters submitted (2009–2013). |

| % QUESTIONS | Percentage of answered questions (2009–2013). |

As explanatory variables, we use six corporate firm characteristics obtained from Bureau van Dijk's OSIRIS. For the size variable, we use the logarithm of total assets (see, e.g., Santos & Santos, 2014). We take the average of the logarithm of total assets for firm i in year t for the period running from 2009 to 2013.

For the leverage variable, we use the average long-term debt ratio, which is defined as the average of total long-term debt divided by total assets for firm i in year t for the period that runs from 2009 to 2013. Authors as Johnson (2003) show that total leverage is mainly determined by the amount of long-term debt.

Profitability is measured as a dummy variable that takes the value of 1 if firm i reports positive net income divided by assets in year t and 0 otherwise, considering the years from 2009 to 2013. Kosi and Reither (2014) use the average return on assets during the period, and Santos and Santos (2014) use average net profits during the period. As an alternative variable, we consider average profit margin.

The age of the firm is measured as the years since the time of incorporation to the last day of 2013 (Akhtar & Oliver, 2009). We also include the industry effect. This variable is measured as a dummy variable based on those subsectors that traditionally use operating leases more intensively than other subsectors. We classify the companies by four-digit SIC Code obtained from the OSIRIS database and consider the classification of sectors made by Gosman and Hanson (2000) and Kostolansky and Stanko (2011). Thus, the intensive lease industries include the airline, other transport, (some) manufacturing, supermarket, family clothing store, restaurant, hotel, energy and communications industries.

Finally, we consider the insider variable (e.g., Kelly, 1985; Koh, 2011) in our model as a dummy variable that takes the value of 1 if any of the firm managers (CEOs or other executives) own more that 5% of the shares of the company and 0 otherwise. Previous studies regarding the effects of managerial ownership on firm performance and managerial behaviour help us to define the percentage of manager shares (see, e.g., Morck et al., 1988). Table 1 shows the variables’ descriptions.

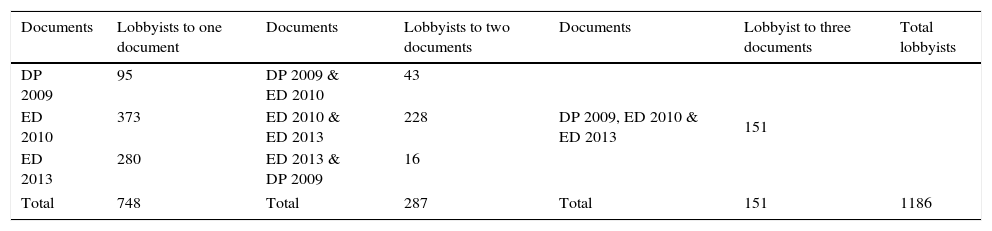

DataDuring the three consultation periods – DP 2009, ED 2010 and ED 2013 – the total number of comment letters collected from the IASB website was 1745. Of those, 302 were received when DP 2009 was issued, whereas 788 and 655 were submitted after the publication of ED 2010 and ED 2013, respectively. We then identify the respondents. Some respondents replied more than once to each document, but we do not consider the additional comment letters to build the respondent sample. Furthermore, some comment letters are signed by several respondents, who are treated as different writers (for example, comment letter number 154 to ED 2013 named a group of Japanese companies and was signed jointly by 17 firms). Hence, the regulators received 1745 comment letters during the three consultation periods. However, for purposes of this paper, we consider each nominative respondent, in absolute terms, including the submission of comment letters for all documents. In this case, 1186 different writers submitted comment letters at least once during the total process. Table 2 shows that 748 different lobbyists submitting comment letters to one document; 287 different lobbyists submitting comment letters to two documents; and 151 different lobbyists submitting comment letters to three documents of the lease standard-setting process

Sample composition by document.

| Documents | Lobbyists to one document | Documents | Lobbyists to two documents | Documents | Lobbyist to three documents | Total lobbyists |

|---|---|---|---|---|---|---|

| DP 2009 | 95 | DP 2009 & ED 2010 | 43 | DP 2009, ED 2010 & ED 2013 | 151 | |

| ED 2010 | 373 | ED 2010 & ED 2013 | 228 | |||

| ED 2013 | 280 | ED 2013 & DP 2009 | 16 | |||

| Total | 748 | Total | 287 | Total | 151 | 1186 |

Note: 748 different lobbyists submitting comment letters to one document; 287 different lobbyists submitting comment letters to two documents; and 151 different lobbyists submitting comment letters to three documents of the lease standard-setting process.

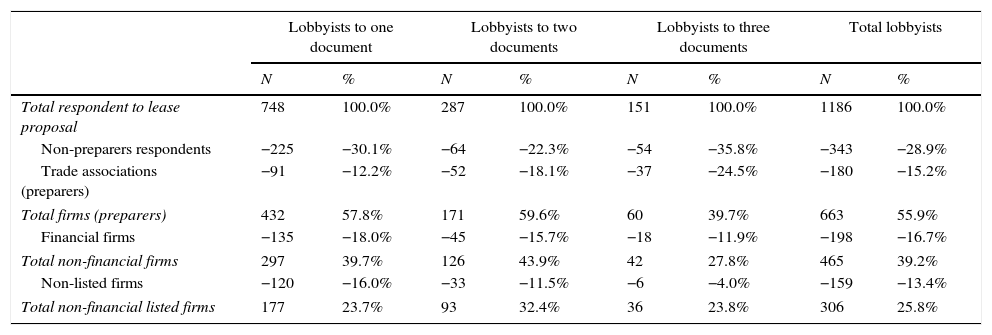

We classified different respondents into groups by distinguishing preparers and trade associations from the rest of constituents, such as academics, regulators or accountants. After excluding trade associations, financial companies and non-listed companies, the sample is consists of 306 non-financial listed firms.

The prior literature distinguishes the group of financial statements’ preparers as the most active group in the submission of comment letters in the accounting regulatory process. The same pattern is observed in the process of replacing the lease standard (663 companies, considered preparers of financial statements, submitted letters, or 55.9% of the sample, which was followed by their trade associations, with 180 respondents, or 15.2% of the sample).

The evidence is consistent with the theory developed by Sutton (1984) regarding the lobbying phenomenon that supposes that preparers might be more involved in the standard-setting process than non-preparers, as preparers are more resourceful, less diversified and will be more affected by the new standard. Similarly, Tandy and Wilburn (1992) and Jorissen et al. (2012) find that the majority of the comment letters are from preparers. More recently, Mora and Molina (2014) and Barral Rivada (2014) focus on the distribution of respondents in the lease accounting project and provide similar evidence, although they do not include the last ED.

In our empirical study, we focus on non-financial listed companies, following the arguments from the prior literature. Orens et al. (2011) find differences in lobbying behaviour between industrial firms and financial firms and between listed and non-listed firms. In most areas, such as the European Union, the application of IFRS are mandatory only to listed companies, which is one reason that may explain the different reactions to the regulatory change between listed and non-listed firms in this geographic zone. A peculiarity of the financial industry is that its companies can be considered both preparers of financial statements and users of financial information (as capital investors or creditors).

Table 3 shows that there are 663 corporate preparers involved in the lease standard-setting process. We use the OSIRIS database to obtain further data about these respondents. The corporate preparer group is divided into 465 non-financial companies and 198 financial companies. Regarding non-financial companies, we separate the 306 listed firms and 159 private firms during the years considered (2009–2013). Of the 159 private firms, 16 were listed once and were delisted before or during the years under consideration. The 306 non-financial listed firms are the sample used for our study.

Sample selection and classification by attendance.

| Lobbyists to one document | Lobbyists to two documents | Lobbyists to three documents | Total lobbyists | |||||

|---|---|---|---|---|---|---|---|---|

| N | % | N | % | N | % | N | % | |

| Total respondent to lease proposal | 748 | 100.0% | 287 | 100.0% | 151 | 100.0% | 1186 | 100.0% |

| Non-preparers respondents | −225 | −30.1% | −64 | −22.3% | −54 | −35.8% | −343 | −28.9% |

| Trade associations (preparers) | −91 | −12.2% | −52 | −18.1% | −37 | −24.5% | −180 | −15.2% |

| Total firms (preparers) | 432 | 57.8% | 171 | 59.6% | 60 | 39.7% | 663 | 55.9% |

| Financial firms | −135 | −18.0% | −45 | −15.7% | −18 | −11.9% | −198 | −16.7% |

| Total non-financial firms | 297 | 39.7% | 126 | 43.9% | 42 | 27.8% | 465 | 39.2% |

| Non-listed firms | −120 | −16.0% | −33 | −11.5% | −6 | −4.0% | −159 | −13.4% |

| Total non-financial listed firms | 177 | 23.7% | 93 | 32.4% | 36 | 23.8% | 306 | 25.8% |

Note: N is the number of comment letters.

The group of non-preparers includes academics, regulators, accounting profession, consultants and users while the group of preparers refers to companies that elaborate financial statements and their trade associations.

Table 3 also reports the sample composition by participation intensity. There are 177 non-financial listed firms (58%) that submitted comment letters in response to any of the three provisional documents (DP 2009, ED 2010 or ED 2013), 93 non-financial listed firms (30%) that submitted comment letters in response to any of the two documents (30%), and 36 non-financial listed firms (12%) that submitted comment letters in response to all three documents of the lease standard-setting process.

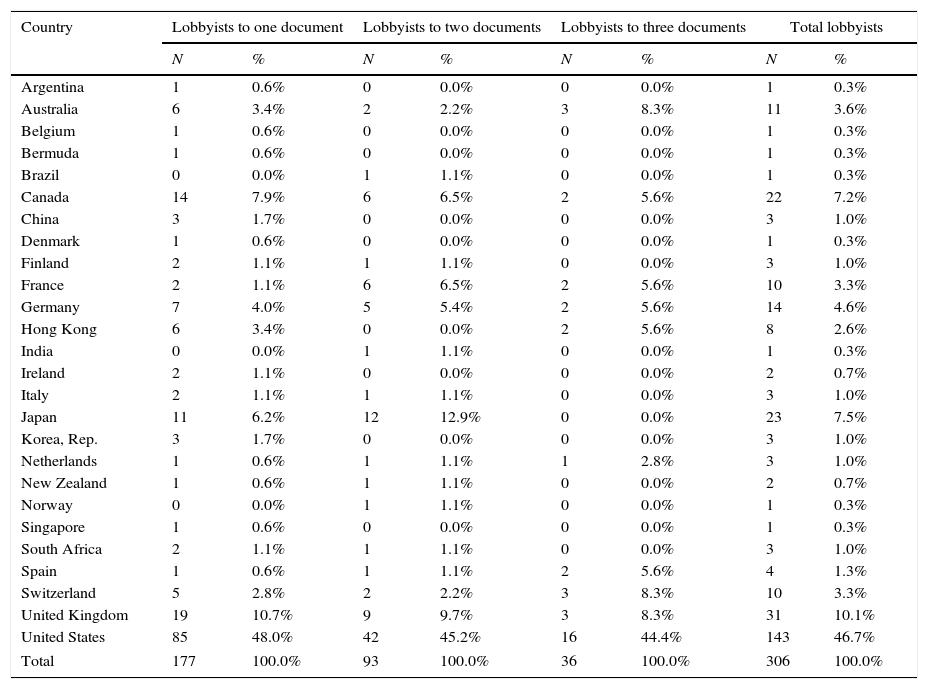

Table 4 reveals the country origin composition for the sample used in this study. Most of the writers come from the United States (47%). The large number of respondents from this country is likely attributable to the fact that this is a convergence project conducted jointly by the IASB and the FASB, which have different scopes. The rules submitted by the FASB are directly applicable to public and private companies located in the United States or listed in United States’ capital markets, whereas the standards submitted by the IASB depend on the approbation of the local authorities where they are permitted or mandatory; for example, in Europe, they are mandatory only for listed companies. The next largest geographic group of respondents comes from the United Kingdom (10%).

Sample composition by country.

| Country | Lobbyists to one document | Lobbyists to two documents | Lobbyists to three documents | Total lobbyists | ||||

|---|---|---|---|---|---|---|---|---|

| N | % | N | % | N | % | N | % | |

| Argentina | 1 | 0.6% | 0 | 0.0% | 0 | 0.0% | 1 | 0.3% |

| Australia | 6 | 3.4% | 2 | 2.2% | 3 | 8.3% | 11 | 3.6% |

| Belgium | 1 | 0.6% | 0 | 0.0% | 0 | 0.0% | 1 | 0.3% |

| Bermuda | 1 | 0.6% | 0 | 0.0% | 0 | 0.0% | 1 | 0.3% |

| Brazil | 0 | 0.0% | 1 | 1.1% | 0 | 0.0% | 1 | 0.3% |

| Canada | 14 | 7.9% | 6 | 6.5% | 2 | 5.6% | 22 | 7.2% |

| China | 3 | 1.7% | 0 | 0.0% | 0 | 0.0% | 3 | 1.0% |

| Denmark | 1 | 0.6% | 0 | 0.0% | 0 | 0.0% | 1 | 0.3% |

| Finland | 2 | 1.1% | 1 | 1.1% | 0 | 0.0% | 3 | 1.0% |

| France | 2 | 1.1% | 6 | 6.5% | 2 | 5.6% | 10 | 3.3% |

| Germany | 7 | 4.0% | 5 | 5.4% | 2 | 5.6% | 14 | 4.6% |

| Hong Kong | 6 | 3.4% | 0 | 0.0% | 2 | 5.6% | 8 | 2.6% |

| India | 0 | 0.0% | 1 | 1.1% | 0 | 0.0% | 1 | 0.3% |

| Ireland | 2 | 1.1% | 0 | 0.0% | 0 | 0.0% | 2 | 0.7% |

| Italy | 2 | 1.1% | 1 | 1.1% | 0 | 0.0% | 3 | 1.0% |

| Japan | 11 | 6.2% | 12 | 12.9% | 0 | 0.0% | 23 | 7.5% |

| Korea, Rep. | 3 | 1.7% | 0 | 0.0% | 0 | 0.0% | 3 | 1.0% |

| Netherlands | 1 | 0.6% | 1 | 1.1% | 1 | 2.8% | 3 | 1.0% |

| New Zealand | 1 | 0.6% | 1 | 1.1% | 0 | 0.0% | 2 | 0.7% |

| Norway | 0 | 0.0% | 1 | 1.1% | 0 | 0.0% | 1 | 0.3% |

| Singapore | 1 | 0.6% | 0 | 0.0% | 0 | 0.0% | 1 | 0.3% |

| South Africa | 2 | 1.1% | 1 | 1.1% | 0 | 0.0% | 3 | 1.0% |

| Spain | 1 | 0.6% | 1 | 1.1% | 2 | 5.6% | 4 | 1.3% |

| Switzerland | 5 | 2.8% | 2 | 2.2% | 3 | 8.3% | 10 | 3.3% |

| United Kingdom | 19 | 10.7% | 9 | 9.7% | 3 | 8.3% | 31 | 10.1% |

| United States | 85 | 48.0% | 42 | 45.2% | 16 | 44.4% | 143 | 46.7% |

| Total | 177 | 100.0% | 93 | 100.0% | 36 | 100.0% | 306 | 100.0% |

Note: The table reports the composition of the sample by country and distinguishes between lobbyists who submitted a comment letter in response to DP 2009, ED 2010 and ED 2013, those who submitted two comment letters in response to the lease standard-setting process and those who submitted three comment letters in response to the lease standard-setting process.

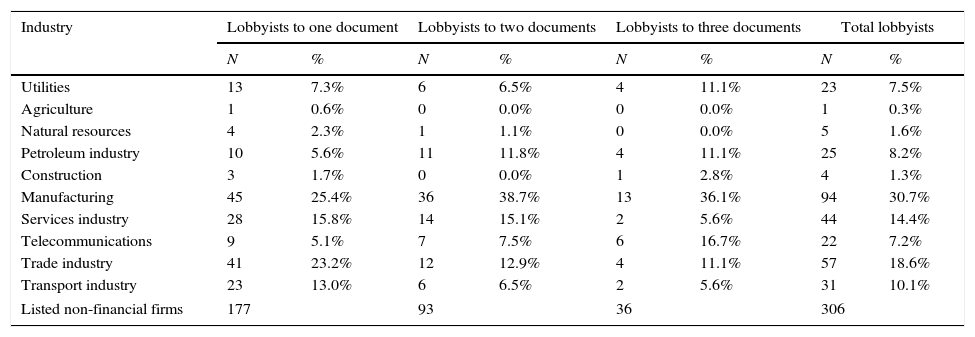

Table 5 shows the composition of the sample by industry based on the 2-digit SIC code. The largest industry group is the manufacturing group (31%), where we find large industrial conglomerate companies such as Siemens and General Electric, which specialize in heavy equipment, followed by the trade industry (19%), services industry (14%), transport industry (10%), utilities (8%), the petroleum industry (8%) and telecommunications (7%). The agriculture, natural resources and construction industries are less represented in the sample.

Sample composition by industry.

| Industry | Lobbyists to one document | Lobbyists to two documents | Lobbyists to three documents | Total lobbyists | ||||

|---|---|---|---|---|---|---|---|---|

| N | % | N | % | N | % | N | % | |

| Utilities | 13 | 7.3% | 6 | 6.5% | 4 | 11.1% | 23 | 7.5% |

| Agriculture | 1 | 0.6% | 0 | 0.0% | 0 | 0.0% | 1 | 0.3% |

| Natural resources | 4 | 2.3% | 1 | 1.1% | 0 | 0.0% | 5 | 1.6% |

| Petroleum industry | 10 | 5.6% | 11 | 11.8% | 4 | 11.1% | 25 | 8.2% |

| Construction | 3 | 1.7% | 0 | 0.0% | 1 | 2.8% | 4 | 1.3% |

| Manufacturing | 45 | 25.4% | 36 | 38.7% | 13 | 36.1% | 94 | 30.7% |

| Services industry | 28 | 15.8% | 14 | 15.1% | 2 | 5.6% | 44 | 14.4% |

| Telecommunications | 9 | 5.1% | 7 | 7.5% | 6 | 16.7% | 22 | 7.2% |

| Trade industry | 41 | 23.2% | 12 | 12.9% | 4 | 11.1% | 57 | 18.6% |

| Transport industry | 23 | 13.0% | 6 | 6.5% | 2 | 5.6% | 31 | 10.1% |

| Listed non-financial firms | 177 | 93 | 36 | 306 | ||||

Note: The table reports the composition of the sample by industry and distinguishes between lobbyists who submitted a comment letter in response to DP 2009, ED 2010 and ED 2013, those who submitted two comment letters in response to the lease standard-setting process and those who submitted three comment letters in response to the lease standard-setting process.

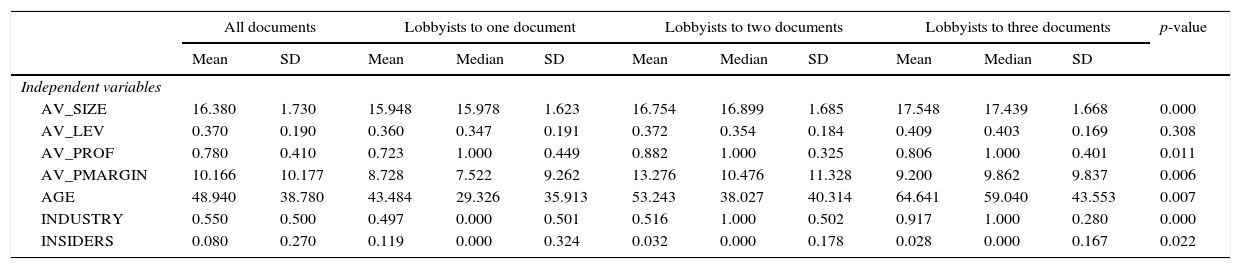

Table 6 presents the descriptive statistics and univariate results through the non-parametric Kruskal–Wallis test. The second, third and fourth columns show the descriptive data for each variable for the three values of the dependent variable: lobbyists that submitted comment letters on one of the three documents, lobbyists that submitted comment letters on two of the three documents, and lobbyists that submitted comment letters on all three documents. The last column shows the p-value of the Kruskal–Wallis test.

Descriptive analysis and univariate results.

| All documents | Lobbyists to one document | Lobbyists to two documents | Lobbyists to three documents | p-value | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | SD | Mean | Median | SD | Mean | Median | SD | Mean | Median | SD | ||

| Independent variables | ||||||||||||

| AV_SIZE | 16.380 | 1.730 | 15.948 | 15.978 | 1.623 | 16.754 | 16.899 | 1.685 | 17.548 | 17.439 | 1.668 | 0.000 |

| AV_LEV | 0.370 | 0.190 | 0.360 | 0.347 | 0.191 | 0.372 | 0.354 | 0.184 | 0.409 | 0.403 | 0.169 | 0.308 |

| AV_PROF | 0.780 | 0.410 | 0.723 | 1.000 | 0.449 | 0.882 | 1.000 | 0.325 | 0.806 | 1.000 | 0.401 | 0.011 |

| AV_PMARGIN | 10.166 | 10.177 | 8.728 | 7.522 | 9.262 | 13.276 | 10.476 | 11.328 | 9.200 | 9.862 | 9.837 | 0.006 |

| AGE | 48.940 | 38.780 | 43.484 | 29.326 | 35.913 | 53.243 | 38.027 | 40.314 | 64.641 | 59.040 | 43.553 | 0.007 |

| INDUSTRY | 0.550 | 0.500 | 0.497 | 0.000 | 0.501 | 0.516 | 1.000 | 0.502 | 0.917 | 1.000 | 0.280 | 0.000 |

| INSIDERS | 0.080 | 0.270 | 0.119 | 0.000 | 0.324 | 0.032 | 0.000 | 0.178 | 0.028 | 0.000 | 0.167 | 0.022 |

Note: The table reports descriptive statistics of the sample for lobbyists who submitted a comment letter in response to DP 2009, ED 2010 or ED 2013, those who submitted two comment letters in response to the lease standard-setting process and those who submitted comment letters in all three periods of the lease standard-setting process.

The table also reports the statistical significance (p-value) of the difference between the three groups using the Kruskal–Wallis test (last column). SD, standard deviation. All of the variables are defined in Table 1.

Table 6 reveals interesting differences in the size variable (AV_SIZE). The average for firm size (measured by the logarithm of assets) is 15.948 for the less intensive lobbyists, 16.754 for the medium-intensive lobbyists and 17.548 for the highest pressure group. The Kruskal–Wallis test shows statistically significant differences (p<0.01) in the size variable. This evidence is consistent with the prediction of H1 and also with the accounting literature (see, e.g., Jorissen et al., 2012; Santos & Santos, 2014). The mean of AV_LEV increases when the lobbying intensity is higher: 0.360 for the less intensive lobbyists, 0.372 for the medium-intensive lobbyists and 0.409 for the most intensive group. However, the Kruskal–Wallis test does not show statistically significant differences in the AV_LEV variable (p>0.05). Thus, the evidence does not confirm the prediction of H2. There are also differences in the intensity of lobbying by the profitability variable. The profitability average is 0.723 for the less intensive lobbyists, 0.882 for the medium-intensive lobbyists and 0.806 for the most intensive lobbyists. In addition, the Kruskal–Wallis test shows statistically significant differences (p<0.05). Similar results are found with average profit margin. Thus, the evidence supports H3.

Table 6 shows that the relationship between the variable intensity of lobbying and the maturity of the company is as follows: the average company maturity is 43.484 years for companies that submitted one comment letter, 53.243 years for companies that submitted two comment letters and 64.641 years for companies that submitted three comment letters. The Kruskal–Wallis test shows statistically significant differences in AGE (p<0.01), thus confirming H4. The variable INDUSTRY measures the industries that are involved in leases more intensively and industries involved in leases less intensively. The Kruskal–Wallis test shows statistically significant differences in the industry variable (p<0.01), thus confirming H5. Finally, Table 6 shows that there are statically significant differences (p<0.05) between the intensity of lobbying and the insider ownership variable (INSIDERS), which supports the last hypothesis, H6.

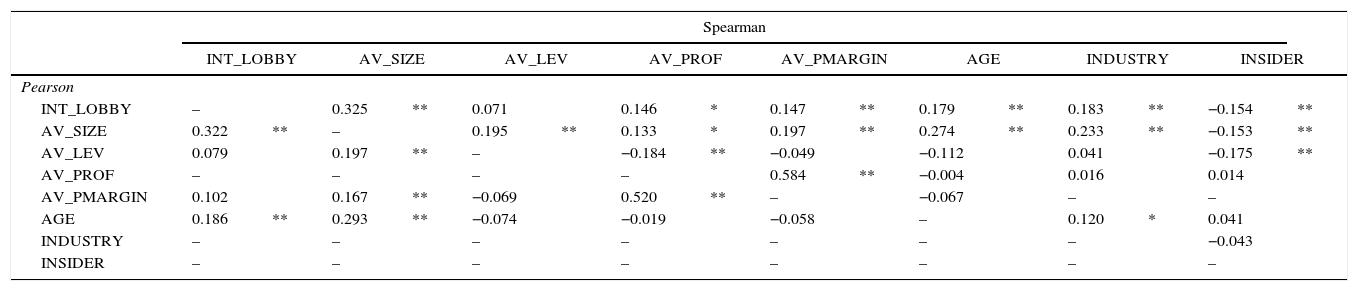

Table 7 shows the pair-wise correlations among the dependent variable and the corporate variables, including the signs of the correlation coefficients. Pearson correlations (below the diagonal) are consistent in signs with the Spearman correlations (above the diagonal). As predicted, the dependent variable INTENSITY_LOBBY is positively correlated with AV_SIZE, AV_LEV, AV_PROF, AV_PMARGIN, AGE and INDUSTRY and negatively correlated with INSIDER. The evidence suggests that intense lobbying is associated with larger firms, profitable firms, more mature firms and firms operating in industries that traditionally use operating leases more intensively. Although many of these pairwise correlations are statistically significant, they are considerably low, which indicates that there is no collinearity problem.

Pearson and Spearman correlations.

| Spearman | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| INT_LOBBY | AV_SIZE | AV_LEV | AV_PROF | AV_PMARGIN | AGE | INDUSTRY | INSIDER | |||||||||

| Pearson | ||||||||||||||||

| INT_LOBBY | – | 0.325 | ** | 0.071 | 0.146 | * | 0.147 | ** | 0.179 | ** | 0.183 | ** | −0.154 | ** | ||

| AV_SIZE | 0.322 | ** | – | 0.195 | ** | 0.133 | * | 0.197 | ** | 0.274 | ** | 0.233 | ** | −0.153 | ** | |

| AV_LEV | 0.079 | 0.197 | ** | – | −0.184 | ** | −0.049 | −0.112 | 0.041 | −0.175 | ** | |||||

| AV_PROF | – | – | – | – | 0.584 | ** | −0.004 | 0.016 | 0.014 | |||||||

| AV_PMARGIN | 0.102 | 0.167 | ** | −0.069 | 0.520 | ** | – | −0.067 | – | – | ||||||

| AGE | 0.186 | ** | 0.293 | ** | −0.074 | −0.019 | −0.058 | – | 0.120 | * | 0.041 | |||||

| INDUSTRY | – | – | – | – | – | – | – | −0.043 | ||||||||

| INSIDER | – | – | – | – | – | – | – | – | ||||||||

Note: The table presents the Pearson (Spearman) correlations below (above) the diagonal for the complete sample (all of the consultation projects). Number of observations 306; *, ** denote statistical significance at the 90 percent and 95 percent confidence levels, respectively. All variables are defined in Table 1.

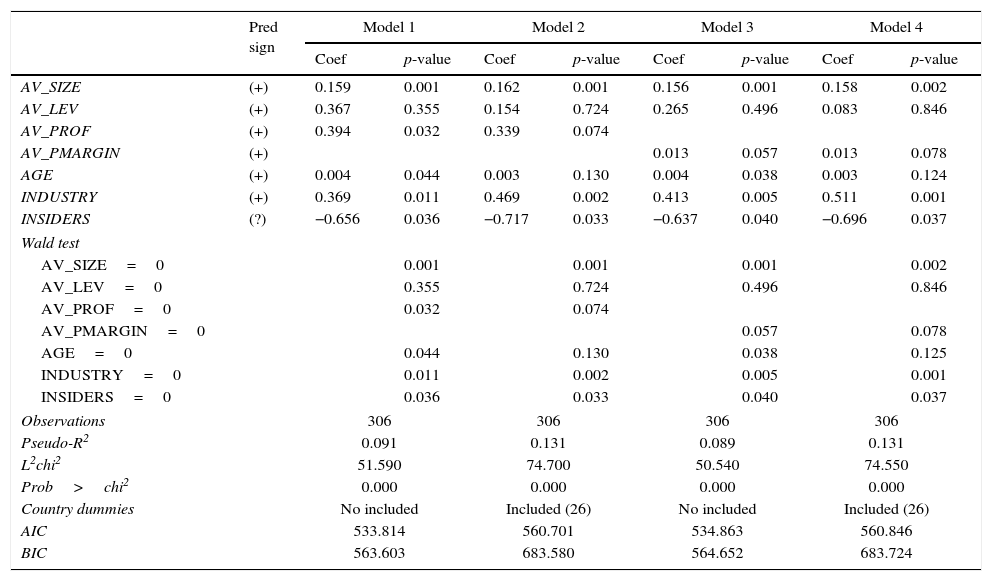

Table 8 reports the ordered probit regression estimation. Models 1 and 2 consider profitability as independent variable. Models 3 and 4 consider average profit margin instead of profitability as independent variable. We estimate separate models for the above independent variable due to they are alternative measures of profitability and the correlation coefficient between them is high and statistical significant (see Table 6). Models 1 and 3 do not include dummy variables, and Models 2 and 4 include country dummies. The (pseudo) R squared of the models ranges from 0.11 (Model 1) to 0.13 (Model 4). In the postestimation, we calculate the BIC and AIC and Wald test, the marginal effects and the predicted probability (not reported).

Results of ordered probit.

| Pred sign | Model 1 | Model 2 | Model 3 | Model 4 | |||||

|---|---|---|---|---|---|---|---|---|---|

| Coef | p-value | Coef | p-value | Coef | p-value | Coef | p-value | ||

| AV_SIZE | (+) | 0.159 | 0.001 | 0.162 | 0.001 | 0.156 | 0.001 | 0.158 | 0.002 |

| AV_LEV | (+) | 0.367 | 0.355 | 0.154 | 0.724 | 0.265 | 0.496 | 0.083 | 0.846 |

| AV_PROF | (+) | 0.394 | 0.032 | 0.339 | 0.074 | ||||

| AV_PMARGIN | (+) | 0.013 | 0.057 | 0.013 | 0.078 | ||||

| AGE | (+) | 0.004 | 0.044 | 0.003 | 0.130 | 0.004 | 0.038 | 0.003 | 0.124 |

| INDUSTRY | (+) | 0.369 | 0.011 | 0.469 | 0.002 | 0.413 | 0.005 | 0.511 | 0.001 |

| INSIDERS | (?) | −0.656 | 0.036 | −0.717 | 0.033 | −0.637 | 0.040 | −0.696 | 0.037 |

| Wald test | |||||||||

| AV_SIZE=0 | 0.001 | 0.001 | 0.001 | 0.002 | |||||

| AV_LEV=0 | 0.355 | 0.724 | 0.496 | 0.846 | |||||

| AV_PROF=0 | 0.032 | 0.074 | |||||||

| AV_PMARGIN=0 | 0.057 | 0.078 | |||||||

| AGE=0 | 0.044 | 0.130 | 0.038 | 0.125 | |||||

| INDUSTRY=0 | 0.011 | 0.002 | 0.005 | 0.001 | |||||

| INSIDERS=0 | 0.036 | 0.033 | 0.040 | 0.037 | |||||

| Observations | 306 | 306 | 306 | 306 | |||||

| Pseudo-R2 | 0.091 | 0.131 | 0.089 | 0.131 | |||||

| L2chi2 | 51.590 | 74.700 | 50.540 | 74.550 | |||||

| Prob>chi2 | 0.000 | 0.000 | 0.000 | 0.000 | |||||

| Country dummies | No included | Included (26) | No included | Included (26) | |||||

| AIC | 533.814 | 560.701 | 534.863 | 560.846 | |||||

| BIC | 563.603 | 683.580 | 564.652 | 683.724 | |||||

Note: The dependent variable is lobbying intensity, which takes the value of 2 for lobbyists who submitted comment letters in all three phases of the lease standard-setting process (DP 2009, ED 2010 and ED 2013), the value of 1 for those who submitted two comment letters in the lease standard-setting process and the value of 0 for those who submitted comment letters only in one of the three phases of the lease standard-setting process. All of the variables are defined in Table 1.

Table 8 shows that the coefficient on AV_SIZE is significant and positive in all the models. This result corroborates H1, that is, larger companies are more likely to lobby more intensively.

The coefficient on AV_LEV is not statistically significant in all the models. This result is not isolated because some prior lobbying studies also provide similar evidence related to this variable (e.g., Ang et al., 2000; Katselas et al., 2011; Kosi & Reither, 2014). One explanation for this result might be that the new lease standard does not have those higher expected effects on leverage because professional analysts currently adjust financial statements to incorporate resources and obligations under operating leases, as they are seeking improved comparability of results and better assessments of the magnitude of debt for entities. Additionally, in the case of leases, some authors question the relationship between debt created from a lease contract and other types of debt, particularly with regard to whether they are substitutes for or are complementary to one another (see, e.g., Ang & Peterson, 1984; Beattie, Goodacre, & Thomson, 2000; Eisfeldt & Rampini, 2009). We can think in the same terms for the results found in this paper.

The coefficient on AV_PROFIT is significant and positive (see models 1 and 2) and AV_PMARGIN (see models 3 and 4), which suggests that more profitable firms are more likely to lobby more intensively. Additionally, the coefficient on INDUSTRY is positive and statistically significant. Thus, firms operating in industries that traditionally use operating leases more intensively are more likely to submit comment letters. Finally, the coefficient on INSIDERS is significant and negative, which means that INSIDERS are less likely to submit comment letters. As mentioned previously, this variable requires further research.

In summary, the ordered logit regression supports our hypotheses that larger firms, profitable firms, more mature firms and firms operating in industries that traditionally use operating leases more intensively are more likely to submit comment letters. The results also show that the quality of the reasoning is positively associated with the probability of engaging in long-term lobbying.

Sensitivity testIn this section, we develop several sensitivity tests based on the sample characteristics and the variables. First, we repeat the regression while excluding the countries that have low representation in the sample and the countries that are heavily represented in the sample. Second, we model the probability of submitting a comment letter using a probit regression where the dependent variable is a binary indicator. Third, we use two alternatives dependent variables, the length of the letters and the percentage of answered question, as other ways to measure the lobbying intensity. Finally, we repeat the univariate and multivariate analyses using alternative measures for the independent variables (not reported).

First, we conduct the same analysis while controlling for country representation. In this case, we repeat the regression excluding countries that are: (1) poorly represented, that is, countries that have three or fewer companies in the sample of observations (Argentina, Belgium, Bermuda, Brazil, China, Denmark, Finland, India, Ireland, Italy, Republic of Korea, Netherlands, New Zealand, Norway, Singapore, and South Africa), (2) heavily represented in the sample of observations (the United States and United Kingdom).

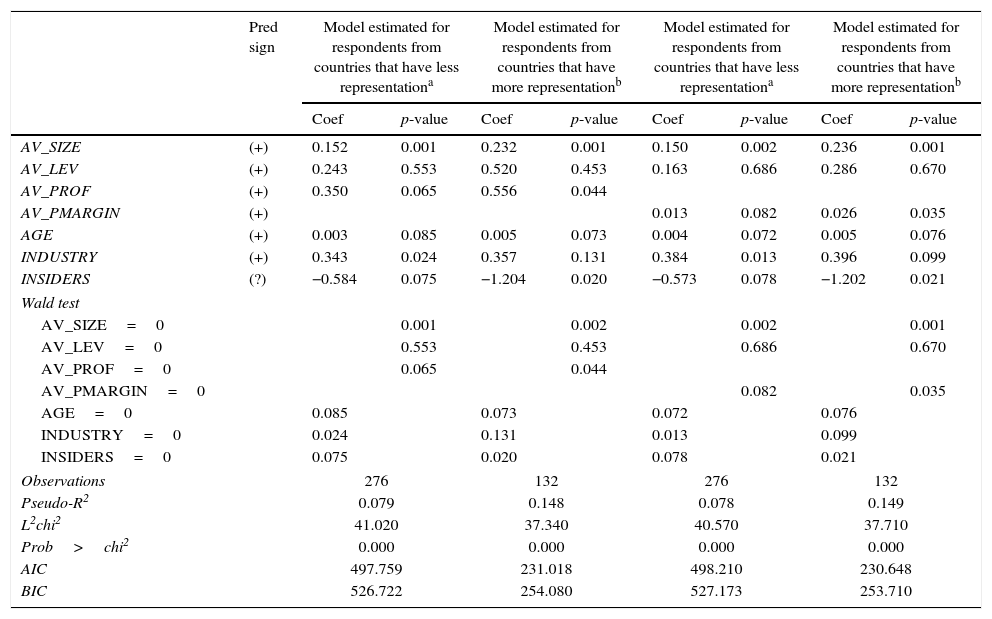

Table 9 indicates that the coefficients on AV_SIZE, AGE, INDUSTRY and AV_PROFIT (models 1 and 2), AV_PMARGIN (models 3 and 4) are positive and statistically significant. The coefficient on INSIDERS is negative and statistically significant, while the coefficient on AV_LEV is not statistically significant. These results support the evidence from ‘Multivariate results’ section.

Results of ordered probit controlling for countries.

| Pred sign | Model estimated for respondents from countries that have less representationa | Model estimated for respondents from countries that have more representationb | Model estimated for respondents from countries that have less representationa | Model estimated for respondents from countries that have more representationb | |||||

|---|---|---|---|---|---|---|---|---|---|

| Coef | p-value | Coef | p-value | Coef | p-value | Coef | p-value | ||

| AV_SIZE | (+) | 0.152 | 0.001 | 0.232 | 0.001 | 0.150 | 0.002 | 0.236 | 0.001 |

| AV_LEV | (+) | 0.243 | 0.553 | 0.520 | 0.453 | 0.163 | 0.686 | 0.286 | 0.670 |

| AV_PROF | (+) | 0.350 | 0.065 | 0.556 | 0.044 | ||||

| AV_PMARGIN | (+) | 0.013 | 0.082 | 0.026 | 0.035 | ||||

| AGE | (+) | 0.003 | 0.085 | 0.005 | 0.073 | 0.004 | 0.072 | 0.005 | 0.076 |

| INDUSTRY | (+) | 0.343 | 0.024 | 0.357 | 0.131 | 0.384 | 0.013 | 0.396 | 0.099 |

| INSIDERS | (?) | −0.584 | 0.075 | −1.204 | 0.020 | −0.573 | 0.078 | −1.202 | 0.021 |

| Wald test | |||||||||

| AV_SIZE=0 | 0.001 | 0.002 | 0.002 | 0.001 | |||||

| AV_LEV=0 | 0.553 | 0.453 | 0.686 | 0.670 | |||||

| AV_PROF=0 | 0.065 | 0.044 | |||||||

| AV_PMARGIN=0 | 0.082 | 0.035 | |||||||

| AGE=0 | 0.085 | 0.073 | 0.072 | 0.076 | |||||

| INDUSTRY=0 | 0.024 | 0.131 | 0.013 | 0.099 | |||||

| INSIDERS=0 | 0.075 | 0.020 | 0.078 | 0.021 | |||||

| Observations | 276 | 132 | 276 | 132 | |||||

| Pseudo-R2 | 0.079 | 0.148 | 0.078 | 0.149 | |||||

| L2chi2 | 41.020 | 37.340 | 40.570 | 37.710 | |||||

| Prob>chi2 | 0.000 | 0.000 | 0.000 | 0.000 | |||||

| AIC | 497.759 | 231.018 | 498.210 | 230.648 | |||||

| BIC | 526.722 | 254.080 | 527.173 | 253.710 | |||||

Note: The dependent variable is lobbying intensity, which takes the value of 2 for lobbyists who submitted comment letters in all three phases of the lease standard-setting process (DP 2009, ED 2010 and ED 2013), the value of 1 for those who submitted two comment letters in the lease standard-setting process and the value of 0 for those who submitted comment letters only in one of the three phases of the lease standard-setting process.

Second, we model the probability of submitting a comment letter using a probit regression where the dependent variable is a binary indicator. In ‘Multivariate results’ section, we use an ordered probit model where the dependent variable takes one of three values based on the number of comment letters submitted during the period. In this model, the intensity of lobbying is a binary indicator that takes the value of 1 for firms that submitted more than one comment letter (we consider that those firms are engaged in long-term lobbying, as they participated during the entire consultation period) and 0 for firms that only submitted one comment letter. The results remain similar (not tabulated).

As an additional test, we consider two variables, the length of the letters (LENGTH) and the percentage of answered questions (%QUESTIONS), as alternative dependents variables. According to the rational choice theory, a lobbyist would only exert the effort to submit a comment letter if he or she expects to influence the outcome; therefore, the expectations of a comment letter's influence based on its characteristics are relevant. In this context, the content of comment letters may be a vehicle to exert pressure over regulators in the accounting standard-setting process.

The literature has used different proxies to investigate the relationship between the content of comment letters and the lobbying behaviour. Hansen (2011) argues that lobbying success is positively correlated with the ability of respondents to transfer valuable information to regulators. He uses a factor to measure the quality of the reasoning (of the arguments) that includes the length of the letter (in number of pages), the percentage of answered questions, references to conceptual frameworks and to other IFRS and, finally, references to national standard setters. He finds a positive association between the quality of the information included in a comment letter, each lobbyist's desired position and the outcome.

In addition, Giner and Arce (2012) and Kosi and Reither (2014) use the length of comment letters, measured as the number of words per comment letter, as proxy to lobby behaviour. Giner and Arce (2012) find that preparers submit the shortest responses compared to other less active groups using several accounting standard projects. Kosi and Reither (2014) suggest that the length of comment letters is not a good proxy for lobbying behaviour.

Based on this literature, we test the association between the intensity of lobbying measured as the attendance of the submission, the length of the comment letters and the percentage of answered questions as dependent variables. The Spearman correlation between the attendance of the submission and the length of the letters is 0.220 (p<0.05) and the correlation between the attendance of the submission and the percentage of answered questions is 0.165 (p<0.01). It seems that the variables are not complete identical looking at the coefficients correlation.

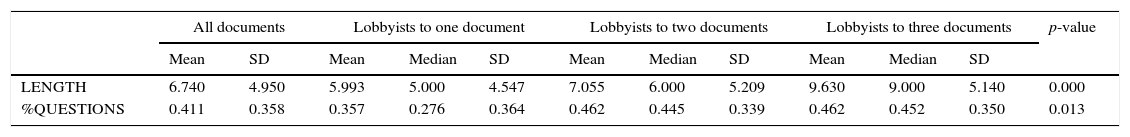

Table 10 shows that the group that lobbied in the long term presents the largest average length (9.630), followed by the group that submitted comment letters on two of the lease documents (7.055) and then the group that only submitted comment letters on one of the documents (5.993). Similarly, the percentage of answered questions of the group that lobbied in the long term are higher (0.452) compared to the group that submitted comment letters on two of the lease documents (0.445) and the group that only submitted comment letters on one of the documents (0.354). The Kruskal–Wallis test shows statistically significant differences in the length variable (p<0.01) and the percentage of answered questions (p<0.05) among the different intensities of lobbying.

Descriptive analysis and univariate results (Length and % of answered questions).

| All documents | Lobbyists to one document | Lobbyists to two documents | Lobbyists to three documents | p-value | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | SD | Mean | Median | SD | Mean | Median | SD | Mean | Median | SD | ||

| LENGTH | 6.740 | 4.950 | 5.993 | 5.000 | 4.547 | 7.055 | 6.000 | 5.209 | 9.630 | 9.000 | 5.140 | 0.000 |

| %QUESTIONS | 0.411 | 0.358 | 0.357 | 0.276 | 0.364 | 0.462 | 0.445 | 0.339 | 0.462 | 0.452 | 0.350 | 0.013 |

Note: The LENGTH is the average number of pages in comment letters submitted (2009–2013).

%QUESTIONS is the % of answered questions (2009–2013).

The last column report the statistical significance (p-value) of the three groups (lobbyists who submitted a comment letter in response to DP 2009, ED 2010 or ED 2013, those who submitted two comment letters in response to the lease standard-setting process and those who submitted comment letters in all three periods of the lease standard-setting process) using the Kruskal–Wallis test. SD, standard deviation. All of the variables are defined in Table 1.

Additionally, we run OLS models using the natural logarithm of length of the letters and percentage of answered questions as dependent variables. The coefficients of independent variables are not significant in all cases as other previous research showed in the field (see e.g. Kosi & Reither, 2014). We considered that a deep analysis of the content of the comment letter (opinion, arguments, quality of the reasoning, etc.) could help to identify alternative proxies to lobbying intensity.

Finally, we repeated the estimations using different specifications and alternative measures for the independent variables (not reported in tables here for brevity). The size variable is a key variable in the study, and there are several ways to measure firm size in the literature, for example, through net sales transformed by its 10 logarithm or its natural logarithm (Jorissen et al., 2012). We consider all this different alternatives to measure the size. The relationship between alternative size measures and the decision to lobby in the long term hold. We also repeat the regression using various proxies for other independent variables, considering, for instance, the logarithm of firm age, the ratio of total debt to total assets for leverage and the categories used by Gosman and Hanson (2000) in the case of industry variable. The results remain similar (not tabulated).

ConclusionsThe requirements of the new lease accounting standard will change the status quo of lease accounting and end most off-balance sheet financing opportunities based on operating lease accounting that is exploited by companies in several industries. The lease standard-setting project has become controversial because it has generated a substantial number of responses from across the corporate environment during the lease standard-setting process. As a result, not only have lessee companies directly affected by the main changes become involved in making the recognition of assets and liabilities from lease contracts compulsory but also lessors have become involved in the process because their destiny is directly linked to the future of the leasing industry. Although lease contracts continue to have other essential advantages, such as tax provisions, flexible financing terms or the transfer of ownership risk, the accounting approach is considered decisive for companies in every jurisdiction, as our study shows.

The objective of this paper has been to identify the determinants of the corporate intensity of lobbying in the lease accounting standard-setting process by including both quantitative and qualitative variables that expand upon previous evidence of lobbying behaviour. The sample consists of comment letters submitted by non-financial listed companies on the lease standard-setting proposal during three consultation periods: DP 2009, ED 2010 and ED 2013. Hence, the analysis of the comment letters during the three consultation periods, including the last draft, helps us to draw conclusions from the entire process and to expand upon the evidence presented in previous studies regarding the lease accounting project. For our statistical analysis, we used an ordered probit regression to obtain results regarding lobbying behaviour during the period considered.

The evidence shows that lobbying intensity is associated with firm characteristics such as firm size, profitability, age, whether the firm belongs to a lease-intensive industry, and insider ownership. Our results also reveal that the most powerful companies in terms of size and profitability lobby with more intensity, thus confirming the political cost hypothesis advocated by Watts and Zimmerman (1978) and the rational choice theories of Sutton (1984). The results for firm leverage are not statistical significant, which is in line with the debate on the relationship between debt and leases and also consistent with the argument that current adjustments made by analysts mitigate leverage effects. Firm age has been introduced as a proxy for experience in lobbying activities, which reduces the marginal costs of participation.

We also validate the hypothesis that those companies that are most intensively involved with leases and that are directly affected by the proposal devote more resources to lobbying, thus supporting positive accounting theory. Our findings confirm this theory, which predicts that self-interested companies are incentivized to participate when they are considerably affected by the potential negative consequences of a proposed standard. Finally, the insiders variable, which represents managerial ownership, is negatively related to the intensity of lobbying. Although there is evidence to suggest that monitoring mechanisms and governance characteristics influence financial reporting, little research on this topic has been conducted in previous lobbying studies. Thus, introducing managerial ownership opens an interesting avenue for future research.

The corporate participants in the lease project demonstrate similar behaviours as shown by the evidence from other accounting projects, but the intensity of the lease accounting project is high because it is a highly controversial convergence project, and the boards delayed publishing the final standard until January 2016. Many large corporate groups have been involved throughout the process to protect their self-interest and to influence the outcome by protecting the status quo. These conclusions have implications for standard setters who wish to predict the intensity of lobbying depending on the degree of controversy of the standard discussed and the specific characteristics of the project.

These findings result in a number of possibilities for future research. One potential direction is to introduce more firm factors and qualitative factors to explore their incidence in the lease accounting project. Examining the effects of additional quantitative and qualitative factors on a particular accounting standard project may generate a complete picture of lobbying behaviour. Specially, the analysis of comment letters’ content might help to find more specific qualitative variables that increase explanations and predictions in lobbying behaviour. It might be interesting to deal with notes of financial statements and debt covenants, as a better proxy for balance sheet leverage, to test the impact of this variable in the participation on the lease accounting standards. These measures may clarify the association between liability and lobbying intensity when addressing lease accounting. Another future direction might expand the results using other accounting projects to provide a more complete picture of lobbying behaviour.

Conflict of interestThe authors declare that they have no conflict of interest.

We appreciate the comments from the workshop participants at the 9th Workshop on European Financial Reporting (EUFIN) 2015 and XI Workshop on Empirical Research in Financial Accounting 2015.